Predictors for Dividen Policy of Non-financial Corporations on the Indonesia Stock Exchange: OLS Method

on

JEKT ♦ 8 [2] : 142 - 154

ISSN : 2301 - 8968

Predictors for Dividen Policy of Non-financial Corporations on the Indonesia Stock Exchange: OLS Method

Agus S. Irfani*)

Program Studi Manajemen Fakultas Ekonomi dan Bisnis Universitas Pancasila

ABSTRACT

Number of previous studies in a variety of capital markets documenting that dividend policy was influenced by many variables including financial performance and firm size variables. However, these studies were still not provide consistent findings about the ability of the independent variables in predicting the dividend policy. The main objective of this study was to examine the effect of financial performance and firm size on dividend policy. The sample was set by adopting purposive sampling technique to have 50 companies of 390 non-financial companies listed on the Indonesia Stock Exchange that was regularly paying dividend during the period of 2010-2012. The hypothesis testing was conducted by emplyoing multiple linear regression technique. This study concluded that not all of the financial performance indicators shown to affect dividend payout ratio. Profitability dan firm size proved to have ability in explaining dividend payout ratio, but this study did not find any evidence that dividend payout ratio was affected by firm’s liquidity and solvability.

Key words: liquidity, solvability, profitability, firm size, dividend payout ratio.

Variabel-Variabel Penduga Kebijakan Dividen Perusahaan Non-Keuangan di Bursa Efek Indonesia: Metode OLS

ABSTRAK

Sejumlah penelitian terdahulu di berbagai pasar modal mendokumentasikan bahwa kebijakan dividen dipengaruhi oleh banyak variabel termasuk kinerja keuangan dan variabel ukuran perusahaan. Namun, berbagai penelitian ini masih belum memberikan hasil yang konsisten tentang kemampuan variabel bebas dalam memprediksi kebijakan dividen. Tujuan utama dari penelitian ini adalah untuk menguji pengaruh kinerja keuangan dan ukuran perusahaan terhadap kebijakan dividen. Sampel ditetapkan dengan mengadopsi teknik purposive sampling memiliki 50 perusahaan dari 390 perusahaan non-keuangan yang terdaftar di Bursa Efek Indonesia yang membayar dividen secara teratur dan berturut-turut selama periode 2010-2012. Pengujian hipotesis dilakukan dengan teknik regresi linear berganda. Penelitian ini menyimpulkan bahwa tidak semua indikator kinerja keuangan yang diteliti memengaruhi rasio pembayaran dividen. Profitabilitas dan ukuran perusahaan terbukti memiliki kemampuan dalam menjelaskan rasio pembayaran dividen, tetapi penelitian ini tidak menemukan bukti bahwa rasio pembayaran dividen dipengaruhi oleh likuiditas perusahaan dan solvabilitas.

Kata kunci: likuiditas, solvabilitas, profitabilitas, ukuran perusahaan, rasio pembayaran dividen.

BACKGROUND

The main objective of investors in investing their fund in stocks on the stock market is to obtain return over a number of funds invested. On the other hand, investors should be willing to bear the potential risks, both market risk that is triggered by the turmoil

of macro conditions and business risk caused by fluctuations in the price of the relevant shares in trading activity on the stock market (Brealey, et al., 2008). The investment’s return include dividends, capital gains, and the possibility of obtaining the bonus shares were sourced from share premium to the initial public offering (Darmadji and Fakhruddin,

2011). Referring to Skinner (2008), stock return in the form of capital gain is much more risky than dividends, because capital gain is strongly influenced by market volatility and the share price fluctuations on the stock exchange. Haugen (2010) supports to the notion of Skinner (2008) by distinguishing between types of investor and investment patterns based on the expected return orientation. There is a type of dividend-oriented investor and there is also a type of capital gains-oriented investor. The dividend-oriented investor has a pattern of longterm investments, so they tend to be less active in conducting transactions on the stock because they expect a stable income periodically. While, the capital gains-oriented investor has a pattern of trading, profit taking, and short-term speculation follows the ups and downs of the stock price movement based on the market mechanism. This dividend-oriented investor is very active in the shares trading by buying shares when prices are low and quickly sell them when the prices rise.

Levy and Sarnat (2006) suggested that the orientation of the dividend has motivated investors to pick stocks of companies that have a large stock capitalization and have good financial performances. The argument is that such firms to ensure certainty relative advantages and ability to pay dividends each year. In line with the opinion of Levy and Sarnat (2006), Lewellen (2004) also documented the synthesis of a number of previous research findings in a variety of world capital markets that the company’s ability to pay dividends to have a heuristic relationship with the size of the company’s assets and the company’s financial performance on a periodic basis. In other words, the company’s size of assets and financial performance are capable to predict the dividend policy.

However, the facts on the Indonesia stock exchange indicate that company size has not always a positive effect on dividend policy. Irfani (2012a, 2012b, and 2012c) suggests evidences that in the last quarter of 2012 there were a number of issuers of State-Owned Enterprises in the mining and banking sectors that have great assets but lower dividend payout ratio (DPR), thereby disappointing investors. In the same period was also found that many large capitalization issuers that delay and even did not pay a dividend. Referring to the empirical facts, it is necessary to study the implications of firm size on dividend policy.

Skinner (2008) and Jones (2009) concurred with Lewellen (2004) in terms of the logical relationship between financial performance and dividend policy, but the category of financial performance which are

thought to influence the dividend policy is necessary to empirically test. The principle can be maintained is that the dividend-oriented investors undoubtedly and selectively choosing the companies issuing stocks that have good financial prospects in the long term.

In line with this issue, a number of previous studies have tested the performance of a number of financial ratios that vary as a predictor of dividend payout ratio (DPR). Chang and Rhee (1990) uses profit growth, earnings variability, firm size, and profitability variables to predict dividend payout ratio (DPR) and found that the variability of earnings, firm size, and profitability have a significant positive effect on the dividend payout ratio. This finding was supported by Fama and French (2000) who also found that the profitability significantly and positively affect dividend payout ratio.

Amidu and Abor (2006) predict the dividend payout ratio of public companies on the stock market by using profitability, cash flow, tax, risk, growth, institutional holding, MBV (market to book value) as the independent variables. The study found evidence that profitability, cash flow, and tax have a significant positive effect on the dividend payout ratio, while the risk, growth, institutional holdings, and MBV have a significant negative effect on dividend payout ratio. Research done by Anil and Kapoor (2008) in the Indian capital market employed the same independent variables, but these studies produce different findings. They found that only cash flow proven to have a significant effect on the dividend payout ratio, while the other predictors are not shown to have an influence on dividend payout ratio.

Similar research has also been conducted on the Indonesia capital market by Suharli (2007), Puspita (2009), and Subrata (2012) which use indicators consist of liquidity ratios, leverage, and profitability, among others, cash ratio, growth, firm size, return on assets (ROA), debt to total assets (DTA), and debt-to-equity ratio (DER) to predict the dividend payout ratio. However, the findings generated by these studies vary widely and are inconsistent to each other. Suharli (2007) find that the dividend policy proved to be only influenced by profitability, while liquidity is just as moderating variable that do not directly affect the dividend payout ratio. The research findings of Puspita (2009) show that liquidity, profitability, and company size has a significant positive effect on dividend payout ratio, while the leverage ratios are not shown to affect the dividend payout ratio. Subrata (2012) found that the dividend payout ratio is influenced by the growth and the size of the company rather than liquidity, leverage, and

profitability. Amidu and Abor (2006) found evidence that profitability, cash flow, tax have a significant positive effect on the dividend payout ratio, while the risk, growth, institutional holdings, and MBV have a significant negative effect on dividend payout ratio.

Based on the inconsistent findings of the previous studies on the influence of financial performance on the dividend policy, this study tries to confirm the results of those previous research by empirically testing the implications of the financial performance variables on the dimensions of liquidity, leverage, and profitability, as well as the firm size on dividend payout ratio (DPR) of the public companies on the Indonesia Stock Exchange.

Research Problem

Referring to Lewellen(2004), Skinner(2008), and Jones(2009), empirically documented a logical relationship between the financial performances of the company and the ability of the company to distribute dividends to shareholders. The problem is that there is a research gap in the previous studies which is characterized by the occurrence of inconsistency of research findings. Each of these studies found various indications of financial performance effect on the dividend payout ratio.

Chang and Rhee (1990) and Puspita (2009) found the variability of earnings, firm size, liquidity, and profitability have a significant positive effect on the dividend payout ratio, but Fama and French (2000) and Suharli (2007) found that only the profitability proven to have a significant positive effect on dividend policy. Amidu and Abor (2006) found evidence that profitability, cash flow, and tax have a significant positive effect on the dividend payout ratio, but Anil and Kapoor (2008) found that only cash flow proven to have a significant effect on the dividend payout ratio, while the other predictors are not shown to have an influence on dividend payout ratio.

Having briefly, based upon these thoughts, the research problem is formulated as “how is the influence of liquidity, leverage, profitability, and firm size on the dividend payout ratio (DPR) of the nonfinancial companies listed on the Indonesia Stock Exchange (IDX) during the period of 2010 to 2012?”

Literature Review

Dividend Theory. Brigham and Houston (2010) mentions three theories of investors’ preference on dividend, those are dividend irrelevance theory, bird in the hand theory, and the tax preference theory. Dividend Irrelevance Theory is a theory which states that dividend policy has no effect, either

on the value of the company as well as the cost of capital. Modigliani and Miller (M&M) in Brigham and Houston (2010) state that the dividend payout ratio is not relevant, because a company’s value is not determined by the size of the dividend payout ratio (DPR) but is determined by the net profit before tax (EBIT) and business risk. M&M argued that the value of the company depends on the income generated by the assets, rather than on how revenues are divided between dividends and retained earnings.

Arifin (2005) suggested that the theory advanced by M&M dividend does not correspond to reality in the capital market, because the reality in the United States, half of the company’s net profits distributed as dividends. The weakness of this theory is that the dividend model built by M&M is based on the assumption of the absence of asymmetric information problems between corporate managers and shareholders. Yet the facts on the ground indicate that the assumptions are difficult to justify.

The bird in the hand theory states that dividends have a higher degree of certainty than capital gains (Brigham and Houston, 2010). Due to the level of certainty of higher dividends than capital gains, investors will tend to buy stocks that pay dividends. The higher the dividend, the higher the investors’ interest in the company’s stock, which will lead to rising stock prices. Relating with the bird in the hand theory by Modigliani and Miller in Brealy and Myers (2011) and Gordon and Litner in Saxena (1995) assume that investors look at a bird in the hand is worth more than a thousand birds in the air. While Modigliani and Miller in Brealy and Myers (2011) argues that not all interested investors to reinvest their dividends in the same company with the same risk. Therefore, the risk level of their income in the future rather than determined by the dividend payout ratio but is determined by the level of new investment risk.

Refering to Brigham and Houston (2010), tax preference theory is a theory which states that because of the tax on dividends and capital gains, the investors prefer capital gains because it can delay the payment of tax. If capital gains taxed at a rate lower than the tax on dividends, the stocks that have high growth becomes more attractive. But otherwise if the capital gains are taxed the same as income on dividends, capital gains, the profit is reduced. However, the tax on dividends as a new tax on capital gains is paid after the shares are sold, while the tax rate on dividends to be paid every year after the payment of dividends. Litzenberger and Ramaswamy in Saxena, 1999 state that the investment period also affects investors’ income. If

investors buy shares only for one year period, then there is no difference between the tax on capital gains and the tax on dividends. So investors will ask for the rate of profit after tax higher on stocks that have high dividend yields than stocks with low dividend yield. Therefore, this theory suggests that the company should determine the dividend payout ratio is low or no dividends.

Dividend Policy. Dividend policy is applied to reduce agency costs, larger dividend payments will increase the chance to get additional funding from external sources (Crutchley and Hansen in Chasanah 2008). According to Brigham and Houston (2010) there are two other theories that can help to understand the dividend policy is. The theories are signaling hypothesis and the clientele effect.

Finance literature has offered various explanations for why companies pay dividends. One explanation why the company paying the dividends is for signaling theory of dividends as an explanation that dominates and has produced a large amount of empirical work in the field over the field of dividends. Refering to the signaling model of dividend, the managers know more about the company than the actual investors and dividends are used to convey information that is not known by the market (Li & Zhung, 2010).

The theoretical model of signal has been formulated to explain how managerial activities strive to reduce the information asymmetry between shareholders and managers. Frankfurter, et al., (2003) sates that there are a number of signaling theoretical model has been developed by previous researchers, such a repurchase of shares (Barclay and Smith, 1988), the proportion of ownership (Leland and Pyle, 1977), capital structure (Ross, 1977), the conversion of convertible bonds (Harris and Raviv, 1985), insider trading (Damodaran and Liu, 1993), and models with multiple signals of insider trading activities going on around the activities of other companies signal (John and Mishra, 1990; John and Lang, 1991).

Referring to Brealy and Myers (2011), the clientele effect theory was first proposed by Black and Scholes (1974) which holds that dividend policy is intended to meet the needs of a particular segment of investors who have their own preference on return. In other words, different shareholders will have different preferences on dividend policy of the company. Companies that have a high dividend payout ratio will attract investors who prefer a return in the form of cash with exact nominal amount. While investors who want to avoid taxes and more like a return in the form of capital gains will choose the company whose stock price increases. So, the company has a specific

dividend policy for particular investor.

Investors invest their capital in the stock market certainly expect a maximum return in the form of dividends and capital gains. Differences in investor interest in addressing the expected return will certainly be an important consideration for the management of the company to increase the value of the company that is reflected in the stock price and dividend policy. Brigham and Houston (2010) revealed that when deciding how much cash to be distributed, financial managers must remember that the purpose of the company is to maximize shareholder value. Consequently, the target payout ratio should be based on the majority of investor preference for dividends over capital gains.

Investors who want a long term income should own shares in companies that give high dividends, while short-term investors do not need to own shares in companies that provide low dividend. According to Brigham & Houston (2010) some studies show that there are effects of clienteles already said by Miller & Modigliani (1961) and others, so that the effect of the presence of the client does not always mean that the dividend policy is better than the other. However, Miller & Modigliani might be wrong, if the investors in the company can be considered neglect the effect of clienteles.

The difference in views on dividend policy make a difference anyway investors have in addressing the dividend payout ratio. Such differences spawned several groups including groups like companies that pay high dividends and groups like companies that pay low dividends and these groups are called clienteles (Ross, et al., 2010). Effects clienteles according to Ross, et al., (2010) is the fact that in the observation that certain groups based on the stock attractive dividend income and tax effects. Dividend irrelevance theory assumes that the company will not have to pay dividends but the fact that dividend to boost share prices. Dividends can push the stock price if there are clienteles and along the the high dividends payment’s company can meet the needs of investors.

Factors affecting Dividend. Brigham and Houston (2010) discloses a number of factors that affect dividend policy, among which is a constraint on the distribution of dividends, investment opportunities, availability and cost of alternative sources of capital, and the cost of equity capital. Empirically the previous investigators examine some of the factors that are believed to affect dividend policy varies. Sugiharti and Taqdir (2011) examined the factors that influence the dividend policy on manufacturing

companies listed on the Stock Exchange. The dependent variable used in the study is the debt-to-equity ratio (DER), dividend per share (DPS), return on equity (ROE), return on assets (ROA) and earnings per share (EPS). The results showed that the DPS and EPS significantly influence dividend payout ratio, while ROE, ROA, and EPS does not significantly influence the dividend payout ratio.

Wahana (2012) who studied the effect of earnings per share, the current ratio, total asset turnover, and the debt ratio to the dividend policy of the companies listed in Indonesia Stock Exchange. The results showed that the four financial ratios simul-taneously have no significant impact on the dividend payout ratio. Wicaksana (2012) who conducted research on the effect of the cash ratio, debt to equity ratio, and return on assets on dividend policy on manufacturing companies in Indonesia Stock Exchange. The study found that cash ratio and return on assets have a significant positive effect on dividend payout ratio, while the debt to equity ratio has a significant negative effect on the dividend payout ratio.

The researchers have filed many different theories about the factors that affect the company’s dividend policy. Some theories include taxes, agency costs, asymmetric information (signaling) and explanations of behavior, meanwhile, other researchers have proposed models of development and empirical testing different to be able to explain the behavior of dividends (Baker, et al., 2001).

The effects of asymmetric information on dividend policy indicates that managers should avoid both the sale of new common stock and dividend cuts, because both measures tend to lower stock prices. Thus, in determining the distribution policy, the manager must begin by considering the company’s future investment opportunities for projecting internal sources of funds. The capital structure also plays a role as to avoid the issuance of new ordinary shares, the target payout ratio of long-term should be designed to allow the company to meet all the requirements of capital with retained earnings. As a result, managers must use the model residuals to establish a dividend, but in the form of long-term framework (Watson & Head, 2007).

Several studies have been conducted to identify the factors that are considered by managers in determining the dividend policy, such as Lintner (1956), Baker and Powell (2000), Baker et al. (2001), Dickens et al. (2002), Anand (2004), Liu and Hu (2005), Naceur et al. (2006), Papadopoulos and Charalambidis (2007), Denis and Osobov (2007) and others.

Baker and Powell (2000) conducted a study

which could be be summarized as follows. First, the results indicate that most important determinants of dividend policy of a company is the level of current earnings and earnings expectations for the future as well as patterns or continuity of previous dividends. These factors are similar to what has been identified by Lintner (1956) in a model of the behavior of the dividends of more than four decades ago. Second, the most important factors influencing the dividend policy in dividend survey since 1983 have had high similarity to those in the current survey. These findings suggest that the key determinants of dividend policy experience remained remarkably stable over time. Finally, the type of industry appears to have an important effect as determinants of dividend policy. The results of this study asserts that it is important for managers to maintain continuity of dividends may affect the stock price.

Study Baker et al. (2001) conducted on 188 top financial officer of the companies whose shares are traded on the Nasdaq and the company should pay a dividend every quarter during 1996 and 1997. The results of the study found that the determinants of dividend decision are the pattern of past dividends, stability of earnings, to the current level of earnings, and earnings expectations for the future. The results of this study do not imply that the factors affect the decisions of the dividend are the same for the entire company. In fact, Baker et al. (2001) identified significant that there is a difference between the managers of financial companies and managers of non-financial companies for nine of the 22 factors analyzed. Three factors are the stability of earnings, the current level of earnings and expected future earnings, among other factors is a very important decision affecting the dividend policy.

Dickens et al. (2002) identifies seven factors that are believed to affect the company’s dividend policy. The results of these study find empirical support for five of the seven factors. The five factors were empirically support that is investment opportunity, size, agency problems, dividend history, and risk.

Anand (2004) conducted a study with the aim to identify the factors that are considered CFOs Indian company in formulating 92 dividend policy. The results of this study are consistent with the theory and they react jointly expressed well. Management of Indian companies believe that decisions are important because the dividend is a dividend policy provides a mechanism for signaling to the future prospects of the company and thus will affect the market value.

Liu and Hu (2005) found that the payment of cash dividend is always smaller than accounting profit.

Payment of cash dividend is positively associated with current returns per share and total assets but negative for the debt-to-asset ratio. Finally, the results of this study indicated that firms with ROE, NOCF (net operating cash flow) higher cash payment of higher dividends.

Baker et al. (2005) found survey results that the most important factors affect dividend policy of the companies Norway is related to earnings. Significant determinants to the dividend policy is including the level of financial leverage for the period and limits liquidity. The managers of the Norway companies sees legal rules and restrictions as more important than did their counterparts in the US In contrast, managers of US companies put the pattern of past dividends as more important than did the managers of Norwegian company. The general manager of Norway supports several statements related to the concept that a company’s dividend policy is a problem. The Norwegian company managers overwhelmingly approved that a firm should plan a dividend policy was to create maximum value for shareholders. Furthermore, they agree that an optimal dividend policy is a balance between current dividends and future growth that maximizes stock price. Even so, these managers seem to have conflicting views (ambivalent) when asked whether a change in a company’s cash dividends affect the value of the company. Compared with their US counterparts, respondents from companies Norway expressed much less agree with the idea that there is a relationship between the dividend policy and the company’s value. Finally, the managers of the Norway companies expressed support for a signaling explanation for the payment of dividends than they do for a tax-preference explanation. Even so, the majority of responses indicate ambiguity (ambivalent) on whether the investor is generally used as a dividend announcement information to help assess a company’s stock price.

Ross, et al. (2010) identified two groups of investors are becoming a factor in determining the dividend policy. First, a group that wants lower dividend for tax due, dividend-tax rate of return on personal, flotation costs and dividend restrictions. Second, a group that wants a high dividend disebakan by desire current income, the resolution of uncertainty, tax benefits and the hum of the dividend.

According to Brigham and Houston (2010) there are four groups that affect dividend policy, which are a constraint on the payment of dividends, investment opportunities, availability and cost of alternative sources of capital, dividend policy impact on stock

prices. While, Ehrhardt and Brigham (2011) there are two groups of factors that influence the dividend policy, those are the dividend payment barriers and alternative capital sources. Barriers distribution of dividend payments including debt contracts, restrictions on preferred shares, reduction of capital rules, the availability of cash, and income tax. While alternative capital sources includes costs of selling new shares, debt to equity replacement capability, and management attention to control. But in practice, distribution based on the capital structure and capital budgeting based upon asymmetric information.

Gitman & Zutter (2012) outlines the factors that influence the dividend policy, the constraints of legal; constraints of the contract; growth prospects, owner considerations, and market considerations. One of the newer theories proposed to explain the company payout decision called catering theory. A theory which says that companies that meet the preferences of investors is to increase dividend payments during the period is very attractive to investors.

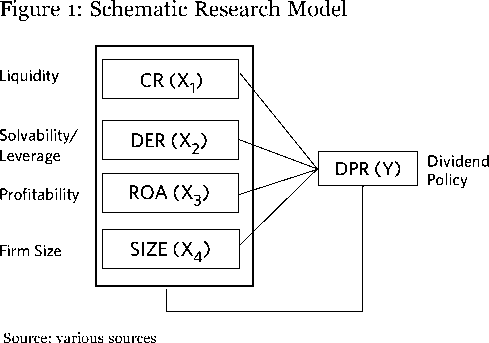

Framework. Thoughts on the variables of this research was motivated by the existing of research gap in the form of a number of inconsistencies in the findings of previous studies on the factors that affect the dividend payout ratio. Sugiharti and Taqdir (2011) find that the debt-to-equity ratio (DER) significant positive effect on dividend payout ratio (DPR), whereas (DPS), return on equity (ROE), return on assets (ROA) and earnings per share (EPS) have no significant effect on the DPR. Wahana (2012) found earnings per share, current ratio, total asset turnover, and debt ratio does not simultaneously affect the dividend payout ratio. Wicaksana (2012) found cash ratio and return on assets have a significant positive effect on dividend payout ratio, while the variable debt to equity ratio significantly and negatively affect dividend payout ratio.

Barclay, Smith, and Watts (1995) find that firm size does not affect dividend policy, while the study of Dickens et al. (2002) found the opposite that size significantly influence the dividend payout ratio. Anand (2004) found that financial leverage effect on dividend policy, while profitability is not. Liu and Hu (2005) found that the profitability of a significant effect, while leverage is not. Baker et al. (2005) found that influential eanings and profitability on dividend policy contributed by the level of liquidity and financial leverage.

Based on such phenomena, this study will examine the effect of liquidity, leverage, profitability, and the size of the company on dividend policy. Liquidity represented by the current ratio (CR); leverage is

proxied by the debt-to-equity ratio (DER); profitability is represented by the ratio of return on assets (ROA); the size of the company is represented by a total ssets, and refer to Marihot & Doddy (2007) dividend policy will be measured by indicators of dividend payout ratio (DPR).

Functional Model: DPR = α + β1CR + β2DER + β3ROA + β4SIZE +ε

Research Hypothesis

H1. Current ratio (CR) positively affect dividend payout ratio (DPR) of non-finacial companies listed on the Indonesia Stock Exchange, 20102012.

H2. Debt to equity ratio (DER) negatively affect dividend payout ratio (DPR) of non-finacial companies liLsitqeudiditoyn the I ndonesia Stock Exchange, 2010-2012.

H3. Return on assets (ROA) positively affect dividend payout ratio (DPR) of non-finacial companies listed on the Indonesia Stock Exchange, 20102012.

H4. Firm size (SIZE) positively affect dividend payout ratio (DPR) of non-finacial companies listed on the Indonesia Stock Exchange, 2010-2012.

DATA AND METHODOLOGY

This study was categorized as a descriptive quantitative research by adopting causal analysis approach in testing hypotheses of relationships, contributions, and influence among studied variables to answer the research question. Data analysis and discussion of the results of this study conducted by the analytical explanation refers to a number of theories and the results of previous studies. Object of this study is testing the effect of the studied companies’ financial performance and size on the dividend policy.

The population was 390 non-financial companies listed on the Indonesia Stock Exchange (IDX) 20102012. The sample was 50 companies that represent the population and selected by purposive sampling technique based upon criteria that the company issuing the financial statements and regularly pay dividends during the observation period 2010-2012.

The data used in this research is quantitative secondary data in the form of financial statements, company profile, and a summary of key financial data, as well as the performance of the studied firms during the observed period that are published by the company or the Indonesian stock exchange through a variety of online and offline medias. The data sources of this research include the BEI website (www.idx. co.id); Indonesian Capital Market Directory (ICMD, 2010-2012), e-exchange, yahoofinance. co.id, and some hardcopy profile and pros-pectus that are available on the Stock Exchange.

Data collection was conducted by a library research approach through online and offline searching of the related literature, data, and information. This study also employs documentation technique to gather the related concepts, theories, secondary data, and the results of previous studies that have been documented in the form of literatures, scientific journals, and economic news.

Given that this research hypothesis testing will be performed by using multiple linear regression model, then to meet criteria BLUE (best linear unbiased estimator), before testing the hypothesis needs to be performed classical assumption (Gozali 2005). The classic test including normality test, multicolinearity, heteroscedasticity, and autocorrelation.

RESULTS AND DISCUSSION

The results of classical assumption test confirm that our model does not have a problem normality, multicollinearity, autocorrelation, and heteroscedasticity with evidence of testing as follows. (i) Research data normality test was conducted by using One Sample Kormogorov-Smirnov Test. The test results showed that the probability Asymptotic Sig (2-tailed)> 0.05 which means that the research data were normally distributed (Table 1).

-

(ii) Multicollinearity test conducted by employing Collinearity Statistics to determine whether there is a correlation between the independent variable in the regression model were used. The test results on the model found that the variance inflation factor (VIF) <10 and tolerance values

Table 1. Tests of Normality

Statistic

Kolmogorov-Smirnova df

Sig.

Statistic

Shapiro-Wilk df

Sig.

DPR

,066

50

,200*

,988

50

,899

CR

,144

50

,110

,937

50

,010

DER

,088

50

,200*

,983

50

,684

ROA

,078

50

,200*

,976

50

,389

SIZE

,082

50

,200*

,971

50

,244

Source : processing results

Explanation:

*. This is a lower bound of the true significance.

a. Lilliefors Significance Correction Sig. > 0,05 no normality problem

Table 2. Tests of Multicollinearity

Model

Unstandardized Coefficients

Standardized Coefficients

t

Sig.

Collinearity Statistics

B

Std. Error

Beta

Tolerance

VIF

(Constant)

1,594

,779

2,046

,047

CR

,021

,114

,025

,181

,857

,897

1,114

1 DER

-,009

,076

-,016

-,113

,911

,796

1,257

ROA

,236

,100

,341

2,370

,022

,812

1,231

SIZE

,090

,039

,312

2,304

,026

,916

1,091

Source : processing results

Explanation:

a. Dependent Variable: DPR

Tolerance > 0,10 VIF < 10 no multicolinearity problem

> 0.10 which means that in this research model there are no symptoms of multicollinearity problem (Table 2).

-

(iii) Heteroscedasticity test on research conducted using glejser test to determine whether the variables have operated the same variance (homogeneous) or vice versa (heterogeneous). This method is done by regressing the independent variables on the absolute value of residuals. The test results found that the significant value of the independent variables on the statistical residual absolute value > 0.05 which means that this research model is not experiencing any heteroscedastisity problem (Table 3).

-

(iv) Autocorrelation test on the research model is done by using the Durbin-Watson (DW test). The test results found that the DW coefficient be between DU and 4-DU or (DU <DW <4-DU). This means that there is no autocorrelation problem in this research model (Table 4).

Thus, the process of regression among the variables of this study feasible to do. Results of research hypothesis testing with multiple linear regression among variables in the model of this study are summarized in the following Table 5.

The results of hypothesis testing found that the probability value for the F-statistic (model significancy) of 0.012, which means significant at the level of (α) = 5%. The results of these tests also

found the F-statitistic coefficient of 3.601 which is greater than the F-table by 2.56 (at α = 5%, k= 4, n= 50). These findings indicate that this research model is feasible to predict the dividend payout ratio (DPR) with a current ratio (CR), debt to equity ratio (DER), return on assets (ROA), and firm size (SIZE) as predictors.

Partially hypothesis testing results show that not all of predictors significantly affect the dependent variable with a constant and standardized β coefficient of predictors as shown in the following functional model.

DPR = 1,594 + 0,025 CR - 0,016 DER + 0,341 ROA + 0,312 SIZE

This study found that only 2 of the 4 independent variables that proved to have significant effect on the dependent variable (DPR), the variable return on assets (ROA) and the SIZE variable with a probability value of each variable significance of 0.022 and 0.026, which means significant at the level of α = 5% with standardized β coefficient of each variable of 0.341 to 0.312 for the ROA and SIZE. While CR and DER have significance probability value of each variable at 0.857 and 0.911, which means no significant effect on the dividend policy at the level of α = 5% and 10 . Both of these variables also have a very small standardized β coefficient, namely 0.025 to CR and -0.016 for DER. The essence of these findings is that the H03 and H04 is rejected, it means that ROA and

Table 3. Tests of Heteroscedasticity

|

Unstandardized Residual |

CR |

DER |

ROA |

SIZE | |

|

Correlation Coefficient Unstandardized |

1,000 |

,024 |

,055 |

-,041 |

-,013 |

|

Residual Sig. (2-tailed) |

. |

,869 |

,703 |

,777 |

,927 |

|

iN |

50 |

50 |

50 |

50 |

50 |

|

Correlation Coefficient |

,024 |

1,000 |

-,203 |

,094 |

,264 |

|

CR Sig. (2-tailed) |

,869 |

. |

,156 |

,515 |

,064 |

|

N |

50 |

50 |

50 |

50 |

50 |

|

Spear- Correlation Coefficient |

,055 |

-,203 |

1,000 |

-,510** |

,010 |

|

man’s DER Sig. (2-tailed) |

,703 |

,156 |

. |

,000 |

,946 |

|

rho N |

50 |

50 |

50 |

50 |

50 |

|

Correlation Coefficient |

-,041 |

,094 |

-,510** |

1,000 |

,147 |

|

ROA Sig. (2-tailed) |

,777 |

,515 |

,000 |

. |

,308 |

|

N |

50 |

50 |

50 |

50 |

50 |

|

Correlation Coefficient |

-,013 |

,264 |

,010 |

,147 |

1,000 |

|

SIZE Sig. (2-tailed) |

,927 |

,064 |

,946 |

,308 |

. |

|

N |

50 |

50 |

50 |

50 |

50 |

Source : processing results

Explanation:

**. Correlation is significant at the 0.01 level (2-tailed).

Sig. (2-tailed) > 0,05 .... no heteroschedacticity problem

-

Table 4. Tests of Autocorelation

Model Summaryb

Model R R Square Adjusted R Square Std. Error of the Estimate Durbin-Watson 1 ,492a ,242 ,175 ,42689 2,097

Durbin-Watson Tabel (k=4, n=50): dl=1,3779, du= 1,7214, 4-du= 2,2786 du < DW < 4-du..............1,7214 < 2,097 < 2,2786 k

no autocorelation problem

Source : processing results

Explanation:

-

a. Predictors: (Constant), SIZE, DER, CR, ROA

-

b. Dependent Variable: DPR

-

Table 5. Results of the Hypotheses Testing

Dependent Variable: Dividend Payout Ratio (DPR)

Independent Variables: CR, DER, ROA, SIZE

Coefficient of

|

Model |

Constant |

Independent Variables | ||||

|

CR |

DER |

ROA |

SIZE | |||

|

ß/ stdzed coefficient |

1,594 |

0,025 |

-0,016 |

0,341** |

0,312** | |

|

t - statistic a |

2,046 |

0,181a |

-0,113 a |

2,370 a |

2,304 a | |

|

p - value (sig.) b |

0,047 |

0,857 |

0,911 |

0,022 |

0,026 | |

R 0,492

R2 0,242

Adj. R2 0,175

F-statistic 3,601c

P-value (sig.)d 0,012*

Source : Appendix 2.

Explanation:

SIZE significantly affect the dividend payout ratio (DPR). Meanwhile, H01 and H02 cannot be rejected, which means that the CR and DER have no significant effect on the dividend payout ratio (DPR).

Discussion. The result of significant effect of

return on assets (ROA) on dividend payout ratio (DPR) in this study indicates that that profitability is one of the factors that could affect the dividend policy adopted by the issuer companies. This finding is very logical that the issuer only burdened obligation

to pay dividends to shareholders if the company is experiencing a profit. The finding of this study contradict to the research result of Anand (2004) and Sugiharti and Taqdir (2011) who did not succeed in proving the existence of significant influence return on assets (ROA), return on equity (ROE), and earnings per share (EPS) on dividend payout ratio (DPR). However, the results of this study support the findings of previous studies by Liu and Hu (2005), Baker, et al. (2005), and Wicaksana (2012) who also found that the return on assets (ROA) have a significant effect on dividend payout ratio (DPR) in manufacturing companies. In addition, the results of this study are also consistent with the results of previous studies conducted by Lintner (1956), Baker and Powell (2000), and Baker et al. (2001).

The result of significant influence of SIZE on dividend payout ratio (DPR) in this study indicates that the dividend policy adopted by listed firms is also influenced by the size of the company as seen from the amount of assets held. This finding is also logical that companies with a higher value of assets is more capable to pay higher dividend. This finding is contrary to the results of previous studies by Barclay, Smith and Watts (1995) who found instead that the size of the company (size) does not affect dividend policy. However, the results of this study are consistent with the findings of Dickens et al. (2002), Naceur et al. (2006), Papadopoulos and Charalambidis (2007), and Denis and Osobov (2007) who also found that the size of the company significantly influence the dividend payout ratio.

The absence of significant influence of current ratio (CR) on the dividend payout ratio (DPR) in this study indicates that the dividend policy adopted by firms does not reflect the level of liquidity which reflects the company ability to fund its short-term operational activities. Liquidity is only concerned with the ability of the company’s operations in the short-term bills to pay suppliers or other parties associated with the company’s short-term operational activities. Meanwhile, the dividend payment is the realm of the different functions of financial management, namely the function of financing and capitalization. Paying short-term bills are imperative, while the obligation to pay dividends is restricted by the condition of the company’s profit. Companies that lose have no longer obligation to pay dividends.

The finding of this study support the results of research Wahana (2012) who studied also did not find empirical evidence of the influence of the current ratio (CR) on dividend payout ratio. However, this study contradict research Wicaksana (2012) who

found that the firm liquidity has a significant and positive effect on dividend payout ratio.

The absence of a significant effect of debt to equity ratio (DER) on dividend payout ratio (DPR) in this study indicates that the dividend policy adopted by the studied companies is not related to the company’s capital structure. Referring to Ross, et al. (2010), such finding is less logical. The argument is that increasingly large proportion of debt over equity should give energy to the company to be capable of paying a dividend, the amount of capital stock that is relatively smaller than the amount of debt capital firm. This finding is incontrary to the results of research Anand (2004), Sugiharti and Taqdir (2011), Wahana (2012), and Wicaksana (2012). Sugiharti and Taqdir (2011) find that the debt to equity ratio (DER) significantly and positively affect dividend payout ratio (DPR). While, Anand (2004), Wahana (2012), and Wicaksana (2012) find that the debt to equity ratio proved to have a negative and significant effect on dividend payout ratio (DPR).

CONCLUSSION

The study concluded that not all of the financial performances affect the company’s dividend policy. This study found only two of the four studied predictors affect dividend policy, those are the return on assets (ROA) and firm size (SIZE) which proved to have positive and significant effect on the dividend payout ratio (DPR). This study failed to find empirical evidence of the influence of the current ratio (CR) and debt-to-equity ratio (DER) on the dividend payout ratio (DPR).

RESEARCH LIMITATION

This study has several limitations. Firstly, the lack in the formulation of models that only led to the dividend policy as dependent variable, without further examine the implications of the dividend policy on the company’s stock price and return. Secondly, this study did not consider other variables such as macroeconomic variables that may also have implications on the company’s financial performance and the company’s ability to pay dividends to shareholders. The problem is that the macroeconomic data are in the form of time series data, so it is difficult to be integrated with the data variables of this research which are in the form of panel data. Another limitation of this study is the short studied period that only covers the last three years, so that this research results might become less comprehensive.

REFERENCE

Allen, Franklin, and Roni Michaely, 2003, “Payout policy” North-Holland Handbook of Economics edited by George Constantinides, Milton Harris, and Rene Stulz; North-Holland.

Anand, M., 2004. Factors Influencing Dividend Policy Decision Of Corporate India. The ICFAI Journal Of Applied Finance.

Ambarih, Ramasastry, Kose John, and Joseph Williams, 1987, Efficient signaling with dividends and investments, The Journal of Finance, 42: 321-343.

Ang, James, S., 1975, Dividend policy: informational content or partial adjustment, The Review in Economics and Statistics,57: 60-70.

Ang, Robert., 1997, Buku Pintar Pasar Modal Indonesia, Edisi Pertama, Jakarta.:Rineka Cipta.

Anil, K dan Kapoor, S., 2008, “Determinant of Dividen d Payout Ratio-A Study of Indian Information Technology Sector”. International Research Journal of Finance and Economics. p.63-71.

Amidu, Mohammed, and Joshua Abor, 2006, “Determinants of Dividend Payout Ratios in Ghana,” The Journal of Risk Finance, Vol. 7, No.2, pp.136-145.

Al-Haddad, Waseem, Salleh Al-Sorqan, Sukairi – Musa, dan Mahmood – Nur, 2011, “ The Effect of Dividend Policy Stability on the Performance of Banking Sector Listed on Amman Stock Exchange”, International Journal of Humanities and Social Science, Vol. 1 No. 5; May 2011.

Asnawi, S. K. & Wijaya, C., 2006. Metodologi Penelitian Keuangan: Prosedur, Ide dan Kontrol. Yogyakarta: Graha Ilmu.

Baker, H. K. & Powell, G. E., 2000. Factors Influencing Dividend Policy Decision. Financial Practice and Education. Forthcoming, Spring(Summer).

Baker, H. K., Veit,T. E. & Powell, G.E., 2001. Factors Influencing Dividend Policy Decisions Of Nasdaq Firms. The Financial Review, Volume 38, pp. 19-38.

Baker, H. K., Mukherjee, T. K. & Paskelian, O. G., 2005. Corporate Dividend Policy: The Views Of British Financial Managers. JEL classification, p. G35.

Bar-Yosef, Sasson, and Lucy Huffman, 1986, The information contens of dividends: signaling approach, Journal of Financial and Quantitative Analysis, 21: 47-58.

Barclay, M. J., Smith, C. W. & Watss, R. L., 1995. The Determinants of Corporate Leverage and Dividend Policies. Journal of Applied Corporate Finance, Volume 8, pp. 4-19.

Benartzi S, Michaely R and Thaler R (1997), “Do Changes in Dividends Signal the Future or the Past?”, Journal of Finance, 52 (3), 1007-1043.

Bhattacharya, S. (1979), Imperfect Information, Dividend Policy and the Bird in the Hand Fallacy Bell. Journal of Economics. 10; pp 259-270.

____________, Desai, H. & Venkataraman, K., 2008. Earnings Quality and Information Asymmetry: Evidence from Trading Costs. [Online] Available at: http://ssrn.com/ abstract= 1266351 or http://dx.doi. org/10.2139/ssrn.1266351

_____________, and Nicodano, G.,2001, Insider trading, investment, and liquidity: a welfare analysis, The Journal of Finance 56 (3): 1141-1156.

Bodie, Zvi, Alex Kane, dan Alan J., Marcus, 2005, INVESTMENT, 6th edition, USA: McGraw-Hill Companies Inc.

Black, F. dan Scholes, M., 1974, “The Effects on Dividend Yield and Dividend Policy on Common Stock Prices and

Returns”. Journal of Financial Economics.

Brav A, Graham J, Harvey C and Michaely R, 2005, “Payout Policy in the 21st Century”, Journal of Financial Economics, 77, 483-527.

Brealey, R. A., Myers, S. C. & Allen, F., 2011. Principles of Corporate Finance 10th Edition. New York: McGraw-Hill.

Brigham, E. F. & Houston, J. F., 2010, Fundamental Of Financial Management. 12nd ed. Ohio: South-Western Cengage Learning.

______________, dan Phillip R. Daves. 2004. Intermediate Financial Management, 8th edition. USA: SouthWestern Co.

______________, dan Michael C. Ehrhardt, 2008, Financial Management: Theory and Practice, Twelfth Edition, USA: Thomson South-Western.

Chang R.P and SG, Rhee, 1990, “Taxes and Dividend : The Impact Of Personal Taxes On Corporate Dividend Policy and Capital Structure Decisions”, Financial Management. Summer 21-31.

Chen, D., Liu, H. & Huang, C., 2009. The announcement effect of dividend changes on share prices. The Chinese Economy 42, pp. 62-85.

Darminto, 2008, Pengaruh Profitabilitas, Likuiditas, Struktur Modal dan Struktur Kepe-milikan Saham Terhadap Kebijakan Dividen. Jurnal Ilmu-ilmu Sosial, vol. 20(2), Hal 44-63.

Denis, D. J. & Osobov, E., 2007. Why Do Firm’s Pay Dividends? International Evidence on The Determinants of Dividend Policy, s.l.: http://ssrn.com/abstract=887643.

Dickens, R. N., Casey, M. K. & Newman, J. A., 2002. Bank Dividend Policy: Explanatory Factors. Quarterly Journal of Business & Economics, 41(1), pp. 1-12.

Ehrhardt, M. C. & Brigham, E. F., 2011. Financial Management: Theory & Practice. 13th ed. Ohio: South-Western Cengage Learning.

Fama, E.F. and K.R. French, 2002, “Testing Trade-off and Pecking Order Predictions about Dividends and Debt,” Review of Financial Studies 15, 1-33.

______________, 2005, “Financing Decisions: Who Issues Stock?” Journal of Financial Economics 76, 549-582.

Gitman, L. J. & Zutter, C. J., 2012. Principles of managerial finance 13th ed. Boston: Prentice Hall.

Grullon, Gustavo, Michaely, R. & Swaminathan, B., 2002. Are Dividend Changes A Sign Of Firm Maturity?. Journal of Business, Volume 75, pp. 387-424.

______________, Benartzi, S. & Thaler, R. H., 2005. Dividend Changes Do Not Signal Changes in Future Profitability. Journal of Business, Vol. 78, pp. 1659-1682.

Gujarati, Damodar N., 2003. Basic Econometrics. fourth edition. Boston: McGraw-Hill.

Hakansson, N. H., 1982, To pay or not to pay dividend, Journal of Finance,37 , 415–428.

Husnan, S. (2001). Corporate Governance dan Keputusan Pendanaan: Perbandingan Kinerja Perusahaan dengan Pemegang Saham Pengendali Perusahaan Multinasional dan Bukan Multinasional. Jurnal Riset Akuntansi, Manajemen, Ekonomi. 1; 1-12.

______________, (2003), Dasar-dasar Teori Portofolio dan Analisis Sekuritas, UPP AMP, Cetakan keempat, Yogyakarta, 2003.

Damodaran, A and C.H. Liu, 1993, Insider trading as a signal of private information, Review of Financial Studies, 6, 79-119.

Darmadji, Tjiptono dan Hendy M. Fakhruddin, 2011, Pasar Modal di Indonesia, Jakarta: Salemba Empat.

Fabozzi, Frank J., dan Franco Modigliani, 2003, Capital

Markets - Institutions and Instruments, Third Edition, New Jersey 07458: Prentice Hall.

______________, 2004, Invesment Management,

Englewood Cliffs, New Jersey 07632: Prentice Hall Inc., Simon & Schuster (Asia) Pte. Ltd.

Frankfurter, George, Bob G. Wood, and James Wansley, 2003, Dividend Policy: Theory and Practice (Google eBook), USA Academic Press, Business & Economics Jun 24.

Harris, M. and A. Raviv, 1985, A sequential signalling model of convertible debt call policy, Journal of Finance, Vol 40, pp 1263-1281.

Haugen, Robert A, dan Nardin L. Baker, 2010, Dedicated stock portfolios, The Jurnal of Portfolio Management, California at Irvine (CA 92717).

Imam, Ghozali. 2005. Aplikasi Analisis Multivariate Dengan Program SPSS, Semarang : Badan Penerbit UNDIP.

Irfani, Agus, 2012, “A Study of Financial Performance and Stock Return in IPO Underpricing Phenomenon on the Indonesia Stock Exchange (IDX)”, Indonesian Capital Market Review (IC MR) International Journal, University of Indonesia, ISSN 1979-8997, Vol. IV, Issue 2, July. Link: journal.ui.ac.id/ index.php/icmr/ view/3618/2873

______________, (dalam berita), 2012, “Rapor Merah BUMN Sektor Tambang: Laba Anjlok, Target Dividen BUMN Meleset”, Berita, Harian Ekonomi Neraca No. 8190 Tahun XXVIII, Jakarta: Jum’at, 2 November 2012, halaman 1.

______________, (dalam berita), 2012, “BUMN Gemuk yang Terus Merugi”, Laporan Khusus, Harian Sore SINAR HARAPAN, Jakarta: Senin, 12 November 2012.

______________, (dalam berita), 2012, “Bapepam-LK Perlu Berikan Sanksi Tegas: Tunda Pembagian Dividen, Trik ‘Akal-Akalan’ Emiten”, Berita Utama, Harian Ekonomi Neraca No. 8228 TH. XXVIII, Jakarta: Rabu, 19 Desember 2012, halaman 1.

Iskandar, Syamsu, 2013, Bank dan Lembaga Keuangan Lainnya, Jakarta: In Media.

Jogiyanto Hartono, 2010, Teori Portofolio dan Analisis Investasi, Yogyakarta: BPFE.

John, K., and Mishra, B., 1990, Information content of insider trading around corporate announcements: The case of capital expenditures. Journal of Finance 45(3): 835-854.

______________, and Lang, L., 1991, Insider trading around dividend announcements: Theory and evidence, Journal of Finance 46: 1361-1390.

John, K., and Williams, J., 1985, Dividends, dilution, and taxes: a signalling equilibrium, Journal of Finance, 40,1053–1070.

Jones, Charles P., 2004, INVESTMENT: Analysis and Management, 9th edition, North Carolina, USA: John Wiley & Sons, Inc.

______________, Siddharta Utama, Budi Frensidy, Irwan Adi Ekaputra, Rachman Untung Budiman, 2009, INVESTMENT: Analysis and Management, An Indonesian Adapta-tion, 10th edition, USA: John Wiley and Sons, Jakarta: Salemba Empat.

Kale, J. R., & Noe, T. H., 1990, Dividends, uncertainty, and underwriting costs under asymmetric information, Journal of Finance,13, 265–277.

Koch, A. S., dan A. X. Sun, 2004, Dividend Changes and the Persistence of Past Earnings Changes, Journal of finance, LIX, No. 5, (October): 2093-2116.

Kuma r, P.,1988, Sha reholder–manager conflict and the information content of dividends, Review of Financial Studies,1, 111–136.

Levy, Haim, dan Marshall Sarnat, 2006, Capital Investment

& Financial Decisions, 7th edition,New Jersey 07632: Prentice-Hall International Editions.

Leland, Hayne E. and David H. Pyle, 1977, Informational Asymmetries, Financial Structure, and Financial Intermediation, The Journal of Finance, Vol. 32, No. 2, Papers and Pro-ceedings of the Thirty-Fifth Annual Meeting of the American Finance Association, Atlantic City, New Jersey, September 16-18, May, 1977, pp. 371387

Lewellen, Jonathan, 2004, “Predicting returns with financial ratios”,Journal of Financial Economics 74 : 209–235.

Lintner, J., 1956. Distribution of incomes of corporations among dividends, retained earnings and taxes. American Economic Review 46:2, p. 97–113.

Li, Dongmei, and Lu Zhang, 2010, Does q-theory with investment frictions explain anomalies in the crosssection of returns? Journal of Financial Economics, 98, 297–314

Liu, S. & Hu, Y., 2005. Empirical Analysis of Cash Dividend Payment in Chinese Listed Companies. Nature and Science, 3(1), p. http://www.sciencepub.org.

Makhija, A. K.,& Thompson, H.E., 1986, Some aspects of equilib rium for a cross-section of firms signaling profitability with dividends: a note, Journal of Finance,41, 249–253.

Marihot, N. & Doddy, S., 2007. Pengaruh Corporate Governance Terhadap Manajemen Laba Di Industri Perbankan Indonesia. Jakarta, Simposium Nasional Akuntansi X.

Miller, M. H. & Modigliani, F., 1961. Dividend Policy, Growth, and the Valuation of Shares. Journal of Business, Volume 34, pp. 411-433.

Miller, M. H. & Rock, K., 1985. Dividend Policy under Asymetric Information. The Journal of Finance 40, pp. 1031-1051.

Naceur, S. B., Goaied, M. & Belanes, A., 2006. On The Determinants And Dynamics Of Dividend Policy. International Review of Finance, 6(1-2), pp. 1-23.

Nissim, D., and A. Ziv., 2001, Dividend changes and future profitability. Journal of Finance,56 (December): 2111–33.

Nuryaman, 2008. Pengaruh Konsentrasi Kepemilikan, Ukuran Perusahaan, dan Mekanisme Corporate Governance Terhadap Manajemen Laba. Jakarta, Simposium Nasional Akuntansi XI.

Ofer, A. R., & Thakor, A. V., 1987, A theory of stock price responses to alternative corporate cash disbursement methods: stock repurchases and dividends, Journal of Finance,42, 365–394.

Papadopoulos, D. L. & Charalambidis, D. P., 2007. Focus on Present Status and Determinants of Dividend Payout Policy: Athens Stock Exchange in Pespective. Journal of financial Management and Analysis, 20(2), pp. 24-37.

Ross, Stephen, A, 1977, The Ditermination of financial structure: The Incentive Signalling Approach, Bell Journal of Economics, 8, 23-40.

______________, Randolph W. Westerfield, dan Jeffrey Jaffe, 2010, Corporate Finance, 9th edition, Boston: McGraw-Hill.

Saxena, Atul K., 1995, Determinant of Dividend Payout Policy: Regulated Versus Unregulated Firms, The Journal of Finance.

Skinner, Douglas J., 2008, “The evolving relation between earnings, dividends, and stock repurchases”,Journal of Financial Economics 87(2008) 582–609.

Shefrin, Hersh dan Meir Statman, 2010, Behavioral Portfolio Theory, The Journal of Financial and Quantitative Analysis, Vol. 35, No. 2, pp. 127 -151 Published by: University of Washington School of Business

Administration.

Smith Jr, Clifford W. dan Ross L. Watts. 1992. The Invesment Opportunity Set and Corporate Financing, Dividend, and Compensation Policies, Journal of Financial Economics. Vol 32 No. 3. P : 263-292.

Sugiharti dan Taqdir (2011) Studi Empiris Terhadap Faktor Penentu Kebijakan Dividen. Jakarta: Jurnal Media Riset Akuntansi, Auditing, dan Informasi.

Talmor, Eli, 1981, Asymmetric information, signaling, and corporate financial decisions, Journal of Financial and Quantitative Analysis, 16, 413-435.

Titman, S., Keown, A. J. & Martin, J. D., 2011. Financial Management: Principles and Applications. Boston: Pearson.

Van Horne, James C., 1995, Financial Management and Policy, tenth edition, New Jersey 07632: Prentice-Hall International Editions.

______________, dan J.M. Wachowicz, Jr., 1998, Fundamentals OfFinancial Management, tenth edition, New Jersey 07632: Prentice-Hall International Editions.

Wahana, Bagus Pandu. 2012.”Pengaruh Earning Per Share, Current Ratio, Total Asset Turnover, dan Debt Ratio terhadap kebijakan Dividen pada Perusahaan Manufaktur yang terdaftar di Bursa Efek Indonesia”. Jurnal. Jakarta: Universitas Gunadarma.

Wicaksana, I Gede Ananditha. 2012. “Pengaruh Cash Ratio, Debt to Equity Ratio, dan Return on Asset terhadap kebijakan Dividen Pada Perusahaan Manufaktur di Bursa Efek Indonesia”. Tesis, Denpasar: program Pascasarjana Universitas Udayana.

Zubir, Zalmi, 2011, Manajemen Portofolio: Penerapannya dalam Investasi Saham, Jakarta: Salemba Empat.

154

Discussion and feedback