Determinants of Financial Reporting Local Government Organization Transparency and Accountability as a Mediator

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 18 No. 2, July 2023

AFFILIATION:

1,2,3Faculty of Economics and

Business, Universitas Muhammadiyah Yogyakarta, Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2023.v18.i02.p06

CITATION:

Nazaruddin, I., Rahmandani, Y. M. & Sibuea, S. P. A. (2023). A Determinants of Disclosure of Fundamental Aspects of Financial Reporting Transparency in Local Government Organizations: Testing of Accountability Mediator. Jurnal Ilmiah Akuntansi dan Bisnis, 18(2) 276-291.

ARTICLE HISTORY Received:

April 3 2023

Revised:

July 17 2023

Accepted:

July 27 2023

Determinants of Financial Reporting Local Government Organization Transparency and Accountability as a Mediator

Ietje Nazaruddin1*, Yustisia Melasari Rahmandani2. Salsabila Putri Aryati Sibuea3

Abstract

This study examines the role of accountability as a mediating variable in understanding how internal control and external pressure influence financial reporting transparency. Data was sourced from a survey, garnering responses from 214 participants. The purposive sampling technique was adopted, focusing on responses from heads of finance departments, financial treasurers, and financial staff supporting local government organizations (OPD). For hypothesis testing, the study employed Structural Equation Modeling (SEM) grounded on the Partial Least Squares (PLS) approach. Results revealed that internal control significantly promotes financial reporting transparency in OPD, with accountability serving as a mediator. In contrast, external pressure alone is inadequate to guarantee the transparency and accountability of financial reports within local governments. Consequently, OPDs are advised to bolster their internal control and accountability mechanisms to enhance the trustworthiness of their financial statements.

Keywords: internal control, external pressure, accountability, and financial reporting transparency

Introduction

Financial reporting transparency has garnered significant attention from researchers. A lack of transparency in disseminating financial information to beneficiaries, stakeholders, and the public can impede effective monitoring of local government performance (Arkorful et al., 2021; Mahdi & Santoso, 2019). Piotrowski & Bertelli (2010) posited that public concern often centers on the ease of access to government-held information. This focus stems from the intricate relationship between transparency and a myriad of issues, including ethics, corruption, administrative malpractices, and accountability (Adiputra et al., 2018).

In Indonesia, the Law Number 14 of 2008 mandates that local governments must ensure public information disclosure. Consequently, websites have become an effective tool for disseminating information to the public (Adiputra et al., 2018; Davici, 2018; Krah & Mertens, 2020; Paranoan & Totanan, 2018; Prihatin & Ritonga, 2020; Sofyani et al., 2020). However, a review of several official local government websites, such as

those in Kalimantan Province, shows a lack of transparency in financial reporting. An assessment by the Open Budget Index (OBI) highlighted that many local governments in Kalimantan Province fall short of optimal transparency standards (Prihatin & Ritonga, 2020). Furthermore, several regencies lack official websites altogether. Notably, Syamsul (2020) reported that 7% of the 411 regency governments in Indonesia, including the Sukamara Regency Government, do not maintain official online portals. A significant impediment to transparency is the absence of punitive measures in most local regulations, hampering their implementation and enforcement (Pebriani et al., 2021).

For instance, the Lamandau Regency Government's official website shows fragmented and incomplete financial management reports, such as the Reports on Budget Outcomes (LRA), Opinions on Local Government Finances Report (LKPD), Budget Implementation Document of the Head of Local Government Financial Management Office (DPA PPKD), and the General Procurement Plan (RUP) as per the records from pemda.lamandaukab.go.id in 2022. This fragmentation poses challenges for the public seeking comprehensive information. Similarly, while the West Kotawaringin Regency Government disclosed financial reports on its website, it received an Unqualified Opinion for the years 2019, 2020, and 2021. Nevertheless, the Audit Board (BPK) identified weaknesses in the internal control system, as detailed on portal.kotawaringinbaratkab.go.id in 2022.

Rasmini & Masdiantini (2018) contend that weaknesses in internal control adversely affect financial reporting transparency. The imperative for a robust internal control system within each local government organization (OPD) is articulated in Government Regulation Number 60 of 2008. This regulation emphasizes the comprehensive and effective implementation of the Internal Control System to oversee OPD activities, thereby enhancing financial reporting transparency (Antika et al., 2020; Oktavia & Aliyah, 2022; Rasmini & Masdiantini, 2018; Sumartono & Pasolo, 2019). Several studies have shown a positive correlation between internal control and the transparency of financial reporting (Fathmaningrum & Mukti, 2019; Setyowati & Yuliani, 2020; Sumartono & Pasolo, 2019; Wintari & Suardana, 2018). However, findings from Budiartini & Putra (2021) and Oktavia & Aliyah (2022) differ, rendering the relationship between internal control and transparency as somewhat ambiguous.

On the other hand, in order to produce transparent financial reports, local governments must respond to external pressures (Oktavia & Aliyah, 2022). These pressures arise from the varied interests of multiple parties within the local government's financial framework (Davici, 2018). Research conducted by Wirawan et al. (2019) indicated that external pressures have a positive impact on the transparency of financial reporting by OPDs. However, this conclusion contrasts with findings from earlier studies by Davici (2018), Oktavia & Aliyah (2022), and Setyowati & Yuliani (2020).

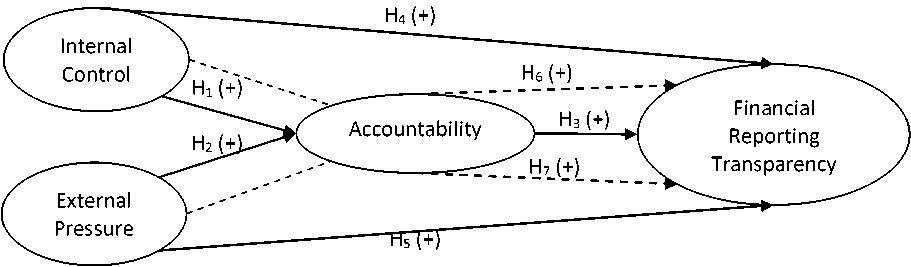

From the discussion above, there are evident inconsistencies in prior research concerning the influence of internal control and external pressure on financial reporting transparency. To address these discrepancies, introducing a mediating variable might be essential to further define the relationships between these variables and bolster the research findings (Ghozali & Latan, 2012). Specifically, introducing the 'accountability' variable adds a novel dimension to this research. This is particularly noteworthy as this variable is infrequently employed in studies focusing on financial reporting transparency, especially as a mediating factor. Accountability plays a crucial role in ensuring

transparency to the public. If OPDs uphold and effectively implement this accountability, it can lead to increased public trust (Asrida et al., 2018; Umaira & Adnan, 2019). Given this perspective, research on financial reporting transparency in OPDs is of paramount importance. Adiputra et al. (2018) and Pina et al. (2010) posit that institutional theory can elucidate the financial reporting practices of local governments.

Within the framework of institutional theory, the control function's role in revealing financial information in local governments is viewed as a mechanism to ensure organizational functions garner legitimacy from the community (Adiputra et al., 2018; Wintari & Suardana, 2018). One primary means of assuring the community is by robustly and effectively enhancing internal control. When executed correctly, this amplifies the accountability of financial reporting, subsequently promoting good governance (Bonsu et al., 2022). Previous studies consistently indicate that internal control exerts a positive and significant influence on accountability (Antika et al., 2020; Bonsu et al., 2022; Hardiningsih et al., 2020; Widyatama et al., 2017; Yesinia et al., 2018). Based on this evidence, the hypothesis can be articulated as.

H₁: Internal control positively influences accountability.

External pressures can emanate from other organizations or stem from cultural expectations of the community in which an organization operates (DiMaggio & Powell, 1983). Such pressures can foster the establishment of good governance by advocating for transparency and public trust in accountability (Diansari et al., 2022). The presence of external pressures serves to monitor relevant stakeholders on the performance of local governments in fulfilling their duties in accordance with established laws and regulations. Furthermore, it provides a platform to address community needs (Diansari et al., 2022). The enhancement of accountability is further fueled by oversight and demands from external entities, compelling OPDs to be answerable for their actions. This observation is consistent with prior studies indicating that external pressure has a positive influence on accountability (Mada et al., 2017; Medianti et al., 2018; Asrida et al., 2018; Diansari et al., 2022; Umaira & Adnan, 2019). Thus, the hypothesis can be formulated as.

H₂: External pressure positively influences accountability.

Accountability entails the responsibility of the entrusted party to report, explain, and disclose all undertakings to the trustor, who possesses both the right and the duty to demand such transparency. This concept underscores the importance of informing the public about all activities of local governments (Budiartini & Putra, 2021; Fathmaningrum & Mukti, 2019; Oktavia & Aliyah, 2022). Reflecting on past studies, it's evident that accountability has a positive bearing on the execution of financial reporting transparency (Asroel et al., 2016; Budiartini & Putra, 2021; Fathmaningrum & Mukti, 2019; Muraina & Dandago, 2020; Rasmini & Masdiantini, 2018; Wibisono et al., 2023). Consequently, the hypothesis can be presented as.

H₃: Accountability has a positive impact on the practice of financial reporting transparency.

Achieving transparency in regional financial reporting lays a foundational bedrock for improved governance. Ensuring transparency and accountability in public funds bolsters public trust in the government's management capabilities. It suggests that heightened internal control aligns with an enhanced application of regional financial reporting transparency (Oktavia & Aliyah, 2022). Prior studies indicate that internal control indeed has a positive influence on the application of financial reporting

transparency (Asroel et al., 2016; Fathmaningrum & Mukti, 2019; Setyowati & Yuliani, 2020; Sumartono & Pasolo, 2019; Wintari & Suardana, 2018). Based on this information, the hypothesis can be articulated as.

H4: Internal control positively influences the application of financial reporting

transparency.

An OPD that emphasizes legitimacy will generally conform to both external and societal expectations. This alignment often subjects the OPD to institutional pressures, leading to homogenization in their approaches (Pebriani et al., 2021). Coercive isomorphism, an external pressure facet, necessitates an organization's adherence to rules for the achievement of objectives (Pebriani et al., 2021; Pradita et al., 2019). The role of external pressure is pivotal in augmenting the application of financial reporting transparency; a rise in external pressures corresponds to an increase in local government financial transparency (Pradita et al., 2019). Previous studies have documented that external pressure favorably impacts an OPD's financial reporting transparency (Budiartini & Putra, 2021; Fathmaningrum & Mukti, 2019; Pebriani et al., 2021; Pradita et al., 2019; Wirawan et al., 2019). From this discussion, the hypothesis can be framed as.

H5: External pressure has a positive influence on the implementation of financial reporting transparency.

Research by Antika et al. (2020) and Bonsu et al. (2022) underscored the potential of internal control to shape accountability in the regional financial management process. Effective internal control boosts public confidence in the OPD's ability to adhere to financial guidelines, thereby meeting accountability standards (Arfiansyah, 2020; Diansari et al., 2022). When such accountability standards are achieved, it is incumbent upon the OPD to disclose financial activities and outcomes to the public, thus facilitating transparent financial reporting (Oktavia & Aliyah, 2022). Hence, internal control can indirectly elevate regional financial reporting transparency by promoting accountability. Consequently, the hypothesis can be expressed as:

H6: Internal control indirectly enhances the implementation of financial reporting transparency via accountability.

To curb deviant behavior, the central government has promulgated regulations that oversee the control mechanisms of an OPD (Oktavia & Aliyah, 2022; Sari, 2017). Institutional pressures and external environmental factors favorably influence the deployment of a performance accountability system (Lestari & Salomo, 2022). Additionally, the tenet of accountability, when buttressed by transparency, embodies the principle of openness. This ensures the public has access to information concerning regional financial management (Budiarto & Damayanti, 2020). Therefore, external pressure can indirectly bolster regional financial reporting transparency via the conduit of accountability. Based on this analysis, the hypothesis can be articulated as:

H7: External pressure indirectly enhances the implementation of financial reporting transparency through accountability.

From this explanation, the hypothesis development can be obtained with the model in Figure 1.

Figure 1. Research Model

Source: Processed Data, 2022

Research Method

In this quantitative study, data was collected using a questionnaire survey. The focus was on the OPD of Central Kalimantan Province, with specific samples drawn from Sukamara Regency, Kotawaringin Regency, and Lamandau Regency. These regions were chosen due to the low accountability levels of the OPDs in implementing transparency in regional financial management, warranting further investigation. To address the contemporary challenges, a purposive sampling technique was utilized, with criteria tailored to the research objectives (Campbell et al., 2020). Eligible respondents were mid-level finance officials with at least one year of service. This criterion was selected because such

Table 1. Respondent Demographic Data

|

Information |

Description |

Number |

Percentage (%) |

|

Gender |

Number of Respondents |

214 |

100% |

|

Male |

104 |

49% | |

|

Female |

110 |

51% | |

|

Age |

Number of Respondents |

214 |

100% |

|

22 – 30 years |

73 |

34% | |

|

31 – 40 years |

108 |

51% | |

|

41 – 56 years |

33 |

15% | |

|

Education |

Number of Respondents |

214 |

100% |

|

Senior high school |

20 |

9% | |

|

Diploma |

51 |

24% | |

|

S1 |

139 |

65% | |

|

S2 |

4 |

2% | |

|

Position |

Number of Respondents |

214 |

100% |

|

Head of Finance Subdivision |

52 |

24% | |

|

Financial Treasurer |

66 |

31% | |

|

Financial Staff |

96 |

45% |

Source: Data Processed, 2022

respondents would possess an in-depth understanding of the OPD's inner workings, ensuring more accurate and insightful responses to the questionnaire, especially in areas concerning internal control, external pressure, and accountability (Hamdi et al., 2017).

Over a span of 25 days, 266 questionnaires were distributed across the Sukamara, Kotawaringin, and Lamandau Regencies. Out of these, 234 were retrieved, constituting 88% of the total. However, 32 of the collected questionnaires were deemed unusable due to inconsistencies with the set criteria, or because they were incomplete. As a result, 214 questionnaires were fit for analysis. Table 1 provides a statistical breakdown of respondent demographics, detailing attributes such as gender, age, education level, and job position.

The variables in this study were measured using instruments adapted from previous research with each variable was gauged using a Likert scale of 1-5, with 1 for "strongly disagree" to 5 for "strongly agree" (Table 2).

The data processing and analysis techniques for this study employed the Structural Equation Modeling (SEM) method, leveraging the Partial Least Square (PLS)

Table 2. Definition of The Research Variables

|

Variable |

Description |

|

Dependent Variable |

The openness of the government in making regional financial policies so that their implementation can be known and |

|

Financial Reporting Transparency (T) |

monitored by stakeholders (Budiartini & Putra, 2021; Fathmaningrum & Mukti, 2019; Pradita et al., 2019; Setyowati & Yuliani, 2020; Sumartono & Pasolo, 2019; Wintari & Suardana, 2018) |

|

Independent Variable |

The process carried out by executives is designed to provide reasonable assurance that financial reports must be presented fairly in accordance with Indonesian accounting principles, in |

|

Internal Control (IC) |

compliance with applicable laws and regulations, and to improve the effectiveness and efficiency of operations (Antika et al., 2020; Bonsu et al., 2022; Budiartini & Putra, 2021; Diansari et al., 2022; Fathmaningrum & Mukti, 2019; Setyowati & Yuliani, 2020; Sumartono & Pasolo, 2019; Wintari & Suardana, 2018) Pressure originating from outside the regional apparatus |

|

External Pressure (EP) |

organization, such as regulations, executive, community, and so on (Fathmaningrum & Mukti, 2019; Oktavia & Aliyah, 2022; Pebriani et al., 2021; Pradita et al., 2019; Setyowati & Yuliani, 2020; Wintari & Suardana, 2018; Wirawan et al., 2019) |

|

Mediating Variable |

Responsibility for providing information and disclosure of financial |

|

Accountability (A) |

activities and performance to the public (Antika et al., 2020; Bonsu et al., 2022; Diansari et al., 2022; Oktavia & Aliyah, 2022; Syarmenda et al., 2016) |

Source: Data Processed, 2022

approach. The predominant reasons for selecting PLS-SEM pertain to its user-friendliness, straightforward guidelines, its capability to work with smaller samples, and its lack of a normality data requirement (Bayonne et al., 2020). Given the intricate hypothesis formulation and model implementation in this research, the PLS approach was deemed appropriate (Bayonne et al., 2020; Becker et al., 2023). Hair et al. (2014) outlined that PLS utilization necessitates several stages, which include: (1) model specification; (2) evaluation of outer models to ensure validity and reliability; and (3) assessment of the inner model. Prior to hypothesis testing, it's imperative for researchers to conduct a Common Method Variance (CMV) test. This ensures that the data isn't compromised by potential biases or errors, such as those stemming from self-reporting, ambiguity, complexity, or the questionnaire's scale format (MacKenzie & Podsakoff, 2012).

Results and Discussion

The study included 214 respondents. Descriptive statistical tests were conducted to provide insights into the context of each variable being examined (Nazaruddin & Basuki, 2015). According to these tests, the variables of financial reporting transparency (T), internal control (IC), external pressure (EP), and accountability (A) all exhibited actual means surpassing their respective theoretical means. This suggests that there was a commendably high degree of accountability, internal control, and transparency in financial reporting (refer to Table 3).

In this study, a self-reporting survey was used, which could introduce a normative bias, commonly referred to as Common Method Variance (CMV). To detect such bias, Harman's Single Factor Test is frequently employed (Tehseen et al., 2017). Hence, to identify potential issues related to errors, complexity, ambiguity, and the questionnaire scale's format, a bias test was conducted (MacKenzie & Podsakoff, 2012). If a single latent factor contributes over 50% to the variance, bias is considered significant (Podsakoff et al., 2003). However, the test results showed that the largest latent factor accounted for only 34.29% of the variance, indicating that normative bias was not a concern in this research.

|

Table 3. Descriptive Statistics | ||||||||

|

No. |

Variable |

Std. Dev |

Theoretical Range |

Actual Range | ||||

|

Min |

Max |

Mean |

Min |

Max |

Mean | |||

|

1. |

Financial Reporting |

3.325 |

5 |

25 |

15 |

11 |

25 |

20.33 |

|

2. |

Transparency (T) Internal |

3.072 |

5 |

25 |

15 |

10 |

25 |

19.15 |

|

3. |

Control (IC) External |

2.939 |

5 |

25 |

15 |

10 |

25 |

17.66 |

|

4. |

Pressure (EP) Accountabilit |

2.643 |

4 |

20 |

12 |

5 |

20 |

15.37 |

|

N = 214 |

y (A) | |||||||

Source: Processed Data, 2022

Table 4. Outer Loading

|

Variables |

Code |

Indicators |

Outer Loading |

AVE |

|

Accountability |

A1 |

OPD has a form of accountability to the public. |

0.825 |

0.623 |

|

A2 |

OPD informs the public about the objectives of the work program. |

0.840 | ||

|

A3 |

Public and group interests are considerations in OPD financial reporting. |

0.664 | ||

|

A4 |

OPD implements and is accountable for the use of the budget. |

0.815 | ||

|

Internal |

IC1 |

Internal control is carried out by competent |

0.666 |

0.579 |

|

Control |

IC2 |

and responsive staff. OPD has a risk assessment and management methods. |

0.778 | |

|

IC3 |

The OPD carries out the oversight. |

0.788 | ||

|

IC4 |

The internal control system has played a good role. |

0.739 | ||

|

IC5 |

Monitoring by staff is adequate. |

0.824 | ||

|

External |

EP1 |

There are regulations governing |

0.725 |

0.569 |

|

Pressure |

EP2 |

transparency. There are aspirations from the public for the implementation of financial reporting transparency. |

0.844 | |

|

EP3 |

There is attention from Non-Governmental Organizations (NGOs) on the implementation of financial reporting transparency. |

0.760 | ||

|

EP4 |

There are demands from a collection of entrepreneurs or the business community regarding applying financial reporting transparency. |

0.695 | ||

|

EP5 |

There are demands from the local head regarding the implementation of financial reporting transparency. |

0.741 | ||

|

Financial |

T1 |

OPD conveys information about its |

0.830 |

0.636 |

|

Reporting |

achievements in financial reports. | |||

|

Transparency |

T2 |

OPD conveys success in achieving financial reports. |

0.842 | |

|

T3 |

OPD delivers financial information on time. |

0.852 | ||

|

T4 |

OPD provides website access to stakeholders on financial reports. |

0.714 | ||

|

T5 |

OPD publishes financial reports that the Supreme Audit Agency has audited. |

0.740 |

Source: Processed Data, 2022

The aim of evaluating the measurement model is to assess the measurement model's quality, specifically its data construct's validity and reliability. Validity testing includes both convergent and discriminant validity (Ghozali & Latan, 2015). As suggested by Hair et al. (2014), indicators for the convergent validity test can be discerned from two metrics: outer loadings and Average Variance Extracted (AVE) values, as shown in Table 4.

As indicated in Table 4, every indicator for each variable yielded a value greater than 0.60. Therefore, all these indicators can be considered valid (Ghozali & Latan, 2015). For the discriminant validity test indicator, the square root of AVE was examined, as shown in the Fornell-Larcker table within the PLS algorithm report. If the square root of the AVE for each variable is greater than the correlation between the variables, then discriminant validity is achieved (Fornell & Larcker, 1981) (refer to Table 5).

Table 5, based on the Fornell-Larcker criterion, indicates that the square root of the AVE for the accountability variable was 0.789. This value was greater than the correlation between the accountability variable and external pressure on financial reporting transparency. Thus, all variables in the study are validated. The study's reliability test employed both Cronbach's alpha and composite reliability. A construct is deemed reliable if it has a Cronbach's alpha value greater than 0.7 and a composite reliability exceeding 0.7 (Ghozali & Latan, 2015). As evident in Table 6, all constructs satisfied the stipulated validity and reliability benchmarks.

The hypothesis testing findings, presented in Table 7, revealed that internal control had a positive and indirect impact on the transparency of financial reporting. Nevertheless, neither direct nor indirect external pressure impacted the transparency of financial reporting.

Table 7 demonstrates that internal control positively influences the implementation of financial reporting transparency. This finding aligns with research by Budiartini & Putra (2021), Erni & Giri (2019), Rinie et al. (2019), Setyowati (2020), and Wintari & Suardana (2018). Moreover, the outcomes are consistent with prior studies indicating that the internal control system has a positive impact on accountability (Antika et al., 2020; Bonsu et al., 2022; Oktavia & Aliyah, 2022). These results suggest that effective internal control directly enhances the transparency of financial reporting.

Table 5. Fornell-Lacker

|

Accountability |

Internal |

External |

Financial |

|

(A) |

Control |

Pressure |

Reporting |

|

(IC) |

(EP) |

Transparency | |

|

(T) |

|

Accountability (A) |

0.789 | |||

|

Income Control (IC) External Pressure |

0.454 |

0.761 |

0.754 | |

|

(EP) Financial |

0.257 |

0.499 | ||

|

Reporting Transparency (T) |

0.665 |

0.443 |

0.282 |

0.797 |

Source: Processed Data, 2022

Table 6. Cronbach’s Alpha and Composite Reliability

Cronbach’s Alpha Composite Reliability

|

0.800 |

0.867 | |

|

Income Control (IC) |

0.817 |

0.873 |

|

External Pressure (EP) |

0.814 |

0.868 |

|

Financial Reporting |

0.856 |

0.897 |

Transparency (T)

Source: Processed Data, 2022

When internal control is robust, the ensuing financial reports become more transparent and credible. Furthermore, the study uncovered a positive correlation between internal control and the application of OPD financial reporting transparency, with accountability acting as a partial mediator. One of internal control's pivotal roles is to guarantee the accuracy, completeness, and reliability of an organization's financial statements. A sound internal control system bolsters OPD's assurance of financial reporting's integrity and accountability, thereby elevating public trust in OPD and reinforcing both legitimacy and transparency. These insights resonate with research by Mualifu et al. (2019) and Oktavia (2022), which assert that enhanced internal control levels correlate with increased accountability, subsequently boosting financial reporting transparency. Moreover, this study's findings bolster the institutional theory, suggesting that OPDs with effective internal control and accountability systems are more inclined to embrace transparent financial report practices, strengthening their community and stakeholder legitimacy.

Drawing from institutional theory, coercive isomorphism describes an organizational compulsion to conform to specific standards under external pressures, be it from the state, other entities, or societal expectations (DiMaggio & Powell, 1983). The inherent coercive force within prevailing regulations amplifies legitimacy (Davici, 2018; Pradita et al., 2019), leading external parties to recognize organizational authenticity (Adiputra et al., 2018; Asrida et al., 2018). As Frumkin & Galaskiewicz (2004) suggest, heightened external pressures catalyze greater organizational openness. Consequently, as external pressure on the OPD escalates, so does its transparency (Davici, 2018).

Contrary to expectations, the research findings did not validate the hypothesis that external pressure would robustly promote the implementation of financial reporting transparency in local governments and accountability. This outcome could be attributed to the lax regulations concerning financial reporting in local administrations, which failed to stimulate transparency in financial reporting. This observation aligns with earlier studies, suggesting that the presence or absence of external pressure doesn't significantly influence regional financial reporting transparency (Davici, 2018). Additionally, if the OPD is reluctant to disclose financial statements, it simply won't (Oktavia & Aliyah, 2022). This less-than-transparent organizational culture is evident in prior research, such as Asrida et al. (2018), which disclosed that external pressures haven't significantly bolstered accountability. Thus, OPD's financial reporting transparency to the public remains limited. Other studies, including those by Davici (2018), Oktavia & Aliyah (2022), and Setyowati & Yuliani (2020), concur that external pressures don't substantially influence the practice of financial reporting transparency.

|

Table 7. Hypothesis Results | ||||

|

Original Sample (O) |

t-statistic |

p-values |

Conclusion | |

|

Panel 1: Direct effect Internal Control ÷ Accountability |

0.433 |

7.255 |

0.000 |

Supported |

|

External Pressure ÷ |

0.039 |

0.662 |

0.254 |

Not |

|

Accountability |

Supported | |||

|

Accountability ÷ Financial Reporting Transparency |

0.582 |

11.845 |

0.000 |

Supported |

|

Internal Control ÷ Financial Reporting Transparency External Pressure ÷ |

0.150 |

2.250 |

0.012 |

Supported Not Supported |

|

Financial Reporting Transparency |

0.056 |

1.112 |

0.133 | |

|

Panel 2: Indirect effect Internal Control ÷ Accountability ÷ Financial Reporting Transparency External Pressure ÷ |

0.252 |

5.625 |

0.000 |

Partial Mediation |

|

Not Supported | ||||

|

Accountability ÷ Financial Reporting Transparency Adjusted R²: 0.704 |

0.023 |

0.674 |

0.250 | |

|

Source: Processed Data, 2022 | ||||

In this context, external pressures haven't sufficiently enlightened OPDs on regulatory transformations that could potentially enhance local government financial report transparency and accountability.

This study's findings yield both theoretical and practical insights. Theoretically, the outcomes contribute to references and empirical literature probing the relationship between internal control, external pressure, and financial management transparency, with a spotlight on accountability as a mediating factor. On a practical note, this study advises OPDs to emphasize internal control, given that external pressures have not significantly shaped OPDs' comprehension of prevailing regulations and policies. Neither external pressures nor public opinion seem potent enough to spur financial reporting transparency. Hence, to augment financial reporting transparency, robust accountability and internal control systems are imperative.

Conclusion

This study sought to investigate and assess the influence of internal control and external pressure on financial reporting transparency, with accountability serving as a mediating factor. The findings indicate that a robust internal control system can ensure that OPD's financial reports are precise, dependable, and accountable, which in turn augments public trust in the OPD and bolsters its legitimacy and transparency. Conversely, external pressure neither directly nor indirectly affected the implementation of financial reporting transparency, even when considering accountability as a mediating or intervening factor.

The research was limited to regencies within the Central Kalimantan Province, which necessitates prudence when extrapolating these results to a wider setting. For enhanced generalizability, subsequent studies might contemplate including a more varied array of provinces across Indonesia. Additionally, for a more comprehensive data collection, future investigations might employ interview techniques, offering a deeper understanding of respondents' perspectives on transparency advancements in financial reporting within the regencies of Kalimantan Province. Drawing from these insights, it is advocated that OPDs amplify their internal control mechanisms to heighten the clarity of their financial disclosures. Furthermore, it is imperative for OPDs to grasp the crucial role of accountability in bridging the gap between internal control and lucid financial reporting. Such initiatives will elevate their overall financial administration, ensuring the authenticity and trustworthiness of their financial statements.

References

Adiputra, I. M. P., Utama, S., & Rossieta, H. (2018). Transparency of local government in Indonesia. Asian Journal of Accounting Research, 3(1), 123–138.

https://doi.org/10.1108/AJAR-07-2018-0019

Antika, Z., Murdayanti, Y., & Nasution, H. (2020). Pengaruh Sistem Akuntansi Keuangan Daerah, Aksesibilitas Laporan Keuangan, Dan Pengendalian Internal Terhadap Akuntabilitas Pengelolaan Keuangan Daerah. Jurnal Wahana Akuntansi, 15(2), 212–232. https://doi.org/10.21009/wahana.15.027

Arfiansyah, M. A. (2020). Pengaruh Sistem Keuangan Desa dan Sistem Pengendalian Intern Pemerintah Terhadap Akuntabilitas Pengelolaan Dana Desa. JIFA (Journal of Islamic Finance and Accounting), 3(1). https://doi.org/10.22515/jifa.v3i1.2369

Arkorful, V. E., Lugu, B. K., Hammond, A., & Basiru, I. (2021). Decentralization and Citizens’ Participation in Local Governance: Does Trust and Transparency Matter?–An Empirical Study. Forum for Development Studies, 48(2), 199–223. https://doi.org/10.1080/08039410.2021.1872698

Asrida, Asnawi, M., & Falah, S. (2018). Determinan Akuntabilitas Pengelolaan Keuangan Daerah Pada Organisasi Perangkat Daerah Pemerintah Provinsi Papua. KEUDA (Jurnal Kajian Ekonomi Dan Keuangan Daerah), 3(1), 1–16.

https://doi.org/10.52062/keuda.v3i1.710

Asroel, R. B. S., Basri, Y. M., & Susilatri, S. (2016). Pengaruh Akuntabilitas, Ketidakpastian Lingkungan, Komitmen Pimpinan, dan Pengendalian Internal terhadap Penerapan Transparansi Pelaporan Keuangan (studi empiris pada SKPD Provinsi Riau). Riau University.

Bayonne, E., Marin-Garcia, J. A., & Alfalla-Luque, R. (2020). Partial Least Squares (PLS) in Operations Management Research: Insights from a Systematic Literature Review. Journal of Industrial Engineering and Management, 13(3), 565–597. https://doi.org/10.3926/JIEM.3416

Becker, J. M., Cheah, J. H., Gholamzade, R., Ringle, C. M., & Sarstedt, M. (2023). PLS-SEM’s most wanted guidance. International Journal of Contemporary Hospitality Management, 35(1), 321–346. https://doi.org/10.1108/IJCHM-04-2022-0474

Bonsu, A. B., Appiah, K. O., Gyimah, P., & Owusu-afriyie, R. (2022). Public sector accountability : do leadership practices , integrity and internal control systems matter ? IIMRanchi JournalofManagement Studies, 2(1), 4-15.

https://doi.org/10.1108/IRJMS-02-2022-0010

Budiartini, L., & Putra, I. P. D. S. (2021). Pengaruh Tekanan Eksternal, Akuntabilitas, Ketidakpastian Lingkungan dan Pengendalian Internal terhadap Penerapan Transparansi Pelaporan Keuangan (Studi Empiris pada Organisasi Perangkat Daerah Kabupaten Badung). Hita Akuntansi Dan Keuangan Universitas Hindu Indonesia, 2(2), 69–93. https://doi.org/10.32795/hak.v2i2.1525

Budiarto, D. S., & Damayanti, D. (2020). Pengujian Struktural pada Komitmen Manajemen, Transparansi dan Akuntabilitas Pemerintah Daerah. Jurnal Akuntansi Dan Bisnis, 20(1), 17. https://doi.org/10.20961/jab.v20i1.508

Campbell, S., Greenwood, M., Prior, S., Shearer, T., Walkem, K., Young, S., Bywaters, D., & Walker, K. (2020). Purposive sampling: complex or simple? Research case examples. Journal of Research in Nursing, 25(8), 652–661. https://doi.org/10.1177/1744987120927206

Davici, N. (2018). Pengaruh Tekanan Eksternal, Komitmen Pimpinan dan Faktor Politik terhadap Transparansi Laporan Keuangan (Studi Empiris pada Organisasi Perangkat Daerah Kabupaten Agam). Jurnal Akuntansi, 6(1), 12–26.

Diansari, R. E., Othman, J. B., & Musah, A. A. (2022). Factors Affecting Accountability Village Fund Management. Linguistics and Culture Review, 6(May), 879–892. https://doi.org/10.21744/lingcure.v6ns1.2186

DiMaggio, P. J., & Powell, W. W. (1983). The Iron Cage Revisited: Institutional Isomorphism in Organizational Fields. American Sociological Review, 48(2), 147– 160. https://doi.org/10.2307/2095101

Falkman, P., & Tagesson, T. (2008). Accrual accounting does not necessarily mean accrual accounting: Factors that counteract compliance with accounting standards in Swedish municipal accounting. Scandinavian Journal of Management, 24(3), 271–283. https://doi.org/10.1016/j.scaman.2008.02.004

Fathmaningrum, E. S., & Mukti, G. B. (2019). Pengaruh Ketidakpastian Lingkungan, Akuntabilitas, Tekanan Eksternal, Pengendalian Internal, dan Komitmen Manajemen Terhadap Penerapan Transparansi Pelaporan Keuangan. Jurnal Sosial Ekonomi Dan Humaniora (JSEH) p-ISSN, 2461, 666.

Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800104

Frumkin, P., & Galaskiewicz, J. (2004). Institutional isomorphism and public sector organizations. Journal of Public Administration Research and Theory, 14(3), 283– 307.

Ghozali, I., & Latan, H. (2012). Partial least square: Konsep, teknik dan aplikasi SmartPLS 2.0 M3. Semarang: Badan Penerbit Universitas Diponegoro.

Ghozali, I., & Latan, H. (2015). Partial least squares konsep, teknik dan aplikasi menggunakan program smartpls 3.0 untuk penelitian empiris. Semarang: Badan Penerbit UNDIP.

Hair, J. F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review, 26(2), 106–121. https://doi.org/10.1108/EBR-10-2013-0128

Hamdi, F., Hardi, & Al Azhar, L. (2017). Pengaruh Akuntabilitas, Tekanan Eksternal,

Komitmen Manajemen, dan Kompetensi Sumber Daya Manusia terhadap Penerapan Transparansi Pelaporan Keuangan (Studi pada Satuan Kerja Perangkat Daerah Kabupaten Indragiri Hulu). Jurnal Online Mahasiswa (JOM) Bidang Ilmu Ekonomi, 4(1), 1–15.

Hardiningsih, P., Udin, U., Masdjojo, G. N., & Srimindarti, C. (2020). Does Competency, Commitment, and Internal Control Influence Accountability? The Journal of Asian Finance, Economics and Business, 7(4), 223–233. https://doi.org/10.13106/jafeb.2020.vol7.no4.223

Krah, R. D. Y., & Mertens, G. (2020). Transparency in Local Governments: Patterns and Practices of Twenty-first Century. State and Local Government Review, 52(3), 200–213. https://doi.org/10.1177/0160323X20970245

Lestari, S., & Salomo, R. V. (2022). Implementasi Sistem Akuntabilitas Kinerja pada Pemerintah Daerah Di Indonesia : Sebuah Tinjauan Literatur. Jurnal MODERAT, 8(November), 798–808. https://doi.org/10.25157/moderat.v8i4.2854

MacKenzie, S. B., & Podsakoff, P. M. (2012). Common Method Bias in Marketing: Causes, Mechanisms, and Procedural Remedies. Journal of Retailing, 88(4), 542–555. https://doi.org/10.1016/j.jretai.2012.08.001

Mada, S., Kalangi, L., & Gamaliel, H. (2017). Pengaruh kompetensi aparat pengelola dana desa, komitmen organisasi pemerintah desa, dan partisipasi masyarakat terhadap akuntabilitas pengelolaan dana desa di Kabupaten Gorontalo. Jurnal Riset Akuntansi dan Auditing" Goodwill", 8(2).

Mahdi, S. A. ., & Santoso, S. I. (2019). Pengaruh Pengetahuan Dewan tentang Anggaran terhadap Pengawasan Keuangan Daerah dengan Komitmen Organisasi, Partisipasi Masyarakat, Akuntabilitas Publik dan Transparansi Kebijakan Publik sebagai Variabel Moderating. Jurnal TRUST, 7(1), 11–23. https://doi.org/10.33387/jtrans.v7i1.5856

Medianti, L., Taufik, T., & Anggraini, L. (2018). Pengaruh Kompetensi Aparatur, Komitmen Organisasi, dan Partisipasi Masyarakat terhadap Pengelolaan Dana Desa (Studi empiris pada Desa-Desa Di Kabupaten Bintan). Jurnal Online Mahasiswa (JOM) Bidang Ilmu Ekonomi, 1(1), 1–13.

Mualifu, Guspul, A., & Hermawan. (2019). Pengaruh Transparansi, Kompetensi, Sistem Pengendalian Internal, dan Komitmen Organisasi Terhadap Akuntabilitas Pemerintah Desa dalam Mengelola Alokasi Dana Desa (Studi Empiris pada Seluruh Desa di Kecamatan Mrebet Kabupaten Purbalingga). Journal of Economic, Business and Engineering, 1(1), 49–59. https://doi.org/10.32500/jebe.v1i1.875

Muraina, S. A., & Dandago, K. I. (2020). Effects of implementation of International Public Sector Accounting Standards on Nigeria’s financial reporting quality. International Journal of Public Sector Management, 33(2/3), 323–338. https://doi.org/https://doi.org/10.1108/IJPSM-12-2018-0277

Nazaruddin, I., & Basuki, A. T. (2015). Analisis statistik dengan SPSS. Yogyakarta: Danisa Media.

Oktavia, W. T., & Aliyah, S. (2022). Analisis Faktor yang Mempengaruhi Penerapan Transparansi Pelaporan Keuangan Daerah. Among Makarti, 15(2), 215–232. https://doi.org/10.52353/ama.v15i2.322

Paranoan, N., & Totanan, C. (2018). Akuntabilitas Berbasis Karma. Jurnal Ilmiah

Akuntansi Dan Bisnis, 13(2), 161–172.

https://doi.org/10.24843/JIAB.2018.v13.i02.p09

Pebriani, N. N., Mareni, P. K., & Yuliastuti, I. A. N. (2021). Pengaruh Tekanan Eksternal, Ketidakpastian Lingkungan, dan Komitmen Manajemen terhadap Penerapan Transparansi Pelaporan Keuangan. Jurnal Karma, 1(6), 87. https://doi.org/10.24269/iso.v3i2.291

pemda.lamandaukab.go.id. (2022). Transparansi Pengelolaan Anggaran Daerah. Kabupaten Lamandau. https://pemda.lamandaukab.go.id/transparansi-pengelolaan-anggaran-daerah/

Pina, V., Torres, L., & Royo, S. (2010). Is E-Government Leading To More Accountable and Transparent Local Governments? an Overall View. Financial Accountability and Management, 26(1), 3–20. https://doi.org/10.1111/j.1468-0408.2009.00488.x

Piotrowski, S. J., & Bertelli, A. (2010). Measuring municipal transparency. 14th IRSPM Conference, Bern, Switzerland, April.

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879.

portal.kotawaringinbaratkab.go.id. (2022). Transparansi Publish Dokumen. Pemerintahan Kabupaten Kotawaringin Barat.

https://portal.kotawaringinbaratkab.go.id/id/Dokumen

Pradita, K. D., Hartono, A., & Mustoffa, A. F. (2019). Pengaruh Tekanan Eksternal, Ketidakpastian Lingkungan, dan Komitmen Manajemen terhadap Penerapan Transparansi Pelaporan Keuangan. ISOQUANT: Jurnal Ekonomi, Manajemen Dan Akuntansi, 3(2), 87–100. https://doi.org/10.24269/iso.v3i2.291

Prihatin, L. J., & Ritonga, I. T. (2020). Analisis Transparansi Pengelolaan Keuangan Daerah Berbasis Website Pada Pemerintah Daerah di Kalimantan. Accounting and Business Information Systems Journal, 5(4), 12–26. https://doi.org/10.22146/abis.v5i4.59259

Rasmini, N. K., & Masdiantini, P. R. (2018). Fiscal Decentralization, Internal Control System, Accountability of Local Government and Audit Opinion. Jurnal Ilmiah Akuntansi Dan Bisnis, 123. https://doi.org/10.24843/jiab.2018.v13.i02.p06

Rinie, Pranata, V. M., & Rapina. (2019). Pengaruh Pengendalian Internal dan Komitmen Organisasi Terhadap Kualitas Pelaporan Keuangan (Survei pada Perusahaan Tekstil di Kota Bandung dan Sekitarnya). Journal of Accounting, Finance, Taxation, and Auditing (JAFTA), 1(1), 15–30. https://doi.org/10.28932/jafta.v1i1.1525

Sari, E. W. (2017). Pengaruh Sistem Pengendalian Intern, Penyajian Laporan Keuangan, Aksesibilitas Laporan Keuangan dan Gaya Kepemimpinan terhadap Transparansi dan Akuntabilitas Pengelolaan Keuangan Daerah Kabupaten Indragiri Hulu. JOM Fekon, 4(1), 571–586.

Setyowati, I., & Yuliani, N. L. (2020). Anteseden Transparansi Laporan Keuangan Pemerintah Daerah. Business and Economics Conference in Utilization of Modern Technology.

Sofyani, H., Riyadh, H. A., & Fahlevi, H. (2020). Improving service quality, accountability and transparency of local government: The intervening role of information

technology governance. Cogent Business & Management, 7(1), 1735690.

Styles, A. K., & Tennyson, M. (2007). The accessibility of financial reporting of US municipalities on the Internet. Journal of Public Budgeting, Accounting & Financial Management.

Sumartono, & Pasolo, M. R. (2019). The factors of financial report transparency in the regional government. Journal of Contemporary Accounting, 1(1), 11–25. https://doi.org/10.20885/jca.vol1.iss1.art2

Syamsul. (2020). Potret Transparansi Pengelolaan Keuangan Daerah (Tpkd) Di Indonesia. Media Riset Akuntansi, Auditing & Informasi, 20(2), 185–204.

https://doi.org/10.25105/mraai.v20i2.7105

Syarmenda, M. A., Rasuli, M., & Diyanto, V. (2016). Pengaruh Akuntabilitas, Tekanan Eksternal, Ketidakpastian Lingkungan, dan Komitmenmanajemen Terhadap Penerapantransparansi Pelaporankeuangan (Studi Empiris Pada Skpd Kabupaten Indragiri Hulu). Riau University.

Tehseen, S., Ramayah, T., & Sajilan, S. (2017). Testing and controlling for common method variance: A review of available methods. Journal of Management Sciences, 4(2), 142–168. https://doi.org/10.20547/jms.2014.1704202

Tywoniak, S., Rosqvist, T., Mardiasmo, D., & Kivits, R. (2009). Towards an Integrated Perspective on Fleet Asset Management: Engineering and Governance Considerations. Proceedings of the 3rd World Congress on Engineering Asset Management and Intelligent Maintenance Systems, 1553–1567.

Umaira, S., & Adnan. (2019). Pengaruh Partisipasi Masyarakat, Kompetensi Sumber Daya Manusia, Dan Pengawasan Terhadap Akuntabilitas Pengelolaan Dana Desa (Studi Kasus Pada Kabupaten Aceh Barat Daya). Jurnal Ilmiah Mahasiswa Ekonomi Akuntansi, 4(3), 471–481. https://doi.org/10.24815/jimeka.v4i3.12580

Wibisono, C., Satriawan, B., & Khaddafi, M. (2023). The Effect of Accountability, Transparency of Financial Reporting and Quality of Accounting Information on The Level of Receiving Zakat Funds with Accestability as a Moderation Variable at Bazanas in Batam City. International Journal of Educational Review, Law And Social Sciences (IJERLAS), 3(1), 189–207.

https://doi.org/https://doi.org/10.54443/ijerlas.v3i1.598

Widyatama, A., Novita, L., & Diarespati, D. (2017). The Effect Of Competence And Internal Control System On Village Government Accountability In Managing Alokasi Dana Desa (Add). Berkala Akuntansi Dan Keuangan Indonesia, 2(2).

Wintari, K. A. T., & Suardana, K. A. (2018). Pengaruh Tekanan Eksternal, Pengendalian Internal, Ketidakpastian Lingkungan dan Komitmen Organisasi Pada Penerapan Transparansi Pelaporan Keuangan. E-Jurnal Akuntansi Universitas Udayana, 22(1), 747–774. https://doi.org/10.24843/EJA.2018.v22.i01.p27

Wirawan, R. C., Yuliani, N. L., & Purwantini, A. H. (2019). Anteseden Transparansi Laporan Keuangan Pemerintah Daerah (Studi Empiris pada OPD Pemerintah Daerah Kota Magelang). Wahana Riset Akuntansi, 7(2), 1551. https://doi.org/10.24036/wra.v7i2.106948

Jurnal Ilmiah Akuntansi dan Bisnis, 2023 | 291

Discussion and feedback