The Effect of Women’s Entrepreneurship Orientation and Local Wisdom on Capital Structure And SMEs Performance

on

Ni Luh Anik Puspa Ningsih, The Effect Of Women’s Entrepreneurship,…

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 16 No. 1, Februari (2022), 77-86

THE EFFECT OF WOMEN’S ENTREPRENEURSHIP ORIENTATION AND LOCAL WISDOM ON CAPITAL STRUCTURE AND SMES PERFORMANCE

Ni Luh Anik Puspa Ningsih1) , Ni Putu Rediatni Giri2),

Putu Hella Mey Artha3),

1,2,3 Universitas Warmadewa, Bali, Indonesia

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2022.v16.i01.p06

ABSTRAK

Tujuan dari penelitian ini adalah untuk menganalisis hubungan antara kewirausahaan perempuan dan nilai-nilai kearifan local dalam keputusan penggunaan hutang dan kinerja UKM di Bali. Penelitian ini mempergunakan data primer yang dikumpulkan dengan mempergunakan kuesioner dan indepth interview. Sampel penelitian terdiri dari 35 UKM dengan pemilik perempuan. Pengujian data menggunakan Partial Least Square (PLS). Hasil penelitian menunjukkan bahwa nilai-nilai kearifan lokal yang digali dari budaya Hindu di Bali yaitu Jengah, Menyama-braya dan Dana Punia secara signifikan mampu meningkatkan keputusan penggunaan hutang UKM tetapi tidak berdampak signifikan terhadap peningkatan kinerja UKM. Ketika pemilik UKM menggunakan hutang yang tinggi, justru menurunkan kinerja UKM. Orientasi kewirausahaan yang tinggi pada kepemilikan perempuan telah mereduksi keputusan penggunaan hutang pada struktur modal usaha, tetapi meningkatkan kinerja UKM. Penelitian ini berkontribusi pada pengembangan teori keuangan khususnya teori struktur modal, bahwa kinerja bisnis tidak hanya ditentukan oleh faktor keuangan tetapi juga faktor non finansial yaitu nilai-nilai kearifan lokal dan orientasi kewirausahaan perempuan.

Kata kunci: orientasi kewirausahaan perempuan, kearifan lokal, hutang, kinerja keuangan, UKM

ABSTRACT

The purpose of this study is to analyze the relationship between women's entrepreneurial orientation and local wisdom values on the capital structure and performance of SMEs in Bali. This study uses primary data collected by using a questionnaire. The research sample consisted of 35 silver craft SMEs in Gianyar, Bali with female owners. Testing the data using Partial Least Square (PLS). The results show that the values of local wisdom extracted from Hindu culture in Bali, namely Jengah, Menyama-braya and Dana Punia are significantly able to improve the decision to use debt, but it does not have a significant impact on improving the SMEs’ performances. When the owner uses high debt, it actually reduces the SMEs’ financial performance. The high entrepreneurial orientation of women's ownership has no significant effect on the decision to use debt on the capital structure, but it does have a significant positive impact on the financial performance of silver handicraft SMEs. This research contributes to the development of financial theory, especially the theory of capital structure, that the financial performance of SMEs is also determined by non-financial factors, namely entrepreneurial orientation.

Keyword : Women’s Entrepreneurial Orientation, Local Wisdom, Debt, Financial Performance, SMEs

INTRODUCTION

The economic growth of a country is generally determined by the performance of SMEs. Some indicators of the performance of SMEs include employment, income, and profits. SMEs are able to reduce unemployment compared to other large industries (Cawood, 2010).

The performance of SMEs is the focus of local and central governments. Various efforts to optimize the performance of SMEs are outlined in various policies including the Kredit Usaha Rakyat (KUR) program (SMEs’ debt platform), SME’s product exhibitions, skills training, and management and development of entrepreneurial programs among university students. Although, there are various obstacles also to overcome, such as meeting credit requirements, bankable SMEs but not yet feasible, network development, production management, ability to adopt information technology, product design and marketing, and interaction with local culture. This study focuses on the financial performance. The relationship between financial performance and local cultural values where the business is located is a dualism and has been investigated previously. In a study conducted by Ningsih et al. (2015) and Wiagustini et al. (2017) found that cultural values extracted from Balinese local wisdom "Catur Purusa Artha" can improve financial performance as measured by the profitability of SMEs in Bali. The values of local wisdom also affect business funding decisions.

Local wisdom values adopted by businesses also have an impact on business funding decisions. Capital management has an impact on business development (Fauzi et al., 2017). In the hierarchy of capital structure (Modigliani & Miller, 1958) a business will use its own capital which has the lowest cost, until finally using additional capital from loans with the lowest cost and risk (Myers & Majluf, 1984). The use of debt in the capital structure in the company's activities has a significant effect on business profitability (Yani, 2016). Research related to the relationship between culture and capital structure includes Hogan & Coote (2014); Ningsih et al. (2015); Naranjo-Valencia et al., (2016); Wiagustini et al., (2017) found that organizational cultural values have an impact on increasing the use of capital for business development. Consistent results were found on Antonczyk & Salzmann (2014); (Fleming, (2015) found that cultural values extracted from local concepts applied to organizations had a significant positive impact on funding decisions as measured by the use of debt.

One of the non-financial aspects that support the optimization of business performance is entrepreneurial orientation (EO). This attitude is reflected by innovation, proactiveness, and risk taking (Covin, Jeffrey & Slevin, Dennis, 1989). A high level of EO is increasingly able to improve business performance. The EO of the business owners or managers will be able to increase profitability (Gupta & Gupta, (2015); Magaji et al., (2017); and Otoluwa et al. (2018)). The EO also plays a role in a business’ financial resources management. The increase in EO is in line with the increasing need for capital. Studies on the increase in the capital needs of SMEs found that the EO of entrepreneurs or business owners has a significant effect on SME funding decisions. (Ningsih et al., (2015); Wiagustini et al. (2017).

The purpose of this study is to examine the relationship between the EO of female business owners and the values of local wisdom and financial factors, namely the use of debt and the financial performance of SMEs.

LITERATURE REVIEW AND HYPOTHESIS FORMULATION

Pecking Order Theory

In pecking order theory, the use of internal financing (retained earnings) is the main choice before using external financing. If the company requires additional sources of funds, the securities, like bonds, options, and shares should be alternatives. This would need to consider the effect of information asymmetry and the cost of issuing shares (Myers & Majluf, 1984)

Trade-Off Theory

The use of debt in the company's capital structure could optimally maximize company profits. Companies can get tax savings from using debt. To manage the capital structure, managers will consider the trade-off between tax savings and the possible costs that may arise (Modigliani & Miller, 1958).

Local Wisdom Values, Debt and Financial Performance of SMEs

The value of local wisdom extracted from Hindu culture in Bali is formed from jengah (internal drive to work hard) taksu (honesty in business activities), menyama braya (togetherness/mutual cooperation in work to achieve goals) (Sitiari et al., 2016) and dana punia (donations for social and religious activities) (Kusuma et al., 2017). The better the application of cultural values, the better the financial resources management by the business actors or owners. An urge to work hard to advance the business, work honestly, work with the principle of togetherness and contribute to social and religious activities require high costs.

The ability of a business to generate profits is a result of the business interaction with the cultural values (Antonczyk & Salzmann, 2014). Fleming (2015) found that the application of local cultural values in an organization has a significant positive influence on funding decisions as measured by the debt use. Ningsih et al. (2015) and Wiagustini et al. (2017) examined the cultural values extracted from Balinese local wisdom that can increase the profitability of SMEs in Bali. The consistent implementation of culture in an organization can be a stimulus in improving business performance (Sitiari et al., 2020).

The pattern of interaction between the values of local wisdom and the decision to use debt in the company's capital structure is carried out by (Hogan & Coote, 2014) (Ningsih et al., 2015); (Naranjo-Valencia et al., 2016); (Wiagustini et al., 2017). The studies found that local wisdom values reflected from cultural values affect the use of debt in the company's capital structure. Therefore, it would be logical to formulate the following hypotheses.

H1. The values of local wisdom have a significant effect on the Financial Performance.

H2. The values of local wisdom have a significant effect on the debt use.

Entrepreneurship Orientation, Debt and Financial Performance of SMEs

Entrepreneurial orientation is the attitude of business actors including being proactive, innovative, and having the courage to take investment risks, that determine the company goals achievement (Covin & Slevin, 1986) and (Covin, Jeffrey & Slevin, Dennis, 1991). Innovation is an effort to improve product/service quality through increasing creativity (Rauch et al., 2009). Proactive is an effort to look for business development opportunities, like product development, introduction of new products, diversification of new products and brands or services with the aim of maintaining the business life cycle (Venkataraman, 1999). Risk taking

is implied from the courage to take risky actions related to business management and the use of business resources for business opportunities where there is an element of uncertainty (Lumpkin & Dess, 1996).

The attitudes that are patterned continuously shape the character of an entrepreneur. Entrepreneurial characters which are important to face business competition include high motivation to meet the needs of life, future oriented, having superior leadership spirit, having extensive business network, responsive and creative in dealing with changes. This entrepreneurial characters affect business performance significantly (Timisela et al., 2017) Pattern of relationship between entrepreneurial orientation and financial performance by (Covin, Jeffrey & Slevin, Dennis, 1989); (Gupta & Gupta, 2015); (Magaji et al., 2017) show that the higher the level of entrepreneurial orientation owned by managers or business owners the higher the profitability of the business. The decision of managers or business owners in using debt as a source of business funding is determined by the level of entrepreneurial orientation. An increase in attitudes that reflect the level of entrepreneurial orientation further increases the need for capital. If internal funding sources are insufficient, debt will be used before deciding to issue new shares. Studies related to the increasing capital needs of SMEs in Bali are explained by the increasing entrepreneurial orientation of business actors or owners conducted by (Ningsih et al., 2015) and (Wiagustini et al., 2017). Thus, the next hypotheses would be as follows.

H3. Entrepreneurial orientation has a significant effect on the Financial Performance of SMEs H4. Entrepreneurial orientation has a significant effect on the use of debt

SME's Debt and Financial Performance

The use of debt in the component of financial resources is in line with the development of a business. Management of financial resources, specifically the use of loan capital in companies, is able to improve financial performance. In reverse, it is also explained that when a company tends to have good performance, it will increase the confidence of investors and creditors in providing loans (Brigham & Houston, 2017)). Several studies have found that companies using bank loan have better financial performance (Jaisinghani & Kanjilal, 2017); (Das & Swain, 2018) also found similar results, namely that optimizing the use of debt has an impact on increasing the company's ability to generate profits. The more optimal the proportion of debt use in the capital structure of SMEs the better the business performance (Ningsih et al., 2015) (Wiagustini et al., 2017). Capital management is important for measuring their impact on the company's financial performance (Taqi et al., 2016). The increase of the use of debt in the capital structure to a certain extent has an impact on increasing business financial performance (Purbawangsa & Suana, 2019). The hypothesis that follows would be:

H5. The use of debt has a significant effect on the Financial Performance of SMEs

RESEARCH METHODS

This study uses a quantitative research design using primary data in the form of business owners' perceptions regarding the variables studied in this study. The population consists of Silver Craft SMEs in Sukawati District, Gianyar Regency, Bali Province which was recorded at the Gianyar Regency Industry and Trade Office in 2019, with a total of 117 business units. Using the purposive sampling method, with the criteria that the business owners are women, a sample of 35 business units is obtained. The data then analyzed using using Partial Least Square.

The variables being studied include the following. Firstly, Local Wisdom, extracted from Hindu cultural values in Bali, which are formed from jengah (internal drive to work hard), taksu (honesty in business activities), menyama-braya (togetherness/mutual cooperation in work to achieve goals). goals) (Sitiari et al., 2016) and dana punia (donations for social and religious activities) (Kusuma et al., 2017). Secondly, The capital structure variable, which is measured by the proportion of debt to equity capital (Ningsih et al., 2015) and (Wiagustini et al., 2017). Thirdly, Entrepreneurial Orientation, which is reflected in the attitude of women entrepreneurs in business activities, namely innovative, proactive, and risk taking (Covin, Jeffrey & Slevin, Dennis, 1991). The last variable is financial performance of SMEs, measured by indicators of the increase in sales volume, profit growth and asset growth (Riana, 2011) (Ningsih et al., 2015).

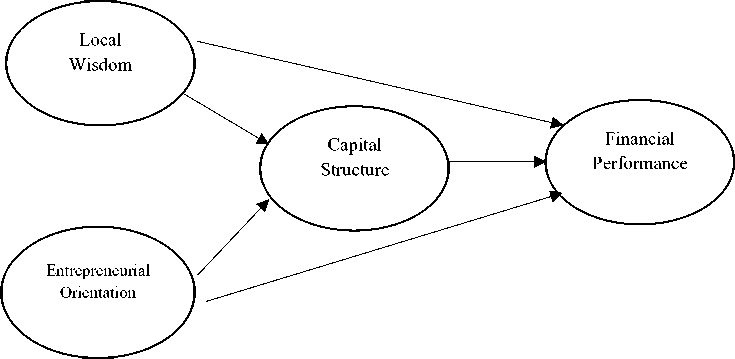

Figure 1. Research Model

RESULTS AND DISCUSSION

Table 1 shows that most of the respondents are in the age of 41-50 (71%); have undergraduate education level (89%), 69% book annual sales of 300 - 2,500 million rupiah, employ workforce of 5-19 people (77%) and have a business age of 11-20 years (63%).

-

Table 1. Respondent Characteristics

Total

Percentage (%)

Age (Person)

< 30

2

6%

31 – 40

5

14%

41 – 50

25

71%

50 >

3

9%

Education (Person)

SMA

3

9%

S1

31

89%

S2

1

3%

Annual Sales (Business Unit)

> 300 – 2.500 million

24

69%

> 2.500 – 50.000 million

11

31%

Employment (Business Unit)

> 5 – 19 orang

27

77%

20 – 99 orang

8

23%

Business Age (Business Unit)

> 5 years

1

3%

5 – 10 years

8

23%

11 – 20 years

22

63%

20 > years

4

11%

Source: Data analysis results (2020)

Based on statistical testing using Partial Least Square (PLS), the results of validity and reliability as well as the pattern of relationships between variables are presented in the following table.

-

Table 2. Test of Composite Reliability and Cronbach Alpha

Construct

Composite Reliability

Cronbachs Alpha

Local Wisdom

0,87

0,81

Debt

0,84

0,72

Financial Performance

0,78

0,75

Entrepreneurial Orientation

0,80

0,78

Source: Results of Data Analysis (2020)

Table 2 shows that the values of Composite Reliability and Cronbachs Alpha of each construct show a value greater than 0.70, which are considered as reliable and valid criteria (Solihin & Ratmono, 2013) so the reliability and validity requirements are met.

-

Table 3. Results of Data Analysis

|

onstruct |

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

Standard Error (STERR) |

T Statistics (|O/STERR|) |

|

Local Wisdom -> Debt |

0,45 |

0,40 |

0,24 |

0,24 |

1,97 |

|

Local Wisdom -> Fin Performance |

0,11 |

0,13 |

0,12 |

0,12 |

1,21 |

|

Debt -> Fin Performance |

-0,31 |

- 0,31 |

0,11 |

0,11 |

2,19 |

|

Entrepr Orient -> Debt |

- 0,37 |

-0,36 |

0,23 |

0,23 |

1,78 |

|

Entrepr Orient -> Fin Performance |

0,49 |

0,50 |

0,08 |

0,08 |

3,02 |

Source: Results of Data Analysis (2020)

At the 5 percent alpha significance level, a significant positive effect is found in the relationship between the values of local wisdom extracted from the values of Hindu culture in Bali on the decision to use the debt, but it does not significantly affect the financial performance of silver handicraft SMEs. This business has indirectly implemented the values of local wisdom in its business operations. The application of local wisdom values, the existence of jengah (intrinsic urges to work hard), menyama-braya (togetherness/mutual cooperation in work to achieve goals), dana punia (donations given sincerely both for religion and helping others) require additional funding. When internal funding sources are insufficient, external funding sources, in the form of debt will be used. The implementation of these local wisdom values does not have a direct significant impact on improving the financial performance of silver handicraft SMEs.

The decision to use debt (capital structure) has negative significant effect on the financial performance. When the female business owners decide to use debt, it will decrease the financial performance of silver handicraft SMEs. The use of debt creates fixed costs for the business unit that could decrease the financial performance of silver handicraft SMEs.

Women entrepreneurs of silver SMEs in Bali have a relatively high level of entrepreneurial orientation, but this does not have impact on the use of debt. This is due to the occurrence of fixed costs of mandatory periodic payments of principal and interest of the debt. On the other hand, the entrepreneurial orientation impacts financial performance significantly. The higher the entrepreneurial orientation the higher the financial performance of silver handicraft SMEs. The more courageous the owners take on risky investment opportunities, the more innovative and proactive they are, which in turn will have significant impact on increasing sales volume, profit and assets growth a of silver handicraft SMEs.

CONCLUSION

Based on the results and discussion, it can be concluded that the optimization of the financial performance of silver handicraft SMEs in Bali is directly influenced by the entrepreneurial orientation of the SME owners. The entrepreneurial orientation of SME owners has no significant effect on the decisions of SME owners in the use of debt. The use of too high debt actually reduces the financial performance of silver SMEs. The values of local Balinese 83

wisdom do not have a significant impact on optimizing the financial performance of silver handicraft SMEs. The findings in this study, the values of local wisdom that are explained by jengah, menyama-braya and dana punia affect the capital structure of the silver handicraft SMEs.

The variables studied were limited to the decision to use debt, the entrepreneurial orientation of female business owners, the values of local wisdom. The research location is also limited to Sukawati sub-district, Gianyar Regency, Bali. Further research is expected to expand the study on other types of SMEs such as the wood craft industry and the traditional food industry in Bali; as well as add the human resources qualification as research variables, as it also an important factor in maximizing business performance.

Business owners are suggested to pay attention to non-financial factors including the values of local wisdom and the entrepreneurial orientation in achieving the financial performance of SMEs.

Further researches are expected to study the pattern of the relationship between the entrepreneurial orientation of business owners and the use of debt. The next researcher can conduct in-depth testing regarding the gender differences of the owners in the pattern of financial decision making

REFERENSI

Antonczyk, R. C., & Salzmann, A. J. (2014). Overconfidence and optimism: The effect of national culture on capital structure. Research in International Business and Finance, 31, 132–151. https://doi.org/10.1016/j.ribaf.2013.06.005

Brigham, E. F., & Houston, J. F. (2017). Fundamentals of Financial Management: Concise 9e (9th ed.). Cengage Learning.

Cawood, G. (2010). Design Innovation and Culture in SMEs. Design Management Journal (Former Series), 8(4), 66–70. https://doi.org/10.1111/j.1948-7169.1997.tb00185.x

Covin, Jeffrey, G., & Slevin, Dennis, P. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10(1), 75–87.

file:///C:/Users/Ichiyanagi/Downloads/Strategic_Management_of_Small_.pdf

Covin, Jeffrey, G., & Slevin, Dennis, P. (1991). A Conceptual Model of Entrepreneurship as Firm Behavior. Entrepreneurhsip Theory and Practice.16 (1), 7-26

Covin, J. G.;, & Slevin, D. P. (1986). Strategic Management of Small Firms in Hostile and Benign Environemnets. Strategic Management Journal. 10, 75-87

Das, C. P., & Swain, R. K. (2018). KIIT School of Management ( KSOM ). Parikalpana - KIIT Journal of Management, 14(1), 161–171.

Fauzi, A., Suharjo, B., & Syamsun, M. (2017). Pengaruh Sumber Daya Finansial, Aset Tidak Berwujud dan Keunggulan Bersaing yang Berimplikasi Terhadap Kinerja Usaha Mikro, Kecil dan Menengah di Lombok NTB. MANAJEMEN IKM: Jurnal Manajemen Pengembangan Industri Kecil Menengah, 11(2), 151–158.

https://doi.org/10.29244/mikm.11.2.151-158

Fleming, A. E. (2015). Improving business investment confidence in culture-aligned indigenous economies in remote Australian communities: A business support framework

to better inform government programs. International Indigenous Policy Journal, 6 (3). 136 1https://doi.org/10.18584/iipj.2015.6.3.5

Gupta, V. K., & Gupta, A. (2015). Relationship between entrepreneurial orientation and firm performance in large organizations over time. Journal of International Entrepreneurship, 13(1), 7–27. https://doi.org/10.1007/s10843-014-0138-0

Hogan, S. J., & Coote, L. V. (2014). Organizational culture, innovation, and performance: A test of Schein’s model. Journal of Business Research, 67(8), 1609–1621.

https://doi.org/10.1016/j.jbusres.2013.09.007

Jaisinghani, D., & Kanjilal, K. (2017). Non-linear dynamics of size, capital structure and profitability: Empirical evidence from Indian manufacturing sector. Asia Pacific Management Review, 22(3), 159–165. https://doi.org/10.1016/j.apmrv.2016.12.003

Kusuma, G. A. T., Wardana, M., Yasa, N. N. K., & Sukatmadja, P. . (2017). Exploring the Domains of Harmonious Culture-Based Corporate Social Responsibility (CSR). International Business Management, 11(2), 498–507.

Lumpkin, G. T., & Dess, G. G. (1996). the Entrepreneurial Clarifying It Construct and Linking Orientation. Academy of Management Review, 21(1), 135–172.

Magaji, M. S., Baba, R., & Entebang, H. (2017). Entrepreneurial Orientation and Financial Performance of Nigerian SMES: Journal of Management and Training for Industries, 4(1), 25–41. https://doi.org/10.12792/jmti.4.1.25

Modigliani, F., & Miller, M. H. (1958). The Cost of Capital, Corporation Finance and the Theory of Investment. The American Economic Review, 48(3), 261–297.

https://www.jstor.org/stable/1809766

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187– 221. https://doi.org/10.1016/0304-405X(84)90023-0

Naranjo-Valencia, J. C., Jiménez-Jiménez, D., & Sanz-Valle, R. (2016). Studying the links between organizational culture, innovation, and performance in Spanish companies. Revista Latinoamericana de Psicología, 48(1), 30–41.

https://doi.org/10.1016/J.RLP.2015.09.009

Ningsih, N. L. A. ., Wiagustini, N. L. ., Artini, L. G. S., & Rahyuda, H. (2015). Organizational Culture, Decision of Funding and Financial Performance: An Evidence from Small and Medium Enterprises. European Journal of Business and Management, 7(32), 148-158– 158.

Otoluwa, N. ., Alimuddin, I. ., Alamzah, N., & Nohong, M. (2018). Innovativeness in Creative Industries : the Case of SMEs in Maros Regency. Hasanuddin Economics and Business Review, 1(3), 195–200.

Purbawangsa, I. B., & Suana, I. W. (2019). Karakteristik Perusahaan dan Struktur Kepemilikan sebagai Determinan Struktur Modal, Kinerja Keuangan serta Nilai Perusahaan. Matrik : Jurnal Manajemen, Strategi Bisnis Dan Kewirausahaan, 13(2), 184–193.

Rauch, A., Wiklund, J., Lumpkin, G. T., & Frese, M. (2009). Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrepreneurship: Theory and Practice, 33(3), 761–787. https://doi.org/10.1111/j.1540-6520.2009.00308.x

Riana, G. (2011). Dampak Penerapan Budaya Tri Hita Karana terhadap Orientasi Kewirausahaan dan Orientasi Pasar serta Konsekuensinya pada Kinerja Usaha (Studi pada Industri Kecil Menengah Kerajinan Perak di Bali). Jurnal Aplikasi Manajemen, 9 (2).601-610

Sitiari, N. ., Ningsih, N. L. A. ., & Dharmanegara, I. B. . (2020). Local Value Based Organizational Culture: a Study of Balinese Cultural Values Effect on Corporatives Employee Performance and Job Stress in Bali. PalArch`s Journal of Archaelogy of Egypt, 17 (4).3209 - 3222

Sitiari, N. ., Suprapti, N. W. ., Sintaasih, D. ., & Sudibya, G. . (2016). Exploration of Bali`s Cultural Values and Entrepreneurial Orientation in Relation to Cooperative Managers in Bali. European Journal of Business and Management, 8(14).158-169

Solihin, M., & Ratmono, D. (2013). Analisis SEM-PLS untuk Hubungan Linier dalam Penelitian Sosial dan Bisnis. ANDI.

Taqi, M., Ajmal, M., & Perves, A. (2016). Impact of Capital Structure on Profitability of Selected Trading Companies in India. Arabian Journal of Business and Management Review, 6(3).1-16

Timisela, N. R., Leatemia, E. D., & Polnaya, F. F. (2017). Analisis Kewirausahaan Agroindustri Pangan Lokal Sagu. Matrik: Jurnal Manajemen, Strategi Bisnis Dan Kewirausahaan, 11(2), 166 – 177

https://doi.org/10.24843/matrik:jmbk.2017.v11.i02.p06

Venkataraman, S. (1999). Stakeholder Value Equilibration and The Entrepreneurial Process. University of Virginia.

Wiagustini, N. L. ., Ningsih, N. L. A. ., Artini, L. G. S., & Rahyuda, H. (2017). Budaya "Catur Purusa Artha dan Orientasi Kewirausahaan sebagai Basis Keputusan Pendanaan dan Kinerja Keuangan. Proceeding Seminar Nasional AIMI.

Yani, D. (2016). Hutang Jangka Panjang Dan Profitabilitas Di Bank Syariah: Studi Pada Pt Bank Muamalat Indonesia. Matrik:Jurnal Manajemen, Strategi Bisnis Dan Kewirausahaan, 10(1), 52–63. https://doi.org/10.24843/MATRIK:JMBK

86

Discussion and feedback