The Social Construction on Financial Reporting of Small and Medium Scaled Production House

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 19 No. 1, January 2024

AFFILIATION:

1,2Faculty of Economics and Business, Universitas Sebelas Maret, Indonesia

*CORRESPONDENCE: safierafaradila@gmail.com

THIS ARTICLE IS AVAILABLE IN: https://ojs.unud.ac.id/index.php/jiab

DOI:

10.24843/JIAB.2024.v19.i01.p01

CITATION:

Azzahra, S. F. & Failkhatun. (2024). the social construction on Financial Reporting of Small and Medium Scaled Production House. Jurnal Ilmiah Akuntansi dan Bisnis, 19(1), 1-18.

The Social Construction on Financial Reporting of Small and Medium Scaled Production House

Safiera F. Azzahra1*, Falikhatun2

Abstract

This study investigates the role of financial reporting in small and mediumsized film production houses, focusing on its economic significance and the social construction surrounding its practices. Utilizing a constructivist approach with grounded theory methodology, the research comprises indepth interviews, observations, and documentation, further analyzed through triangulation. The findings reveal that these production houses view financial reporting as essential for business sustainability, with stakeholder theory explaining the need for both financial and non-financial information to meet internal and external requirements. Specifically, financial reports typically include simple income statements, cash flows, and balance sheets with tangible assets and trade payables, alongside nonfinancial data. These results offer a foundation for further studies and insights for financial reporting regulations within the film industry. However, the research scope is limited to specific regional practices and a narrow observational timeframe.

ARTICLE HISTORY

|

Received: June 23 2023 |

Keywords: SMEs, production house, grounded theory, financial reporting, business sustainability |

Revised:

December 7 2023

Accepted:

January 4 2024

Introduction

Small and Medium Enterprises (SMEs) give an important contribution to the Indonesian economy because of their wide dispersion to various levels of the community’s economy and its ability to absorb a large number of workers up to 99.8 percent of the workforce (Tambunan, 2011). The dominance of SMEs in Indonesia is spread over various types of businesses, one of which is the creative industry. The film industry is one of the fastest growing sub-sectors in creative industry due to its potential for new economic strength. The film sub-sector has a significant impact on the national economy with 64 percent growth (Bekraf, 2018). The SMEs potentials have been acknowledged by the International Accounting Standard Board (IASB) as indicated by the issuing International Financial Reporting Standard for Small and Medium Enterprises (IFRS for SMEs) accounting standards in 2009.

The important role of SMEs can be well maintained through the application of fundamental financial and accounting practices (Abdul-Rahamon & Adejare, 2014; Zotorvie, 2017). According to the IASB, SMEs deal with financial institutions, suppliers, customers, credit rating agencies, venture capital companies and investors outside their home countries (IASB, 2009). Therefore, entities involving in international level business activity are considered more advantageous in creating internationally reliable financial reports by applying the standards (Guerreiro et al., 2008). However, SMEs are unable to compile adequate accounting records to produce the information required by stakeholders for their decision-making purposes (Madurapperuma et al., 2016). Okoli (2011) linked adequate SMEs financial records to profitability, and emphasized that as a result of adequate records, SMEs can effectively assess their financial performance. Thus, SMEs need to keep adequate records to help owner-managers track business performance and also improve business sustainability.

Businesses in the creative industry have fewer assets and younger ownership than regular businesses, especially those in the form of SMEs. Creative industries’ problems raising funding is higher due to their high risk characteristics or profile caused by high uncertainty and low ownership of tangible assets (Fraser, 2011).

Table 1. Criteria for MSMEs and Large Enterprises Based on Assets and Turnover

Criteria

Business Size

Assets Turnover

|

Micro business |

Max Rp50 millions |

Mas Rp300 millions |

|

Small business |

> Rp50 millions – Rp500 millions |

> Rp300 millions – Rp2,5 millions |

|

Medium business |

> Rp500 millions – Rp10 billions |

> Rp2,5 billions – Rp50 billions |

|

Large business |

> Rp10 millions |

> Rp50 billions |

Source: Micro, Small and Medium Enterprises (MSMEs) Business Profile, Bank Indonesia, 2015.

Apart from the number of turnover, the characteristics of MSMEs are also divided based on the nature of the business. Small businesses have the characteristics that the main business are commodities or goods which, generally fixed and unchanging, business locations are generally fixed, administrative and financial records are simple, the separation between personal finance and business finance is present, have legal documentation of business establishment, human resources possess entrepreneurial experience, but most have not made adequate business management (Bank Indonesia, 2015). Meanwhile, medium-sized businesses have the characteristics of better management and organization with a clear division of tasks between sections or divisions within the organization, have carried out financial management and implemented an accounting system to facilitate business assessment and inspection, have managed workers in accordance with applicable regulations, have business legality, and generally have trained and educated human resources (Bank Indonesia, 2015)

Characteristics of SMEs in creative industry in the film sub-sector have characteristics such as a commercially driven business scope whose main resources are creativity and intellectual property and survive through profit creation (HOTN, 2000). Creativity is the main resource. Creativity is inherent in individuals, so that human resources are a key production factor (Fraser & Lomax, 2011) and have a higher composition of tacit knowledge than their explicit knowledge, so they often cannot be verbalized and cannot be explained, are intuitive, and cannot be said (Kianto et al., 2019). Revenue streams are unpredictable due to market uncertainty and inherent

unknownability (Townley et al., 2009; 2009; Fraser, 2011). Thus, the value of business and products is difficult to measure quantitatively (Fritzke, 2008). Even though in producing an artwork or product it follows the demand of consumers or the market, the creator of the work still incorporates his tastes and cultural values into his work or product (Banks et al., 2002). The organizational and managerial structure of this type of business also tends to be informal, and the creative ecology and creative partnerships of the industry are often a hidden ecology (Shorthose & Strange, 2004). Professions in these fields are driven not only by economic growth and technological innovation, but also include social and cultural developments and creative and cultural content (Matheson, 2006). Creative business actors also emphasize not only the material production of the products they produce, but also their construction as works of value (Bourdieu, 1993)

Financial reporting has a role to stabilize business uncertainty (Ferracuti & Stubben, 2019). Financial report contain entity specific information needed by decision maker to deal with uncertainty (Lantto, 2022), such as in credit evaluation (Cascino et al., 2014; Libby, 1979). Financial records provide beneficial information for SMEs internally in performance valuation and decision making purposes (Muslichah et al., 2020), and gives stakeholders a tool to monitor and evaluate business activities (Iriyadi et al., 2018). Financial reporting and accounting plays an important role in reducing financial constraints in SMEs (Flayyih et al., 2019).

Some of the previous research are conducted to study the role of accounting for SMEs (Nwobu et al., 2015; Nyathi et al., 2018; Silaen & Tulig, 2023). Exploration of financial reporting in SMEs is also been widely discussed from time to time. The different meanings of SMEs in each country (Beaver, 2002), and differences in size, sector, culture, and economic development in which these SMEs operate (Kushnir, 2010) indicate that SMEs accounting research requires context-specific research. Discussions on SMEs financial reports in general have been widely researched by accounting academics from various points of view, including the application of IFRS for SMEs (Aboagye‐Otchere & Agbeibor, 2012; Bakr & Napier, 2022; Kiliç et al., 2016; Perera et al., 2023; Perera & Chand, 2015; Quagli & Paoloni, 2012), management accounting in SMEs (Ahmad & Mohamed Zabri, 2015), accounting planning in SMEs (Samuelsson et al., 2016), and budgeting in SMEs (Sandalgaard & Nielsen, 2018).

Some research explore more specific context, such as the role of accounting in the context manufacturing SMEs (Husin & Ibrahim, 2014), and winery SMEs (Reddaway et al., 2011). The role of financial accounting in creative SMEs research begin to emerge, such as the topic of funding issue in cultural and creative sector SMEs (Borin et al., 2018). Meanwhile, in the field of film, research on accounting is quite limited. A research is conducted to understand the role of accounting documents in the film industry (Jeacle, 2009) and the influence of budgeting on creativity in filmmaking (Friis & Hansen, 2015). Both studied accounting in film on a large business scale, while for small and medium scale are still limited. As SMEs in general, production house in small and medium scale needs the role of accounting in their business (Hasanah et al., 2020). Therefore, accounting research is needed in the film industry as a specific context.

This research is an effort to fill the gap on how SMEs perceive financial reporting and how the meaning of financial reporting is generated in the specific context. This research will explore the social construction of financial reporting specifically in the context of the film creative industry in a form of production house. Film sub-sector is considered to be the main topic because of its significant growth potential and

contribution to Indonesian economy (Bekraf, 2018). Thus, this research will contribute by providing an overview of financial reporting in the context of production house SMEs as a reference for determining policies and literature regarding financial reporting in the context.

This research is aimed to understand the social construction of a phenomenon. Social construction can be interpreted as formation of meaning or “sense-making”. Sensemaking is a discursive process in constructing and interpreting the social world (Gephart, 1993). In a case study conducted by Hasan & Gould (2001), sense-making is often referred to as “understanding the situation”, “gaining information”, “knowing where the organization is going” and “getting a picture” (Hasan and Gould, 2001). Understanding the meaning of an occurring phenomena is the basis for subsequent accounting research on this topic. In order to gain knowledge on the social construction of financial reporting in SMEs film business, the grounded theory method is employed.

Financial report should be tailored specific to the industry and the needs of its user, such as movie industry in preparing its financial information based on projects and accepted rules and definition for revenue, expenses, and profits recognition specific to the film industry (Vogel, 2005). Industry level film sector and the SMEs are different in context. Therefore, to understand the meaning of financial reporting in production house SMEs, this research is guided by two research questions:

RQ1: Why is the financial reporting in small and medium scale production house is socially constructed?

RQ2: How is the financial reporting in small and medium scale production house is socially constructed?

Research Method

Social construction theory states that human experience of a reality is governed by social and cultural influences (Santos, 2015), so that a definition is determined by social groups in which objectivity and subjectivity exist simultaneously (Rutherford, 2003). To gain an understanding of social construction, the approach used is an interpretive approach that begins with data collection and then draws a theory about the phenomenon that is the focus of the observed data (Bhattacherjee, 2012). Interpretive research views social reality as inherent in social settings, so that reality interpretation is done by thinking, not by testing hypotheses (Bhattacherjee, 2012). The grounded theory methodology is employed to conduct this research by adopting a Straussian approach. The grounded theory method is used to develop a theory because what is known is still limited, or to provide new direction from existing knowledge (Goulding, 1998).

The selected informants are actors eligible to provide in-depth data and access to the organization, such as the leaders of each production house and their finance department. The snowballing technique is conducted to obtain the required data. Data collection is carried out using triangulation techniques, such as in-depth interviews, observation, and documentation. Data analysis is carried out through three stages, namely open coding, axial coding, and selective coding (Corbin & Strauss, 1990). Open coding is conducted as an interpretive process by describing the data analytically. Axial coding connects each category to sub-categories, then the relationship is tested with data. Selective coding is conducted to unify all categories into core categories. While the core category presents a central phenomenon in research that will answer the research questions (Corbin & Strauss, 1990).

The selected informants are production houses in the city of Surakarta. The movement of the film community and small and medium scaled production house in Surakarta is emerging, as evidenced by the various films that have been shown and screened at national and international film screenings such as films by Bani Nasution (Saddha, 2018).

Data collection is carried out through in-depth interviews using semi-structured question guidelines derived from research questions, then the answers to each question are explored in more depth through unstructured and spontaneous questions. Interviews are recorded and documented to maintain data credibility. During the interview, notetaking is used to assist the researcher. The interviews are conducted in a comfortable situation and there is no time to make informants more flexible in telling their activities and the data obtained would be more representative and comprehensive. Non-participatory observation is carried out by observing the daily activities of production house SMEs business actors to find out the meaning contained in each of the actions taken. These activities include financial records, preparation of budget plans (RAB), preparation of accountability reports (LPJ), meetings with customers, internal meetings, and other activities. Documenting observations is done to maintain the credibility of the data. Documentation is done using photos after being approved by the party being observed.

Data analysis tool in this research is the coding process carried out by researchers which consists of open coding, axial coding, and selective coding in straussian approach (Corbin & Strauss, 1990). In qualitative research, researchers are also research instruments because the researcher uses critical analysis to process data in making analysis drawing conclusions (Wa-Mbaleka, 2020).

Result and Discussion

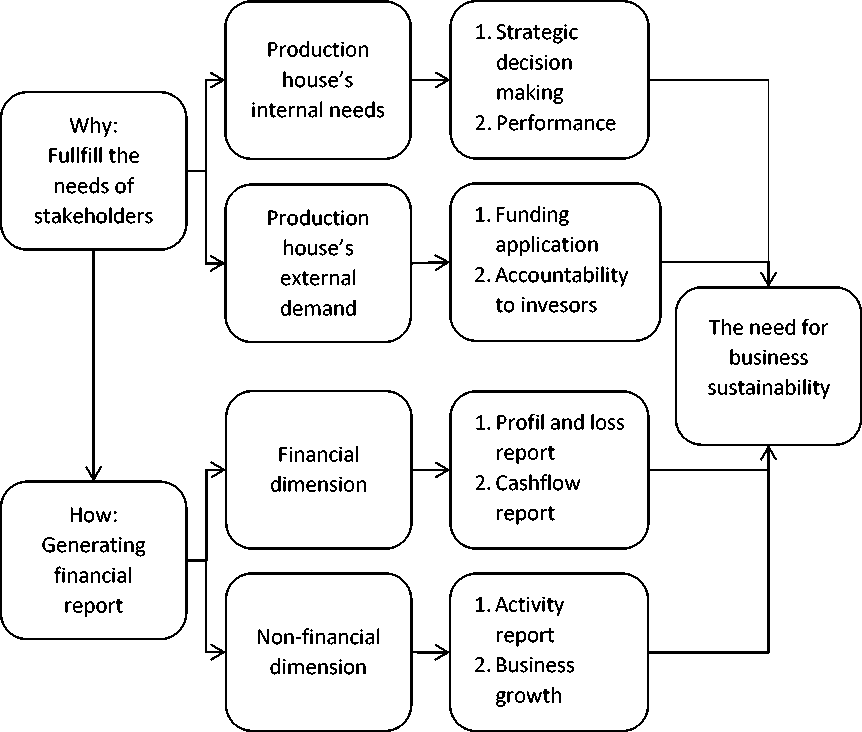

Central phenomena can be analyzed after performing 3 stages of coding, namely open coding, axial coding, and selective coding. Based on the analysis, the need for business continuity or sustainability is a central phenomenon of the problem on the research focus. The need for business continuity answers the why and how of the research questions as presented in Figure 1.

Figure 1 is based on the data collected from in-depth interview, observation and documentation. The data from interview are processed into data reduction to obtain the information relevant to the topic. The data reduction is summarize and is presented in Appendix 1.

Production house is a business organization. As with other business organizations, financial motivation is one of the main objectives of the organization. This financial goal is a motivation for production house to run their business, therefore production house require itself to obtain business sustainability. This need for business sustainability and long term continuity is conveyed by informant 2:

“… Kan kalau bikin bisnis kayak gini kan nanti bisa untuk investasi jangka panjang gitu, lho. Kalau misalkan berhasil nih, kan bisa jadi bisnis keluarga. Bisa diturunun, diturunin, diturunin. Investasi jangka panjang juga sih…” (If you make a business like this, you can use it for long-term investment, you know. If this is successful, it could become a family business. It can be inherited, inherited, inherited. It's a long term investment too.)

Figure 1. The Social Construction of Financial Reporting in the Production House Source: Processed Data, 2023

Production house as a creative business has an artistic goal and a need for artistic expression. However, this goal will not be achieved if there is no business sustainability. With the stability of its financial activity, production house will have adequate financial resources to continue its creative process. This information then drawn as the central phenomenon in this research.

The need for business sustainability is carried out by conducting financial reporting. This is in line with research conducted by (Abdul-Rahamon & Adejare, 2014; Okoli, 2011; Zotorvie, 2017) which states that adequate financial reporting can improve business sustainability in SMEs. The financial reports are used by production house to fulfil the needs of internal and external parties. For internal parties, financial reporting is useful for strategic decision making, performance valuation, and pricing. Meanwhile, for external parties, financial reporting is used to make funding application and as an accountability reports for funding parties such as investors and business grant providers.

Financial reporting is performed by production house by reporting financial and non-financial aspects. Financial aspects are presented in profit/loss statements, simple cash flow statements, and balance sheet accounts which are reported limited to tangible assets and liabilities in the form of trade payables. Non-financial aspects are also important content in financial reporting. Production house’s activity reports, business

development descriptions, and simple corporate social responsibility (CSR) reports are prepared to meet the needs of the production house's internal and external parties.

The main reason for production house in conducting financial reporting is to fulfill internal and external needs for financial information. Internal information is used for making strategic decisions and for determining the fee rates for making videographic works. While external information is used for funding submissions and accountability reports.

Based on the data obtained and analyzed using the triangulation process, production house receives external funding from investors and activity grant providers, one of which is from the government through the Ministry of Tourism and Creative Economy (Kemenparekraf). These parties need financial reports to supervise production house.

Production house plea for funding through business or project proposal. For investors or funding providers, information required in proposals are simple profit/loss reports, cash flow reports, and company financial projections. Investors put more reliance on business growth reports and activity projections to make investment decisions for production house. Meanwhile, funding grants are based on the project, such as, per project for making a short fiction film, project for making a documentary film, project for advertisement videos, and others. To get funding per project, production house must prepare a proposal added by an Expenditure Budget Plan (RAB) attached. RAB can be prepared based on the production house’s financial information in running the business and working on the project.

Funding to financial institutions such as banks or cooperatives or union is not an option because production house does not perceive to need financial support or funding from banks. This is due to relatively small business activities, so the funding investors and grant providers are sufficient to keep the business going. However, production house keeps financial records in anticipation of the need to apply for funding to a bank in the future. This concern is stated by informant 1:

“… Nah terus akhirnya, kalo… kita kan nyari lagi nih, jujur kita nggak mau dulu yang namanya minjem. Aku tuh takut yang namanya minjem bank, tapi kayaknya tuh butuh besok…”

(So in the end, if… we are looking for it (funding) again, to be honest we don't want to make loan. I'm afraid of borrowing from bank, but I think we’ll need it in the future.)

Accountability reports (LPJ) are also the reason for financial reporting in production house. Accountability reports are prepared according to the needs of fund providers or external parties. For investors, overall business information, both financial and non-financial, is a major requirement. Meanwhile, for grant providers whose funding applications are made per project, accountability reports are also prepared based on the projects undertaken. For example short film projects, documentary film projects, and promotion video projects. This information is stated by an informant 2:

“... (laporan pertanggungjawaban disusun) tiap project. Jadi... habis satu project tersebut kan ada timeline. Jadi, di observasi 2 bulan, terus bikin konsep, seumpama 2 bulan juga, produksi 1 bulan, 1 bulan untuk pameran. Nah, itu kan pertanggungjawabannya otomatis di... di per-site dan pertanggungjawaban besarnya di akhir project…”

(accountability report is prepared) for each project. So... after one project there is a timeline. So, 2 months of observation, then making concepts, for example 2 months too, 1 month of production, 1 month for exhibitions. So, the accountability (report) is automatically on per-site and the big accountability (report) is at the end of the project.)

An informant investor also expressed his need for accountability report. According to investors as stakeholders, their need for accountability report is not merely financially motivated, but to fulfil their right to know about developments and growth of the production house. According to the informant, the development and increasing quality of films produced by production house is s important as financial returns, as he stated:

“… Iya, saya mensyaratkan (LPJ) untuk setiap project yang dilakukan. Karena… sebgai investor saya berhak tahu aliran penggunaan dana yang telah saya berikan pada perusahaan untuk tiap project. Saya nggak semata-mata ingin tahu keuagan mereka, tetapi saya lebih ingin memantau perkembangan kinerja mereka dan perkembangan yang mereka lakukan dari project ke project, apakah karya yang dihasilkan semakin bagus atau nggak. Kita sebagai investor kan pengennya mereka bikin karya yang semakin bagus.”

(… Yes, I require (accountability report) for every project. Because… as an investor, I have the right to know the flow of the funds I have given to the company for each project. I’m not just wanting to know their finances, but I would rather monitor the development of their performance and the developments they make from project to project, whether the work they produce is getting better or not. We as investors want them to make better work.)

Internal parties also have important part in production house. Production house make financial reports to make funding decisions. This information is stated by informant 3:

“... targetku selama beberapa ini, yang penting, aku tidak meminta suntikan dana dari manapun dulu. Duitku dari bulan January sampai May ini harus bisa mencukupi semuanya. Targetku itu dulu. Kalau tidak bulan itu aku masih oke, masih jalan, berarti aku masih bisa bernafas ini. Gitu. Besok gimana caranya aku harus bisa jalan… bisa lari dan seterusnya.…”

(my target for these several months, the important thing, I did not ask for an injection of funds from anywhere first. My money from January to May should be enough for everything. That’s my target. If outside those months I'm still okay, still walking, meaning I can still breathe. That's it. Tomorrow how do I have to be able to walk… can run (the business) and so on)

The production house determines funding decisions based on the financial condition of its operational activities. To find out the financial condition, a simple analysis of financial data is needed. Financial data is stored in financial records, and communicated through financial reports to interested parties. Communication is carried

out in writing through reports, supplemented by verbal discussions so that all members can easily understand them in carrying out their respective duties.

Financial reports are also used to review production house performance whether it has reached the target. In addition, the existing financial information is used as one of the bases for determining production house service rates for commercial activities.

Production house answers the needs of external and internal parties for financial information by conducting financial reporting. The financial reports prepared contain financial information and non-financial information. Financial information is dominated by profit/loss reports, followed by recording cash flows, and balance sheets are limited to recording assets. Meanwhile, non-financial reports contain descriptions or schedules of activities carried out by PH, reports on business development and growth, as well as CSR reports.

Financial reports are dominated by company profit/loss information. Recording profit/loss begins with recapitulating income and expenses. This information is conveyed by informant 3 as follows:

“... aku cuma menggabungin aja. Nanti setelah dikumpulin itu aku punya rekapan... income-outcome-nya doang tapi ya, tidak detail. Jadi, setelah dibikin temen-temen pasti punya debitnya di bulan keberapa, kreditnya berapa, balance-nya berapa. Ini aku jadiin satu tabel…”

(... I’m just merging (the report). Later, after collecting it, I will have a summary... just the income-outcome, but yeah, no details. So, after (the report is) made by other member (financial dept.), what month will the debit be, how many credits, what is the balance. It is summarized in one table…)

Based on the data, profit/loss is the main information sought by users of financial statements. Therefore, production house profit/loss reporting tend to be highly detailed. Information regarding profit/loss can be used by internal parties to determine pricing and funding decisions. Profit/loss information is also used for making company strategic decisions. Production house prepares profit/loss reports meticulously to avoid misleading information in decision making.

For external parties, profit/loss reports can influence funding decisions. Information regarding the break even point (BEP) is the main thing needed by investors. By knowing the BEP, investors can find out when a given investment generates returns. This information is stated by informant 2:

“... tujuannya untuk apa. Tujuannya untuk apa, terus perkembangannya kayak gimana. Yang tadi itu. Kayak misalkan per project segini, segini segini, BEP-nya kapan. Nah, kayak gitu. Itu juga diperhitungin.”

(for what purpose (the business). What is the purpose of it, and how is it going to develop? That was it. Like for example per project will require this amount of cash, this way, when is the BEP. Well, like that. That’s also counted.)

Profit/loss information not only provides historical information, but also projected production activities. In the business activities carried out by production house, the investors involved are dominated by the closest people such as family, and a small portion comes from entrepreneurial funding competitions or grant providers. Both types of investors need profit/loss information on the investment they provide. Meanwhile,

profit/loss reports will be useful if production house apply for funding through financial institutions such as banks or cooperatives in the future. Profit/loss information can be useful for conducting a simple analysis of production house performance in the future.

Other financial information considered important by production house is the statement of cash flows. This report includes cash in and cash out balances for every financial transaction made by the business. The recording of cash flows is carried out very simply because it aims to be easily understood by the users of the report. This is conveyed by informant 3:

“(format pencatatan)... tidak ada. Aku hanya merujuk di buku tabungan. Buku tabungan cuma ada deskripsi, debit, kredit, balance. Udah, sama. laporanku cuma itu. Karena... as simple as that, yang penting aku dan temen-temen bisa baca, gitu. Dipahami sama kita semua yang ada di sini…” ... ((records format) none. I’m just referring to the general savings book. The savings book only has a description, debit and credit balance. OK, same. My report is just that. Because... as simple as that, the important thing is that my friends and I can read, that’s it. We all understand here…)

Cash flows is recorded simply and pays little attention to file for evidence of transactions. Evidence of transactions is not properly maintained so that monitoring of cash flow reports is inadequate.

The preparation of a balance sheet is the least important aspect of production house’s financial reporting. The recorded balance sheet accounts are limited to tangible assets and liabilities in the form of trade payable. The usefulness of financial information considered to be the most relevant is tangible assets and debt. This is stated by informant 1:

“... (pencatatan aset)... itu penting, sangat penting. Karena aset itu bisa digunakan untuk... apa namanya... strategi ke depan mau ngapain. Jadi kalau aku punya sebuah amunisi nih, aset itu kan amunisi, aku mau mau menyerang sesuautu, aku kan mempertimbangkan amunisi ini, nih. Amunisiku tuh apa nih, oh amunisiku A sampai Z, berarti aku nyerangnya nananana... gitu harusnya…”

((recording of assets)... it’s important, very important. Because those assets can be used for... what's the name... what you are going to do in the future strategy. So if I have an ammo, an asset is an ammo, I want to attack something, I will consider this ammunition, here. What’s my ammunition, oh my ammunition is A to Z, it means I'm attacking nananana... that’s how it should be.)

Production houses recognize the importance of intangible assets in their business activities, but do not know how to record and manage their intangible assets such as creativity, artistic taste, artistic skills, and other creative knowledge. Therefore, the artistic skills and creativity is reflected in the price of the film and videographic services provided. If making a film or video requires high artistic skills, then the rates they charge for the project are also high.

The non-financial aspects of production house’s financial reporting are dominated by activity reports and business development reports. Both are submitted in an informal form, such as activity tables, personal notes for each production house’s members, oral discussion, or as part of a proposal for funding or an accountability report. For investors,

reports on business activities and developments are highly useful and relevant in making investment decisions. In addition, for internal parties these two reports are useful for determining activities to be carried out in the future. This information is stated by informant 2:

“... (yang dibutuhkan oleh investor) laporan perkembangan, sih… perkembangan sama keuangan juga. Jadinya perkembangannya apa, udah ngapain aja, bikin event apa aja, misalkan kayak gitu…”

((what investors need is) business and activity development description, anyway… development reports are as important as financial ones too. So what's the development, what activities done, any event held, something like that.)

Another non-financial information report submitted by production house is a report on social responsibility or CSR. Even though it is a small-scale organization, production house has moral responsibility to play a role in the surrounding community. This is conveyed by informant 1:

“… walaupun kita sociopreneur dan seniman sekalipun kita harus sustain dalam bisnis itu kan, kita harus dapet uang dari situ. Jadinya nggak hanya uang, tapi kita juga memberikan hal-hal yang baik untuk sekitar kita…” (Even though we are sociopreneurs and artist, we have to be sustainable in that business, right? We have to get money from it. So it's not only money, but we also give good things to those around us.)

Production houses reporting CSR activity in a simplistic way. The report is in the form of CSR implementation plans and budgets, visual documentation in the form of photos and videos, and a brief description of CSR plans and implementation. One of the CSR programs undertaken by production house is collaborating with local reading houses to screen short films and book donations, create videography projects for those in need, or collaborate with other communities to carry out social and charitable activities. Production house in small and medium scale understand philanthropy and charity as a corporate responsibility, so that philanthropic and charitable activities are categorized into CSR reports.

The research findings have relevance to stakeholder theory which states that a business have important relationships with various groups or stakeholders who are affected by the activities carried out by the company, and these stakeholders are also able to influence company performance (Freeman, 1999). The CSR activities explored in the study also indicating that the production house SMEs are aware of this engagement.

Stakeholder theory explains why production houses consider the interests of all parties involved in conducting financial reporting. The financial reporting might not meet standards such as IFRS for SMEs or SAK-ETAP, but the social construction behind it is discovered, which is to fulfill the needs of their stakeholders. By fulfilling these needs, stakeholders have a strong basis to support the business activities of the production house. Having support from stakeholders means the production house can continue to operate and achieve sustainability.

Financial reporting also unite the perspectives of stakeholders regarding how the production house interprets its business success. As stated by the informants, for production houses, “success” means continuing to produce work, and development of its business activities, not just making profits. Business growth is important. Alignment of

stakeholder perspectives regarding what “success” means to them can be an important predictor of business success, especially for SMEs, because this alignment results in the way and extent of stakeholder involvement (Antonelli et al., 2016).

Conclusion

This research portrays the SMEs production house as a business organization and artistic community. The central phenomena on the research to answer “why” is the need of the business to sustain. To continue artistic production, the sustainability has to be achieved and maintained. Financial reporting is production house’s effort to achieve its business sustainability. This finding can be reflected with stakeholder theory, in which a business entity meets the needs of all parties involved and affected through financial reporting. These parties comes from internal and external organizations. Internal parties need financial information for making strategic business decisions, determining fee or rates, and for conducting performance valuation. Meanwhile, external parties require an accountability report on the funds provided, as well as a form of funding submission by the production house if it requires external funding. The result from the study to answer “how” shows that information reported is financial and non-financial information. Financial information consists of income statements, simple cash flow statements, and assets and liabilities information. Meanwhile, non-financial information consists of activity description reports, business development descriptions, and social activities or CSR.

This research is an initial research on the construction of financial reporting in the context of a production house by exploring the “why” and “how” production house is conducting financial reporting. Therefore, future research can explore the accounting process in the form of identification, recognition, measurement, valuation and presentation of the elements in the financial statements. Intangible assets and CSR found in production house have a potential to be explored in future studies. The limitation of this research is the informants are limited to production houses in Surakarta. Regional differences may provide different results because SMEs have very specific characteristics, depending on region, size, culture, and other factors (Kushnir, 2010). This research is also conducted in a relatively short period of time, therefore it cannot capture production house activities during 1 annual reporting period.

References

Abdul-Rahamon, O. A., & Adejare, A. T. (2014). The analysis of the impact of accounting records keeping on the performance of the small scale enterprises. International Journal of Academic Research in Business and Social Sciences, 4(1), 1–17.

Aboagye‐Otchere, F., & Agbeibor, J. (2012). The International Financial Reporting Standard for Small and Medium‐sized Entities (IFRS for SMES). Journal of Financial Reporting and Accounting, 10(2), 190–214.

https://doi.org/10.1108/19852511211273723

Ahmad, K., & Mohamed Zabri, S. (2015). Factors explaining the use of management accounting practices in Malaysian medium-sized firms. Journal of Small Business and Enterprise Development, 22(4), 762–781. https://doi.org/10.1108/JSBED-04-2012-0057

Antonelli, V., D’Alessio, R., & Francesca, C. (2016). Beyond Stakeholder Theory: Financial

Reporting and Voluntary Disclosure in Italian SME According to A Unitary Perspective. Business and Management Sciences: International Quarterly Review, 7(4).

Bakr, S. A., & Napier, C. J. (2022). Adopting the international financial reporting standard for small and medium-sized entities in Saudi Arabia. Journal of Economic and Administrative Sciences, 38(1), 18–40. https://doi.org/10.1108/JEAS-08-2018-0094

Bank Indonesia. (2015). Profil Bisnis Usaha Mikro, Kecil, dan Menengah (UMKM).

Banks, M., Calvey, D., Owen, J., & Russell, D. (2002). Where the art is: defining and managing creativity in new media SMEs. Creativity and Innovation Management, 11(4), 255–264.

Beaver, G. (2002). Small Business, Entrepreneurship and Enterprise Development. Prentice Hall.

Bekraf. (2018). Ekonomi Kreatif Outlook 2019.

Bhattacherjee, A. (2012). Social science research: Principles, methods, and practices.

Borin, E., Donato, F., & Sinapi, C. (2018). Financial sustainability of small-and mediumsized enterprises in the cultural and creative sector: The role of funding. Entrepreneurship in Culture and Creative Industries: Perspectives from Companies and Regions, 45–62.

Bourdieu, P. (1993). Sociology in question (Vol. 18). Sage.

Cascino, S., Clatworthy, M., García Osma, B., Gassen, J., Imam, S., & Jeanjean, T. (2014). Who uses financial reports and for what purpose? Evidence from capital providers. Accounting in Europe, 11(2), 185–209.

Corbin, J. M., & Strauss, A. (1990). Grounded theory research: Procedures, canons, and evaluative criteria. Qualitative Sociology, 13(1), 3–21.

Ferracuti, E., & Stubben, S. R. (2019). The role of financial reporting in resolving uncertainty about corporate investment opportunities. Journal of Accounting and Economics, 68(2–3), 101248.

Flayyih, H. H., Mohammed, Y. N., & Talab, H. R. (2019). The role of accounting information in reducing the funding constraints of small and medium enterprises in Iraq. African Journal of Hospitality, Tourism and Leisure, 8(4), 1– 10.

Fraser, S., & Lomax, S. (2011). Access to finance for creative industry businesses. Department for Business and Innovation & Skills (BIS) and Media and Sport (Dcms) and Department for Culture (Final Report May 2011).

Freeman, R. E. (1999). Divergent stakeholder theory. Academy of Management Review, 24(2), 233–236.

Friis, I., & Hansen, A. (2015). Line-item budgeting and film-production. Qualitative Research in Accounting & Management, 12(4), 321–345.

https://doi.org/10.1108/QRAM-01-2015-0016

Fritzke, L. (2008). An examination of the impact of records on the value of artworks. Records Management Journal, 18(3), 221–235.

Gephart, R. P. (1993). The textual approach: Risk and blame in disaster sensemaking.

Academy of Management Journal, 36(6), 1465–1514.

https://doi.org/10.2307/256819

Goulding, C. (1998). Grounded theory: the missing methodology on the interpretivist agenda. Qualitative Market Research: An International Journal, 1(1), 50–57.

Guerreiro, M. S., Rodrigues, L. L., & Craig, R. (2008). The preparedness of companies to adopt International Financial Reporting Standards: Portuguese evidence. Accounting Forum, 32(1), 75–88.

Hasan, H., & Gould, E. (2001). Support for the sense-making activity of managers. Decis. Support Syst., 31, 71–86.

Hasanah, N., Armeliza, D., Muliasari, I., & Wahyuningrum, I. (2020). Accounting Application for Small and Medium Enterprises and Compatibility with EMKM Standards: A Case Study in Jakarta, Indonesia. Journal of Southwest Jiaotong University, 55. https://doi.org/10.35741/issn.0258-2724.55.5.4

HOTN. (2000). The Heart of The Nation: A Cultural Strategy for Aotearoa New Zealand.

Husin, M. A., & Ibrahim, M. D. (2014). The role of accounting services and impact on small medium enterprises (SMEs) performance in manufacturing sector from East Coast Region of Malaysia: A conceptual paper. Procedia-Social and Behavioral Sciences, 115, 54–67.

IASB. (2009). International Financial Reporting Standards.

Iriyadi, I., Maulana, M. A., & Nurjanah, Y. (2018). Financial Reporting for Micro Small and Medium Enterprises Towards Industrial Revolution Era 4.0. International Conference On Accounting And Management Science 2018, 32–38.

Jeacle, I. (2009). “Going to the movies”: accounting and twentieth century cinema. Accounting, Auditing & Accountability Journal, 22(5), 677–708. https://doi.org/10.1108/09513570910966333

Kianto, A., Shujahat, M., Hussain, S., Nawaz, F., & Ali, M. (2019). The impact of knowledge management on knowledge worker productivity. Baltic Journal of Management, 14(2), 178–197.

Kiliç, M., Uyar, A., & Ataman, B. (2016). Preparedness of the entities for the IFRS for SMEs: an emerging country case. Journal of Accounting in Emerging Economies, 6(2), 156–178. https://doi.org/10.1108/JAEE-01-2014-0003

Kushnir, K. (2010). A Universal Definition of Small Enterprise: A Procrustean Bed for SMEs?

Lantto, A.-M. (2022). Obtaining entity-specific information and dealing with uncertainty: Financial accountants’ response to their changing work of financial reporting and the role of boundary objects. Critical Perspectives on Accounting, 85, 102277.

Libby, R. (1979). The impact of uncertainty reporting on the loan decision. Journal of Accounting Research, 35–57.

Madurapperuma, M. W., Thilakerathne, P. M. C., & Manawadu, I. N. (2016). Accounting record keeping practices in small and medium sized enterprise’s (SME’s) in Sri Lanka. Journal of Finance and Accounting, 4(4), 188–193.

Matheson, B. (2006). A culture of creativity: design education and the creative industries. Journal of Management Development, 25(1), 55–64.

Muslichah, M., Sunarto, S., Kusnanto, A. A., Indrawati, S., & Hariyanto, H. (2020). The Adoption of Financial Accounting Standards for Small Medium Enterprises by Muslim Entrepreneurs. Journal of Accounting, Business and Management (JABM), 27(1), 54–65.

Nwobu, O., Faboyede, S. O., & Onwuelingo, A. T. (2015). The role of accounting services in small and medium scale businesses in Nigeria. Journal of Accounting, Business and Management (JABM), 22(1).

Nyathi, K. A., Nyoni, T., Nyoni, M., & Bonga, W. G. (2018). The role of accounting information in the success of small & medium enterprises (SMEs) in Zimbabwe: A case of Harare. Journal of Business and Management (DRJ-JBM), 1(1), 1–15.

Okoli, B. E. (2011). Evaluation of the accounting systems used by small scale enterprises in Nigeria: The case of Enugu-South East Nigeria. Asian Journal of Business Management, 3(4), 235–240.

Perera, D., & Chand, P. (2015). Issues in the adoption of international financial reporting standards (IFRS) for small and medium-sized enterprises (SMES). Advances in Accounting, 31(1), 165–178.

https://doi.org/https://doi.org/10.1016/j.adiac.2015.03.012

Perera, D., Chand, P., & Mala, R. (2023). Users’ perspective on the usefulness of international financial reporting standards for small and medium-sized enterprises-based financial reports. Meditari Accountancy Research, 31(5), 1133–1164. https://doi.org/10.1108/MEDAR-03-2020-0809

Quagli, A., & Paoloni, P. (2012). How is the IFRS for SME accepted in the European context? An analysis of the homogeneity among European countries, users and preparers in the European commission questionnaire. Advances in Accounting, 28(1), 147–156. https://doi.org/https://doi.org/10.1016/j.adiac.2012.03.003

Reddaway, M., Goodman, S., & Graves, C. (2011). The role of accounting information in the management of winery SMEs: a review of the broader existing literature and its implications for Australia’s wine industry. 6th AWBR International Conference, 1, 1–13.

Rutherford, B. A. (2003). The social construction of financial statement elements under Private Finance Initiative schemes. Accounting, Auditing & Accountability Journal, 16(3), 372–396.

Saddha, O. (2018). Merangkum Batas Perfilman di Solo. Solopos.

Samuelsson, J., Andersén, J., Ljungkvist, T., & Jansson, C. (2016). Formal accounting planning in SMEs. Journal of Small Business and Enterprise Development, 23(3), 691–702. https://doi.org/10.1108/JSBED-12-2015-0167

Sandalgaard, N., & Nielsen, C. (2018). Budget emphasis in small and medium-sized enterprises: evidence from Denmark. Journal of Applied Accounting Research, 19(3), 351–364. https://doi.org/10.1108/JAAR-08-2016-0087

Santos, J. L. (2015). Social construction theory. The International Encyclopedia of Human Sexuality, 1115–1354.

Shorthose, J., & Strange, G. (2004). The new cultural economy, the artist and the social configuration of autonomy. Capital & Class, 28(3), 43–59.

Silaen, P., & Tulig, S. (2023). The Role of Accounting in Managing Micro, Small and Medium Enterprises (MSMEs): The Case of Indonesia. Australasian Accounting, Business and Finance Journal, 17(2), 113–121.

Tambunan, T. (2011). Development of small and medium enterprises in a developing country: The Indonesian case. Journal of Enterprising Communities: People and Places in the Global Economy, 5(1), 68–82.

Townley, B., Beech, N., & McKinlay, A. (2009). Managing in the creative industries: Managing the motley crew. Human Relations, 62(7), 939–962.

Vogel, H. L. (2005). Movie industry accounting. A Concise Handbook of Movie Industry Economics, 59–79.

Wa-Mbaleka, S. (2020). The Researcher as an Instrument BT - Computer Supported

Qualitative Research (A. P. Costa, L. P. Reis, & A. Moreira (eds.); pp. 33–41). Springer International Publishing.

Zotorvie, J. S. T. (2017). A study of financial accounting practices of small and medium scale enterprises (SMEs) in Ho Municipality, Ghana. International Journal of Academic Research in Business and Social Sciences, 7(7), 29–39.

Appendix

Appendix 1. Data Summary/Data Reduction

|

No. |

Point of Information Question Informant 1 Informant 2 Informant 3 |

|

1. |

Why the does Production house is a The owner wish to The founder want owner or the way to express establish a family to live by his founder make a feelings through business through artistic skills and production hobby and artistic her film-making make a living by house? business, and as a hobby. having It as his job. creative worker, the founder wants to live by his competence and fondness in art. |

|

2. |

Does production Yes. Yes. Yes. house perform book keeping? |

|

3. |

Does the book No. No. No. keeping process follow certain standard? |

|

4. |

Why does Financial reporting Production house Keeping records production lead to fulfilling wants to be helps production house perform stakeholders needs to sustainable in house track their book keeping or obtain business business, and performance to financial stability and financial reporting value their reporting? continuity. leads to this goal. business sustainability. |

|

5. |

How does The production house A simple format is The recording is production create simplistic applied, displaying simple, starting house record format for financial cash inflows and from revenue and financial reporting to be easily cash outflows cost recap. transactions? understood by users. information, sales, and net profit. |

|

6. |

Why does Financial report is a Keeping records Knowing financial production form of accountability may help activities such as house record report to investors production house revenue and cost, transaction or and funding poviders, to apply for income and keep reports on tracking internal funding. expenses, gives their financial performance, and as a production house transaction? basis for funding basis to determine application decision. their fee. |

|

7. |

How production The report is delivered Written report is Informal written house report verbally and written. prepared for report is prepared their (financial internal and for internal and non- external use, and purpose, yet the financial) verbal explanation formal report is activities? is an additional prepared to follow |

|

feature to help |

the demand of | |||

|

8. 9. |

What kind of information disclosed in financial reports? Does the financial information equipped with adequate proof of transaction as an attachment? |

Financial information disclosed are: profit and loss, cash inflows and outflows, tangible assets, and payables. Production house is aware of the important of intangible assets yet has no capacity in displaying it. No. The transaction proof such as invoice and receipt are not well-maintained. |

user understand the written text. Revenue and cost, expenses, assets, payables, business or project activities, business growth, project schedule, business targets and objectives, social activities. No. Receipt are not maintained and some are missing. |

external users. Cash inflows and outflows, assets, revenue, cost, expenses, schedule and activity descriptions, social events, business growth and targets. No. There is no adequate filing for financial transaction proof. |

|

Source: Processed Data, 2023 | ||||

Jurnal Ilmiah Akuntansi dan Bisnis, 2024 | 18

Discussion and feedback