Measuring the Resilience of Rural Banks Against COVID-19 Pandemic: Evidence from West Java, Indonesia

on

pISSN : 2301 – 8968

JEKT ♦ 17 [1] : 126-144

eISSN : 2303 – 0186

Measuring the Resilience of Rural Banks Against COVID-19 Pandemic: Evidence from West Java, Indonesia

ABSTRACT

The potential disruption of operational activities in rural banks is linked to MSME actors' inability to repay loans amid the COVID-19 pandemic. The quality of credit and financing provided by these banks is vital in ensuring income and interest continuity, thereby impacting profitability. This study aims to analyze the financial performance dynamics and factors influencing rural banks' profitability in West Java, Indonesia, during COVID-19. The research utilized multiple linear regression with REM estimation. Despite the pandemic's challenges, the ROA, CAR, and equity values of the rural banks met minimum standards, though NPL values exceeded maximum limits. The combined factors of CAR, NPL, equity, net income, and the pandemic collectively influence profitability. Specifically, NPL and the pandemic have significant negative effects, while net income positively impacts profitability. To bolster the resilience of rural banks during crises, suggested policy measures include strengthening capital reserves, tightening credit policies, implementing good governance practices, and enhancing operational cost efficiency.

Keywords: COVID-19 pandemic, financial performances, profitability, rural banks

JEL Classification: G21, G32, I18, O16, R11 INDTRODUCTION

Rural banks are financial institutions that play a crucial role in mobilizing funds and providing credit services to the public, with a particular focus on MSMEs. MSMEs are known for their resilience and significant contribution to the national economy, making rural banks essential partners in supporting this sector. Indonesia has experienced various crises, such as the 1998 Asian monetary crisis triggered by a sharp depreciation of the Indonesian rupiah (IDR) and the accumulation of foreign debt (Tambunan 2021) and additionally, the 2008 global

financial crisis (Nezky 2013). Lestari (2017) highlighted the adverse impact of the 1998 and 2008 crises on the credit performance and deposit collection of rural banks. When a crisis negatively affects the gross regional domestic product, it can disrupt the lending activities and deposit collection of rural banks.

Drawing from past crisis patterns, it was anticipated that the world would face another global crisis in 2020, stemming from the lingering effects of the 2007-2009 crisis (Poruchnyk et al. 2021). In 2019, global growth was predicted to be at its lowest level since 2008, with household

debt, corporate debt, trade wars, and declining interest rates identified as primary factors contributing to the anticipated recession in 2020 (Balbaa 2020). The projected economic crisis for 2020 was further accelerated and intensified by the extraordinary events surrounding the COVID-19 pandemic.

The COVID-19 pandemic had a significant impact on economic growth, resulting in a decline of -5,32% in the

second quarter of 2020 (BPS 2021). In the second quarter of 2020, there were observable signs of deteriorating performance, reflected in the decline of ROA and the increase in NPLs of rural banks in Indonesia compared to the previous year (OJK 2020). The developments in NPLs can be seen as concerning indicators of performance issues in rural banks. For a comprehensive overview of the general indicators of rural banks nationwide, please refer to Table 1.

|

Indicators |

June 2019 |

March 2020 |

June 2020 |

|

CAR (%) |

22,78 |

31,45 |

30,80 |

|

ROA (%) |

2,37 |

2,28 |

1,98 |

|

NPL net (%) |

5,58 |

6,25 |

6,58 |

Table 1: General Indicators of Rural Banks in Indonesia

Source: OJK (2020)

As one of the provinces making a substantial contribution to the national economy, West Java also experienced a negative economic growth rate of -4,08% in the third quarter of 2020. The business and corporate services sector witnessed the most significant decline, with a contraction of -18,93%. The MSME sector in West Java encountered substantial risks of financial

losses and closures due to the COVID-19 pandemic, impacting at least 80% of MSME players. Policies for credit restructuring were implemented to assist two million debtors affected by COVID-19, out of the two million debtors affected by COVID-19 in West Java, 1,8 million MSMEs received restructuring assistance, representing an outstanding nominal amount of IDR 54 trillion out of a total of

IDR 102 trillion (BAPPEDA Jawa Barat 2020).

Based on the available data from the annual financial reports of rural

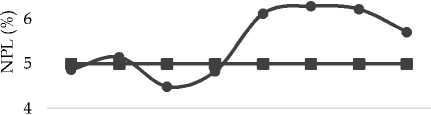

banks in West Java, it is evident that the NPL conditions of the 26 rural banks included in the West Java Regional Owned Enterprises indicate an average NPL value above 5% throughout 2020 and 2021 (OJK 2022). Specifically, the average NPL values based on quarterly reports for 2020 were 6,12% (Q1), 6,29% (Q2), 6,22% (Q3), and 5,71% (Q4). These findings indicate an increase in NPLs that coincides with the onset of the COVID-19 pandemic. For a visual representation of the average NPL values of rural banks in West Java, please refer to Figure 1.

NPL of Rural Banks in West Java

Q12029 q∖∏2029 Q ∖ 20⅛' q1∏2020

=O= Average NPL

Figure 1: Chart of Average NPL of Rural Banks in West Java

Source: OJK (processed)

In this research, the dependent variable chosen is ROA, while the independent variables include NPL, CAR, equity, net income, and the COVID-19 pandemic. NPL, CAR, equity, and net income are financial ratio components found in the financial statements of rural banks. Preliminary research data indicates that rural banks in West Java are encountering issues reflected in the increasing NPL. Based on this observation, the researchers assume that there might be a problem with the profitability of rural banks, thereby necessitating this study.

The primary objective of this study is to examine the dynamics of financial performance and the factors that influence the profitability of rural banks in West Java during the COVID-19 pandemic. In Indonesia, the first COVID-19 case was reported in March 2020; therefore, this study considers the occurrence of the pandemic in the second quarter. By analyzing the dynamics of financial performance, this research aims to derive managerial implications and strategies for rural banks to enhance profitability

through the utilization of financial ratio components. These steps can be instrumental in addressing the crisis, facilitating post-crisis recovery, and preparing for potential future crises.

RESEARCH METHODS

The panel data set comprises 26 samples of rural banks, covering the period from the first quarter to the fourth quarter of 2019 and 2020. The data used in this study is secondary data obtained from

financial reports published by rural banks, which were accessed through the website of the Indonesia Financial Services Authority. The research samples consist of conventional rural banks that are categorized as West Java Regional Owned Enterprises. Table 2 provides an overview of the 26 rural banks selected as research samples in West Java province.

|

No |

Code |

Rural Bank |

Regency/City |

|

1 |

RB01 |

BPR LPK Parung Panjang |

Bogor Regency |

|

2 |

RB02 |

PT BPR Cianjur Jabar |

Cianjur Regency |

|

3 |

RB03 |

PD BPR Intan Jabar |

Garut Regency |

|

4 |

RB04 |

PT BPR Cipatujah Jabar Perseroda |

Tasikmalaya Regency |

|

5 |

RB05 |

PD BPR Astanajapura |

Cirebon Regency |

|

6 |

RB06 |

PT BPR Majalengka Jabar |

Majalengka Regency |

|

7 |

RB07 |

BPR PK Balongan |

Indramayu Regency |

|

8 |

RB08 |

PT BPR Karya Utama Jabar |

Subang Regency |

|

9 |

RB09 |

PD BPR Karawang Jabar |

Karawang Regency |

|

10 |

RB10 |

PT BPR Wibawa Mukti Jabar |

Bekasi City |

|

11 |

RB11 |

PT BPR Kerta Raharja |

Bandung Regency |

|

12 |

RB12 |

BPR Garut |

Garut Regency |

|

13 |

RB13 |

PD BPR Artha Sukapura |

Tasikmalaya Regency |

|

14 |

RB14 |

PD BPR Kuningan |

Kuningan Regency |

|

15 |

RB15 |

Perumda BPR Kab. Cirebon (BKC) |

Cirebon Regency |

|

16 |

RB16 |

PD BPR Majalengka |

Majalengka Regency |

|

17 |

RB17 |

PD BPR Sumedang |

Sumedang Regency |

|

18 |

RB18 |

PD BPR Karya Remaja Indramayu |

Indramayu Regency |

|

19 |

RB19 |

PD BPR Subang |

Subang Regency |

|

20 |

RB20 |

PD BPR BKPD Pangandaran |

Pangandaran Regency |

|

21 |

RB21 |

PERUMDA BPR BKPD Cijulang |

Pangandaran Regency |

|

22 |

RB22 |

PD BPR BKPD Lakbok |

Ciamis Regency |

|

23 |

RB23 |

PERUMDA BPR Bank Kota Bogor |

Bogor City |

|

24 |

RB24 |

PERUMDA BPR Sukabumi |

Sukabumi City |

|

25 |

RB25 |

PD BPR Kota Sukabumi |

Sukabumi City |

|

26 |

RB26 |

PD BPR Kota Sukabumi |

Bandung City |

Table 2: Research Samples

This study employs descriptive and quantitative data analysis methods.

Descriptive analysis is utilized to provide an overview of the financial ratios of rural banks, while quantitative analysis is employed to examine the impact of independent variables on the dependent variable. Descriptive methods are employed to calculate key values such as the minimum, maximum, average, median, and standard deviation for each variable. The quantitative analysis utilizes the multiple linear regression analysis method with panel data. Microsoft Excel and STATA are the software applications used for this analysis.

In panel data analysis, two estimation model approaches can be used: the Fixed Effects Model (FEM) and the Random Effects Model (REM). The model in this is multiple linear regression referring to prior research by Almaqtari et al. (2018). The basic model of multiple linear regression is as follows:

Yt = αi + β1X1t + β2X2t + β3X3t +...+ βnXnt + ε,

the model used in this study is as follows:

ROAit = αi + βCARit + βNPLit + βEit + βNIit + βdCPt + ε,

where ROAit is the level of ROA of banki at timet, αi is intercept, β is regression coefficient, CARit is the level of CAR of banki at timet, NPLit is the level of NPL of banki at timet, Eit is the level of equity of banki at timet, NIit is the level of net income of banki at timet, dPCt is COVID-19 pandemic dummy at timet, and ε is residual.

RESULTS AND DISCUSSION

The mean values of ROA, CAR, and equity prior to the COVID-19 pandemic period have satisfied the standard, which are above 1,5% (BI 2013), a minimum of 8% (BI 2013), and a minimum of IDR 6 billion (OJK 2015). However, the average NPL value has not met the standard, which specifies a maximum of 5% (BI 2019). Table 3 displays the descriptive statistical values of the financial ratios of rural banks in West Java during the period from the first quarter of 2019 to the first quarter of 2020, prior to the COVID-19 pandemic.

According to Table 4, during the COVID-19 pandemic in 2020, the average values of ROA, CAR, and equity of rural banks in West Java met the established standards. However, the average NPL value did not meet the

prescribed standard. These descriptive statistics provide an overview of the financial ratios of rural banks in West Java from

the second quarter to the fourth quarter of 2020.

|

Financial Ratios |

Min |

Max |

Mean |

Median |

Std. Dev. |

|

ROA (%) |

-3,90 |

7,40 |

2,63 |

2,63 |

2,05 |

|

CAR (%) |

10,86 |

92,42 |

30,10 |

23,93 |

16,67 |

|

NPL (%) |

0,30 |

18,66 |

5,65 |

5,03 |

3,86 |

|

Equity (IDR billion) |

3,97 |

99,04 |

33,20 |

28,56 |

24,59 |

|

Net Income (IDR billion) |

-2,78 |

8,24 |

1,24 |

0,80 |

1,50 |

Table 3: Financial Ratio of Rural Bank in West Java before COVID-19 Pandemic

|

Financial Ratios |

Min |

Max |

Mean |

Median |

Std. Dev. |

|

ROA (%) |

-1,00 |

6,59 |

2,21 |

1,65 |

1,89 |

|

CAR (%) |

13,75 |

108,16 |

34,07 |

25,75 |

22,29 |

|

NPL (%) |

0,82 |

21,58 |

7,39 |

6,43 |

5,00 |

|

Equity (IDR billion) |

3,94 |

110,58 |

36,48 |

31,08 |

26,45 |

|

Net Income (IDR billion) |

-2,00 |

6,47 |

0,94 |

0,51 |

1,50 |

Table 4: Financial Ratio of Rural Bank in West Java during COVID-19 Pandemic

During the COVID-19 pandemic in 2020, the ROA experienced a decline

The ROA Dynamics of Rural Banks in West Java

Qt2019 q∏20O q∏12019 q1v20D q;2020 q∏2020 qφ2020 Q1y 2020

—•— Rural Bank - Research Sample (total)

⅛ Rural Bank - Research Sample Group 1 (managed by provincial and district governments)

—•— Rural Bank - Research Sample Group 2 (managed by district governments)

—■— The Bank of Indonesia's Minimum Standard

starting from the second quarter and continued until the final quarter of 2020.

The fluctuations in ROA for rural banks in West Java can be observed in Figure 3, illustrating the dynamic changes over the specified period.

maintain profitability above the established standards during the pandemic.

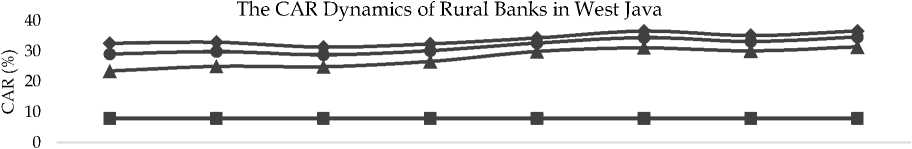

Figure 4 demonstrates a similar trend in the movement of CAR between Group 1 and Group 2. Throughout the COVID-19 pandemic, both groups experienced fluctuations in CAR

However, a few banks, specifically six in Group 1 and six in Group 2, recorded

Figure 3 illustrates a similar pattern in the movement of ROA between two groups of rural banks: those managed by provincial and district governments (Group 1) and

Qf2019 q∏2019 qUV20W qW2019 q12020 q∏2020 qφ2O2O qW 2020

=O= Rural Bank - Research Sample (total)

—*— Rural Bank - Research Sample Group 1 (managed by provincial and district governments)

—^- Rural Bank - Research Sample Group 2 (managed by district governments)

■ The Bank of Indonesia's Minimum Standard

-

Figure 3: Chart of Average NPL of Rural Banks in West Java

those managed solely by district governments (Group 2). Throughout the COVID-19 pandemic, both groups experienced a decline in profitability, but Group 2 managed to maintain ROA values above the set standards. Most rural banks in West Java were able to

ROA values below 1,5% since the second quarter of 2020.

CAR experienced a decrease in the third quarter of 2019 but subsequently increased in the following quarters until the second quarter of

2020. During the pandemic, CAR declined in the third quarter of 2020 but rebounded in the subsequent quarter. Figure 4 provides an overview of the dynamics in the CAR of rural banks in West Java.

performance, but they managed to maintain CAR values above the established standards. Furthermore, both groups displayed an upward movement in CAR compared to the

resilience in maintaining robust CAR values.

The average NPL value initially

Figure 5 depicts a similar pattern in the movement of NPLs between Group 1 and Group 2. Group 1 displayed a poorer performance with higher average NPL values and a more pronounced increase, particularly in the second quarter of 2020. Despite the pandemic, both groups recorded NPL values that exceeded the maximum standards. Only a limited number of

-

Figure 4: Chart of Average NPL of Rural Banks in West Java

previous year. All rural banks in West Java exhibited commendable CAR performance, surpassing the minimum standards consistently. In general, rural banks in West Java demonstrated

rural banks, specifically six rural banks from Group 2, were able to maintain NPLs below 5% during the COVID-19 declined in the third quarter of 2019, followed by a gradual increase until the

12

The NPL Dynamics of Rural Banks in West Java

QllOD q¾2019 qu120D qW2019 q12020 q∏2020 qφ2020 qW2020

—•— Rural Bank - Research Sample (total)

—*— Rural Bank - Research Sample Group 1 (managed by provincial and district governments)

^^^ Rural Bank - Research Sample Group 2 (managed by district governments) ■ The Bank of Indonesia's Maximum Standard

second quarter of 2020. However, upon entering the COVID-19 pandemic, the average NPL value gradually decreased until the final period of 2020. The dynamics of NPLs in rural banks of West Java are clearly depicted in Figure 5.

pandemic. On the other hand, several rural banks consistently reported NPLs above 5% throughout the pandemic, including eight rural banks from Group 1 and five rural banks from Group 2. Notably, in the second quarter of 2020, three rural banks from Group 1 witnessed a significant surge in NPLs, surpassing the average NPL levels.

As the COVID-19 pandemic emerged, equity movements tended to stabilize, with marginal changes, and the average equity value during the pandemic exceeded the previous year.

-

Figure 6 indicates a similar trend in the movement of equity between Group 1 and Group 2. Throughout the COVID-19 pandemic, both groups witnessed marginal fluctuations in equity performance, yet they managed to maintain equity values above the established standards. Only one rural bank from Group 1 recorded an equity value below the minimum standards

Figure 5: Chart of Average NPL of Rural Banks in West Java

50 The Equity Dynamics of Rural Banks in West Java

.2 40

-

3 t^---* --∙ ∙-----*

-

3 30 • -------

A 20 ⅛-------⅛------------ * * * * *

^ 10 _______________________________________________________________________

⅛ 0

w Q12019 qii 2019 q∏12019 qW2019 q12020 q∏2020 qφ2020 qW2020

=C= Rural Bank - Research Sample (total)

—*— Rural Bank - Research Sample Group 1 (managed by provincial and district governments)

—^- Rural Bank - Research Sample Group 2 (managed by district governments)

-

■ Financial Services Authority's Minimum Standard

Figure 6: Chart of Average NPL of Rural Banks in West Java

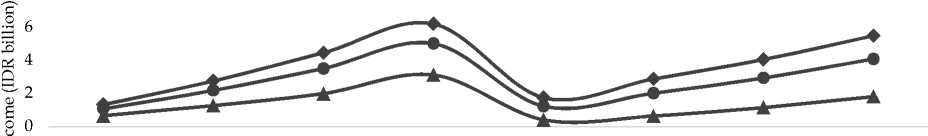

The Net Income Dynamics of Rural Banks in West Java

Ql2W9 q∏2019 qφ2019 qW2019 q12020 qu202° qφ2020 qW2020

Z —•— Rural Bank - Research Sample (total)

⅛ Rural Bank - Research Sample Group 1 (managed by provincial and district governments) =o= Rural Bank - Research Sample Group 2 (managed by district governments)

-

The dynamics of equity in rural banks of

that six rural banks in Group 1 reported

West Java are illustrated in Figure 6.

during the C OVID-19. pandemic.

-

Figure 7 illustrates the dynamics of net income in rural banks located in West Java. The net income exhibited an upward trend from quarter I to quarter IV, indicating a positive movement. However, during the COVID-19 pandemic, the growth in net income was relatively lower compared to the previous year.

-

Figure 7 indicates a similar pattern in the movement of net income between Group 1 and Group 2 in rural banks. Throughout the COVID-19 pandemic, both groups experienced

losses during the crisis, while seven rural banks in Group 2 managed to maintain net income levels above the average despite the challenging circumstances.

According to the Hausman test results presented in Table 5, the Prob>chi2 value is 0,522, indicating that REM is the appropriate estimation model. The REM approach suggests that the residual variation (ε) varies among individuals and/or over time, while the intercept (αi) and slope (β) remain constant.

relatively stable net income with minimal fluctuations, as evidenced by the average values. It is worth noting

|

Coefficients | |

|

Variables |

(b-B) (b) (B) sqrt (diag(V_b-V_B)) S.E. Difference Fixed Random |

|

CAR |

0,016 0,014 0,001 0,005 |

|

NPL |

-0,041 -0,111 0,070 0,020 |

|

Equity |

-0,297 0,320 -0,617 0,194 |

|

Net Income |

0,068 0,145 -0,077 . |

|

COVID-19 Pandemic |

-0,538 -0,461 -0,078 . |

chi2(5) = (b-B)'[(V_b-V_B)^(-1)](b-B) Prob>chi2 = 0,522

|

= 4,19 |

Table 5: Hausman Test Results |

The normality test results with a Prob>z value of 0,481, indicate that the residuals exhibit a normal distribution. The multicollinearity test results reveal that the correlation value between variables is <0,75, indicating the absence

of multicollinearit problems. The autocorrelation test results show a Prob>F value of 0,000, suggesting the presence of autocorrelation. To address this issue, the Feasible Generalized Least Square (FGLS) method is employed, with a coefficient of 0,671 for all panels. Based on Table 6, the Prob>chi2 value is 0,000. This implies that all independent variables

collectively have a significant impact on the dependent variable. The P>|z| values for CAR, NPL, and the COVID-19 pandemic variables are 0,042, 0,001, and 0,002. However, the P>|z| values for the equity and net income variables are 0,108 and 0,061. Therefore, it can be concludedthat CAR, NPL, and the COVID-19 pandemic significantly affect the ROA, while equity and net income do not have an impact on ROA. The overall R-squared value for the employed model is 0,421, indicating that all independent variables can explain 42,10% of the dependent variable. Consequently, 57,90% of the dependent variable is influenced by other factors not included in the model.

|

Variables |

Coef. |

Robust Std. Error |

z |

P>|z| |

[95% Conf. |

Interval] |

|

CAR |

0,015 |

0,007 |

2,03 |

0,042 |

0,000 |

0,029 |

|

NPL |

-0,111 |

0,034 |

-3,26 |

0,001 |

-0,177 |

-0,044 |

|

Equity |

0,320 |

0,199 |

1,61 |

0,108 |

-0,070 |

0,711 |

|

Net Income |

0,145 |

0,077 |

1,87 |

0,061 |

0,006 |

0,296 |

|

COVID-19 Pandemic |

-0,460 |

0,149 |

-3,09 |

0,002 |

-0,752 |

-0,168 |

|

Constant |

-7,632 |

4,566 |

-1,67 |

0,095 |

-16,582 |

1,316 |

|

R-square: |

Wald chi2(5) = |

47,140 | ||

|

within |

= 0,124 |

Prob>chi2 = |

0,000 | |

|

between |

= 0,528 | |||

|

overall |

= 0,421 | |||

|

Table 6: REM Regression |

The decline in financial performance, particularly in terms of ROA, NPL, and net income, can be attributed to the economic downturn

caused by the COVID-19 pandemic. The implementation of government policies such as Large-Scale Social Restrictions further hindered economic activity and affected the ability of borrowers to fulfill their obligations to rural banks. As loan products are a primary source of income for banks, the decline in credit quality and repayment difficulties have negatively impacted profitability. These

challenges disrupt the asset turnover in banks, increase credit risk, and raise the costs of debt and equity financing. During the COVID-19 pandemic, rural banks in West Java experienced a significant decline in ROA and a notable increase in NPLs. However, CAR was successfully maintained and even exhibited a positive trend. This suggests that rural banks focused on maintaining capital adequacy to mitigate losses stemming from deteriorating credit quality.

The statistical significance of CAR indicates its influence on profitability in

the studied rural banks. This finding is consistent with previous research by Ekinci and Poyraz (2019), which demonstrated a positive relationship between the capital ratio and ROA. Banks with a robust capital structure tend to generate higher profits as they rely less on external funding and have lower funding costs. The rural banks in West Java demonstrated sufficient capital adequacy to withstand the risks posed during the crisis, as their CAR ratios met the minimum standards set by the Central Bank before and during the COVID-19 pandemic.

In contrast, equity was found to have no statistically significant effect on ROA in the rural banks studied. This suggests that the management of equity by these banks may not have been efficient in generating profitability. Efficient banks, as identified by Widyasari and Nataherwin (2017), rely more on equity than leverage and tend to increase their equity in the business process. The positive effect of equity on ROA may result from shareholders assessing the financial health of banks

based on equity and net income. This factor encourages bank management to prioritize effective equity management to maintain investor confidence. However, in this study, equity did not demonstrate a significant impact on profitability.

NPL was found to have a statistically significant negative effect on profitability, aligning with the findings of previous studies by Ekinci and Poyraz (2019) which states that there is a significant negative effect between credit risk (NPL/total loan) on ROA. The increase in NPLs during a crisis is a common phenomenon, with a sharp upward movement followed by a gradual decline. The significant rise in NPLs during crises reflects unresolved NPL issues from the pre-crisis period, exacerbating their adverse impact on profitability in rural banks. Ineffective debtor supervision by the banks could also contribute to NPL issues.

Net income was not found to have a statistically significant effect on profitability in the studied rural banks. This contradicts the findings of Siswanti and Kharima (2016), which established a

significant positive influence of net profit before tax on ROA. While net profit is a component of profitability, the specific conditions of the studied banks during the COVID-19 pandemic indicated that profitability was not solely dependent on net profit. Other factors, such as CAR, NPL, and the pandemic itself, played significant roles in shaping the profitability of rural banks in West Java. It is possible that the banks' asset management strategies were not optimized, resulting in low profitability despite generating high net profits.

The COVID-19 pandemic was found to have a statistically significant negative effect on profitability in the rural banks studied. This finding differs from the assertion by Ali and Puah (2018) that financial crises do not significantly impact bank stability or profitability. In this study, assumptions were made that the MSMEs partnered with the rural banks were facing difficulties in meeting their obligations, leading to problems in loan repayment. Despite countercyclical policies, the adverse effects of the COVID-19

pandemic on banks and debtors persisted. Restructuring of credit and financing was only provided to debtors deemed capable of withstanding the impact of the pandemic and with viable business prospects. Overall, the pandemic had a significant negative impact on the profitability of rural banks in West Java.

The financial crisis is a foreseeable event, and bank management should leverage their expertise and knowledge to analyze and track economic trends. It is crucial for banks to proactively prepare for capital adequacy based on forecasts, utilizing every opportunity to increase their capital. Rural banks should focus on strengthening their capital buffers during the post-crisis recovery period when economic activities gradually stabilize. The primary capital and capital buffers serve as a protective cushion during recessions, enabling rural banks to support MSMEs facing difficulties. Thus, rural banks should be ready to expand their loan products business.

Strict credit policies and regular supervision are imperative for rural banks. Prudent principles must be applied when disbursing credit, with specific criteria in place for selecting debtors. Regular supervision helps evaluate the eligibility of borrowers. While rural banks can aggressively increase loan disbursement to enhance profitability through interest income, such lending should be limited to debtors meeting the predefined criteria. The board of commissioners plays a vital role in improving management oversight. Implementing good corporate governance practices is a strategy to boost profitability in rural banks. By optimizing the board's supervisory function, risky capital structure decisions that deplete internal capital can be restrained.

Cost efficiency plays a crucial role in maximizing net profits. Excessive operating costs can erode profitability, as bank management must allocate profits to cover these expenses. Emphasizing cost efficiency during normal times helps banks reduce risks and the possibility of

failure during financial crises, ultimately maintaining or even increasing profitability. Cost efficiency can be a superior strategy compared to profitability efficiency because high returns generated from high-risk investments tend to be temporary, while the benefits of cost efficiency are sustainable in the long term, even during future financial crises.

CONCLUSION

This study demonstrates a decline in the financial performance of rural banks in West Java during the COVID-19 pandemic, characterized by a decrease in ROA and an increase in NPLs. However, CAR and equity show a tendency to increase, while net income fluctuates. Despite the decline, the average ROA value remains above the minimum standards set by the Central Bank. Moreover, CAR and equity are also maintained at levels beyond the minimum requirements, although NPLs have risen sharply and do not meet the Central Bank's maximum standards. The average values of ROA, CAR, NPLs, equity, and net income during the

COVID-19 pandemic in 2020 were 2,21%, 34,07%, 7,39%, IDR 36,48 billion, and IDR 0,94 billion, respectively, compared to the previous year's averages of 2,63%, 30,10%, 5,65%, IDR 33,20 billion, and IDR 1,24 billion.

The determinants of CAR, NPLs, equity, net income, and the COVID-19 pandemic collectively influence the profitability of rural banks in West Java. Specifically, CAR has a significant positive effect, while NPLs and the COVID-19 pandemic have significant negative effects. However, all independent variables only account for 42,10% of the explained variance in the dependent variable, indicating that 57,90% is influenced by other factors.

To maintain and enhance profitability for rural banks in West Java, several strategies and policies can be implemented. These include increasing capital buffers during the post-crisis recovery period, enforcing strict credit policies with regular supervision, increasing the volume of credit disbursed, implementing good governance practices by optimizing the

role of the board of commissioners in supervision, and limiting risky management decisions related to capital structures. Additionally, focusing on operational cost efficiency can help reduce burdensome expenses for the company.

REFERENCE

Ali, M., & Puah, C. H. (2018). The internal determinants of bank profitability and stability: An insight from the banking sector of Pakistan. Management Research Review, 42(2), 49-67.

Almaqtari, F. A., Al-Homaidi, E. A., Tabash, M. I., & Farhan, N. H.

(2018). The determinants of profitability of Indian commercial banks: A panel data approach. International Journal of Finance and Economics, 24(1), 1-18.

Ari, A., Chen, S., & Ratnovski, L. (2021). The dynamics of non-performing loans during banking crises: A new database with post COVID-19 implications. Journal of Banking and Finance, 133, 1-22.

Assaf, A. G., Berger, A. N., Roman, R. A., & Tsionas, M. G. (2019). Does efficiency help banks survive and thrive during a financial crisis? Journal of Banking and Finance, 106, 445-470.

Badan Perencanaan Pembangunan Daerah Jawa Barat [BAPPEDA]. (2020). Rencana Kerja Pemerintah Daerah Provinsi Jawa Barat Tahun 2021. Bandung, ID: Badan Perencanaan Pembangunan Daerah Jawa Barat.

Badan Pusat Statistik [BPS]. (2021). Pertumbuhan Ekonomi Indonesia Triwulan I-2021. Jakarta, ID: Badan Pusat Statistik.

Balbaa, M. E. (2020). The predicted 2020 global economic crisis: Causes and prospects. The Light of Islam, 2, 182192.

Bank Indonesia [BI]. (2013). Peraturan Bank Indonesia Nomor 15/11/PBI/2013. Prinsip Kehati-hatian dalam Kegiatan Penyertaan Modal. Jakarta, ID: Bank Indonesia.

Bank Indonesia [BI]. (2019). Peraturan Bank Indonesia Nomor 21/12/PBI/2019. Rasio Intermediasi Makroprudensial dan Penyangga

Likuiditas Makroprudensial bagi Bank Umum Konvensional, Bank Umum Syariah, dan Unit Usaha Syariah. Jakarta, ID: Bank Indonesia.

Ekinci, R., & Poyraz, G. (2019). The effect of credit risk on the financial performance of deposit banks in Turkey. Procedia Computer Science, 158, 979-987.

Lestari, M. (2014). Dampak krisis ekonomi dan masuknya bank umum pada dasar kredit usaha mikro kecil terhadap kinerja bank

perkreditan rakyat (BPR) DIY. KINERJA, 18(1), 45-63.

Nezky, M. (2013). The impact of the US Crisis on trade and the stock market in Indonesia. Buletin Ekonomi Moneter dan Perbankan, 15(3), 83-96.

Otoritas Jasa Keuangan [OJK]. (2015). POJK Nomor 5/POJK.03/2015. Kewajiban Penyediaan Modal Minimum dan Pemenuhan Modal Inti Minimum Bank Perkreditan Rakyat. Jakarta, ID: Otoritas Jasa Keuangan.

Otoritas Jasa Keuangan [OJK]. (2020). Laporan Profil Industri Perbankan Triwulan II 2020. Jakarta, ID: Otoritas Jasa Keuangan.

Otoritas Jasa Keuangan [OJK]. (2022). Statistik BPR Konvensional. [Diakses 2022 Juni 25].

https://www.ojk.go.id/id/kanal/ perbankan/data-dan-statistik/Statistik-BPR-Konvensional/Default.aspx

Poruchnyk, A., Kolot, A., Mielcarek, P., Stoliarchuk, Y., & Ilnytskyy, D. (2020). Global economic crisis of 2020 and a new paradigm of countercyclical management. Business Perspectives, 19(1), 397-415.

Siswanti, T., & Kharimsa. (2016). Analisis pengaruh laba bersih sebelum pajak dan total aset terhadap return on assets (ROA) pada perusahaan properti yang terdaftar di Bursa Efek Indonesia periode 2011-2015. Jurnal Akuntansi & Bisnis UNSURYA, 1(1), 59-76.

Tambunan, T. (2021). Micro, small, and medium enterprises in times of crisis: Evidence from Indonesia. Journal of the International Council for Small Business, 2(4), 278-302.

Widyasari, N., & Nataherwin. (2016). Faktor-faktor yang mempengaruhi kinerja dan efisiensi bank perkreditan rakyat di Jakarta. Jurnal Ekonomi, 21(3), 408-419.

144

Discussion and feedback