The Calculation of Life Insurance Premiums with A Multiple-State Model on Critical Illness Insuranceance

on

Jurnal Matematika Vol. 12, No.2, Desember 2022, pp. 68-77

Article DOI: 10.24843/JMAT.2022.v12.i02.p150

ISSN: 1693-1394

The Calculation of Life Insurance Premiums with A Multiple-State Model on Critical Illness

Insurance

Inggriani Millennia Taraly

Program Studi Statistika, Fakultas MIPA – Universitas Tanjungpura e-mail: inggriani.millennia@student.untan.ac.id

Neva Satyahadewi

Program Studi Statistika, Fakultas MIPA – Universitas Tanjungpura e-mail: neva.satya@math.untan.ac.id

Hendra Perdana

Program Studi Statistika, Fakultas MIPA – Universitas Tanjungpura e-mail: hendra.perdana@math.untan.ac.id

Ray Tamtama

Program Studi Statistika, Fakultas MIPA – Universitas Tanjungpura e-mail: ray.tamtama@gmail.com

Abstract: Based on data from the Basic Health Research (Riskesdas) in 2018, the risk of critical illness is increasing and is the highest cause of death for Indonesian population. Currently, the cost of treating disease is not cheap, so maintaining health and preparing for the possibility of being diagnosed with a critical illness in the future is an important step. Critical Illness insurance premiums calculation includes cancer, stroke, heart, and diabetes mellitus. The benefits provided are in the form of death compensation, treatment costs when diagnosed with a critical illness, and there are also costs for Angioplasty surgery. Angioplasty surgery is performing when the individual has a serious critical heart condition and must be performed immediately 24 hours after a heart attack. The data information is in the form of the 2019 Indonesian Mortality Table, and the prevalence of critically ill patients with angioplasty surgical conditions. The premium calculation is carriying out for the insured male aged 40 years in good health, interest rate is 3.75%, the premium payment period and the insurance coverage period is 10 years. The annual net premium value obtained is IDR 5,859,788, of which the sum insured is IDR 500,000,000. There are 3 benefits obtained by the insured: (1) The cost of compensation received for Angioplasty surgery is 25% of the sum insured; (2) The cost of treatment compensation that will be given annually until the insurance coverage period ends when the insured is diagnosed with a critical illness, which is 100% of the sum insured minus the cost of compensation in the event of Angioplasty surgery; and (3) The value of compensation for death due to any cause, which is 100% of the sum insured minus the critical illness benefit for Angioplasty surgery

Keywords: Prevalence, Angioplasty Surgery, Heart Attack

Humans always carry out community life activities such as interacting between one individual and another. The activities carried out often contain risks, no one knows the cause, time, place and how the adverse event occurred (Wahono & Leng, 2022). Risk is an event that occurs suddenly and some bad events can cause material or non-material losses. Risk is unavoidable so it needs to be minimized in many ways, one of which is by taking insurance (Chumaida, 2013). Insurance is a form of agreement between the insured party/customer and the insurer/insurance company. In this agreement, the insurer is willing to bear several losses that may arise in the future, after the insured party is willing to pay a sum of money with an agreement called a premium (Agustina, 2019). The amount of insurance premiums is determined by the insurance provider and agreed upon by the policyholder where the size of the insurance premium can be determined by the level of risk borne by the insurance company (Malini, Putri, & Apriyani, 2021). Factors that may be considered in determining the amount of premium include the insured's age, medical and lifestyle records, gender to the insured's occupation.

Insurance is broadly differentiated fundamentally, namely social insurance and private insurance. Private insurance is divide into two, namely general insurance and personal insurance. Personal insurance is divide into life insurance and health insurance (Suryanto, 2019). Life insurance is an agreement between the insurance company and the prospective policyholder, in the form of a guarantee in the event of a death disaster in the policyholder which results in a loss of productivity in the form of finances (Trisnawati, Widana, & Jayanegara, 2014). When a person has insured his life to an insurance company it means that both parties have agreed to the written agreement (Sembiring , 2016). Sembiring (2016) states that the form of life insurance is divided into three, namely term life insurance, whole life insurance, and endowment insurance. In this study, the type of insurance used was term life insurance. Term life insurance is insurance that provides sum insured if the policyholder dies within the period as written on the policy and the contract/insur-ance agreement (Kamil, Suherman, & Murni, 2021).

Life insurance ownership is very important for families that depend on income, because when the policyholder (heir) dies, the insurance will pay a sum assured to the family left behind (heirs) (Pratama, Barkatullah, & Erliyani, 2019). Sum insured is compensation in the form of a sum of funds that will be given to heirs if someone as an insurance participant experiences short life or dies (Surya, 2020). Insurance will not prevent death, but insurance protects a person's economic value when suddenly dying, so that the heirs get compensation for the value of lost income to continue living. Many insurance companies currently offer life insurance products with various facilities and different benefits for each product. As a consumer, of course, you need to be smart in choosing what kind of life insurance product and from which company to choose, because the insurance you have must be useful and profitable for customers. There are also insurance products that combine life insurance with health insurance.

One of the insurance products offered is Fortuna Critical Illness Protection which is a combination product between life insurance and health insurance. Fortuna Critical Illness Protection provides 100% certainty of the sum insured when there is a risk of critical illness or death by paying a premium for 10 or 20 years and obtaining protection until the age of 99. This product offers critical illness benefits, death benefits, additional death benefits due to accidents, final policy benefits and additional insurance such as minor critical illness benefits and additional payor benefit insurance. The definition of death benefit is that if the insured dies for any reason, the insurer will pay a death benefit of 100% of the sum insured, minus the critical illness benefit for angioplasty surgery that has been paid (if any), then the policy ends. If the insured undergoes angioplasty surgery at the age of 45 and if there is a risk of death at 50 years, the net annual premium for life insurance products will be calculate.

Jones (1994) wrote an article discussing actuarial calculations based on the Markov chain model and published it by the Department of Statistics and Actuarial Science, The University of Iowa (Syamdena, Devianto, & Yozza, 2019). One of the actuarial calculation applications is Long Term Care (LTC) health insurance, one of its products being Annuity as A Rider Benefit. Long Term Care Insurance provides compensation to the insured if the insured needs medical treatment or for people with chronic diseases or disabilities, which are not guarantee by other health insurance, this insurance will protect the insured for a long period.

Based on this description, if previous research describes an approach by which akutuaria can determine the probabilities required for computations in applications that are represented as multistate processes. This study will model the chances of transition from healthy status to critical illness status, healthy status to death, and critical illness to death status with a multi-status model based on discrete time Markov Chains. Then calculate the premium from critical illness insurance when the interest varies. The critical diseases selected in this study were cancer, heart disease, stroke, kidney failure, diabetes mellitus, and hypertension. The calculation is carryout on a patient aged 40 years in good health and 10 years of coverage. The data used in this study are secondary data, critical illness prevalence data from Riskesdas 2018, and the Indonesian Mortality Table (TMI) in 2019.

Markov chain is a future event that is not influence by past events but is highly dependent on present events. In this study, the Discrete Markov Chain model is a stochastic process with discrete state space and discrete space parameters (processing time). In the Markov chain (Markov properties) the probability of a state at the (n +1) time

only depends on the state conditions at the nth time and does not depend on the conditions from previous times (Haryono & Ratnaningsih, 2018).

A multi-state process is a stochastic process (Xt)√∈T) with a finite state space

S = Jl.....^ , where T = [O, t], t < ∞ is a time interval (Li, 2017). The characteristics of a

multi-state process are affected by the following probability of transation between states : and :

λig.⅛) = p(χ(t) = j∣χω = o

(1)

with i,j E S; s,t E T and s < t

Generally, the conditional probability of a transition from state i at time s to state j at time t is usually write on Pii (s∙ t) . The transition probability has following properties

(Haberman & Pitacco, 2018):

G) o≤^,G,t) ≤ i, for all i, Jt O ≤ s < t

-

(ii) Σ j Pi j (s, t) = 1, for all t;O ≤ s < t

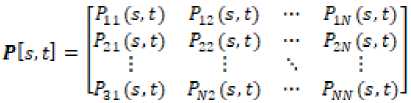

All transition probabilities atO <s <tcan be brought into a transition probability ma-

trix *,kt] as follows:

(2)

(3)

If t = k +1) else:

Pii(s,s + 1) = P(X(s + 1) = ;|XG) = i)

So, Equation (3) is called a 1-step transition probability.

The Chapman Kolmogorov equation is a method for calculating the transition probability h-steps which is defined as follows:

h^j G. t) — ∑rπ∈λ^tm (s∙^-Pmj Gt. t); s < k < t (4)

The Chapman Kolmogorov equation states that a Markov path starts at state i at time s, goes to state j at time t through several states m continuously at time k (Miftahuddin,

Maulidawani, Setiawan, Ilhamsyah, & Fadhli, 2020).

One of application actuarial calculations is Long Term Care (LTC) insurance, which protects the insured who suffers from a critical illness or disability (Haberman & Pitacco, 2018). LTC insurance provides compensation for the insured party who needs medical treatment or for patients with critical illness and disability in the form of benefits for taking treatment and care costs, this insurance will protect the insured for a long period, while short term care insurance is a health insurance that protect in the near term, usually for 1 year.

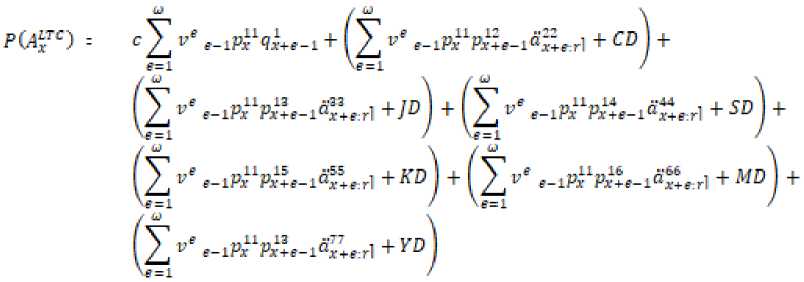

Annuity as A Rider Benefit is a product of long term care insurance that provides medical care costs for the period and death benefit benefits. In the Annuity as A Rider Benefit product, there is no transition from a sick state to a healthy state (there is no assumption of healing). The net single premium value of LTC insurance based on Annuity as a Rider Benefit (Haberman & Pitacco, 2018), is as follows:

n-1

^x:n = C ∑ V e-1Px qx+e-1

e = 1

n-1

+∑

e=1

ve-1PX1pX+e-1 ×

(baX2+e.,r + ∑(c - hb)vh × h-1PXie × ⅛+e+h-1)j

(5)

where:

n : length of insurance coverage period

C : amount of compensation

-

x : age

-

V : discount value

-

h : step or transition

-

b : enefits provided regularly every year

-

qx : chances of someone aged x dying

-

px : assess transition opportunities when a person is x years old

-

e : timing of payment of benefit annuities

Notation of is a death benefit given when the insured died. Also denoted as a benefit that is pay regularly every year if the insured experiences a period of treatment. It is assumed that , where is the maximum value of the annuity payment period if the dependent is in treatment. The discount factor is formula as where is the interest rate.

In the health sciences, prevalence and mortality rates are the most frequently using measures to describe events occurring in a population. Disease prevalence data is the percentage of the population with certain characteristics within a certain period. In contrast, the characteristics in question in the medical world include diseases or risk factors.

Table 1. Recapitulation of the Number of Sufferers of Each Critical Illness

|

Critical Illness |

Number of Sufferers (1) |

Prevalence of Patients |

Number of Deaths (2) |

Prevalence of Deaths |

|

Cancer (C) |

4.836.650 |

1,79% |

652.948 |

13,50% |

|

Heart Disease (J) |

4.053.059 |

1,50% |

502.579 |

12,40% |

|

Stroke (S) |

29.452.227 |

1,09% |

6.184.968 |

21,00% |

|

Kidney Failure (K) |

1.026.775 |

0,38% |

30.085 |

2,93% |

|

Diabetes Mellitus (M) |

4.053.059 |

1,50% |

217.555 |

6,70% |

|

Hypertension (Y) |

22.589.047 |

8,36% |

3.252.823 |

14,40% |

|

Total Population of Indonesia in 2020 |

270.203.917 | |||

|

Source: (1). The Basic Health Research (Riskesdas) in 2019; (2). Ministry of Health Indonesia | ||||

In this study, data on the prevalence of six critical diseases in Indonesia were obtained from Riskesdas in 2019 (KEMENKES, 2019), namely cancer, stroke, kidney failure, diabetes mellitus, hypertension and heart disease. Table 1 is a data recapitulation of the probability of death from the number of sufferers of each critical illness.

In determining critical illness insurance premiums, data on the probability of death and the prevalence of critical illness deaths are needed based on gender at each age. The mortality probability data uses the 2019 Indonesian Mortality Table (TMI-2019) (AAJI, 2019). Meanwhile, mortality prevalence data was obtained using the following equation: prβvi = q*×fi (6)

where,

I^e⅛ = Prevalence of deaths because of critical illness i at age x

Qt = The probability that a person of gender g, who is currently age x, will die one year later (g = male, female)

f' = The persentage of deaths disease i where i = C,], S, K, M, Y

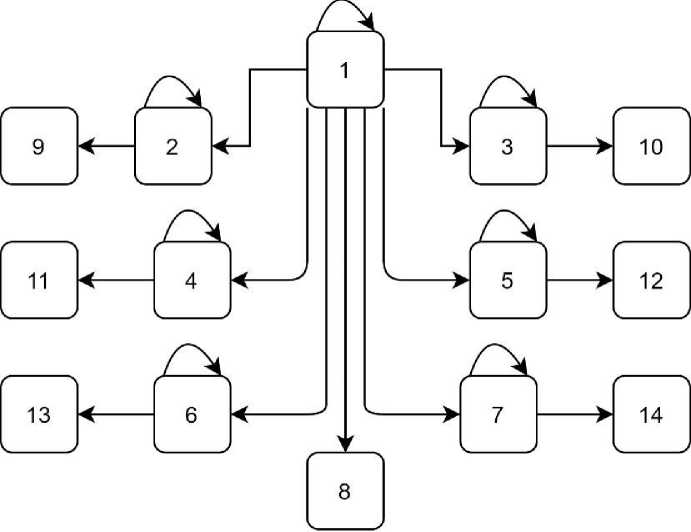

In the preparation of the matrix, a one-way transition is used with a 14-state model as follows:

-

(1) Health

-

(2) The incidence of cancer

-

(3) The incidence of heart disease

-

(4) The incidence of stroke

-

(5) The incidence of kidney failure

-

(6) The incidence of diabetes mellitus

-

(7) The incidence of hypertension

-

(8) The death incident due to other reasons

-

(9) The death incident due to cancer

-

(10) The death incident due to heart disease

-

(11) The death incident due to a stroke

-

(12) The death incident due to kidney failure

-

(13) The death incident due to diabetes mellitus

-

(14) The death incident due to hypertension

The transition diagram in this study is presented in Figure 1.

Based on Figure 1, states the possibility of a person being in certain circumstances. For example, state 1 to state 3 expresses the switch in a person's state from healthy to heart disease. In State 3 it is likely that the sufferer will still suffer from heart disease. While state 3 to state 10 state the likelihood of someone dying of heart disease.

Figure 1. The Transition Diagram 14-State Model

The transition probability matrix for the insured from age to c*+υ is as follows:

|

H |

C |

S |

K |

if |

F |

D |

D<⅛ |

b<o |

D^ |

D ■ |

D^ | ||||

|

.L⅛" |

x; |

^r |

lptz |

LP?" |

ipΓ |

0 |

O |

O |

O |

: |

0 |

O ■ |

fl | ||

|

: |

lP? |

O |

O |

O |

O |

O |

Lflf^ |

O |

O |

O |

: |

0 |

O |

C | |

|

: |

O |

lPj? |

O |

O |

O |

O |

0 |

JLflj |

O |

O |

O |

0 |

O |

1 | |

|

O |

O |

O |

.∣jpj |

O |

O |

O |

0 |

O |

Lflj |

O |

O |

0 |

O |

S | |

|

O |

O |

O |

O |

LP?* |

O |

O |

0 |

O |

O |

^v' |

O |

0 |

O |

K | |

|

O |

O |

O |

O |

O |

O |

0 |

O |

O |

O |

Lflr’■ |

0 |

O |

M |

(7) | |

|

Λ⅛' = 0 |

O |

O |

O |

O |

O |

JLPj |

0 |

O |

O |

O |

O |

πrV'1 Jbflj |

O |

Y | |

|

O |

O |

O |

O |

O |

O |

O |

1 |

O |

O |

O |

O |

0 |

^ |

BrfO | |

|

O |

O |

O |

O |

O |

O |

O |

0 |

1 |

O |

O |

O |

0 |

O |

Brffl | |

|

O |

O |

O |

O |

O |

O |

O |

O |

O |

1 |

O |

O |

: |

O |

B<O | |

|

: |

O |

O |

O |

O |

O |

O |

0 |

O |

O |

1 |

O |

0 |

O |

U(S) | |

|

O |

O |

O |

O |

O |

O |

O |

0 |

O |

O |

O |

1 |

0 |

O |

Dt*> | |

|

O |

O |

O |

O |

O |

O |

O |

0 |

O |

O |

O |

O |

1 |

O |

BrfO | |

|

O |

D |

0 |

O |

O |

O |

D |

0 |

D |

D |

D |

O |

0 |

1 ■ |

D |

Because in the Annuity as Rider Benefit product, the recovery of the insured's sick status is not considered, there is a possibility that some transitions are zero, and the insured who is healthy will not switch to death due to illness directly.

The equation for net single premium LTC insurance based on Annuity as a Rider Benefit is as follows:

(8)

The probability value when a person aged years who is currently in good health (1) will remain in good health (1) the next time denotes p*L. While the probability value of a person aged years from being healthy (1) and then dying denotes by q* .

In Equation (8), as an example CD is an equation, namely:

(9)

CD = M)υft × h-ιPx+r × tix^h-ι

K = L

The probability that a person aged years currently suffering from cancer (2) will remain in a state of cancer (2) the next time denotes Px". While the probability value of a person aged years suffering from cancer (2) will die is denoted cIx .

Premium calculation is also carried out based on interest rates, age, gender and varying coverage periods, in order to estimate the exact amount of premium with the benefits and circumstances of a policyholder.

Table 2. Comparison of Annual Net Premium

|

Age |

Interest Rate (%) |

Male |

Annual Net Premium Female | ||||||

|

5 |

10 |

5 |

10 | ||||||

|

3,75 |

Rp |

439.456 |

Rp |

1.378.514 |

Rp |

330.124 |

Rp |

1.022.194 | |

|

25 |

5,00 |

Rp |

438.177 |

Rp |

1.381.980 |

Rp |

329.176 |

Rp |

1.025.010 |

|

6,00 |

Rp |

437.127 |

Rp |

1.384.325 |

Rp |

328.397 |

Rp |

1.026.940 | |

|

3,75 |

Rp |

902.657 |

Rp |

3.447.666 |

Rp |

651.098 |

Rp |

2.254.373 | |

|

35 |

5,00 |

Rp |

900.222 |

Rp |

3.449.532 |

Rp |

649.491 |

Rp |

2.257.812 |

|

6,00 |

Rp |

898.217 |

Rp |

3.450.053 |

Rp |

648.163 |

Rp |

2.259.900 | |

|

3,75 |

Rp |

1.538.787 |

Rp |

5.859.788 |

Rp |

994.590 |

Rp |

3.606.972 | |

|

40 |

5,00 |

Rp |

1.534.370 |

Rp |

5.865.498 |

Rp |

991.950 |

Rp |

3.611.706 |

|

6,00 |

Rp |

1.530.745 |

Rp |

5.868.360 |

Rp |

989.775 |

Rp |

3.614.435 | |

|

50 |

3,75 5,00 |

Rp Rp |

7.194.083 7.120.412 |

Rp 13.339.794 Rp 13.392.151 |

Rp Rp |

4.373.347 4.328.006 |

Rp Rp |

8.543.172 8.568.222 | |

Based on Table 2, it can see that if a person's age increases, the premium will be more expensive. The premium is influent by the chance of death or developing a critical illness, which is higher as age increases. In addition, based on gender, it was found that the premium for men was more expensive than for women. The probability of death influences the premium or the chance of developing a critical illness for men is more significant than for women. Based on various interest rate from Table 2, there more expensive the premium because the higher the interest rate. This is because the interest rate is a discount variable.

The multistate model of determining premiums for critical illness insurance shows changes in a person's status over time. A person's health condition from time to time will definitely undergo changes. At any given time a person from healthy status may move to affected status or from healthy status to deceased status. The state change is an example of a process modeled with a multistate model.

Based on the results of research that if a person gets older, the premium will be more expensive. This is influenced by the chance of death or the chance of developing critical illness is higher as age increases. In addition, based on gender, it is found that premiums for men are more expensive than premiums for women. This is influenced by the chance of death or the chance of developing critical illness for men is greater than women. Then based on the interest rate, the higher the interest rate, the cheaper the premium value obtained. This is because the interest rate is a discount variable. Based on the length of the coverage period, the longer the coverage period, the greater the premium value paid. This is because the longer it takes, the greater the protection that will be obtained.

Acknowledgments

The authors would like to thank FMIPA Tanjungpura University for providing the 2022 DIPA FMIPA Untan research funding in conducting this research study.

References

AAJI. (2019). E-Book Tabel Mortalitas Indonesia IV v1.

Agustina, M. (2019). Implementasi Metode Multi Factor Evaluation Process (MEP) dalam Membuat Keputusan untuk Memilih Asuransi Kesehatan. Jurnal Ilmiah MATRIK, 21(2), 108-117.

Chumaida, Z. V. (2013). Risiko dalam Perjanjian Asuransi Jiwa. Surabaya: PT Revka Petra Media.

Haberman, S., & Pitacco, E. (2018). Actuarial Models for Disability Insurance. Routledge: CRC Press.

Haryono, & Ratnaningsih, D. (2018). Pengantar Proses Stokastik. Tangerang Selatan : Universitas Terbuka.

Kamil, I., Suherman, & Murni, D. (2021). Modifikasi Cadangan Premi Tahunan Retrospektif pada Asuransi Jiwa Berjangka Kasus Joint Life dengan Metode Zillmer. Jurnal of Mathematic UNP, 4(2), 12-17.

KEMENKES. (2019). Laporan Nasional RISKESDAS 2018. Retrieved Agustus 20, 2022, from http://repository.bkpk.kemkes.go.id/3514/1/Laporan%20Riskesdas%202018%20 Nasional.pdf.

Li, J. (2017). A Multi-State Model for Pricing Critical Illness Insurance Products. Simon Faraser University.

Malini, H., Putri, D. N., & Apriyani, R. (2021). Pengaruh Pendapatan, Umur dan Dana Kelangsungan Terhadap Keputusan Pemakaian Jasa Asuransi Jiwa pada AJB Bumiputera 1912 Kantor Cabang Baturaja. KOLEGIAL, 9(2), 126-139.

Miftahuddin, Maulidawani, Setiawan, I., Ilhamsyah, Y., & Fadhli. (2020). Rainfall analysis in the Indian Ocean by using 6-States Markov . IOP Conference Series: Earth and Environmental Science, 429. Aceh. doi:10.1088/1755-

1315/429/1/012012

Pratama, A. S., Barkatullah, A. H., & Erliyani, R. (2019). Kedudukan Dana Asuransi Jiwa dalam Relevansinya dengan Pembagian Harta Warisan. Lambung Mangkurat Law Journal, 4(1), 17-33.

Sembiring , R. (2016). Asuransi 1. Tangerang Selatan: Universitas Terbuka.

Surya, I. (2020). Manfaat Bebas Premi dalam Asuransi Jiwa (Suatu Penelitian pada PT. Asuransi Jiwa Bumiputera 1912 dan PT. Prudential Life Assurance di Banda Aceh). JIM Bidang Hukum Keperdataan, 4(1), 191-199.

Suryanto. (2019). Manajemen Risiko dan Asuransi (Edisi 2). Tangerang Selatan: Universitas Terbuka.

Syamdena, L., Devianto, D., & Yozza, H. (2019). Actuarial Present Value pada Asuransi Long Term Care dalam Kasus Mutistates. J. Mat. UNAND, 3(3), 47-54.

Trisnawati, D. N., Widana, I., & Jayanegara, K. (2014). Analisis Komponen Biaya Asuransi Jiwa Dwiguna (Endowment). Jurnal Matematika , 4(1), 11-21.

Wahono, C., & Leng, P. (2022). Pengaruh Literasi Keuangan dan risk Attitude Terhadap Kepemilika Asuransi Jiwa. Jurnal Administrasi Bisnis, 18(1), 17-35.

77

Discussion and feedback