The Influence of Financial Literacy, and Investment Knowledge on Investment Interest mediated by Investment Motivation

on

pISSN : 2301 – 8968

JEKT ♦ 17 [1] : 63-75

eISSN : 2303 – 0186

The Influence of Financial Literacy, and Investment Knowledge on Investment Interest mediated by Investment Motivation

ABSTRACT

This study attempted to determine the influence of investment knowledge and financial literacy on capital market investing interest via investment motivation. All IDX Investment Gallery users in the Faculty of Economics and Business, University of Mataram, made up the study's population, and 85 Investment Gallery users were chosen as the study's sample using a purposive selection approach. Associative quantitative research is the term used to describe this sort of study. Smart-PLS 4 was utilized to process the data in this study, and the following tests were run: validity test, reliability test, R-Square, inner model, and path coefficient. The findings demonstrated that, while investment knowledge has a negligible impact on investment interest, financial literacy, and investment motivation have a favorable and considerable impact. Investment motivation is positively and significantly impacted by financial knowledge and literacy. Financial literacy and investment interest can be mediated by investment motive, but investment knowledge cannot.

Keywords: Financial Literacy, Investment Interest, Investment Motivation, Investment Knowledge.

JEL Classification: G11, G20, G53

INTRODUCTION Investment in the capital market has

The capital market has a major role in the country's economy to support the implementation of development aimed at increasing national economic stability. A capital market is a meeting place between investors and companies that need capital or long-term investment (Triana & Yudiantoro, 2022). A capital market is a tool that may be utilized by issuers or firms that require finances to expand their business, as well as investors that need a location or medium to invest in order to profit from capital market investments (Sunatar et al., 2023).

been a realistic alternative for the general people since the founding of the Indonesia Stock Exchange (IDX) (Bakhri, 2018). The number of Indonesian capital market investors over the past 4 years has increased significantly. Investment can be made or occur if there is interest from a person or organization who wants to invest in (Sunatar et al., 2023). Investment interest is the attention and interest in carrying out an activity related to investment without coercion from anyone accompanied by a feeling of pleasure.

(Sunatar et al., 2023) concluded that interest is a persistent tendency to pay attention to and remember some activities. (Hikmah & Rustam, 2020), People are already interested in investing in the stock market. However, they confront several challenges, particularly for new investors. If beginner investors do not fully comprehend the methods for investing and the potential hazards. Prospective investors must have financial literacy and knowledge so that they are concerned about investment because it will determine the success of the investment made (Pangestika & Rusliati, 2019).

According to, (Siregar et al., 2023), Financial literacy refers to an individual's understanding and ability to handle their money in terms of insurance, savings, investment, and budgeting. Four factors are used to assess financial literacy: a broad awareness of personal financial management, Investment, protection, and lending for savings (Chen & Volpe, 1998). Financial knowledge can help individuals in determining optimal financial decisions. So it can be concluded that financial literacy is a person's knowledge and skills to manage and make decisions about their

finances. Supported by previous research by (Fishbein, 2008) and (Harahap et al., 2021) It claims that financial literacy has a positive and substantial influence on investing interest, as opposed to the findings of (Viana et al., 2022) which demonstrates that financial awareness has little influence on investment interest. Because of the disparity in these results, more research into the influence of financial literacy on investing interest is required.

Individuals gain investment expertise when they learn how to use part of their money to make money. The information in question can be obtained by attending seminars, workshops, investment training, and learning through books on investment fields (Yusuf, 2019). So that potential investors can understand the investment literature in the capital market. Kusmawati, (2011) cited by (Mahdi et al., 2020). Investment knowledge is measured using three indicators, namely: fundamental understanding of stock value, amount of risk, and the expected return. Investment knowledge is proven to have a positive and significant effect found in previous research by (Listyani et al., 2019);

(Viana et al., 2022); (Eka et al., 2022), and (Syaputra & Aslami, 2022). However, different results were found by (Sari & Lestari, 2023) that financial knowledge does not affect one's intention to invest.

Motivation plays an important role in investment interest because it can provide a strong impetus or reason for someone to invest. Investing involves financial risk and commitment, so strong motivation is needed to help a person overcome the uncertainties and challenges that may arise. According to (Uno, 2013), motivation is a drive that can move a person in behavior. In investing, the motivation needed by an investor is the desire to carry out investment activities. In line with the opinion of Pajar & Pustikaningsih (2017) cited by (Wahyuningtyas et al., 2022), investment motivation is a condition or state of an individual that encourages to carry out an activity related to investment.

In the Theory of Reasoned Action (TRA) proposed by Martin Fishbein and Icek Ajzen in 1967, investment motivation can be considered as an exogenous variable or independent variable that affects attitudes toward investment and subjective norms towards investment. If a

person has high investment motivation, they tend to have a positive attitude towards investment and feel that investment is an important and worthwhile thing to do. A positive attitude towards investment and subjective norms in favor of investment will affect an individual's intention to invest. If a person has a positive attitude towards investment and feels that the people around them support investment, they tend to have a high intention to invest (Fishbein, 2008).

Investment a person's motivation is an inclination to perform an action in relation to investment. Motivation is a method of providing encouragement that can decide the intensity, direction, and perseverance of persons in achieving objectives and directly impacts one's tasks and psychology (Maharani & Farhan Saputra, 2021). Investment motivation describes the psychological variables that inspire each individual to engage in certain investment activities (Pajar & Pustikaningsih, 2017) mentioned by (Maharani & Farhan Saputra, 2021). In this context, financial literacy and financial knowledge can act as push factors that influence investment motivation. This

means that people are motivated to do something because they want something that is expected. In terms of investment, if people assume and have the belief that by investing they will get benefits in the form of profits and so on, then that person will have an interest in investing according to their expectations. However, there is no previous research related to motivation as a mediating variable in the relationship between the variables of this study so it is expected to strengthen previous research.

From the explanation of the sources and theories above, motivation may be very influential on a person's investment interest, even motivation is able to become a mediating variable in the relationship between financial literacy and knowledge. Because strong motivation can encourage someone to achieve long-term financial goals, such as preparing for retirement, owning their own home, or creating financial security. Financial literacy and investment knowledge can provide an understanding of how to achieve these goals, while motivation will help translate this understanding into real action in investing. There are three indicators to measure investment motivation including

a change in motivation oneself, the emergence of feelings that lead to behavior, and reactions to achieving goals (Widiyastuti et al., 2004) cited by (Kusumastuti & Waluyo, 2013).

Afdalia et al., (2014) The notion of reasoned action has been modified by Ajzen into the notion of Planned Behavior. The three components that make up the core of this theory are: (1) beliefs about potential outcomes and assessments of these behaviors (behavioral beliefs); (2) beliefs about expected norms and motivation to live up to these expectations (normative beliefs); and (3) beliefs about the existence of factors that can encourage or inhibit behavior and awareness of the potency of these factors.

The process of deciding between two or more alternative investments, coming to a conclusion on a number of challenges or problems, or taking part in the conversion of inputs into outputs is known as investment decision-making. For this reason, prior to making an investment, one has to have solid financial literacy (Dewi et al., 2022).

A person has knowledge when they have arranged information they have

learned and acquired (Baihaqi, 2016) cited by (Darmawan & Japar, 2019). Investment is defined as a commitment to utilize money or resources in the hopes of earning future rewards. (Tandelilin, 2010 in the book Suteja and Gunardi, 2016) mentioned by (Darmawan & Japar, 2019). If one is to draw any conclusions from these two definitions, investing knowledge would be the understanding of how to employ part of one's assets to generate future returns. Investment knowledge is an awareness of the numerous facets of investing, starting with the fundamental understanding of investment value, risk tolerance, and rate of return (Chaerul Pajar, 2017). (Darmawan & Japar, 2019) concluded that Making investment decisions is made simpler when one has a fundamental grasp of investing, including the many types of investments, returns, and investment risk. The ability to assess which assets to purchase while investing in the capital market requires significant information, experience, and business acumen (Merawati and Putra, 2015). When investing in the capital market, such as in stock investment instruments, enough understanding is required to prevent

losses. Making investment decisions is made simpler when one has a fundamental grasp of investing, including the many types of investments, returns, and investment risk. To successfully invest in the capital market, one must have the necessary skills, knowledge, and business acumen (Merawati and Putra (2015) cited by (Darmawan & Japar, 2019). When investing in the stock market or other financial instruments, it is important to have the necessary information in order to prevent losses.

RESEARCH METHOD

Associative research is carried out using a quantitative technique to identify the association between two or more variables, which is expressed in numbers or on a numerical scale. This study's population was 555 users of the IDX Investment Gallery, Faculty of Economics and Business, University of Mataram. In determining the sample in the study using the Slovin formula with a tolerance level of 10%, then from the calculations carried out a sample of 85 users was obtained. The sample criteria are: 1). Active students at the University of Mataram, 2). having

invested the IDX Investment Gallery, Faculty of Economics and Business, University of Mataram, 3). Registered as a user in the IDX Investment Gallery FEB University of Mataram. The sampling approach employed in this study was a nonprobability sampling technique using the purposive sampling method, which is a sample selection method with particular considerations. The data collection technique is an online questionnaire, which is data collection in the form of a closed set of questions and must be filled

in by respondents by choosing one of the alternative answers that are available. This study used Partial Least square (PLS) analysis techniques.

RESULT AND DISCUSSION

A convergent validity test in PLS is used to observe the association between items rating or element scores and construct scores. Based on table 2 shows that indicators with a value> 0.5 are indicators that meet the criteria of convergent validity.

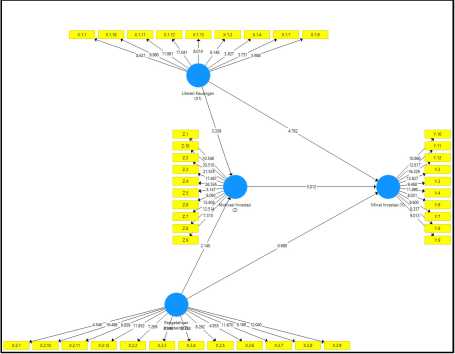

Figure 1. Outer Loadings

Source: Primary Data Processed 2023

Based on this figure, it can be seen 0.5, so it can be said that all indicators used that all measurement items on each are valid.

variable, both financial literacy variables, investment knowledge, and investment motivation, show an outer loading value>

Cronbach's Alpha and Composite Reability ratings are used to assess reliability in Smart-PLS. The following

table displays Cronbach's Alpha and Composite Reability values.

Table 1. Cronbach's Alpha and Composite Reability

Based on table 1, shows that Cronbach's alpha value for financial literacy, investment knowledge, and investment motivation is above 0.7, namely 0.827 for variable X1 (financial literacy), 0.906 for variable X2 (investment knowledge), 0.903 for Z (investment motivation), and 0.885 for variable Y (investment interest). So All variables may be regarded to be

dependable because alpha value is greater square value is used visualize how much

independent variables

their Cronbach's

than 0.7. The R-

to

the

(X)

anticipate and effect of the

contributes to

variable Y at the same time. The R-square values are 0.25, 0.50, and 0.75, indicating that the R-square value is mild, moderate, orstrong.

|

Variables |

Cronbach’s Alpha |

Composite Reability |

|

Financial Literacy (X1) |

0.827 |

0.866 |

|

Investment Knowledge (X2) |

0.906 |

0.919 |

|

Investment Motivation (Z) |

0.903 |

0.921 |

|

Investment Interest (Y) |

0.885 |

0.906 |

Source: Primary Data Processed 2023

Table 2. R-

|

Variable |

R-square |

R-square Adjusted |

|

Investment Interest |

0.689 |

0.677 |

|

(Y) | ||

|

Investment |

0.519 |

0.507 |

|

Motivation (Z) |

Source: Primary Data Processed 2023

According to Table 2 above, the R-square of the investment interest construct is 0.689. This implies that the variables of financial literacy, investment knowledge, and investment desire account for 68.9% of

their effect on investment interest, with the remaining 31.8% influenced by factors beyond the purview of this study. The R-

square value of the investment motivation variable is 0.519. This number implies that the financial literacy and investing knowledge factors explain 51.9% of this variable, while the remaining 48.1% is impacted by other variables not included in this study.

JURNAL EKONOMI KUANTITATIF TERAPAN Vol. 17 No. 1 ▪ FEBRUARI 2024

The t-test is used in hypothesis variables. The value created by the testing to determine if exogenous factors bootstrapping procedure serves as the have a significant influence on endogenous foundation for evaluating the hypothesis.

|

Table 3. Path Coefficients | ||

|

P-Values |

Keterangan | |

|

Financial Literacy (X1) → Investment Interest (Y) |

0.000 |

Diterima |

|

Financial Literacy (X1) → Investment Motivation (Z) |

0.001 |

Diterima |

|

Investment Knowledge (X2) → Investment Interest (Y) |

0.492 |

Ditolak |

|

Investment Knowledge (X2) → Investment Motivation (Z) |

0.029 |

Diterima |

|

Investment Motivation (Z) → Investment Interest (Y) |

0.000 |

Diterima |

|

Financial Literacy (X1) → Investment Motivation (Z) → Investment Interest (Y) |

0.002 |

Diterima |

|

Investment Knowledge (X2) → Investment Motivation (Z) → Investment Interest (Y) |

0.065 |

Ditolak |

Source: Primary Data Processed 2023

In a model with a value range of -1 to 1, this test is used to determine the direct influence of an independent variable on the dependent variable. This number indicates the direction of the link between variables with positive or negative effect. The P-value, on the other hand, is used to assess the degree of significance of the independent variable on the dependent variable. If the P-value is less than 0.05, the association is significant. Figure 1 shows the route diagram for the study structural model.

The first hypothesis test findings in Table 3 show that H1 is accepted and it means the financial literacy influences investment interest in the capital market. This demonstrates that students who wish to invest in the stock market must be financially literate. Furthermore, having financial literacy will allow you to evaluate everything about money sensibly, which is consistent with the theory of planned behavior (TPB), which is influenced by the notion of behavior. Individuals who have strong financial control might be directed

to behave selectively to manage their finances.

The findings of the second hypothesis test demonstrate that H2 is accepted, implying that the financial literacy variable influences investment motivation. This shows that the better financial literacy you have, the higher the motivation you have to invest, and vice versa, the lower the motivation you have, the less you know about financial management. If an individual has the skills to manage his finances, the individual will realize the potential of profit and risk, the individual will instill in himself to be motivated in investment activities.

The third hypothesis test findings demonstrate that H3 is rejected, implying that the investment knowledge variable does not influence investment interest in the capital market. This shows that having basic investment knowledge alone does not provide sufficiency in encouraging interest in investing. There are different perceptions in each person about facing risk, so the individual will think a thousand times to invest because he already knows the risks he will face.

Students are novice investors so many have a low tolerance for investment risk, this is due to the absence of sufficient experience. This means that even though they have good knowledge, it is not certain that students will invest in the capital market.

The results of the fourth hypothesis test show that H4 is accepted so that the investment knowledge variable influences investment motivation. Adequate knowledge of something can motivate an individual to decide to take action. So that one of the factors that influence a person's knowledge is experience so individual motivation arises. If an individual has good enough knowledge, the individual will instill in himself to be motivated to carry out investment activities.

The fifth hypothesis test results show that H5 is accepted so that investment motivation affects investment interest in the capital market. An investor invests his funds in investment activities, of course, to have a target to make a profit, so that something interesting will cause a feeling to achieve his goals. This is by the goal-setting theory of motivation where

there are challenges so that individuals will be motivated to achieve their goals. In addition, the existence of factors from the environment that have entered the capital market will motivate students to participate in investment activities.

The outcomes of the sixth hypothesis test demonstrate that H6 is accepted and Financial literacy has an impact on investment interest, which is mediated through investment motive. The existence of great financial literacy will drive an individual to invest in a range of assets, meaning that the individual will plan his investment. Investment motivation is something that arises within an individual to increase his enthusiasm and ambition in taking investment actions so that through these actions it will be able to increase interest in trying to invest.

The seventh hypothesis test results show that H7 is rejected so that investment knowledge does not affect investment interest mediated by investment motivation. It means that investment is less attractive because it contains considerable risk, this is also due to students' knowledge of the investment guarantee system that is not yet known

and the lack of information received. The results of this study also explain that the stronger investment motivation that exists in an individual can increase his investment understanding and vice versa so that it can influence whether or not to try investing.

CONCLUSION

This study might draw the following conclusions: first, financial literacy has a beneficial influence on capital market investing interest. Second, financial literacy boosts investing incentives. Third, investing knowledge has little influence on capital-market investment interest. Fourth, investing knowledge influences investment motivation positively. Fifth, investment motivation increases investment interest. Sixth, investing motive influences financial literacy. Seventh, investment knowledge has little influence on investment motivation.

Based on the conclusions and findings, suggestions can be recommended for further research. Future research is expected to use a wider sample, the variables used in the study can be developed and added with more complex

variables, and it is hoped that the next researcher can find more information which can then be used as a reference in further research related to investment motivation.

REFERENCE

Afdalia, N., Pontoh, G. T., & Kartini, K. (2014). Theory Of Planned Behavior Dan Readiness For Change Dalam Memprediksi Niat Implementasi Peraturan Pemerintah Nomor 71 Tahun 2010. Jurnal Akuntansi & Auditing Indonesia, 18(2), 110–123. Https://Doi.Org/10.20885/Jaai.Vol 18.Iss2.Art3

Bakhri, S. (2018). Minat Mahasiswa Dalam Investasi Di Pasar Modal. Al-Amwal∏: Jurnal Ekonomi Dan Perbankan Syari’ah, 10(1), 146.

Https://Doi.Org/10.24235/Amwal. V10i1.2846

Chen, H., & Volpe, R. P. (1998). An Analysis Of Financial Literacy Among College Students. Financial Services Review, 7(1), 107–128.

Darmawan, A., & Japar, J. (2019). Pengaruh Pengetahuan Investasi, Modal Minimal, Pelatihan Pasar Modal Dan Motivasi Terhadap Minat Investasi Di Pasar Modal. 5(1).

Darmawan, A., Kurnia, K., & Rejeki, S. (2019). Pengetahuan Investasi,

Motivasi Investasi, Literasi Keuangan Dan Lingkungan Keluarga Pengaruhnya Terhadap Minat Investasi Di Pasar Modal.

Jurnal Ilmiah Akuntansi Dan Keuangan, 8(2), 44–56.

Https://Doi.Org/10.32639/Jiak.V8i 2.297

Dewi, L. G. K., Herawati, N. T., & Wati, L. P. A. W. (2022). Pengaruh Literasi Keuangan, Efikasi Keuangan Dan Return Investasi Terhadap Minat Investasi Mata Uang Kripto Pada Mahasiswa Di Provinsi Bali. Jurnal Ilmiah Pendidikan Profesi Guru, 13(3), 649–659.

Eka, R., Falhamdany, Z., Rahmadani, K., & Haqiqi, N. (2022). Pengaruh Pengetahuan Investasi, Motivasi, Dan Pelatihan Pasar Modal Terhadap Keputusan Investasi Yang Dimediasi Oleh Minat Investasi. Journal Of Engineering, 3(1).

Fishbein, M. (2008). Reasoned Action, Theory Of. In W. Donsbach (Ed.), The International Encyclopedia Of Communication (P. Wbiecr017). John Wiley & Sons, Ltd. Https://Doi.Org/10.1002/97814051 86407.Wbiecr017

Harahap, S. B., Bustami, Y., & Syukrawati, S. (2021). Pengaruh Literasi

Keuangan Terhadap Minat

Investasi Saham Syariah: Studi Kasus Galeri Investasi Syariah Iain Kerinci. Al Fiddhoh: Journal Of Banking, Insurance, And Finance, 2(2), 75–82.

Https://Doi.Org/10.32939/Fdh.V2i 2.955

Hikmah, H., & Rustam, T. A. (2020). Pengetahuan Investasi, Motivasi Investasi, Literasi Keuangan Dan

Persepsi Resiko Pengaruhnya Terhadap Minat Investasi Pada Pasar Modal. 8(2).

Hogarth, J. M., & Hilgert, M. A. (2002). Financial Knowledge, Experience And Learning Preferences: Preliminary Results From A New Survey On Financial Literacy. 48.

Kusumastuti, R., & Waluyo, I. (2013). Pengaruh Motivasi Dan Pengetahuan Uu No.5 Tahun 2011 Tentang Akuntan Publik Terhadap Minat Mahasiswa Akuntansi Mengikuti Pendidikan Profesi Akuntansi (Ppak). Nominal, Barometer Riset Akuntansi Dan Manajemen, 2(2).

Https://Doi.Org/10.21831/Nomin al.V2i2.1662

Listyani, T. T., Rois, M., & Prihati, S. (2019). Analisis Pengaruh Pengetahuan Investasi, Pelatihan Pasar Modal, Modal Investasi Minimal Dan Persepsi Risiko Terhadap Minat Investasi Mahasiswa Di Pasar Modal (Studi Pada Pt Phintraco Sekuritas Branch Office Semarang). Jurnal Aktual Akuntansi Keuangan Bisnis Terapan (Akunbisnis), 2(1), 49.

Https://Doi.Org/10.32497/Akunbi snis.V2i1.1524

Maharani, A. & Farhan Saputra. (2021). Relationship Of Investment Motivation, Investment Knowledge And Minimum Capital To Investment Interest. Journal Of Law, Politic And Humanities, 2(1), 23–32. Https://Doi.Org/10.38035/Jlph.V2i 1.84

Mahdi, S. A., Jeandry, G., & Wahid, F. A. (2020). Pengetahuan, Modal Minimal, Motivasi Investasi Dan Minat Mahasiswa Untuk Berinvestasi Di Pasar Modal. Jurnal Ekonomi, Akuntansi Dan Manajemen Multiparadigma (Jeamm), 1(2).

Https://Doi.Org/10.51182/Jeamm. V1i2.1840

Pangestika, T., & Rusliati, E. (2019). Literasi Dan Efikasi Keuangan Terhadap Minat Mahasiswa Berinvestasi Di Pasar Modal. Jurnal Riset Bisnis Dan Manajemen, 12(1), 37.

Https://Doi.Org/10.23969/Jrbm.V 12i1.1524

Sari, S. P., & Lestari, W. (2023). Pengaruh Pengetahuan Investasi, Kebijakan Modal Minimal, Pelatihan Pasar Modal Terhadap Minat Mahasiswa Berinvestasi. Jurnal Manajemen Dan Ilmu Administrasi Publik (Jmiap), 5(2), 123–130.

Https://Doi.Org/10.24036/Jmiap.V 5i2.615

Sunatar, B., Hendra, M., & Suharmoko, S. (2023). Pengaruh Pengetahuan Investasi Dan Motivasi Investasi Terhadap Minat Berinvestasi Di Pasar Modal Syariah Pada Mahasiswa Prodi Ekonomi Syariah Iain Sorong. 5.

Syaputra, A., & Aslami, N. (2022). Pengaruh Pengetahuan Investasi Di Pasar Modal Terhadap Minat Berinvestasi Mahasiswa. Journal Of Social Research, 1(3), 163–168.

Https://Doi.Org/10.55324/Josr.V1i 3.51

Triana, O. F., & Yudiantoro, D. (2022). Https://Doi.Org/10.21009/Jdmb.0

Pengaruh Literasi Keuangan, 2.2.3

Pengetahuan Investasi, Dan Motivasi Terhadap Keputusan Berinvestasi Mahasiswa Di Pasar

Modal Syariah. Serambi: Jurnal Ekonomi Manajemen Dan Bisnis Islam, 4(1), 21–32.

Https://Doi.Org/10.36407/Seramb i.V4i1.517

Uno, H. B. (2013). Teori Motivasi Dan Pengukurannya. Jakarta: Bumi Aksara.

Viana, E. D., Febrianti, F., & Dewi, F. R. (2022). Literasi Keuangan, Inklusi Keuangan Dan Minat Investasi Generasi Z Di Jabodetabek. Jurnal Manajemen Dan Organisasi, 12(3), 252–264.

Https://Doi.Org/10.29244/Jmo.V1 2i3.34207

Wahyuningtyas, E. T., Hasanah, F., & Susesti, D. A. (2022). Dampak Motivasi Investasi, Persepsi Resiko, Literasi Dan Efikasi Keuangan Terhadap Minat Mahasiswa Berinvestasi Di Pasar Modal: Keywords: Investment Motivation; Risk Perception; Financial Literacy; Financial Efficacy; Investment Interest. Jurnal Akuntansi Akunesa, 10(2), 57–66.

Https://Doi.Org/10.26740/Akunes a.V10n2.P57-66

Yusuf, M. (2019). Pengaruh Kemajuan Teknologi Dan Pengetahuan Terhadap Minat Generasi Milenial Dalam Berinvestasi Di Pasar Modal. Jurnal Dinamika Manajemen Dan Bisnis, 2(2), 86–94.

75

Discussion and feedback