Insightfully Explore the Ethical Decision Making of Tax Consultants During COVID-19 Pandemic

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 1, January 2022

AFFILIATION:

1,2,3,4Faculty of Economics and Business, Universitas Udayana, Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2022.v17.i01.p011

CITATION:

Pramana, I K. A., Budiasih, I G. A. N., Dwirandra, A. A. N. B., Putri, I G. A. M. A. D.

(2022). Insightfully Explore the Ethical Decision Making of Tax Consultants During COVID-19 Pandemic. Jurnal Ilmiah Akuntansi dan Bisnis, 17(1), 159-170.

ARTICLE HISTORY Received:

29 September 2021

Revised:

18 December 2021

Accepted:

5 January 2022

Insightfully Explore the Ethical Decision

Making of Tax Consultants During COVID-19

Pandemic

I Kadek Adhi Pramana 1*, I Gusti Ayu Nyoman Budiasih2, Anak Agung Ngurah Bagus Dwirandra3, I Gusti Ayu Made Asri Dwija Putri4

Abstract

Weakening economic performance during COVID-19 pandemic has an impact on state revenues in the tax sector caused dilemma for a tax consultant. This study aims to explore various ethical decisions making by tax consultants. Transcendental phenomenology Husserl's is used to obtain pure consciousness from informants. Data was collected by interview and based on the interpretation, the dilemma caused by non-optimal income and client's internal policies. In addition, several clients experience tax audits during the pandemic. Ethical assessment of decision making is considered into several aspects, such as: moral considerations, commitment to providing optimal services, and awareness that the role of tax consultants is helping the government to gain state revenue in tax sector. This study provides the relevance use of ethical theory and the theory of planned behaviour. For practitioners, this research can be used as advice in making decisions both in pandemic situations and other unexpected events.

Keywords: phenomenology, dilemma, tax consultant, explore, ethical decision

Introduction

The COVID-19 harmed the global economy and has caused many entrepreneurs to experience losses, so they chose to close their businesses and lay off their employees. Declining economic performance also has an impact on state revenues in the tax sector. For the State, taxes are one of the important sources of revenue that will be used to finance state expenditures, both routine expenditures, and development expenditures. On the other hand, for companies, taxes are a burden that will reduce net income (Suandy, 2016). Because of these differences in interests, the tax must be taken into account in every decision by the company. In terms of taxation, taxpayers often need a tax consultant to help them plan their corporate tax (Dewi et al., 2018).

The dilemma felt by the tax consultant is where the tax consultant has to comply with the regulations. However tax consultant considers compensation factor given by the taxpayer and the continuity of his service business (Suardika, 2016). This is where ethical decision-making by a tax consultant is needed. This issue arises as a result of dual agency problems in the relationship between tax consultants and, clients, tax

consultants need to maintain good relations with clients in contrast, tax consultants must comply with tax regulations and professional codes of ethics. Concerning the duties of the tax consultant profession, it seems as if there is a conflict of interest, which on the one hand must fully assist taxpayers in their taxation problems, but on the other hand, must also help the government participate in securing tax revenues (Budileksmana, 2016). In this COVID-19 pandemic there are challenges that tax consultants are facing such as how to provide optimum services based on the client economical and financial condition, client or government policies and to perform duty as a tax but in the other hand the tax consultants are required to make profits to finance expenses, business continuity must be carried out so that the business can be maintained (Jurnal.id, 2021). The author is trying to explore what kind of dilemmas they are facing, how they make ethical decisions and how personal beliefs affected their action to handle their clients during this COVID-19 pandemic so it can be used as a consideration in the future when facing the unprecedented event such as this pandemic.

The purpose of this study is to be able to explore various ethical decisions tax consultants make during the COVID-19 in overcoming the perceived dilemma. The transcendental phenomenology method is the right method to use because this method explores pure information from informants who are free from perception (Dewi et al., 2019). Phenomenology in the concept of consciousness according to Husserl is open. The phenomenon of experience is what is produced by human activity and consciousness. Husserl discussed a lot about the concept of consciousness in experience, so that until now phenomenology has been defined as the study of consciousness and the experiences in it. Phenomenology studies the form of experience from someone who experiences it directly as if it was experienced by people who research about the experience. In addition to classifying conscious actions, phenomenology also predicts future actions as well as interpreting objects in experience (Kuswarno, 2009). The urgency of this research can be seen from the phenomena that have been presented previously, that previous research was carried out when economic condition was normal so that they did not deeply know how the dilemma felt and how consultants could take an ethical decision in unexpected events such as the COVID-19. The novelty of this research is that research does not only focus on the dilemmas experienced but also explores what decisions are taken and what considerations are believed.

According to Bertens (2000) ethical theory has a goal, which is to help individuals in making decisions related to morals and provide consideration for decisions made. Ethical theory is closely related to the resolution of ethical dilemmas. Ethical theory can help individuals in considering the decisions that will be made to avoid them from feeling a dilemma. An ethical dilemma is where the individual is a condition where the individual is having difficulty in making decision between two action that are not mutually beneficial or comparable. Ethical dilemmas are often found in professional work, including tax consultants. The tax consultant is placed in a difficult position where they must choose an action and the consequences that will result whether it is under ethical morals or not. Ethical dilemmas can be overcome by choosing a good judgment.

The clause Insightfully explore in this study is intended to explain the ethical considerations of an action or decision taken by the informant based on their respective experiences. By exploring the ethical considerations of the informants’ decisions, the researcher can obtain a fair decision according to what they believe.

Tax consultant is a person who provides tax services to clients in the context of exercising their rights and fulfilling their tax obligations by tax laws and regulations. Tax services are services provided by tax consultants in the form of tax consulting services, tax rights, and obligations management services, taxpayer assistance services in the context of tax audits and tax disputes (including regional taxes) at the tax government, tax courts, supreme courts, preliminary evidence examinations and investigation of criminal acts in the field of taxation (Ikatan Konsultan Pajak Indonesia, 2019).

Tax planning is the process of organizing the business of individual taxpayers and business entities in such a way by utilizing various loopholes that can be taken in the corridor of tax regulations (loopholes) so that companies can pay taxes in a minimum amount (Pohan, 2016). Tax planning is the initial stage to systematically analyse various alternative tax treatments to achieve optimum fulfilment of tax obligations. After tax planning, the next stage is to carry out the function of organizing, implementing, and controlling taxation (Ikatan Akuntan Indonseia (IAI), 2015).

Research Method

This study aims to explore various ethical decisions tax consultants make during the COVID-19 in overcoming the dilemmas. The research approach used is phenomenological. Phenomenology can be an analytical tool to get what Husserl calls pure subjectivity. (Burrell & Morgan, 1979) explains that there are at least three kinds of phenomenology, namely transcendental phenomenology, existential phenomenology, and sociological phenomenology. The phenomenology used in this study is transcendental phenomenology. Transcendental phenomenology proposed by Edmund Husserl focuses on a study of consciousness. Phenomenology studies how phenomena are connected with complex consciousness. Husserl introduced the terms noesis and noema, which come from the Greek noeaw meaning to feel, think, intend, and nous meaning thought. Noesis is termed the deliberate process of consciousness, and noema for the content of that consciousness. Noema of conscious action and call ideal meaning, and visible object. Noema is a phenomenon. Intentionality refers to the correlation between noema and noesis that directs the interpretation of experience. An intentional analysis is a process of exploring a person's experience (noema) to obtain the essence of his consciousness (noesis) by performing an epoche application (Kamayanti, 2016). Husserl explained that when epoche or bracketing is done, the confinement of the meaning must be accompanied by an understanding that the meaning appears at a certain time and space which makes it an experience for the “I”. Epoche is a method of delaying assumptions about reality to bring out the essence (Hardiansyah A, 2013). Epoche suggests certain reductions to reduce accidental phenomena to the object of his investigation, where the reductions include the first eidetic reduction, this reduction aims to reveal the basic structure (edios) of a pure phenomenon that has been purified by removing the experience that the phenomenologist has had. on the object under study so that what remains is only the essence of the object itself. The next reduction is phenomenological reduction, which is a reduction directed at the subject, stemming all the prejudices that phenomenologists have.

The subject of this research is the informant, who provides information on the situation and background conditions of the problem being studied. Interviews were

Table 1. List of Informants

|

No |

Name |

Experience |

City |

|

1 |

Informant PY |

2013 to recent |

Denpasar |

|

2 |

Informant GM |

2009 to recent |

Denpasar |

|

3 |

Informant UA |

2011 to recent |

Denpasar |

|

4 |

Informant NF |

2009 to recent |

Denpasar |

|

5 |

Informant RE |

2008 to recent |

Denpasar |

Source: Processed by Researchers, 2021

conducted with informants who were considered competent. Key informants are determined for their involvement in the social situation/condition that will be studied in the research focus (Suyitno, 2018). The technique of determining the informants used snowball sampling. In every interview with the informant, the researcher asked for the name, address, and/or telephone number that could be contacted and approximately willing to be interviewed. The interview was stopped when there were no more variations in the answers (Shidiq & Choiri, 2019). Interviews were conducted with informants who were considered competent according to the snowball sampling method is as shown in Table 1.

The research instrument in this study is the phenomenologist himself, who is the person who interacts directly with the informant during the interview. Other supporting instruments are several questions related to research issues, besides the primary data collection media or supporting instruments used in this study are recording devices and memos.

Result and Discussion

The function of theory in this qualitative research is only for comparison of research results/explaining phenomena, because this method explores pure information from informants who are free from researcher perception. The theory of planned behavior focuses on an individual's intention to perform a certain behavior. This theory is suitable for describing any behavior that requires planning. Ethical decisions are the best steps that a tax consultant can take in overcoming the dilemma they are experiencing. The size of a decision that can be said to be ethical is certainly different from one informant to another. Each informant certainly has its balance or perspective based on experience, culture, and other factors. Pure awareness arises from the consideration that is believed in a decision. This study explores various ethical decisions tax consultants make during the COVID-19 who is trusted as an informant using phenomenological analysis. Phenomenology is defined as a science that is oriented to get an explanation of the visible reality. The main method of phenomenology is by conducting in-depth interviews.

The PY informant was the first informant to be interviewed. When asking about the impact of the COVID-19 pandemic on the tax consultant profession, PY Informant revealed his experience regarding the client's situation that had an impact on his profession, so that several dilemmas were felt before making a decision. The following is the explanation of PY's informants:

"... during the meeting {the client said he couldn't afford to pay for the company's operational costs and there were difficulties... in terms of liquidity}..." (PY Informant)

Even though the client closes his business, either temporarily or permanently, tax obligations must still be carried out. In addition, even though there are a pandemic and experiencing liquidity difficulties, there are also clients who are undergoing inspections. The PY informant decided to continue to help his client by taking the mechanisms and use the incentives covid that have been regulated in the general provisions of taxation. To warn the client's burden, PY informants provide fee discounts to their clients who are still operating. As in the following statement:

"...This is ethically done (smiles) to {help restore the condition of taxpayers so that they can immediately return to operating properly as in the pre-pandemic era} ..."(PY Informant)

The PY informant consciously said that it was ethical to do this even though from a business perspective it was unethical, for him the decision to help restore the client's condition so that it can operate as before is a moral responsibility. PY informants help clients according to their field of expertise, namely fulfilling tax obligations.

GM informants are recommendations from the first informants who are members of a professional association. For the GM informant, reporting the Annual SPT is a routine agenda that brings in additional fees because it only occurs in March and April, besides that it is an annual obligation for taxpayers. However, in 2021 the receipt of fees, especially the annual fee, has decreased. The following is the explanation of the GM informant:

"...After that, from that time until now the hardest affected, I feel, I feel in 2021 because we don't get 100% annual tax fees, far from last year..." (GM Informant)

In addition to declining fee receipts, government policies that is rapidly changing have created a dilemma of their own. But on the other hand, the exploration of potential inspections is still being carried out. Fulfillment of tax obligations is still carried out even though the GM informant also tries to cover his office operations and even uses her savings. The character of love for the homeland is manifested by helping the acceptance of the State, but the final decision remains in the hands of the client, he said. The statement was conveyed by the GM informant as follows:

“…The obligation remains because I feel that it is our responsibility when they can also pay us, at what time can we help at this time} yes, give them a deferral of the fee. That's all I can do…” (GM informant)

"... {it's not like my character is really happy to help for state revenue, trying to do this if the taxpayer wants it but if the taxpayer doesn't want it it's beyond my control} ...” (GM informant)

The third informant in this study is a UA informant who started his career as a tax consultant in February 2011 until now. The UA informant admitted that his profession was affected but he was grateful that he was still able to maintain the integrity of his team because the main problem during the pandemic was the issue of taxpayer cash flow which affected mandatory compliance. As stated by the following UA informants:

"... {the pandemic or corona situation is one, cash flow is affected but we are grateful as a team we can still keep all of our teams} ..."(UA informant)

"... {in terms of compliance, I also see that there is a tendency for taxpayer compliance, not a decrease because on average the problems faced by clients are liquidity problems, namely liquidity problems. So, initially, the compliance was

good, then it was hampered by liquidity problems. So this pandemic will hit all sectors, especially Bali, which is the base of tourism…” (UA Informant)

The saving cost strategy of the taxpayer causes a dilemma because costs are prioritized to earn income to survive, besides that the audit process continues even though the government has a priority audit program. Moral support is provided with counseling in the business aspect because psychologically the taxpayer feels shocked. UA informants make decisions by offering mechanisms that can be taken to ease the burden on taxpayers in terms of paying taxes based on applicable regulations. Like what the client did, the UA informant also carried out a cost-saving strategy by reducing some costs but not reducing costs that could reduce services. As stated in the following statement:

"... {there are several mechanisms by the general provisions of taxation, yes, our KUP requests to postpone or pay in installments and apply for the abolition or reduction of such defamation sanctions} ...."(UA informant)

"... {So because our focus is really on service to our clients, so we try not to reduce something that can reduce our service to clients} even though we may not be able to run but what we call it trying to continue can move…” (UA informant)

The NF informant shared his experience of clients who depend on income which during this pandemic declines, clients have to reduce costs and one of them is the cost of tax consultants. As stated in the following statement:

"...Well, the clients themselves depend on income to live, right now with the covid condition like this {their income automatically decreases they have to cut costs too to survive, so sometimes the consultants are cut off} that’s the problem..."(NF informant)

Another obstacle that causes the dilemma is the client's internal policy to lay off employees or apply for shift work. Despite the declining revenue, NF informants still carry out their professional responsibilities to assist state revenues with using covid incentives and fulfilling their client's tax obligations with moral considerations. The following is the perspective of the NF Informants regarding this matter:

“…still… so the term is {The state still needs to receive a tax consultant, right, one of the fronts for that}. One year not the only one, one in front. {So we still have to help with our professional obligations} ..."(NF informant)

"...It's because the provisions are rules and terms {with this consideration, there are moral considerations too, right} ..." (NF Informant)

The last informant is a senior in the tax consulting profession who passed the certification exam in 2007 and has a license in 2008 until now. According to the RE informant, his profession was not directly affected by the COVID-19 but was affected by the domino effect because the taxpayers served were mostly in the tourism sector. As stated in the following statement by the RE informant:

“...the impact is {not direct. So like it or not, because we are located in Bali which incidentally then we serve taxpayers, most of whom are tourism, when tourism closes it will automatically have an impact. So we have a domino effect}. That's why I said earlier not directly…” (RE informant)

The decrease in the ability to pay from clients certainly has an impact on the continuity of employee salaries which causes a dilemma. The RE informant emphasized that if the client still communicates well with him, the service will still be provided, of course following applicable professional standards. Utilization of incentives, provision of

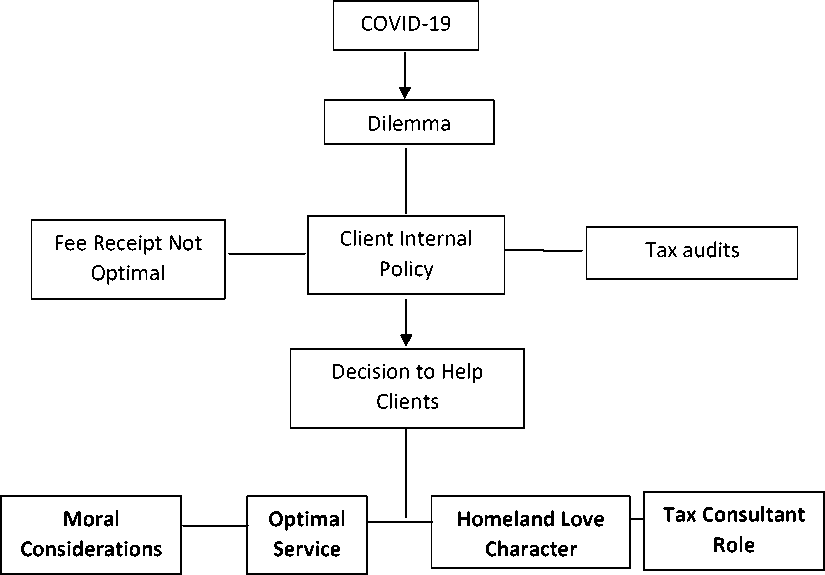

Figure 1. Summary Interpretation of the Informants

Source: Processed by Researchers, 2021

alternative tax planning, and delays in salary adjustments are carried out. The RE informant said that therein lies the role of tax consultants, namely as a bridge between the tax governments and taxpayers. The emphasis is conveyed through the following statement:

"... {as long as he still thinks we are consultants, what are the name and he communicates whether it's a matter of financial difficulty to pay us or whether we provide services or services}, we will continue to do the standards set by IKPI or IAI...”(RE informants)

“… {Here's what we call the bridge between government tax and taxpayer} ..."(RE Informant)

Based on the interpretation of each informant, it can be mentioned that the summary interpretation of each informant is as shown in Figure1.

COVID-19 Pandemic start in November 2019. Since that period there are research that studying the dilemma of tax consultant on making tax planning (Dewi et al., 2019). The dilemma arises due to a decrease in the client's income due to the impact of the COVID-19 pandemic in various sectors so that the client does not have sufficient funds to pay fees to his consultant, in addition to the client's internal policies such as laying off employees, cutting or saving costs causing compliance has decreased, plus there are clients who are undergoing examinations during the pandemic.

The Theory of Planned Behavior states that in addition to attitudes toward behaviour and subjective norms, individuals also consider their perceived behavioural control, namely their ability to perform these actions. This theory is not directly related to the amount of control a person has. However, this theory emphasizes more on the possible effects of perceived behavioural control in achieving goals on a behaviour. If

intentions indicate a person's desire to try to perform a certain behaviour. The ethical decision of a tax consultant has planned behaviour that must be taken because it can result in the continuity of the client's business. The theory of planned behaviour is suitable to explain any behaviour that requires planning (Ajzen, 1991). In line with Theory of Planned Behavior, in this research we found that tax consultant have a plan and special considerations so that in the future new problems do not arise when they are facing an economical dilemma that their clients are facing, but in under any circumstances the tax consultant must perform their duty and make some profit for their expenses, in reality both cannot be fulfilled due their client economical reason, the tax consultant can still help to fulfil their tax obligation despite taking no profit from it, but if tax consultant ignore this problem there are consequences that will follow such as losing their relation to clients or fail to fulfil their clients tax obligation, this will result a tax penalty or tax inspection which will be a burden for both client and their tax consultant, therefore a specific consideration are needed to plan a ethical decision making.

Previous research only explores the form of dilemmas and mostly researched with a positivist approach. Dilemma forms tax consultants such that the dilemma posed by tax consultants have concern for the client and tax consultants think of business continuity services (Dewi et al., 2019). This study explores the form of dilemmas, in this research also explore how tax consultant make the ethical decision based on some consideration. Experience strengthens the positive influence of the relationship between idealism and ethical decisions of tax consultants, while experience does not affect the relationship between professional commitment and ethical decisions of tax consultants in the Bali region (Wirakusuma, 2019). The perception of the importance of ethics and social responsibility which are individual factors of tax consultants that have a positive effect on ethical decision making. This means that whether or not the perception of the importance of ethics in a person is high has a strong influence on ethical decision making (Arestanti et al., 2016). Qualitative research on the Phenomenological Study of the Ethical Dilemma of Government Internal Auditors obtained the results that the auditor felt a dilemma when he received intervention, the auditor experienced a bad feeling when reporting a friend's error, the auditor had to face public perceptions, the auditor felt disappointed when the Audit Result Report was not signed and the limited number of auditors, audit time and supporting infrastructure are factors hindering audits (Noviriani et al., 2015). This study also gives the ethical decision making and the consideration based on moral beliefs. The result shows that moral considerations are prioritized because tax consultants understand the situation of their clients. After all, in situations like this communication is an important thing in every decision making. Continuing to provide optimal service is one of the commitments that must be made. The importance of the role of tax consultants in assisting state revenues is well recognized by every informant as a reflection of the character of love for the homeland.

Conclusion

Can be concluded the noema dilemma that arises due to non-optimal fee receipts, client internal policies, and tax audits during the COVID-19 are felt by tax consultants. While the noesis consideration of the decisions taken are different. The decision to help restore the client's condition so that it can operate as before is a moral responsibility.

The COVID-19 pandemic certainly has an impact on the continuity of the client's business, but profit is not the main thing. As a profession, the commitment to provide optimal service in fulfilling the client's tax obligations according to the code of ethics and applicable regulations is more important. The role of a tax consultant as a party that bridges the interests of taxpayers with the Directorate General of Taxes is the embodiment of the character of love for the homeland in helping state revenues in the tax sector.

There are some limitations in this research. Determination of informants, the informants used are 5 key informants who are leaders or owners of a tax consulting office without additional informants from the office concerned. Interviews were conducted once at a time so that the validity in terms of time was not met. Time limitations in data collection, because the schedule of informants is quite busy and the policies of the COVID-19 have postponed the interview schedule. There were also technical problems during online interviews, such as voice not coming in and signal being interrupted.

The suggestions submitted are based on the results of the conclusions obtained, namely: further researchers can conduct similar research in different professions because course, each profession has different dilemmas and perceptions in measuring a decision during the covid 19 pandemic. Further researchers can research different areas so that the resulting ethical decisions are more diverse.

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human

Decision Processes, 50(2), 179–211. https://doi.org/10.1016/0749-

Arestanti, M. A., Herawati, N., & Rahmawati, E. (2016). Faktor-Faktor Internal Individual dalam Pembuatan Keputusan Etis: Studi pada Konsultan Pajak di Kota Surabaya. Jurnal Akuntansi Dan Investasi, 17(2), 104–117.

https://doi.org/10.18196/jai.2016.0048.104-117

Auliyana, E. (2017). Studi Kasus Fenomenologi Atas Opini Audit WTP di Kalangan Pejabat Pemerintah Provinsi Jawa Timur. Jurnal Akuntansi Aktual, 4(1), 22–33.

https://doi.org/10.17977/um004v4i12017p022

Badan Pusat Statistik. (2020). Pertumbuhan Ekonomi Indonesia Triwulan II-2020.

Www.Bps.Go.Id, 17/02/Th. XXIV, 1–12.

https://www.bps.go.id/pressrelease/2020/02/05/1755/ekonomi-indonesia-

Badan Pusat Statistik. (2020). Pertumbuhan Ekonomi Indonesia Triwulan III-2020.

Www.Bps.Go.Id, No. 15/02/(15), 1–12.

Badan Pusat Statistik. (2020). Statistik Pertumbuhan Ekonomi Indonesia Triwulan I-2020.

https://www.bps.go.id/pressrelease/2020/02/05/1755/ekonomi-indonesia-

Badan Pusat Statistik. (2020). Statistik Pertumbuhan Ekonomi Indonesia Triwulan IV-

https://www.bps.go.id/pressrelease/2020/02/05/1755/ekonomi-indonesia-

Bertens, K. (2000). Pengantar Etika Bisnis. Kanisius.

Budileksmana, A. (2016). Manfaat dan Peranan Konsultan Pajak dalam Era Self Assessment Perpajakan. Jurnanl Akuntansi & Investasi Vol. 1 No. 2 Hal: 77-84 ISSN: 1411-6227 MANFAAT, 1(July), 1–23.

Burrell, G., & Morgan, G. (1979). Sociological Paradigms and Organisational Analysis. The ANNALS of the American Academy of Political and Social Science, 1, 5–95. https://doi.org/10.1177/003803858001400219

Chaezahranni, S. (2016). Penerapan Perencanaan Pajak (Tax Planning) atas Pemotongan Pajak Penghasilan Pasal 21 Pegawai Tetap PT RSA dalam Meminimalkan Pajak Penghasilan Badan. In Prosiding Seminar Nasional Cendekiawan (Vol. 0, Issue 0). https://www.trijurnal.lemlit.trisakti.ac.id/index.php/semnas/article/view/909

Creswell, J. W. (2013). Qualitative inquiry and research design : choosing among five approaches. Vicki Knight.

Dalughu, M. (2015). Analisis Perhitungan dan Pemotongan PPh Pasal 21 pada Karyawan PT. BPR Primaesa Sejahtera Manado. Jurnal Berkala Ilmiah Efisiensi, 15(3), 106– 113.

Darori. (2017). Peran Auditor Internal Pemerintah dalam Pencegahan dan Pendeteksian Fraud (Sebuah Studi Fenomenologi). Jurnal Ilmiah Administrasi Publik, 3(2), 83– 91. https://doi.org/10.21776/ub.jiap.2017.003.02.1

Dewantari, D. P. D., Budiasih, I., Sujana, I. K., & Wirajaya, I. G. A. (2020). Accounting and Happiness : Revealing The Meaning of Profit From The Perspective of Business Actors. Palarch’s Journal of Archaeology of Egypt/Egyptology (PJAEE), 17(9), 40– 57.

Dewi, A. A. I. P., Sudarma, M., & Baridwan, Z. (2018). Dilema Etis Konsultan Pajak dalam Tax Planning: Studi Fenomenologi. Jurnal Ilmiah Administrasi Publik (JIAP), 4(2), 128–139. https://doi.org/10.21776/ub.jiap.2018.004.02.6

Dewi, A. A. I. P., Sudarma, M., & Baridwan, Z. (2019). Mengupas Bentuk Dilema Dari Sisi Konsultan Pajak. Jurnal Ilmiah Akuntansi Dan Bisnis, 14(1), 132–141. https://doi.org/10.24843/jiab.2019.v14.i01.p12

Dewi, D. P. N., Sudana, I. P., Dwirandra, A. A. N. B., & Wirajaya, I. G. A. (2020). Debt Refinancing Decision Making: a Phenomenological Study in a Not-for-Profit Organization. Russian Journal of Agricultural and Socio-Economic Sciences, 104(8), 3–14. https://doi.org/10.18551/rjoas.2020-08.01

Direktorat Jenderal Pajak. (2018a). Laporan Tahunan 2017 Direktorat Jendral Pajak.

Www.Pajak.Go.Id, 226. www.pajak.go.id

Direktorat Jenderal Pajak. (2018b). SE-15/pj/2018 tentang Kebijakan Pemeriksaan Direktorat Jendral Pajak. Www.Pajak.Go.Id, 79.

http://www.ncbi.nlm.nih.gov/pubmed/7556065%0Ahttp://www.pubmedcentral .nih.gov/articlerender.fcgi?artid=PMC394507%0Ahttp://dx.doi.org/10.1016/j.hu mpath.2017.05.005%0Ahttps://doi.org/10.1007/s00401-018-1825-

z%0Ahttp://www.ncbi.nlm.nih.gov/pubmed/27157931

Direktorat Jenderal Pajak. (2019). Laporan Tahunan 2018 Direktorat Jenderal Pajak. Www.Pajak.Go.Id, 1–250. https://www.pajak.go.id/sites/default/files/2019-11/Laporan Tahunan DJP 2018 - bahasa Indonesia.pdf

Direktorat Jenderal Pajak. (2020). Laporan Tahunan 2019 Direktorat Jendral Pajak. Www.Pajak.Go.Id, i–140. https://www.speakindonesia.org/peningkatan-kapasitas/

Dwirandra, A. A. N. B., & Astika, I. B. P. (2020). Impact of Environmental Uncertainty, Trust and Information Technology on User Behavior of Accounting Information Systems. Journal of Asian Finance, Economics and Business, 7(12), 1215–1224. https://doi.org/10.13106/JAFEB.2020.VOL7.NO12.1215

Egsaugm. (2021). Pariwisata Indonesia di Tengah Pandemi. Egsa.Geo.Ugm.Ac.Id, 1. https://egsa.geo.ugm.ac.id/2021/02/11/pariwisata-indonesia-di-tengah-pandemi/

Frecknall-Hughes, J., & Kirchler, E. (2015). Towards a General Theory of Tax Practice. Social and Legal Studies, 24(2), 289–312. https://doi.org/10.1177/0964663915571787

Hardiansyah A. (2013). Teori Pengetahuan Edmund Husserl. Jurnal Substantia, 14(2), 228–238.

Harnanto. (2013). Perencanaan Pajak, Edisi Pertama. BPFE.

Heryana, A. (2018). Informan dan Pemilihan Informan pada Penelitian Kualitatif. Universitas Esa Unggul, 25, 15.

Ikatan Akuntan Indonesia (IAI). (2015). Manajemen Perpajakan. Ikatan Akuntan Indonesia.

Ikatan Konsultan Pajak Indonesia. (2019). Kode Etik Profesi Ikatan Konsultan Pajak. www.ikpi.or.id

Indonesia, C. (2020). Corona Bikin Likuiditas Seret, Fitch Downgrade 32 Perusahaan. www.cnbcindonesia.com.

https://www.cnbcindonesia.com/market/20200925100956-17-189375/corona-bikin-likuiditas-seret-fitch-downgrade-32-perusahaan

Jurnal.id. (2021). Strategi Penjualan di Masa Pandemi Covid-19 Yang Efektif.

Www.Jurnal.Id, 1–13. https://www.jurnal.id/id/blog/strategi-penjualan-yang-efektif-saat-pandemi-covid-19/

Kamayanti, A. (2016). Metodologi Penelitian Kualitatif Akuntansi: Pengantar Religiositas Keilmuan. Yayasan Rumah Peneleh.

Kuswarno, E. (2009). Meotde Penelitian Komunikasi Fenomenologi. Widya Padjadjaran.

Lektur.ID. (2020). 2 Arti Kata Menakar di Kamus Besar Bahasa Indonesia (KBBI). In

Lektur.Id. https://lektur.id/arti-kompetensi/

Mangoting, Y., Sukoharsono, E. G., & Nurkholis. (2017). Menguak Dimensi Kecurangan Pajak. Jurnal Akuntansi Multiparadigma (JAMAL), 8(2), 227–429. http://dx.doi.org/10.18202/jamal.2017.08.7054

Massie, J. . (2017). Pengaruh Etika Profesi, Religiusitas dan Kompetensi Terhadap Pegambilan Keputusan Etis Konsultan Pajak. Thesis. Universitas Kristen Maranatha, Bandung.

Moleong, L. J. (2017). Metodologi Penelitian Kualitatif (Edisi Revisi). PT.Remaja Rosdakarya.

Noviriani, E., Ludigdo, U., & Baridwan, Z. (2015). Studi Fenomenologi Atas Dilema Etis Auditor Internal Pemerintah. Ekuitas: Jurnal Ekonomi Dan Keuangan, 19(2), 217– 240.

Pohan, C. A. (2016). Manajemen Perpajakan Strategi Perencanaan dan Bisnis Edisi Revisi. PT Gramedia Pustaka Utama.

Ponemon, L. A. (1992). Ethical reasoning and selection-socialization in accounting. Accounting, Organizations and Society, 17(3–4), 239–258. https://doi.org/10.1016/0361-3682(92)90023-L

Purnamasari, V. (2006). Sifat Machiavellian dan Pertimbangan Etis: Anteseden Independensi dan Perilaku Etis Auditor. Simposium Nasional Akuntansi, 9, 23– 26.

Redaksi WE Online. (2020). Dampak Pandemi Covid-19 Terhadap Perekonomian Dunia | Infografis. Www.Wartaekonomi.Co.Id. www.wartaekonomi.co.id

Sari, D. M. M. Y., & Sudana, I. P. (2020). Managerial Accountability of Badan Usaha Milik Desa Wija Sari in Samsam Village: A Case Study Research. Jurnal Ilmiah Akuntansi Dan Bisnis, 15(2), 152.

https://doi.org/10.24843/jiab.2020.v15.i02.p02

Shidiq, U., & Choiri, M. (2019). Metode Penelitian Kualitatif di Bidang Pendidikan. In Journal of Chemical Information and Modeling (1st ed., Vol. 53, Issue 9). CV. Nata karya. http://repository.iainponorogo.ac.id/484/1/METODE PENELITIAN KUALITATIF DI BIDANG PENDIDIKAN.pdf

Suandy, E. (2016). Perencanaan Pajak, Edisi 6. Salemba Empat.

Suardika. (2016). Desain Pembelajaran Dengan Pendekatan Siklus Belajar (learning Cycle). https://aritmaxx.wordpress.com/2016/10/17/desain-pembelajaran-dengan-pendekatan-siklus-belajar-learning-cycle/

Sugiyono. (2017). Metode Penelitian Kuantitatif, Kualitatif, dan R&D. Alfabeta.

Suyitno. (2018). Metode Penelitian Kualitatif: Konsep, Prinsip, dan Operasionalnya. In Akademia Pustaka.

Tan, L. M. (1999). Taxpayers’ preference for type of advice from tax practitioner: A preliminary examination. Journal of Economic Psychology, 20(4), 431–447. https://doi.org/10.1016/S0167-4870(99)00016-1

Vishnuputri, I. G. A. A. U., Sudana, I. P., Budiasih, I. G. A. N., & Ratnadi, N. made D. (2019). Makna Penyusunan Travelife Sustainability Report. Jurnal Akuntansi Multiparadigma (JAMAL), 10(1), 115–134.

Wirakusuma, M. G. (2019). Pengalaman Memoderasi Pengaruh Idealisme dan Komitmen pada Keputusan Etis Konsultan Pajak di Wilayah Provinsi Bali. Jurnal Ilmiah Akuntansi Dan Bisnis (JIAB), 14(1), 10–18.

https://doi.org/10.24843/jiab.2019.v14.i01.p02

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 170

Discussion and feedback