Risk Perception as Mediator in the Effect of Financial Literacy to Entrepreneurial Orientation among MSMEs

on

34 Matrik: Jurnal Manajemen, Strategi Bisnis dan Kewirausahaan Vol. 17, No. 1, Februari 2023

P-ISSN: 1978-2853

E-ISSN: 2302-8890

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 17 No. 1, Februari (2023), 34-47

Risk Perception as Mediator in the Effect of Financial Literacy to Entrepreneurial Orientation among MSMEs

Tiara Carina1), Ni Made Indah Mentari2), I Dewa Made Arik Permana Putra3), Melani Gita Sari4), Ni Putu Tasiya Purnama Dewi5) 1,2,3,4,5 Universitas Mahasaraswati Denpasar

Email: tiaracarina@unmas.ac.id

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2023.v17.i01.p03

ABSTRACT

This study aims to analyze the mediating role of risk perception on the effect of financial literacy to entrepreneurial orientation. From a total population of 32,026 MSMEs in Denpasar, 244 samples were taken through purposive sampling. Data were collected through the administration of Financial Literacy Instruments (rxx=0.639-0.891; r=0.974), Risk Perception Instruments (rxx=0.873-0.956; r=0.989), and Entrepreneurship Orientation Instruments (rxx=0.894-0.988; r=0.988). According to data analysis with Partial Least Square (PLS), it was found that financial literacy significantly affects entrepreneurial orientation; financial literacy significantly influences risk perception; risk perception significantly influences entrepreneurial orientation; and risk perception partially mediates the effect of financial literacy to entrepreneurial orientation in MSMEs in Denpasar. It was found that 49.8% of the variation in the entrepreneurial orientation variable is explained by financial literacy and risk perception variables, while the remaining 50.2% is contribution of other variables outside this research.

Keyword: risk perception, financial literacy, entrepreneurship orientation, MSME

INTRODUCTION

A country might be referred as prosper if it has at least 2% of entrepreneurs of the total population according to McClelland (Suparno & Saptono, 2018). Micro, Small and Medium Enterprises (MSMEs) are the biggest part of Indonesia’s economic development. MSMEs are profitable companies that conform to Indonesian law's definition of an MSME which posessed by individual or group of people. Owning a limited 1 billion asset, receiving a limited 50 billion income, and empowering a limited of 99 employees are criterias of MSMEs (Tanjung, 2017). MSMEs contributes 61.07% of GDP or worth 8,573.89 trillion rupiah with total number of MSMEs registered in Department of Cooperatives and SMEs currently reaches 64.2 million.

During the Covid-19 pandemic, Bali's economy decreased by 10.98 percent compared to the previous year (Kristanto, 2020). This decline is very significant and has a negative impact on all business fields. Many business sectors, including MSMEs, experienced negative growth due to not being able to survive the crisis. To be able to remain from these conditions, MSME managers need a good entrepreneurial orientation. According to the in-depth interviews, MSME owners still lack the necessity of entrepreneurial orientation to survive from the change caused by the pandemic. It is shown by the MSME owners who were not able to creatively produce more attractive product, could not forecast demand in the future market, and did not

dare to take risk because of the uncertain situation. The lack of entrepreneurial orientation is a problem that needed to be solved to support Bali’s economic growth during pandemic.

For a firm to succeed and function well, entrepreneurial orientation is crucial for business’ owners or managers (Mahmood et al., 2013; Zainol & Ayadurai, 2011). The approach used by a company or business when it enters a new state is refered as entrepreneurial orientation (Lumpkin & Dess, 2001; Lee & Peterson, 2000). Entrepreneurial orientation variable consists of five dimensions, which consists of autonomy, innovation, risk-taking behavior, proactiveness, and competitive aggressiveness (Lumpkin & Dess, 1996).

The idea of entrepreneurship, which assesses an individual's level of entrepreneurship based on innovation, proactiveness, and risk-taking behavior, is the source of entrepreneurship (Miller, 1983). Innovation demonstrates the ability to explore creativity by funding R&D projects (Hossain & Azmi, 2021). Being proactive means anticipating and acting on market demands and wants in order to outperform rivals as soon as possible (Lumpkin & Dess, 1996). Risk-taking behavior has been proposed by Wang & Poutziouris (2010) as a strategic thinking to support company growth that might provide a potential source of competitive advantage with favorable consequences that last for a long time on financial value and performance of a business.

The ability of MSMEs to innovate, manage their staff and customers, and recoup their initial investment are indicators of their sustainability (Fitria et al., 2018). This demonstrates that the business is growth-oriented and recognizes chances for further innovation (Hudson et al., 2001). Enhancing MSME actors' financial literacy is one approach to do this, enabling improved management and responsibility of MSME players, similar to what happened in large corporations. Financial literacy can help MSME owners to make best decision to get source, spend and manage financial sources to manage their business. Previous study revealed that financial literacy significantly and positively correlates entrepreneurial characteristics (Sarsale, 2021).

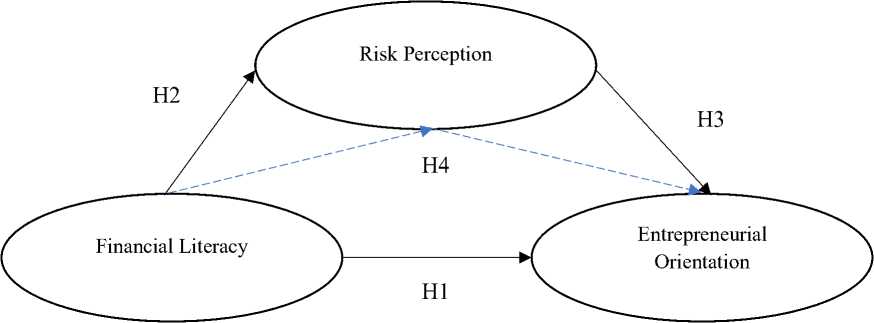

H1. Financial literacy influences entrepreneurial orientation.

Laily (2013) suggests that financial literacy is an individual’s intelligence about finance and financial management skills. Financial literacy includes knowledge related to financial topics, such as an introduction to financial service institutions, kind of financial products and services, the features attached in financial products and services, the benefits and risks of financial products and services, in addition rights and obligations as consumer users of financial services. Financial literacy is an important factor for individuals who want to be entrepreneurs and reduce the risk of entrepreneurship failure (Avlijaš & Avlijaš, 2014).

Financial literacy is the ability to handle money intelligently through understanding of facts, concepts, principles, and technology (Garman & Raymond, 2010). A person's capacity to handle common financial issues and assist in making financial decisions can be improved by someone who is financially literate. According to Xu & Zia (2012), the term financial literacy refers to a variety of concepts, including financial awareness and knowledge of financial institutions, products, and concepts; financial skills, such as the capacity to calculate complex interest rates; and general financial capacity, which includes the ability to manage money and make financial plans. General financial knowledge, savings and loans, investments, and insurance understanding are the four components that make up financial literacy (Chen & Volpe, 1998).

Financial literacy positively influences risk tolerance (Permanasari et al., 2020). Based on behavioral finance theory, individual behavior in making financial decisions is rational, which means acting based on logical and reasonable considerations (Nosffinger, 2018). Risk must be considered when making decisions in times of crisis, therefore the perception of an entrepreneur's risk plays a very important role in determining the orientation of an entrepreneur.

H2. Financial literacy influences risk perception.

Risk perception is defined as an individual's subjective estimate to get the consequences of losses in receiving a desired outcome (Pavlou, 2003). Risk perception is measured through 6 dimensions, namely social risk, time risk, financial risk, physical risk, functional risk, and psychological risk (Wulandari, 2012). Social risk is the risk that comes from making a wrong decision that causes embarrassment about considering what other people think about the choice, the potential for losing people's recognition, or appreciation from friends. Time risk is the limited time to make decisions to satisfy needs, time consumption of product use, and potential loss of time when searching for information. Financial risk refers to financial loss due to mis-allocation of investments and indiscretion in making decisions. Physical risks are health and safety risks. Functional risk is defined as the loss that occurs when a decision does not go as expected. Psychological risk generally describes how a decision may hurt individual’s selfesteem or certain perception of themselves (Cases, 2002).

According to Ajzen (1991), theory of planned behavior assumed that humans act rationally according to their attitudes and normative beliefs. Individual with better risk perception will be able to run business with confidence as an individual with high entrepreneurial orientation do. Entrepreneurship can not be separated from risk-taking behavior, while the risk-taking behavior often refers to their perception of risk (Agustina, 2021). Previous study confirmed the effect of entrepreneurial risk perception to entrepreneurial intention (Shah et al., 2019).

H3. Risk perception influences entrepreneurial orientation.

Studies conducted to predict the effect of financial literacy to entrepreneurial orientation are very limited. Financial literacy is an important factor to support entrepreneurial advancement. Business owners are frequently involved in decision making regarding purchasing, alllocating, and take advantage of their financial resources (Pandey & Gupta, 2018). Contrary to these results, some entrepreneurs in previous study have deficient understanding of bank and equity finance while running a business. It is stated that new microentrepreneurs in South Africa have low level of financial literacy (Fatoki, 2014). Therefore, research on the direct relationship between financial literacy and entrepreneurial orientation requires mediating factor. Risk perception is variable that needed to be examined as mediator between the relationship of financial literacy and entrepreneurial orientation.

H4. Risk perception mediates the effect of financial literacy to entrepreneurial orientation.

According to the background and the results of previous studies, the influence of financial literacy and risk perception on entrepreneurial orientation needs to be analyzed. Through this study, researchers also want to explore the mediating role of risk perception in the effect of financial literacy to entrepreneurial orientation among MSMEs in Denpasar.

METHODS

This research method is inferential quantitative research that focuses on analyzing the influence of financial literacy and risk perception on entrepreneurial orientation, as well to explore how risk perception mediates the effect of financial literacy to entrepreneurial orientation among MSMEs in Denpasar.

The population of this research were 32,026 MSMEs in Denpasar which were registered in the Denpasar City Cooperatives and SMEs Department data. The samples of this study were choosen by purposive sampling, a sampling method that takes certain factors into account to improve the research data representativeness (Sugiyono, 2008). MSMEs which selected as samples must be registered in the Denpasar City Cooperatives and SMEs Department and

having a business which have been running for at least one year when the research data was

collected. The number of samples used is 244 samples using the formula by Isaac and Michael

(Sugiyono, 2008).

λ2.N.P.Q

(1)

S = ----------

d2(N-l)+λ2.PQ

1.96!%32026%0.5x0.5

0.05!x(32026 - 1) + 1.645!%0.5%0.5

= 243.9968 ≈ 244

The primary data in this study were obtained through in-depth interviews with MSMEs in Denpasar as an initial study and FGDs with the Denpasar City Cooperatives and SMEs Department. Primary data was also collected through the administration of the research variables, which consists of adaptation of Financial Literacy Instruments with dimensions of general knowledge about finance, savings and loans, investment, and insurance (Elvara & Margasari, 2019), adaptation of Entrepreneurial Orientation Instruments with dimensions of innovation, proactiveness, and risk-taking behavior (Covin et al., 2020), as well as modification of Risk Perception Instruments consisting of dimensions of social risk, time risk, financial risk, physical risk, functional risk, and psychological risk (Wulandari, 2012). The research instruments use likert scale in the measurement consisting of a score of 1 to 4 which describes as strongly disagree (STS = score 1), disagree (TS = score 2), agree (S = score 3), and strongly agree (SS = score 3) 4). Secondary data in this study was acquired from Denpasar City Cooperatives and SMEs Department which is about the number of MSMEs in Denpasar which registered at the depatment.

Instrument Validity and Reliability Test Results

Table 1. Financial Literacy Instruments Validity Test Results

|

Item |

Corelation Coefficient |

Description |

|

Finl 1 |

0,843 |

Valid |

|

Finl 2 |

0,772 |

Valid |

|

Finl 3 |

0,891 |

Valid |

|

Finl 4 |

0,856 |

Valid |

|

Finl 5 |

0,825 |

Valid |

|

Finl 6 |

0,870 |

Valid |

|

Finl 7 |

0,859 |

Valid |

|

Finl 8 |

0,820 |

Valid |

|

Finl 9 |

0,833 |

Valid |

|

Finl 10 |

0,821 |

Valid |

|

Finl 11 |

0,829 |

Valid |

|

Finl 12 |

0,800 |

Valid |

|

Finl 13 |

0,800 |

Valid |

|

Finl 14 |

0,750 |

Valid |

|

Finl 15 |

0,688 |

Valid |

|

Finl 16 |

0,683 |

Valid |

|

Finl 17 |

0,639 |

Valid |

|

Finl 18 |

0,795 |

Valid |

|

Finl 19 |

0,889 |

Valid |

|

Finl 20 |

0,842 |

Valid |

|

Finl 21 |

0,839 |

Valid |

|

Finl 22 |

0,849 |

Valid |

Table 2. Risk Perception Instruments Validity Test Results

|

Item |

Corelation Coefficient |

Description |

|

Risk 1 |

0,873 |

Valid |

|

Risk 2 |

0,935 |

Valid |

|

Risk 3 |

0,956 |

Valid |

|

Risk 4 |

0,927 |

Valid |

|

Risk 5 |

0,938 |

Valid |

|

Risk 6 |

0,919 |

Valid |

|

Risk 7 |

0,917 |

Valid |

|

Risk 8 |

0,874 |

Valid |

|

Risk 9 |

0,916 |

Valid |

|

Risk 10 |

0,921 |

Valid |

|

Risk 11 |

0,949 |

Valid |

|

Risk 12 |

0,900 |

Valid |

|

Risk 13 |

0,937 |

Valid |

|

Risk 14 |

0,925 |

Valid |

|

Risk 15 |

0,944 |

Valid |

|

Risk 16 |

0,889 |

Valid |

|

Risk 17 |

0,904 |

Valid |

|

Risk 18 |

0,912 |

Valid |

Table 3. Entrepreneurial Orientation Instruments Validity Test Results

|

Item |

Corelation Coefficient |

Description |

|

Ent 1 |

0,938 |

Valid |

|

Ent 2 |

0,933 |

Valid |

|

Ent 3 |

0,988 |

Valid |

|

Ent 4 |

0,988 |

Valid |

|

Ent 5 |

0,946 |

Valid |

|

Ent 6 |

0,977 |

Valid |

|

Ent 7 |

0,977 |

Valid |

|

Ent 8 |

0,977 |

Valid |

|

Ent 9 |

0,894 |

Valid |

A total of 30 respondents were used in the trial of the research instrument. According to the results of SPSS program analysis, all items in Financial Literacy Instruments, Risk Perception Instruments, and Entrepreneurial Orientation Instruments are declared valid because they have a correlation coefficient > 0.3. The correlation coefficients of valid items are listed in the table 1, 2 and 3.

Table 4. Reliability of Research Instruments

|

Variable |

Cronbach Alpha Coefficients |

Item Total |

|

Financial Literacy |

0,974 |

22 |

|

Risk Perception |

0,989 |

18 |

|

Entrepreneurial Orientation |

0,988 |

9 |

The reliability test of Financial Literacy Instruments, Risk Perception Instruments, and Entrepreneurial Orientation Instruments were carried out using a single trial administration method with the alpha coefficient formula (Azwar S., 2013: 115). The research instrument can be declared reliable if the Cronbach Alpha coefficient value is above 0.6. Based on the table 4,

because the three research instruments have a Cronbach Alpha coefficient > 0.6, they are claimed as reliable research instruments.

In this study, partial least squares (PLS) methodology is used in conjunction with structural equation modeling (SEM) analysis tool. PLS is known as a powerful analytical procedure since it doesn't need that the data be measured on a specific scale, the number of samples used can be low, it can be applied to test a theory, and it aids in the extraction of latent variables for prediction purposes (Ghozali, 2011). The SEM-PLS analytical procedure employs probability to test hypotheses (p-value). The test shows a significant relationship between the latent variables of risk perception, financial literacy, and entrepreneurial orientation if the p-value of 0.05 (alpha of 5%) is attained.

Two approach methods can be used to determine the role of mediation in the model, namely examination and testing. The examination method is done by looking at the difference in path coefficients, while the testing method is done by testing the indirect effect path coefficients. In this study, the role of mediation is seen using an examination approach with the following steps (Solimun et al., 2017): investigate the direct relationship between the exogenous variable and the endogenous variable in the model without the mediating variable; investigate the relationship between the exogenous variable and the endogenous variable in the model with the mediating variable; investigate the relationship between the exogenous variable and the mediating variable; and investigate the relationship between the mediating variable and the endogenous variable.

According to the results of the four hypotheses examination, then the intervention of the mediating variable can then be determined with the following stages of analysis:

-

1) The analysis' findings, specifically the path coefficient in H1, must be significant.

-

2) The risk perception is referred to as a complete mediation variable if path coefficients in H3 and H4 are both significant but H2 is not.

-

3) The perception of risk is said to as partial mediation if H3 and H4 are confirmed significant and H2 is also significant as well, where H2's path coefficient is smaller than H1's.

-

4) The perception of risk is stated to not be a mediating variable if H3 and H4 are significant and H2 is also confirmed significant, where the path coefficient of H2 is nearly identical to H1.

-

5) Risk perception is not a mediating variable if either H3 or H4 or both are not significant.

Figure 1. Conceptual Framework

RESULTS AND DISCUSSION

Characteristics of Research Respondents

The demographic factors of gender, age, and business location were analyzed to explain the traits of respondents in this research. This study has 244 respondents. Table 5 details the characteristics of the respondents as well as the respondent's identification.

Table 5. Respondent’s Characteristics

|

Characteristics |

Classification |

Number of Respondents |

Percentage (%) |

|

Gender |

Male |

68 |

27,9 |

|

Female |

176 |

72,1 | |

|

Total |

244 |

100,0 | |

|

Age |

13 - 18 years |

8 |

3.3 |

|

19 - 40 years |

212 |

86.9 | |

|

41 - 60 years |

24 |

9.8 | |

|

Total |

244 |

100.0 | |

|

Business Location |

Denpasar Utara |

50 |

20.5 |

|

Denpasar Timur |

78 |

32.0 | |

|

Denpasar Barat |

71 |

29.1 | |

|

Denpasar Selatan |

45 |

18.4 | |

|

Total |

244 |

100.0 |

In Table 5, it can be seen that there are more female respondents than male respondents. In terms of age, the largest number of respondents were in the age range of 19-40 years which can be clustered in the early adult stage as many as 212 people, followed by the age group of 41-60 years and the least in the age range of 13-18 years. The business location of respondents in this study were evenly distributed in all sub-districts in Denpasar City.

Research Model Analysis Using PLS Method

Structural Equation Modeling (SEM) and the Partial Least Squares (PLS) method were used to examine this study. There are two basic model evaluations in this test, the outer model and the inner model.

Outer Model Evaluation Results

Latent variables in this study, which consists of entrepreneurial orientation (Y), financial literacy (X), and risk perception (M) are measurement models with reflective indicators. Convergent and discriminant validity, as well as composite reliability are analyzed to evaluate reflective indicator in this research model.

Convergent Validity

According to the results of testing the convergent validity using PLS, outer loading value of the indicators of financial literacy are range from 0.783 to 0.852; the indicators of entrepreneurial orientation have outer loading value range from 0.792 to 0.966; and the indicators of risk perception have outer loading value range from 0.812 to 0.925. All of the indicators for the latent variables of financial literacy, risk perception, and entrepreneurial orientation have an outer loading value greater than 0.5, indicating that they are all valid indicators for determining each variable's value.

Discriminant Validity

The measurement model's cross loading evaluation is used to determine whether the construct has strong discriminant validity. When each indicator is cross loaded onto the relevant variable, which has the highest value if it is set side by side with the cross loading

value of another latent variables in this research, discriminant validity is said to be valid. Based on the data analysis performed using PLS, conclusion can be drawn that the three instruments exercised in this study have achieved discriminant validity because the cross loading correlation score of each indicator in the pertinent variable has the highest score when it is compared to the cross loading of other latent variables.

Examining the average variance recovered for each concept in the model is another technique to judge the discriminant validity of the model. If the AVE value is greater than 0.50, the model's discriminant validity is satisfactory. Table 6 displays the findings of the discriminant validity test.

Table 6. AVE Value

|

Average Variance Extracted (AVE) | |

|

Financial Literacy |

0.654 |

|

Entrepreneurial Orientation |

0.851 |

|

Risk Perception |

0.785 |

According to Table 6, the AVE value of each research instrument has been above 0.50, hence a conclusion can be drawn that the instrument in this study has matched the criteria of adequate discriminant validity.

Composite Reliability

By examining the composite reliability value, researchers can assess the instrument reliability of the measurement model with reflected indicators. If the composite reliability number is at least 0.70, it is considered to be good. The results of the instruments' reliability are shown in Table 7.

Table 7. Composite Reliability

|

Composite Reliability | |

|

Financial Literacy |

0.976 |

|

Entrepreneurial Orientation |

0.981 |

|

Risk Perception |

0.985 |

Table 7 shows that the composite reliability value for financial literacy, entrepreneurial orientation and risk perception constructs has a value of greater than 0.7. Hence, each instrument in this research has good reliability.

Structural Model Evaluation Results (Inner Model)

Based on the substantive theory of research, the inner model is a structural model that describes the link between latent variables (Solimun, et al., 2017). In PLS, before interpreting the results of hypothesis testing, the model must be ensured to have a good Godness of Fit. By computing the Q-Square value, godness of Fit model is measured. The formula for Q-Square is: Q2 = 1 – [(1-R12) (1-R22)]. This formula requires an R-Square value to be inputted, which has a function to find out how much the contribution of the X variable to the Y variable. From the R-Square value researchers can see how the exogenous variable affects the endogenous variable. The R-Square value can be grouped into strong category, moderate category and weak category. The score of R-Square from 0.75 to 1 is classified in the strong category, the R-Square value from 0.5 and above is in the moderate category and the R-Square value of 0.25 is included in the weak classification (Hair et al., 2011).

Table 8. R Square Test

|

R Square |

R Square Adjusted | |

|

Entrepreneurial Orientation |

0.516 |

0.512 |

|

Risk Perception |

0.563 |

0.561 |

In Table 8, the R-Square value for the variable Financial Literacy on Entrepreneurial Orientation is 0.516 which is included in the moderate category. It indicates that the contribution of the financial literacy variable affects the entrepreneurial orientation of 51.6%. Meanwhile, the effect of financial literacy variable on risk perception is included in the moderate category which can be seen by the R square value of 0.563. This value shows that the risk perception variable affects the entrepreneurial orientation variable by 56.3%. Godness of Fit is used to validate the overall structural research model which identified by calculating the Q-Square value. A model has a relative relevance value if the Q-Square value is more than 0 (zero), whereas a model lacks a relative relevance value if the Q-Square score is below 0. Calculating a Q-Square can be done as shown below:

Q-square = 1 – [(1-R12) (1-R22)] …………………………………………………………. (2) Q-square = 1 – [(1-0,5162) (1-0,5632)]

Q-square = 1 – [(0,734) (0,683)

Q-square = 1 – 0,501

Q-square = 0,498

According to the calculation, the Q-Square value is obtained at 0.498, which is greater than 0, hence the model in this research has a predictive relevance value of 49.8%. This means that variations in the entrepreneurial orientation is explained by financial literacy variable and risk perception variable, while variables not included in this research model are responsible for explaining the remaining 50.2%.

Hypothesis Testing Results

Probability values are seen to test the hypothesis. To reject or accept the hypothesis, using an alpha value of 5%, then H0 is rejected if the p-values <0.05.

Table 9. Direct Effect Test Results

|

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

T Statistics (|O/STDEV|) |

P Values | |

|

Financial Literacy -> Entrepreneurial Orientation |

0.214 |

0.219 |

0.069 |

3.084 |

0.002 |

|

Financial Literacy -> Risk Perception |

0.750 |

0.755 |

0.030 |

25.004 |

0.000 |

|

Risk Perception -> Entrepreneurial Orientation |

0.544 |

0.537 |

0.069 |

7.879 |

0.000 |

Based on Table 9, the p-values of the effect of financial literacy to entrepreneurial orientation are 0.002, where 0.002 < 0.05, it means that having a strong financial literacy foundation has a significantly favorable impact on having an entrepreneurial orientation. The p-values of financial literacy to risk perception are 0.000, where 0.000 < 0.05, it can be said that risk perception is significantly and positively influenced by financial literacy. The p-values of the effect of risk perception to entrepreneurial orientation are 0.000, where 0.000 < 0.05. This leads to the conclusion that risk perception significantly enhances entrepreneurial orientation.

Table 10. Indirect Effect Test Results

|

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

T Statistics (|O/STDEV|) |

P Values | |

|

Financial Literacy - |

> Risk 0.408 |

0.405 |

0.053 |

7.695 |

0.000 |

Perception -> Orientasi

Kewirausahaan (OK)

The p-values of the financial literacy variable on entrepreneurial orientation through risk perception in Table 7 are 0.000 which is 0.000 < 0.05. According to the value found, risk perception has a positive and significant mediating role in the influence of financial literacy on entrepreneurial orientation.

According to the mediation test criteria, the results of hypothesis testing using PLS analysis are in accordance with the criteria for point 3 where P2, P3 and P4 are significant and P2 < P1, consequently it can be concluded that there is partial mediation model in this study.

The Effect of Financial Literacy on Entrepreneurial Orientation

Based on Table 9 in results, the coefficient of financial literacy path towards entrepreneurial orientation is 0.214 and the p-values are 0.002. This shows that entrepreneurial orientation is positively affected by financial literacy. The higher score of financial literacy will make an impact on the higher score of entrepreneurial orientation of MSME owners in Denpasar. A person's capacity to solve practical financial issues and assist in entrepreneurial decision-making can both be improved by having a solid understanding of finance. MSME owners will be more active in innovating, more proactive in taking steps in business development, and have a better risk taking in making business decisions. Segura & Zamar (2019) supports this study results which states that there is a relationship between financial education and creative entrepreneurship. Laiea et al. (2020) also supported this research results, which stated that financial resources, orientation, and performance affects entrepreneurial orientation in research that takes place in Europe, Asia, and Africa. Good financial literacy can help MSMEs increase their business performance and innovate (Yuliati et al., 2022).

The Effect of Financial Literacy on Risk Perception

The influence of financial literacy on risk perception can be seen from the path coefficient score of 0.750 and p-values of 0.000 which indicates that financial literacy positively affects risk perception. The better the financial literacy will affect to the higher perception of risk owned by MSMEs. This shows that having good financial knowledge can make MSMEs increase subjective estimates to avoid the consequences of losses in achieving company goals. MSMEs owners may fail growing business because they do not have a good risk perception while running the company. Better financial knowledge will help them in risktaking action, because the increasing of financial literacy leads to the better risk perception. The results of research by Bannier & Neubert (2016) show that both actual and perceived financial literacy are relevant for financial risk taking. Investment risk perceptions were affected by financial knowledge in the research of Aren & Dinç Aydemir, (2015). Another previous research also supported this research results which stated that financial literacy encourages risk-taking behavior (Korkmaz et al., 2021).

The Effect of Risk Perception on Entrepreneurial Orientation

The influence of risk perception on entrepreneurial orientation can be seen from the path coefficient value of 0.544 and p-values of 0.000 which indicates that risk perception has a positive effect on entrepreneurial orientation. The better an individual’s risk perception, the better his entrepreneurial orientation will be. Individuals who have a positive perception of risk tolerance tend to have entrepreneurial intentions (Wijaya et al., 2015). Individuals often do not want to start a business for fear of failing or suffering losses, so this individual will not want to become an entrepreneur. Meanwhile, individuals who have a positive tolerance for risk will be able to become entrepreneurs. Traditionally, the tendency of individuals to take risks is an individual personality characteristic that is considered to be able to influence an individual's decision to start a business (Annisa et al., 2021). Therefore, an individual's assessment of risk can affect his mindset in building a business. Individuals who assess risk positively will not be afraid to start a business or innovate in a business that he knows is likely to fail.

Mediating Role of Risk Perception on the Effect of Financial Literacy on Entrepreneurial Orientation

Based on the results of data analysis, it is found that risk perception is able to positively mediate the influence of financial literacy on entrepreneurial orientation which can be seen from the path coefficient value of 0.408 and p-values of 0.000. The better financial knowledge they have, the MSMEs will be able to better assess the risks that their business may face in the future. This will make MSMEs not afraid or hesitant to start a business or innovate in their business to achieve their business goals. Groups with entrepreneurial activities have quite prominent characteristics in terms of their tendency to take risks than other groups (Hariani & Irfan, 2021). This research is in line with (Bezzina, 2010) which stated that an entrepreneur will accept risks after thoroughly evaluating the circumstance and developing a plan to lessen the risk's effects. It takes a high level of entrepreneurial orientation for people to handle crises effectively (Carina & Mentari, 2021). Increasing risk perception should be taken into an account to increase entrepreneurial orientation in MSMEs because of its mediating role on the influence of financial literacy to entrepreneurial orientation.

CONCLUSION

According to this study results, some conclusions can be drawn, which financial literacy significantly affects the entrepreneurial orientation of MSMEs in Denpasar; financial literacy significantly influences risk perception on MSMEs in Denpasar; risk perception significantly influences entrepreneurial orientation among MSMEs in Denpasar; and risk perception significantly mediates the effect of financial literacy to entrepreneurial orientation among MSMEs in Denpasar.

The results of this study can contribute to management science, especially in the field of financial and human resources management regarding the relationship between financial literacy, risk perception, and entrepreneurial orientation. The results of this study can also be a reference for MSME owners to improve financial literacy and risk perception to improve entrepreneurial orientation, so that they can become MSMEs that are more resilient in facing various challenges that may occur. The results of this study can also be a guide for the government, especially the Ministry of Cooperatives and SMEs to increase the number of MSMEs in Denpasar because of the significant contribution of MSMEs to economic growth in

Indonesia. The government can provide training on financial literacy and risk perception for MSMEs to increase entrepreneurial orientation. Business incubators can also use the results of this research as a guide in making programs for MSMEs that are fostered to have a high entrepreneurial orientation, so that they can survive in all conditions.

There are several limitations in this study that can be taken into consideration for subsequent research. This research is a cross sectional study, which carried out to examine the relationship between variables at only one time. In addition, the scope of the research is only on MSMEs in Denpasar area only, so it cannot be generalized to a wider scope. Only financial literacy, risk perception, and entrepreneurial orientation were the variables addressed in this study; additional characteristics that may have an impact on entrepreneurial orientation were not examined. This can be a consideration for the next researcher to examine different model, wider scope, and more variables studied in the future.

REFERENCES

Agustina, M. N. (2021). Entrepreneur’s perceived risk and risk-taking behavior in the smallsized creative businesses of tourism sector during COVID-19 pandemic. JEMA: Jurnal Ilmiah Bidang Akuntansi dan Manajemen, Vol 18 (21), 187-209.

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, Vol. 50 (2), 179-211.

Annisa, O.:, Fitriyani, N., Mulyadi, H., & Kurjono, K. (2021). Pengaruh kecenderungan mengambil risiko terhadap intensi berwirausaha. Jurnal Education and Development, 9(3), 58–61. https://doi.org/https://doi.org/10.37081/ed.v9i2.2681

Aren, S., & Dinç Aydemir, S. (2015). The moderation of financial literacy on the relationship between individual factors and risky investment intention. International Business Research, 8(6), 17–28. https://doi.org/10.5539/ibr.v8n6p17

Avlijaš, G., & Avlijaš, R. (2014). Financial literacy as a factor in reducing entrepreneurial risk. Finiz, 112–114. https://doi.org/10.15308/finiz

Azwar S. (2013). Sikap Manusia. Yogyakarta: Pustaka Pelajar.

Bannier, C. E., & Neubert, M. (2016). Gender differences in financial risk taking: The role of financial literacy and risk tolerance. Economics Letters, 145, 130–135. https://doi.org/10.1016/j.econlet.2016.05.033

Bezzina, F. (2010). Characteristics of the maltese entrepreneur. International Journal of Arts and Sciences, 3(7), 292–312.

Carina, T., & Mentari, N. M. I. (2021). The impact of self efficacy towards entrepreneurial orientation among MSME in Denpasar, Bali. International Journal of Economics, Commerce and Management, IX(7), 175–184. http://ijecm.co.uk/

Cases, A. S. (2002). Perceived risk and risk-reduction strategies in Internet shopping. International Review of Retail, Distribution and Consumer Research, 12(4), 375–394. https://doi.org/10.1080/09593960210151162

Chen, H., & Volpe, R. P. (1998). An analysis of personal financial literacy among college students. Financial Services Review, 7(2), 107–128.

Covin, J. G., Rigtering, J. P. C., Hughes, M., Kraus, S., Cheng, C. F., & Bouncken, R. B. (2020). Individual and team entrepreneurial orientation: Scale development and configurations for success. Journal of Business Research, 112, 1–12.

https://doi.org/10.1016/j.jbusres.2020.02.023

Elvara, N. A., & Margasari, N. (2019). Pengaruh literasi keuangan terhadap keputusan investasi mahasiswa. Thesis.

Fatoki, O. (2014). The Financial Literacy of Micro Enterprises in South Africa. Journal of Social Science, Vol 40 (2), 151-158.

Fitria, M., Yurniawati, & Rahman, A. (2018). The effect of financial literacy on growth and sustainability of SMEs (small and medium enterprises) in the handicraft sector in Padang City. International Journal of Progressive Sciences and Technologies, 10(2), 382–393. http://ijpsat.ijsht-journals.org

Garman, E. T., & Raymond, E. F. (2010). Personal Finance International Edition. Canada: South Western Cengage Learning.

Ghozali, I. (2011). Aplikasi Analisis Multivariate Dengan Program SPSS. Semarang: Badan Penerbit Universitas Diponegoro.

Hair, J., Rolph, E. A., Ronald, L. T., & William, C. B. (2011). Multivariate Data Analysis Fifth Edition. New Jersey: PrenticeHall, Inc.

Hariani, M., & Irfan, M. (2021). Keluarga, konsep diri, dan risiko: Determinan intensi berwirausaha bagi mahasiswa prodi akuntansi. Journal of Trends Economics and Accounting Research, 2(1), 11–16. https://journal.fkpt.org/index.php/jtear

Hossain, K., & Azmi, I. B. A. G. (2021). The effect of entrepreneurial orientation on the export performance of apparel industry. Uncertain Supply Chain Management, 9(1), 11–20. https://doi.org/10.5267/j.uscm.2020.12.006

Hudson, M., Smart, A., & Bourne, M. (2001). Theory and practice in SME performance measurement systems. International Journal of Operations and Production Management, 21(8), 1096–1115. https://doi.org/10.1108/EUM0000000005587

Korkmaz, A. G., Yin, Z., Yue, P., & Zhou, H. (2021). Does financial literacy alleviate risk attitude and risk behavior inconsistency? International Review of Economics and Finance, 74, 293–310. https://doi.org/10.1016/j.iref.2021.03.002

Kristanto, F. (2020). Ekonomi Bali Semester I-2020 “Terjun” Akibat Pandemi Covid-19. Https://Bali.Bisnis.Com/Read/20200805/538/1275290/Ekonomi-Bali-Semester-i-2020-Terjun-Akibat-Pandemi-Covid-19.

Laiea, A.-M. F., Purnomo, M., & Maulina, E. (2020). A scoping review of financial themes in entrepreneurial orientation. Russian Journal of Agricultural and Socio-Economic Sciences, 98(2), 85–100. https://doi.org/10.18551/rjoas.2020-02.11

Laily, N. (2013). Pengaruh literasi keuangan terhadap perilaku mahasiswa dalam mengelola keuangan. Journal of Accounting and Business Education, 1(4).

Lee, S. M., & Peterson, S. J. (2000). Culture, entrepreneurial orientation, and global competitiveness. Journal of World Business, 35(4), 401–416.

Lumpkin, G. T., & Dess, G. G. (1996). Clarifying the entrepreneurial orientation construct and linking it to performance. The Academy of Management Review, 21(1), 135–172.

Lumpkin, G. T., & Dess, G. G. (2001). Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. Journal of Business Venturing, 16, 429–451.

Mahmood, R., Abdullah, O. Y., & Hanafi, N. (2013). Entrepreneurial orientation and business performance of women-owned small and medium enterprises in Malaysia: Competitive advantage as a mediator. International Journal of Business and Social Science, 4(1). www.ijbssnet.com

Miller, D. (1983). The correlates of entrepreneurship in three types of firms. Management Science, 29(7), 770–791. https://doi.org/10.1287/mnsc.29.7.770

Nosffinger, J. R. (2018). The Psychology of Investing. New York: Routledge.

Pandey, A., & Gupta, R. (2018). Entrepreneur’s Performance and Financial Literacy – A Critical Review. International Journal of Management Studies, Vol 5 (3). 1-14.

Pavlou, P. A. (2003). Consumer acceptance of electronic commerce: Integrating trust and risk with the technology acceptance model. International Journal of Electronic Commerce, 7(3), 101–134. https://doi.org/10.1080/10864415.2003.11044275

Permanasari, F. M., Harya Kuncara, & Ari Warokka. (2020). Pengaruh literasi keuangan dan antesedennya terhadap toleransi risiko dengan moderasi faktor demografi pada pekerja muda di Indonesia. JRMSI - Jurnal Riset Manajemen Sains Indonesia, 11(2), 338–363. https://doi.org/10.21009/jrmsi.011.2.08

Sarsale, M. S. (2021). Linking financial literacy and entrepreneurial characteristics. International Journal of Economics, Business, and Accounting Research, Vol 5 (1), 1-12.

Segura, E. A., & Zamar, M. D. G. (2019). Effects of financial education and financial literacy on creative entrepreneurship: A worldwide research. Education Sciences, 9(3). https://doi.org/10.3390/educsci9030238

Shah, S. I., Shahjehan, A., Ali, M. D., & Manzoor, H. (2019). Effect of entrepreneurial risk perception on entrepreneurial intention with the mediating role of perceived behavioral control. International Journal of Management Research and Emerging Sciences, Vol 9 (1), 140-148.

Solimun, Fernandes, A. A., & Nurjannah. (2017). Metode Statistika Multivariat Permodelan Persamaan Struktural (SEM). Malang: UB Press.

Sugiyono. (2008). Metode Penelitian Kuantitatif Kualitatif dan R D. Bandung: Alfabeta.

Suparno, & Saptono, A. (2018). Entrepreneurship education and its influence on financial literacy and entrepreneurship skills in college. Journal of Entrepreneurship Education, 21(4).

Tanjung, M. A. (2017). Koperasi Dan UMKM: Sebagai Fondasi Perekonomian Indonesia. Jakarta: Erlangga.

Wang, Y., & Poutziouris, P. (2010). Entrepreneurial risk taking: Empirical evidence from UK family firms. International Journal of Entrepreneurial Behaviour and Research, 16(5), 370–388. https://doi.org/10.1108/13552551011071841

Wijaya, T., Nurhadi, N., & Kuncoro, A. M. (2015). Intensi berwirausaha mahasiswa: Perspektif pengambilan risiko. Jurnal Siasat Bisnis, 19(2), 109–123.

https://doi.org/10.20885/jsb.vol19.iss2.art2

Wulandari, R. (2012). Dimensi-dimensi persepsi risiko keseluruhan konsumen. Jurnal Riset Manajemen Bisnis, 7(2), 115–124.

Xu, L., & Zia, B. (2012). Financial Literacy around the World: An Overview of the Evidence with Practical Suggestions for the Way Forward. http://econ.worldbank.org.

Yuliati, U., Fitriasari, F., & Mergans, M. (2022). The role of business innovation on the influence of entrepreneurship orientation on the performance of COVID-19 affected MSMES. In Social and Political Issues on Sustainable Development in the Post Covid-19 Crisis. London: Routledge.

Zainol, F. A., & Ayadurai, S. (2011). Entrepreneurial orientation and firm performance: The role of personality traits in Malay family firms in Malaysia. International Journal of Business and Social Science, 2(1), 59–71. www.ijbssnet.com

Discussion and feedback