Human Development Index, Liquidity Risk, Credit Risk and Financial Performance of Rural Credit Institutions in Bali

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 15 No. 2, July 2020

Human Development Index, Liquidity Risk, Credit Risk and Financial Performance of Rural Credit Institutions in Bali

AFFILIATION:

Faculty of Economics and Business, Universitas Udayana, Indonesia

*CORRESPONDENCE: ketutmuliartha@unud.ac.id

THIS ARTICLE IS AVAILABLE IN: https://ojs.unud.ac.id/index.php/jiab

DOI:

10.24843/JIAB.2020.v15.i02.p08

CITATION:

Muliartha RM, K. (2020). Human Development Index, Liquidity Risk, Credit Risk and Financial Performance of Rural Credit Institutions in Bali. Jurnal Ilmiah Akuntansi dan Bisnis, 15(2), 252267.

ARTICLE HISTORY Received:

24 April 2020

Revised:

25 June 2020

Accepted:

17 July 2020

Ketut Muliartha RM*

Abstract

Research aims to analyse the strategic role of rural credit institutions (LPD) in realizing the independence of society. Research using human development index variables, the ratio of loan to deposit, the ratio of quality of earning assets to see the impact on the financial performance of LPD as measured by return on Asset. The research sample is 305 units of LPD financial performance. The results of the study showed asset value, positive impact on the LPD's instability. The risk of credit and liquidity risk negatively impacts the LPD's instability. The higher the Human Development Index, the development of LPD is increasingly positive seen from the total value of managed assets.

Keywords: Human development Index, liquidity risk, credit risk, financial performance, asset earning.

Introduction

The existence of rural credit institutions (LPD) in Bali is governed by the regulation of the governor of Bali number 44 year 2017 and regulation of the implementation of Bali provincial regulations number 3 year 2017 about the rural credit institution. The regulation stated that the LPD is a financial institution that has a business field including accepting and raising funds from village agencies in the form of slow funds and low funds. In addition, LPD also provides loans to Krama village and other village Krama based on agreed cooperation. The management of rural credit institutions (LPD) must be carried out based on prudence principles (Putra & Sudibya, 2018; Setyawan & Putri, 2013).

LPD's performance is assessed by health level in carrying out its operational activities. LPD's operational health level is assessed based on five aspects: capital adequacy, productive asset quality, management, profit and liquidity. The number of LPD in the Bali Province by supervisory Board (LP) LPD for book year 2018 amounted to 1,433 LPD. The LPD does not operate 149 units and still actively amounted to 1,284 units. The objectives of LPD were established to improve the welfare of citizens, by distributing part of LPD profits to village communities.

Profit or profitability of LPD is a measure of the operational performance of the vital. Profit has a strategic role in developing LPD operational capacity. LPD set aside 60% of the profits gained as an LPD

capital reserve and assume the operational risks especially. The operational risk that LPD has is lending to the community so that it needs the establishment of a doubtful loan backup. Management, academics and local governments need information related to profit or profitability to support the development decision making of LPD sustainably.

Research on the determination of LPD's operating profit has been conducted by several researchers with varied findings. Meitasari & Budiasih (2016) reported the total asset variable had no effect on LPD profitability. The number of LPD employees has also no effect on LPD profitability. Cahyani & Dana (2014) reveal the magnitude of the assets negatively affect the profitability of LPD. The research findings of asset influence on LPD's profitability reveal the LPD's asset structure to provide different implications for LPD's profitability. Asset growth has not always been a positive impact on the LPD profit.

Capital structure as the proportion of the combination of own capital and external capital used to finance operational activities (Caskey Et Al., 2012; Gupta & Newberry, 1997; Saryani, 2013). In the case of cost of capital can be charged as a deduction for income tax agency, with positive business prospects then the capital structure positively impacts the value of the company. This theory is in accordance with the provisions of regional Regulation No. 3 of 2017 concerning rural creditors. Regulation mentions that the minimum capital adequacy ratio of LPD is set at 12%. This means that the LPD can receive funds from the village's manners either in the form of a plan or a plan of up to 88% of the total asset value. The utilization of third party funds to finance productive operational activities is reported as an asset element that is a loan given to the village's debtor. LPD's operating income source is the realization of the loan to “Krama Desa”. Alternatively, cash received and entrusted from village crates can be used to buy operational equipment assets or be stored in other banks to obtain interest differences as LPD earnings.

The effectiveness of LPD in using third-party funds entrusted by the village crane is measured by the ratio of loans to third party funds or Loan to Deposit Ratio (LDR) (Ottay & Alexander, 2015; Prapita Cahyani & Dana, 2014). The higher LDR ratio the LPD has, the greater the interest income the loan is received to cover the operating costs so that the LPD profit tends to be higher. On the other hand, when the ratio of loans provided with third party funds received is too high, potentially the LPD is facing liquidity risk (Ariani & Ardiana, 2015). This is due to the LPD not being able to pay an exact amount and timely obligation at maturity. Such conditions are called liquidity risks. Failure to pay the bill on time and exact amount at maturity is potentially lowering the trust of the village manners. The existence of unbelief can be in the form of withdrawal as a plan and a village manners in LPD.

The working area of village financial institutions in Bali is scattered in 9 districts and cities. The spread of human quality in the province of Bali varies and can be measured by Human Development Index (HDI). The Central Bureau of Statistics of the Bali Province in 2019, reveals the value of human development index in the province of Bali in the year 2017-2018 is in the range of 65.57-83.01. The regencies and cities that have the highest human development index are the city of Denpasar with the index value 83.01. Meanwhile, Karangasem Regency has the lowest human development index value of 66.49.

|

Tabel 1. Human Development Index and LPD developments Data | |||||

|

No |

Region |

Asset >50M |

HDI |

Amount % | |

|

1 |

Jembrana |

50,425,299 |

70.20 |

1 |

13.0 |

|

2 |

Tabanan |

381,882,683 |

74.86 |

4 |

5.2 |

|

3 |

Badung |

4,835,499,168 |

80.54 |

28 |

36.0 |

|

4 |

Gianyar |

108,215,763 |

76.09 |

15 |

20.0 |

|

5 |

Klungkung |

98,195,341 |

70.13 |

1 |

1.3 |

|

6 |

Bangli |

140,839,815 |

68.24 |

2 |

2.6 |

|

7 |

Karangasem |

335,366,310 |

65.57 |

4 |

5.2 |

|

8 |

Buleleng |

56,441,040 |

71.11 |

8 |

10.5 |

|

9 |

Denpasar |

1,551,629,854 |

83.30 |

13 |

17.0 |

Source: LPLPD Data, 2017

The highest increase in 2018 was reached by the Karangasem regency of 1.4 percent. When associated with the quality of operational achievement of LPD in Bali province data shows that the LPD operating in the region with a high human development index, shows more positive developments than the LPD operating in the region with the lower human Development index. Data on the achievement of LPD asset value in the province of Bali in 2017 is presented in Table 1.

Table 1. shows that LPD developments are viewed from the asset value, associated with the Human development index. The LPD operating in the region with better human quality demonstrates a more positive development. The three districts that have the highest human quality are the city of Denpasar (83.30) reported that the number of LPD that ruled the asset above Rp50 billion as much as 13 LPD, Badung Regency (80.54) reported the amount of LPD with the value of assets above Rp50 billion as many as 28 units and and Gianyar Regency (76.09) reported the number of LPD which

This research is different from previous research that tests human contributions to the profitability of LPD by entering human resource variables in models. The Human Development Index (HDI) as a human quality proxy in the LPD region operates. IPM was included as an alternative to the number of people in previous studies (Meitasari & Budiasih, 2016). The quality of human resources according to Gigante (2013) as the Human capital index affects the performance of the Bank. Based on Gigante (2013), this study examined the influence of Human Development Index (HDI) on the financial performance of rural financial institutions (LPD).

The implementation of gathering LPD fund should be aligned with loan realization activities which include working capital loan, Investment loan and consumer loan. The utilization of third party funds to finance the loan realized by the LPD will provide interest income and administrative income to the LPD. This income is used to pay interest to the village manners and cover the operational costs of LPD. The funds controlled by the LPD sourced from internal funds or external sources of funds must be used to support the operation of the LPD. The LPD profitability ratio can be measured based on the Return on Asset (ROA), Return on Equity (ROE), Net Profit Margin (NPM), and operating cost ratio (Widiasari & Mimba, 2015). The profitability of LPD illustrates the extent to which the success of using the funds invested (Ottay & Alexander, 2015).

Meitasari & Budiasih (2016) revealed that the growth of LPD assets does not necessarily positively impact profitability. This means that some of the LPD is experiencing asset growth but does not report increased profitability. This condition is

because most of LPD investments are used to fund the procurement of fixed assets. Cahyani & Dana (2014) separately revealed that the size of the LPD expressed in the total value of the assets negatively impacted the profitability.

Kusumayanti & Jati (2014) which reveals that the growth of productive assets in the form of loan provided positively impacts the LPD's financial performance, but the growth of third-party funds does not make a significant impact on the financial performance of LPD. These findings reveal that the management of the LPD does not use third party funds entrusted to the LPD to fund productive LPD activities. Most third party funds are not used for the realization of loans to debtors, but rather for investments in fixed assets that do not generate revenue. Investments in fixed assets will add to the depreciation of assets and maintenance costs, thereby lowering the profitability of LPD.

The size of the financial institution defined as the gross circulation or the total value of the overpowered asset provides a different impact on the financial institution's profitability. Flamini et al. (2009). Defines the size of the financial institution as the total value of gross circulation delivery service reported a positive impact on the financial institution's profitability. While Pasiouras & Kosmidou (2007), which defines the company's size as the total value of the company's assets reported a negative impact on profitability. The findings of Pasiouras & Kosmidou (2007) are aligned with the production theory that states that production factors (money, labour, technology, land) controlled by an entity are used to generate maximum profit. The combined use of different production factors provides different results, called production functions. Based on this, the hypothesis is formulated as follows.

H1 : Asset value has a significant positive effect on LPD profitability.

The implementation of the financial function of the rural institution is governed by the regulation of Governor of Bali Province number 44 year 2017 and implementation of the regional regulation of Bali Province number 3 year 2017 about the rural financial institution. Liquidity must be managed carefully. The LPD must withhold cash received from third parties in the form of a plan and a minimum of 20% to fulfill the obligation of payment of the village manners funds. The funds that constitute the LPD liquidity reserve must be secured and stored at a legal financial institution. These terms explain that the ratio of the maximum Loan to Deposit tolerated in liquidity management is 80%. In other words for each of the third-party funding dollars received by the LPD can be used to finance its operational activities in order to generate operating income at a maximum of 80%. When the ratio of Loan to Deposit exceeds the limit of 80% it will potentially cause the LPD to fail in fulfilling the third party funds payment obligations in an exact amount and timely or experiencing liquidity risk. To avoid the impact of negative imagery due to failure to pay due obligations and meet the obligations of the LPD can obtain new loans at a higher cost of funds at the time of need. This condition will impact increasing the workload and lowering the profitability of the LPD.

Information on the effectiveness of third-party funds by the LPD is demonstrated by the Loan to Deposit Ratio (LDR). LDR simultaneously provides information regarding the liquidity risk faced by LPD. The ratio of the Loan to Deposit Ratio explains the part of the third-party funds used to finance productive activities by the management of the LPD. The Putri & Dewi (2017) revealed that LDR has significant negative effect on the LPD's profitability. While Ariani & Ardiana (2015) proved that the

Loan to Deposit Ratio was positively influential towards the profitability of the LPD. The higher the LDR nudge ratio increases LPD profitability. The use of third-party funding sources to finance the realization of a productive and quality LPD loan enables the LPD to have a more operational income source than the loan interest provided to cover the cost of funds, overhead costs and fostering operating profit.

LDR level indicates the risk of long-term liquidity (liquidity risk) faced by financial institutions. Rahmi (2014) mentioning liquidity risk are the inherent risks faced by financial institutions and LPD to fulfill obligations and other obligations and ability to fulfill the proposed loan demand without suspension. This ratio indicates the liquidity level of the financial institution/LPD. The Loan Deposit Ratio is the ratio between the entire amount of loan provided with the funds received from a third party. Saryani (2013) states that the higher the LDR shows the higher the liquidity risk of financial institutions and the lower the low Loan Deposit Ratio shows the low effectiveness of the financial services institution in utilizing the funds originating from third parties for productive activities or channeling as loan. The higher the Loan Deposit Ratio then the company profit tends to be higher. The effect of LPD Loan Deposit Ratio on LPD's profitability is formulated as follows:

H2 : Loan deposit ratio positively affects the profitability of LPD.

Theory Signal explains that the loan deposit ratio explains the effectiveness of the LPD in utilizing third-party funds entrusted by the village and simultaneously explaining the liquidity risks faced by the LPD. Access to Asymetry information causes third parties who entrust their funds to the LPD can not estimate the effectiveness of the use of third-party funding to the profitability performance or risk of liquidity faced by LPD only by basing in the Loan Deposit Ratio information.

Nobanee et al. (2011) explains that cash for financial institutions is the primary and beneficial working capital in the realization of lending services that provide income to such financial institutions. The paradigm of cash conversion cycle stated that the efficiency of the management of working capital can be increased by shorten the conversion time of cash received from third parties to cash paid by the village manners debtors through the repayment of the principal loan and the right loan interest (Nobanee et al., 2011).

The efficiency of the LPD financial institution in managing third party funds is calculated by comparing the total balance of the loan to a given time with the total value of the realized loan then divided by 365 days. These calculation results will inform the time/average period required for the return of a given loan. If the average period of cash conversion is longer than the agreed time in the loan agreement between the LPD and the village debtor, it means that the efficiency of third party funds management by LPD decreases. A longer Conversion cash cycle than an agreed period in a loan agreement means that a portion of the loan cannot be paid back on the exact amount and timely manner of the debtor. The loan balance of the loan is doubtful referred to as the Non Performing Loan (NPL) which describes the risk of loans faced by the LPD and should be monitored and anticipated by the management of LPD in order to maintain the level of operational health of LPD which is responsible by forming a loan reserve doubtful doubt (CPRR) in sufficient value.

The research findings of Ariani & Ardiana (2015) revealed that credit risk expressed in the NPL magnitude negatively affects profitability (ROA. In different

studies the princess and Putri & Dewi (2017) proved similar findings, that the NPL variables have significant negative effect on the profitability. Meanwhile, Widiasari & Mimba (2015) reported that the problematic credit ratio had significant effect on the profitability of the LPD in Tabanan Regency in the period 2012-2013. Empirical facts show that the influence of Non Performing Loan against the profitability of LPD operating in Tabanan district is not the same as the LPD operating in the Badung Regency and Denpasar City. The impact of the loan quality provided by the LPD to different village manners can be caused by the adequacy of additional collateral loans submitted by the debtor on the LPD. Bhutto et al. (2015) reported that cash conversion cycles were significantly correlated with company sizes measured by asset value. It was concluded that the larger the value of the asset, the cash conversion cycle tends to be longer and ultimately potentially lower the company's profitability.

In order to manage credit risk and apply the principles of management care LPD is required to classify the productive assets in four categories and acknowledge the doubtful loan removal proposal in the category as the current loan if there is no arrears and interest on the loan; Loans are less fluid when there are arrears and interest in loans exceeds 3 times installment and loans are not yet due; Loans are doubtful when there are principal and interest loans exceeding 3 times the instalment but not exceeding 6 times the installment and the loan has not been due; The loan is doubtful if there is arrears and the interest of the loan exceeds 6 installments or is due but not exceeding 6 months; A bad loan is if the loan has maturities of more than six months. For each LPD loan category should form a backup of the loan abolition in a row for consecutive: 0%; 10%; 50% and 100% of loan debit balances in each category. Thus the value of the loan is not smooth, the loan is doubtful and the bad loan is the risk of credit faced by the LPD and should be made a loan backup hesitate to anticipate the losses caused by debtor's failure to repay the collateral on the LPD. The larger the loan debit balance which is not smooth, doubtful and jammed then the greater the burden of loan removal charged on LPD interest income that period so potentilose the profitability of LPD.

The research findings of Uyar (2009) revealed the company's Bahwaukuran negatively correlates significantly with the cash conversion cycle. This suggests that in companies that have large asset value, the cash conversion cycles tend to be longer and lower profitability than in companies with smaller aasset values. This ratio indicates that the higher the NPL ratio shows the worse the credit quality of financial institutions or in other words the greater the risk of credit faced by financial institutions (Ottay & Alexander, 2015; Putra, 2017; Vivin & Wahono, 2015). Putra (2017) said that the high conditions of Non-Performing Loan (NPL) will enlarge the operational costs in the form of acknowledgement of cost of productive assets or other costs, thereby potentially to cause decreased profitability of LPD. Non Performing Loan (NPL) negatively affects the profitability of financial institutions (Septiani & Lestari, 2016). The influence of credit risk measured by the balance of Non-Performing Loan LPD to the profitability of LPD is formulated as follows:

H3 : Non Performing Loan LPD negatively affects LPD profitability

Human development is a very broad development concept where people become the center of attention that aims to expand the choice for the population. Human development Index or IPM is an indicator that measures success in the effort to build quality of human life/society/population. The calculation of human development

index is formed by three basic dimensions i.e. longevity and healthy living, knowledge and standards of decent living. In general, human development in the province of Bali shows improvement. Period 2017-2018 the achievement of increase in IPM Bali averages grow by 0.63 percent annually. Three areas that have the highest achievement of IPM in 2017, is Denpasar City with an index magnitude 83.30, followed by the Badung Regency with an index of 80.87 and Gianyar regency with the achievement of the index 76.71. Connected with the data on the value of asset development LPD operating in the district and city in Bali data shows that the number of LPD that mastered the value of assets above Rp 50 billion is located in Badung Regency, Gianyar Regency and Denpasar City. Similarly, the number of healthy LPD is the highest percentage in the city of Denpasar for 86% and Badung regency of 68% and Jembrana district amounted to 86% and Buleleng Regency amounted to 63%. While the percentage of healthy LPD in Bangli Regency amounted to 62% and Karangasem Regency amounted to 52%. Bangli Regency and Karangasem Regency are two districts with the value of human development index which is catalyzed at a moderate level and lower than other districts in the region of Bali province.

Bedard (2001) reveals that from the perspective of Human Capital Theory The higher the education of individuals, the higher income is increasingly high. This statement is based on the assumption that the higher the individual education the individual skills tend to increase and then improve the productivity of individual work. High working productivity will ultimately increase individual income. Mishra & Nayak (2010) reported the Human Capital Index's impact on the efficiency of the economy. In different research (Gigante, 2013) also reported the impact of Human Capital on Bank performance. Dewi & Sutrisna (2014) revealed that 63.54 percent of the economic growth of the province of Bali was influenced by the health index, education Index and purchasing Power Index of the public as the achievement of human capital quality.

Thus, the hypothesized IPM role was formulated in the relationship value of LPD assets with LPD profitability as follows:

H4: There is a difference of ROA on LPD in the regency and city which has high and low HDI

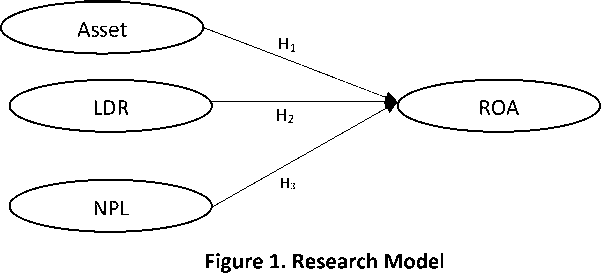

The complete model of Human development Index role (HDI) on asset value, liquidity risk and credit risk of LPD asset loan in Bali province is depicted in Figure 1.

Source: Processed Data, 2018

RESEARCH METHOD

The research site is conducted on LPD operating in the regency and city area of Bali province. The object of this research is the financial performance of village creditors which is measured based on the amount of asset profitability/Return to Total assets with predictor of liquidity risk, credit risk, set value and human development index as a differentiator on the asset relationship with Return to Total assets.

The population of this research is a rural credit institution operating in the region of Bali province in 2017. Based on secondary data recorded at the LPD Supervision Agency recorded 1,433 units. The Target population of this research is a rural credit institution that actively organizes operational activities of 1,285 units because 149 village creditors are not actively implementing operational activities. Determination of the number of research samples conducted by Slovin method.

The results of the calculation were obtained sample research samples as many as 305 sample units. The selection of sample units observed by the sample unit selection procedure is Purposif sampling taking into account the value of the LPD asset. The spread of sample counties can be seen in Table 2.

The research variable Return to Total assets as the financial performance of LPD, is measured in the percentage of profitability of operations of the Total value of LPD's operating assets. Asset value is defined as the net value of assets owned and used in LPD operational activities. The loan to Deposit Ratio is defined as a comparison of the loan value financed by the value of third party funds entrusted to the LPD. Credit risk is defined as the ratio of the loan removal backup balance to a doubtful loan debit tray. The Human development Index is a basic three-dimensional composite index, namely longevity and healthy living (a long and healthy life), knowledge, and decent standard of living published by the Central Bureau of Statistics of Bali province.

The research Data was analyzed gradually in two phases using multiple regression analysis methods to test the main effect of asset value, Loan to Deposit Ratio and the ratio of the loan reserve to indecisive to LPD profitability. Fourth hypothesis testing using Anova test. The regression formula of multiple liner as follows:

Y Profit = a + β1Asset + β2LDR+ β3CPRR + β4IPM + ε (1)

Table 2. Research Sampling Distribution

|

Regency and city |

Amount LPD |

Percentage (%) |

Number of sample units |

|

Denpasar |

35 |

3.0 |

9 |

|

Badung |

122 |

9.0 |

27 |

|

Buleleng |

169 |

12.0 |

37 |

|

Jembrana |

64 |

4.0 |

12 |

|

Tabanan |

307 |

21.0 |

64 |

|

Gianyar |

270 |

19.0 |

58 |

|

Bangli |

159 |

11.0 |

34 |

|

Klungkung |

117 |

8.0 |

24 |

|

Karangasem |

190 |

13.0 |

40 |

|

Total |

1433 |

100 |

305 |

Source: Processed Data, 2018

RESULT AND DISCUSSION

The results of the descriptive analysis showed that the average return on investment LPD level was 3.1% with a standard deviation of 0.087 with a total observation of 305 data samples. The average value of Loan to Deposit Ratio is 87.41% with a standard deviation of 0.206. While the average credit risk is 1.99% with a standard deviation of 1.57%. The average LPD total asset value is Rp. 38,151,841,-with the standard deviation of Rp. 6,539,818,-.

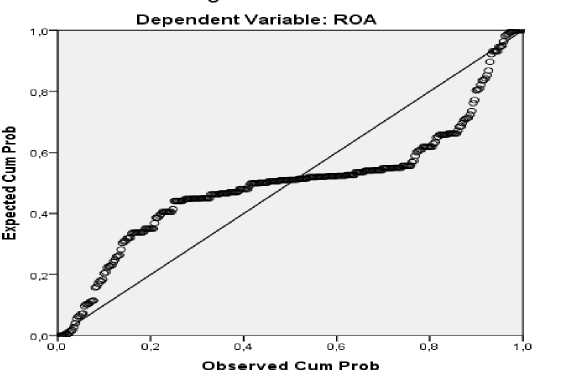

Before interpret the analysis results of multiple regression models, verification of classical assumption compliance test results. The test results assume normality of data with Plot graphs showing points of distribution close to normal lines so that the data can be mentioned that the observation data is normally distributed. Figure 2. shows observations of ROA's data distribution in the P-P Plot chart.

Multicholinarity testing was conducted to ensure that no linear relationship occurred perfectly or approached perfectly between independent variables in the regression model. Data analysis results indicate that the variable tolerance magnitude of free ROA = 0.992; LDR = 0.999 and Risk_Pinj = 0.992 which is greater than 0.1, and the magnitude value of VIF variable ROA = 1.008; LDR = 1.001 and Risk_Pinj. = 1.008 which is worth less than 10. It was concluded that the Mullti koliniarity did not occur between free variables. In other words there is no breach of assumptions related to the multicholinarity between free variables in a regression model.

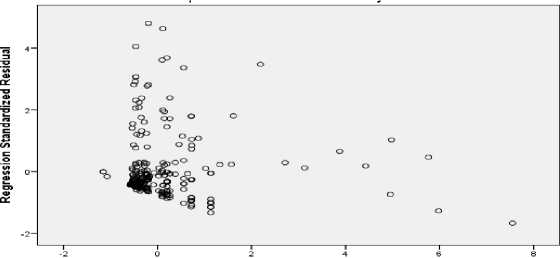

Testing the assumption that it did not occur heteroskedastisity. Heteroskedastisity testing in this study was conducted to verify the inequality of the residual variant between observation data on the regression model. The test of heteroskedasticity assumptions was carried out with the Scatterplot method as presented in Figure 3. The residual data spread shows most of the data spread in the area above or below the number 0.

The results of processing using MRA, can be obtained model of the total asset value relationship, Loan to Deposit Ratio (LDR), and indecisive receivables (CPRR) in Table 4.

The adjusted value of R2 of 0.23 shows that variations of Return on Asset of the rural credit institution are influenced by variations in the Loan to Deposit Ratio, value Asset, and the value of receivables deposits in doubt. The regression Model is declared valid where the F count is 31.428 and P of < 0.005.

The first hypothesis that states the value of total assets positively affects the Return on Asset of village creditors, received. Data analysis results reveal that the value of LPD-controlled assets has a positive and significant impact on ROA LPD (B = 0.0277; t = 3.956 ' P < 0.005).

Tabel 3. Descriptive Analysis Results

|

Variabel |

Mean |

Std. Deviation |

N |

|

ROA |

0.031 |

0.080 |

305 |

|

LDR |

0.874 |

0.206 |

305 |

|

ASET |

38,151,841 |

6,539,818 |

305 |

|

CPRR |

0.019 |

0.015 |

305 |

Source: Processed Data, 2018

Figure 2. P-P Plot of Regression Standardized Residual

Source: Processed Data, 2018

In accordance with the perspective of production theory, the capital of the Rural credit institution (LPD) is a resource or one of the production factors that is absolutely necessary to implement its function as a financial institution that is channeling credit/lending to the village manners. The loan then provides sufficient interest income to cover the operating burden and to collect the profit that is the source of the next rural credit institution. LPD Capital is a source of funds in the form of cash LPD wealth, work facilities, bills on other parties and financial assets stored in other financial institutions. The perspective of the company's value maksismisation theory explains this finding that increased assets financed from external sources such as village deposits provide greater capacity in implementing production in this case resulting in a production financial service for village crates to support their productive economic activities. Village Savings Fund is a cash asset is a capital to reconstitute the loan for the village manners to earn income, the higher the value of assets owned by LPD then the higher the potential profit earned. The findings of this study revealed that the value of the asset is positive and significant in the village's ROA financial agency. The findings are aligned with findings reported by previous researchers (Flamini et al., 2009; Kusumayanti & Jati, 2014). ROA, which was achieved during certain operating periods, reflects the success or effectiveness of the LPD in investing its funds (Ottay & Alexander, 2015).

Figure 3. Scatterplot Test Heteroskedastisity ROA

Source: Data Processed, 2018

Tabel 4. Multiple Linear Regression Test Results

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig | |

|

B Std. |

Error |

Beta | |||

|

(Constant) |

0.018 |

0.020 |

8.413 |

0.000 | |

|

Aset |

0.277 |

0.0003 |

3.995 |

0.000 | |

|

LDR |

0.150 |

0.002 |

0.346 |

6.649 |

0.036 |

|

CPRR |

-0.670 |

0.290 |

0.174 |

-3.331 |

0.034 |

|

R2 |

0.237 | ||||

|

F hitung |

31.428 | ||||

|

F sig |

0.001 | ||||

|

Adjusted R2 |

0.230 |

Source: Processed Data, 2018

Data Table 4. forms the regression equation as follows:

Y = 0,018+ 0,2773 (Asset) + 0,15 (LDR) - 0,67(CPRR) + ε

The rural credit institution needs to increase its operational size by raising funds from the village, which is essentially the primary stakeholders in the area of its work to enlarge the production capacity of loan services. The second hypothesis states that Loan to Deposit Ratio positively affects the Return on Asset of the village's creditor, accepted. The test results of the variable Loan to Deposit Ratio show the value (B 0.015; t = 6.649; p < 0.05) positively and significantly affect the return to assets of the LPD. Based on data analysis results, most LPD assets used to finance loan channeling are shown by the average magnitude of the 87 percent LDR ratio. This ratio exceeds the maximum policy limit in LPD liquidity management which is stated in the regional regulation of Bali Province number 3 year 2017 about the rural credit institution where the maximum limit of loan distribution is 80 percent. These findings provide information on the management of LPD and LPLPD to conduct careful monitoring of loans provided by the LPD. When monitors do not run effectively, the high LDR ratio will not positively impact the LPD's profit as expressed by the data analysis results of this research and reported by previous researchers Ariani & Ardiana, (2015). The high LDR ratio can negatively impact ROA in the event of a decrease in the quality of the loan earning assets, since the LPD should admit the loan removal burden is higher in percentage compared to the percentage of interest growth in loan income gained from credit outsourced activities, Dewi (2014).

The third hypothesis that states the value of the reserve of receivables adversely affect the Return on Asset of village creditors, received. The credit risk defined as LPD's CPRR balance has a negative impact on LPD’s ROA (B = 0.67; t = 3.331; p < 0.05). Credit risk control is done by monitoring the size of the loan reserve and doubtful (CPRR) of the village credit institution. The research findings reveal that the average CPRR of the village creditors observed was 1.9 percent. This value is still within the fairness limitation. Referring to the paradigm of Cash Conversion Cycle, LPD must control the risk of crediting carefully to avoid doubtful loan increase or decrease in the quality of productivity assets (Vivin & Wahono, 2015). Doubtful loan increase will increase LPD operating burden and potentially lower LPD operating income. The risk of credit faced by LPD is varied by the magnitude of the village creditor.

Tabel 5. Results of the descriptive analysis of ROA at high and low HDI levels

|

Level HDI |

Level |

Aset |

Mean |

Std. Deviation |

N |

|

1.00 |

1.00 |

.0231 |

.03701 |

68 | |

|

2.00 |

.0280 |

.04044 |

79 | ||

|

Total |

.0204 |

.03884 |

147 | ||

|

2.00 |

1.00 |

.0292 |

.15252 |

83 | |

|

2.00 |

.0428 |

.05691 |

75 | ||

|

Total |

.0372 |

.11924 |

158 | ||

|

Total |

1.00 |

.0395 |

.12007 |

151 | |

|

2.00 |

.0401 |

.05054 |

154 | ||

|

Total |

.0316 |

.08702 |

305 |

Source: processed data, 2018

The larger the LPD indicated by the value of the asset or the gross circulation value of the service, the higher the risk of the credit faced by the LPD. The findings are aligned with the findings of Putra (2017); Septiani & Lestari (2016). Analysis of the second stage data is done by ANOVA method to test the difference of Human Development Index (HDI) with LPD financial performance measured by return on asset (ROA) in LPD. The grouping of asset values and human development index is done by dividing the two distributions based on the Median value of the asset variable score and the Human Development index variable. The distribution of assets and the Human Development index for 305 LPD observed is presented in Table 5.

Table 5. reveals that the village-crediting institution operating in a region that has a high development index, has a higher average Return on Asset achievement (X = 0.037; std Dev. = 0.119) compared to a rural credit institution operating in a region with a low human development index (X = 0.02; Std. Dev = 0.388).

The asset variable score data spread and the human Development index showed that 68 LPD has a low asset value and operates in areas with low HDI access to the average Return on asset is 2.3 percent with a standard deviation of 0.038. LPD which is classified as having large assets but operating in a region that has a low human development index, the average Return on Asset achievement is 2.8 percent with standard deviation 0.04 amounting to 79 LPD. The Total observation unit in the area with human development index is relatively low total of 147 LPD. The achievement of ROA LPD operating in the working area that has a human development index is relatively high of 2.9 percent for rural creditor village which belongs to small assets, while for institutions that have a large asset of the average access return on asset can reach 4.2 percent. The number of LPD observations operating in the working area with the high HDI index with large assets is 75 LPD while the rural credit institution has a small asset of 83 LPD. The Total observation unit of the area with human development index is classified as total of 158 LPD.

Testing human Development index on asset value relationships with ROA LPD showed that LPD with low assets and operating in areas with low HDI value, significantly had a lower ROA achievement (Mean = 0.023; Std. deviation = 0.11) compared to the LPD group operating in a region that has a high HDI (Mean = 0.040; Std. Deviations = 0.10). Similarly, the LPD group with high assets, which operates in areas with low HDI, is significantly lower access to ROA (Mean = 0.028; Std. deviation = 0.10) compared to groups operating in areas that have high HDI (Mean = 0.053; Std. Deviations = 0.10).

Tabel 6. Estimation of Asset and IPM value intraction effect on ROA

95% Confidence Interval

Level Aset Level HDI Mean Std. Error

|

Lower Bound |

Upper Bound | ||||

|

1.00 |

1.00 |

.023 |

.011 |

.012 |

.054 |

|

2.00 |

.040 |

.010 |

.080 |

.118 | |

|

2,00 |

1.00 |

.028 |

.010 |

.008 |

.048 |

|

2.00 |

.053 |

.010 |

.033 |

.073 | |

Source: processed data, 2018

In summary the HDI moderation effect on the asset relationship with the performance of ROA village creditors is presented in Table 6. The Table shows that the average achievement of Return on Asset of the rural's credit institution Category 1 (small assets and low HDI) is lower than the average achievement of Return on Asset of rural Institutions Category 2 (small assets and high HDI). Meanwhile, in a group of rural creditors who have large assets, the highest achievement of Return on Asset is the Category 4 Rural credit institution (large assets; High HDI). Difference in access to Return on Asset the institution of the Village Group 3 (small assets; Low HDI) is not significantly different from the achievement of the average Return on Asset of the village Group 1 creditor.

The main contribution of this research is the HDI which is the role of social linkness where LPB is having a significant influence on the achievement of the credit performance of LPD. Research findings suggest that the LPD group which has a low asset is reporting lower of ROA's achievement compared to the access of ROA LPD group which has a high asset. Based on observations on the performance of the rural credit institution that has both high and low assets, operating in the region of Bali province that has a different human development index in the range of 65.57-83.30 indicates the achievement of different ROA performance. The number of LPD that master the asset is at least Rp50 billion is located and has a working area of Badung Regency (80.54), Gianyar Regency (76.09) and Denpasar City (83.30) which has a human development index of high and very high. The LPD group, which has a working area in the district that has a higher human development index, reported that the performance of ROA is higher than that of the village creditors who have a working area in the district with a low human development index. In areas with high HDI, the LPD, which has low and high assets, reported higher ROA than those in the region that had a low human development index.

This finding in line with Human Capital's perspective reveals that from the perspective of Human Capital Theory is increasingly higher in individual education, the higher income is increasingly high. This statement is based on the assumption that the higher the individual education the individual skills tend to increase and then improve the productivity of individual work (Bedard, 2001). The findings were reported by Mishra & Nayak (2010) that the positive impact of Human Capital Index on the efficiency of an economy and Gigante (2013) Reporting the positive impact of human quality on the Bank's financial performance in Europe. Findings related to the IPM's role in the financial performance of LPD in the province provide an alternative explanation and approach to the impact of human resources on LPD's financial performance.

CONCLUSION

The results of this study revealed that the value of the asset and the ratio of Loan to Deposit correlate positively and significantly to the financial performance of rural credit institutions operating in the Bali province area. The contribution of kusus that this research is the quality of human being defined as human development index has different roles on the value of assets and financial performance of LPD. An access to ROA on the LPD which has a working area in the district and the city with a higher human development index has a higher ROA access than the rural credit institution operating in the working area with a lower human development index.

This research findings confirms the importance of human role as one of the production factors in improving LPD performance. The government is advised to give attention and support to human development activities in the LPD working area for improvement of LPD performance and improvement of the welfare of the village.

Further research related to the performance and independence of LPD need to be continued with the development of models that expand the measurement of socioeconomic aspects of Indigenous village members where the LPD was formed by testing the social identification effect of individuals of LPD owners to the participation, support of the LPD and utilization of LPD in improving LPD performance and fulfillment of individual financial services needs.

References

Ariani, M., & Ardiana, P. (2015). Pengaruh Kecukupan Modal, Tingkat Efisiensi, Risiko Kredit, Dan Likuiditas Pada Profitabilitas Lpd Kabupaten Badung. E-Jurnal Akuntansi, 13(1), 259–275.

https://ojs.unud.ac.id/index.php/Akuntansi/article/view/12640/10721

Bedard, K. (2001). Human capital versus signaling models: University access and high school dropouts. Journal of Political Economy, 109(4), 749–775.

https://doi.org/10.1086/322089

Bhutto, N. A., Abbas, G., Rehman, M. ur, & Shah, S. M. M. (2015). Relationship of Cash Conversion Cycle with Firm Size, Working Capital Approaches and Firm’s Profitability: A Case of Pakistani Industries. Pakistan Journal of Engineering, Technology & Science, 1(2). https://doi.org/10.22555/pjets.v1i2.148

Caskey, J., Hughes, J., & Liu, J. (2012). Leverage, excess leverage, and future returns.

Review of Accounting Studies. https://doi.org/10.1007/s11142-011-9176-1

Flamini, V., Schumacher, L., & McDonald, C. A. (2009). The Determinants of Commercial Bank Profitability in Sub-Saharan Africa. In IMF Working Papers.

https://doi.org/10.5089/9781451871623.001

Gigante, G. (2013). Intellectual Capital and Bank Performance in Europe. Accounting and Finance Research, 2(4), 120–129. https://doi.org/10.5430/afr.v2n4p120

Gupta, S., & Newberry, K. (1997). Determinants of the Variability in Corporate Effective Tax Rate. In Journal of Accounting and Public Policy.

https://doi.org/10.1016/S0278-4254(96)00055-5

Kusumayanti, A. D., & Jati, I. K. (2014). Pengaruh Aktiva Produktif, Dana Pihak Ketiga Dan Letak Geografis Pada Kinerja Operasional LPD. E-Jurnal Akuntansi Universitas Udayana, 9(3), 617–632.

https://ojs.unud.ac.id/index.php/Akuntansi/article/view/9338/7880

Lilya Santika Dewi, N., & Sutrisna, I. (2014). Pengaruh Komponen Indeks Pembangunan Manusia Terhadap Pertumbuhan Ekonomi Provinsi Bali. E-Jurnal Ekonomi Pembangunan Universitas Udayana, 3(3), 106–114.

https://ojs.unud.ac.id/index.php/eep/article/view/8161

Meitasari, I. G. A. S., & Budiasih, I. G. A. N. (2016). Pengaruh ukuran perusahaan, struktur modal, dan. E- Jurnal Akuntansi Universitas Udayana, 16(2), 1516–1543. https://ojs.unud.ac.id/index.php/Akuntansi/article/view/18332/15130

Mishra, S. K., & Nayak, P. (2010). Facets and Factors of Human Development in Tripura.

January 2008, 281–296. https://doi.org/2010

Nobanee, H., Abdullatif, M., & Alhajjar, M. (2011). Cash conversion cycle and firm’s performance of Japanese firms. Asian Review of Accounting, 19(2), 147–156. https://doi.org/10.1108/13217341111181078

Ottay, M., & Alexander, S. (2015). Analisis Laporan Keuangan Untuk Menilai Kinerja Keuangan Pada Pt. Bpr Citra Dumoga Manado. Jurnal Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi, 3(1), 923–932. https://doi.org/10.35794/emba.v3i1.7621

Pasiouras, F., & Kosmidou, K. (2007). Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Research in International Business and Finance, 21(2), 222–237. https://doi.org/10.1016/j.ribaf.2006.03.007

Prapita Cahyani, N., & Dana, I. (2014). Pengaruh Pertumbuhan Aktiva Produktif, Dana Pihak Ketiga, Dan Ukuran Perusahaan Terhadap Profitabilitas Lembaga Perkreditan Desa Di Kabupaten Badung. E-Jurnal Manajemen Universitas Udayana, 3(4), 1050– 1065.

Putra, A. F. (2017). Pengaruh LDR, IPR, APB, NPL, IRR, PDN, BOPO, FBIR Dan FACR Terhadap Return On Asset ( ROA ) Pada Bank Pembangunan Daerah di Indonesia. Jurnal Akuntansi, 2(3), 1–17.

Putra, I. P. A. K., & Sudibya, I. G. A. (2018). Pengaruh Kepuasan Kerja, Komitmen Organisasional Dan Motivasi Kerja Terhadap Organizational Citizenship Behavior. E-Jurnal Manajemen Universitas Udayana, 7(8), 4447.

https://doi.org/10.24843/ejmunud.2018.v07.i08.p15

Putri, R., & Dewi, S. (2017). Pengaruh Ldr, Car, Npl, Bopo terhadap Profitabilitas Lembaga Perkreditan Desa di Kota Denpasar. E-Jurnal Manajemen Universitas Udayana, 6(2), 5607–5635.

https://ojs.unud.ac.id/index.php/Manajemen/article/view/32426/20968

Rahmi, C. L. (2014). Pengaruh Risiko Kredit, Risiko Likuiditas Dan Risiko Tingkat Bunga Terhadap Profitabilitas (Studi Empiris pada Perusahaan Perbankan Terdaftar di Bursa Efek Indonesia). Artikel Srkipsi, 1–22.

http://ejournal.unp.ac.id/students/index.php/akt/article/view/1537

Saryani, D. (2013). Analisis Capital Adequacy Ratio, Non Performing Loan, Net Interest Margin, Biaya Operasional, Loan To Deposit Ratio, Ukuran Perusahaan Terhadap Profitabilitas Bank Umum Di Indonesia Yang Terdaftar Pada Bursa Efek Indonesia. Journal of Petrology, 369(1), 1689–1699.

https://doi.org/10.1017/CBO9781107415324.004

Septiani, R., & Lestari, P. (2016). Pengaruh Npl Dan Ldr Terhadap Profitabilitas Dengan Car Sebagai Variabel Mediasi Pada PT BPR Pasarraya Kuta. E-Jurnal Manajemen Universitas Udayana, 5(1), 293–324.

https://ojs.unud.ac.id/index.php/Manajemen/article/view/15907

Setyawan, K. M., & Putri, I. G. A. M. A. D. (2013). Pengaruh Good Corporate Governance Terhadap Kinerja Keuangan Lembaga Perkreditan Desa di Kecamatan Mengwi Kabupaten Badung. E-Jurnal Akuntansi Universitas Udayana, 5(3), 586–598.

Uyar, A. (2009). The relationship of cash conversion cycle with firm size and profitability: An empirical investigation in Turkey. International Research Journal of Finance and Economics, 24(2), 186–193.

https://www.researchgate.net/publication/290982782_The_relationship_of_cash_ conversion_cycle_with_firm_size_and_profitability_An_empirical_investigation_in _Turkey

Vivin, Y. A., & Wahono, B. (2015). Analisis Perbandingan Kinerja Keuangan Bank Umum Syariah dengan Bank Umum Konvensional di Indonesia. E-Jurnal Riset Manajemen, 6(2), 15–28. https://doi.org/10.1123/ijsb.8.1.1

Widiasari, N., & Mimba, N. (2015). Pengaruh Loan To Deposit Ratio Pada Profitabilitas Dengan Non Performing Loan Sebagai Pemoderasi. E-Jurnal Akuntansi, 10(2), 588– 601.

Jurnal Ilmiah Akuntansi dan Bisnis, 2020 | 267

Discussion and feedback