The Effect of Trust and Related Party Transaction on Firm Value

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 2, July 2022

AFFILIATION:

1,2,3Department of Accounting, Faculty of Economic and Business, Syiah Kuala University, Aceh, Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2022.v17.i02.p10

CITATION:

Ramadhani, R., Diantimala, Y. & Afan, M. (2022). The Effect of Trust and Related Party Transaction on Firm Value. Jurnal Ilmiah Akuntansi dan Bisnis, 17(2), 333-344.

ARTICLE HISTORY Received:

30 April 2022

Revised:

14 June 2022

Accepted:

7 July 2022

The Effect of Trust and Related Party Transaction on Firm Value

Raihan Ramadhani1, Yossi Diantimala2*, Muhammad Arfan3

Abstract

This study examines the effect of trust and related party transactions on firm value. The total observation in this study is 185 banking companies listed on the Indonesia Stock Exchange for the 2016-2020 period. Multivariate analysis is employed to test the hypothesis. The results illustrate that the trust and related party transactions have a positive and significant effect on firm value. This implies that the disclosure of the word 'trust' in the management discussion and analysis report (MD&A) reflects that the company's ethical culture and good management responsibility in managing the business convince investors to invest. The increase in debt-related party transactions shows that it is easier for the companies to receive funding to finance the company's operational activities and increase investment rather than making loans with the third parties which seems to be complicated to approach.

Keywords: trust, related party transactions, firm value, MD&A

Introduction

High stock prices encourage an increase in company value and reflect increased market confidence not only in the company's performance but also in the company's future prospects (Damayanti, 2019). During the 2016-2018 period, the share performance of the banking sector in Indonesia continued to experience a sharp decline (Cnnindonesia, 2018) and remains decrease until 2021. The performance of the banking sector shares is likely below other sectors (Cnbcindonesia, 2021). This phenomenon of falling stock prices in the banking sector illustrates a decrease in the level of investor confidence in the banking sector since the stock price variability is an important aspect investors need to consider before investing in the stock market (Audi, Loughran, & Mcdonald, 2016).

Trust is one of the factors that cause an increase in firm value (Cao et al., 2016; Audi et al., 2016; Qiu et al., 2019). Companies with a high level of trust tend to experience a higher share value and low information asymmetry (Qiu et al., 2019). A work environment with a high level of trust makes investors more audacious to invest as it encourages them to expect for high returns. Some previous studies examined the relationship between trust and performance based on a subjective point of view (employees or certain parties) using primary data with a limited sample

(De Jong & Elfring, 2010; Goergenet al., 2013). Nevertheless, there has not been a test of confidence in the overall firm level of firm value before, only Audi et al. (2016), who has developed a computational linguistic measure of the word 'trust'.

The research of Xu et al. (2019) has validated the measurement of a set of trust words which was developed by Audi et al. (2016) by testing the effect of trust on financial performance. However, this study does not examine the effect of trust on firm performance but rather focuses on its effect on firm value. The argument that underlies this research is not to test the effect of trust on company performance since the financial performance can be influenced by changes in financial regulations, such as the implementation of IFRS (Abdullah & Tursoy, 2019). Audi et al. (2016) also found that the word ‘trust’ was written mostly by company managers in the Management Disclosure and Analysis (MD&A) report.

An MD&A report is a report made by management for external parties that reviews fairly complex information, such as operations, finance, accounting, financial performance reports, marketing, business directions, and business risks. Based on the 2019 Annual Report Award (ARA), among the eight items disclosed in the annual report, the MD&A report is the second–highest position (22%) in which it has received significant attention from investors. The finding by Audi et al. (2016) revealed that the tobacco, alcohol, and gambling industries do not disclose the set of confidence measures they developed in the MD&A report. Their findings confirm that the use of the words of trust expressed in the MD&A report is not merely a figurative word. However, it reflects the burden of legal responsibility as well as ethical culture.

In addition to trust, related party transaction (RPT) becomes one of the consequences of the decline in firm value (Wong & Kim, 2015; Bona-sánchez et al., 2016; Elkelish, 2017; Tambunan et al., 2017; Hendratama & Barokah, 2020). A related party transaction (RPT) is a transaction between a company and individuals or organizations related to the company, such as managers, boards of directors, directors, major shareholders, and affiliates (Shin, Sohn, & Park, 2019). In relation to this, there are two conflicting views regarding RPT. First, in terms of benefits, RPT can reduce transaction costs and increase firm value (Chen et al., 2012), shorten the negotiation process (Jian & Wong T. J., 2010), and increase financial profitability (Carlo, 2014; Al-Dhamari et al., 2017). However, from the second point of view, RPT can be identified as a transaction that seems to be worrying to detrimental for the minority shareholders. This is because the related parties of a highly concentrated firm (such as managers, directors, and controlling owners have better access to the information) are in a better bargaining position than outsiders, such as non-controlling (minority) shareholders and creditors of the firm (Hendratama & Barokah, 2020).

The results of previous studies related to the effect of RPT on firm value are still not consistent. Diab & Aboud (2019) showed that RPT does not affect firm value. Kuan at al. (2010) and Pozzoli et al. (2014) also reported the same result that RPT does not cause the firm value to fluctuate. In contrast to the three studies, Bona-sánchez et al. (2016) found that RPT is negatively related to firm value. This negative relationship illustrates that high RPT reduces firm value. However, the results of Bona-sánchez et al. (2016) were opposed by Hendratama & Barokah (2020). Hendratama & Barokah (2020) demonstrated that not all RPT disclosures are negatively related to firm value. They found that debt disclosure from related parties was positively related to firm value. The market considers

loans or cash assistance provided by related parties to companies as profitable activities, and companies are obliged to disclose them to the public.

This study aims to examine the effect of trust and related party transactions on the firm value of banking companies on the Indonesia Stock Exchange. This study was motivated by the interest of researchers to examine the effect of trust on firm value using the trust measurement developed by Audi et al. (2016). Based on our observations using the Publish and Perish literature search engine, research examining the effect of the relationship between these two variables in developing countries using secondary data has not been available yet. Therefore, this research aims to fill in the gaps by using secondary data measurements.

Qiu et al. (2019) stated that companies with a high level of trust tend to experience an increase in share value and low information asymmetry. The statement describes a work environment with a high level of trust that tends to make investors eager to invest due to the level of trust maintained by each other. They also perceive a high level of motivation in company management to adopt a reciprocal strategy so that there is a possibility of higher profits in transactions. Therefore, it can be stated that trust affects firm value.

Signalling theory is used to relate the effect of the trust relationship to firm value. A large number of disclosures of trustworthiness in the MD&A report is perceived as good news for investors because it reflects the company's ethical culture and good management responsibility in managing the business. The high disclosure of the word 'trust' can increase investors' confidence in the company, so this indicates that there is an increase in the value of MVA as a proxy for company value. In addition to signalling theory, stewardship theory is also associated to describe the relationship between these three hypotheses. This theory explains that managers tend to act in the interests of the company to reduce the potential conflicts with the agency (Obermann et al., 2020). Based on the findings of previous studies, Guay et al., (2016) stated that complex companies are more informative by disclosing voluntary reports aimed at reducing information asymmetry between agents and principals. One of them is by publishing an MD&A report. The number of disclosures of trustworthiness in MD&A becomes the basis for investors' assessment of the company's culture and disclosure of words of trust to help investors determine the ethical character of the company and its approach in producing goods and services.

H1: Trust has a positive effect on firm value.

Related Party Transactions (RPT) in this study focuses on the type of RPT debt that mostly occurs in Indonesian Banking. It is also based on the results of previous studies, which are still inconsistencies in research results related to its effect on firm value. Wang & Lu. (2019) stated that loans to related parties are preferred to fund operating and financing activities of companies in developing countries due to relatively difficult contracts if they make loans with outside parties. This idea illustrates that related party debt transactions are viewed positively by investors because it is easier for the companies to obtain funding through debt. The positive influence in the relationship between related party transactions and firm value is supported by Hendratama & Barokah (2020).

In this study, the RPT payables on firm value use signalling theory. Disclosure of the RPT of payables can be considered as a signalling issued by the company's management to the public. Disclosure of RPT is a means for reducing information

Figure 1. Theoretical Framework

asymmetry between management and external parties of the company. This is because RPT is a transaction carried out by the company with a concentrated company insider, which results in accessing better information. Thus, investors tend to respond to the disclosure, which is reflected in the increase or decrease in the value of the company as measured by the market value of asset (MVA).

H2: Related party payables have a positive effect on firm value.

The theoretical framework of this research is presented in Figure 1. Trust and related party transactions are expected to maximize firm value.

Research Method

This study used a quantitative method. The population of this study was all banking sector companies listed on the Indonesia Stock Exchange (IDX) in the 2016-2020 period. The sample selection in this study employed a purposive sampling technique based on the criteria of (1) banking sector companies listed on the IDX during 2016-2020; (2) the company issues an annual report containing audited financial statements as of December 31, 2016-2020 and MD&A reports; (3) the company publishes the required information during the 2016-2020 period. The number of samples in this study was 37 companies. The next stage is to test the research hypothesis using 185 observational data. The results of hypothesis testing answer the research problem formulation.

This study used 3 variables: the dependent variable, the independent variable, and the control variable. Firm value is the dependent variable measured using the market value of assets (MVA). MVA is a market-based company performance measure (Perryman et al., 2015; Singh et al., 2017). Thenmozhi & Sasidharan (2020) stated that the MVA proxy makes it easy to assess a company's market strength which is a forward-looking indicator that reflects the company's current plans and future strategies. MVA ratio formula to calculate firm value:

MK4 = MVE+TD TA

......................................................................................................(01)

Where, MVE is the market value of equity; TD is total debt, and TA is total assets.

Trust is the first independent variable in this study. Trust was measured using the synonym term "trust" found in the MD&A report. This study uses 21 trust words developed by Audi et al. (2016), namely ‘accountability’, ‘character’, ‘ethic’, ‘ethical’, ‘ethically’, ‘fairness’; ‘honest’, ‘honesty’, ‘integrity’, ‘respect’, ‘respected’, ‘respectful’, ‘responsible’, ‘responsibility’, ‘responsibilities’, ‘transparency’, ‘trust’, ‘trusted’, ‘truth’, ‘virtue’, and ‘virtues’. These terms were then counted as occurrences of each word in the MD&A report and referred to as the frequency of trust.

To avoid providing a high weight since it uses the frequency of the word ‘trust’, this study utilized a measurement of the range (trust range) as suggested by previous studies, i.e., Loughran & Mcdonald, (2014) and Audi et al. (2016), to measure the word ‘trust’. Calculation using the confidence range is not a simple approach as it needs to

ignore some repetitions of the same word. To understand the difference between confidence frequency and confidence range, see the following illustration. For example, in the MD&A report of company A, the word 'accountability' occurs five times, the word 'responsibility' once, and there is no other word for trust. The measure of the frequency of trust in this report is 6 (5 words of “accountability” + 1 word of “responsibility”), while the confidence range is only 2 (“accountability” and “responsibility”).

To find the value of trust in the MD&A report, the company's annual report file is downloaded first in PDF format. After retrieving the file, the MD&A report section is converted into plain text format using the Foxit Phantom PDF tool. In the conversion process, the text file is cleaned so that it can be read by the trust word counting software, and text in non-paragraph forms, such as tables, is removed. The process of calculating the confidence word is carried out with Python’s version 3.9.5, which is a language programming software.

Related party transactions (RPT) are the second independent variable in this study. RPT was measured using the same measurement as employed by Downs et al. (2015); Wong & Kim. (2015), and Hendratama & Barokah (2020). In their research, RPT is obtained by distributing the total transaction payable to related parties with total assets.

The control variables in this study include firm age and profitability. The Firm age variable is proxied by age which is calculated using the natural logarithm of the company's registration on the stock exchange (Wong & Kim, 2015; Hendratama & Barokah, 2020). The profitability variable is proxied by return on assets (ROA) (Wong & Kim, 2015; Diab & Aboud, 2019) measured by the ratio of net income scaled by total assets.

To test the hypothesis, researchers used a panel regression analysis to examine the effect of trust and related party transactions on firm value. The following is the regression equation used in this study.

MVAjt = αθ + βιTstjt + β2RPTjt + β3^5εit + β4ROAit + εi......................................(2)

Where, MVA = Firm Value as measured by market value of assets; Tst = Trust; RPT = Related Party Transaction; Age = Firm Age; ROA = Profitability; and ε = Error Term.

Result and Discussion

Variable analysis in this study began with descriptive analysis. Descriptive analysis describes the characteristics of the observed variables. The results of the descriptive statistical analysis are presented in Table 1.

Table 1. presents descriptive statistics for all variables used in this study. A total of 185 observations were reviewed from 2016 to 2020 to test the hypothesis. The average firm value for the MVA measurement is 1.23. This average value reflects that most of the banking companies listed on the IDX are companies that have a market value above their book value. The average trust value is 3.28, which means that the overall company

Table 1. Descriptive Statistical Results

|

Variables |

Min. |

Max. |

Mean |

Std. Dev. |

|

MVA |

0.12 |

3.28 |

1.23 |

0.52 |

|

Tst |

0.00 |

9.00 |

3.28 |

2.18 |

|

RPT |

0.00 |

0.47 |

0.08 |

0.09 |

|

Age |

0.00 |

38.00 |

15.05 |

8.94 |

|

ROA |

-0.11 |

0.29 |

0.02 |

0.05 |

Source: Processed Data, 2022

Table 2. Classical Assumption Test Results

|

Tolerance |

VIF |

Durbin- Watson | |

|

Multicolinearity | |||

|

Tst |

0.76 |

1.32 | |

|

RPT |

0.73 |

1.38 | |

|

Age |

0.86 |

1.16 | |

|

ROA |

0.97 |

1.03 | |

|

Non-Autocorrelation |

1.90 |

Source: Processed Data, 2022

sampled in this study expresses the words of trust in MD&A as many as 3 (rounded results from 3.28) up to 21 types of terms of trust. The average value of the related party payables in banks listed on the IDX shows a range of 0.09. These results indicate that the companies studied in this study owe 0.09 or 9% of the company's total assets to related parties. The age of the company has an average value of 8.94, meaning that the sample companies in this study have been on the Indonesia Stock Exchange (IDX) for nine years (rounded off from 8.94). Profitability has an average value of 0.02 or 2%. This figure broadly describes the overall ability of the companies observed in this study to be able to generate a profit of 2% of their total assets.

This study performs a classical assumption test to prove that the research model is free from bias. The stages included in this test consist of normality test, multicollinearity test, and autocorrelation test. The results of the classical assumption test are shown in Table 2. which contain multicollinearity test and autocorrelation test.

Based on Table 2. the results of the multicollinearity test for all variables in this study (independent and control variables) show a Variance Inflation Factors (VIF) value of less than 10 and a greater tolerance value of 0.1. Thus, it can be stated that the multiple linear regression equation in this study does not occur multicollinearity. Table 2. shows the Durbin-Watson (dw) value of 1.90. The test to assess if there is no autocorrelation in this study uses the du<dw<4-du equation. The value of du is 1.80 (for 185 firms with four

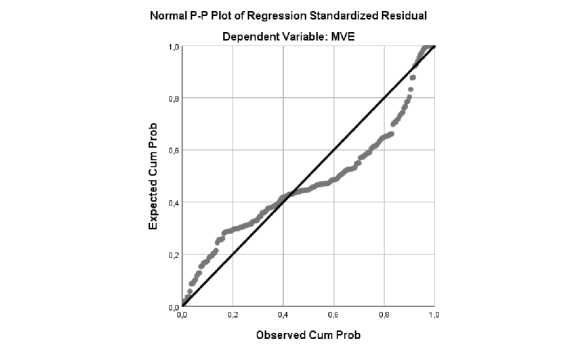

Figure 2. Normality Test

Table 3. Pearson Correlation Test Results

|

Correlation | |||||

|

MVA |

TST |

RPT |

AGE |

ROA | |

|

MVA Correlation |

1.00 | ||||

|

Sig. (2-tailed) | |||||

|

TST Correlation |

**0.37 |

1.00 | |||

|

Sig. (2-tailed) |

0.00 | ||||

|

RPT Correlation |

**0.48 |

**0.40 |

1.00 | ||

|

Sig. (2-tailed) |

0.00 |

0.00 | |||

|

AGE Correlation |

-0.129 |

*0.16 |

**-0.24 |

1.00 | |

|

Sig. (2-tailed) |

0.08 |

0.03 |

0.00 | ||

|

ROA Correlation |

0.06 |

0.06 |

-0.12 |

0.03 |

1.00 |

|

Sig. (2-tailed) |

0.41 |

0.44 |

0.09 |

0.73 | |

|

Notes: ** significant at 0.01 level; |

* significant at the 0. |

05 level. N |

185 | ||

Source: Processed Data, 2022

independent variables). If the value of dw is compared with the value of du and the value of 4-du, then the value of dw is greater than the value of du (1.90 > 1.80) and dw is smaller than 4-du (1.90 < 2.20) such that the equation becomes (du) = 1.80 < (dw) = 1.90 < (4-du) = 2.20. Since the obtained value is in accordance with the requirements for no autocorrelation, one would conclude that the regression equation formed is free from autocorrelation.

This study also conducted a normality test to determine whether the residual regression model is normally distributed or not. If the test results indicate that the data is normally distributed, then the research data can be used to test the hypothesis model. The normality test in this study was carried out using a scatter plot. The results of the normality test are depicted in Figure 2.

Based on Figure 2. the points contained in the normal probability plot are spread around the diagonal line. These results interpret that the research data has been normally distributed.

Table 3. illustrates the correlation matrix between variables using Pearson's correlation. The test results demonstrate that almost all variables are significantly correlated at 1% (denoted by **) and few are correlated at 5% (denoted by *). Only a few variables have a significant correlation with other variables (correlation symbol * or **). Thus, no potential problems influence the results of this study.

Based on Table 3. the findings point out that the relationship between the trust variable and firm value has a significant level of 0.00, less than 0.05 or 0.01, which implies that the two variables have a correlation. Related party transactions have a correlation with firm value, indicated by a significance value of 0.00, which is less than 0.05 or 0.01. While the two control variables–company age and profitability–have no correlation in this study as the significance value exceeds 0.05.

Table 4. presents that the t-value of the confidence variable is 2.05 with a significance value of 0.04. The significance value of the confidence variable is less than 0.05 (0.04 < 0.05). The value of the coefficient of the effect of trust on firm value is 0.05, which is positive. It means that the results of this study support hypothesis 1, which states that trust has a positive effect on firm value. Referring to Table 4. the empirical test results reveal that related party payables have an effect on firm value. It is evident from the t value of 2.71 with a significance value smaller than 0.05 (0.00 < 0.05). It implies that the

Table 4. Trust, Related-Party Transaction, and Firm Value

|

Variables |

Stat. Indic. | |||

|

Market Value of Asset | ||||

|

Coeff |

Std. Error |

T-statistic |

P value | |

|

TST |

0.05 |

0.03 |

2.05 |

0.04* |

|

RPT |

2.04 |

0.75 |

2.71 |

0.00* |

|

AGE |

-0.00 |

0.00 |

-0.44 |

0.66 |

|

ROA |

0.58 |

0.54 |

1.07 |

0.29 |

|

C |

0.91 |

0.09 |

10.35 |

0 |

|

R-squared |

0.44 | |||

|

Adjusted R-squared |

0.26 | |||

|

F-statistic |

2.49 | |||

|

P value |

0.00 | |||

|

Durbin-Watson |

2.05 | |||

Source: Processed Data, 2022

results of this study confirm hypothesis 2, namely related party payables have a positive influence on firm value.

Furthermore, the findings suggest that the age of the company has no effect on the value of the company. It is indicated by the t-value of -0.44 with a significance level of 0.66 which exceeds 0.05 (0.66 > 0.05) and the regression coefficient value of this variable is 0.00. The results also report that there is no effect of profitability on firm value. It is demonstrated by the t-value of 1.07 with a significance value of less than 0.29 (0.29 < 0.05) with the regression coefficient value of 0.58 for the effect of profitability on firm value.

The results of hypothesis testing indicate that trust has a positive effect on firm value. This result suggests that the higher the trust, the higher the firm value. Therefore, one of the efforts that can be made to increase the value of the company is improving investor confidence. Sousa-lima et al. (2013) express that building trust in organizations is a key component for developing fairness relationships because of the discretionary nature of the reciprocal process. The statement describes a work environment with a high level of trust; investors are more daring to invest because trust is already established in both parties and they recognize a high level of motivation in company management to adopt a reciprocal strategy that leads to a possibility of higher profits in transactions. Therefore, it can be concluded that trust has a positive effect on firm value.

Moreover, the results of this study support the signalling theory which explains that investors react positively to information related to the disclosure of trustworthiness in MD&A reports published by companies. It pinpoints those numerous disclosures of the word trust in the MD&A report are perceived as good news for investors because they reflect the company's ethical culture and good management responsibility in managing the business. Hence, the high disclosure of the word trust can increase investor confidence in the company to invest. Thus, it indicates that there is an increase in the value of MVA as a proxy for company value.

In addition to signalling theory, stewardship theory is also aligned with these findings. Stewardship theory contrasts with agency theory, where agency theory assumes a conflict of interest between managers and agents to benefit themselves. This theory describes that managers will act in the interests of the company, thereby reducing the potential for agency conflicts (Obermann et al., 2020). Managers will make voluntary

disclosures more informative about their responsibilities in managing the company. One of them is by publishing an MD&A report. The number of disclosures of trustworthiness in MD&A becomes the basis for investors' assessment of the company's culture, and disclosure of words of trust can help investors to determine the ethical character of the company and its approach to producing goods and services.

The results of this study confirm the results of previous studies (i.e., Audi et al., 2016; Qiu et al., 2019). Qiu et al. (2019) state that the positive effect of trust on firm value indicates that companies with a high level of social trust tend not to be involved in conflicts of interest thus, this makes investors confident to invest. The results of this study also verify hypothesis 2, namely related party payables have a positive influence on the firm value. This finding can be explained that the higher the related party payables, the higher the firm value. For that reason, one of the efforts that can be made to increase the value of the company is escalating the related party payables. This finding is relevant to signalling theory, which means that the market responds to a firm's RPT that increases its value. Disclosure of RPT means to reduce information asymmetry between management and external parties of the company. This is because RPT is a transaction carried out by the company with a very concentrated company insider, which results in them being able to access better information. Thus, investors will respond to the disclosure, which is reflected in the increase or decrease in the value of the company as measured by the Market Value of Assets (MVA). The market views that the existence of an RPT debt will provide stable future cash flows. It is likely caused by investors' assessment of increasing the amount of RPT debt as an effective activity for companies to obtain funding, especially in developing countries where contracts to be executed with third parties are highly complicated (Wang & Lu, 2019). This result is in line with the findings of Cheung et al., (2006) and Hendratama & Barokah (2020), which reveal that related-party debt is pleasing to the eye of the market. Therefore, related parties tend to have the effect of increasing firm value.

Conclusion

This study aims to examine the effect of trust and related party transactions on the firm value. This study was motivated by the interest of researchers to examine the effect of trust on firm value using the trust measurement developed by Audi et al. (2016). Based on our observations using the Publish and Perish literature search engine, research examining the effect of the relationship between these two variables in developing countries using secondary data has not been available yet. Therefore, this research aims to fill in the gaps by using secondary data measurements.

This study is the first study in a developing country that measures corporate trust using secondary data. This study found a significant effect between trust and firm value. Furthermore, this study has answered questions related to whether RPT can reduce or increase firm value. The empirical results of this study indicate that related party payables can significantly increase the value of banking firms in Indonesia. It means that the market views the number of such transactions as not opportunistic and efficient in obtaining cash.

Moreover, this study has several limitations that we leave room for future research to address. First, this research was only conducted on banking companies listed on the Indonesia Stock Exchange with predetermined criteria. Thus, it allows for different results and conclusions when compared with research results in other sectors and countries.

References

Abdullah, H., & Tursoy, T. (2019). Capital structure and firm performance : evidence of Germany under IFRS adoption. Review of Managerial Science, 15(0123456789), 379–398. https://doi.org/10.1007/s11846-019-00344-5

Al-Dhamari, R. A., Al-Gamrh, B., Ismail, K. N. I., & Ismail, S. S. H. (2017). Related party transactions and audit fees : the role of the internal audit function. Journal of Management & Governance, 22(1), 187–212. https://doi.org/10.1007/s10997-017-9376-6

Audi, R., Loughran, T., & Mcdonald, B. (2016). Trust , but Verify : MD & A Language and the Role of Trust in Corporate Culture. Journal of Business Ethics, 139(3), 551–561. https://doi.org/10.1007/s10551-015-2659-4

Bona-sánchez, C., Fernández-senra, C. L., & Pérez-alemán, J. (2016). value. BRQ Business Research Quartely, 20(1), 11–21. https://doi.org/10.1016/j.brq.2016.07.002

Cao, C., Xia, C., & Chan, K. C. (2016). Social trust and stock price crash risk: Evidence from China. International Review of Economics and Finance, 46(September 2015), 148– 165. https://doi.org/10.1016/j.iref.2016.09.003

Carlo, E. Di. (2014). Related party transactions and separation between control and direction in business groups : the Italian case. Corporate Governance, 14(1), 58-85. https://doi.org/10.1108/CG-02-2012-0005

Chen, S., Wang, K., & Li, X. (2012). Product market competition , ultimate controlling structure and related party transactions. China Journal of Accounting Research, 5(4), 293–306. https://doi.org/10.1016/j.cjar.2012.11.001

Cheung, Y., Rau, P. R., & Stouraitis, A. (2006). Tunneling , propping , and expropriation : evidence from connected party transactions in Hong Kong $. Journal of Financial Economics, 82(9040938), 343–386. https://doi.org/10.1016/j.jfineco.2004.08.012

Cuevas-rodríguez, G., Gomez-mejia, L. R., & Wiseman, R. M. (2012). Has Agency Theory Run its Course ?: Making the Theory more Flexible to Inform the Management of Reward Systems. Corporate Governance: An International Review, 20(6), 526–546. https://doi.org/10.1111/corg.12004

Damayanti, I. G. A. E. (2019). Fenomena Faktor yang Mempengaruhi Nilai Perusahaan. Jurnal Ilmiah Akuntansi Dan Bisnis, 14(2), 208–218.

https://doi.org/10.24843/JIAB.2019.v14.i02.p06

De Jong, B. A., & Elfring, T. (2010). How Does Trust Affect the Performance of Ongoing Teams? The Mediating Role of Reflexivity , Monitoring , and Effort. Academy of Management Journal, 53(3), 535–549.

Diab, A. A., & Aboud, A. (2019). The impact of related party transactions on fi rm value Evidence from a developing country. Journal of Financial Reporting and Accounting, 17(3), 571–588. https://doi.org/10.1108/JFRA-08-2018-0064

Downs, D. H., Ooi, J. T. L., Wong, W., & Ong, S. E. (2015). Related Party Transactions and Firm Value : Evidence from Property Markets in Hong Kong , Malaysia and Singapore. The Journal of Real Estate Finance and Economics, 52(4), 408–427. https://doi.org/10.1007/s11146-015-9509-0

Elkelish, W. W. (2017). Journal of Accounting in Emerging Economies. Journal of Accounting in Emerging Economies, 7. http://dx.doi.org/10.1108/JAEE-05-2015-0035

Goergen, M., Chahine, S., Brewster, C., & Wood, G. (2013). Trust , Owner Rights , Employee Rights and Firm Performance. Journal oF Business Finance & Accounting, 40(July), 589–619. https://doi.org/10.1111/jbfa.12033

Gras-gil, E., Manzano, M. P., & Fernández, J. H. (2016). Investigating the relationship between corporate social from Spain. Cuadernos de Economía y Dirección de La Empresa, 19(4), 289–299. https://doi.org/10.1016/j.brq.2016.02.002

Guay, W., Samuels, D., & Taylor, D. (2016). Author ’ s Accepted Manuscript. Journal of

Accounting and Economics, 62(2–3), 234–269.

https://doi.org/10.1016/j.jacceco.2016.09.001

Hendratama, T. D., & Barokah, Z. (2020). Related party transactions and firm value : The moderating role of corporate social responsibility reporting. China Journal of Accounting Research, 13(2), 223–236. https://doi.org/10.1016/j.cjar.2020.04.002

Jian, M., & Wong T. J. (2010). Propping through related party transactions. Review of

Accounting Studies, 15(1), 70–105. https://doi.org/10.1007/s11142-008-9081-4

Kuan, L., Tower, G., Rusmin, & Zahn, J.-L. W. M. Van der. (2010). Related party transactions and earnings management. Jurnal Akuntansi Dan Auditing Indonesia, 14(2).

Loughran, T., & Mcdonald, B. (2014). Measuring Readability in Financial Disclosures. Journal of Finance, 69(4), 1643–1671.

Obermann, J., Velte, P., Gerwanski, J., & Kordsachia, O. (2020). Mutualistic symbiosis ? through behavioral characteristics. Management Research Review, 43(8), 989– 1011. https://doi.org/10.1108/MRR-07-2019-0317

Perryman, A. A., Fernando, G. D., & Tripathy, A. (2015). Do gender differences persist ? An examination of gender diversity on fi rm performance , risk , and executive compensation. Journal of Business Research, 69(2), 579–586.

https://doi.org/10.1016/j.jbusres.2015.05.013

Pozzoli, M., Venuti, M., & Parthenope, N. (2014). Related Party Transactions and Financial Performance : Is There a Correlation ? Empirical Evidence from Italian Listed Companies. Open Journal of Accounting, 2014(January), 28–37.

https://doi.org/DOI:10.4236/ojacct.2014.31004

Qiu, B., Yu, J., & Zhang, K. (2019). Trust and Stock Price Synchronicity : Evidence from China. Journal of Business Ethics, (1988), 1–13. https://doi.org/10.1007/s10551-019-04156-1

Scholtens, B., & Kang, F. (2012). Corporate Social Responsibility and Earnings Management: Evidence from Asian Economies. Corporate Social Responsibility and Environmental, 20(2), 95–112. https://doi.org/10.1002/csr.1286

Shin, I. H., Sohn, S. K., & Park, S. (2019). Related party transactions and income smoothing : new evidence from Korea. Asia-Pacific Journal of Accounting & Economics, 00(00), 1–18. https://doi.org/10.1080/16081625.2019.1566011

Singh, S., Tabassum, N., & Darwish, T. K. (2017). Corporate Governance and Tobin ’ s Q as a Measure of Organizational Performance. British Journal of Management, 00, 1–20. https://doi.org/10.1111/1467-8551.12237

Sousa-lima, M., Michel, J. W., & Caetano, A. (2013). Clarifying the importance of trust in organizations as a component of effective work relationships. Journal of Applied Social Psychology, 43, 418–427. https://doi.org/10.1111/j.1559-1816.2013.01012.x

Tambunan, M. E., Siregar, H., & Manurung, A. H. (2017). Related Party Transactions and Firm Value in the Business Groups in the Indonesia Stock Exchange. Journal of

Applied Finance & Banking, 7(3), 1–20.

Thenmozhi, M., & Sasidharan, A. (2020). Does board independence enhance fi rm value of state-owned enterprises ? Evidence from India and China. European Business Review. https://doi.org/10.1108/EBR-09-2019-0224

Wang, W. K., & Lu, W. M. (2019). Related ‐ party transactions and corporate performance following the adoption of International Financial Reporting Standards in Taiwan. Journal of Business Research, 101(October), 411–425.

https://doi.org/10.1002/mde.3106

Whelan, J., & Demangeot, C. (2015). Signallinging Theory. Wiley Encyclopedia of Management.

Wong, R. M. K., & Kim, J. (2015). Are Related-Party Sales Value-Adding or ValueDestroying ? Evidence from China. Journal of International Financial Management & Accounting, 26(1), 1–38.

Xu, Q., Fernando, G. D., & Tam, K. (2019). Advances in Accounting Trust and firm performance : A bi-directional study. Advances in Accounting, 47, 100433. https://doi.org/10.1016/j.adiac.2019.100433

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 344

Discussion and feedback