Corporate Governance, Political Connection, Family Ownership and Tax Aggressiveness in Indonesia

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 1, January 2022

AFFILIATION:

1,2,3 Accounting Department, Faculty of Economics and Business, Universitas Brawijaya, Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2022.v17.i01.p010

CITATION:

Setyasrini, N. L. P., Subekti, I. prastiwi, a. (2022). corporate Governance, Political Connection, Family Ownership and Tax Aggressiveness in Indonesia. Jurnal Ilmiah Akuntansi dan Bisnis, 17(1), 146-158.

ARTICLE HISTORY Received:

3 February 2021

Revised:

16 January 2022

Accepted:

16 January 2022

Corporate Governance, Political Connection, Family Ownership and Tax Aggressiveness in Indonesia

Ni Luh Putri Setyastrini1*, Imam Subekti2, Arum Prastiwi3

Abstract

Tax aggressiveness is a strategy of companies to present lower taxable earnings through tax planning without being accused of committing tax fraud, hence considered as one of the weaknesses of the selfassessment system. The purpose of this study was to examine and analyze the effect of corporate governance and political connection on tax aggressiveness with family ownership as the moderator. This research was conducted on manufacturing companies listed on the Indonesia Stock Exchange from 2016 to 2020. Using purposive sampling method, 49 companies were selected as the sample, resulting in 245 observations. The data were analyzed using multiple regression analysis and moderated regression analysis. This study found that corporate governance does not influence tax aggressiveness, that political connection has a negative effect on tax aggressiveness, and that family ownership does not moderate the influence of corporate governance and political connection on tax aggressiveness.

Keywords: tax aggressiveness, corporate governance, political

connection, family ownership

Introduction

As tax are the main source of Indonesia’s income, it is acceptable that the government has made various efforts to increase its revenue (Hasanah & Ardini, 2021). One of the efforts is to implement tax reform. Starting from 1983, the reform started from a change from the official-assessment system (tax collection by the tax fiscus) to the self-assessment system. The application of the latter system is expected to be able to fulfill the principle of justice and to simplify the fulfillment of tax obligations. However, it still contains a weakness, namely tax aggressiveness by taxpayers (Wardani & Nurhayati, 2019).

Tax aggressiveness is an act of manipulating taxable earnings by presenting lower taxable earnings through tax planning without being accused for committing tax fraud; the legality of the action is still in the grey area (Wahab, Ariff, Marzuki, & Sanusi, 2017). Indonesia has suffered considerable losses from tax aggressiveness. Integrity (2019) found that in 2016 the Indonesian government lost potential taxes from exportimport transactions of USD 6.5 billion. The Secretary General of the

Indonesian Forum for Budget Transparency (FITRA) also emphasized that, as a result of tax aggressiveness, Indonesia experiences tax revenue losses of up to IDR 110 trillion annually (Himawan, 2017).

Tax aggressiveness is a conflict between company management as the internal party and the tax fiscus (government) as the external party. This conflict can be explained through the Agency Theory, especially type III (Pratiwi, Subekti, & Rahman, 2019). Previous studies have shown that tax aggressiveness can be influenced by diversification of company types (Zheng, 2017), incentive pay for executives (Huang, Ying, & Shen, 2018), company characteristics (K. S. Dewi & Yasa, 2020), political connection (Putra & Suhardianto, 2020), company's ownership structure (Bimo, Prasetyo, & Susilandari, 2019), and corporate governance (Kerr, Price, Roman, & Romney, 2021).

Agency conflicts in companies can be minimized through the implementation of good corporate governance (Dey, 2008). Tax aggressiveness as a form of agency conflict in companies can also be minimized through the implementation of corporate governance. Corporate governance is defined by the Organization for Economic Cooperation and Development (OECD) as procedures and processes related to the implementation and supervision of companies that involve various stakeholders (OECD, 2015). The implementation of corporate governance through supervision by all stakeholders is believed to encourage companies to be more compliant with tax regulations or prevent them from carrying out tax aggressiveness (Kerr et al., 2021). The results of other studies are in fact different; corporate governance cannot minimize tax aggressiveness (Syamsuddin, Ali, & Sobarsyah, 2020).

Political connections owned by companies affect their choices of strategy; one of which is tax aggressiveness. Companies are considered as having political connections if one of the major shareholders or the company's top executives (board of commissioners, board of directors and company secretary) are (a) members of parliament, (b) ministers or heads of state or (c) having close relationships with high-ranking officials (Faccio, 2006). Companies that are politically connected through shareholders and company boards are believed to be more daring in aggressive tax avoidance (Sudibyo & Jianfu, 2016) due to lower demands for transparency and stronger connections to government (C. Kim & Zhang, 2016). However, other studies have found that political connection can reduce tax aggressiveness (Lestari & Putri, 2017) for a better corporate image (Anggraeni, 2018).

Companies that implement tax-aggressive activities are those who feel that taxes payment are costs that reduce earnings (Pratama, 2019). The choice to implement these activities is also determined by the company's ownership structure. One of the dominant ownership structures in Indonesian companies is family ownership (Claessens, Djankov, & Lang, 1999). Companies owned by families are more considerate of the company's reputation, so they are not aggressive in tax (Mafrolla & D’Amico, 2016). Nevertheless, other studies have different results that family companies tend to do tax aggressiveness for cost saving (Sunaryo, 2016).

The inconsistencies of the findings above have prompted this study to reexamine the effect of corporate governance and political connection on tax aggressiveness with family ownership as the moderating variable. Inconsistencies in the influence of corporate governance on tax aggressiveness are caused by, one of them,

the method in which corporate governance in previous studies was tested individually using several proxies. This study examines corporate governance comprehensively by referring to the Circular Letter of the Financial Service Authority (SE-OJK) Number 32/SEOJK.04/2015 concerning Guidelines for Public Company Governance.

Inconsistencies in the influence of political connection on tax aggressiveness in Indonesia are caused by the method that political connection is studied based on government ownership in companies. This study re-examines the influence of political connection on tax aggressiveness by looking at the political positions held by shareholders and top executives. The assessment of political positions refers to the measurements that are based on the structural positions of civil servants (Pegawai Negeri Sipil – PNS), as carried out by Supatmi, Sutrisno, Saraswati, & Purnomosidhi (2019).

This study uses family ownership as the moderating variable to find the cause of the said inconsistencies. In the research of (Landry, Deslandes, & Fortin, 2013), the aforementioned moderating variable is able to strengthen the negative influence of corporate social responsibility on tax aggressiveness. Family ownership can be a moderating variable as it affects the dependent variable and is contingent in nature, as prescribed by Hartono (2017).

This study refers to the agency theory, which explains the contract between principal and agent, where the latter (agent) provides services on the behalf of the former (principal), who delegates some authority for decision making (Jensen & Meckling, 1976). The delegation may trigger agency conflicts caused by information asymmetry because the agent has more relevant information than the principal regarding the condition of the company and because the principal cannot judge whether the agent has worked in accordance with the agreement (Armour, Hansmann, & Kraakman, 2009). Tax aggressiveness is one of the type III agency conflicts, which occurs between the company as the internal party and the tax fiscus as the external party. Tax aggressiveness is a form of information asymmetry since the tax fiscus does not know about tax aggressiveness committed by the company as a whole.

Agency conflict within companies is believed to be minimized by the implementation of good corporate governance, which helps improve the mechanism of supervision by internal and external parties as well as by the government (Ararat, Claessens, & Yurtoglu, 2021; Kim, Kim, Kim, & Byun, 2010). Optimal supervision of corporate governance is expected to reduce tax aggressiveness (Chan, Mo, & Zhou, 2013; Kerr et al., 2021). Therefore, the following hypothesis was formulated.

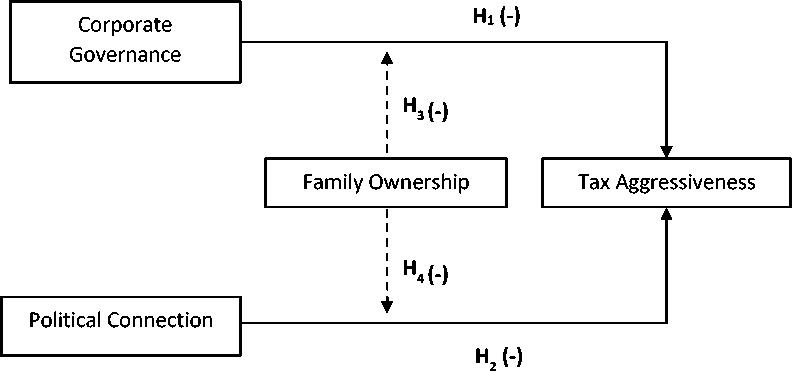

H1: Corporate governance negatively influences tax aggressiveness.

Government’s involvement in companies through political connection is believed to be able to reduce agency conflicts between companies and the government. Politically connected companies tend to be more compliant with tax regulations and avoid tax aggressiveness (Putra & Suhardianto, 2020) because they get more optimal supervision from the government (Lestari & Putri, 2017) and try to maintain their image by avoiding high-risk actions such as tax aggressiveness (Anggraeni, 2018). Therefore, the following hypothesis was formulated.

H2: Political connection negatively influences tax aggressiveness.

Figure 1. Theoretical Framework

Family companies tend to have a long investment period, focus on long-term benefits and pay attention to the company's reputation (Villalonga & Amit, 2020). One of the efforts to maintain reputation is by avoiding high-risk actions such as tax aggressiveness (Bimo et al., 2019). Family companies generally place family members on the ranks of the board of commissioners and the board of directors. The involvement of family members on the board is able to optimize supervision (Ulupui, Utama, & Karnen, 2015). Family members on the board as a component of corporate governance are believed to be able to minimize tax aggressiveness (Bimo et al., 2019; Mafrolla & D’Amico, 2016). Therefore, the following hypothesis was formulated.

H3: Family ownership strengthens the negative effect of corporate governance on tax aggressiveness.

The presence of the government through political connections and family members on the board optimizes supervision and prevents high-risk actions such as tax aggressiveness because family companies tend to maintain reputation (Lee & Bose, 2021), and political connection guarantees better supervision from regulators, media, and the public (Chaney, Faccio, & Parsley, 2011). Therefore, the following hypothesis was formulated.

H4: Family ownership strengthens the negative effect of political connection on tax aggressiveness.

The theoretical framework of this research is presented in Figure 1. Corporate governance and political connection are expected to minimize tax aggressiveness. Family ownership as the moderator is expected to strengthen the negative influence of corporate governance and political connection on tax aggressiveness.

Research Method

This associative quantitative research was conducted on manufacturing companies listed on the Indonesia Stock Exchange (IDX) in the period of 2016-2020. The criteria and the results of the purposive sampling applied in this study are presented in Table 1. Negative operating earnings are put under exception to avoid the mix-up between tax

Table 1. Procedure for Sample Selection

|

No |

Criteria |

Number |

|

1. |

Manufacturing companies listed continuously in IDX from 2016 to 2020 |

147 |

|

2. |

Companies not releasing annual report from 2016-2020 |

(3) |

|

3. |

Companies using currencies other than IDR |

(11) |

|

4. |

Companies with negative operation earnings |

(70) |

|

5. |

Companies with the Effective Tax Rate (ETR) of > 1 |

(14) |

|

Number of samples |

49 | |

|

Number of observations from 2016 to 2020 |

245 | |

Source: Processed Data, 2021

expense and the loss compensation period. Companies with ETR of > 1 and currencies other than IDR under exception to keep the estimation model error-free.

Tax aggressiveness is measured using effective tax rate (ETR) and book-tax difference (BTD) because ETR has a good ability to detect the possibility of tax aggressiveness in the current year (Schwab, Stomberg, & Xia, 2018) and because BTD is able to provide information related to the current condition and future valuation of a company and to detect the possibility of earnings management between commercial profit and fiscal profit to produce lower tax calculations (Luo, 2019).

ETR is measured by dividing the company's tax obligation by profit before tax, and BTD is measured by dividing the difference between profit after tax and taxable earnings by total assets of the previous year. Companies that do tax aggressiveness will have a negative ETR and positive BTD. In other words, the higher the ETR or the lower the BTD, the lower the likeliness of a company to commit tax aggressiveness.

Corporate governance is measured by dividing the number of recommendations that have been implemented by the company by the number of recommendations from SE-OJK Number 32/SEOJK.04/2015, i.e. 25 recommendations. Political connection is measured using the formula of Ln(1+PCI), with PCI (Political Connection Index) referring to the list of political connection scores according to Supatmi et al. (2019). Family ownership is measured using the ultimate approach by looking at the percentage of company share ownership directly and indirectly by family members. These percentages are retrieved from reports available in OSIRIS. A company is said to be a family company if more than 20% of its shares are owned by family members (Claessens, Djankov, Fan, & Lang, 2002).

This study uses control variables to present a better research model. A variable can be used as a control variable if it has been frequently tested against the dependent variable and if the research results show that the variable is influential. This study uses three control variables: profitability, fixed assets, firm size. Profitability is measured by return on assets with the formula of net profit after tax divided by total assets of the previous year. Fixed assets are calculated by dividing the value of net fixed assets by total assets. Firm size is measured by Ln (total assets).

This study uses two regression models because the dependent variable, i.e. tax aggressiveness, was measured using two different measurement methods: ETR and BTD. Equation (1) and (4) in the regression model are used to test H1 and H2, while equations (2), (3), (5) and (6) are used to test H3 and H4. The regression model of this research is as

follows:

ETR= α + β1CG + β2PC + β3ROA + β4PPE + β5SIZE + ε ........................................ (1)

ETR= α + β1CG + β2PC + β3FO + β4ROA + β5PPE + β6SIZE + ε ............................ (2)

ETR= α + β1CG + β2PC + β3FO + β4FO*CG + β5FO*PC + β6ROA + β7PPE +

BTD= α + β1CG + β2PC + β3ROA + β4PPE + β5SIZE + ε (4)

BTD= α + β1CG + β2PC + β3FO + β4ROA + β5PPE + Β6SIZE + ε (5)

BTD= α + β1CG + β2PC + β3FO + β4FO*CG + β5FO*PC + Β6ROA +β7PPE +

Notes:

ETR : BTD : CG :

PC :

FO : ROA : PPE : SIZE :

: Tax aggressiveness measured by effective tax rate

: Tax aggressiveness measured by book-tax difference

: Corporate governance

: Political connection

: Family ownership

: Profitability (Return on asset)

: Fixed asset (Property, plant, equipment)

: Firm size

Result and Discussion

Descriptive statistics are used to present an overview of the data. It consists of minimum value, maximum value, average value, and standard deviation, as presented in Table 2. ETR has the mean value of 0.253 or 25.3%, close to the corporate tax rate of 25% as applicable in Indonesia. This indicates that the sample companies tend to comply with the tax regulations. It is supported by the negative mean value of BTD, i.e. -0.035, which indicates that tax income is higher than the book income, signifying the low tendency for earnings management to reduce taxable earnings.

Corporate governance has the mean value of 0.733, indicating that the sample companies have implemented at least 18 of the 25 recommendations based on SE-OJK Number 32/SEOJK.04/2015. Political connection has the standard deviation of 1.174, more than the average value of 1.037, which suggests a high gap between minimum and maximum values. Profitability (ROA), fixed assets (PPE), firm size (SIZE), and family ownership (KK) have the mean value greater than the standard deviation value, which indicates a low gap between minimum and maximum values.

Table 3. and Table 4. present the results of the analysis of the regression model for the two measurement methods, ETR and BTD. Equation (1) of regression model 1 (Table 3.) is used to answer hypotheses 1 and 2: the effect of corporate governance on tax aggressiveness (ETR measurement method), while equation (2) and (3) are used to

Table 2. Result of Descriptive Statistics

|

Minimum |

Maximum |

Mean |

Std. Deviation | |

|

ETR |

0.002 |

0.959 |

0.253 |

0.116 |

|

BTD |

-0.586 |

0.104 |

-0.035 |

0.057 |

|

CG |

0.280 |

1.000 |

0.733 |

0.228 |

|

PC |

0.000 |

3.784 |

1.037 |

1.174 |

|

ROA |

0.000 |

0.581 |

0.102 |

0.094 |

|

PPE |

0.26 |

0.800 |

0.459 |

0.162 |

|

SIZE |

25.640 |

33.495 |

28.980 |

1.654 |

|

FO |

0.000 |

0.931 |

0.470 |

0.327 |

Source: Processed Data, 2021

Table 3. Analysis Result of Regression Model 1 (ETR)

|

Variable |

Equation 1 |

Equation 2 |

Equation 3 |

|

CG |

-0.015 |

-0.011 |

0.021 |

|

(t-value) |

(-0.427) |

(-0.316) |

(0.320) |

|

PC |

0.017* |

0.010 |

0.010 |

|

(t-value) |

(2.236) |

(1.272) |

(0.749) |

|

ROA |

-0.196** |

-0.23** |

-0.229** |

|

(t-value) |

(-2.360) |

(-2.673) |

(-2.706) |

|

PPE |

-0.049 |

-0.053 |

-0.053 |

|

(t-value) |

(-0.982) |

(-1.064) |

(-1.051) |

|

SIZE |

-0.008 |

-0.006 |

-0.006 |

|

(t-value) |

(-1.306) |

(-0.979) |

(-1.010) |

|

FO |

-0.053* |

0.002 | |

|

(t-value) |

(-2.151) |

(0.985) | |

|

FO*CG |

-0.074 | ||

|

(t-value) |

(-0.658) | ||

|

FO*PC |

-0.003 | ||

|

(t-value) |

(-0.111) | ||

|

F |

2.264 |

2.686 |

2.071 |

|

Sig F |

0.049* |

0.015* |

0.039* |

|

Adj. R2 |

0.025 |

0.040 |

0.034 |

*significant at 5%, **significant at 1%

Source: Processed Data, 2021

test hypotheses 3 and 4: the moderation of family ownership in the effect of corporate governance and political connection on tax aggressiveness (ETR measurement). The hypothesis will be accepted if the coefficient of the variable is positive against ETR.

Equation (4) of regression model 2 (Table 4.) is used to test hypotheses 1 and 2: the effect of corporate governance on tax aggressiveness (BTD measurement), while equation (5) and (6) are used to test hypotheses 3 and 4: the effect of corporate governance on tax aggressiveness (BTD measurement). The hypothesis will be accepted

Table 4. Analysis Result of Regression Model 2 (BTD)

|

Variable |

Equation 4 |

Equation 5 |

Equation 6 |

|

CG |

0.021 |

0.020 |

0.032 |

|

(t-value) |

(1390) |

(1.344) |

(1.162) |

|

PC |

-0.007** |

-0.006** |

-0.004 |

|

(t-value) |

(-2.383) |

(-1.897) |

(-0.656) |

|

ROA |

-0.305** |

-0.301** |

-0.307** |

|

(t-value) |

(-8.716) |

(-8.490) |

(-8,536) |

|

PPE |

0.000 |

0.000 |

-0.003 |

|

(t-value) |

(-0.020) |

(0.008) |

(-0.128) |

|

SIZE |

0.001 |

0.001 |

0.001 |

|

(t-value) FO (t-value) FO*CG (t-value) FO*PC (t-value) |

(0.605) |

(0.477) 0.009 (0.811) |

(0.450) 0.038 (1.135) -0.032 (-0.671) -0.006 (-0.653) |

|

F |

21.106 |

17.673 |

13.376 |

|

Sig F |

0.000** |

0.000** |

0.000** |

|

Adj. R2 *significant at 5%, |

0.292 **significant at 1% |

0.291 |

0.289 |

Source: Processed Data, 2021

Table 5. Hypothesis Testing Result

|

Hypothesis |

Coefficient |

Significance |

Remark | ||

|

ETR |

BTD |

ETR |

BTD | ||

|

H1 |

-0.015 |

0.021 |

0.335 |

0.083 |

Rejected |

|

H2 |

0.017 |

-0.007 |

0.013 |

0.009 |

Accepted |

|

H3 |

-0.074 |

-0.032 |

0.255 |

0.251 |

Rejected |

|

H4 |

-0.003 |

-0.006 |

0.456 |

0.257 |

Rejected |

Source: Processed Data, 2021

if the coefficient of the variable is negative against BTD. The regression model of this study has met the classical assumption test, i.e., normality, multicollinearity, and heteroscedasticity tests. Table 5. briefly presents the results of the hypothesis test Based on Table 5., only H2 is supported, that is political connection has a negative effect on tax aggressiveness. H1 in this study is not supported, that is corporate governance does not influence tax aggressiveness. Family ownership in this study does not strengthen the negative influence of corporate governance and political connection on tax aggressiveness (H3 and H4 are not supported).

Based on the results of the hypothesis testing, corporate governance does not influence tax aggressiveness (H1 is rejected). This finding is different from the finding of Kerr et al. (2021), that corporate governance is able to minimize tax aggressiveness, but is consistent with the finding of Apriliyana & Suryarini (2019) and Syamsuddin et al. (2020), that corporate governance is not able to minimize tax aggressiveness. Further, the results of this study do not support the application of corporate governance to reduce agency conflicts from the perspective of Agency Theory. Based on the results of the descriptive statistics in Table 2, the sample companies have shown the implementation of good corporate governance with the mean value of 0.733 or 73.3%. The good application of corporate governance is believed to be as an effort to minimize tax aggressiveness and to comply with the regulations of the Financial Service Authority (Otoritas Jasa Keuangan-OJK) as the supervisor of stock issuers in the Indonesia Stock Exchange (Bursa Efek Indonesia-BEI).

This study finds that political connection has a negative effect on tax aggressiveness (H2 is accepted), showing that political connection is able to prevent tax aggressiveness (Iswari, Sudaryono, & Widarjo, 2019; Putra & Suhardianto, 2020). Government involvement in companies through political connections increases supervision on companies’ operations (Lestari & Putri, 2017). Companies whose shareholders or top executives are politically connected tend to maintain their image, so they avoid actions that may hinder their reputation, such as tax aggressiveness (Anggraeni, 2018).

This study also finds that family ownership does not strengthen the negative effect of corporate governance on tax aggressiveness (H3 is rejected). This finding differs from the findings of Bimo et al. (2019) and Chen, Chen, Cheng, & Shevlin (2010) but supports the findings of Hanna & Haryanto (2017) and Utami & Setyawan (2015) that tax aggressiveness in family and non-family firms is no different. This shows that the two types of companies do not consider corporate governance as a solution to minimize tax aggressiveness; it is done as a mere formality for the fulfillments of the requirements issued by the Financial Service Authority (OJK).

The last finding is that family ownership does not strengthen the negative effect of political connection on tax aggressiveness (H4 is rejected). Family ownership actually

eliminates the negative influence of political connection on tax aggressiveness. In other words, family ownership does not moderate the relationship. Based on Table 3, family ownership, when tested independently, has a negative effect on ETR, or a positive effect on tax aggressiveness. The results indicate that family-owned companies tend to commit tax aggressiveness. This can be explained from the point of view of the second type of the Agency Theory: agency conflict occurs between majority and minority shareholders (Armour et al., 2009). Family companies as the majority shareholder tend to get more benefits from tax savings or rent extraction from tax aggressiveness (Gaaya, Lakhal, & Lakhal, 2017; Pratama, 2021).

In regards to profitability (ROA), fixed assets (PPE), and firm size (SIZE), which serve as control variables, only does profitability affects tax aggressiveness (Table 3 and Table 4). The findings about the effect of profitability on tax aggressiveness in this study are contrasting each other. Based on the measurement of tax aggressiveness using ETR, profitability or return on assets has a positive effect on tax aggressiveness (negative coefficient on ETR method). Companies with high profitability tend to commit tax aggressiveness, and vice versa. The decision of a company to commit tax aggressiveness is caused by the fact that the company is able to position itself (with adequate resources) to do tax planning so that they are able to reduce tax and maintain company earnings to remain high (Dewi & Yasa, 2020; Dewi & Noviari, 2017).

When BTD is used, the opposite result is obtained; that is, profitability or return on assets has a negative effect on BTD (tax aggressiveness). This result indicates that companies with high profitability tend to avoid tax aggressiveness, and vice versa, because they have earned high earnings and do not have incentives to do tax aggressiveness to increase profits. Tax payments made by the company do not make the company feel disadvantaged, so the company does not intend to commit out tax aggressiveness (Subagiastra, Arizona, & Mahaputra, 2016; Wicaksono, 2017).

Conclusion

The conclusions of the study are that corporate governance is not a solution to prevent tax aggressiveness and that political connection through the involvement of the government as a shareholder or top executive can prevent tax aggressiveness. In fact, companies owned by families have a higher likeliness of committing tax aggressiveness. However, family ownership is not a factor that strengthens or weakens the effect of corporate governance and political connection on tax aggressiveness.

This research is limited to manufacturing companies in the period of 2016-2020; different sectors and periods may produce different results. In addition, this study failed to trace the ultimate ownership of several companies using OSIRIS. Therefore, whether or not a company is family owned cannot be concluded. Future studies are recommended to use samples other than manufacturing companies and use different periods to get findings that are more comprehensive. It can also use other databases, e.g. ORBIS or information from relevant ministries, to explore more deeply about the ultimate ownership of a company. In addition, it need to consider the distinction between the period before and after tax incentives in relation with COVID-19 pandemic.

References

Anggraeni, R. (2018). Pengaruh Koneksi Politik terhadap Tax Aggressiveness (Studi

Empiris : Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun 2014-2017). Jurnal Akuntansi, 6(3), 1–15.

Apriliyana, N., & Suryarini, T. (2019). The Effect Of Corporate Governance and the Quality of CSR to Tax Avoidation. Accounting Analysis Journal, 7(3), 159–167. https://doi.org/10.15294/aaj.v7i3.20052

Ararat, M., Claessens, S., & Yurtoglu, B. B. (2021). Corporate governance in emerging markets: A selective review and an agenda for future research. Emerging Markets Review, 48, 100767. https://doi.org/10.1016/j.ememar.2020.100767

Armour, J., Hansmann, H., & Kraakman, R. (2009). Agency Problems, Legal Strategies, and Enforcement (No. 135).

Bimo, I. D., Prasetyo, C. Y., & Susilandari, C. A. (2019). The Effect of Internal Control on Tax Avoidance: The Case of Indonesia. Journal of Economics and Development, 21(2), 131–143. https://doi.org/10.1108/jed-10-2019-0042

Chan, K. H., Mo, P. L. L., & Zhou, A. Y. (2013). Government Ownership, Corporate Governance and Tax Aggressiveness: Evidence from China. Accounting and Finance, 53(4), 1029–1051. https://doi.org/10.1111/acfi.12043

Chaney, P. K., Faccio, M., & Parsley, D. (2011). The Quality of Accounting Information in Politically Connected Firms. Journal of Accounting and Economics, 51, 58–76. https://doi.org/10.1016/j.jacceco.2010.07.003

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are Family Firms More Tax Aggressive than Non-Family Firms? Journal of Financial Economics, 95(1), 41–61. https://doi.org/10.1016/j.jfineco.2009.02.003

Claessens, S., Djankov, S., Fan, J. P. H., & Lang, L. H. P. (2002). Disentangling the Incentive and Entrenchment Effects of Large Shareholdings. Journal of Finance, 57(6), 2741–2771. https://doi.org/10.1111/1540-6261.00511

Claessens, S., Djankov, S., & Lang, L. H. P. (1999). Who Controls East Asian Corporationsand the Implications for Legal Reform. Retrieved from www.worldbank.org/html/fpd/notes/

Dewi, K. S., & Yasa, G. W. (2020). The Effects of Executive and Company Characteristics on Tax Aggressiveness. Jurnal Ilmiah Akuntansi Dan Bisnis, 15(2), 280–292. https://doi.org/10.24843/jiab.2020.v15.i02.p10

Dewi, N. L. P. P., & Noviari, N. (2017). Pengaruh Ukuran Perusahaan, Leverage, Profitabilitas dan Corporate Social Responsibility Terhadap Penghindaran Pajak (Tax Avoidance). E-Jurnal Akuntansi, 21(2), 882–911.

https://doi.org/10.24843/EJA.2017.v21.i02.p01

Dey, A. (2008). Corporate Governance and Agency Conflicts. Journal of Accounting

Research, 46(5), 1143–1181. https://doi.org/10.1111/j.1475-679X.2008.00301.x

Faccio, M. (2006). Politically Connected Firms. American Economic Review, 96(1), 369–

386. https://doi.org/10.1257/000282806776157704

Gaaya, S., Lakhal, N., & Lakhal, F. (2017). Does Family Ownership Reduce Corporate Tax Avoidance? The Moderating Effect of Audit Quality. Managerial Auditing Journal, 32(7), 731–744. https://doi.org/10.1108/MAJ-02-2017-1530

Hanna, & Haryanto, M. (2017). Agresivitas Pelaporan Keuangan, Agresivitas Pajak, Tata Kelola Perusahaan dan Kepemilikan Keluarga. Jurnal Akuntansi, 20(3), 407–419.

https://doi.org/10.24912/ja.v20i3.6

Hartono, J. (2017). Metode Penelitian Bisnis Salah Kaprah dan Pengalaman-pengalaman (6th ed). Yogyakarta: BPFE.

Hasanah, A., & Ardini, L. (2021). Etika dan Kepatuhan Pajak. Dinamika Akuntansi,

Keuangan Dan Perbankan, 10(1), 1–7.

Himawan, A. (2017). Fitra: Setiap Tahun, Penghindaran Pajak Capai Rp110 Triliun.

Retrieved from https://www.suara.com/bisnis/2017/11/30/190456/fitra-setiap-tahun-penghindaran-pajak-capai-rp110-triliun

Huang, W., Ying, T., & Shen, Y. (2018). Executive Cash Compensation and Tax Aggressiveness of Chinese Firms. Review of Quantitative Finance and Accounting, 51(4), 1151–1180. https://doi.org/10.1007/s11156-018-0700-2

Integrity, G. F. (2019). Indonesia: Potential Revenue Losses Associated with Trade Misinvoicing. Retrieved from https://gfintegrity.org/report/indonesia-potential-revenue-losses-associated-with-trade-misinvoicing/

Iswari, P., Sudaryono, E. A., & Widarjo, W. (2019). Political Connection and Tax Aggressiveness: A Study on the State-Owned Enterprises Registered in Indonesia Stock Exchange. Journal of International Studies, 12(1), 79–92.

Jensen, M. C., & Meckling, W. H. (1976). Theory of The Firm: Managerial Behavior, Agency Cost and Ownership Structure. Journal of Financial Economics, 3(4), 305– 360.

Kerr, J. N., Price, R., Roman, F. J., & Romney, M. A. (2021). Corporate Governance and Tax Avoidance: Evidence from Governance Reform.

http://dx.doi.org/10.2139/ssrn.3861965

Kim, C., & Zhang, L. (2016). Corporate Political Connections and Tax Aggressiveness. Contemporary Accounting Research, 33(1), 78–114. https://doi.org/10.1111/1911-3846.12150

Kim, I. J., Eppler-Kim, J., Kim, W. S., & Byun, S. J. (2010). Foreign Investors and Corporate Governance in Korea. Pacific Basin Finance Journal, 18(4), 390–402.

https://doi.org/10.1016/j.pacfin.2010.04.002

Landry, S., Deslandes, M., & Fortin, A. (2013). Tax Aggressiveness, Corporate Social Responsibility and Ownership Structure. Journal of Accounting, Ethics and Public Policy, 14(3), 611–645. https://doi.org/10.2139/ssrn.2304653

Lee, C.-H., & Bose, S. (2021). Do Family Firms Engage in Less Tax Avoidance than NonFamily Firms? The Corporate Opacity Perspective. Journal of Contemporary Accounting & Economics, 17(2), 100263.

https://doi.org/10.1016/j.jcae.2021.100263

Lestari, G. A. W., & Putri, I. G. A. M. A. D. (2017). Pengaruh Corporate Governance, Koneksi Politik dan Leverage terhadap Penghindaran Pajak. E-Jurnal Akuntansi Universitas Udayana, 18(3), 2028–2054.

Luo, B. (2019). Effects of Auditor-Provided Tax Services on Book-Tax Differences and on Investors’ Mispricing of Book-Tax Differences. Advances in Accounting, 47, 100434. https://doi.org/10.1016/j.adiac.2019.100434

Mafrolla, E., & D’Amico, E. (2016). Tax Aggressiveness in Family Firms and the NonLinear Entrenchment Effect. Journal of Family Business Strategy, 7(3), 178–184. https://doi.org/10.1016/j.jfbs.2016.08.003

OECD. (2015). Glosarry of Statistical Terms: Corporate Governance. Retrieved January

21, 2020, from https://stats.oecd.org/glossary/detail.asp?ID=6778

Pratama, A. (2019). Analysis of Tax Amnesty Disclosures, Tax Avoidance, and Firm Value. Indonesian Journal of Contemporary Accounting Research, 1(1), 21.

https://doi.org/10.33455/ijcar.v1i1.89

Pratama, A. (2021). Tax Agressiveness in Family Firms: Can Corporate Governance Mitigate It? Journal of Accounting, Finance, Taxation, and Auditing (JAFTA), 3(1), 1– 18. https://doi.org/10.28932/jafta.v3i1.3282

Pratiwi, N. P. S. D. R., Subekti, I., & Rahman, A. F. (2019). The Effect of Corporate Governance and Audit Quality on Tax Aggressiveness with Family Ownership as The Moderating Variable. International Journal of Business, Economics and Law, 19(5), 31–42. https://doi.org/10.31014/aior.1992.02.01.76

Putra, Z. K. P., & Suhardianto, N. (2020). The Influence of Political Connection on Tax Avoidance. Jurnal Akuntansi Dan Keuangan, 22(2), 82–90.

https://doi.org/10.9744/jak.22.2.82-90

Schwab, C. M., Stomberg, B., & Xia, J. (2018). How U.S. GAAP Distorts the Effective Tax Rate As a Measure of Tax Avoidance. SSRN Electronic Journal.

https://doi.org/10.2139/ssrn.3281289

Subagiastra, K., Arizona, I. P. E., & Mahaputra, I. N. K. A. (2016). Pengaruh Profitabilitas, Kepemilikan Keluarga, dan Good Corporate Governance terhadap Penghindaran Pajak (Studi pada Perusahaan Manufaktur di Bursa Efek Indonesia). Jurnal Ilmiah Akuntansi, 1(2), 167–193. https://doi.org/10.23887/jia.v1i2.9994

Sudibyo, Y. A., & Jianfu, S. (2016). Political Connections, State Owned Enterprises and Tax avoidance: An Evidence from Indonesia. Corporate Ownership and Control, 13(3), 279–283. https://doi.org/10.22495/cocv13i3c2p2

Sunaryo, S. (2016). Effect of Family Ownership towards Tax Aggressiveness on Food and Beverages Industrial Company Listed in Indonesia Stock Exchange. Binus Business Review, 7(1), 53. https://doi.org/10.21512/bbr.v7i1.1450

Supatmi, Sutrisno, T., Saraswati, E., & Purnomosidhi, B. (2019). The Effect of Related Party Transactions on Firm Performance: The Moderating Role of Political Connection in Indonesian Banking. Business: Theory and Practice, 20, 81–92.

Syamsuddin, R., Ali, M., & Sobarsyah, M. (2020). The Effect of Corporate Governance on Financial Performance and Tax Avoidance on LQ45 Companies. Hasanuddin Journal of Business Strategy, 2(4), 10–25. https://doi.org/10.26487/hjbs.v2i4.362

Ulupui, I. G., Utama, S., & Karnen, K. A. (2015). Pengaruh Kepemilikan Keluarga, Kedekatan Direksi dan Komisaris dengan Pemilik Pengendali terhadap Kompensasi Direksi dan Komisaris Perusahaan di Pasar Modal Indonesia. Jurnal Organisasi Dan Manajemen, 11(1), 62–74. https://doi.org/10.1016/j.fsigen.2013.08.015

Utami, W. T., & Setyawan, H. (2015). Pengaruh Kepemilikan Keluarga terhadap Tindakan Pajak Agresif dengan Corporate Governance sebagai Variabel Moderating (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun 2010-2013). Confernce in Business, Accounting and Management, 2(1), 413– 421.

Villalonga, B., & Amit, R. (2020). Family Ownership. Oxford Review of Economic Policy, 36(2), 241–257. https://doi.org/10.1093/oxrep/graa007

Wahab, E. A. A., Ariff, A. M., Marzuki, M. M., & Sanusi, Z. M. (2017). Political Connections, Corporate Governance, and Tax Aggressiveness in Malaysia. Asian

Review of Accounting, 25(3), 424–451. https://doi.org/10.1108/ARA-05-2016-0053

Wardani, D. K., & Nurhayati, N. (2019). Pengaruh Self Assement System, E-Commerce dan Keterbukaan Akses Informasi Rekening Bank terhadap Niat Melakukan Penghindaran Pajak. Jurnal Akuntansi Pajak Dewantara, 3(1), 38–48.

https://doi.org/10.29230/ad.v3i1.3340

Wicaksono, A. P. N. (2017). Koneksi Politik dan Agresivitas Pajak: Fenomena di Indonesia. Akuntabilitas: Jurnal Ilmu Akuntansi, 10(1), 167–180.

https://doi.org/10.15408/akt.v10i1.5833

Zheng, S. (2017). Can Corporate Diversification Induce More Tax Avoidance? Journal of Multinational Financial Management, 41, 47–60.

https://doi.org/10.1016/j.mulfin.2017.05.008

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 158

Discussion and feedback