Biased Behavior and Stock Investment Decisions of Investors in Bali, Indonesia

on

Agus Wahyudi Salasa Gama, Biased Behavior and Stock Investment… 123

P-ISSN: 1978-2853

E-ISSN: 2302-8890

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 17 No. 2, Agustus (2023), 123-135

Biased Behavior and Stock Investment Decisions of

Investors in Bali, Indonesia

Agus Wahyudi Salasa Gama1), Ni Putu Yeni Astiti2),

Ni Wayan Eka Mitariani3)

1,2,3Universitas Mahasaraswati Denpasar

Email: salasa.gama@unmas.ac.id

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2023.v17.i02.p02

ABSTRACT

Investment decisions are often affected by irrational behavioral factors that cause improper logical analysis. Herding and overconfidence are two behaviors that lead to biased decision-making, specifically regarding investment. Therefore, this study aimed to test the effect of herding and overconfidence on investment decisions moderated by financial knowledge and attitude. Using a sample of 267 stock investors, the test was conducted with PLS-SEM. The results showed that overconfidence positively influences individuals' investment decisions, while herding has no effect. Financial knowledge and attitude were found not to moderate this effect but could act as predictor variables with a significant positive impact on investment decisions.

Keywords: Herding; Financial Knowledge; Financial Attitude; Financial Behavior Overconfidence.

INTRODUCTION

In the 1980s, a new concept emerged that financial behavior combines financial knowledge with psychology (Kumar & Goyal, 2015), which determines individuals' investment decisions. Prospect theory developed by Kahneman and Tversky (1979) explained that individuals' investment decisions are highly determined by biased behavior. This behavior determines whether investors make decisions as rational or irrational individuals. The investors’ psychology and emotions often trigger speculations about their overconfidence in something. This overconfidence is caused by the effect of contagion and mutual imitation among investors, increasing the speculation bubble generated by herding (Setiawan et al., 2018). Investors demonstrate herding through overconfidence in information validated by many people rather than their judgment. This is fueled by the perception that investment decisions taken by the majority cannot be wrong. Aristiwati & Hidayatullah (2021) observed the behavior of gold investors and stated that herding does not affect their decisions. The study concluded that investors could easily obtain information through the technology available today, enhancing rational decision-making. Similarly, Bakar & Yi (2016) examined investors' behavior in the Malaysian capital market and found that herding does not affect investment decisions, This is because investors feel it is not appropriate to invest only by following the decisions of many people.

Investment decisions made based on overconfidence in predictions and information

could cause knowledge overestimation and risk underestimation (Setiawan, et al., 2018). Overconfidence is a form of biased behavior that leads investors to make irrational decisions. According to previous studies, this overconfidence positively affects investment decisions (Aristiwati & Hidayatullah, 2021; Budiarto & Susanti, 2017; Budiman et al., 2021; Dewi & Krisnawati, 2021). This contradicts other findings that overconfidence does not affect investment decisions (Afriani & Halmawati, 2019; Bakar & Yi, 2016; Bodnaruk & Simonov, 2015; Lathifatunnisa & Wahyuni, 2021). To explain this finding, Afriani & Halmawati (2019) stated that investors lack sufficient investment knowledge, making them less confident in making decisions. Investors' decision-making behavior is determined by their financial knowledge and attitude (Sandi et al., 2020). Financial knowledge refers to individuals' understanding and mastery of financial concepts (Aditya & Azmansyah, 2021). Better knowledge leads to improved financial management behavior, facilitating rational decisionmaking. Similarly, attitude shapes investors' approach to financial management, making the decisions made more productive (Aditya & Azmansyah, 2021).

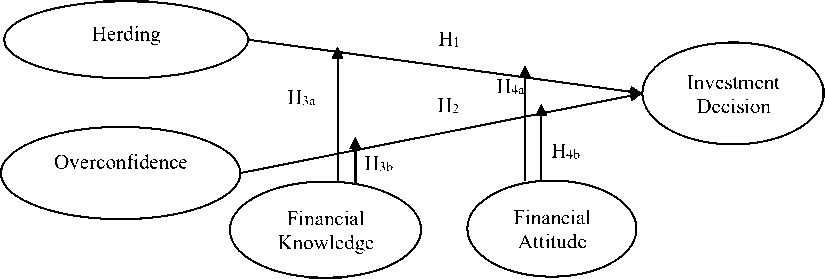

This study was motivated by the inconsistencies in several findings regarding the relationship between herding and overconfidence in investment decisions. The existence of inconsistencies indicates the presence of other factors that affect this relationship. Therefore, this study aimed to examine the role of financial knowledge and attitude in the effect of biased behavior on investment decisions. Theories in financial behavior provided clues that individuals' behavior results from their knowledge and attitude (Ozmete & Hira, 2011). Therefore, biased behavior in making investment decisions varies depending on individuals' financial knowledge and attitude. This study used financial knowledge and attitude as moderation variables of herding and overconfidence. Previous studies rarely examined the effect of individuals' financial knowledge and attitude on herding and overconfidence in investment decisions. According to Kumar & Goyal (2015), individuals' investment decisions are significantly affected by their behavior. The concept of financial literacy presented by Kaiser et al. (2015) implies that financial behavior changes with variations in individuals' knowledge and attitude toward finance. Therefore, this study aimed to examine the moderation of financial knowledge and attitude on the effect of herding and overconfidence on investment decisions. The findings are expected to provide theoretical and practical contributions. Theoretically, this study confirms the prospect theory that investment decisions are determined by individuals' behavior toward external factors. Furthermore, it aimed to prove that negative behaviors such as herding and overconfidence could be reduced with financial behavior and attitude. Regarding practical contribution, the findings could be used by authorities to understand the characteristics of investors, specifically those in Bali. This understanding could help determine investors’ education needs to anticipate and overcome investment problems.

Herd behavior is a behavior shown by an investor by imitating the decisions taken by other investors (Demirer & Kutan, 2006). Decision making becomes irrational because an investor's decision depends on the decisions of other investors (Kumar & Goyal, 2015). Investors feel more secure when following the actions decided by other investors (Ah Mand et al., 2021). Herding can occur because investors feel they do not have complete information about market conditions, so they will feel safe if they follow other investors. Herding behavior is divided into two types, namely intentional herding and unintentional herding (Setiawan et al., 2018). Intentional herding is the behavior of investors who deliberately follow the actions of other investors by ignoring the information they have obtained. Intentional herding is very likely to occur when reliable information is not widely available in the market. Unintentional

herding is the behavior of a group of investors who make the same decision due to obtaining the same information. In unintentional herding, investors acknowledge that the information is reliable. In general, herding can be described as irrational investor behavior in making a decision. The investor's decision is not based on reliable market information but simply follows the behavior of other investors. This is the behavior of investors seeking a sense of security because of doubts about their own ability to make decisions and a fear of losing momentum if they do not follow the behavior of most investors.

Herding is a biased financial behavior that shows a tendency for individuals to follow other investors’ decisions. Investors rely on collective information obtained to make decisions (Zahera & Bansal, 2018). In this regard, Rehan et al. (2021) found that herding could positively affect decision-making in the Pakistani stock market. This finding supports Malik et al. (2021) that herding affects investment decisions. Furthermore, a previous study showed that investors in the real estate sector in Pakistan quickly respond to majority opinions in determining their decisions. Herding could also be caused by a lack of information available to investors when making decisions. As a result, following majority decisions is the safest way when investors lack information or have doubts about making decisions. This shows that herding is a way for investors to protect themselves from losses (Afriani & Halmawati, 2019). Investors with herding behavior can have more confidence that the information is valid if all investors make the same decision on the information. Based on these observations, the following hypothesis was proposed:

H1: Herding positively affects investment decisions

Overconfidence is a condition where an investor has excessive optimism for an investment. An investor feels that the information he currently has is sufficient to make a profitable decision (Zahera & Bansal, 2018). The impact of overconfidence is that investors will overestimate their ability to evaluate companies as potential investments, tend to overtrade, and underestimate risks (Afriani & Halmawati, 2019). Investor behavior that overestimates will tend to distort the investment portfolio because the investors are overconfident and ignore the impact of other factors on investment (Rehan et al., 2021). Overconfidence behavior arises when someone believes that their decision is the best decision, even though in reality it is an irrational one (Malik et al., 2021). Overconfidence can occur because investors feel they have a high understanding of managing investment portfolios and become overconfident in themselves. Someone who is overconfident will overestimate their knowledge, underestimate risks, and overly control everything (Shukla, 2021).

Overconfident investors tend to believe that their decisions would produce the expected results (Setiawan et al., 2021). Malik et al. (2021) stated that overconfidence causes individuals to engage in high-volume trading transactions more frequently. Investors with high confidence make courageous decisions due to a belief that their investment would yield significant profits. In this process, this overconfidence causes investors to ignore the risks that may arise from their choices. This belief arises because investors feel very confident in their abilities and knowledge (Aristiwati & Hidayatullah, 2021). According to Budiarto & Susanti (2017) study, overconfidence could positively affect decision-making. This is because investors with high overconfidence are more daring in making decisions. Therefore, the following hypothesis was formulated:

H2: Overconfidence positively affects investment decisions

Financial knowledge refers to individuals' understanding of financial concepts and facts needed for effective management and decision-making (Aditya & Azmansyah, 2021). Financial

knowledge is a part of financial literacy and can have an impact on decision making and one's financial behavior (Lusardi, 2019). Financial knowledge is not equivalent to financial literacy but is part of it. Financial knowledge is human capital that is specific to personal finance and can assist in making financial decisions (Huston, 2010). A person is said to have good financial knowledge if he has the ability and confidence to implement this knowledge in making financial decisions (Potrich et al., 2016). A person's financial knowledge will increase if he is active in educating himself about finance (Kaiser et al., 2015; Lusardi, 2019). Education can be obtained through education, including formal education such as schools, seminars, and training, and nonformal education such as from parents, friends, work experience, and personal experience (Sandi et al., 2020). The experiences gained are actively integrated into previous knowledge, which can also increase one's financial knowledge in the future (Ademola et al., 2019).

Herdjiono et al. (2016) stated that individuals with high financial knowledge exhibit good behavior, and vice versa. Individuals use their knowledge to make the right decisions by properly managing resources. In this context, financial knowledge determines individuals' behavior and affects decision-making (Rai et al., 2019). This knowledge helps investors understand and evaluate information to make the right decisions. Investors with high knowledge obtain and maintain more information compared to those with low knowledge (Cruijsen et al., 2021). This statement implies a strong relationship between financial knowledge and behavior as well as investment decisions. Biased decision-making behavior cannot emerge when individuals have a good cognitive understanding (West, 2012). When making an investment decision, people with good knowledge will be able to manage information effectively to lessen herding behavior. People with high financial knowledge prefer to think logically and in accordance with financial principles, which reduces their tendency to overconfidence while making investment decisions. Based on these explanations, the following hypotheses were proposed:

H3a: Financial knowledge moderates the effect of herding on investment decisions

H3b: Financial knowledge moderates the effect of overconfidence on investment decisions

Sandi et al. (2020) define a financial attitude as a person's state of mind, opinion, and assessment of his personal finances, which are all applied to their attitude. Financial attitude is a form of human psychology that is manifested when an individual evaluates financial practices by producing different levels of acceptance of these practices, namely agreeing or disagreeing (Talwar et al., 2021). Paluri & Mehra (2016) identified four groups of Indian women's financial attitudes. The group consists of the financially prudent, conservative, greedy, and unsure. Based on the results of his research, of a total sample of 177 Indian women, only one third did not choose financial products. The most popular financial product is deposits. The selection of deposit products as a financial asset shows a conservative attitude because they tend to choose security. Financial attitude can be expressed as a personal tendency towards financial problems. The ability to plan for the future by managing savings accounts is an important activity of financial attitude (Rai et al., 2019).

Financial attitude is the application of financial principles to generate and maintain value by making the right decisions and managing resources. This attitude could also be defined as individuals' financial mindset, opinion, and evaluation (Aditya & Azmansyah, 2021) that shapes the tendency to spend, save, hoard, and dispose of the money. Therefore, poor financial management and attitude practices could trigger financial problems and behavior (Sandi et al., 2020). Many studies showed that financial attitude is an important determinant of literacy (Rai et al., 2019). Financial attitude is a fundamental determinant of individuals' evaluation of

financial activities (Talwar et al., 2021), which determine the decisions made. Individuals with a good financial attitude manage their expenses and income well for their current and future well-being (Herdjiono et al., 2016). Therefore, unfavorable behaviors could be avoided by nurturing a good attitude in considering every decision to ensure future financial security. Individuals who have a strong financial attitude will reduce the possibility of simply following market trends. A strong financial attitude can also suppress the emergence of overconfidence in a person, because they are aware of their strengths and weaknesses in making decisions and will avoid unfavorable behaviors. Based on these considerations, the following hypotheses were proposed:

H4a: Financial attitude moderates the effect of herding on investment decisions

H4b: Financial attitude moderates the effect of overconfidence on investment decisions

Figure 1. Conceptual Framework

Source: development of previous research studies

METHOD

Table 1. Variables and Indicators

|

Concept |

Indicator |

Items |

Source |

|

Investment Decisions |

Love investment in the stock, Able to analyze stock liquidity, and Perception of risk |

3 |

(Putri & Rahyuda, 2017a) |

|

Herding This is the behavior of investors who bandwagon in making investment decisions. |

Make decisions based on a majority vote, and Lack of decisions made individually. |

4 |

(Setiawan et al., 2018) |

|

Overconfidence This is the behavior of investors with excessive confidence in making decisions. |

Overestimate the decisions taken, and Underestimate the decisions of other investors |

4 |

(Dewi & Krisnawati, 2021) |

|

Financial Knowledge Is the knowledge to manage finance in making financial decisions. |

General knowledge of finance, Savings, Insurance, and Investment |

4 |

(Herdjiono et al., 2016) |

|

Financial Attitude Is the application of financial principles to create and maintain value by making the right decisions and managing resources. |

Obsession, Power, Effort, Inadequacy, Retention, and Security |

6 |

(Aditya & Azmansyah, 2021) |

Source: Aditya & Azmansyah, 2021; Dewi & Krisnawati, 2021; Herdjiono et al., 2016; Putri & Rahyuda, 2017;

Y. C. Setiawan et al., 2018

This study was conducted on stock investors in Bali. Data from the Indonesia Stock Exchange indicated that Bali had 86,507 stock investors as of 2022. The Isaac and Michael formula with a 10% error rate was used to determine the study sample, resulting in 267 investors. The study used financial knowledge and attitude as moderation variables to test their effect on herding and overconfidence in investment decisions. The conceptual model was analyzed using PLS-SEM with the assistance of SmartPLS 3.0 software. The test involved examining the direct effect of herding and overconfidence on investment decisions. Furthermore, a moderation analysis technique was used to determine the moderation effect of financial knowledge and attitude variables.

RESULTS AND DISCUSSION

The data were tested with PLS-SEM by first evaluating the model feasibility using convergent validity, discriminant validity, and composite reliability. The outer loading values of the indicators in each variable in the convergent validity test exceeded 0.5, meaning they were valid. Similarly, the resulting AVE values exceeded 0.5, fulfilling the requirements for convergent validity.

Table 2. Convergent validity test

|

Indicators |

Herd(X1) |

Over(X2) |

FK (M1) |

FA (M2) |

ID (Y) |

|

X1.1 |

0.951 | ||||

|

X1.2 |

0.972 | ||||

|

X1.3 |

0.959 | ||||

|

X1.4 |

0.976 | ||||

|

X2.1 |

0.944 | ||||

|

X2.2 |

0.947 | ||||

|

X2.3 |

0.759 | ||||

|

X2.4 |

0.795 | ||||

|

M1.1 |

0.905 | ||||

|

M1.2 |

0.857 | ||||

|

M1.3 |

0.901 | ||||

|

M1.4 |

0.840 | ||||

|

M2.1 |

0.890 | ||||

|

M2.2 |

0.923 | ||||

|

M2.3 |

0.927 | ||||

|

M2.4 |

0.871 | ||||

|

M2.5 |

0.888 | ||||

|

M2.6 |

0.920 | ||||

|

Y1.1 |

0.861 | ||||

|

Y1.2 |

0.926 | ||||

|

Y1.3 |

0.804 | ||||

|

Y1.4 |

0.906 |

Source: processed data using Smart PLS 3

The discriminant validity test using the Fornell-Larcker Criterion in Table 3 showed that the correlation between each latent variable is smaller than the AVE square root of the compared variable. The results indicate that the model fulfilled the criteria for discriminant validity. Therefore, all endogenous variables are feasible for use in predicting exogenous variables.

|

Table 3. AVE, √AVE, Correlation among latent variables | ||||||||||||

|

Variab les |

Comp osite Reliab ility |

AVE |

√AVE |

Correlation among latent variables | ||||||||

|

FA |

FK |

Herd |

ID |

Over |

Herd *FK |

Herd *FA |

Over *FK |

Over *FA | ||||

|

FA |

0.964 |

0.816 |

0.904 |

1.000 | ||||||||

|

FK |

0.930 |

0.768 |

0.876 |

0.425 |

1.000 | |||||||

|

Herd |

0.982 |

0.930 |

0.964 |

0.049 |

0.043 |

1.000 | ||||||

|

ID |

0.929 |

0.766 |

0.875 |

0.320 |

0.297 |

0.078 |

1.000 | |||||

|

Over |

0.922 |

0.749 |

0.865 |

0.289 |

0.242 |

0.093 |

0.218 |

1.000 | ||||

|

X1*M1 |

1.000 |

1.000 |

1.000 |

0.020 |

0.084 |

0.138 |

0.029 |

0.062 |

1.000 | |||

|

X1*M2 |

1.000 |

1.000 |

1.000 |

0.078 |

0.018 |

0.047 |

0.080 |

0.169 |

0.402 |

1.000 | ||

|

X2*M1 |

1.000 |

1.000 |

1.000 |

- |

- |

0.049 |

- |

- |

0.081 |

0.135 |

1.000 | |

|

0.261 |

0.305 |

0.216 |

0.050 | |||||||||

|

X2*M2 |

1.000 |

1.000 |

1.000 |

- |

- |

0.155 |

- |

- |

0.155 |

- |

0.533 |

1.000 |

|

0.298 |

0.268 |

0.244 |

0.137 |

0.024 | ||||||||

Source: processed data using Smart PLS 3

Description: FA= Financial Attitude; FK= Financial Knowledge; Herd= Herding; Over= Overconfidence; ID= Investment Decisions; X1*M1= Interaction of Herding with Financial Knowledge; X1*M2= Interaction of Herding with Financial Attitude; X2*M1= Interaction of Overconfidence with Financial Knowledge; X2*M2= Interaction o Overcon idence with Financial Attitude

Table 3 shows that the composite reliability values of each latent variable exceed 0.7, meaning all the indicators are reliable. The overall test indicates that the indicators have good feasibility values and could measure the variables in the model. Furthermore, the R2 value is 0.177, meaning that all the variables used explain 17.7% of investment decisions. The remaining 82.3% is explained by other variables outside the model.

Table 4. Test for Exogenous and Moderation Variables on Endogenous Variables

|

Variables |

Coefficients |

p-values |

Descriptions |

|

Herding_(X1) ÷ Investment Decision_(Y) |

-0.095 |

0.141 |

Non Significant |

|

Overconfidence_(X2) ÷ Investment Decision_(Y) |

0.113 |

0.041 |

Significant |

|

Financial Knowledge_(M1) ÷ Investment Decision_(Y) |

0.157 |

0.029 |

Significant |

|

Financial Attitude_(M2) ÷ Investment Decision_(Y) |

0.177 |

0.015 |

Significant |

|

X1*M1 ÷ Investment Decision_(Y) |

0.055 |

0.539 |

Non Significant |

|

X1*M2 ÷ Investment Decision_(Y) |

0.036 |

0.650 |

Non Significant |

|

X2*M1 ÷ Investment Decision_(Y) |

-0.065 |

0.293 |

Non Significant |

|

X2*M2 ÷ Investment Decision_(Y) |

-0.078 |

0.232 |

Non Significant |

Source: processed data using Smart PLS 3

Table 4 shows that H1 is rejected, which implies no significant effect of herding on investment decisions (p-value = 0.141). Meanwhile, H2 is accepted, meaning that overconfidence positively affects investment decisions (p-value = 0.041). H3a and H3b were rejected, meaning that the moderation effect of financial knowledge on herding and overconfidence toward investment decisions is insignificant (p-value = 0.539 and 0.293). Similarly, the moderation effect of financial attitude on herding and overconfidence toward investment decisions is insignificant (p-value = 0.650 and 0.232), contradicting H4a and H4b. The results also showed that financial knowledge and attitude only act as predictor variables, as seen from their partial effect on investment decisions (p-value = 0.029 and 0.015).

The findings indicated that herding does not significantly affect investment decisions, contradicting Malik et al. (2021) and Rehan et al. (2021). However, these findings support Aristiwati & Hidayatullah (2021) and Bakar & Yi (2016) that herding does not significantly affect investment decisions. The study showed that investors use their logic rationally to utilize information in making decisions. This is facilitated by information accessibility, which helps investors understand market conditions and select their preferred investment alternatives (Demirer & Kutan, 2006). Additionally, technological advancements and information openness support investor rationality in making decisions. Regulators are very concerned about individuals’ interests and needs regarding viable investments in capital markets. These regulations aim to protect investors, making them comfortable and confident in their investment decisions. Bakar & Yi (2016) found that herding is more common among institutional than individual investors. Institutional investors seek to protect their credibility by avoiding losses in making investment decisions. Therefore, these investors follow market movements to secure their positions in the market.

The findings indicated that overconfidence positively affects investment decisions, supporting Aristiwati & Hidayatullah (2021), Budiarto & Susanti (2017), Budiman et al. (2021), and Dewi & Krisnawati (2021). This implies that overconfidence affects how investors make their decisions. Investors with high overconfidence tend to take higher risks in their decisions, while those with low overconfidence are generally cautious (Budiarto & Susanti, 2017). Overconfidence causes individuals to underestimate risks believing their predictions are very accurate (Setiawan, et al., 2018). According to Aristiwati & Hidayatullah (2021), high confidence in information management skills sometimes causes investors to overlook potential risks. Investors who overestimate their knowledge of certain information have high confidence in making investment decisions.

The findings of this study state that financial knowledge cannot moderate the effect of herding and overconfidence on investment decisions. Financial knowledge does not moderate herding behavior, which can be caused by investors' trust in available information. Although financial knowledge fosters rationality, investors could ignore private information and follow the market (Demirer & Kutan, 2006).

High overconfidence causes investors to overestimate their knowledge and underestimate the risks (Ellen & Yuyun, 2018). This makes investors certain about their investment decisions and expects high returns (Bakar & Yi, 2016). In this regard, Huston (2010), Lusardi (2019), and Nair (2022) stated that confidence disregarding risks contradicts the financial knowledge concept. Financial knowledge is individuals' understanding of financial concepts for effective management and decision-making (Aditya & Azmansyah, 2021).

Investors should consider psychological aspects in making decisions based on information, emotions, and other social factors (Shukla, 2021). According to West (2012),

financial education programs aimed at improving knowledge have an insignificant role in minimizing biased behavior. Investors with financial knowledge may still exercise herding and overconfidence because this behavior is also strongly affected by information, emotions, and other social factors. As a result, financial knowledge may not necessarily moderate such biased behavior.

This study found that financial attitude cannot moderate herding and overconfidence in investment decisions. Individuals have different levels of literacy, bias, and emotions, which affect their investment decision-making process to limit or avoid discomfort (Alsemgeest, 2015). Financial attitude developed from literacy has an insignificant role in making decisions. The complexity of financial instruments shows that attitude alone cannot intervene in investors' management behavior (West, 2012). Investment decisions should match market reality and expectations to give investors more confidence (Demirer & Kutan, 2006). This market information brings investors' expectations closer to the actual results of their decisions. Therefore, financial attitude cannot moderate herding and overconfidence in investment decisions due to asymmetric information, limitations in understanding, and inadequate skills (Willis, 2008). In this case, investors should process knowledge to avoid making biased decisions based on asymmetric information. Moreover, applying knowledge shown in attitude cannot result in similar decisions among investors due to differences in understanding and skills in performing calculations. Such conditions make financial attitude irrelevant in weakening herding and overconfidence.

The results showed that financial knowledge positively affects investment decisions, supporting Potrich et al. (2016). In line with this, Rai et al. (2019) and Sharma & Joshi (2015) stated that increasing financial knowledge produces better investment decisions. Individuals with high knowledge understand financial concepts better and use money wisely to obtain economic benefits. These individuals make better financial decisions that require knowledge in analyzing and selecting investment assets. Therefore, financial knowledge is obtained when individuals have adequate education (Kaiser et al., 2015; Lusardi, 2019) or regularly attend training sessions (Bodnaruk & Simonov, 2015).

The findings also showed that financial attitude is a predictor variable that positively affects investment decisions. These findings suggest that a better financial attitude increases the individuals’ likelihood to invest. Previous studies also showed that financial attitude positively affects investment decisions (Herdjiono et al., 2016; Rai et al., 2019). Investors’ decisions are largely determined by their attitude toward various investment alternatives. Furthermore, investors are guided by their attitude in evaluating the acceptable outcomes of financial practices (Talwar et al., 2021). Decisions are made based on considerations of future investment prospects. This means that investors make decisions only when the investment provides returns commensurate with the capital.

The findings of this research are in line with behavioral financial theory, which states that financial behavior will be determined by one's knowledge and attitude towards finance. This behavior in this study is shown in financial decisions. High knowledge and strong financial attitudes will tend to encourage individuals to make investments. In behavioral theory, it is also explained that a person's behavior is also driven by their nature and emotions. In this study, it is proven that individuals with a high level of overconfidence tend to invest more than individuals with a low level of overconfidence. These results also provide a practical view, especially for investors in Bali, that investors in Bali will decide to invest if they have high financial knowledge and attitudes and have high self-confidence. The results of the study show

that herding has no impact on investment decisions, indicating that investors in Bali do not want to just go along with the investment without having financial knowledge, financial attitudes, and high self-confidence.

CONCLUSION

This study found that biased behavior as well as financial knowledge and attitude affect investment decisions. The results showed that overconfidence is a form of biased behavior that plays a role in determining investment decisions. Investors have high confidence in all information obtained and promote courage in making decisions. This ease in the accessibility of unlimited information is facilitated by technological developments. However, the ability to process information is highly needed to make accurate decisions. Overconfidence in one piece of information by ignoring risk factors could result in bias in investment decisions. Therefore, investors should take this condition seriously to avoid losses. Different emotions and personalities contribute to the rationalization of investors' decision-making. Psychological factors should also be considered in individuals' financial management due to their role in decision-making.

Financial knowledge and attitude cannot weaken biased behavior such as herding and overconfidence. Biased behavior as well as knowledge and attitude do not interact in shaping investment decisions, though each factor has an individual effect. Making investment decisions requires related information. According to the findings, knowledge, and attitude are insignificant in reducing biased behavior in making decisions, which are also affected by personal factors.

Financial knowledge and attitude cannot reduce herding behavior or overconfidence but still contribute to decision-making. Investors could increase their financial knowledge through education to process information properly and generate profits. Similarly, financial attitude is formed from education which helps individuals avoid losses. Individuals with good attitudes know how to act when facing financial problems.

This study focused on making investment decisions by considering biased behavior as well as financial knowledge and attitude. It did not explore the performance impact of investment decisions resulting from herding, overconfidence, knowledge, and attitude. Therefore, future studies should evaluate these results because decisions could produce profits and losses. When biased behavior such as herding and overconfidence results in profits, it should be considered favorable. Additionally, future studies could examine other psychological effects of biased behavior as well as financial knowledge and attitude to obtain a holistic overview of financial behavior.

REFERENCES

Ademola, S. A., Musa, A. S., & Innocent, I. O. (2019). Moderating Effect of Risk Perception on Financial Knowledge, Literacy and Investment Decision. American International Journal of Economics and Finance Research, 1(1), 34–44.

https://doi.org/10.46545/aijefr.v1i1.60

Aditya, D., & Azmansyah. (2021). Pengaruh Financial Knowledge, Financial Attitude, dan Income terhadap Financial Behavior pada Usaha Mikro kecil dan Menengah di Kecamatan

Marpoyan Damai Pekanbaru. Jurnal Ekonomi KIAT, 32(2), 116.

https://journal.uir.ac.id/index.php/kiat

Afriani, D., & Halmawati, H. (2019). Pengaruh Cognitive Dissonance Bias, Overconfidence Bias Dan Herding Bias Terhadap Pengambilan Keputusan Investasi. Jurnal Eksplorasi Akuntansi, 1(4), 1650–1665. https://doi.org/10.24036/jea.v1i4.168

Ah Mand, A., Janor, H., Abdul Rahim, R., & Sarmidi, T. (2021). Herding behavior and stock market conditions. PSU Research Review. https://doi.org/10.1108/prr-10-2020-0033

Alsemgeest, L. (2015). Arguments for and against financial literacy education: Where to go from here? International Journal of Consumer Studies, 39(2), 155–161.

https://doi.org/10.1111/ijcs.12163

Aristiwati, I. N., & Hidayatullah, S. K. (2021). Pengaruh Herding Dan Overconfidence Terhadap Keputusan Investasi (Studi Pada Nasabah Emas Kantor Pegadaian Ungaran). Among Makarti, 14(1), 15–30. https://doi.org/10.52353/ama.v14i1.202

Bakar, S., & Yi, A. N. C. (2016). The Impact of Psychological Factors on Investors’ Decision Making in Malaysian Stock Market: A Case of Klang Valley and Pahang. Procedia Economics and Finance, 35(October 2015), 319–328. https://doi.org/10.1016/s2212-5671(16)00040-x

Bodnaruk, A., & Simonov, A. (2015). Do financial experts make better investment decisions? Journal of Financial Intermediation, 24(4), 514–536.

https://doi.org/10.1016/j.jfi.2014.09.001

Budiarto, A., & Susanti. (2017). Pengaruh Financial Literacy, Overconfidence, Regret Aversion Bias, dan Risk Tolerance terhadap Keputusan Investasi (Studi pada investor PT. Sucorinvest Central Gani Galeri Investasi BEI Universitas Negeri Surabaya). Jurnal Ilmu Manajemen (JIM), 5(2), 1–9.

Budiman, I., Maulana, Z., & Kamal, S. (2021). Pengaruh Literacy Financial Experienced Regret dan Overconfidence Terhadap Pengambilan Keputusan Investasi Di Pasar Modal. 4(2), 321–330.

Demirer, R., & Kutan, A. M. (2006). Does herding behavior exist in Chinese stock markets? Journal of International Financial Markets Institutions and Money, 16(2), 123–142. https://doi.org/10.1016/j.intfin.2005.01.002

Dewi, N. P. P. K., & Krisnawati, A. (2021). Pengaruh Financial Literacy, Risk Tolerance Dan Overconfidence Terhadap Pengambilan Keputusan Investasi Pada Usia Produktif Di Kota Bandung. Jurnal Mitra Manajemen, 5(10), 718–735. http://e-

jurnalmitramanajemen.com/index.php/jmm/article/view/578/509

Ellen, P., & Yuyun, I. (2018). Pengaruh Financial Literacy, Illusion of Control, Overconfidence, Risk Tolerance, dan Risk Perception Terhadap Keputusan Investasi Pada Mahasiswa di Kota Surabaya. Jurnal Ilmu Manajemen (JIM), 6(4), 424–434.

Herdjiono, I., Damanik, L. A., & Musamus, U. (2016). Pengaruh Financial Attitude , Financial Knowledge , Parental Income Terhadap Financial Management. Jurnal Manajemen Teori Dan Terapan, 3, 226–241.

Huston, S. J. (2010). Measuring Financial Literacy. Journal of Consumer Affairs, 44(2), 296– 316. https://doi.org/10.1111/j.1745-6606.2010.01170.x

Kaiser, T., Lusardi, A., Menkhoff, L., & Urban, C. J. (2015). Financial Education Affects Financial Knowledge And Downstream Behaviors. NBER Working Paper Series Financial, April, 49–58.

Kumar, S., & Goyal, N. (2015). Behavioural biases in investment decision making – a

systematic literature review. Qualitative Research in Financial Markets, 7(1), 88–108. https://doi.org/10.1108/QRFM-07-2014-0022

Lathifatunnisa, & Wahyuni, A. N. (2021). Pengaruh Faktor Demografi, Risk Tolerance Dan Overconfidence Terhadap Pengambilan Keputusan Investasi Mahasiswa Di Kota Pekalongan. Jurnal Bisnis Terapan, 05(2), 203–216.

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1–8.

https://doi.org/10.1186/s41937-019-0027-5

Malik, M. A. S., Zafar, M., Ullah, S., & Ullah, A. (2021). Role of Behavioral Biases in Real Estate Prices in Pakistan. Real Estate Management and Valuation, 29(1), 41–53. https://doi.org/10.2478/remav-2021-0005

Nair, G. K. (2022). Dynamics of Locus of Control, Financial Knowledge, Financial Behaviour and Financial Position: An Empirical Study. EMAJ: Emerging Markets Journal, 12(1), 58–66. https://doi.org/10.5195/emaj.2022.245

Ozmete, E., & Hira, T. (2011). Conceptual analysis of behavioral theories/models: Application to financial behavior. European Journal of Social Sciences, 18(3), 386–404.

Paluri, R. A., & Mehra, S. (2016). Financial attitude based segmentation of women in India: an exploratory study. International Journal of Bank Marketing, 34(5), 670–689. https://doi.org/10.1108/IJBM-05-2015-0073

Potrich, A. C. G., Vieira, K. M., & Mendes-Da-Silva, W. (2016). Development of a financial literacy model for university students. Management Research Review, 39(3), 356–376. https://doi.org/10.1108/MRR-06-2014-0143

Putri, N. M. D. R., & Rahyuda, H. (2017). Pengaruh Tingkat Financial Literacy Dan Faktor Sosiodemografi Terhadap Perilaku Keputusan Investasi Individu. E-Jurnal Ekonomi Dan Bisnis Universitass Udayana, 9, 3407–3434.

Rai, K., Dua, S., & Yadav, M. (2019). Association of Financial Attitude, Financial Behaviour and Financial Knowledge Towards Financial Literacy: A Structural Equation Modeling Approach. FIIB Business Review, 8(1), 51–60.

https://doi.org/10.1177/2319714519826651

Rehan, M., Alvi, J., Javed, L., & Saleem, B. (2021). Impact of Behavioral Factors in Making Investment Decisions and Performance: Evidence from Pakistan Stock Exchange. Market Forces, 16(1), 22. https://doi.org/10.51153/mf.v16i1.435

Sandi, K., Worokinasih, S., & Darmawan, A. (2020). Pengaruh Financial Knowledge dan Financial Attitude Terhadap Financial Behavior Pada Youth Entrepreneur Kota Malang. Jurnal Administrasi Bisnis, Ekosistem Strat p, 140.

Setiawan, B., Nugraha, D. P., Irawan, A., Nathan, R. J., & Zoltan, Z. (2021). User innovativeness and fintech adoption in indonesia. Journal of Open Innovation: Technology Market and Complexity, 7(3), 1–18. https://doi.org/10.3390/joitmc7030188

Setiawan, Y. C., Atahau, A. D. R., & Robiyanto, R. (2018). Cognitive Dissonance Bias, Overconfidence Bias dan Herding Bias dalam Pengambilan Keputusan Investasi Saham. AFRE (Accounting and Financial Review), 1(1), 17–25.

https://doi.org/10.26905/afr.v1i1.1745

Sharma, A., & Joshi, B. (2015). Finance Financial Literacy of Women and its Effect on Their Investment Choice Decision CA Anupama Sharma Dr . Bhavesh Joshi ( Research Scholar ), CA , Associate Professor , HOD ( F ) SBM , Noida International University Greater Noida , UP Professor & Guid. Global Journal For Research Analysis, 7, 190–192.

Shukla, A. (2021). Behavioural Biases and its Implications on Investment Decision-Making: A Literature Review. PalArch’s Journal of Archaeology of Egypt/Egyptology, 18(10), 311– 319. https://www.archives.palarch.nl/index.php/jae/article/view/9775

Talwar, M., Talwar, S., Kaur, P., Tripathy, N., & Dhir, A. (2021). Has financial attitude impacted the trading activity of retail investors during the COVID-19 pandemic? Journal of Retailing and Consumer Services, 58(September 2020), 102341.

https://doi.org/10.1016/j.jretconser.2020.102341

van der Cruijsen, C., de Haan, J., & Roerink, R. (2021). Financial knowledge and trust in financial institutions. Journal of Consumer Affairs, 55(2), 680–714.

https://doi.org/10.1111/joca.12363

West, J. (2012). Financial Literacy Education and Behaviour Unhinged : Combating Bias and Poor Product Design. International Journal of Customer Studies, 36(5), 523–530.

Willis, L. E. (2008). Legal Scholarship Repository Against Financial Literacy Education. Faculty Scholarship, 1–57.

Zahera, S. A., & Bansal, R. (2018). Do investors exhibit behavioral biases in investment decision making? A systematic review. Qualitative Research in Financial Markets, 10(2), 210–251. https://doi.org/10.1108/QRFM-04-2017-0028

Discussion and feedback