Determinant of Foreign Exchange Reserve in 6 Asian Developing Country Before and During Crisis Pandemic COVID-19

on

pISSN : 2301 – 8968

JEKT ♦ 15 [1] : 197-215

eISSN : 2303 – 0186

Determinant of Foreign Exchange Reserve in 6 Asian Developing Country Before and

During Crisis Pandemic COVID-19

Annis Khoirunnisa, Shanty Oktavilia

ABSTRACT

This research looks at the factors that affect foreign exchange reserves in developing countries in Asia 6 in the period before and during the crisis due to the covid-19 pandemic. Used panel data regression estimates, which are a combination of time series data (Q1 2018-Q4 2020) and cross sections (India, Indonesia, Philippines, Thailand, Mongolia, and Uzbekistan). The variables used are foreign exchange reserves as the dependent variable then exchange rate, GDP, FDI, net exports, the period before and during the crisis (dummy) as independent variables. The results of this study are partially variable exchange rate, GDP, FDI, net exports have a significant positive effect on foreign exchange reserves. The period before and during crisis (dummy) have a different effect on foreign exchange reserves.

Keywords: Foreign Exchange Reserves, Developing Countries, Pandemic COVID-19, Panel.

Classification JEL: F31, O1, C33 INTRODUCTION

One of developing country problems is that it requires huge funding. The source of these funds comes from the country's foreign exchange reserves, which is an important aspect of seeing how far the country is in carrying out international trade and shows how strong a country's economy is. The accumulation of large foreign exchange reserves is one of the things used by developing countries to balancing effect of macroeconomic dynamics (Moore & Glean, 2016). The

effectiveness of storing large foreign exchange reserves increases the resilience of the country,s economy against shocks that occur anytime (Allegret , 2018). Availability of sufficient foreign exchange reserves in a country is one to maintain monetary and macroeconomic stability (Sayoga & Tan, 2017). Foreign exchange reserves are important as a crisis buffer (Blanchard et al., 2010).

The World Bank classifies group of countries according to per capita income. Low-income (<$1,036/year), lower-middle

income ($1,036-$4,046/year), uppermiddle income ($4,046-$12,535/ year) and high income countries of more than $12,535/ year (World Bank, 2020). So far, World Bank has recorded that there are 109 middle-income countries in the world which occur according to the per capita income.

effect on the economy whose impact spread throughout the world, especially the Asian region. This continued impact of the economy affects the real sector. International economic activity has been shaken by various new rules to break and prevent a bigger impact.

The global health crisis that started in China at the end of 2019 caused contagious

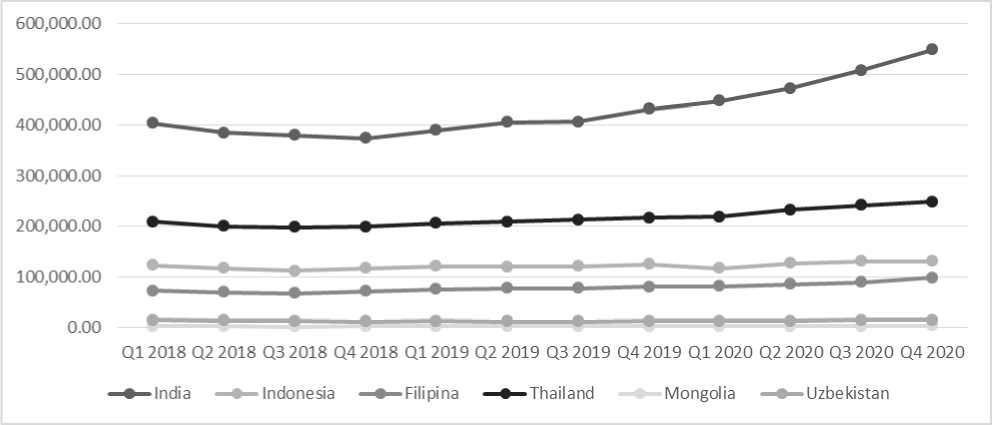

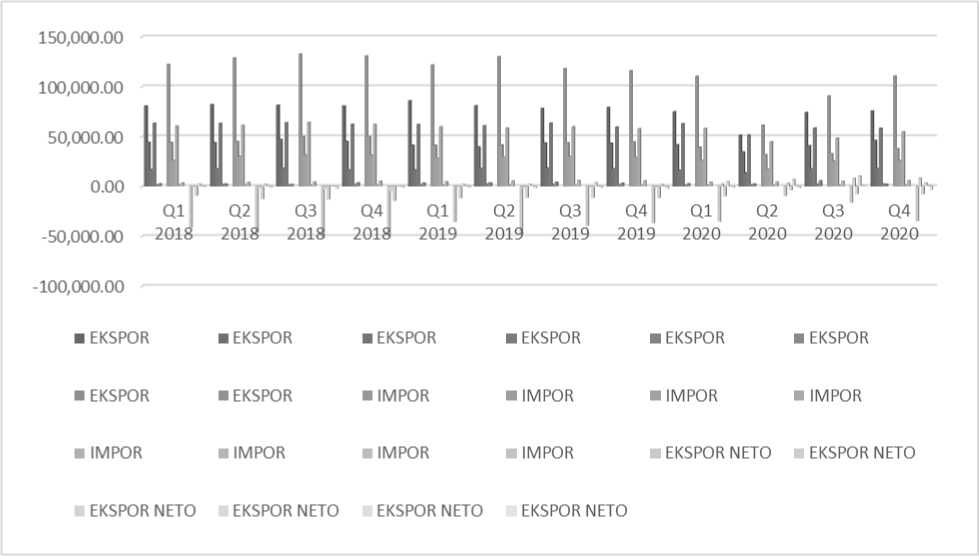

Figure 1. The Foreign Exchange Reserves of Developing Countries in Asia 6 (million US$), processed

Source: International Financial Statistics

(IFS)

In general, there has been an increase

over the twelve quarters in Figure 1 of

foreign exchange reserves in developing Asia 6 (India, Indonesia, Philippines, Thailand, Mongolia, and Uzbekistan). These countries have higher foreign exchange reserves growth than other developing countries in Asia. The movement of foreign exchange reserves

tends to be slow in the period before pandemic. The total increase in the foreign exchange reserves of developing countries was only 1% in the period before pandemic, while during pandemic it reached 20%. This is very fast movement in conditions of economic turmoil. Various countries are shaken by the economic crisis due to the covid-19 pandemic, but foreign exchange reserves are increasing rapidly.

Change in the position of foreign exchange occured due to various factor, both internal factors and external. One of the internal factors is the trade balance deficit which affect the balance of payment. External factors are the influx of direct investment as well as global economic conditions that are always changing and cannot be predicted in advance such as a crisis. This includes the covid-19 pandemic.

|

Ql 2018 |

Q2 2018 |

Q3 2018 |

Q4 2018 |

Ql2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

Ql 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 | |

|

■ India |

65.04 |

68.58 |

72.55 |

69.79 |

69.17 |

68.92 |

70.69 |

71.27 |

75.39 |

75.53 |

73.80 |

73.05 |

|

■ Indonesia |

13,756.0 |

14,404.0 |

14,929.0 |

14,481.0 |

14,244.0 |

14,141.0 |

14,174.0 |

13,901.0 |

16,367.0 |

14,302.0 |

14,918.0 |

14,105.0 |

|

■ Filipina |

52.21 |

53.52 |

54.25 |

52.72 |

52.78 |

51.36 |

52.04 |

50.74 |

51.04 |

49.85 |

48.47 |

48.04 |

|

■ Thailand |

31.23 |

33.17 |

32.41 |

32.45 |

31.81 |

30.74 |

30.59 |

30.15 |

32.67 |

30.89 |

31.66 |

30.04 |

|

■ Mongolia |

15.41 |

2,462.82 2,552.13 2,643.69 2,631.512,657.76 2,667.64 2,734.33 2,777.74 2,823.89 2,854.72 2,849.89 | ||||||||||

|

■ Uzbekistan |

8,114.867,871.668,079.288,339.558,389.978,562.349,424.549,507.569,554.22 |

10,173.3 |

10,321.2 |

10,476.9 | ||||||||

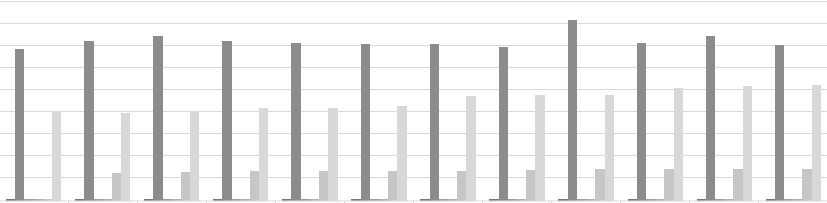

Figure 2. Exchange Rates of Developing Countries in Asia 6 (domestic currency per US$).

Sourc: International Financial Statistics (IFS)

It can be seen in Figure 2 that the condition of the exchange rate of each country tends to be stable, there are also

times when the exchange rate depreciates against the Dollar. The currencies of India, Indonesia, Mongolia and Uzbekistan experienced the highest depreciation in Q2 2020, Q1 2020, Q3 2020 and Q4 2020, which were periods during the pandemic. While the Philippines and Thailand currencies

experienced the highest depreciation in Q3 2018 and Q4 2020 which were the period before the pandemic. The turbulence that occurred in international trade certainly affected the exchange rates of each country. Foreign exchange reserves are affected by the trade balance, foreign direct investment, foreign debt and exchange rates (Yugang, 2017). Exchange

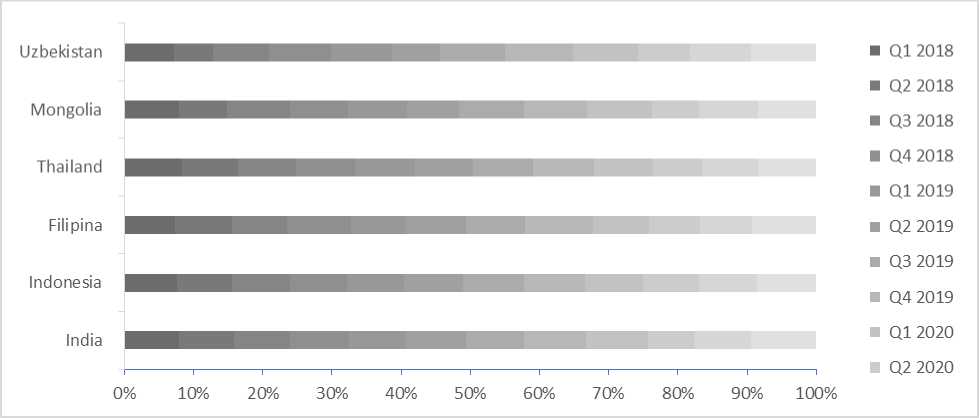

Figure 3. Gross Domestic Product (GDP) Growth of Developing Countries in Asia 6 (%), processed.

Source: International Financial Statistics (IFS)

Figure 3 shows the trend of increasing GDP in each country. The period before the Q1 2018-Q4 2019 pandemic had positive GDP growth, in contrast to GDP growth during the Q4 2019-Q4 2020 pandemic which showed small numbers in

rate stability plays an important role in overall trade and macroeconomic performance (Abbas et al., 2020). In the long term, the exchange rate has an impact on foreign exchange reserves, as well as in the short term the exchange rate is also maintained its stability (Jena & Sethi, 2020).

each country. India before and during pandemic had GDP growth was stagnant at 6 %. Indonesia amounted $ 556,994,900 equivalent to 16% before pandemic, and during pandemic of $-87,276,400 equivalent with -2%. Philippines prepandemic growth was $624,754 equivalent to 15%, and during the pandemic of $344,778 equivalent to -6%. Thailand, Mongolia and Uzbekistan had GDPs of

$167,738 $603,036 and $3,915,301, respectively, or equivalent to 4%, 19% and 33% in the pre-pandemic period and of $193,162 $-248.068 and $-487,390 or equivalent to -5%, - 7% and -3% during the pandemic. The small numbers during the pandemic were caused by macroeconomic activities and disrupted international trade, causing recessions in various countries. However, in general, GDP growth shows an upward trend, meaning that GDP grows very rapidly in times of crisis.

GDP as a method for calculating national income which includes the value

of goods and services in a certain period of time. GDP is a significant determinant of foreign exchange reserves (Ana Maria, 2015; Bosnjak et al., 2019). Strong economic growth will be followed by the accumulation of foreign exchange reserves because national income affects foreign exchange reserves through international trade mechanisms (Astuty, 2020). National income according to Keynes has a negative relationship to foreign exchange reserves. Meanwhile, according to the monetarist approach, national income has a positive influence on foreign exchange reserves.

Figure 4. Foreign Direct Investment (FDI) of Developing Countries in Asia 6 (US$)

Source: International Financial Statistics

(IFS)

FDI growth in each country tends to be stable. Before the pandemic showed a fairly good increase compared to the increase during the pandemic. 12% for India, 10% for Indonesia, 11% for the

Philippines, 16% for Thailand, 12% for Mongolia and 7% for Uzbekistan for seven quarters starting from Q1 2018-Q3 2019. As for the period during the pandemic for five quarters from Q4 2019- Q4 2020 had 6% gains for India, Indonesia and the Philippines 10%, Thailand 18%, Mongolia 5% and Uzbekistan 0%. FDI is a source of income for a country in the form of direct investment. Studies conducted in India show that FDI is one of the factors that can affect the value of foreign exchange

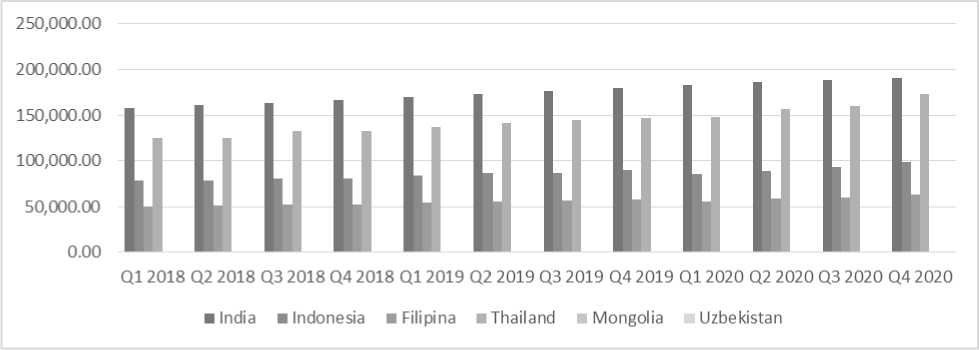

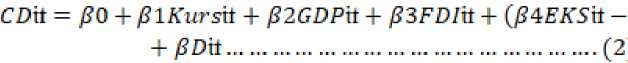

Figure 5. Export, Import, Export Net of Developing Countries in Asia 6 (US$)

Source: International Financial Statistics

(IFS)

reserves, with increasing FDI it can also help maintain liquidity in the event of an economic shock (Suman & Aman, 2021). The relationship between direct investment and foreign exchange reserves is that if direct investment enters a country, it can affect the condition of the country's real sector. The increase in the flow of funds will be accompanied by an increase in foreign exchange because in this case it is one of the sources of country income.

Figure 5 shows the net export data for each country obtained from the difference between exports and imports. The growth of net exports before the pandemic

experienced a more trade deficit than during the Covid-19 pandemic. India and Philippines have high import growth in each quarter resulting in a continuous trade deficit. The largest deficit was in Q3 2018 of $-51,477.00 experienced by India, while the Philippines amounted to $14,551.15, both of which experienced the largest trade deficits in the pre-pandemic period. It is different with Indonesia, Thailand, and Mongolia. Data shows the three countries experienced the highest trade surpluses during the pandemic, namely in Q3 2020 and Q4 2020 of $8,271.00, $10,397.00 and $1,063.00, respectively. Uzbekistan experienced a surplus only once in Q3 2020 of $850.71. The period before the pandemic experienced more trade deficits compared to the period during the pandemic when there was an economic shock. Exports have a positive relationship with foreign exchange reserves. Through export activities will generate a portion of foreign exchange reserves. An increase in exports will improve the performance of the current account surplus and will improve the condition of foreign exchange reserves (Dananjaya et al., 2019; Andriyani et al.,

2020; jalunggono et al., 2020; Natasha & Aminda, 2021). Exports bring in foreign exchange which is then used to pay for imports and the interests of the domestic economic sector. Theoretically, there is a positive correlation between exports and the growth of foreign exchange reserves. If exports decline, foreign exchange reserves will also decrease, and vice versa. The amounts of imports will affect changes in the BOP value which affect foreign exchange reserves. The dependency of imports can reduce trade profits so that it affects the BOP in the long term (Civcir et al., 2021). In the short and long term, imports have no effect on foeign exchange reserves (Laksono & Tarmidi, 2021). This means, if there is an economic crisis in the short term, imports activities will reduce foreign exchange reserves for domestic financing. Theoretically, the more financing for import activities, the balance of payment will be in deficit (Arifin & Juniawaty, 2022).

Based on background that has been explained that foreign exchange reserves are related to international trade. Foreign exchange reserves period before and

during for the period before and during the pandemic are fluctuated. The availability before the pandemic showed an increase but it was not as goood as compared to conditions during the pandemic. the increase in total foreign exchange reserves in India, Indonesia, Philippines, Thailand, Mongolia and Uzbekistan before pandemic was only 1% then during pandemic it was 20%. This is not followed by several influencing factors. The depreciating exchange rate, GDP and FDI which decreased during the pandemic as well as trade fluctuations that occured in each country both in the periode before and during the pandemic. Based on those problems, researchers are interested in studying and analyzing further the factors that affect foeign exchange reserves before and during the covid-19 pandemic.

Various studies that have been conducted state that the elements in the International Balance of Payments (BOP) affect the availability of a country’s foreign exchange reserves (Bosnjak, 2019; Andriyani et al., 2020; Laksono & Tarmidi, 2021; Suman & Aman, 2021). Therefore,

this study uses a grand theory that shows the factors that influence the BOP.

Monetarist Approach to the Balance of Payment Theory (MABP) is an approach that views the BOP as a monetary phenomenon which there is a relationship between balance of payments and money supply. This approach explains the balance of payments with a fixed exchange rate and a floating exchange rate (Oluwole & Oloyede, 2020). The money supply is determined by the availability of foreign exchange reserves and domestic credit. The demand for money is determined by national income, inflation and interest rates. This supply and demand for money makes foreign exchange reserves the dependent variable and forms the basis for a monetarist approach to foreign exchange reserves.

The elasticity approach in the Keynesian Balance of Payment Theory developed by Robinson in 1937 focuses on the elements contained in the balance of payments and the exchange rate. The relationship described in this theory is through the price mechanism where if the exchange rate depreciates it will cause the price of

export goods to increase and eventually an increase in exports. This causes a surplus in the trade balance which in turn can increase foreign exchange reserves. Through this approach, the exchange rate is positively related to foreign exchange reserves. Studies conducted in developing countries show that in the period before the crisis, shocks that occurred in the exchange rate played a small role in changes in foreign exchange reserves, so that after the crisis the central bank intervened to maintain exchange rate stability and avoid depreciation, which in turn could maintain changes in foreign exchange reserves (Chen & Ling, 2019). The mercantilists believed that the state had to do large exports and minimize imports so that the economy of a country was in a state of surplus. In mercantilist theory, the emphasis of international trade is on exports. A country that carries out exports will get results or revenues in the form of foreign exchange or foreign exchange. This foreign exchange reserve will be used to finance obligations and imports to foreign parties (Krugman & Obstfeld, 2018).

RESEARCH METHODS

This study using quarterly data from Q1 2018-Q4 2020 in developing Asian countries namely India, Indonesia, Philippines, Thailand, Mongolia and Uzbekistan. Source of data obtained from the official site International Financial Statistics (IFS). Data obtained is the panel data which is a combination of time series and cross section data (Gujarati, 2012; Widarjono, 2017). The variables used are foreign exchange reserves as the dependent variable, while the independent variables are the exchange rate, GDP, FDI, net exports as well as before and during the covid-19 pandemic as a dummy variable, using panel data regression in which there is variable dummy to see the effect of foreign exchange reserves before and during the crisis due to the covid-19 pandemic.

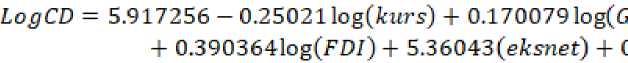

This study uses a transformation of a linear logarithm. The linear logarithm model is a model in which the dependent

variable and the independent variable are transformed into logarithmic form (Gujarati, 2012). Logarithmic transformation is used to avoid bias in the model (Mahmudah, 2019). The model equation of this research is the transformation of equations 1 and 2 as follows:

t = Period time research (Q1

2018-Q4 2020)

RESULTS AND DISCUSSIONS

Results

Panel data analysis results via chow test, hausman test, and lagrange multiplier test for choose the model to be used in research (Widarjono, 2017).

|

LCDti = alLKursh + a2LGDPh^ a3LFDIh+aAEKSNETh^ aSDPERh Table 1. Chow Test Results + μ⅛..........................................K | ||||||

|

Description: LCD = The change of foreign exchange LKURS = The change of exchange |

Effect Test |

Statistics |

Probability | |||

|

Crosssection F |

258,944597 |

0.0000 | ||||

|

Crosssection Chisquare |

223.287573 |

0.0000 | ||||

|

rate LGDP = The change of GDP LFDI = The change of FDI EKSNET = Net Exports DPER = dummy variable period economy conditions; 0 = period before pandemic; 1 = period during pandemic 0 = Constanta α1,α3,...α5 =Coefficient regression µ = Error term i = Country |

Source: Results of data processing using Eviews 9, 2022 Table 1 shows the test result and the Cross-section F value is 99.051727 with a probability of 0.0000. The probability of these results has a value less than 0.10 (α=10%), it can be concluded that H0 is rejected and the best model is Fixed Effect (FEM). Table 2. Hausman Test Results | |||||

|

Test Summary |

Chi-Sq. Statistics |

Prob | ||||

|

Random cross-section |

0.000000 |

1.0000 | ||||

Source: Results of data processing using E- Table 4. Normality Test Results

views 9, 2022

The test results in table 2 can be seen from score probability Chi-Square is 1.0000, the value is greater than 0.10 (α=10%). It can be concluded that the best model is Random Effects (REM).

Table 3. Lagrange Multiplier Test Results

|

Crosssection |

Both | ||

|

Breusch- |

314.5986 |

318.5230 | |

|

Pagan |

(0.0000) |

(0.0000) | |

|

Source: E-Views 9 data processing results, 2022 | |||

Table 3 the value from Breusch-Pagan in the Both column is 0.0000, this value is less than 0.10 (α=10%). It can be concluded that the best model is Random Effect (REM). The three tests have been carried out, the conclusion of the test is that the best model will be used in the study is the Random Effect Model (REM) approach.

Classic Assumption Test

To determine the condition of the data whether there are some problems with the classical assumptions. A good regression is if the model does not find a correlation (Gujarati, 2012).

|

Jarque- Bera |

2.765495 |

|

Probability |

0.250888 |

Source: Results of data processing using EViews 9, 2022

A data is declared normally distributed if the probability value of Jarque-Bera is greater than alpha (Gujarati, 2012). In this study, the alpha used was 5%. Jarque-Bera probability value is 2.765495, the value is greater than 0.10 (α=10%) meaning that the data is normally distributed.

Table 5. Multicollinearity Test Results

|

Variabl e |

LOG(E XCHA NGE) |

LO G(G DP) |

LO GS (FD I) |

EX NE T |

DP ER |

|

LOG(E XCHA NGE) |

1.00000 00 |

0.51 8213 |

-0.6 226 31 |

0.4 039 71 |

0.0 088 03 |

|

LOG(G DP) |

0.51821 3 |

1.00 0000 0 |

0.3 243 62 |

-0.5 546 4 |

0.0 060 29 |

|

LOG(F DI) |

- 0.62263 1 |

0.32 4362 |

1.0 000 000 |

-0.3 531 78 |

0.0 228 18 |

|

EKSNE T |

0.40397 1 |

-0.05 5464 |

-0.3 531 78 |

1.0 000 000 |

0.1 694 48 |

|

DPER |

0.00880 |

0.00 |

0.0 |

0.1 |

1.0 |

|

3 |

6029 |

228 18 |

694 48 |

000 000 |

Variable |

t-Stat |

Prob |

Results | |

|

Exchange rate |

- 2.146353 |

0.0355 |

Significant | ||||||

|

Source: Results of data processing using EViews 9, 2022 Based on the results of the multicollinearity test conducted, it shows | |||||||||

|

GDP |

1.951231 |

0.0553 |

Significant | ||||||

|

FDI |

3.816894 |

0.0003 |

Significant | ||||||

|

EKSNET |

2.952603 |

0.0044 |

Significant | ||||||

|

DPER |

1.719300 |

0.0902 |

Significant | ||||||

that the correlation value of the Source: E-Views 9 data processing results,

2022

independent variable used has a value less

than 0,8 meaning that there is no linear The results in table 6 explain that relationship between the independent partially the exchange rate, GDP, net variables and the model is free from the export FDI and dummy variables are assumption of multicollinearity. significant at 0.10 (α=10%). This means

that the variable exchange rate, GDP, FDI, The next classic assumption test is , , ,

net exports have a significant effect on

heteroscedasticity and autocorrelation test.

foreign exchange reserves and the dummy

This study uses a random effect model

variable for different periods on foreign with the Generalized Least Squares (GLS)

approach so that the test is not continued exchange reserves.

in the heteroscedasticity test because the Table 7. F- Statistic Test

GLS approach is used to cure heteroscedasticity symptoms. Autocorrelation only occurs in time series data so that testing on panel data will be in vain (Nachrowi, 2006).

T-statistic Test

Statistical calculations are said to be significant if the probability value is less than alpha.

Table 6. T-statistic results

|

F- Statistics |

21.56270 |

|

Prob (F- Statistics) |

0.000000 |

Source: E-Views 9 data processing results, 2022

The value of F-statistics in table 7 is 21.56270 with a probability of F-statistics of 0.000000. It can be concluded that the probability value of F-statistics is less than 0.10 (α=10%), meaning that the quantitative independent variable and the dummy variable simultaneously affect the dependent variable.

Coefficient Determination Test (R-

Squared)

Viewed from table 8 the results of the Random Effect Model, the R-Squared value is 0.620283, which means that 62 percent of the dependent variable can be explained by variations in the independent variable. This means that the variables of exchange rate (exchange rate), GDP, FDI, net exports and the period before and during the pandemic used in the model are able to explain the foreign exchange reserve variable by 62 percent and 38 percent of the foreign exchange reserve variable is explained by other factors that are not used. in models.

Analysis Results Panel Data Regression Table 8. Random Effect Model Results

|

Variable |

Coeffici ent |

t-Stat |

Prob |

|

constant |

5.917256 |

4.7451 86 |

0.00 00 |

|

LOG(EXCHAN GE) |

-0.250217 |

- 2.1463 53 |

0.03 55 |

|

LOG(GDP) |

0.170079 |

1.9512 31 |

0.05 53 |

|

LOG(FDI) |

_0. 390364 |

3.8168 94 |

0.00 03 |

|

EXNET |

5.36E-60 |

2.9526 03 |

0.00 44 |

|

DPER |

0.041812 |

1.7193 00 |

0.09 02 |

Source: Results of data processing using EViews 9, 2022

The Random Effect Model in table 8 shows results that all variable independent are significant at 0,10 (α=10%). Table 8 shows the estimation results of the random effect model and the regression coefficient values for each research variable are obtained, namely:

Discussions

The results of data processing that have been carried out show that the results of the exchange rate variable have a positive and significant effect on foreign exchange reserves in developing countries in Asia 6 with a coefficient value of -0.25021. Based on these results, it can be concluded that each exchange rate depreciates by 1 percent, it will reduce foreign exchange reserves with the assumption of ceteris paribus. According to the results obtained are in line with the hypothesis in this study. An appreciating exchange rate will encourage foreign exchange reserves to increase. The results of this study are also in line with research in South Africa which

states that the exchange rate significantly affects foreign exchange reserves in the long term but has no effect in the short term, this study shows that the exchange rate is a significant determinant of foreign exchange reserves in South African countries (Sanusi et al., 2019). In addition, the results of other studies also show that the exchange rate has a significant effect on foreign exchange reserves (Isramaulina Ismaulina, 2021). The results of this study are not in line with research conducted in Indonesia which states that the exchange rate has no effect but significant on foreign exchange reserves (Indriany A.L et al., 2021). Developing country economies use foreign exchange reserves during times of crisis and allow the exchange rate to depreciate (Dominguez et al., 2012). According to the Keynesian Balance of Payment Theory, through an elasticity approach, it states that currency devaluation will improve the trade balance deficit so that the accumulation of foreign exchange reserves will increase.

Processing of data that has been conducted show results that GDP variable has an effect positive and significant to

effect on foreign exchange reserves in developing countries in Asia 6 with a coefficient value of 0.170079. Based on these results, it can be concluded that an increase in GDP by 1 percent will increase foreign exchange reserves with the assumption of ceteris paribus. These results are in accordance with the hypothesis in the study. An increase in GDP will encourage an increase in foreign exchange reserves as well. The results of this study are in line with research conducted in Eswatini which revealed that foreign exchange reserves were driven by GDP as well as government spending (Khomo., et al, 2018). In addition, research conducted in GCC countries also states that GDP is one of the macroeconomic components that affects foreign exchange reserves (Azar & Aboukhodor, 2017), as well as other studies which state that GDP has a significant effect on foreign exchange reserves (Islami & Rizki, 2018; Astuty, 2020).

The results of data processing show that the FDI variable has a positive and significant effect on foreign exchange reserves in developing countries in Asia 6.

With the assumption of ceteris paribus, it can be concluded that an increase in FDI of 1 percent will increase foreign exchange reserves. This result is in accordance with the research hypothesis that FDI has a positive effect on foreign exchange reserves. The increased flow of funds from abroad as a source of state income will be accompanied by an increase in foreign exchange reserves. This research is in line with previous research in India which stated that increasing FDI can help foreign exchange reserves to maintain liquidity in the event of an economic shock (Suman & Aman, 2021). Developing countries with good accumulation of foreign exchange reserves are able to attract foreign investors through FDI because at optimal levels of foreign exchange reserves generate positive movements and growth in technology and current transactions, this is what attracts FDI inflows (Wang, 2019).

The net export variable has a positive and significant effect on foreign exchange reserves in developing Asian countries 6 according to the results of data processing. It can be concluded that an increase in net

exports of 1 percent will increase foreign exchange reserves with the assumption of ceteris paribus. This result is in accordance with the hypothesis of this study which states that net exports have an effect on foreign exchange reserves. This is the same as several previous studies which revealed that net exports are related to foreign exchange reserves (Minhaj & Wahyudi, 2022). Net exports, which are the difference between exports and imports, have an important role in the BOP because exports and imports are an element that measures all international transactions. Net exports have two characteristics, namely negative if imports are worth more than exports, which is called a trade balance deficit, and positive if the value of exports is more, which is also known as a trade balance surplus. So that if net exports are positive, the better it will be in helping to improve the BOP which ultimately increases foreign exchange reserves. The Mercantilist theory also states that the state must export large amounts of imports and minimize imports so that the trade balance is in a surplus, the emphasis in this theory is on exports.

Foreign exchange reserves in the period before and when pandemic different at the level of =10%, it means that there is difference in foreign exchange reserves of 0.41812 with assumption ceteris paribus. The increase that occurred in the prepandemic period was lower but it was also better because the influencing factors were at a value that tends to be stable, while what happened during the pandemic was an increase in foreign exchange reserves which was not accompanied by stability in the influencing factors. This is in line with research on the financial crisis that occurred in 2008 which showed that the accumulation of foreign exchange reserves before the crisis was better than after the crisis (Dominguez et al., 2012).

CONCLUSION

Based on analysis that has been done, it is concluded that the exchange rate, GDP, FDI, and net exports affect foreign exchange reserves. Meanwhile, foreign exchange reserves in the period before and during the pandemic were different or not the same. Exchange rates, GDP, FDI, and net exports affect foreign exchange reserves partially and simultaneously.

Economic stability in developing countries follows global economic conditions, shocks can occur at any time which of course affects the country's economic conditions. The governments of developing countries have to maintain the availability of foreign exchange reserves so that they are always in good condition, in the event of a shock that is severe enough the country can survive with the availability of foreign exchange reserves. Foreign exchange reserves are very important in overcoming the crisis.

REFERENCES

Abbas, S., Nguyen, V. C., Yanfu, Z., & Nguyen, H. T. (2020). The impact of China exchange rate policy on its trading partners: Evidence based on the GVAR model. Journal of Asian Finance, Economics and Business, 7(8), 131–141.

https://doi.org/10.13106/JAFEB.2020 .VOL7.NO8.131

Allegret, J. P., & Allegret, A. (2018). The role of international reserves holding in buffering external shocks. Applied Economics, 50(29), 3128–3147.

https://doi.org/10.1080/00036846.20 17.1418075

Andriyani, K., Marwa, T., Adnan, N., & Muizzuddin, M. (2020). The Determinants of Foreign Exchange Reserves: Evidence from Indonesia. The Journal of Asian Finance, Economics

and Business, 7(11), 629–636.

https://doi.org/10.13106/jafeb.2020.v ol7.no11.629

Arifin, M. Z., & Juniawaty, R. (2022).

Analyzing the influence of Export and Import on the Foreign Exchange Reserves of Indonesia from 1997 to 2018. 1(1), 24– 30.

Astuty, F., Manajemen, P., & Prima, U. (2020). Pengaruh Produk Domestik Bruto , Ekspor Dan Kurs Terhadap Cadangan Devisa Di Indonesia. 4(2), 301–313. https://doi.org/10.29408/jpek.v4i2.29 98

Azar, S. A., & Aboukhodor, W. (2017). Foreign Exchange Reserves and the Macro-economy in the GCC Countries. Accounting and Finance Research, 6(3), 72.

https://doi.org/10.5430/afr.v6n3p72

Blanchard, O., Faruqee, H., Das, M., 2010. The initial impact of the crisis on emerging market countries. Brookings Papers on Economic Activity, Spring, 263–323.

Bosnjak, M. (2019). Determinants Of Foreign Exchange Reserves In Croatia: A Quantile Regression Approach. June.

Chen, S., & Lin, T. (n.d.). Do Exchange Rate Shocks have Asymmetric Effects on Reserve Accumulation? Evidence from Emerging Markets*.

https://doi.org/10.1111/sjoe.12348

Civcir, I., Panshak, Y., & Ozdeser, H.

(2021). A multi-sectoral balance of payments constrained growth

approach with intermediate imports: The case of Nigeria. Structural Change and Economic Dynamics, 56, 240–250.

https://doi.org/10.1016/j.strueco.202 0.12.002

Dhuita, R., Minhaj, H., Wahyudi, I., & Sekuritas, J. (2022). Analysis The Effect of Net Exports and The Rate of Exchange On Indonesia ’ s Foreign Exchange Reserves in 1990-2020. 5(2), 159–168.

Dominguez, K. M. E., Hashimoto, Y., & Ito, T. (2012). International reserves and the global financial crisis. Journal of International Economics, 88(2), 388–406. https://doi.org/10.1016/J.JINTECO.2 012.03.003

Exchange Rates incl. Effective Ex. Rates - IMF Data. (n.d.). Retrieved June 24, 2022, from https://data.imf.org/regular.aspx?key =61545850

External Sector - IMF Data. (n.d.). Retrieved June 20, 2022, from

https://data.imf.org/regular.aspx?ke y=63087879

Finance, A., Review, B., & Oluwole, F. O. (2020). Test of Monetary Approach to Balance of Payments in West Africa Monetary Zone. 4(1), 9–17.

GDP - IMF Data. (n.d.). Retrieved June 24, 2022, from

https://data.imf.org/regular.aspx?ke y=63122827

Gujarati, D. (2012). Dasar-Dasar

Ekonometrika (5th ed.). Salemba Empat.

He, Y. (2017). A Study on the Impact of some Factors on Holdings of Foreign Exchange Reserve in China. American International Journal of Humanities and Social Science, 3(5), 18–28.

International Liquidity - IMF Data. (n.d.).

Retrieved June 24, 2022, from

https://data.imf.org/regular.aspx?ke y=63087882

Islami, H., & Rizki, C. Z. (2017). Pengaruh Suku Bunga, Kurs dan Inflasi terhadap Cadangan Devisa Indonesia. Jurnal Ilmiah Mahasiswa (JIM), 3(1), 1– 15.

Isramaulina, I., & Ismaulina, I. (2021).

Foreign Exchange Reserves And Other Factors Affecting The

Indonesian Economy (Period 20142018). E-Mabis: Jurnal Ekonomi

Manajemen Dan Bisnis, 22(1), 62–70.

https://doi.org/10.29103/e-mabis.v22i1.656

Jena, N. R. (2020). Determinants of foreign exchange reserves in Brazil: An empirical investigation. May.

https://doi.org/10.1002/pa.2216

Khomo M., Mamba N., L. M. (2018). Determinants of foreign exchange reserves in Eswatini: An ARDL approach. African Review of Economics and Finance, 10(2), 134–150.

http://www.separc.co.sz/wp-content/uploads/2018/12/Article-6_Determinants-of-foreign-reserves.pdf

Krugman, P. R., & Obstfeld, M. (n.d.).

International Economics.

Merry Indriany, A. ., Dijirimu, M., Anam, H., Sading, Y., & Rafika, I. (2021). The Determinant Analysis of the Indonesia’s Foreign Exchange

Reserves in 2008 – 2018. Proceedings of the International Conference on Strategic Issues of Economics, Business and, Education (ICoSIEBE 2020),

163(ICoSIEBE 2020), 51–56.

https://doi.org/10.2991/aebmr.k.210 220.010

Moore, W., & Glean, A. (2016). Foreign exchange reserve adequacy and

exogenous shocks. Applied Economics, 48(6), 490–501.

https://doi.org/10.1080/00036846.20 15.1083085

Novalina, A., Pembangunan, U., Budi, P., Rusiadi, R., Pembangunan, U., &

Budi, P. (2019). Keynesian vs Monetaris Approach: Which Model Effectively

Controls Indonesia ' s Economy ?

Keynesian vs Monetaris Approach:

Which Model Effectively Controls Indonesia ' s Economy ? July 2020.

Online, I., & Cetak, I. (2019). Proceeding Seminar Nasional & Call For Papers. 778–790.

Romero, A. M. (2005). Comparative Study : Factors that Affect Foreign Currency Reserves in China and India. The Park Place Economist, XIII(1), 79–88.

Sanusi, K. A., Meyer, D. F., & Hassan, A. S. (2019). An investigation of the determinants of foreign exchange reserves in Southern African

countries. Journal of International

Studies, 12(2), 201–212.

https://doi.org/10.14254/2071-8330.2019/12-2/12

Sayoga, P., & Tan, S. (2017). Analisis

Cadangan Devisa Indonesia dan Faktor-Faktor Yang Mempengaruhinya. Prodi Ekonomi Pembangunan, Fakultas Ekonomi dan Bisnis, Universitas Jambi. 12(1), 25–30.

Suman, B., & Aman, V. (2021).

Determinants of Foreign Exchange

Reserves in India.

Tahun, I. P., Jalunggono, G., Cahyani, Y. T., & Juliprijanto, W. (2020). Pengaruh Ekspor, Impor, dan Kurs Terhadap Cadangan Devisa Abstrak. 22(2), 171– 181.

Trade of Goods - IMF Data. (n.d.). Retrieved June 24, 2022, from

https://data.imf.org/regular.aspx?ke y=63087885

Wang, M. (2019). Foreign Direct Investment and Foreign Reserve Accumulation. Economic Fluctuations Colloquium and Monetary Colloquium, 8, 1–61.

Widarjono, A. (2017). Ekonometrika Pengantar dan Aplikasi.

215

Discussion and feedback