Moderation of Contingency Factors on the Effect of Fiscal Decentralization Inequality between Regencies/Cities in the Province of Bali

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 16 No. 1, January 2021

AFFILIATION:

-

1 Faculty of Economics and Business, Universitas Udayana, Indonesia

*CORRESPONDENCE: dwirandra2012@unud.ac.id

THIS ARTICLE IS AVAILABLE IN: https://ojs.unud.ac.id/index.php/jiab

DOI:

10.24843/JIAB.2021.v16.i01.p09

CITATION:

Dwirandra, A. A. N. B. (2021). Moderation of Contingency Factors on The Effect of Fiscal Decentralization Inequality Between Regencies/City In The Province Of Bali. Jurnal Ilmiah Akuntansi dan Bisnis, 16(1), 137153.

ARTICLE HISTORY Received:

16 December 2020

Revised:

-

11 January 2021

Accepted:

14 January 2021

Moderation of Contingency Factors on the Effect of Fiscal Decentralization Inequality between Regencies/City in the Province of Bali

Anak Agung Ngurah Bagus Dwirandra1*

Abstract

Fiscal decentralization affects inequality between regions but is not always linear because of contingent factors. The purpose of this study is to confirm the effect of fiscal decentralization on inequality between regions in the Bali Province. Specifically, this research aims to examine the moderating effect of contingent factors, such as regional spending, private investment, and general allocation funds, on fiscal decentralization. Secondary data published on the local government/municipal government website and Bali provincial statistics agency were used. Data were analyzed using moderated regression analysis techniques. Results conclude that fiscal decentralization has no significant negative effect on inequality between regions. Both regional expenditures and general allocation funds are unable to moderate the negative effect of fiscal decentralization on inequality between regions. On the other hand, private investment moderates the negative effect of fiscal decentralization on inequality between regions.

Keywords: fiscal decentralization, inequality between regions/cities, regional spending, private investment, general allocation funds.

Introduction

Fiscal decentralization is regulated in Law Number 33 of 2004 concerning Central and Regional Financial Balancing which supports the implementation of regional autonomy which was later revised into Law of the Republic of Indonesia Number 23 of 2014 concerning Regional Government. The implementation of fiscal decentralization in regencies/cities in Bali Province based on statistical data 2016 to 2018 has a different impact on economic growth and inequality between regions, as presented in Table 1. Based on this table, it can be seen that economic growth, which is measured by GDP at Constant Price, always increases from year to year for all districts/cities in Bali Province. Meanwhile, inequality between regions, which is measured by the Gini ratio, still exists in all districts/cities in Bali Province but fluctuates and tends to differ

between districts/cities. Inequality between regions in Badung Regency, Gianyar Regency, Klungkung Regency, and Denpasar City, for example, inequality between regions fluctuates but tends to widen as indicated by the increase in the Gini ratio in 2018 compared to 2016. Inequality between regions in Buleleng Regency is relatively constant in 2018 compared to the year 2016. Meanwhile, inequality between regions in Bangli, Jembrana, and Tabanan Regencies has decreased, which is indicated by the smaller Gini ratio in 2018 compared to 2016.

Inequality between regencies/cities in Bali Province as described above cannot be denied that it is still ongoing, but the varied or different trends between districts/cities is actually interesting to conduct further investigations, whether the impact of fiscal decentralization on inequalities between districts/cities in the Province Bali has reached its peak and will then experience a decline, as confirmed by Kuznets (1995) inverted U curve theory. This phenomenon is interesting to reveal because the results of Putri & Natha (2015) research still found a significant positive effect of fiscal decentralization on inequality between districts/cities in Bali Province for the period 2008 to 2012.

Tiebout (1956) describes a positive relationship between fiscal decentralization and regional inequality through the nature of taxpayer mobility, where people (taxpayers) have the ability to "vote by feet" (can freely) in choosing which areas to occupy through two considerations, namely taste and the amount of tax imposed in the area. Thus, wealthier regions with better public facilities and services will be more attractive to live in than less developed regions (poor regions).

Bonet (2006) research found the problem of inequality between regions due to the implementation of fiscal decentralization in developing countries (case study: Colombia). The same phenomenon also occurs in Indonesia, as shown in the results of research by Siagian & Miyasto (2010) for example, finding that there is regional economic growth every year along with fiscal decentralization, but the regional imbalance of 25 districts/cities in West Java Province in the 2004-2008 period has increased. The same findings were obtained by Sianturi & Miyasto (2011) who conducted a study with the 2004-2008 research period in 19 districts/cities in North Sumatra Province; Nurhuda et al., (2013); Putri & Natha (2015) found that fiscal decentralization, with a proxy for local revenue, has a significant positive effect on inequality between districts/cities. However, different results were found by other researchers, such as research: Rosdyana & Suhendra

Table 1. Gini Ratio of Regencies/Cities in Bali Province 2016-2018

|

Regencies/Cities |

GDP Constant Price*) |

Gini Ratio | ||||

|

2016 |

2017 |

2018 |

2016 |

2017 |

2018 | |

|

Badung |

47,208.170 |

52,343.650 |

62,794.580 |

0.320 |

0.320 |

0.340 |

|

Bangli |

5,457.230 |

5,976.570 |

6,999.410 |

0.350 |

0.300 |

0.310 |

|

Buleleng |

27,690.110 |

30,318.760 |

35,509.340 |

0.340 |

0.310 |

0.340 |

|

Gianyar |

22,113.250 |

24,224.220 |

28,581.340 |

0.300 |

0.270 |

0.310 |

|

Jembrana |

11,167.670 |

12,116.480 |

14,162.330 |

0.360 |

0.320 |

0.330 |

|

Karangasem |

13,410.890 |

14,598.380 |

17,106.630 |

0.290 |

0.320 |

0.340 |

|

Klungkung |

7,112.020 |

7,784.620 |

9,119.830 |

0.360 |

0.370 |

0.390 |

|

Tabanan |

18,630.250 |

20,376.580 |

23,885.630 |

0.340 |

0.310 |

0.320 |

|

Denpasar |

42,384.430 |

46,835.750 |

55,676.480 |

0.330 |

0.340 |

0.340 |

*) in billions of rupiah

Source: Bali provincial statistics agency, 2019

-

(2015) who found that fiscal decentralization has no significant positive effect on inequality between regions; Research by Sasana (2009); Apriesa & Miyasto (2013); Kundhani (2015) reveals that fiscal decentralization has a significant negative effect on inequality between regions.

Govindarajan (1986) and Murray (1990) emphasize that the inconsistency of these results is thought to be due to the role of other factors or variables, which they refer to as contingent factors. Govindarajan (1986) states that there may not be a unified research result depending on certain factors or better known as contingent factors. Murray (1990) adds that in order to reconcile conflicting results, a contingency approach is needed to identify other variables that act as moderators or mediators in the research model. In this study, we want to reveal the moderating role of regional spending, private investment, and general allocation funds because they are more relevant to fiscal decentralization and inequality between regions.

Regional expenditures will be stronger in stimulating regional economic growth if more is allocated to capital expenditures. The development of facilities and infrastructure by local governments has a positive effect on economic growth (Kuncoro, 2004). Increasing public sector services in a sustainable manner will improve public facilities and infrastructure, government investment also includes improvements to education, health and other supporting facilities. The fundamental requirement for economic development is a level of provision of development capital in proportion to population growth. The formation of capital must be broadly defined so that it includes all expenditures that are productivity-enhancing (Ismerdekaningsih & Rahayu, 2002). With the addition of infrastructure and improvement of existing infrastructure by local governments, it is hoped that it will spur economic growth in the regions (Harianto & Hadi, 2006). However, the different magnitudes and effectiveness of capital expenditures between districts/cities will have different implications for inequality between regions.

Private investment is one of the pillars of economic growth. Private investment can be a starting point for the success and sustainability of development in the future because it can absorb labor, so that it can open up new job opportunities and in the end will increase economic growth and ultimately have the potential to reduce the disparity between regions. However, if investment is concentrated in one district/city, it will actually encourage inequality between regions. Likewise, the general allocation fund, the amount of which is determined based on the fiscal gap of each district/city, should have an impact on narrowing inequality between regions, but in reality this could not be the case if the local government allocates it less wisely, let alone general allocation funds including fund transfers without conditions/unconditional transfer of grant from the central government to regional governments.

This study aims to examine the effect of fiscal decentralization on inequality between districts/cities. Meanwhile, the specific objectives of this study is to examine the moderating effect of contingent factors, such as: regional spending, private investment, and general allocation funds on the effect of fiscal decentralization on inequality between districts/cities in Bali Province. This study replicates the research of Nurhuda et al., (2013) and Putri & Natha (2015) to reconfirm the existence of the inverted U curve theory from Kuznets (1995). This study is an extension of Nurhuda et al., (2013) and Putri & Natha (2015) by adding to the test for the moderating effect of contingent factors and at the same time confirming the existence of Hayek (1945) theory of fiscal decentralization.

The theory of Fiscal Federalism which was developed by Hayek (1945); Musgrave (1959); Oates (1972) emphasized that economic growth was achieved by fiscal decentralization through autonomy (regional autonomy). In view of this theory, there are two theoretical perspectives that explain the economic impact of decentralization, namely according to traditional theories (first generation theory) and new perspective theories (second generation theories). The traditional theoretical view of fiscal federalism emphasizes the allocative benefits of decentralization to obtain easy information from the public. In this case, there are two ideas that underlie this allocative advantage. First, namely the use of 'knowledge in society' which according to Hayek (1945) is a form of ease of decision making that can be achieved due to efficient use of information. In the context of public finance, local governments have better information than the central government about the conditions of their respective regions so that local governments will be better at making decisions about the provision of public goods and services than if they were left to the central government. Decentralization also allows for local experimentation by seeing and studying experiences from other regions so that they can imitate the successes of those areas and learn from their failures. This form of experimentation reduces the cost of failure of a centralized system of government. This is known as the "laboratory of federalism".

In Indonesia, the era of decentralization was preceded by the promulgation of Law no. 22 of 1999 concerning Regional Government which was then followed by a fiscal decentralization policy based on Law no. 25 of 1999 concerning the Financial Balance between the Central and Regional Government is inseparable from the demands for reforms that rolled in several years earlier, where the peak of the demands for reform occurred in 1998. The implementation of fiscal decentralization will run well if it is supported by the following factors: who are able to carry out supervision and enforcement; Second, strong human resources in the Regional Government to replace the role of the Central Government; Third, balance and clarity in the distribution of responsibilities and authorities in collecting local taxes and levies.

Inequality is a phenomenon that occurs in almost every layer of countries in the world, be it poor countries, developing countries or developed countries, the only thing that distinguishes between them is the magnitude of the level of inequality, therefore it cannot be eliminated but can only be reduced to the limit. which can be tolerated. The difference in progress between regions which means that the ability to grow is different, which is analogous to inequality, so that what arises is inequality so that opinions and empirical studies have emerged that place equity and growth in a dichotomous position. In this case, Kuznets (1995) proposed a hypothesis known as the inverted U curve theory. This hypothesis is generated through an empirical study of economic growth patterns that confirm the existence of a tradeoff between growth and equity. The historical pattern of growth in developed countries shows that in the early stages of economic growth, income distribution tends to deteriorate, while at later stages it tends to improve.

The economic growth of a country will encourage an increase in inequality between regions within that country in the early stages of economic development, and will gradually decrease when economic development reaches a stable point. This hypothesis is generated through an empirical study of the growth patterns of a number of countries in the world, in the early stages of economic growth there is a trade-off between growth and equity. This pattern was due to the fact that growth in the early

stages of development tended to be focused on the modern sector of the economy, which at that time had little absorption of labor. Inequality is widening as the gap between modern and traditional sectors increases. This increase occurred because the development of the modern sector was faster than the traditional sector. However, in the long run, when economic conditions reach maturity levels and assuming the free market mechanism and the mobility of all production factors between countries without the slightest obstacle or distortion, then the difference in output growth rates between countries will tend to shrink along with the level of per capita income and its average growth rate is getting higher in each country, which in turn eliminates the gap.

Sjafrizal (2012) states that there are several factors that cause inequality between regions, such as: first, differences in the content of Natural Resources, namely that if an area has an abundance of natural resources, it will be able to produce a product at a lower cost compared to other areas that lack natural resource content; Second, differences in demographic conditions, namely differences seen based on the growth rate and population structure, education and health levels, employment conditions, and work ethic habits of the local community in question will cause inequality in development between regions; Third, the lack of smooth mobility of goods and services so that there will be an accumulated supply of products as a result of not being able to sell them to other areas in need. As a result, it is difficult for underdeveloped regions to push the development process and cause high development inequality between regions; Fourth, the concentration of regional economic activities in an area that will affect faster economic growth in that area and on the other hand will affect development in underdeveloped areas, resulting in development inequality; And finally, the imbalance caused by the allocation of development funds between regions or a large increase in investment from the central government and investment in a certain region will have faster economic growth and development, which can result in inequality in development between regions.

Klassen Typology analysis tool (Klassen Typology) is used to describe the pattern and structure of economic growth in each region. Klassen Typology basically divides regions based on two main indicators, namely regional economic growth and regional per capita income. Through this analysis, four characteristics of different patterns and structures of economic growth are obtained, namely: fast-forward and fast-growing regions (high growth and high income), advanced but depressed regions (high income but low growth), fast developing regions (high growth but income), and regions are relatively underdeveloped (low growth and low income) (Aswandi & Kuncoro, 2002).

The criteria used to divide regencies/cities in this research are as follows: (1) fast-developed and fast-growing regions, regions that have higher levels of economic growth and per capita income than the average of Bali Province; (2) developed but depressed regions, regions that have a higher per capita income, but whose economic growth rate is lower than the average of Bali Province; (3) fast developing regions, regions with high growth rates, but lower income per capita than the average of Bali Province; (4) relatively underdeveloped regions are regions that have lower levels of economic growth and income per capita than the average of Bali Province. It is said to be "high" if the indicators in a district/city are higher than the average of all regencies/cities in Bali Province and classified as "low" if the indicators in a district/city are lower than the average of all regencies/cities in Bali Province.

According to Klassen's typology, of the four types of typology of economic patterns and structures, regencies/cities in Bali Province are divided into four patterns and structures, namely: 1) A developed and fast growing area, namely Badung Regency, 2 ) Regions are developing fast but not progressing, namely Denpasar City, Gianyar and Buleleng Regency, 3) Developed but depressed regions, namely Klungkung Regency; and, 4) Underdeveloped areas, namely Tabanan, Jembrana, Bangli and Karangasem Regencies.

In the context of a unitary state, fiscal decentralization is the transfer of fiscal authority from state authorities to autonomous regions. Fiscal authority includes at least the authority to manage revenue/taxation, flexibility to determine budgets and allocate resources owned by regions to finance public services which are the task of the regions. The definition of fiscal decentralization is in line with what Davey (2003) states: Fiscal decentralization is the division of public expenditure and revenue between levels of government, and the discretion given to regional and local government to determine their budgets by levying taxes and fees and allocating resources.

Meanwhile, in the context of decentralization, the problem of redistribution has two dimensions, namely horizontal equality (between regions) and equality within regions. Horizontal equality refers to a condition in which local governments have the same capacity in providing public goods (Ebel & Yilmaz, 2002). Tiebout (1956) describes a positive relationship between fiscal decentralization and regional inequality through the nature of taxpayer mobility, where people (taxpayers) have the ability to "vote by feet" (can freely) in choosing which areas to occupy through two considerations, namely taste. and the amount of tax imposed in the area. Thus, wealth regions with better public facilities and services will be more attractive to live in than less developed regions (poor regions). Several researchers have also conducted similar research, such as: Bonet (2006); Siagian & Miyasto (2010); Nurhuda et al. (2013); Putri & Natha (2015) found that there is a significant positive effect of fiscal decentralization on inequality between districts/cities.

The existence of fiscal decentralization provides opportunities for districts/cities to optimize their regional potential so as to increase local revenue. However, the ability of each regional government to increase local revenue by optimizing regional potential is not the same. However, the increase in local revenue with the fiscal decentralization policy has the potential to increase inequality between districts/cities. Based on the theoretical, conceptual basis, and the results of empirical research, as well as the logical framework described above, the following research hypothesis can be developed: H1: Fiscal decentralization has a positive effect on inequality between districts/cities in Bali Province.

The regional autonomy system of each district/city can provide a variety of various public services, according to the needs of the region. So that this certainly can encourage economic growth and at the same time is expected to reduce regional inequality. Government expenditures must be made to finance various activities or functions which are their responsibility (Muluk, 2007). According to Mangkoesoebroto (2001) there are 3 government functions, namely: first, the allocation function, namely the function of the government to ensure that the allocation of economic resources (public goods, private goods, mixed goods) is carried out efficiently; Second, the distribution function, namely the function of the government to realize an even distribution of income or wealth; Furthermore, thirdly, the function of stability, namely the function of the government to maintain the stability of economic conditions, because

the economy that is submitted to the market will be vulnerable to shocks (inflation and deflation).

Government expenditure is the consumption of goods and services by the government as well as financing by the government for government administration and development activities (Sukirno, 2016). Furthermore, Tadaro & Smith (2006) say that reducing income disparities, both between regions and between groups of people, is a government effort at various levels directly in the form of transfer payments and indirectly through job creation, education subsidies, health subsidies and others. Samuelson & Nordhaus (1994) emphasized that government spending is the smallest relative component compared to other expenditures, but the effect is quite large, both as a function of allocation, distribution, and stabilization. Government spending is autonomous, because the determination of the government budget is more on: a. Taxes that are expected to be received; b. Political considerations; and c. Problems faced by Investments

Districts/cities that are more aware of their regional priority problems will certainly allocate their regional expenditures in an effort to encourage regional economic growth while reducing poverty, so that in the end they can reduce the regional inequality with other regions. Thus, it can be said that increasing regional spending has the opportunity to reduce the positive effect of fiscal decentralization on inequality between regions.

Based on the theoretical, conceptual basis, and the results of empirical research, as well as the logical framework described above, the following research hypothesis can be developed:

H2: Regional spending weakens the positive effect of fiscal decentralization on inequality between districts/cities in Bali Province.

Private investment is defined as spending or spending by investors or companies to buy capital goods and production equipment to increase the ability to produce goods and services available in the economy, so investment is also known as investment (Sukirno, 2016). The success of development in an area is determined not only by the amount of government expenditure, but also by the amount of investment. Investment is one of the pillars of economic growth. Investment can be a starting point for the success and sustainability of development in the future because it can absorb labor, so that it can open new job opportunities for the community which in turn will have an impact on increasing people's income.

With the characteristics of private investment like that, furthermore, investment is certainly an additional regional resource in addition to local revenue which can be expected to increase the ability of fiscal decentralization to increase economic growth on the one hand, and at the same time reduce inequality between regions. Based on the theoretical, conceptual basis, and the results of empirical research, as well as the logical framework described above, the following research hypothesis can be developed: H3: Private investment weakens the positive impact of fiscal decentralization on inequality between districts/cities in Bali Province.

General allocation funds are funds sourced from state budget revenues allocated for the purpose of equal distribution of inter-regional financial capacity to finance regional needs in the context of implementing decentralization. From the understanding taken from Law number 33 of 2004, it can be concluded that the general allocation fund is a

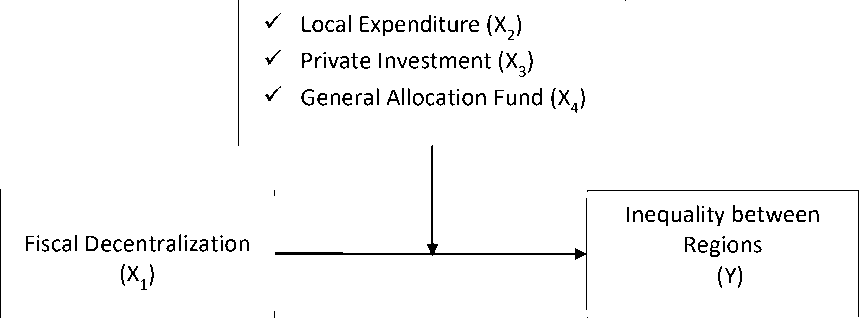

Figure 1. Research Model

Source: Processed Data, 2019

means of overcoming fiscal imbalances between regions and on the other hand also provides a source of regional financing. This indicates that the general allocation funds are prioritized for regions with low fiscal capacity. Meanwhile, the proportion of the distribution of general allocation funds for provinces and regencies/cities is determined in accordance with the balance of authority between provinces and districts/cities. General allocation funds are in the form of "Block Grant" which means that their use is given to the regions in accordance with regional priorities and needs for improving services to the community in the context of regional autonomy. In recent years, the proportion of general allocation funds to regional revenues is still the highest compared to other regional revenues, including local revenue (Harianto & Hadi, 2006). It is hoped that this large amount of general allocation funds, together with local revenue, can increase the allocation of capital expenditures.

The larger the general allocation fund, the less physical infrastructure inequality and at the same time will be able to encourage sufficient capital expenditure to reduce inequality between regencies/cities. Of course, this condition provides an opportunity to weaken the positive impact of fiscal decentralization on inequality between districts/cities. Based on the theoretical, conceptual basis, and the results of empirical research, as well as the logical framework described above, the following research hypothesis can be developed:

H4: General allocation funds weaken the positive effect of fiscal decentralization on inequality between districts/cities in Bali Province.

Based on the research allegations or research hypotheses developed from the above framework of thought, this research model can be developed as presented in Figure 1.

Research Method

The object of this research is the imbalance between regencies/cities in Bali Province. Meanwhile, the locations of this research are districts/cities in Bali Province. The research was conducted in nine (9) regencies/cities in Bali Province with the following

considerations: first, regencies/cities in Bali make business or tourism their core business, while the district/city tourism sector in other provinces is not their main business; second, this research wants to see the effectiveness of changes in the tourism business management pattern carried out by the Bali provincial government to anticipate imbalances between regencies/cities in Bali, namely from the concept of "Single Destination Multi Management" to "One Island Management" (CNN indonesia, 2018) and third, researchers want to re-examine the existence of the inverted U curve theory from Kuznets (1995) because based on research by Putri & Natha (2015) it was found that fiscal decentralization had a significant positive effect on inequality between regencies/cities in Bali Province in the period 2008 to 2012 or in other words until that period the existence of the theory has not been proven.

This research data is panel data of nine (9) districts/cities in Bali for the period 2015 to 2019, so the number of observations used is 45 observations. Sources of research data are the website of the district/city government and the website of the Bali provincial government, as well as the website of the Bali Province Central Bureau of Statistics.

Variables are defined as objects of observational research or factors that play a role in the events and phenomena to be studied (Ghozali, 2018) The variables used in this study are 1) The dependent variable of this study is the inequality between regions; 2) The independent variable of this study is fiscal decentralization, 3) The moderating variables of this study are regional expenditure, private investment, and general allocation funds, Solimun (2010) classified moderation variables into 4 (four) types, namely pure moderation, quasi moderation, moderation homologation (potential moderation), and Predictor moderation.

Inequality between regions is used as a proxy in accordance with that used in research conducted by Bonet (2006) which bases the size of the regional gap on the concept of relative GDP per capita.

IBR = it

(1)

GDP_Dit-1 GDP_ Pit

Where:

IBRit = inequality between regencies/cities i, in year t

GDP_Dit = gross domestic regional product per capita of district/city i, in year t GDP_ Pit = gross domestic regional product per capita of Bali Province, in year t

Lin & Liu (2000) describe the measurement of the degree of fiscal decentralization using the revenue approach, namely measuring the degree of fiscal decentralization from the share of regional revenue to total regional revenue. According to Law number 33 of 2004. Original regional income consists of regional taxes, regional levies, proceeds from the management of separated regional assets, and other legitimate regional original revenues. Local taxes and levies are limitative (closed-list), meaning that local governments cannot collect other types of taxes and levies other than those stipulated in law. The value of original regional income data is in accordance with the realization of the district/city budget and expenditure revenue in Bali Province.

Regional spending is the consumption of goods and services carried out by the government as well as financing by the government for government administration needs and development activities (Sukirno, 2016). Regional expenditure data is data on the realization of district/city regional spending in the Province of Bali which is presented in the district/city regional revenue and expenditure budget realization report.

Private investment is defined as spending or spending by investors or companies to buy capital goods and production equipment to increase the ability to produce goods and services available in the economy, so investment is also known as investment (Sukirno, 2016). Data on the value of private investment is the realization of private investment in the regencies/municipalities of Bali Province.

General allocation funds are funds sourced from state budget and revenue revenues allocated for the purpose of equal distribution of inter-regional financial capacity to finance regional needs in the context of implementing decentralization. From the understanding taken from Law number 33 of 2004, it can be concluded that the general allocation fund is a means of overcoming fiscal imbalances between regions and on the other hand also provides a source of regional financing. This indicates that the general allocation funds are prioritized for regions with low fiscal capacity.

The portion of the general allocation funds is determined to be at least 26% (twenty-six percent) of the Net Domestic Revenue stipulated in the state budget and revenue. Meanwhile, the proportion of the distribution of general allocation funds for Provinces and Regencies/Cities is determined in accordance with the balance of authority between provinces and districts/cities. General allocation funds are "Block Grant", which means that their use is given to the regions according to regional priorities and needs. General allocation funds in this study use the realization of general allocation funds for districts/cities in Bali Province.

One way that can be used to test whether a variable is a moderating variable is by conducting an interaction test (Ghozali, 2018). The interaction test between variables is called Moderated Regression Analysis (MRA). MRA is a special application of multiple linear regression where the regression equation contains elements of interaction or multiplication of two or more independent variables (Ghozali, 2018).. The Moderated Regression Analysis (MRA) equation is as follows:

Y = a + b1X1 + b2X2 + b3X3 + b4X4 + b6X1.X2 + b7X1.X3 + b8X1.X4 + ɛ ......... (2)

Where:

Y = Inequality between Regions of District/City in Bali Province

a = Constant

-

b1 … b8 = regression coefficient

-

X1 = fiscal decentralization/FD

-

X2 = regency/city spending/RS

-

X3 = private investment/PI

-

X4 = general allocation fund/GAF

-

X1.X2 = FD and RS interactions

-

X1.X3 = FD and PI Interaction

-

X1.X4 = FD and GAF interaction

ɛ = residual value

Result and Discussion

The classical assumption test according to Ghozali (2018) test for data normality, multicollinearity test, autocorrelation test, and heteroscedasticity test, was carried out to provide certainty that the regression equation obtained will have accuracy in estimation, unbiased, and consistent or best linear unbiased estimator (BLUE). The results of the Kolmogorov-Smirnov normality test have been carried out and show that the data is

Table 2. Test Results with Moderated Regression Analysis (MRA)

|

Model |

Unstandardized Coefficients |

MRA Test Results Sig. | |

|

B |

Std. Error | ||

|

1 (Constant) |

7.560 |

2.399 |

0.003 |

|

FD |

-0.023 |

0.024 |

0.352 Not significantly, H1 was rejected |

|

RS |

0.081 |

0.133 |

0.545 Insignificant |

|

PI |

0.023 |

0.011 |

0.049 Significant |

|

GAF |

-0.402 |

0.152 |

0.011 Significant |

|

FD.RS _ |

1.395 |

0.000 |

0.189 Not significant, H2 is rejected |

|

FD.PI_ |

3.789 |

0.000 |

0.001 Significantly, H3 is rejected |

|

FD.GAF |

-7.135 |

0.000 |

0.720 Not significant, H4 is rejected |

Source: Data Processed, 2019

-

a. Dependent Variable: IBR = inequality between regions

-

b. FD = fixal decentralization, RS = regional spending, PI = private investment,

GAF = general allocation fund.

normally distributed, indicated by the Asymp value. Sig (2-tailed) is 0.145 which is greater than α (0.05).

Furthermore, the multicollinearity test results obtained a tolerance value greater than 10% (0.1) and VIF less than 10, which means that there are no symptoms of multicollinearity. Then, the autocorrelation test results show that the Durbin-Watson value is 1,866. The dU value for a sample size of 45 with four independent variables is 1.7203 and the dL (4-dU) value is 4-1.7203 = 2,280. The Durbin Watson value is 1.866, which is greater than the upper limit (du) of 1.7203 and less than (4-du) 4-1.7203 = 2.280, so it can be said that there are no autocorrelation symptoms. Furthermore, the last classical assumption test, namely the heteroscedasticity test, shows the results of the significance value of each variable: fiscal decentralization, regency spending, private investment, and general allocation funds are greater than α (0.05), which indicates no heteroscedasticity symptoms.

Moderation regression analysis (MRA) has been carried out and the results are as presented in Table 2. Based on this table, it can be seen that the P-value of the effect of fiscal decentralization on inequality between districts/cities in Bali Province is 0.352, which is greater than α (0.05) beta (unstandardized) of -0.023. This means that fiscal decentralization, with a proxy for locally-generated revenue, has an insignificant negative effect on inequality between districts/cities in Bali Province. The results of this test reject the H1 hypothesis which states that fiscal decentralization has a positive effect on inequality between districts/cities in Bali Province.

The results of this research, which are not in line with hypothesis H1, actually provide hope for the realization of dual targets for fiscal decentralization, namely not only to increase regional economic growth but also at the same time narrowing disparities between regencies/cities in Bali Province. This is also a note considering the research results of Putri & Natha (2015) revealed that in the period 2008 to 2012 fiscal density has a significant positive effect on inequality between regencies/cities in Bali Province.

However, it should also be noted that the reduction in inequality between regions as a result of the increase in locally-generated revenue due to the fiscal decentralization policy has not been real or significant. In this regard, the district/city governments in Bali Province should reduce their locally-generated revenue allocation for routine expenditures as much as possible and at the same time increase the allocation of capital/development expenditures.

From a theoretical perspective, although the effect of fiscal decentralization on inequality between regencies/cities in Bali Province is not yet significant, the direction of the influence shows the possibility of the existence of an inverted U curve theory from (Kuznets, 1999). The results of this research indicate that the curve line has crossed the peak of the curve and is starting to decline, which indicates that since twenty (20) years the fiscal decentralization policy, as part of regional autonomy in districts/cities in Bali Province, has begun to show that the fiscal decentralization policy is not alone can increase regional economic growth but also at the same time reduce inequality between regions, although once again it is emphasized that the intensity is not significant.

The results of this research differ from the research findings of Bonet (2006); Siagian & Miyasto (2010); Sianturi & Miyasto (2011), which reveal a significant positive effect of fiscal decentralization on inequality between regions. The findings of this research are also different from those of Rosdyana & Suhendra (2015) who found that fiscal decentralization has no significant positive effect on inequality between regions. And, finally the results of this research are also different from the research results of Sasana (2009); Apriesa & Miyasto (2013); Kundhani (2015) who found that fiscal decentralization has a significant negative effect on inequality between regions.

Based on Table 2., additional information can be obtained on the partial effect of other independent variables, such as: regional expenditure, private investment, and general allocation funds. Regional spending has a positive and insignificant effect on inequality between regions, which is indicated by a P-Value of 0.545 with a beta coefficient (unstandardized) of 0.081, which means that regional spending has a positive and insignificant effect on inequality between regions. Furthermore, private investment has a significant positive effect on inequality between regions, which is indicated by a P-value of 0.049 and a beta coefficient (unstandardized) of 0.023. Meanwhile, other results, general allocation funds have a significant negative effect on inequality between regions, as indicated by the P-Value value of 0.011 and the (unstandardized) beta coefficient of -0.402. This result is good news because it indicates that the regency/city government in Bali Province has allocated general allocation funds according to the allocation or objective of the balance fund transfer policy.

The results of the first moderation test, based on Table 2., show that the interaction of fiscal decentralization and regional spending (FD.RS) has a positive and insignificant effect on inequality between regions, which is indicated by the P-Value of 0.189 and the beta coefficient (unstandardized) of 1.389. This means that it is unable to weaken the positive effect of fiscal decentralization on inequality between regions. This result rejects the H2 hypothesis which states that regional spending weakens the positive effect of fiscal decentralization on inequality between districts/cities in Bali Province.

The interaction of fiscal decentralization and private investment (FD.PI) has a significant positive effect on inequality between regions, as indicated by the P-Value of 0.001 and the beta coefficient (unstandardized) of 3.789. This means that the interaction

of private investment and fiscal decentralization increases inequality between regions or in other words the increase in private investment will weaken the negative effect of fiscal decentralization on inequality between regions. This result rejects the H3 hypothesis which states that private investment strengthens the positive effect of fiscal decentralization on inequality between districts/cities in Bali Province. This condition is more caused by unequal private investment in districts/cities in Bali, which is indicated by the results of a partial test which shows that private investment has a significant positive effect on inequality between regencies/cities in Bali Province. This condition also illustrates the imbalance in the ability to attract investors or private investment between districts/cities and other districts in Bali Province.

Furthermore, it can be seen that the results of the third moderation test, that the interaction of fiscal decentralization and general allocation funds (FD.GAF) have a negative and insignificant effect on inequality between regions, as indicated by the P-Value of 0.720 and the beta coefficient (unstandardized) of -7.135. This means that the general allocation funds amplify the negative effect of fiscal decentralization on inequality between regions but the effect is not significant. This result rejects the hypothesis H4 which states that general allocation funds weaken the positive effect of fiscal decentralization on inequality between districts/cities in Bali Province. Although the results of this study reject the research hypothesis H4, it shows encouraging developments because partially general allocation funds have a significant negative effect on fiscal decentralization. That the results of moderation are not significant, this indicates that some districts should increase the proportion of general allocation funds allocated to capital expenditures rather than routine expenditures.

The results of the interaction test of fiscal decentralization and general allocation funds (FD.GAF), according to Table 2., are insignificant negative effects on inequality between regions, as indicated by the P-Value of 0.720 and the (unstandardized) beta coefficient of -7.135. This means that the general allocation funds amplify the negative effect of fiscal decentralization on inequality between regions but the effect is not significant. This result rejects the hypothesis H4 which states that general allocation funds weaken the positive effect of fiscal decentralization on inequality between districts/cities in Bali Province. Although the results of this study reject the research hypothesis H4, they show encouraging developments because partially general allocation funds have a significant negative effect on fiscal decentralization. That the results of moderation are not significant, this indicates that several districts should further increase the proportion of general allocation of funds allocated to capital expenditures or development expenditures.

The value of the constant and the unstandardized beta coefficient value of the effect of each independent and moderating variable on the dependent variable inequality between regions can be developed. So that, the Prediction Model of Inequality Between Regions (Ŷ) can be developed as follows:

Ŷ = 7,560 - 0.023FD + 0.081RS + 0.023PI - 0.402GAF + 1.395FD.RS - 3,789FD.PI-7,135FD.GAF

The results of the feasibility test for the prediction model of inequality between regions or Ŷ use the F test and the results are as presented in Table 3. Based on this table, the sig value can be seen. F is 0.000 which is smaller than α (0.05), so it can be said that

the model is suitable to be used to estimate the magnitude of inequality between regencies/cities in Bali Province.

The results of the feasibility test for the prediction model of inequality between regions or Ŷ use the F test and the results are as presented in Table 3. Based on this table, the sig value can be seen. F is 0.000 which is smaller than α (0.05), so it can be said that the model is suitable to be used to estimate the magnitude of inequality between regencies/cities in Bali Province.

Furthermore, it can also be seen that the value of the determination coefficient (R2) of the predictive model for inequality between regions or Ŷ is 76.0%, which means that variations or changes in inequality between districts/cities in Bali Province can be explained by 76.0% by the variables in the model. while the remaining 24.0% is explained by other variables outside the model.

The results of this research show that fiscal decentralization, which is measured by locally-generated revenue, has a negative and insignificant effect on inequality between regions of districts/cities in Bali Province for the period 2015 to 2019. These results indicate that the implementation of fiscal decentralization, with the proxy of locally-generated revenue, in districts/cities in Bali Province has begun to reduce inequality between regions even though the intensity is not yet significant. This development is certainly encouraging, especially when referring to the research results of Putri & Natha (2015) which found that fiscal decentralization has a significant positive effect on inequality between regions district/city in Bali Province. The results of this test also signal the potential that the implementation of fiscal decentralization in regencies/cities in Bali Province is heading in the right direction, namely the possibility of achieving dual targets for fiscal decentralization, namely economic growth on the one hand, and on the other hand minimizing the gap between regions.

Based on the basic theory perspective, although fiscal decentralization has started to have a negative effect on inequality between regions districts/cities in Bali Province, but because the intensity of the effect is not significant, it can be said that the results of this research have not been able to prove/confirm the existence of inverted U theory developed by (Kuznets, 1995). Furthermore, the results of this research also provide information on the type of moderation of each contingency factor, as follows: first, regional spending is based on a partial test and the effect of interaction is not significant, so according to Solimun (2010), it is a potential or homologous moderation type. Second, the results of the partial effect test and the interaction of the private investment variable on inequality between regions are significant/real so that it is categorized as quacy moderator. Third, the test results of the partial effect of public

Table 3. Model Feasibility Test Results

|

Model |

Sum of Squares |

df |

Mean Square |

Sig. | |

|

1 |

Regression |

1.795 |

5 |

.359 |

.000a |

|

Residual |

1.384 |

69 |

.020 | ||

|

Total |

3.179 |

74 |

Source: Processed Data, 2019

a. Predictors: (Constant), FD, RS, PI, GAF, FD.RS, FD_PI, FD.GAF

b. Dependent Variable: inequality between regions (IBR)

location funds on inequality between regions are significant but the effect of the interaction is not significant, so that the general allocation funds are categorized as the type of predictor moderation. The results of this study also remind the provincial government of Bali that implementing a tourism business strategy with the concept of "One Island Management" needs to pay attention to these findings so that implementation can guarantee the multiplier effect of the tourism business results. For example, private investment related to tourism should be integrated and reoriented in districts which according to Klassen's topology, include underdeveloped or depressed areas, namely: Tabanan, Jembrana, Bangli, Karangasem and Klungkung districts. The Provincial Government of Bali should also provide incentives for districts that are creative and/or capable of creating productive capital expenditure programs that have a negative impact on regional disparities.

This research contains several limitations that need to be considered for future researchers if they wish to conduct similar research. First, this research was carried out in districts/cities in Bali Province so that researchers wanting to generalize better results need to consider a wider research area. This study produces a prediction model of inequality between regions which, although it is appropriate to use it to estimate the magnitude of inequality between regencies/cities in Bali Province, but this prediction model is still limited as indicated by only 76% of R2 so it still needs to be developed by including several other relevant variables. with the hope that a more complete predictive model will be obtained to estimate the magnitude of inequality between regencies/cities in Bali Province.

Conclusion

Based on the results of hypothesis testing and discussion, it can be concluded as follows: first, fiscal decentralization reduces the gap in inequality between regencies/cities in Bali Province but the effect is not significant/real. Second, regional spending, was unable to moderate the negative effect of fiscal decentralization on inequality between regencies/cities in Bali Province. Third, private investment moderates the negative effect of fiscal decentralization on inequality between districts/cities in Bali Province. And finally, the general allocation funds are not able to moderate the negative effect of fiscal decentralization on the inequality between districts/cities in Bali Province.

Based on the results and discussion of the research that has been described, the following suggestions can be given: First, districts based on Klassen typology are categorized as underdeveloped and/or depressed, such as: Tabanan, Jembrana, Bangli, Karangasem, and Klungkung Regencies, in order to increase locally-generated revenue so that more equitable economic growth among regencies/cities in Bali Province, so that inequality between regions can be reduced; Second, regency/city governments in Bali Province to be more creative in creating more productive capital expenditure/development programs that are also able to have an impact on eliminating inequality between regions; Third, district governments, especially Tabanan, Jembrana, Bangli, Karangasem, and Klungkung Regencies, strive even harder to make the investment climate more attractive in order to increase private investment in their respective regions and at the same time the Bali Provincial Government must take effective steps stimulate investors to invest in districts with relatively low private investment.

Furthermore, fourthly, it is suggested that district governments make more efforts to take advantage of the general allocation funds in the accelerator program which is able to create multiplier effects on economic growth while reducing inequality between regions; Fifth, the provincial government of Bali should make more efforts to create new areas of economic growth in the regions, which according to Klassen's Typology, fall into the depressed and/underdeveloped categories, such as: Klungkung, Tabanan, Jembrana, Bangli and Karangasem Regencies.

For the next researcher, they can consider expanding the research population to districts/cities in other provinces where one of the sources of locally-generated revenue is the tourism sector or more extended to all districts/cities in Indonesia. The coefficient of determination (R2) of this study is 76% so that the next researcher has the opportunity to include other independent variables to test their effect on regional disparities, for example: special allocation funds, village funds, and village fund allocations, and remaining more budget ceiling.

References

Apriesa, L. F., & Miyasto. (2013). The Effect Of Fiscal Decentralization On Regional

Economic Growth And Income Inequality (Case Study: District/City In Central Java). Diponegoro Journal Of Economics, 2(1), 1–12.

Aswandi, H., & Kuncoro, M. (2002). Evaluation of Mainstay Designation: Empirical Study in South Kalimantan 1993-1999. Indonesian Journal of Economics and Business, 17(1), 27–45.

Bonet, J. (2006). Fiscal decentralization and regional income disparities : evidence from the Colombian experience. The Annals of Regional Science, 40, 661–676.

https://doi.org/10.1007/s00168-006-0060-z

CNN indonesia. (2018, August). The concept of “One Island Management” will be applied to Bali. CNN Indonesia.

Davey, K. J. (1988). Pembiayaan Pemerintah Daerah: Praktek-Praktek Intemasional dan Relevansinya bagi Dunia Ketiga. Terjemahan: Amanullah dkk. Penerbit UI-Press.

Ebel, R. D., & Yilmaz, S. (2002). Concept of Fiscal Decentralization and World Wide Overview. World Bank Institute

Ghozali, I. (2018). Multivariate Analysis Application with IBM SPSS 25 Program.

Diponegoro University Publishing Agency.

Govindarajan, V. (1986). Impact Of Participation In The Budgetary Process On Management Attitudes And Performance: Universalistic And Contigency Perspectives. Decision Sciences, 17(4), 496–516.

Harianto, & Hadi, A. P. (2006). Relationship between DAU, Capital Expenditure, PAD, and Income Per Capita. Accounting National Symposium IX.

Hayek, F. (1945). The Use of Knowledge in Society. American Economic Review, 35(4), 519–530.

Ismerdekaningsih, H., & Rahayu, E. S. (2002). Analisis Hubungan Penerimaan Pajak Terhadap Produk Domestik Bruton Di Indonesia (Studi Tahun 1985-2000). ITB Central Library

Kuncoro, M. (2004). Autonomy and Regional Development: Reform, Planning, Strategy and Opportunities. Erlangga.

Kundhani, E. Y. (2015). Analisis Pengaruh Desentralisasi Fiskal terhadap Kesenjangan

Ekonomi Antar Daerah: studi kasus pada Kabupaten / Kota di Provinsi Jawa Tengah Kristen Satya Wacana University.

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review, 45(1), 1-28. https://doi.org/10.4324/9780429311208-4

Lin, J. Y., & Liu, Z. (2000). Fiscal decentralization and economic growth in China.

Economic Development and Cultural Change, 49(1), 1-21.

https://doi.org/10.1086/452488

Mangkoesoebroto, G. (2001). Public Economics Edition – III. BPPE.

Muluk, K. M. R. (2007). Challenging Public Participation in Local Government (In a Study With a Systems Thinking Approach) (Edition I). Bayumedia Publishing.

Murray, D. (1990). The Performance Effect of Participative Budgeting: An Integration of Intervening and Moderating Variables. Behaviour Research in Accounting, 2(2), 104–123.

Musgrave, R. (1959). Theory of Public Finance: A Study in Public Economy. McGraw.

Nurhuda, R., Muluk, M. R. K., & Prasetyo, W. Y. (2013). Analysis of Development Inequality (Study in East Java Province 2005-2011). Journal of Public Administration, 1(4), 110–119.

Oates, W. E. (1972). Fiscal Decentralization and Economic Development. National Tax Journal, 46(2), 237-243.

Putri, N. P. V. S., & Natha, I. K. S. (2015). Pengaruh pendapatan asli daerah, dana alokasi umum dan belanja modal terhadap ketimpangan distribusi pendapatan. E-Journal of EP Udayana University, 4(1), 41–49.

Rosdyana, D., & Suhendra, E. S. (2015). The Effect Of Fiscal Decentralization On Regional Economic Growth And Income Inequality In The Island Of Java 2009-2013.

Proceedings PESAT (Psikologi, Ekonomi, Sastra, Arsitektur&Sipil), 6, 123–132.

Samuelson, P. A., & Nordhaus, W. D. (1994). Economic Development (Translated edition) (Editioni k). Erlangga.

Sasana, H. (2009). Analisis Dampak Pertumbuhan Ekonomi, Kesenjangan Antar Daerah, dan Tenaga Kerja yang Terserap terhadap Kesejahteraan Kabupaten / Kota di Provinsi Jawa Tengah dalam Era Desentralisasi Fiskal. Journal of Business and Economics (JBE), 16(1), 50–72.

Siagian, A. R., & Miyasto, M. (2010). Dampak Desentralisasi Fiskal Terhadap Pertumbuhan Ekonomi Daerah dan Ketimpangan Wilayah (Studi Kasus Propinsi Jawa Barat) (Doctoral dissertation, Universitas Diponegoro).

Sianturi, Y. S., & Miyasto, M. (2011). Dampak Desentralisasi Fiskal Terhadap Ketimpangan Pendapatan Antar Wilayah (Studi Kasus Kabupaten/Kota Propinsi Sumatera Utara) (Doctoral dissertation, Universitas Diponegoro).

Sjafrizal. (2012). Regional and Urban Economics. Raja Grafindo Persada.

Solimun. (2010). Analisis Multivariat Pemodelan Struktural Metode Partial Least SquarePLS. CV. Citra.

Sukirno, S. (2016). Macroeconomics: An Introductory Theory (Editioni 3). Rajawali Press.

Tadaro, M. P., & Smith, S. C. (2006). Economic Development in The Third World (Edition 2). Erlangga.

Tiebout, C. (1956). A Pure Theory of Local Expenditures. Journal of Political Economy, 64(5), 416–424.

Jurnal Ilmiah Akuntansi dan Bisnis, 2021 | 153

Discussion and feedback