The Impact of Corruption and Money Laundering on Foreign Direct Investment in ASEAN

on

JEKT ♦ 6 [2] : 106 - 111

ISSN : 2301 - 8968

The Impact of Corruption and Money Laundering on Foreign Direct Investment in ASEAN

I Wayan Yasa Nugraha*)

Pusat Pelaporan dan Analisis Transaksi Keuangan (PPATK) Republik Indonesia

ABSTRACT

The purpose of this study is to examine the impact of corruption and money laundering on Foreign Direct Investment (FDI) inflow in ASEAN by using panel data which covers ten years observation (2000–2009) and five cross sections of selected countries i.e. Indonesia, Malaysia, Singapore, Thailand, and Philippines. The model is estimated using ordinary least square method with fixed effect estimation. The result shows that there is a significant positive association between the establishment of Financial Intelligence Unit (FIU) and FDI inflow, while Corruption Perception Index (CPI), as the proxy of corruption, does not significantly affect FDI inflow.

Key words: corruption, money laundering, FDI, panel data analysis

Dampak Korupsi dan Pencucian Uang Pada Penanaman Modal Asing di ASEAN

ABSTRAK

Tujuan penelitian ini adalah untuk menguji dampak dari korupsi dan pencucian uang terhadap aliran Modal Asing (FDI) masuk di ASEAN dengan menggunakan data panel yang mliputi 10 tahun masa observasi (2000-2009) dan cross section dari lima Negara terpilih, yaitu Indonesia, Malaysia, Singapura, Thailand dan Filipina. Model diestimasi dengan menggunakan metode persamaan regresi dan fixed effect. Hasil penelitian menunjukkan bahwa terdapat hubungan yang positif dan signifikan antara pembentukan Financial Intelligence Unit (FIU) dan aliran FDI masuk, sementara Indeks Persepsi Korupsi (CPI), sebagai proksi dari besarnya korupsi, tidak berpengaruh signifikan terhadap aliran FDI yang masuk.

Kata kunci: korupsi, pencucian uang, FDI, analisis data panel

INTRODUCTION

The issues of corruption and money laundering in economic and business decisions have become a prominent topic in economics and finance and among businessmen and policy makers. Uncertainty due to lack of law enforcement in one country could cause unattractiveness for investment, either from the point of view of domestic investor or foreign ones. Jain (2001) argued that corruption seems to affect the level of investment, entrepreneurial incentives, and the design or implementation of rules and regulations regarding access to resources and assets within a country. Besides, pervasive money laundering erodes financial institutions through fraudulent, embezzlement, and corruption which is conducted by corrupt individuals and criminal interest. Such dangers come under the formal heading of operational risk, and can contribute significantly to reputational risks

faced by financial institutions (Bartlett, 2002). The efforts in building the regime of anti-corruption and anti-money-laundering would lead to minimization of the country risk in terms of investment.

According to Corruption Perception Index (CPI) 2000–2009 most of ASEAN countries were evaluated with score less than 5.0, except Singapore with the score 9.2. However, statistic shows a positive trend of ASEAN countries’ CPI during the above-mentioned period. In addition, based on the List of Members of Egmont Group1 as of year 2009, there have been five Financial Intelligence Unit (FIU)2 of ASEAN countries registered in the association. These two facts might indicate that there are awareness among the governments and societies in the region about the

vulnerability of corruption and money laundering, as well as efforts to build global trust towards the good investment climate.

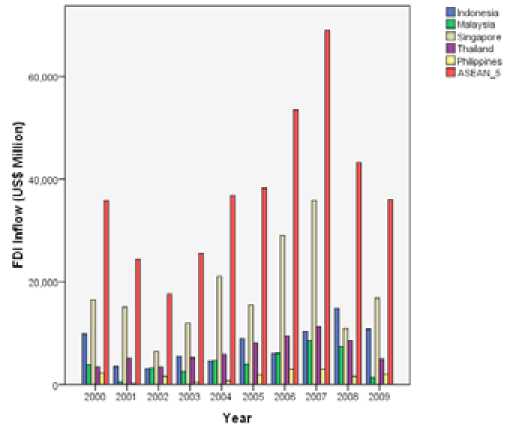

Figure 1. Statistics of FDI Inflow in ASEAN, 2000

2009

Source: OECD Data and Statistics, 2010.

While the effort in building the regime of anticorruption and anti-money laundering is in progress, the governments in Southeast Asia are actively promoting the countries to attract FDI as it has been one of important contributor for economic growth considering that most of the countries are still developing. The Statistics of FDI Inflow in ASEAN as described by Figure 1 shows positive trend in general, especially during the year of 2002-2007. The declining trend in 2008 and 2009 is presumed to be the impact of global economic crisis. In glance the increasing value of FDI Inflow in ASEAN is line with the improvement in law enforcement.

The objective of this study is to examine the impact of corruption and money laundering on FDI in ASEAN, using panel data on five major ASEAN countries and covering period of 2000–2009. The paper is next organized as follows: section two reviews the theoretical literature on FDI, corruption, and money laundering. The data and methodology are discussed in section three, while the results of estimation and their interpretations are presented in section four. Finally, section five provides the conclusion.

Foreign Direct Investment

According to the UNCTAD (1999), FDI can complement local development efforts by: (a) increasing financial resources for development; (b) boosting export competitiveness; (c) generating

employment and strengthening the skills base; (d) protecting the environment and social responsibility; and (e) enhancing techno-logical capabilities (transfer, diffusion and generation of technology). For those reasons, many governments are concerned with this issue by creating good climate investment in their countries, including establishing necessary regulatory framework.

UNCTAD (2006) distinguished four motives of FDI, they are; market-seeking, efficiency-seeking, resourceseeking, and created asset-seeking. Nevertheless, law certainty would be another contributing factor.

Corruption and Its Relationship with FDI

Transparency International defined corruption as the abuse of public office for private gain. This, in point of fact, means that the decisions are taken to serve private interests, rather than for the public needs. However, there are some opposite arguments whether or not corruption negatively affects FDI inflow.

Understanding the pernicious role of corruption in FDI is important considering the fact that corruption produces bottlenecks, heightens uncertainty, and raises costs. Furthermore, corruption creates distortions by providing some companies preferential access to profitable markets (Habib & Zurawicki, 2002).

Drabek and Payne (1999) tested how FDI is affected by non-transparency, a composite of corruption, unstable economic policies, weak and poor property rights protection, and poor governance. Results indicated the negative impact of high levels of nontransparency on FDI. Wei (2000) analyzed data on FDI in the early 1990s from twelve source countries to forty five host countries. It is shown that corruption give significant and negative effect on FDI. Mauro (1995) found that corruption significantly, both in a statistical and an economic sense, lower private investment, thereby reducing economic growth. Another important research conducted by Habib and Zurawicki (2002), in which they assessed the impact of corruption on FDI, and it is found that there is a significant negative relationship between the two.

Meanwhile, Hines (1995) examined four dimensions of the behaviour of US firms after the enactment of Foreign Corrupt Practices Act 1977, and found a non-significant effect of the law on foreign business operations (FDI) in corrupt countries. Besides, Wheeler and Mody (1992) did not detect a significant negative relationship between FDI and the host country risk factor, a composite measure including corruption. Furthermore, Busse et al (1996) looked at the relationship between FDI and the level of

corruption exposed by the local media. Reviewing the inconsistent results pertaining to different countries, they hypothesized that FDI increases when investors believe that the government would curb corruption. Alternatively, FDI will decrease with media exposure, should investors assume that the government is unwilling to improve the environment.

Money Laundering and Its Relation with FDI

The first official definition of money laundering was stipulated in the United Nation’s Convention Against illicit Traffic in Narcotic Drugs and Psychotropic Substance (commonly known as the 1988 Vienna Convention), and it has been referred by many countries in drafting anti-money laundering laws3. Additionally, McDonell4 (1998) defined money laundering as the process of converting cash, or other property which is derived from criminal activity, so as to give it the appearance of having been obtained from a legitimate source.

McDowell and Novis (2001) described the economic effects of money laundering: (a) undermining the legitimate private sector; (b) undermining the integrity of financial market; (c) causing loss of control in economic policy; causing economic distortion and instability; (d) causing loss of revenue; (e) increasing risk to privatization efforts; and (f) causing reputation risk. The last one is very much relevant to this study. In terms of global economy, none of nations would afford to have their reputations and financial institutions tarnished by any association with money laundering. As one country is deemed high risk and unattractive, foreign investors would be reluctant running the business in the territory.

Based on the explanation above, the rationale of money laundering and FDI should be a negative relationship. However, there was an interesting research carried out by Brada et al (2010) where they estimated that 10% of total FDI outflows and over half of FDI to money-laundering countries were made to facilitate illicit money flows.

DATA AND METHODOLOGY

Model Specification

The econometric model of this paper is presented in the following equation:

logFDIit = βo+β1logGDPit- β2INFit + β3logEXit

-

- β4Rit + β5logLABit+ β6OPit +

-

β7CPIit + β8DFIUit + εt

Where:

FDIit : Foreign Direct Investment;

GDPit : Gross Domestic Product as the proxy of market size;

INFit : Inflation;

EXit : Exchange Rate;

Rit : Interest Rate;

LABit : Labour Force;

OPit : Degree of Openness;

CPIit : Corruption Perception Index; and

DFIUit: Dummy of Financial Intelligence Unit, value of 1 is for the observations in which FIU exists while value of 0 is for the ones where FIU has not yet exist.

Estimation of the model above is run by Eviews 6 using fixed effects and ordinary least square method. Fixed effects estimation is used only, instead of also using random effects (RE) estimation, because RE requires more number of cross sections than number of coefficients. Besides, it is assumed that unobserved effect to be uncorrelated with explanatory variables in each time period.

Data and Variables Definitions

This paper applies panel data which covers ten years observations (2000–2009) and five cross sections (ASEAN Countries). The five ASEAN countries are determined by referring to the operational existence and effectiveness of FIU in the region. According to Egmont Group there are only five FIUs in ASEAN which have been accepted as the member of Egmont Group in 2009, they are:

-

1) . Indonesia: Indonesian Financial Transaction Reports and Analysis Centre (INTRAC), accepted as the member of Egmont Group in June 2004;

-

2) . Malaysia: Unit Perisikan Kewangan, Bank Negara Malaysia, accepted as the member of Egmont Group in July 2003;

-

3) . Singapore: Suspicious Transaction Reporting Office (STRO), accepted as the member of Egmont Group in June 2002;

-

4) . Thailand: Anti-Money Laundering Office (AMLO), accepted as the member of Egmont Group in June 2001;

-

5) . Philippines: Anti Money Laundering Council

(AMLC), accepted as the member of Egmont Group in June 2005.

We assumes that an FIU is considered effective if it already becomes the part of Egmont Group as it allows them to transfer information, concerning money laundering, corruption and related offences, with other FIUs across borders. Therefore, the cross sections are limited to Indonesia, Malaysia, Singapore, Thailand, and Philippines.

The data is extracted from various sources i.e. International Monetary Funds’ International Financial Statistics, World Bank’s Data, United Nations Conference on Trade and Development’s Statistics, FDI Statistics of Investment Coordinating Board, Transparency International’s Corruption Perception Index, and The Egmont Group’s List of Members.

The variables analyzed in this paper are as follows: Dependent Variable:

Foreign Direct Investment (FDI). FDI is the annual inflow of foreign capital to ASEAN (host) countries. The FDI data is collected from International Monetary Funds’ International Financial Statistics and Indonesia Coordinating Investment Board’s Publications and Statistics.

Independent Variables:

-

1) Corruption Perception Index (CPI)

Transparency International’s CPI is the proxy for a country’s corruption level. The higher CPI score of one country would mean the lower level of corruption, and it is paralleled to the safer business climate. Thus, it is expected that a high CPI score would attract more FDI in the country. The data of CPI are obtained from Transparency International’s CPI Report 2000-2009.

-

2) Financial Intelligence Unit (FIU)

FIU is the focal point of anti-money laundering regime in any countries, including ASEAN’s. The presence of FIU in the designated ASEAN countries is included as dummy variable in this study. It is expected that the existence of FIU will improve the investment climate, which then raise FDI.

Control Variables:

-

1) Market size

Market size is considered as an essential factor for FDI attraction, especially for market-seeking investment. Market size is approximated by gross domestic product (GDP). Vogiatzoglou (2008) argued that a large domestic market is expected to attract more FDI because of bigger possibilities in production and consumption. The data of GDP is taken from World Bank’s Data.

-

2) Inflation

Inflation reflects a country’s macroeconomic stability and it becomes important consideration for

FDI. A high inflation rate indicates the instability of macroeconomic. Thus, inflation is expected to be negatively correlated with FDI. The data of inflation were collected from World Bank’s Data.

-

3) Exchange rate

A variable measuring the fluctuation of the national currency to the U.S. dollar is included as a proxy for exchange rate stability. A country with an unstable currency tends to pose more risk and uncertainty and thus be less attractive. Therefore, it is expected that exchange rate stability is positively related to FDI. The data of exchange rate is obtained from United Nations Conference on Trade and Development’s Statistics.

-

4) Interest rate

The high volatility of interest rate in one country may cause the reduction of FDI inflow. The data of interest rate is taken from World Bank’s Data.

-

5) Labour Force

The number of labour force is significant factor of FDI attraction, especially for the cost minimizing motive. It is estimated that there is positive effect of labour force on FDI. The data of labour force is extracted from United Nations Conference on Trade and Development’s Statistics.

-

6) Degree of openness

Vogiatzoglou (2008) approximated the degree of openness by the following openness index: opt - XD 1Mit , where Xit, Mit, and GDPit respectively refer to totiat l exports, total imports, and gross domestic product of ASEAN countries in the period of 2000–2009. It is expected that the degree of openness would give positive effect on FDI. The data of total exports and total imports is taken from International Monetary Funds’ International Financial Statistics.

RESULTS AND DISCUSSION

Table 1 provides the estimation results regarding the determinants of FDI Inflow in ASEAN. Since the focus of this study is the impact of corruption and money laundering on FDI Inflow, the discussion will mainly interpret the two subjects.

Overall, variation of Log FDI Inflow in ASEAN can be explained 89.62% by all independent variables as shown by the value of R2. The high value of R2 indicates the goodness of the model. From the independent variables, only FIU is estimated to be significant at 5% level, while CPI is not significant in determining FDI Inflow in ASEAN.

The significant estimation of FIU in relation with FDI Inflow in ASEAN can be interpreted as an improvement made by the governments in the region in building the anti-money laundering regime and also

Table 1. The Estimation Results: Determinants of FDI Inflow in ASEAN

Dependent Variable: LOG_FDI?

Method: Pooled EGLS (Cross-section SUR)

Date: 04/30/11 Time: 10:41

Sample: 2000 2000

Included observations: 10

Cross-sections included: 5

Total pool (balanced) observations: 50

Linear estimation after one-step weighting matrix

|

Variable |

Coefficient |

Ξtd. Error |

LStatistic |

Prob. |

|

C |

1 8.1 6293 |

11.61465 |

1.563794 |

0.1264 |

|

LOG GDP? |

0.495091 |

0.389100 |

1.272399 |

0.2112 |

|

INF? |

-0.01 9041 |

0.007931 |

-2.400735 |

0.0215 |

|

LOG EX? |

-0.91 8404 |

0.812482 |

-1.1 30369 |

0.2656 |

|

R? |

-0.034670 |

0.005169 |

-6.707467 |

0.0000 |

|

LOG LAB? |

-1.692352 |

2.018861 |

-0.838271 |

0.4073 |

|

OP? |

-0.005995 |

0.014095 |

-0.425331 |

0.6731 |

|

CPI? |

-0.0031 63 |

0.1 17723 |

-0.026867 |

0.9787 |

|

FIU? |

0.145293 |

0.061734 |

2.35351 5 |

0.0240 |

|

Fixed Effects (Cross) | ||||

|

Indonesia-C |

3.453657 | |||

|

mal⅛ysia-c |

-1.637233 | |||

|

SINGAPORE-C |

-2.367832 | |||

|

thailand-c |

0.389432 | |||

|

PHILIPPINES-C |

0.161977 |

Effects Specification

Cross-section fixed (dummy variables)

|

Weighted Statistics | |||

|

R-squared Adjusted R-squared S.E. Ofregression F-statistic Prob(F-Statistic) |

0.8961 85 0.862516 1.069403 26.61700 0.000000 |

Mean dependent var S.D. dependent var Sum squared resid Durbin-Watson stat |

87.1 5221 45.07521 42.31401 2.321936 |

|

Unweighted Statistics | |||

|

R-squared Sum squared resid |

0.8481 30 1.569092 |

Mean dependent var Durbin-Watson stat |

9.689923 2.343689 |

Source: Authors’ estimation result using Eviews 6.

reducing the reputation risk as a part of the efforts in creating good climate investment.

Meanwhile, the non-significant result of CPI on FDI Inflow in ASEAN might indicate that the perception of corruption is not considerably an obstacle for foreign-investors to run business activities in SouthEast Asia. This might also indicate that the main motive of FDI Inflow in ASEAN is resource-seeking one, considering that massive natural resources are available in the regions, especially in Indonesia, Malaysia, and Thailand. This result is in line with the study conducted by Wheeler and Mody (1992) and Busse et al. (1996).

CONCLUSION

The purpose of this study is to examine the impact of corruption and money laundering (as independent variables) on FDI Inflow in ASEAN (as dependent variable) by using panel data which covers ten years observations (2000–2009) and five cross sections of

selected countries i.e. Indonesia, Malaysia, Singapore, Thailand, and Philippines. The model includes some control variables i.e. market size, inflation, exchange rate, interest rate, labour force, and degree of openness. The model is estimated using ordinary least square method with fixed effect estimation. The result shows that there is a significant positive association between the establishment of FIU and FDI Inflow, while CPI as the proxy of corruption does not significantly affect FDI Inflow.

ACKNOWLEDGEMENT

We would like to thank all Economic Forum Group Discussion (EFGD) participants for valuable comments and Romi, Zulfa, Vica, and Anisha Wirasti C who provided superb research assistance.

REFERENCES

Badan Koordinator Penanaman Modal [Indonesia Coordinating Investment Board]. Publications and Statistics. Available online at http://www.bkpm.go.id/contents/p16/ publications-statistics/17, accessed on February 26, 2011.

Barlett, B.L., 2002. “The Negative Effects of Money Laundering on Economic Development”. Manila: Asian Development Bank. Available at: http://www.adb.org/ documents/others/ogc-toolkits/anti-money-laundering/ documents/money_laundering_neg_effects.pdf, accessed on February 5, 2011.

Brada, J.C., et al., 2010. “Illicit Money Flows as Motives for FDI: Evidence from a Sample of Transition Economies”. Available online at: http://sitemaker.umich.edu/ipc-enforcement-confrence/files/perez-ilicit-capital-fdi.pdf, accessed on December 4, 2010.

Busse, L., et al., 1996. “The Perception of Corruption: A Market Discipline Approach”. Working Paper. Atlanta: Emory University.

Drabek, Z., and W. Payne, 1999. “The Impact of Transparency on Foreign Direct Investment”. Staff Working Paper ERAD-99-02. Geneva: World Trade Organization.

Habib, M., and L. Zurawicki, 2002. “Corruption and Foreign Direct Investment”. Journal of International Business Studies, 33 (2), 291-307.

Hines, J., 1995. “Forbidden Payments: Foreign Bribery and American Business After 1977”. Working Paper 5266. Cambridge: National Bureau of Economic Research.

International Monetary Funds. International Financial Statistics. Available online at http://www.imfstatistics.org/ imf/, accessed on February 26, 2011.

Jain, A.K., 2001. “Corruption: A Review”. Journal of Economic Surveys, 15 (1).

Lall, S., 1997. “Attracting foreign investment: new trends, sources and policies”. Economic Paper, 31.

Mauro, P., 1995. “Corruption and Growth”. Quarterly Journal of Economics, 110 (3), 681-712.

McDonell, R., 1998. “Money Laundering Methodologies And International and Regional Counter-Measures”. Available online at http://www.aic.gov.au/events/aic%20 upcoming%20events/1998/~/media/conferences/gam-bling/mcdonnell.ashx, accessed on February 12, 2011.

McDowell, J., and G. Novis, 2001. “The Consequence of Money

Laundering and Financial Crime”. Economic Perspective. OECD.org, 2010. Post-Crisis FDI Inflow to ASEAN.Available online at http://www.oecd.org/dataoecd/2/23/46485385. pdf, accessed on January 28, 2011.

The Egmont Group of Financial Intelligence Unit. List of Members of Egmont Group in Asia. Available online at http://www.egmontgroup.org/about/list-of-members/ by-region/asia, accessed on January 28, 2011.

Transparency International. Corruption Perception Index. Available online at www.transparency.org, accessed on January 28, 2011.

United Nation. Convention Against illicit Traffic in Narcotic Drugs and Psychotropic Substance. Available online at http://www.unodc.org/pdf/convention_1988_en.pdf, accessed on March 5, 2011.

United Nations Conference on Trade and Development. Online Statistics. Available online at http://unctadstat. unctad.org/ReportFolders/reportFolders.aspx?sRF_ ActivePath=P,5,27&sRF_Expanded=,P,5,27&sCS_ ChosenLang=en, accessed on March 4, 2011

UNCTAD, 1999. World Investment Report 1999: Foreign Direct Investment and the Challenge of Development. New York: United Nations Publication.

UNCTAD, 1999. World Investment Report 2006: Foreign Direct Investment for Developing and Transition Economies. New York: United Nations Publication.

Vogiatzoglou, K., 2008. “The Triad in Southeast Asia: What Determines U.S., EU and Japanese FDI within AFTA?” ASEAN Economic Bulletin, 25 (2), 140-160.

Wei, S.J., 2000. “How Taxing is Corruption on International Investors?” The Review of Economics and Statistics, 82 (4): 1-12.

Wheeler, D., and A. Mody, 1992. “International Investment Location Decisions: The Case of U.S. Firms”. Journal of International Economics, 33, 57-76.

Wooldridge, J.M., 2009. Introductory Economics: A Modern Approach. 4th ed. South-Western: Cengage Learning.

World Bank. Online Data and Statistics. Available online at http://data.worldbank.org/indicator, accessed on March 4, 2011.

111

Discussion and feedback