The Influence of Financial Literacy and Financial Behavior on Investment Decision for Young Investor in Badung District, Bali

on

Annabella Claudia Kurnaidi, The Influence of Financial Literacy… 323

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 16 No. 2, Agustus (2022), 323-332

The Influence of Financial Literacy and Financial Behavior on Investment Decision for Young Investor in Badung District, Bali

Annabella Claudia Kurniadi 1)*, Timotius FCW Sutrisno 2),

Irantha Hendrika Kenang 3),

1,2,3 Universitas Ciputra

email: aclaudia02@student.ciputra.ac.id

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2022.v16.i02.p11

ABSTRACT

Various factors that indicate the increase in the rate of investment scam cases are allegedly due to people who are lack education about finance and investment. The purpose of this research was to determine the influence of Financial Literacy and Financial Behavior as independent variables on Investment Decisions as a dependent variable with Financial Behavior as well as a mediating variable. This study uses a survey method with data collection techniques through the distribution of online questionnaires with Likert scale measurements. The purposive sampling technique was used to determine the sample size using the Hair formula and data analysis using Partial Least Square (PLS) with SmartPLS software. The sample of this research is young investors in the age range of 18 to 40 years old who are domiciled in Badung District, Bali as many as 156 respondents. Based on data analysis, it is concluded that Financial Literacy and Financial Behavior have a significant influence on Investment Decisions. Financial Behavior does not provide a mediating role as the relationship between Financial Literacy and Investment Decisions. The result of this research explains that the higher the level of Financial Literacy and the level of Financial Behavior of an investor, the more helpful investors are in making investment decisions.

Keyword: financial literacy; financial behavior; investment decision; young investors

Pengaruh Literasi Keuangan dan Perilaku Keuangan Terhadap Keputusan Berinvestasi Pada Investor Muda Di Kabupaten Badung, Bali

ABSTRAK

Berbagai faktor yang menyebabkan meningkatnya tingkat kasus investasi fiktif disinyalir karena masyarakat yang kurang memiliki edukasi mengenai keuangan dan investasi. Tujuan dari penelitian adalah untuk mengetahui pengaruh Financial Literacy dan Financial Behavior selaku variabel independen terhadap Investment Decision selaku variabel dependen dengan Financial Behavior sekaligus sebagai variabel mediasi. Penelitian ini menggunakan metode survei dengan teknik pengumpulan data melalui pembagian kuesioner secara daring dengan pengukuran skala likert. Teknik Purposive Sampling digunakan dengan penentuan ukuran sampel menggunakan rumus Hair dan analisis data menggunakan Partial Least Square (PLS) dengan software SmartPLS. Sampel penelitian ini yaitu investor muda dalam rentang umur 18 sampai 40 tahun yang berdomisili di Kabupaten Badung, Bali sebanyak 156 responden. Berdasarkan analisis data, disimpulkan bahwa Financial Literacy dan Financial Behavior, berpengaruh signifikan terhadap Investment Decision. Financial Behavior tidak memberikan peran mediasi sebagai hubungan antara Financial Literacy terhadap Investment Decision. Hasil riset ini menjelaskan bahwa memang semakin tingginya tingkat Financial Literacy dan tingkat Financial Behavior seorang investor akan semakin membantu investor dalam membuat keputusan berinvestasi atau Investment Decision.

Kata kunci: financial literacy; financial behavior; investment decision; investor muda

INTRODUCTION

Every year, the reporting of investment scam cases increases. According to OJK (Financial Services Authority), in a span of 10 years from 2008-2018, recorded losses from investment scams reached Rp. 117.4 trillion (Hakim, 2022). According to Bappebti (Commodities and Futures Trading Regulatory Agency), investment scams that are currently rife in Indonesia are forex trading with automatic robots, binary options, and illegal cryptocurrencies. Many people lose money from fictitious investments because of attractive offers such as high profits with minimum capital (Tennant, 2011).

One of the factors that have fueled the increase in investments scam is the low understanding of investment risk because people are still easily lulled by high-profit returns and override investment risks (Chariri et al., 2018). Whereas currently, according to KSEI and BEI (Indonesian Stock Exchange), there is an increase in Single Investor Identification (SID) transactions of 92.7%, from 3.88 million investors in 2020 to 7.48 million investors in 2021, with the majority of 88% investors coming from groups in the economic range age under 40 years. This creates great concern because according to OJK (Financial Services Authority) Indonesia's level of financial literacy is still low. Moreover, the younger generation tends to have low financial literacy and investment awareness so they are easily fooled by investment scams (Padil et al., 2020).

This triggers concern from the Bank of Indonesia, especially because the transaction rate from the younger generation is getting higher but not yet supported by the level of financial literacy. Minimizing and being aware of the level of losses in investing is needed by the younger generation by increasing financial literacy (Mohd Padil et al., 2022). But before an action occurs, it is influenced by behavioral factors that have an important role in making investment decisions (Manurung, 2012). Therefore, this urgent situation needs further analysis of how financial literacy and financial behavior of younger investors could influence their investment decisions.

Goal setting theory of motivations explains that motivation with clear goal settings will increase performance. The clearer the goals and targets that an individual has will affect how much the individual can solve a problem or job. With a clear goal coupled with a sense of challenge, the outcome of a job tends to be better (Edwin A. Locke, 1968). With clear goals and motivations, it will be easier for an investor to achieve their financial targets. Therefore, motivation is closely related to financial literacy and financial behavior (Klein & Mandell, 2007). This is supported by research which states that motivation can trigger investors to invest because motivation is something that can encourage a person's behavior (Darmawan et al., 2019).

Financial Literacy is a combination of skills, awareness, knowledge, attitudes, and behaviors needed for an individual to make financial decisions in order to achieve financial goals (Organisation for Economic and Cooperation and Development, 2011). Financial literacy is very useful to avoid someone from financial problems such as loans, investments, savings, pension funds, etc., as well as fixing financial problems. This is done by understanding financial instruments, risks, and financial returns (Gupta, 2021).

Although the younger generation is currently investing heavily, there are still many who don't fully understand the products they choose. Financial literacy is needed to be able to determine the appropriate financial product. Financial literacy can also help a person to avoid or face difficult financial situations (Lusardi, 2019). Prior studies found that financial literacy has a significant effect on investment decisions (Hasanuh, 2020). Based on this description, this study formulates the H1 hypothesis.

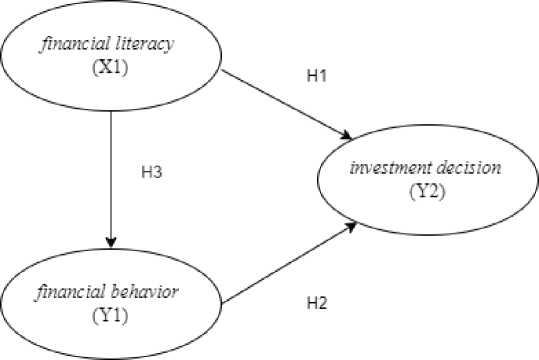

H1: There is a significant positive association between Financial literacy and investment decision

The behavior or actions of an individual in making a financial decision is described as financial behavior. In practice in everyday life, individuals are always faced with situations to make financial decisions such as how much to save and spend (Sorongan, 2022). Financial attitude shapes financial behavior, so individuals are said to not have good financial behavior if they have not been able to solve their personal financial problems (Marsh, 2006). In contrast, if individuals can make the right financial decisions, these individuals have a tendency to avoid financial problems because they already understand their personal financial needs and goals (Chinen & Endo, 2012). Sugiyanto et al., (2019) also explains that the higher a person’s financial literacy, the higher the impact of their financial behavior.

Previous research found that Financial Behavior has a positive and significant effect on investment decisions (Mutiara & Agustian, 2020; Upadana & Herawati, 2020). Financial behavior was also found to fully mediate the relationship between financial literacy and investment decisions (Perwito et al., 2020). Based on this description, this study formulates hypotheses H2 and H3.

H2: There is a significant positive association between Financial behavior and investment decisions

H3: There is a mediating role of financial behavior to increase the influence of Financial Literacy on Investment Decisions

Investment is explained as an individual's commitment to use money or other resources and is expected to bring results or returns in the future (Ayu Wulandari & Iramani, 2014; Bodie et al., 2013). In investing, individual must choose an investment product that suits their needs with the expected return in a well-calculated time period and risks (Nur Aini & Lutfi, 2019). Two aspects are used to explain investment decisions, namely based on investor psychology and the decision to multiply wealth (Mahastanti, 2011).

METHOD

This research uses a survey method by distributing online questionnaires with population of young investors in the age range of 18-40 years located in the district with the highest minimum wage in Bali, namely Badung. The selection of the age range was chosen because the phenomenon in this study found that the increase in transactions came from the majority of investors with an age range of 18-40 years. The sampling technique used is purposive sampling with the determination of the sample size using the Hair formula, because the population size could not be known with certainty. The number of samples is determined by the number of indicators multiplied by 5 to 10. Thus, 14 indicators x 10 = 140 samples (Hair et al., 2017). Although the target was only 140 respondents, in its distribution, this research managed to get 156 respondents. The questionnaire was distributed online with a Likert scale of 1-5, from the lowest point is strongly disagree to highest point is strongly agree. Operational definition and measurements of each variables are as follows: Financial Literacy is defined as financial knowledge for individuals on managing their own spending to achieve their financial goals (Lusardi & Mitchell, 2014) and it is measured by five basic concepts such as: knowledge of financial concepts, the ability to communicate financial concepts, skills to manage personal finances, skills to make the right financial decisions, and confidence in planning effective financial needs in the future (Remund, 2010). Financial Behavior is defined as behavior in managing income in accordance with goals and financial realization (Potrich et al., 2016), with

five measurements such as: paying bills on time, habits of making financial records, controlled finances, saving habits, availability of emergency funds (Potrich et al., 2015). Investment Decisions is the activity of individuals gaining profits or income from doing business or investing to financial products (Ayu Wulandari & Iramani, 2014), with four measurements, namely ability to measure security in investing, risk factors and changes in investment value, cash and definite income, value increases (Rasuma Putri & Rahyuda, 2017).

Data analysis used was Structural Equation Modeling (SEM) based on Partial Least Square (SEM-PLS) variant using SmartPLS software. The analysis data consist of outer and inner model. Outer model is the first stage of data analysis which consist of convergent validity, discriminant, and reliability. Convergent validity is used to show the correlations between dependents and independents variables and only considered valid if the value is more than 0,7 (Abdillah et al., 2015). Discriminant test is used to determine whether a reflective indicator counts as a good measure for its construct, and only accepted if the value of the variable has greater value than its correlation to other variables. Reliability test in this research is using Cronbach’s Alpha and Composite Reliability and only accepted if the value is greather than 0.7. Inner model test consist of R Square and Q Square (Abdillah et al., 2015).

Figure 1. Research Design

RESULTS AND DISCUSSION

Table 1 shows that respondents who participated in filling out the questionnaire were citizens in Badung, Bali who are in age range from 18 until 40 years old. This research targeting 140 respondents, but in the distributions, it managed to get 156 respondents. Based on the questionnaire results, the majority of respondents are students (44.23%), the total monthly income of the majority of respondents is Rp. 3,000,000 (46.79%), and from the amount of investment, the majority of respondents investing per month is Rp. 500,000 (40.38%). The option for investment products used, respondents can choose more than one product. The investment product that the majority of respondents use is mutual funds (40.5%).

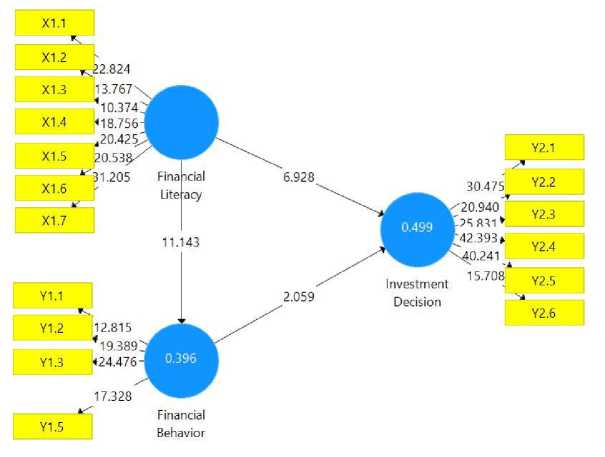

In Figure 2, it shows that the results were obtained using SmartPLS software and PLS method.

In Table 2 shows that all indicators are valid because all of the value is more than 0.7. Besides that, for discriminant test, it was found that the value of the cross loading for each variable has greater value than its correlation to other variables, so this shows that the discriminant test is accepted. Based on table 3, it can be explained that all variables in this research has met the criteria of the test, because both the value of the Cronbach’s Alpha and the Composite Reliability has greater value than 0.7.

Table 1. Respondent’s Demographics Profile

|

Variable |

Category |

Count |

Percentage |

|

Job |

Students |

69 |

44.23% |

|

State Officials |

7 |

4.49% | |

|

Private Employee |

58 |

37.18% | |

|

Entrepreneurs |

22 |

14.10% | |

|

Income per Month |

≤ Rp. 3.000.000 |

73 |

46.79% |

|

Rp. 3.000.000 – |

43 |

27.56% | |

|

Rp. 6.000.000 | |||

|

≥ Rp. 6.000.000 |

40 |

25.64% | |

|

Amount Invested |

≤ Rp. 500.000 |

63 |

40.38% |

|

per Month |

Rp. 500.000 – |

53 |

33.97% |

|

Rp. 1.500.000 | |||

|

Rp. 1.500.000 – |

20 |

12.82% | |

|

Rp. 3.000.000 | |||

|

≥ Rp. 3.000.000 |

20 |

12.82% | |

|

Investment Products |

Precious Metals |

27.8% | |

|

Used |

Certificate of | ||

|

Deposits |

32.9% | ||

|

Stocks |

39.2% | ||

|

Mutual Funds |

40.5% | ||

|

Others (Crypto, P2P |

44.3% | ||

|

Lending, etc) |

Figure 2. Partial Least Square Model

Inner model test as shows on table 3, shows that R Square value of the financial behavior (Y1) variable is 0.396 and R Square value of investment decisions (Y2) is 0.499. This shows that the financial behavior (Y1) can explain the financial literacy (X1) of 39,6%, and other variables outside the study explains the remaining 60.4%. In addition, the investment decision (Y2) model can explain the financial literacy (X1) of 49,9%, and the remaining 50.1% is explained by other variables outside the study. For Q Square, financial behavior explains financial literacy of 0.226. Investment decision explains financial behavior and financial literacy in total of 0.348, then investment decision explains the remaining of financial literacy of 0.122.

|

Table 2. Factor Loading | ||

|

Latent Construction |

Variables |

Factor Loading |

|

Understanding financial concepts |

0.837 | |

|

knowledge Understanding in interest and credits |

0.734 | |

|

Understanding in savings and |

0.713 | |

|

Financial Literacy (X1) |

investment Ability to communicate |

0.770 |

|

financial concepts | ||

|

Aptitude in managing personal |

0.795 | |

|

finance Making appropriate financial decision |

0.787 | |

|

Confidence in planning future financial needs |

0.839 | |

|

effectively Saving habits and |

0.754 | |

|

routine | ||

|

Making financial |

0.792 | |

|

records | ||

|

Financial Behavior (Y1) |

Controlled |

0.829 |

|

budgeting | ||

|

Emergency funds availability |

0.754 | |

|

Choosing the right investment products |

0.847 | |

|

Calculating risk and return in investment |

0.862 | |

|

Predicting the component of risk |

0.863 | |

|

Investment Decision |

factors in investment Measuring the rate | |

|

(Y2) |

of change in the |

0.889 |

|

value of investment | ||

|

in the future Predicting income from investing |

0.872 | |

|

Analyzing the level of investment |

0.806 | |

|

liquidity | ||

Table 3. Validity and Reliability Model

|

Latent Construct |

Cronbach’s alpha |

Average Variance Extracted |

Composite Reliability |

R Square |

Q Square |

|

X1 |

0.790 |

0.613 |

0.863 | ||

|

Y1 |

0.894 |

0.614 |

0.917 |

0.396 |

0.226 |

|

Y2 |

0.928 |

0.735 |

0.943 |

0.499 |

0.348 |

Table 4 shows that from the total of 156 respondents with a significance level of 5%, making a t-table of 1.65468, the results indicate that the first hypothesis is accepted. This fact

is based on the Financial Literacy test on Investment Decision, the t-statistics value is 6.73 > t-table 1.65468 and the P-Values value is 0.000 < 0.05. The second hypothesis is also accepted based on the facts of Financial Behavior on Investment Decision, the t-statistics value is 2,005 > t-table 1,65468 and the P-Values value is 0.045 < 0.05.

|

Table 4. Hypothesis Test Results | ||||

|

Hypothesis |

P-Value |

T-Statistic |

Information | |

|

H1 |

Financial Behavior -> Investment Decision |

2.005 |

Accepted | |

|

H2 |

Financial Literacy -> Financial Behavior |

11.804 |

Accepted | |

|

H3 |

Financial Literacy -> Investment Decision |

6.73 |

Accepted | |

Table 5. Indirect Level

|

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

T Statistics (|O/STDEV|) |

P Values | |

|

Financial Behavior -> Investment Decision Financial Literacy -> Financial Behavior Financial Literacy -> Investment Decision |

0.106 |

0.115 |

0.055 |

1.939 |

0.053 |

Table 5 shows that, as for the third hypothesis, Financial Behavior cannot mediate Financial Literacy on Investment Decision by using a significance level of 5% because the indirect level value is 0.053 > 0.05.

The result of the first and second hypothesis is accepted. Align with the previous research which stated that there is significant influence between financial literacy on investment decision (D.A.T, 2020; Darmawan et al., 2019; Mutiara & Agustian, 2020), and there is significant influence between financial behavior on investment decision (DM, 2021; Normalasari et al., 2022; Rasuma Putri & Rahyuda, 2017; Raut, 2020).

In goal setting theory of motivation it is described that motivation might influence individuals to improve their Financial Literacy if the individual is going to make investment decisions. Because motivation encourages someone to achieve a goal, and if that goal is an investment decision, the individual will be motivated to increase knowledge of financial products and control their confidence (Ghasarma et al., 2017). This research is in line with Fitriah (2021) opinion where financial literacy is very important to improve people's welfare by managing personal finances. There are even studies that find that financial literacy can help increase investment returns (DM, 2021).

Goal Setting Theory of Motivation also states that motivation will help investors in determining which behavior needed to manage and control their own money for investment because they have various reasons to invest, adjusted to their needs (Ghasarma et al., 2017). Good financial behavior is very necessary because it can help minimize losses and even help investors be alert and careful in making investment decisions (DM, 2021), in order to avoid fictitious investment products (Mohd Padil et al., 2022).

However, for the third hypothesis, Financial Behavior cannot mediate the effect of Financial Literacy on Investment Decision. It explains that, Financial Behavior can weaken the

influence of Financial Literacy on Investment Decision, because before making investment decisions, investor behavior in controlling finances will prevent investors from investing because they have to adjust to their financial situation first.

This can be triggered by the characteristics of respondents who are millennials and generation Z where this generation tends to invest without setting the priority scale for primary needs. Then seen from the demographic data of respondents, respondents tend to choose low risk investment. This explains that although respondents have good financial behavior by being able to manage budgets and control finances, it does not guarantee young investors to dare to take risks to invest or continue to invest with low risk investment products.

CONCLUSION

Financial literacy influences investment decisions and financial behavior also influences investment decisions. This indicates that the better the financial literacy of an investor and the better the investor’s behavior in managing their finances, the more helpful it is in making investment decisions and more alert to fictitious investment products. However, the mediating role of financial behavior to increase the influence of financial literacy on investment decisions is not significance.

Individuals with a good understanding of financial concepts, can communicate financial concepts, are confident in making decisions and can manage finances will be able to make good investment decisions. Moreover, if the individual also understands about setting priorities and budgeting needs, it will also help investors in making investment decisions. It would be better for individuals to continue to be willing to learn and enter into a community or environment that can lead to making better priorities.

The distribution of questionnaires is pretty obstructed because of the limited time to find respondents who have investment experience, although in the end it exceeded the respondent's target. Through this research, it is hoped that investors can improve their financial literacy and financial behavior skill before making investment decisions in order to avoid scam investments. For further research is suggested to use another demographic background and variables to examine the background difference such as, education level, risk perception, locus of control, financial knowledge etc.

REFERENCES

Abdillah, W., Hartono, J., & Prabantini, D. (2015). Partial Least Square (PLS) Alternatif

Structural quation Modeling (SEM) dalam Penelitian Bisnis. Andi Offset.

Ayu Wulandari, D., & Iramani, R. (2014). Studi Experienced Regret, Risk Tolerance, Overconfidance Dan Risk Perception Pada Pengambilan Keputusan Investasi. Journal of Business and Banking, 4(1), 55. https://doi.org/10.14414/jbb.v4i1.293

Bodie, Z., Kane, A., & Marcus, A. J. (2013). Investment, 10th Edition. In McGraw Hill Education.

Chariri, A., Sektiyani, W., Nurlina, & Wulandari, R. W. (2018). Individual Characteristics, Financial Literacy and Ability in Detecting Investment Scams. 15(1), 91–114.

Chinen, K., & Endo, H. (2012). Effects of Attitude and Background on Personal Financial Ability : A Student Survey in the United States. International Journal of Management, 29(1), 33–46.

D.A.T, K. (2020). The Impact of Financial Literacy on Investment Decisions: With Special Reference to Undergraduates in Western Province, Sri Lanka. Asian Journal of Contemporary Education, 4(2), 110–126.

https://doi.org/10.18488/journal.137.2020.42.110.126

Darmawan, A., Kurnia, K., & Rejeki, S. (2019). Pengetahuan Investasi, Motivasi Investasi, Literasi Keuangan Dan Lingkungan Keluarga Pengaruhnya Terhadap Minat Investasi Di Pasar Modal. Jurnal Ilmiah Akuntansi Dan Keuangan, 8(2), 44–56.

https://doi.org/10.32639/jiak.v8i2.297

DM, R. (2021). Financial Literacy, Financial Behavior and Financial Attitudes Towards Investment Decisions and Firm Bankruptcy. ATESTASI: Jurnal Ilmiah Akuntansi, 4(1), 79–87. https://doi.org/10.33096/atestasi.v4i1.693

Edwin A. Locke. (1968). Toward a Theory of Task Motivation and Incentives. Organizational Behavior and Human Performance, 3(M), 157–189.

Fitriah, W. (2021). Financial Literacy and Financial Inclusion on the Financial Planning of the City of Palembang. Review of Management and Entrepreneurship, 5(1), 19–32.

https://doi.org/10.37715/rme.v5i1.1629

Ghasarma, R., Putri, L., & Adam, M. (2017). International Journal of Economics and Financial Issues Financial Literacy; Strategies and Concepts in Understanding the Financial Planning With Self-Efficacy Theory and Goal Setting Theory of Motivation Approach. International Journal of Economics and Financial Issues, 7(4), 182–188.

http:www.econjournals.com

Gupta, P. K. (2021). The Impact of Financial Literacy on Investment Decisions. Laxmi Book Publication.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks. Sage, 165.

Hakim, A. R. (2022). OJK: Kerugian Akibat Investasi Bodong Capai Rp 117 Triliun dalam 10 Tahun Terakhir. Liputan6.Com. Arief Rahman Hakim

Hasanuh, N. (2020). Influence of financial literacy and financial attitude on individual investment decisions. Advances in Business, Management and Entrepreneurship, 1993, 424–428. https://doi.org/10.1201/9780429295348-92

Klein, L. S., & Mandell, L. (2007). Motivation and financial literacy. Financial Services Review, 16(2), 105.

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1–8.

https://doi.org/10.1186/s41937-019-0027-5

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52(1), 5–44.

https://doi.org/10.1257/jel.52.1.5

Mahastanti, L. A. (2011). Faktor-Faktor Yang Dipertimbangkan Investor Dalam Melakukan Investasi. Jurnal Manajemen Teori Dan Terapan| Journal of Theory and Applied Management, 4(3), 37–51. https://doi.org/10.20473/jmtt.v4i3.2424

Manurung, A. H. (2012). Teori Perilaku Keuangan ( Behaviour Finance ). Economis Of Management, 41(4), 1–13. http://finansialbisnis.com/Data2/Riset/Teori Perilaku

Keuangan.pdf

Marsh, B. A. (2006). Knowledge Levels of First-Year and Senior Students At Baptist. August, 31–42.

Mohd Padil, H., Kasim, E. S., Muda, S., Ismail, N., & Md Zin, N. (2022). Financial literacy and awareness of investment scams among university students. Journal of Financial Crime, 29(1), 355–367. https://doi.org/10.1108/JFC-01-2021-0012

Mutiara, I., & Agustian, E. (2020). Pengaruh Financial Literacy dan Financial Behavior terhadap Keputusan Investasi pada Ibu-Ibu PKK Kota Jambi. J-MAS (Jurnal Manajemen Dan Sains), 5(2), 263. https://doi.org/10.33087/jmas.v5i2.193

Normalasari, Maslichah, & Sudaryanti, D. (2022). The Effect of Financial Behavior, Financial

Literacy and Demographic Factor on Students’Investment Decision Making. Jurnal Ilmiah Riset …, 11(02), 53–61.

http://riset.unisma.ac.id/index.php/jra/article/view/15073%0Ahttp://riset.unisma.ac.id/in dex.php/jra/article/download/15073/11268

Nur Aini, N. S., & Lutfi, L. (2019). The influence of risk perception, risk tolerance, overconfidence, and loss aversion towards investment decision making. Journal of Economics, Business & Accountancy Ventura, 21(3), 401.

https://doi.org/10.14414/jebav.v21i3.1663

Organisation for Economic and Cooperation and Development. (2011). Measuring financial literacy: questionnaire and guidance notes for conducting an internationally comparable survey of financial literacy. Oecd, 31. https://www.oecd.org/finance/financial-

education/49319977.pdf

Padil, H. M., Kasim, E. S., & Ismail, N. (2020). An Exploratory Factor Analysis of Financial Literacy and Awareness of An Exploratory Factor Analysis of Financial Literacy and Awareness of Investment Scam. 3(November), 61–67.

Perwito, Nugraha, & Sugianto. (2020). Efek Mediasi Perilaku Keuangan Terhadap Hubungan Antara Literasi Keuangan Dengan Keputusan Investasi. Competition: Jurnal Ilmiah Manejemen, X1(2), 155–164.

Potrich, A. C. G., Vieira, K. M., Coronel, D. A., & Bender Filho, R. (2015). Financial literacy in Southern Brazil: Modeling and invariance between genders. Journal of Behavioral and Experimental Finance, 6, 1–12. https://doi.org/10.1016/j.jbef.2015.03.002

Potrich, A. C. G., Vieira, K. M., & Mendes-Da-Silva, W. (2016). Development of a financial literacy model for university students. Management Research Review, 39(3), 356–376. https://doi.org/10.1108/MRR-06-2014-0143

Rasuma Putri, N. M. D., & Rahyuda, H. (2017). Pengaruh Tingkat Financial Literacy Dan Faktor Sosiodemografi Terhadap Perilaku Keputusan Investasi Individu. E-Jurnal Ekonomi Dan Bisnis Universitas Udayana, 9, 3407.

https://doi.org/10.24843/eeb.2017.v06.i09.p09

Raut, R. K. (2020). Past behaviour, financial literacy and investment decision-making process of individual investors. International Journal of Emerging Markets, 15(6), 1243–1263. https://doi.org/10.1108/IJOEM-07-2018-0379

Remund, D. L. (2010). Financial literacy explicated: The case for a clearer definition in an increasingly complex economy. Journal of Consumer Affairs, 44(2), 276–295.

https://doi.org/10.1111/j.1745-6606.2010.01169.x

Sorongan, F. A. (2022). The Influence of Behavior Financial and Financial Attitude on Investment Decisions With Financial Literature as Moderating Variable. 7(1), 265–268.

Sugiyanto, T., Radianto, W. E., Efrata, T. C., & Dewi, L. (2019). Financial Literacy, Financial Attitude, and Financial Behavior of Young Pioneering Business Entrepreneurs. 100(Icoi), 353–358. https://doi.org/10.2991/icoi-19.2019.60

Tennant, D. (2011). Why do people risk exposure to Ponzi schemes? Econometric evidence from Jamaica. Journal of International Financial Markets, Institutions and Money, 21(3), 328–346. https://doi.org/10.1016/j.intfin.2010.11.003

Upadana, I. W. Y. A., & Herawati, N. T. (2020). Pengaruh Literasi Keuangan dan Perilaku Keuangan terhadap Keputusan Investasi Mahasiswa. Jurnal Ilmiah Akuntansi Dan Humanika, 10(2), 126. https://doi.org/10.23887/jiah.v10i2.25574

Discussion and feedback