Does Risk Taking Behavior Drive MSME Innovation During Covid-19 Pandemic?

on

Memarista, Does Risk-Taking Behavior Drive…

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 16 No. 01, Februari (2022), 179-193

Does Risk-Taking Behavior Drive MSME Innovation During Covid-19 Pandemic?

Gesti Memarista1), Olivia Wijaya2), Tiffany Cahyadi3),

Melissa Afandi4),

-

1) Universitas Katolik Widya Mandala Surabaya

-

2) KKP Shinta Wulandari

-

3) PT Sari Warna Asli

-

4) Samator Group

email: gestimema@ukwms.ac.id

SINTA 2

DOI: https://doi.org/10.24843/MATRIK:JMBK.2022.v16.i01.p14

ABSTRACT

The research will examine the effect of risk-taking behavior on Micro, Small, Medium Enterprises (MSMEs) innovation. The risk-taking behavior indicates the business owners make a decision that may be risky for their business, especially for doing some innovations nowadays, in the pandemic Covid-19 era. There will be an appropriate level of required return that compensates the business owner’s risk-taking behavior. This study used 307 MSMEs owners in Indonesia as the research’s respondents. It has been done by distributing the online questionnaires through google forms. In addition, this paper also used several control variables, such as the number of family members involved, generation level, founder-CEO duality, and business capital. The research used binary logistic regression for the analysis technique. The results show that the business owner's risk-taking behavior, number of family members involved, generation level, founder-CEO duality, and business capital significantly influence MSMEs innovation in Indonesia.

Keywords: risk-taking behavior, innovation, micro small medium enterprises

Apakah Risk Taking Behavior Mempengaruhi Inovasi UMKM Selama Pandemi Covid-19?

ABSTRAK

Penelitian ini menguji pengaruh perilaku pengambilan risiko terhadap inovasi Usaha Mikro Kecil Menengah (UMKM). Perilaku pengambilan risiko mengindikasikan bahwa pemilik bisnis mengambil keputusan yang dapat berisiko untuk bisnis, khususnya ketika melakukan beberapa inovasi pada saat terjadi pandemi Covid-19. Tingkat keuntungan yang diharapkan oleh pemilik bisnis akan mengompensasi perilaku pengambilan risiko tersebut. Penelitian ini menggunakan sampel yang terdiri dari 307 pemilik UMKM yang bertempat tinggal di Indonesia sebagai responden. Pengambilan sampel dilakukan dengan menyebarkan kuesioner secara online melalui google forms. Penelitian ini juga menggunakan beberapa variabel kontrol seperti jumlah keterlibatan anggota keluarga dalam bisnis, tingkat generasi yang terlibat, dualitas pemilik-CEO, serta modal usaha. Teknik analisa yang digunakan dalam penelitian yakni menggunakan regresi logistik binary. Hasil penelitian menunjukkan bahwa perilaku pengambilan risiko, jumlah keterlibatan anggota keluarga dalam bisnis, tingkat generasi yang terlibat, dualitas pemilik-CEO, serta modal usaha berpengaruh singnifikan terhadap inovasi UMKM di Indonesia.

Kata kunci: perilaku pengambilan risiko, inovasi, usaha mikro kecil menengah

INTRODUCTION

Micro, Small, and Medium Enterprises (MSMEs) drive the regional economy to support national economic growth. MSMEs play a crucial role by absorbing labor and distributing wealth development for family business owners in Indonesia (Memarista, 2016). MSMEs contributed to the Gross Domestic Product (GDP) value for the last ten years, which has reached more than 61 percent. Micro enterprises dominate the contribution for MSMEs, equal to 98 percent. The labor absorption by MSMEs reached more than 97 percent.

MSMEs are also one of the business units that can face an economic crisis. The number of MSMEs in Indonesia continued to grow after the financial crisis in 1997-1998. It is increased by 57 percent in 2013 since 1998. The economic crisis in 1998 triggered many big corporations not to grow, suffered losses, and even bankruptcy. With this challenging financial condition, 96 percent of MSMEs could demonstrate their ability to survive and even continue to grow. In addition, since the pandemic Covid-19, MSMEs have also tried to grow by joining the online shop or e-commerce, and it is a 56 percent increase among MSMEs in Indonesia (Shimomura UNDP Indonesia Resident Representative, 2020). So, MSMEs have been challenged with adapting to innovation since the pandemic.

The government of Indonesia pays more attention to the growth of MSMEs by providing various facilities and conveniences for MSMEs, hoping that they will continue to grow even in the pandemic Covid-19 situation. One of the facilities and conveniences offered by the government for MSMEs is launching an economic policy package. In this case, the government provides interest subsidy facilities to obtain additional working capital and investment for MSMEs with the People's Business Credit funding program known as KUR, giving fresh money of 2.4 million Rupiah for each selected MSME. In addition, the government also provides various types of training for MSMEs so that they can face multiple existing challenges, such as technical and operational capabilities to achieve innovation, global company standards, access to adequate capital for investment, quality of Human Resources (HR), and changes in business practices. With these various facilities and conveniences, the government hopes that MSMEs continue growing and competing in the international market.

Due to this condition, MSMEs have to grow their business with innovation. The family business owner can make one or several innovations by the product, the production process, the form of organization, and the market. Innovation is needed to distinguish an MSME from other products with a comparative advantage. The existing innovations make MSMEs products have benefits that are not owned and cannot be imitated by competitors. Both are useful for increasing competitiveness in national and international markets. In addition, with good innovation, MSMEs can grow better.

The innovation capability is an essential concept from strategic business theory. Innovation will be used in the business to describe how to manage the venture in making new product processes, services, methods, and organizational approaches to achieve the company’s expected results (Wheelen et al., 2015). Innovation can identify the changes which the business needs to reposition the organization. The Resource-Based View (RBV) theory explained that the business owner is trying to quickly the strategy by making changes to keep up with the external challenge, for example, the pandemic Covid-19. The company has a competitive advantage through the innovation with the use of the company’s resources, so thus it is hoped that the business will have better performance even in difficult times (Saunila et al., 2014).

Innovation itself is influenced by risk-taking behavior. Innovation shows activity with risks and uses many resources. The Resource-Based View theory describes how entrepreneurs can use their unique internal resources to innovate as a business strategy. The uniqueness, creativity, and sensitivity to make a business innovation will bring its own risk impact (Saunila et al., 2014). The courage of a business owner in making decisions to innovate describes the level of risk that will be taken. The innovation has its trial period in the market and needs time to have a break event point. The worst risk is that the invention fails to be applied to the business and may bankrupt the company since most innovation needs a lot of funding.

Even with government support with various facilities and conveniences, the MSME owners still have risk-taking behavior to keep running their business during the pandemic. The risk-taking behavior of family business owners would engage in risky business activities to achieve their goals. If the business owner did not take the risk-taking behavior, their company would find it difficult to progress. It shows that high risk will also give a high return on business investment (Memarista & Puspita, 2021). Especially in this pandemic Covid-19 period, the economic condition is full of uncertainty. The government often enforces restrictions on community activities, known as PPKM, which causes many MSMEs to close more quickly, thus reducing their business return.

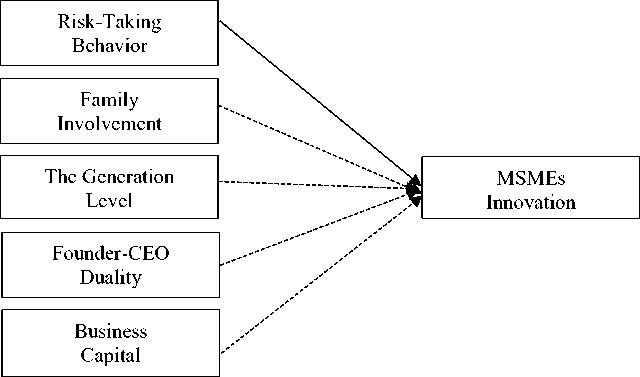

Moreover, various factors, such as family involvement, family descendants or generation level, founders - CEO duality, and business capital, also determine the MSME's innovation. The existence of family involvement and the involvement of family descendants can encourage the creation of inventions for MSMEs (Chua et al., 1999). Because of the design of harmony in growing companies owned and operated by the younger generation, the opportunities for innovation will be even more excellent (Zahra, 2005). Applicability founders-CEO duality leads to harmony between owners and management, thereby reducing the possibility of conflicts of interest (Daily & Dalton, 1997). This reduction will also facilitate risk management because there is alignment. With this alignment, the opportunities for innovation to occur are even higher. However, limited financial capital drives little innovation for MSMEs. If there is support from these factors, then innovation will be easier to implement. Implemented innovations will trigger the growth of MSMEs.

Based on previous research and the phenomenon above, this study wants to examine whether risk-taking behavior, with control variables such as family involvement, generation level, founders-CEO duality, and business capital, has a significant effect on MSMEs innovation in Indonesia. By knowing the impact, this study hoped that MSMEs could grow better by innovating with controlled risk-taking behavior due to good management of business owner behavior factors since the pandemic Covid-19 era.

LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

Business Strategy Theory

According to business strategy theory, innovation is a strategic decision-making process and managerial actions which can determine long-term business performance (Wheelen et al., 2015). The business strategy also includes an analysis of the environment. In the business strat here theory, a middle-range theory called Resource-Based View (RBV) theory explains more about the business’s internal environment for innovation (Wheelen et al., 2015). With the internal resources, the organization improves performance and

outperforms its competitors. The business owners can recognize their competitive advantage and potential market for profit from opportunities, avoid threats and achieve excellent competition sustainably by doing innovation.

The input of business innovation is the resources and competencies. The ResourceBased View (RBV) theory explained that the business could focus on internal resources that connect directly to the product innovativeness (Vaona & Pianta, 2008). The internal environment consists of management, finance, operation, marketing, and research and development (Allen & Sriram, 2000). For example, the leader’s entrepreneurial traits, human capital skills, financial information, internal funding, and the quality of innovation itself. The increasinureaucracy in the intern will reduce innovation because there is an increasing organizational resistance to change, and it takes a long time.

The Concept of Risk and Innovation

Innovation is related to uncertainty and risk. Since there is more competition from the market, higher customer expectations, and technology changing more rapidly, the level of innovation grows more complex, and the outcome becomes less predictable (Keizer et al., 2005). There is unquantifiable uncertainty in the innovation, leading to innovation diffusion. Thus, the business owners have to manage this risk. The entrepreneur conceptualized the risk of innovation in terms of cost under uncertainty. During the innovation process, as the active actor, the business owner has the dynamic capability to learn and accumulate the experience to face the risk.

Entrepreneurship and innovation have their risk role. The business owners have to act with confidence when taking the risks behavior. The precondition for the entrepreneur is uncertainty (Freel, 2005). Since the uncertainty inherent in the entrepreneur in investing the effort, time, and money with an uninsurable return. The innovation may create a temporary profit, yet it can be changed if predictable (Brouwer, 2000). Due to the uncertainty of the economic life fact, the business owner creates opportunities and needs for innovation through risk-taking behavior. Indeed, risk-bearing will be necessary as the prerequisite of being an entrepreneur. Even though innovation may be an obstacle, the business owner is willing to engage and manage its risk, so the entrepreneur is a risk-taker. Innovation will be the entrepreneur's choice if someone is likely to take the risk.

Engaging with risk indicated that the entrepreneur has risk management strategies. It shows an excellent decision-making process that responds to the risk (Bowers & Khorakian, 2014). The business owner will assemble and analyze the information, estimate the risk, and consider the remaining uncertainties by doing those strategies. Eight risks may happen in the business, such as changing technology, regulation or institutional, social or political, market, timing, managerial, legitimacy, and consequences. Entrepreneurs tend to engage in risk management strategies when trying to achieve the company goals and adopt bold actions rather than cautious actions (Wiklund & Shepherd, 2003). It is challenging for companies to grow if they do not want to take risks.

Innovation shows an activity that is affected by risk-taking behavior. The innovation uses many business resources (Li & Atuahene-Gima, 2001). During the innovation process, the business owners have to manage the risk. Companies that dare to take risks tend to be more innovative and produce radical innovations (Das & Joshi, 2007). However, the tendency or dare to take risks usually occurs in large businesses with significant resources and more experienexperience. Business owners are generally more willing to take more risks than someone who works as a professional. The entrepreneur is more likely to have the illusion of 182

control, better knowledge than average, and tends to be overconfident. Entrepreneurs deal with the risk because high risk will gain a higher return for their investment (Memarista & Puspita, 2021). The reason is possibilities faced by entrepreneurs are less structured and more uncertain. The entrepreneur is fully responsible for those decisions (Memarista, 2016). Thus, entrepreneurs are more willing to accept risks in pursuing their opportunities in innovation.

H1: Risk-taking behavior has a significant effect on innovation

Family involvement is the extent to which family members control company ownership and involvement in managing the organization and its structure (Chua et al., 1999). Family involvement will influence the decision to innovate. However, there is an argument that the family’s involvement will make the company less innovative (Zahra, 2005). The reason is that family-run businesses tend to be conservative and afraid of taking risks (Lee, 2006). In a family-owned company, the propensity to take risks is weak. Because of the desire to preserve the company's heritage for future generations, the family members involved have a wealth investment in the company. It is because of the desire to build and maintain a legacy for future generations. This problem makes it difficult for family firms to recruit effectively, reward, and monitor their managers (Williams et al., 2021). One form of family involvement that often occurs is parental altruism, which causes nepotism, thus causing labor recruitment to be unfair. Family members are more common to be recruited and usually monitor the performance of family members is weaker than the workforce from outside the family (Gibb Dyer, 2006). Another consequence is inhibiting the recruitment and promotion of non-family managers (Gedajlovic et al., 2004). The non-family managers are people who can carry out innovation activities (Chen & Hsu, 2009). For this reason, it is necessary to align the interests between the company and the family so that the company will be more daring to take risks to innovate (Chen & Hsu, 2009).

H2: Family involvement has a significant effect on innovation

In a business run by a family, there must be a succession process one day. The younger generation should be involved in the business early to prepare for succession. Innovation in family-owned companies is the younger generation's responsibility (Litz & Kleysen, 2001). Young people need to be appropriately trained and free to innovate to achieve this succession goal, especially for the second generation (Meissner & Kotsemir, 2016). The previous research used a case study approach to explore the conceptualization of intergenerational innovation in family firms and found that innovative experiences and responsibilities in young people are critical to the success of innovation strategies (Litz & Kleysen, 2001).

The innovation idea starts when the business owners sense a new opportunity in their generation. The decision-making processes of the first generation in family firms are more centralized than in later generations, limiting the exchange of innovative ideas. The second or third generation in the family usually tends to be impatient in proving self-worth and independence. Therefore, the second and third generations will be easier to deal with changes such as innovative ideas and better understand the importance of entrepreneurial or innovative behavior to the company's long-term survival.

H3: The generation level has a significant effect on innovation

When a business founder behaves like a CEO, they usually form a unity of command and clarify decision-making authority (Finkelstein & D’aveni, 1994). It is called founder-CEO duality. The existence of duality will eliminate the possibility of information asymmetry between these two roles. When the two positions are separated, there will be a decentralized power and authority, the organization becomes less rigid, and innovation is possible. The existence of the authority they have and the desire to continue to have the position, the MSME owner who doubles as the highest leader (CEO) will try to have high innovation ideas to improve the ability of MSMEs (Zahra, 2005).

H4: Founder-CEO Duality has a significant effect on innovation

Business capital demonstrated the business owner’s ability to obtain financial sources (Memarista, 2016). Large companies with financial resources, various facilities, professional human resources, higher technical knowledge and skills, and economies of scale in raising better capital tend to be more innovative than smaller firms. Business capital will provide the MSMEs with financial support to make some innovations (Zhang et al., 2019). As the business grows, the entrepreneur reports increasing financial risk because of fundraising, accumulated debt, and new investment (Williams et al., 2021). Yet, firstly, the business owner has to evaluate the innovation plan and make a preliminary market testing and financial feasibility analysis. The MSMEs capital can be obtained from owner equity, retained earnings, and longterm debt. Every type of financing for MSME’s business capital has a risk tolerance that impacts the innovation. Especially, external funding has higher risk-taking to make innovation for the business (Wang & Chu, 2019). With limited capital, MSMEs will find it challenging to innovate. More business capital leverages the company's ability to invest in more assets and do more innovation for long-term investment (Williams et al., 2021).

H5: Business capital has a significant effect on innovation.

According to the explanation above about the literature review and hypothesis development, then the following figure 1 will show the theoretical research framework:

Figure 1

Research Theoretical Framework

RESEARCH METHODS

This study used a quantitative approach and primary data. The research data was obtained by distributing online questionnaires to the owners of MSMEs through google form in Indonesia. This study analyzed risk-taking behavior, family involvement, generation level, founder-CEO duality, and business capital on innovation in Indonesian MSMEs. The population of this study is business owners who have total assets from 50 million Rupiah to 10 billion Rupiah following UU no. 20 of 2008 concerning Micro, Small, and Medium Enterprises in Indonesia. The study used purposive technique sampling to reach the research samples that needed family business owner requirements, which are still active in the pandemic Covid-19 era.

Research Variables

Risk-taking behavior (RTB) shows the behavior of MSME owners towards the business risks they take. Three statements measure this variable. The first statement is about the tendency for business owners to be involved in high-risk projects with high-profit opportunities. Second, the business owners are fearless because it is very much needed for the success of MSMEs. Third, the business owners dare to take an aggressive position when the decision is unsafe and with no fear. For example, take the innovation in a complex technology environment without any doubt when the pandemic Covid-19 happened, even though it may change the business model and business organization’s comfort zone. The statement will be measured with 5 Likert scales, from strongly disagree to agree strongly. This study performs an average of the three statements grouped into two categories: high (code 1) and low (code 0) risk-taking behavior. If the respondent’s statement average value lies from 1 to 3, thus the respondent is included in the category of low risk-taking behavior. On the contrary, if it lies in more than three to 5, the respondent is included in the category of low-risk-taking behavior.

Family involvement (FI) indicates the number of nuclear family members currently contributing to holding management positions in the MSME organization. There are five categories, namely none (code 0), one person (code 1), two people (code 2), three people (code 3), and more than three people (code 4).

The generation level (GL) indicates the level of generations who join in the highest management leader of the family business. There are three categories such as first-generation (code 1), second-generation (code 2), third-generation (code3), and more than third-generation (code 4).

Founder-CEO duality (FCD) shows that owners also have a position as the highest management leader in the family business. There are two categories: yes (coded 1) and no (coded 0).

Business Capital (BC) is measured by the statement that sufficient funds can make innovation more accessible. Statements will measure the following variables through a 5 Likert scale rating, namely strongly disagree (1) to strongly agree (5).

MSME innovation (IN) is measured by using dummy variables. The owners have made innovations for their family business such as product, process, organizational, market, or technological innovations in the last two years since pandemic Covid-19. Code (1) is given if there is at least one innovation, and code (0) is shown if there is no innovation.

The analytical model for this research used binary logistic regression. The model can be formulated as follows:

Ln = ‰ + PiRTBi + ⅛f1i + ⅛GLi + ‰FCDi + ^BCi + εi(1)

(1-pt)

pt

Where Ln indicates the dependent variable that is showed the probability of

family business owner i for implementing innovation (IN). At the same time, the independent variable was risk-taking behavior (RTB). Furthermore, the control variables were family involvement (FI); the generation level (GL); founder-CEO duality (FCD); and business capital (BC). β0 was Constanta; β1, β2, β3, β4, β5 were binary logistic regression coefficient; ε was a standard error; i was the family business owner i.

ANALYSIS AND DISCUSSION

There were 307 family business owners as the research respondents. The study distributed online questionnaires by spreading link questionnaires filled out through google forms. Based on the samples data, the dominant demographic characteristics of MSME family business owners in this study are male (52.12 percent), the age of the respondent is more than 40 years (43.32 percent), formal education level up to high school (53.09 percent), married (54.72 percent). Table 1 shows the detail of statistics descriptive from the demographic data from respondents of this study.

Table 1. The Demographic Data of Respondents

|

Demographic Data |

Categorical |

Total |

Percentage |

|

Gender |

Male |

160 |

52.12% |

|

Female |

147 |

47.88% | |

|

Owner’s Age (Years Old) |

17-25 |

72 |

23.45% |

|

More Than 25-40 |

102 |

33.22% | |

|

More Than 40 |

133 |

43.32% | |

|

Education Level |

Less Than High School |

20 |

6.51% |

|

High School |

163 |

53.09% | |

|

Diploma |

13 |

4.23% | |

|

Bachelor Degree |

102 |

33.22% | |

|

Master Degree |

7 |

2.28% | |

|

Doctoral Degree |

2 |

0.65% | |

|

Marital Status |

Single |

132 |

43.00% |

|

Married |

168 |

54.72% | |

|

Divorce |

2 |

0.65% | |

|

Widowed |

5 |

1.63% |

Source: Primary data, processed (2021)

Furthermore, the business characteristics of MSMEs are dominated by old businesses that are more than ten years old established (28.34 percent), sole proprietorship business form (84.04 percent), and selling goods (61.24 percent), grouped as food and beverages sector (36.16 percent). The research samples consisted of 50.16 percent micro-enterprises, 31.60 percent small enterprises, and 18.24 percent medium enterprises. Table 2 shows the statistics descriptive of the business characteristics of MSMEs.

Table 2. The Business Characteristics of MSMEs

|

Business Characteristics |

Categorical |

Total |

Percentage |

|

Business Age |

Less Than Until 6 Months |

50 |

16.29% |

|

More Than 6 Months – 1.5 Years |

66 |

21.50% | |

|

More Than 1.5 Years – 4.5 Years |

60 |

19.54% | |

|

More Than 4.5 Years – 5 Years |

12 |

3.91% | |

|

More Than 5 Years – 10 Years |

32 |

10.42% | |

|

More Than 10 Years |

87 |

28.34% | |

|

Products |

Services |

46 |

14.98% |

|

Goods |

188 |

61.24% | |

|

Goods and Services |

73 |

23,78% | |

|

Type of Business |

Sole Proprietorship |

258 |

84,04% |

|

Partnership |

35 |

11,40% | |

|

Corporation |

14 |

4,56% | |

|

Business Sector |

Food and Beverages |

111 |

36.16% |

|

Fashion |

65 |

21,17% | |

|

Automotive |

26 |

8,47% | |

|

Agribusiness |

70 |

22,80% | |

|

Beauty Product |

35 |

11,40% |

Source: Primary data, processed (2021)

The research variables also had validity tests and reliability tests. The results showed that all variables had a significance value of less than 5 percent by the Pearson Correlation Test. Thus, these research variables have been valid. In addition, the data has been reliable. The value of Cronbach's Alpha was more than 0.6, which is 0.65.

Based on the research data, owners' dominance as the respondents did not innovate their family business during the pandemic Covid-19 (72.31 percent). They had lower risktaking behavior (59.93 percent) and involved only one family member in the business (50.81 percent). The first generation joined the highest management leader of the family business (79.48 percent), and they agree that sufficient funds can make innovation easier to reach and accessible (38.76 percent).

The results showed the value of Nagelkerke R Square of 0.69, which means that the variability of innovation can be explained by the variability of the independent and control variables in this study of 69 percent. In comparison, other factors outside the research model explain the remaining 31 percent. Furthermore, the significance value of Chi-square on the Hosmer and Lemeshow Test (Goodness-of-fit) is 0.92, which is greater than 5 percent. Thus, the research model can predict the value of the observation, or the research model can be accepted because it follows the observed MSMEs data. The research result of the binary logistic regression equation can be shown as follows:

Ln -^- = -29.84 + 0.99 RTBi + 2.22 FIi + 3.26 GLi + 9.91 FCDi + 0.70 BCi + ε..(2)

(1-pi) l l l l i i ∖ ∕

Furthermore, the results showed that the independent variable that is risk-taking behavior (RTB); the control variables such as family involvement (FI); the generation level (GL); founder-CEO duality (FCD); and business capital (BC) have a significant positive effect on MSME innovation. Table 3 below will show the research results of the binary logistics regression.

Tabel 3. Research Result of Variables in the Equation

|

Variable |

B |

S.E. |

Wald |

Sig. |

Exp. |

|

RTB |

0.99 |

0.57 |

2.98 |

0.04** |

2.69 |

|

FI |

2.22 |

0.49 |

20.71 |

0.00*** |

9.25 |

|

GL |

3.26 |

0.71 |

21.00 |

0.00*** |

26.05 |

|

FCD |

9.91 |

4.24 |

4.69 |

0.03** |

9389.16 |

|

BC |

0.70 |

0.35 |

4.06 |

0.04** |

2.02 |

|

Constant |

-29.84 |

6.62 |

20.34 |

0.00*** |

0.00 |

Source: Primary data, processed (2021)

*, **, and *** significant at α = 0.10, 0.05, and 0.01

The risk-taking behavior regression coefficient (RTB) is 0.99, which means that if a business owner has a higher level of risk-taking behavior, they will increase the potential for implementing innovation by 0.99. The RTB significance result is 0.04, smaller than the 0.05 significance level. Thus, it means that RTB has a significant positive effect on the potential for implementing innovation. The chances of respondents who take high risks can carry out innovations of 2.69 times than of respondents who take low risks.

The regression coefficient for family involvement (FI) is 2.22, which means every increase in one family member involved in the business management will increase the potential for implementing innovation by 2.22. The result of the FI significance is 0.00, smaller than the 5 percent significance level. Thus, FI has a significant positive effect on the potential for implementing innovation. The probability of respondents whose families are more involved in the business decision to make innovation by 9.25 times compared to respondents whose families are less engaged in the business.

The regression coefficient for the generation level (GL) is 3.26, which means that the younger generation level involved in the family business will increase the potential for implementing innovation by 3.26. The GL significance result is 0.00, less than the 5 percent significance level. That is, GL has a significant positive effect on the potential for implementing innovation. The younger generation level involved in the business will innovate 26.05 times than respondents who have an older generation level engaged in the business.

The regression coefficient for founder-CEO duality (FCD) is 9.91. If the owner is also in a position as the highest management leader in the family business, it will increase the potential for implementing innovation 9.91. The FCD significance result is 0.03, smaller than the 5 percent significance level. That is, FCD has a significant positive effect on the potential for innovation implementation. The probability of respondents who are CEOs and the highest leaders in the business tend to make some innovations of 9389.16 times compared to respondents who are not CEOs and the highest business leaders.

The regression coefficient of business capital (BC) is 0.70. If the owner has a higher agreement level on the statement that sufficient funds make the innovation easier to reach, thus it will increase the potential for implementing innovation by 0.70. The BC significance result is 0.04, smaller than the 5 percent significance level. That is, BC has a significant positive effect on the potential for innovation implementation. The opportunity for respondents with more business capital cannot create constraints to innovate 2,02 times compared to respondents with capital limitations.

Risk-taking behavior has a significant positive effect on MSME innovation at a significance level of 0.05. Based on this study's data, most respondents have low risk-taking behavior (59.93 percent), so most MSMEs never innovate during the pandemic Covid-19 (72.31 percent). Respondents still have a low propensity to engage in high-risk projects with high-profit opportunities as family business owners. In addition, the respondents still have low confidence in the MSME business environment, which can act fearlessly and try very hard to achieve the success of MSME goals. Furthermore, when respondents face an insecure situation, they tend to take a non-aggressive position and are afraid to maximize business opportunities. Thus, low risk-taking behavior causes the probability that MSME innovation will not be carried out. Table 4 below shows the results of crosstabulation research data regarding risk-taking behavior with innovation.

Table 4 The Crosstabulation Data Between Risk-Taking Behavior with Innovation in Pandemic Covid-19 Situation

|

Risk-Taking Behavior Statements |

Level |

Doing Innovation |

Total | |

|

No |

Yes | |||

|

The tendency for the family |

Low |

176 |

55 |

231 |

|

business owners to be involved in high-risk projects taking behavior with high-profit opportunities |

High |

46 |

30 |

76 |

|

The tendency for the family |

Low |

144 |

45 |

189 |

|

business owner is fearless because it is very much needed for the success of MSMEs. |

High |

78 |

40 |

118 |

|

Family business owners tend |

Low |

149 |

43 |

192 |

|

to take an aggressive position when the decision situation is not safe. |

High |

73 |

41 |

115 |

|

Total |

222 |

85 |

307 | |

Source: Primary data, processed (2021)

The results of this study follow the existing business strategy theory and the concept of risk and innovation. If MSMEs do not dare to take the current risks, MSMEs will tend not to innovate. Other than that, companies that dare to take risks are companies with a large scale with sufficient resources and experience (Rosenbusch et al., 2011). The sample of this research is MSMEs, most of which have micro-scale businesses. The small business scale causes MSMEs not to innovate well because they may not have sufficient resources and experience to innovate.

Family involvement has a significant positive effect on innovation at a significance level of 0.01. Based on this research data, most respondents have at least one family member involved in the MSME business (50.8 percent). The fewer family members involved in the business makes the innovation in the MSME business may not occur. The lack of family involvement shows less energy to work and fewer ideas to think creatively, reducing the owner's motivation to advance the business (Nieto et al., 2015). The family business owner is carried out to meet the needs of the sharing economy so that more family members are

involved in the business. It is hoped that innovation will occur so that the MSME business continues and the family's needs are well met.

Furthermore, the involvement of generations of family descendants has a significant positive effect on innovation at a significance level of 0.01. Most respondents had first-generation involvement in this study when managing MSME businesses (64.3 percent). The more generations who follow the business will explore the concept of intergenerational innovation ideas in family businesses (Litz & Kleysen, 2001). The first generation is, known as the black box model, shows the innovation itself is somehow not too important (Meissner & Kotsemir, 2016). In addition, the study results show that most MSMEs have at least a first generation of involvement in managing the business and tend to make decisions centrally. If there is a high involvement of generations of family descendants in a business, then the younger generation can encourage innovation because they have a more open mind. The second generation is the linear model that will open the way for innovation for their business by using a step-by-step process, for example, using technology for the business activities, since the MSME’s environment is changing (Meissner & Kotsemir, 2016).

Founder-CEO duality has a significant positive effect on innovation at a significance level of 0.05. Most research respondents are business owners and have the highest position in running the MSME business as the CEO (88.6 percent). This study shows that the respondents had a unity of command as the founder and the CEO. When the two positions are not separated, the existence of authority will make more innovative ideas (Daily & Dalton, 1997). Furthermore, most business owners in this research have led the MSME business for the last 1-5 years with founder-CEO positions (29.2 percent).

Business capital has a significant positive effect on innovation at a significance level of 0.05. The results of this study are consistent with several previous studies that higher business capital leads to more innovation development. Most respondents used 100 percent of their funds to start a business (56.2 percent). Until today, they are still 100 percent funded their business for daily operations in 2021 for this pandemic Covid-19 era (69.7 percent). The higher the limited capital for doing business, the innovation will not occur because there are no funds used to innovate (Zhang et al., 2019). Limited money causes limited financial resources, facility development, and the development of knowledge and technical management of the business owner, thus limiting innovation.

CONCLUSIONS, LIMITATIONS, AND RECOMMENDATIONS

MSMEs are one of the factors driving the country's economy, so the government pays more attention to MSMEs for development. The government must make MSME owners build their businesses through innovation. If MSMEs were trying to innovate, it indicated that the business is growing due to success motivation. Therefore, this study will analyze the factors that can influence MSME owners to innovate and the effect of innovation on MSME growth.

Several factors drove MSMEs innovation decisions (Fernández & Nieto, 2006). It can be characteristics within the MSME owners (Nieto et al., 2015), such as risk-taking behavior (Rosenbusch et al., 2011). Furthermore, innovation can be influenced by family involvement (Chua et al., 1999), involvement of family descendants or generation level (Litz & Kleysen, 2001), owner-CEO of duality (Zahra, 2005), as well as the business capital.

The results showed that risk-taking behavior, family involvement, generations level, founder-CEO duality, and business capital significantly affect innovation. By knowing those 190

influences, it is hoped that many parties can take advantage of the results of this study by looking at the condition of MSMEs in Indonesia, especially in the pandemic Covid-19 era. MSMEs are expected to develop further and manage their internal factors so that MSMEs can grow and develop even better. Banks can also take advantage of research results for financial products suitable for MSMEs since pandemic Covid-19 because most business owners in this research still used 100 percent of private funding. Meanwhile, the government can find out the condition of existing MSMEs to find out the problems MSMEs face to develop and compete in the international market. If MSMEs can grow and develop, the Indonesian economy can get better, especially for the wealth of family business owners.

This research still faces several shortcomings: the research sample is relatively small, with 307 respondents only, and the distribution is only around the big cities in Indonesia. So, future research, is expected to use more samples and spread evenly throughout more small towns in Indonesia. More and more evenly distributed results will give more varied results in various aspects, such as the number of assets, economic capacity, types of work, and culture. The more varied the research results, the more accurate the research can raise the phenomenon. In addition, this study only uses five variables to determine the MSME's innovation, and the 31 percent research model may explain with other variables. Thus, in the reality of MSME life, many other factors influence the decision of MSMEs to innovate.

REFERENCES

Allen, R. H., & Sriram, R. D. (2000). The Role of Standards in Innovation. Technological Forecasting and Social Change, 64(2–3), 171–181. https://doi.org/10.1016/S0040-

1625(99)00104-3

Bowers, J., & Khorakian, A. (2014). Integrating risk management in the innovation project. European Journal of Innovation Management, 17(1), 25–40.

https://doi.org/10.1108/EJIM-01-2013-0010

Brouwer, M. (2000). Entrepreneurship and uncertainty: Innovation and competition among the many. Small Business Economics, 15(2), 149–160.

https://doi.org/10.1023/A:1008147829791

Chen, H. L., & Hsu, W. T. (2009). Family ownership, board independence, and R&D investment. Family Business Review, 22(4), 347–362.

https://doi.org/10.1177/0894486509341062

Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the Family Business by Behavior. Entrepreneurship Theory and Practice, 23(4), 19–39.

https://doi.org/10.1177/104225879902300402

Daily, C. M., & Dalton, D. R. (1997). CEO and board chair roles held jointly or separately: Much ado about nothing? Academy of Management Executive, 11(3), 11–20.

https://doi.org/10.5465/ame.1997.9709231660

Das, S. R., & Joshi, M. P. (2007). Process innovativeness in technology services organizations: Roles of differentiation strategy, operational autonomy and risk-taking propensity. Journal of Operations Management, 25(3), 643–660.

https://doi.org/10.1016/j.jom.2006.05.011

Fernández, Z., & Nieto, M. J. (2006). Impact of ownership on the international involvement of SMEs. Journal of International Business Studies, 37(3), 340–351.

https://doi.org/10.1057/palgrave.jibs.8400196

Finkelstein, S., & D’aveni, R. A. (1994). CEO Duality as a Double-Edged Sword: How Boards of Directors Balance Entrenchment Avoidance and Unity of Command. Academy of Management Journal, 37(5), 1079–1108. https://doi.org/10.5465/256667

Freel, M. S. (2005). Perceived Environmental Uncertainty and Innovation in Small Firms. Small Business Economics, 25(1), 49–64. https://doi.org/10.1007/s11187-005-4257-9

Gedajlovic, E., Lubatkin, M. H., & Schulze, W. S. (2004). Crossing the threshold from founder management to professional management: A governance perspective. Journal of Management Studies, 41(5), 899–912. https://doi.org/10.1111/j.1467-6486.2004.00459.x

Gibb Dyer, W. (2006). Examining the “Family Effect” on Firm Performance. Family Business Review, 19(4), 253–273. https://doi.org/10.1111/j.1741-6248.2006.00074.x

Keizer, J. A., Vos, J.-P., & Halman, J. I. M. (2005). Risks in new product development: devising a reference tool. R and D Management, 35(3), 297–309.

https://doi.org/10.1111/j.1467-9310.2005.00391.x

Lee, J. (2006). Family firm performance: Further evidence. Family Business Review, 19(2), 103–114. https://doi.org/10.1111/j.1741-6248.2006.00060.x

Li, H., & Atuahene-Gima, K. (2001). Product Innovation Strategy And The Performance Of New Technology Ventures In China. Academy of Management Journal, 44(6), 1123– 1134. https://doi.org/10.2307/3069392

Litz, R. A., & Kleysen, R. F. (2001). Your Old Men Shall Dream Dreams, Your Young Men Shall See Visions: Toward a Theory of Family Firm Innovation with Help from the Brubeck Family. Family Business Review, 14(4), 335–351.

https://doi.org/10.1111/j.1741-6248.2001.00335.x

Meissner, D., & Kotsemir, M. (2016). Conceptualizing the innovation process towards the ‘active innovation paradigm’—trends and outlook. Journal of Innovation and Entrepreneurship, 5(1), 1–18. https://doi.org/10.1186/s13731-016-0042-z

Memarista, G. (2016). Measuring the Entrepreneur’S Financial Knowledge: Evidence From Small Medium Enterprises in Surabaya. Jurnal Manajemen Dan Kewirausahaan, 18(02), 132–144. https://doi.org/10.9744/jmk.18.2.132–144

Memarista, G., & Puspita, A. M. A. (2021). Young Investors’ Instagram Usage Behavior and Investment Risk Appetite. Management Research and Behavior Journal, 1(1), 15–25. https://doi.org/10.29103/mrbj.v1i1.3849

Nieto, M. J., Santamaria, L., & Fernandez, Z. (2015). Understanding the Innovation Behavior of Family Firms. Journal of Small Business Management, 53(2), 382–399.

https://doi.org/10.1111/jsbm.12075

Rosenbusch, N., Brinckmann, J., & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26(4), 441–457. https://doi.org/10.1016/j.jbusvent.2009.12.002

Saunila, M., Ukko, J., & Rantanen, H. (2014). Does Innovation Capability Really Matter for the Profitability of SMEs? Knowledge and Process Management, 21(2), 134–142. https://doi.org/10.1002/kpm.1442

Shimomura UNDP Indonesia Resident Representative. (2020). Impact of Pandemic on MSMEs in Indonesia.

Vaona, A., & Pianta, M. (2008). Firm Size and Innovation in European Manufacturing. Small Business Economics, 30(3), 283–299. https://doi.org/10.1007/s11187-006-9043-9

Wang, X., & Chu, X. (2019). External financing and enterprises’ green technology innovation: A study based on the threshold model of firm size. Xitong Gongcheng Lilun Yu Shijian/System Engineering Theory and Practice, 39(8), 2027–2037.

https://doi.org/10.12011/1000-6788-2018-1350-11

Wheelen, T. L., Hunger, J. D., Hoffman, A. N., & Bamford, C. D. (2015). Strategic Management and Business Policy: Globalization, Innovation and Sustainability (15th ed.). Pearson.

Wiklund, J., & Shepherd, D. (2003). Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strategic Management Journal, 24(13), 1307–1314. https://doi.org/10.1002/smj.360

Williams, A. M., Rodríguez Sánchez, I., & Škokić, V. (2021). Innovation, Risk, and Uncertainty: A Study of Tourism Entrepreneurs. Journal of Travel Research, 60(2), 293– 311. https://doi.org/10.1177/0047287519896012

Zahra, S. A. (2005). Entrepreneurial Risk Taking in Family Firms. Family Business Review, 18(1), 23–40. https://doi.org/10.1111/j.1741-6248.2005.00028.x

Zhang, L., Zhang, S., & Guo, Y. (2019). The effects of equity financing and debt financing on technological innovation: Evidence from developed countries. Baltic Journal of Management, 14(4), 698–715. https://doi.org/10.1108/BJM-01-2019-0011

193

Discussion and feedback