A Blue Ocean Strategy for Herbal Liniment: Escaping Tight Competition in Indonesian Market

on

Elvina Yohana Santoso, A Blue Ocean Strategy for Herbal Liniment… 1 53

P-ISSN: 1978-2853

E-ISSN: 2302-8890

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 17 No. 2, Agustus (2023), 153-170

A Blue Ocean Strategy for Herbal Liniment: Escaping Tight Competition in Indonesian Market

Elvina Yohana Santoso1), Werner Ria Murhadi2),

1,2 Universitas Surabaya

Email: werner@staff.ubaya.ac.id

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2023.v17.i02.p04

ABSTRACT

The herbal liniment industry operates in a highly competitive and saturated market. This study focuses on developing a blue ocean strategy for Yodosan Herba Natur, an herbal liniment manufacturer, to treat musculoskeletal pain. Through qualitative interviews with 17 participants in Surabaya, customer preferences and latent needs for musculoskeletal pain treatment were explored. Data analysis revealed seven main themes: effectiveness, experience, ease of use, sensation, availability, recommendation, and other factors. This research assessed the competitive landscape comprehensively using blue ocean strategy analysis tools. The blue ocean strategy is to develop an odorless product with long-lasting heat, a strong brand image, widespread availability, compact size, and affordable prices. New factors introduced are packaging designs, niche marketing, and strategic partnerships. The findings highlight the potential for Yodosan Herba Natur to revolutionize musculoskeletal pain treatment and capture the untapped markets of second and third-tier non-consumers.

Keywords: Blue ocean strategy; Herbal Liniments; Musculoskeletal Pain.

INTRODUCTION

Musculoskeletal pain is one of the primary causes of pain that affect 1.71 billion people worldwide (World Health Organization, 2022). In Indonesia, low back pain is ranked 7th as the cause of the combined number of disabilities and deaths (Abbafati et al., 2020). Based on the 2018 Laporan Nasional Riskesdas (Tim Riskesdas 2018, 2019), the prevalence of joint disease (a type of musculoskeletal pain), based on a doctor's diagnosis, in people aged 15 years and over is 7.3%. In Surabaya, the city with the second largest population in Indonesia, musculoskeletal disorders are among the 10 most common diseases. About 7.93% of the ailments are musculoskeletal disorders (Dinas Kesehatan Kota Surabaya, 2019). The pain could arise from external factors such as strenuous muscle movements, prolonged repetitive activities, poor work postures, and internal factors such as age, sex, tobacco use, physical conditioning, and muscular power (Majdi & Ruhardi, 2020; Prima et al., 2021; Rachman et al., 2019). As it significantly reduces the quality of life of the sufferers, musculoskeletal pain becomes a world health priority. Correspondingly, various types of treatment emerged, both modern medicine and traditional medicine, including from parties fighting for profits. There are three methods of treatment: self-medication (self-treatment), treatment by experts, and combination methods. And there are two types of treatment: modern medicine and traditional medicine (Andarini et

al., 2019). Self-treatment includes oral or topical medications such as consuming pills, capsules, tablets, or herbs and using creams, gels, ointment, or herbal liniment. Treatment by doctors, Chinese physicians, therapy, or massage is some examples of treatment by experts. In addition, this method includes acupuncture, chiropractic, and osteopathy (Sugai et al., 2021). Sociodemographics, socioeconomic conditions, and health facilities shape diverse community treatment options (Nanjunda, 2017). In Indonesia, the population commonly practices selfmedication, often relying on traditional medicine for treatment (Pengpid & Peltzer, 2018; Widayati et al., 2021). Among traditional medication, herbal liniment is the general choice to treat musculoskeletal pain (Ofori-Kwakye & Kumadoh, 2017). Generally, herbal liniment is easily accessible for convenient over-the-counter (OTC) purchases. Liniments' common usage is to alleviate musculoskeletal discomfort in the shoulders, neck, lower back, and muscles resulting from sprains, strains, bruises, muscle inflammation, and arthritis (Guo et al., 2022). As a country rich in natural resources, with at least 80% of the medicinal plant species in South East Asia present, whether native or introduced (Cahyaningsih et al., 2021), Indonesia has many liniment manufacturers in various regions utilizing the mainstay medicinal plants in their areas of origin. Traditional medicine practices in regions like Java, Sunda, Manado, Kalimantan, and other locations have been passed down from generation to generation (Adiyasa & Meiyanti, 2021). Not limited to local products, currently, sales of Chinese tonics and medicines in Indonesia have reached large numbers (Liu, 2021). More than 150 liniments from various country have obtained official distribution permits from The Indonesian Food and Drug Authority (Badan POM, 2023). Beyond this figure, many illegal medicines are freely distributed online through social media and marketplaces (Ariestiana, 2020).

However, the large number does not make herbal liniments dominate the market in Indonesia. Instead, herbal liniment manufacturers compete for similar offerings to a narrow group of consumers. Yodosan Herba Natur, an herbal liniment manufacturer primarily operating in Surabaya, faces the same situation. With commonly agreed characteristics such as packaging with an old-fashioned impression and a distinctive herbal smell (Yang, 2009), this industry created over-traded market conditions with almost indistinguishable variations available to end-users. A confined mindset within the prevailing boundaries and rules of competition has constrained the industry in seizing the available but invisible market opportunities. The product, including tincture, scarcity in community pharmacies and other retail shops results in other treatment alternatives having the upper hand on the market. Several muscle patches and creams won the top brand award, a credible award to indicate brand performance in Indonesia based on three parameters: top of mind, last usage, and future purchase intentions. Yet, none of the herbal liniment brands appear in the top brand index (Top Brand Award, 2023).

A trend that emerges every time a new player enters the market is the increasingly intense zero-sum battle for market share. Consecutive attempts to differentiate the products bring about merely 'different in the same way' offerings and have been hard to tell apart. In this state, competitive advantage has a brief lifespan. With the continuous addition of players caged in a hotly contested space, there will come a time when 'price' will be the sole competition factor (Priilaid et al., 2020). As companies reduce their prices, profits continue to erode, thus causing losses for many players. It appears to be an undeniable irony, reminded that this industry can get the hands-on available uncontested market spaces of a mass of musculoskeletal pain suffe e s.

This so-called 'red ocean' is nothing new. A high level of competition to exploit the existing market demand by making the value-cost trade-off has occurred in many industrial fields for decades as they adhere to the strategic framework proposed by Porter (1996). Fortunately for industries, a solution called the 'blue ocean strategy' was formulated (Kim & Mauborgne, 2005). It is a form of disruptive innovation that arises by capitalizing on untapped market opportunities, which incumbents tend to disregard or underestimate (Christensen et al., 2018). Since then, the blue ocean strategy has proved its powerful notion in bringing various industrial fields out of the 'bloody' competition zone. One of the notable successes in implementing the blue ocean strategy is the invention of the Tata Ace (Kulkarni & Sivaraman, 2020). Its success in the commercial vehicle industry has made Tata Motors Limited a market leader by controlling 70% market share in the sub-2-tonnes market. In the smartphone sector, Xiaomi has succeeded in attracting a potential market without needing to compete but opening a so-far-ignored market niche (Rasyid et al., 2021). The outcome would be the same for nonprofit organizations, for instance, Thunder Bay Public Library (TBPL). The realization of the blue ocean shift enables TBPL to escape the declining trend of personal visits and physical circulation for 10 years (Pateman, 2019). Amid other sectors' successes, there is hope for Yodosan Herba Natur in the herbal liniment industry. The blue ocean strategy serves as a bridge to meet the 'unmet' market demands leading to a breakthrough in market and profit growth for this sector.

Accordingly informed, this study explores customer preferences for musculoskeletal pain's various treatment methods and uncovers their latent needs from the point of view of endusers and sales intermediaries qualitatively through interviews. The results will become the basis for preparing a blue ocean strategy for Yodosan Herba Natur according to the blue ocean shift (Kim & Mauborgne, 2017). Blue ocean shift (Kim & Mauborgne, 2017) provides a comprehensive framework for the practical application of the theory and tools explained in blue ocean strategy (2005) for transitioning from a red to a blue ocean. Progressing toward a successful market-creation strategy involves a systematic five-step process: getting started, understanding where you are now, imagining where you could be, finding how you get there, and making your move. The initial step involves the selection of an appropriate initial marketcreating offering and a competent team to lead it. The tool needed is a 'pioneer-migrator-settler' map. Nonetheless, this phase becomes superfluous in the case of companies exclusively focused on a single product line. The step 'understand where you are now' encompasses an as-is strategy canvas to draw 5-12 essential factors as a single-page picture to construct a concise visual representation of the strategic profiles of the firm and its competitors. This step aids in comprehending the current competitive landscape. Transitioning from a red to a blue ocean lies in the third step, imagining where you could be. This phase focuses on identifying 'latent challenges' constraining industry growth and exploring untapped markets among noncustomers. The essential instruments required include the buyer utility map and the three-tier of the noncustomers framework. After identifying the concept, the subsequent stage involves finding how you get there. This step includes reconstructing market boundaries to identify alternative blue ocean opportunities using tools like the Six Paths Framework and the ERRC grid, which embody the Four Action Framework. Typically, paths one and two within the Six Paths Framework present the most significant potential rewards, making them the frequently chosen routes. The final step, making your move, involves consolidating all the information into tangible actions. Leavy (2018) adds that the "wisest rollout strategy is to start small" to further test and enhance the feasibility of the new blue ocean initiative and subsequently "go fast and

wide." Consequently, the formulated solution in this study will help herbal Yodosan Herba Natur shift practice away from an over-loaded market space towards a profitable and promising uncontested one, and on top of that, fabricate hitherto unfulfilled desirable products for customers.

METHODS

An exploratory qualitative research design is utilized in this study, employing a case study approach to investigate an herbal liniment manufacturer, Yodosan Herba Natur, with a primary market presence in Surabaya. Throughout this paper, Yodosan Herba Natur product will be called ‘tincture’. This study conducted observations in retail shops (2 community pharmacies and 2 Chinese medicine shops) and depth interviews with 17 informants of 13 end-users and 4 sales intermediaries in Surabaya. That figure was obtained as interviews with a specific informal group were terminated once information saturation was achieved, signifying the absence of any additional pertinent information. End-users are essential as they would be the target market of the blue ocean strategy formulated. The questions for end-users focus on (1) their experience, (2) current alternative(s) of choice, (3) the reason for choosing it, and (4) ideal products according to their preference for treating musculoskeletal pain. On the other hand, sales intermediaries would provide information regarding existing competition between industries and a wider group of customers' preferences. The sales intermediaries are two Chinese medicine shop owners and two community pharmacies staffs. The questions for sales intermediaries focus on (1) the type of products sold in their retail shops, (2) the reason behind the products' number of sales, (3) customers' preferences, and (4) customers' feedback. The ultimate interview aim was to explore customer opinion on musculoskeletal pain's various treatment methods and uncover their latent needs.

All the audio recordings were transcribed and analyzed using open, axial, and selective coding methods with the help of NVIVO v.12. The coding technique used was inductive coding with initial codes developed from a sample of transcription data. The completed coding dictionary encompasses 7 main themes and 14 sub-nodes nested within these themes, resulting in a comprehensive collection of 21 nodes. Once the customers' latent needs were identified, the blue ocean strategy for Yodosan Herba Natur was formulated using the five steps described in the blue ocean shift (Kim & Mauborgne, 2017) and its supplementary materials provided by Leavy (2018). The pioneer-migrator-settler map and creating a team were neglected. The formulation of the blue ocean strategy focuses on just one line of business due to Yodosan Herba Natur's exclusive production of a specific product. The process is undertaken solely by researchers. Therefore, the outcomes of interviews and observations will be directly incorporated into the second step, shaping the 'as-is' strategy canvas. In the third step, a buyer utility map and the three-tier noncustomers framework facilitated the creation of blue ocean strategy opportunities. As in step four of the blue ocean shift, this study would also analyze paths one and two of the six paths framework and create an ERRC grid to illustrate the four action frameworks analysis results. This step will help actualize the Blue Ocean initiative derived from step three. In the last step, a new blue ocean strategy canvas pictured the outcomes of step four. This step also considers the details of the implementation actions and the business models.

RESULTS AND DISCUSSION

There are two groups of informants, end-users and sales intermediaries. Of the 13 endusers, 9 were currently using herbal liniments to treat musculoskeletal pain, 3 had experience using it, and 1 never used it. End-users have an age range of 26-76 years. Five of them are over 50 the rest are below 50. To gain different perspectives, of the 4 sales intermediaries, 2 are Chinese medicine shop owners and 2 are community pharmacy staffs. The Chinese medicine shops sell various herbal liniments; the community pharmacies sell none. The results of the observations and interviews showed that all end-users used more than one type of treatment. The treatment methods mentioned in the interviews included oral medication, herbal liniments, other topical medications (creams, gels, liquid medications, balms, and patches), massage, medical treatment, acupuncture, and therapy.

The 7 main themes identified in this research and their explanations are listed in Table 1. Six of the main themes was the result obtained from majority of the informants. The other one is ‘Other factors’ that comes from the factors mentioned by a few informants. The explaination of each theme and sub-nodes will encompass illustrative quotations from interviews to provide qualitative evidence. It will also present frequencies to display the extent of agreement within the sample (13 end-users and 4 sales intermediaries) regarding specific thematic aspects. In cases deemed necessary, quotations have been edited to exclude nonsubstantive interjections or partial phrases.

Table 1. Main Themes of The Interview Results

|

Theme |

Explanation of Theme |

|

Effectiveness |

Customers interpretations and belief of the effectiveness of the products or services, both the efficacy and its speed of reaction. |

|

Experience |

Customers explanations about their experiences with various treatment methods. There are three sub-nodes in this theme that is previous treatments experience, habit, and side effects including traumas. |

|

Ease of use |

Customers understanding of the ease of use of the product or service. Three sub-nodes in this theme are applicator type and packaging for topical products and the ability to reach painful body parts. |

|

Sensation |

Customers perception of the sensations produced by the products or services. This includes the perception of smell, heat, and comfort each of which becomes a subnode. |

|

Availability |

Customers knowledge of the availability and ease of obtaining both products and services of the chosen treatment method. |

|

Recommendation |

Customers sources of information about the products and services. This includes recommendation from friends, family, and experts. |

|

Other factors |

Factors that are mentioned by a few informants. This includes brand image, knowledge of product existence, price, packaging design, and promotion programs. |

Source: NVIVO coding result based on informations obtained through in-depth interviews, 2023

All informants, both end-users and sales intermediaries, agree that effectiveness is one of the main factors in choosing treatment alternatives. Effectiveness means the ability to relieve pain and the speed of reaction.

“Most importantly the effect, does it have an effect or not? If I use it often but it doesn’t have an effect, it’s useless. That’s for sure.”

All sales intermediaries and 6 end-users said effectiveness also depends on the level and type of pain. Thus, customers use disparate treatments for different pain levels. For severe pain, customers tend to use a combination of topical and oral medications simultaneously. Four end-users mentioned ineffectiveness as the reason to stop using their previous treatment option.

Treatment experience, habits, side effects, and trauma are major factors for 8 end-users. Previous treatment forms an impression that directly influences the customer selection decision. This finding aligns with the research conducted by Kevrekidis et al. (2018) and (Shah et al., 2020) highlighting that prior experience plays a pivotal role in choosing Over-The-Counter medications. Medications that were effectively used in the past, including in childhood, tend to make customers seek similar remedies today.

“When I was little, someone gave me these herbal medicines they made themself. It works, but I only got it that one time. And then when I first see this tincture, it smells similar. Then I thought I would just try it. Turns out it worked.”

Positive experiences sometimes lead to habits and create a feeling of inadequacy when they are not used. On the other hand, negative impressions, for instance, experiencing side effects, especially one that leads to trauma, could cause customers to reduce the frequency of use or even stop the medication.

“Voltaren tablet has side effects that can cause stomach ulcers. Because I already have a history of ulcers, I use it as seldom as possible.”

These findings align with Idacahyati et al. (2020) research that gastrointestinal discomfort is frequently reported as an adverse drug reaction (ADR) linked to NSAID consumption, constituting 56.7% of ADR cases.

The type of applicator, packaging, especially its size, and the ease of reaching painful parts of the body influences the product’s or service’s ease of use.

“I like it because the packaging is practical. It uses a sprayer. To use it, I only need to spray it. It is simple.”

The sprayer is customers’ favorite applicator for herbal liniments in Chinese medicine shops. However, according to pharmacies staffs, the best-selling topical medicines in community pharmacies are creams in tubs that are applied directly by rubbing on the skin. Package size also affects the ease of use based on condition and frequency of usage. A product with a small size is preferred for its easy-to-carry feature, especially for traveling use.

“It’s just that if it’s too big, it’s also not good to carry. The ones that are most comfortable to carry around are the small ones, easily fit in a bag, carried everywhere as if there’s no burden.”

It is an idea to improve herbal liniments as 5 end-users complained that the product they used did not provide a small-size variant. However, old customers with daily use prefer products with larger sizes to last longer. Another important feature of ease of use is the ability to reach pain points all over the body. This lacking characteristic of herbal liniment is fulfilled in another treatment method, namely massage.

Perception of sensations also plays a crucial role in buying decisions. That includes the perception of smell, heat, or comfort produced by treatment alternatives. The pungent smell of herbal liniments or massage oils had bothered 7 end-users. As a result, some refused to use them at all. And the users are forced to mix them with a fragrant product or use them while staying away from public places.

“When I apply the tincture, I have to be alone, because everyone in the house doesn’t like the smell.”

More influential than the smell is the level of heat. Of the 13 end-users, 11 prefer warm or hot sensations, and 2 prefer products with no heat sensation. That is in line with the statements of sales intermediaries. The majority of customers in both Chinese medicine shops and pharmacies prefer warm or hot products.

“Majority [of customers] like it hot. The problem comes from the customer’s psychological point of view. [In their mind] usually, cold products do not work. That is why most of them choose hot ones.”

In addition to those elements is comfort. Most end-users (8 of 13) complained about oily and sticky products. In addition to the uncomfortable sensation, they claim those products also leave stains on the surfaces of the objects touched, mainly their clothes. Pharmacies staff are voicing the same opinions. Most customers prefer the cream form over the gel, as it absorbs directly to the skin, not greasy or sticky.

“[I] actually prefer the non-oil. Because oil sticks all the time, it doesn’t seep [into the skin] right away. For example, when I apply it here, it gets all greasy. The oil is everywhere.”

End-users and sales intermediaries are aligned in the view that availability greatly influences the selection of alternative treatments. That is because pain generally comes on suddenly, and delayed treatment causes a burden. Customers in pharmaceutical shops will buy any available drug regardless of whether it is their favorite product.

“Yunnan baiyao is often out of stock from its distributors. So the stock here is not much. If it is not in stock, we give Zheng Gu Shui to the customers, and most of them become Zheng Gu Shui customers.”

Treatment in the form of services, such as acupuncture and massage, is generally perceived a less available than in the form of products. It takes time to go to the places offering these

services. Thus, customers of massage services and acupuncture also use topical drugs as an alternative ready-to-use at any time.

Recommendations are the dominant sources of treatment alternatives introduction. Information from relatives or friends was the most common (all end-users) as customers consider them honest and trustworthy witnesses.

“To be honest right now is the era of social media. There’s a lot of fake information that you see on the internet. Also, not a few people sell products and then put on good reviews themselves. The product sold in the marketplace could have 5 stars, but we don’t know if it is true or if they are buying reviews. But, [if the information is] from friends, at least they have experience, they have used it themselves.”

Moreover, if the informant is an athlete, customers perceive the product recommended as more effective. Advice from experts is the second most mentioned source (from 6 end-users), primarily for rare cases that involve severe pain. Chinese medicine shop owners’ and pharmacy staff’s opinions are also considered credible. Even so, most customers already know which product they want to buy when visiting the store. Only 2 end-users use treatment alternatives advertised on social media.

Other factors mentioned by a few informants include brand image (mentioned by all sales intermediaries), knowledge of product existence, price, promotion programs, and packaging design. Customers tend to buy medicinal products with a strong brand image, predominantly regarding their effectiveness. That applies in Chinese drug stores and pharmacies.

“Yunnan Baiyao and Zheng Gu Shui were the most dominant because these two brands have existed for a long time. Many people like them and are recommended by friends and family, so many buy them and prove that it works for them.”

Related to this, product existence has to be known beforehand. With so many alternatives available, customers will start to compare prices.

“To be honest, because of the price. Voltaren cream is worth IDR 200,000. Meanwhile, one bottle of tincture is only around IDR 50,000. So I thought I’ll use this [Voltaren cream] only if it hurts a lot.”

Not only compare different products, but customers also compare different sizes of the same product to get the most cost-effective alternative. Correspondingly, promotion programs, such as discounts, could increase sales temporarily. In addition, promotional strategies aimed at sales intermediaries, such as giving bonuses when achieving sales targets, have also proven effective in boosting sales. Another aspect to consider is packaging design. Young customers, in particular, find this to be a crucial factor. Ginting & Affandi (2022) reached a similar finding, emphasizing the impact of product packaging on consumer purchasing choices.

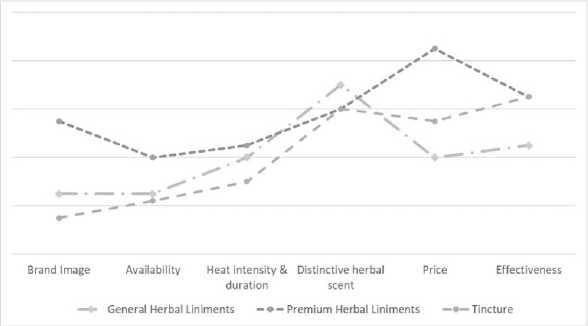

The blue ocean shift formulation refers to Kim & Mauborgne (2017). Table 2 presents the performed blue ocean shift steps in this study and provides their explanations. Designed specifically for a particular industry sector, the initial phase of the blue ocean shift involves crafting an as-is strategy canvas, see Figure 1. The key competitive factors in the herbal liniment industry establish through information shared by Chinese medicine shop owners. A

section of end-users also provided insights. These key factors are brand image, availability, heat intensity & duration, distinctive herbal scent, price, and effectiveness. The brand image significantly influences the competitive landscape of the herbal liniment industry. Primarily, the brand image in this industry stems from experiential encounters that lead to endorsements or positive word-of-mouth. It is uncommon for herbal liniment firms to promote beyond word of mouth. That is the situation in Chinese Medicine shops, where most herbal liniments, including tincture, are exclusively available. In their quest for greater availability, certain brands strive to market their products in other retail shops, aiming to expand their reach beyond traditional channels.

Another crucial aspect to consider is the intensity of heat perception, which ranges from a lack of heat sensation to mild warmth and scorching heat. There are instances of prolonged heat that can persist, while others exhibit a fleeting duration. On average, products offer gentle warmth with moderate heat resistance. The tincture from Yodosan Herba Natur provides a strong but brief sensation of heat. More aspect associated with herbal liniments is their distinct aroma. The combination of ingredients used produces the fragrance. While general and premium products may differ in aroma, all herbal products possess an herbal scent.

Table 2. Blue Ocean Shift Steps

Explaination of Steps

|

Step 1: Getting started |

This step consists of creating a pioneer-migrator-settler map and a competent team. This study omitted step one due to Yodosan Herba Natur's exclusive production of a specific product. The process was also undertaken solely by researchers. |

|

Step 2: Understanding where you are now |

This step involves the creation of an 'as-is' strategy canvas for a comprehensive understanding of Yodosan Herba Natur and its competitors' positions in the current competitive environment. This study outlines six critical factors, as depicted in Figure 1, with detailed information in Table 1. |

|

Step 3: Imagining where you could be |

This step creates and evaluates a buyer utility map and the three-tier noncustomers framework to uncover customers' hidden pain points impeding industry growth and delving into untapped markets among noncustomers. Table 3 and Table 4 display the buyer utility map and the three tiers of noncustomers found through this study. |

|

Step 4: Finding how you get there |

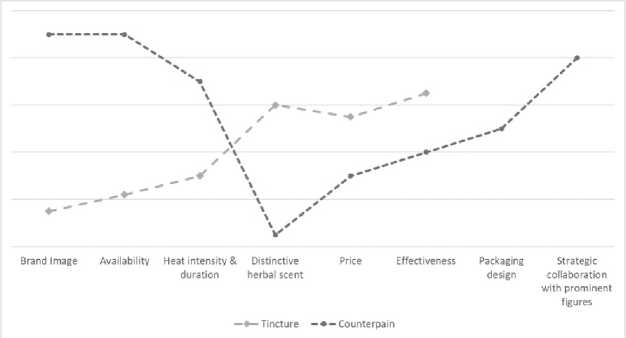

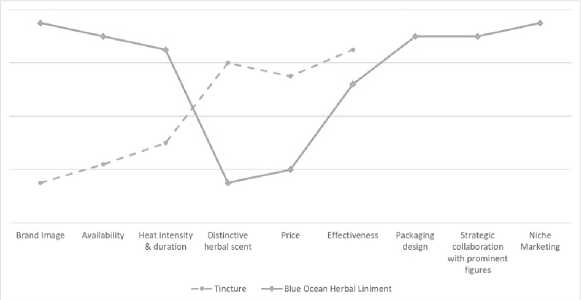

Based on the preceding phase information, this step involves restructuring market boundaries to uncover alternative blue ocean opportunities. This process employs the Six Paths Framework and the ERRC grid in Figure 3, representing the Four Action Framework analysis result. This study utilized paths one and two as Leavy (2018) suggests that these paths typically offer the highest potential benefits. In addition, Figure 2 presents a strategy canvas to illustrate the strategic positioning of Yodosan Herba Natur's tincture versus Counterpain, a leading domestic Over-The-Counter product for musculoskeletal pain. |

|

Step 5: Making your move |

This step consolidates all the information into tangible actions. A new blue ocean strategy canvas generated, as shown in Figure 4, guides the detailed action plan to relocate Yodosan Herba Natur from a red ocean competition to a competition-free blue ocean market. |

Source: Blue ocean shift formulation steps analysis result based on Kim and Mauborgne (2017)

Figure 1. As-Is Strategy Canvas of Herbal Liniments Industry

Source: Analysis result based on informations obtained through observations and in-depth interviews, 2023

Typically, these products are available in sizes ranging from 50 to 100 ml, some provide even larger volumes, and a few have smaller packaging, as compact as 30 ml or even less. Yodosan Herba Natur’s tincture is conveniently available in 60 ml and 100 ml options. Even when certain brands with a stronger brand image dare to market their products at a premium price, these products sell at a comparable average price per volume unit, more or less IDR 50.000 per 100 ml, just as the tincture produced by Yodosan Herba Natur. That seems justified, given that they are in a fiercely competitive market where pricing plays a significant role. The factor that is no less important than all of those is effectiveness. Companies strive to outdo each other by utilizing a blend of raw materials with a strong reputation for superior efficacy. Sometimes, they race to incorporate more ingredients than their competitors, aiming to position themselves as more effective. Nevertheless, according to some informants, medications containing chemically active ingredients were reported to produce faster effects compared to herbal remedies. Given our familiarity with the competition condition, the subsequent phase involves identifying hidden customers’ pain points. By addressing these industry “blind spots” that have long hindered the market from reaching its full potential, we can unlock the “trapped value” within the industry’s existing value chain and stimulate new demand. A buyer utility map is suitable for understanding the underlying pain points experienced throughout the product journey, see Table 3.

Those hidden pain points are sometimes responsible for preventing non-consumers from using tincture. Based on the blue ocean strategy (Kim & Mauborgne, 2004), three categories of non-customers demand consideration: those on the verge of becoming non-consumers, those who actively reject, and those who remain untapped and unexplored as potential targets. Table 4 reveals the presence of three tiers of non-customers of Yodosan Herba Natur.

Amidst the pursuit of solutions for customers’ hidden pain points, six paths emerge to reshape market boundaries. These alternatives could also identify potential solutions or features that appeal to non-costumers. Based on Leavy’s (2018) insights, the initial two paths generally yield the most significant potential rewards. Path One involves identifying the needs addressed by the current offering and generating a list of alternative solutions or industries that non-customers use to satisfy their specific needs. The goal is to pinpoint the decisive factors driving customers to choose offerings from other alternatives and then streamline or eliminate everything else to create a compelling solution. When dealing with musculoskeletal pain, a

significant number of individuals opt for synthetic chemical drugs in the form of topical cream or gels.

Table 3. Buyer Utility Map of Yodosan Herba Natur

|

Purchase |

Delivery Use Supple- Maintenance Disposal ments |

|

Customer Sales outlets Productivity operate during specific hours. |

Online purchases The product's may entail responsiveness prolonged may lag behind delivery times, that of other while offline alternatives. availability is limited. |

|

Simplicity |

Using it It is imperative independently to store it in a on the back of secure the body poses a location, out of challenge. reach of young children. |

|

Convenience The distribution outlets are scarce and distant from consumers. |

It can be Average product challenging to size is quite secure the sprayer large, making it in a manner that inconvenient to prevents leakage. carry. Furthermore, the heat sensation tends to fade quickly and is generally not as enduring as creams. |

|

Risk Fear regarding counterfeit products |

There is a The packaging There is a risk potential for spills is damaged, of product and packaging exposing deterioration if damage. sensitive areas not stored of the body, properly, such such as the eyes, as exposure to which should be sunlight. strictly avoided. |

|

Fun and Image The packaging appears outdated, lacking a well-established brand image |

Herbal characteristic odor |

|

Environmental Friendliness |

Currently, there is no established program for recycling plastic sprayers. |

Source: Analysis result based on informations obtained through observations and in-depth interviews, 2023

As per the pharmacies staffs, the top-selling drugs are Counterpain and Voltaren, which are also relied upon by some end-users for their needs. That aligns with the findings of (Wiratama et al., 2019), who affirm the prominent position of Counterpain in the domestic

Over-The-Counter product market. Additionally, (Isnenia, 2020) emphasizes that non-steroidal anti-inflammatory drugs (NSAIDs), including Voltaren, are a primary therapy for managing pain in musculoskeletal patients. Voltaren offers the advantage of effectively alleviating intense pain associated with specific medical conditions. It is characterized by its odorless nature and absence of a heating sensation, though it has a relatively higher price. Counterpain, classified as a cream, exhibits a prolonged heat effect. Similar products in the same category typically feature a refreshing menthol scent. Consumers highly appreciate the comforting warmth that Counterpain provides. But a few end-users have noted that Counterpain offers a soothing sensation without significant therapeutic benefits. Both types of drugs, Voltaren and Counterpain, are widely available in nearly all pharmacies and other pharmaceutical retailers. Counterpain, being more affordable, is also commonly found in convenience stores. The widespread distribution of these drugs ensures easy access for end-users when needed.

Both establish brand image through Above-The-Line (ATL) marketing strategies like television commercials. In addition, they go beyond that and implement Below-The-Line promotional initiatives such as pharmacy competitions to boost sales and collaborations with doctors for prescription endorsements. Figure 3 illustrates the strategic positioning of Yodosan Herba Natur tincture to Counterpain.

Table 4. Characteristics of Three Tiers Non-Customers of Yodosan Herba Natur

|

First Tier Non-Customers: soon to be non-customers |

Second Tier Non-Customers: refusing non-customers |

Third Tier NonCustomers: unexplored non-customers |

|

Perceiving the product as less effective |

Have mild pain that can be alleviated with rest alone |

Lack awareness or knowledge about the product |

|

Ad hoc (one-time users) |

Prefer immediate treatment and opt for oral medication |

Millenials |

|

Interchangeably use multiple brands |

Face affordability challenges or perceive the offered product as costly |

Gen Z |

|

Utilize a combination of treatments and prefer alternative methods |

Have skepticism towards herbal medicine |

Always seek advice from professionals |

|

Rely on the product solely because it is readily available at home or has been given by friends or relatives |

Find product features uncomfortable |

Never make their own medicine purchases |

|

Have negative product experiences or perceptions |

Acquainted with alternative forms of topical medications, such as oils, creams, or gels. |

Athletes |

Source: Analysis result based on informations obtained through observations and in-depth interviews, 2023

Path Two aims to explore opportunities by analyzing different strategic groups within the industry. The objective is to understand the factors that shape buyers' choice to upgrade or downgrade between these groups and to identify strategies to overcome the trade-offs involved. Within the herbal liniment industry, there is a distinguished category that proudly carries a rich heritage, passed down through generations, and is renowned for its exceptional efficacy. These products, predominantly from China, come with a premium price tag. Two noteworthy examples mentioned by Chinese medicine shop owners are Zheng Gu Shui and Yunnan Baiyao. There is also a category of less-known drugs packaged in larger containers at lower prices and

with insufficient evidence of effectiveness. An opportunity lies in a product that combines efficacy with affordability. It doesn't necessarily have to be an age-old product to gain recognition. One idea that has emerged is to establish a brand image by collaborating with reputable individuals who serve as role models within the community. That could take the form of promotional programs featuring athletes, experts in traditional medicine, or respected figures in the pharmaceutical industry.

After comprehensively understanding the competitive landscape, customer pain points, and the strategies employed by alternative industries and strategic groups, the subsequent step involves formulating four action frameworks. The analysis concludes that the herbal scent, a common characteristic of herbal products, requires elimination. While a few individuals may perceive the herbal scent as potent, many end-users find it bothersome. This factor does not contribute to added value; It diminishes the overall worth. However, market players, including Yodosan Herba Natur, rarely address it due to its longstanding presence.

Figure 2. Value Curve of Yodosan Herba Natur Tincture and Counterpain

Source: Analysis result based on informations obtained through observations and in-depth interviews, 2023

The factors that require raising include the brand image, availability, and heat sensation duration. Drawing inspiration from the alternative chemical drug industry, which has successfully established a strong brand image among the public, developing a powerful brand image for herbal liniments is imperative. That is especially significant, considering that most individuals are already familiar with the products available at pharmaceutical retailers, implying that a specific product has already formed an associated brand image. Moreover, one cannot undermine the importance of widespread availability, as pain can arise at any location and time. Considering its tincture is limited to drugstores and a few pharmacies and supermarkets, Yodosan Herba Natur must address this issue proactively. Furthermore, heat sensation resistance is crucial, offering soothing relief and alleviating discomfort, both highly desired by end-users.

The essential factors that require reduction are package size and pricing. Yodosan Herba Natur currently package tincture primarily for home use. However, based on the interview findings, it is evident that end-users also require smaller portable, and convenient to carry in a bag size. Introducing smaller packaging is expected to expand the target market to attract young consumers who frequently travel and may not experience frequent pain. Moreover, it is crucial to lower prices to ensure affordability for a broader range of individuals. By reducing the package size, the costs can automatically adjust accordingly. The price factor, being one of the

main determinants, enables products to be sold in minimarkets, catering to consumers from various socioeconomic backgrounds, including the lower middle class, and allowing for faster sales and higher turnover volumes in line with the characteristics of minimarket products. Giving priority to minimarket sales locations involves considering their operating hours and distribution, and the subsequent step entails expanding distribution to a network of pharmacies located in malls across Indonesia.

Key factors to incorporate are developing modern packaging designs, implementing targeted niche marketing, and establishing strategic collaborations with influential figures. Packaging design is vital in attracting younger generations, such as millennials and Gen Z, who prefer modern aesthetics over traditional packaging. Additionally, leveraging recommendations as a primary means of product introduction and establishing a powerful brand image is essential, thus necessitating marketing strategies that capitalize on these aspects. By targeting pain-prone groups and harnessing their influence as information sources in their social circles, niche marketing strategies are implemented across various sports groups, including gymnastics, running, martial arts, badminton, and more, utilizing customized marketing materials tailored to each group. Moreover, niche marketing efforts extend to elderly communities, such as elderly gymnastic groups, devotional groups, and reunion gatherings, effectively reaching and engaging with diverse target audiences. Strategic collaborations with prominent figures can effectively develop the brand image.

|

Eliminate |

Raise |

|

Distinctive herbal scent |

Brand image Availability Heat sensation duration |

|

Reduce |

Create |

|

Packing size and therefore price |

Packaging design Strategic collaboration with prominent figure Niche marketing |

Figure 3. ERRC Grid of Yodosan Herba Natur

Source: Analysis of the blue ocean strategy based on the results of blue ocean strategy frameworks and analytical tools, 2023

The promotional strategies can include providing commissions to prescribers, offering bonuses to drug stores based on product sales, sponsoring sporting events, and implementing promotional programs featuring athletes, traditional medicine experts, or reputable figures in the pharmaceutical industry. See the resulting ERRC Grid in Figure 3.

The new strategy canvas in Figure 4 represents a departure from the old, exemplifying the essence of a successful blue ocean strategy. The developed Blue Ocean strategy aims to capture untapped markets consisting of second and third-tier non-consumers, encompassing individuals who have faced barriers in purchasing, perceive products as costly, find product features inconvenient, lack awareness about the products, athletes, the younger generation, and individuals who rely on others for their medicine purchases.

Figure 4. Blue Ocean Herbal Liniment Strategy Canvas

Source: Analysis of the blue ocean strategy based on the results of blue ocean strategy frameworks and analytical tools, 2023

CONCLUSIONS

Yodosan Herba Natur, an herbal liniment manufacturer for musculoskeletal pain contends with fierce competition within the red ocean. However, the blue ocean strategy, which has yielded success across diverse industries, holds the potential for a market and profit breakthrough for this company. This research thoroughly examines the competitive landscape, uncovers latent customer pain points, and assesses the strategies employed by alternative industries and strategic groups within the industry to formulate an effective blue ocean strategy. Through in-depth interviews, the research uncovers factors influencing end-user treatment choices. These factors, along with an analysis using a set of frameworks and analytical tools from the Blue Ocean Strategy presented in Kim & Mauborgne (2005), have led to the formulation of four action framework works, resulting in a new strategy. The new blue ocean strategy canvas departs from the old Yodosan Herba Natur tincture and aims to capture untapped markets comprising second and third-tier non-consumers.

Nevertheless, as this study of herbal liniments' blue ocean strategy is in its initial stage, further research is warranted, preferably employing quantitative methods to encompass a wider population while considering additional informant types, such as masseuses, to provide valuable insights on alternative treatments. This comprehensive approach will allow for a thorough evaluation and refinement of the Blue Ocean strategy formulated as a rapid test. Additionally, to enhance representativeness, it is recommended to enrich the pool of informants by including individuals from diverse cities, thereby capturing a broader range of perspectives and ensuring a more robust analysis.

REFERENCES

Abbafati, C., Abbas, K. M., Abbasi-Kangevari, M., Abd-Allah, F., Abdelalim, A., Abdollahi, M., Abdollahpour, I., Abegaz, K. H., Abolhassani, H., Aboyans, V., Abreu, L. G., Abrigo, M. R. M., Abualhasan, A., Abu-Raddad, L. J., Abushouk, A. I., Adabi, M., Adekanmbi, V., Adeoye, A. M., Adetokunboh, O. O., Amini, S. (2020). Global burden of 369 disease and injuries in 204 countries and territories, 1990–2019: a systematic analysis for the

Global Burden of Disease Study 2019. The Lancet, 396(10258), 1204–1222. https://doi.org/10.1016/S0140-6736(20)30925-9

Adiyasa, M. R., & Meiyanti, M. (2021). Pemanfaatan obat tradisional di Indonesia: distribusi dan faktor demografis yang berpengaruh. Jurnal Biomedika Dan Kesehatan, 4(3), 130– 138. https://doi.org/10.18051/jbiomedkes.2021.v4.130-138

Andarini, S., Arif, A. Z., Al Rasyid, H., Wahono, C. S., Kalim, H., & Handono, K. (2019). Factors associated with health care seeking behavior for musculoskeletal pain in Indonesia: A cross-sectional study. International Journal of Rheumatic Diseases, 22(7), 1297–1304. https://doi.org/10.1111/1756-185X.13536

Ariestiana, E. (2020). Analisis penanggulangan peredaran obat keras dan obat-obat tertentu melalui media online. Indonesia Private Law Review, 1(2), 65–76.

https://doi.org/10.25041/iplr.v1i2.2054

Badan POM. (2023). Cek Produk BPOM. Retrieved March 23, 2023, from https://cekbpom.pom.go.id/

Cahyaningsih, R., Magos Brehm, J., & Maxted, N. (2021). Setting the priority medicinal plants for conservation in Indonesia. In Genetic Resources and Crop Evolution (Vol. 68, Issue 5). Springer Netherlands. https://doi.org/10.1007/s10722-021-01115-6

Christensen, C. M., McDonald, R., Altman, E. J., & Palmer, J. E. (2018). Disruptive Innovation: An Intellectual History and Directions for Future Research. In Journal of Management Studies (Vol. 55, Issue 7). https://doi.org/10.1111/joms.12349

Dinas Kesehatan Kota Surabaya. (2019). Statistik 10 Penyakit Terbanyak. Dinas Kesehatan Kota Surabaya. https://dinkes.surabaya.go.id/portalv2/profil/dkk-dalam-angka/statistik-10-penyakit-terbanyak/

Ginting, O. S. Br., & Affandi, A. A. (2022). Analisis pengaruh citra produk, harga jual dan desain kemasan terhadap keputusan pembelian vco di apotek matahari. Forte Journal, 2(1), 83–88. https://doi.org/10.51771/fj.v2i1.206

Guo, J., Hu, X., Wang, J., Yu, B., Li, J., Chen, J., Nie, X., Zheng, Z., Wang, S., & Qin, Q. (2022). Safety and efficacy of compound methyl salicylate liniment for topical pain: A multicenter real-world study in China. Frontiers in Pharmacology, 13. https://doi.org/10.3389/fphar.2022.1015941

Idacahyati, K., Nofianti, T., Aswa, G. A., & Nurfatwa, M. (2020). Hubungan Tingkat Kejadian Efek Samping Antiinflamasi Non Steroid dengan Usia dan Jenis Kelamin. Jurnal Farmasi Dan Ilmu Kefarmasian Indonesia, 6(2), 56. https://doi.org/10.20473/jfiki.v6i22019.56-61

Isnenia. (2020). Penggunaan Non-Steroid Antiinflamatory Drug dan Potensi Interaksi Obatnya Pada Pasien Muskuloskeletal. Pharmaceutical Journal of Indonesia, 6(1), 47–55. https://doi.org/10.21776/ub.pji.2020.006.01.8

Kevrekidis, D. P., Minarikova, D., Markos, A., Malovecka, I., & Minarik, P. (2018). Community pharmacy customer segmentation based on factors influencing their selection of pharmacy and over-the-counter medicines. Saudi Pharmaceutical Journal, 26(1), 33– 43. https://doi.org/10.1016/j.jsps.2017.11.002

Kim, W. C., & Mauborgne, R. (2005). Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant. Boston: Harvard Business Review Press.

Kim, W. C., & Mauborgne, R. (2017). Blue ocean shift: Beyond competing-proven steps to inspire confidence and seize new growth. New York: Hachette Books.

Kulkarni, B., & Sivaraman, V. (2020). Making a Blue Ocean Shift: Tata Ace captures a new market. Journal of Business Strategy, 41(4), 11–20. https://doi.org/10.1108/JBS-03-2019-0057

Leavy, B. (2018). Value innovation and how to successfully incubate “blue ocean” initiatives. Strategy and Leadership, 46(3), 10–20. https://doi.org/10.1108/SL-02-2018-0020

Liu, C. xiao. (2021). Overview on development of ASEAN traditional and herbal medicines. Chinese Herbal Medicines, 13(4), 441–450. https://doi.org/10.1016/j.chmed.2021.09.002

Majdi, M., & Ruhardi, A. (2020). Analisis Faktor Dan Kebiasaan Melakukan Pengobatan Tradisional Dengan Keluhan Muskuloskeletal Pada Pekerja Tenun di Desa Kembang Kerang Daya, Kabupaten Lombok Timur. Afiasi: Jurnal Kesehatan Masyarakat, 5(1), 11– 22. https://doi.org/10.31943/afiasi.v5i1.91

Nanjunda, D. (2017). Beyond the rational choice: The social dynamics of the changing nature of the rural people’s health concept. Muller Journal of Medical Sciences and Research, 8(1), 1. https://doi.org/10.4103/0975-9727.199368

Ofori-Kwakye, K., & Kumadoh, D. (2017). Dosage forms of herbal medicinal products and their stability considerations-an overview. Journal of Critical Reviews, 4(4), 1–8. https://doi.org/10.22159/jcr.2017v4i4.16077

Pateman, J. (2019). Blue Ocean Strategy: Making a Blue Ocean Shift at Thunder Bay Public Library. Public Library Quarterly, 38(4), 353–368.

https://doi.org/10.1080/01616846.2019.1612700

Pengpid, S., & Peltzer, K. (2018). Utilization of traditional and complementary medicine in Indonesia: Results of a national survey in 2014–15. Complementary Therapies in Clinical Practice, 33(February), 156–163. https://doi.org/10.1016/j.ctcp.2018.10.006

Porter, M. E. (1996). What is Strategy? Harvard Business Review, 74(6), 61–78. https://doi.org/10.1057/9780230378117_2

Priilaid, D., Ballantyne, R., & Packer, J. (2020). A “blue ocean” strategy for developing visitor wine experiences: Unlocking value in the Cape region tourism market. Journal of Hospitality and Tourism Management, 43(December 2019), 91–99.

https://doi.org/10.1016/j.jhtm.2020.01.009

Prima, D. W., Setyaningsih, Y., & Lestantyo, D. (2021). Risiko keluhan muskuloskeletal disorders dalam studi kasus pada postur kerja berdiri: literatur review. Jurnal Ilmiah Permas: Jurnal Ilmiah STIKES Kendal, 11(2), 365–374.

https://doi.org/10.32583/pskm.v11i2.1375

Rachman, R., Suoth, L. F., & Sekeon, S. A. S. (2019). Hubungan antara sikap kerja dan umur dengan keluhan musculoskeletal pada tenaga cleaning service di rsup prof. Dr. R. D. Kandou manado. Jurnal Kesmas, 8(7), 372–379.

Rasyid, M. K., Hurriyati, R., Dirgantari, P. D., & Disman. (2021). The Design of the Xiaomi Smartphone Marketing Model Based on an Innovative Strategy of Blue Ocean Shift. Proceedings of the 5th Global Conference on Business, Management and Entrepreneurship (GCBME 2020), 187(Gcbme 2020), 686–689.

https://doi.org/10.2991/aebmr.k.210831.130

Shah, S., Gilson, A. M., Jacobson, N., Reddy, A., Stone, J. A., & Chui, M. A. (2020). Understanding the Factors Influencing Older Adults’ Decision-Making about Their Use of Over-The-Counter Medications—A Scenario-Based Approach. Pharmacy, 8(3), 175. https://doi.org/10.3390/pharmacy8030175

Sugai, K., Tsuji, O., Takahashi, S., Matsumoto, M., Nakamura, M., & Fujita, N. (2021). Internet survey on factors associated with care-seeking behaviours of people with chronic musculoskeletal pain in Japan. Journal of Orthopaedic Surgery, 29(3), 1–14. https://doi.org/10.1177/23094990211044836

Tim Riskesdas 2018. (2019). Laporan Nasional Riskesdas 2018. Lembaga Penerbit Badan Penelitian dan Pengembangan Kesehatan (LPB).

http://labdata.litbang.kemkes.go.id/ccount/click.php?id=19

Top Brand Award. (2023). Top Brand Index. Retrieved June 1, 2023, from https://www.topbrand-award.com/top-brand-index/

Widayati, A., Candrasari, D. S., Mariana, L. J., & Veronica, V. (2021). Perceptions of Traditional Medicines for Self-Medication Among People in Dieng Plateau Central Java Province, Indonesia. Jurnal Riset Kesehatan, 10(2), 132–138.

https://doi.org/10.31983/jrk.v10i2.7692

Wiratama, A., Muktiadji, N., & Cahyani, N. (2019). Asset Management, Pt Taisho Pharmaceutical Tbk. Jurnal Ilmiah Manajemen Kesatuan, 7(1), 145–152. https://doi.org/10.37641/jimkes.v7i1.207

World Health Organization. (2022, July 14). Musculoskeletal health. https://www.who.int/news-room/fact-sheets/detail/musculoskeletal-conditions

Yang, Y. (2009). Chinese herbal medicines: comparisons and characteristics (2nd ed.). Elsevie Health Sciences.

Discussion and feedback