Countercyclical, COVID-19, and Financial Distress of Rural Bank Setting the Agenda for the Post Covid-19’s Stimulus

on

Putu Vera Wulandari, Countercyclical, COVID-19, dan Financial Distress BPR... 293

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 16 No. 2, Agustus (2022), 293-309

Countercyclical, COVID-19, and Financial Distress of Rural Bank

Setting the Agenda for the Post Covid-19’s Stimulus

Putu Vera Wulandari 1)* , Gede Sri Darma 2), Luh Putu Mahyuni 3)

1,2,3 National University of Education

email: vera_wulan08@yahoo.co.id

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2022.v16.i02.p09

ABSTRACT

This study aims to determine Countercyclical, COVID-19, and Financial Distress of Rural Bank Setting the Agenda for the Post Covid-19's Stimulus. The research design used in this study is an associative design. This study uses two approaches, namely qualitative and quantitative approaches. This study, in addition to examining the effect of the independent variables (ROA, CAR, and NPL) on the dependent variable (Financial Distress) which is moderated by the moderating variable (GCG). The sample in this study was 134 rural banks in Bali. Bali was chosen because Bali was most affected by the Covid-19 pandemic because the tourism MSME sector is the main economy in Bali. The result of this study is Profitability (ROA) has a significant negative effect on Financial Distress. CAR has a significant negative effect on Financial Distress. NPL has a significant positive effect on Financial Distress. GCG is a Quasi Moderation variable. GCG strengthens the negative effect of ROA on financial distress. GCG weakens the effect of CAR on financial distress. GCG does not moderate the effect of NPL on Financial Distress.

Keyword: GCG; NPL; ROA; CAR; financial distress

Countercyclical, COVID-19, dan Financial Distress BPR untuk Penetapan Agenda

Stimulus Pasca Covid-19

ABSTRAK

Pandemi Covid-19 membuat perekonomian terpuruk. UMKM gagal membayar karena penurunan daya beli masyarakat, akibatnya Bank Perkreditan Rakyat (BPR- Bank Pengkreditan Rakyat) yang menjadi pemberi kredit utama bagi UMKM terancam kesulitan keuangan. Penelitian ini bertujuan untuk mengetahui Countercyclical, COVID-19, dan Financial Distress BPR Menetapkan Agenda Stimulus Pasca Covid-19. Desain penelitian yang digunakan dalam penelitian ini adalah desain asosiatif. Penelitian ini menggunakan dua pendekatan, yaitu pendekatan kualitatif dan kuantitatif. Penelitian ini selain menguji pengaruh variabel independen (ROA, CAR, dan NPL) terhadap variabel dependen (Financial Distress) yang dimoderasi oleh variabel moderasi (GCG). Sampel dalam penelitian ini adalah 134 BPR di Bali. Bali dipilih karena Bali paling terdampak pandemi Covid-19 karena sektor UMKM pariwisata menjadi ekonomi utama di Bali. Hasil penelitian ini adalah Profitabilitas (ROA) berpengaruh negatif signifikan terhadap Financial Distress. CAR berpengaruh negatif signifikan terhadap Financial Distress. NPL berpengaruh positif signifikan terhadap Financial Distress. GCG merupakan variabel Quasi Moderation. GCG memperkuat pengaruh negatif ROA terhadap financial distress. GCG melemahkan pengaruh CAR terhadap financial distress. GCG tidak memoderasi pengaruh NPL terhadap Financial Distress.

Kata kunci: GCG; NPL; ROA; CAR; kesulitan keuangan

INTRODUCTION

The Covid-19 pandemic has resulted in many deaths in various countries. Several countries have suppressed their budgets and some have projected deficits in fiscal policy 2020 to cover COVID-19 response spending which involves purchasing extra-medical equipment from neighboring countries and pumping monetary aid to local small and medium-sized enterprises (SMEs) (Fauzi & Paiman, 2020). Indonesia is one of the ASEAN-5 countries affected by COVID-19 in various sectors. The President of the Republic of Indonesia declared

the Covid-19 pandemic a national disaster through Presidential Decree Number 12 of 2020 dated April 13, 2020 (Satuan Tugas Penanganan COVID-19, 2020). Indonesia established the Task Force for the Acceleration of Handling COVID-19 as a national task force to fight COVID-19 (Djalante et al., 2020). The Minister of Finance of the Republic of Indonesia stated that there are 4 (four) sectors that are most depressed due to Covid-19, namely the Household sector, MSMEs, Corporate and Financial Sector (Saubani, 2020). Indonesia, which is dominated by Micro, Small, and Medium Enterprises (MSMEs) needs to pay special attention to this sector, because the contribution of MSMEs to the national economy is quite large (Pakpahan, 2020). MSMEs have a contribution of 60.3% of Indonesia's total gross domestic product (GDP). In addition, MSMEs absorb 97% of the total workforce and 99% of the total employment (Jayani, 2020). The following figure shows the very rapid development of the MSME unit from 2015 to 2019. As a result of the policies of all countries to overcome the Covid-19 pandemic, MSME businesses have had a huge impact, especially those that rely on the tourism sector in addition to the declining purchasing power of the people. MSMEs, which are the creative economy sector, face 4 (four) main problems, including difficulty in obtaining raw materials, reduced demand for products from creative economy actors, depressed cash flow, and difficulties in borrowing capital (CNN Indonesia, 2020). The MSME sector is the most affected by the Covid-19 pandemic because Indonesia has implemented the Large-Scale Social Restriction (PSBB- Pembatasan Sosial Berskala Besar) policy which began on January 11, 2021 (Nugraheny, 2021). This PSBB policy causes a decrease in the income of MSME actors, this is because many restaurants, shops, and others have to close their shops or places of business early.

The development of MSMEs cannot be separated from the role of banks in terms of funding. Associated with the fall of the MSME sector in Indonesia due to the implications of the PSBB policy and policies in other countries to overcome the spread of the virus, resulting in a high risk of non-payment of loans (default risk) for MSMEs and sectors related to tourism. The implication of this is the inhibition of economic growth, one of which is in the banking sector. In the financial sector, banking plays a very important role, related to its main function as an intermediary institution to collect funds from parties with excess funds (surplus of funds) and parties with shortage of funds (lack of funds), especially for productive activities. Based on Law No. 10 of 1988 concerning Banking, Banking is everything related to banks, including institutions, business activities, as well as methods and processes in carrying out their business activities. Meanwhile, a bank is a business entity that collects funds from the public in the form of savings and distributes them to the public in the form of credit and/or other forms in order to improve the standard of living of the community, consisting of Commercial Banks and Rural Banks (BPR) in both conventional and sharia forms. The most basic difference between Commercial Banks and Rural Banks is that Commercial Banks can provide service activities in payment traffic, while BPRs cannot. In addition, its establishment also requires capital and the complexity of different business activities. The following is data on MSME Credit Distribution for Conventional Rural Banks and Commercial Banks for 2019-2020.

Based on the data in Figure 1, BPRs are known to be more dominant in lending to MSMEs compared to commercial banks. The contribution of BPRs in encouraging the development of MSMEs is believed to be able to produce positive social implications in terms of empowering economic and social life in their local communities. The impact of MSMEs that become BPR debtors increases the default risk or the debtor's inability to pay their obligations.

The Financial Services Authority (OJK- Otoritas Jasa Keuangan) at the end of 2020 stated that the number of BPRs would be 1,587 offices, decreased from 2017 as many as 1,636 offices. The number of BPRs has decreased every year. This indicates that many rural banks are experiencing liquidation. Based on data from the Financial Services Authority (OJK), as

of 2020 in Bali there are 134 Rural Banks (BPR) and 1 Sharia Rural Bank (BPRS- Bank Perkreditan Rakyat Shariah). Until December 2020, the ratio of non-performing loans to the BPR industry in Bali was 7.47 percent with a value of Rp.864.18 million from 4,555 accounts. This ratio exceeds the threshold set by the authorities, which is 7.47 percent and is the highest compared to other regions (Wiratmini, 2021).

60.00%

40.00%

20.00%

0.00%

Rural Bank Commercial banks

2019

Rural Bank Commercial banks

2020

■ UMKM ■ Non UMKM

Figure 1. Micro, Small and Medium Enterprises Credit Distribution for Conventional

Rural Banks and Commercial Banks

Source: Financial Services Authority (data processed by researchers), 2021

Bankruptcy according to Law No. 04 of 2008 is a situation that is declared bankrupt by a court decision. According to Hanafi & Halim, (2016) bankruptcy analysis aims to find out the early signs of bankruptcy that will be useful for management parties in anticipating bankruptcy by improving the company's financial performance and also formulating new strategies. Apart from miss management, the bankruptcy of the BPR was also caused by the weak implementation of Good Corporate Governance (GCG) such as fraud by owners, management, employees, or other parties. Previous study by Sari & Mahyuni (2020) stated that there are five factors that cause fraud in LPD (Village Credit Institution- Lembaga Perkreditan Desa), namely the weak organizational structure, weak supervisory function, lack of a system or unwillingness to use the system, weak LPD governance, and the “ewuh pakewuh” culture. Meanwhile, other study from Sukariana & Darma (2015) shows that things that affect the disclosure of material losses and GCG are competence, objectivity and HR investment.

The bankruptcy prediction analysis can be seen by calculating the financial ratios in the financial statements. There are several models to determine the level of bankruptcy such as G-Score by Grover, Y-Score by Ohlson, X-Score by Zmijewski, S-Score by Springate, and Z-Score by Altman (Yuliana, 2018). The Altman Z Score model has three types including the Original Altman Model, the Altman Private Firm Model, and the Modified Altman Model (Yuliana, 2018). In this study, researchers used the Modified Altman Model because this model can be applied to public and non-public companies, to all types of company sizes, and to all companies in different industries (Yuliana, 2018). This is in line with study from Ihsan & Kartika (2015) who conducted study in Sharia banks using a modified Altman Z-Score. The Altman model also has a 95% correctness rate in predicting bankruptcy (E. Altman, 1983). Several financial performance factors that affect bankruptcy are in accordance with the modified Altman Z Score equation, namely Working Capital to Total Assets (WCTA), Retained Earning to Total Assets (RETA), Earning Before Interest and Tax to Total Assets (EBITTA), and Book Value of Equity to Total Liabilities (BTL).

According to Simanjuntak et al., (2017) the condition of Financial Distress is a condition where there is a financial decline before the company goes bankrupt. Anggarini (2010) argues that Financial Distress can be caused by a series of decision-making errors, and interrelated weaknesses that can contribute directly or indirectly to management as well as the

lack of efforts to monitor financial conditions so that the use of money is not in accordance with the needs.

Rivai et al., (2013) stated that in measuring the performance of a bank, in addition to referring to the provisions regarding the Bank Soundness Level, many banks complete their financial performance analysis using bank financial ratios. Financial statements will report the company's position at a certain point in time and its operations during a period in the past. From the management's point of view, analysis of financial statements will be useful to help anticipate future conditions and as a starting point for planning steps that will improve the company's performance in the future.

Financial Distress can be effected by several factors including CAR. According to Sudirman (2013: 109-111), CAR is a ratio that serves to minimize the risk of losses that may occur to the bank, the higher the CAR, the better the ability of the bank to bear the risk of any credit/productive assets that are considered risky. CAR measures the level of capital adequacy or bank financial stability (Hidayat, 2014: 70).

Credit disbursement by banks to the public will be faced with a risk, namely credit risk. Credit risk is the most significant risk faced by banks, and business success depends on accurate measurement and a higher level of efficiency in managing this risk than any other risk. Credit risk will be faced by the bank when the debtor fails to pay the debt or credit it receives at maturity. Restructuring credit policies affect NPL performance (Ridwan, 2018). So this study is important to do to assess the effect of NPL on Financial Distress.

ROA is a measure of net profit derived from the use of assets. Companies that have a high ROA indicate that the company can manage asset productivity well in obtaining net profits. Hidayat & Merianto (2014), revealed that the higher the ROA owned by the company, the smaller the chance that the company will be indicated by Financial Distress.

Good Corporate Governance (GCG) is a bank governance that applies the principles of transparency, accountability, responsibility, professionalism and fairness (Rustam, 2013). There are several previous studies that discuss the bankruptcy of a company using the Altman Z Score model for the banking sector taken from Pradhan (2014) with the results of the Z-Score being able to predict the level of bankruptcy in banking, especially BPR.

In this regard, the government and the Financial Services Authority (OJK) as a state institution established under Law Number 21 of 2011 have the function of organizing an integrated regulatory and supervisory system for all activities in the financial services sector, issued various stimuli to deal with the impact on the banking business, one of them is through POJK No.48/POJK.03/2020 concerning Amendments to Financial Services Authority Regulation Number 11/POJK.03/2020 concerning National Economic Stimulus as a Countercyclical Policy for the Impact of the 2019 Coronavirus Disease Spread. In addition to the OJK Regulation, the government is also pursuing an economic recovery policy through Government Regulation in Lieu of Law (PERPU- Peraturan Pemerintah Pengganti Undang-Undang) Number 1 of 2020 Regarding State Financial Policy and Financial System Stability for Handling the Pandemic Coronvirus Disease 2019 (COVID-19) and/or in Facing Threats That Endanger the National Economy and/or Financial Stability, which was stipulated on March 31, 2020. However, the stimuli provided do not guarantee that BPRs will not experience Financial Distress or financial difficulties, as evidenced by the existence of several BPRs publishing losses and financial ratios that are outside the healthy ratio limits, especially the ratio of capital and liquidity. However, many BPRs have managed to maintain their performance in the midst of the crisis due to the impact of the Covid-19 pandemic.

Based on the explanation above, it is important to know the factors that have a significant effect or are the determinants of BPR Financial Distress with GCG as moderating during the Covid-19 pandemic. The interesting thing is that the regulator's countercyclical policy makes factors that were previously under normal conditions believed to significantly

affect Financial Distress, but in the presence of a countercyclical, the effect of these factors can be different. The countercyclicals are in the form of a credit restructuring policy for debtors affected by Covid-19, relaxation of credit quality determination, freezing of the Foreclosed Collateral (AYDA- Agunan yang Diambil Alih) period, there is no obligation to form PPAP with current credit quality, and there is no obligation to establish an education fund budget of at least 5% of the previous year's labor costs. Therefore, it is necessary to reexamine the determinants of BPR Financial Distress during the Covid-19 pandemic, to test previous studies, using two approaches, namely qualitative and quantitative approaches. In addition to examining the effect of the independent variables (ROA, CAR, and NPL) on the dependent variable (Financial Distress) which is moderated by the moderating variable (GCG), This study will also examine how the overall effect of credit restructuring on Financial Distress is discussed descriptively. This is because credit restructuring is a policy issued to overcome credit problems that occur due to the Covid-19 Pandemic, so that the two approaches will increase the accuracy of the results of the study conducted.

After knowing the determinants of BPR Financial Distress, it is hoped that BPR and regulators can predict the possibility of Financial Distress that will be faced and how to mitigate it, and what is the agenda for banks and regulators after the relaxation period ends on March 31, 2022. In addition, different tests will be carried out with financial conditions before the pandemic and mapped out how many BPRs are systemically important or Systemically Important Rural Banks in Bali that are required to have more resilience against the various risks that exist, so that it does not have an impact on trust in other financial service institutions or mitigate the systemic risk and domino effect due to the liquidation of the financial services sector, in this study, namely BPR.

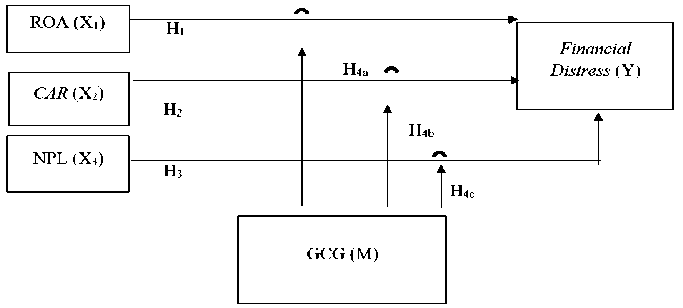

Figure 2. Formulation Hypothesis

Based on Figure 2, the formulation of the hypothesis in this study is:

H1: Profitability has a significant effect on Financial Distress.

H2: CAR has a significant effect on Financial Distress.

H3: NPL has a significant effect on Financial Distress.

H4: GCG moderates the effect of ROA (H4a), CAR (H4b), and NPL (H4c) on Financial Distress.

METHOD

The research design used in this study is an associative design. This study uses two approaches, namely qualitative and quantitative approaches. This study in addition to examining the effect of the independent variables (Return On Asset, Capital Adequacy Ratio, and Net Performing Loan) on the dependent variable (Financial Distress) which is moderated by the moderating variable (GCG), This study also examines how the overall effect of credit

restructuring on Financial Distress is discussed descriptively. This is because credit restructuring is a policy issued to overcome credit problems that occur due to the Covid-19 Pandemic, so that the two approaches will increase the accuracy of the results of the study conducted. The data used in this study is quantitative data containing data on independent and dependent variables obtained in the BPR publication report on the OJK website. In this study, the population used is all Conventional Rural Banks (BPR) in Indonesia during the 2019-2020 period, namely 1,497 (one thousand four hundred ninety-seven) BPRs. The sampling technique in this study is purposive sampling, namely by taking samples that have been determined previously based on the aims and objectives of the study or selected based on criteria. In accordance with the description of the introduction, Bali is an area that has been significantly affected due to the high impact of Covid-19 on the MSME and Tourism sectors, where most of the BPR lending focused on MSME loans and debtors who have a business or work in the tourism sector, so the sample used is all BPRs in Bali Province as many as 134 (one hundred and thirty four) BPRs. Bali was chosen because Bali was most affected by the Covid-19 pandemic, because the tourism MSME sector is the main economy in Bali. In this study using secondary data. The data analysis technique used is descriptive statistical analysis and Moderated Regression Analysis (MRA), as well as hypothesis testing using SPSS.

RESULTS AND DISCUSSION

Table 1. Multiple Linear Regression Test Results

|

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. | ||

|

B |

Std. Error |

Beta | |||

|

(Constant) |

6.233 |

.052 |

120.596 |

.000 | |

|

ROA |

.024 |

.004 |

.268 |

6.134 |

.000 |

|

CAR |

1.542 |

.127 |

.522 |

12.171 |

.000 |

|

NPL |

-.020 |

.002 |

-.358 |

-8.215 |

.000 |

Source: processed data, 2021

This regression test is used to determine the effect of Return On Asset (ROA), Capital Adequacy Ratio (CAR), and Net Performing Loan (NPL) on financial distress. The resulting equation is as follows.

Financial Distress = 6.233 + 0.024 ROA +1.542 CAR – 0.020NPL ……………..(1)

The multiple linear regression equation shows the direction of each independent variable to the dependent variable, where the regression coefficients of the independent variables Return On Asset (ROA) and Capital Adequacy Ratio (CAR) are positive so that when the company experiences an increase in the value of ROA and CAR, the Z-score will increase or in other words financial distress will decrease, and vice versa when ROA and CAR decrease, the Z-score will decrease or in other words financial distress will also increase. While the regression coefficient which is negative on the NPL variable means that it has the opposite effect on financial distress, so that when there is an increase in NPL it will be accompanied by a decrease in Z-score or in other words Financial Distress will increase and vice versa.

The value of the coefficient of determination is close to one, then the independent variable provides almost all the information needed to predict the dependent variable and if the value of the coefficient of determination = 0 means that the independent variable has no

effect on the dependent variable. The adjusted R2 value in this study is 0.532, which means that the independent variables in this study in the regression model simultaneously affect the dependent variable by 53.2% percent, while 46.8% percent is explained by other factors outside the independent variables used in this study.

Table 2. Coefficient of Determination Test Results

Model R R Square Adjusted R Square Std. Error of the Estimate

1 .729a .532 .526 .34847

Source: processed data, 2021

Table 3. F-Test Result

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

1 Regression |

35.310 |

3 |

11.770 |

96.926 |

.000a |

|

Residual |

31.087 |

256 |

.121 | ||

|

Total |

66.396 |

259 |

Source: processed data, 2021

The purpose of the F test is to see whether the independent variables simultaneously affect the dependent variable. The results of the F test can be seen in the SPSS processed regression by comparing the level of significance between the independent variables with = 0.05. If the significance level of F = 0.05, the independent variable significantly affects the dependent variable and the regression model is considered feasible to be tested. The results of the F test in this study can be seen in Table 3.Table 3 shows the Sig value of 0.000 < 0.05; it can be concluded that simultaneously the independent variables have an effect on the dependent variable.

Table 4. t-Test Results

|

Unstandardized Standardized Coefficients Coefficients g. B Std. Error Beta | |

|

(Constant) ROA CAR NPL |

6.233 .052 120.596 .000 .024 .004 .268 6.134 .000 1.542 .127 .522 12.171 .000 -.020 .002 -.358 -8.215 .000 |

Source: processed data, 2021

Testing the results of each independent variable (X) on the dependent variable (Y) in this study used the t test which was tested with a one-sided test. An explanation of the effect of each independent variable partially on financial distress can be seen in Table 4. Not only using multiple regression analysis, this study also uses the MRA method to analyze the effect of the moderator variable on the relationship between the independent variable and the dependent variable. Equation 1 is a multiple linear regression that has been described previously and has been able to answer H1, H2 and H3 in this study. Equation 1 is contained in Table 4. Multiple Linear Regression Test Results The resulting equation:

Financial Distress = 6.233 + 0.024 ROA +1.542 CAR – 0.020NPL……………...(2)

The first hypothesis in this study states that Profitability (ROA) has a significant negative effect on Financial Distress. The Return On Asset (ROA) regression coefficient value is 0.024, this shows that ROA has a positive effect on the Z-score or in other words, it

has a negative effect on Financial Distress. The significance of this effect was tested with the t-test which resulted in a t-value of 6.134 and a significance of 0.000. The significance value of less than 0.05 indicates that the first hypothesis in this study is accepted. This means that Return On Asset (ROA) has a significant positive effect on the Z-score or in other words a significant negative effect on Financial Distress. This shows that if ROA increases, financial distress will decrease and vice versa.

Table 5. Multiple Linear Regression Test Results Equation 2

|

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. | ||

|

B |

Std. Error |

Beta | |||

|

(Constant) |

6.509 |

.050 |

130.512 |

.000 | |

|

ROA |

.276 |

.033 |

.545 |

8.320 |

.000 |

|

CAR |

.358 |

.027 |

.707 |

13.186 |

.000 |

|

NPL |

-.164 |

.023 |

-.323 |

-7.241 |

.000 |

|

KM |

.055 |

.026 |

.109 |

2.101 |

.037 |

|

ROA_KM |

.194 |

.034 |

.399 |

5.757 |

.000 |

|

CAR_KM |

-.165 |

.031 |

-.331 |

-5.390 |

.000 |

|

NPL_KM |

-.006 |

.030 |

-.010 |

-.194 |

.847 |

Source: processed data, 2021

Equation 2 is used to determine the effect of GCG as a proxy for KM in moderating the effect of ROA, CAR, and NPL on financial distress. The results of the regression test in equation 2 are presented in Table 5. Based on Table 5, the resulting equation is as follows.

Financial Distress = 6.509 + 0.276 ROA + 0.358CAR – 0.164 NPL +0.055 KM +0.194ROA_KM – 0.165 CAR_KM + -0.006 NPL_KM …….….(3)

The linear regression equation shows the direction of each independent variable to the dependent variable, and it can be seen the effect of KM in moderating the effect of ROA, CAR and NPL on financial distress. The ROA_KM regression coefficient is positive, meaning that KM strengthens the effect of ROA on financial distress. Then the regression coefficient CAR_KM is negative, meaning that KM weakens the effect of CAR on financial distress. While the NPL_KM regression coefficient is negative, it means that KM weakens the effect of NPL on financial distress.

The second hypothesis in this study states that Capital Adequacy Ratio (CAR), has a significant negative effect on Financial Distress. The Capital Adequacy Ratio (CAR), regression coefficient value is 1.542, this shows that CAR has a positive effect on the Z-score or in other words, it has a negative effect on Financial Distress. The significance of this effect was tested by the t-test which resulted in a tcount of 12,171 and a significance of 0.000. The significance value of less than 0.05 indicates that the second hypothesis in this study is accepted. This means that CAR has a significant positive effect on the Z-score or in other words a significant negative effect on Financial Distress. This shows that if the CAR has increased then financial distress has decreased and vice versa. Research that carried out by (Prasetyo, 2010; Halim, 2016; Sofiasani & Gautama, 2016; Zahronyaan & Mahardika, 2018; vijaya, 2019).

The third hypothesis in this study states that Net Performing Loan (NPL) has a significant positive effect on Financial Distress. The NPL regression coefficient value is -0.020, this shows that NPL has a negative effect on the Z-score or in other words, it has a positive effect on Financial Distress. The significance of this effect was tested by the t-test which resulted in a tcount of -8.215 and a significance of 0.000. The significance value of

less than 0.05 indicates that the third hypothesis in this study is accepted. This means that NPL has a significant negative effect on the Z-score or in other words a significant positive effect on Financial Distress. This shows that if the NPL increases, financial distress will decrease and vice versa. This result is corroborated by the results of research conducted by research (Hidayati & Yuvia, 2015; Listiani Putri, 2018; Astuti & Permata Sari, 2021)

Table 6. Moderated Regression Analysis (MRA) Coefficient of Determination Test Results

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.782a |

.611 |

.600 |

.32017 |

|

Source: processed data, 2021 | ||||

The value of the coefficient of determination is close to one, then the independent variable provides almost all the information needed to predict the dependent variable and if the value of the coefficient of determination = 0 means that the independent variable has no effect on the dependent variable. The adjusted R2 value in this study is 0.611, which means that the independent variable in this study in the regression model simultaneously affects the dependent variable, which is 61.1% percent, while 38.9% percent is explained by other factors outside the independent variables used in this study.

Table 7. MRA F Test Results

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

1 Regression |

40.564 |

7 |

5.795 |

56.530 |

.000a |

|

Residual |

25.832 |

252 |

.103 | ||

|

Total |

66.396 |

259 |

Source: processed data, 2021

The purpose of the F test is to see whether the independent variables simultaneously affect the dependent variable. The results of the F test can be seen in the SPSS processed regression by comparing the level of significance between the independent variables with α = 0.05. If the significance level of F ≤ α = 0.05, the independent variable significantly affects the dependent variable and the regression model is considered feasible to be tested. The results of the F test in this study can be seen in Table 7. Table 7 shows the Sig value of 0.000 < 0.05; it can be concluded that simultaneously the independent variables have an effect on the dependent variable.

Testing the role of GCG to moderate the effect of ROA, CAR, and NPL on Financial Distress in this study used a t-test which was tested with a one-sided test. The explanation of the moderating effect on ROA, CAR, and NPL partially on financial distress can be seen in Table 8.

Table 8. MRA t-Test Results

|

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. | ||

|

B |

Std. Error |

Beta | |||

|

(Constant) |

6.509 |

.050 |

130.512 |

.000 | |

|

ROA |

.276 |

.033 |

.545 |

8.320 |

.000 |

|

CAR |

.358 |

.027 |

.707 |

13.186 |

.000 |

|

NPL |

-.164 |

.023 |

-.323 |

-7.241 |

.000 |

|

KM |

.055 |

.026 |

.109 |

2.101 |

.037 |

|

ROA_KM |

.194 |

.034 |

.399 |

5.757 |

.000 |

|

CAR_KM |

-.165 |

.031 |

-.331 |

-5.390 |

.000 |

|

NPL_KM |

-.006 |

.030 |

-.010 |

-.194 |

.847 |

Source: processed data, 2021

To prove whether there is a significant difference between ROA, CAR, and NPL on financial distress with GCG as moderating, the Z-score value will be compared during the study period using a different test. Based on Table 9, it can be seen that the significance value of financial distress is 0.000 which is lower than 0.05. This means that there is a difference between financial distress before the pandemic and during the pandemic.

The Effect of Profitability on Financial Distress. The first hypothesis in this study states that profitability (ROA) has a significant negative effect on Financial Distress. The Return On Asset (ROA) regression coefficient value is 0.024, this shows that ROA has a positive effect on the Z-score or in other words it has a negative effect on financial distress. The significance of this effect was tested with the t-test which resulted in a t-count value of 6.134 and a significance of 0.000. The significance value of less than 0.05 indicates that the first hypothesis in this study is accepted. This means that ROA has a significant positive effect on the Z-score or in other words a significant negative effect on Financial Distress.

Profitability is the company's ability to generate profits (Hery, 2015). Based on the signal theory that the manager or management of the company has the responsibility to provide the results of the financial statements and annual reports that contain information on the company's finances, and the condition of the company. Companies with high profitability values will give a positive signal that the company is able to utilize assets effectively so that there is an increase in revenue that affects the amount of profit generated (Fahlevi & Mukhibad, 2018). Hapsari (2012), shows that profitability has a negative effect on Financial Distress, which means that effective and efficient asset management allows the company to meet all the company's costs to run its business, as well as generate large profits. Thus, the greater the company's profitability will prevent the company from financial distress. This is in line with Zaki et al., (2011); Baimwera & Muriuki (2014); Aisyah et al., (2017) who revealed that profitability has a negative effect on Financial Distress.

Table 9. Paired Sample t-Test

Paired Differences

95% Confidence

|

Mean |

Std. Deviation |

Std. Error Mean |

interval of the Difference |

t |

df |

Sig. (2tailed) | |||

|

Lower |

Upper | ||||||||

|

Pair 1 |

Financial Distress_sblm | ||||||||

|

Pair |

covid-Financial Distress_saat covid ROA_sblm |

.12243 |

.30028 |

.02634 |

.07032 |

.17454 |

4.649 |

129 |

.000 |

|

2 Pair |

covid- ROA _saat covid CAR_sblm |

1.42492 |

7.68586 |

.67409 |

.09121 |

2.75864 |

2.114 |

129 |

.036 |

|

3 Pair |

covid- CAR _saat covid NPL_sblm |

-.02025 |

.14324 |

.01256 |

-0.4511 |

.00460 |

-1.612 |

129 |

.109 |

|

4 Pair |

covid- NPL _saat covid KM_sblm |

-.025692 |

6.98401286 |

.61253845 |

-1.23761 |

1.186230 |

-.042 |

129 |

.967 |

|

5 |

covid- KM _saat covid |

.02061 |

.16344 |

.01433 |

-.00775 |

.04897 |

1.438 |

129 |

.153 |

Source: processed data, 2021

The Effect of Capital Adequacy Ratio (CAR) on Financial Distress. The second hypothesis in this study states that CAR has a significant negative effect on Financial Distress. The CAR regression coefficient value is 1.542, this shows that CAR has a positive effect on the Z-score or in other words, it has a negative effect on Financial distress. The significance of this effect was tested by t-test which resulted in a tcount of 12,171 and a significance of

0.000. The significance value of less than 0.05 indicates that the second hypothesis in this study is accepted. This means that CAR has a significant positive effect on the Z-score or in other words a significant negative effect on Financial Distress.

Capital Adequacy Ratio (CAR) is a bank's performance ratio to measure the adequacy of capital owned by a bank to support assets that contain risks, for example loans provided by banks. Signal theory emphasizes the importance of information issued by companies to stakeholders in decision making. If the CAR shows a low value, this is a signal that the company will be in a condition of Financial Distress. Rivai et al., (2013) revealed that the lower the CAR, the smaller the bank's capital to cover risky assets, the more likely the bank will experience a problematic condition because the capital owned by the bank is not sufficient to bear the decline in the value of risky assets. This is also reinforced by the study of Kristanti et al., (2016) that CAR negatively and significantly affects the prediction of bank bankruptcy. The results of study by Kowanda et al., (2015) state that CAR has negative implications for Financial Distress. This means that if there is a positive change in the level of capital adequacy, it will reduce the probability for the company to experience Financial Distress. This is also supported by Sholikati (2018), a high CAR ratio in a bank can finance operational activities and increased profitability can anticipate the occurrence of Financial Distress.

The variable that has the greatest direct effect as a determinant of BPR Financial Distress in this study is CAR, where CAR has a significant negative effect on Financial Distress. If the CAR shows a low value, this is a signal that the company will be in a condition of Financial Distress. This means that if there is a positive change in the level of capital adequacy, it will reduce the probability for the company to experience Financial Distress.

The Effect of Non-Performing Loans on Financial Distress. The third hypothesis in this study states that NPL has a significant positive effect on Financial Distress. The NPL regression coefficient value is -0.020, this indicates that NPL has a negative effect on the Z-score or in other words, it has a positive effect on Financial distress. The significance of this effect was tested by t-test which resulted in a t-count value of -8.215 and a significance of 0.000. The significance value of less than 0.05 indicates that the third hypothesis in this study is accepted. This means that NPL has a significant negative effect on the Z-score or in other words a significant positive effect on Financial Distress.

Non Performing Loans (NPL) can be used to measure the extent to which nonperforming loans can be met with productive assets owned by a bank. Non-performing loans are defined as loans that have difficulty repaying due to intentional factors and or external factors beyond the control of the debtor (Siamat, 2005). If the NPL shows a high value then this is a signal that the company will be in a condition of Financial Distress. As revealed by Hardianti (2019). The greater the number of non-performing loans owned by a bank, the credit conditions of the bank will be worse and have the potential to cause financial problems. According to Kasmir (2014) a high NPL will increase costs, so the potential for the number of non-performing loans to be even greater. Therefore, banks must bear losses in their operational activities so that it affects the decline in profits obtained by the Bank because the higher the NPL ratio, the higher the bad loans, thus preventing banks from obtaining income from credit interest so that Financial Distress will increase. This is reinforced by study by Kowanda et al., (2015); Prasidha & Wahyudi (2015) who found that NPL has a positive and significant effect on financial distress.

The Role of Good Corporate Governance (GCG) in Moderating the Effect of ROA, CAR, and NPL on Financial Distress. Testing the role of GCG to moderate the effect of ROA on Financial Distress resulted in a tcount of 5.757 with a significance of 0.000. A significance value smaller than 0.05 indicates a significant effect of GCG on the relationship between the effect of ROA on Financial Distress. Based on the second equation (Table. 5) the effect of GCG on financial distress is significant with the value of Sig. 0.037 (smaller than 0.05), then

the second and third equations are equally significant so that it can be said that GCG is a Quasi-Moderation variable. Quasi moderation is a variable that moderates the relationship between the independent variable and the dependent variable where the pseudo moderating variable interacts with the independent variable as well as being the independent variable. This means that the hypothesis which states that GCG strengthens the negative effect of ROA on financial distress is accepted.

Testing the role of Good Corporate Governance (GCG) in moderating the effect of CAR on Financial Distress resulted in a tcount of – 5,390 with a significance of 0.000. A significance value smaller than 0.05 indicates a significant effect of GCG on the relationship between the effect of CAR on Financial Distress. Based on the second equation (Table. 5) the effect of GCG on financial distress is significant with the value of Sig. 0.037 (less than 0.05), then the second and third equations are equally significant so that it can be said that GCG is a Quasi-Moderation variable. Quasi moderation is a variable that moderates the relationship between the independent variable and the dependent variable where the pseudo moderating variable interacts with the independent variable as well as being the independent variable. This means that the hypothesis which states that GCG strengthens the negative effect of CAR on financial distress is rejected. This negative effect indicates that GCG weakens the effect of CAR on financial distress.

Testing the role of Good Corporate Governance (GCG) in moderating the effect of Net Performing Loan (NPL) on Financial Distress resulted in a t-count value of -0.194 with a significance of 0.847. A significance value greater than 0.05 indicates an insignificant effect of GCG on the relationship between the effect of NPL on Financial Distress. Based on the second equation (Table. 5) the effect of GCG on financial distress is significant with the value of Sig. 0.037 (less than 0.05), then the second and third equations are not equally significant so that it can be said that GCG does not moderate the effect of NPL on Financial Distress.

According to Gunawan (2016), Good Corporate Governance (GCG) is the supervisory role and process by which companies manage and reduce business risks. Widiatmika & Darma (2018) revealed that the better the implementation of good corporate governance in a company, the better the company's financial performance. Kuncoro & Agustina (2017) also revealed that the better the implementation of corporate governance mechanisms, the bank will be in a good monitoring condition, so that it will improve the performance of the bank concerned thereby reducing the tendency of Financial Distress conditions. Agency theory explains that in agency relationships there are different directions and goals that can cause agency conflicts. Good Corporate Governance is needed to reduce agency problems between owners and managers and reduce the occurrence of information asymmetry and Financial Distress (Fathonah, 2017). GCG in this study is proxied by managerial ownership. Managerial ownership is the percentage of the number of shares owned by management of the total number of shares of the company managed by (Boediono (2005). Nur DP (2007) reveals that the greater managerial ownership will be able to unite the interests of shareholders and managers so as to reduce the potential for Financial Distress. Study results Md-Rus et al., (2013); Yudha & Fuad (2014): Widhiadnyana & Ratnadi (2019) stated that managerial ownership has a negative effect on Financial Distress.

Research Implication. Based on the results of the research and discussion that have been described, there are implications of this study both theoretically and managerially. Based on the study results, the theoretical implications of this study are ROA, and CAR have a significant negative effect on Financial Distress, and NPL has a positive effect on Financial Distress, and GCG as a Quasi Moderation variable. These results enrich knowledge which adds to the latest study results related to ROA, CAR, GCG, NPL and Financial Distress variables, so that they can be used as support for future study. Based on the results of the study, the managerial implication of this study is that restructuring policies can improve credit

quality and reduce the profitability of rural banks, but this does not push the company into financial distress. The banking sector is expected to maintain the level of NPL, by maintaining the NPL it will reduce the risk of BPR experiencing financial distress. Banks can provide restructuring solutions by considering the benefits and costs to customers The benefits of restructuring must be greater than the costs incurred so that it has the potential to improve bank performance. The planning and implementation of loan restructuring must be based on an agreement between the debtor and creditor in rearranging the loan repayment agreement.

Research Limitations. This study only examines the effect of profitability, CAR, NPL on financial distress moderated by GCG, so these results may not necessarily represent other variables, and this research was only conducted at BPRs in Bali, so these results cannot be generalized to other BPRs / other conventional banks. This study only uses 2019 and 2020 as comparison years.

CONCLUSION

Based on the results of research and discussions that have been carried out, the conclusion in this study is that Profitability (ROA) has a significant negative effect on Financial Distress. This means that ROA has a significant positive effect on the Z-score or in other words a significant negative effect on Financial Distress. CAR has a significant negative effect on Financial Distress. This means that CAR has a significant positive effect on the Z-score or in other words a significant negative effect on Financial Distress. NPL has a significant positive effect on Financial Distress. This means that NPL has a significant negative effect on the Z-score or in other words a significant positive effect on Financial Distress. GCG is a Quasi-Moderation variable. GCG strengthens the negative effect of ROA on financial distress. GCG weakens the effect of CAR on financial distress. GCG does not moderate the effect of NPL on Financial Distress. The variable that has the greatest direct effect as a determinant of BPR Financial Distress in this study is CAR, where CAR has a significant negative effect on Financial Distress. If the CAR shows a low value, this is a signal that the company will be in a condition of Financial Distress. This means that if there is a positive change in the level of capital adequacy, it will reduce the probability for the company to experience Financial Distress.

Suggestions that can be given to BPR / Banking are effective and efficient asset management so that the company can meet all the company's costs to run its business, and generate large profits. Thus, the greater the company's profitability will prevent the company from financial distress. Banks are expected to maintain the level of capital adequacy in order to reduce the probability of companies experiencing financial distress. Banks are also expected to be able to maintain the level of NPL so as not to experience financial distress. Implementation of the corporate governance mechanism, the bank will be in a good monitoring condition, so that it will improve the performance of the bank concerned so as to reduce the tendency of the condition of Financial Distress. Suggestions that can be given for further research, namely future research is expected to add other variables that are estimated to have an effect on financial distress such as the number of boards of directors, and others. Further research is expected to expand the scope of research to Indonesia, not just one province so that the results of further research can provide a more significant contribution.

REFERECES

Aisyah, N. N., Kristanti, F. T., & Zultilisna, D. (2017). Pengaruh Rasio Likuiditas, Rasio Aktivitas, Rasio Profitabilitas, dan Rasio Leverage Terhadap Financial Distress. EProceeding of Management, 4(1), 411–419. Retrieved from

http://libraryeproceeding.telkomuniversity.ac.id/index.php/management/article/view/4

419/4149

Astuti, D & Permatasari, S. (2021). Overview of Company Internal Factors Affecting Financial Distress(Empirical Study on Banking Companies Listed onthe Indonesia Stock Exchange). Duconomics Sci-meet 1(2).

Anggarini, T. V. (2010). Pengaruh Karakteristik Komite Audit Terhadap Financial Distress (Studi Empiris pada Perusahaan yang Terdaftar di Bursa Efek Indonesia). (Skripsi). Semarang: Universitas Diponegoro.

Baimwera, B., & Muriuki, A. M. (2014). Analysis of corporate financial distress

determinants: A survey of non-financial firms listed in the NSE. International Journal of Current Business and Social Sciences, 1(2), 58–80

https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.1077.7173&rep=rep1&typ e=pdf

Boediono, G. SB. (2015). Kualitas Laba: Studi Pengaruh Mekanisme Corporate Governance dan Dampak Manajemen Laba Dengan Menggunakan Analisis Jalur. Simposioum Nasional Akuntansi (SNA) VIII Solo, 172-194.

https://smartaccounting.files.wordpress.com/2011/03/kakpm-09_2.pdf

CNN Indonesia. (2020). UMKM Sektor Ekonomi Kreatif Hadapi 4 Masalah saat Corona. Retrieved from: https://www.cnnindonesia.com/ekonomi/20200828112705-92-

540259/umkm-sektor-ekonomi-kreatif-hadapi-4-masalah-saat-corona. (Diakses pada 29 Mei 2021 pukul 11.49 WITA).

Djalante, R., Lassa, J., Setiamarga, D., Sudjatma, A., Indrawan, M., Haryanto, B., … Warsilah, H. (2020). Review and analysis of current responses to COVID-19 in Indonesia: Period of January to March 2020. Progress in Disaster Science, 6, 1-9 https://doi.org/10.1016/j.pdisas.2020.100091

Fahlevi, E. D., & Mukhibad, H. (2018). Use of Financial Ratios and Good Corporate Governance to Predict Financial Distress. Jurnal Reviu Akuntansi dan Keuangan, 8(2), 147–158. https://doi.org/10.22219/jrak.v8i2.34

Fathonah, A. N. (2017). Pengaruh Penerapan Good Corporate Governance Terhadap Financial Distress. Jurnal Ilmiah Akuntansi, 1(2), 133-150.

https://doi.org/10.23887/jia.v1i2.9989

Fauzi, M. A. & Paiman, N. (2020). COVID-19 pandemic in Southeast Asia: intervention and mitigation efforts. Asian Education and Development Studies, 10(2), 176-184.

https://doi.org/10.1108/AEDS-04-2020-0064

Gunawan, R. (2016). GRC (Good Governance, Risk Management, And Compliance) Konsep dan Penerapan. Jakarta: Salemba Empat

Hanafi, M.M. & Halim, A. 2016. Analisis Laporan Keuangan. Yogyakarta: UPP STIM YKPN

Hapsari, E. I. (2012). Kekuatan Rasio Keuangan Dalam Memprediksi Kondisi Financial Distress Perusahaan Manufaktur Di Bursa Efek Indonesia. Jurnal Dinamika Manajemen, 3(2), 101-109.

https://journal.unnes.ac.id/nju/index.php/jdm/article/view/2438/2491

Hardianti, S. (2019). Analisis Pengaruh Tingkat Kesehatan Bank Konvensional Berdasarkan Risk-Based Bankrating Dalam Memprediksi Financial Distress Pada Perbankan Indonesia. (Skripsi). Medan: Universitas Sumatera Utara

Halim, C. (2016). Analysis Effect Accounting Ratio and Market Effect to Predicting Bank’s Bankruptcy with Logistic Regression Model. JOM Fekon, 3(1), 1294– 1308.

Hery. (2015). Analisis Laporan Keuangan. Yogyakarta: CAPS

Hidayat, M. A., & Merianto, W. (2014). Prediksi Financial Distress Perusahaan Manufaktur Di Indonesia. Jurnal Of Accounting Universitas Diponegoro, 3(3), 1-11.

https://ejournal3.undip.ac.id/index.php/accounting/article/view/6198

Hidayat, R. (2014). Efisiensi Perbankan Syariah Teori dan Praktik. Bekasi: Gramata Publishing.

Hidayati, & Yuvia. (2015). Pengaruh Capital Adequacy Ratio (CAR), Net Interest Margin (NIM), Loan To Deposit Ratio (LDR) dan Non Performing Loan (NPL) Terhadap Return On Assets (ROA) pada PT. Bank Mandiri (persero). Tbk. Holistic Journal Of Management Research 3 (2): 37-50.

Ihsan, D. N., & Kartika, S. P. (2015). Potensi Kebangkrutan Pada Sektor Perbankan Syariah Untuk Menghadapi Perubahan Lingkungan Bisnis. Etikonomi, 14(2), 113-146.

https://doi.org/10.15408/etk.v14i2.2268

Jayani, D. H. (2020). Pemerintah Beri Stimulus, Berapa Jumlah UMKM di Indonesia? Retrieved from: https://databoks.katadata.co.id/datapublish/2020/04/08/pemerintah-beri-stimulus-berapa-jumlah-umkm-di-indonesia. (Diakses pada 29 Mei 2021 pukul 12.51 WITA).

Kasmir.(2014). Bank dan Lembaga Keuangan Lainnya. Jakarta: Rajawali Pers.

Kowanda, D., Pasaribu, R. B. F., & Firdaus, M. (2015). Financial Distress prediction on public listed banks in Indonesia stock exchange. In Interdisciplinary Behavior and Social Sciences - Proceedings of the 3rd International Congress on Interdisciplinary Behavior and Social Sciences, ICIBSoS 2014 (pp. 333–338). CRC Press/Balkema.

Kristanti, F. T., Rahayu, S., & Huda, A. N. (2016). The Determinant of Financial Distress on Indonesian Family Firm. Procedia - Social and Behavioral Sciences, 219, 440–447. https://doi.org/10.1016/j.sbspro.2016.05.018

Kuncoro, S., & Agustina, L. (2017). Factors To Predict The Financial Distress Condition Of The Banking Listed In The Indonesia Stock Exchange. Accounting Analysis Journal, 6(1), 39–47. https://doi.org/10.15294/aaj.v6i1.11343

Listiani P, Elisabet L, K. H. (2018). Bisnis properti masih melambat, analis sarankan hold saham emiten properti. Kontan.Co.Id.

Md-Rus, R., Mohd, K. N. T., Latif, R. A., & Alassan, Z. N. (2013). Ownership Structure and Financial Distress. Journal of Advanced Management Science, 1(4), 363-367.

https://doi.org/10.12720/joams.1.4.363-367

Nugraheny, D. E. (2021). Pembatasan kegiatan Jawa Bali mulai 11 Januari, ini bedanya dengan PSBB. Retrieved from: https://newssetup.kontan.co.id/news/pembatasan-kegiatan-jawa-bali-mulai-11-januari-ini-bedanya-dengan-psbb?page=all. (Diakses pada 1 Juni 2021 pukul 20.00 WITA).

Nur DP, E. (2007). Analisis Pengaruh Praktek Tata Kelola Perusahaan (Corporate Governance) Terhadap Kesulitan Keuangan Perusahaan (Financial Distress): Suatu Kajian Empiris. Jurnal Bisnis dan Akuntansi, 9(1), 88-108.

https://jurnaltsm.id/index.php/JBA/article/view/604

Pakpahan, A. K. (2020). COVID-19 dan Implikasi Bagi Usaha Mikro, Kecil, dan Menengah. Jurnal Ilmiah Hubungan Internasional, Edisi Khusus, 59-64.

https://journal.unpar.ac.id/index.php/JurnalIlmiahHubunganInternasiona/article/view/ 3870

Pradhan, R. (2014). Z Score Estimation for Indian Banking Sector. International Journal of Trade, Economics and Finance, 5(6), 516-520. DOI: 10.7763/IJTEF.2014.V5.425

Prasidha, D. K., & Wahyudi, S. T. (2015). Dampak Nilai Tukar Dan Risk-Based Bank Rating Terhadap Prediksi Kondisi Perbankan Indonesia. Quantitative Economics Journal, 4(3), 122-142. https://doi.org/10.24114/qej.v4i3.17467

Prasetyo, D. A. (2010). Pengaruh risiko kredit, likuiditas, kecukupan modal, dan efisiensi operasional terhadap profitabilitas pada PT BPD Bali. EJurnal Manajement Unud 4(9):2590-2617.

Ridwan, M. (2018). Analisis Pengaruh Restrukturisasi Kredit, Recovery Rate, Baki Debet

(BADE) dan Write Off (WO) Terhadap Non-Performing Loan (NPL) Pada Unit Card Collection PT. Bank Mandiri Kanwil VI Bandung. Jurnal of Materials Processing Technology, 1(1), 1-23.

http://repository.stp-bandung.ac.id//handle/123456789/668

Rivai, H., Basir, S., Sudarto, S., & Veithzal, A. (2013). Commercial Bank Management (Manajemen Perbankan Dari Teori Ke Praktik). Jakarta: PT. Raja Grafindo Persada.

Rustam, B. R. (2013), Manajemen Risiko Perbankan Syariah di Indonesia, Jakarta: Salemba Empat.

Sari, N. M. L., & Mahyuni, L. P. (2020). Pencegahan Fraud pada LPD: Eksplorasi Implementasi Good Corporate Governance dan Nilai-Nilai Kearifan Lokal. Jurnal Akuntansi Berkelanjutan Indonesia, 3(3), 233-252.

https://doi.org/10.32493/jabi.v3i3.y2020.p233-252

Satuan Tugas Penanganan COVID-19. (2020). Keputusan Presiden Republik Indonesia Nomor 12 Tahun 2020 tentang Penetapan sebagai Bencana Nasional. Retrieved from: https://covid19.go.id/p/regulasi/keputusan-presiden-republik-indonesia-nomor-12-tahun-2020. (Diakses tanggal 29 Mei 2021 pukul 12.22 WITA).

Saubani, A. (2020). Empat Sektor Ekonomi yang Paling Tertekan Pandemi Covid-19.

Retrieved from: https://republika.co.id/berita/q83llp409/empat-sektor-ekonomi-yang-paling-tertekan-pandemi-covid19. (Diakses pada 6 Juli 2020 pukul 16.35 WITA).

Sholikati, P. (2018). Analisis pengaruh RGEC terhadap Financial Distress Bank Umum Syariah di Indonesia. (Skripsi). Surakarta: Universitas Muhammadiyah.

Siamat, D. (2005). Manajemen Lembaga Keuangan, Kebijakan Moneter dan Perbankan. Jakarta: FEUI.

Simanjuntak, C., Titik, F., & Aminah, W. (2017). Pengaruh Rasio Keuangan Terhadap Financial Distress ( Studi Pada Perusahaan Transportasi Yang Terdaftar Di Bursa Efek Indonesia Periode 2011-2015). E-Proceeding of Management, 4(2), 1580–1587.

https://openlibrarypublications.telkomuniversity.ac.id/index.php/management/article/v iew/1411

Sudirman, I W. (2013). Manajemen Perbankan: Menuju Bankir Konvensional yang Profesional. Jakarta: Kencana Prenada Media Group.

Sukariana, I. W., & Darma, G. S. (2015). Peran Audit Dalam Pengendalian Internal Serta Pengungkapan Kerugian Material Untuk Good Corporate Governance. Jurnal Manajemen Bisnis, 12(2), 181-194. https://journal.undiknas.ac.id/index.php/magister-manajemen/article/view/305

Sofiasani, G., & Gautama, B. P. (2016). Pengaruh CAMEL terhadap Financial Distress Pada Sektor Perbankan Indonesia Periode 2009- 2013. Journal of Business Management and Enterpreneurship Education, 1(1), 136–146

Widhiadnyana, I. K., & Ratnadi, N. M. D. (2019). The impact of managerial ownership, institutional ownership, proportion of independent commissioner, and intellectual capital on Financial Distress. Journal of Economics, Business & Accountancy Ventura, 21(3), 351-360. https://doi.org/10.14414/jebav.v21i3.1233

Widiatmika, P. H., & Darma, G. S. (2018). Good Corporate Governance, Job Motivation, Organization Culture Which Impact Company Financial Performance. Jurnal Mananjemen Dan Bisnis, 15(3), 82–99.

https://journal.undiknas.ac.id/index.php/magister-manajemen/article/view/608

Wiratmini, N. P. E. (2021). Rasio Kredit Bermasalah BPR di Bali Tembus 7 Persen, Masih Sehat?. Retrieved from: https://bali.bisnis.com/read/20210304/538/1363648/rasio-kredit-bermasalah-bpr-di-bali-tembus-7-persen-masih-sehat. (Diakses tanggal 29 Mei 2021 pukul 12.22 WITA)

Yudha, A., & Fuad. (2014). Analisis Pengaruh Penerapan Mekanisme Corporate

Governance terhadap Kemungkinan Perusahaan Mengalami Kondisi Financial Distress (Studi Empiris Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun 2010-2012). Diponegoro Journal of Accounting, 3(4),1-12.

https://ejournal3.undip.ac.id/index.php/accounting/article/view/10278

Yuliana, D. (2018). Prediksi Kebangkrutan Perusahaan Dari Aspek Keuangan Dengan Berbagai Metode. Malang: UIN-Maliki Press.

Zahronyana, B.,D & Mahardika, Dewa P.K. (2018). Capital Adequacy Ratio, Non Performing Loan, Net Interestmargin, Biaya Operasional Pendapatan Operasional Danloan To Deposit Ratio Terhadap Financial Distress. Jurnal Riset Akuntansi Kontemporer. 9(2), Oktober 2018, Hal. 90-98. ISSN 2088-5091.

Zaki, E., Bah, R., & Rao, A. (2011). Assessing probabilities of Financial Distress of banks in UAE. International Journal of Managerial Finance, 7(3), 304–320.

https://www.researchgate.net/publication/243463673_Assessing_probabilities_of_fina ncial_distress_of_banks_in_UAE

Discussion and feedback