Financial Investment Behavior of Individual Investors in Indonesia After the Revocation of the Covid-19 Policy

on

184Matrik: Jurnal Manajemen, Strategi Bisnis dan Kewirausahaan Vol. 17, No. 2, Agustus 2023

P-ISSN: 1978-2853

E-ISSN: 2302-8890

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 17 No. 2, Agustus (2023), 184-195

Financial Investment Behavior of Individual Investors in

Indonesia After the Revocation of the Covid-19 Policy

SINTA 2

Thasrif Murhadi1), Ghazali Syamni2*), Marzuki3), Zamzami

Zainuddin4), Sari Yulis Terfiadi5)

1,Universitas Muhammadiyah Aceh and Head of IDX at Indonesia Stock Exchange Banda Aceh

2,3,5 Universitas Malikussaleh

4 University of Malaya, Malaysia

Email: ghazali.syamni@unimal.ac.id

DOI : https://doi.org/10.24843/MATRIK:JMBK.2023.v17.i02.p06

ABSTRACT

This study explores the impact of psychological, social, and demographic aspects on individual stock investor decision-making after the revocation of COVID-19 in Indonesia. With the cooperation of local representatives of the Indonesian Stock Exchange, this study uses data collection approaches such as sending questionnaires to participants. The questionnaires were sent out between the three weeks of January 2023 after President Joko Widodo announced the lifting of social restrictions during the pandemic, and then at the end of 2022. In this way, 108 questionnaire responses were thus collected for the study. The results showed that individual stock investor behavior gender, age, and marital status didn’t affect individual investor's investment behavior. Work, education, and experience positively and significantly impact an individual investor's investment behavior. However, the revocation of social constraints negatively affects this behavior. A study finds education is the most important variable influencing equity investor behavior.

Keyword: Behavior; Covid-19; Investors; Individuals.

INTRODUCTION

The Indonesian government finally put into practice a strategy for restricting community activities in response to the COVID-19 outbreak after almost three years. On December 30, 2022, the government finally removed the limitations on communal activities. For society, including (potential) investors, the PPKM's revocation is of course a new source of hope. Considering that the Covid-19 outbreak shocked and decimated the economies of many nations, including Indonesia.

The capital market is one of the economic sectors that has been severely impacted by the Covid-19 pandemic, as seen by the drop in the stock price index (Budiarso et al., 2020); Subramaniam & Chakraborty, 2021). According to Rose Nirmala et al. (2022), Covid-19 has made it impossible for people to purchase assets in the best possible way because of constraints

on their activities, income insecurity, and lifestyle choices. Furthermore, this is a trait of individual investors who engage in inefficient trading (De Bondt, 1998).

Investors were concerned about any news that mentioned pandemic situations or information during COVID-19. Smales (2020), Subramaniam & Chakraborty, (2021), and Smales and Chakraborty (2021), investors pay more attention to news concerning Covid-19, which has a detrimental effect on stock price fluctuations. According to Budiarso et al. (2020), the market was successfully stimulated during COVID 19 and efficiency theory, prospect theory, and signaling theory all became phenomena.

According to Allam et al. (2020), news regarding allegations of mortality caused by Covid-19 is sensitive to influencing investor trading behavior. Markoulis and Vasiliou (2022), the stock market has grown inefficient because of the Covid-19 panic. To make wise investments, investors need to be intelligent people with greater self-assurance (Kurniadi et al., 2022). In other words, the outbreak of Covid-19 has impacted investors' psychological components of stock market investing because psychological factors influence the way investors behave when making financial decisions.

Djalilov & Ülkü (2021). Covid-19's presence reduced the number of shares bought, particularly by individual investors. Priem (2021) and Ortmann et al. (2020) described how individual investors particularly conducted more trade transactions during Covid-19. Furthermore, it was claimed by Rose Nirmala et al. (2022) and Fernandez-Perez et al. (2021) that government policies such as lockdowns were a factor in the high and low stock trading during COVID-19. According to Perrotta et al., (2021) during the Covid-19 pandemic, parents continued to worry about themselves and their children, women felt highly threatened, and trust declined.

The behavior-finance theory (BF) is a theoretical framework that explains the role of psychological elements in financial decision-making. In order to explain investor behavior in reaction to the introduction of information, Zhang & Zheng (2015) present the BF theory as a hypothesis that incorporates psychological and sociological variables. BF is a field of study that explains how investors behave while buying and selling stocks by taking irrational decisionmaking characteristics into account (Bashir et al., 2013)..Expressed this irrationality on the grounds that investors have different personalities than other people and that there is insufficient data to compare their perceptions (Mak et al., 2011). They behave irrationally when it comes to investing because of these natural variances (Fisher & Mandel, 2021).

According to Zaidi & Tahir (2019), the actions of individual investors include purchasing shares in their own accounts in accordance with their budget and for a specific quantity. Financial behavior is the volume of investments that investors select and place in their accounts (Mutswenje, 2009). Additionally, Antony & Joseph (2017) demonstrate that investors are presented with a variety of options that are considered cognitively when making investing decisions. According to some of the criteria given above, purchasing shares of a company using irrational assumptions is considered an investment decision.

The factors that investors consider when making investment decisions is demographics, sociological, and psychological. Demographic, sociological, and psychological aspects were identified by Mak & Ip (2017) as one the elements affecting investors' investment decisions. The demographic information provided by Rizvi & Fatima, (2015) includes gender, age group, total income, profession, marital status, and the number of dependent family members. Bashir et al. (2013) stated that other elements including religion, family, and family opinion had little

influence on investment behavior. Meanwhile, Hamad et al. (2021) found that demographic characteristics benefit financial market investment.

Sociological and demographic characteristics on investors' investment decision

Many empirical research on demographic, and sociological their impact on investors' capital market investment decisions yield contradictory findings. Alquraan et al. (2016), demographic parameters like gender, age, education level, and income had no bearing on investment choices. Meanwhile, investors' investing choices are influenced by their level of education. Dash (2010) said age and gender were characteristics that influenced investors' investment decisions, nonetheless it had no effect on investors' actions. Khawaja and Alharbi (2020) show that an education degree has an impact on investment decisions. According to Ortmann et al. (2020), elderly men dominate the trade population in America. Priem (2021), male investors between the ages of 18 and 35 participated less actively in stock trading during Covid-19 than female investors.

Septyanto & Adhikara's (2014) research conducted in Indonesia indicates that investors place greater trust and preference in their own subjective investing guidelines as opposed to financial information. Tjandrasa & Tjandraningtyas (2018) found that personality type, career history, family status, and income all had an impact on students' investment time during college. Fachrudin et al. (2018) found that decisions about investments were unaffected by the genders of men and women. According to Lutfi (2011), an investor's choice of investments is influenced by demographic factors such gender, age, marital status, income, and number of families. The summary provided above demonstrates how socio-demographic characteristics affect the decision-making of investors. Thus, based on the previous description, the following formulation of the research hypothesis might be made:

H1: Investors' investing decisions are influenced by gender

H2: Investment decisions made by investors are not influenced by age

H3: Investor decision-making is influenced by job level

H4: Investing decisions are influenced by investors' educational attainment

H5: Marital status affects investors' investing decisions

Psychological aspects and investors' investment decision

Besides sociological and demographic characteristics, other factors that influence investment decisions are psychological aspect. Psychological aspect is represented by investor experience and the lifting of community social restrictions. The analysis also takes the repeal of the Covid-19 policy into account as a factor influencing investors' judgments regarding their investment behavior.

Previous studies demonstrate that psychological factors have an impact on investors' investment decisions. Bakar & Yi (2016) and Zhang & Zheng (2015), the psychological aspects of investors influence their decision-making while making investments. Individual personal traits have an impact on investors' investment decisions, according to Sattar et al. (2020). Madaan & Singh, (2019) said the psychology of individual investors is often wrong because of their ignorance. The essay by Naseem et al. (2021) talks about the negative psychological effects on investing decisions they make. According to Görling et al. (2009) and Phan & Zhou (2014), psychological factors influence investors' investment decisions. Investment decisionmaking is influenced by the perception of the individual investor. Maditinos et al. (2007) state that professional investors depend less on portfolio analysis and more on technical and fundamental analysis. Malmendier & Nagel (2011), however, asserted that although individual

investors are more susceptible to media bias and inaccurate market information, investors who participate in transactions earn smaller historical returns, which appears to reduce risk. As a result, the hypothesis can be expressed as:

H6. Psychological aspects influence investors' investment decisions

METHOD

In this study, data were gathered via survey methods with investors. By giving out questionnaires to investors who are actively engaging in trade transactions across Indonesia, the survey technique was used. The survey asked on demographics, such as gender and age, sociology, and psychology, such as education level and marital status, as well as demographics, such as gender and age. The topic of the removal of social restrictions during the Covid-19 epidemic era was also added as a factor affecting investor psychology.

After President Joko Widodo declared that social restrictions imposed during the previous pandemic had been lifted, the spread began in the third week of 2023. The distribution of the survey was carried out by providing a link to it to all the representative offices of the Indonesian Stock Exchange in the provinces where there were representatives via email, telegram, and WhatsApp. The factors employed in this study are shown in Table 1 below and can be seen based on the questionnaire content indicators above:

|

Table 1. Variables and Measurements | ||||

|

No |

Variables |

Representation |

Symbol |

Scale |

|

1 |

Investment Decisions |

Number of investor's asset portfolios (Mak and Ip, 2017; Jagongo and Mutswenje (2014) |

FoP |

Nominal |

|

2 |

Age |

Investors’ age (Mak and Ip, 2017 |

Age |

Nominal |

|

3 |

Gender |

Investors’ gender (Mak and Ip, 2017 |

G |

Nominal |

|

4 |

Investo” s type of employment |

JOB |

Nominal | |

|

4 |

Education |

Investors’ level of education (Mak and Ip, 2017) |

EDU| |

Nominal |

|

5 |

Marital Status |

Investors’ marital status (Mak and Ip, 2017) |

MS |

Nominal |

|

6 |

Investing’s Experiences |

The time period over which investors invest (Mak and Ip, 2017 |

ExI |

Nominal |

|

7 |

Repeal of regulations regarding Covid-19 |

Investor’s attitudes regarding repeal of social distancing Allam et al. (2020) |

EPSBB |

Nominal |

|

Source: Various research | ||||

The SPSS software was used to process the data after it had been collected and tabulated. The study model was estimated using Eviews, and the data from previously gathered questionnaires were described using the SPSS application. A multiple regression research model was used in this investigation. This is the research model:

FoPt = a + βιGt + β2Aget + β3J0Bt + β4EDUt + β5MSt + β6 ExIt + j?7EPSBB + ε;

Where: α is a constant coefficient, FoP is the amount of money contributed by investors; Age is the age of investors; G as the gender of the investor; Investor's income level (LI), investor's educational level (EDU), etc. MS stands for the investor's marital status, ExI for the investor's prior investment experience, and EPSBB as the revocation of the social distancing

policy; ε as a confounding variable, and β1-β7 as the coefficient of each variable and α as a constant coefficient.

This study tests the classic assumptions before testing the model to investigate the elements that affect investors' investing decisions. To make sure the research model is accurate and unbiased, this classic assumption test is run. If the conditions outlined in the classical assumption are met, this research model is said to be fit (Gujarati, 2004) and; Porter & Gujarati, 2009) First, a plot test with the SPSS application is utilized to conduct the normality test in this study. If the data is distributed normally, it will follow the diagonal line. Second, the scatter plot test and the heteroscedasticity test were used to examine the variance dissimilarity of data observations, particularly cross-sectional data. The outcomes of dot distribution patterns with placements between zero values can determine if heteroscedasticity is present or absent. The multicollinearity test was lastly performed to examine the connection between the independent variables. When multicollinearity occurs, it is marked by the Variance inflation factor (VIF) value which is < 10.

RESULTS AND DISCUSSION

The indicators employed in this study and the origin of the respondents are described in Table 2 below. Table 2 explains why there are 108 respondents overall, originating from as many as 30 different locations. North Sumatra 16 (14.8%), Lhokseumawe 15 (13.9 %), Banda Aceh 14 (13.0), and Palembang 11 (10.2%) had the highest proportion of responses. Thus, it can be said that the respondents in this study were not dominated in one area. The indicators utilized in the study were described after describing information about the respondents’ location.

Table 2. Respondents’ Location

|

Location |

Frequency |

% |

Location |

Frequency |

% |

|

Aceh besar |

1 |

.9 |

Lampung |

1 |

.9 |

|

Aceh Timur |

2 |

1.9 |

Lhokseumawe |

15 |

13.9 |

|

Aceh Utara |

7 |

6.5 |

Palembang |

11 |

10.2 |

|

Banda Aceh |

14 |

13.0 |

Palu |

1 |

.9 |

|

Banjarmasin |

1 |

.9 |

Pekanbaru |

2 |

1.9 |

|

Batam |

5 |

4.6 |

Simeulu |

1 |

.9 |

|

Bengkulu |

1 |

.9 |

Sulawesi Tengah |

1 |

.9 |

|

Bireuen |

1 |

.9 |

Sulawesi Tenggara |

1 |

.9 |

|

Denpasar |

1 |

.9 |

Sulawesi Utara |

1 |

.9 |

|

Jakarta |

3 |

2.8 |

Sulawesi-Selatan |

3 |

2.8 |

|

Jambi |

3 |

2.8 |

Sumatera Barat |

3 |

2.8 |

|

Jawa Barat |

1 |

.9 |

Sumatera Utara |

16 |

14.8 |

|

Jawa Tengah |

2 |

1.9 |

Tanjungpinang |

1 |

.9 |

|

Jawa Timur |

5 |

4.6 |

Yogyakarta |

4 |

3.7 |

|

47 |

108 |

61 | |||

|

Total |

43.5 |

100 |

56.4 |

Source: Data is processed with SPSS

The research data indicates that there is not a significant disparity, as shown statistically in Table 3 below. The comparison of the standard deviation values, which are all lower than

the mean values for all indicators, demonstrates this. Table 3 further shows that 32 female respondents (29.6%) and 70 male respondents (70.6%) made up the majority of the study's participants.

This indicates that men investors dominate the Indonesian capital market more than female investors. Investors' ages indicate that they are in a productive period of life. Most investors are between the ages of 30 and 39, making up 37 (34.3%) of them. The most age of investors was 37 (34.3%) aged 30-39 years, less 24 years old is 27 (25%), 40-49 years old as many as 26 (24.1%) and the rest are followed by 25-29 years old and 50 years and older.

Most of the investor’s occupation is business owners or private companies, which employ up to 29 people (26.9%), followed by students, who employ up to 25 people (23.1%), businesspeople, who employ up to 24 people (22.5%), government employees, who employ up to 20 people (18.5%), and teaching staff, journalists, and even those with no work, who employ up to 5 people each (4.6%). It may be claimed that students are becoming more conscious of the value of investing. While this is happening, many investors have completed their undergraduate degrees 44 people (40.7%), are currently enrolled in classes—26 people (24.1%), have a master's degree (22%), five people have doctorates (4.6%), seven people have diplomas (6.5%), and as few as two people (1.9%) are still in school. This suggests that investors have very high levels of education and awareness. Additionally, the investors who made investments and turned into research respondents are largely married, accounting for 60.2% (65) of them, and not married, accounting for 39.8%.

Furthermore, based on investment experience, most investors have invested in the past one to two years, with 33 people (30.6%) having the greatest experience, followed by 24 people (22.2%) with more than five years, and newcomers with less than six months. As many as 14 people (13%), 21 people (19.4%), and an additional 4 years. In other words, it may be claimed that on average, investors have better experiences.

In the meantime, 67.5% of 73 respondents indicated that social limitations being lifted by the government had little impact on investing. As a result, investors, particularly individual investors during the epidemic, can continue to invest from the comfort of their homes without worrying about being troubled by Covid-19.

The number of investment portfolios held by respondents to this study is also detailed in Table 3 above. According to the above table, 49 investors with investment portfolios worth more than 10 million rupiah (45.4% of all investors), were followed by 29 investors with portfolios worth less than 2.5 million rupiah (26.9%). In addition, the portfolio group consists of 11 people (10.2%) who have a total of 7.5 million rupiahs to 10 million rupiahs, 14 people (13%), and the remaining 5 people (4.6%). The conclusion can be drawn that stock market investors are better equipped to increase the value of their holdings.

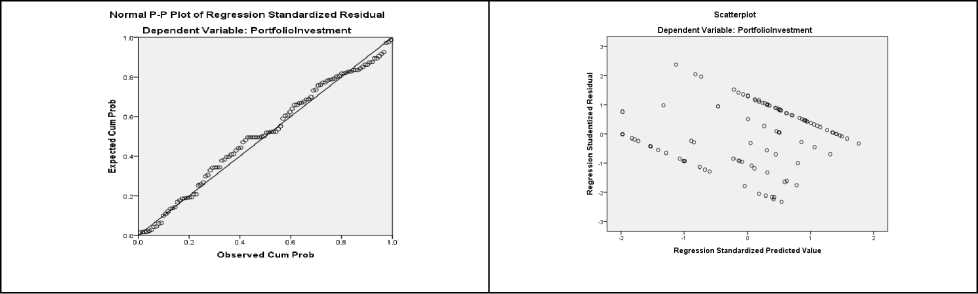

To make sure the model employed in this study conforms with the multiple regression rules, a classical assumption test was performed. Due to the absence of panel data in this model, the classical assumption test is that only tests for data normality, heteroscedasticity, and multicollinearity are run. The three SPSS tests' findings indicate that the regression model is free of these assumption issues.

All the respondent's data points tend to follow a diagonal pattern, according to the findings of the normality test performed using the scatter plot method. The data are therefore presumed to be regularly distributed. Additionally, the heteroscedasticity test findings, which demonstrate that the data in the analysis of all sample points are between zero and one, demonstrate the same thing (Figure 1). Finally, Table 4's multicollinearity test demonstrates

that this model is devoid of this issue. This is evident from the VIF value, which displays a number below 10 (Gujarati, 2004; and Porter & Gujarati, 2009).

|

Table 3. Data Descriptions | |||||

|

Indicator |

Explanation |

Frequency |

% |

Mean |

S D |

|

Gender |

Male |

76 |

70.4 | ||

|

Female |

32 |

29.6 |

1.30 |

0.46 | |

|

Age |

<24 years old |

27 |

25.0 | ||

|

25-29 years old |

10 |

9.3 | |||

|

30-39 years old |

37 |

34.3 |

2.80 |

1.27 | |

|

40-49 years old |

26 |

24.1 | |||

|

>50 years old |

8 |

7.4 | |||

|

Occupation |

Students |

25 |

23.1 | ||

|

Civil servants |

20 |

18.5 | |||

|

Lecturers Private |

5 |

4.6 |

3.20 |

1.63 | |

|

29 |

26.9 | ||||

|

Entrepreneur |

24 |

22.2 | |||

|

Others |

5 |

4.6 | |||

|

Education |

High schoolers |

2 |

1.9 | ||

|

University Students |

26 |

24.1 | |||

|

Three-year college graduate |

7 |

6.5 |

3.71 |

1.24 | |

|

Bachelor |

44 |

40.7 | |||

|

Magister |

24 |

22.2 | |||

|

Doctorate |

5 |

4.6 | |||

|

Marital status |

Single |

43 |

39.8 |

1.60 |

0.49 |

|

Married |

65 |

60.2 | |||

|

Investment’s experiences |

6 months |

21 |

19.4 | ||

|

1-2 years |

33 |

30.6 | |||

|

2.5-3 years |

10 |

9.3 |

3.21 |

1.85 | |

|

3.5 4 years |

14 |

13.0 | |||

|

4.5 -5 years |

6 |

5.6 | |||

|

> 5.5years |

24 |

22.2 | |||

|

PSBB |

Yes |

35 |

32.4 |

1.68 |

0.47 |

|

No |

73 |

67.5 | |||

|

Portfolio Fund Amount |

<IDR 2.500.000 |

29 |

26.9 | ||

|

IDR 2.500-Rp5.000.000 |

14 |

13.0 | |||

|

IDR 5.000.000-Rp7.500.000 |

5 |

4.6 |

3.34 |

1.74 | |

|

IDR7.500.000-Rp10.000.000 |

11 |

10.2 | |||

|

>IDR10.000.000 |

49 |

45.4 | |||

|

Source: Data is processed with SPSS | |||||

Following an explanation of the data description and conventional presumptions, this part discusses the estimation outcomes of the regression model as displayed in Table 3 above. The table above demonstrates how effective this regression model is. The significant F-statistic test score of 1% demonstrates this. The coefficient of determination (R2), which is 0.458 or 45.80, supports this finding. That is, the independent variables included in this study, including sociological and psychological characteristics connected to investment experience and the lifting of the PSBB, as well as demographic parameters (gender and age), can account for up to

45.80% of the behavior of investors. Meanwhile, 54.20% is influenced by other factors not tested in this study. `The estimation results listed in Table 4 above indicate that the constant in this study is 0.645 and the probability value is 0.462, both of which are not statistically significant at all levels (1%, 5%, and 10%).

Figure 1. Classical Assumption Test: Normality & Heteroscedasticity Results

Source: Data is processed with SPSS

|

Table 4. Research Result Estimate | |

|

Variables |

Coefficient t-statistic Probabilitiy VIF |

|

Constant G Age JOB EDU MS ExI EPSBB |

0.645 0.738 0.462 na

0.157* 1.721 0.088 1.346 0.579*** 4.482 0.000 1.554 0.576 1.555 0.123 2.023 0.176** 2.129 0.036 1.429

|

|

F-statistic R2 Adj.R2 |

12.049*** 0.458 0.420 |

Source: Data is processed with SPSS

The gender variable (G) has a negative coefficient value of -0.294 and a probability value that is insignificant. This shows that the behavior of investors is unaffected by gender when it comes to investing. Therefore, the first hypothesis which holds that investors' decisions about what to buy are influenced by their genderis not supported by these findings.This result is consistent with studies by Fachrudin et al. (2018); Khawaja & Alharbi, (2021), and Alquraan et al. (2016), which demonstrate that investor behavior is not influenced by gender. However, this study differs from those by Dash (2010), Lutfi (2011); Mak & Ip (2017); and Ortmann et al. (2020) who discovered that investors' behavior in making investment decisions is influenced by their gender.

Age's coefficient value is -0.068, and its probability value is insignificant. The results of these findings reject the second hypothesis which states that age influences investors' investment decisions.This result is consistent with research by Alquraan et al. (2016) and Khawaja & Alharbi (2021), who found no relationship between age and investor behavior. The research supports the assertions made by Hamad et al. (2021) and Lutfi (2011) that an investor's

age affects their behavior while making investments. This finding indicates that regardless of the investors’ age, cautions are still important when it comes to investing.

In contrast, the job level (JOB) has a probability value of 0.088 (significant 10%) and a coefficient value of 0.157. In other words, an investor's behavior when investing is influenced by the amount of work, they put in. This result lends credence to the third hypothesis, which holds that employment levels affect investors' choices of investments. This result is in line with research by Rizvi & Fatima (2015), Mak & Ip (2017), and Lutfi (2011), which found that an investor's level of work influences their behavior. The results of this study imply that risk-averseness may be higher among investors with better-paying jobs. Because it is believed that even if they do not gain from stock investing, they will continue to have a competitive advantage elsewhere. However, this research differs from that of Alquraan et al. (2016), which found that employment level has no impact on investor behavior.

Furthermore, the coefficient for education level (EDU) is 0.579, and the probability is 0.000 (significant 1%). In other words, stock market investors' conduct is influenced by their level of education. Thus, it can be said that the results research not reject the fourth hypothesis which states that the level of education influences investment decisions. The study's findings suggest that an investor becomes more mature, thoughtful, and possibly more confident as their educational level increases. This result is in line with research by Khawaja & Alharbi (2021); Mak & Ip (2017) and Lutfi (2011), which found that investors' investment behavior is influenced by their degree of education. However, Alquraan et al. (2016) claim that an investor's degree of education has no bearing on their conduct, which is where this study differs with it.

Meanwhile, the variable marital status (MS) is estimated using a coefficient value of 0.576 and a probability value of 0.123 (more than 10%). In other words, a representative's status has no impact on how an investor makes investments or rejects hypothesis five which states that investment decisions are affected by marital status. This means that an individual's investment behavior is independent of their marital status. Because everybody who actively seeks out and assimilates knowledge when investing can generate good returns. This conclusion contrasts with those made by Tjandrasa & Tjandraningtyas (2018); Mak & Ip (2017); Rizvi & Fatima (2015), and Lutfi (2011), who found that marital status affects investment behavior.

The investment experience variable (ExI) is significant at the 5% level (0.036) with a coefficient value of 0.176. Stated differently, investment experience affects investment behavior. This research suggests that investors with more expertise make better investments to increase the value of the assets in their portfolios. This result agrees with claims made by Tjandrasa & Tjandraningtyas (2018); Malmendier & Nagel (2011); Gärling et al., (2009); and Phan & Zhou (2014) that psychological aspects affected their investment. Contrary to Alquraan et al. (2016), who claim that experience has no bearing on an investor's investment behavior. Therefore, the sixth hypothesis that experience affects investors' investing decisions is not rejected by these results.

Finally, the social distance removal variable then exhibits a coefficient value of -0.521 with a probability of 0.068 (significant 10%), indicating that the government's repeal of social distance influences stock investors' behavior. Therefore, the final hypothesis of this study is not rejected. Research by Naseem et al., (2021); Maditinos et al. (2007); Allam et al. (2020); Rose Nirmala et al. (2022); Fernandez-Perez et al. (2021); as well as Djalilov & Ülkü (2021). The coefficient's negative sign suggests that investors may be inclined to marginally lessen their investment activity. This is feasible given that it is still early in the year, the January impact still exists, and greater possibilities to arise following the easing of social distance are still expected.

CONCLUSION

The purpose of this study was to investigate the variables that influence stock market behavior among individual investors. According to the study's findings, age and gender have little bearing on an investor's investment behavior. Additionally, the factors of job level and educational attainment have an impact on investors' investing decisions. However, investors' investment behavior is unaffected by their marital status. The results of this study also revealed that government limitations against social distance had an impact on investors' investment behavior, as had the investors' prior investing experience.

The number of respondents to the questionnaire, which was not a large number due to time restrictions, was a limitation of this study. The study's findings may not be able to be generalized as a result. Another drawback is that this research does not distinguish between novices and investors with extensive financial experience. The variables of economic level, religion, and social media usage are suggested to be included in future studies. Future research will also carry out experiments pertaining to the deviations (anomalies) created by investors.

REFERENCES

Allam, S., Abdelrhim, M., & Mohamed, M. (2020). The effect of the COVID-19 spread on investor trading behavior on the Egyptian Stock Exchange. Available at SSRN 3655202.

Alquraan, T., Alqisie, A., & Al Shorafa, A. (2016). Do behavioral finance factors influence stock investment decisions of individual investors?(Evidences from Saudi Stock Market). American International Journal of Contemporary Research, 6(3), 159–169.

Antony, A., & Joseph, A. I. (2017). Influence of behavioural factors affecting investment decision—An AHP analysis. Metamorphosis, 16(2), 107–114.

Bakar, S., & Yi, A. N. C. (2016). The impact of psychological factors on investors’ decision making in Malaysian stock market: A case of Klang Valley and Pahang. Procedia Economics and Finance, 35, 319–328.

Bashir, T., Javed, A., Butt, A. A., Azam, N., Tanveer, A., & Ansar, I. (2013). An assessment study on the factors influencing the individual investor decision making behavior”. IOSR Journal of Business and Management, 9(5), 37–44.

Budiarso, N. S., Hasyim, A. W., Soleman, R., Zam, I. Z., & Pontoh, W. (2020). Investor behavior under the COVID-19 pandemic: The case of Indonesia. Innovations, 17(3), 308– 318.

Dash, M. K. (2010). Factors influencing investment decision of generations in India: An econometric study. Int. J. Buss. Mgt. Eco. Res, 1(1), 15–26.

De Bondt, W. F. M. (1998). A portrait of the individual investor. European Economic Review, 42(3–5), 831–844.

Djalilov, A., & Ülkü, N. (2021). Individual investors’ trading behavior in Moscow Exchange and the COVID-19 crisis. Journal of Behavioral and Experimental Finance, 31, 100549.

Fachrudin, K. R., Lumbanraja, P., Sadalia, I., & Lubis, A. N. (2018). Are men or women more overconfident in investment decision-making? 1st Economics and Business International Conference 2017 (EBIC 2017), 68–72.

Fernandez-Perez, A., Gilbert, A., Indriawan, I., & Nguyen, N. H. (2021). COVID-19 pandemic and stock market response: A culture effect. Journal of Behavioral and Experimental

Finance, 29, 100454.

Fisher, S. A., & Mandel, D. R. (2021). Teaching & learning guide for: Risky‐choice framing and rational decision‐making. Philosophy Compass, 16(12), e12794.

Gärling, T., Kirchler, E., Lewis, A., & Van Raaij, F. (2009). Psychology, financial decision making, and financial crises. Psychological Science in the Public Interest, 10(1), 1–47.

Gujarati, D. N. (2004). Basic Econometrics (4. Baskı). Londra: McGraw Hill.

Hamad, H. A., Qader, K. S., Gardi, B., Abdalla, P., Hamza, D., & Anwar, G. (2021). The essential variables to consider before investing in financial markets during Covid-19. International Journal of Electrical, Electronics and Computers. Vol-6, (5).

Khawaja, M. J., & Alharbi, Z. N. (2021). Factors influencing investor behavior: an empirical study of Saudi Stock Market. International Journal of Social Economics, 48(4), 587-601.

Kurniadi, A. C., Sutrisno, T. F., & Kenang, I. H. (2022). The influence of financial literacy and financial behavior on investment decision for young investor in Badung District, Bali. Matrik :Jurnal Manajemen, Strategi Bisnis dan Kewirausahaan, 323.

https://doi.org/10.24843/matrik:jmbk.2022.v16.i02.p11

Lutfi, L. (2011). The relationship between demographic factors and investment decision in Surabaya. Journal of Economics, Business, & Accountancy Ventura, 13(3).

Madaan, G., & Singh, S. (2019). An analysis of behavioral biases in investment decisionmaking. International Journal of Financial Research, 10(4), 55–67.

Maditinos, D. I., Šević, Ž., & Theriou, N. G. (2007). Investors’ behaviour in the Athens Stock Exchange (ASE). Studies in Economics and Finance, 24(1), 32–50.

Mak, M. K. Y., Ho, G. T. S., & Ting, S. L. (2011). A financial data mining model for extracting customer behavior. International Journal of Engineering Business Management, 3, 16.

Mak, M. K. Y., & Ip, W.-H. (2017). An exploratory study of investment behaviour of investors. International Journal of Engineering Business Management, 9, 1847979017711520.

Malmendier, U., & Nagel, S. (2011). Depression babies: Do macroeconomic experiences affect risk taking? The Quarterly Journal of Economics, 126(1), 373–416.

https://doi.org/10.1093/qje/qjq004

Markoulis, S., & Vasiliou, N. (2022). The resilience of the Euro in the era of COVID-19. In Financial Transformations Beyond the COVID-19 Health Crisis (pp. 475–498). World Scientific.

Mutswenje, V. S. (2009). A survey of the factors influencing investment decisions: the case of individual investors at the NSE. Doctoral Dissertation, University of Nairobi.

Naseem, S., Mohsin, M., Hui, W., Liyan, G., & Penglai, K. (2021). The investor psychology and stock market behavior during the initial era of COVID-19: A study of China, Japan, and the United States. Frontiers in Psychology, 12, 626934.

Nirmala, A. R., Bhalaji, R. K. A., Kumar, S. B., Gnanaraj, S. J. P., & Appadurai, M. (2022). Study on the effect of COVID-19 pandemic on the savings and investment pattern of the manufacturing sector. Materials Today: Proceedings, 68, 1319–1323.

Ortmann, R., Pelster, M., & Wengerek, S. T. (2020). COVID-19 and investor behavior. Finance Research Letters, 37, 101717.

Perrotta, D., Grow, A., Rampazzo, F., Cimentada, J., Del Fava, E., Gil-Clavel, S., & Zagheni, E. (2021). Behaviours and attitudes in response to the COVID-19 pandemic: insights from a cross-national Facebook survey. EPJ Data Science, 10(1), 17.

Phan, K. C., & Zhou, J. (2014). Factors influencing individual investor behavior: An empirical study of the Vietnamese stock market. American Journal of Business and Management,

3(2), 77–94.

Porter, D. C., & Gujarati, D. N. (2009). Basic Econometrics. New York: McGraw-Hill Irwin.

Priem, R. (2021). An exploratory study on the impact of the COVID-19 confinement on the financial behavior of individual investors. Economics, Management, and Financial Markets, 16(3), 9–40.

Rizvi, S., & Fatima, A. (2015). Behavioral finance: A study of correlation between personality traits with the investment patterns in the stock market. Managing in Recovering Markets, 143–155.

Sattar, M. A., Toseef, M., & Sattar, M. F. (2020). Behavioral finance biases in investment decision making. International Journal of Accounting, Finance and Risk Management, 5(2), 69.

Septyanto, D., & Adhikara, M. F. A. (2014). Individual investors’ behaviour in decision making on securities investment in Indonesia Stock Exchange (ISE). Journal of Economics, Business, and Accountancy Ventura, 17(2), 187–196.

Smales, L. A. (2020). Title: Investor attention and the response of us stock market sectors to the COVID-19 crisis. SSRN Electron J.

Subramaniam, S., & Chakraborty, M. (2021). COVID-19 fear index: Does it matter for stock market returns? Review of Behavioral Finance.

Tjandrasa, B. B., & Tjandraningtyas, J. M. (2018). The effects of personality types and demographic factors on overconfidence bias and decision making of investment types. Petra International Journal of Business Studies, 1(2), 57–62.

Zaidi, A. Z. A., & Tahir, N. S. H. (2019). Factors that influence investment decision making among potential individual investors in Malaysia. Advances in Business Research International Journal, 5(1), 9–21.

Zhang, Y., & Zheng, X. (2015). A study of the investment behavior based on behavioral finance. European Journal of Business and Economics, 10(1).

Discussion and feedback