The Completion of Non-Performing Loans in Financial Technology Peer to Peer Lending

on

The Completion of Non-Performing Loans in Financial Technology Peer to Peer Lending

Kadek Januarsa Adi Sudharma1, I Gede Agus Kurniawan2, Mario Binsar Martua Sihombing3

1Faculty of Law, Universitas Pendidikan Nasional, E-mail:januarsa.adi@undiknas.ac.id

2Faculty of Law, Universitas Pendidikan Nasional, E-mail: gedeaguskurniawan@undiknas.ac.id

3Faculty of Law, Universitas Pendidikan Nasional, E-mail: mario91020@gmail.com

Article Info

Received: 9th August 2022

Accepted: 27th September 2023

Published: 29th September 2023

Keywords:

Dispute Resolution, Non Performing loans, Peer to Peer

Lending

Corresponding Author:

Kadek Januarsa Adi Sudharma, E-mail:

DOI:

10.24843/JMHU.2023.v12.i0

3.p03

Abstract

This study aimed at defining the forms of disputes resolution conducted by the parties involved in peer to peer lending fintech business. article aims to analyze the forms of dispute resolution that can be taken by the parties in the peer to peer lending fintech business. This article uses normative legal research with statutue approach. The results show that the parties in the dispute on bad loans in the Peer to Peer Lending Fintech business can take two forms of dispute resolution, namely litigation and non-litigation. The litigation route is to file a simple lawsuit or by Parate Executie, while through the non-litigation route, it could yo use the Alternative Dispute Resolution Institution for the Financial Service Sector.

The influence of information technology causes changes in people's habits, culture, law enforcement, and especially changes in the economy. The development of information technology that causes changes in the habits mentioned above is a form of the Industrial Revolution 4.0. currently implemented in Indonesia. Some activities can be controlled only with mobile phones or other electronic devices that are connected to each other through the internet network. The development of information technology also affects the birth of new forms of legal action. 1 In addition, the existence of information technology for the wider community is able to help work faster and increase work productivity. Human activities are currently influenced by the development of technology and the internet. Many community activities use technology and the internet to make work in various sectors easier.2 One of the sectors that has developed due to the influence of technology is the financial system sector, starting with a digital financial

innovation (Financial Technology). The financial system in a country has an important role, namely as a supporter of economic growth, besides that the financial system also functions as a facilitator in domestic and international business relations..3 In the development of the times accompanied by economic demands, the role of fintech is as a non-bank institution that carries out financial activities such as transfers, financing and payments to be more efficient, easy, safe and practical.

Fintech is a form of digital financial innovation, as regulated in the Financial Services Authority Regulation Number 13/POJK.02/2018 concerning Digital Financial Innovation in the Financial Services Sector in Article 1 number 1 providing a definition of Digital Financial Innovation (IKD) is the activity of updating business processes, business models, and financial instruments that provide new added value in the financial services sector by involving the digital ecosystem.4 Further, another definition of Digital Financial Innovation is contained in Bank Indonesia Regulation Number 19/12/PBI/2017 concerning the Implementation of Financial Technology in Article 1 number 1 explaining that IKD is the use of technology in the financial system that produces products, services, technology, and/or or new business models and have an impact on monetary stability, financial system stability, and/or efficiency, smoothness, security, and reliability of the payment system. The use of Fintech is currently widely used and utilized by the Indonesian people in carrying out their daily business, for the financial sector fintech is the driving force of the Indonesian economy. Currently, there are 4 (four) types of fintech developing in Indonesia, namely: (1) Crowdfunding, is a type of fintech that provides fundraising features or donates to social service programs to the community; (2) Microfinancing, is a fintech that provides loans, specifically to micro and small business actors who have not yet obtained banking access; (3) Digital Payment System, this fintech provides features for the public in terms of bill payments such as payment of credit, electricity tokens, and other bills that can be accessed through the user's device; (4) Peer To Peer Lending (P2P Lending), this fintech provides loans in the form of funds to people in need, by bringing together lenders (Lenders) and loan recipients (Borrowers). The use of Fintech in the type of Borrowing and borrowing money (Peer to Peer Lending) makes it easier for people who do not have access to banking services, so the role of fintech P2P Lending for people who live in remote areas is to facilitate the distribution of funds. The use of fintech as a digital financial innovation has advantages over banking, namely the process of borrowing and borrowing money is more efficient and simple without having to require collateral for loans.. 5 This makes fintech lending and borrowing money (P2P Lending) as an alternative to bank financing loans. The Financial Services Authority (OJK) noted that the accumulation of fintech loans of the Peer to Peer Lending type reached 13.6 trillion

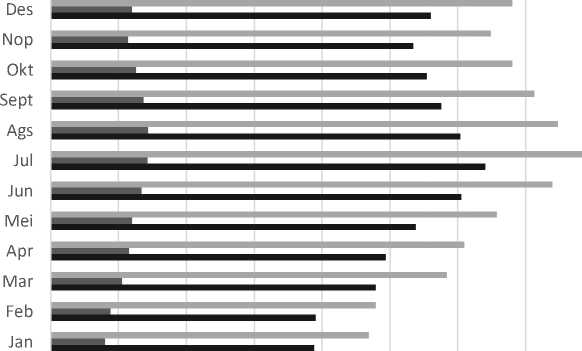

rupiah at the end of 2021, which has increased since the beginning of 2021 which the authors describe in Figure 1.6

Figure 1, Graph of Accumulated Loans to Borrowers by Location

0,00 2.000,004.000,006.000,008.00T0o,0ta01l 0.00L0u,a0r01J2a.w00a0,001J4a.w00a0,0016.000,0018.000,00

This increase is due to the various features provided by fintech P2P Lending that make it easier for the community, efficient and fast use makes fintech P2P Lending the prima donna for Indonesian people who do not have access to banking. People who need loan funds through fintech P2P lending, simply download the application or can go through the website, then fill in the data and upload the documents required by the P2P Lending fintech business organizer and after that the borrowed funds will be directly received by the community as the lender.7 Micro and small business actors who want to develop their business and are having difficulty applying for loans to banks, the best choice is a loan through Fintech P2P Lending. Besides the convenience of various features in Fintech P2P Lending, there are problems related to the P2P Lending fintech business in Indonesia, namely the problem of defaults caused by bad loans by the borrower. When there is a default or bad credit problem, the P2P Lending fintech organizer is not responsible for this risk, so that default is an obligation for the loan recipient to be personally responsible.8 Bad Credit is an act of default because the debtor does not fulfill his obligations to the creditor, so the default causes a dispute for the parties. For this reason, a dispute resolution option clause is required in a contract

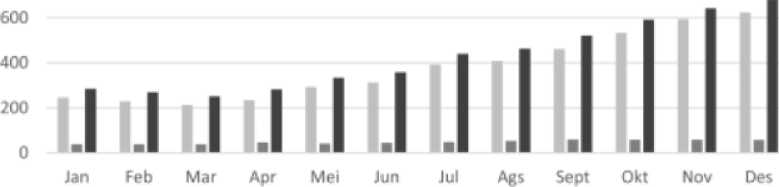

as a means of dispute resolution. At the end of 2019, the Corona Virus Disease-2019 (Covid-19) pandemic caused paralysis in various sectors, one of which was the economic sector. The Covid-19 pandemic has changed people's habit patterns, for example in the economic sector, people are required to transact virtually through financial technology. The momentum of the Covid-19 pandemic has encouraged people who are experiencing economic difficulties to use Fintech P2P Lending services.9 The COVID-19 pandemic is one of the factors that has caused a decline in people's incomes as consumers of the P2P Lending fintech business, resulting in the ability to fulfill loan repayment obligations.10 OJK noted that in the 2021 period, there was an increase in bad credit problems reaching a value of 683 billion rupiah, users in the category of individuals and business entities in P2P Lending fintech, which the authors describe in \Figure 2.

Bad Loans (More Than 90 Days) Outstanding Loans In Billions

Perseorangan IBadanUsaha IJumIah

Lending in a loan agreement with Fintech P2P Lending is in the form of an electronic contract contained in an electronic document. One that must be contained in an electronic contract is a dispute resolution clause. This is in line with the provisions in the Financial Services Authority Regulation Number 77/POJK.01/2016 concerning Information Technology-Based Borrowing-Lending Services, Article 19 paragraph (1) and paragraph (2).11 However, in the regulation there is a vagueness of norms in letter k in the phrase "dispute settlement mechanism" as a clause that must be contained in the electronic document of information technology-based lending and borrowing agreements. The phrase is not followed by a more detailed explanation, whether the settlement of the dispute resolution mechanism is carried out by litigation or nonlitigation. So that the ambiguity of the norms in the regulation becomes a gap for the P2P Lending fintech business operators to deploy third party services (Debt Collectors) to collect bad loans by terrorizing, confiscation or other methods that tend to be against the law as a form of version of the dispute resolution mechanism. The organizers of P2P Lending fintech. There is no limit to the form of dispute resolution mechanism in

information technology-based lending and borrowing agreements as there is a vague norm in OJK Regulation No.77/POJK.01/2016 in Article 19 paragraph (2) letter k. The purpose of this study is to determine the form of the Dispute Resolution mechanism that can be taken by the parties in an information technology-based lending and borrowing agreement. Thus, the theme of this research is " The Completion Of NonPerforming Loans In Financial Technology P2P (Peer To Peer) Lending".

Based on the literature study conducted, no writing with the same theme or title was found. However, there are several related writings, including the Journal with the title "Credit Agreement Through Financial Technology in Business Law Traffic" written by Komang Satria Wibawa Putra with the aim of examining the validity and legal force of credit agreements through financial technology, examining the determination of credit agreement interest rates in financial technology and examining the responsibilities of bad debtors related to credit obtained through financial technology. It can be concluded that this writing is different from previous research, which will focus on the Settlement of Non-Performing Loan in P2P (Peer To Peer) Lending Financial Technology12.

-

2. Research Methods

The method used in this research is normative legal research, where legal research uses library materials and secondary legal materials to be researched.13 Normative legal research can be referred to as doctrinal research, library research and documentary study.14 The approach used in this research is the statutory approach by analyzing the laws and regulations related to legal issues in this study. The legal materials used are Primary legal materials and Secondary legal materials. The primary legal material in this study uses legal rules related to the implementation of the Peer to Peer Lending financial technology business and legal regulations regarding dispute resolution mechanisms. While secondary legal materials consist of international and national books and journals relating to the implementation of the P2P Lending fintech business and dispute resolution in Fintech P2P Lending.

-

3. Results and Discussion

The Indonesian Civil Code (KUHPer) is a guideline for the public in making an electronic contract before the enactment of the Information Technology Electronics Law (ITE Law) as legal protection for the parties in an electronic agreement. Legal protection can be interpreted as a legal effort that is regulated in a legal rule to provide a sense of

security for the soul and body from disturbances and threats.15 An agreement is a legal relationship that regulates property between two parties who promise to do something or not to do something, and the other party has the right to demand the obligation to carry out the promise. Contracts are a form of engagement. A contract is an agreement that is agreed upon by two people, which bind themselves to each other in an obligation with the intent to perform a certain act and are regulated in a set of agreed norms.16 Electronic contracts. Information technology-based lending and borrowing agreements are set out in the form of electronic documents. The electronic document contains the rights and obligations of the parties, resulting in a legal relationship for the parties. Information technology-based lending and borrowing agreements in the P2P Lending fintech business involve three parties, namely the lender (lender), the fintech business operator, and the borrower (borrower). Electronic contracts can be interpreted as contracts made by the parties in electronic form. 17 An electronic contract can be categorized as an engagement accompanied by the threat of punishment, because in an electronic contract there are rights and obligations for the parties who make it. An Electronic Contract is valid when the object of the contract is only a transferable object.18 The definition of an electronic contract is regulated in Law Number 19 of 2016 concerning Amendments to Law Number 11 of 2008 concerning Information and Electronic Transactions, Article 1 number 17 reads "an electronic contract is an agreement between parties made through an electronic system." Information technology-based lending and borrowing agreements are the same as agreements made in general, because the legal terms of an electronic contract are the same as the legal terms of an agreement in general. This is in line with the conditions for the validity of electronic contracts as regulated in the Provisions of Government Regulation of the Republic of Indonesia Number 82 of 2012 concerning the Implementation of Electronic Systems and Transactions, Article 41 paragraph (2), namely:

-

a. There is an agreement of the parties;

-

b. Performed by a legal subject who is capable or authorized to represent in accordance with the laws and regulations;

-

c. There are certain things; and

-

d. The object of the transaction must not conflict with the laws and regulations, decency and public order.

The legal terms of the electronic contract above describe that the legal terms of the electronic contract are the same as the legal terms of the agreement in Article 1320 of

the Civil Code.19 If the author relates the legal terms of the electronic contract with the legal requirements of Article 1320 of the Civil Code, the information technology-based money loan agreement is legally valid when the parties, namely the lender, the P2P Lending fintech business operator, and the loan recipient agree to bind themselves to an agreement to borrow and borrow money based on information technology, then the agreement is carried out by a legally competent party as stipulated in Article 1320 of the Civil Code, there are certain things, namely the activity of borrowing and borrowing money based on information technology, and the object of the agreement is not contradictory with statutory regulations. The difference between electronic contracts and contracts in general lies in the existence of a completeness in producing the contract.20

Dispute is a condition where one party feels harmed by the other party. These losses cause dissatisfaction due to a conflict of interest.21 Historically, dispute resolution in Indonesia was carried out through customary law. The dispute resolution process begins with consensus deliberation without involving a third party, this condition is called negotiation. However, if the deliberation process does not resolve the dispute, then the parties to the dispute will involve someone from one of the family parties, where that person is respected by the wider community who acts as a mediator in the dispute, this process can be called mediation.22 Formally, in a non-performing loan dispute, Peer to Peer Lending fintech providers can take litigation. Litigation efforts can be carried out by taking a simple lawsuit, as for the mechanism, namely: a civil lawsuit against the borrower (borrower) because in this case the borrower has defaulted on the loan agreement. If the value of the object of the agreement is not more than Rp.500.000.000,00 (two hundred million rupiah) then it can be pursued with a simple lawsuit, as regulated in Supreme Court Regulation Number 4 of 2019 concerning Amendments to Supreme Court regulation Number 2 of 2015 concerning Procedures for Settlement of Simple Lawsuits, Article 1 number 1. The provisions for the implementation of Simple Lawsuits are:

-

a. The domicile of the plaintiff and the defendant are in the same jurisdiction, but if the domicile is different, then the plaintiff can file a lawsuit by appointing a proxy with the same address as the defendant, accompanied by a letter of assignment from the plaintiff as the attorney;

-

b. In a simple lawsuit, it only consists of a plaintiff and a defendant, each of which is not more than one, unless there is a common legal interest;

-

c. The dispute resolution time is 25 (twenty five) days, starting from the first day of trial

Apart from litigation, there are non-litigation efforts, namely through the Financial Services Sector Alternative Dispute Resolution Institution (LAPS SJK) established by the OJK. Financial Services Authority Regulation Number 61/POJK.07/2020 concerning Alternative Financial Services Sector Dispute Resolution Institutions, regulates the definition of SJK LAPS, is an institution that resolves disputes in the financial services sector out of court. The FSS LAPS was formed to protect the interests of the public as consumers, and is designed to respond to the changing times that are influenced by the Information Technology system and to expand the scope of dispute resolution in the Financial Technology sector. LAPS SJK replaces the roles and functions of six alternative Dispute Resolution institutions, namely: (1) the Indonesian Insurance Mediation and Arbitration Agency (BMAI) which handles disputes in the insurance sector; (2) The Indonesian Capital Market Arbitration Board (BAPMI) handles capital market sector disputes; (3) The Pension Fund Mediation Agency (BMPD) handles disputes in the pension fund sector; (4) The Indonesian Banking Dispute Settlement Alternative Institution (LAPSPI) handles banking sector disputes; (5) The Indonesian Guarantee Company Arbitration and Mediation Board (BAMPPI) resolves guarantee sector disputes; (6) The Indonesian Pawnshop and Venture Financing Arbitration and Mediation Agency (BMPPVI) resolves disputes in the mortgage and venture capital financing sector.

Financial Services Sector LAPS has three forms of dispute resolution, namely mediation, arbitration and binding opinion. Here, the author describes the form of dispute resolution through the Alternative Dispute Resolution Institution for the Financial Services Sector.

-

1. Mediation. Mediation through the SJK LAPS is a dispute resolution process assisted by a mediator who is tasked with finding various possible ways to resolve disputes without having to impose their will. The mediation process is preceded by the agreement of the parties to mediate through the SJK LAPS. Mediation provisions in the SJK LAPS are regulated in the SJK LAPS Regulation number 01 concerning Mediation Rules and Procedures, while those contained in the regulation are about mediation costs, mediator provisions, mediation period, place of mediation, and results of mediation.Arbitrase.

-

2. Another effort that can be taken by the parties in the Bad Credit dispute is in an Information technology-based money-lending agreement, namely through Arbitration at the SJK LAPS. Settlement of disputes by Arbitration begins with an arbitration agreement agreed upon by the parties to be further examined by a single arbitrator and given an arbitration award. The legal basis for Arbitration at LAPS SJK is regulated in LAPS SJK Regulation Number 02 concerning Arbitration Rules and Procedures.

-

3. Binding Opinion. Dispute resolution through binding opinion is to use the opinion of experts who have expertise in their fields. Binding opinions can be used for problems related to clauses in the agreement, such as adding and changing agreement clauses, clauses that have multiple interpretations, and other problems related to the substance of the agreement clause. The legal

basis of a binding opinion on LAPS SJK is regulated in LAPS SJK Regulation Number 3 concerning Binding Opinions

Dispute resolution through SJK LAPS has advantages, namely in terms of cost efficiency. In Article 19 paragraph (1) letter a, SJK LAPS Regulation No. 06 concerning Dispute Settlement Service Fees, it is regulated that the value of disputes in the financing, pawnshop and financial technology sector is not more than Rp. 200,000,000.00 (two hundred million rupiah) is freed from all costs. In carrying out its functions, duties and authorities, SJK LAPS relies on four principles, namely: (1) the principle of accessibility; (2) the Principle of Independence; (3) the Principle of Justice; (4) Principles of Efficiency and Effectiveness. These four principles stipulate that in carrying out their duties, SJK LAPS must have easy access and procedures for the wider community and have a good communication strategy to improve consumer understanding, must pay attention to the dispute resolution period and efficient costs.

As a form of resolving bad credit disputes, the P2P Lending fintech business organizers also use the services of third parties (debt collectors) in collecting non-performing loans.23 Debt Collector is a party who is authorized to collect or settle bad loans that cannot be resolved by internal collectors.24 The role of the Debt Collector in the Fintech P2P Lending business is to act as a liaison when collecting non-performing loans. The use of Debt Collector services must be with the knowledge of the borrower (borrower), this is because the agreement between the debt collector and the P2P Lending fintech business operator is an agreement between two parties without an agreement from the loan recipient.25 Debt Collector services are allowed to collect non-performing loans, but their use must comply with the provisions stipulated in the Decree of the Management of the Indonesian Joint Funding Fintech Association (AFPI) Number 002/SK/COC/INT/2020 concerning the establishment of Special Regulations on the AFPI Code of Conduct 2020. these provisions are:

-

1. The use of third party services (Debt Collector) is allowed as long as the Debt Collector is registered with the Indonesian Joint Funding Fintech Association, accompanied by a collection agency certification issued by AFPI or other parties appointed by AFPI;

-

2. The use of the Debt Collector is specifically for loans that have been recognized as having a delay of more than 90 (ninety days) as of the maturity date;

-

3. It is forbidden to use the services of a Debt Collector who is listed in the black list issued by the Financial Services Authority.

Indeed, the use of third party services (Debt Collector) must pay attention to the principle of good faith in collecting loans, such as not using intimidation methods such as physical violence, offending ethnicity, religion, race, and between groups, or using

methods that can demean man. Essentially, the borrower has an obligation in a technology-based money-borrowing agreement. This obligation is stated in the form of an electronic contract in an electronic document in which the loan recipient, the lender, and the P2P Lending fintech business operator agree with each other. So that when there is a problem of default due to bad credit, the recipient can be subject to sanctions as stipulated in the agreement clause. The recipient of the loan has an obligation to seek settlement of the debt. Negotiations can be carried out by the loan recipient to convince the P2P Lending fintech business organizers not to deploy debt collector services to collect debt, provided that the loan recipient does not run away or disappear when it is time to carry out obligations.

The resolution of bad credit disputes in Fintech P2P Lending can take litigation and non-litigation efforts. Litigation efforts can be in the form of a simple lawsuit and parate executie. A simple lawsuit against a loan recipient can be made on the basis of default (breach of promise). The legal basis for a simple lawsuit is regulated in PERMA No. 4 of 2019 concerning Amendments to PERMA No. 2 of 20015 concerning Procedures for Settlement of Simple Lawsuits. Efforts through Parate Executie can be taken when an information technology-based lending and borrowing agreement has determined the object of fiduciary security, as regulated in Article 15 paragraph (2) and paragraph (3) of Law Number 42 of 1999. However, the implementation of the fiduciary guarantee execution must pay attention to the provisions of the Constitutional Court Decision Number 18/PUU-XVII/2019 which limits the applicability of Article 15 paragraph (2) and paragraph (3) of Law No. 42 of 1999. Nonlitigation settlements in non-performing credit disputes in Fintech P2P Lending can be made by utilizing the Financial Services Sector Alternative Dispute Resolution Institution (LAPS SJK) which has the function of resolving disputes on Financial Technology, as regulated in Financial Services Authority Regulation No. .61/POJK.07/2020 concerning Alternative Institutions for Settlement of Financial Services Sector Disputes.

References

Adiningsih, Sri. “Transformasi Ekonomi Berbasis Digital Di Indonesia.” 58. Gramedia Pustaka Utama, 2019.

Abdillah, Leon A. “FinTech E-Commerce Payment Application User Experience Analysis during COVID-19 Pandemic.” Scientific Journal of Informatics 7, no. 2 (2020): 267.

http://arxiv.org/abs/2012.07750%0Ahttp://dx.doi.org/10.15294/sji.v7i2.26056.

Adi Sudharma, Kadek Januarsa, Agus Putu Abiyasa, and Ni Ketut Elly Sutrisni. “Regulation of Protection and Fulfillment of Employee Rights of Go-Jek Drivers under Indonesian Employment Regulation.” International Journal of Social Sciences and Humanities 2, no. 3 (2018): 59.

Agustin, Windi Dianti, I Nyoman Bagiastra, and Bagus Gede Ari Rama. “Pengaturan

Hukum Penyelesaian Sengketa Fintech P2P Lending Berstatus Ilegal.” Jurnal Kertha Semaya 9 (2021): 2237–2238.

Asmara Putra, Dewa Nyoman Rai, and I Putu Rasmadi Arsha Putra. “Akibat Hukum Pendaftaran Penyelesaian Sengketa Alternatif.” Jurnal Hukum Acara Perdata 6, no. 1 (2020). http://jhaper.org/index.php/JHAPER/article/view/102.

Damanik, N. G. (2020). Perlindungan Data Pribadi Konsumen Pada Online Marketplace Dari UU No.11 Tahun 2008 Jo. UU No.19 Tahun 2016 Tentang Informasi dan Transaksi Elektronik (Studi pada Lazada Indonesia). Skripsi, Universitas Sumatera Utara. Available from:

https://repositori.usu.ac.id/handle/123456789/1076/browse?type=author&value =Damanik%2C+Novida+Gabriella

Fitria, Annisa. “Penundaan Prestasi Pelaksanaan Kontrak Bisnis Disebabkan Pandemi Covid-19 Sebagai Dasar Force Majeure.” Lex Jurnalica 18 (2021): 229.

HS, H. Salim, and Erlies Septiana Nurbaini. “Penerapan Teori Hukum Pada Penelitian Tesis Dan Disertasi.” 19. Jakarta: Raja Grafindo Persada, 2013.

Herianto Sinaga, David, and I Wayan Wiryawan. “Keabsahan Kontrak Elektronik (EContract) Dalam Perjanjian Bisnis.” Kertha Semaya: Journal Ilmu Hukum 8, no. 9 (2020): 1385.

Indah Parwati, Desak Nyoman Dwi, and I Made Sarjana. “Penerapan Force Majeure Dalam Pemenuhan Isi Kontrak Akibat Pandemi Covid-19 Di Indonesia.” Jurnal Magister Hukum Udaya 11 (2022): 122.

Keuangan, Otoritas Jasa. “Statistik Fintech Lending Periode Desember 2021.” Last modified 2021. Accessed April 25, 2022.

Khoiriyah, Ismi, Dian Apradika Kusumawati, and Ika Indriasari. “Analisis Minat Bertransaksi Menggunakan Financial Technology (Fintech) Di Jawa Tengah.” Stability: Journal of Management and Business 3, no. 2 (2020): 49.

Lilyani, Kadek, and I Nyoman Bagiastra. “Keabsahan Kontrak Perdagangan Secara Elektronik: Perspektif UU ITE.” Jurnal Kertha Negara 9 (2021): 546.

Novinna, Veronica. “Perlindungan Konsumen Dari Penyebarluasan Data Pribadi Oleh Pihak Ketiga: Kasus Fintech Peer”To Peer Lending”.” Jurnal Magister Hukum Udayana (Udayana Master Law Journal) 9, no. 1 (2020): 92.

Novridasati, Wening, Ridwan, and Aliyth Prakasa. “Pertanggungjawaban Pidana Desk Collector Fintech Ilegal Serta Perlindungan Terhadap Korban.” Jurnal Litigasi 21, no. 2 (2020): 241. http://journal.unpas.ac.id/index.php/litigasi.

Pakpahan, Elvira Fitriyani, Jessica, Corris Winar, and Andriaman. “Peran Otoritas Jasa Keuangan (OJK) Dalam Mengawasi Maraknya Pelayanan Financial Technology

(Fintech) Di Indonesia.” Jurnal Magister Hukum Udayana (Udayana Master Law Journal) 9, no. 3 (2020): 567.

Prabowo, M Shidqon, and Lulu’ul Karimah. “Perlindungan Hukum Bagi Konsumen Yang Dirugikan Dalam Fintech Lending Transaksi Peminjaman Uang Online Perspektif UU No 8 Tahun 1999.” Jurnal Magister Hukum Udayana 10, no. 8 (2021): 755.

Putra, Komang Satria Wibawa. "Perjanjian Kredit Melalui Financial Technology dalam Lalu Lintas Hukum Bisnis." Jurnal Analisis Hukum 2.1 (2019): 73-92.

Putri, Wahyu Suwena, and Nyoman Budiana. “Keabsahan Kontrak Elektronik Dalam Transaksi E-Commerce Ditinjau Dari Hukum Perikatan.” Jurnal Analisis Hukum 1, no. 2 (2018): 302. http://journal.undiknas.ac.id/index.php/JAH/index.

Rachmawati, Ayudya Rizqi, Rahmadi Indra Tektona, and Dyah Ochtorina Susanti. “Prinsip Kemanfaatan Penyelesaian Sengketa Elektronik Sebagai Alternatif Penyelesaian Transaksi.” Jurnal Hukum Acara Perdata 6, no. 2 (2020): 68.

Sari, Pipit Buana, and Handriyani Dwilita. “Prospek Financial Technology (Fintech) Di Sumatera Utara Dilihat Dari Sisi Literasi Keuangan, Inklusi Keuangan Dan Kemiskinan.” Kajian Akuntansi 19, no. 1 (2018): 12.

Sitinjak, Daniel Richardo, Emilda Kuspraningrum, and Erna Susanti. “Tanggung Jawab Perdata Debt Collector Dalam Wanprestasi Perjanjian Kerja Waktu Tertentu Pada PT. Sinarmas Multifinance Di Kota Balikpapan.” Beraja Niti 3, no. 2 (2014): 2. http://journal.unpas.ac.id/index.php/litigasi.

Sudharma, Kadek Januarsa Adi, and Ida Bagus Agung Andhika Putra. “Pengaturan Penyelesaian Kredit Macet Pada Pt.Bank Perkreditan Rakyat Balaguna Perasta Kabupaten Klungkung.” Jurnal Analisis Hukum 2, no. April (2019): 24.

Susanti, Dyah Ochtorina, and A’an Efendi. “Penelitian Hukum (Legal Research).” 48. Sinar Grafika, 2014.

Syaifudin, Arief. “Perlindungan Hukum Terhadap Para Pihak Di Dalam Layanan Financial Technology Berbasis Peer to Peer (P2P) Lending (Studi Kasus Di PT. Pasar Dana Pinjaman Jakarta).” Dinamika, Jurnal Ilmiah Ilmu Hukum 26 (2020): 411. http://riset.unisma.ac.id/index.php/jdh/article/view/5485.

Trisna Dewi, Dewa Ayu, and Ni Ketut Supasti Darmawan. “Perlindungan Hukum Bagi Pengguna Pinjaman Online Terkait Bunga Pinjaman Dan Hak-Hak Pribadi Pengguna.” Acta Comitas 6, no. 02 (2021): 261.

Widarto, Joko. “Keabsahan Kontrak Elektronik Berdasarkan Undang-Undang Nomor 11 Tahun 2008 Tentang Informasi Dan Transaksi Elektronik Juncto Kitab Undang-Undang Hukum Perdata.” Lex Jurnalica 18, no. 2 (2021): 180.

Law and Regulations

Undang-Undang Dasar Negara Republik Indonesia Tahun 1945

Staatsblad 1847 Nomor 23 tentang Burgerlijk Wetboek Voor Indonesia (BW) atau Kitab Undang-Undang Hukum Perdata

Undang-Undang Nomor 11 Tahun 2008 tentang Informasi dan Transaksi Elektronik Lembaran Negara Republik Indonesia Nomor 58 Tahun 2008

Undang-Undang Nomor 19 Tahun 2016 tentang Perubahan Undang-Undang Nomor 11 Tahun 2008 tentang Informasi dan Transaksi Elektronik Lembaran Negara Republik Indonesia Tahun 2016 Nomor 251

Peraturan Pemerintah Nomor 82 Tahun 2012 Tentang Penyelenggaraan Sistem dan Transaksi Elektronik

Peraturan Otoritas Jasa Keuangan Nomor 13/POJK.02/2018 Tentang Inovasi Keuangan Digital di Sektor Jasa Keuangan

Peraturan Otoritas Jasa Keuangan Nomor 77/POJK.01/2016 tentang Layanan Pinjam Meminjam Uang Berbasis Teknologi Informasi, Lembaran Negara Republik Indonesia Tahun 2016 Nomor 324

Peraturan Otoritas Jasa Keuangan Nomor 61/POJK/07/2020 tentang Lembaga Alternatif Penyelesaian Sengketa Sektor Jasa Keuangan

Peraturan Bank Indonesia Nomor 19/12/PBI/2017 tentang Penyelenggaraan Teknologi Finansial

522

Discussion and feedback