Intention to Use Digital Finance MSMEs: The Impact of Financial Literacy and Financial Inclusion

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 1, January 2022

AFFILIATION:

1,2,3 Faculty of Economics and Business, Universitas Pasundan, Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2022.v17.i01.p12

CITATION:

Hermawan,A., Gunardi, A., Sari, L. M. (2022). Intention to Use Digital Finance MSMEs: The Impact of Financial Literacy and Financial Inclusion . Jurnal Ilmiah Akuntansi dan Bisnis, 17(1), 171-182.

ARTICLE HISTORY Received:

11 December 2021

Revised:

22 January 2022

Accepted:

24 January 2022

Intention to Use Digital Finance MSMEs: The Impact of Financial Literacy and Financial Inclusion

Atang Hermawan1*, Ardi Gunardi2, Lira Mustika Sari3

Abstract

The purpose of this study is determine financial literacy affects intention to use digital finance and financial inclusion affects intention to use digital finance. Collecting data using questionnaires and PLS analysis method. The results show the intention to use digital finance is influenced by financial literacy with medium significance and financial inclusion with a very strong significance. This finding contributes for fintech knowledge, because the intention to use digital finance’s research is rare expecially for MSME actors, so this results provide suggestions for disseminating financial knowledge and services that have impact on usage intentions to end up with better market and MSME development. This research focuses on the intention to use digital finance for MSMEs, which is important because it requires adjustment to the times that lead to digitalization. The city of Bandung as a city with a fairly large number of MSMEs has attracted the attention of researchers

Keywords: financial inclusion, financial literacy, intention to use digital finance

Introduction

Financial literacy can be defined as knowledge that is basic in financial inclusion so that it is closely related to economic concepts to support decision making, be it investment, borrowing, and saving (Agarwal, 2016). Knowledge of the financial system possessed can increase the ability of producers to benefit from competition between financial service providers (Leyshon, Thrift, & Pratt, 1998). Ownership of low financial literacy has an impact on daily financial management for both individuals and families and has an impact on the ability to save in the long term so that if management is not carried out effectively, it is vulnerable to a financial crisis (Braunstein & Welch, 2002). Financial literacy can be regarded as input in modeling needs related to education and variations of finance (Huston, 2010). Financial knowledge is a form of investment in human resources which endogenously has an impact on welfare, with certain policies an increase in financial knowledge will occur in large numbers (Lusardi & Mitchell, 2014).

Financial literacy is an important ownership for MSME actors. The role of financial literacy has an impact on improving skills, to increasing the ability to touch financial products as indicated by the acceptance and

using products as needed (Deka, 2015). With financial literacy ownership the benefits of this can be felt. Having financial literacy or knowledge related to finance will get the opportunity to know the kind of financial services are available. If financial literacy increases, investment activities and long-term capital placements will increase in every productive sector (Herdinata, 2020). Even so, in fact, in Indonesia the low level of financial literacy is still a problem and challenge in the future (Damayanti, Murtaqi, & Pradana, 2018).

Similarity with financial literacy, financial inclusion also has an important role to development MSME business. Financial inclusion is an activity to gain access to financial services by eliminating various barriers (Lumenta & Worang, 2019). Financial inclusion enables universal access and coverage financial services so their benefits for economy and development can be widely felt in various countries (Senyo, Osabutey, & Seny Kan, 2020). In addition, the important role of financial inclusion is also to narrow the economic gap as an effort to reduce barriers related to access and use financial services (Yanti, 2019). Although infrastructure for banking has a faster average growth, its presence does not determine the adequacy of overall development and economic growth (Myeni, Makate, & Mahonye, 2020). Financial inclusion is not just open access but can influence on the development of MSMEs. The role is very important in increasing economic growth and development so that it becomes a solution to the problem about unemployment which has an impact on reducing poverty levels and increasing job opportunities (Abduh, 2017) so that MSMEs development needs attention.

Along with developments, increasingly sophisticated technology changes every activity that was originally carried out conventionally into a digital-based that not only changes activities in one field but also in various fields. This also applies to MSME actors in carrying out business activities, they need the ability to adapt these conditions. In marketing activities, MSME actors compete to sell their products using the internet with a higher intensity than large businesses (Abduh, 2017). Likewise in the financial sector, the emergence digital services is the result from innovation between the financial sector and technology, both provided by financial institutions and fintech companies. Innovations from technology and finance in research will focus on payments. Digital finance is technology, infrastructure, services, and financial products that provide convenience so that it is not done conventionally but can use the internet, computers, cellphones, or cards (Ozili, 2018).

The emergence mobile wallet as a payment alternative with convenient and easy services can increase its use whether it is intended for online transactions, storing a certain amount of money, and to make other payments according to available technology (Alwi, Salleh, Alpandi, Ya’acob, & Abdullah, 2021). Donner (2008), states that using mobile phones based on Technology, Information and Communication (ICT) development can affect work and increase welfare levels. In 2019 the Susenas survey, internet access in Indonesia reached 47.69 percent of the population, which shows that the public has openness information and technological developments that can be well received so that it leads an information society (Central Bureau of Statistics Indonesia, 2019). Based on this information, Indonesia is a country that has considerable potential in adopting digital payment financial services.

There are previous studies related to the variables involved. Financial literacy does not have a significant impact on adopting financial technology which is possible

due to the lack of financial literacy and financial technology understanding (Herdinata, 2020). This is different from Shen, Hu, and Hueng (2018) who found that increasing public financial literacy and popularizing internet use were an effort to introduce using digital financial products for progress in financial inclusion. Interventions from good financial literacy design can expand and promote digital payment and savings activities (Chiwaula, Matita, Kamwanja, Cassim, & Agurto, 2020). Financial literacy has an impact on entrepreneurial intentions to use the internet positively (Bayrakdaroğlu & Bayrakdaroğlu, 2017). Likewise in Nugroho and Apriliana (2021) research which states that Islamic financial literacy also has a positive impact on the use of digital finance, in this case Go-Pay.

Relationship in other variables, Narok District, Kenya, the financial services existence such as mobile banking, agency banking, ATM, and online banking has a high influence on access as well as using banking financial services for women entrepreneurs (Melubo & Musau, 2020). For women entrepreneurs in Narok District, Kenya, Using online banking services is not only related to limitations in literacy, internet networks availability, and the ability to use computers but also requires socialization to confirm that digital services availability is known. Myeni et al., (2020), in their research found that individual mobile money users have a high probability to have a formal banking account which could also be the result from offer role. The existence of a positive correlation between bank account ownership and higher users in urban areas does not increase these financial services reach for most rural communities. Expectations for business can also significantly increase the intention to use mobile money (Senyo & Osabutey, 2020). The availability of services in the form of mobile banking and the formulation of policies in shaping mobile banking services is very important so that both in terms of access and use it can increase so as to have a positive impact on financial inclusion (Siddik, Sun, Yanjuan, & Kabiraj, 2014). In contrast to the research conducted by C.O, C, C, C.O, and P (2020), financial inclusion is a problem for Nigeria, other developing countries are also faced with the next challenge, namely the lack of efficiency in the use of banking agents so that there is still limited space for service providers without strict regulations.

Based on this explanation, this study will attempt to find out how the relationship between financial literacy and financial inclusion variables in increasing the intention to use digital payment services MSMEs in Bandung city. The area selection was based on a survey conducted where area-based internet usage in 2019 was 68.75 percent for urban areas while for rural areas it was 31.25 percent (Central Bureau of Statistics Indonesia, 2019) which has great potential in the use of financial services. This research is important because to be able to compete and survive, MSMEs need to adapt to the changing environment. This research can certainly contribute to stakeholders to see how financial literacy and financial inclusion are obtained by MSME actors so that MSMEs intend to use digital financial services. Therefore, this study takes the variable of intention to use digital finance as a unique variable.

Financial literacy ownership for the general public and MSMEs actor in particular is a basic thing that needs to be owned. The importance of financial literacy is due to several reasons, including literacy raises financial understanding so that financial problems can be overcome and possible to have several financial products such as insurance, savings, and diversification in investment activities (Gunardi, Ridwan, & Sudarjah, 2017). Financial literacy ownership also supports financial product service

facilities acceptance, because of the ability to choose and subsequently determine the best services usage and according to needs so that it can give an impact on increasing inclusion, (Bongomin, Ntayi, Munene, & Nkote Nabeta, 2016) impacting lifestyle and financial level well-being (Hermawan, Gunardi, & Agustine, 2018). For some communities, such as in rural areas, strategies implementation as an effort to increase infrastructure investment activities, financial education, and the introduce mobile money usage through roadshows is very necessary in increasing awareness and usage (Myeni et al., 2020). A high understanding regulations and cooperation application regulations can increase their financial literacy and end up with support for small and medium-sized businesses to adopt financial technology (Herdinata, 2020). There are also several factors that influence internet banking usage, one of that is a poor knowledge about it (Gerrard, Barton Cunningham, & Devlin, 2006). Financial literacy increase and internet usage prestige have become a means of introducing the use of digital financial products which also leads to the advancement of financial inclusion (Shen et al., 2018). H1: Financial Literacy Affects Intention to Use Digital Finance.

Financial inclusion is important because it is related public to access financial services provided to be open or in other words removing barriers to access. The financial sector and fintech emergence are gateways that can increase business opportunities through mobile-based applications launch or other services in exploring these opportunities (Stewart & Jürjens, 2018). It is proven that greater open access to formal financial services emerges through financial technology (fintech) using which also has an impact on economic growth and sustainable and inclusive development (Herdinata, 2020). Basically, financial inclusion is related to transactional activities so that it becomes a driving force for mobile money services (payments) usage (Senyo et al., 2020). Activities to adopt payment products are the first step towards the next step, namely usage, while payment activities are the first step in creating financial inclusion (Arun & Kamath, 2015). Payments with mobile-based services for developing countries are an important tool to increase financial inclusion for the unbanked and play a role for funds cross-border in this case remittances (Leng, Talib, & Gunardi, 2018). Service channels availability with easy access and low costs can promote the level of financial inclusion with advantages such as timeliness, affordability, and related regulations so that the expansion for all society segments to use them can occur (Melubo & Musau, 2020).

H2: Financial Inclusion Affects Intention to Use Digital Finance.

Research Method

The research method used is explanatory to explain the relationship between the variables involved in the study. Data was obtained by distributing questionnaires online and offline to 100 MSME actors in Bandung city. The questionnaire uses a four Likert scale to determine respondents' choices tendency whether they have a tendency to the right or vice versa. Financial literacy which is basic financial knowledge in obtaining financial inclusion and increasing the ability to use various services available along with the times. Financial literacy as an independent variable was measured using financial knowledge, actions on financial decisions, ability to tell, manage, and attitudes related about finance which was adapted from Kartawinata and Mubaraq (2018), Sina (2017), Bongomin, Munene, Ntayi, and Malinga (2017), Bongomin, Ntayi, Munene, and Nkote Nabeta (2016), and Nkundabanyanga, Kasozi, Nalukenge, and Tauringana (2014).

|

Table 1. Loading Score and Cross Loading for each Statement | ||||||

|

Loading Score |

Cross Loading for each Statement | |||||

|

FI |

IUDF |

FL |

FI |

IUDF |

FL | |

|

FL01 |

0.673 |

0.365 |

0.376 |

0.673 | ||

|

FL011 |

0.739 |

0.418 |

0.365 |

0.739 | ||

|

FL012 |

0.711 |

0.489 |

0.405 |

0.711 | ||

|

FL021 |

0.651 |

0.448 |

0.448 |

0.651 | ||

|

FL03 |

0.703 |

0.369 |

0.381 |

0.703 | ||

|

FL031 |

0.786 |

0.492 |

0.458 |

0.786 | ||

|

FL032 |

0.739 |

0.543 |

0.428 |

0.739 | ||

|

FL04 |

0.653 |

0.391 |

0.427 |

0.653 | ||

|

FI011 |

0.775 |

0.775 |

0.583 |

0.477 | ||

|

FI02 |

0.756 |

0.756 |

0.530 |

0.492 | ||

|

FI031 |

0.680 |

0.680 |

0.427 |

0.483 | ||

|

FI04 |

0.770 |

0.770 |

0.610 |

0.431 | ||

|

IUDF01 |

0.769 |

0.612 |

0.769 |

0.514 | ||

|

IUDF011 |

0.768 |

0.575 |

0.768 |

0.608 | ||

|

IUDF012 |

0.776 |

0.559 |

0.776 |

0.465 | ||

|

IUDF013 |

0.741 |

0.530 |

0.741 |

0.366 | ||

|

IUDF02 |

0.658 |

0.439 |

0.658 |

0.299 | ||

|

IUDF021 |

0.684 |

0.409 |

0.684 |

0.271 | ||

|

IUDF022 |

0.702 |

0.551 |

0.702 |

0.369 | ||

|

Source: Processed Data, 2021 | ||||||

Financial inclusion is also an independent variable measured using the ability to access, using services, service quality, to perceived benefits, adapted from Bongomin et al. (2017) and Bongomin et al. (2016). Digital finance is a digital-based financial service or product that has emerged along with the times so that previously conventional activities have changed with the emergence of electronic products and cellular services as well as in the form of applications. Intention to use digital finance is measured by convenience perceptions, benefits, payment activities, transfers, and account management adapted from Qian (2019), Azam (2015), and Zhou, Lu, and Wang (2010).

The questionnaire used was tested first to ensure that was valid and reliable. The emergence of testing the validity and reliability variables can be shown in Table 1., Table 2., and Figure 1.

Validity testing consists of convergent (by considering the loading factor and Average Variance Extracted (AVE) value) and discriminant (by considering the indicator's loading value). Convergent validity can occur when the factor loading value is equal to and more than 0.6 (Bagozzi & Yi, 1988 in Go & Govers, 2011) and the AVE value is more than 0.5 (Abdillah & Hartono, 2015) while for discriminant validity indicator's loading

Table 2. Average Variance Extracted (AVE) and Composite Reliability

|

Variables |

Average Variance Extracted (AVE) |

Composite Reliability |

|

FL |

0.502 |

0.889 |

|

FI |

0.557 |

0.834 |

|

IUDF |

0.532 |

0.888 |

|

Source: Processed Data, 2021 | ||

19 ∖{ 3,012(19- 3,O12)'∣

19 -17 V 19 × 87,477 )

Figure 1. Kuder-Richardson 21 Calculation

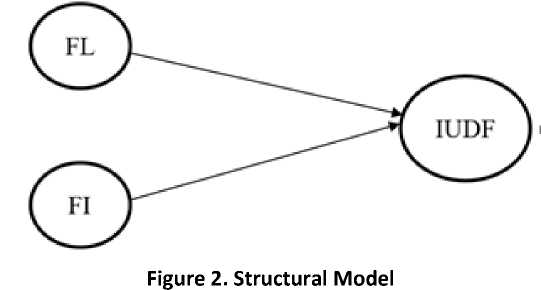

value must be greater than the overall cross loading (Hair, Ringle, & Sarstedt, 2011). The next test is reliability which can occur when the composite reliability value is higher than 0.7 (Hair et al., 2011) and Kuder-Richardson 21 which is between 0.85 and 0.95 even more than that (Salkind, 2007). All statements used have gone through both tests so it can be said valid and reliable. After knowing validity and reliability level, then conducted a relationship analysis between variables using Partial Least Square (PLS) method and 95 percent confidence level. Based on this explanation, the structural model can be formed by following equation.

= T τ S ........................................................................................... (1)

IUDF is intention to use digital finance, FL is financial literacy, FI is financial inclusion, /1,2 is the path coefficient, and l; is the measurement error. If the model equation above described, the flow will be formed as shown in Figure 2.

Result and Discussion

Questionnaires were distributed to 100 respondents with male respondents 37 percent and female respondents 63 percent. The respondents final education is dominated by respondents with undergraduate education 46 percent, diploma 23 percent, high school 20 percent, masters and doctoral degrees 8 percent, and the rest with a junior high school education 3 percent. The total respondents, micro-scale businesses dominate with 83 percent, followed by small businesses with 13 percent and medium-sized businesses with 4 percent. The business fields carried out by MSME actors starting with businesses in the fields of food and beverages, handicrafts, fashion, services, agribusiness, and conventions.

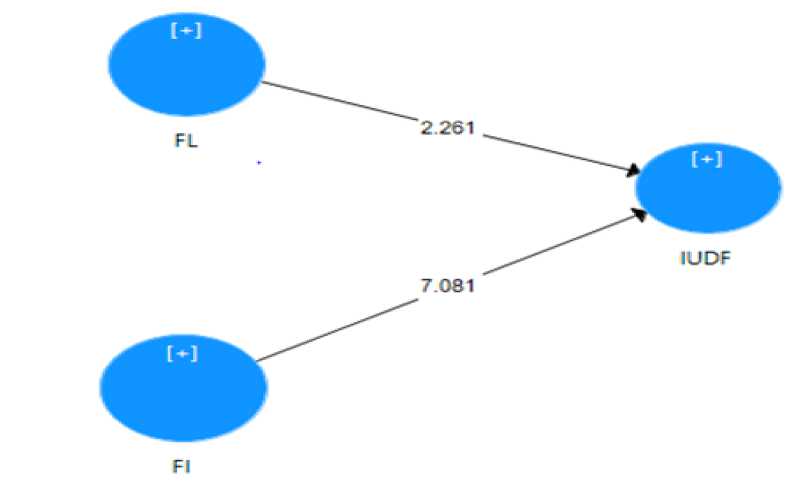

Data collection using questionnaires based on previous research, however, the items on the questionnaire were still tested for validity and reliability as shown in Table 1., Table 2., and Figure 1. The first stage is testing the structural model on the three variables used in Figure 3.

Figure 3. Model Structure

Source: Processed Data, 2021

Based on Partial Least Square (PLS) results analysis, the r-square value is obtained as shown in Table 3. R-square value is important to know because it relates independent variable contribution in explaining the dependent variable. Based on the results in Table 3. the variable Intention to Use Digital Finance (IUDF) value is 0.559, which means that Financial Literacy (FL) and Financial Inclusion (FI) explain Intention to Use Digital Finance (IUDF) with 55.9 percent while the rest are explained by others factors. 0.559 value can be interpreted as the prediction model use belongs to the medium category. This is in line with Hair et al. (2011), the r-square value of 0.75 is classified as substantial, 0.5 is moderate, and 0.25 is weak. In addition to using r-square, this study also uses predictive relevance (Q2) which is shown in Table 3.

The analysis Q2 results in Table 4. obtained 0.264 which is higher than zero, then the exogenous construct in this case the intention to use digital finance has predictive relevance.

The next stage is the core from this research, namely the relationship between the variables involved. The confidence level used is 95 percent with three variables so α is 0.05 with a df value 97. From these calculations, the t-table value use 1.660. The t-table value then compared with the t-statistics in testing the predetermined hypothesis.

The significance level of the relationship between variables (p-value) has several

Table 3. Predictive Relevance Measurement Q2 and R-Square

|

SSO |

SSE |

Q2(=1-SSE/SSO) |

R-Square | |

|

FI |

400.000* |

400.000** | ||

|

FL |

800.000* |

800.000** | ||

|

IUDF |

700.000* |

515.192** |

0.264*** |

0.559 |

Notes: * average in predictions; ** squared value for prediction error; *** Q2 value.

Source: Processed Data, 2021

Table 4. Variable Linkage

|

Variable Linkage |

Original Sample (O) |

T Statistics (|O/STDEV|) |

P Values |

Significance |

|

FL -> IUDF |

0.212* |

2.261** |

0.024*** |

Medium |

|

FI -> IUDF |

0.597* |

7.081** |

0.000*** |

Very strong |

Notes: * indicates the relationship direction if it is positive the relationship between the variables is positive; ** t-statistic value in deciding the hypotesis; *** p-value to determine significance relationship between variables.

Source: Processed Data, 2021

criteria where if p is greater than 0.1 then the significance is classified as very weak, 0.05 < p < 0.1 then the significance is classified as weak, 0.01 < p < 0.05 then the significance is moderate, 0.001 < p < 0.01 then the significance is classified as strong, and p is less than 0.001 then the significance is classified as very strong (Jawlik, 2016). Based on variables linkage in Table 4. financial literacy and the intention to use digital finance with t-statistics value higher than t-table indicates that H1 is accepted with moderate significance which indicates there is evidence related to this relationship. The results prove that financial literacy affects the intention to use digital finance. These results support previous research from Chiwaula, Matita, Kamwanja, Cassim, and Agurto (2020) interventions from good financial literacy design can expand and promote digital payment and savings activities. Financial literacy is important for MSME actors to know. The financial literacy ownership for MSME actors can increase knowledge about financial services availability and financial institutions and then selected according to their needs and support their business activities. Financial literacy not only plays a better role in financial management but also encourages MSME actors to know the latest developments in the financial sector so that adjustments can be made to changes. Financial knowledge, actions on financial decisions, the ability to tell, manage, and related attitudes about finance as indicators of financial literacy which show that the financial literacy of MSME actors in Bandung City affects interest in using digital financial services. With the knowledge they have, MSME actors can find out the types of digital financial services available, know their functions and operations, and end up with the intention to use certain digital financial services according to their preferences and business needs. Therefore, financial literacy ownership can increase MSME actors intention to use digital financial services.

The next variable linkage, is financial inclusion variable and the intention to use digital finance, has a higher t-statistics value than t-table so that H2 can be accepted with a very strong significance level which shows very large correlation evidence. The results prove that financial inclusion has an effect on the intention to use digital finance. These results support previous research from Melubo and Musau (2020), financial services existence such as agency banking, mobile banking, ATM, and online banking have a high influence on access as well as for banking financial services usage. Digital-based financial services existence, provided by financial institutions and fintech companies, have opportunity to improve facilities and community accessibility to touch these facilities. Increasing financial inclusion through service availability can lead to increased usage because the facilities are already provided. The popularity for using the service and the perceived ease of use also make this facility suitable with users expectations, in this case MSME actors. Obstacles that were previously a challenge can be minimized better. Now, most MSME players use digital financial services in their efforts to simplify and facilitate

consumers with various types of transactions. Therefore, the higher the level of financial inclusion, the more diverse the digital financial service facilities will be. This can certainly increase the intention of MSME actors to use digital financial services in line with the need to compete and the ability to adapt to a changing environment.

Conclusion

Financial literacy and financial inclusion ownerships are important for MSME actors. Financial literacy is knowledge related about finance and financial inclusion in minimizing existing obstacles so that the whole community in general can touch banking products. Along with the technology development, digital-based financial services have emerged, both offered by banks and fintech companies. Based on the results, financial literacy has an influence on the intention to use digital finance with moderate significance. Financial literacy ownership can increase knowledge about product availability until it the ends intentions to use services emergence that suit their needs and can support business activities. The next variable no less important is financial inclusion. Financial inclusion has a very strong influence on the intention to use digital finance. This shows very strong evidence on the relationship between variables. Financial inclusion as an effort to minimize barriers for access is helped by digital financial service presence. Financial inclusion with digital financial service facilities can increase MSME actors intention to using these facilities. This is in line with Otoritas Jasa Keuangan (2016) POJK regulation Number 76/POJK.07/2016 concerning Improvement of Financial Literacy and Inclusion in the Financial Services Sector for Consumers and/or the Community, there are two objectives of financial literacy, namely improving the quality of decision-making and changing attitudes and behaviors that have an impact on financial management so that in the end it can determine and utilize financial institutions and services that suit their needs as well as financial inclusion with the scope of expanding access to and providing financial products and/or services.

This finding is expected to contribute fintech knowledge, especially payments, considering that research is still quite rare regarding the intention to use digital finance for MSME actors. The results expected to provide input for related parties disseminate financial knowledge and introduce the kind of financial services availability so that has impact on service use intentions, market coverage, and the better MSMEs development. Even so, the small number of samples used and not involving other factors are limitations in this study so that further research can involve a larger number for samples.

References

Abdillah, W., & Hartono, J. (2015). Partial Least Square (PLS) Alternatif Structural

Equation Modeling (SEM) dalam Penelitian Bisnis. Yogyakarta: CV. ANDI OFFSET.

Abduh, T. (2017). Strategi Internasionalisasi UMKM. Makasar: CV. Sah Media.

Agarwal, T. (2016). An Analysis of the Twin Pillars of the Banking in India: Financial

Literacy and Financial Inclusion. Gavesana Journal of Management, 8(1&2). Retrieved from https://search.proquest.com/openview/4ecd051122f97a63c203ae566bb2c26d/ 1?pq-origsite=gscholar&cbl=2044546

Alwi, S., Salleh, M. N. M., Alpandi, R. M., Ya’acob, F. F., & Abdullah, S. M. M. (2021).

Fintech As Financial Inclusion: Factors Affecting Behavioral Intention To Accept

Mobile E-Wallet During Covid-19 Outbreak. Turkish Journal of Computer and Mathematics Education, 12(7), 2130–2141.

Arun, T., & Kamath, R. (2015). Financial inclusion: Policies and practices. IIMB Management Review, 27(4), 267–287.

https://doi.org/10.1016/j.iimb.2015.09.004

Azam, M. S. (2015). Diffusion of ICT and SME Performance.

https://doi.org/10.1108/S1069-096420150000023005

Badan Pusat Statistik. (2019). Statistik Telekomunikasi Indonesia. Retrieved from https://www.bps.go.id/publication/2020/12/02/be999725b7aeee62d84c6660/s tatistik-telekomunikasi-indonesia-2019.html

Bagozzi, R. P., & Yi, Y. (1988). On the Evaluation of Structural Equation Models. Journal of the Academy of Marketing Science, 16(1), 74–94.

Bayrakdaroğlu, F., & Bayrakdaroğlu, A. (2017). A Comparative Analysis Regarding The Effects of Financial Literacy and Digital Literacy on Internet Entrepreneurship Intention. Journal of Entrepreneurship and Development, 12(2), 27–38.

Bongomin, G. O. C., Munene, J. C., Ntayi, J. M., & Malinga, C. A. (2017). Financial literacy in emerging economies. Managerial Finance, 43(12), 1310–1331.

https://doi.org/10.1108/MF-04-2017-0117

Bongomin, G. O. C., Ntayi, J. M., Munene, J. C., & Nkote Nabeta, I. (2016). Social capital: mediator of financial literacy and financial inclusion in rural Uganda. Review of International Business and Strategy, 26(2), 291–312.

https://doi.org/10.1108/RIBS-06-2014-0072

Braunstein, S., & Welch, C. (2002). Financial literacy: An overview of practice, research, and policy. Fed. Res. Bull, 88, 445.

C.O, I. E., C, E. G., C, O. M., C.O, O. O., & P, O. I. (2020). Digital Finance and Financial Inclusion in Nigeria: Lessons From Other Climes. Nigerian Journal of Banking and Finance, 12(1), 97–105.

Chiwaula, L., Matita, M., Kamwanja, T., Cassim, L., & Agurto, M. (2020). Combining Financial-Literacy Training and Text-Message Reminders to Influence Mobile-Money Use and Financial Behavior among Members of Village Savings and Loan Associations: Experimental Evidence from Malawi.

Damayanti, S. M., Murtaqi, I., & Pradana, H. A. (2018). The Importance of Financial Literacy in a Global Economic Era. The Business and Management Review, 9, 435–441. Retrieved from

https://cberuk.com/cdn/conference_proceedings/2019-07-14-11-03-17-AM.pdf

Deka, P. P. (2015). Financial literacy and financial inclusion for women empowerment: A study. International Journal of Applied Research, 1(9), 145–148. Retrieved from http://www.allresearchjournal.com/archives/2015/vol1issue9/PartC/1-9-19.pdf

Donner, J. (2008). Research Approaches to Mobile Use in the Developing World: A Review of the Literature. The Information Society, 24(3), 140–159. https://doi.org/10.1080/01972240802019970

Gerrard, P., Barton Cunningham, J., & Devlin, J. F. (2006). Why consumers are not using internet banking: a qualitative study. Journal of Services Marketing, 20(3), 160– 168. https://doi.org/10.1108/08876040610665616

Go, F. M., & Govers, R. (2011). International Place Branding Yearbook 2011 (Managing Reputational Risk). New York: Palgrave Macmillan.

Gunardi, A., Ridwan, M., & Sudarjah, G. M. (2017). The Use of Financial Literacy for Growing Personal Finance. Jurnal Keuangan Dan Perbankan, 21(3), 446–458.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a Silver Bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. https://doi.org/10.2753/MTP1069-6679190202

Herdinata, C. (2020). The Effect of Regulation, Collaboration, and Financial Literacy on Financial Technology Adoption. Expert Journal of Business and Management, 8(2), 131–138.

Hermawan, A., Gunardi, A., & Agustine, W. M. I. (2018). Understanding the Determinants of Financial Literacy: A quantitative Study on Students. Advances in Economics, Business and Management Research, 65.

Huston, S. J. (2010). Measuring Financial Literacy. Journal of Consumer Affairs, 44(2), 296–316. https://doi.org/10.1111/j.1745-6606.2010.01170.x

Jawlik, A. A. (2016). Statistics from A to Z Confusing Concepts ClarifieJawlik, A. A. (2016). Statistics from A to Z Confusing Concepts Clarified. Canada: John Wiley & Sons Inc.d. Canada: John Wiley & Sons Inc.

Kartawinata, B. R., & Mubaraq, M. I. (2018). Pengaruh Kompetensi Keuangan Terhadap Literasi Keuangan Bagi Wanita di Makassar. Oikos: Jurnal Kajian Pendidikan Ekonomi Dan Ilmu Ekonomi, 2, 87–100.

Leng, S. Y., Talib, A., & Gunardi, A. (2018). Financial Technologies: A Note on Mobile Payment. Jurnal Keuangan Dan Perbankan, 22(1), 51–62.

Leyshon, A., Thrift, N., & Pratt, J. (1998). Reading Financial Services: Texts, Consumers, and Financial Literacy. Environment and Planning D: Society and Space, 16(1), 29–55. https://doi.org/10.1068/d160029

Lumenta, U. Z., & Worang, F. G. (2019). The Influence of Financial Inclusion on The Performance of Micro Small and Medium Enterprises in North Sulawesi. Jurnal EMBA, 7, 2910–2918. Retrieved from https://ejournal.unsrat.ac.id/index.php/emba/article/view/24034/23721

Lusardi, A., & Mitchell, O. S. (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature, 52(1), 5–44.

Melubo, K. D., & Musau, S. (2020). Digital Banking and Financial Inclusion of Women Enterprises in Narok County, Kenya. International Journal of Current Aspects in Finance, Banking and Accounting, 2(1), 28–41.

Myeni, S., Makate, M., & Mahonye, N. (2020). Does mobile money promote financial inclusion in Eswatini? International Journal of Social Economics, 47(6), 693–709. https://doi.org/10.1108/IJSE-05-2019-0310

Nkundabanyanga, S. K., Kasozi, D., Nalukenge, I., & Tauringana, V. (2014). Lending terms, financial literacy and formal credit accessibility. International Journal of Social Economics, 41(5), 342–361. https://doi.org/10.1108/IJSE-03-2013-0075

Nugroho, A. P., & Apriliana, R. M. (2021). Islamic Financial Literacy and Intention to Use Gopay in Yogyakarta: Extended Theory of Acceptance Models. International Conference on Islamic Studies and Social Sciences (ICONISSS) 2021. Yogyakarta.

Otoritas Jasa Keuangan. (2016). POJK regulation Number 76/POJK.07/2016.

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329–340. https://doi.org/10.1016/j.bir.2017.12.003

Qian, W. X. (2019). Determinants and Consequences of the Use of Digital Finance Platform for Personal Financial Management in Rural China (Curtin University). Retrieved from https://espace.curtin.edu.au/handle/20.500.11937/76185

Salkind, N. J. (Ed.). (2007). Encyclopedia of Measurement and Statistics. California: Sage Publications, Inc.

Senyo, P., & Osabutey, E. L. C. (2020). Unearthing antecedents to financial inclusion through FinTech innovations. Technovation, 98, 102155.

https://doi.org/10.1016/j.technovation.2020.102155

Senyo, P., Osabutey, E. L. C., & Seny Kan, K. A. (2020). Pathways to improving financial inclusion through mobile money: a fuzzy set qualitative comparative analysis. Information Technology & People, ahead-of-p(ahead-of-print).

https://doi.org/10.1108/ITP-06-2020-0418

Shen, Y., Hu, W., & Hueng, C. J. (2018). The Effects of Financial Literacy, Digital Financial Product Usage and Internet Usage on Financial Inclusion in China. MATEC Web of Conferences, 228, 05012. https://doi.org/10.1051/matecconf/201822805012

Siddik, M. N. A., Sun, G., Yanjuan, C., & Kabiraj, S. (2014). Financial Inclusion through Mobile Banking: A Case of Bangladesh. Journal of Applied Finance & Banking, 4(6), 109–136.

Sina, P. G. (2017). Financial Contemplation Part 1. Bogor: Guepedia.

Stewart, H., & Jürjens, J. (2018). Data security and consumer trust in FinTech innovation in Germany. Information & Computer Security, 26(1), 109–128.

https://doi.org/10.1108/ICS-06-2017-0039

Yanti, W. I. P. (2019). Pengaruh Inklusi Keuangan dan Literasi Keuangan Terhadap Kinerja UMKM di Kecamatan Moyo Utara. Jurnal Manajemen Dan Bisnis, 2. Retrieved from http://jurnal.uts.ac.id/index.php/jmb/article/view/305

Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior, 26(4), 760–767.

https://doi.org/10.1016/j.chb.2010.01.013

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 182

Discussion and feedback