Bank Profitability Analysis: the Role of Liquidity, Company Size, Asset Quality and Leverage

on

196 Matrik: Jurnal Manajemen, Strategi Bisnis dan Kewirausahaan Vol. 17, No. 2, Agustus 2023

P-ISSN: 1978-2853

E-ISSN: 2302-8890

MATRIK: JURNAL MANAJEMEN, STRATEGI BISNIS DAN KEWIRAUSAHAAN

Homepage: https://ojs.unud.ac.id/index.php/jmbk/index

Vol. 17 No. 2, Agustus (2023), 196-208

Bank Profitability Analysis: the Role of Liquidity, Company

Size, Asset Quality and Leverage

Desi Nurvitasari1) , Ulil Hartono2)

1,2 Universitas Negeri Surabaya

Email: ulilhartono@unesa.ac.id

SINTA 2

DOI : https://doi.org/10.24843/MATRIK:JMBK.2023.v17.i02.p07

ABSTRACT

Banks are one of the most important sectors for a country’s economic growth, so banks must be appropriately managed. The success of bank management is reflected in resulting profitability. This research aims to analyse the effect of liquidity, firm size, asset quality, and leverage on bank profitability in 2017-2021. The population in this study is 27, and the sample is 25, which was selected using purposive sampling. This study uses secondary data from Bank financial reports obtained from the bank website. The result shows that liquidity and company size did not affect profitability, while asset quality and leverage affected profitability. This research implies that manager banks must pay attention to asset quality and leverage by considering the 5C principle in assessing creditworthiness.

Keyword: Asset Quality; Company Size: Leverage; Liquidity; Profitability.

INTRODUCTION

Banks are one of the most important sectors for a country's economic growth. Banks are used to collect funds from the public and promote national development (OJK, 2017). Based on RI Law Number 10 of 1998 concerning Banking, "Banks are business entities that collect funds from the public in the form of savings and distribute them in the form of credit or other forms to improve the standard of living of the common people". Banks are used as liaisons between people with surplus funds and those with deficits. People with excess funds (surplus) can save their money in the bank, and later the bank will distribute the money to people who need funds (deficit) (Siahaan, 2016).

Bank management must be carried out correctly to achieve long-term goals. The effectiveness of bank management can be measured by its level of profitability. Profitability reflects the company's work performance in managing the company (Amelia Anhar, 2019). Profitability is an essential factor for maintaining the continuity of the company in the long term because profitability will show the company's prospects in the future. The higher profitability show that the company is more guaranteed in the future (Hermuningsih, 2013). According to Siahaan (2016), Return on Assets (ROA) is the most crucial ratio in measuring bank profitability because it can show the effectiveness of bank management in managing its assets to generate profits for the bank. Return on Assets (ROA) is a ratio that shows how a

company generates earnings by utilizing its assets. The greater Return on Assets (ROA) indicates better profitability because the profit level is more outstanding. Other factors, including liquidity, company size, asset quality, and leverage, can influence profitability (Ibrahim, 2017; Puteri, 2021).

According to Puteri (2021), liquidity is defined as the ability to guarantee the availability of sufficient funds so that the bank can fulfil all of its obligations. Loan Deposit Ratio (LDR) is a liquidity ratio that shows the amount of loan disbursement from banks to customers with money received by banks from third parties. Based on Indonesia Bank Regulation Number 15/7/PBI/2013, the minimum limit for LDR value is 78%; meanwhile, the maximum limit for LDR value has been 92% since 2 December 2013. Banks must be able to maintain the value of the Loan Deposit Ratio (LDR) to be manageable (Agustina Wijaya, 2013). If the LDR is too high, it will make the bank illiquid. While the LDR is too low, it will show a lot of idle funds so that the bank can earn very little profit. Pinasti Mustikawati (2018) explained that the total amount of credit given to customers would affect the amount of profit bank because the bank will receive payment of debt interest from the debtor. Based OJK No. 14/SEOJK.03/2017, LDR is calculated by comparing total debt and total third-party funds. A high LDR shows that the bank can distribute third-party funds to customers through loans. The distribution of loans to debtors will provide profit to the bank through loan interest income. Aldizar Agustina (2022), Alphamalana (2021), Pinasti Mustikawati (2018), Fadillah (2021), Nasrulloh (2018), and Lestari et al. (2021) found that liquidity has no significant effect on profitability. However, Saputri (2021), Ibrahim (2017), and Yusuf (2017) have a significant positive effect on profitability. On the other hand, Awulo et al. (2019) and Budhathoki et al. (2020) stated that liquidity significantly negatively affects profitability.

According to Cardilla et al. (2019), company size will reflect how big the company is. In the banking sector, company size can be calculated using total assets, liabilities, and deposits (Samad, 2015). Astivasari Siswanto (2018) explained that a large company size would make it easier to obtain funds. It can happen because the company gains investors' trust, so that it will increase profitability. Big corporations enjoy a competitive edge over smaller firms because they can diversify into multiple product lines, thus reaping the benefits of scale and size. As a result, they are better positioned to capitalize on technical and financial economies of scale in production, marketing, management, and fundraising (Yadaf et al., 2022). Furthermore, Wardana Widyarti (2015) stated that significant total assets at banks could be used to channel funds to third parties, such as deposits, investments and financing, so that they can provide benefits for banks. Puteri (2021), Lestari et al. (2021), Budhathoki et al. (2020), and Serly Jennifer (2021) proved that profitability is significantly positively affected by company size. Meanwhile, Syafi'i Haryono (2021), Yusuf (2017), Ali Ghazali (2018), Goso (2022), Mustafa Sulistyowati (2022), and Mailinda et al. (2018) proved that profitability is not significantly affected by company size. Wardana Widyarti (2015) and Rahaman Akhter (2015) found that profitability has a significantly negative effect on company size.

Asset quality indicates a bank's ability to avoid problem loans. Non-Performing Loans (NPL) can determine the quality of bank assets by assessing how well the banking capacity is related to managing loans distributed to debtors. High NPL indicates an increase in bad loans (Puteri, 2021). A rise in non-performing loans (NPLs) can lead to a loss of opportunities for banks to earn revenue from loan interests, which can have a negative impact on profitability and return on assets (ROA). This indicates poor asset quality, as an increase in NPLs indicates

a higher financial risk. Therefore, good credit management is critical for banks to avoid increasing Non-Performing Loans (NPL). Board of Governors Regulation Number 23/6/PDAG/2021 states that a Non-Performing Loan (NPL) limit is <5%. Sari Septiano (2020) stated that NPL would describe the failure of banks in managing credit where, which can cause liquidity problems at the bank. Bad loans prevent banks from obtaining income, affecting company profitability (Pinasti Mustikawati, 2018). Aldizar Agustina (2022), Siahaan (2016), Puteri (2021), Silvia (2017), Alphamalana (2021), Nasrulloh (2018), and Sari Septiano (2020) found that asset quality has a significant negative effect on profitability.

However, Sugiarto Lestari (2017), Fadillah (2021), Uddin (2022), Wardana Widyarti (2015), and Ningsih et al. (2017) show that asset quality has no significant effect on profitability. Meanwhile, on the other side, Saputri (2021) and Yusuf (2017) stated that asset quality significantly influences profitability.

Tangngisalu Hemanuhutu (2020) define leverage as the ratio used to measure the ratio between total assets and financing provided by creditors (debt). Using large debt will increase the risk because the company must repay the debt with additional interest payments. The greater the leverage ratio will increase the risk of default and affect the decline in profitability. Ownership of large debt will increase the risk because the company must repay the debt accompanied by additional interest payments. Therefore, it is crucial for companies to manage their debt effectively in order to increase profitability in the future Debt to Equity Ratio (DER) and Debt to Asset Ratio (DAR) can be used to assess leverage. DAR is a leverage ratio that compares the bank's total assets and debt. A high DAR indicates financial risks are more remarkable because the risk of debt default increases. The higher DAR also indicated that total debt is higher than total assets.

Based on Al-Habashneh (2022), Bunyaminu et al. (2021), Kaur (2022), Okeke Chinedu (2023), and Dewi Wisadha (2015), leverage significantly negatively affects profitability. Syafi'i Haryono (2021), Ibrahim (2017), Budhathoki et al. (2020), and Mailinda et al. (2018) stated that leverage has a significant positive effect on profitability. In contrast, Lestari et al. (2021), Uddin (2022), and Rahaman Akhter (2015) stated that leverage has no significant effect on profitability.

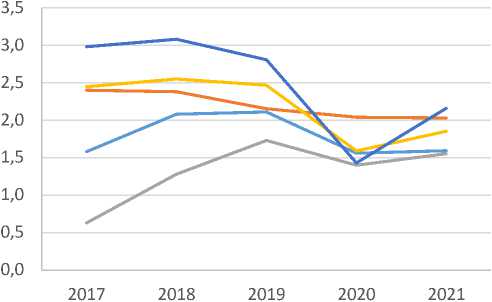

Development of ROA Value in 2017-2021

^^^^^^^≡ Private Bank

^^^^^^^v Regional Bank

^^^^^^^^»Sharia Bank

^^^^^mCommercial Bank

^^^^^^^^» State-Own Bank

Figure 1. Development of Indonesian Banks ROA Value

Source: OJK

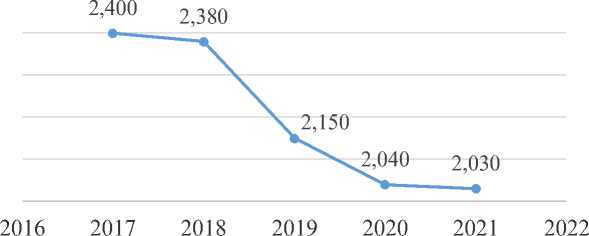

Figure 2. Development of Indonesian Regional Banks ROA values Source: OJK

This study analyses the influence of liquidity, company size, asset quality, and leverage of Regional Banks in the 2017-2021 period. Figure 1 shows the Return on Aset (ROA) of Private Bank, Regional Banks, Sharia Bank, Commercial Bank, and State-Own Bank in 2017-2021. Based on Figure 1, in 2018 and 2021, ROA values in all banking sectors are increasing except Regional Banks. While Figure 2 shows that in 2017-2021 the ROA value of Regional Banks continued to decline. Based on Figure 2, the ROA value of Regional Banks in 2018 dropped by 0,02% and in 2019 fell by 0,23%. Then the ROA value of Regional Banks in 2020 continued to shrink by 0,11% and in 2021 by 0,01%. Decreased ROA value of Regional Banks shows they cannot use their assets effectively to generate profits.

The anticipated income theory explains the relationship between liquidity and profitability (Mohammad et al., 2021). The theory states that banks must be able to provide long-term credit with the repayment schedule of the principal and interest expected to be paid following a predetermined period. Timely debt payments by a debtor will help the bank maintain its cash reserves to keep its liquidity needs. Liquidity is a bank's ability to pay its short-term debts. This debt financing is done by returning the funds deposited by the customer in the form of a credit to the public. Customers can withdraw these funds anytime, so the bank must have sufficient cash reserves to return customer funds. Cash reserves can be obtained from credit payments made by debtors. With abundant cash reserves, bank liquidity can be fulfilled, and banks can increase lending. Liquidity has a significant effect on profitability. This effect shows that higher liquidity indicates an increase in lending. This increase will help banks to increase profits because banks will benefit from loan interest payments made by debtors. Moreover, most of the banks' profits are from debtor interest payments. Liquidity affects profitability (Ibrahim, 2017; Puteri, 2021; Saputri, 2021; Yusuf, 2017).

H1: Liquidity affects regional banks' profitability for the 2017-2021 period.

Signalling theory explains that positive information about a company's financial performance can interest investors (Fadillah, 2021). Investors will use information about the company's financial performance to evaluate it, which will then be used as material for investment consideration. Larger companies will be relatively stable and able to generate profit (Setiadewi Purbawangsa, 2015). It shows that companies are wealthy because it can be challenging to generate profit so that investors can invest more safely in the company. Also, it will be easier for a big company to increase their profits through expansion. Expansion is an active action to expand and enlarge the company (Ramadhanti et al., 2021). Company size significantly affects profitability. This condition can occur because the larger company indicates increased bank market confidence. Significant assets can be used to increase bank

profitability through its operational activities, especially by extending credit, which will increase bank profitability. (Budhathoki et al., 2020; Lestari, et al., 2021; Puteri, 2021; Serly Jennifer, 2021).

H2: Company size affects Regional Bank's profitability for the 2017-2021 period.

Good asset quality can be seen from the low value of non-performing loans. In the anticipated income theory, it is explained that good bank liquidity occurs when loan repayments by debtors are made on time. Timely repayment of loans will increase bank profitability. The bank will return the money distributed to the debtor and benefit from the loan interest paid. Re-acceptance of disbursed loans will create enormous cash reserves to fulfil funding needs. As reflected in NPL, high asset quality would describe a bank's failure to manage credit, which could lead to liquidity problems. High credit defaults will also cause banks to delay obtaining income, affecting company profitability (Sari Septiano, 2020; Pinasti Mustikawati, 2018). According to Aldizar Agustina (2022), asset quality significantly affects profitability. The more outstanding quality of assets indicates that there needs to be better credit management at the bank. It will lead to the emergence of more special financing, which will cause a decrease in profits (Alphamalana, 2021; Nasrulloh, 2018; Puteri, 2021; Sari Septiano, 2020; Siahaan, 2016; Silvia, 2017).

H3: Asset quality affects regional banks' profitability for the 2017-2021 period.

High leverage will increase the company's obligation to repay its debts accompanied by interest payments. If the leverage doesn't generate a profit greater than the interest expense, losses may occur. It can increase the risk of default on debt. The influence between leverage and profitability is explained using the pecking order theory. This theory illustrates that companies with high profitability have less debt. With a small debt value, the company can reduce the risk of default on debt so that the risk of bankruptcy can also be avoided. A small amount of corporate debt will increase the company's profit because the company's obligation to pay the principal debt and interest is also tiny. It also will reduce company expenses and increase profitability. Leverage significantly influences profitability. These findings indicate that an increase in bank debt will reduce the profit received by the bank. It can happen because the more outstanding the total debt, the greater the interest expense. Also, the more outstanding the total debt will increase the expense so that it can decline generated profit (Al-Habashneh, 2022; Bunyaminu et al., 2021; Dewi Wisadha, 2015; Kaur, 2022; Okeke Chinedu, 2023).

H4: Leverage affects regional banks' profitability for the 2017-2021 period.

METHOD

This research uses quantitative research. The population of this study are 27 regional banks in Indonesia. This study censuses all regional banks in Indonesia that published financial reports on their website for the 2017-2021 period, i.e., 25 regional banks. This research uses secondary data, i.e., regional bank financial reports from company websites. The dependent variable in this study is profitability, which is measured by Return on Asset (ROA). In contrast, the independent variables used are liquidity using the Loan to Deposit Ratio (LDR) proxy, company size by assets proxy, asset quality using the Non-Performing Loan (NPL) proxy, and leverage by using the Debt to Assets Ratio (DAR) proxy. The testing phase is by carrying out classical assumption tests (normality test, multicollinearity test, autocorrelation

test, and heteroscedasticity test), multiple linear regression analysis, and hypothesis testing (t-test, F test, and coefficient of determination) using SPSS 2020.

RESULTS AND DISCUSSION

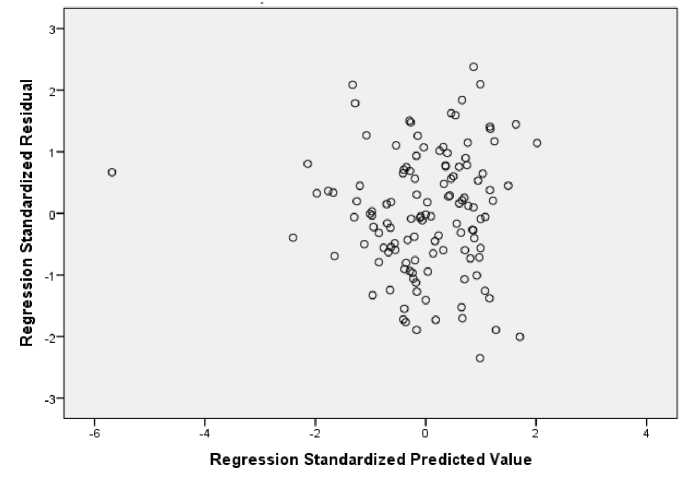

Classic Assumption Test

The normality test results using the One-Sample Kolmogorov-Smirnov (KS test) in Table 1 show a sig value of 0.130 > 0.05, so the data used is normally distributed. The multicollinearity test results in Table 2 show a Variance Inflation Factor (VIF) value of ≥10 and a tolerance value of ≤0.10. Based on the multicollinearity test, it can be interpreted that the independent variables used in this study did not experience symptoms of multicollinearity because there was no relationship between the independent variables. Furthermore, the autocorrelation test in this research uses the Durbin-Watson test to identify the occurrence of autocorrelation symptoms. In this study, the number of independent variables (k) = 4 and the number of samples (N) = 125. From the Durbin-Watson test, the du value is 1.7745, and the Durbin-Watson value is 2.115, presented in table 3. When this value is entered into the du<dw<4-du equation, the result is 1.7745<2.115<2.2255, so there is no autocorrelation problem. The scatterplot graph in this study is used to test heteroscedasticity. Figure 3 shows the results of the heteroscedasticity test. The data points do not create regular patterns; their distribution is up and down the Y axis, indicating no heteroscedasticity relationship. Based on the classic assumption test, the regression model is the Best Linear Unbias Estimator (BLUE). It means that the parameter value of the regression model is linear, unbiased, and have the most negligible variance from other estimation.

Table 1. Normality Test Result (K-S Test)

|

abs_res | ||

|

N |

125 | |

|

Normal Parametersa,b |

Mean |

0.4663 |

|

Std. Deviation |

0.34394 | |

|

Absolute |

0.105 | |

|

Most Extreme Differences |

Positive |

0.105 |

|

Negative |

-0.090 | |

|

Kolmogorov-Smirnov Z |

1.170 | |

|

Asymp. Sig. (2-tailed) |

0.130 | |

|

Source: Output SPSS, 2020 | ||

Table 2. Multicollinearity Test Result

|

Model |

Collinearity Statistics |

|

tolerance VIF |

(Constant)

|

LDR |

0.908 |

1.101 |

|

Ln_Asset |

0.861 |

1.162 |

|

NPL |

0.916 |

1.091 |

|

DAR |

0.894 |

1.119 |

Source: Output SPSS, 2020

Table 3. Autoccorelation Test Result

|

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Durbin-Watson |

|

0.550a |

0.303 |

0.279 |

0.59053 |

2.115 |

Source: Output SPSS, 2020

Figure 3. Heteroscedasticity Test Result

Source: Output SPSS, 2020

Multiple Linear Regression Test

A multiple linear regression test is used to predict the condition of the dependent variable, which is influenced by two or more independent variables. The multiple linear regression test in this study is utilized to predict the state of profitability, which is influenced by liquidity, company size, asset quality, and leverage.

Table 4.

Linear

Test Results

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. | |

|

B |

std. Error |

Beta | |||

|

(Constant) |

7.487 |

1.711 |

4.377 |

0.000 | |

|

LDR |

0.004 |

0.004 |

0.068 |

0.847 |

0.399 |

|

Ln_Asset |

-0.136 |

0.072 |

-0.155 |

-1.882 |

0.062 |

|

NPL |

-0.171 |

0.031 |

-0.443 |

-5.560 |

0.000 |

|

DAR |

-0.032 |

0.015 |

-0.165 |

-2.048 |

0.043 |

Source: Output SPSS, 2020

The constant value has a positive value that is 7.487. The positive sign shows a unidirectional influence between the independent and dependent variables. It shows that if the independent variables, including asset quality and leverage, have 0 value or do not change the value, profitability will increase by 7.487. The value of the asset quality coefficient is -0.171, which indicates that if the asset quality increases by 1 unit, the profitability value will decrease

by 0.171 units. The higher the asset quality value, the smaller the profitability value. While leverage coefficient -0.032 indicates that if leverage has increased by 1 unit, the profitability value has decreased by 0.032 units, so the higher the leverage value, the smaller the profitability value.

Hypothesis Testing

The t-statistical test is a statistical measurement used to prove the effect of each independent variable on the dependent variable. Table 4 shows the results of partial testing of liquidity variables, company size, asset quality, and leverage on profitability. Based on the t-test produced in Table 4, it is known that the sig value of liquidity is 0.399. Its values are more than 0.05, so H1 is rejected, meaning liquidity does not affect profitability. Then table 4 shows the t-test about company size. It shows that the sig value of the company size is 0.062. The sig value is more than 0.05, so H2 is rejected, which means company size does not affect profitability. This T-test in Table 4 also shows the effect of asset quality on profitability. Based on Table 4, the sig value of asset quality is 0.00. This value is smaller than 0.05, so H3 accepted or asset quality significantly affects profitability. Furthermore, based on Table 4, the t-test result shows that the sig value of leverage is 0.043. This value is smaller than 0.05, so H4 accepted or leverage significantly affects profitability.

The results of the F test presented in Table 5 show a sig value of 0.000 <0.05, so Hα is accepted with the conclusion that liquidity, firm size, asset quality, and leverage affect profitability. The coefficient of determination is 0,279. This value shows that the independent variable, liquidity, firm size, asset quality, and leverage, can explain information about the dependent variable by 27,9%. In comparison, the remaining 72.1% is described by other independent variables not used in this study.

Table 5. F Test Result

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

Regression |

18,156 |

4 |

4,539 |

13,016 |

0,000b |

|

Residual |

41,848 |

120 |

0,349 | ||

|

Total |

60,003 |

124 |

Source: Output SPSS, 2020

Effect of Liquidity on Profitability

This study proves that liquidity does not influence profitability, so H1 is rejected. Liquidity measured by LDR is not the main factor influencing a bank to generate profit.This finding differs from the anticipated income theory, which states that good liquidity will provide regular cash flow for banks so that it can be used to gain profits through lending. Liquidity, as measured using the Loan Deposit Ratio (LDR), will describe the ability of banks to extend credit using third-party funds. Liquidity does not affect profitability because banks cannot channel their credit properly (Wardana Widyarti, 2015). Credit distribution that is not managed correctly can cause bad credit problems. It will delay the bank from obtaining profit from interest payments by debtors. So liquidity is not the main factor used to determine the success of making a profit, but good credit management will be crucial for banks to increase their profits. With good management, banks will avoid credit defaults and have regular cash flow to meet the bank's liquidity needs adequately. While Aldizar Agustina (2022) stated that liquidity does not affect profitability because liquidity banks have disturbances such as disruptions to the management of bank financing where banks only focus

on long-term financing than raising funds from third parties. The results of this research follow the findings of Alphamalana (2021), Pinasti Mustikawati (2018), Fadillah (2021), Nasrulloh (2018), and Lestari et al. (2021).

Effect of Company Size on Profitability

This study proves that company size, as reflected in total assets, does not affect profitability, so H2 is rejected. This result confirms previous research that measuring company profitability by total assets can only be accurate if assets are used for financing, which can impact profitability (Abeyrathna Priyadarshana, 2019). Companies with large sizes have high operational costs, which will cause an increase in the company's burden (Syafi’i Haryono, 2021). Even though the company can generate higher income, the financing that the company must issue also increases so that this does not affect the profit generated by the company. Then Mailinda et al. (2018) explain that this situation can occur because banks do not maximize the use of their assets to generate profits. Even though the bank has significant total assets, it must maximize its use to make its assets more stable to generate maximum profits. It shows that company size cannot be used as a benchmark in creating bank profits. The results of this research support the results of research by Yusuf (2017), Ali Ghazali (2018), Goso (2022), Mustafa Sulistyowati (2022) and are not in line with signalling theory. Based on signalling theory, the larger the company's size will increase profitability because the company gains the trust of third parties such as investors and customers. It will make it easier for banks to obtain funds that can be used to increase lending in order to increase company profits. This statement differs from the research results, which explain that company size cannot be used to assess a bank's success in generating profits because other factors influence the bank's generating profits, such as optimal and effective asset management.

Effect of Asset Quality on Profitability

This study proves that profitability is affected by asset quality. Thus H3 is accepted. The result indicates the opposite effect between the independent and dependent variables. The greater the asset quality measured with NPL, the higher the credit default, making lower profitability. The higher credit default indicates the asset quality is worsening, so the higher NPL means low asset quality. The results of this study are in line Aldizar Agustina (2022), Siahaan (2016), Puteri (2021), Silvia (2017), Alphamalana (2021), Nasrulloh (2018), and Sari Septiano (2020). This finding follows the anticipated income theory, which explains that timely credit payments provided by debtors will provide more significant profits. With timely credit payments, the bank will receive regular debt payments so that the bank will get a profit from the credit interest paid by the debtor. Asset quality, as measured using NPL, will provide information regarding the occurrence of problem loans. High NPL will cause the bank to experience a decrease in profitability. It can happen because a high NPL will cause banks to experience delays in receiving debt and interest payments. With this delay in payment, the bank will lose its profit because most of the profit it generates comes from interest on lending. If the company's profits fall, this will impact bank profitability because the bank's ability to generate profits using its assets, which is reflected in ROA, also decreases.

Effect of Leverage on Profitability

This study proves that leverage influences profitability, so H4 is accepted. High leverage will cause losses for the bank if the leverage used cannot generate more profit than the interest expense it bears. A negative beta (β) value indicates that the greater the leverage will reduce the profitability value. This research results align with the pecking order theory,

which explains that companies with high profitability tend to have less debt. Using large debt will increase the risk because the company must repay the debt with additional interest payments. If the bank cannot generate a profit more than the interest expense on its debt, it will cause the bank to experience a decrease in the value of its assets. It will affect bank liquidity. If the bank continues to suffer losses and experiences a decrease in the number of assets, this can lead to bankruptcy. In addition, the declining value of assets will also affect the number of cash reserves at the bank and reduce the bank's ability to distribute credit. A decrease in credit capacity will result in a decrease in the profit generated by the company's credit interest receipts. In addition, the larger the loan, the greater the expenditure and the lower the profits.The results of this study support the results of research by Al-Habashneh (2022), Bunyaminu et al. (2021), Kaur (2022), Okeke Chinedu (2023), and Dewi Wisadha (2015).

CONCLUSION

This research concludes that liquidity does not have an impact on profitability. However, banks should ensure proper distribution of credit, which could play a vital role in profitability. Profitability is also not affected by the size of the firm. However, companies with larger sizes and high operational costs may face an increase in the burden on the company. Asset quality, on the other hand, does affect profitability. This study indicates that higher NPLs (non-performing loans) generally result in higher profitability, suggesting that better asset quality may lead to higher profitability. This, in turn, suggests that an increase in nonperforming loans may lead to lower profitability. Leverage also has an effect on profitability. This study proves that greater leverage reduces profitability since higher leverage leads to a significant increase in interest expenses, which increases the risk of default.

The study recommends conducting further research on profitability by using other independent variables to identify the various factors that affect it, such as the ratio of BOPO, NIM, and CAR. Third parties, including customers and investors, should consider the quality of assets and leverage owned by the company, as these two variables can negatively impact the company's profit. If companies, especially banks, possess high asset quality and low leverage, it indicates good performance and ensures future prospects. Banking institutions should evaluate the eligibility of debtors applying for credit based on the 5C principle, which includes character, capacity, capital, collateral, and conditions. Along with the 5C principles, banks must also manage their debts to generate profitability by maximizing the use of debt for lending. This strategy will help the bank generate more significant profits by receiving credit interest payments from debtors.

REFERENCES

Abeyrathna, S. P. G. M., Priyadarshana, A. J. M. (2019). Impact of Firm size on Profitability. International Journal of Scientific and Research Publications (IJSRP), 9(6). http://doi.org/10.29322/ijsrp.9.06.2019.p9081

Agustina, Wijaya, A. (2013). Analisis Faktor-Faktor yang Mempengaruhi Loan Deposit Ratio Bank Swasta Nasional di Bank Indonesia. Jurnal Wira Ekonomi Mikroskil, 3(2),

101–109. http://doi.org/10.55601/jwem.v3i2.206

Al-Habashneh, A. G. (2022). Impact of Financial Leverage and Return on Investment on the Profitability of Jordanian Commercial Banks. International Journal of Academic Research in Accounting, Finance and Management Sciences, 12(3), 804–822. http://doi.org/10.6007/IJARAFMS /v12-i3/15320

Aldizar, A., Agustina, V. (2022). Analysis of The Influence of Asset Quality, Liquidity, and Capital on Profitability (Empirical Study on Islamic Commercial Banks 2015-2019 period). International Journal of Economics, Business and Accounting Research (IJEBAR), 6(2), 1702–1711. http://doi.org/10.29040/ijebar.v6i2.3029

Ali, S. A., Ghazali, Z. (2018). Impact of Firm Size on Profitability: A Comparative Study of Islamic Bank and Commercial Bank in Pakistan. Global Journal of Management and Business Research, 18(5), 30–35.

Alphamalana, I. L. (2021). Pengaruh Capital Adequacy Rasio, Dana Pihak Ketiga, dan Non Performing Loan, terhadap Profitabilitas dengan LDR sebagai Variabel Intervening pada Bank Umum Konvensional di Indonesia. Jurnal Ilmu Manajemen, 9(1), 437–450. http://doi.org/10.26740/jim.v9n1.p437-450

Amelia, F., Anhar, M. (2019). Pengaruh Struktur Modal dan Pertumbuhan Perusahaan terhadap Nilai Perusahaan dengan Profitabilitas sebagai Variabel Intervening (Studi Empiris pada Perusahaan Pertambangan yang Terdaftar di Bursa Efek Indonesia 20132017). Jurnal STEI Ekonomi, 28(1), 44–70.

Astivasari, N., Siswanto, E. (2018). Pengaruh Struktur Modal dan Ukuran Perusahaan terhadap Profitabilitas Perusahaan Indonesia (Studi pada Perusahaan Sektor Properti dan Real Estate yang Listing di BEI Periode 2012-2014). Ekonomi Bisnis, 23(1), 35–42. http://doi.org/10.17977/um042v23i1p35-42

Awulo, T., Alemu, A., & Chala, B. W. (2019). Impact of Liquidity on Profitability of Bank : A Case of Commercial Bank of Ethiopia. Research Journal of Finance and Accounting, 10(1), 26–34. http://doi.org/10.7176/RJFA

Budhathoki, P. B., Rai, C. K., Lamichhane, K. P., Bhattarai, G., Rai, A., 1. (2020). The

Impact of Liquidity, Leverage, and Total Size on Banks’ Profitability: Evidence from Nepalese Commercial Banks. The Asian Institute of Research Journal of Economics and Business, 3(2), 545–555. http://doi.org/10.31014/aior.1992.03.02.219

Bunyaminu, A., Yakubu, I. N., Bashiru, S. (2021). The Effect of Financial Leverage on Profitability: An Empirical Analysis of Recapitalized Banks in Ghana. International Journal of Accounting & Finance Review, 7(1), 93–102.

http://doi.org/10.46281/ijafr.v7i1.1227

Cardilla, A. L., Muslih, M., Rahadi, D. R. (2019). Pengaruh Arus Kas Operasi, Umur Perusahaan, dan Ukuran Perusahaan terhadap Kinerja Perusahaan Perbankan yang Terdaftar di Bursa Efek Indonesia Periode 2011-2016. Firm Journal of Management Studies, 4(1), 66–78. http://doi.org/10.33021/firm.v4i1.686

Dewi, N. T., Wisadha, I. G. S. (2015). Pengaruh Kualitas Aktiva Produktif, CAR, Leverage, dan LDR pada Profitabilitas Bank. E-Jurnal Akuntansi Universitas Udayana, 12(2), 295–312.

Fadillah, N. N. A. (2021). Pengaruh CAR, NPF, FDR, Inflasi dan BI Rate terhadap Profitabilitas Perusahaan Perbankan Syariah di Indonesia Periode 2014-2018. Jurnal Ilmu Manajemen, 9(1), 191–204. http://doi.org/10.26740/jim.v9n1.p191-204

Goso, G. (2022). The Influence of Capital Structure, Liquidity, and Company Size on

Sulselbar Bank’s Profitability. Enrichment: Journal of Management, 12(4), 2847-2853. http://doi.org/10.35335/enrichment.v12i4.745

Hermuningsih, S. (2013). Pengaruh Profitabilitas, Growth Opportunity, Sruktur Modal terhadap Nilai Perusahaan pada Perusahaan Publik di Indonesia. Buletin Ekonomi Moneter Dan Perbankan, 16(2), 127–148. http://doi.org/10.21098/bemp.v16i2.27

Ibrahim, S. S. (2017). The Impacts of Liquidity on Profitability in Banking Sectors of Iraq: A Case of Iraqi Commercial Banks. International Journal of Finance & Banking Studies, 6(1), 113–121.

Kaur, R. (2022). A Study of Impact of Capital Structure on The Profitability of Public and Private Sector Banks in India. Academy of Accounting and Financial Studies Journal, 26(5), 1–10.

Lestari, Henny Setyo ; Tarigan, Giovani Gesela; Pohan, L. A. (2021). The Effect of Liquidity, Leverage and Bank’s Size of the Profitability Conventional Banks Listed on Indonesia Stock Exchange Henny. International Journal of Economics, Business and Accounting Research (IJEBAR), 12(2), 188–201. http://doi.org/10.32832/jm-uika.v12i2.3946

Mailinda, R., Azharsyah, Zainul, Z. R. (2018). Pengaruh Leverage, Likuiditas dan Ukuran Perusahaan terhadap Profitabilitas pada BNI Syariah di Indonesia Periode 2015-2017. Jurnal Ilmiah Mahasiswa Ekonomi Manajemen, 3(4), 147–160.

http://doi.org/10.24815/jimen.v3i4.9794

Mohammad, S. S., Prajanti, S. D. W., Setyadharma, A. (2021). The Analysis of Financial Banks in Libya and Their Role in Providing Liquidity. Journal of Economic Education, 10(1), 1–13.

Mustafa, A. N., Sulistyowati, E. (2022). Pengaruh Capital Adequacy Ratio, Non Performing Loan, Loan to Deposit Ratio, dan Firm Size terhadap Profitabilitas BUMN Sektor Perbankan. Jurnal Proaksi, 9(1), 84–96. http://doi.org/10.32534/jpk.v9i1.2511

Nasrulloh, A. A. (2018). The Impact of Micro Economics Factors on Financial Performance of Islamic Banks in Indonesia. Jurnal Ekonomi Dan Keuangan Syariah, 2(2), 205–221.

Ningsih, W., Badina, T., Rosiana, R. (2017). Pengaruh Permodalan, Kualitas Aset, Rentabilitas dan Likuiditas terhadap Profitabilitas Bank Pembiayaan Rakyat Syariah (BPRS) di Indonesia. Jurnal Ilmu Akuntansi, 10(1), 181–192.

http://doi.org/10.15408/akt.v10i1.6116

OJK. (2017, December). Lembaga Perbankan.

Okeke, Chinedu, P. (2023). Financial Leverage and Profitability of Recapitalized Banks in Nigeria from 2010 - 2021. Nigerian Journal of Management Sciences, 24(1), 344–351.

Pinasti, W. F., Mustikawati, R. I. (2018). Pengaruh CAR, BOPO, NPL, NIM dan LDR terhadap Profitabilitas Bank Umum Periode 2011-2015. Nominal, Barometer Riset Akuntansi Dan Manajemen, 7(1), 126–142. http://doi.org/10.21831/nominal.v7i1.19365

Puteri, N. K. A. F. (2021). Do Liquidity, Asset Quality, Firm Size, and Efficiency Affect Bank Profitability? Evidence from Indonesia Stock Exchange. IPTEK Journal of Proceedings Series, 7(1), 317–321. http://doi.org/10.12962/j23546026.y2020i1.10862

Rahaman, M. M., Akhter, S. (2015). Bank-Specific Factors Influencing Profitability of Islamic Banks in Bangladesh. Journal of Business and Technology (Dhaka), 10(1), 21– 36.

Ramadhanti, A. A., Amaliawiati, L., Nugraha, N. M. (2021). Inflation, Leverage, and Company Size and Their Effect on Profitability. Journal of Applied Accounting and Taxation, 6(1), 63–70. http://doi.org/10.30871/jaat.v6i1.2854

Samad, A. (2015). Determinants Bank Profitability: Empirical Evidence from Bangladesh Commercial Banks. International Journal of Financial Research, 6(3), 173–179. http://doi.org/10.5430/ijfr.v6n3p173

Saputri, D. N. (2021). The Effect of Non Performing Loan, Loan to Deposit Ratio and Third Party Funds on Profitability during The Covid - 19 Pandemic in Government Banking. Otonomi, 21(2), 332–340. http://doi.org/10.32503/otonomi.v21i2.2059

Sari, L., Septiano, R. (2020). Effects of Intervening Loan to Deposit Ratio on Profitability. Journal of Accounting and Finance Management, 1(2), 239–252.

http://doi.org/10.38035/jafm.v1i2.28

Serly, Jennifer. (2021). Analisis Pengaruh Modal Bank, Ukuran Bank, Konsentrasi Pasar, Kepemilikan, Inflasi terhadap Profitabilitas Bank. Jurnal Akuntansi Profesi, 12(2), 481– 490. http://doi.org/10.23887/jippg.v3i2

Setiadewi, K. A. Y., Purbawangsa, I. B. A. (2015). Pengaruh Ukuran Perusahaan dan Leverage Terhadap Profitabilitas dan Nilai Perusahaan. E-Jurnal Manajemen, 4(2).

Siahaan, D. (2016). Pengaruh Likuiditas dan Kualitas Aset terhadap Profitabilitas pada Bank Umum Nasional (Studi pada Bursa Efek Indonesia Periode 2010-2014). Journal of Chemical Information and Modeling, 53(9), 1689–1699.

http://doi.org/10.26740/bisma.v9n1.p1-12

Silvia, S. A. (2017). Pengaruh Kualitas Aset terhadap Profitabilitas pda Perbankan Syariah di Indonesia. AL-FALAH: Journal of Islamic Economics, 2(1), 53-80.

http://doi.org/10.29240/jie.v2i1.192

Sugiarto, S., Lestari, H. S. (2017). Faktor-Faktor yang Mempengaruhi Profitabilitas Bank pada Bank Konvensional yang Terdaftar d Bursa Efek Indonesia. Jurnal Manajemen Dan Pemasaran Jasa, 10(2), 267–280. http://doi.org/10.25105/jmpj.v10i2.2510

Syafi’i, I., Haryono, S. (2021). Pengaruh Leverage, Ukuran Perusahaan dan Inflasi terhadap Profitabilitas pada Bank Umum Syariah di Indonesia. MALIA: Journal of Islamic Banking and Finance, 5(1), 17–26. http://doi.org/10.21043/malia.v5i1.10482

Tangngisalu, J., Hemanuhutu, I. (2020). Pengaruh Struktur Modal dan Leverage Financial terhadap Profitabilitas. YUME: Journal cf Management, 3 (1), 179-191.

http://doi.org/10.37531/yume.vxix.324

Uddin, M. K. (2022). Effect of Leverage , Operating Efficiency , Non-Performing Loan , and Capital Adequacy Ratio on Profitability of Commercial Banks in Bangladesh. European Journal of Business and Management Research, 7(3), 289–295.

http://doi.org/10.24018/ejbmr.2022.7.3.1463

Wardana, R. I. P., Widyarti, E. T. (2015). Analisis Pengaruh CAR, FDR, NPF, BOPO, dan Size terhadap Profitabilitas pada Bank Umum Syariah di Indonesia (Studi Kasus pada Bank Umum Syariah di Indonesia Periode 2011-2014). Diponegoro Journal Of Management, 4(4), 1–12.

Yusuf, M. (2017). Dampak Indikator Rasio Keuangan terhadap Profitabilitas Bank Umum Syariah di Indonesia. Jurnal Keuangan Dan Perbankan, 13(2), 141–151.

Discussion and feedback