Fraud Analysis on Illegal Online Lending Using Habermas' Theory of the Public Sphere

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 1, January 2022

AFFILIATION:

1 Faculty of Economics and Business, Universitas Hayam Wuruk

Perbanas , Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2022.v17.i01.p03

CITATION:

Shonhadji N. (2022). Fraud Analysis on Illegal Online Lending Using Habermas’ Theory of the Public Sphere. Jurnal Ilmiah Akuntansi dan Bisnis, 17(1), 33-49.

ARTICLE HISTORY Received:

24 August 2021

Revised:

24 November 2021

Accepted:

22 November 2021

Fraud Analysis on Illegal Online Lending Using Habermas' Theory of the Public Sphere

Nanang Shonhadji 1*

Abstract

This study aims to find out and reveal how fraudulent practices in illegal online loans are carried out by P2P lending service providers from the point of view of Habermas' critical thinking. Research site was an illegal online lending practice and the informant were users and victims of fraud from illegal online lending practices who are domiciled in Surabaya, Sidoarjo and Pasuruan, East Java. This qualitative research uses the Radical Humanist Paradigm approach. Result of this research have shown that Habermas' theory of the public sphere can be used as a basis for thinking to reveal the fraud media used by illegal financial technology lenders. The need for clarity on regulations for peer to peer (P2P) lending transactions through online media and firmness of sanctions for perpetrators of illegal online loan fraud to protect the public is a form of consciousness proposed idea.

Keywords: fraud, online loans, Habermas

Introduction

Public unrest and problems with illegal online lending services will only arise after the loan is approved and realized by the illegal peer to peer lending (P2P) providers. The unrest and problems occur because of intentional fraud committed by illegal online lending companies by ensnaring their customers through fraudulent actions. Charging large interest fees of up to 30% per month, imposing daily fines for late payments of up to 10% - 30% of loan principal, charging administrative fees that are not informed honestly and clearly. Falsifying office identity and address, utilizing personal data for actions that are against the law and social norms, intentionally changing the name of the application without notification to the customer. Furthermore, it will be difficult for the customer to make installment payments or repayment on time, but at the same time the interest on the loan keeps getting bigger, and others (Budiyanti, 2019; Ozcelik, 2020; Suseno & Yeti, 2021).

These fraudulent practices are actual and felt by customers who initially had good intentions to borrow to maintain their business. However, the fraud committed by illegal P2P lending service providers has actually made customers helpless and their economy worse off. This raises concerns, in the context of efforts to protect customers from

intentional fraud committed by P2P lending services, especially among MSMEs (Raden & Bambang, 2019; Romānova & Kudinska, 2016). P2P lending fintech service companies offer financing solutions without collateral for customers (borrowers), in this case MSMEs, with a sophisticated credit analysis system and provide flexibility to investors (lenders) for alternative real investment options with the advantages of an online platform, fast time, and competitive rates of return yields (Cheng & Guo, 2020; Davis, Maddock, & Foo, 2017). The number of illegal online credit practices that are disturbing the community in Indonesia is also the reason for conducting this research. Until now, with the increasing number of existing fintech providers, only about 15% are registered in the OJK database, while the regulations governing the fintech business have been issued through financial Services Authority Regulation Number 77/POJK.01/2016 concerning LPMUBTI Gazette Republic of Indonesia Year 2016 Number 324. Ps.1 number 3.

The lack of strong educational infrastructure and security against online lending practices, especially illegal online loans, has been debatable amongst practitioners, academics and regulators to find the best solution (Manan, 2019; Pollari, 2016; Stewart & Jürjens, 2018). Advances in information technology with digital business platforms that have been integrated with play store on Android have made it easier for illegal P2P lending business actors to find customers to then be tricked and targeted for their fraudulent accounting practices (Manan, 2019; Saksonova & Kuzmina-Merlino, 2017; Teten, 2021). The phenomenon of illegal online lending practices that are suspected of having committed fraudulent acts is interesting to study from a different perspective, namely the critical paradigm of Habermas (Jaduk, 2017).

The reason for choosing the critical paradigm of Habermas with his public sphere theory is because the practice of illegal P2P lending in practice uses the internet as a public sphere to commit fraud and crime since 2015 until now. Actually, there are still loopholes that can harm customers, even though the security structure in transactions is clear. This digital system must be prepared in advance by regulators and stakeholders so that the public sphere becomes secure, comfort and supports customers' economic activities (Ferrari, 2016; Wang, Han, Li, & Liu, 2021). The more dangerous thing is that efforts to resolve illegal online loan cases are like “one case completed, a thousand other cases appear”. On this basis, this study seeks to uncover the fraud, as a form of social criticism of the phenomena that occur.

According to Habermas (1962), the public sphere is a discourse that allows debate that arises because of economic inequality. The guide is rational argumentation and critical discussion which makes the strength of the argument more important than the identity of the speaker (Habermas, 2010). The public sphere was formed along with the emergence of early finance and trade capitalism where lenders, or in Habermas' terminology referred to as bourgeois merchants, require the exchange of material economic information. Habermas (1962) states that the public sphere is formed in bourgeois groups (lenders), where deliberation in the exchange of arguments is very important, so the term public opinion appears. Furthermore, according to Habermas (1962), in the liberal model of the public sphere, online media as a public sphere plays an important role in strengthening commercial interests and economic capitalization (Jaduk, 2017). Based on this phenomenon, the formulation of the research problem is: how is the fraud analysis on illegal online loans using Habermas' critical thinking review?

The purpose of this study is to find out how the fraud analysis on illegal online loans using Habermas’ critical thinking review

There are various online loan applications and they can be classified in different categories. Fintech applications are classified into four main operational business processes: payments, consulting services, financing, and compliance. Based on this classification, this study discusses further about what technologies are built in the online loan service industry and how these technologies can create business value. Fintech which operates in the business sector as a cashless payment tool is the first innovative loan product and is widely applied by each developer. Online lender in the payment sector helps customers make online loan applications as a payment medium for purchased commodities. This loan payment model is very popular and is the main payment alternative used by customers to facilitate their transactions (Duma & Gligor, 2018; Saksonova & Kuzmina-Merlino, 2017). The existence of online lender in payment services can increase people's purchasing power by up to 30%. This increase indicates that digital payments are able to improve the economy while still focusing on service security and convenience (Davis et al., 2017; Lee & Shin, 2018).

Online loan in the field of consulting services includes all types of related services, such as investment consulting, asset management consulting, insurance services, customer support, and management decision making. Fintech has been seen as disrupting innovation for the traditional consulting services sector. Research conducted by Saksonova and Kuzmina-Merlino (2017) and Pollari (2016) shows that asset management and insurance entrepreneurs have serious concerns about how online loan will disrupt their business. Meanwhile, according to Leong, Tan, Xiao, Tan, and Sun (2017), 74% of insurance companies and 51% of asset managers stated that their industry would be disrupted. The development of internet-of-things, the use of computers, advanced sensors, artificial intelligence, machine learning, big data, expert algorithms, and automation built with loan platforms in the consulting field are digital innovations that are currently developing rapidly. Investment consulting services are currently no longer dependent on the services of conventional brokers or stock broker consultants, but have turned into the main need for online lender consulting that helps investors to make investment decisions (Ferrari, 2016; Gomber, Koch, & Siering, 2017; Wang et al., 2021).

The internet serves as a public medium that can be used by economic actors to distribute information and conduct transactions. Internet facilities allow business activities to be easier and faster without any limitations of space and time. The Fintech P2P Lending service industry players do not stop at the function of informing only, but also involve citizens to interact in a discussion about the phenomena that occur. The context of the discussion about citizen involvement will grow when it includes a discussion about citizen commodity. This concept was first introduced by Habermas (1962) through his book "The Structural Transformation of the Public Sphere", a book on the virtual destruction of public sphere rationality that developed in the 19th century in England and Germany (Midgley, 2012). According to Habermas, the rapidly growing public sphere at that time should have been able to put forward a rational process. But in reality, there was a restraint on freedom and domination (Habermas, 2010). At that time the public sphere was controlled by a group of bourgeoisie or the owners of capital and took on the role of the state. The state should make this public sphere for the welfare of its people, and not as an arena for capital owners to conduct transactions, as

is currently being done by capital owners through the internet, which is identical to the fraudulent practice of illegal online loans that tend to make people anxious. Along with the development of internet technology, according to Habermas, the public sphere with internet media also plays an important role. As stated by Goode (2005), “most discussions of the new media scape and the public sphere have highlighted the role of, say, the Internet as a public sphere, focusing on how well or how poorly the practices it embodies live up to the values of Habermasian discourse ethics” (Goode, 2005). The internet makes it possible for everyone to get access to information. The internet offers a prototype of how the virtual world can be applied to make economic transactions more open (Jaduk, 2017). The public sphere is described by Habermas as an inclusive space where people collectively make a public opinion in an environment related to socio-political and economic conditions (Habermas, 2010; Midgley, 2012).

Synthesis of the Idea of Raising Awareness and Liberation, according to the Habermas language paradigm, the social interaction that occurs between illegal online loan services and MSME customers, in the basic framework of the diamond fraud theory, is not only limited to the concept of a system mechanism, but is also included in the lifeworld concept. Judging from the concept of a system mechanism, fraudulent practices and white corral crime that occur in P2P lending services tend to be caused by the economic media (money) and media power (principal pressure and rules). Meanwhile, in terms of the lifeworld concept, there is an effort to raise awareness for P2P online lender not to commit fraud and white collar crime with the foundation of thinking on beyond-compliance. The idea of raising consciousness and enlightenment which reflects on the concepts of ethics and morality which is fused with the Fraud Diamond Theory is a liberation effort that will be carried out in this research (Jaduk, 2017; Rengganis, Sari, Budiasih, Wirajaya, & Suprasto, 2019; Shonhadji, 2020). The use of Habermas theory in accounting research will be able to reflect the role of humans as individual beings as well as social beings as the basis for the growth of humanist values.

Research shows that fraud is likely to occur when someone is under pressure. Weak control, lack of supervision, and poor governance provide an opportunity for fraud perpetrators to rationalize their actions. Fraud diamond is referred to as another way to improve fraud prevention and detection by considering individual capabilities (fourth element) in addition to pressure, opportunity, and rationalization. According to Rengganis et al. (2019), fraud worth billions will not occur without the right people with the right abilities. Opportunities, pressures, and rationalizations can open the door to fraud and attract someone to commit fraud, but the person must have the capability to recognize an opportunity as a chance to take advantage of his or her actions. Rengganis et al. (2019) states that based on the fraud diamond theory, there are four elements that cause fraud which can be described. First is pressure or incentive, means a sense of having a need or encouragement from within a person to commit fraud. Second is opportunity, means that there is a weakness in the system that can be exploited. Third is rationalization, means that the fraud carried out is proportional to the risk and fourth is capability, means the ability needed by the right person to commit fraud (Shonhadji, 2020).

The fraud diamond describes four interrelated elements, and the capability element makes the main contribution to the occurrence of fraud. The diamond fraud theory also provides a broader perspective in terms of opportunities so that environmental and situational factors are also considered in auditing standards. The

relationship between the diamond fraud theory and the Habermas public space theory can be seen from the fraudulent practice of illegal online loan providers or perpetrators in P2P lending transactions due to the opportunity to use the internet as a public space that should be protected by the state, in reality it is not. as well as the material economic activities of the workers according to (Habermas, 1962) there must be government intervention to provide protection.

Research Method

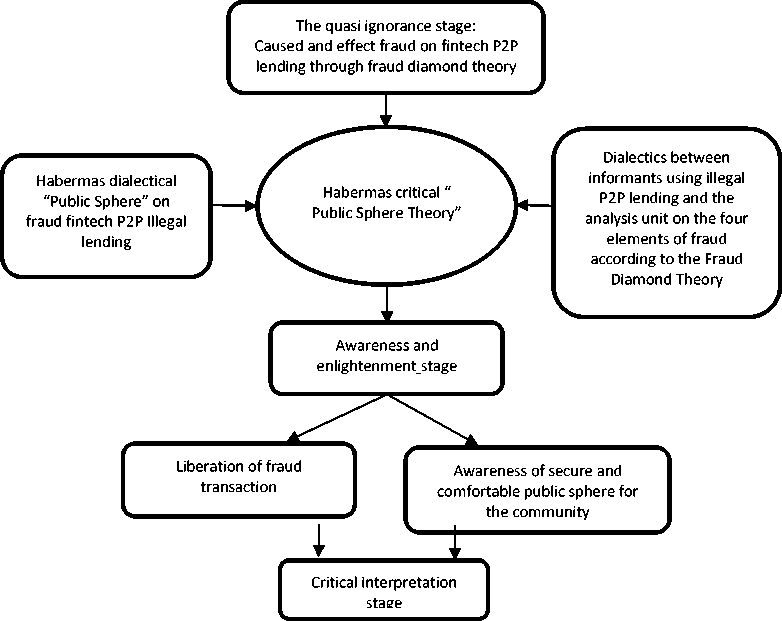

Systematically, the conceptual framework in this study follows the research method initiated by Jaduk (2017) and Shonhadji (2020) by carrying out several modifications that are adapted to the object of research. However, the novelty in this study is the use of Habermas' public sphere theory as a critical foothold to analyze the occurrence of fraud in illegal online lending practices. The research framework Figure 1 in this study can be described in several steps. The quasi ignorance stage, this is a preparatory stage before carrying out research by conducting a literature review and documentation study and mapping the four elements in the fraud diamond theory: Pressure, Opportunity, Rationalization and Capability. The formation and extension of critical theorems stage. This is the stage of understanding the object of research that is carried out through a process of in-depth interview with informants and extension critical dialectic of fraud diamond theory through public sphere theory. The consciousness and enlightenment stage. This is the stage of submitting the idea of raising consciousness and enlightenment which is carried out by reflecting on the concepts of public sphere theory of Habermas which is fused with the Fraud Diamond theory. The selection of

Figure 1. Research Framework

appropriate strategies stage. This is the stage of drawing conclusions, evaluating and verifying through the process of synthesizing the understanding of the meaning of the reality of fraud in P2P illegal lending or online illegal lending.

This qualitative research uses the Critical Paradigm approach, especially the Radical Humanist Paradigm, in looking at the phenomenon of illegal online loans in P2P lending services. The Radical Humanist Paradigm views that change is made by raising consciousness and enlightenment. The reason for choosing the critical paradigm is because it has a dual purpose: 1) understanding an illegal online lending practice in P2P lending services where it is applied; 2) finding solutions to improvements.

This research was conducted in the case of illegal online loans. The type of data used is the documentation of the results of interviews with informants. The criteria for informants in this study are business actors in the micro, small and medium enterprises and private employees. The informants are users and victims of fraud from illegal online lending practices who are domiciled in Surabaya, Sidoarjo and Pasuruan, East Java. Respondent selection is based on the decision to be able to reach the respondent directly and conduct more in-depth interviews. The selected informants are informants who have transacted with illegal online loans for more than six months and used illegal online loan applications in more than five illegal online applications. These informant criteria are needed in research to understand how illegal online loan companies carry out deception and fraud along with intimidation. Interviews were conducted directly during the Covid-19 pandemic, so that at the time of the interview, it was conducted with the health protocols that have been required by the government.

The expected result of the interview is the disclosure of the fact that illegal online loans have a big risk for customers. This risk is explored and disclosed through the process of extracting data in the field. The critical dialectical method referred to in this study is the development of data analysis techniques carried out by (Habermas, 2010; Jaduk, 2017). Shonhadji (2020) said that the research begins with the process of collecting data through interviews with informants. Next is the data analysis process which is carried out through three stages. First, data reduction (preliminary tracing) is a form of analysis that sharpens, categorizes, directs, discards unnecessary, and organizes data so that the data generated and used in presenting research findings can be drawn and verified. Second is data presentation (advanced search) is the stage of data analysis carried out by dialoguing information derived from informants related to fraudulent practices in illegal online loans using dialectical analysis. The dialectical process at this stage is a combination of arguments from informants who explain the practice of fraudulent illegal online loans. The dialectic is analyzed in four elements of the theory of fraud diamond, pressure, capability, opportunity and rationalization. Third, the results of the critical dialectic process are then presented in the form of a narrative text which is then interpreted according to Habermas' public sphere theory, making it easier to draw conclusions about the reality of illegal online lending practices found. Drawing conclusions (final search) is a data analysis process with an effort to draw a conclusion and it is possible for the researcher to verify the conclusions that have been drawn. Verification process allows researcher to increase his confidence in research findings.

Results and Discussion

Fraud that are often carried out by illegal online loans are (a). deliberately violated the regulations set by the OJK related to the license to carry out P2P lending-based online

Table 1. History of Using Illegal online Loan Applications Mr. Teguh

|

Informant |

Illegal online Loan Applications Transaction Histories |

|

Mr. Teguh |

ALI Uang (Developer: Yuanzhiyan) February 2020 Dokter Dana (Developer: Doctor Dana Limited) April 2020 Dompet Harimau (Developer: Kyle Levine) April 2020 Jalur Laba (Developer: Zeli) June 2020 Uang Cepat (Developer: Cepat Uang) August 2020 Uang Banyak (Developer: Wannxiao) August 2020 |

DANAQ (Developer: Wenkai Zeng) August 2020

Cash Go (Developer: Tajuan Chretien) October 2020

Source: results of interviews with informant, January 2021.

operations. (b). deliberately and applying a system of much larger interest and loan penalties that tend to make customers a cash cow exceeding the loan interest rate limit that has been determined by the Financial Services Authority (c). using actions that violate ethical and legal norms in terms of collection and lending because they tend to force in harsh ways, tend to be threatening, inhumane, and against the law and (d). do not have a clear office location, in fact most of these companies run their operations from abroad to avoid the legal apparatus.

Suseno and Yeti (2021) and Teten (2021) agree that illegal online loan transactions are full of fraud that is harmful to the public. This research using fraud diamond theory to interpret this phenomenon. The fraud diamond theory is a new refinement of the fraud triangle theory. The list of Illegal Online Loans in 2020 that has been released by the Financial Services Authority (OJK) comes from the official website www.ojk.go.id which often commits fraud and fraud as many as 125 financial technology (fintech) companies from various developers. The results of interviews and observations have shown that the informants of this study also agreed and admitted that they had been trapped by manipulated and fraud that had been carried out by the following names of illegal online loan companies:

Mr. Teguh initiated illegal online loan transactions in February amounting to IDR 4.000.000, but in April 2020, the loan amount grew to IDR 8.400.000. Mr. Teguh began to panic and be confused until finally to cover the debt he had to register for an illegal online loan application during the period from February to October 2020 as many as eight applications. The amount of debt at that time had reached IDR 53.000.000.

Table 2. History of Using Illegal online Loan Applications Mrs. Nirmala

|

Informant |

Illegal online Loan Applications |

Transaction Histories |

|

Cash Room (Developer: DanaRoom) |

April 2020 | |

|

Cashbus (Developer: Jackma) |

May 2020 | |

|

Nirmala |

Pinjaman Pro (Developer: KSP Modal Usaha) |

May 2020 |

|

UANG (Developer: Ou Hu) |

June 2020 | |

|

PinjamanMu (Developer: Wangsan) |

June 2020 | |

|

Uang Cepat (Developer: Cepat Uang) |

June 2020 | |

|

Uang Banyak (Developer: Wannxiao) |

September 2020 | |

|

Pinjaman Pintar (Developer: Cash Instant) |

September 2020 |

Source: results of interviews with informant, January 2021.

Table 3. History of Using Illegal online Loan Applications Mrs. Maria

|

Informant Illegal online Loan Applications |

Transaction Histories |

|

KSP Dana Kilat Pinjaman (Developer: A Kang) |

July 2020 |

|

Rupiah Rush (Developer: Zhangxz) |

August 2020 |

|

Digi Dana (Developer: Aeffendi572) |

September 2020 |

|

KTA Kilat (Developer: Xiewenjun) |

September 2020 |

|

ar a Dompet Kredit (Developer: Jocelyn Johnson) |

September 2020 |

|

Keuangan Singa (Developer: Amy Rockefeller) |

September 2020 |

|

Dana Rupiah (Developer: TopAppShopz) |

October 2020 |

|

DANAQ (Developer: Wenkai Zeng) |

November 2020 |

|

Dana Indah (Developer: Richard Hargrave) |

December 2020 |

|

Pinjaman Kelapa (Developer: Kelapa) |

January 2021 |

Source: results of interviews with informant, March 2021

Mrs. Nirmala started using the online loan application in April 2020, when she needed money for her business working capital of IDR 10.000.000. During the COVID-19 pandemic season, funds were needed to maintain the continuity of her business. She did not realize that within three months her debts had grown to IDR 32.000.000 just because she was in arrears three times until in the end she used more than seven illegal online loan applications to cover one arrears to another. Her biggest misfortune happened in September 2020, her debt became 64 million and she does not know how to pay it off.

Mrs. Maria started using online loan applications in July 2020, for her business working capital, aggressive online loan marketing has persuaded Mrs. Maria to borrow IDR 10.000.000, but when it was realized, it was only IDR 8.500.000, the reason being for administrative costs of IDR 1.500.000. Mrs. Maria could not refuse because the money was directly transferred to her bank account with the transaction process only 15 minutes, through proof of self-photo while holding an identity card (KTP). The following month there were arrears so that Mrs. Maria was confused about paying it. In the end, Mrs. Maria was stuck from one online loan application to another. Mrs. Maria's interview results stated that her debt until January 2021 grew to IDR 57.000.000 without clarity on how to pay it off.

Table 4. History of Using Illegal online Loan Applications Mrs. Renti

|

Informant Illegal online Loan Applications |

Transaction Histories |

|

Apel Kaya (Developer: Tergesa-gesa) |

August 2020 |

|

Gudang Uang (Developer: DMI Internet) |

August 2020 |

|

Ada Dana (Developer: Sumber Berkah Usaha) |

September 2020 |

|

Renti Mitra Pedagang (Developer: Rizka Nuhung) |

October 2020 |

|

Pasar Tunai (Developer: Pinjaman Go) |

October 2020 |

|

Data Tepat (Developer: Antoini Man) |

November 2020 |

|

Depot Pinjaman (Developer: PT Kedai Uang) |

December 2020 |

|

Dokter Dana (Developer: Doctor Dana Ltd) |

January 2021 |

|

Solusi Cepat (Developer: Cepat Go) |

February 2021 |

Source: results of interviews with informant, March 2021

Table 5. History of Using Illegal online Loan Applications Rendy

|

Informant |

Illegal online Loan Applications |

Transaction Histories |

|

Saku Hijau (Developer: KSP Dana Pengembangan Perikanan) |

March 2020 | |

|

Pinjam Sini (Developer: Finance Mobile Crew) |

March 2020 | |

|

Keuangan Singa (Developer: Amy |

April 2020 | |

|

Rendy |

Rockefeller) | |

|

Dana Rupiah (Developer: TopAppShopz) |

May 2020 | |

|

Saku Cepat (Developer: Komang) |

June 2020 | |

|

Cash laba (Developer: Cash-AJK) |

July 2020 | |

|

Mudah Dana (Developer: PT Mudah Dana) |

August 2020 | |

|

Mudah Dana (Developer: PT Mudah Dana) |

August 2020 | |

|

Saku Cepat ( Developer: Komang) |

September 2020 | |

|

Saku Cepat (Developer: Komang) |

December 2020 |

Source: results of interviews with informant, January 2021

Renti got to know an online loan application from her friend, when she needed money for her business working capital, Renti took advantage of the illegal online loan application. He borrowed IDR 8.000.000, but only the remaining IDR 7.000.000 was for the administrative costs required by the online loan service. Renti was also affected by the manipulation carried out by illegal online loans, it was known that in February 2021 the debt became IDR 51.000.000.

Unlike the victims of illegal online loan manipulation and fraud, Rendy is a private employee who uses online loan applications to support his living cost. Initially, Rendy borrowed from an illegal online loan of IDR 5.000.000, but the realization of the remaining IDR 4.200.000 according to the online loan marketing was used to pay administrative costs. Rendy had experienced delays in paying loan installments. It was subject to a fine of IDR 50.000 per day of delay. Unbeknownst to Rendy, the cost of the fine and his total debt on December 2020 had increased to IDR 41.000.000, until the interview was conducted in January 2021, Rendy was still unable to pay off his debt. Rendy is lamenting for being trapped in an illegal online loan transaction fraud.

Currently, people are restless with the number of frauds committed by illegal online loan services. This can be seen by the many complaints and reports in online media about fraudulent practices carried out by these illegal online loan services. People are confused about how to avoid fraud carried out through telemarketing illegal online loans, financial criminals who use the Internet to deceive others by offering fast credit but with stifling loan interest (Teten, 2021). This fraud is also intended to steal customer identities and other personal information to commit fraud. One of the victims of fraudulent illegal lending practices, Mrs. Maria (informant) says:

“At first I only borrowed IDR 10,000,000 at the beginning of January for a period of 6 months with a monthly interest of 1%. But in reality, I was only given IDR 8,500,000 directly transferred to my account without any confirmation to me. Then in less than 1 month I was asked to pay installments of IDR 500,000 and if I didn't pay, I would be subject to a daily fine with 5% interest per day. So at that time, if I was 4 days late, the fine I had to pay would be IDR 100,000 plus installments of IDR 500,000. This is where I got into trouble and in the end I was caught in a cycle of fraud from one illegal online loan to another. In total, there

were 10 illegal online loan applications that I used to cover debt by digging for new debt. Initially I only borrowed and realized IDR 8,500,000 and now it has swelled to IDR 57,000,000 in January 2021.”

The fraud committed by these illegal online loan services is a serious crime and it may take the victim years to clear their good name. This is as expressed by Mrs. Renti (an informant), a private employee who is a customer of illegal online loan services in the following interview:

“Initially, I was offered by a friend who is also a user of online loan services via the internet and online applications. I tried to use it by downloading the application and then I was contacted by a person claiming to be an employee of an online loan provider. Next, I was asked to take a selfie using my mobile phone while holding my ID card. The photo must also clearly show the face and ID card. Then I was asked to send the photo via WhatsApp. From there, apparently I just found out that the photo was edited and used to spread my unethical photo to several contacts on my cell phone number. I was embarrassed and confused by the actions of someone who claimed to be an employee of this online loan provider.”

The same thing also happened to Mrs. Nirmala. This informant, who works as a private employee, just realized that her inappropriate photos had been spread to one of her WhatsApp group networks. This incident, of course, caused Mrs. Nirmala to be ashamed and psychologically her life was depressed. Ethical violations and criminal acts of fraudulent practices on illegal online loans are indeed very disturbing to the public. Mr. Rendy (informant), who was also a victim of illegal online loan fraud, also informed that debt collectors had come to him when he was at work and abused him using harsh words, even threatening to spread unethical photos. This incident made Rendy panic and embarrassed his office mates

The news about the increasing cases of fraud committed by illegal online loan services is very disturbing to the public (Raden & Bambang, 2019). Therefore, the discussion in this study will describe and reveal how fraudulent practices are carried out by illegal online loan services using Habermas' critical thinking review. Researcher analyzes four elements of the fraud diamond theory, consisting of Pressure, Opportunity, Rationalization and Capability, to reveal how fraudulent practices occur in illegal online loan services (P2P online lending). Pressure means that the fraud committed is based on a sense of having a need or encouragement from within a person to commit fraud (Omarini, 2018). Opportunity means that there is a gap or weakness in the state control system that can be exploited by illegal online lender to commit fraud. Rationalization means that Indonesia is a very large market for consumer lending services. This is believed to be a reason to conduct illegal online loan service business aggressively. Capability means that the company can be seen from the support of strong capital and the use of an open and free internet space. This strengthens the practice of fraud in this illegal online loan service business.

The indicator of pressure or incentive is a sense of having a need or encouragement to commit fraud. The industrial era 4.0 and the covid-19 pandemic are driving factors to increase online transactions by utilizing internet media. Information technology in bank and non-bank financial institutions continues to develop along with the increase in services provided to customers who always want speed and convenience in transactions and in using all products and services of bank and non-bank financial institutions (Kiarie, 2021). This causes lending and borrowing transactions carried out by

owners of capital to their customers to also take advantage of the development of this information technology. The pandemic condition that requires business actors to be more rigorous and strategic in managing their business is also a separate obstacle. In the midst of the COVID-19 pandemic, business actors and the public need sources of funds, both for consumption needs and for business capital needs. This condition triggers the need and impetus for the emergence of illegal online loan services to meet the funding needs of the community and MSME actors who need funds with easy requirements. In addition, illegal online loan providers also see a large need for funds that they can fulfill considering that Indonesia is one of the most populous countries in the world. This need is the pressure for illegal online loan providers to channel their funds in the form of loans but in a fraudulent and deceptive way by charging very large fees and loan terms that tend to ensnare their customers.

Pressure also comes from capital owners who invest their funds in the online loan business. These investors need and want the funds invested in these online loan services to provide big profits. The motive for large profits in a short time is the pressure for illegal online loan providers to carry out fraudulent transaction practices. These illegal online loan providers intentionally and systematically commit fraudulent practices when transacting with their customers by charging high interest and administrative fees and large interest payments late in installments so that most customers who are entangled with illegal online loan services will no longer be able to pay off the principal because the installments paid are only used to cover interest and penalties.

The pressure that also causes these illegal online loan providers to commit fraud is the great need for loan services in the form of these illegal online loans. These illegal online loan providers are aware that many people are dependent on the services they provide. It has been realized that the online loan business run by these illegal providers will one day have many problems and will eventually go bankrupt. The pressure of bankruptcy on their business causes these illegal online loan providers to cheat in their business by seeking and making as much profit as possible before their business goes bankrupt and closes. In practice, the illegal online loan business has encountered many legal and regulatory challenges from the Financial Services Authority and consumer and customer protection legal institutions. The regulator has taken preventive action based on complaints and information from the public about the fraud committed by these illegal online loan services. Therefore, the regulator will close the illegal online loan providers that have been identified.

One indicator of opportunity is the existence of several weaknesses and gaps in regulations regarding online loan transactions which are then used as opportunities by illegal online loan companies. Analysis is used to create customer protection policies by utilizing an online loan fraud detection information system (Manan, 2019; Pollari, 2016). The design of analysis and data collection uses primary data by conducting direct interviews with informant actors who have used the illegal online lending application to find out the fraud on their transaction. Regulations that cover the Fintech business have been issued through POJK Number 77 of 2016 concerning Information TechnologyBased Lending and Borrowing Services (LPUMBTI). One of the points in the POJK explains a lot about Fintech business governance that requires an explanation of derivation in the form of technical regulations, especially in the management system and business risk management of Fintech-based P2P Lending. There are opportunities to make large and material transactions with prospective customers in the online loan business that can

bring huge profits. This opportunity is then exploited by illegal online loan providers to do business in the hope of obtaining the maximum profit even with fraudulent and deceptive practices.

The indicator of rationalization is the excessive desire of illegal online loan providers to maximize profits. It is undeniable that they are very aggressive in offering their services through online media and short message service to cellular. Offers are also made in a deceptive way by providing low-interest loan information and prospective customers are asked to download an online loan application that has been made and provided (Huda, Sarno, & Ahmad, 2016; Ozili., 2018). Once interested, the customer will download the application for further processing. However, the downloaded application also secretly and deceptively records and retrieves contact person data on the customer's mobile phone. The contact list on the customer's cellphone will later be used as a tool to blackmail customers and threaten customers when customers encounter problems in paying their loan installments.

The excessive desire to dominate the online lending market is also a strong reason for illegal online loan service providers to commit fraudulent and deceptive practices to customers (Manan, 2019; Stewart & Jürjens, 2018). The very large population in Indonesia is certainly a reason for business actors to gain market share and even dominate the market. The online lending market in Indonesia started to grow in 2015 and has been growing rapidly since the COVID-19 pandemic because most transactions, both goods and services, are carried out online.

The indicator of capability includes different ways of thinking about the risk of fraud committed by illegal online loan service providers. Therefore, this study believes that fraud committed by illegal online loan service providers can be identified to improve fraud prevention and detection by considering the four elements of the fraud diamond theory. In addition to overcoming pressure, opportunity, and rationalization, fraud diamond theory also considers individual capabilities which are personal traits and abilities that play a major role in causing fraud committed by illegal online loan service providers to actually occur. Many frauds committed by illegal online loan service providers will not occur without the right people with the right capabilities. The majority of online loan investors, who also act as operators, are citizens of foreign countries who employ Indonesian citizens as operational implementers in the field. Weak knowledge of online-based loan services opens the door to fraud. Pressure and rationalization can attract a person to commit fraudulent acts. But the person must have the capability to recognize an open door as an opportunity and take advantage of it by walking through it, not once, but many times. Therefore, the critical question is, "Who can turn the opportunity of fraud into reality in this case of illegal online lending?

Assessing capabilities and responding to concerns about these fraudulent illegal online lending should not be seen as a one-time practice. Continuous updating of capability assessments and responses is necessary for two reasons. First, illegal online loan providers can develop new capabilities from time to time, especially when they want to improve their company's capabilities. Although these illegal online loan providers do not have sufficient strength or knowledge to commit fraud in an area, there is no guarantee that they will not develop their strength or knowledge to acquire as many customers as possible in the future. Their ability to commit fraud may increase, so additional control or oversight is needed. Second, organizational processes, controls, and circumstances change over time. As a result, some people may be better suited to

commit fraud in a new environment, even though they were not capable in the previous conditions. For example, consider an illegal online loan company that recently implemented a new complex information technology system. The new system could make digitally less savvy employees unable to exploit their controls. On the other hand, for those with strong IT skills, such changes can increase their ability to commit fraud to customers.

The idea of raising consciousness in Habermas's concept can be started from Habermas' public sphere theory which states that:

“The bourgeois sphere may be conceived above all as the sphere of private people come together as a public; they soon claimed the sphere regulated from above against the public authorities themselves, to engage them in a debate over the general rules governing relations in the basically privatized but publicly relevant sphere of commodity exchange and social labor.” (Habermas, 1962)

Based on the public sphere theory of Habermas (1962), it can be understood that fraudulent practices by illegal online loan providers can occur because the group of investors or online loan service providers (bourgeoisie) feels strong and believes that they can do whatever they want. They will claim that their business is a business that is very much needed during the covid-19 pandemic. Many business actors need capital loans so that their businesses can rise and survive in the midst of the economic crisis caused by the COVID-19 pandemic. The internet, as a public sphere that has no boundaries and can provide privacy, is believed by Habermas as a public sphere that should have a clear regulatory platform and be controlled by the state. The role of the government to exercise control by making a series of rules that protect the public regarding transactions using the online media space is necessary, otherwise the capitalists, or the bourgeoisie in Habermas' terminology, will control this online media space to carry out illegal online loan transactions fraudulently which can harm society.

This Habermas’ statement is supported by the statement of the informant Mr. Teguh, one of the victims of fraudulent illegal lending practices as follows:

“The government should be able to protect us, as victims of fraud and theft committed by this illegal online loan service. In fact, many victims, like me, can't do anything because we don't know what legal channels and protections we can take. We give up and in the end have to pay off our loans which are much larger than the principal. I really hope the government can protect us. If it is an illegal transaction, the business can be stopped and the perpetrators can be prosecuted. If this is allowed or the handling is too late, the number of victims of fraud will be more and more.”

However, Habermas (1962) also emphasizes that in the public sphere, the bourgeoisie actually consciously or unconsciously represent two identities in the public: as the owner of capital, who must represent the voice of the capital owner’s sphere to obtain maximum profit in running his business and the voice of private sphere to fulfill his life necessities. The critical analysis is that the public sphere and private sphere in online media are used by illegal online loan services providers as media to carry out fraudulent practices due to weak government supervision. According to Habermas:

“The fully developed bourgeois public sphere was based on fictitious identity of the two roles assumed by the privatized individuals who came together to form a public: the role of property owners and the role of human beings pure and simple.” (Habermas, 1962)

This means that the bourgeois public sphere in online media should be used to help people who need capital loans, but in reality it is developed completely based on the fictitious identity of this illegal online loan company. It can be seen that the company does not have a clear office address and business profile. In addition, the company also does not have a business license from the Financial Services Authority representing the state. According to Habermas (1962), in his critical analysis, the bourgeois public sphere should be based on the real identity and not the fictitious identity of its two roles, as property owner and as a pure and simple human being. The simple conclusion is that the Habermas’ public sphere is a sphere that works on the basis of practical moral discourse that involves rational and critical interactions that are built to find solutions to economic problems, and not the other way around which causes economic problems as it is today due to fraudulent practices carried out by providers of illegal online loans.

Furthermore, Habermas (1962) says that:

“This focuses the attention an anonymous and dispersed public on select topics and information allowing citizens to concentrate on the same critically filtered issues and journalistic pieces at any given time. The price we pay for the growth in egalitarianism offered by the internet is the decentralized access to unedited stories. In this medium, contributions by intellectual lose their power to create a focus.” (Habermas, 1962).

The public sphere through online media which is used as a medium for fraudulent practices by illegal online loan companies has become the focus of public attention. In order to form a condition referred to by Habermas (2010) as the growth of egalitarianism, what the internet offers is decentralized access which must involve the role of the state to control and supervise. The criticism built on the existence of public sphere through online media which is used as a medium for fraudulent practices by illegal online loan companies is based on the profiling of financial technology-online lending businesses in Indonesia related to governance and risk management systems. The gap aspect is divided into two important domains: 1) OJK regulatory domain; and 2) Fintech provider domain.

Critical analysis related to the regulatory domain of the Financial Services Authority includes the absence of a special supervisory unit and online lending business certification services including variations and complex P2PL online lender platform models so that standardization efforts are needed in governance and risk management. In addition, the low level of public literacy on online lender business risks allows fraud to occur. The next critical analysis is that the Financial Information Service System Database (SLIK) has not yet covered the MSME database, both in terms of legal licensing and business feasibility systems. In the process of credit analysis, applications for electronic transaction systems and electronic signatures are still very few. There is no standardized procedure for issuing digital certificates and regulations governing the process of digital financial transactions. The last thing that must be a concern of regulators is that along with the development of increasingly sophisticated information technology, a qualified and IT-based audit management instrument and management is needed. Meanwhile, critical analysis related to the domain of financial technology lending providers includes the lack of optimal internal IT risk management systems, promotion processes, and education to the public about financial technology-based lending. The number of unregistered and uncertified financial technology companies is also a problem in online lending practices.

Conclusion

This study aims to find out how to analyze fraud on illegal online loans using Habermas' critical thinking review. This study is a qualitative research using the critical paradigm approach, especially the radical humanist paradigm in viewing the phenomenon of illegal online loans in peer to peer (P2P) lending services. The results of the study inform that pressure to commit fraud in illegal online lending practices is due to the need from the public to obtain loans for consumption and startup or working capital by using applications via the internet during the covid 19 pandemic. The weakness regulations on non-banking financial transactions through the media online services are a gap and opportunity for online loan providers to do their business in a fraudulent way to get the maximum profit. According to Habermas, raising consciousness begins with the consciousness of intellectuals to mobilize actors who have high knowledge and involve the government in dealing with public unrest due to fraud committed by illegal online loan providers. Raising consciousness begins with making clear and firm rules regarding the mechanism of illegal online lending practices. Raising consciousness is also carried out by encouraging regulators to create a clear and firm legal umbrella to take action against fraudulent crimes committed by illegal online loan providers as well as a legal umbrella to protect customers who are victims of such fraud.

The limitation in this study is that the dialectical pattern between informants, regulators, and illegal online loan management to find problems in causal relationships has not been obtained. This study only looks at the critical aspects of Habermas, with his theory of the public sphere, using the four aspects mentioned in the fraud diamond theory. Further research is expected to be able to create an interview pattern so as to obtain information that can answer causal relationships related to fraud committed by illegal online loan providers by involving all relevant stakeholders.

References

Brahmantyo, A. S. (2021). Karakteristik Penagihan Secara Bertanggung Jawab yang Dilakukan oleh Layanan Pinjam Meminjam Uang Berbasis Teknologi Informasi. Jurist-Diction, 4(5), 1739-1766. doi:10.20473/jd.v4i5.29817

Budiyanti, E. (2019). Upaya Mengatasi Bisnis finansial teknologi Ilegal., Vol XI. Jurnal Info Singkat, XI(04/II/Puslit), 19-24.

Cheng, H., & Guo, R. (2020). Risk Preference of the Investors and the Risk of Peer-to-Peer Lending Platform Emerging Markets Finance & Trade, 56(7), 1520-1531. doi:10.1080/1540496X.2019.1574223

Davis, K., Maddock, R., & Foo, M. (2017). Catching up with indonesia’s fintech industry. Law and Financial Markets Review, 11(1), 33–40.

doi:https://doi.org/10.1080/17521440.2017.1336398

Duma, F., & Gligor, R. (2018). Study regarding Romanian students’ perception and behaviour concerning the fintech area with a focus on cryptocurrencies and online payments Online Journal Modelling the New Europe, 27, 86-106.

doi:https://doi.org/10.24193/OJMNE.2018.27.04

Ferrari, R. (2016). FinTech Impact on Retail Banking - From a Universal Banking Model to Banking Verticalization The FinTech Book (pp. 248–252). USA: Entrepreneurs and Visionaries.

Gomber, P., Koch, J.-A., & Siering, M. (2017). Digital Finance and FinTech: current research and future research directions Journal of Business Economics, 87(5), 537–580. doi:https://doi.org/10.1007/s11573-017-0852-x

Goode, L. (2005). Jurgen Habermas: Democracy and the Public Sphere (Modern European Thinkers). Northampton: Pluto Press.

Habermas, J. (1962). The Structural Transfornation of the Public Sphere: An Inquiry into a Category of a Bourgeois Cambridge, MA: MIT: Society Press.

Habermas, J. (2010). Ruang Publik, Sebuah Kajian Tentang Kategori Masyarakat Borjuis (terjemahan) Bantul: Kreasi Wacana.

Huda, S., Sarno, R., & Ahmad, T. (2016). Increasing accuracy of Process-based Fraud Using Behavior Models. International Journal of Software Engineering and Its Applications, 10(5), 175-188. doi:http://dx.doi.org/10.14257/ijseia.2016.10.5.16

Jaduk, G. P. (2017). Rekonstruksi Pemikiran Habermas Di Era Digital. Jurnal Komunikasi Dan Kajian Media, 1(1), 1-14. doi:10.31002/jkkm.v1i1.381

Kiarie, R. K. (2021). Ethics in Mobile Banking: A Case Study of Kenya's Mobile Money Platform Research Anthology on Concepts, Applications and Challenges of Fintech. USA: IGI Global Publisher.

Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35-46.

doi:https://doi.org/10.1016/j.bushor.2017.09.003

Leong, C., Tan, B., Xiao, X., Tan, F. T. C., & Sun, Y. (2017). Nurturing a FinTech ecosystem: The case of a youth microloan startup in China International Journal of Information Management, 37(2), 92–97. DOI: 10.1016/j.ijinfomgt.2016.11.006, 37(2), 92-97. doi: https://doi.org/10.1016/j.ijinfomgt.2016.11.006

Manan, Y. M. (2019). Sistem Integrasi Proteksi & Manajemen Resiko Platform Fintech peer to peer (P2P) Lending dan Payment Gateway untuk Meningkatkan Akselerasi Pertumbuhan UMKM 3.0. Ihtifaz: Journal of Islamic Economics, Finance, and Banking, 2(1), 73-87. doi: https://doi.org/10.12928/ijiefb.v2i1.847

Midgley, D. (2012). Beyond Habermas: Democracy, Knowledge, and the Public Sphere. London: British Library Montag.

Omarini, E. (2018). Peer-to-Peer lending: Business Model Analysis and the Platform Dilemma. International Journal of Finance, Economics and Trade, 2(3), 31-41. doi:http://dx.doi.org/10.19070/2643-038X-180005

Ozcelik, H. (2020). An Analysis of Fraudulent Financial Reporting Using the Fraud Diamond Theory Perspective: An Empirical Study on the Manufacturing Sector Companies Listed on the Borsa Istanbul. Contemporary Issues In Audit Management and Forensic Accounting, 102, 131-153.

doi:https://doi.org/10.1108/s1569-375920200000102012

Ozili., P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329-340. doi:https://doi.org/10.1016/j.bir.2017.12.003

Pollari, I. (2016). The rise of Fintech opportunities and challenges. JASSA: The Journal of The Securities Institute of Australia, 3, 15-21.

doi:https://search.informit.org/doi/10.3316/informit.419743387759068

Raden, A. E. W., & Bambang, E. T. (2019). Praktik Finansial Teknologi Ilegal dalam Bentuk Pinjaman online Ditinjau dari Etika Bisnis Jurnal Pembangunan Hukum Indonesia, 1(3), 379-391. doi:https://doi.org/10.14710/jphi.v1i3.379-391

Rengganis, R. M. Y. D., Sari, M. M. R., Budiasih, I. G. A., Wirajaya, I. G. A., & Suprasto, H.

B. (2019). The Fraud Diamond: Element In Detecting Financial Statement of Fraud. International Research Journal of Management, IT and Social Sciences, 6(3). doi:https://doi.org/10.21744/irjmis.v6n3.621

Romānova, I., & Kudinska, M. (2016). Banking and Fintech: A Challenge or Opportunity? . Contemporary Studies in Economic and Financial Analysis, 98, 21-35. doi: https://doi.org/10.1108/S1569-375920160000098002

Saksonova, S., & Kuzmina-Merlino, I. (2017). Fintech as financial innovation - The possibilities and problems of implementation. European Research Studies Journal, 20(3), 961-973. doi: 10.35808/ersj/757

Shonhadji, N. (2020). Paradox of White Collar Crime and Fraud in Banking: Critical Analysis of Agency Theory and Gone Theory. ASSETS Jurnal Akuntansi dan Pendidikan, 9(2), 142-155. doi:http://doi.org/10.25273/jap.v9i2.6415

Stewart, H., & Jürjens, J. (2018). Data security and consumer trust in FinTech innovation in Germany. Information and Computer Security, 26(1), 109-128.

doi:https://doi.org/10.1108/ICS-06-2017-0039

Suseno, A. W., & Yeti, S. (2021). Tanggung Jawab Korporasi Fintech Lending Ilegal dalam Perspektif Perlindungan Konsumen Law Review, XXI(1), 117-144.

doi:http://dx.doi.org/10.19166/lr.v0i0.3544

Teten, T. (2021). Pelanggaran Penyelenggara Peer To Peer (P2P) Lending Financial Technology Ilegal Terhadap Debitur Logika: Jurnal Penelitian Universitas Kuningan, 12(1), 85-93. doi:https://doi.org/10.25134/logika.v12i01.4040

Wang, Y., Han, X., Li, Y., & Liu, F. (2021). Efficiency and Effect of Regulatory Policies on the Online Peer-to-peer (P2P) Lending Industry. Emerging Markets Finance & Trade, ahead of print, 1-14. doi:10.1080/1540496x.2021.1882987

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 49

Discussion and feedback