Perspective Contradiction Regarding Competition and Financial Stability in the Banking Sector: Review of Literature

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 2, July 2022

AFFILIATION:

1,2,3,4Faculty of Economics and Business, Universitas Udayana, Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2022.v17.i02.p09

CITATION:

Safitri, N. W. N., Wiksuana, I. G. B., Sedana, I. B. P. & Baskara, I. G. K.

(2022). Persepective Contradiction Regarding Competition and Financial Stability in the Banking Sector: Review of Literature. Jurnal Ilmiah Akuntansi dan Bisnis, 17(2), 313-332.

ARTICLE HISTORY Received:

13 May 2022

Revised:

10 July 2022

Accepted:

11 July 2022

Perspective Contradiction Regarding Competition and Financial Stability in the Banking Sector: Review of Literature

Ni Wayan Noviana Safitri1*, I Gusti Bagus Wiksuana2, Ida Bagus Panji Sedana3, I Gde Kajeng Baskara4

Abstract

This study aims to provide a systematic literature review (SLR) on the scope, measurement, and impact of competition on banking stability. PRISMA technique was used to undertake a meta-analysis of scientific articles. After applying all of the criteria, a total of 42 relevant studies were discovered. Previous research has examined the relationship between banking stability and competition in a variety of countries around the world, and has produced two opposing viewpoints, namely competition fragility and competition stability. The first perspective gets more support. When it comes to the measurement instrument, most studies use the Lerner index to quantify the intensity of competition. It is also discovered that the GMM (Generalized Approach of Moment) approach is widely used. Future research can examine each indicator's strengths and weaknesses further so that it can be used to gauge banking competition in accordance with the banking systems examined in each nation, yielding reliable results.

Keywords: competition, stability, banking

Introduction

In recent decades, there have been numerous monetary crises that have had significant economic repercussions. The economic crisis caused the economic system to become unstable. A nation's sustainable economy is largely shaped and maintained by its financial system. Maintaining financial system stability is crucial to ensuring that it continues to operate effectively, efficiently, and with the ability to withstand both internal and external vulnerabilities. In order to help economic recovery, banks play a crucial role in the financial system by actively participating in credit programs and adopting flexible policies. Failures of banks can result in systemic events that affect things like regional entrepreneurship and the labour market and have a major effect on small businesses, which typically rely significantly on bank financing (Contreras et al, 2021). Due to its unique functions, the banking industry is extremely different from other economic sectors and is therefore more susceptible to tight regulation, oversight, and government involvement (Danisman, 2018). As a result, financial institutions need to show that they can respond to a variety of situations that may arise as a result of this volatility.

Market power or bank competitive behaviour is a crucial factor that is taken into account when determining bank stability because preserving bank stability in a competitive environment is challenging (Akande et al., 2018). There is still a theoretical and empirical debate about whether high competition would lead to stability or instability (Beck et al., 2011). According to charter value theory, the competition mechanism can cause the banking system to become morerisky because it erodes profits and further reduces the value of the bank's charter value (Nicolo, 2016). On the other hand, the too big to fail argument emphasizes that the incentive for risk-taking by banks is greater in a less competitive environment because when large banks fail, financial authorities will try to protect them from failure in order to prevent contagion (Clark et al., 2018). Finally, two competing theories have emerged in the literature on the connection between competition and financial stability, making the issue of bank competition a persistent topic of debate (Kasman & Kasman, 2015). Both "competition-fragility or concentration stability" and "competition-stability or concentration fragility" offer different viewpoints on the connection between the level of competition and financial stability. The competition stability view holds that banks with significant market dominance would charge high loan interest rates to business owners and this encourages business owners to take on more risk, which raises the likelihood that they will default on their loans and increases the chance of bank bankruptcy (Yusgiantoro et al., 2019). On the other hand, the competitive fragility view holds that market competition reduces the monopoly rents received by banks and increases the risk of their assets, along with certain decreases in profits, capital ratios, and charter value (Phan et al., 2019).

Additionally, earlier studies examined a number of models for financial stability and competitiveness, but the results were different. According to research (Santoso et al., 2021; Amidu et al., 2019; Yusgiantoro et al., 2019), banks take less risk when there is a high level of market dominance (low competition), which is why this finding supports the idea of competitive fragility. While this is going on, (Goetz, 2018; Clark et al., 2018; Ibrahim et al., 2019) support the idea of competitive stability, which holds that competition will strengthen bank stability and decrease the likelihood of bank failure. The relationship between stability and competition can also be non-linear, as shown by (Cuestas et al., 2020), who found that there is an inverse U-shaped relationship between stability and competition. Above a certain threshold, this relationship means that a lack of competition tends to exacerbate risk-taking behavior among individual banks and can harm the stability of the banking sector.

Goetz (2018) asserts that there are several reasons why it is challenging to determine the relationship between competition and bank stability, one of which is the difficulty in assessing competition. In the literature on bank competition, there are two methods used to measure the level of bank competition: structural and non-structural approaches (Alyousfi et al., 2018). The structural method infers bank competitive behavior from market structure characteristics such as the number and size distribution of companies in the market. The structure-conduct-performance (SCP) and efficientstructure (ES) paradigms are part of the structural approach. According to the SCP paradigm, banks in concentrated markets conspire to raise lending rates, cut deposit rates, and increase profits (Mirzaei et al., 2013). The ES paradigm states that certain businesses are more profitable than others due to their increasing efficiency, which increases their market share and concentration (Demsetz & Strahan, 1997). A non-

structural approach based on the new industrial organization theory (NEIO), which claims that competitive behavior can persist in a concentrated market if businesses are exposed to hit-and-run entry; in other words, when the market is open to grabs (Baumol et al., 1985). As a result, the extent of market competition in a given industry must be evaluated directly by taking into account real bank conduct (Bikker & Haaf, 2002; Claessens & Laeven, 2004). Additionally, according to (Ibrahim et al., 2019), the impact of competition on banking stability can be positive or negative depending on the banking system under study.

Based on the conflicting views of competition-stability caused by several factors such as the size of competition and the banking system studied, a systematic literature review (SLR) is needed to provide clarity on banking competition, with a focus on the extent, measurement, and impact on banking stability. (Asif & Akhter, 2019) stated that SLR is an analytical review approach that is highly useful in properly reviewing prior empirical studies, and that this method is carried out by scholars through numerous distinct and repeatable steps to increase the overall quality of the review process. (Tranfiels et al., 2003) assert that SLR, as opposed to conventional unstructured reviews, employs a scientific and open method to minimize prejudice and inaccuracies. SLR is an appropriate methodology for making a justified synthesis of the evidence connected to the variables in this study, as the goal is to understand the relationship between banking competition and banking stability.

Research Method

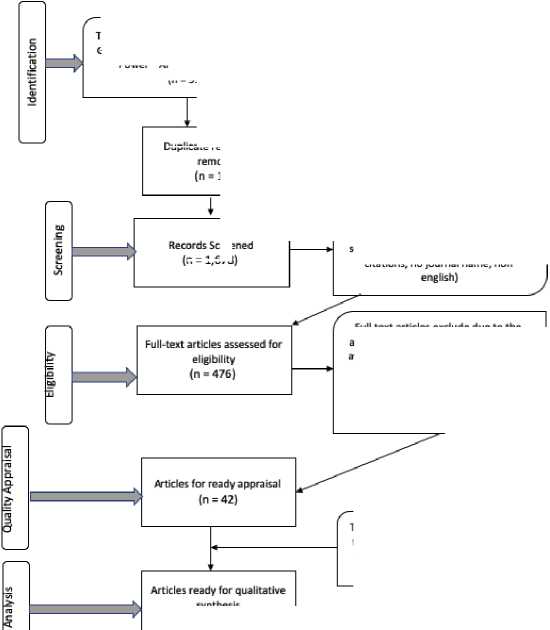

The Systematic Literature Review (SLR) approach was employed to fulfill the research objectives. (Nicolás & Toval, 2009) explains, SLR is a research technique for analyzing state-of-the-art in spesific field of knowledge by formally defining problem statements, sources of information, search strings, criteria for including and excluding papers found in searches, quantitative analysis to be performed (if necessary), and templates for organizing the information gathered from the papers. The Preferred Reporting Items for Systematic Reviews and Meta-Anaysis (PRISMA) technique was used to undertake a metaanalysis of scientific articles (Figure 2), following (Noory et al., 2021). In order to understand the scope and measurement of competition's impact on financial stability due to its conflicting consequences, this method was used to pick the articles published in scientific literature.

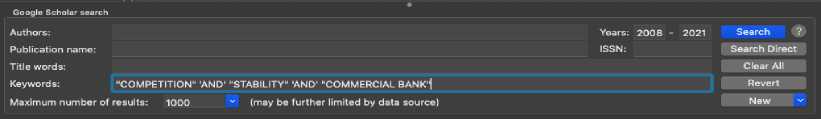

To sum up the goal of this study, Publish or Perish software was utilized as a search engine to find important material (Figure 1). Publish or Perish obtains information on citations from Google Scholar inquiries, which is then processed and transformed into a variety of statistics (Aulianto et al., 2019). Publish or Perish is used to determine which author receives the most citations, the oldest and most current year of an article, and we will obtain a bibliometric record of each research that will be employed (Husaeni & Nandiyanto, 2022). The phrase "AND" was used to limit down the search for empirical literature. In this study, the literature search was conducted twice. The first search entered "keywords" on Google Scholar in the form of "Market Power" 'AND' "Bank Stability", a total of 999 articles were retrieved containing related terms (retrieved on May 25, 2021). While the second search was carried out on January 14, 2022 by entering the keywords "Competition" 'AND' "Stability" 'AND' "Commercial Bank" to narrow the scope of the search. In most of the articles, the key terms competition and market power are

Figure 1. Literature search through Publish or Perish software

used but not all are relevant for this study. Therefore, only the selected articles were relevant to the objectives of the current literature review.

The papers in this study are all from legitimate journals, and practically all of them have been published. Because the goal of this research is to see how competition affects banking stability, the studies included in this study are all empirical. According to (Asif & Akhter, 2019) there are two criteria used to judge the quality of a literature review: the relevance of the content and the publishing sources: (a) The pieces chosen for this SLR are of high quality, one of which is noteworthy from a publication standpoint. The articles must be from a respectable publication. One of the websites that analyzes and assesses scientific fields, including scientific journals, is https://www.scopus.com/. (b) The basis for this article's selection is its importance in identifying how banking competition and financial stability are related.

Table 1. Quality Assessment Based on Publishing Source

|

Database |

Count of no. |

|

Elsevier |

22 |

|

Routledge Taylor & Francis Group |

04 |

|

Wiley Online Library |

04 |

|

Emerald |

04 |

|

SSRN |

02 |

|

Proquest |

01 |

|

Science Direct |

01 |

|

Springer |

03 |

|

SAGE |

01 |

|

Grand Total |

42 |

Sources: Data Processed, 2022

The second search entered keywords "Competition" 'AND, "Stability" 'AND, "Commercial Bank" (n = 790)

The first search entered “keywords" on Google Scholar in the form of "Market Power" 'AND' "Bank Stability’ (n = 999)

(n = 1,6781

Duplicate records were oved 111)

Full text articles exdude due to the aren't about banking competitiveness and stability, the list of chosen articles include publications about SME's, microfinance, or other non bank financial institutions and Islamic banks (n = 434)

syntnesis (n = 421

The authors made the choice to defend the decision to include all 42 papers in the review by claiming that they were ail of high quality.

Figure 2. PRISMA Flow Chart of the Systematic Literature Review and Article Indentification Process

Records excluded (n ■ 1,202 ) (excluded due to: not indexed s∞pus, systematic review journals, book series, book, chapter in book, have no citations, no journal name, non

Source: Adapted (Noory et al., 2021)

This criterion also restricts the time frame to papers published between 2008 and 2021. The reason for choosing this time period is because the financial crisis of 2008 spurred the government to implement a number of regulations aimed at reducing competition in the banking industry, which was thought to be jeopardizing the banking system's soundness. This began with the financial liberalization in the late 1980s, which aimed to increase competition in the financial sector (Soedarmono et al., 2013). Financial liberalization, on the other hand, eventually pushed banks to undertake aggressive business methods in order to boost their bottom lines, and the consequent degree of risk in bank balance sheets was a major component in the global financial crisis of 2008 (Alyousfi et al., 2018).

Table 1. shows the total number of articles collected from various databases. Elsevier published 52,4 percent of the articles reviewed in this literature review, and they were all cited. Articles have also been published in Emerald (4 articles), Springer (3 articles), Wiley Online Library (4 articles), SSRN (2 articles), SAGE (1 article), Science Direct (1 article), and Proquest publications (1 article). All articles that aren't about banking competitiveness and stability aren't included. A total of 42 relevant studies were found after applying all of these criteria. The publications included for this study contain sufficient information on banking competitiveness and its relevance to banking stability. The original search was based on the article's title, but in some situations, that was

insufficient. The screening process is then completed by reading the abstract and conclusion of the paper. If the abstract and conclusion do not provide all of the needed information, the complete article is read and included in the SLR. The list of selected articles only includes journal articles or working papers that have enough citations; uncited publications are not included. Finally, the list of chosen articles did not include publications about SME's, microfinance, or other non-bank financial institutions. Islamic banks were also removed from the sample since their market share and business style varies slightly from those of other banks. Quantitative and mixed methods approaches were used in all relevant empirical papers reviewed for this narrative review.

Result and Discussion

The specific goals of this literature study are to assess the breadth and measurement of competition in the banking industry as stated in prior work, as well as to investigate the impact of banking competition on banking stability. This SLR aims to reveal many perspectives on the influence of competition in the banking sector by considering

RESEARCH YEAR

2010 2011 2013 2014 2015 2016

2017 2018 2019 2020

various contexts and environmental circumstances. The information offered in the selected articles shows: (1) Author and research year; (2) The country in which the SLR

literature study is carried out; (3) SLR theory; (4) The number of samples/observations used, as well as the duration of the study; (5) The proxy used to measure banking competition; (6) The approach for calculating the relationship between banking stability and competition; (7) The key conclusions of the investigation.

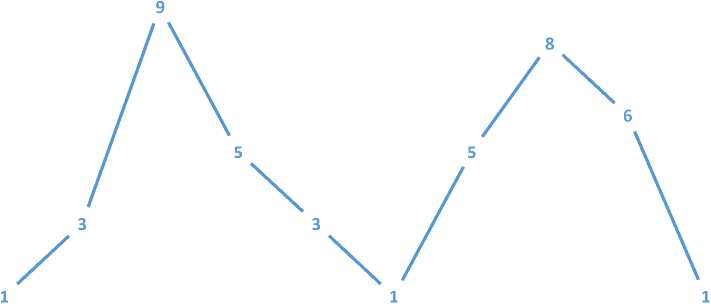

This SLR is narrative in character, and it includes summaries of 42 articles that were retrieved once the appropriate review methodology was followed. Figure 3 shows the competition's scope in relation to the year of publication. Competition research and its relevance to financial stability began in 2010, with a considerable increase in 2013. This could be because, since the financial liberalization of the 1980s, which was supposed to be the root of the 2008 financial catastrophe, academics are becoming concerned about competition in the banking industry. There was no literature relevant to this study in 2012 because, according to the search results, the focus of research in 2012 was on the government's policies and regulations to address the monetary crisis. In addition, the graph shows that the increasing trend continued in 2017–2019. This could be owing to the various contradictions in prior research' findings, making it difficult to interpret the conclusions and debate about how banking competitiveness affects banking system stability.

Figure 3. SLR Article Publication Year

Source: Data Processed, 2022

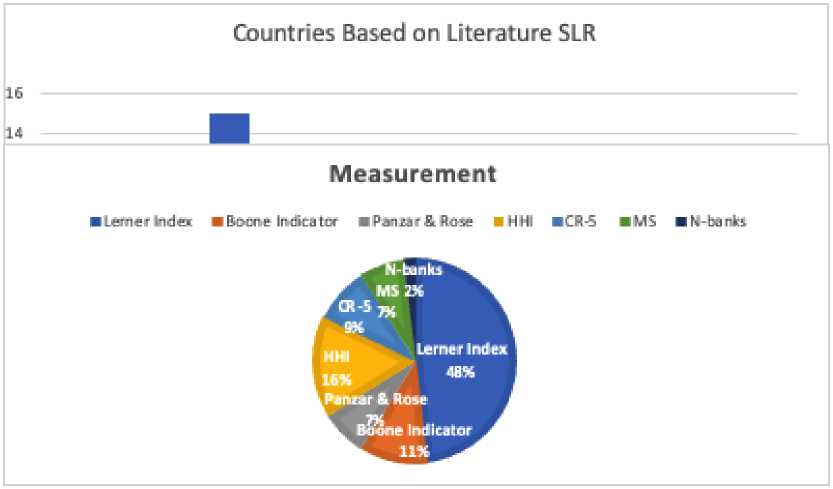

Figure 4 depicts the country in which the research on the selected SLR literature was undertaken. The location of countries is classified based on continents in this study. The researchers' preferred research destination became Asia. Many studies have been undertaken in Asia based on the results of a literature review because this region underwent an unprecedented restructuring process, including regulatory reform, as a result of the financial crisis. The main goal of financial sector liberalization was to foster

Figure 5. Measurement of Banking Competition Source: Data Processed, 2022

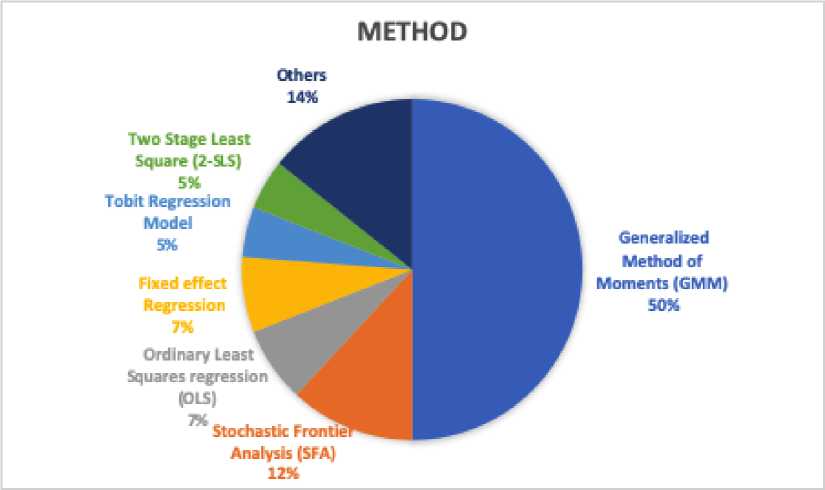

Figure 6. The method used in the SLR

competition, but there is insufficient evidence to say if the changed competitive climate has prompted riskier behavior by Asian banks.

Competition is quantified using a variety of approaches based on the findings of the literature research. The Lerner Index, as shown in Figure 5, is the most extensively used measuring instrument. The Lerner index is calculated as a percentage of the price of a bank's total assets divided by its marginal cost (Alyousfi et al., 2018). As a result, the index value runs from one to zero, with a higher number signifying stronger market strength and hence less competition. The Lerner Index has various features that have led to its widespread adoption by scholars. According to (Kouki & Al-Nasser, 2017) the Lerner index is calculated based on observations of specific banks for each nation. This will aid in the reduction of small sample bias. According to (Danisman & Demirel, 2019) the Lerner index is a flexible indicator that does not require the definition of the relevant market. Furthermore, the Lerner index is simpler to grasp and does not require persuasive data. Greater pricing stability and less market competition are indicated by a higher index value (Tan & Floros, 2019). Other indicators in the SLR used to measure banking competition are the Herfindahl-Hirschman Index (HHI), Boone indicator, Panzar & Rose, concentration of the 5 largest bank assets (CR-5), market share (MS), and number of banks operating in each market (N-Bank).

The GMM (Generalized Approach of Moment) method is commonly utilized in SLR research (as indicated in Figure 6). The use of the GMM method is based on the potential for endogeneity problems that often occur in the relationship between bank competition and financial stability (Fu et al., 2014). Endogeneity, unobserved heterogeneity, and dependent variable persistence are all challenges that GMM can solve (Kasman & Kasman, 2015). Furthermore, the GMM technique accounts for the problem of heteroscedasticity (Phan et al., 2019).

Appendix 1 summarizes key findings from the papers, focusing on those that are pertinent to the study's goal. The author's name and the year the article was published are displayed in the second column of Appendix 1. The number of article citations is displayed in the third column. All of the publications utilized in this study contain citations, according to the data in the table. The research of (Beck et al., 2012) has received the most citations, with 1,050 total. The sample size/observations, as well as the research period, are listed in column four. Most research are longitudinal and based on panel data analysis, as indicated by the timeframe. The direction of the association between banking competition and banking stability is shown in column five. The article's major conclusions on the relationship between competitiveness and banking stability are presented in the last column.

According to a review of the literature, past academics disagree about the potential impact of competition on bank stability. Five categories of correlations are deduced from the prior literature about the potential effects of competition on bank performance: (1). According to 19 articles (45,2 percent), there is a positive association between the two factors; (2). According to 15 articles (35,7 percent), there is a negative

Table 2. Theory Used in SLR Research

|

No |

Theory |

Effect of Market Power |

Freq |

|

1 |

Competition Fragility & Competition Stability |

The Competition Fragility concept is the traditional way of looking at how competition and banking stability are related. The issue about franchise value is crucial in the literature on competitive fragility (Danisman & Demirel, 2019). This perspective connects the value of a franchise to caution (Keeley, 1990). A modern viewpoint on the connection between competition and financial stability is the Competition Stability View. This idea was put up in 1986 by Chan and Greenbaum. The main defense is the risk shift paradigm, which gained traction after (Boyd & De Nicoló, 2005) conducted research on the optimal contract problem solving model with moral hazard and demonstrated that higher deposit rates and lower loan interest rates may be attained in a competitive environment. |

35 |

|

2 |

SCP Theory |

The Structure Conduct Performance (SCP) paradigm is the most current and well-established method for evaluating industrial structure research. (Mason, 1939) was the first to present the SCP method, which was later developed by (Bain, 1951). The framework's core hypothesis is that observable structural aspects of a market affect firm activity in that market, and firm behavior in a market determines measurable market performance (Bain, 1951). |

6 |

|

3 |

NEIO |

To explain market behavior and economic performance, the New Emperical Industrial Organization (NEIO) focuses primarily on thorough empirical examinations of the behavior of individual enterprises in the industry. NEIO's empirical research focuses on econometric testing of |

1 |

certain components within a single industry with the goal of finding market dynamics or collusive competitive developments (Bresnaham & Schmalensee, 1987).

Total 42

Source: Processed Data, 2022

association between the two factors; (3). According to the two publications (4,8 percent), multiple research show that competition has no impact on banking stability; (4) Five papers (11,9 percent) indicate a U-shaped or non-linear relationship between the relevant variables. (5) One article (2,4 percent) shows how the relationship between competition and bank stability varies depending on the characteristics of the banking under consideration.

Conclusion

Using the SLR (PRISMA technique), the current study examines the relevant literature to asses the relationship between stability and competitiveness in the banking industry in the wake of the financial crisis that put the world economy in danger. Competitiveness is a key factor that affects financial stability, a subject that is extensively discussed in management literature. Since the 1980s, when the economy was liberalized, banks have been forced to embrace aggressive commercial tactics in order to boost their bottom lines, hence boosting risk taking. Many research on Asian banking have been undertaken, but the results are mixed, according to SLR's current findings. Researchers have also used a variety of measurement tools and approaches to figure out the link between competitiveness and bank stability, but no consensus has emerged. The indicators in the SLR used to measure banking competition are the Lerner Index, Herfindahl-Hirschman Index (HHI), Boone indicator, Panzar & Rose, concentration of the 5 largest bank assets (CR-5), market share (MS), and number of banks operating in each market (N-Bank).

Researchers looked at the location, time period of the study, different measurement tools, and methodology to find five correlations between competitiveness and banking stability in prior work. Different bank-specific and macroeconomic aspects were also considered by previous studies. The results of a literature review of 42 articles from credible journals show that support for the perspective of competition fragility is higher than support for the view of competition stability, with 19 versus 15 in favor of competition fragility. However, there are also earlier research that concur with these two points of view. The rationale for this is that depending on the specific circumstances of the banking under investigation, both perspectives may be appropriate. Meanwhile, most researchers utilize the Lerner index to quantify the intensity of competition when it comes to the measuring instrument. When estimating competition with the Lerner index, a geographic market definition is not required; nevertheless, the results will differ depending on whether the calculation is made using market share or market concentration. GMM is the most extensively utilized method when dealing with endogeneity, which is common in the relationship between competitiveness and banking stability. This technique also takes into account the issue of heteroscedasticity.

This study is limited to presenting the general scope of competition without going deeper into the respective indicators and methods used. Future research can examine each indicator's strengths and weaknesses further so that it can be used to gauge banking competition in accordance with the banking systems examined in each nation, yielding

reliable results. In addition, future research can also focus on the direction of research to find factors that can be used to minimize risks that occur as a result of too much competition, taking into account the results of previous studies that are more inclined to the competition-fragility view, where competition in the banking system can contribute to banking fragility and provide incentives to increase risky behavior.

References

Abel, S., Roux, P. Le, & Mutandwa, L. (2018). Competition and bank stability.

International Journal of Economics and Financial Issues, 8(3), 86–94.

Akande, J. O., Kwenda, F., & Ehalaiye, D. (2018). Competition and commercial banks risktaking: Evidence from Sub-Saharan Africa region. Applied Economics, 50(44), 4774–4787. https://doi.org/10.1080/00036846.2018.1466995

Alyousfi, A. Y. H. S., Saha, A., & Md-Rus, R. (2018). The impact of bank competition and concentration on bank risk-taking behavior and stability: Evidence from GCC countries. North American Journal of Economics and Finance, 51, 1–50.

https://doi.org/10.1016/j.najef.2018.10.015

Amidu, M., Coffie, W., & Sissy, A. M. (2019). The effects of market power on stability: Do diversification and earnings strategy matter?. Afro-Asian Journal of Finance and Accounting, 9(4), 381–405. https://doi.org/10.1504/AAJFA.2019.102994

Amidu, M., & Wolfe, S. (2013). Does bank competition and diversification lead to greater stability? Evidence from emerging markets. Review of Development Finance, 3(3), 152–166. https://doi.org/10.1016/j.rdf.2013.08.002

Anginer, D., Demirguc-Kunt, A., & Zhu, M. (2013). How does competition affect bank systemic risk? Journal of Financial Intermediation, 23(1), 1–26.

https://doi.org/10.1016/j.jfi.2013.11.001

Ariss, R. T. (2010). On the implications of market power in banking: Evidence from developing countries. Journal of Banking and Finance, 34(4), 765–775.

https://doi.org/10.1016/j.jbankfin.2009.09.004

Asif, R., & Akhter, W. (2019). Exploring the influence of revenue diversification on financial performance in the banking industry: A systematic literature review. Qualitative Research in Financial Markets, 11(3), 305–327.

https://doi.org/10.1108/QRFM-04-2018-0057

Aulianto, D. R., Yusup, P. M., & Setianti, Y. (2019). Pemanfaatan Aplikasi “Publish Or Perish” Sebagai Alat Analisis Sitasi Pada Jurnal Kajian Komunikasi Universitas Padjadjaran. In Book Chapter Seminar Nasional MACOM III "Communication and Information Beyound Boundaries (pp. 873–880).

Bain, J. S. (1951). Relation of Profit Rate to Industry Concentration: American

Manufacturing 1936-1940. The Quarterly Journal of Economics, 65(3), 293–324.

https://doi.org/https://doi.org/10.2307/1882581

Barra, C., & Zotti, R. (2020). Market power and stability of financial institutions: evidence from the Italian banking sector. Journal of Financial Regulation and Compliance, 28(2), 235–265. https://doi.org/10.1108/JFRC-05-2019-0055

Baumol, W. J., Panzar, J. C., & Willig, R. D. (1983). An Uprising in the Theory of Industry Structure: Reply. The American Economic Review, 73(3), 491–496.

https://www.jstor.org/stable/1808145

Beck, T., Jonge, O. De, & Schepens, G. (2011). Bank Competition and Stability: Reconciling Conflicting. Paolo Baffi Centre Reseach No. 2011-97. https://doi.org/http://dx.doi.org/10.2139/ssrn.1884150

Beck, T., Jonghe, O. De, & Schepens, G. (2012). Bank competition and stability: Crosscountry heterogeneity. Journal of Financial Intermediation, 22(2), 218–244. https://doi.org/http://dx.doi.org/10.1016/j.jfi.2012.07.001

Bikker, J. A., & Haaf, K. (2002). Competition, concentration and their relationship: An empirical analysis of the banking industry. Journal of Banking & Finance, 26(11), 2191–2214. https://doi.org/https://doi.org/10.1016/S0378-4266(02)00205-4

Boyd, J. H., & De Nicoló, G. (2005). The theory of bank risk taking and competition revisited. Journal of Finance, 60(3), 1329–1343. https://doi.org/10.1111/j.1540-6261.2005.00763.x

Bresnaham, T. F., & Schmalensee, R. (1987). The Empirical Renaissance in Industrial Economics: An Overview. The Journal of Industrial Economics, 35(4), 371–378. https://doi.org/https://doi.org/10.2307/2098578

Claessens, S., & Laeven, L. (2004). What Drives Bank Competition? Some International Evidence. Journal of Money, Credit, and Banking, 36(3b), 563–583.

https://doi.org/10.2307/3838954

Clark, E., Radić, N., & Sharipova, A. (2018). Bank competition and stability in the CIS markets. Journal of International Financial Markets, Institutions and Money, 54, 190–203. https://doi.org/10.1016/j.intfin.2017.12.005

Contreras, S., Delis, M. D., Ghosh, A., & Hasan, I. (2021). Bank failures, local business dynamics, and government policy. Small Business Economics, 58(4), 1823–1851. https://doi.org/10.1007/s11187-021-00478-5

Cuestas, J. C., Lucotte, Y., & Reigl, N. (2020). Banking sector concentration, competition and financial stability: the case of the Baltic countries. Post-Communist Economies, 32(2), 215–249.

https://doi.org/https://doi.org/10.1080/14631377.2019.1640981

Danisman, G., & Thong, W. L. (2018). Overview of Competition in the Banking Sector. International Journal of Economics, Commerce and Management, VI(4), 59–71.

Danisman, G. O., & Demirel, P. (2019). Bank risk-taking in developed countries: The influence of market power and bank regulations. Journal of International Financial Markets, Institutions and Money, 59, 202–217.

https://doi.org/10.1016/j.intfin.2018.12.007

Demsetz, R. S., & Strahan, P. E. (1997). Diversification, Size, and Risk at Bank Holding Companies. Journal of Money, Credit and Banking, 29(3), 300–313.

https://doi.org/10.2307/2953695

Dwumfour, R. A. (2017). Explaining banking stability in Sub-Saharan Africa. Research in International Business and Finance, 41, 260–279.

https://doi.org/10.1016/j.ribaf.2017.04.027

Fu, X. (Maggie), Lin, Y. (Rebecca), & Molyneux, P. (2014). Bank competition and financial stability in Asia Pacific. Journal of Banking and Finance, 38(1), 64–77.

https://doi.org/10.1016/j.jbankfin.2013.09.012

Fungáčová, Z., & Weill, L. (2013). Does competition influence bank failures? Evidence from Russia. Economics of Transition, 21(2), 301–322.

https://doi.org/10.1111/ecot.12013

Goetz, M. R. (2018). Competition and bank stability. Journal of Financial Intermediation, 35, 57–69. https://doi.org/10.1016/j.jfi.2017.06.001

Hamid, F. S. (2017). The Effect of Market Structure on Banks’ Profitability and Stability: Evidence from ASEAN-5 Countries. International Economic Journal, 31(4), 578– 598. https://doi.org/10.1080/10168737.2017.1408668

Husaeni, D. F. A, & Nandiyanto, A. B. D. (2022). Bibliometric Using Vosviewer with Publish or Perish (using Google Scholar data): From Step-by-step Processing for Users to the Practical Examples in the Analysis of Digital Learning Articles in Pre and Post Covid-19 Pandemic. ASEAN Journal of Science and Engineering, 2(1), 19– 46.

Hussain, M., & Bashir, U. (2020). Risk-competition nexus: Evidence from Chinese banking industry. Asia Pacific Management Review, 25(1), 23–37.

https://doi.org/10.1016/j.apmrv.2019.06.001

Ibrahim, M. H., Salim, K., Abojeib, M., & Yeap, L. W. (2019). Structural changes, competition and bank stability in Malaysia’s dual banking system. Economic Systems, 43(1), 111–129. https://doi.org/10.1016/j.ecosys.2018.09.001

Jiménez, G., Lopez, J. A., & Saurina, J. (2013). How does competition affect bank risktaking? Journal of Financial Stability, 9(2), 185–195.

https://doi.org/10.1016/j.jfs.2013.02.004

Kanas, A., Hassan Al-Tamimi, H. A., Albaity, M., & Mallek, R. S. (2018). Bank competition, stability, and intervention quality. International Journal of Finance and Economics, 24(1), 568–587. https://doi.org/10.1002/ijfe.1680

Kasman, A., & Kasman, S. (2016). Bank size, competition and risk in the Turkish banking industry. Empirica, 43(3), 607–631. https://doi.org/10.1007/s10663-015-9307-1

Kasman, S., & Kasman, A. (2015). Bank competition, concentration and financial stability in the Turkish banking industry. Economic Systems, 39(3), 502–517.

https://doi.org/10.1016/j.ecosys.2014.12.003

Keeley, M. C. (1990). Deposit insurance, risk, and market power in banking. American Economic Review, 80(5), 1183–1200. https://doi.org/10.2307/2006769

Kim, J. (2018). Bank Competition and Financial Stability: Liquidity Risk Perspective. Contemporary Economic Policy, 36(2), 337–362.

https://doi.org/10.1111/coep.12243

Kouki, I., & Al-Nasser, A. (2017). The implication of banking competition: Evidence from African countries. Research in International Business and Finance, 39, 878–895. https://doi.org/10.1016/j.ribaf.2014.09.009

Liu, H., Molyneux, P., & Nguyen, L. H. (2012). Competition and risk in south east Asian commercial banking. Applied Economics, 44(28), 3627–3644.

https://doi.org/10.1080/00036846.2011.579066

Mason, E. (1939). Price and production policies of large scale enterprises. American Economic Review, 39(1), 61–74. https://doi.org/10.2307/1806955

Mirzaei, A., Moore, T., & Liu, G. (2013). Does market structure matter on banks’ profitability and stability? Emerging vs. advanced economies. Journal of Banking & Finance, 37(8), 2920–2937. https://doi.org/10.1016/j.jbankfin.2013.04.031

Moudud-Ul-Huq, S. (2020). Does bank competition matter for performance and risktaking? empirical evidence from BRICS countries. International Journal of Emerging Markets, 16(3), 409–447. https://doi.org/10.1108/IJOEM-03-2019-0197

Nguyen, T. L., Le, A. H., & Tran, D. M. (2018). Bank competition and financial stability: Empirical evidence in Vietnam. Studies in Computational Intelligence, 760(Mishkin 1999), 584–596. https://doi.org/10.1007/978-3-319-73150-6_46

Nicolás, J., & Toval, A. (2009). On the generation of requirements specifications from software engineering models: A systematic literature review. Information and Software Technology, 51(9), 1291–1307.

https://doi.org/10.1016/j.infsof.2009.04.001

Nicolo, V. (2016). Competition And Stability in The Banking Sector: Theory And Empirical Evidence. Universita’ Degli Studi Di Padova.

Noman, A. H. M., Gee, C. S., & Isa, C. R. (2018). Does bank regulation matter on the relationship between competition and financial stability? Evidence from Southeast Asian countries. Pacific Basin Finance Journal, 48, 144–161. https://doi.org/10.1016/j.pacfin.2018.02.001

Noory, S. N., Shahimi, S., & Ismail, A. G. (2021). A Systemic Literature Review on the Effect of Risk Management Practices on the Performance of Islamic Banking Instutution. Asian Journal of Accounting and Governance, 16, 53–75. https://doi.org/10.17576/AJAG-2021-16-05

Ovi, N. Z., Perera, S., & Colombage, S. (2014). Market power, credit risk, revenue diversification and bank stability in selected ASEAN countries. South East Asia Research, 22(3), 399–416. https://doi.org/10.5367/sear.2014.0221

Pak, O., & Nurmakhanova, M. (2013). The Effect of Market Power on Bank Credit RiskTaking and Bank Stability in Kazakhstan. Transition Studies Review, 20(3), 335– 350. https://doi.org/10.1007/s11300-013-0297-z

Park, K. H. (2016). How Competitive and Stable is the Commercial Banking Industry in China after Bank Reforms? KDI Journal of Economic Policy, 38(1), 53–70. https://doi.org/10.23895/kdijep.2016.38.1.53

Phan, H. T., Anwar, S., Alexander, W. R. J., & Phan, H. T. M. (2019). Competition, efficiency and stability: An empirical study of East Asian commercial banks. North American Journal of Economics and Finance, 50, 100990.

https://doi.org/10.1016/j.najef.2019.100990

Santoso, W., Yusgiantoro, I., Soedarmono, W., & Prasetyantoko, A. (2021). The bright side of market power in Asian banking: Implications of bank capitalization and financial freedom. Research in International Business and Finance, 56, 101358. https://doi.org/10.1016/j.ribaf.2020.101358

Schaeck, K., & Cihak, M. (2013). Competition , Efficiency , and Stability in Banking. Financial Management, 43(1), 215–241.

https://doi.org/https://doi.org/10.1111/fima.12010

Shim, J. (2019). Loan portfolio diversification, market structure and bank stability. Journal of Banking and Finance, 104, 103–115.

https://doi.org/10.1016/j.jbankfin.2019.04.006

Soedarmono, W., Machrouh, F., & Tarazi, A. (2011). Bank market power, economic growth and financial stability: Evidence from Asian banks. Journal of Asian Economics, 22(6), 460–470. https://doi.org/10.1016/j.asieco.2011.08.003

Soedarmono, W., Machrouh, F., & Tarazi, A. (2013). Bank competition, crisis and risk taking: Evidence from emerging markets in Asia. Journal of International Financial

Markets, Institutions and Money, 23(1), 196–221.

https://doi.org/10.1016/j.intfin.2012.09.009

Tabak, B. M., Gomes, G. M. R., & Da Silva Medeiros, M. (2015). The impact of market power at bank level in risk-taking: The Brazilian case. International Review of Financial Analysis, 40, 154–165. https://doi.org/10.1016/j.irfa.2015.05.014

Tan, Y., & Anchor, J. (2017). Does Competition only Impact on Insolvency Risk? New Evidence from the Chinese Banking Industry. International Journal of Managerial Finance, 13(3), 332–354. https://doi.org/10.1108/IJMF-06-2016-0115

Tan, Y., & Floros, C. (2019). Risk, competition and cost efficiency in the Chinese banking industry. International Journal of Banking, Accounting and Finance, 10(2), 144– 161. https://doi.org/10.1504/IJBAAF.2019.099424

Tongurai, J., & Vithessonthi, C. (2020). Bank regulations, bank competition and bank risktaking: Evidence from Japan. Journal of Multinational Financial Management, 56, 100638. https://doi.org/10.1016/j.mulfin.2020.100638

Tranfiels, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14, 207–222. https://doi.org/10.1111/1467-8551.00375

Wang, X., Zeng, X., & Zhang, Z. Z. (2014). The influence of the market power of Chinese commercial banks on efficiency and stability. China Finance Review International, 4(4), 307–325. https://doi.org/10.1108/CFRI-07-2013-0096

Yusgiantoro, I., Soedarmono, W., & Tarazi, A. (2019). Bank consolidation and financial stability in Indonesia. International Economics, 159, 94–104.

https://doi.org/10.1016/j.inteco.2019.06.002

Appendix 1. The Effect of Banking Competition on Banking Stability

|

No |

Author (Year) |

Times Cited |

Sample Size |

Impact on Stability |

Major Findings |

|

1 |

9 |

440 banks (2006 – 2015) |

- |

Bank fragility is exacerbated by the competitive banking environment, which encourages risk-taking. | |

|

2 |

50 |

70 banks (1998 – 2016) |

- |

Increased competition leads to less stability. | |

|

3 |

442 |

3.325 banks, (1995 – 2005) - |

+ |

Strong competition improves stability by increasing efficiency. | |

|

4 |

29 |

100 banks (2003 – 2013) |

+ |

A reduced chance of bankruptcy is associated with greater competition in each kind of bank ownership. | |

|

5 |

47 |

127 banks (2005 – 2010) |

- |

Higher levels of market power are linked to increased efficiency and stability. | |

|

6 |

32 |

99 banks (2004 – 2014). |

- |

Increased competition may lead to a loss of stability. | |

|

7 |

14 |

21 banks (2000 – 2009) |

varied |

Depending on the banking features investigated, market power has a varying association with bank stability in Chinese banks. | |

|

8 |

13 |

130 banks (2001 – 2013) |

- |

The results contradict the SCP hypothesis. The results show that concentration stabilizes the banking sector. | |

|

9 |

44 |

333 banks (2005 – 2013) |

+ |

In CIS countries, competition has a considerable positive impact on bank stability | |

|

10 |

78 |

76 banks (2001 – 2011) |

- |

Regardless of changes in the bank’s level of capital, the market power of Brazilian banks is negatively associated to their risk-taking 328ehaviour. |

|

11 |

49 |

136,400 - observati ons (2002 -2013) |

Banks with less market concentration are more vulnerable to financial instability than banks with higher market concentration. | ||

|

12 |

941 |

107 banks – (1988 – 2003) |

U-Shaped/ Non Linier |

When employing a common measure of market concentration in the loan and deposit markets, the data clearly demonstrate a nonlinear connection. In the lending market, the connection between competition and risk taking is convex, while in the deposit market, it is unexpectedly concave. | |

|

13 |

27 |

40 banks (2000 -2014) |

U-Shaped/ Non Linier |

Competition and financial stability have an inverse U-shaped relationship, according to the findings. This indicates that, above a certain point, a lack of competition is likely to intensify individual banks’ risktaking 329 ehaviour, thereby jeopardizing the Baltic banking sector’s stability. | |

|

14 |

9 |

67 banks (2000 – 2012) |

+ |

The findings demonstrate that having a lot of market power raises bank credit risk, which supports the competitive stability hypothesis. | |

|

15 |

394 |

1.929 banks (1999 – 2008) |

+ |

Concentration is adversely correlated with bank health in industrialized countries, implying that a concentrated market can induce banks to take risks. | |

|

16 |

48 |

180 banks – (1990 – 2014) |

+ |

This competition helps to maintain financial stability by lowering credit risk in the banking sector. | |

|

17 |

154 |

1,216 observati ons (1998 – 2008) |

no effect |

Bank risk-taking 329 ehaviour does not rise as a result of competition. | |

|

18 |

4 |

7.632 banks |

U-shaped/ |

The relationship between financial stability inefficiency | |

|

(2001 – 2012) |

nonlinear |

and a measure of market power is discovered to be U-shaped. | |||

|

19 |

56 |

6.936 banks (2007 – 2015) |

- |

Banking with more market power reduces risky conduct, verifying the fragilitycompetition theory. | |

|

20 |

24 |

62 banks-(1994 – 2006) |

- |

The impact of increased competition on banks’ risktaking incentives will be higher. | |

|

21 |

1.050 |

17.055 banks (1994 – 2009) |

- |

Bank fragility will be exacerbated by increased competition. | |

|

22 |

9 |

1,461 bankyear observati ons (1993 – 2016) |

- |

Bank competition is positively related to bank risk taking | |

|

23 |

123 |

20,000 bank quarter observati ons (2001 – 2007) |

- |

Bank failures are more likely when bank competition becomes more intense. As a result, policies that boost bank competitiveness risk jeopardizing financial stability. | |

|

24 |

16 |

153 banks (1998 – 2010) |

no effect |

Market pressures, on the other hand, have no bearing on bank stability. | |

|

25 |

31 |

1.137 banks (2000 – 2015) |

- |

By reducing credit risk, more competition supports financial stability and bank efficiency. | |

|

26 |

15 |

19 Banks (2007 – 2011) |

- |

Market power is negatively related to the taking of credit risk by Kazakh banks. At the same time, this increase in market power has a significant positive impact on bank stability. | |

|

27 |

3 |

15 banks (1992 – 2008) |

+ |

Higher market concentration could have a negative impact |

|

on the financial stability of the entire banking system. | |||||

|

28 |

165 |

28 banks (2002 – 2012) |

- |

In a less competitive and concentrated market, banks are more stable. | |

|

29 |

19 |

10.979 banks (2000 – 2014) |

+ |

Financial fragility is implied by the fact that banks with more market power take on more liquidity risk. | |

|

30 |

6 |

24 banks (2008 – 2016) |

U-Shaped/ non-linier |

The financial sector in Vietnam has become more stable because to increased competition. The relationship between competition and stability, on the other hand, is nonlinear. | |

|

31 |

12 |

7.227 banks (2009 – 2015) |

U-Shaped/ non-linier |

In high competition, stability can increase and decline; in medium competition, stability has mixed 331ehaviour; and in low competition, stability grows. | |

|

32 |

7 |

11 banks (2010 – 2016) |

- |

Banking fragility is caused by increased competition in the banking sector. | |

|

33 |

464 |

1.872 banks (1997 – 2009) |

+ |

Greater competition encourages banks to diversify their risks, making the financial sector more resilient to shocks. | |

|

34 |

40 |

32 banks (2000 – 2014) |

- |

Less competition during crisis periods can help increase stability. | |

|

35 |

545 |

3369 banks (2003 – 2009) |

+ |

Financial instability is aided by greater concentration. | |

|

36 |

(Soedarm ono et al., 2013) |

259 |

636 banks (19942009) |

+ |

Increased bank risk taking and bank bankruptcy risk, as well as higher capital ratios, are related to higher levels of market dominance in the banking industry. |

|

37 |

(Soedarm ono et al., 2011) |

196 |

607 banks |

+ |

Higher volatility is associated with greater market power in the banking sector. |

|

(2001 – | |

|

38 |

2007) (Kasman 28 2002Q1 – - The “competitive fragility” |

|

39 |

& 2012Q2 argument is supported by the Kasman, fact that competition increases 2016) profits volatility. (Tabak et 119 473 + Concentration lowers |

|

40 |

al., 2015) banks, productivity and raises the (2001 – danger of insolvency. The fact 2008) that concentration promotes friability contradicts the “concentration-stability” theory. (Goetz, 149 8.412 + Bank stability is greatly |

|

41 |

2018) banks improved by increasing market (1978 – competitiveness. Increased 2006) competition decreases a bank's risk of failing, reduces the proportion of non-performing loans, and increases profitability. (Ariss, 736 821 - Increasing the degree of |

|

42 |

2010) banks market power leads to greater (1999 – bank stability and increased 2005) profit efficiency (Amidu & 200 978 + Competition increases stability |

|

Wolfe, banks as diversification across and 2013) (2000 – within bank activities that 2007) generate interest and non interest income increases. |

Source: Processed Data, 2022

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 332

Discussion and feedback