COVID-19 Pandemic on MSMEs in Bandar Lampung

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 2, July 2022

AFFILIATION:

1Faculty of Economics and Business, Universitas Lampung, Indonesia

2,3,4Faculty of Economic, Universitas Malahayati, Indonesia

*CORRESPONDENCE:

THIS ARTICLE IS AVAILABLE IN:

https://ojs.unud.ac.id/index.php/jiab

DOI:

10.24843/JIAB.2020.v17.i02.p07

CITATION:

Yuliansyah, Listyaningsih, E., Sariningsih, E. & Indriani, W.

(2022). COVID-19 Pandemic on MSMEs in Bandar Lampung. Jurnal Ilmiah Akuntansi dan Bisnis, 17(2), 286-297.

ARTICLE HISTORY

Received:

25 March 2022

Revised:

27 June 2022

Accepted:

27 July 2022

COVID-19 Pandemic on MSMEs in Bandar

Lampung

Yuliansyah1, Erna Listyaningsih2*, Eka Sariningsih3, Wiewiek Indriani4

Abstract

The COVID-19 pandemic has an impact on the global economy, including MSMEs. This study aimed to determine the impact of COVID-19 on the financial performance and labor of MSMEs in the Bandar Lampung banana chip centre, as well as the impact of labor on financial performance and labor as an intervening factor. The data collected were analyzed using Partial Least Square. It was found that the COVID-19 pandemic impacted financial performance and labor. Additionally, labor influenced financial performance. The main strength of this study is the discovery of direct and indirect effects of the COVID-19 pandemic on financial performance, with labor acting as an intervening variable between the COVID-19 pandemic and financial performance. This finding implies that people are used to the new normal life, namely by carrying out routine activities while implementing health precautions to avoid COVID-19 transmission.

Keywords: COVID-19 pandemic, the effect of COVID-19 pandemic, MSME

Introduction

Coronavirus disease (COVID-19) that started in Wuhan, Hubei province, China, quickly spread worldwide. It causes massive human tragedy and economic damage. COVID-19 documented approximately 63 million cases worldwide as of November 2020, with more than 1.4 million deaths (Brodeur et al., 2021). The rapid spread of the COVID-19 outbreak in Indonesia has had a major impact on the Indonesian economy; there has been a spike in the number of sufferers with a high fatality rate of accumulated data from March 2 to May 4, 2020 as many as 11,192 positive cases and 8,452 deaths. Some illnesses caused by the covid-19 virus, such as breathing problems, fever, heart attack, kidney failure, and croak, which lead people to death (Dissanayake, 2021). It is very worrying and causes panic in the government, society, and the business world (Haryanto, 2020). A huge impact of the covid-19 virus hit several institutions in Indonesia (Fitriyani et al., 2022).

MSMEs are affected by the Covid-19 Pandemic (Shafi, Liu, & Ren, 2020). Covid-19 pandemic affects MSMEs in the world including Indonesia (Amri, 2020; Marsusanti, Riyanto, Yulistria, Syabaniah, & Nugraha, 2021; Rosita, 2020; Suryani, 2021; Taufik & Ayuningtyas, 2020). According to Naab & Bans-Akutey (2021), the majority of small business owners have no option to survive during the pandemic situation. At the same time, MSME

is one of the strategic sectors for the world economic survival since it provides the employment generations and has the production role and service sectors (Gerald et al., 2020).

The Ministry of Cooperatives and SMEs reported that 1,785 cooperatives and 163,713 were affected by the COVID-19 pandemic. Most cooperatives affected by COVID-19 are engaged in daily necessities, while the MSMEs sector most affected is food and beverage (Amri, 2020). In addition, the number of customers decreased because of social distancing restrictions (Pertiwi & Kartika, 2021). Previous research reported that MSMEs' performance was influenced by internal and external factors (Dewi Hanggraeni, 2017; Purwaningsih & Kusuma, 2015). Therefore, the COVID-19 pandemic is an external factor affecting the performance of MSMEs.

Another qualitative study examining the impact of COVID-19 on MSMEs reported a decrease in the turnover of MSMEs actors during the pandemic (Amri, 2020). Similarly, the study by Reniati et al. (2019) reported that the turnover of the MSMEs in Bangka Belitung was below 10 million, which was lower than before the pandemic. Another qualitative research that examined MSMEs found that the threat of COVID-19 affected the income decrease of MSMEs (Akpan et al., 2020; Andika et al., 2020; Fathoni, 2019; Sarmigi, 2020; Soehardi et al., 2020). The results also showed that the implementation of large-scale social restrictions or PSBB decreases the income of MSMEs. The interview conducted in the research with several informants, namely MSME entrepreneurs in East Java and conducted a literature study found that pandemics such as COVID-19 had a very significant impact on reducing the sales income of MSME entrepreneurs by more than 80% (Wijaya, 2020). The study found that the pandemic impact was enormous on the economy due to the extreme decline in sales revenue and excessive concern that it would exacerbate the impact of the pandemic that may result in worsening economic conditions on a larger scale.

Another study on online platform-based business activities in Jakarta using qualitative methods reported that COVID-19 pandemic impact was clustered in three conditions of business activity, namely: first, stable business survives, namely online business, second, the decrease of business is based on visits or the presence of consumers, and third, the growing business due to the dynamics and adjustment of interactions using online application platforms, including MSMEs that switch to innovative health products (Taufik & Ayuningtyas, 2020). Another study gives the solution to COVID-19 is the development of digital MSMEs that have become an alternative saviour during the COVID-19 pandemic (Arianto, 2020). Meanwhile, another study that looked at the extent to which the use of e-marketing during a pandemic for the sustainability of MSMEs in Pekalongan found that the use of e-marketing had a positive impact on the sustainability of MSMEs in the pandemic (Awali, 2020). Other studies also found an effect of the COVID-19 pandemic on employee work shifts (Marsusanti et al., 2021).

According to a previous study, the COVID-19 pandemic significantly impacted MSMEs actors in several regions of Indonesia with low turnover and lower income. The number of workers has changed, and MSMEs actors must change their marketing strategy to survive amid the pandemic. However, according to the author's knowledge, previous research has not been carried out comprehensively, so it does not provide a comprehensive image of the COVID-19 pandemic on MSMEs.

The Bandar Lampung banana chip centre is a legendary banana chip centre in Bandar Lampung and is one of eleven MSME centres in Indonesia, according to BI in 2019.

There are 40 banana chip shops along Gang PU Street in Bandar Lampung. During this pandemic, the most affected MSMEs sector was the food and beverage sector, with the decline in sales turnover due to the impact of the enactment of the PSBB that restricted the movement of people and goods. Therefore, this study will analyze how the COVID-19 pandemic has impacted MSMEs in the banana chip centre in Bandar Lampung. This is the background of this research conducted on the MSMEs in the Bandar Lampung banana chip centre.

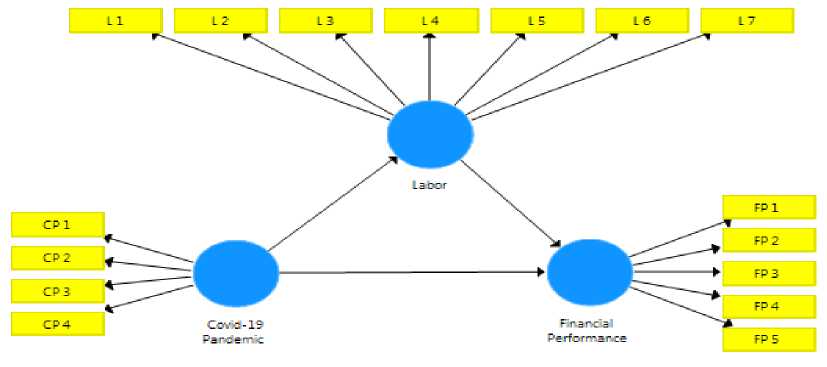

This study examined the impact of the COVID-19 pandemic on MSMEs in the Bandar Lampung banana chip centre both descriptively and analytically; the findings in the field can be analyzed and tested. The tests were conducted to determine the effects of the COVID-19 pandemic on MSMEs in the Bandar Lampung banana chip centre. Smart Partial Least Square (PLS) is used for testing. This study investigated the impact of the COVID-19 pandemic in the second year on the financial performance of MSMEs as well as on labor, as well as whether the COVID-19 pandemic affects financial performance directly or indirectly through labor. Additionally, this study also investigated the effect of labor on financial performance resulting in a model that differs from previous research. This study is different from those previous studies that looked at the impact of the COVID-19 pandemic on financial performance because the impact of the COVID-19 pandemic was tested not only for financial performance but also for the labor. Furthermore, the labor was tested for the impact on financial performance as well as an intervening variable between the COVID-19 pandemic and financial performance, resulting in a model that differs from previous studies. Figure 1 shows that in this study, three variables were employed: the COVID-19 pandemic, financial performance, and labor. The researchers investigated the impact of the COVID-19 pandemic on financial performance and labor, as well as the impact of labor on financial performance. The presence of labor was also investigated to see the effect on the relationship between the COVID-19 pandemic and financial performance as an intervening factor. Previous research found that the pandemic had a massive economic impact due to the extreme decline in sales revenue and excessive concern that may exacerbate the pandemic impact, potentially worsening economic conditions on a larger scale (Wijaya, 2020). Sales turnover and revenue are indicators of financial performance. MSMEs' financial performance indicators include total assets, number of workers, turnover or sales volume or income and operating profit earned by MSMEs over a certain period (Jubaedah & Destiana, 2016; Talom & Tengeh, 2020). Financial performance is related to the expenses and income of an entity, such as costs for the production process, marketing, and employee salaries. Therefore, the entity must be able to manage finances effectively and efficiently. A high level of financial performance means that the entity has carried out operational activities well, and the entity's opportunity to earn high profits can be achieved (Winarsih et al., 2021). Previous studies showed a decrease in MSMEs turnover and revenue during the COVID-19 pandemic. Therefore, hypothesis (H1) is.

H1: The COVID-19 pandemic has an effect on the financial performance of MSMEs.

Figure 1. Research framework

Source: Processed Data, 2021

The COVID-19 pandemic has affected the world economy, including Indonesia. With its policy to break the COVID-19 chain, the government has imposed a lockdown and social restriction policy. This resulted in business losses and bankruptcy and impacted labor (Nuryadi & Lestari, 2020). Based on data from the Ministry of Manpower on April 13, 2020. As many as 1.2 million formal workers and 212.4 thousand were laid off (Dewi et al., 2020). Other studies showed that the COVID-19 pandemic affects labor shifts (Marsusanti et al., 2021). Many companies have cut off their employees because they cannot pay their wages due to the PSBB policy and the government lockdown to break the COVID-19 pandemic chain. Therefore, the hypothesis (H2) is.

H2: The COVID-19 pandemic affects the labor of MSMEs.

Based on previous studies, it can be concluded that the COVID-19 pandemic had a significant impact on MSMEs actors in several regions in Indonesia, where the turnover has decreased, the income has decreased, and MSME actors had to change their marketing strategy in order to survive in the midst of a pandemic (Amri, 2020; Marsusanti et al., 2021; Rosita, 2020; Suryani, 2021; Taufik & Ayuningtyas, 2020). With the COVID-19 pandemic, the government implemented a lockdown and PSBB policy to break the COVID-19 spread by closing schools and workplaces, limiting activities in public facilities and places, restricting transportation activities, and health protocols that disrupt normal economic activity. This resulted in decreased income and changes in the workforce, such as layoffs or a reduction in the number of employees. A change in the number of MSME employees affects the size of MSME income, affecting MSME's financial performance. Where the number of workers that are not reduced will result in a decrease in income because sales turnover decreases during the pandemic. Consequently, the relationship between the COVID-19 pandemic and financial performance is indirect when the labor is present. Therefore, the hypotheses are as follows.

H3: Labor affects the financial performance of MSMEs.

H4: The existence of the labor variable affects the relationship between the COVID-19 pandemic variable and the financial performance variable.

Research Method

This research was conducted in MSMEs banana chip centre on Pagar Alam Street, Segala Mider, Tanjung Karang Barat, Bandar Lampung or known as the legendary name, Gang PU. The object of this research is the MSMEs in the banana chip center, Pagar Alam Street, Segala Mider, Tanjung Karang Barat, Bandar Lampung. There are about 40 stalls in the area.

This study employed two research methods: descriptive and analytical. The descriptive method was carried out to describe the findings in the field in relation to the impact of the COVID-19 pandemic on MSMEs at Bandar Lampung banana chip centre. While the analytical method is used to analyze the relationship between the variables in the field and in the end, a new model obtained the impact of the COVID-19 pandemic on the MSMEs in the Bandar Lampung banana chip centre.

The population in this study is the MSMEs in the banana chip centre located in Bandar Lampung, as many as 40 MSMEs. The sample used in this study was the total population of 40 SMEs. This study used two types of data, namely primary and secondary data. Primary data were obtained directly from the source, namely the MSMEs in the

Table 1. Research Variables and Indicators

|

No |

Variables |

Indicators |

Sources |

|

1 |

Covid-19 |

1. PSBB Policy: Close the schools and | |

|

Pandemic |

workplace.

| ||

|

2 |

Labor |

|

(Martanti et al., 2021), (Statistik, 2020), (Marsusanti et al., 2021) |

|

3 |

Financial |

1. Income is currently increasing | |

|

Performance |

compared to before the Covid-19 pandemic

|

(Statistik, 2020), (Soehardi et al., 2020) (Talom & Tengeh, 2020) (Destiana, 2016) |

Source: Processed Data, 2021

Bandar Lampung banana chip centre, while secondary data was obtained from various sources of the studies and research relevant to this issue.

Primary data were collected using questionnaires and interviews. Questionnaires and interviews to find out the description of MSME actors in Bandar Lampung banana chip centres. The data collected in this study include the number of MSMEs in banana chip centres that are still actively operating, the number of assets, business turnover, education level, age, income, business length, and workers. In determining the sample. A purposive sampling method is used, namely the business owner or business leader who has been running his business for three years and is willing to fill out the questionnaire.

Furthermore, the collected data will be processed by categorizing and tabulating it, so it is ready to be analyzed with analytical tools. Then the data will be processed using Smart PLS. Finally, from these findings, a model will be obtained.

Smart PLS was used as an analytical tool in this study to test the variables because Smart PLS can handle all coefficient directions at the same time, allowing the analysis of direct, indirect, and false relationships that cannot be analyzed using regression analysis.

Table 1 shows this study's variables, indicators, and sources. Each variable has an indicator (Amri, 2020; Destiana, 2016; Marsusanti et al., 2021; Martanti et al., 2021; Nariswari & Putra, 2021; Soehardi et al., 2020; Statistik, 2020; Talom & Tengeh, 2020).

Result and Discussion

The respondents in this study were MSMEs actors in Bandar Lampung that run various types of businesses. Questionnaires were submitted directly containing a collection of questions about the respondents' profile: age, education level, length of business, number of labors, assets, turnover, health insurance and the use of technology. Table 2 shows the descriptive statistics of the respondents.

Table 2. shows the data on the characteristics of the respondents obtained from the questionnaires that were distributed and then collected. Based on Table 2, it can be seen that the age level is dominated by the age of 31 to 40 years, while the level of education is more than the high education, that is 36.84% for undergraduate education, only 13.15%. For the business period, 36.84% is under 5 years while between 5 to 10 and is 36.84%; the rest are above ten years. Furthermore, the number of workers is dominated by 55.26% and the number of workers under five people, while for assets of 84.21% are assets with amount to under 50 million Rupiah, turnover is dominated by 73.68% amounts to less than Rp 300,000,000.00. As for health insurance, each company had BPJS Health 68.42%, and the use of technology used was 63.15%.

Factor analysis of the variables is shown in Table 3. with the grouping of factor loading is above 0.5, it can be interpreted if previously the financial performance variable consisted of 5 dimensions into three dimensions, namely the existing factors into one dimension that we can name the new change in income after the COVID-19 pandemic, Additional Capital is in the form of labor or others to increase income. The COVID-19 pandemic variable also experienced a grouping that originally consisted of 4 to 3, namely PSBB Policy.

Closing the schools and workplaces; PSBB Policy: Limiting activities in public facilities and places; and PSBB Policy: Limiting the transportation activities. It happens that every policy and activity carried out during the pandemic continues to implement

Table 2. Characteristics of Respondents: Age, Education Level, Length of Business, Number of Labor, Assets, Turnover, Health Insurance, Use of Technology

|

No |

Age |

Frequency |

Percentage |

|

1 |

< 30 |

7 |

18.42 |

|

2 |

31–40 |

14 |

36.84 |

|

3 |

41–50 |

9 |

23.68 |

|

4 |

4) > 51 |

8 |

21.05 |

|

No |

Education Level |

Percentage | |

|

1 |

Basic Education |

8 |

21.05 |

|

2 |

Middle Education |

11 |

28.94 |

|

3 |

High Education |

14 |

36.84 |

|

4 |

Other |

5 |

13.15 |

|

No |

Length of Business |

Frequency |

Percentage |

|

1 |

5 years |

14 |

36.84 |

|

2 |

6-10 years |

14 |

36.84 |

|

3 |

11 years |

10 |

26.31 |

|

No |

Number of Labors |

Frequency |

Percentage |

|

1 |

5 employees |

21 |

55.26 |

|

2 |

5-10 employees |

6 |

15.78 |

|

3 |

> 10 employees |

4 |

10.52 |

|

4 |

Have no employee |

7 |

18.42 |

|

No |

Assets |

Frequency |

Percentage |

|

1 |

< Rp 50,000,000.00 |

32 |

84.21 |

|

2 |

Rp 50,000,000.00 – Rp 500,000,000.00 |

5 |

13.15 |

|

3 |

Rp 500,000,000.00 – |

1 |

02.63 |

|

Rp 10,000,000,000.00 | |||

|

No |

Turnover |

Frequency |

Percentage |

|

1 |

< Rp 300,000,000.00 |

28 |

73.68 |

|

2 |

Rp 300,000,000.00 – Rp 2,500,000,000.00 |

3 |

07.89 |

|

3 |

Rp 2,500,000,000.00 – |

7 |

18.42 |

|

Rp 50,000,000,000.00 | |||

|

No |

Health Insurance |

Frequency |

Percentage |

|

1 |

Health BPJS |

26 |

68.42 |

|

2 |

Health Insurance |

9 |

23.68 |

|

3 |

Other |

3 |

07.89 |

|

No |

Use of Technology |

Frequency |

Percentage |

|

1 |

Already |

24 |

63.15 |

|

2 |

Not yet |

14 |

36.84 |

Source: Processed Data, 2021

the health protocols. The Labor variable is grouped into three and is given the new name, labor experienced changes in working hours, short-term recruitment of workers laid off (unpaid), laid off (not partially), dismissed (not full).

The results of the Reliability Test on the construct can be seen from the Composite reliability and Cronbach Alpha values with more values above 0.7 as seen

|

Table 3. Result of Component Matrix and Result of Cross Loadings | ||||||

|

Result of Component Matrix |

Result of Cross Loadings | |||||

|

Financial Performance |

Covid-19 Pandemic |

Labor |

Financial Performance |

Covid-19 Pandemic |

Labor | |

|

KK1 |

0.760 |

0.760 | ||||

|

KK4 |

0.801 |

0.801 | ||||

|

KK5 |

0.898 |

0.898 | ||||

|

PC1 |

0.883 |

0. 883 | ||||

|

PC2 |

0.928 |

0. 928 | ||||

|

PC3 |

0.856 |

0. 856 | ||||

|

TK5 |

0.945 |

0. 817 | ||||

|

TK6 |

0.897 |

0. 945 | ||||

|

TK7 |

0.817 |

0. 897 | ||||

|

Source: |

Processed Data, 2021 | |||||

|

in Table 4. | ||||||

A construct had a strong Convergent Validity value with the AVE value higher than 0.50, as seen in Table 4. The construct had met a good Convergent Validity value for Financial Performance 0.675 of Covid-19 pandemic 0.791, and labor 0.788.

According to the Cross-loading requirements, the value between the constructs had a better correlation; this can be observed in Table 3. for additional constructs with good discriminant validity.

Meanwhile, based on the discriminant validity criteria, a good comparison is to compare the squared value of the correlation between the constructs and the AVE value, or the correlation between the constructs and the AVE roots was higher than the correlation between the constructs. It can be seen in Table 5.

Meanwhile, based on testing the second hypothesis (H2): There is an effect of the COVID-19 pandemic on the labor of MSMEs. The hypothesis was accepted. The test results between the COVID-19 pandemic on the labor had a positive effect 4.20 with a t-statistic value of 3.172 and very significant at 0.01, which means that if the COVID-19 pandemic increases, the workforce will experience the changes.

Furthermore, Hypothesis 3 explained that there was an accepted influence of labor on the financial performance of MSMEs based on the test results between labor on financial performance, and there was a positive effect of 7.23 with a t-statistical value of 7.028 and very significant at 0.01 this means that if the labor increases, the financial performance will change.

While in Hypothesis 4: The presence of labor affected the relationship between the Covid-19 pandemic variable and the financial performance variable, either indirectly or directly. Based on the test results, it can be concluded that the

Table 4. Results of Quality Criteria reliability, Cronbach Alpha and Result of Quality Criteria

|

Composite Reliability |

Cronbach Alpha |

AVE | |

|

Financial Performance |

0.861 |

0.758 |

0.675 |

|

Covid-19 Pandemic |

0.919 |

0.867 |

0.791 |

|

Labor |

0.918 |

0.866 |

0.788 |

|

Table 5. Result of Latent Variable Correlations | |||

|

Financial Performance |

COVID-19 Pandemic |

Labor | |

|

1.000 | |||

|

COVID-19 Pandemic |

0.420 |

1.000 | |

|

Labor |

0.767 |

0.442 |

1.000 |

|

Source: Processed Data, 2021 | |||

COVID-19 pandemic influenced financial performance both directly and indirectly through the labor. While the magnitude of the direct influence coefficient was 0.442 and the indirect effect was 0.303, it is also seen that the direct effect was greater than the indirect effect.

The COVID-19 pandemic had an impact on financial performance, according to the findings of the investigation. The findings of this study were consistent with prior research that found the COVID-19 pandemic had an impact on financial performance, so the findings of this study are consistent with past research. (Amri, 2020; Fathoni, 2019; Sayuti & Hidayati, 2020; Soehardi et al., 2020; Wijaya, 2020).

These findings suggest that improving financial performance can be accomplished in various ways, including adding additional capital to hire more skilled workers and increasing technology in various fields, particularly in the marketing sector, where the shift from traditional to digital marketing is conducted. (Akpan et al., 2020; Awali, 2020)

Furthermore, the analysis result of the impact of the COVID-19 pandemic on the labor with the hypothesis showed an effect of the COVID-19 pandemic on the labor found that the COVID-19 pandemic affected the labor. It means that with the increase in the COVID-19 pandemic, the number of workers will increase. This increase can take the form of an increase in the number of laid-off workers and the presence of labors who are sent home, either unpaid or partially or fully paid. This research is in line with previous research that the COVID-19 pandemic affects labor shifts (Marsusanti et al., 2021; Martanti et al., 2021; Nuryadi & Lestari, 2021; Soehardi et al., 2020).

Additionally, this study also succeeded in accepting the hypothesis that there was an influence of labor on financial performance, it showed that an increase in the laid-off labor will increase the decrease in financial performance, so we need a special strategy carried out by business actors, namely in the form of utilizing technology in various production lines as well as recruiting new workers who are oriented towards the use of technology. MSMEs can use strategies to survive in their business during the pandemic: making sales by utilizing digital technology (laura Hardilawati, 2020; Liguori & Pittz, 2020; Nalini, 2021).

Furthermore, the COVID-19 pandemic has a direct effect on the financial performance variable, but it has an indirect effect on financial performance through the labor based on the results of the analysis in the fourth hypothesis. It means that to increase financial performance in the face of the COVID-19 pandemic, a variety of government-supported activities are required, including the addition of corporate capital and technology advancements in the framework of firm innovation.

COVID-19 pandemic has positively affected financial performance and labor, which means that the COVID-19 pandemic will improve financial performance with additional capital, labor and technology improvements. Meanwhile, as the number of labor declines increases during the COVID-19 pandemic, so does the decline in financial

performance. It implies that MSME actors must adapt to this situation and change their marketing strategy, such as using e-marketing, in order for the business to run smoothly.

However, the COVID-19 pandemic affects financial and labor performance; this is in line with previous research (Fathoni, 2019; Marsusanti et al., 2021; Nalini, 2021; Pedauga, Sáez, & Delgado-Márquez, 2022; Rosita, 2020; Sarmigi, 2020; Shafi et al., 2020; Wijaya, 2020). Additionally, the new findings report that the COVID-19 pandemic had not only a direct effect on financial performance variables but also had an indirect effect on financial performance through the labor.

Conclusion

This study investigated the impact of the COVID-19 pandemic on MSMEs in the banana chip centre in Bandar Lampung, specifically testing the effect of the COVID-19 pandemic on the financial performance and labor of the MSME in the banana chip centre in Bandar Lampung and examining the effect between the variables. Based on this study, the COVID-19 pandemic impacts both financial performance and labor. Furthermore, the labor. The COVID-19 pandemic had a direct or indirect impact on financial performance. The labor, on the other hand, had an impact on financial performance. The discovery of direct and indirect impacts of the COVID-19 pandemic on financial performance, with labor acting as an intervening variable between the COVID-19 pandemic and financial performance that is the main strength. It suggests that the changes in the labor will have an impact on the COVID-19 pandemic to financial performance. According to the findings, MSME actors should adapt to the changes in consumer behavior, such as obtaining information, utilizing, and buying, during the COVID-19 pandemic by taking the methods to accommodate the changes in consumer behavior, such as leveraging technology.

This study is limited to banana chips MSMEs; different sectors may result in different results. Therefore, for future research, it is suggested to employ other sectors and add the other variable that is suspected to influence the performance of MSMEs in the COVID-19 pandemic.

ACKNOWLEDGMENT

The authors would like to thank the research grants from LPPM of Universitas Lampung and LPPM of Universitas Malahayati, which provided support for the creation of this research collaboration so that this research can be carried out smoothly and successfully.

References

Akpan, I. J., Udoh, E. A. P., & Adebisi, B. (2020). Small business awareness and adoption of state-of-the-art technologies in emerging and developing markets, and lessons from the covid-19 pandemic. Journal of Small Business & Entrepreneurship, 1-18.

Amri, A. (2020). Pengaruh periklanan melalui media sosial terhadap umkm di indonesia di masa pandemi. Jurnal Brand, 2(1), 123-130.

Andika, R., Pratiwi, S., Anisa, A., & Putri, S. A. (2020). Dampak covid-19 terhadap pendapatan pedagang mikro pada pasar tradisional. Al-Sharf: Jurnal Ekonomi Islam, 1(1).

Arianto, B. (2020). Pengembangan umkm digital di masa pandemi covid-19. ATRABIS: Ju(Jubaedah & Destiana, 2016; Talom & Tengeh, 2020)rnal Administrasi Bisnis (eJournal), 6(2), 233-247.

Awali, H. (2020). Urgensi pemanfaatan e-marketing pada keberlangsungan umkm di kota pekalongan di tengah dampak covid-19. BALANCA: Jurnal Ekonomi dan Bisnis Islam, 2(1), 1-14.

Brodeur, A., Gray, D., Islam, A., & Bhuiyan, S. (2021). A literature review of the economics of covid‐19. Journal of Economic Surveys, 35(4), 1007-1044.

Dewi, M. M., Magdalena, F., Ariska, N. P. D., Setiyawati, N., & Rumboirusi, W. C. B. (2020). Dampak Pandemi Covid-19 terhadap Tenaga Kerja Formal di Indonesia The Impact of Covid-19 Pandemic on Formal Labour in Indonesia. Populasi, 28(2), 32– 53.

Dewi Hanggraeni, L. (2017). Determinan kinerja usaha mikro, kecil dan menengah. Jurnal Akuntansi Multiparadigma, 8(3), 487-498.

Dissanayake, D. (2021). Battle with covid-19: The best recommendations for business professionals. Annals of Human Resource Management Research, 1(1), 1-14.

Fathoni, A. (2019). Dampak covic 19 dan kebijakan psbb pemerintah terhadap umkm di wiyung surabaya. Dinar: Jurnal Prodi Ekonomi Syariah, 3(1), 30-69.

Fitriyani, L. N., Handayani, T., & Sari, L. P. (2022). Analysis of the marketing strategy of savings products at bmt nasuha during the covid-19 pandemic. Dirham: Journal of Sharia Finance and Economics, 1(1), 1-13.

Gerald, E., Obianuju, A., & Chukwunonso, N. (2020). Strategic agility and performance of small and medium enterprises in the phase of covid-19 pandemic. International Journal of Financial, Accounting, and Management, 2(1), 41-50.

Haryanto, H. (2020). Dampak covid-19 terhadap pergerakan nilai tukar rupiah dan indeks harga saham gabungan (ihsg). Jurnal Perencanaan Pembangunan: The Indonesian Journal of Development Planning, 4(2), 151-165.

Jubaedah, S., & Destiana, R. (2016). Kinerja Keuangan Usaha Mikro Kecil dan Menengah di Kabupaten Cirebon Sebelum dan Sesudah Mendapatkan Pembiayaan Syariah. Jurnal Riset Keuangan Dan Akuntansi, 2(2), 93–103.

laura Hardilawati, W. (2020). Strategi bertahan umkm di tengah pandemi covid-19. jurnal akuntansi dan ekonomika, 10(1), 89-98.

Liguori, E. W., & Pittz, T. G. (2020). Strategies for small business: Surviving and thriving in the era of covid-19. Journal of the International Council for Small Business, 1(2), 106-110.

Marsusanti, E., Riyanto, A., Yulistria, R., Syabaniah, R. N., & Nugraha, R. (2021). Dampak pendemi covid 19 terhadap perubahan shift kerja dan kinerja cleaning service. Swabumi, 9(1), 19-31.

Martanti, D. M., Magdalena, F., Ariska, N. P. D., Setiyawati, N., & Rumboirusi, W. C. (2021). Dampak pandemi covid-19 terhadap tenaga kerja formal di indonesia. Populasi, 28(2), 52-69.

Naab, R., & Bans-Akutey, A. (2021). Assessing the use of e-business strategies by smes in ghana during the covid-19 pandemic. Annals of Management and Organization Research, 2(3), 145-160.

Nalini, S. N. L. (2021). Dampak dampak covid-19 terhadap usaha mikro, kecil dan menengah. Jesya (Jurnal Ekonomi dan Ekonomi Syariah), 4(1), 662-669.

Nariswari, M. A. S., & Putra, I. B. W. (2021). Implikasi kebijakan psbb dan protokol kesehatan covid-19 terhadap minat wisatawan berkunjung ke bali. Kertha Desa(5), 45-57%V 49.

Nuryadi, N., & Lestari, N. (2021). Dampak pandemi covid-19 terhadap tenaga kerja desa cibanteng kecamatan ciampea kabupaten bogor. YUSTISI, 6(1), 29-38.

Pedauga, L., Sáez, F., & Delgado-Márquez, B. L. (2022). Macroeconomic lockdown and smes: The impact of the covid-19 pandemic in spain. Small Business Economics, 58(2), 665-688.

Pertiwi, I. W., & Kartika, L. (2021). Analysis strategic entrepreneurship model in bogor city culinary smes. Indonesian Journal of Business and Entrepreneurship (IJBE), 7(1), 1-1.

Purwaningsih, R., & Kusuma, P. D. (2015). Analisis faktor-faktor yang mempengaruhi kinerja usaha kecil dan menengah (ukm) dengan metode structural equation modeling (studi kasus ukm berbasis industri kreatif kota semarang). Prosiding SNST Fakultas Teknik, 1(1).

Reniati, R., Akbar, M. F., & Rudianto, N. A. R. (2019). The effect of covid-19 on the economy of bangka-belitung and the performance of msme and its impact on competitive strategies in the new normal era. Annals of Management and Organization Research, 1(1), 51-63.

Rosita, R. (2020). The influence of the covid-19 pandemic on umkm in indonesia. Jurnal Lentera Bisnis, 9(2), 109.

Sarmigi, E. (2020). Analisis pengaruh covid-19 terhadap perkembangan umkm di kabupaten kerinci. Al-Dzahab: Journal of Economic, Management and Business, & Accounting, 1(1), 1-17.

Sayuti, R. H., & Hidayati, S. A. (2020). Dampak pandemi covid-19 terhadap ekonomi masyarakat di nusa tenggara barat. RESIPROKAL: Jurnal Riset Sosiologi Progresif Aktual, 2(2), 133-150.

Shafi, M., Liu, J., & Ren, W. (2020). Impact of covid-19 pandemic on micro, small, and medium-sized enterprises operating in pakistan. Research in Globalization, 2, 100018.

Soehardi, S., Permatasari, D. A., & Sihite, J. (2020). Pengaruh pandemik covid-19 terhadap pendapatan tempat wisata dan kinerja karyawan pariwisata di jakarta. Jurnal Kajian Ilmiah, 1(1).

Statistik, B. P. (2020). Analisis hasil survei dampak covid-19 terhadap pelaku usaha. BPS RI.

Suryani, E. (2021). Analisis dampak covid-19 terhadap umkm (studi kasus home industri klepon di kota baru driyorejo). Jurnal Inovasi Penelitian, 1(8), 1591-1596.

Talom, F. S. G., & Tengeh, R. K. (2020). The impact of mobile money on the financial performance of the smes in douala, cameroon. Sustainability, 12(1), 183.

Taufik, T., & Ayuningtyas, E. A. (2020). Dampak pandemi covid 19 terhadap bisnis dan eksistensi platform online. Jurnal Pengembangan Wiraswasta, 22(01), 21-32.

Winarsih, W., Winarti, W., Machmuddah, Z., & Tahar, E. binti. (2021). The Relationship between Capital Financial, Accounting Capability and Micro-, Small- and MediumSized Enterprises’ (MSMEs) Financial Performance in Indonesia. Jurnal Dinamika Akuntansi Dan Bisnis, 8(2), 229–242. Retrieved from http://e-repository.unsyiah.ac.id/JDAB/article/view/21425

Wijaya, O. Y. A. (2020). The impact of covid-19 on micro, small and medium enterprises (msmes) in easr java province, indonesia and strategies for overcoming: Ad interim. International Research Association for Talent Development and Excellence, 12, 3454-3465.

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 297

Discussion and feedback