The Role of Female and Millennial Directors on the Environmental Performance of Indonesian SOEs

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 2, July 2022

AFFILIATION:

1,2Vocational School of

Diponegoro University, Indonesia 3School of Information Systems & Technology Management, University of New South Wales, Australia

*CORRESPONDENCE:

diankusumawardhani@lecturer.undip.ac.id

THIS ARTICLE IS AVAILABLE IN: https://ojs.unud.ac.id/index.php/jiab

DOI:

10.24843/JIAB.2022.v17.i02.p12

CITATION:

Wardhani, D. K., Purwinanti, E. N. & Priandi, M. (2022). The Role of Female and Millennial Directors on the Environmental Performance of Indonesian SOEs. Jurnal Ilmiah Akuntansi dan Bisnis, 17(2), 362-375.

ARTICLE HISTORY Received:

20 April 2022

Revised:

25 July 2022

Accepted:

26 July 2022

The Role of Female and Millennial Directors on the Environmental Performance of Indonesian SOEs

Dian Kusuma Wardhani1*, Eiffeliena Nur'aini Purwinanti2, Muhammad Priandi3

Abstract

The Indonesian Ministry of SOEs seeks to increase the proportion of female and millennial directors on the SOE board of directors to improve the environmental performance of SOE. This study aims to obtain empirical evidence of female and millennial directors' influence on the environmental performance of SOE. The results indicate that female directors have a negative effect on environmental performance. The proportion of female directors is only a political reason to meet the quota requirements for women directors on the SOE board of directors. They only practice tokenism without having management power over the environment. Conversely, millennial directors have a positive impact on environmental performance. Robustness testing shows the same results as the primary research model and proves that this study's findings are robust. This research has implications for The Ministry of SOEs to increase millennial directors' representation to improve SOE corporate governance and obtain high environmental performance.

Keywords: female directors, millennial directors, environmental performance

Introduction

Since 2002, the Government of Indonesia has organised the Public Disclosure Program for Environmental compliance (PROPER) to assess the company's environmental management. Indonesian SOEs, as state-owned companies, must be responsible for their environmental management (Chariri et al., 2017; Harymawan et al., 2020). Unfortunately, not all SOEs have participated in PROPER because of its voluntary nature. Nevertheless, their participation in PROPER seems to be an arena for SOE directors to show that their company has good environmental management and hopes for awards from the program. This thinking is in line with Chariri et al. (2017) reveal that in a two-tier system, the board of directors' characteristics are a determining factor for the success of environmental performance because they are responsible for all management agendas and the company's environmental performance. The better the personal characteristics

of the directors, the better the company's strategic quality related to environmental management and resulting in high environmental performance (Cho et al., 2019; García Martín &Herrero, 2020; Shahab et al., 2020; Tran &Pham, 2020).

The theoretical approach of this research is based on upper echelon and stakeholder theory perspectives. The upper echelon theory shows that the characteristics of the board of directors reflect the values and personal cognition of the directors, which affect the perception and choice of strategic decisions of the company and ultimately affect the level of performance or growth of the company (Hambrick, 2007; Hambrick &Mason, 1984; Tran &Pham, 2020). Furthermore, concerning environmental management practices, the personal characteristics of the board of directors can encourage the commitment of the board of directors to comply with government regulations related to environmental standards to create added value for environmental management so that their environmental performance increases (García Martín &Herrero, 2020; Li et al., 2019). Based on these thoughts, the board of directors' characteristics are important actors in company management and environmental performance.

The stakeholder theory states that the responsibility of company management is not only limited to generating benefits for shareholders but, further than that, which must show closeness and provide benefits to consumers, employees, suppliers, regulators, the public, and other company stakeholders (Colvin et al., 2020; Freeman, 1984; Shah &Guild, 2022). According to García Martín & Herrero (2020), a good board of directors will improve the relationship between the company and stakeholders to encourage the company's survival. Hussain et al. (2018) state that stakeholder theory bridges the relationship between management and environmental performance produced by aligning the long-term goals of the board of directors and stakeholders related to the company's environmental management policy.

Female and millennial directors are interesting characteristics to research in Indonesian SOE today because of the agenda of increasing the representation of women and millennials by the Ministry of SOEs to 15% and 5% on the SOE board of directors (Fauzan, 2021; Idris, 2021). Indonesian SOEs have a unique board of director election in which the Minister of SOE elects their board of directors. However, the political connection may bias this freedom in increasing the representation of women and millennials. Therefore, responding to the plan and minimising concerns about bias in political connections, this study aims to analyse the influence of female and millennial directors on Indonesian SOE's environmental performance to provide empirical evidence and contribute to the plans of the Minister of SOE. This research contributes in several ways. First, additional literature provides empirical evidence of the influence of female and millennial directors on environmental performance from an upper echelon and stakeholders theory perspective. The previous study only used stakeholders theory, and this research adds upper echelon theory to enrich the perspectives for comprehensive results (Chariri et al., 2017). Second, as a basis for decision-making for the Ministry of SOE regarding increasing the representation of women and millennials on the SOE board of directors to improve SOE governance.

The presence of female directors in the management of Indonesian SOEs is getting more attention because they show a positive influence by having the ability to align stakeholder interests and their acceptance of environmental problems, resulting in high

environmental performance (Alazzani et al., 2017; García Martín &Herrero, 2020; McGuinness et al., 2017; Shahab et al., 2020; Tran &Pham, 2020). PT PLN evidences this. The representation of a female director during 2014 - 2018 earned them a green PROPER score. In 2019, three female directors of PLN managed to get a gold score (Ministry of Environment and Forestry of the Republic of Indonesia, 2021). This success is motivated by the board of directors' management, who focus on and continue to carry out PT PLN's business operations based on environmental, social, and governance (ESG) aspects (Banjarnahor, 2020).

This phenomenon strengthens previous research that female directors care more about environmental issues than men (Oware et al., 2022; Wu et al., 2022). As a result, their presence improves the company's environmental management quality and results in high environmental performance (Konadu et al., 2022). However, Cucari et al. (2018) stated that having female directors is not guaranteed to provide a better different perspective and instead shows a negative effect if they cannot play an active role in making strategic decisions related to the corporate environment. Alazzani et al. (2017) and Li et al. (2019) show different results by not finding a significant effect of female directors on the company's environmental performance. The inconsistency of the results of previous studies makes the influence of female directors attractive to be re-examined.

In line with this argument, Shahab et al. (2020) argue that female directors tend to avoid unethical business behaviour and prioritise activities oriented to social and environmental issues. These findings support the upper echelon theory that female directors' character describes their cognition and influences their decision-making and actions related to the company environment's management (Hambrick, 2007; Tran &Pham, 2020). Companies' investment in the environment tends to be high if female directors are on the board of directors; therefore, their environmental performance is also high (Jiang &Akbar, 2018). Furthermore, stakeholder theory shows that female directors' presence strengthens relationships with stakeholders who currently pay more attention to environmental performance (Freeman, 1984; Hussain et al., 2018). Liao et al. (2015) noted that female directors provide a better perspective and communication, increasing the quality of decision-making, management's effectiveness, and performance related to its environment. Refers to upper echelon theory, stakeholder theory, and inconsistent results of previous research, we propose the first hypothesis.

H1: Female directors have a significant effect on environmental performance.

Directors are included in the millennial category if born between 1981 and 1996 (Williams, 2020). Referring to Kang (2017), the age of directors is proven to determine the level of environmental performance produced by the company. The presence of millennial directors can have a positive effect because they can adapt to technological developments, are proficient in producing and searching for internet-based information and have the advantages of digital marketing (Beji et al., 2020). These advantages make millennial directors able to accommodate stakeholders' needs and interests better. In addition, they have broad insights for making strategic environmental decisions to produce high environmental performance (Elmagrhi et al., 2019; Hörisch et al., 2020). PT Bio Farma is actual evidence of the representation of millennial directors who won the gold PROPER in 2020 after the last time it received it in 2017 (Media Indonesia, 2020; Ministry of Environment and Forestry of the Republic of Indonesia, 2021). The millennial directors of PT Bio Farma responded quickly to handling the Covid-19 pandemic by making

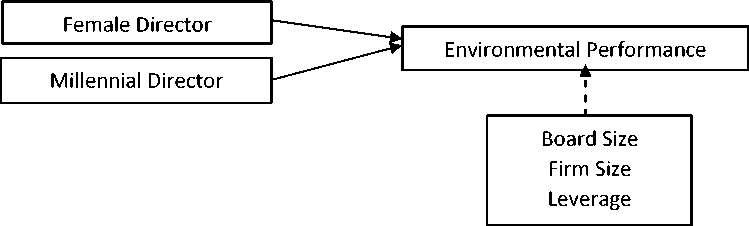

Figure 1. Conceptual Framework

Source: Processed Data, 2021

and developing vaccines, covalent plasma, test kits, and distributing direct assistance to the community (Alamsyah, 2020). This rapid response has made the PROPER assessment beyond compliance with PT Bio Farma's environmental performance showing a high value because the directors are responsive to environmental issues and management practices (Chariri et al., 2017). These thoughts support the upper echelon and stakeholder theory that millennial directors have cognitive skills, critical thinking, and superior corporate environmental management strategy decisions (Li et al., 2019). Based on the two theories and previous studies, the second hypotheses are.

H2: Millennial directors have a significant positive effect on environmental performance.

Research Method

The study used 67 Indonesian non-financial state-owned companies from 2014 to 2020 as a sample. SOE was selected because, as agents of state development and generating profits, they also serve public interests, including environmental management. The Ministry of Environment and Forestry's publication on the page www.proper.menlhk.go.id. provides data regarding PROPER uses in this study. Meanwhile, other variable data are from the annual reports and the official website of each company. This study uses panel data that excludes companies that do not present

Table 1. PROPER Rating Category

Category Definition

Gold Management has carried out the best environmental management

practices that consistently exceed the statutory provisions required and are accountable to the public.

Green Management has practised environmental management beyond statutory regulations by applying reducing, reuse, recycling, and recovery properly and efficiently.

Blue Management has carried out environmental management practices

following the applicable laws and regulations.

Red Management has carried out environmental management practices but

has not complied with the applicable regulations.

Black Management has deliberately and or been involved in environmental pollution practices or violates statutory regulations.

Source: Ministry of Environment and Forestry of the Republic of Indonesia (2021)

complete research data, and the final sample consists of 316 observations during the observation period.

Environmental performance as the dependent variable is measured using the PROPER assessment results issued by the Ministry of Environment and Forestry each year (Chariri et al., 2017). There are five PROPER assessment categories: gold, green, blue, red, and black. Referring to Chariri et al. (2017) each of these categories will be weighted provided that 5 = gold, 4 = green, 3 = blue, 2 = red, 1 = black, 0 = not following PROPER (Table 1).

In line with Lucas et al. (2021), female directors calculate using the percentage of women on the board of directors of SOE. Millennial directors are the percentage of directors born from 1981 - to 1996 on the board of directors of SOE (Sogari et al., 2017; Williams, 2020). The control variables in this study refer to Cucari et al. (2018) and Shahab et al. (2020) using the board of directors size. The board of directors' size is the number of board members on the board of directors (Cucari et al., 2018). Firm Size is measured by the natural logarithm of total assets (Lin et al., 2019). Leverage using debt to equity ratio (Gregory, 2022).

The study used ordinal logistic regression because the study's dependent variable is ordinal data (Chariri et al., 2017; Cohen et al., 2020). The equation for the function of the research regression model processed with Stata is:

EP = a + β1FDi,t + β2MDi,t + β3BSi,t + β4FSi,t + β5LEVi,t + ε............................(1)

FD is female directors, MD means millennial directors, and BS is the board of directors size. FS is firm size. LEV is leverage. EP is the environmental performance of SOE, and ε is an error.

Result and Discussion

Ninety-three observations received a PROPER assessment from the Ministry of Environment and Forestry consisting of 20 gold, 20 green, and 53 blue PROPER (Table 2). Indonesia SOEs are in the blue category, which means the company has carried out management practices according to the laws and regulations. Female directors have an average of 0.086, and the representation of women on the board of directors of non-

Table 2. Descriptive statistics

|

Variable |

Obs |

Mean |

Min |

Max |

Std Dev |

|

FD |

316 |

0,086 |

0,000 |

1,000 |

0,155 |

|

MD |

316 |

0,005 |

0,000 |

0,250 |

0,028 |

|

BS |

316 |

5,354 |

2,000 |

12,000 |

1,960 |

|

FS |

316 |

29,567 |

19,959 |

34,999 |

2,114 |

|

LEV |

316 |

1,496 |

0,017 |

19,032 |

1,749 |

|

PROPER Rank |

Freq |

Per cent (%) | |||

|

Emas |

20 |

6,329 | |||

|

EP |

Hijau |

20 |

6,329 | ||

|

Biru |

53 |

16,772 | |||

|

No Rank |

223 |

70,570 | |||

|

Total |

316 |

100 |

Source: Processed Data, 2021

financial SOEs is 8.6%. Meanwhile, the average representation of millennial directors in the sample is 0.005 or 0.5%. Observation companies have the most significant board size of 12 people. The average firm size and observational leverage are 29.567 and 1.496, respectively.

FD= female directors; MD= millennial directors; BS= board size; EP= environmental performance.

Table 3. shows the results of the ordinal logistic regression processed using Stata. The chi-squared likelihood ratio shows a value of 35,530 with a p-value of 0,000 < 0,010. The overall research model is more significant than without predictors or models with only the dependent variable. At least one independent variable significantly influences the environmental performance of SOE. Furthermore, looking at the pseudo R2 value of 0,063, the independent variable's ability to explain the environmental performance of SOE is 6,3%, and other factors outside the model influence the remaining 93,7%.

The first hypothesis testing by looking at Table 3. for the female director variable shows a significant value of 1%. This value indicates that female directors significantly affect the company's environmental performance. Furthermore, a regression coefficient of -3,872 indicates a negative value, meaning that female directors have a negative effect on environmental performance. Based on this analysis's results, the first hypothesis of this study is rejected because the findings indicate that female directors have a negative effect on the environmental performance of SOE.

The study results in the negative effect of female directors on the environmental performance of SOE strengthens Cucari et al. (2018) by showing the same result. This adverse finding is due to the focus of female directors on improving the financial performance of SOE. Based on Table 4, the female directors in the observation sample generally occupy the positions of finance director, marketing director, or commercial Director, and their responsibility is to increase the company's finances. Therefore, female directors of SOE are more concerned with financial performance than environmental performance. In line with Aigbedo (2021), female directors prefer high corporate financial performance over environmental management. When the company's financial performance stabilised, the female directors of SOE just shifted their focus to environmental management. The female directors of SOE do not sacrifice their financial performance because they know their primary responsibility is to generate profits for the

Table 3. Ordinal Logistic Regression

|

Variable |

Coef |

Std. Err |

Z |

|

FD |

-3,872 |

1,308 |

**-2,960 |

|

MD |

7,972 |

3,801 |

*2,100 |

|

BS |

0,300 |

0,079 |

**3,810 |

|

FS |

-0,061 |

0,078 |

-0,780 |

|

LEV |

-0,148 |

0,116 |

-1,280 |

|

Pseudo R2 |

0,063 | ||

|

LR chi2 |

35,530 | ||

|

Prob > chi2 |

0,000 |

* significant at the 5% levels **significant at the 1% levels. Source: Processed Data, 2021

Table 4. Position of Female Board of Directors who Participate in PROPER

|

Firm |

Year |

Number of FD |

Position |

PROPER rating |

|

PT Bio Farma |

2017 |

1 |

Director of Marketing |

Gold |

|

2019 |

1 |

Director of Marketing |

Green | |

|

2020 |

1 |

Director of Marketing |

Gold | |

|

PT Kimia |

2014 |

1 |

Director of Finance |

Blue |

|

Farma |

2015 |

1 |

Director of Finance |

Blue |

|

2016 |

1 |

Director of Finance |

Blue | |

|

PT Krakatau |

2015 |

1 |

Director of Finance |

Blue |

|

Steel |

2016 |

1 |

Director of Finance |

Blue |

|

2017 |

1 |

Director of Finance |

Blue | |

|

2019 |

1 |

Director of Business Development |

Blue | |

|

2020 |

1 |

Director of Business Development |

Blue | |

|

PT |

2019 |

1 |

Director of Commercial |

Blue |

|

Pelabuhan Indonesia II |

2020 |

1 |

Director of Commercial |

Blue |

|

PT PAL |

2018 |

1 |

Director of HCM & General Affairs |

Blue |

|

Indonesia |

2019 |

1 |

Director of HCM & General Affairs |

Blue |

|

2020 |

1 |

Director of HCM & General Affairs |

Blue | |

|

PT Pertamina |

2014 |

1 |

Director of New and Renewable Energy |

Gold |

|

2015 |

1 |

Director of New and Renewable Energy |

Gold | |

|

2016 |

1 |

Director of New and Renewable Energy |

Gold | |

|

2017 |

1 |

Director of Human Resources |

Gold | |

|

2018 |

1 |

CEO |

Gold | |

|

2019 |

2 |

CEO and Director of Finance |

Gold | |

|

2020 |

2 |

CEO and Director of Finance |

Gold | |

|

PT Semen |

2019 |

1 |

Director of Human Resources and Legal |

Green |

|

Indonesia |

2020 |

1 |

Director of Human Resources and Legal |

Blue |

|

PT Semen |

2014 |

1 |

Director of Marketing |

Blue |

|

Baturaja |

2015 |

1 |

Director of Marketing |

Blue |

|

2016 |

1 |

Director of Marketing |

Blue | |

|

PT PLN |

2014 |

1 |

Director of Commerce, Risk Management and Compliance |

Green |

|

2015 |

1 |

Director of Commerce, Risk Management and Compliance |

Green | |

|

2016 |

1 |

Director of Commerce, Risk Management and Compliance |

Green | |

|

2017 |

1 |

Director of Corporate Planning |

Green | |

|

2018 |

1 |

Director of Corporate Planning |

Green | |

|

2019 |

3 |

Director of Finance; Director of Corporate Planning; Director of |

Gold | |

|

Strategic Procurement |

Source: Processed Data, 2021

state. It is clear that PROPER is a voluntary program, so as long as the company gets a good rating, this is enough for female directors of SOE because they have shown environmental management efforts (Alazzani et al., 2017; Chariri et al., 2017).

Female directors can provide added value if they hold positions that influence corporate governance and environmental management (Alazzani et al., 2017). Referring to Table 4, female directors of state-owned companies hold strategic positions where they have the power to influence corporate governance and environmental management.

However, they cannot use their authority for environmental management because their representation is minimal on the SOE board of directors, so their votes are ineffective (see Table 5). It takes at least three female directors with strategic positions related to environmental management to produce positive environmental management performance (Fernandez ‐ Feijoo et al., 2014). From an environmental performance perspective, the proportion of female directors is only a political reason to meet the quota requirements for women directors on the SOE board of directors (Alazzani et al., 2017). Therefore, the potential excellence in the ability of women directors does not get enough attention to be able to play a role in environmental management. Therefore, female directors of Indonesian SOE cannot play an active role and instead negatively affect environmental performance because they only practice tokenism without having management power over the environment (Low et al., 2015).

In line with Cuadrado‐Ballesteros et al. (2017), female directors' influence on environmental performance is also influenced by their other personal characteristics, not only by their cognition as women. Other characteristics that play a role in choosing this strategy include their expertise and work experience related to the company's environmental management Cucari et al. (2018). Female directors' cognitive abilities are the initial filters that affect the choice of information they receive. Still, female directors' skills and work experience will determine their strategic choices regarding environmental management (Abatecola & Cristofaro, 2018). These findings support the idea of the upper echelon theory that directors have many personal characteristics that influence their choice of strategies and workings (Hambrick, 2007). A female director on the board of directors of an SOE has not strengthened management relations with stakeholders who currently have more attention to the company's environmental performance. In other words, female directors in the study sample cannot support stakeholder theory thinking (Freeman, 1984). The management ability of women directors has not been able to actively accommodate stakeholder needs for the high demands of environmental management (Liao et al., 2015).

The second hypothesis is that millennial directors have a significant positive effect on the company's environmental performance. Table 3. shows that the millennial directors' variable is significant at 5%, which means that millennial directors significantly affect environmental performance. According to the analysis results, the impact is positive because the millennial directors' regression coefficient shows 8,865. Based on this analysis results, the second research hypothesis is accepted. The research findings prove that millennial directors have a significant positive effect on environmental performance. In addition, the research control variable, namely the board of directors' size, has a significant positive impact on environmental performance.

The analysis results related to the representation of millennial directors prove that millennial directors have a significant positive effect on the environmental performance

of SOE. These findings support Elmagrhi et al. (2019) that millennial directors have superior technical knowledge and skills because they are responsive and adept at technological developments. In addition, the ability of millennial directors to utilise technology makes them many sources of detailed and up-to-date information on global environmental issues and stakeholder needs that are useful in the company's strategic formulation process.

Kang (2017) shows that millennial directors tend to be courageous in taking high-risk strategies related to environmental management. Upper echelon theory states that young directors have the ambition to get high performance which is always a high risk

Table 5. Representation Female Directors of SOE Participating in PROPER

|

Firm |

Number of Female Directors |

PROPER rating |

Firm |

Number of Female Directors |

PROPER rating |

|

PT Bio |

2014 = 0 |

Gold |

PT |

2014 = 1 |

Gold |

|

Farma |

2015 = 0 |

Gold |

Pertamina |

2015 = 1 |

Gold |

|

2016 = 0 |

Gold |

2016 = 1 |

Gold | ||

|

2017 = 1 |

Gold |

2017 = 1 |

Gold | ||

|

2018 = 0 |

Green |

2018 = 1 |

Gold | ||

|

2019 = 1 |

Green |

2019 = 2 |

Gold | ||

|

2020 = 1 |

Gold |

2020 = 2 |

Gold | ||

|

PT Kimia |

2014 = 1 |

Blue |

PT Semen |

2014 = 0 |

Green |

|

Farma |

2015 = 1 |

Blue |

Indonesia |

2015 = 0 |

Green |

|

2016 = 1 |

Blue |

2016 = 0 |

Green | ||

|

2017 = 0 |

Blue |

2017 = 0 |

Green | ||

|

2018 = 0 |

Blue |

2018 = 0 |

Green | ||

|

2019 = 0 |

Blue |

2019 = 1 |

Green | ||

|

2020 = 0 |

Blue |

2020 = 1 |

Blue | ||

|

PT |

2014 = 0 |

Blue |

PT Semen |

2014 = 1 |

Blue |

|

Krakatau |

2015 = 1 |

Blue |

Baturaja |

2015 = 1 |

Blue |

|

Steel |

2016 = 1 |

Blue |

2016 = 1 |

Blue | |

|

2017 = 1 |

Blue |

2017 = 0 |

Blue | ||

|

2018 = 0 |

Blue |

2018 = 0 |

Green | ||

|

2019 = 1 |

Blue |

2019 = 0 |

Blue | ||

|

2020 = 1 |

Blue |

2020 = 0 |

Blue | ||

|

PT |

2014 = 0 |

Blue |

PT PLN |

2014 = 1 |

Green |

|

Pelabuhan |

2015 = 0 |

Blue |

2015 = 1 |

Green | |

|

Indonesia |

2016 = 0 |

Blue |

2016 = 1 |

Green | |

|

II |

2017 = 0 |

Blue |

2017 = 1 |

Green | |

|

2018 = 0 |

Blue |

2018 = 1 |

Green | ||

|

2019 = 1 |

Blue |

2019 = 3 |

Gold | ||

|

2020 = 1 |

Blue | ||||

|

PT PAL |

2018 = 1 |

Blue | |||

|

Indonesia |

2019 = 1 |

Blue | |||

|

2020 = 1 |

Blue |

Source: Processed Data, 2021

Table 6. Robustness Test Results

|

Variable |

Coef |

Std. Err |

Z |

|

FD |

-0,547 |

0,285 |

*-1,920 |

|

MD |

1,456 |

0,612 |

**2,380 |

|

BS |

0,316 |

0,082 |

***3,860 |

|

FS |

-0,048 |

0,078 |

-0,610 |

|

LEV |

0,149 |

0,116 |

-1,250 |

|

Pseudo R2 |

0,051 | ||

|

LR chi2 |

27,610 | ||

|

Prob > chi2 |

0,000 | ||

|

Durbin |

0,005 | ||

|

Wu-Hausman |

0,005 | ||

|

FD= female directors; MD= |

millennial directors; BS= board |

size. **p < |

0,05; ***p < |

0,01

Source: Processed Data, 2021

(Hambrick & Mason, 1984). The higher the risk, the better the results. Therefore, a high-risk strategy proven to be effective will add value to the company's environmental management, further enhancing the company's image in the eyes of the public. Therefore, the presence of millennial directors has a positive effect because they can provide satisfaction to stakeholders by accommodating their demands for sound environmental management (Ali & French, 2019; Kang, 2017).

These findings support the upper echelon and stakeholder theory. Furthermore, this study provides additional empirical evidence that millennial directors have cognitive skills, critical thinking, and technology awareness. What motivates them to maximise all stakeholder interests so that the quality of strategic decision-making is superior and results in high corporate environmental performance (Freeman, 1984; Hambrick, 2007; Jahn & Brühl, 2018). These findings support the SOE Minister's plan to increase the proportion of millennial directors. In addition, an increase in the proportion of millennial directors will make SOE management aware of the importance of environmental management. As expected, the millennial directors' presence increases the SOE participating in PROPER to create better SOE environmental performance.

This study uses Robustness testing by replacing the independent variable measurements to test this study's resilience. Referring to Konadu et al. (2022), female directors in the robustness test are measured with a dummy of 1 if female directors are on the board of directors and 0 vice versa. Millennial directors use dummy 1 if millennial directors are on the board of directors and 0 if not (Bhagat & Bolton, 2019). Additionally, the robustness testing maintains the ordinal logistic regression model and the board of directors' control variable size.

Based on Table 6, female and millennial directors significantly affect the environmental performance of SOE. The coefficient value of female directors is -0,547, indicating a negative influence. Millennial directors have a positive influence because the coefficient value is 1,456. The findings of this robustness test show the same results as the primary research model. Previous research has found endogeneity problems related to the influence of female directors on company environmental performance (Elmagrhi et al., 2019). Therefore, this study used an additional test using two-stage least squares (2sls) to determine whether a similar problem occurred in this study (Bhagat & Bolton,

2019). Millennial directors and board size are instrumental variables. The Durbin and Wu-Hausman test results showed a value of less than 5%, meaning that the female directors in this study were endogenous variables (Table 6). In line with Elmagrhi et al. (2019), these findings indicate that in research related to the characteristics of directors, female directors generally have an endogenous sample problem.

Conclusion

This study aims to obtain empirical evidence of female and millennial directors' influence on the environmental performance of SOE. Research observations in 2014 - 2020 show that female directors prioritise improving financial performance. Female directors can provide added value if they hold positions that influence corporate governance and environmental management. Therefore, female directors of Indonesian SOE cannot play an active role and instead negatively affect environmental performance because they only practice tokenism without having management power over the environment. Conversely, millennial directors have a positive effect. Millennial directors have cognitive skills, critical thinking, and technology awareness. What motivates them to maximise all stakeholder interests so that the quality of strategic decision-making is superior and results in high corporate environmental performance. In addition, millennial directors tend to be courageous in taking high-risk strategies related to environmental management. As a result, they can satisfy stakeholders by accommodating their demands for sound environmental management.

This research has implications for the Ministry of State-Owned Enterprises to increase millennial directors' representation to improve SOE corporate governance and obtain high environmental performance. Other characteristics, such as expertise, age, and female directors' work experience, must be considered for high environmental performance. The existence of SOEs that do not publish their annual reports on the official website and the lack of feedback on requests for access to their annual reports are limitations of the study. Future studies can extend the findings of this study by using different characteristics of the directors. Subsequent studies can replicate this research by selecting a sample of non-state-owned companies that may have different results.

References

Abatecola, G. & Cristofaro, M. (2018). Hambrick and Mason’s “Upper Echelons Theory”: evolution and open avenues. Journal of Management History, 26(1), 116-136 https://doi.org/10.1108/JMH-02-2018-0016

Aigbedo, H. (2021). An empirical analysis of the effect of financial performance on environmental performance of companies in global supply chains. Journal of Cleaner Production, 278, 121741. https://doi.org/10.1016/j.jclepro.2020.121741

Alamsyah, I. E. (2020). Bio Farma Raih Anugerah PROPER Emas Ke-5. Retrieved from https://republika.co.id/berita/qlessk349/bio-farma-raih-anugrah-proper-emas-ke-5

Alazzani, A., Hassanein, A., & Aljanadi, Y. (2017). Impact of gender diversity on social and environmental performance: evidence from Malaysia. Corporate Governance:

The International Journal of Business in Society, 17(2), 266-283 https://doi.org/10.1108/CG-12-2015-0161

Ali, M. & French, E. (2019). Age diversity management and organisational outcomes: The role of diversity perspectives. Human Resource Management Journal, 29(2), 287307.

Banjarnahor, D. (2020). Pembangkit PLN Raih 5 PROPER Emas dan 16 PROPER Hijau di 2019. Retrieved from https://www.cnbcindonesia.com/news/20200108185651-4-128682/pembangkit-pln-raih-5-proper-emas-dan-16-proper-hijau-di-2019

Beji, R., Yousfi, O., Loukil, N., & Omri, A. (2021). Board diversity and corporate social responsibility: Empirical evidence from France. Journal of Business Ethics, 173(1), 133-155. https://doi.org/10.1007/s10551-020-04522-4

Bhagat, S. & Bolton, B. (2019). Corporate governance and firm performance: The sequel. Journal of Corporate Finance, 58, 142-168.

Cancela, B. L., Neves, M. E. D., Rodrigues, L. L., & Dias, A. C. G. (2020). The influence of corporate governance on corporate sustainability: new evidence using panel data in the Iberian macroeconomic environment. International Journal of Accounting & Information Management, 28(4), 785-806 https://doi.org/10.1108/IJAIM-05-2020-0068

Chariri, A., Januarti, I, & Yuyetta, E. N. A. (2017). Firm characteristics, audit committee, and environmental performance: Insights from Indonesian companies. International Journal of Energy Economics and Policy, 7(6), 19-26.

Cho, C. K., Cho, T. S., & Lee, J. (2019). Managerial attributes, consumer proximity, and corporate environmental performance. Corporate Social Responsibility and Environmental Management, 26(1), 159-169. https://doi.org/10.1002/csr.1668

Cohen, A., Alhuraish, I., Robledo, C., & Kobi, A. (2020). A statistical analysis of critical quality tools and companies’ performance. Journal of Cleaner Production, 255, 120221.

Colvin, R. M., Witt, G. B., & Lacey, J. (2020). Power, perspective, and privilege: The challenge of translating stakeholder theory from business management to environmental and natural resource management. Journal of Environmental Management, 271, 110974. https://doi.org/10.1016/j.jenvman.2020.110974

Cuadrado‐Ballesteros, B., Martínez‐Ferrero, J., & García‐Sánchez, I. M. (2017). Board structure to enhance social responsibility development: A qualitative comparative analysis of US companies. Corporate Social Responsibility and Environmental Management, 24(6), 524-542.

Cucari, N., Esposito de Falco, S., & Orlando, B. (2018). Diversity of board of directors and environmental social governance: Evidence from Italian listed companies. Corporate Social Responsibility and Environmental Management, 25(3), 250-266.

Elmagrhi, M. H., Ntim, C. G., Elamer, A. A., & Zhang, Q. (2019). A study of environmental policies and regulations, governance structures, and environmental performance: The role of female directors. Business Strategy and the Environment, 28(1), 206-220.

Fauzan, M. R. (2021). Mantap Guys, Erick Thohir Inginkan 15% Kursi Direksi BUMN untuk Generasi Millenial. Retrieved from https://www.wartaekonomi.co.id/read323161/mantap-guys-erick-thohir-

inginkan-15-kursi-direksi-bumn-untuk-generasi-millenial

Fernandez‐Feijoo, B., Romero, S., & Ruiz‐Blanco, S. (2014). Women on boards: Do they affect sustainability reporting? Corporate Social Responsibility and Environmental Management, 21(6), 351-364.

Freeman. (1984). Strategic management: A stakeholder perspective. Englewood Cliffs, NJ: Prentice Hall.

García Martín, C. J. & Herrero, B. (2020). Do board characteristics affect environmental performance? A study of EU firms. Corporate Social Responsibility and Environmental Management, 27(1), 74-94.

Gregory, R. P. (2022). ESG scores and the response of the S&P 1500 to monetary and fiscal policy during the Covid-19 pandemic. International Review of Economics & Finance, 78, 446-456. doi:https://doi.org/10.1016/j.iref.2021.12.013

Hambrick, D. C. (2007). Upper echelons theory: An update. Academy of management review, 32(2), 334-343.

Hambrick, D. C. & Mason, P. A. (1984). Upper echelons: The organisation as a reflection of its top managers. Academy of management review, 9(2), 193-206.

Harymawan, I., Nasih, M., Suhardianto, N., & Shauki, E. (2020). How does the presidential election period affect the performance of the state-owned enterprise in Indonesia? Cogent Business & Management, 7(1), 1750330.

Hörisch, J., Schaltegger, S., & Freeman, R. E. (2020). Integrating stakeholder theory and sustainability accounting: A conceptual synthesis. Journal of Cleaner Production, 275, 124097. https://doi.org/10.1016/j.jclepro.2020.124097

Hussain, N., Rigoni, U., & Orij, R. P. (2018). Corporate governance and sustainability performance: Analysis of triple bottom line performance. Journal of business ethics, 149(2), 411-432.

Idris, M. (2021). Erick Thohir Minta 15 Persen Direksi BUMN Dijabat Perempuan.

Retrieved from https://money.kompas.com/read/2021/01/17/084248826/erick-thohir-minta-15-persen-direksi-bumn-dijabat-perempuan?page=all

Jahn, J. & Brühl, R. (2018). How Friedman's View on Individual Freedom Relates to Stakeholder Theory and Social Contract Theory. Journal of business ethics, 153(1), 41-52.

Jiang, X. & Akbar, A. (2018). Does increased representation of female executives improve corporate environmental investment? Evidence from China. Sustainability, 10(12), 4750.

Kang, J. (2017). Unobservable CEO characteristics and CEO compensation as correlated determinants of CSP. Business & Society, 56(3), 419-453.

Konadu, R., Ahinful, G. S., Boakye, D. J., & Elbardan, H. (2022). Board gender diversity, environmental innovation and corporate carbon emissions. Technological Forecasting and Social Change, 174, 121279.

https://doi.org/10.1016/j.techfore.2021.121279

Li, D., Lin, A., & Zhang, L. (2019). Relationship between Chief Executive Officer characteristics and corporate environmental information disclosure in Thailand. Frontiers of Engineering Management, 6(4), 564-574.

Liao, L., Luo, L., & Tang, Q. (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review, 47(4), 409-424.

Lin, W. L., Cheah, J. H., Azali, M., Ho, J. A., & Yip, N. (2019). Does firm size matter? Evidence on the impact of the green innovation strategy on corporate financial performance in the automotive sector. Journal of Cleaner Production, 229, 974988. https://doi.org/10.1016/j.jclepro.2019.04.214

Low, D. C., Roberts, H., & Whiting, R. H. (2015). Board gender diversity and firm performance: Empirical evidence from Hong Kong, South Korea, Malaysia and Singapore. Pacific-Basin Finance Journal, 35, 381-401.

Lucas, R., Gunasekarage, A., Shams, S., & Edirisuriya, P. (2021). Female directors and acquisitions: Australian evidence. Pacific-Basin Finance Journal, 68, 101600. https://doi.org/10.1016/j.pacfin.2021.101600

McGuinness, P. B., Vieito, J. P., & Wang, M. (2017). The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. Journal of Corporate Finance, 42, 7299.

Media Indonesia. (2020). Bio Farma Meraih Anugerah PROPER Emas untuk yang Kelima Kali. Retrieved from https://mediaindonesia.com/humaniora/369389/bio-farma-meraih-anugerah-proper-emas-untuk-yang-kelima-kali

Ministry of Environment and Forestry of the Republic of Indonesia. (2021). Retrieved from https://proper.menlhk.go.id/

Oware, K. M., Iddrisu, A. A., Worae, T., & Adaletey, J. E. (2022). Female and environmental disclosure of family and non-family firms. Evidence from India. Management Research Review, 45(6), 760-780.

Shah, M. U. & Guild, P. D. (2022). Stakeholder engagement strategy of technology firms: A review and applied view of stakeholder theory. Technovation, 114, 102460. https://doi.org/10.1016/j.technovation.2022.102460

Shahab, Y., Ntim, C. G., Chen, Y., Ullah, F., Li, H. X., & Ye, Z. (2020). Chief executive officer attributes, sustainable performance, environmental performance, and environmental reporting: New insights from upper echelons perspective. Business Strategy and the Environment, 29(1), 1-16.

Sogari, G., Pucci, T., Aquilani, B., & Zanni, L. (2017). Millennial generation and environmental sustainability: The role of social media in the consumer purchasing behavior for wine. Sustainability, 9(10), 1911.

Tran, N. & Pham, B. (2020). The influence of CEO characteristics on corporate environmental performance of SMEs: Evidence from Vietnamese SMEs. Management Science Letters, 10(8), 1671-1682.

Williams, G. (2020). Management millennialism: Designing the new generation of employee. Work, Employment and Society, 34(3), 371-387.

Wu, Q., Furuoka, F., & Lau, S. C. (2022). Corporate social responsibility and board gender diversity: a meta-analysis. Management Research Review, 45(7), 956-983.

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 375

Discussion and feedback