Corporate Governance Toward Sustainability Disclosure: Recent Development and Future Research Agenda

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 2, July 2022

Corporate Governance Toward Sustainability Disclosure: Recent Development and Future Research Agenda

|

AFFILIATION: 1,2,3 Faculty of Economics and Business, Universitas Udayana, Indonesia |

Luh Gede Krisna Dewi1*, Ni Luh Putu Wiagustini2, Henny Rahyuda3, I Putu Sudana4 Abstract |

|

*CORRESPONDENCE: |

The concept of sustainability is important in global business practices. Companies should manage business practices that are in line with the achievement of the SDGs agenda. This study aims to review previous |

|

THIS ARTICLE IS AVAILABLE IN: |

research and fill gaps using a literature review approach. It critically reviews the theoretical perspectives and issues based on the relationship |

|

DOI: 10.24843/JIAB.2022.v17.i02.p05 |

between corporate governance mechanisms and the level of corporate sustainability disclosure. This study adopts a systematic literature review |

|

CITATION: Dewi, L. G. K., Wiagustini, N. L. P., rahyuda, h. & sudana, i p. (2022). Corporate Governance Toward Sustainability Disclosure: Recent Development and Future Research Agenda. Jurnal Ilmiah Akuntansi dan Bisnis, 17(2), 252-271. |

approach with bibliometric analysis methods and content analysis using 44 articles from the Scopus database. The results of this study describe three clusters in the latest research developments. The first cluster is with regard to corporate social responsibility, the second is board composition; and the third is practical implications. Another finding is female director and independent director variables appear to be predictors of the sustainability report disclosure. The implication of the research is to provide comprehensive future research agenda. |

|

ARTICLE HISTORY Received: 20 January 2022 |

Keywords: corporate governance, sustainability disclosure, board composition, bibliometric analysis |

Revised:

20 May 2022

|

Accepted: |

Introduction |

|

25 June 2022 |

The declaration of the Sustainable Development Goals (SDGs) is an important milestone in achieving the company's sustainability goals. The company's involvement in achieving this agenda is driven by demands from stakeholders regarding the transparency of the impact of business practices on the environment and society (KPGM, 2020). The company is considered the party most responsible for the exploitation of earth's resources (Zainal, 2017). Sustainable business practices will encourage companies to establish business practice policies that emphasize sustainability and reduce activities that harm the environment and society. Companies should manage business practices that are in line with the achievement of the SDGs agenda. Like two sides of a sword, a company's activities can have an impact on the environment and social improvement and progress, but on the other hand, it has the opposite effect. Without being based on the right spirit, the company's business activities will harm the quality of the environment and social conditions (Sudana, 2014). |

The company communicates activities and efforts to increase the effectiveness and efficiency of the economic, environmental and social dimensions through sustainability reports (Stacchezzini et al., 2016). Stakeholders need information related to the company's involvement in the social and environmental fields because in an efficient market share prices reflect financial and non-financial information (Arayssi, 2016; Richardson & Welker, 2001). This report is a sign of the willingness company's to maintain good relations with stakeholders (Schaltegger et al., 2006), create competitive advantage (Jiang et al., 2021), avoid sanctions and pressure from stakeholders (Guidry & Patten, 2012), reduce agency costs (Shamil et al., 2014), increase reputation and credibility through transparency (Brown et al., 2009; Bini & Bellucci, 2020), as well as being a transformational driver towards sustainable development goals (GRI, 2021). The integration of sustainability information in business strategy is essential considering that traditional financial reporting is no longer adequate for the development of business organizations (Obiamaka & Akintola, 2016; Amorelli & García-Sánchez, 2021).

Sustainability reporting is an important aspect of transparency and disclosure in corporate governance (Obiamaka & Akintola, 2016). Rapid developments occurred in previous studies that examined the relationship between the company's internal corporate governance mechanisms and the quality of sustainability disclosure. Several recent studies examine the disclosure of sustainability reports related to corporate governance mechanisms such as diversity, attributes, and board composition (Haji, 2013; Alazzani et al., 2017; Ahmad et al., 2018; Bakar et al., 2019; Moses et al., 2020), and ownership structure (Zainal, 2017). Other studies have focused on the relationship between board gender diversity and sustainability disclosure (Ahmad et al., 2018; Al-Shaer & Zaman, 2016; Alazzani et al., 2017; Anazonwu et al., 2018; Arayssi, 2016; Bakar et al., 2019; Buallay, 2019a; Handajani et al., 2014; Moses et al., 2020; Mungai et al., 2020; Shamil et al., 2014; Zhuang et al., 2018). Some previous studies stated that board gender diversity positively affects sustainability disclosure, but on the contrary, there are also research findings which state that there is no significant relationship between those variables (Ahmad et al., 2018; Handajani et al., 2014; Shamil et al., 2014; Zhuang et al., 2018). This shows that results of previous research are not entirely conclusive, so it is necessary to examine the reasons for these differences. This study summarizes several previous studies examining the effect of corporate governance mechanisms on sustainability disclosure and provides directions for further research.

The majority of research uses agency theory as the main theory and is supported by stakeholder theory to analyze practice and sustainability disclosure in the context of corporate governance. This agency relationship is prone to conflict because management has a personal interest that is not aligned with the owner's agreement (Eisenhardt, 1989). Agency conflicts that trigger agency costs can be overcome by implementing good corporate governance. In companies with dispersed ownership, corporate governance mechanisms through transparency and accountability of corporate organs are crucial (Ogden, Jen, & O’Connor, 2012). By maximizing the function of the company's board, it is expected to reduce conflicts of interest and information asymmetry, as well as create a transparent and accountable process. Submission of transparent and accountable reporting is imperative to provide confidence that management acts to protect stakeholders’ interests. Agency theory focuses on the motivation of managers to carry out sustainability disclosure and its impact on the decisions taken (de Klerk et al., 2015).

Agency theory states that the corporate governance structure and the quality of board monitoring have an impact on the interaction of social-environmental activities with the interests of shareholders (Arayssi, 2016).

The perspective in agency theory is expanded with the view of stakeholder theory which explains that increasing board monitoring on the company's social orientation is a positive signal for stakeholders. Thus placing the company as a good citizen who can protect the interests of stakeholders (Mahmood & Orazalin, 2017). Management should create, protect and align value for different stakeholders (Freeman, 2015). Companies face strong pressure in their business practices to adopt the concept of sustainability and be transparent about these sustainability practices (Stacchezzini et al., 2016). Submission of sustainability reporting is the company's response to these pressures. Submission of sustainability reporting is seen as an effort to protect the interests of various stakeholders. Sustainability disclosure is part of the company's dialogue with stakeholders, which reflects the company's commitment to the social environment (Arayssi, 2016).

This study aims to synthesize the state of research on the relationship between corporate governance mechanisms, especially the composition of the board and the company's sustainability disclosures, to obtain views about the potential and direction of further research. The bibliometric review reveals the exponential growth of this line of research. The results of the analysis show that the latest topic that is related to sustainability disclosure is the existence of female directors and independent directors. The content analysis revealed main theoretical frameworks that guide empirical research into the relationship between corporate governance and sustainability reporting are agency theory, stakeholder theory and social psychology theory. These results indicate a new direction in future research using social psychology theory as a supporting theory to explain the relationship between governance mechanisms, especially board composition, and sustainability disclosure.

Research Method

Based on the purpose of this study, the research methodology used is a systematic literature review. This approach makes it possible to identify, assess and interpret research in a particular field by testing and analyzing concepts, theories, and practices (Rodrigues & Mendes, 2018). There are two objectives of the literature review, namely 1) to map and summarize the content of previous research by identifying patterns, themes, and research issues, 2) to identify the conceptual and contribution of research results to theory development. Based on research (Rodrigues & Mendes, 2018) the process of compiling a literature review consists of three stages, namely 1) planning the review process, 2) selecting articles and synthesizing data, 3) delivering results and dissemination.

Literature was selected from the Scopus database to ensure the quality of the literature. The literature selected was sourced from all quartiles listed in the Scopus database. The keywords used are "sustainability reporting", "disclosure" and "corporate governance". The determination of these keywords is based on the research objective to analyze the disclosure of sustainability reporting in the context of corporate governance. The article selection process is carried out by applying the limits and the use of predetermined keywords. The first step in selecting articles is to enter the keywords

“sustainability reporting” AND “disclosure” AND “corporate governance” in the title, abstract, and literature keywords (TITLE-ABS-KEY). The next limitation is that the language of the article is selected in the language of "English". To increase the possibility of obtaining the appropriate amount of literature, the field is determined using all fields of knowledge, as well as the year of publication is not limited. The type of display option is determined by the article "open access". Based on these stages, 54 pieces of literature were obtained in accordance with the established limits. The next stage is to choose the type of publication, namely scientific articles (“ar”) only so that the number of appropriate literature is 44 articles.

Analysis of the collected literature was carried out in two stages. The first stage is descriptive analysis, namely, the literature metadata is exported in CSV format. Furthermore, based on these data, the distribution of literature data is presented based on the source, researcher, year, number of citations, research field, and country or geography. To provide a more comprehensive understanding, this first stage of analysis is complemented by the second stage of analysis, namely bibliometric and content analysis. This analysis aims to identify and analyze research streams, describe the state of the art so that future research directions are obtained (Rodrigues & Mendes, 2018). Bibliometric analysis was performed using the VOSViewer software version 1.6.16. The use of this software makes it possible to create a network of scientific publications, journals, research, research organizations, countries, keywords, and terms (van Eck & Waltman, 2020). Furthermore, content analysis is carried out manually by conducting an in-depth review so as to describe further research ideas.

Result and Discussion

Based on the selection of articles in this study, the first article was published in 2002 by Africa Merlin-Tao Visser W in the journal Corporate Environmental Strategy. The most recent article published in 2021 is an article by Naciti V., Cesaroni F., and Pulejo., L in the Journal of Management and Governance. Figure 1 shows the trend of publications on sustainability from 2002 to July 2021. The increasing number of articles on the topic of sustainability began in 2015 to coincide with the declaration of the SDGs by the United Nations. Since that year, the concept of sustainability has attracted the attention of scientific circles in various forms and implementations (Secinaro et al., 2021). Trends show

Publication Trends in the Period 2002-2021

■ Number of Publication

Figure 1. Publication Trends in the Period 2002-2021

Source: Authors’ construction based on scopus database (2021)

that 2019 and 2020 are the years with the highest number of publications and showing that after three years of the SDGs declaration, the topic of sustainability in the realm of business governance became an important topic that attracted the attention of academics. There were nine publications each in that year, with various topics relating the concept of sustainability to governance mechanisms.

The research discusses, among other things, internal governance mechanisms such as gender diversity in corporate boards and audit committees (Ararat & Sayedy, 2019; Bravo & Reguera-Alvarado, 2019; Furlotti et al., 2019; Ong & Djajadikerta, 2020), size and composition of company boards (Correa-Garcia et al., 2020; Ong & Djajadikerta, 2020), the existence of a sustainability committee (Adel et al., 2019; Giannarakis et al., 2020), presence of directors independent (Giannarakis et al., 2020), the existence of an audit committee (Buallay & Al-Ajmi, 2020), and ownership structure (Amidjaya & Widagdo, 2020; Correa-Garcia et al., 2020; Pham et al., 2020) as a predictor in the disclosure of corporate sustainability reports. Research published in the 2019-2020 range also discusses the quality and measurement of disclosure of sustainability reports (Czernkowski et al., 2019; Maroun, 2019; Stanciu & Bran, 2019; Wachira et al., 2020), sustainability information as a predictor of financial performance (Buallay, 2019b) or vice versa financial performance is a predictor of the quality of sustainability disclosure (Embuningtiyas et al., 2020). Based on the results of the analysis, the countries where the research is located are spread across all continents from Europe to Africa.

The results of the analysis show interesting things. South Africa became the first and largest research location for the African continent, and this frequency is equal to that of the United Kingdom. In the first article published in 2002, highlighting the disclosure of sustainability issues in the annual reports of large companies in South Africa, on average still needs improvement (Africa Merlin-Tao Visser, 2002). Subsequent articles discuss the measurement of sustainability disclosure by adopting GRI standards and local corporate governance standards (al Farooque & Ahulu, 2017; de Jongh & Möllmann, 2014; Wachira et al., 2020). African countries pay great attention to sustainability issues, such as Nigeria which developed the NSE Sustainability Disclosure Guideline as a guideline for disclosure of sustainability reports (Anazonwu et al., 2018). Mungai et al. (2020) raised the issue of environmental performance which is influenced by the composition of companies’ boards in Kenya, an indication that this theme is growing and is attracting researchers.

Furthermore, research related to the concept of sustainability has been carried out across Australia and Europe. The research located in Australia examines the issue of corporate governance structure in influencing the submission of sustainability reports (al Farooque & Ahulu, 2017; Kend, 2015; Ong & Djajadikerta, 2020) and the transformation of GRI standards adopted by companies (Czernkowski et al., 2019). Several studies using companies in Europe highlighted the link between corporate governance indicators and disclosure of sustainability reports (Adel et al., 2019; Bonsón & Bednárová, 2015; al Farooque & Ahulu, 2017; Kend, 2015). Other studies discuss the effect of CSR disclosure on stock prices (de Klerk et al., 2015) and the quality of disclosure of sustainability information and its effect on financial performance (Buallay, 2019b; Stanciu & Bran, 2019). Another issue relates to the role of government regulations in the submission of sustainability reports (Camilleri, 2015), as well as the influence of the presence of women on the board of directors on the disclosure of gender policies in CSR reports (Furlotti et al., 2019).

|

Table 1. The Ten Most Cited Articles | |||

|

Authors |

Articles |

No. of cititations |

Sources |

|

Sustainability, accountability and |

366 |

Business Strategy | |

|

corporate governance: exploring multinationals’ reporting practices |

and the Environmental | ||

|

Reporting on sustainability and |

129 |

International | |

|

HRM: a comparative study of sustainability reporting practices by the world’s largest companies. |

Journal of Human Resource Management | ||

|

Valuing Stakeholder Engagement |

82 |

Corporate | |

|

and Sustainability Reporting. |

Reputation Review | ||

|

Corporate sustainability: historical |

76 |

Management | |

|

development and reporting practices. |

Research Review | ||

|

Women on boards, sustainability |

67 |

Sustainability | |

|

reporting and firm performance. |

Accounting, Management and Policy Journal | ||

|

The influence of corporate social |

60 |

Pacific | |

|

responsibility disclosure on share prices. |

Accounting Review | ||

|

CSR reporting practices of |

59 |

Revista de | |

|

Eurozone companies. |

Contabilidad- Spanish Accounting Review | ||

|

Is sustainability reporting (ESG) |

52 |

Management of | |

|

associated with performance? Evidence from the European banking sector. |

Environmental Quality: An International Journal | ||

|

Internal Audit’s Role in GHG Emissions and Energy Reporting: Evidence from Audit Committees, Senior Accountants, and Internal Auditors. |

50 |

Auditing | |

|

A Cross-Country Investigation of |

48 |

Sustainability | |

|

Corporate Governance and Corporate Sustainability Disclosure: A Signaling Theory Perspective. |

(Switzerland) |

Source: Authors’ construction based on scopus database (2021)

The results of the analysis also show that research related to the topic of sustainability is also developing in Asian countries. The topic raised in the South East Asia

country is related to the characteristics of corporate governance such as board composition and ownership structure affecting sustainability disclosure (Amidjaya & Widagdo, 2020; Hu & Loh, 2018; Pham et al., 2020; Siew, 2017). Another interesting topic is the moderating role of culture in the relationship between corporate governance and sustainability disclosure (Mohamed Adnan et al., 2018), as well as the influence of financial performance on the quality of sustainability disclosure (Stanciu & Bran, 2019). The South Asia region is represented by India, Pakistan, Bangladesh, and Sri Lanka. Company board involvement, board composition, gender diversity, CSR committee, ownership structure determine the quality of corporate sustainability report disclosure of Sri Lanka, Bangladesh, India, and Pakistan (Bae et al., 2018; Rathnayaka Mudiyanselage, 2018). This shows that this topic is growing in developing economic countries in the South Asia region. For other Asian regions such as the Middle East (including Turkey, Saudi Arabia, Oman, Qatar, Kuwait, UAE, Bahrain) and East Asia, the research analyzes business characteristics, gender diversity, corporate governance characteristics, audit committees affecting sustainability disclosure (Ararat & Sayedy, 2019; Amina Buallay & Al-Ajmi, 2020; Wang, 2017), and disclosure of materiality assessment in sustainability reports (al Farooque & Ahulu, 2017).

North America is represented by two countries, namely the United States and Mexico, while South America is represented by research in Chile, Colombia, and Peru. The growing research discusses the influence of corporate board structure and ownership structure on the quality of disclosure (Correa-Garcia et al., 2020; Giannarakis et al., 2020) and the evolutionary process of the concept of sustainability governance (Elsayed & Ammar, 2020). The results of the analysis also show that several studies use companies spread across the world and included in databases such as Fortune Global 250, Forbes 200, DJSI World; FTSE 350 (Arayssi, 2016; Christofi et al., 2012; Crespy & Miller, 2011; Kolk, 2008).

The results of the analysis in Table 1 show the most cited articles in the first quartile journal (Q1) Business Strategy and the Environment which has a total of 5,799 citations throughout the publication period from 2017 to 2020. Among the 44 articles analyzed in this study, the article that most cited citation was Kolk (2008), with a total of 366 citations. This analysis is strengthened by the results of VOSviewer which shows the network between the authors. The results describe a network of inter-authors who are related to the use of references in articles. For example, an author in one cluster uses articles written by an author in the same cluster or from another cluster as a reference. The network also illustrates that articles in a cluster use reference to at least one of the same or related articles.

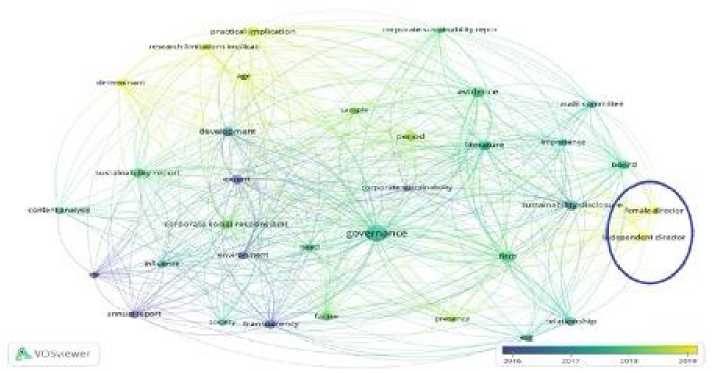

Bibliometric analysis is an analysis to measure quantitative and qualitative changes in publications using mathematical and statistical methods (von Ungern-Sternberg & Lindquist, 1995). This method makes it possible to describe the content, structure, and development of the research. In this study, the analysis was carried out using the VOSviewer application to provide an overview of the network between keywords that could provide an overview of the theme of further research. Figure 2 shows some words that are related to the concepts of sustainability reporting and corporate governance. The results of the analysis visualize 3 (three) clusters namely cluster 1 (red), cluster 2 (green), and cluster 3 (blue). In cluster 1 (red) “governance” is seen as the keyword that has the clearest visuals. The keyword “governance” has links that are

connected to other keywords in clusters 1, 2, and 3. Likewise, the keyword “sustainability report” is in the same cluster as “governance”, which means that these two concepts are closely related.

Cluster one highlights the keywords “governance”, “corporate social responsibility”, “transparency” and “sustainability report” respectively as keywords that have the number of links and the largest total link strength (Table 2). This number shows that these keywords have more important meaning when compared to other keywords in cluster one. The greater the weight (link value and total link strength) of the item, the more important the keyword is. The relationship between keywords in cluster one supports agency theory. The application of the principles of transparency and accountability in corporate governance is an option to prevent agency conflicts. The principle of transparency encourages companies to improve the quality of reporting of management activities in achieving company goals (Eisenhardt, 1989; Jensen & Meckling, 1976). One form of transparency implementation is the disclosure of ESG information through CSR and sustainability reports. Improving the quality of ESG disclosure can minimize internal supervision so as to reduce agency costs while improving the company's reputation (Brown et al., 2009; Shamil et al., 2014). The keyword also confirms voluntary disclosure theory that companies have an incentive to voluntarily disclose ESG information to attract investors' attention, reduce the cost of capital and ultimately increase the value of the company (Hummel & Schlick, 2016).

The keyword mapping in the second cluster visualizes the composition of the board (audit committee, independent commissioner, and gender diversity) as items related to the company's sustainability disclosure. Table 2 shows the keywords mapped are "board", "audit committee", "independent director" and "female director". This visualization shows that the role of the company's board as a source of knowledge and expertise is crucial in determining strategic policies related to sustainability information.

Source: Authors’ construction based on scopus database (2021)

As the highest level of management, the company's board has a major influence on the company's reporting practices and procedures (Ong & Djajadikerta, 2020). Through strategic and monitoring roles, the board can make decisions and supervise management actions in the business practices (Zahra & Pearce, 1989). The composition of the company's board has an impact on strategic decisions and actions, including in complex and voluntary sustainability disclosures (Elkington, 2006; Rao & Tilt, 2016). Based on a review of selected articles, it is apparent that audit committee, independent commissioners, and female directors are the composition of the board most often associated with sustainability practices and reporting (Ararat & Sayedy, 2019; Arayssi, 2016; Bae et al., 2018; Bravo & Reguera-Alvarado, 2019; Buallay & Al-Ajmi, 2020; al Farooque & Ahulu, 2017; Furlotti et al., 2019; Goyal & Dhamija, 2018; Hu & Loh, 2018; Rathnayaka Mudiyanselage, 2018; Ong & Djajadikerta, 2020; Trotman & Trotman, 2015; Wang, 2017).

The keyword mapping that appears in cluster three describes sustainability disclosure practices in the corporate setting. The analysis shows that the keyword that has the greatest weight is "practical implication", which shows that each study has practical implications for companies, regulators (policy-makers), and investors. The commitment to achieving the sustainability agenda at the corporate level is reflected in the process of determining strategy, operations, accounting, and reporting practices so that practical implications can be applied in the short and long term in the company (Stanciu & Bran, 2019). Practical implications for policymakers are related to the enforcement of rules and setting standards used in sustainability report disclosure practices. For investors, these practical implications relate to aspects of transparency in information disclosure and sustainability reports that can affect the quality of investment decisions. Other keywords are "age" and "presence". "Age" indicates the age of the company and the individual age of board members, while "presence" indicates the representation of certain groups within the company's board such as women, audit

|

Table 2. The Important Keywords | |||

|

Cluster and Item |

Link Total Link Strength |

Occurrence | |

|

Cluster 1 Governance |

*33 |

**208 |

35 |

|

Corporate social responsibility |

32 |

68 |

9 |

|

Transparancy |

30 |

69 |

11 |

|

Sustainability report |

29 |

69 |

11 |

|

Cluster 2 Board |

*27 |

**68 |

10 |

|

Audit committee |

26 |

41 |

6 |

|

Independent director |

21 |

42 |

6 |

|

Female director |

21 |

35 |

5 |

|

Cluster 3 Practical implication |

*28 |

**72 |

10 |

|

Age |

27 |

41 |

5 |

|

Presence |

24 |

48 |

6 |

|

* : the largest number of links in each cluster ** : the largest total link strength of each cluster | |||

|

Source: Authors’ construction based on scopus database (2021) | |||

committees, and sustainability committees. The occurrence of this keyword indicates the close relationship between corporate governance mechanisms and the level of disclosure of sustainability reports.

Overall, the results of the analysis show that the current growing research topic is the relationship between the presence of female directors and independent directors to the disclosure of corporate sustainability reports. In Figure 3, a light-colored topic item (yellow) is the latest topic, while the darker (purple-blue) item shows a topic that has long since developed. Female director and independent director variables appear in bright areas, indicating that these two topics are future research opportunities.

Agency theory focuses on the controlling role of the board in corporate governance that is can reduce agency costs while overcoming conflicts of interest through improving the quality of reporting. The company's board conducts monitoring to ensure management takes policies and strategies that protect shareholder interests (Eisenhardt, 1989). Management responds to such internal monitoring by making greater efforts in improving the quality of the disclosure (Shamil et al., 2014) . As the highest level of management, the company's board has a major influence on reporting practices and procedures (Ong & Djajadikerta, 2020). So that the disclosure of sustainability reports is inseparable from the role of the company's board as a source of knowledge and expertise in taking the company's strategic decisions and actions (Nielsen & Huse, 2010). The sustainability report demonstrates corporate governance commitment on sustainability issues and supports the achievement of sustainable development goals.

The relationship between the existence of a female director and the disclosure of sustainability reports is identified in agency theory, with the emphasis that the greater representation of women on the company’s board encourages the improvement of the quality of strategic decisions including sustainability report submission decisions. This change in gender dynamics leads to the expansion of perspectives, attributes, and knowledge in board discussions, which further improves board performance (Arayssi, 2016). The diversity of women's perspectives and thoughts can provide different orientations related to sustainability practices within the company (Amorelli & García-Sánchez, 2021). There are three roles of the company's board, namely strategic roles,

Figure 3. Overlay Visualization

Source: Authors’ construction based on scopus database (2021)

supervision, and service. The role allows the company's board to formulate and set company goals that are aligned with the concept of sustainability, further overseeing management actions in business sustainability practices and fostering good relations with the company's externals (Zahra & Pearce, 1989). This confirms the crucial role of the company's board in implementing sustainability practices and disclosures.

Previous literature revealed varying results related to relationships between those variables. Some literature says that the higher representation of women encourages the increasingly widespread disclosure rate of sustainability reports (Al-Shaer & Zaman, 2016; Alazzani et al., 2017; Anazonwu et al., 2018; Arayssi, 2016; Bakar et al., 2019; Buallay, 2019a; Moses et al., 2020; Mungai et al., 2020). The existence of a female director or board gender diversity leads to the disclosure of broader social responsibility, pro-environmental and pro-social investment choices, and leadership styles that support marginal and anti-conflict groups (Al-Shaer & Zaman, 2016; Amorelli & García-Sánchez, 2021; Bristy et al., 2021; Powell, 1990; Rao & Tilt, 2016). Instead, another study (Ahmad et al., 2018; Handajani et al., 2014; Shamil et al., 2014; Zhuang et al., 2018) It reveals that there is no influence between the growing number of women on corporate boards and the disclosure rate of sustainability reports. This is likely due to the influence of cultural collectivity and the lack of attention of female directors to the interests of stakeholders (Handajani et al., 2014; Zhuang et al., 2018). This indicates if there is no clarity whether the female director becomes a supporter of sustainability practices or precisely as a barrier in applying the concept of sustainability.

Another perspective used to explain the existence of female directors with sustainability reporting practices is social role theory. Differences in cognitive behavior between men and women are due to differences in roles created in the fabric of society. Powell (1990) said women have people-oriented behavior that is more concerned with the welfare of subordinates, building confidence, paying attention to comfort, and listening to input from subordinates. In line with this, Konrad et al. (2000) concluded that men are more profit-oriented and responsible, and women are more concerned with prestige, challenges, and job security. These differences affect managerial positions where women are placed in positions related to more "soft" issues such as human resources, social responsibility, marketing, advertising, public relations, and so on. However, in its development, social role theory asserts that female leaders have a transformational nature and are able to communicate the values, goals, and mission of the organization. This trait causes female leaders to be more optimistic and have new perspectives in solving problems and carrying out tasks (Eagly & Carli, 2003).

The use of social role theory perspectives in previous literature is still limited in term of explaining the relationship between the presence of female directors and the level of disclosure of sustainability reports. Women, who have high communication skills, have a strong desire to collaborate in a way that is democratic and participatory, and to apply ethical leadership, so they tend to support ethical and conservative reporting (Eagly & Johnson, 1990; Martínez-Ferrero et al., 2018). Research (Al-Shaer & Zaman, 2016; Amorelli & García-Sánchez, 2021; Bristy et al., 2021; Nielsen & Huse, 2010; Rao & Tilt, 2016) highlights how the personal characteristics of women on corporate boards influence strategic decisions primarily related to sustainability practices. With a feminine nature, women have a higher concern and empathy for environmental problems (Amorelli & García-Sánchez, 2021), tend to be protective of the environment and social

(Bristy et al., 2021) , direct companies to behave pro-socially (Rao & Tilt, 2016), as well as tend to avoid disputes to protect the company's reputation (Al-Shaer & Zaman, 2016).

This topic generally describes the existence of female directors influencing the decision-making process and strategic actions of the company's board. But most previous research has limited this relationship, resulting in findings that are not conclusive. Some issues related to this topic require deeper thinking, for example, related to the context of male dominance in the board. The ability of female directors to influence the decisions of the male board (majority) needs to be further investigated. Boutchkova, Gonzalez, Main, & Sila (2021) revealed that the influence of female directors' presence depends largely on the extent to which they are taken seriously (not symbolically) and allowed to contribute effectively to the company's board. Another interesting issue is the position of women as senior managers associating them as acting like men according to the saying "think manager, think male" (Schein et al., 1996; Boutchkova et al., 2021). This whole shows if this topic is worth researching and provides the direction of the future research agenda.

The important role of an independent director is to provide independent judgment in the decision-making process of the company's board (Cadbury, 1992). The position of independent director represents a particular group of key stakeholders or represents all interested parties. The existence of independent directors becomes a necessity, at least half of the company's board members are independent directors (Gracheva, 2004). Independent directors are able to conduct more effective management monitoring, because they provide more objective company performance feedback, careers that are not related to management, and have no incentive to collude with internal directors (Carter et al., 2010; Liao et al., 2015).

The results of the study said that the increasingly large independent director can improve the company's image, improve social and environmental responsibility, and improve the quality of the sustainability reporting (Al-Shaer & Zaman, 2016; Anazonwu et al., 2018; Cullinan et al., 2019; Hu & Loh, 2018; Rathnayaka Mudiyanselage, 2018; Ong & Djajadikerta, 2020). This is because the board of directors becomes more responsive and oriented to the interests of stakeholders with their extensive experience and opinion (Liao et al., 2015). Independent directors tend to have a long-term perspective that supports the achievement of sustainable development goals, as well as directing companies to achieve social values and legitimacy (Prado-Lorenzo & Garcia-Sanchez, 2010). This is related to the positive influence of the existence of independent directors on the disclosure of corporate sustainability.

Issues related to the composition of the company's board are still interesting to research, especially related to the personal independent director's background such as education, experience, age, and citizenship (Hussain et al., 2016; Naciti et al., 2021). The cognitive basis and personal values of the board of director shape strategy choices based on their interpretation of the situation or environment at hand (Hambrick, 2007). The diversity of personal independent director backgrounds will provide a new perspective on the role of board monitoring as well as the company's sustainability accountability practices.

Conclusion

This article aims to review the literature on the relationship between corporate governance mechanisms, especially board composition and corporate sustainability

disclosure practices. The results of this research review and mapping result in a view of the future direction of research. Variations in recent research findings indicate that this topic is still worthy of analysis in a more comprehensive empirical study. Mapping previous literature findings provide a gap for subsequent research. The controversy over previous research findings offers future research direction, considering the company's internal and external factors as predictors of sustainability report disclosure levels. The theoretical framework used in research is under development. The theory used is not only limited to agency theory and socio-political theory based on economics such as stakeholder and legitimacy theory but leads to social psychology theories such as social role theory. Female and independent directors emerge as variables that have a relationship with the disclosure of sustainability reports in the corporate governance order.

The practical implications of the study's findings offer a broader research gap as well as being on the agenda of future research, both theoretically and empirically. These findings provide further research gaps that support the achievement of sustainability agendas such as gender equality. The results of the study become the foundation and direction of empirical research, to explain the phenomenon of disclosure of information and sustainability reports in the context of corporate governance. Since research only uses the Scopus database in article withdrawals, further research can expand the reach of the article database, so that the study and assessment of research in this field become comprehensive. Advanced empirical research can be conducted to test the influence of internal as well as external governance factors on sustainability disclosure.

References

Adel, C., Hussain, M. M., Mohamed, E. K. A., & Basuony, M. A. K. (2019). Is corporate governance relevant to the quality of corporate social responsibility disclosure in large European companies? International Journal of Accounting and Information Management, 27(2), 301–332. https://doi.org/10.1108/IJAIM-10-2017-0118

Africa Merlin-Tao Visser, W. (2002). Sustainability reporting in South Africa. Corporate Environmental Strategy, 9(1), 79–85. https://doi.org/10.1016/S1066-7938(01)00157-9

Ahmad, N. B. J., Rashid, A., & Gow, J. (2018). Corporate board gender diversity and corporate social responsibility reporting in Malaysia. Gender, Technology and Development, 22(2), 87–108. https://doi.org/10.1080/09718524.2018.1496671

al Farooque, O., & Ahulu, H. (2017). Determinants of social and economic reportings: Evidence from Australia, the UK and South african multinational enterprises. International Journal of Accounting and Information Management, 25(2), 177–200. https://doi.org/10.1108/IJAIM-01-2016-0003

Alazzani, A., Hassanein, A., & Aljanadi, Y. (2017). Impact of gender diversity on social and environmental performance: evidence from Malaysia. Corporate Governance (Bingley), 17(2), 266–283. https://doi.org/10.1108/CG-12-2015-0161

Al-Shaer, H., & Zaman, M. (2016). Board gender diversity and sustainability reporting quality. Journal of Contemporary Accounting and Economics, 12(3), 210–222. https://doi.org/10.1016/j.jcae.2016.09.001

Amidjaya, P. G., & Widagdo, A. K. (2020). Sustainability reporting in Indonesian listed banks: Do corporate governance, ownership structure and digital banking matter?

Journal of Applied Accounting Research, 21(2), 231–247. https://doi.org/10.1108/JAAR-09-2018-0149

Amorelli, M. F., & García-Sánchez, I. M. (2021). Trends in the dynamic evolution of board gender diversity and corporate social responsibility. Corporate Social Responsibility and Environmental Management, 28(2), 537–554.

https://doi.org/10.1002/csr.2079

Anazonwu, H. O., Egbunike, F. C., & Gunardi, A. (2018). Corporate Board Diversity and Sustainability Reporting: A Study of Selected Listed Manufacturing Firms in Nigeria. Indonesian Journal of Sustainability Accounting and Management, 2(1), 65. https://doi.org/10.28992/ijsam.v2i1.52

Ararat, M., & Sayedy, B. (2019). Gender and climate change disclosure: An interdimensional policy approach. Sustainability (Switzerland), 11(24), 1–19. https://doi.org/10.3390/su11247217

Arayssi, M. (2016). Women on boards, sustainability reporting and firm performance. Sustainability Accounting, Management and Policy Journal, 7(3), 376–401. https://doi.org/10.1108/SAMPJ-07-2015-0055

Bae, S. M., Masud, M. A. K., & Kim, J. D. (2018). A cross-country investigation of corporate governance and corporate sustainability disclosure: A signaling theory perspective. Sustainability (Switzerland), 10(8). https://doi.org/10.3390/su10082611

Bakar, A. B. S. A., Ghazali, N. A. B. Mohd., & Ahmad, M. B. (2019). Sustainability Reporting and Board Diversity in Malaysia. International Journal of Academic Research in Business and Social Sciences, 9(2), 91–99.

https://doi.org/10.6007/ijarbss/v9-i2/5663

Bini, L., & Bellucci, M. (2020). Integrated Sustainability Reporting. In Integrated Sustainability Reporting. https://doi.org/10.1007/978-3-030-24954-0

Bonsón, E., & Bednárová, M. (2015). CSR reporting practices of Eurozone companies. Revista de Contabilidad-Spanish Accounting Review, 18(2), 182–193. https://doi.org/10.1016/j.rcsar.2014.06.002

Boutchkova, M., Gonzalez, A., Main, B. G. M., & Sila, V. (2021). Gender diversity and the spillover effects of women on boards. Corporate Governance: An International Review, 29(1), 2–21. https://doi.org/10.1111/corg.12339

Bravo, F., & Reguera-Alvarado, N. (2019). Sustainable development disclosure: Environmental, social, and governance reporting and gender diversity in the audit committee. Business Strategy and the Environment, 28(2), 418–429. https://doi.org/10.1002/bse.2258

Bristy, H. J., How, J., & Verhoeven, P. (2021). Gender diversity: the corporate social responsibility and financial performance nexus. International Journal of Managerial Finance, 17(5), 665–686. https://doi.org/10.1108/IJMF-04-2020-0176

Brown, H. S., de Jong, M., & Levy, D. L. (2009). Building institutions based on information disclosure: lessons from GRI’s sustainability reporting. Journal of Cleaner Production, 17(6), 571–580. https://doi.org/10.1016/j.jclepro.2008.12.009

Buallay, A. (2019). Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality: An International Journal, 30(1), 98–115. https://doi.org/10.1108/MEQ-12-2017-0149

Buallay, Amina. (2019). Management of Environmental Quality: An International Journal Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality: An International Journal, 30(1), 98–115.

Buallay, Amina, & Al-Ajmi, J. (2020). The role of audit committee attributes in corporate sustainability reporting: Evidence from banks in the Gulf Cooperation Council. Journal of Applied Accounting Research, 21(2), 249–264.

https://doi.org/10.1108/JAAR-06-2018-0085

Cadbury, A. (1992). Report of the commitee on the financial aspects of corporate governance. Gee.

Camilleri, M. A. (2015). Valuing Stakeholder Engagement and Sustainability Reporting.

Corporate Reputation Review, 18(3), 210–222. https://doi.org/10.1057/crr.2015.9

Carter, D. A., D’Souza, F., Simkins, B. J., & Simpson, W. G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: An International Review, 18(5), 396–414.

https://doi.org/10.1111/j.1467-8683.2010.00809.

Christofi, A., Christofi, P., & Sisaye, S. (2012). Corporate sustainability: Historical development and reporting practices. Management Research Review, 35(2), 157– 172. https://doi.org/10.1108/01409171211195170

Correa-Garcia, J. A., Garcia-Benau, M. A., & Garcia-Meca, E. (2020). Corporate governance and its implications for sustainability reporting quality in Latin American business groups. Journal of Cleaner Production, 260, 121142.

https://doi.org/10.1016/j.jclepro.2020.121142

Crespy, C. T., & Miller, V. v. (2011). Sustainability reporting: A comparative study of NGOs and MNCs. Corporate Social Responsibility and Environmental Management, 18(5), 275–284. https://doi.org/10.1002/csr.248

Cullinan, C. P., Mahoney, L., & Roush, P. B. (2019). Directors & Corporate Social Responsibility: Joint Consideration of Director Gender and the Director’s Role. Social and Environmental Accountability Journal, 39(2), 100–123.

https://doi.org/10.1080/0969160X.2019.1586556

Czernkowski, R., Kean, S., & Lim, S. (2019). Impact of ASX corporate governance guidelines on sustainability reporting. Accounting Research Journal, 32(4), 692– 724. https://doi.org/10.1108/ARJ-07-2017-0122

de Jongh, D., & Möllmann, C. M. (2014). Market barriers for voluntary climate change mitigation in the south african private sector. South African Journal of Economic and Management Sciences, 17(5), 639–652.

https://doi.org/10.4102/sajems.v17i5.532

de Klerk, M., de Villiers, C., & van Staden, C. (2015). The influence of corporate social responsibility disclosure on share prices: Evidence from the United Kingdom. Pacific Accounting Review, 27(2), 208–228. https://doi.org/10.1108/PAR-05-2013-0047

Eagly, A. H., & Carli, L. L. (2003). The female leadership advantage: An evaluation of the evidence. Leadership Quarterly, 14(6), 807–834.

https://doi.org/10.1016/j.leaqua.2003.09.004

Eagly, A. H., & Johnson, B. T. (1990). Gender and Leadership Style: A Meta-Analysis. Psychological Bulletin, 108(2), 233–256. https://doi.org/10.1037/0033-2909.108.2.233

Ehnert, I., Parsa, S., Roper, I., Wagner, M., & Muller-Camen, M. (2016). Reporting on sustainability and HRM: a comparative study of sustainability reporting practices by the world’s largest companies. International Journal of Human Resource Management, 27(1), 88–108. https://doi.org/10.1080/09585192.2015.1024157

Eisenhardt, K. M. (1989). Agency Theory: An Assessment and Review. The Academy of

Management Review, 14(1), 57–74. https://doi.org/10.2307/258191

Elkington, J. (2006). Governance for sustainability. Corporate Governance: An International Review, 14(5), 522–529. https://doi.org/10.1111/j.1467-8683.2006.00527.x

Elsayed, N., & Ammar, S. (2020). Sustainability governance and legitimisation processes: Gulf of Mexico oil spill. Sustainability Accounting, Management and Policy Journal, 11(1), 253–278. https://doi.org/10.1108/SAMPJ-09-2018-0242

Embuningtiyas, S. S., Puspasari, O. R., Utama, A. A. G. S., & Ardianti, R. I. (2020). Bank financial soundness and the disclosure of banking sustainability reporting in Indonesia. International Journal of Innovation, Creativity and Change, 10(12), 237– 247.

Freeman, R. E. (2015). Stakeholder Theory. Wiley Encyclopedia of Management, 1–6. https://doi.org/10.1002/9781118785317.weom020179

Furlotti, K., Mazza, T., Tibiletti, V., & Triani, S. (2019). Women in top positions on boards of directors: Gender policies disclosed in Italian sustainability reporting. Corporate Social Responsibility and Environmental Management, 26(1), 57–70.

https://doi.org/10.1002/csr.1657

Giannarakis, G., Andronikidis, A., & Sariannidis, N. (2020). Determinants of environmental disclosure: investigating new and conventional corporate governance characteristics. Annals of Operations Research, 294(1–2), 87–105. https://doi.org/10.1007/s10479-019-03323-x

Goyal, S., & Dhamija, S. (2018). Corporate governance failure at Ricoh India: rebuilding lost trust. Emerald Emerging Markets Case Studies, 8(4), 1–20.

https://doi.org/10.1108/EEMCS-06-2017-0166

Gracheva, M. (2004). Development of Corporate Governance Standards in UK: The Higgs Report. Voprosy Ekonomiki, (1), 118–128. https://doi.org/10.32609/0042-8736-2004-1-118-128

GRI. (2021). Global Reporting Index. Retrieved from Global Reporting Index website: https://www.globalreporting.org/

Guidry, R. P., & Patten, D. M. (2012). Voluntary disclosure theory and financial control variables: An assessment of recent environmental disclosure research. Accounting Forum, 36(2), 81–90. https://doi.org/10.1016/j.accfor.2012.03.002

Haji, A. A. (2013). Corporate social responsibility disclosures over time: Evidence from Malaysia. Managerial Auditing Journal, 28(7), 647–676.

https://doi.org/10.1108/MAJ-07-2012-0729

Hambrick, D. C. (2007). Upper echelons theory: An update. Academy of Management Review, 32(2), 334–343. https://doi.org/10.5465/AMR.2007.24345254

Handajani, L., Subroto, B., T., S., & Saraswati, E. (2014). Does board diversity matter on corporate social disclosure? An indonesian evidence. Journal of Economics and Sustainable Development, 5(9), 8–16.

Hu, M., & Loh, L. (2018). Board governance and sustainability disclosure: A crosssectional study of Singapore-listed companies. Sustainability (Switzerland), 10(7). https://doi.org/10.3390/su10072578

Hummel, K., & Schlick, C. (2016). The relationship between sustainability performance and sustainability disclosure – Reconciling voluntary disclosure theory and legitimacy theory. Journal of Accounting and Public Policy, 35(5), 455–476. https://doi.org/10.1016/j.jaccpubpol.2016.06.001

Hussain, N., Rigoni, U., & Orij, R. P. (2016). Corporate Governance and Sustainability Performance: Analysis of Triple Bottom Line Performance. Journal of Business Ethics, 149(2), 411–432. https://doi.org/10.1007/s10551-016-3099-5

Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs And Ownership Structure. Journal of Financial Economics, 3(4), 305– 360. https://doi.org/10.1016/0304-405X(76)90026-X

Jiang, L., Cherian, J., Sial, M. S., Wan, P., Filipe, J. A., Mata, M. N., & Chen, X. (2021). The moderating role of CSR in board gender diversity and firm financial performance: empirical evidence from an emerging economy. Economic Research-Ekonomska Istrazivanja , 34(1), 2354–2373. https://doi.org/10.1080/1331677X.2020.1863829

Kend, M. (2015). Governance, firm-level characteristics and their impact on the client’s voluntary sustainability disclosures and assurance decisions. Sustainability Accounting, Management and Policy Journal, 6(1), 54–78.

https://doi.org/10.1108/SAMPJ-12-2013-0061

Kolk, A. (2008). Sustainability, accountability and corporate governance: Exploring multinationals’ reporting practices. Business Strategy and the Environment, 17(1), 1–15. https://doi.org/10.1002/bse.511

Konrad, A. M., Ritchie, J. E., Lieb, P., & Corrigall, E. (2000). Sex Differences and Similarities in Job Attribute Preferences: A Meta-Analysis. Psychological Bulletin, 126(4), 593–641. https://doi.org/10.1037/0033-2909.126.4.593

Liao, L., Luo, L., & Tang, Q. (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. British Accounting Review, 47(4), 409– 424. https://doi.org/10.1016/j.bar.2014.01.002

Mahmood, M., & Orazalin, N. (2017). Green governance and sustainability reporting in Kazakhstan’s oil, gas, and mining sector: Evidence from a former USSR emerging economy. Journal of Cleaner Production, 164, 389–397.

https://doi.org/10.1016/j.jclepro.2017.06.203

Maroun, W. (2019). Exploring the rationale for integrated report assurance. Accounting, Auditing and Accountability Journal, 32(6), 1826–1854.

https://doi.org/10.1108/AAAJ-04-2018-3463

Martínez-Ferrero, J., García-Sánchez, I. M., & Ruiz-Barbadillo, E. (2018). The quality of sustainability assurance reports: The expertise and experience of assurance providers as determinants. Business Strategy and the Environment, 27(8), 1181– 1196. https://doi.org/10.1002/bse.2061

Mohamed Adnan, S., Hay, D., & van Staden, C. J. (2018). The influence of culture and corporate governance on corporate social responsibility disclosure: A cross country

analysis. Journal of Cleaner Production, 198, 820–832. https://doi.org/10.1016/j.jclepro.2018.07.057

Moses, E., Che-Ahmad, A., & Abdulmalik, S. O. (2020). Board governance mechanisms and sustainability reporting quality: A theoretical framework. Cogent Business and Management, 7(1). https://doi.org/10.1080/23311975.2020.1771075

Mungai, E. M., Ndiritu, S. W., & Rajwani, T. (2020). Raising the bar? Top management teams, gender diversity, and environmental sustainability. Africa Journal of Management, 6(4), 269–294. https://doi.org/10.1080/23322373.2020.1830688

Naciti, V., Cesaroni, F., & Pulejo, L. (2021). Corporate governance and sustainability: a review of the existing literature. Journal of Management and Governance. https://doi.org/10.1007/s10997-020-09554-6

Nielsen, S., & Huse, M. (2010). involvement: The role of equality perception. European Management Review, 16–29.

Obiamaka, N., & Akintola, O. (2016). Governance Commitment and Time Differences in Aspects of Sustainability Reporting in Nigerian Banks. International Journal of Economics and Management Engineering, 10(1), 328–332.

https://doi.org/doi.org/10.5281/zenodo.1111598

Ogden, J., Jen, F. C., & O’Connor, P. F. (2012). Advanced Corporate Finance 1st Edition (1st Editio). Prentice Hall.

Ong, T., & Djajadikerta, H. G. (2020). Corporate governance and sustainability reporting in the Australian resources industry: an empirical analysis. Social Responsibility Journal, 16(1), 1–14. https://doi.org/10.1108/SRJ-06-2018-0135

Pham, H. T. T., Jung, S. C., & Lee, S. Y. (2020). Governmental ownership of voluntary sustainability information disclosure in an emerging economy: Evidence from Vietnam. Sustainability (Switzerland), 12(16). https://doi.org/10.3390/su12166686

Powell, G. N. (1990). One More Time: Do Female and Male Managers Differ? Academy of Management Perspectives, 4(3), 68–75.

https://doi.org/10.5465/ame.1990.4274684

Prado-Lorenzo, J. M., & Garcia-Sanchez, I. M. (2010). The Role of the Board of Directors in Disseminating Relevant Information on Greenhouse Gases. Journal of Business Ethics, 97(3), 391–424. https://doi.org/10.1007/s10551-010-0515-0

Rao, K., & Tilt, C. (2016). Board Composition and Corporate Social Responsibility: The Role of Diversity, Gender, Strategy and Decision Making. Journal of Business Ethics, 138(2), 327–347. https://doi.org/10.1007/s10551-015-2613-5

Rathnayaka Mudiyanselage, N. C. S. (2018). Board involvement in corporate sustainability reporting: evidence from Sri Lanka. Corporate Governance (Bingley), 18(6), 1042–1056. https://doi.org/10.1108/CG-10-2017-0252

Richardson, A. J., & Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Accounting, Organizations and Society, 26(7–8), 597–616. https://doi.org/10.1016/S0361-3682(01)00025-3

Rodrigues, M., & Mendes, L. (2018). Mapping of the literature on social responsibility in the mining industry: A systematic literature review. Journal of Cleaner Production, 181, 88–101. https://doi.org/10.1016/j.jclepro.2018.01.163

Schaltegger, S., Bennett, M., & Burrit, R. (2006). Corporate Sustainability – the Basis of Sustainability Accounting and Reporting. In Sustainability Accounting and Reporting.

Schein, V. E., Mueller, R., Lituchy, T., & Liu, J. (1996). Think manager—think male: a global phenomenon? Journal of Organizational Behavior, 17(1), 33–41.

https://doi.org/10.1002/(SICI)1099-1379(199601)17:1<33::AID-JOB778>3.0.CO;2-F

Secinaro, S., Calandra, D., Petricean, D., & Chmet, F. (2021). Social finance and banking research as a driver for sustainable development: A bibliometric analysis. Sustainability (Switzerland), 13(1), 1–18. https://doi.org/10.3390/su13010330

Shamil, M. M., Shaikh, J. M., Ho, P. L., & Krishnan, A. (2014). The influence of board characteristics on sustainability reporting Empirical evidence from Sri Lankan firms. Asian Review of Accounting, 22(2), 78–97. https://doi.org/10.1108/ARA-09-2013-0060

Siew, R. Y. J. (2017). Critical evaluation of environmental, social and governance disclosures of Malaysian property and construction companies. Construction Economics and Building, 17(2), 81–91. https://doi.org/10.5130/AJCEB.v17i2.5328

Stacchezzini, R., Melloni, G., & Lai, A. (2016). Sustainability management and reporting: the role of integrated reporting for communicating corporate sustainability management. Journal of Cleaner Production, 136, 102–110.

https://doi.org/10.1016/j.jclepro.2016.01.109

Stanciu, V., & Bran, F. P. (2019). Sustainability Reporting. A Romanian Insight. QualityAccess to Success, 20(S2), 604–608.

Sudana, I. P. (2014). Transformasi Laporan Keuangan Entitas Bisnis Dengan Spirit Sustainable Development. Universitas Brawijaya.

The Time Has Come! The KPMG Survey of Sustainability Reporting 2020. (2020).

Retrieved from KPMG website: https://home.kpmg/sustainabilityreporting

Trotman, A. J., & Trotman, K. T. (2015). Internal audit’s role in GHG emissions and energy reporting: Evidence from audit committees, senior accountants, and internal auditors. Auditing. https://doi.org/10.2308/ajpt-50675

van Eck, N. J., & Waltman, L. (2020). VOSviewer Manual version 1.6.16. Univeristeit

Leiden, (November), 1–52. Retrieved from

https://www.vosviewer.com/download/f-33t2.pdf

von Ungern-Sternberg, S., & Lindquist, M. G. (1995). The impact of electronic journals on library functions. Journal of Information Science, 21(5), 396–401.

https://doi.org/10.1177/016555159502100507

Wachira, M. M., Berndt, T., & Romero, C. M. (2020). The adoption of international sustainability and integrated reporting guidelines within a mandatory reporting framework: lessons from South Africa. Social Responsibility Journal, 16(5), 613– 629. https://doi.org/10.1108/SRJ-12-2018-0322

Wang, M. C. (2017). The relationship between firm characteristics and the disclosure of sustainability reporting. Sustainability (Switzerland), 9(4).

https://doi.org/10.3390/su9040624

Zahra, S. A., & Pearce, J. A. (1989). Boards of Directors and Corporate Financial Performance: A Review and Integrative Model. Journal of Management, 15(2), 291–334. https://doi.org/10.1177/014920638901500208

Zainal, D. (2017). Quality of Corporate Social Responsibility Reporting (CSRR): The Influence of Ownership Structure and Company Character. Asian Journal of Accounting Perspectives, 10(1), 16–35. https://doi.org/10.22452/ajap.vol10no1.2

Zhuang, Y., Chang, X., & Lee, Y. (2018). Board composition and corporate social responsibility performance: Evidence from Chinese public firms. Sustainability (Switzerland), 10(8). https://doi.org/10.3390/su10082752

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 271

Discussion and feedback