The Dynamics of Credit Procyclicality and Stability of Macroeconomics in Indonesia

on

ISSN : 2301-8968

Vol. 14 No.2, Agustus 2021

EKONOMI

KUANTITATIF

TERAPAN

Volume 14

JEKT

Nomor 2

ISSN 2301-8968

Denpasar Agustus 2021

Halaman

243-431

Balinese Indigenous Knowledge about Water : A Way to Achieve Water Sustainability

Amrita Nugraheni Sarawaty, I Wayan Gita Kesuma, I Gusti Wayan Murjana Yasa

Planning Consistency and the Political Budget Cycle in Indonesia Farina Rahmawati, Khoirunurrofik Khoirunurrofik

PROVINCE Analysis of Financial Institutions Credit Impact on MSE Income in Bali Province Ksama Putra, Ni Putu Wiwin Setyari

The Dynamics of Credit Procyclicality and Stability of Macroeconomics in Indonesia Ni Putu Nina Eka Lestari, Made Kembar Sri Budhi, I Ketut Sudama, Ni Nyoman Reni Suasih, I Nyoman taun

The The Impact of COVID-19 on FinTech Lending in Indonesia: Evidence From Interrupted Time Series Analysis

Abdul Khaliq

The Dynamics of Exchange Rate, Inflation, and Trade Balance in Indonesia Yon Widiyono, David Kaluge, Nayaka Artha Wicesa

Volatilitas inflasi sebagai fenomena kombinasi moneter-fiskal di Indonesia Eli Marnia Henira, Raja Masbar, Chenny Seftarita

The Analysis of Willingness to Pay (WTP) Visitors to The Development of Rafting Toutism in Serayu Watershed

Nobel Sudrajad, Waridin, Jaka Aminata, Indah Susilowati

Relatiomships Between Characteristic of Local Government and Website Based Financial Gabriela Amanda Widyastuti, Dena Natalia Damayanti, Marwata

The Relationship Among Economic Structure, Sectoral Workforce, and Community Welfare in Bali Province I Nyoman Mahendrayasa

pISSN : 2301 - 8968

JEKT ♦ 14 [2] : 351-368

eISSN : 2303 - 0186

The Dynamics of Credit Procyclicality and Stability of Macroeconomics in Indonesia

Ni Putu Nina Eka Lestari Made Kembar Sri Budhi I Ketut Sudama Ni Nyoman Reni Suasih I Nyoman taun

ABSTRACT

Credit growth is one of the important indicators of the financial system that can drive the country economic growth, but on the other hand credit growth can also cause risks in the financial system due to the economic actors’ moral hazard. The purpose of this research is to analyze the credit procyclicality pattern and economic growth in Indonesia. In addition, this study aims to determine the relationship pattern between credit and some macroeconomic variables. The method used is VECM with quarterly time series data during 1998 until 2016. The analysis shows that credit growth and economic growth have positive causality. This shows pro-cyclicality between credit and economic growth in Indonesia. However, in the long run this pattern shows a downward trend although still positive and permanent, which means that excessive credit growth can also lead to a decline in economic growth

Keywords: Credit; Economic Growth; Pro-cyclicality; Vector Error Correction Model JEL Classification: E51, E59, E66

INTRODUCTION

The role of banks in the economic constellation experienced very rapid dynamics parallel with technological and information advances and even unlimited financial mobility in the space and time dimensions. Changes in the structure of banking become own concentration for the economy of a country, especially for developing countries as an economic support. A

smooth and strong financial structure is assumed to have an impact on economic stability and can be an indicator of economic growth especially for developing countries (Korkmaz, 2015). Banking economically plays a role in facilitating the funds operation especially on borrowing so that will lead to increased investment. In general, the synchronization between macroeconomic stability and banking

stability is a key instrument in the economic stability. This condition is based the emergence of macro economy and banking policy mix. However, the banking role has decreased confidence due to the global financial crisis phenomenon in 2008 which led to inefficiency and resulting in economic doubts about the role of banks.

On one side, credit movement has a significant impact in an economy because credit is able to provide a boost to the productive sector that will have an impact on the macro and micro economy. A credit flow in productive sector will increase aggregate demand that will also directly affect aggregate output.

Figure 1: Credit Growth Movement in Indonesia

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

Source: International Financial Statistic, IFS, 2017, Data Processed

Credit movement increased during the 1998 crisis and then declined in 2011 and raised again slowly in 2014 when the economy showed a stable condition. Credit condition increase during economic recession is feared will increase systemic risk in banking so that risk mitigation is needed through

synergy of banking, macroeconomic and monetary policy (Bank Indonesia, 2014). The banking role especially in financial development has been the focus of attention in recent times. Global financial crisis phenomenon in 2009 showed a massive expansion of credit in economic recession times. This 352

encourages the occurrence of procyclical behavior on credit so that’s feared will pose a systemic risk to the banking (Bouvatier & Mignon, 2014; Bank Indonesia, 2014).

After global financial crisis, the role of macroeconomic and monetary instruments becomes very important in synergizing the credit movement. Lowe's study (2002) uses macroeconomic variables in the credit risk measurement, especially in an increasing business cycle, indicating that risk measurement is based on price, thereby increasing amplification in the financial business cycle. In addition, synergy in monetary policy control and macro variable control has a major role in the work evaluation. Empirical studies (Thierry et al., 2016) also look the relationship of credit and economic growth showing that there is a causal relationship between economic growth and credit which indicates that credit-related monetary policy is able to promote economic growth well and vice versa.

This study aims to analyze the macroeconomic and monetary variables response to credit movement and credit growth response to the occurrence of shocks that sourced from macroeconomic variables in Indonesia.

Literature Review

Global financial crisis in 2008 has had a significant impact on the national economy to systemic impact on the banking sector. Public trust in the banking performance is drop, especially on the credit instrument that became the cornerstone of financial deepening for the un-bankable community. In addition, economic development intervened through the financial sector further decreased confidence. Exchange rate fluctuations and purchasing power that driven by inflation are very vulnerable influential to the banking sector especially on the credit instruments performance (Korkmaz, 2015). It also directly affects economic growth.

Studies on the impact of financial sector deepening have been conducted in

various countries. McKinnon (1973), Rob (1997), and Hernando et al. (2004) undertook studies related to the impact of financial development on the economy. The McKinnon and Shaw (1973) studies indicate that the financial deepening via liberalization and financial deepening supports economic growth and development. Another study that become theoretical basis of financial development was carried out by Levine et al. (2008) showing that financial intermediation can affect growth classified into three groups: savings effects, the savings proportion that are channeled to investment effects and the efficiency of capital allocation. These three components have a strong role in the credit flow to the real sector. When viewed in the context of financial inclusion as an economic development program through the financial sector, credit growth is needed in order to increase the real sector in production so that it will contribute to economic growth (Kim et al., 2017). The findings of Kim et al. (2017) study show that financial development through financial

inclusion has a positive impact on economic growth even both are mutually beneficial through one of the banking instruments that so-called credit.

Various literature studies show the result that massive and excessive credit expansion in the long run will have a significant effect on the decline in financial performance even financial crises such as the 2008 global financial crisis (Shin et al., 2016; Goldstein, 2001; Fund, 2014). In addition to Kraft (2005), also shows that rapid credit growth will increase credit risk, but on the other side credit growth will also enhance financial deepening that trigger the long-term economy. This condition creates a policy dilemma for policy makers so there is a need depth study focused on financial stability and financial development. The loan boom is a factor that indicates a banking and currency crisis that will create a macroeconomic shock (Kraft, 2005). In addition to Beck et al. (2006), describes his findings that the high money circulation triggered by the burst of credit loans if not controlled

optimally will lead to systemic problems in the financial sector.

Dilemma between banking sector acceleration through credit expansion with economic stability and banking stability is shown from several studies. Mandel & Seydl (2016) says that credit acceleration will have a systemic impact on the economy after a major recession in the United States crisis. This condition is shown by the analysis that high credit supply side will depreciate the economy in a certain time due to uncertainty of activity and economic condition. Some of the above studies show that the economic assumption in 19th century that economic system by relying on the banking sector is better. This condition can be seen from the savings mobility and investment and capital so can exploit economies scale and accommodate the market system lack (Korkmaz, 2015).

Credit becomes a financial instrument that has a major contribution to the economy through the business cycle. Credit contributions to the productive

sector have a positive impact on increased output, employment and economic growth. But at some point, when a credit spike in an economic recession will pose a risk to the stability of the financial system. The consistency of policies in financial markets and credit markets through monetary and banking policies can provide opportunities for financial and credit targets and reduce systemic risk arising from credit procyclical behavior (Friedman, 1981). In addition, macroeconomic variables related to interest rates that have a major role in credit risk and its flow. In this case the interest rate becomes an intrinsic component that plays a major role in the determination of profit and loss so that it can be taken into account the risks to be faced as the expected outcome of credit flow travel (Drehmann et al., 2006). However, English (2002) explained that interest rate is not a determinant in banking stabilization when viewed from a macroeconomic point of view.

METHODOLOGY

This study uses data obtained from International Financial Statistics (IFS). The data used is quarterly time series data with Indonesian objects starting from 1998Q1 to 2016Q3. The determination of the data series is motivated by the global financial crisis phenomenon that occurred in 1998/1999 and 2008 due to loss of control on credit performance resulting in global price level and economic instability until developing countries like Indonesia get the impact. The variables used consist of Gross Domestic Product (GDP) as a proxy for economic growth (%), policy rate BI Rate (%), real effective exchange rate (%) and money supply (JUB) in USD as a proxy for monetary variables. Credit gap represents the ratio of credit to GDP (%).

The method used in this research is Vector Error Correction Model (VECM). In the VECM estimation, some preestimation tests are performed before entering the VECM estimate. In the pretest phase VECM estimation is the same as the VAR pre estimate test. Some of

them consist of stationary test data through unit root test, cointegration test through Johansen test to see the longterm and short-term relationship, optimum lag test by looking at AIC value to know best lag to see estimation result, impulse response function (IRF) to see pattern response between variables, variance decomposition (VD) to see the amount of contribution between variables.

The general model of the study is as follows.

δ t =γiδz t-1 + •■• + γp-1δz t - p+1 +πz t - p + ut γ = —(I — A1 — •■•- Ai), i = !,■••, p —1 Π = —(I — A1 — ••■ — Ap) = αβ

α shows the coefficient of adjustment and β long-term coefficients. Cointegration vector is the relation or interrelation of z variable that converges in the long run.

RESULTS

Analysis method that used is Vector Error Correction Model (VECM) to see the response pattern and the amount of macro-economic contribution and monetary variable to credit movement

and vice versa. Important preestimation tests consist of data stationary test, cointegration test, optimum lag test, impulse response function (IRF) and variance decomposition (VD). Each test has each purpose such as unit root test to see the data stationary, cointegration test to see the short-term and long-term relationship on the variable, the optimum lag test to see the best lag to read the estimation result, IRF to see the pattern response of macroeconomic and monetary variable to credit movement, VD to see the amount of contribution of macro-economic and monetary variable to credit movement. After passing the pre-estimation test, an estimate test of the VECM model is performed.

The unit root test is a stationary test of data intended to observe whether a particular coefficient of an autoregressive model is estimated to have one or no value. The behavior of data from each variable can be seen in Table 1 which shows that all data moves away from the mean. This indicates that not all stationary variables at level I (0) except credit, exchange rates and money supply variables. Since all variables are not stationary at the level, the first degree of integration test I (1) is tested and the credit variable and the money supply are not stationary. Therefore, based on table 1 it’s seen that by using Augmented Dickey Fuller test on the second integration degree I (2) seen that all variables are stationary on the same degree with the degree of trust α = 5%.

Table 1. Unit Root Test I(0) and Integration Degree

|

Variable |

I(0) Test Statistic |

I(1) Test Statistic |

I(2) Test Statistic |

|

Credit Gap |

-2,978** |

0,202 |

-13,498*** |

|

GDP |

-1,167 |

-10,648*** |

-15,041*** |

|

BI Rate |

-1,749 |

-7,434*** |

-9,934*** |

|

REER |

-4,070*** |

-10,883*** |

-17,103*** |

|

Money Supply |

-2,597* |

-1,615 |

-9,851*** |

Notes: ***,**,*indicates significance atα=1%,5% and 10%

Source: Data Processed, 2017

The next step is to determine the optimal lag number by using Schwarz Information Criterion and Hannan-Quinn Information Criterion which shows lag 2 is the optimum lag used to see the best estimation result on all variables. While the cointegration test with Johansen Cointegration Test shows the long-term relationship between variables. In the long run only the variable of money supply is not significant to credit growth in Indonesia. This means that changes in money supply or liquidity during the study period have no impact on credit changes.

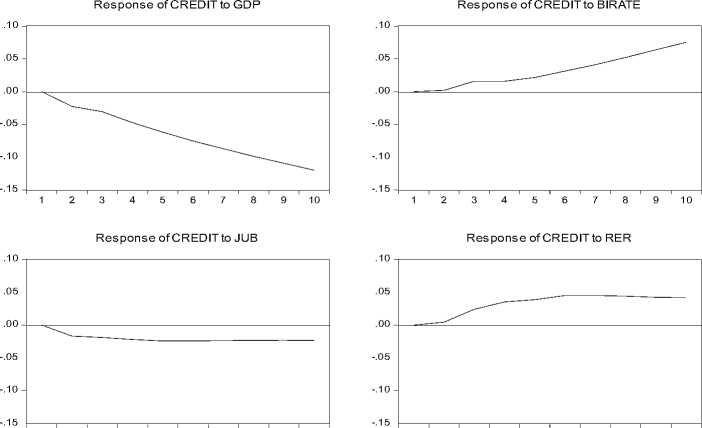

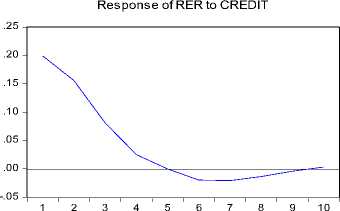

The impulse response analysis illustrates the effect of shock on the endogenous variables contained in the model and to see the dynamic interrelations between the variables in the model. Here is the result of credit response to the shocks of all macroeconomic variables.

The impulse response analysis illustrates the effect of shock on the endogenous variables contained in the model and to see the dynamic interrelations between the variables in the model. Here is the result of credit response to the shocks of all macroeconomic variables.

Figure 2: Response of Credit to Macroeconomic Variables Shocks

Response to Cholesky One S.D. Innovations

1 2 3 4 5 6 7 8 9 10

1 2 3 4 5 6 7 8 9 10

Source: Data Processed, 2017

Based on Figure 2, it can be seen that the pattern of relationship between credit and GDP is negative, meaning that a 1% shocks rise from GDP causes a 0.022 decline in credit at the beginning of the period and are permanent. Also, with the money supply (JUB) shows a negative relationship pattern. While the pattern of positive relationships is shown from the shock that comes from exchange rates (RER) and policy rates.

The amount of independent variable contribution in responding to credit

movement can be seen in table 2 which shows that GDP and BI Rate have consistency of stable response up to period 10 where GDP has biggest contribution response compared with others variable. While Money Supply and exchange rate have a less stable response on the 7th to 10th period that decreased response. This condition indicates that GDP has a big contribution in responding to credit ratio, besides BI rate also become variable which have big response in credit movement.

Table 2: Variance Decomposition of Credit

|

Period |

Credit |

GDP |

BI-Rate |

Money Supply |

Real Exchange Rate |

|

1 |

100.0000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

|

2 |

96.63910 |

2.108509 |

0.015310 |

1.152932 |

0.084148 |

|

3 |

95.26940 |

2.318802 |

0.410971 |

1.023758 |

0.977070 |

|

4 |

94.37328 |

2.895215 |

0.398345 |

0.874393 |

1.458769 |

|

5 |

93.99971 |

3.327667 |

0.432195 |

0.753849 |

1.486582 |

|

6 |

93.71662 |

3.624267 |

0.541926 |

0.630924 |

1.486265 |

|

7 |

93.63599 |

3.806770 |

0.671651 |

0.522134 |

1.363456 |

|

8 |

93.61789 |

3.920900 |

0.819378 |

0.435378 |

1.206453 |

|

9 |

93.62472 |

3.978588 |

0.979612 |

0.367471 |

1.049613 |

|

10 |

93.63321 |

4.002807 |

1.136498 |

0.314990 |

0.912490 |

Source: Data Processed, 2017

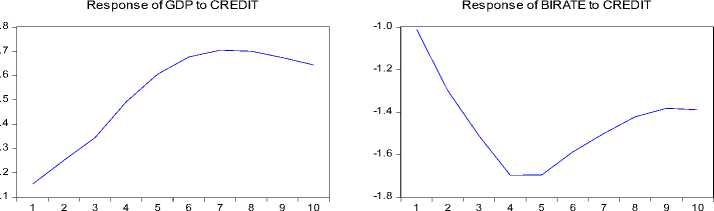

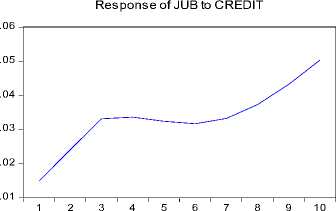

While based on figure 3, it is seen that the pattern of credit relationship and GDP is positive when there are shocks that come from credit growth. So is the

money supply. This shows that the increase in credit gives an impact on economic growth and vice versa if credit decline, economic growth will also

decrease. The pattern of credit procyclicality and economic growth is indicated by the influence of shocks that comes from credit growth. However, this pattern has decreased although it is still positive at the end of period and is permanent, which means that excessive

credit growth can also lead to a decline in economic growth. This is due to the excessive expectations of economic actors or moral hazards that tend to ignore the risks that cause a decrease in macroeconomic stability.

Figure 3: Response of Macroeconomic Variables to Credit Shocks

Response to Cholesky One S.D. Innovations

Source: Data Processed, 2017

Discussion

Credit growth in Indonesia tends to increase especially in the productive sector. Aside from being an instrument of accelerated banking growth, credit is also an instrument of economic growth alignment through the financing performance that has a big role in the

creation of output. In this case, credit is a popular banking instrument among society for real sector financing which will directly impact on economic growth. Based on the results of a survey by the Financial Services Authority (OJK, 2016) with the objective to see the consideration and evaluation of OJK

related inclusion and financial literacy there is an increase in financial literacy of 21.84% in 2013 increased to 29.66% in 2016. On the other side, financial inclusion index also increased from the year 2013 to 2016 by 59.74% increased to 67.82% (OJK, 2016). This condition

shows that the financial development program through financial inclusion has successfully increased economic development. It also showed an increase in economic growth along with the credit increase in real sector.

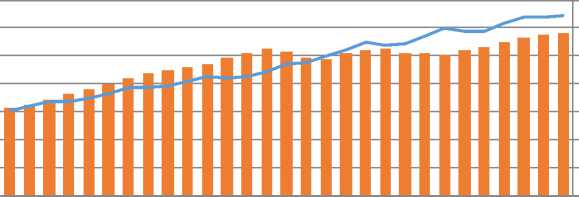

Figure 4: The Dynamics of GDP and Credit Movement in Indonesia

1,400,000.000

1,200,000.000

1,000,000.000

800,000.000

600,000.000

400,000.000

200,000.000

0.000

3,500,000 3,000,000 2,500,000 2,000,000

1,500,000 1,000,000 500,000

Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1 Q3 Q1

2010 2010 2011 2011 2012 2012 2013 2013 2014 2014 2015 2015 2016 2016 2017

^H Credit ^^^^M Real GDP

Source: IFS, 2017, Data Processed

Figure 4 shows the development of credit in Indonesia in 2011 until 2013 has been stable and good enough, this condition is also triggered by the improving business climate, business optimism, increasing of external financing and the improvement of government capital expenditure (Bank Indonesia, 2014). In addition, the weakening condition of the economic

performance reflected in the decline in economic growth is due to the pressure on the banking sector in the form of credit problems and the weakening of credit performance (LPS, 2015). Some of these phenomena can’t be separated from the role of the global economy such as the weakening of the Chinese stock index which is known to be the determinant of world stocks and the

Greek debt crisis that resulted in market mover for the movement of global financial markets including Indonesia (LPS, 2015). Another thing that resulted in credit decline and economic growth in 2015 was due to the increase in the Non-Performing Loan (NPL) ratio in the construction sector through 5.5% at the end of April 2015. In general, the Indonesian economy during the last decade experienced a significant increase in performance. These conditions can be seen in the increase in economic growth that has increased significantly.

The uncertain global economic that increased in 2015 resulted an increase in domestic financial risks, especially in the increased credit risk driven by rising prices of imported commodities and uncertainties in volatile exchange rate (Bank Indonesia 2016). This condition gives a signal that credit distribution especially in productive sector especially in import industry need to get extra treatment. Based on the analysis result, the highest response of BI rate and GDP variable to credit movement

indicates that macro policy has a dominant role in minimizing credit risk. This condition is indicated by the annual report of Indonesian banking (2014) which confirmed that an increase in lending rates set by banks resulted in a slowdown in credit growth. These fluctuations in interest rates will be responded by the movement of credit especially to big companies so that it will provide linkages to the business cycle (Stiglitz, 2016). The empirical debate over the role of interest rates in banking stability by English (2002) confirms that interest rates are not an important factor in banking stability even though interest rates are a source of volatility for banking benefits. While the empirical study from Maes (2006) found an important role of interest rates on banking stability and measurement of interest rate exposure as a banking risk detection instrument that proxy through the flow of credit. This condition is different from the role of interest rate instruments in Indonesia in responding to the movement of credit. The increase in interest rates will be

responded negatively by the credit as reflected in the decline in credit performance when there is an increase in interest rates (Bank Indonesia, 2014) resulting a credit slowdown. This is confirmed by the decline in the ratio of credit by banks from 21.60% (yoy) in 2013 down by 11.58% (yoy). The response is quickly responded by the company due to the company's reluctance to expand its business and lower demand for credit.

While viewed from testing IRF and VD also shows that GDP gives the greatest response to the credit ratio movement. This condition is indicated by a high contribution value compared to other macro and monetary variables as well as an increase in the contribution rate response shown in the credit movement. The movement of gross domestic product (GDP) will encourage credit increase and vice versa so that the role of GDP to respond growth and movement of credit is very large and it becomes a banking supporting instrument in credit acceleration (Thierry et al., 2016). This condition 363

indicates that with a high economic growth it can be said that the economy in good condition so that credit risk concerns decreased. Increased supply of banks will increase economic growth so that this condition indicates that economic growth and credit have a similar pattern and have a causal relationship (McKinnon, 1973). A portrait of the national economy reflected in the movement of GDP also plays a role in the pro-cyclicality of bank credit.

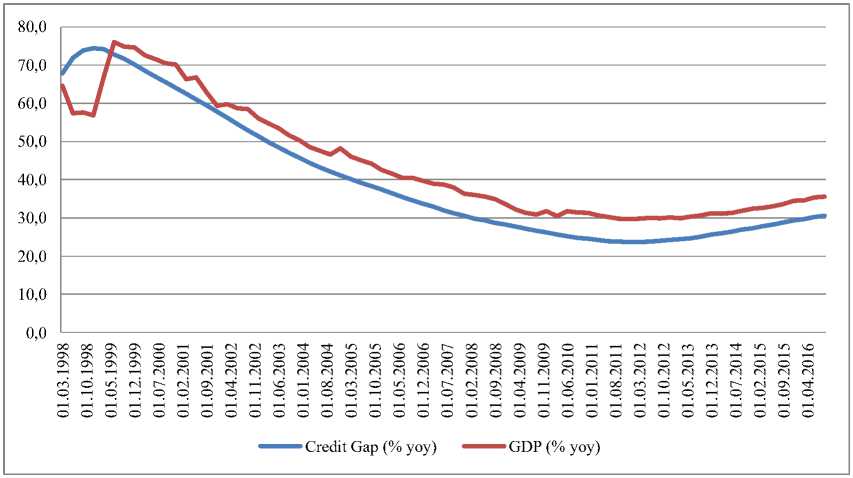

The movement of credit and GDP can be seen in Figure 5 which reflects the behavior of credit pro-cyclicality on Indonesia's GDP. At the beginning of the 1998 crisis, post-crisis 1999 portraits of credit fluctuations and GDP went against each other. Pro-cyclical conditions stabilized slightly in the fourth quarter of 1999 to the first quarter of 2016 with a pattern that parallels GDP growth despite a more stable credit movement compared to GDP. The parallel fluctuations of GDP and credit indicate that GDP gives a large response to credit movement and reflects that

credit and GDP have a positive causal relationship (Thierry, et al., 2016),

reflected in the trend patterns seen in Figure 3.

Figure 5: Procyclicality of Banking Credit Growth

Source: IFS, 2017, Data Processed

The prognosis based on estimation results indicating that GDP and BI rate show the greatest and stable response to Indonesian credit movement. In addition, GDP and BI rate as the proxy of interest rates give a significant effect on the movement of credit. Granger test

results also show that economic growth that proxy GDP has a positive causality relationship with the movement of Indonesia’s credit. This condition is supported by Thierry et al. (2016) research that credit movement has a positive relationship with GDP growth

and vice versa. In addition, Korkmaz (2015) and Escribano & Han (2015) and Ananzeh (2016) indicating that credit growth will be responded by economic growth and vice versa even both have a positive correlation. While the response and impact of domestic interest rates proxy by the BI rate is supported by an empirical study conducted in Belgium by Maes (2006) which shows the result that interest rates contribute substantially in responding and affecting credit movement directly by companies. Interest rate movement is used as an instrument to support business expansion so that its role is very dominant for the determination of credit.

Based on the analysis results can be simulated some policies that can provide a boost to the credit movement and minimize systemic risk caused by taking into account national and global economic conditions. Some policies that can be simulated from the banking sector itself through Outstanding credit which generally aims to manage credit distribution based on loan guarantees so 365

as to minimize bad debts as well as to maintain the stability of credit disbursement performance. This policy setting can also be made for the minimum portion of the credit ratio so that credit performance can be properly monitored (OJK, 2015). Study He, et al., (2016) also implements outstanding credit for the purpose of managing the flow of credit in the form of loans and debit cards involving community social behavior. This policy can efficiency the non-performing loans improve so as to maintain the stability of credit distribution and its contribution to economic growth. In addition, through the instrument setting interest rates on loans so that the need for synchronization between monetary and banking policy. This policy can be undertaken primarily at pioneering businesses that experiencing massive financing constraints such as the policy framework undertaken by Ovat (2016) in Nigeria. In addition, this reduction in loan interest can also increase the competitiveness of the banking industry and increase the sensitivity of credit that

can be responded positively by the real sector (Li et al., 2016).

CONCLUSIONS

Based on the analysis results can be concluded that there is a pattern of credit pro-cyclicality and economic growth in Indonesia where credit growth shows a pattern in same way with economic growth. GDP and credit also have a causal relationship where they affect each other. However, this pattern has decreased although it is still positive at the end of the period and is permanent, which means that excessive credit growth can also lead to decline in economic growth. This is due to excessive expectations of economic actors or moral hazards that tend to ignore the risks so caused to a decline in macroeconomic stability. Policy

recommendations that can be done from the banking side can be through the outstanding credit to minimize bad debts and maintain banking stability, while from the macro-economic side can be controlled on interest rate instruments to minimize banking risk

and balance the flow of bank credit especially in the productive sector.

REFERENCES

Ananzeh, I. E. N (2016) Relationship between Bank Credit and Economic Growth: Evidence from Jordan, 7(2). https://doi.org/10.5430/ijfr.v7n2p5 3

Beck T, Demirgu A, Levine R (2006) Bank concentration, competition, and crises: First results, 30, 1581–1603. https://doi.org/10.1016/j.jbankfin.2 005.05.010

Bouvatier V, López-villavicencio A, Mignon V (2014) Short-run dynamics in bank credit: Assessing nonlinearities in cyclicality. Economic Modelling, 37, 127–136.

https://doi.org/10.1016/j.econmod. 2013.10.027

D, O. O. O. P (2016) Commercial Banks Credit and the Growth of Small and Medium Scale Enterprises: The Nigerian Experience, 7(6), 23–30.

https://doi.org/10.9790/5933-0706042330

Drehmann M, Sorensen S, Stringa M (2006) Integrating credit and interest rate risk: A theoretical framework and an application to banks balance sheets.

English WB (2002) Interest rate risk and bank net interest margins. BIS Quarterly Review, part 7, December 2002, (December), 67–82.

Friedman BM (1981) The Roles of Money and Credit in Macroeconomic

Analysis. NBER Working Paper Series (831).

IMF (2014) Annual Report 2014.

Garcia-escribano M, Han F (2015) Credit Expansion in Emerging Markets: Propeller of Growth?

He, et al (2016) The key factors of outstanding credit balances among revolver: a case study of a bank in China. Procedia - Procedia Computer Science, 91(Itqm), 341–350.

https://doi.org/10.1016/j.procs.201 6.07.091

Hernando I, Lo JD, Andre J (2004) The role of the financial system in the growth - inflation link: the OECD

experience, 20, 941–961.

https://doi.org/10.1016/j.ejpoleco.2 003.10.007

Bank Indonesia (2016) Memperkuat Resiliensi.

Insurance, I. D. insurance C (2015). Perekonomian dan Perbankan.

Bank Indonesia (2014) Perkembangan Ekonomi dan Kebijakan Moneter, 1– 23.

Kim D, Yu J, Hassan MK (2017) Financial Inclusion and Economic Growth in OIC Countries.

https://doi.org/10.1016/j.ribaf.2017 .07.178

Korkmaz S (2015) Impact of Bank Credits on Economic Growth and Inflation. Journal of Applied Finance and Banking, 5(1), 51.

Kraft E (2005) Does speed kill? Lending booms and their consequences in

Croatia, 29, 105–121.

https://doi.org/10.1016/j.jbankfin.2 004.06.025

Laporan Tahunan Perbankan (2014) Laporan tahunan perbankan.

Levine R., Zervos S, Levine BR (2008). Stock Markets, Banks, and Economic Growth, 88(3), 537–558.

Li, et A (2016) PT US CR. Expert Systems with Applications.

https://doi.org/10.1016/j.eswa.2016 .05.029

Lowe P (2002) BIS Working Papers Credit risk measurement and

procyclicality, (116).

Maes K (1994) Interest Rate Risk in the Belgian Banking Sector, (2), 157–179.

Mandel BR, Seydl J (2016) Credit conditions and economic growth: Recent

evidence from US banks, 147, 63–67. https://doi.org/10.1016/j.econlet.20 16.08.017

OJK (2015) Potensi Pertumbuhan Ekonomi ditinjau dari Penyaluran Kredit Perbankan Kepada Sektor Prioritas Ekonomi Pemerintah.

OJK (2016) Survei Nasional Literasi dan Inklusi Keuangan.

Rob J (1997) Financial Development and Economic Growth: Views and

Agenda, XXXV(June), 688–726.

Ronald MK (2014) Money and Capital in Economic Development by Ronald I . McKinnon Review by: W . W. Rostow The American Political

Science Review , Vol . 68 , No . 4 ( Dec ., 1974 ), pp . 1822-1824

Published by: American Political Science Association American Political, 68(4), 1822–1824.

Shin S, Hook S, Ibrahim MH (2016) Credit expansion and financial stability in Malaysia. Economic Modelling,

(October 2015), 1–12.

https://doi.org/10.1016/j.econmod. 2016.10.013

Stiglitz JE (2016) The Theori of Credit and macro-Economic Stability.

Thierry B, Jun Z, Doumbe D (2016) Causality Relationship between Bank Credit and Economic Growth: Evidence from a Time Series Analysis on a Vector Error Correction

368

Discussion and feedback