The Moderating Role of Board Independent in Managerial Ownership and Firm Value: Evidence in Indonesia

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 18 No. 1, January 2023

AFFILIATION:

1,2,3,4 Faculty Business and Education, Universitas Pendidikan Indonesia, Indonesia 1Computerized Accounting, Piksi Ganesha Polytechnic, 40274, Indonesia

*CORRESPONDENCE: perwitoe@upi.edu

THIS ARTICLE IS AVAILABLE IN: https://ojs.unud.ac.id/index.php/jiab

DOI:

10.24843/JIAB.2023.v18.i01.p05

CITATION:

Perwito, Nugraha, Mayasari, & S, Y. (2023). The Moderating Role of Board Independent in Managerial Ownership and Firm Value: Evidence in Indonesia. Jurnal Ilmiah Akuntansi dan Bisnis, 18(1), 58-74.

ARTICLE HISTORY Received:

22 November 2022

Revised:

21 January 2023

Accepted:

29 January 2023

The Moderating Role of Board Independent in Managerial Ownership and Firm Value: Evidence in Indonesia

Perwito1*, Nugraha2, Mayasari3, Yayat S4

Abstract

This study aims to empirically assess the conditional effect of managerial ownership on the firm value moderating role of the independent board. Using a sample of Indonesian listed firms from 2015-2020 and panel data of 2,627, we used PROCESS V3.4. for SPSS to estimate research models. Research findings; there is a non-linear relationship between the effect of managerial ownership on firm value, in line with the entrenchment hypothesis. Furthermore, the findings of this study indicate that the independent board does not provide a moderating effect on the relationship, but the independent board is a predictor of firm value. The critical implications are; It enriches existing knowledge of agency theory by emphasizing the importance of the involvement of an independent board. A new perspective in the conditional effect analysis of management ownership on firm value, moderated by the role of an independent board.

Keywords: managerial ownership, independent boards, firm value, the moderation effect

Introduction

In the last few decades, many studies have analyzed the direct effect on the firm value influenced by managerial ownership. However, examining the indirect impact as a moderating effect of the Independent Board variable is still limited. The moderating effect is intended when interest is focused on the question of when or under what conditions the effect is more robust (Igartua & Hayes, 2021; Hayes, 2022); the effect of managerial ownership on firm value works effectively when or in a corporate condition involving an independent board.

The role of an independent board of directors is vital and should be controlled with respect to managerial (Jensen & Meckling, 1976); previous research has shown that the relationship between CEO Duality and firm performance depends on the role of the independent Board of Directors (Duru et al., 2016). Also, the role of independent Boards is in the high category (Zaid et al., 2020) and where interaction takes place (Combs et al., 2007). This demonstrates that the impact of ownership structure and CEO duality on performance depends on the independent agency involvement. This can positively impact corporate governance systems and improve corporate performance (Liu et al., 2015).

Various theoretical and empirical studies show that ownership structure creates appropriate management oversight of business activities and influences corporate value creation. However, the agency's problems are complex due to differing interests between managers and shareholders (Jensen & Meckling, 1976). Fundamentally, a company’s agency costs must be controlled and monitored; ownership structure, managerial ownership, the board size, independent board members, independent committees, and CEO duality (Panda & Leepsa, 2017).

However, boards have not led to improvements in corporate performance by external parties (Hermalin & Weisbach, 1991), boards have not created optimal external oversight mechanisms (Agrawal & Knoeber, 1996), boards are independent and structural leadership has no impact on firm performance (Drakos & Bekiris, 2010). In addition, empirical results show that board structure does not significantly affect stock price response (Ding et al., 2020).

It is hoped that the distribution of shares to managers will result in an allocation of business risks, the positive causal relationship between risk and insider ownership, and the increase in management ownership, which directly controls differences between the company's performance and management, is expected to it reduces profit for company owners and ultimately increase the value of the firm (Demsetz & Lehn, 1985). Moreover, empirical evidence of insider ownership indicates a growing role in corporate control because it arises from improved alignment of interest; it can affect corporate value (Morck et al., 1988).

In line with previous research results, this ownership structure positively correlates with firm value (Rashid, 2020) [Bangladesh]. In Africa, ownership structure and independent boards have become essential to corporate governance, reducing agency problems and promoting good corporate performance (Munisi et al., 2014), (Jumanne & Keong, 2018). However, a range of empirical evidence shows that high levels of management ownership in the short term have a negative impact on firm value because it leads to a convergence of benefits (Davies et al., 2005). Management ownership is the only determinant of corporate performance (Mugobo et al., 2016). Various research results in Indonesia show that; Monitoring and supervision through the provision of stock compensation in the form of management ownership can enhance firm value (Rizqia et al., 2013; Perwitasari, 2014; William, 2015; Fahdiansyah et al., 2018; Novianti & Irni Yunita, 2019), has been to have no impact on firm value (Sugosha & Artini, 2020).

Overcome agency problems by optimizing corporate governance mechanisms to create economic efficiency and ultimately increase firm value (Denis, 2001; Mak & Kusnadi, 2005; Bonazzi & Islam, 2007). Empirical evidence also shows that a dynamic corporate governance and leadership system can respond to uncertainty during the Covid-19 pandemic in the first quarter of 2020 in 56 countries worldwide (Ding et al., 2020). In addition, managerial ownership creates more value and enthusiasm for management in increasing work effectiveness and making good corporate governance so that various conflicts of interest can be reduced.

To produce a research gap, examine the conditional effect of the role of the independent board so that it can be known under what conditions and when the impact of managerial ownership on firm value occurs. There is an interaction between managerial ownership in creating the business operational effectiveness and the implications for

improving corporate performance (Drakos & Bekiris, 2010; Kao et al., 2018; Coletta & Arruda de Souza Lima, 2020; Mak & Kusnadi, 2005; Kusumastuti & Sastra, 2007). The effectiveness of monitoring is expected to increase management performance so that it will have an impact on improving corporate performance and ultimately on firm value (Dwivedi & Jain, 2005) [India]; (Almudehki & Zeitun, 2012) [Qatar]; (Bentivogli & Mirenda, 2017) [Italy]; (Hong Nguyen et al., 2020) [Vietnam], (Gurbuz & Aybars, 2010) [Turkey].

However, there are different arguments that the board of directors from external parties is not related to improving company performance (Hermalin & Weisbach, 1991), an outside board of directors does not create a more optimal oversight mechanism (Agrawal & Knoeber, 1996), Independent Board of Directors and leadership structure do not affect the corporate performance (Drakos & Bekiris, 2010), the same thing happened in the UK (Weir & Laing, 2000); Swiss (Beiner et al., 2006); Yunani (Drakos & Bekiris, 2010); Malaysia (Johl et al., 2015); Kenya (Ongore et al., 2015); Mesir (Abobakr, 2017) that the composition of the board from external does not affect improving company performance.

Furthermore, the presence of an independent board of directors within the company minimizes the incidence of management misconduct. There are interactions between owners and independent boards (Weisbach, 1988; Duru et al., 2016), and managerial opportunism and inappropriate investment projects can be avoided (Ozdemir et al., 2021). The involvement of an independent board has a greater impact on performance (Yu Liu et al., 2015).

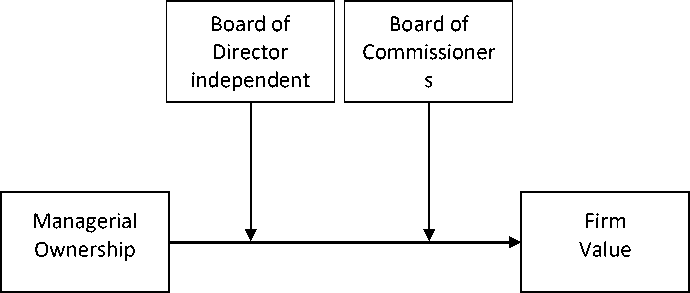

The contributions of this study are; First, strengthen the entrenchment hypothesis; there is evidence that there is a practice of maintaining power through management teams such that managers tend to make decisions based on their own interests or those of the group. Second, management ownership affects firm value when the board, independent directors, and commissioners exercise effective control and monitoring. Third, development in measuring firm value using a market basis, namely Tobin's Q and Market Capitalization (MBVE). Considering two market performance-based indicators is very important and consistent with previous research (Kao et al., 2018; Rashid, 2020). To keep this article interesting for readers, we present it in several sections: 1) research background, 2) research method, 4) results and discussion, and 5) conclusions. The conceptual research framework is shown in Figure 1.

Figure 1. Conceptual Research Framework

Research Method

The perspective of financial management science is the basis for research analysis to answer research problems and objectives using explanatory and descriptive methods. The study population is Indonesian public companies in the non-financial sector for the period 2015-2020, with a total of 615 emiten; the purposive sampling technique considers the company's consistency in presenting financial reports and corporate governance practices. The determination of research observation data is shown in Table 1.

The firm value uses a market proxy-based approach, namely; Tobin's Q (TbQ), market capitalization (MBVE) (Perwito et al., 2021), and this is consistent with the research (Bhagat & Bolton, 2013; Vafeas & Vlittis, 2019; Rashid, 2020). Ownership structure and corporate governance practices; Independent board and executive have consistent with the investigation (Kao et al., 2018; Rashid, 2020). Table 2 shows the operational research variables.

As an effort to produce a research gap using moderating variables, moderators are used to determine the moderation/ interaction effect of the moderator's influence on the relationship of the predictor /independent variable's relationship to the outcome /dependent variable, so that can know the strength of the relationship between these variables, the inclusion of mediator and moderator variables into this study as an effort to answer the research gap (Kusnendi, 2019; Hayes, 2018; Hayes, 2022). Moderators for this study are BODind and BOCind, Tobin's-q and MBVE proxies.

This can be illustrated in Figure 1; managerial ownership of firm value depends on the board of independence. An independent board of Directors and Commissioners in Moderating the impact of management Ownership (MgOwn) on Firm Value (TbQ)

according to model 2 (Hayes, 2018; Hayes, 2022).

Y= iY+ B1X+B2W+ B3Z + B4XW+ B5XZ+ ey ........................................................................... (1)

Tobin’s-Q / MBVE =α1 + β1MgOwnO + β2BODind+ β3BOCind+ β4MgOwn*BODind+ β5MgOwn*BOCind +ɛit ................................................................ (2)

The next stage is to formulate statistical hypotheses, statistics, and test criteria, in answering the hypotheses and model estimates that are consistent with model 2 (Hayes, 2018; Hayes, 2022) using Process Macro for SPSS V3.4.

|

Description |

Firm-year observations |

|

Main sample number (2015-2020) Less |

615 Emiten public 615 x 6 annual report : 3.690 observation data |

|

incomplete data Observations |

966 |

|

Outliers’ data |

97 |

|

Total data observation Sample |

2,627 data observation |

Source: Fact Book, IDX. 2020

Table 2. Definition of the research variables

|

Variable |

Description |

|

Dependent Variable Firm Value (TbQ) |

The ratio of market capitalization plus debt divided by total assets (Yermack, 1996; Bhagat & Bolton, 2013; Vafeas & Vlittis, 2019; Rashid, 2020) |

|

Market-to-book value of Equity (MBVE) Independent Variable Managerial Ownership (MgOwn) Moderation Variable Board of Independent Directors (BOD) |

The ratio of total market capitalization divided by total equity (Kao et al., 2018; Rashid, 2020) Percentage of common stock owned by managers/insiders (Yermack, 1996; Cho, 1998; (Ang et al., 2000; Singh & Davidson, 2003; Bhagat & Bolton, 2013; Rashid, 2016; Vafeas & Vlittis, 2019; Rashid, 2020) Percentage of independent directors to total directors (Kao et al., 2018; Rashid, 2020) |

|

Board of Independent Commissioners (BOC) |

Percentage of independent Commissioners to the total number of board (Kao et al., 2018; Rashid, 2020) |

Source: Developed from several journals

Result and Discussion

Based on Table 3, it can explain; in public companies in Indonesia, managerial ownership with an average value of 5.63% (min 0% and max 43.00%), consistent with research results in Indonesia, namely 5.26% (Sutrisno, 2020), 6,79% by (Sahrul & Novita, 2020), slightly different that is equal to 8.308 (Nathaniel & Sansaloni, 2016), close to India at 3.66

Table 3. Summary of Descriptive Analysis results

|

Description |

Average value |

Minimum Value |

Maximum Value |

Standard Deviation |

|

Managerial Ownership = MgOwn) |

0.0562 |

0.000 |

0.430 |

0.105 |

|

Total Board of Directors (Total BOD) |

4.490 |

1.000 |

16.000 |

1.877 |

|

Independent Board of Directors (%) (BODind) |

0.143 |

0.000 |

0.750 |

0.156 |

|

Total Board of Commissioners (Total BOC) |

3.971 |

1.000 |

12.000 |

1.740 |

|

Independent Board of Commissioners (%) (BOCind) |

0.378 |

0.000 |

0.830 |

0.131 |

|

Firm Value (TbQ & MBVE) |

*2.476 |

0.290 |

2.710 |

0.372 |

Source: Processed Data, 2021

(Agarwal, 2020), Nigeria by 4.19% (Sani, 2020), in Jordania 10,21% (Al Amosh & Khatib, 2022), different from Thailand which only amounted to 1.8% (Al Farooque et al., 2020), and this is very different from sponsorship and director ownership in Bangladesh of 43.15%. (Rashid, 2020), in Australia, an average of 35% (Shan, 2019).

The findings relate to the number of BOD, the average value of BOD is 4.49, and BOC is 3.97, close to the results (Sutrisno, 2020), namely with a BOD of 5.2 and a BOC of 4.6, while a BOD of 4.36 (Prabowo & Simpson, 2011), BOD of 5.89 by (Pratiwi & Chariri, 2021), while the BOC results are close to the results (Hidayat & Utama, 2016) of 4.58, while the proportion of BOC with an average value of 37.80% (min 37.80, max 83.00) these results are slightly different from other studies (Oktaviani & Ariyanto, 2019) namely with an average value of 40.56, and 43.60 (Islamudin et al., 2020).

Table 3 also presents the Tobin-Q score with an average value of 2.47 (min 0.29 and max 2.71). There are slight differences when compared with other results in Indonesia; the TbQ score is 1.499 (Nugroho & Stoffers, 2020), the TbQ score is 1,994 (Wati et al., 2019), and close research results (Sahrul & Novita, 2020) of 2.61. The results of this study are not significantly different from those of Malaysia, which is an average of 2.185 (Zandi et al., 2020), in China is 2,343 (Lin & Fu, 2017), Bangladesh of 1.5828 (Rashid, 2020), in India of 1,90 (Mishra & Kapil, 2017), in Taiwan of 1,336 (Kao et al., 2018), the average in South Africa is 2.26 (Doorasamy, 2021).

To serve the purpose of this study, Table 4 is the result of a data analysis of causality between study variables, where the effect of the predictor on the outcome variable is moderated/interacted with by other variables.

As can be seen in Table 4, The effect of MgOwn on TbQ, coeff B1 = -0.217 and p-value 0.015* <0.05, means that there is a significant negative effect., and hypothesis 1 was accepted. The conditional effect of MgOwn on TbQ is that the Int1 value is obtained, The coeff value of B3 = -0.532, and p-value 0.584* > 0.05, which is not significant; the effect of managerial ownership on firm value is not dependent on the existence of an independent board of directors, the test result value is 0.000, with p-value Chng 0.584* > 0.05. The conditional effect on TbQ obtained a coeff B5 = -0.071 and a p-value of 0.940> 0.05, which is insignificant. Therefore, managerial ownership effect on firm value does not dependent on the BOCind, including moderating variables in the model cannot significantly increase the model's feasibility, with a test result value of 0.000, p-value Chng 0.940> 0.05, hypothesis 2 was rejected.

To strengthen the results of data analysis, the authors conducted a study using MBVE as the outcome variable, as can be seen in Table 4; The MgOwn effect on MBVE, with a coefficient B1 = -0.217 and a p-value of 0.046* <0.05, has a significant and negative impact on MBVE, hypothesis 1 was accepted. The conditional effect of MgOwn on MBVE is the Int1 value; the coefficient value of B3 = -0.755 and p-value 0.627* > 0.05, which is not significant, the effect of managerial ownership on firm value does not dependent on the presence of the Board of Directors (BODind) Independent, the inclusion of moderating variables into the model is not able to significantly increase feasibility model, with a test result value of 0.000, p-value Chng 0.627* > 0.05.

Meanwhile, the inclusion of the Board of Commissioners (BOC) Independent variable into the model can be explained; The conditional effect of the role of the Board of Commissioners Independent (BOCind) obtained the Int1 coefficient value; B5 = -0.646 and p-value 0.671*> 0.05, which is not significant, the effect of managerial ownership on

Table 4. Summary of Results of the Regression Effects of Firm Value, Managerial Ownership, and Boards of Directors and Commissioners Independent

|

Predictor/Independent Variables |

constant/t-value/ p-value | |

|

Tobin’s-Q |

MBVE | |

|

Managerial Ownership | ||

|

Constant |

2.476 |

4.450 |

|

B1 |

-0.217 |

-0.244 |

|

p-value |

*0.015 |

*0.046 |

|

Board of Directors Independent (BOD) (+/-), | ||

|

B2 |

-0.112 |

-0.493 |

|

p-value |

*0.016 |

*0.000 |

|

Int_BOD, B3 |

-0.532 |

-0.755 |

|

p-value |

0.584 |

0.627 |

|

R2-chng |

0.000 |

0.000 |

|

p-Value Chng |

0.584 |

0.627 |

|

Board of Commissioners independent (BOC) (+/-) | ||

|

B4 |

0.191 |

0.269 |

|

p-value |

*0.020 |

*0.040 |

|

Int_BIC, B5 |

-0.071 |

-0.646 |

|

p-value |

0.940 |

0.671 |

|

R2-chng |

0.000 |

0.000 |

|

p-Value Chng |

0.940 |

0.671 |

|

Both | ||

|

R2-chng |

0.000 |

0.000 |

|

p-Value Chng |

0.839 |

0.754 |

*logN, n=2627

*Note: significant at the 0.05 level, N=2627

Source: Processed Data, 2021

firm value does not dependent on the presence of the Board of Commissioners Independent. Therefore, including the Board of Commissioners' Independent variable in the model cannot significantly increase the model's feasibility, with the test result value being 0.000, p-value Chng 0.671*> 0.05, and hypothesis 2 was rejected.

The analysis also shows that BODind and BOCind are not able to significantly increase the feasibility of the model, with a test value of 0.000, p-value Chng 0.839* > 0.05 (TbQ), and a value of 0.000, p-value Chng 0.754* > 0.05. The BODind variable tends to be a predictor of firm value, model TbQ with a value of B2 = -0.112 and p-value of 0.000* > 0.05, model MBVE with a value of B2 = -0.493 and p-value of 0.000* > 0.05, while BOCind tends to be a predictor of firm value, model TbQ B4 = 0.191 and a p-value of 0.020* > 0.05, and MBVE with a value of B4= 0.269 and a p-value of 0.040* > 0.05.

The results of various theoretical and empirical studies show that an ownership structure can create effective management supervision in business activities, thereby impacting the company's value creation. The distribution of shares to management leads to increased sharing of business risks, positive causality between risk and managerial ownership, and increased management direct ownership of full control of the company, reducing conflicts of interest and improvement in leads corporate performance (Demsetz

& Lehn, 1985). Empirical evidence for a positive relationship between insider ownership and firm value after taking and controlling (Morck et al., 1988). The complexity of conflict of interest leads to agency costs (Jensen & Meckling, 1976). Fundamentally, agency costs must be controlled and monitored; ownership structure, managerial ownership, the board size, independent board members, independent committees, and CEO duality (Panda & Leepsa, 2017).

The first finding of this research is quite interesting to be discussed. Further, the direction of the relationship is negative and significant and has a non-linear effect on firm value, consistent with (Morck et al., 1988; Lins, 2003) in Emerging Markets; in Nigeria (Sani, 2020), Australia (Shan, 2019), as well as in Indonesia (Haruman, 2008; Sukirni, 2012; Suriawinata & Nurmalita, 2022), it means firm value increase while managerial ownership decrease.

However, this differs from other studies that suggest that managerial ownership can enhance firm value (Wahyudi & Pawestri, 2006; Ardianingsih & Ardiyani, 2010; Anita & Yulianto, 2016; Sahrul & Novita, 2020), different results for no significant effect (Sujoko & Soebiantoro, 2007; Sugosha & Artini, 2020; Sutrisno, 2020), so also in Malaysia (Abdullah et al., 2017), happened in Jordan (Al Amosh & Khatib, 2022).

Increased insider ownership is inversely related to stock returns; Excessive requirements lead to control of the board (Han & Suk, 1998), a convergence of interests (Davies et al., 2005), excessive discretionary costs (Rashid, 2016; Suriawinata & Nurmalita, 2022), and exacerbate Nigerian agency conflicts (Sani, 2020). Managers tend to make decisions based on their own or group’s interests, paying little attention to business continuity and increasing shareholder value (Al Amosh & Khatib, 2022). The results of this study are consistent with the entrenchment hypothesis that there is evidence of the practice of power retention by the leadership team. At the same time, there is pressure from company owners (Morck et al., 1988) to engage in expropriation because of their protected control as controlling shareholders (Fan & Wong, 2002).

The BODind and BOCind moderation variables are based on the premise that when the company has a managerial ownership structure, both originating from being the founder and/or owner of the company, it can also be obtained due to incentive policies or compensation for achievement. Therefore, high managerial ownership, BODind and BOCind roles are highly needed to improve management performance monitoring, and we expect to be able to make a variety of decisions in line with the company's main objective of maximizing firm value.

The effectiveness of the Independent Board in carrying out strict supervision can reduce the occurrence of conflicts of interest, playing a strategic role in controlling the company's management activities (Mak & Kusnadi, 2005) [Singapore dan Malaysia]; (Kusumastuti & Sastra, 2007) [Indonesia]; (Drakos & Bekiris, 2010) [Yunai]; (Kao et al., 2018) [Taiwan]; (Coletta & Arruda de Souza Lima, 2020) [Brasil], the monitoring system can improve investment efficiency, effective in reducing the cost of debt (Nazir, 2021), influence the improvement of corporate value (Ullah et al., 2020).

This second finding is of interesting for further investigation; The effect of managerial ownership on firm value is not dependent on the presence of Board and

Commissioners' Independent members; previous research has shown that board involvement by external parties is not associated with improved corporate performance, this is consistent with the research (Hermalin & Weisbach, 1991), it does not create a more optimal monitoring mechanism (Agrawal & Knoeber, 1996), does not affect firm performance (Drakos & Bekiris, 2010), or provides a meaningful response to stock prices (Ding et al., 2020). In Pakistan, findings (Latief et al., 2014) that the presence of BODind does not affect increasing company performance and firm value in Malaysia (Yusoff & Alhaji, 2012); (Zabri et al., 2016), China (Wang, 2017), Indonesia (Situmorang & Simanjutak, 2019); India (Yameen et al., 2019), the same is true for US companies that show independent boards have nothing to do with company performance (Hermalin & Weisbach, 2003).

The conditional effect of management ownership of goodwill does not depend on an independent board of directors. This case is likely to occur in Indonesia, which, from our analysis, applies a two-tier board system, and the board and officers require an independent board to be involved. Whether the company's independent body total holdings or holdings of 0.5218 or 52.18% (0.1438 + 0.3780) are summed up, which is well above the legal requirement of 30% and eliminates the role of supervision and control is optimal (Agrawal & Knoeber, 1996), management is not agile in operational and strategic business decisions. Furthermore, recruitment mechanisms do not take into account competence and professionalism, but perhaps affiliation, particular interests, or political reasons (including politicians, environmentalists, and environmental activists) (Agrawal & Knoeber, 1996), and it is not simply about fulfilling our obligations under Good Corporate. Rules. Governance (GCG) influences increased agency costs that shareholders must bear (Jensen & Meckling, 1976; Panda & Leepsa, 2017).

Findings the results of his study found are inconsistent with previous research that CEO Duality on company performance depends on independent directors (Duru et al., 2016), the policy ownership structure, and the company’s disclosure of Corporate Social Responsibility in moderation of the board of independent directors (Zaid et al., 2020), female board on corporate performance through CSR are most powerful when female directors hold high power (Yonghong Liu et al., 2020), positive impact on corporate governance system, avoidance of opportunistic management behaviour (Ozdemir et al., 2021; Yu Liu et al., 2015), the impact of profitability on dividend policy is mitigated by liquidity (Puspitaningtyas et al., 2019), creating a positive signal and impact on corporate value.

In connection with the finding that the effects of managerial ownership and firm value do not depend on the presence of an Independent Board, then as another approach to improve company monitoring, namely through the establishment of an Independent Board Committee, this approach can provide clearer results regarding the relationship between the independent directors monitoring effectiveness and organization performance (Klein, 1998; Cotter & Silvester, 2003), involves the role of the company's Board of Committees (Xie et al., 2003; Wang, 2017), The audit committee board can help create reliable financial reports (Oktaviani & Ariyanto, 2019), The presence of the Board of Committees is, of course, very helpful to the Board of Commissioners in carrying out

and increasing supervision of the Board of Directors in operational and strategic company policies; it is hoped that will be done without interference from various parties and or political pressure.

Conclusion

Conclusion: This study focuses on the role of the independent board in moderating managerial ownership of firm value within an agency theory frame. Very limited research in the financial sector that uses the conditional effects analysis approach, this study uses 2627 observational data that can present actual conditions so as to clarify various gaps in previous research in estimating models using PROCESS V3.4. for SPSS.

This study's findings show a non-linear relationship between the effect of managerial ownership on firm value, in line with the entrenchment hypothesis, which allows for discretionary policies carried out by managers so that they impact agency costs. Furthermore, the findings of this study indicate that the independent board does not provide an interaction or moderating effect on the relationship, but the independent board as a predictor of firm value, which is in line with agency theory, further enhances the effective monitoring and control of management.

Finally, for policymakers, it would be better to increase the number of independent boards by at least 30%, prioritizing the principle of impartiality when recruiting independent boards and paying attention to expertise and experience. Research limitations: the moderating variable of this study only involved the independent Board of Directors and Commissioners, and the independent variable only the managerial ownership structure, have not tried the independent board as a mediator variable. Further research: 1) expanding the scope of research variables, for example, adding mediating variables as part of creating corporate value, 2) adding proxies to measure ownership structure, proxies to measure corporate governance practices, and using accounting bases to measure company performance.

References

Abdullah, N. A. I. N., Ali, M. M., & Haron, N. H. (2017). Ownership structure, firm value and growth opportunities: Malaysian evidence. Advanced Science Letters, 23(8), 7378–7382. https://doi.org/10.1166/asl.2017.9479

Abobakr, M. G. (2017). Corporate Governance and Banks Performance: Evidence from Egypt. Asian Economic and Financial Review, 7(12), 1326–1343.

https://doi.org/10.18488/journal.aefr.2017.712.1326.1343

Agarwal, S. (2020). Relationship between Managerial Ownership and Agency Cost. International Journal of Financial Management, 10(4), 35–43.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3799983

Agrawal, A., & Knoeber, C. R. (1996). Firm Performance and Mechanisms to Control Agency Problems between Managers and Shareholders Analysis , Vol . 31 , No . 3 ( Sep ., 1996 ), pp . Published. The Journal of Financial and Quantitative, 31(3), 377– 397. https://www.jstor.org/stable/2331397?origin=crossref

Al Amosh, H., & Khatib, S. F. A. (2022). Ownership structure and environmental, social and

governance performance disclosure: the moderating role of the board independence. Journal of Business and Socio-Economic Development, 2(1), 49–66. https://doi.org/10.1108/jbsed-07-2021-0094

Al Farooque, O., Buachoom, W., & Sun, L. (2020). Board, audit committee, ownership and financial performance – emerging trends from Thailand. Pacific Accounting Review, 32(1), 54–81. https://doi.org/10.1108/PAR-10-2018-0079

Almudehki, N., & Zeitun, R. (2012). Ownership Structure and Corporate Performance: Evidence from Qatar. SSRN Electronic Journal, 1–21.

https://doi.org/10.2139/ssrn.2154289

Ang, J. S., Cole, R., & Lin, J. W. (2000). Agency costs and ownership structure. The Journal Of Finance, LV(1), 81–106. https://doi.org/10.4324/9780203940136

Anita, A., & Yulianto, A. (2016). Pengaruh Kepemilikan Manajerial Dan Kebijakan Dividen Terhadap Nilai Perusahaan. Management Analysis Journal, 5(1), 229–232.

Ardianingsih, A., & Ardiyani, K. (2010). Analisis Pengaruh Struktur Kepemlikan Terhadap Kinerja Perusahaan. Jurnal Pena, 19(2), 97–109.

Beiner, S., Drobetz, W., Schmid, M. M., & Zimmermann, H. (2006). An integrated framework of corporate governance and firm valuation. European Financial Management, 12(2), 249–283. https://doi.org/10.1111/j.1354-7798.2006.00318.x

Bentivogli, C., & Mirenda, L. (2017). Foreign Ownership and Performance: Evidence from Italian Firms. International Journal of the Economics of Business, 24(3), 251–273. https://doi.org/10.1080/13571516.2017.1343542

Bhagat, S., & Bolton, B. (2013). Director Ownership , Governance , and Performance (Vol. 48, Issue 1). https://doi.org/10.1017/S0022109013000045

Bonazzi, L., & Islam, S. M. N. (2007). Agency theory and corporate governance: A study of the effectiveness of board in their monitoring of the CEO. Journal of Modelling in Management, 2(1), 7–23. https://doi.org/10.1108/17465660710733022

Cho, M. H. (1998). Ownership structure, investment, and the corporate value: an empirical analysis. Journal of Financial Economics, 47(1), 103–121.

Coletta, C., & Arruda de Souza Lima, R. (2020). Board of directors, performance and firm value in Brazilian listed state-owned enterprises. Brazilian Review of Finance, 18(2), 1. https://doi.org/10.12660/rbfin.v18n2.2020.80898

Combs, J. G., Ketchen, D. J., Perryman, A. A., & Donahue, M. S. (2007). The moderating effect of CEO power on the board composition-firm performance relationship. Journal of Management Studies, 44(8), 1299–1323. https://doi.org/10.1111/j.1467-6486.2007.00708.x

Cotter, J., & Silvester, M. (2003). Board and Monitoring Committee Independence. A Journal of Accounting, Finance, and Business Studies and Business Studies, 39(2).

Davies, J. R., Hillier, D., & McColgan, P. (2005). Ownership structure, managerial behavior and corporate value. Journal of Corporate Finance, 11(4), 645–660.

https://doi.org/10.1016/j.jcorpfin.2004.07.001

Demsetz, H., & Lehn, K. (1985). The Structure of Corporate Ownership: Causes and Consequences. Readings in Applied Microeconomics: The Power of the Market, 93(6), 1–439. https://doi.org/10.4324/9780203878460

Denis, D. K. (2001). Twenty-five years of corporate governance research...and counting. Review of Financial Economics, 10(3), 191–212. https://doi.org/10.1016/S1058-3300(01)00037-4

Ding, W., Levine, R., Lin, C., & Xie, W. (2020). Corporate Immunity to the COVID-19 Pandemic. National Bureau of Economic Research. https://doi.org/10.3386/w27055

Doorasamy, M. (2021). Capital structure , firm value and managerial ownership : Evidence from East African countries. "Investment Management and Financial Innovations, 18(1), 346–356. https://doi.org/10.21511/imfi.18(1).2021.28

Drakos, A. A., & Bekiris, F. V. Ã. (2010). Endogeneity and the Relationship Between Board Structure and Firm Performance : A Simultaneous Equation Analysis for the Athens Stock Exchange. Anagerial and Decision Economics, 401(February), 387–401. https://doi.org/10.1002/mde

Duru, A., Iyengar, R. J., & Zampelli, E. M. (2016). The dynamic relationship between CEO duality and firm performance: The moderating role of board independence. Journal of Business Research, 69(10), 4269–4277.

https://doi.org/10.1016/j.jbusres.2016.04.001

Dwivedi, N., & Jain, A. K. (2005). Corporate governance and performance of Indian firms: The effect of board size and ownership. Employee Responsibilities and Rights Journal, 17(3), 161–172. https://doi.org/10.1007/s10672-005-6939-5

Fahdiansyah, R., Qudsi, J., & Bachtiar, A. (2018). Struktur Kepemilikan Dan Nilai Perusahaan: (Studi Pada Perusahaan Manufaktur Yang Listing Di Bursa Efek Indonesia). Jurnal Varian, 1(2), 41–49. https://doi.org/10.30812/varian.v1i2.70

Fan, J., & Wong, T. (2002). Corporate ownership structure and the informativeness of accounting earnings in East Asia. Accounting and Business Research, 33(4), 245–257. https://doi.org/10.1080/00014788.2002.9728973

Gurbuz, A., & Aybars, A. (2010). The impact of foreign ownership on corporate governance: Evidence from an emerging market: Turkey. American Journal of Economics and Business Administration, 4(2), 350–359.

https://doi.org/10.21511/imfi.16(2).2019.09

Han, K. C., & Suk, D. Y. (1998). The effect of ownership structure on firm performance: Additional evidence. Review of Financial Economics, 7(2), 143–155.

https://doi.org/10.1016/S1058-3300(99)80150-5

Haruman, T. (2008). The Effect of Ownership Structure on Financial Decisions and Firm Value. Simposium Nasional Akuntansi XI, 150–166.

http://repository.widyatama.ac.id/xmlui/handle/123456789/3311

Hayes, A. (2018). Introduction to Mediation, Moderation, and Conditional Process Analysis, A Regression-Based Approach (David A. Kenny (ed.); Second Edi). The Guilford Press. A Division of Guilford Publications, Inc.

Hayes, A. (2022). Introduction to Mediation, Moderation, and Conditional Process Analysis. A Regression-Based Approach (David A. Kenny (ed.); Third Edit). The Guilford Press. A Division of Guilford Publications, Inc.

Hermalin, B. E., & Weisbach, M. S. (2003). Boards of Directors as an Endogenously Determined Institution: A review of the Economic Literature. National Bureau of Economic Research, 3, 41.

Hermalin, B., & Weisbach, M. (1991). The Effects of Board Composition and Direct Incentives on Firm Performance. Financial Management Association International, 20(4), 101–112.

Hidayat, A. A., & Utama, S. (2016). Board Characteristics and Firm Performance : Evidence from Indonesia. INternational Research Journal of Business Studies, 8(3), 137–154.

Hong Nguyen, T. X., Pham, T. H., Dao, T. N., Nguyen, T. N., & Ngoc Tran, T. K. (2020). The impact of foreign ownership and management on firm performance in Vietnam. Journal of Asian Finance, Economics and Business, 7(9), 409–418.

https://doi.org/10.13106/JAFEB.2020.VOL7.NO9.409

Igartua, J. J., & Hayes, A. F. (2021). Mediation, Moderation, and Conditional Process Analysis: Concepts, Computations, and Some Common Confusions. Spanish Journal of Psychology, 24(6), 1–23. https://doi.org/10.1017/SJP.2021.46

Islamudin, A., Wurintara, G. G., & Bernawati, Y. (2020). The Odd-Even Effect in The Boards of Commissioners and Corporate Values. Jurnal Ilmiah Akuntansi Dan Bisnis, 15(2). https://doi.org/10.24843/JIAB.2020.v15.i02.p12

Jensen, M., & Meckling, W. (1976). Theory Of The Firm: Managerial Behavior, Agency Costs And Ownership Structure. Journal of Financial Economics, 3(10), 305–360. https://doi.org/10.1177/0018726718812602

Johl, S. K., Kaur, S., & Cooper, B. J. (2015). Board Characteristics and Firm Performance: Evidence from Malaysian Public Listed Firms. Journal of Economics, Business and Management, 3(2), 239–243. https://doi.org/10.7763/joebm.2015.v3.187

Jumanne, B. B., & Keong, C. C. (2018). Ownership concentration, foreign ownership and corporate performance among the listed companies in East African community: the role of quality institutions. African J. of Accounting, Auditing and Finance, 6(1), 70. https://doi.org/10.1504/ajaaf.2018.10012250

Kao, M. F., Hodgkinson, L., & Jaafar, A. (2018). Ownership structure, board of directors and firm performance: evidence from Taiwan. Corporate Governance: The International Journal of Business in Society, 19(1), 189–216.

https://doi.org/10.1108/CG-04-2018-0144

Klein, A. (1998). Firm performance and board committee Structure. The Journal of Law and Economics, 41(1), 275–304.

Kusnendi. (2019). Model Struktural Persamaan Tunggal 2019. In Model Struktural Persamaan Tunggal Dengan Variabel Moderator. Sekolah Pascasarjana Universitas Pendidikan Indonesia.

Kusumastuti, S., & Sastra, P. (2007). Pengaruh Board Diversity Terhadap Nilai Perusahaan Dalam Perspektif Corporate Governance. Jurnal Akuntansi Dan Keuangan, 9(2), 88– 98. https://doi.org/10.9744/jak.9.2.pp.88-98

Latief, R., Raza, S. H., & Gillani, S. A. H. (2014). Impact of corporate governance on performance of privatized firms; evidence from non-financial sector of Pakistan. Middle - East Journal of Scientific Research, 19(3), 360–366.

https://doi.org/10.5829/idosi.mejsr.2014.19.3.13607

Lin, Y. R., & Fu, X. M. (2017). Does institutional ownership influence firm performance? Evidence from China. International Review of Economics and Finance, 49(March 2016), 17–57. https://doi.org/10.1016/j.iref.2017.01.021

Lins, K. V. (2003). Equity Ownership and Firm Value in Emerging Markets. The Journal of Financial and Quantitative Analysis, 38(1), 159. https://doi.org/10.2307/4126768

Liu, Yonghong, Lei, L., & Buttner, E. H. (2020). Establishing the boundary conditions for female board directors ’ influence on firm performance through CSR. Journal of Business Research, 121(February 2019), 112–120.

https://doi.org/10.1016/j.jbusres.2020.08.026

Liu, Yu, Miletkov, M. K., Wei, Z., & Yang, T. (2015). Board independence and firm

performance in China. Journal of Corporate Finance, 30, 223–244.

https://doi.org/10.1016/j.jcorpfin.2014.12.004

Mak, Y. T., & Kusnadi, Y. (2005). Size really matters: Further evidence on the negative relationship between board size and firm value. Pacific Basin Finance Journal, 13(3), 301–318. https://doi.org/10.1016/j.pacfin.2004.09.002

Mishra, R., & Kapil, S. (2017). Effect of ownership structure and board structure on firm value: evidence from India. Corporate Governance (Bingley), 17(4), 700–726. https://doi.org/10.1108/CG-03-2016-0059

Morck, R., Shleifer, A., & & Vishny, R. (1988). Management ownership and market valuation. An empirical analysis. Journal of Financial Economics, 20(C), 293–315. https://doi.org/10.1016/0304-405X(88)90048-7

Mugobo, V. V., Mutize, M., & Aspeling, J. (2016). The ownership structure effect on firm performance in South Africa. Corporate Ownership and Control, 13(2CONT2), 461– 464. https://doi.org/10.22495/cocv13i2c2p7

Munisi, G., Hermes, N., & Randøy, T. (2014). Corporate boards and ownership structure: Evidence from Sub-Saharan Africa. International Business Review, 23(4), 785–796. https://doi.org/10.1016/j.ibusrev.2013.12.001

Nathaniel;, & Sansaloni, B. (2016). Determinasi Efisiensi Investasi Perusahaan Publik di Indonesia. Jurnal Akuntansi Bisnis, 17(1), 165–175.

Nazir, M. (2021). How Corporate Governance Practices Affect the Cost of Debt: A CrossCountry Comparison of Pakistan and India. Jurnal Ilmiah Akuntansi Dan Bisnis, 16(2). https://doi.org/10.24843/JIAB.2021.v16.i02.p01

Novianti, L., & Irni Yunita, S. T. (2019). Influence Analysis of Managerial Ownership and Institutional Ownership on Firm Performance in Indonesia Stock Exchange. International Journal of Science and Research (IJSR), 8(1), 236–240.

https://www.ijsr.net/archive/v8i1/ART20193975.pdf

Nugroho, A. C., & Stoffers, J. (2020). Market Competition and Agency Problem : a Study in Indonesian Manufacturing Companies Persaingan Pasar dan Pemasalahan Keagenan : Studi Kasus di Perusahaan Manufaktur di Indonesia. 11(85), 65–77. https://doi.org/10.15294/jdm.v11i1.21684

Oktaviani, N. P. S., & Ariyanto, D. (2019). Pengaruh Financial Distress, Ukuran Perusahaan, dan Corporate Governance pada Audit Delay. E-Jurnal Akuntansi Universitas Udayana, 27(3), 2154–2182.

Ongore, V. O., K’Obonyo, P. O., Ogutu, M., & Bosire, E. M. (2015). Board composition and financial performance: Empirical analysis of companies listed at the Nairobi securities exchange. International Journal of Economics and Financial Issues, 5(1), 23–43.

Ozdemir, O., Vegas, L., Erkmen, E., & Binesh, F. (2021). Board diversity and firm risk-taking in the tourism sector : Moderating effects Board diversity and firm risk-taking in the tourism sector : Moderating effects of board independence , CEO duality , and free cash flows. May. https://doi.org/10.1177/13548166211014367

Panda, B., & Leepsa, N. M. (2017). Agency theory: Review of theory and evidence on problems and perspectives. Indian Journal of Corporate Governance, 10(1), 74–95. https://doi.org/10.1177/0974686217701467

Perwitasari, D. (2014). Ownership Structure, Company Characteristics, And Profit Management. Jurnal Akuntansi Multiparadigma, 5(3).

https://doi.org/10.18202/jamal.2014.12.5032

Perwito, P., Nugraha, N., Disman, D., & Gunardi, G. (2021). Intangible Asset Moderation and the Sustainable Investment and Firm Value Relation. BIS-HSS.

https://doi.org/10.4108/eai.18-11-2020.2311719

Prabowo, M., & Simpson, J. (2011). Independent directors and firm performance in family controlled firms : evidence from Indonesia. Asian-Pacific Economic Literature, 25(1), 121–132. https://doi.org/10.1111/j.1467-8411.2011.01276.x

Pratiwi, R. D., & Chariri, A. (2021). Effectiveness of The Board of Directors and Company Performance: Corporate Governance Perspective in Indonesia. Jurnal Penelitan Ekonomi Dan Bisnis, 6(1), 17–27. https://doi.org/10.33633/jpeb.v6i1.4351

Puspitaningtyas, Z., Prakoso, A., & Masruroh, A. (2019). Pengaruh Profitabilitas Terhadap Kebijakan Dividen Dengan Likuiditas Sebagai Pemoderasi. Jurnal Administrasi Bisnis, 9(3), 1. https://doi.org/10.35797/jab.9.3.2019.25120.1-17

Rashid, A. (2016). Managerial Ownership and Agency Cost: Evidence from Bangladesh. Journal of Business Ethics, 137(3), 609–621. https://doi.org/10.1007/s10551-015-2570-z

Rashid, M. M. (2020). “Ownership structure and firm performance: the mediating role of board characteristics.” Corporate Governance (Bingley), 20(4), 719–737.

https://doi.org/10.1108/CG-02-2019-0056

Rizqia, D. A., Aisjah, S., Program, P., & Java, E. (2013). Effect of Managerial Ownership , Financial Leverage , Profitability , Firm Size , and Investment Opportunity on Dividend Policy and Firm Value. 4(11), 120–130.

Sahrul, M., & Novita, S. (2020). Ownership Structure, Firm Value and Mediating Effect of Firm Performance. Jurnal Akuntansi, 24(2), 219.

https://doi.org/10.24912/ja.v24i2.692

Sani, A. (2020). Managerial Ownership and Financial Performance of the Nigerian Listed Firms: The Moderating Role of Board Independence. International Journal of Academic Research in Accounting, Finance and Management Sciences, 10(3), 64–73. https://doi.org/10.6007/ijarafms/v10-i3/7821

Shan, Y. (2019). Managerial ownership, board independence and firm performance. Accounting Research Journal, 34(1), 1–28.

Singh, M., & Davidson, W. N. (2003). Agency costs, ownership structure and corporate governance mechanisms. Journal of Banking and Finance, 27(5), 793–816.

https://doi.org/10.1016/S0378-4266(01)00260-6

Situmorang, A., & Simanjutak, A. (2019). Pengaruh Good Corporate Governance Terhadap Kinerja Keuangan Perusahaan Perbankan Yang Terdaftar Di Bursa Efek Indonesia. Jurnal Akuntansi Dan Bisnis: Jurnal Program Studi Akuntansi, 5(2), 160–169.

Sugosha, M., & Artini, S. L. (2020). The Role of Profitability in Mediating Company Ownership Structure and Size of Firm Value in the Pharmaceutical Industry on the Indonesia Stock Exchange. International Research Journal of Management, IT & Social Sciences, 7(1), 104–115. https://doi.org/10.21744/irjmis.v7n1.827

Sujoko, S., & Soebiantoro, U. (2007). The Effect of Share Ownership Structure, Leverage, Internal Factors and External Factors on Firm Value (Indonesian Manufactur and non Manufactur Sector). Jurnal Ekonomi Manajemen, 9(1), 41–48.

Sukirni, D. (2012). Managerial Ownership, Institutional Ownership, Dividend Policy and Debt Policy Analysis of Company Value. Accounting Analysis Journal, 1(2).

https://doi.org/10.15294/aaj.v1i2.703

Suriawinata, I. S., & Nurmalita, D. M. (2022). Ownership Structure, Firm Value and the Moderating Effects of Firm Size: Empirical Evidence From Indonesian Consumer Goods Industry. Jurnal Manajemen Dan Kewirausahaan, 24(1), 91–104.

https://doi.org/10.9744/jmk.24.1.91-104

Sutrisno, S. (2020). Corporate Governance, Profitability, and Firm Value Study on the Indonesian Sharia Stock Index. Jurnal Ekonomi Dan Bisnis Islam (Journal of Islamic Economics and Business), 6(2), 292. https://doi.org/10.20473/jebis.v6i2.23231

Ullah, I., Zeb, A., Khan, M. A., & Xiao, W. (2020). Board diversity and investment efficiency: evidence from China. Corporate Governance (Bingley), 20(6), 1105–1134.

https://doi.org/10.1108/CG-01-2020-0001

Vafeas, N., & Vlittis, A. (2019). Board executive committees , board decisions , and firm value. Journal of Corporate Finance, 58(March 2018), 43–63.

https://doi.org/10.1016/j.jcorpfin.2019.04.010

Wahyudi, U., & Pawestri, H. P. (2006). Implications of Ownership Structure on Firm Value: With Financial Decisions as Intervening Variables. Simposium Nasional Akuntansi 9 Padang, 53, 160. https://doi.org/10.1017/CBO9781107415324.004

Wang, B. (2017). Ownership, institutions and firm value: Cross-provincial evidence from China. Research in International Business and Finance, 44, 547–565.

https://doi.org/10.1016/j.ribaf.2017.07.125

Wati, L. N., Primiana, H. I., Pirzada, K., & Sudarsono, R. (2019). Political connection, blockholder ownership and performance. Entrepreneurship and Sustainability Issues, 7(1), 52–68. https://doi.org/10.9770/jesi.2019.7.1(5)

Weir, C., & Laing, D. (2000). The performance-governance relationship: The effects of Cadbury compliance on UK quoted companies. Journal of Management and Governance, 4(4), 265–281.

Weisbach, M. S. (1988). Outside directors and CEO turnover. Journal of Financial Economics, 20, 431–460. https://doi.org/10.1016/0304-405X(88)90053-0

Willim, A. P. (2015). Price Book Value & Tobin’s Q: Which One is Better for Measure Corporate Governance? European Journal of Business and Management Www.Iiste.Org ISSN, 7(27), 74–79. www.iiste.org

Xie, B., Davidson, W. N., & Dadalt, P. J. (2003). Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance, 9(3), 295–316. https://doi.org/10.1016/S0929-1199(02)00006-8

Yameen, M., Farhan, N. H., & Tabash, M. I. (2019). The impact of corporate governance practices on firm’s performance: An empirical evidence from Indian tourism sector. Journal of International Studies, 12(1), 208–228. https://doi.org/10.14254/2071-8330.2019/12-1/14

Yermack, D. (1996). Higher Market Valuation for Firms with a Small Board of Directors. Journal of Financial Economics, 40(40), 185–211.

Yusoff, W. F. W., & Alhaji, I. A. (2012). Corporate governance and firm performance of listed companies in Malaysia. Trends and Development in Management Studies, 1(1), 43–65. https://doi.org/10.9734/ajeba/2021/v21i1530478

Zabri, S. M., Ahmad, K., & Wah, K. K. (2016). Corporate Governance Practices and Firm Performance: Evidence from Top 100 Public Listed Companies in Malaysia. Procedia Economics and Finance, 35(October 2015), 287–296.

https://doi.org/10.1016/s2212-5671(16)00036-8

Zaid, M. A. A., Abuhijleh, S. T. F., & Pucheta-Martínez, M. C. (2020). Ownership structure, stakeholder engagement, and corporate social responsibility policies: The moderating effect of board independence. Corporate Social Responsibility and Environmental Management, 27(3), 1344–1360. https://doi.org/10.1002/csr.1888

Zandi, G., Singh, J., Mohamad, S., & Ehsanullah, S. (2020). Ownership Structure and Firm Performance. International Journal of Financial Research, 11(2), 293–300.

https://doi.org/10.5430/ijfr.v11n2p293

Jurnal Ilmiah Akuntansi dan Bisnis, 2023 | 74

Discussion and feedback