Determinants of Audit Report Lag of Financial Statements in Banking Sector

on

142 Matrik : Jurnal Manajemen, Strategi Bisnis dan Kewirausahaan Vol. 13, No. 2, Agustus 2019

P-ISSN : 1978-2853

E-ISSN : 2302-8890

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 13 No. 2, Agustus 2019, 142 - 152

Determinants of Audit Report Lag of Financial Statements in Banking Sector

Sigit Handoyo1), Erza Diandra Maulana2)

1)Faculty of Economics, University Islam Indonesia, Yogjakarta

2)PT. Sinergi Informatika Semen Industri

email: 963120101@uii.ac.id

DOI : https://doi.org/10.24843/MATRIK:JMBK.2019.v13.i02. p02

SINTA 2

ABSTRACT

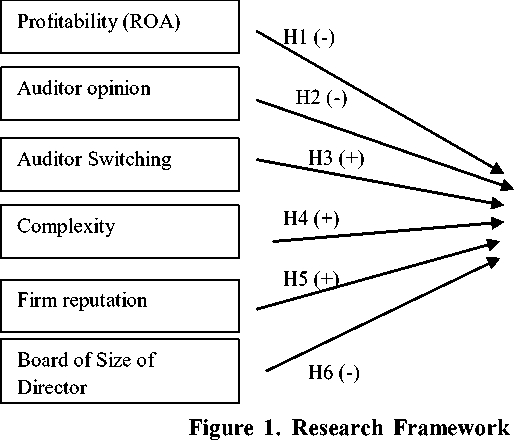

Audit Report Lag (ARL) is the time length of the auditor completing their activities on the client is measured from the end of the fiscal year until the date of audit report was signed. Research related to ARL has been widely carried out in some countries, considering the importance of this issue. This study analyzed the factors that affect ARL on the Conventional Bank Companies listed in the Indonesia Stock Exchange. The sample consisted of 84 companies listed in Indonesia Stock Exchange (IDX) which submitted financial reports to OJK (the Financial Service Authority) in the period of 2013-2015. The data used in this research was selected by using purposive sampling method and analysis used multiple linear regression. Based on the analytical results, Profitability, Auditor Opinion, and Firm Reputation had negative significant effect toward ARL. Then Auditor Switching, Complexity, and Board of Size of Director had positive significant effect toward ARL.

Keywords: ARL, complexity, firm reputation, profitability, size of board of director

Penentu Keterlambatan Laporan Audit Atas Laporan Keuangan di Sektor Perbankan

ABSTRAK

ARL (ARL) adalah lama waktu auditor menyelesaikan aktivitas mereka pada klien diukur dari akhir tahun fiskal hingga tanggal laporan audit ditandatangani. Penelitian yang terkait dengan ARL hingga saat ini telah banyak dilakukan di beberapa negara, mengingat akan pentingnya isu ini. Penelitian ini menganalisis faktor-faktor yang mempengaruhi ARL pada Bank Konvensional yang terdaftar di BEI. Faktor-faktor tersebut adalah Profitabilitas, Opini Auditor, Pergantian Auditor, Kompleksitas, Reputasi Perusahaan, dan Ukuran Dewan Direksi. Sampel terdiri dari 84 perusahaan yang terdaftar di BEI yang menyerahkan laporan keuangan kepada OJK pada periode 20132015. Data yang digunakan dalam penelitian ini dipilih dengan menggunakan metode purposive sampling dan analisa dengan menggunakan analisis regresi linier berganda. Berdasarkan hasil analisis, Profitabilitas, Opini Auditor, dan Reputasi Perusahaan berpengaruh negatif dan signifikan terhadap ARL sedangkan Pergantian Auditor, Kompleksitas, dan Ukuran Dewan Direksi berpengaruh positif dan signifikan terhadap ARL.

Kata Kunci: ARL, kompleksitas, reputasi perusahaan, profitabilitas, ukuran dewan direksi

INTRODUCTION

Companies in Indonesia are required to prepare Financial Statement in each period, especially for go public companies to Otoritas Jasa Keungan (OJK). OJK performs its regulatory and supervisory duties over financial services activities in banking, capital markets, and non-bank financial industries sectors. Financial Statements reported to Bapepam-LK and OJK are structured from the presentation of the financial position and financial performance of an entity is made to provide information regarding

the financial position, performance and any changes in financial position of a company that is useful for users in decision making (IASB, 2008). In addition, one of the obstacles to obtain information from released Financial Statement is the constraints of timeliness.

Company timeliness in publishing financial report to the public and OJK depend on the auditor’s timeliness in completing its audit report. The completion of the audit report is marked with the date of the audit opinion which means it is the last

day of fieldwork. The time length of the auditor completing their activities on the client is measured from the end of the fiscal year until the date of audit report was signed. The time length is often called audit delay or ARL (Knechel and Payne, 2001). ARL will influence the accuracy of the information published. Thus, it will affect the level of uncertainty on decisions based on the information published. According to Abdullah (1996), more time is required in the publishing annual Financial Statement since the end of the financial year of a company book belonging to the client. The great chance of the information will be discovered to certain investors or even cause a bias that causes rumors exchanges stock.

Statement of Financial Accounting Standards (SFAS) No. 1 Paragraph 38 stated that the benefits of the Financial Statement will be reduced if the Financial Statement were not available on a right time. If there is a delay, the information generated will reduced or lost its relevance. The closer the distance between the date of the Financial Statement to the date of the audit opinion on the Financial Statement, the more relevance and more benefits the statements obtained. Over time, the normative value of audited Financial Statement will reduce proportionately.

Therefore, timeliness in reporting Financial Statement is important for users to make a decision. It stated clearly in Act No. 21 year 2011 about capital market that public companies are required to submit periodic reports and other incidental reports to OJK. With these regulations, the expected quality and timeliness of information annual report compiled a public company for the better and regulation OJK No. 44 /POJK.04/2016 stated that every public company that has become effective shall submit a financial statement to the OJK no later than in the end of the fourth month after the end of the fiscal year.

This research explored about factors affecting ARL on the Conventional Bank Companies that listed in Indonesia Stock Exchange. Some researchers had conducted various studies about factors affecting ARL. In this research, there are some independent factors, which are not consistent in the results of the previous researches. The variables were Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation and Firm Type. In previous studies it showed a significant effect but in the other studies it showed the vice versa which

was insignificant. Profitability is inconsistent because studies based on Hariza and Maria (2012), Aziz et al. (2014), and Ariyani and Budiartha (2014) mentioned that profitability had significant result, but according to Alkhatib and Marji (2012), and Angruningrum and Wirakusuma (2013), it showed the vice versa. Auditor Opinion had significant influence on ARL which was stated by Arifa (2013), Aziz et al. (2014), and Hariza and Maria (2012) but others stated that it had insignificant influence in Vuko and Cular (2014) research. Auditor Switching showed significant influence which was conducted by Rustiarini and Sugiarti (2013), Wibowo (2012) but had insignificant result according to Maria (2012), Permatasari and Widuri (2013), Putra and Sukirman (2014), and Tambunan (2014). Complexity had significant relationship according to Ariyani and Budiartha (2014) but Angruningrum and Wirakusuma (2013) stated that it had insignificant influence. Firm Reputation, showed significant influence according to Ariyani and Budiartha (2014), Austine et al. (2014), and Berliana (2015), but showed different result in Alkhatib and Marji (2012), Angruningrum and Wirakusuma (2013), and Vuko and Cular (2014). Last is Board of Size of Director showed significant result according to Ofuan James and Christian (2014), but insignificant result according to Li and Wang (2014), and Mohamad-Nor et al. (2010). Most researchers used difference statistic testing tools. The researchers used different model because of differences in the independent variables.

This study aims to examine about factors affecting ARL that inconsistent on previous research, which are Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation, and Board of Director Size. This research used Conventional Bank Companies as the object because Banking Companies is a highly-regulated industry, always become a public spotlight, and have different accounting system and reporting format that makes Banking Companies are more complex than others. Besides that, reviewed from debt level and to have high debt level, Companies that have high debt level are required to have high transparency to fulfill information needed. This led to auditor to improve their accuracy in doing audit on the Banking Companies client. Thus, there is a possibility it can affect the time length of audit completion.

Profitability is one of the indicators of the company’s success in generating profits. The higher

the profitability, the higher the company’s ability to generate profits. Research of Dyer and McHugh (1975) and Carslaw and Kaplan (1991) in Ariyani and Budiartha (2014) showed that companies that suffered losses ask their auditors to audit more slower than it should be, and the consequent is late submission of Financial Statement. Otherwise, companies that get more profit tend to be timely in reporting their Financial Statement and it contains good news and required to publish the good news as soon as possible to the public. Companies that experience high profitability level also bring positive effect on the company’s performance.

Public accountant is responsible in achieving good quality financial reporting in capital market. Accountant must provide an assurance to the fairness of the Financial Statement which is prepared and published by the management. There are five kinds of Auditor Opinion based on PSA 29 Section 508 are (1) Unqualified Opinion (2) Unqualified Opinion with explanatory language (3) Qualified Opinion (4) Adverse Opinion (5) Disclaimer Opinion. Hariza and Maria (2012) stated that companies that acquire Qualified Opinion have longer ARL than the companies that received unqualified opinion. This is because the management is trying to delay the submission of Financial Statement for Qualified Opinion which is bad news for investors or other interested parties. Companies that get Unqualified Opinion tends to be more timely in publishing its Financial Statement because it contains good news.

The changing of auditor generally happens because of the end of contract between the Public Accounting Firm and the Client (Ahmed and Hossain, 2010). The changing of the auditor requires the new auditor to communicate with the previous auditor to identify the client’s reason to understand more about the client, and develop audit strategy by understanding client industry and business more detail. Besides that auditor requires longer time to complete audit process and resulting in delay on submission of financial statement and ARL (Tambunan, 2014). In addition, company that underwent auditor changes will sign a new auditor, whereas it takes a long time for the auditor to identify the characteristic of client business and system (Rustiarini and Sugiarti, 2013).

The complexity of a company indicates the impact on the length of the auditors in doing audit

activity. Ariyani and Budiartha (2014) stated that complexity of the company is measured by the number and operating unit location of subsidiaries, diversification of product lines and markets. Besides, company that has many operating unit of subsidiaries, will take more time for the auditors to perform their audit work because of the complexity of the transaction and consolidated reports that need to be audited by the auditor. Ariyani and Budiartha (2014) concluded that Complexity has significant influence on ARL, but Angruningrum and Wirakusuma (2013) concluded that Complexity has no influence on ARL

Every company wants its Financial Statement to be audited quickly and has good quality. Thus, the company would prefer to entrust it to large Public Accounting Firm that has a good reputation, because large Public Accounting Firm has more resources and better supporting system. Therefore, the audit reports are more accurate and faster (Petronila, 2007). Lee and Jahng (2008) in Angruningrum and Wirakusuma (2013) stated that The Big Four Accounting Firms that have better access to advanced technology and specialist staff when compared than that to non-Big Four, have an impact on audit quality and timeliness of audit completion and submission of Financial Statement of a company. If the company is audited by large Public Accounting Firm services that have good reputation (including the Big Four), the company is expected to have shorter ARL period than companies audited by Public Accounting Firm and not included to the Big Four (Mohamad-Nor et al., 2010).

Board of Directors Size is one of the components of Corporate Governance that can affect ARL. Board of Directors are not only responsible for monitoring the policy and the function of internal management, but also the quality of information contained in the Financial Statement that are communicated to the public (Ofuan James and Christian, 2014). Dimitropoulos and Asteriou (2010) stated that too many members of the Board of Directors can lead such as problems to inefficiency, difficulty of monitoring, less establishment of communication among members and the difficulty in decision making; thus, lead to longer ARL. Mak and Li (2001) argued that large board causes less participation, less organized board and is difficult to have an agreement about the audit process and procedures. On the other hand, small Board of

Directors or Board of Director that have few members is considered to be easier in the bureaucracy and more functional. Thus it has better

supervision during the financial reporting process (Xie and DaDalt, 2003).

ARL

RESEARCH METHOD

This research took place in Indonesia with the population used in this research were all Conventional Bank Companies listed in the Indonesia Stock Exchange (IDX) from 2013-2015. The sampling technique used in this research was the judgment /purposive sampling with criteria is as following: (1) The companies are listed in the Indonesia Stock Exchange (IDX) and not listed/ delisted in the middle of period, respectively for the period of 2013-2015; (2) The companies had published audited annual financial statement and their audit report is per December, 31 for the period of 2013-2015; (3) Displaying the data and information needed to analyze the factors affecting ARL for the period of 2013-2015.

Data collection method used in this research is indirect method by using secondary data in the form of annual Financial Statement of Conventional Bank Companies listed in Indonesia Stock Exchange (IDX) for the period of 2013-2015. Dependent variable used in this research is ARL. Independent variables used are profitability, auditor opinion, auditor switching, complexity, firm reputation, and board of director size.

In this research, ARL variable is measured quantitatively by the number of days between the date of end of fiscal year and date of audit report of the company. The data for this variable is obtained from the annual report. The measurement can be formulated as follows:

ARL = Date of Audit Report – Date of Financial

Statement …...................................….(1)

Profitability is measured by Return On Assets (Kartika, 2009). ROA is the ratio that indicates the ability of the capital invested in total assets to generate profits. ROA can be formulated as follows:

ROA = Income After Tax …………………….(2) Total Assets

Auditor Opinion is measured by using dummy variable. If the company receives except unqualified Auditor Opinion, the value is 1. If the company receives unqualified Auditor Opinion, the value is 0.

Auditor switching is measured by using by dummy variable. For the company that does not change the auditor on the following year, the value is 0. For the company that changes the auditor on the following year, the value is 1.

Complexity is measured by using dummy variable. For the company that does not have subsidiary companies, the value is 0. For the company that has subsidiary companies, the value is 1.

Firm Reputation is measured by using dummy variable. For the company that is audited by the Big Four Audit Firm, the value is 0. For the company that is not audited by the Big Four Audit Firm, the value is 1. Board of Size of Director variable is measured by counting the number of the member Board of Director in the company.

Descriptive statistics analysis has the objective to analyze variables characteristic used in this research, such as ARL, Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation, and Board of Size of Director and has also to analyze the data and calculate the various characteristics of the data, such as number of samples, the minimum, maximum, and average value, and deviation standard (Ghozali, 2013).

This research used multiple regression analysis to examine the relationship among ARL, Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation, and Board of Size of Director. The following is the regression equation model of the research:

Y = a + b1X1 + b2X2 + b3X3+ b4X4 + b5X5 + b6X6 + e

Y = a + b1X1+ b2X2+ b3X3+ b4X4+ b5X5+ b6X6 +

e ……………......................……………..(3)

Whereas:

Y : ARL

a : Intercept Value / Constanta

b1-b6 : Coefficient Direction

-

X1 : Profitability

-

X2 : Auditor Opinion

-

X3 : Auditor Switching

-

X4 : Complexity

-

X5 : Firm Reputation

-

X6 : Board of Size of Director

e : Error

Multiple Coefficient Determination (Adj.R2) with coefficient determination value is between 0 and 1. Value of R2 that is nearly close to 1 means the independent variable provide almost all of the information needed to predict the dependent variable (Ghozali, 2013). R2 value is obtained from the output

of regression. If R2 = 1, means there is a perfect variable influence. If R2 = 0, means there is no relationship between the independent and dependent variable. The higher the R2 value, the better the model used.

The basis of decision making on T-Test is measured by comparing confidence level of 95 percent or significance level of 0.05. Thus, the degree of errors is 5 percent The hypothesis formulations are as follow (Ghozali, 2013): (1) If significant level is less than 0.05, the influence of independent variables toward the dependent variable is significant (H0 rejected, Ha Accepted); (2) If significant level is higher than 0.05, the influence of independent variables toward the dependent variable is insignificant (H0 Accepted, Ha Rejected).

F-Test is used to perform a test toward goodness of fittest which stated that the independent variables simultaneously influence toward dependent variable by using the right equation. The basis of decision making is measured by comparing confidence level of 95 percent or significance level of 0.05. Thus, the degree of errors is 5 percent. The hypothesis formulations are as follow (Ghozali, 2013): (1) If significant level is less than 0.05, the influence of independent variables toward the dependent variable is significant (H0 rejected, Ha Accepted); (2) If significant level is higher than 0.5, the influence of independent variables toward the dependent variable is insignificant (H0 Accepted, Ha Rejected).

RESULT AND DISCUSSION

The type of sample selection obtained were based on certain considerations and generally adapted for certain purpose or research problems. The sample selection process of the research was described in detail as follow:

Table 1. Total Research Sample

|

No |

Data |

Total |

|

1 |

Conventional Bank Companies listed on the Indonesia Stock Exchange (IDX), and not listed/delisted in the middle of period respectively for the period 2013-2015 |

42 |

|

2 |

Conventional Bank Companies that do not published audited annual financial statement and their audit report per December, 31 for the period of 2013-2015 |

9 |

|

3 |

Conventional Bank Companies that do not provide data and information on their audit report per December, 31 for the period of 2013-2015 |

5 |

|

4 |

Total Sample |

28 |

|

5 |

Period Observed (Year) |

3 |

|

6 |

Total Number of Observations |

84 |

Source: Secondary data process, 2016

The result of Descriptive Statistics can be seen on table 2:

Table 2. Descriptive Statistics

|

N |

Minimum |

Maximum |

Mean |

Std. Deviation | |

|

X1 |

84 |

-1.00 |

3.90 |

1.3882 |

.98463 |

|

X2 |

84 |

.00 |

1.00 |

.1190 |

.32579 |

|

X3 |

84 |

.00 |

1.00 |

.1071 |

.31115 |

|

X4 |

84 |

.00 |

1.00 |

.4286 |

.49784 |

|

X5 |

84 |

.00 |

1.00 |

.2619 |

.44231 |

|

X6 |

84 |

2.00 |

8.00 |

4.4762 |

1.33061 |

|

Y |

84 |

7.00 |

119.00 |

60.8929 |

23.29539 |

|

Valid N (listwise) |

84 |

Source: Data processing result, 2016

Based on table 2, it showed the overall value obtained for (1) Profitability (X1) that had the minimum value of -1.00 with the maximum value of 3.96, mean value of 1.3882. Thus, it indicated that the mean of all Conventional Bank Companies had ROA value of 1.3882; (2) Auditor Opinion (X2) had the minimum value of 0, maximum value of 1, mean value of 0.1190; (3) Auditor Switching (X3) had the minimum value of 0, maximum value of 1, mean value of 0.1071; (4) Complexity (X4) had the minimum value of 0, maximum value of 1, mean value of 0.4286; (5) Firm Reputation (X5) had the minimum value of 0, maximum value 1, mean value of 0.261 9; (6) Board of Size of Director (X6) had the minimum value of 2, maximum value of 8, and mean value of 4.4762.

Normality test was statically used to test the residual normality which was Kolmogorov-Smirnov (K-S) non-parametric statistic test. Based on result, the Asymp. Sig. (2-tailed) value was 0 if it was higher than the significance level of α = 5 percent or (0.333>0.5). Thus, H0 was accepted; which means that the data was distributed normally.

To detect the existence of multicollinearity in these regression model, we can see it from Opponents Tolerance and VIF value. If the tolerance value > 0.10 or < 1 and VIF < 10, there is no multicollinearity. Based on result, it showed that the VIF (Variance Inflation Factors) was < 10. The VIF value of profitability was 1.155; VIF value of auditor opinion was 1.168; VIF value of auditor switching was 1.028; VIF value of complexity was 1.457; VIF value of firm reputation was 1.449 and VIF value of Board of Size of Directors was 1.015.

The value of Tolerance > 0.10 or < 1 with the Tolerance value of profitability was 0.866;

Tolerance value of auditor opinion was 0.856; Tolerance value of auditor switching was 0.973; Tolerance value of complexity was 0.686; Tolerance value of firm reputation was 0.690; Tolerance value of Board of Size of Directors was 0.985. Based on Variance Inflation Factors and Tolerance value, it can be concluded that the regression model did not contain any multicollinearity.

The method used in this research to test the heteroscedasticity was by using scatterplot diagram. Through Scatterplot diagram, it can be concluded from the data distribution patterns. The patterns of data distribution were the dot that spread above and below the scatterplot diagram and the distribution patterns does not form any specific pattern. Resulting from this pattern, it can be concluded that there is no heteroscedasticity.

Autocorrelation test was conducted by using Durbin Watson (DW) test (Ghozali, 2013). From the result, it can be seen that the value of Durbin-Watson (DW) was 1.733. From the DW criteria, it can be determined that the value between -2 and 2 was -2 ≤ 1.733 ≤ 2 which means that there was no autocorrelation. The result of Multiple Regression calculation with SPSS was presented in the following Table 3.

From Table 3, the multiple regression equation which was derived from the calculation above was as follow:

Y = 114.844 – 2.947X1 – 8.185X2+ 3.407X3 +

4.543X4 – 14.958X5 + 6.545X6

From the regression equation above, we can see that there were a negative relationship among X1 (profitability), X2 (auditor opinion), X5 (firm reputation) and Y (ARL) and there were positive

Table 3. Multiple Regression Analysis Coefficientsa

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. | |

|

B Std. Error |

Beta | ||||

|

1 (Constant) |

114.844 |

10.063 |

11.412 |

.000 | |

|

X1 |

-2.947 |

2.354 |

-.125 |

-1.252 |

.014 |

|

X2 |

-8.185 |

7.156 |

-.114 |

-1.144 |

.026 |

|

X3 |

3.407 |

7.028 |

.046 |

2.485 |

.029 |

|

X4 |

4.543 |

5.229 |

.097 |

2.869 |

.038 |

|

X5 |

-14.958 |

5.870 |

-.284 |

-2.548 |

.013 |

|

X6 |

6.545 |

1.633 |

.374 |

4.008 |

.000 |

|

Dependent Variable: ARL Source: Data processing result, 2016 | |||||

|

relationship among X3 (auditor switching), X4 (complexity), X6 (board of size of director) and Y |

(ARL). T-Test result following table: |

can be |

shown in | ||

|

Table 4. |

T-Test | ||||

|

Model |

Standardized Unstandardized Coefficients Coefficients |

T |

Sig. | ||

|

B Std. Error |

Beta | ||||

|

1 (Constant) |

114.844 |

10.063 |

11.412 |

.000 | |

|

X1 |

-2.947 |

2.354 |

-.125 |

-1.252 |

.014 |

|

X2 |

-8.185 |

7.156 |

-.114 |

-1.144 |

.026 |

|

X3 |

3.407 |

7.028 |

.046 |

2.485 |

.029 |

|

X4 |

4.543 |

5.229 |

.097 |

2.869 |

.038 |

|

X5 |

-14.958 |

5.870 |

-.284 |

-2.548 |

.013 |

|

X6 |

6.545 |

1.633 |

.374 |

4.008 |

.000 |

this

a. Dependent Variable: ARL Source: Data processing result, 2016

Based on the calculation result on Table 4, p-value of T-Test on Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation and Board of Director Size was lower than the significance level of α = 5 percent (Sig < 0.05), H0

was rejected. It means that there was an influence of Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation and Board of Size of Director toward ARL.F-Test result can be shown in this following table:

F-Test

Table 5.

ANOVAb

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. | ||

|

1 |

Regression |

15312.686 |

6 |

2552.114 |

6.610 |

.000a | |

|

Residual |

29729.350 |

77 |

386.095 | ||||

|

Total |

45042.036 |

83 | |||||

a. Predictors: (Constant), Board_size, profitability, firm_rep, auditor_switching, auditor_opinion, complexity b. Dependent Variable: ARL

Source: Data processing result, 2016

From Table 5, it can be concluded that p-value of F-Test was 0.000. Because the p-value was lower than the significance level of α = 5 percent (0.00 < 0.5), H0 was rejected. It means that there was an

influence of Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation, Board of Size of Directors toward ARL. Thus that the model of this research can be accepted.

The results of the correlation coefficient and following Table 6.

determination coefficient were show in the

Table 6. Correlation and Determination Coefficient

Model Summary

|

Model |

R R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.793a .662 |

.612 |

19.64931 |

a. Predictors: (Constant), Board_size, profitability, firm_rep, auditor_switching, auditor_opinion, complexity

Source: Data processing result, 2016

R value of 0.793 showed that Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation, Board of Directors Size variables correlate together of 0.793 toward ARL.

Adjusted R square value (R2) of 0.612 showed that the variables contribution of Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation, Board of Size of Directors toward ARL was 61.2 percent, while the rest 38.8 percent was explained by other variables except the six variables above.

Based on the Multiple Regression result on partial test, there is a negative significant effect of Profitability toward ARL. It means that the higher the Profitability owned by the Company, the shorter the ARL will be. Thus, the first hypothesis in this research variable was accepted.

This research is in line with Hariza and Maria (2012) that stated Profitability had significant influence toward ARL. It was also stated by Ariyani and Budiartha (2014) that reinforced statement that Profitability have significant influence toward ARL. Besides that, Dyer and McHugh (1975) also showed that company that get more profit tend to be timely in reporting their financial report. Otherwise, if the company run into loss, they will ask their auditor to do their audit slower than expected, and led to delay its financial reporting (Carslaw and Kaplan, 1991). Companies that had low profitability will likely untimely submitted their Financial Statement because it contained bad news. Companies that experienced losses or low profitability level will bring bad effects that cause a decline in the performance assessment of a company. Otherwise, companies that generate more profit tend to be timely in reporting their Financial Statement and it contained good news and required to publish the good news as soon as possible to the public. Companies experiencing

high profitability level will also bring positive effect on company’s performance.

Thus, it can be concluded that Profitability had negative influence on ARL and H1 is accepted.

Based on the Multiple Regression result on partial test, there is a negative significant effect of Auditor Opinion toward ARL. Based on the above result Auditor Opinion had negative influence on ARL. It means that the more the unqualified opinion that the Companies obtained, the shorter the ARL will be. Thus, the second hypothesis in this research variable was accepted. This research is in line with Hariza and Maria (2012) that stated Companies that acquire Qualified Opinion has longer ARL than the companies that received unqualified opinion. This is because the management is trying to delay the submission of Financial Statement for Qualified Opinion is bad news for investors or other interested parties. Companies that obtained Unqualified Opinion tend to be more timely in publishing its Financial Statement because it contained good news. This research showed that there is an influence of Auditor Opinion toward ARL but in the negative form. It was also supported by Arifa (2013) that stated Auditor Opinion had negative influence on ARL. Thus, it can be concluded that Auditor Opinion had negative influence on ARL and H2 is accepted.

Based on the Multiple Regression result on partial test, there is a positive significant efect of Auditor Switching toward ARL. It means that if there was an auditor changing, the ARL will be longer. The changing of auditor generally happens because of end of employment contract between client and Public Accounting Firm and Client. The changing of the auditor requires the new auditor to communicate with the previous auditor to identify client reason, get more understandability of the client, and develop audit strategy by

understanding client industry and business more detail, it makes auditor require longer time to complete audit process and resulting in delay on submission of financial statement and ARL (Tambunan, 2014). This research is in line according to Wibowo (2012) and Rustiarini and Sugiarti (2013) stated that Auditor Switching have significant influence on ARL. So it can be concluded that Auditor switching had positive influence on ARL and H3 is accepted.

Based on the Multiple Regression result on partial test, there is a positive significant effect of Complexity toward ARL. Complexity was measured by the number and operating units of subsidiaries. It means that the higher the complexity of the Company, the longer the time of the ARL. This research result is supported by Ariyani and Budiartha (2014) that concluded Complexity had significant influence on ARL and indicated that if company had many operating unit of subsidiaries, it would take more time for the auditor to perform their audit work because of the complexity of the transaction and consolidated reports needed to be audited by the auditor. Thus, it can be concluded that Complexity had positive influence on ARL and H4 is accepted.

Based on the Multiple Regression result on partial test, there was a negative significant effect of Firm Reputation toward ARL. It means that if the Company was audited by the Big Four Accounting Firms, the audit time would be faster and it would decrease the time of ARL. It happened because the Big Accounting Firm, especially the Big Four had better access to advanced technology and professional staff compared to the non-Big Four, which had an impact on audit quality and timeliness of audit completion and submission of Financial Statement of a company. It is in line with Mohamad Nor et al. (2010), if the company is audited by large Public Accounting Firm services that had good reputation (including the Big Four), the company is expected to have shorter ARL period than companies audited by Public Accounting Firm and do not include the Big Four. This result was also supported by Austine et al. (2014) and Berliana (2015) that stated that Firm Reputation had significant influence on ARL. Thus, it can be concluded that Firm Reputation had negative influence on ARL and H5 is accepted.

Based on the Multiple Regression result on partial test, there was a positive siginificant effect of Board of Size of Directors toward ARL. It

means that if there is too many members of Board of Directors in Company, it will increase the ARL. This statement was strengthen by Dimitropoulos & Asteriou (2010) that stated too many members of the Board of Directors can lead to problems of communication or coordination, resulting in inefficiency and the difficulty of monitoring. It is also supported by Mak and Li (2001) that large board that creates less participation, is less organized and is less able to reach an agreement on audit process and procedures. Ofuan James and Christian (2014) also stated that Board of Size of Directors was one of the components of Corporate Governance that can influence ARL. Board of Directors are responsible for monitoring the policy and the function of internal management and also the quality of information contained in the Financial Statement that are informed to the public. Thus, it can be concluded that Board of Size of Directors had positive influence on ARL and H6 is accepted.

CONCLUSIONS

Based on the analysis and discussion that had been done, it can be concluded that there is negative significant influence of Profitability, Auditor Opinion, and Firm Reputation toward ARL while other variables which are Auditor Switching, Complexity and Boards of Size of Directors have positive influence and significant toward ARL.

Based on the result of the Correlation and Determination of Coefficient, the variables contribution such as Profitability, Auditor Opinion, Auditor Switching, Complexity, Firm Reputation, Board of Size of Directors have an influence toward ARL of 61.2 percent, while the rest 38.8 percent explained by other variables except the six variables above. This indicated that there is still another variable that can give contribution to ARL. Besides that, it is suggested that for further research, researchers could find and measure another variable except the six variables above.

REFERENCES

Abdullah, J. Y. A. (1996). The Timeliness of Bahrain Annual Reports. Journal of Advances in International Accounting, 9, 73–88.

Ahmed, A., & Hossain, M. S. (2010). ARL/ : A study of the Bangladeshi listed companies. ASA University Review, 4(2), 49–56.

Alkhatib, K., & Marji, Q. (2012). Audit Reports Timeliness: Empirical Evidence from Jordan. Procedia - Social and Behavioral Sciences, 62, 1342–1349. doi: doi. org/ 10.1016/j.sbspro.2012.09.229

Angruningrum, S., & Wirakusuma, M. G. (2013). Pengaruh Profitabilitas, Leverage, Kompleksitas Operasi, Reputasi KAP dan Komite Audit Pada Audit Delay. E-Jurnal Akuntansi Universitas Udayana, 5(2), 251– 270.

Arifa, A. N. (2013). Pengembangan Model Audit Delay dengan Audit Report Lag dan Total Lag. Accounting Analysis Journal, 2(2), 172–181.

Ariyani, N. N. T. D., & Budiartha, I. K. (2014). Kompleksitas Operasi Perusahaan Dan Reputasi Kap Terhadap Audit Report Lag Pada Perusahaan Manufaktur. E-Jurnal Akuntansi Universitas Udayana, 8(2), 217– 230.

Austine, O. E., Chijioke, O. M., & Henry, S. A. (2014). Audit Firm Rotation and ARL in Nigeria. IOSR Journal of Business and Management (IOSR-JBM), 12(4), 1 3–19. Retrieved from http://www. iosrjournals.org/ iosr-jbm/papers/Vol 1 2-issue4/ C01241319.pdf?id=4052

Aziz, A. A., Isa, F., & Abu, M. F. (2014). Audit Report Lags of Federal Statutory Bodies in Malaysia. International Conference on Economics, Management and Development, 73–78.

Bapepam (2015). Laporan. Retrieved from: https:/ /www.ojk.go.id/id/Default.aspx

Berliana, R. (2015). The Effect of Workload, Auditor Tenure, Specialist Auditor and Public Accounting Firm Size on ARL. Economic and Business Faculty of Jenderal Soedirman University Journal, 1–30.

Carslaw, C. a. P. N., & Kaplan, S. E. (1991). An Examination of Audit Delay: Further Evidence from New Zealand. Accounting and Business Research, 22(85), 21–32. doi: doi.org/10.1080/00014788.1991.9729414

Dimitropoulos, P. E., & Asteriou, D. (2010). The effect of board composition on the informativeness and quality of annual earnings: Empirical evidence from Greece. Research in International Business and Finance, 24(2), 1 90–205. doi: doi. org/ 10.1016/j.ribaf.2009.12.001

Dyer, Jc and McHugh, Aj.(1975). Timeliness of Australian Annual-Report. Journal of Accounting Research, 13(2), pp. 204-219

FASB. (2008). Statement of Financial Accounting Concepts No. 2 - Qualitative Characteristics of Accounting Information. FASB Concepts Statements, (2), 0.

Ghozali, I. (2013). Aplikasi Analisis Multivariate dengan progrma IBM SPSS 21. Semarang.

Hariza, J. A., Wahyuni, N. I., & Maria W, S. (2012). Faktor-Faktor yang Berpengaruh terhadap ARL (Studi Empiris pada Emiten Industri Keuangan di BEI). Jurnal Akuntansi Universitas Jember, 10(2), 30– 47.

IASB. (2008). International Financial Reporting Standards (IFRSs) 2008 (including International Accounting Standards (IASs) and Interpretations as at 1st January 2008). International Accounting Standards Board (IASB). Retrieved from http://www.iasb.org

Kartika, A. (2009). Faktor-Faktor yang Mempengaruhi Struktur Modal pada Perusahaan Manufaktur yang Go Public di BEI. Jurnal Dinamika Keangan Dan Perbankan, 1(2), 105–122.

Knechel, W. Robert., & Payne, J. (200 1). Additional evidence on ARLs. Auditing: A Journal of Practice & Theory, 20(1), 137– 146. doi: doi.org/10.2308/aud.2001.20.1.137

Lee, H. Y., & Jahng, G. J. (2008). Determinants of ARL: Evidence from Korea - An examination of auditor-related factors. Journal of Applied Business Research, 24(2), 27–44.

Li, Y., Zhang, D., & Wang, X. (2014). The Influence of Corporation Governance Structure on Internal Control ARL: Evidence from China. Accounting & Taxation, 6(2), 101–115. Retrieved from http:// search.proquest.com/openview/ 5ec15bdcccb5b6b00fc6ce62b4c2c985/1?pq-origsite=gscholar

Mak, Y., & Li, Y. (2001). Determinants of corporate ownership and board structure: evidence from Singapore. Journal of Corporate Finance, 7(3), 235–256. doi: doi.org/10.1016/S0929-1199(01)00021-9

Maria, A. (2012). Analisis Faktor-Faktor yang Berpengaruh terhadap Audit Delay pada Perusahaan Consumer Goods di Bursa Efek Indonesia. Jurnal Universitas Gunadarma.

Mohamad-Nor, M. N., Rohami, S., & Wan-Hussin, W. N. (2010). Corporate governance and ARL in Malaysia. Asian Academy of Management Journal of Accounting and Finance, 6(2), 57–84.

Ofuan James, I., & Christian, I. (2014). Corporate Governance and ARL in Nigeria. International Journal of Humanities and Social Science, 4(13), 172–180.

Permatasari, A., & Widuri, R. (2013). Faktor – Faktor yang Mempengaruhi ARL (Studi Empiris Pada Perusahaan Pertambangan yang Terdaftar di Bursa Efek Indonesia Tahun 2011- 2013), Jurnal Universitas Bina Nusantara.

Petronila, T. A. (2007). Analisis pengaruh skala perusahaan, profitabilitas, kap, opini audit, pos luar biasa dan umur perusahaan terhadap audit delay/ : studi empiris pada bursa efek jakarta tahun 2003. Jurnal Akuntabilitas, 6(2), 129–141.

Putra, A. B. S., & Sukirman. (2014). Opini Auditor, Laba atau Rugi Tahun Berjalan, Auditor Switching dalam Memprediksi Audit Delay. Accounting Analysis Journal, 3(2), 187–193.

Rustiarini, N. W., & Sugiarti, N. W. M. (2013). Pengaruh karakteristik auditor, opini audit, audit tenure, pergantian auditor pada audit

delay. Jurnal Ilmiah Akuntansi Dan Humanika, 2(2), 657–675. doi: doi. org/ 10.1017/ CBO9781107415324.004

SFAC. (1978). Statement of Financial Accounting Concepts No.1

Tambunan, P. U. (2014). Pengaruh Opini Audit, Pergantian Auditor dan Ukuran Kantor Akuntan Publik terhadap ARL (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia). Jurnal Akuntansi Universitas Negeri Padang, 3(1).

Vuko, T., & Cular, M. (20 14). Finding determinants of audit delay by pooled OLS regression analysis. Croatian Operational Research Review, 5, 81–91.

Wibowo, A. C. (2012). Analisis Faktor-Faktor yang Mempengaruhi Total Lag Publikasi Laporan Keuangan Sebagai Indikasi Kepatuhan Terhadap Pihak Regulator (Studi Empiris Keberadaan Komite Audit dan Proporsi Komisaris Independen). Efektif Jurnal Bisnis Dan Ekonomi, 3(2), 111–122.

Xie, B., III, W. D., & DaDalt, P. (2003). Earnings management and corporate governance: the role of the board and the audit committee. Journal of Corporate Finance, 9(3). Retrieved from http://www.sciencedirect. com/science/article/pii/S092911990200006

Discussion and feedback