Minimizing Fraud Behavior through Leadership Based on Tri Kaya Parisudha and Good Corporate Governance

on

Ida Ayu Putu Widani Sugianingrat, Minimizing Fraudulent Behavior through …123

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 15 No. 1, Februari (2021), 123 - 136

Minimizing Fraudulent Behavior through Trikaya Parisudha-based leadership and Good Corporate Governance

Ida Ayu Putu Widani Sugianingrat1), Putu Atim Purwaningrat2),

Luh Nik Oktarini3), Ida I Dewa Ayu Yayati Wilyadewi4)

1,2,3,4) Faculty of Economics, Business and Tourism, Universitas Hindu Indonesia

e-mail: widanidayu147@gmail.com

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2021.v15.i01.p11

ABSTRACT

Fraudulent behavior could be detrimental for a business’ going concern, and therefore it needs to be minimized and even eliminated. This research atempts to propose solutions to minimize fraudulent behavior through the implementation of the Tri Kaya Parisudha-based leadership and good corporate governance (GCG) practices). The research was conducted at 94 Multipurpose Cooperatives in Bali, with the managers as the respondents. Data collection was carried out by distributing questionnaires to respondents via Google form media. The collected data was analysed using the SmartPLS program. The results of hypothesis testing show that leadership based on Tri Kaya Parisudha has a significant positive effect on GCG, but has no significant effect on Fraud Behavior. On the other hand, GCG shows a significant negative effect on fraudulent behavior. Furthermore, GCG acts as a full mediator in the relationship between the TKP-based leadership and FB.

keyword: leadership based on tri kaya parisudha, good corporate governance (gcg), fraudulent behavior

Meminimalisir Perilaku Fraud melalui Kepemimpinan yang Berlandaskan Tri Kaya Parisudha dan Tata Kelola Perusahaan yang Baik

ABSTRAK

Fenomena bisnis online shop C2C yang saat ini sedang banyak diminati oleh pelanggan, mengakibatkan jumlah Perilaku fraud dapat mengganggu keberlangsungan bisnis, oleh karena itu perlu diminimalisasi bahkan dihilangkan. Penelitian ini mencoba menawarkan solusi meminimalisasi perilaku fraud melalui penerapan kepemimpinan berlandaskan Tri Kaya Parisudha dan Good Corpoate Governance (GCG). Penelitian dilakukan di 94 Koperasi Serba Usaha di Bali. Responden penelitian adalah manajer koperasi pada masing-masing koperasi yang menjadi lokasi penelitian. Pengumpulan data dilakukan dengan penyebaran kuesioner kepada responden melalui googleform. Data yang telah terkumpul selanjutnya diolah dengan program SmartPLS. Hasil pengujian hipotesis menunjukkan kepemimpinan berlandaskan Tri Kaya Parisudha berpengaruh positif terhadap GCG, tetapi tidak signifikan pengaruhnya terhadap perilaku fraud. Pada sisi lain, GCG menunjukkan pengaruh negatifterhadap perilaku fraud. Lebih lanjut, GCG berperan sebagai full mediator pada hubungan kepemimpinan berlandaskan Tri Kaya Parisudha dengan Fraud Behavior.

Kata kunci: kepemimpinan berlandaskan tri kaya parisudha, good corporate governance (gcg), fraud behavior

INTRODUCTION

Fraud is a growing problem these days. Currently, the perpetrators who commit fraud are not limited to the upper classes, but many are also committed by lower levels of employees. The research results of the Association of Certified Fraud Examiners Global in the Association of Certified Fraud Examiners/ACFE (2017) states that every year on average of 5 percent of the organization's income is a victim of fraud. Fraud is any deliberate fraudulent attempt, which is intended to take the property or rights of another person or party (Arens, et. Al., 2012).

Fraudulent action can be caused by pressure, opportunity, and rationalization (Cressey, 1953). The three causes or the background for the alleged fraud are referred to as the fraud triangle. Bologna (1993) states that fraud can be influenced by inadequate rewards, inadequate control, poor mechanisms/systems, less strict discipline, hostility, and other motivational factors. Fraud is very detrimental to the company/organization, therefore efforts are needed to reduce fraudulent behavior.

In an effort to minimize fraud, it is necessary to control the three causes of fraud, namely reducing pressure, minimizing opportunities, and rationalizing in a more rational direction. In this case, the manager is one of the parts capable of minimizing fraudulent behavior through exemplary, namely by applying the principles of the Tri Kaya Parisudha (manacika means thinking well, wacika means saying good, kayika means doing good). Leadership based on Tri Kaya Parisudha is synonymous with ethical leadership.

LITERATURE REVIEW, PREVIOUS RESEARCH, AND RESEARCH HYPOTHESIS Fraud Behavior

Fraud is an action taken by a party or individual for the purpose of obtaining benefits, avoiding obligations, or causing financial or non-financial losses to other parties (Ruin, 2009). Arens, et al. (2012) states that fraud is any deliberate fraudulent attempt, which is intended to take the property or rights of another person or party. Furthermore, Tjahjono (2013) states that fraud is an intentional illegal act and brings harm to other parties.

The factors causing fraud according to Cressey (1953) are pressure, opportunity, and rationalization. Pressure to be able to have something within limitations can encourage someone to commit fraud, but if there is no opportunity to commit fraud, then fraud is difficult to implement. Conversely, if there is a pressure accompanied by opportunities, then fraud can be done freely. In this case, minimizing fraud can be done through limiting opportunities, namely by tightening supervision by leaders/managers. The supervising role of the leader/manager is very important in minimizing fraud. The adoption of ethical leadership patterns can minimize fraudulent behavior among followers. Apart from leadership, good corporate governance can also minimize fraud. .

The Tri Kaya Parisudha-based Leadership

Leadership is the most important part of an demonstration of appropriate normative behavior through personal actions and interpersonal relationships, and the promotion of these behaviors to followers through two-way communication, reinforcement, and decision making (Brown et al., 2005). In proposing a theory of leadership, Brown et al. (2005) suggest that ethical leadership behavior plays an important role in promoting employee attitudes and behavior because employees want to deal with managers who are honest, credible, and fair (Kouzes & Posner, 2007: 54). Ethical leadership can provide an effective approach to fostering positive employee views and actions. Ethical leadership refers to a type of leadership style in which leaders demonstrate and promote a code of ethics to their subordinates (Brown et al., 2005). Ethical leadership helps giving meaning to employees at work and ensures that organizational decisions are based on ethical spoken values (Piccolo et al., 2010). Ethical leadership always seeks to incorporate moral principles into their beliefs, values and behavior; they are committed to higher goals, prudence, pride, patience, and persistence (Khuntia & Suar, 2004).

Ethical leader's behavior can influence employee behavior not to cheat. This argument is supported by the results of research conducted by Subramaniam (2010). According to him, the increasing incidence of fraud, scandal, corruption at the global level, is due to weak ethical behavior, and to create ethical behavior requires ethical leadership as well. Another study, namely Said et al. (2017), finds that ethical behavior has a negative effect on fraudulent

behavior. Gan (2018) finds a negative indirect influence between ethical leadership and fraudulent behavior among employees. However, Houdek's research (2019) states that ethical behavior is not related to fraudulent behavior.

One of the concepts of ethics and morality in Hinduism in Bali is Tri Kaya Parisudha (Parmajaya, 2017). Tri Kaya Parisudha is the basis of ethics in Hinduism, namely three types of right actions, namely: manacika (right thinking), wacika (saying the right thing), kayika (doing right), because the right thoughts will lead to correct speech. Thus, realizing the right actions as well (Sudartha and Atmaja, 2001: 53). Therefore, Tri Kaya Parisudha can be used as a foundation of ethical leadership. In this connection, the following research hypothesis is developed.

Hypothesis 1: Trikaya parisudha-based leadership has a negative effect on Fraud Behavior

Good Corporate Governance (GCG)

Good corporate governance is a guidance for organization to achieve goals based on the principles of good governance (Widjajanti, 2015). Hamdani (2016: 27) states that GCG is a structured process that is implemented in running a company, which has the aim of increasing shareholder value in the long term. Good corporate governance (GCG) is by definition a system that regulates and controls companies that create value added for all stakeholders (Monks and Minow, 2003). There are two things that are emphasized in this concept, first, the importance of the right of shareholders to obtain information correctly and in a timely manner. Second, the company's obligation to disclose accurately, in a timely, transparent manner to all information on company performance, ownership, and stakeholders.

Good GCG implementation must be in accordance with five existing principles, including: transparency, accountability, responsibility, independencyorganization. Leadership is defined as the, and fairness (Daniri, 2005; Zarkasyi, 2008: 39; Effendi, 2009; Sutedi, 2012). Transparency, to maintain objectivity in running a business, companies must provide material and relevant information in a way that is easily accessible and understood by stakeholders. Accountability, a company must be accountable for its performance in a transparent and fair manner. For this reason, the company must be managed properly, measured and in accordance with the interests of the company by taking into account the interests of shareholders and other stakeholders. Responsibility, the company must comply with the laws and carry out responsibility for the community and the environment so that business continuity can be maintained in the long term and gain recognition as a good corporate citizen. Independency, to facilitate the implementation of GCG principles, companies must be managed independently so that each company organ does not dominate each other and cannot be intervened by other parties. Equality and fairness, in carrying out its activities, the company must always pay attention to the interests of shareholders and other stakeholders based on the principles of equality and fairness. In essence, GCG aims to increase efficiency and reduce the occurrence of deviations.

This argument is supported by the results of research conducted by Razali & Arshad (2014) which found that the implementation of good governance reduces the possibility of skewing. Research results that are consistent with the opinion of Razali & Arshad (2014), among others, Kaya & Birol (2007), Ponduri et al (2014), Sebhatu & Pei-lin (2016), In'airat (2015), Halbouni et al. (2016), Syamsudin et al. (2017), Endah et al. (2020). However, in the research of Uwuigbe et al (2020), it was found that good governance had no effect on fraud behavior. Based on these arguments, the following research hypothesis is built.

Hypothesis 2: Good corporate governance has a negative effect on Fraud Behavior

It has also been discussed that the implementation of good corporate governance can

be influenced by ethical leadership patterns. This is revealed in a number of studies which have found that there is a significant influence between ethical leadership and good corporate governance. Othman & Rahman (2010) state that good ethics can encourage good governance as well. According to Okagbue (2011) ethical leadership, leadership based on ethical norms and practices, can be used as an important vehicle to achieve organizational goals and promote good governance. Other research results consistent with the opinion of Okagbue (2011) include, Naidoo (2012), Othman & Rahman (2014), El-Kassar et al (2015), Ahmad (2017), Thebe (2017), Kwakye et al. (2018), and Agbim (2018). Based on these arguments, the following research hypothesis is built.

Hypothesis 3: Trikaya parisudha-based leadership has a positive effect on good corporate governance

As has been explained, good corporate governance can be influenced by ethical leadership. This statement is supported by research results from Othman & Rahman (2010), Okagbue (2011), Naidoo (2012), Othman & Rahman (2014), El-Kassar et al (2015), Ahmad (2017), Thebe (2017), Kwakye. et al. (2018), and Agbim (2018). Furthermore, good corporate governance is also able to influence Fraud Behavior, this is consistent with the results of research by Kaya & Birol (2007), Ponduri et al (2014), Sebhatu & Pei-lin (2016), In'airat (2015), Halbouni et al. (2016), Syamsudin et al. (2017), Endah et al. (2020) who found that good governance affects fraud behavior. Referring to the concept of Barron and Kenny (1998), good corporate governance can act as a mediator in the leadership relationship based on Tri Kaya Parisudha on Fraud Behavior. Based on this, the following research hypothesis is built:

Hypothesis 4: Good corporate governance can mediate the influence of Trikaya parisudha-based leadership on Fraud behavior.

Based on a theoretical study and the results of previous research where ethical leadership affects good corporate governance (Othman & Rahman, 2010; Okagbue, 2011; Naidoo, 2012; Othman & Rahman, 2014; El-Kassar et al., 2015; Ahmad, 2017 ; Thebe, 2017, Kwakye et al., 2018; and Agbim, 2018), and on the other hand good corporate governance also affects fraud behavior (Kaya & Birol, 2007; Ponduri et al., 2014; Sebhatu & Pei-lin, 2016) ; In'airat, 2015; Halbouni et al., 2016; Syamsudin et al., 2017; Endah et al., 2020), then good corporate governance can act as a mediator for the influence of ethical leadership based on Tri Kaya Parisudha on fraudulent behavior. Thus it can be described the conceptual framework / research model as in Figure 1.

Figure 1. Research Conceptual Framework

Note:

X: Trikaya parisudha-based leadership

M: Good corporate governance (GCG)

Y: Fraud Behavior .

RESEARCH METHODS

This research was conducted at the Multipurpose Cooperative in Bali. The number of Bali Multipurpose Cooperatives is 2,366 units spread across nine districts / cities. The research sample calculation is based on the three districts that have the highest number of cooperatives, namely Gianyar (rank 1), Denpasar (rank 2) and Tabanan (rank 3) as shown in Table 1.

Table 1. Number of Multipurpose Cooperatives in Bali

|

No |

Regency / City |

Number of KSU |

Population |

Rank according to the number of KSU |

|

1 |

Denpasar |

374 |

374 |

2 |

|

2 |

Buleleng |

123 |

6 | |

|

3 |

Karangasem |

151 |

5 | |

|

4 |

Bangli |

87 |

7 | |

|

5 |

Klungkung |

32 |

9 | |

|

6 |

Gianyar |

828 |

828 |

1 |

|

7 |

Badung |

345 |

4 | |

|

8 |

Tabanan |

347 |

347 |

3 |

|

9 |

Jembrana |

79 |

8 | |

|

Total |

2.366 |

1.549 |

Source: BPS Bali Province. 2018. Bali in Figures of 2018

The sampling method was probability sampling with a proportionate random sampling technique. The calculation of the research sample is based on the Slovin formula in the district that is the target of the study with a precision of 10%, then the total sample size is 94 with the following calculations: n = N/ [1+ N.e2)] n = 1.549/ [1+ (1.549 x 0,12)] n = 1.549/[1+(15,49)] n = 1.549/16,49 n = 93,94 (round to 94)

The proportion of the number of samples in each district that was the research target is shown in Table 2. The three districts selected were those with the largest number of cooperatives in Bali Province.

Table 2. Total Population and Research Sample

|

No |

Regency / City |

Number of KSU | |

|

Population |

Sample Calculation | ||

|

1 |

Denpasar |

374 |

(374/1549)x94=22.69 =>23 |

|

2 |

Gianyar |

828 |

(828/1549)x94=50.24 =>50 |

|

3 |

Tabanan |

347 |

(347/1549)x94=21.05 =>21 |

|

Total |

1.549 |

94 | |

Data Collection and Analysis

Data collection was carried out through questionnaires containing statements with a Likert scale answer ranging from 1 to 5. Ethical leadership variables based on Tri Kaya Parisudha consisted of three indicators, the GCG variable consisted of five indicators, and the fraud variable consisted of three indicators.

The data that has been collected is then processed by the SmartPLS 3.0 program through three stages, namely the measurement model stage, the structural model, and hypothesis testing. The evaluation stage of the research model consists of testing the validity and reliability, while the structural evaluation stage measures the accuracy of the research model. Testing the research hypothesis, aims to determine the effect of the path coefficient of each

relationship between variables at the 5% significance level. Validity and reliability testing is based on convergent validity, composite reliability and AVE. While testing the accuracy of the model is based on R Square and Goodness of Fit (GoF).

RESULTS AND DISCUSSION

Validity and Reliability

Testing the validity and reliability of the indicators of the research variables is shown in the following table. The validity of the research data is based on the convergent validity convergent (outer loading), meanwhile, the reliability is based on the value of Cronbach alpha. If the outer loading indicator shows a value> 0.50 then convergent is said to be valid. The data set can be said to be reliable if the Cronbach alpha value is> 0.60. The minimum Average Variance Extracted (AVE) value has a value of 0.50. The results of the validity and reliability based on the SmartPLS output are shown in Table 3.

Based on Table 3, it shows that all indicators of each variable has an outer loading value of> 0.50, thus it can be stated that all research indicators are valid. Judging from the value of composite reliability, it shows a value greater than 0.60, so that all research variables can be declared reliable. AVE value is greater than the minimum required value, which is greater than 0.50. Based on the results of the validity and reliability assessment, hapus all variables have been declared valid and reliable, then the process is carried on by assessing the accuracy of the research model.

|

Table 3. Test of the validity and reliability of the research indicators | ||||

|

Variables |

Indicators |

Outer Loading |

Composite Reliability |

Average Variance Extracted |

|

Trikaya parisudha- |

Manacika Parisudha |

0.895 |

0,673 | |

|

based leadership |

Wacika Parisudha |

0.890 |

0.746 | |

|

Kayika Parisudha |

0.653 | |||

|

Tranparency |

0.884 | |||

|

Good corporate governance |

Accountability |

0.901 | ||

|

Responbility |

0.868 |

0.906 |

0,730 | |

|

Independency |

0.881 | |||

|

Fairness |

0.727 | |||

|

Pressure |

0.802 | |||

|

Fraud Behavior |

Opportuity |

0.900 |

0.832 |

0,748 |

|

Razionalization |

0.890 | |||

Source: Data processed, 2019

The accuracy of the research model is carried out through The value of Goodness of

Fit (GoF), which is calculated based on the following formulation:

GoF = V [A.R2 x A.AVE]

GoF = V [{(0.390 + 0.205)/2} x{(0.730 + 0.673 + 0.748)/3}]

GoF = V [(0,595/2) x (2,151/3)]

GoF = V [0.2975 x 0.717]

GoF = V [0.2133075)

GoF = 0,4619

The results of the GoF calculation are 0.4619 and according to the criteria of Akter et al. (2011) is classified as a high level of accuracy. Because the model is classified as having

high accuracy, it can be continued with the next process, namely testing the research hypothesis.

Hypothesis Testing

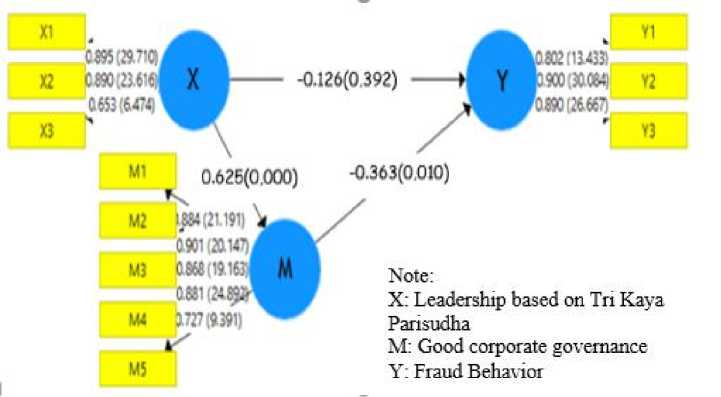

The results of hypothesis testing are shown in Figure 2 and Table 4, as follows.

Figure 2. Results of SmartPLS 3.0 Processing

Table 4. Direct and indirect influence between Leadership Based on Tri Kaya Parisuda, Good Corporate Governance (GCG) on Fraud Behavior

|

Relations between Variables |

Path Coefficient |

p-value |

Information | ||

|

Independent |

Mediation |

Dependent | |||

|

Leadership based on Tri Kaya Parisudha (X) |

- |

Fraud Behavior (Y) |

- 0.126 |

0.392 |

H1 Rejected |

|

Leadership based on Tri Kaya Parisudha (X) |

Good corporate governance (M) |

- |

0.625 |

0.000 |

H2 Accepted |

|

- |

Good corporate governance (M) |

Fraud Behavior (Y) |

- 0.363 |

0.010 |

H3 Accepted |

|

Leadership based on Tri Kaya Parisudha (X) |

Good corporate governance (M) |

Fraud Behavior (Y) |

- 0.227 |

0.011 |

H4 Accepted |

Source: Data processed, 2020

Based on Figure 2 and Table 4, it can be argued that the direct influence of leadership based on Tri Kaya Parisudha (X) on fraud behavior (Y) shows a negative but insignificant effect. These results are shown from the path value of -0.126 with a p-value of 0.392> 0.05. These results indicate that hypothesis 1 which states that leadership based on Tri Kaya Parisudha has a significant negative effect on fraud behavior is rejected.

The direct effect of leadership based on Tri Kaya Parisudha (X) on good corporate governance (M) shows a value of 0.625 with a p-value of 0.000 <0.05, this indicates that leadership based on Tri Kaya Parisudha has a positive effect on good corporate governance. The effect of good corporate governance (M) on fraud behavior (Y) shows a value of -0,363 with a p-value of 0.010 <0.05. This means that the effect of good corporate governance (M) on fraud behavior (Y) is negative, thus Hypothesis 3 is accepted. Furthermore, the indirect effect of leadership based on Tri Kaya Parisudha (X) on fraud behavior (Y) through good corporate governance (M) shows a value of -0.227 with a p-value of 0.011 <0.05. That is, the influence of leadership based on Tri Kaya Parisudha (X) on fraud behavior (Y) through good corporate

governance (M) is positive. Thus hypothesis 4 is accepted.The results of testing the direct effect of Tri Kaya Parisudha on Fraud Behavior are insignificant (p-value 0.392> 0.05), although the coefficient is -0.126 higher when compared to Tri Kaya Parisudha's indirect influence coefficient on Fraud Behavior with the mediation of Good Corporate Governance, namely -0.227 but the indirect effect of the result is significant (p-value 0.011 <0.05).

DISCUSSION

Leadership based on Tri Kaya Parisudha which is reflected in Manacika Parisudha (good thinking), Wacika Parisudha (good speaking), and Kayika Parisudha (doing good) turns out to have no direct effect on fraud behavior. The results of this study are consistent with the results of research conducted by Dhany et al. (2016) and Nursandi (2017), which in their research found that leadership style has no effect on Fraud Behavior. The results of this study are inconsistent with the results of research conducted by Brown & Trevin'o (2006); Detert et al. (2007); Mayer et al. (2009) who found that ethical leadership helps reduce fraud behavior. The ethical behavior of cooperative leaders / managers has not been able to influence fraud behavior. Cooperative leaders who are ethical (have good thoughts, words, and actions) have not be able to become role models for their employees not to commit fraud be. This means that apart from having good ethical leadership, other ways are needed to prevent fraud behavior.

The most dominant role of TKP-based leadership indicator is Manacika Parisudha (good thinking). This illustrates that ethical leadership starts with good thoughts. Good thoughts can bring out good words and good behavior as well.

Good corporate governance, which is a guidance for an organization to achieve goals based on the principles of good governance, has a major role in overcoming fraud behavior. The better the governance that is implemented, the lower the deviation that occurs. Good corporate governance, which is reflected in Transparency, Accountability, Responsibility, Independency, and Fairness, significantly shows positive impact in reducing fraud behavior. The results of this study can confirm a number of previous research results, such as those conducted by Besari (2009), Law (2011), and Soleman (2013), Jannah (2016), and Kwatingtyas (2017). It becomes very interesting, where accountability is an indicator that has a dominant role in good corporate governance in cooperatives in Bali. Actions from the leadership who are able to do something responsibly are the key to the success of reducing fraud behavior. The implementation of good corporate governance is able to significantly influence opportunities for fraudulent behavior.

The joint implementation between TKP-based leadership and GCG has a greater impact on reducing fraud behavior, compared to partial implementation. Including good corporate governance in leadership based on Tri Kaya Parisudha has an impact on a very large reduction in fraud behavior.

CONCLUSIONS, SUGGESTIONS AND RECOMMENDATIONS

The implementation of leadership based on Tri Kaya Parisudha (thinking, saying, and doing good) accompanied by the implementation of good corporate governance can have an impact on reducing fraud behavior in multi-business cooperatives in Bali. Leadership based on Tri Kaya Parisudha alone has not been able to significantly suppress fraud behavior, but by including the implementation of good corporate governance, fraud behavior can be minimized.

Therefore, it is recommended that in managing cooperatives in a better direction (in the sense of avoiding fraud behavior), it is necessary to apply leadership based on Tri Kaya Parisudha accompanied by the consistent and collective implementation of good corporate governance.

The results of this study make an important contribution, that is leadership is not the only factor capable of controlling fraud behavior. It is necessary to integrate a number of

relevant factors in an effort to minimize fraud behavior to a greater extent, such as the implementationof GCG.

LIMITATIONS AND FUTURE RESEARCH

This research is very limited to specific leadership variables, namely leadership based on Tri Kaya Parisudha, and good corporate governance, which is associated with efforts to minimize fraud behavior. Thus, the results of this study have not been able to be generalized to various other organizations / companies. Many factors have the possibility to influence fraud behavior. Therefore, future research needs to explore and analyze other factors that are likely to influence fraud behavior. This research is also limited to multi-business cooperatives, so it is necessary to develop research in other places and fields.

REFERENCE

ACFE Indonesia Chapter #111. 2017. Survai Fraud Indonesia, Association of Certified fraud

Examiners.

Agbim, K. C. (2018). Effect of ethical leadership on corporate governance, performance and social responsibility: A study of selected deposit money banks in Benue state, Nigeria. International Journal of Community Development and Management Studies, 2, 019035. https://www.informingscience.org/Articles/v2p019-035Agbim4291.pdf

Ahmad, P. (2017). Ethical Leadership between Governance and Human Nature. Pro Publico

Bono–Magyar Közigazgatás, (1), 164-179. http://real.mtak.hu/92343/1/PPB-

MK_2017_1_Paiman_Ethical_Leadership.pdf

Akter, S., D’Ambra, J. and Ray, P. (2011), An evaluation of PLS based complex models: the roles of power analysis, predictive relevance and GoF index, Proceedings of the Seventeenth Americas Conference on Information Systems, Detroit, Michigan August 4th-7th 2011.Arens, Alvin A & Loebbecke, James K. 2012. Auditing, an Integrated Approach.14th Edition. Upper Saddle River, New Jersey: Prentice-Hall, Inc

Baron, R.M. and Kenny, D.A. (1986), The moderator – mediator variable distinction in social psychological research: conseptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, Vol. 103, No. 6, pp. 1173-1182

Besari. 2009. Pengaruh Kualitas Pelaksanaan Good Corporate Governance, Ukuran (Size), dan Kompleksitas Bank Terhadap Fraud (Studi Kasus pada Bank Umum 2007). Tesis. Program Studi Magister Akuntansi Universitas Diponegoro

Bologna, J. (1993), Handbook on Corporate Fraud, Butterworth-Heinemann, Stoneham, MA BPS Provinsi Bali. 2018. Bali Dalam Angka Tahun 2018.

Brown, M. E., & Treviño, L. K. 2006. Ethical Leadership: A Review and Future Directions.

Leadership Quarterly, Vol.17, No.6, pp. 595-616.

https://www.mcgill.ca/engage/files/engage/ethical_leadership_2006.pdf

Brown, M. E., Trevin˜o & Harrison. 2005. Ethical Leadership: A Social Learning Perspective for Construct Development and Testing, Organizational Behavior and Human Decision Processes, Vol.97, pp.117-134. https://doi.org/10.1016/j.obhdp.2005.03.002

Cressey, D.R. 1953. Other people’s money, dalam: “Detecting and Predicting Financial Statement Fraud: The Effectiveness of The Fraud Triangle and SAS No. 99”, Skousen et al. 2009. Journal of Corporate Governance and Firm Performance, Vo;13: 53-81

Daniri, Mas Achmad. 2005. Good Corporate Governance: Konsep dan Penerapannya dalam

Konteks Indonesia, Cetakan 1. Jakarta: PT. Ray Indonesia.

Detert, J. R., Treviño, L. K., Burris, E. R., & Andiappan, M. (2007). " Managerial modes of influence and counterproductivity in organizations: A longitudinal business-unit-level investigation": Correction. https://doi.org/10.1037/0021-9010.93.2.328

Dhany, Umi Rahma, Priantono, S., & Budianto, M. (2016). Pengaruh Gaya Kepemimpinan Dan Budaya Organisasi Terhadap Peminimalisir Fraud (Kecurangan) Pengadaan Barang/Jasa Pada Dinas Pekerjaan Umum Kota Probolinggo, 4(2), 46–60

Effendi, Muh. Arief. 2009. The Power of Good Corporate Governance : Teori Implementasi, Jilid 1. Jakarta: Salemba Empat.

El-Kassar, A. N., Messarra, L. C., & Elgammal, W. (2015). Effects of ethical practices on corporate governance in developing countries.

http://www.virtusinterpress.org/IMG/pdf/cocv12i3c5p1.pdf

Endah, N., Tarjo, T., & Musyarofah, S. (2020). The Implementation Of Good Corporate Governance And Efforts To Prevent Fraud In Banking Companies. Jurnal Reviu Akuntansi dan Keuangan, 10(1), 136-149. https://doi.org/10.22219/jrak.v10i1.10268

Gan, C. (2018). Ethical leadership and unethical employee behavior: A moderated mediation model. Social Behavior and Personality: an international journal, 46(8), 1271-1283. https://doi.org/10.2224/sbp.7328

Halbouni, S. S., Obeid, N., & Garbou, A. (2016). Corporate governance and information technology in fraud prevention and detection. Managerial Auditing Journal. https://doi.org/10.1108/MAJ-02-2015-1163

Hamdani. 2016. Good Corporate Governance (Tinjauan Etika dalam Praktik Bisnis). Jakarta: Mitra Wacana Media.

Houdek, P. (2019). Fraud and Understanding the Moral Mind: Need for Implementation of Organizational Characteristics into Behavioral Ethics. Science and Engineering Ethics, 1-17. https://doi.org/10.1007/s11948-019-00117-z

In'airat, M. (2015). The Role of Corporate Governance in Fraud Reduction-A Perception Study in the Saudi Arabia Business Environment. Journal of Accounting & Finance (2158-3625), 15(2). http://www.na-

businesspress.com/JAF/In_airatM_Web15_2_.pdf

Jannah, Sitti Fitratul. 2016. Pengaruh Good Corporate Governance Terhadap Pencegahan Fraud di Bank Perkreditan Rakyat (Studi Pada Bank Perkreditan Rakyat Di Surabaya). Jurnal Akuntansi Unesa. Vol.7, No.2.

https://journal.unesa.ac.id/index.php/aj/article/view/1340

Kaya, C. T., & Birol, B. (2007). Association Between Corporate Governance And Fraud Detection: Evidence From Borsa Istanbul. Journal of Economics Finance and Accounting, 6(2), 95-101. https://dergipark.org.tr/tr/download/article-file/747433

Khuntia, R., & Suar, D. (2004). A scale to assess ethical leadership of Indian private and public sector managers. Journal of business ethics, 49(1), 13-26.

https://doi.org/10.1023/B:BUSI.0000013853.80287

Kouzes, J. M., & Posner, B. Z. (2007). The leadership challenge (Vol. 3). John Wiley & Sons. https://books.google.co.id/books?hl=id&lr=&id=kHt_CeUoVZQC&oi=fnd&pg=PR 13&dq=Kouzes,+J.+M.,+%26+Posner,+B.+Z.+2007.+The+Leadership+Challenge+( 4th+ed.).+San+Francisco,+CA:+Jossey-

Bass.&ots=RUw4cmx2b6&sig=DE8mLfy5GMDIkKRPUY4X6d4qO5Q&redir_esc =y#v=onepage&q&f=false

Kwakye, O., Yusheng, K., Ayamba, E. C., & Osei, A. A. (2018). Influence of ethical behavior on Corporate Governance of firm’s performance in Ghana. International Journal of Scientific Research and Management, 6(06).

https://www.ijsrm.in/index.php/ijsrm/article/view/1548

Kwatingtyas, Lidia Pascalia Ayu. 2017. Pengaruh Pengendalian Internal dan Manajemen Risiko pada Good Corporate Governance serta Implikasinya pada Pencegahan Fraud (Studi Kasus pada Credit Union di Daerah Istimewa Yogyakarta). Tesis. Program Magister Manajemen Fakultas Ekonomi Universitas Sanata Dharma.

Law, Philip. 2011. Corporate Governance and No Fraud Occurrence in Organizations. Managerial Auditing Journal, Vol. 26, Iss 6, pp. 501-518.

Mayer, D. M., Kuenzi, M., Greenbaum, R., Bardes, M., & Salvador, R. 2009. How Low Does Ethical Leadership Flow? Test of A Trickle-Down Model. Organizational Behavior & Human Decision Processes, Vol.108, pp.1-13.

https://doi.org/10.1016/j.obhdp.2008.04.002

Monks, Robert A.G, dan Minow, N, 2003. Corporate Governance 3rd Edition, Blackwell Publishing.

Naidoo, G. (2012). A critical need for ethical leadership to curb corruption and promote good governance in the public sector of South Africa.

https://repository.up.ac.za/bitstream/handle/2263/57856/Naidoo_Critical_2012.pdf?s equence=1&isAllowed=y

Nursandi, Haritsa Amri. 2017. Pengaruh Pengendalian Internal, Kesesuaian Kompensasi, dan Gaya Kepemimpinan terhadap Kecenderungan Kecurangan (Fraud) pada PT. Astra Graphia Tbk Cabang Surabaya. Thesis. Universitas Airlangga.

Okagbue, B. O. (2011). Ethical leadership and good governance in Nigerian local governments.

https://scholarworks.waldenu.edu/cgi/viewcontent.cgi?article=2035&context=dissert ations

Othman, Z., & Rahman, R. A. (2010). Ethics an Malaysian corporate governance practices. International Journal of Business and Social Science, 1(3), 98-109.

http://www.ijbssnet.com/journals/Vol._1_No._3_December_2010/10.pdf

Othman, Z., & Rahman, R. A. (2014). Attributes of ethical leadership in leading good governance. International Journal of Business and Society, 15(2), 359.

http://www.ijbs.unimas.my/repository/pdf/Vol15-no2-paper10.pdf

Parmajaya I.P.G. 2017. Ajaran Tri Kaya Parisudha Sebagai Landasan Pendidikan Nilai Moral dan Etika dalam Membentuk Karakter Anak, Purwadita, Volume 1, No.1, pp. 33-40.

Piccolo, R., Greenbaum, R., Den Hartog, D., & Folger, R. 2010. The Relationship Between Ethical Leadership and Core Job Characteristics. Journal of Organizational Behavior, Vol.31, pp. 259 –278. https://doi.org/10.1002/job.627

Ponduri.S.B, Sailaja V., Amina Begum S.A. (2014).Corporate Governance -Emerging Economies Fraud and Fraud Prevention, OSR Journal of Business and Management (IOSR-JBM), Volume 16, Issue 3, PP 01-07. http://www.iosrjournals.org/iosr-jbm/papers/Vol16-issue3/Version-3/A16330107.pdf

Razali, W. A. A. W. M., & Arshad, R. (2014). Disclosure of corporate governance structure and the likelihood of fraudulent financial reporting. Procedia-Social and Behavioral Sciences, 145, 243-253. https://core.ac.uk/download/pdf/82472647.pdf

Ruin, J. E. 2009. Internal auditing: Supporting risk management, fraud awareness management and Corporate Governance. Leeads Publication

Said, J., Alam, M., Ramli, M., & Rafidi, M. (2017). Integrating ethical values into fraud triangle theory in assessing employee fraud: Evidence from the Malaysian banking industry. Journal of International Studies, 10(2).

http://bazekon.icm.edu.pl/bazekon/element/bwmeta1.element.ekon-element-000171480769

Sebhatu, S. P., & Pei-lin, L. (2016). What is Governance? The Ethical Dilemma for Leaders and Managers: Multiple Case Studies of Corruption from China. Procedia-Social and Behavioral Sciences, 224, 467-474. https://core.ac.uk/download/pdf/82566211.pdf

Soleman, Rusman. 2013. Pengaruh Pengendalian Internal Dan Good Corporate Governance Terhadap Pencegahan Fraud. JAAI, Volume 17, No.1,pp 57-74

Subramaniam, S. (2010). Ethical Leadership Views from Tamil Classical Literature-With

Reference to Thirukural. Available at SSRN 1605320.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1605320

Sudartha, Tjok Rai dan Atmaja, Ida Bagus Oka Punia. 2001. Upadesa tentang Ajaran-Ajaran Agama Hindu. Surabaya: Paramita.

Sutedi, Adrian. 2012. Good Corporate Governance, Edisi 1 Cetakan 2. Jakarta: Sinar Grafika. Syamsudin, S., Imronudin, I., Utomo, S. T., & Praswati, A. N. (2017). Corporate Governance in Detecting Lack of Financial Report. JDM (Jurnal Dinamika Manajemen), 8(2), 167176. https://journal.unnes.ac.id/nju/index.php/jdm/article/view/12757/7289

Thebe, T. P. (2017). Ethics and corporate governance: a model for South African public service. International Conference on Public Administration and Development Alternatives (IPADA).

http://ulspace.ul.ac.za/bitstream/handle/10386/1842/thebe_ethics_2017.pdf?sequenc e=1&isAllowed=y

Tjahjono, S. 2013. Business Crimes and Ethics: Konsep dan Studi Kasus Fraud di Indonesia dan Globa. Yogyakarta: ANDI.

Uwuigbe, O. R., Olorunshe, O., Uwuigbe, U., Ozordi, E., Asiriuwa, O., Asaolu, T., & Erin, O. (2020, September). Corporate governance and financial statement fraud among listed firms in Nigeria. In IOP conference series: earth and environmental science (Vol. 331, No. 1, p. 012055). IOP Publishing.

https://iopscience.iop.org/article/10.1088/1755-1315/331/1/012055/pdf

Widjajanti, Kesi. 2015. Gaya Kepemimpinan Dan Good Governance Sebagai Upaya Peningkatan Excellent Service Dan Kepercayaan Masyarakat (Studi Kasus Dinperindag Jawa Tengah) J. Dinamika Sosbud. Volume 17 Nomor 2, pp. 270 – 284.

Zarkasyi, Moh. Wahyudi. 2008. Good Corporate Governance: Pada Badan Usaha

Manufaktur, Perbankan, dan Jasa Keuangan Lainnya. Cetakan 1. Bandung: Alfabeta.

Appendix

Questionnaire

Answer options:

STS = Strongly Disagree; TS = Disagree; KS = Disagree; S = Agree; SS = Strongly Agree

I. Leadership based on Tri Kaya Parisudha

|

No |

Statement |

STS (1) |

TS (2) |

KS (3) |

S (4) |

SS (5) |

|

Manacika Parisudha | ||||||

|

1 |

I am able to manage my thoughts in a positive direction for the progress of the cooperative that I lead | |||||

|

Wacika Parisudha | ||||||

|

2 |

I am able to convey messages / instructions in a kind word in directing employees to the cooperative that I lead | |||||

|

Kayika Parisudha | ||||||

|

3 |

I am able to carry out work activities well in the cooperative that I lead | |||||

II.Good Corporate Government (GCG)

|

No |

Statement |

STS (1) |

TS (2) |

KS (3) |

S (4) |

SS (5) |

|

Transparency | ||||||

|

1 |

The cooperative that I lead provides access to information that is open to all stakeholders. | |||||

|

Accountability | ||||||

|

2 |

The cooperative that I lead always provides accurate and measurable accountability reporting | |||||

|

No |

Statement |

STS (1) |

TS (2) |

KS (3) |

S (4) |

SS (5) |

|

Responsibility | ||||||

|

3 |

The cooperative that I lead always complies with laws and carries out responsibility for stakeholders | |||||

|

Independency | ||||||

|

4 |

The cooperative that I lead is run independently and is not intervened by other parties | |||||

|

Fairness | ||||||

|

5 |

The cooperative that I lead is very concerned about the interests of shareholders and other stakeholders based on the principles of equality and fairness | |||||

III.Fraud Behavior

|

No |

Statement |

STS (1) |

TS (2) |

KS (3) |

S (4) |

SS (5) |

|

Pressure | ||||||

|

1 |

Fraud behavior can occur in the cooperative that I lead because of the pressure to fulfill needs | |||||

|

Opportunity | ||||||

|

2 |

Fraud behavior can occur in the cooperative that I lead because of the opportunity that allows fraud | |||||

|

Razionalization | ||||||

|

3 |

Fraud behavior can occur in the cooperative that I lead because it feels that the actions taken are normal | |||||

Discussion and feedback