CEO Overconfidence as Moderator of Sales Growth, Interest Coverage, Fixed Asset Intensity to Financial Distress

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 18 No. 2, July 2023

AFFILIATION:

1,2Faculty of Economics and Business, Universitas Esa Unggul

*CORRESPONDENCE:

frankif92@student.esaunggul.ac.id

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2023.v18.i02.p08

CITATION:

Slamet, F. & Ramadhan, Y. (2023). CEO Overconfidence as Moderator of Sales Growth, Interest Coverage, Fixed Asset Intensity to Financial Distress. Jurnal Ilmiah Akuntansi dan Bisnis, 18(2) 308-321.

ARTICLE HISTORY Received:

May 13 2023

Revised:

July 1 2023

Accepted:

July 25 2023

CEO Overconfidence as Moderator of Sales Growth, Interest Coverage, Fixed Asset Intensity to Financial Distress

Franki Slamet1*, Yanuar Ramadhan2

Abstract

This study seeks to explore the influence of certain factors, namely company growth, interest coverage ratio, and fixed asset intensity, on a company's financial health or distress. We pay special attention to the potential role of CEO overconfidence as a variable that might change or moderate these influences. Drawing from a quantitative approach, we used publicly available financial statements of primary consumer goods companies listed on the Indonesia Stock Exchange from 2017 to 2021. Our findings suggest that company growth and the value of fixed assets play roles in determining financial distress, but the interest coverage ratio does not. Moreover, when factoring in CEO overconfidence, we found it changes the way company growth and fixed assets relate to financial distress. Yet, this CEO trait doesn’t alter the relationship between the interest coverage ratio and financial distress.

Keywords: company growth, interest coverage ratio, fixed asset intensity, CEO overconfidence, financial distress

Introduction

As reported by CNN Indonesia in 2020, Matahari Department Store initiated the permanent shutdown of 25 outlets dispersed across Indonesia. This decision stems from the store's declining financial health. Specifically, in 2020, the store's gross sales stood at 8.59 trillion Rupiah, marking a sharp decline of 52.3% from its 2019 figures, which amounted to 18.03 trillion Rupiah. Consequently, the company registered a substantial loss of 823 billion Rupiah in 2020, a stark contrast to its 2019 net profit of 1.36 trillion Rupiah. A similar course of action was taken by PT. Hero Supermarket Tbk, prompted by continuous financial losses.

This research is anchored on discrepancies observed in extant literature. Prasetya & Oktavianna (2021) posited that company growth negatively influences financial difficulties, a stance corroborated by studies from Amanda & Tasman (2019) and Widhiari & Merkusiwati (2015). Conversely, a study by Muzharoatiningsih & Hartono (2022) indicated that company growth doesn't significantly affect financial distress, a conclusion mirroring the findings of Saputra & Salim (2020). When evaluating the impact of the interest coverage ratio on financial distress, Meryana & Setiany (2021) contend that the ratio significantly influences financial distress, a sentiment echoed by Hanafi et al. (2021), Shetty & Vincent (2021), and Abu Bakar & Yahya (2021).

This study presents findings divergent from those of Ananda et al. (2022), which posited that the interest coverage ratio lacks a significant effect on financial distress. Clearly, there exists an inconsistency in addressing the impact of the interest coverage ratio on financial distress across studies. Damajanti et al. (2021) emphasize that employing a company's total assets to harness profits from sales and investment activities can bolster its resilience against financial distress, a sentiment echoed by Akmalia (2020) and Hai et al. (2022). Conversely, Sulastri & Zannati (2018) contend that companies possessing large fixed assets might incur significant depreciation costs, potentially dampening profits.

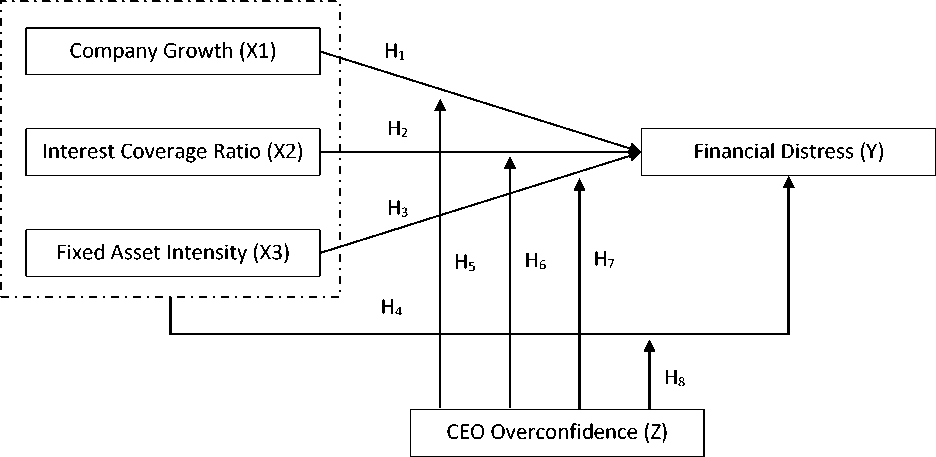

In this research, CEO overconfidence is introduced as a moderating variable. Decision-making trajectories set by CEOs, especially those exhibiting excessive selfconfidence, might entail bold strategies, capitalizing on available opportunities. This research's uniqueness stems from its focus on company growth, interest coverage ratio, and fixed asset intensity as independent variables, with CEO overconfidence serving as a moderating agent. Given that myriad factors could precipitate a company into financial distress, strategic finesse becomes imperative to forestall financial challenges. Ghayour et al. (2022) underscore that CEO decisions can amplify ties with financial distress. Corporate strategies are thus pivotal for sustaining a company's fiscal health. This investigation zeroes in on variables that either attenuate or amplify the determinants of financial distress, aiming to offer actionable insights for corporate decision-making.

Contrasting conclusions from prior studies underscore the need for this research, which seeks to advance our understanding of the determinants of financial distress. Here, we expand the study's scope concerning its population, temporal span, and variables, particularly emphasizing CEO Overconfidence's moderating role in the relationship between the interest coverage ratio, company growth, fixed asset intensity, and financial distress.

Jensen & Meckling (1976) define agency relationships as contracts between a principal and an agent, whereby the latter receives decision-making authority. Brigham & Daves (2007) concur, suggesting that agency relationships emerge when a principal, typically a company owner, delegates decision-making authority to managers. Challenges in this dynamic often arise from misaligned expectations and outcomes, as well as potential conflicts with creditors. These conflicts often pivot on individualistic pursuits. For instance, agents might seek to optimize strategies around investments or borrowed funds, possibly leading to discord with principals. Principals, in contrast, often desire continuously increasing operational profits without proportional hikes in corporate expenditure (Pearce & Robinson, 2008). In the throes of financial distress, agency theory postulates heightened conflicts between companies and their creditors. As indebtedness surges, potential losses for creditors amplify, intensifying conflicts (Nurlinda & Bertuah, 2019).

Hery (2015) asserts that company growth serves as an indicator of its success. A rising sales growth ratio suggests that the company is meeting its targets with an escalating percentage of sales year over year. If this ratio continues to expand, the likelihood of the company facing financial distress diminishes (Amanda & Tasman, 2019). Oktaviyani & Munandar (2017) posit that sales growth can be utilized to project a company's profits over a specified period. Growth metrics assess a company's capability to sustain its economic standing amidst economic expansion and within its industry. Increased sales growth is indicative of augmented revenue. This growth can be

determined from the difference in sales between two consecutive years. Consistent growth in core activities indicates positive development for a company. Higher sales growth generally leads to improved revenue, reducing the risk of financial distress (Sanchiani & Bernawati, 2018). The signaling theory suggests that management employs metrics such as sales growth to communicate to the company's external stakeholders about its current conditions (Brigham & Houston, 2014).

-

H1: Company growth positively influences financial distress.

The interest coverage ratio, as defined by Bruner (2004), is a financial metric that gauges a company's operational income capacity to cover its interest expenses within an accounting period. The agency theory delves into the motivations that influence the manipulation of financial statements, especially when a firm grapples with financial challenges. Abu Bakar & Yahya (2021) note that elevated interest rates suggest that companies require more capital for sustenance. Meryana & Setiany (2021) highlight the impact of the interest coverage ratio on financial distress, emphasizing the need for companies to manage their debt policies judiciously to avoid being overly encumbered by interest obligations. Relying extensively on external financing increases a company's interest burden, diminishing its net profit or amplifying its losses.

-

H2: The interest coverage ratio negatively impacts financial distress.

Sugiono & Untung (2016) classify fixed assets as long-term investments utilized for business purposes, excluding land. The intensity of fixed assets signifies the proportion of a company's fixed assets relative to its total assets. The scale of fixed assets each company possesses varies based on operational needs or strategies for activity optimization. Akmalia (2020) and Ambarukmi et al. (2017) argue that possessing substantial fixed assets can bolster production, subsequently enhancing sales and averting financial distress. However, Hai et al. (2022) found a negative correlation between fixed asset intensity and corporate financial performance, serving as a signal for potential investors.

-

H3: Fixed asset intensity positively correlates with financial distress.

Information on a company's financial standing is pivotal for evaluating its capability to secure financing or other fiscal resources. Factors influencing this status include the management of financial resources, financial structure, liquidity, solvency, and adaptability to diverse changes (Ramadhan & Marindah, 2021). Within the examined variables, company growth is represented through sales growth, and decisions made by management, along with resource allocation, are epitomized by fixed asset intensity. High sales growth values indicate a company's adeptness in executing product sales and marketing strategies, offering signals to financial statement users (Prasetya & Oktavianna, 2021). Hanafi et al. (2021) point out that increasing corporate debt can erode profits, leading to financial distress. Conversely, companies with significant fixed assets are perceived to be more secure due to their potential use as collateral, thereby diminishing financial distress risks (Akmalia, 2020).

-

H4: Company growth, interest coverage ratio, and fixed asset intensity collectively influence financial distress.

The variable of CEO Overconfidence can be quantified through several metrics, such as the propensity of CEOs to invest aggressively in innovation. CEOs exhibiting overconfidence often have a higher probability of realizing profits vis-à-vis developmental costs. This inclination can augment company value and mitigate associated risks (Sumunar & Djakman, 2020). Elevated sales growth in companies augments the likelihood of higher

profits and correlates positively with the associated debt obligations (Widiyantoro & Sitorus, 2019). The CEO's role is pivotal in steering the trajectory of company growth. Such leaders persistently devise strategies to foster positive growth trajectories, thereby mitigating financial distress scenarios. In this context, overconfident CEOs can amplify the influence of company growth on financial distress, as their overarching goal remains to elevate reputation and operational performance, surpassing industry counterparts (Nurcahyani & Rahmawati, 2020).

-

H5: CEO overconfidence moderates and accentuates the correlation between company growth and financial distress.

In strategizing financial pathways, overconfident CEOs often exhibit a preference for external financing to bolster the company's capital. They harbor the aspiration that operational profits will suffice to service both the principal and interest obligations. Consequently, this can escalate interest expenses, amplifying the company's financial burden and potentially leading to fiscal strain. Such a characteristic of CEO overconfidence might exacerbate financial distress. For investors, this becomes a salient consideration, given that a judicious debt structure can offer them assurance (Yulianti & Ramadhan, 2022).

-

H6: CEO overconfidence moderates and amplifies the relationship between the interest coverage ratio and financial distress.

The emphasis on fixed asset ownership within a company can be evaluated by the proportion of fixed assets to total assets. A preponderance of fixed assets implies higher concurrent depreciation expenses (Hidayah & Umiah, 2022). Overconfident CEOs may disproportionately channel the company's resources towards fixed assets, perceiving them as low-risk ventures (Salsabila, 2020). Thus, CEO overconfidence can potentially diminish financial distress, rooted in the belief that adept asset management forestalls fiscal challenges (Akmalia, 2020).

-

H7: CEO overconfidence moderates and enhances the interplay between fixed asset intensity and financial distress.

CEO Overconfidence has garnered notable attention in both academic research and corporate realms due to its influence on organizational decision-making. Highly overconfident CEOs may occasionally falter in timing and judgment, leading to erroneous decisions (Kaplan et al., 2021). Investment and managerial decisions hinge on the CEO's self-assurance, necessitating scrutiny of their choices. Overconfident CEOs are inclined towards outcome-oriented strategies they deem effective. Nurcahyani & Rahmawati (2020) argue for the CEO's paramount role in navigating company performance based on endorsed policies. Moreover, Yustisi & Putri (2021) note that excessively confident management often exhibits aggressive, potentially irrational decision-making tendencies. This might overlook emergent risks, such as the ramifications of debt-financed operations or the presumptive benefits of fixed asset investments (Salsabila, 2020).

-

H8: CEO overconfidence moderates and intensifies the interconnectedness of company growth, interest coverage ratio, and fixed asset intensity with financial distress.

Research Method

This study employs a quantitative research approach, utilizing secondary data extracted from financial statements available on the Indonesia Stock Exchange website. It specifically examines financial statements from primary consumer goods sub-sector companies listed on the Indonesia Stock Exchange between 2017 and 2021. These

statements have undergone audit processes and have been subsequently published. The study encompasses independent, moderating, and dependent variables. The independent variables are comprised of company growth, interest coverage ratio, and fixed asset intensity. CEO overconfidence serves as the moderating variable, while financial distress is the dependent variable. Due to specific inclusion criteria relating to the financial statements, not all companies within the primary consumer goods sub-sector registered between 2017 and 2021 are sampled. Non-random and purposive sampling techniques were employed. Key inclusion criteria were consistent listing during the study period, financial statement publication, documented losses or profit declines between 2017 and 2021, and availability of comprehensive data pertinent to the study. Based on these criteria, 27 primary consumer goods sub-sector companies were incorporated as study samples.

Company growth serves as an evaluative metric for organizational success. Forecasts of company growth that transcend mere sales growth assumptions are more informative (Krantz & Johnson, 2020). This is measured by comparing sales of the current year with those of the preceding year. The Interest Coverage Ratio, a tool that gauges a company's operational income potential to meet its interest obligations within a fiscal period (Bruner, 2004), is determined by contrasting earnings before interest and tax with interest expenses. Fixed assets, which are long-term investments subject to depreciation—with the exception of land—are integral to business operations (Sugiono & Untung, 2016). Their intensity is gauged by the ratio of total fixed assets to total assets. Financial distress depicts a scenario where a company struggles financially, primarily due to inadequate cash flows to satisfy its financial commitments (Altman, 1968). It is measured using the Altman Z-Score five-coefficient formula. The moderating variable, CEO Overconfidence, embodies five distinct characteristics (Liang et al., 2020). These include gender, age, education level, academic program, term of office, and positional dualism. Each characteristic is assigned a binary value based on predetermined criteria. A cumulative score of four or above categorizes a CEO as overconfident.

Figure 1. Research Model Framework

Source: Processed Data, 2022

The analytical methodology encompasses several stages, including the determination of the panel data regression model (informed by the Chow test, Hausman test, and Lagrange Multiplier test), descriptive statistics, a classic assumption test (comprising multicollinearity, normality, autocorrelation, and heteroscedasticity tests), hypothesis testing (employing partial tests for each independent variable's influence on the dependent variable, simultaneous tests for collective independent variable impacts, and the R2 test for variable variation predictions), and the Moderated Regression Analysis (MRA) model to evaluate the moderating variable's role in amplifying or attenuating intervariable relationships (Suliyanto, 2011)

Results and Discussion

Based on the descriptive statistical data presented in Table 1, the study encompassed 135 company samples spanning the years 2017-2021. For the company growth variable, the data revealed a minimum value of -0.709 and a maximum value of 0.827, with a median of 0.016, a mean of 0.023, and a standard deviation of 0.224. The notable disparity between the growth of the smallest and largest companies indicates that the mean may not be a holistic representation of the dataset. The interest coverage ratio variable showcased a minimum value of -206.22 and a maximum value of 321.39. Its median was recorded at 1.075, its mean at 13.213, and the standard deviation was 53.447. Given the vast difference between the lowest and highest interest coverage ratios, the mean may not adequately encapsulate the entire dataset. For the fixed asset intensity variable, the minimum and maximum values were identified as 0.056 and 0.960, respectively. The median for this variable was 0.583, the mean was 0.595, and the standard deviation was 0.220. Notably, the standard deviation was smaller than the mean, suggesting that the mean can be a reliable representation for the entirety of the data. The financial distress variable displayed a minimum value of -3.952 and a maximum of 6.614. The median was found to be 1.354, the mean 1.401, and the standard deviation 1.569. The fact that the standard deviation surpassed the mean indicates that the mean might not adequately

Table 1. Descriptive Statistics

|

PP |

ICR |

IAT |

CEOOVER |

FINDIS | |

|

Mean |

0.023 |

13.213 |

0.595 |

0.437 |

1.401 |

|

Median |

0.016 |

1.075 |

0.583 |

0.000 |

1.354 |

|

Maximum |

0.827 |

321.395 |

0.960 |

1.000 |

6.614 |

|

Minimum |

-0.709 |

-206.220 |

0.056 |

0.000 |

-3.952 |

|

Std. Dev. |

0.224 |

53.447 |

0.220 |

0.497 |

1.569 |

|

Skewness |

0.168 |

3.306 |

-0.190 |

0.253 |

-0.065 |

|

Kurtosis |

5.187 |

22.267 |

2.026 |

1.064 |

3.966 |

|

Jarque-Bera |

27.571 |

2,334.293 |

6.148 |

22.523 |

5.356 |

|

Probability |

0.000 |

0.000 |

0.046 |

0.000 |

0.068 |

|

Sum |

3.203 |

1783.838 |

80.406 |

59.000 |

189.233 |

|

Sum Sq. Dev. |

6.781 |

382793.3 |

6.540 |

33.214 |

330.219 |

|

Observations |

135 |

135 |

135 |

135 |

135 |

Source: Processed Data, 2022

|

Table 2. T-Test | ||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

-0.830 |

0.603 |

-1.374 |

0.172 | |

|

Sales Growth |

-2.331 |

0.379 |

6.137 |

0.000 |

|

Interest Coverage Ratio |

0.001 |

0.002 |

0.657 |

0.512 |

|

Fixed Asset Intensity |

3.675 |

0.957 |

3.840 |

0.000 |

|

Source: Processed Data, 2022 | ||||

reflect the entire data spectrum. It's noteworthy that the overall mean for financial distress stands at 1.4, implying that the collective sample for this study resides within a gray zone. This aligns with the observed trends for primary consumer goods sub-sector companies between 2017 and 2021. Nonetheless, the companies exhibited an average growth rate of 2.3% (0.023), which might be influenced by the fact that their cash flows are relatively smaller compared to their liabilities (Nailufar et al., 2018).

Table 2 delineates the impact of company growth, interest coverage ratio, and fixed asset intensity on financial distress. The growth of the company has a negative influence on financial distress, evident from a computed value of 6.137, which surpasses the critical value of 1.977. Given its significance value of 0.00, which is less than the threshold of 0.05, the first hypothesis is consequently rejected. Growth is deemed favorable when it manifests consistently across periods and fosters increased revenue or profits (Sanchiani & Bernawati, 2018). The agency theory accentuates sales augmentation without adequately considering the consequent expenditures stemming from such growth. A disproportionately high expense-to-sales ratio is a primary factor contributing to dwindling company profits.

The interest coverage ratio does not significantly impact financial distress. This is evident from its calculated value of 0.650, which falls below the benchmark of 1.977, and a significance value of 0.512, which exceeds the threshold of 0.05. Since the interest coverage ratio predominantly portrays the potency of profits in defraying interest costs, it does not holistically represent the overall debt condition. This observation aligns with the findings of Ananda et al. (2022). Per the agency theory, the strategic focus of companies lies in meeting set targets. Firms opting for external financing inevitably incur obligations, including principal repayments coupled with the associated interest. Thus, a higher reliance on external funding results in a commensurate increase in the interest liabilities the company must shoulder.

The fixed asset intensity positively correlates with financial distress, demonstrated by its computed value of 3.840, which exceeds the critical value of 1.977, and a significance value of 0.000, falling below the 0.05 threshold. Such results infer that as the value of fixed asset intensity escalates, the likelihood of financial distress

Table 3. F-Test

|

R-squared |

0.772 |

Mean dependent var |

1.401 |

|

Adjusted R-squared |

0.706 |

S.D. dependent var |

1.569 |

|

S.E. of regression |

0.850 |

Akaike info criterion |

2.711 |

|

Sum squared resid |

75.155 |

Schwarz criterion |

3.378 |

|

Log likelihood |

-152.020 |

Hannan-Quinn criter. |

2.982 |

|

F-statistic |

11.765 |

Durbin-Watson stat |

1.976 |

|

Prob(F-statistic) |

0.000 |

Source: Processed Data, 2022

Table 4. Result Moderated Regresion Analysis (MRA) 1

|

Coefficient |

Std. Error t-Statistic |

Prob. | |

|

C |

1.362 |

0.216 6.289 |

0.000 |

|

SG |

2.819 |

0.480 5.870 |

0.000 |

|

CEOOVER |

0.070 |

0.466 0.152 |

0.879 |

|

SGCEOOVER 1.934 0.792 2.442 Effects Specification Cross-section fixed (dummy variables) |

0.016 | ||

|

R-squared |

0.753 |

Mean dependent var |

1.401 |

|

Adjusted R-squared |

0.685 |

S.D. dependent var |

1.569 |

|

S.E. of regression |

0.880 |

Akaike info criterion |

2.777 |

|

Sum squared resid |

81.492 |

Schwarz criterion |

3.423 |

|

Log likelihood |

-157.484 |

Hannan-Quinn criter. |

3.039 |

|

F-statistic Prob(F-statistic) |

11.050 0.000 |

Durbin-Watson stat |

1.346 |

Source: Processed Data, 2022

diminishes. A considerable portfolio of fixed assets can bolster companies in enhancing production, which in turn augments sales and potentially mitigates the risk of financial distress. This data can furnish comprehensive insights into financial health, thereby guiding potential investors' decisions prior to their investments. This observation resonates with the studies conducted by Hai et al. (2022) and Akmalia (2020).

Results of F-Test, a showed f value 11.765 > f table of 2.67 was obtained with a significance value 0.000 < 0.05. Results of this f test, can describe simultaneously that company growth, interest coverage ratio and fixed asset intensity affect financial distress.

SGCEOOVER is a multiplication between the value of sales growth and CEO Overconfidence to be used in moderation test. Based on Table 4, the variable SGCEOOVER obtained a significance value 0.016 < 0.05, and the adjusted R Square after moderation 0.685 increased from 0.673. It can describe that CEO Overconfidence can moderate and strengthen the influence of company growth on financial distress. In line with Nurcahyani & Rahmawati (2020) research, where this is due to the role of the CEO with

Table 5. Result Moderated Regresion Analysis (MRA) 2

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

C |

1.302 |

0.253 |

5.136 |

0.000 |

|

ICR |

0.003 |

0.003 |

0.921 |

0.358 |

|

CEOOVER |

0.134 |

0.544 |

0.247 |

0.805 |

|

ICRCEOOVER |

0.000 |

0.004 |

-0.077 |

0.938 |

|

Effects Specification | ||||

|

Cross-section fixed (dummy variables) | ||||

|

R-squared |

0.672 |

Mean dependent var |

1.401 | |

|

Adjusted R-squared |

0.582 |

S.D. dependent var |

1.569 | |

|

S.E. of regression |

1.014 |

Akaike info criterion |

3.059 | |

|

Sum squared resid |

108.002 |

Schwarz criterion |

3.704 | |

|

Log likelihood |

-176.496 |

Hannan-Quinn criter. |

3.321 | |

|

F-statistic |

7.449 |

Durbin-Watson stat |

1.192 | |

|

Prob(F-statistic) |

0.000 | |||

Source: Processed Data, 2022

|

Table 6. Result Moderated Regresion Analysis (MRA) 3 | |||

|

Coefficient |

Std. Error t-Statistic |

Prob. | |

|

C |

-1.129 |

0.772 -1.463 |

0.146 |

|

FAI |

3.711 |

1.157 3.205 |

0.001 |

|

CEOOVER |

3.979 |

1.605 2.478 |

0.014 |

|

FAICEOOVER Cross-section fixed (dummy variables) |

5.471 2.139 2.557 Effects Specification |

0.012 | |

|

R-squared |

0.702 |

Mean dependent var |

1.401 |

|

Adjusted R-squared |

0.620 |

S.D. dependent var |

1.569 |

|

S.E. of regression |

0.966 |

Akaike info criterion |

2.963 |

|

Sum squared resid |

98.160 |

Schwarz criterion |

3.609 |

|

Log likelihood |

-170.046 |

Hannan-Quinn criter. |

3.226 |

|

F-statistic Prob(F-statistic) |

8.559 0.000 |

Durbin-Watson stat |

1.249 |

Source: Processed Data, 2022

overconfidence nature can strengthen the influence of company growth on financial distress, because CEO Overconfidence continues to aim to improve reputation and operational performance above the average with similar industries. Also, changing the direction of the influence of company growth to positive on financial distress is due to the strategy implemented by the CEO, as well as external factors such as political conditions and national conditions that are not revealed in this study. CEO Overconfidence can result in positive performance and many use profit management (Habib et al., 2012). Also, it can be done with tax avoidance, where tax avoidance is an added value for investors, because it has succeeded in reducing tax costs without violating tax regulations (Edastami & Kusumadewi, 2022).

ICRCEOOVER is a multiplication between the value of interest coverage ratio and CEO Overconfidence to be used in moderation test. Based on Table 5, the ICRCEOOVER variable obtained a significance value 0.938 > 0.05. It can be concluded that CEO Overconfidence cannot moderate the relationship of interest coverage ratio with financial distress. This is in line with the second hypothesis, where the interest coverage ratio only describes the condition of the strength of earnings in covering interest expenses, does not describe the overall debt condition, so CEO Overconfidence cannot strengthen or weaken the relationship between interest coverage ratio and financial distress. In line with research conducted by Yulianti & Ramadhan (2022) that the use of debt is considered reasonable, because the use of debt structures reasonably will provide certainty to investors.

|

Table 7. T-Test With Moderating | |

|

R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) |

0.674 Mean dependent var 1.401 0.584 S.D. dependent var 1.569 1.012 Akaike info criterion 3.055 107.601 Schwarz criterion 3.701 -176.245 Hannan-Quinn criter. 3.317 7.490 Durbin-Watson stat 1.229 0.000 |

Source: Processed Data, 2022

FAICEOOVER is a multiplication between the value of Fixed Asset Intensity and CEO Overconfidence to be used in moderation test. Based on Table 6, the FAICEOOVER variable obtained a significance value 0.012 < 0.05, and the adjusted R Square after moderation of 0.620 increased from 0.604. It can describe that CEO Overconfidence can moderate and amplify the effect of fixed asset intensity on financial distress. In line with research conducted by Salsabila (2020) and Akmalia (2020) assuming a high amount of fixed assets can reduce the occurrence of financial distress conditions. This is due to the nature of CEO Overconfidence which assures that ownership of fixed assets on a large scale, can determine the condition of the company. If the company experiences financial difficulties, the assets owned can be collateral to other parties to get loans even the nature of fixed assets that are easily converted into additional capital.

Result of T-test, a calculated f value 7.490 > f table 2.67 was obtained with a significance value 0.000 < 0.05. Results of f test, can concluded simultaneously that CEO Overconfidence can moderate Company Growth, Interest Coverage Ratio, and fixed asset intensity against financial distress. In line with research conducted by Yustisi & Putri (2021).

Conclusion

The impact of a company's growth on financial distress is negative, leading to the rejection of the first hypothesis. Elevated company growth does not necessarily imply an augmentation in the firm's revenue or profits. This can be attributed to suboptimal management efficiency in relation to sales growth. Consequently, operational costs surge, increasing the potential for financial distress. The interest coverage ratio, on the other hand, does not influence financial distress. This suggests that merely the magnitude of interest expense neither characterizes the financial distress status of the company nor precipitates its onset. Fixed asset intensity exhibits a positive correlation with financial distress. The empirical results indicate that an increase in fixed asset intensity corresponds to a decreased likelihood of financial distress. When evaluated collectively, it's evident that company growth, interest coverage ratio, and fixed asset intensity jointly influence financial distress.

CEO overconfidence serves as a moderating variable, intensifying the effect of company growth on financial distress. However, it fails to moderate the relationship between the interest coverage ratio and financial distress. CEO overconfidence does moderate and amplify the influence of fixed asset intensity on financial distress. Further testing underscores that CEO overconfidence can act as a moderator for company growth, interest coverage ratio, and fixed asset intensity in relation to financial distress.

From this study, it's imperative for companies to strategically utilize funds from third-party sources. Injudicious utilization of external financing can precipitate adverse ramifications. Companies should optimize asset management to bolster profits, enabling the generation of internal funds for varied purposes. While CEO overconfidence can moderate aspects like company growth and fixed asset intensity, it's essential to ensure this overconfidence doesn't compromise financial decision-making.

The research encounters limitations in the criteria adopted for company selection, as it doesn't encompass all manufacturing firms in Indonesia. There exists a disparity in the interest coverage ratio and fixed asset intensity when factored into the financial distress component. The measurement of CEO overconfidence is still reliant on dummy variables, and the study overlooks external variables.

Future research endeavors could consider a broader sample scope and an extended research timeframe. Introducing novel or disparate variables might unveil additional determinants of financial distress that remained obscured in this study. Comparing the financial landscapes during and post the Covid-19 pandemic could offer invaluable insights. For companies grappling with financial challenges, prompt intervention is advised. This could entail judicious asset management, undertaking debt restructuring initiatives, curbing unnecessary expenditures, and maintaining vigilance towards external factors, including political dynamics.

References

Abu Bakar, D. B., & Yahya, M. H. Bin. (2021). Financial Information Fraudulence and

Financial Distress: Evidence from Singapore. Turkish Journal of Computer and

Mathematics Education, 12(9), 2732–2746.

https://doi.org/10.17762/turcomat.v12i9.4332

Akmalia, A. (2020). Pengaruh Struktur Modal, Struktur Aset Dan Profitabilitas Terhadap Potensi Terjadinya Financial Distress Perusahaan (Studi pada Perusahaan Manufaktur Sektor Aneka Industri yang Terdaftar di Bursa Efek Indonesia periode 2014-2017). Business Management Analysis Journal (BMAJ), 3(1), 1–21. https://doi.org/10.24176/bmaj.v3i1.4613

Altman, E. I. (1968). Financial Ratios, Discriminant Analysis and the Prediction of

Corporate Bankruptcy. The Journal of Finance, 23(4), 589–609.

Amanda, Y., & Tasman, A. (2019). Pengaruh Likuiditas, Leverage, Sales Growth dan Ukuran Perusahaan Terhadap Financial Distress Pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia (BEI) Periode 2015- 2017. Jurnal Ecogen, 2(3), 453–462. http://dx.doi.org/10.24036/jmpe.v2i3.7417

Ambarukmi, K. T., Diana, N., & Adhikara, A. (2017). Pengaruh Size, Leverage, Profitability, Capital inttensity Ratio Dan Activity Ratio Terhadap Effective Tax Rate (ETR) (Studi Empiris Pada Perusahaan LQ-45 Yang Terdaftar Di BEI Selama Periode 2011- 2015). E_Junal Ilmiah Riset Akuntansi, 6(17), 13–26.

Ananda, Y. Y., Permana, A. H., & Pohan, E. R. (2022). Determinasi Financial Distress Pada Perusahaan Properti Dan Real Estate Di Indonesia Sebuelum dan Selama Bencana Covid-19. Syntax Idea, 4(2). https://doi.org/ 10.36418/syntax-idea.v4i2.1767%0D

Brigham, E. F., & Daves, P. R. (2007). Intermediate financial management. The British Accounting Review.

Brigham, E. F., & Houston, J. F. (2014). Dasar-Dasar Manajemen Keuangan (11th ed).

Salemba Empat.

Bruner, R. F. (2004). Applied Mergers and Acquisitions. Wiley Finance.

Damajanti, A., Wulandari, H., & Rosyati. (2021). Pengaruh Rasio Keuangan Terhadap

Financial Distress Pada Perusahaan Sektor Perdagangan Eceran Di Bursa Efek

Indonesia Tahun 2015-2018. SOLUSI : Jurnal Ilmiah Bidang Ilmu Ekonomi, 19(1), 29–44. http://dx.doi.org/10.26623/slsi.v19i1.2998

Edastami, M., & Kusumadewi, Y. (2022). Pengaruh kepemilikan institusional, kepemilikan publik dan profitabilitas terhadap penghindaran pajak dengan manajemen laba sebagai variabel intervening. Fair Value : Jurnal Ilmiah Akuntansi Dan Keuangan, 4(9), 3764–3772. https://doi.org/10.32670/fairvalue.v4i9.1544

Ghayour, F., Farahany, M. H., & Shahi, S. (2022). The Efficiency of Inventory Management and Financial Distress: The Interactive Role of Management Behavioral Strains. Iranian Journal of Management Studies (IJMS), 15(2), 253– 269. https://doi.org/10.22059/IJMS.2021.319848.674456

Habib, A., Sun, J., Cahan, S., & Hossain, M. (2012). CEO Overconfidence, Earnings Management and the Global Financial Crisis. University of Auckland and Curtin Business School.

Hai, B. lu, Yin, X. M., Xiong, J., & Chen, J. (2022). Could more innovation output bring better fnancial performance? The role of fnancial constraints. Financial Innovation, 8(6), 1–26. https://doi.org/10.1186/s40854-021-00309-2

Hanafi, A. H. A., Md-Rus, R., & Mohd, K. N. T. (2021). Predicting Financial Distress In Malaysia And Its Effect On Stock Returns. The International Journal of Banking and Finance, 16(2), 81–110. https://doi.org/10.32890/ ijbf2021.16.2.4

Hery. (2015). Analisis Laporan Keuangan. Center for Academic Publishing Service.

Hidayah, I., & Umiah, Ri. (2022). Faktor–Faktor yang mempengaruhi Intensitas Aset Tetap, Profitabilitas, Leverage, dan Size terhadap Manajemen Pajak (studi kasus pada sektor pertambangan yang terdaftar di BEI tahun 2018-2020). Jurnal SEKURITAS (Saham, Ekonomi, Keuangan Dan Investasi), 5(3), 222–237. http://dx.doi.org/10.32493/skt.v5i3.17580

Jensen, M. C., & Meckling, W. H. (1976). Theory Of The Firm : Managerial Behavior, Agency Costs And Ownership Structure. Journal of Financial Economics, 3, 305– 360.

Kaplan, S. N., Sorensen, M., & Zakolyukina, A. A. (2021). What Is CEO Overconfidence? Evidence from Executive Assessments. Chicago Booth Paper, 20(22). https://doi.org/10.1016/j.jfineco.2021.09.023

Krantz, M., & Johnson, R. R. (2020). Investment Banking For Dummies. John Wiley & Sons, Inc.

Liang, Q., Ling, L., Tang, J., Zeng, H., & Zhuang, M. (2020). Managerial overconfidence, firm transparency, and stock price crash risk: Evidence from an emerging market. China Finance Review International, 10(3), 271–296. https://doi.org/10.1108/CFRI-01-2019-0007

Meryana, & Setiany, E. (2021). The Effect Of Investment, Free Cash Flow, Earnings Management and Interest Coverage Ratio On Financial Distress. Journal Of Social Science, 64–69. https://doi.org/10.46799/jss.v2i1.86

Muzharoatiningsih, & Hartono, U. (2022). Pengaruh Rasio Keuangan, Sales Growth, Dan Ukuran Perusahaan Terhadap Financial Distress Pada Sektor Industri Barang Konsumsi Di BEI Periode 2017-2020. Jurnal Ilmu Manajemen, 10(3), 747–758. https://doi.org/10.26740/jim.v10n3.p747-758

Nailufar, F., Sufitrayati, & Badaruddin. (2018). Pengaruh Laba dan Arus Kas Terhadap Kondisi Financial Distress Pada Perusahaan Non Bank Yang Terdaftar Di Bursa Efek Indonesia. Jurnal Penelitian Ekonomi Akuntansi, 2(2), 147–162. https://doi.org/10.33059/jensi.v2i2.943

Nurcahyani, C., & Rahmawati, I. P. (2020). Pengaruh CEO Overconfidence Terhadap Manajemen Laba Riil Dengan Kualitas Audit Sebagai Pemoderasi (Studi Pada Sub Sektor Industri Dasar Dan Kimia Tahun 2015- 2018). Jurnal Akuntansi Dan Manajemen Mutiara Madan, 8(2), 110–133.

Oktaviyani, R., & Munandar, A. (2017). Effect of Solvency, Sales Growth, and Institutional Ownership on Tax Avoidance with Profitability as Moderating Variables in Indonesian Property and Real Estate Companies. Binus Business Review, 8(3), 183. https://doi.org/10.21512/bbr.v8i3.3622

Prasetya, E. R., & Oktavianna, R. (2021). Financial Distress Dipengaruhi Oleh Sales Growth Dan Intellectual Capital. Jurnal Akuntansi Berkelanjutan Indonesia, 4(2), 170–182. http://dx.doi.org/10.32493/JABI.v4i2.y2021.p170-182

Ramadhan, Y., & Marindah, M. (2021). Financial Distress Analysis in an Indonesian Textile Company. KnE Social Sciences, 2021, 602–621. https://doi.org/10.18502/kss.v5i5.8846

Salsabila, N. E. P. A. (2020). Pengaruh Overconfidence, Illusion Of Control, Loss Aversion Bias, Dan Regret Aversion Bias Terhadap pengambilan Keputusan INVESTASI. STIE Perbanas Surabaya.

Sanchiani, D., & Bernawati, Y. (2018). Pengaruh Kinerja Keuangan Dan Pertumbuhan PerusahaanTerhadap Kondisi Financial Distress (Studi Pada Perusahaan Tekstil Dan Garmen Yang Terdaftar Di Bursa Efek Indonesia Periode 2012-2016). Jurnal Manajemen Bisnis Indonesia, 5(3), 378–392. https://doi.org/10.31843/jmbi.v5i3.174

Saputra, A. J., & Salim, S. (2020). Pengaruh Profitabilitas, Leverage, Firm Size, Dan Sales Growth Terhadap Financial Distress. Jurnal Multiparadigma Akuntansi Tarumanagara, 2(1), 262–269. https://doi.org/10.24912/jpa.v2i1.7154

Shetty, S. H., & Vincent, T. N. (2021). The Role of Board Independence and Ownership Structure in Improving the Efficacy of Corporate Financial Distress Prediction Model: Evidence from India. Journal of Risk and Financial Management, 14(333), 1–13. https://doi.org/10.3390/jrfm14070333

Sugiono, A., & Untung, E. (2016). Panduan Praktis Dasar Analisa Laporan Keuangan. PT Grasindo.

Sulastri, E., & Zannati, R. (2018). Prediksi financial distress dalam mengukur kinerja perusahaan manufaktur. Jurnal Manajemen Strategi Dan Aplikasi Bisnis, 1(1), 27–36. https://doi.org/10.36407/jmsab.v1i1.17

Sumunar, K. I., & Djakman, C. D. (2020). CEO Overconfidence, ESG Disclosure, And Firm Risk. Jurnal Akuntansi Dan Keuangan Indonesia, 17(1), 1–21. https://doi.org/10.21002/jaki.2020.01

Widhiari, N. L. M. A., & Merkusiwati, N. K. L. A. (2015). Pengaruh Rasio Likuiditas, Leverage, Operating Capacity, Dan Sales Growth Terhadap Financial Distress. E-Jurnal Akuntansi Universitas Udayana, 11(2), 456–469.

Widiyantoro, C. S., & Sitorus, R. R. (2019). Pengaruh Transfer Pricing Dan Sales Growth Terhadap Tax Avoidance Dengan Profitabilitas Sebagai Variabel Moderating. Media Akuntansi Perpajakan, 4(2), 01–10. https://doi.org/10.52447/map.v5i1.4182

Yulianti, V., & Ramadhan, Y. (2022). Pengaruh Struktur Modal, Profitabilitas dan Ukuran Perusahaan Terhadap Nilai Perusahaan. Jurnal Ilmiah Indonesia, 7(3). https://doi.org/10.36418/syntax-literate.v7i2.6336

Yustisi, Y. P., & Putri, D. D. (2021). Manajemen Laba Yang Dipengaruhi Oleh Managerial Overconfidence Dan Kepemilikan Keluarga. Journal Ekombis Review, 9(1), 121– 134. https://doi.org/10.37676/ekombis.v9i1.1271

Jurnal Ilmiah Akuntansi dan Bisnis, 2023 | 320

Discussion and feedback