Asset Misappropriation Employee Fraud: A Case Study on an Automotive Company in Indonesia

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 17 No. 2, July 2022

Asset Misappropriation Employee Fraud: A Case Study on an Automotive Company

|

Nanang Setiawan1, Tarjo2*, Bambang Haryadi3 | |

|

AFFILIATION: 1,2,3Faculty of Economics and Business, Universitas Trunojoyo Madura, Indonesia |

Abstract This study is aimed to provide an exploration of asset misappropriation employee fraud and its prevention program on an automotive company in Indonesia. This study is a case study researches collecting data by |

|

*CORRESPONDENCE: |

document analysis and interviews with ten informants from various departments to obtain more in-depth information about the occurrence |

|

THIS ARTICLE IS AVAILABLE IN: |

of fraud. This study found that the most popular types of fraud on |

|

automotive company are manipulation of customer account payments (lapping), embezzlement of customer deposits that are not deposited to | |

|

DOI: |

the company (skimming) and theft of inventory. The driving factors for |

|

10.24843/JIAB.20222.v17.i02.p03 |

committing fraud are financial pressure, lifestyle extravagant, opportunities for fraud, and lack of understanding of fraudulent |

|

CITATION: |

behavior. Employee fraud disrupts company’s operations, consumes |

|

Setiawan, N., Tarjo, Haryadi, B. (2022). Asset Misappropriation Employee Fraud: A Case Study on an Automotive Company. Jurnal Ilmiah Akuntansi dan Bisnis, 17(2), 214-233. |

work time and manpower, and damages the business reputation. Fraud causes the company to incur unnecessary financial losses and expenses that will affect the company's sustainability in the future. Keywords: asset misappropriation, employee fraud, automotive company |

|

ARTICLE HISTORY |

Introduction |

|

Received: 12 October 2021 |

An automotive company, especially sales operations, is one type of business that is very vulnerable to fraud risk. Even though it has |

|

Reviewed: |

implemented an appropriate internal control system, the fraud risk still |

|

27 November 2021 |

exists (Omar et al., 2016). It's related to the nature of the sales operation business in the automotive industry, whose operations are always in direct |

|

Accepted: 24 December 2021 |

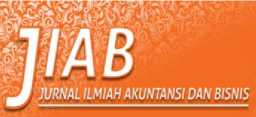

contact with customers, both on sales and aftersales operations, especially in transactions for receiving customer deposits, both for a down payment, additional, and settlement. It's also a phenomenon occurring in this case study that is inseparable from the risk of fraud. The risk of fraud can occur from external or internal parties. Fraud committed by internal parties can happen to employees, managers, and directors. The Fraud Indonesia Survey (ACFE Indonesia Chapter, 2019) shows that the most dominant fraud perpetrators were employees (31.8%), followed by directors/owners (29.4%) and managers (23.7%) shown in Figure 1. Regardless of the business size, the fraud risk that occurs is unavoidable, indicating that no industry is immune to fraud (Krambia‐Kapardis & Zopiatis, 2010; Murray, 2014) and that small-scale companies are more prone to failure (Bressler & Bressler, 2007). |

■ Lain-lain ■ Manajer ■ Atasan DireksiZPemilik Karyawan

Figure 1. Position of Fraud Perpetrator

Source: ACFE Indonesia Chapter, 2019

The dominant cause of failure in small businesses is due to internal corruption and employee dishonesty (Kennedy, 2018), lack of manpower to implement efficient and effective internal control (Kennedy & Benson, 2016; Kramer, 2015), the absence of information technology systems as anti fraud programs to prevent employee errors (Zuberi & Mzenzi, 2019), and the lack of monitoring from external parties such as external audits (Kassem, 2014) makes small businesses more vulnerable to fraud.

Several types of fraud committed by employees at work are theft of cash for personal need (Aba et al., 2020; Kalovya, 2020; Kazemian et al., 2019), fraud by taking customer deposit money without depositing it to the company (Kennedy, 2018; Nigrini, 2019; Yusrianti et al., 2020), fraud involving suppliers or contractors in a collusive manner aimed at taking personal gain (Feess & Timofeyev, 2020; Pacini et al., 2021; Reurink, 2018), fraud employees through salary and commission mechanisms (Adenuga et al., 2020; Maynard-Patrick & Higgins, 2019), abuse of company costs through fictitious, overstated or mischaracterized expenses (Bakri et al., 2017; Le & Tran, 2018), fraud using cheque instruments (Raj et al., 2018; Yusuf et al., 2020), theft of inventory (Yusrianti et al., 2020; Zuberi & Mzenzi, 2019) and manipulation of financial statements (Aris et al., 2015). ACFE defines fraud as a process of using one's responsibility to satisfy one's personnel interests by enriching oneself through the deliberate abuse of power (ACFE, 2017). ACFE classifies employee fraud into three parts: corruption, asset misappropriation, and financial statement fraud.

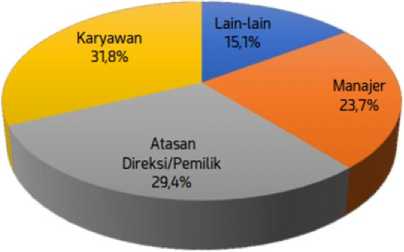

In Indonesia, most frauds are detected through the whistle-blower system. The Indonesian Fraud Survey by ACFE in 2019, which illustrates that the most common detection method is the whistle-blower system (22.6%), then anti-fraud policies of organizations/institutions (13.8%), monitoring data proactively, internal audit, and external audit (9.6% each) as shown in Figure 2. Fraud can also be detected when there is employee rotation (3.3%) (ACFE Indonesia Chapter, 2019). Employee deviant behavior can hurt an uncomfortable work environment and lousy company image. If the company's internal control system does not work well, the opportunities for fraud will be more omprehensive, especially for employees who have pressure and are looking for opportunities. Fraud perpetrators at any motive like an epidemic that will become a disease and adversely affect the company survival. Employee fraud has become a concern of management because of its negative impacts such as lowering performance, damaging the company image, and the most significant risk is causing the loss of money and

Figure 2. Fraud Detection

Source: ACFE Indonesia Chapter, 2019

company inventories. The company's performance will decline due to low employee productivity, decreased customer satisfaction, and high employee turnover. There will be wasted costs, and cause a decrease of company's long-term profitability (Cialdini et al., 2004).

Based on this problem, It is important to study employee fraud in an organization. This study continues the previous research from Omar et al (2016) who took a study on automotive companies in Malaysia to develop the study in Indonesia by increasing the number of informants (at least two informants in the same department) and using the source triangulation test (Hermawan & Amirullah, 2016) as a test of the validity of the data. Many studies on employee fraud have been carried out (Albrecht & Schmoldt, 1988; Goh & Kong, 2018; Hollow, 2014; Kalovya, 2020; Kazemian et al., 2019; Kennedy, 2016; Moorthy et al., 2015; Suh et al., 2018) but research conducted in the field and focused on the automotive industry is still very rare. This study aims to explore employee fraud in an automotive company in Indonesia, the motivation of perpetrators to commit fraud, and how it impacts the company. This study examines employee fraud reports and various other documents obtained directly from internal and generally difficult for researchers to access for publication.

This study contributes to helping companies solve problems related to employee fraud and improve work environment control. Identifying the causes of employee fraud and their appropriate behavior will reduce employee fraud. This research helps companies in formulating effective employee fraud prevention programs. This research can also add to the literature on the profile of fraud perpetrators and their impact on automotive companies. The findings in this study are valuable because they are concluded from actual cases and events in the company.

Literature Review Employee Fraud. Employees are the main contributors to the company in achieving the common objectives and goals (Mani, 2001). When a company loses employees, it also means the loss of skills and experience that can interfere with productivity. Employees exposed to fraudulent behavior can negatively impact their work

environment and perceptions of other employees, especially if they are not immediately followed up with an investigation process and punishment decisions (if proven). As a result, best quality manpower will become demotivated and leave the company and join another more professional company. The Fraud cases may begin to disrupt the business performance and impact the company's unhealthy relationship with customers. Skilled people use their outward appearance to commit fraud, but the management only realized the loss later on. Employee fraud will affect for the company because it will adverse impact for the operations, opportunity costs to lose sales, lose assets both cash and inventories, increase costs and decrease employee ethics.

In Indonesia, the threat of employee fraud is very high; by data from the Indonesia Fraud Survey 2019 (ACFE Indonesia Chapter, 2019) that the most significant fraud perpetrators are employees at 31.8%, followed by directors/owners at 29.4%, managers at 23.7% and other positions 15.1%. Furthermore, the data shows that fraud committed by employees is dominant at IDR 10 million up to IDR 100 million, in contrast to the fraud committed by the directors/owners who were dominant at IDR 500 million up to IDR 1 billion. This indicates that fraud committed by employees uses a relatively small model and scale of fraud. When viewed by the work department, the most significant fraud perpetrators were in the department of operational at 24.3%, followed by the department of finance 19.2%, the department of purchasing at 18.8%, the department of marketing and distribution at 17.2%, and other departments at 20,5%. As for automotive companies, especially sales operations, generally, the operational department is an integral part of the marketing department, directly related to conducting sales transactions with customers. When combined, it becomes 41.5%. This indicates the highest threat of employee fraud is in departments that involve a lot of direct interaction with customers, with opportunities for fraud to occur because there are transactions for receiving money from customers, significantly cash, both for a down payment, additional and settlement.

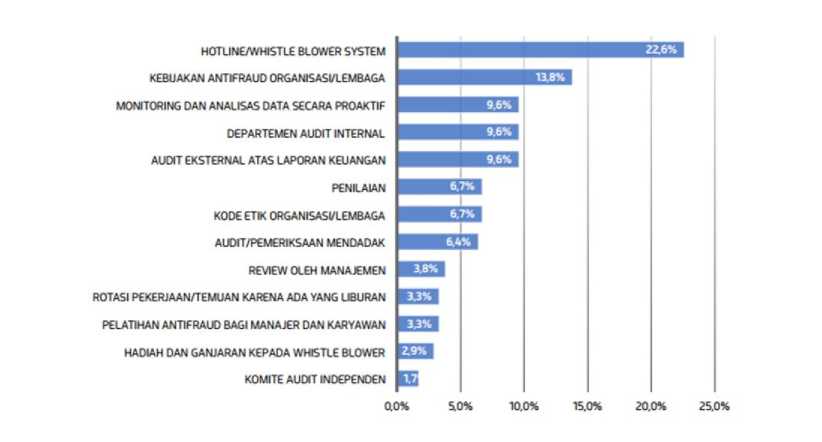

Fraud Triangle and Fraud Diamond Theory. The Fraud Triangle Theory explains the causes of fraud (Cressey, 1950), which states that three factors make fraud possible; when one of them is not fulfilled, then fraud will not occur. These factors are pressure, opportunity, and rationalization. Figure 3. provides a diagrammatic description of the Fraud Triangle Theory (Cressey, 1950). Pressure can occur in various forms, including luxury lifestyle factors, financial difficulties, pressure from family, and work pressure (ACFE Indonesia Chapter, 2019). Employees are under pressure to meet the needs of their families as a result of low incomes, so they seek shortcuts by taking company funds for their personal and family interests. Opportunity is also a factor causing fraud, often related to weak internal control, such as the opportunity to commit fraud when there is no segregation of duties in the process of receiving, recording, and disbursing money by the same person. The rationalization concerns how an employee evaluates his actions by doing the same thing when he sees his boss or co-worker abusing authority by using company assets for personal gain. There is no warning or punishment from the company.

Wolfe & Hermanson (2004) extend the Fraud Triangle Theory by adding the element “capability” to the fraud component to become Fraud Diamond Theory. Fraud Diamond Theory argues that although the perceived pressure has emerged and, on the other hand, is also supported by opportunities and rationalizations, fraud is not possible without the ability (Wolfe & Hermanson, 2004) so that the potential for fraudsters to continue their actions is when they already have the expertise/ability to commit fraud

Figure 3. Fraud Triangle and Fraud Diamond Theory

Source: Cressey, 1950; Wolfe & Hermanson, 2004

(Mansor, 2017). Figure 3. provides an overview of the Fraud Diamond Theory (Wolfe & Hermanson, 2004).

The Automotive Market Overview in Indonesia. The Indonesian automotive industry began in 1960. The Government of Indonesia, through the Ministry of Trade and Industry, issued a policy to import motor vehicles in CBU (completely built-up) and CKD (completely knocked-down), as well as policies regarding the development of the assembly and agency industry (GAIKINDO, 2015). The policies established many car assembly industries and supported component industries, such as spare parts, painting, batteries, and other components. In 1996 there was a discourse on developing a national car program, "Timor" brand, which had been running, but this program was stopped and did not continue. Until now, the car industry in Indonesia has been dominated by brands from Japanese manufacturers (Toyota, Daihatsu, Honda, Mitsubishi, Suzuki, Isuzu, and Nissan) and by other brands from Europe and the United States (Chevrolet, BMW, Mercedes-Benz, Volkswagen, and Scania), South Korea (KIA and Hyundai) then China (Wuling).

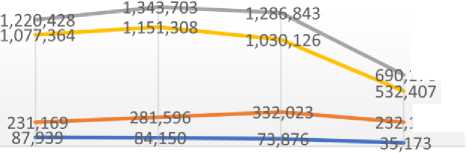

Based on GAIKINDO data, the average car sales in Indonesia for the last four years (2017-2020) on a wholesale basis reached 947,801 units as shown in Figure 4. In the 2017 to 2019 period, it got more than 1 million units, but entering 2020, it fell drastically to 532,407 units due to the economic downturn during the COVID'19 pandemic. The

Car Sales Data in Indonesia

1,500,000

176

175

2017 2018 2019 2020

Expor Produksi Wholesales

Impor

1,000,000

500,000

Figure 4. Car Sales Data in Indonesia 2017-2020

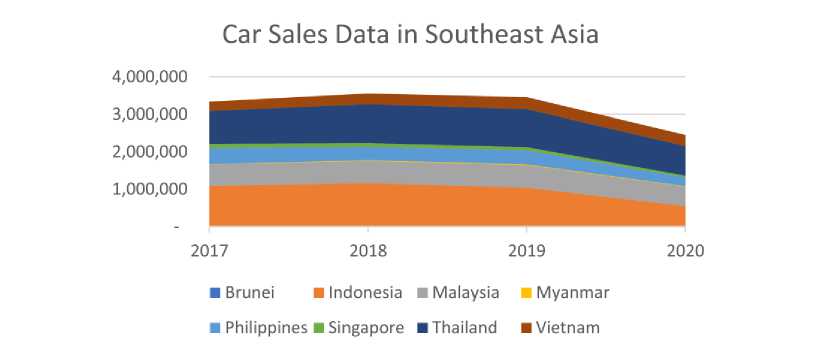

Figure 5. Car Sales Data in Southeast Asia 2017-2020

Source: AFF, 2021

achievements of production, exports and imports also have the same trend, which fell drastically in 2020. The year 2020 is a challenging year for the Indonesian economy and the world due to the outbreak of the COVID'19 virus outbreak, which is continuing until 2021, and there is no bright spot when it will end.

As for car sales data compared to other countries in Southeast Asia, based on data from the ASEAN Automotive Federation (AFF), Indonesia's car sales for the last four years (2017-2020) were the highest in Southeast Asia, average annual sales of 948,245 units. (30%), then Thailand with 928,272 units (29%), Malaysia with 575,522 units (18%), Philippines with 344,304 units (11%), Vietnam with 289,565 units (9%), Singapore with 89,561 units (3%), Myanmar as many as 16,343 units (1%) and Brunei as many as 11,712 units (0.4%) as shown in Figure 5. However, in 2020, car sales in Indonesia will be smaller than in Thailand. Thailand in 2020 sold 792,146 units (32%) and Indonesia only 532,027 units (22%).

Research Method

This study is case study research that uses two data collection methods, namely document analysis and interviews. The use of methods is carried out to utilize multiple sources of evidence to reduce the potential bias of a single method and therefore increase the credibility of the findings (Bowen, 2009). Document analysis was carried out on various documents and records of the Department of Finance and Department of Human Resources & General Affairs (HRGA), such as company financial statements, reports on internal audit results, records of disciplinary actions against employees, investigative reports, and employee fraud reports. Document analysis in this study provides a rich picture of the phenomenon, especially fraud, helping to uncover meaning and understand the research problem (Yin, 2009). The determination of the case study is considering the experience of researchers who are part of the research site, making it easier to get access to data and informants in extracting in-depth information that will be very useful in data collection and analysis.

Semi-structured interviews were conducted with ten employees as informants from various departments who are competent in their fields and interact directly to get more in-depth information about fraud in the company. Informant data is shown in Table

1. This method is used to dig up more information and explanations from interviewees (Moleong, 2017). Includes examining whether interviewees understand the meaning of fraud, the company's efforts to prevent and detect fraud, the impact on the company, and the motivation or reasons for committing fraud.

Before an interview, the informants were informed of the purpose of the study and the information collected after the interview. Permission was requested that the interview be recorded and transcribed. Transcriptions were manually encoded and analyzed to identify emerging patterns or relationships. A similar method is also used by Ermongkonchai (2010). All data collected from the above methods have been analyzed in three phases: data reduction, data display, and data conclusion (Sugiyono, 2020). In the data reduction, the emphasized and the most crucial information is selected, while the information that is not important is removed. Common themes will be developed and researched. In the second stage, data displays, visuals, and diagrams are used to observe patterns, relationships, or trends between the selected information or themes. The last stage is data retrieval. In this step, the meaning of the theme or information is analyzed and verified to ensure that all information collected will meet the aims and objectives of the study. For obtaining data trust or accuracy, a data credibility test was conducted by a source triangulation test by confirming data on different sources of informants in the same department (Hermawan & Amirullah, 2016). It's to achieve confidence that the resulting data is under the reality in the field.

Description of Case Study Object. There are several reasons why this company was selected for the case study. First, it allows the accessibility of data and information to be retrieved through report documents and other internal records related to the research topic. Second, the object is an automotive company in sales operations with the main activity of selling directly to customers as end customers. They have a high potential for fraud. The company also provides aftersales services, acting as a service provider for repairing and selling spare parts. This company is a vehicle dealer with a national scale, and this research takes a case study in one branch with a complete type of branch with sales and aftersales services. The object is a relatively new branch. Therefor most of the employees employed are young graduates and new to work. However, most of the seniorlevel officials are transferred from other units and are experienced employees. Third, what is unique about this branch is has outlets located not closed from the branch (more

than 200 kilometers away) with manual operations (does not have an operating system integrated with the branch). It has a very high potential for fraud. Fourth, an absence of literature provides empirical evidence about employee fraud in the automotive industry, particularly in Indonesia.

Result and Discussion

The Impact of Employee Fraud on the Company's Financial Losses. The significant impact of fraud is financial loss which is the priority for companies to investigate when facing fraud cases (Kalovya, 2020; Suh et al., 2018; Yekini et al., 2018; Zuberi & Mzenzi, 2019). Researchers observed and collected company documents for the last three years on employee records, customer complaint data, financial company loss data due to fraud, fraud case files, and other related documents. After the data is collected and sufficient to prove the financial company's losses due to fraud cases, the findings are analyzed and grouped. Grouping findings by fraud type, department, and location. The next step is organizing findings into a classification of the fraud types according to the level of occurrence and amount of loss, then classifying by department and location of the office or outlet (shown in Apendix 1).

Apendix 1 shows the number of employee fraud cases, a description of the fraud committed, the department and location of the fraudster, and the losses incurred. The highest number of cases and the highest losses are in the first year, with 5 cases at IDR 169.8 million recorded. This object is a new branch built in less than five years. As a new branch, with entry-level and untrained employees, operating systems that have not been running smoothly, and internal controls that have not been implemented perfectly, especially in at outlets that are not in the same location as the branch with manual operations (there is no operating system integrated the branch) and the lack of supervision from management, contributed to the high number of fraud cases. The situation improved in the second year; there were also 5 cases recorded, but the losses were reduced by 73% to IDR 46.2 million. Then in the third year, it decreased 68% to IDR 15 million. This shows that the company has carried out internal control properly and fraud prevention efforts in the company after experiencing significant losses in the previous year.

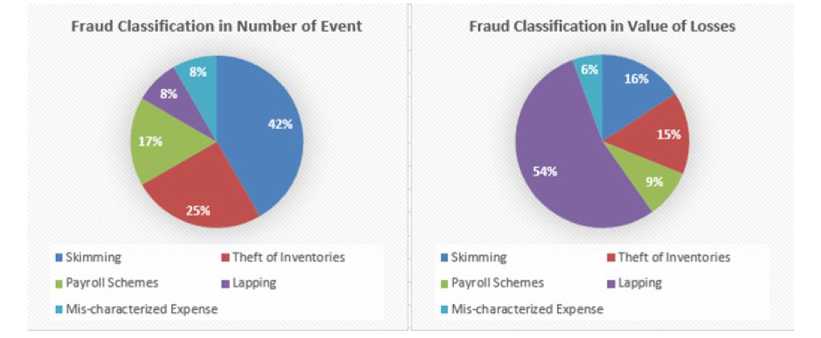

Figure 6. Fraud Classification by Number of Events and Value of Losses

Source: Processed Data, 2021

Figure 6. shows the fraud classification by the number of incidents and the value of losses. There are five types of fraud that occur in the case study: skimming, lapping, payroll schemes, mischaracterized expenses, and theft of inventories. Based on the number of incidents, the most dominant are skimming (42%), theft of inventories (25%), and payroll schemes (17%), but if based on the value of losses, lapping is the most losses fraud (54%) then skimming (16%) and theft of inventories (15%). Lapping is a manipulation of recording the customer accounts by switching mechanism between customer accounts, among the modus is by not depositing customer's money, and when there is a more deposit from customer B, B's funds are recorded as payment in account A. When there is a deposit from customer C, fund C is recorded as payment in account B, and so on so that there will always be outstanding for the last customer's account (or other customers determined by the fraudster, for example, corporate customers due to having a longer term of payment, or other types of customers who do not ask vehicle delivery immediately. Skimming is the simplest method of fraud and is easiest for fraudsters to do; that is, money deposits from customers are not deposited into the company to be used for personal gain. Theft of inventories is the theft of company inventories such are spare parts and consumables such are batteries and oil. This result is different from the previous research by Omar et al (2016) that found that the dominant types of employee fraud on automotive companies in Malaysia are theft of cash, theft of inventory, and fraudulent salary documents.

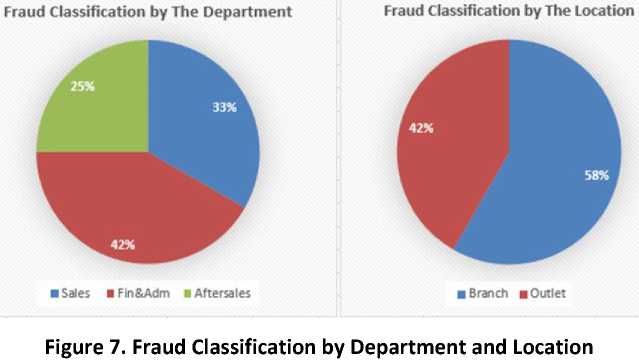

Figure 7. shows the fraud classification by department and location. Most of the fraud occurrence is in the department of finance & administration (42%), then the department of sales (33%), and the department of aftersales (25%). Based on results of the 2019 Indonesia fraud survey (ACFE Indonesia Chapter, 2019) that the most fraud cases is the department of operational (24.3%), then the department of finance (19.2%), the department of purchasing (18.8%) and the department of marketing/distribution (17.2%). In fact, in the case study, the department of operational does not exist and is functionally included in the department of finance and the department of sales, so the findings in this case study are in line with the survey results (ACFE Indonesia Chapter, 2019). As for the fraud classification by location, the most dominant is in the branch (58%) then outlets (42%). It's related to the complexity at the branch greater than the outlet. However, the figure of 42% at outlets is also not small and becomes dominant considering the potential for fraud to occur is very high because of the absence of an operating system and lack of

supervision from management. This result is different from the research of Omar et al (2016) that found that the most dominant fraud by the department on automotive companies in Malaysia is the department of aftersales than the department of sales.

Causes and Motivation of Employee Fraud. Analysis of fraud findings can help management find out the reasons why employees are involved in fraud. Using The Fraud Triangle Theory (Cressey, 1950) and The Fraud Diamond Theory (Wolfe & Hermanson, 2004) as a theoretical basis to explain the causes and motivations of employee fraud that consists of the aspects of pressure, opportunity, rationalization, and capability. The results of the analysis show the causes of employee fraud are mostly related to people's morality, lack of supervision from internal control, and lack of knowledge and understanding of fraud. Most of the fraud cases were carried out by employees with a high motivation of financial pressure and extravagant lifestyle, as found in the case study, that new employees receive a certainly reasonable salary. Still, because of their lifestyle, they tend to improve their lifestyle and spend more than their salary so that they try to find additional income from the company improperly. It’s in line with the results of the ACFE Indonesia survey, which stated that the most dominant signs of fraudulent behavior were lavish behavior (ACFE Indonesia Chapter, 2019). It's similar to the results of research Omar et al (2016) found that employee fraud at automotive companies in Malaysia is because of high lifestyle pressure that exceeds the salary obtained. Hollow (2014) and Kazemian et al (2019) found that bank employees commit fraud because of financial motivation as a pressure to meet personal needs. Goh & Kong (2018) found that hotel employees commit fraud because of financial motivation, unethical values, and sensation-seeking behavior. Moorthy et al (2015) found that supermarket retail employee fraud because of the pressure of needs, attitudes to theft, and an unethical work climate.

Pressure from the environment and co-workers to maintain a certain level of lifestyle can also contribute to or motivate employees to commit fraud. Because it is difficult to find other legitimate sources of income, it takes time and energy; fraud is the fastest way to earn more money. As in the case study, an employee wants a new smartphone, which is comparable to his friends, but his income is only enough to live on. So, he took the easy way by taking the customer's deposit money, not deposited to the company and taking it for personal use (skimming modus). Because he was not caught, he repeatedly took this action. The management only realized it when he carried out internal control in confirmation to customers and taking the verification of sales documents.

Weak internal control is also an opportunity for fraud to occur. Most frauds occur in outlets not closed from the branch and do not have an integrated operating system; this causes internal control to not be optimally due to the distance and lack of supervision (monitoring is only carried out when there is a visit). Management not monitoring routinely considering the travel costs). Weak internal control at the outlet causes fraud opportunities both in the department of sales and department of finance & administration in receiving customer deposits and the department of aftersales in obtaining customer service activities. Another internal control weakness in the department of aftersales has a lot of inventories, such are spare parts and consumables; if stock-taking monitoring not doing routinely and by independent parties will increase the chance of fraud (theft of inventory modus) not be known until the day of stock-taking. As a new branch with limited human resources, there has not been a separation of duties in a crucial part; this can be part of weak internal control that causes the potential for

fraud. Weak internal control as an opportunity for employee fraud is in line with the research of Albrecht & Schmoldt (1988); Moorthy et al (2015) and Omar et al (2016).

The lack of understanding of some employees on the standard operating procedure (SOP) and the fraud risks also causes fraud without realizing it. It's a rationalization for employees who commit fraud because of ignorance of the rules and limits of authority, including things prohibited from doing (negative list). In the case study, some employees think that it does not matter using used spare parts or used consumables, such as oil and ex-claimed batteries, because it's paid for the transaction, even though the selling of used oil is recorded as the other income. Ex-claim batteries must be sent to the insurance company as one of the requirements for the disbursement of the claim. If the requirements are not complete, the insurance will not disburse the claim and become the company's loss. The employee did not think that selling used spare parts and consumables without management approval is illegal and included in the negative list, which is not allowed by the employee. The lack of employee understanding of the rules as a cause of employee fraud is in line with research by Goh & Kong (2018) and Omar et al (2016).

Employee Understanding of Fraud. Providing an understanding of fraud to employees can reduce the potential for fraud to occur (Kennedy, 2016). The researcher conducted interviews with ten informants from various departments. In one department, there are at least two informants who were interviewed with the same questions to obtain more complete data as well as to validate the validity of the data. There were questions to informants regarding employees' understanding of fraud and examples of fraudulent behavior at work. Each department has a different potential for fraud depending on business processes. Informants were asked about the potential for fraud in the informant's department and other departments. The informant was also asked about the fraud case that occurred in the company whether he knew of the fraud case and understood the pattern of fraud committed.

The interview results show that most informants understand fraud in general and it's illegal. Most informants can distinguish the transactions are permitted or prohibited. All employees have received an explanation regarding the prohibition of fraud on employee training. However, the understanding of fraud is still limited to the potential for fraud in their departments. Only a small number of them understand the potential for fraud in other departments. Regarding the fraud case that occurred in the company, not all informants knew about the details of the fraud case because it was related to management's directives to keep secrets. The company wants to protect the company's good reputation. Every fraud case is immediately closed within the company's internal and does not provide access to information to the public.

The informant's understanding of fraud in the department of sales, for example, Mr. E, a sales executive gave an example:

"There are cases where employees receive cash as a deposit from a customer and do not deposit it to the company, keeping the money and using it for personal gain."

Mr. D, a sales supervisor who is also Mr. E's superior, confirmed Mr. E in the fraud explanation. Mr. D added:

"Fraud is not only stealing cash from customers, but borrowing and using customer money for personal interests and then depositing it to the company within a few days is also a fraud, and it's prohibited within the company"

The informant's understanding of fraud in the aftersales department, for example, Mr. F, a technician gave an example:

"Fraud involving company assets such as spare parts and engine oil, employees will smuggle it out of the warehouse and do not input the recording of goods expenditures in the operating system"

Mr. C, a service head who is also Mr. F's superior, confirmed Mr. C in the fraud explanation.

Impact of Employee Fraud. More questions to informants about employees' understanding of the impact caused by fraud for the company and for the fraudsters who did it. Some informants do not care about the impact of fraud on the company, but all informants are very afraid of the impact on employees who commit fraud because it is related to the future career of employees. Some of the informants agreed that employee fraud had a significant impact on the company's operations, such as disrupted business operations, spending extra time on the settlement process, and damaging its image. If an employee is suspected of committing fraud, the employee may not continue his work process. After it is proven with sufficient evidence, the employee is asked to immediately settle his obligations, including (if any) to refund the company's losses and finally be asked to file resignation. This process causes an abandoned job, thus requiring the company to find a replacement. It does not immediately work smoothly when it gets relief because it requires a training process and works habituation that is not short. Mr. B, as finance & administration head, expressed his frustration:

"If there is employee fraud, operations will be disrupted because they have to deal with problems with the perpetrators and must immediately complete the pending work so as not to have an impact on service to customers".

Management faces difficulties in handling fraud cases and needs to allocate specific resources to solve them. However, management refrains from resolving internally by the company and does not report it to the legal realm. Mr. A, as the branch head, stated:

"The company does not report employee fraud to law enforcement officials by considering protecting the company's good name and will be high costs a legal process. Even if they win, it still impacts the company's negative image, especially customer trust.

Employees provide the best service to customers, whether they come to the showroom or service vehicles at the workshop. If employee fraud occurs, management will face customer complaints that can damage the company's image. Mrs. J, as customer relations officer, confirmed:

"Fraud is time-consuming and adds to the burden of thought; the company is harmed in the form of money, assets and image."

Fraud cases, especially if they involve law enforcement officers (police or legal advisors). Sometimes, management has to suffer the loss of having to pay extra compensation. Loss of assets such as spare parts and oil, especially for fast-moving spare parts, will increase service lead time, especially when stock is empty and needs to be sent from the depot warehouse. It's causing a decrease in customer satisfaction with the lead time of the service process and will impact the overall level of customer satisfaction. Consistent with Hollow (2014); Johnson et al (2014) and Omar et al (2016) found that fraud that damaged the company's reputation could decrease sales to customers, thereby

reducing the company's performance. Mr. B as a Finance & Administration Head, give confirmation:

"Fraud consumes time, adds to the burden of thought, and makes work unfocused and neglected; the company is also harmed in the form of money, assets and reputation."

Causes of Employees Fraud. In line with The Fraud Triangle Theory (Cressey, 1950), several studies note that employee fraud in a company can occur because of an opportunity (Farooq & Brooks, 2013; Hollow, 2014; Kazemian et al., 2019; Moorthy et al., 2015; Ojo & Ayadi, 2014; Omar et al., 2016). Farooq & Brooks (2013) note that an employee freely commits fraud from opportunities created by lack of supervision. Kazemian et al (2019) mention that the fraud opportunity created by weak internal control and the absence of segregation of duties. The results of the analysis of this case, the majority of informants agree with this theory. In this case study, the fraud opportunity is vast in the operations, such as easy access to customer deposits and company assets such as spare parts and consumables, especially at outlets located in separate locations from the branch and lack of supervision due to distance from the branch. Even though SOPs have been implemented, the fraud risk cannot be eliminated. Mr. D explained:

“The department of sales and department of aftersales holds the highest fraud record in the company so far because they collect cash directly from customers. Therefore, they have many opportunities to commit fraud.”

Mr. A verified and agreed with Mr. D's explanation. Furthermore, Mr. B described the situation:

“When an employee receives cash from a customer, the employee must issue a receipt as an official receipt and immediately deposit the cash in the safe. Sometimes, for trust reasons, customers do not ask for receipts for handing over cash to employees. It will cause opportunities for employees not to deposit money to the company and take the money for personal use.”

It happens especially when you are under pressure to meet particular needs and your family. On the other hand, employees also base their rationalization that their work is too heavy and feel that their salary is not commensurate with the weight of the work, so they are entitled to higher compensation. Mr. G as a HR officer, thinks:

"There are several factors that cause employees to commit fraud, including low salaries, opportunities, and feeling that their actions are not wrong."

Management Efforts to Reduce Employee Fraud. Companies that implement internal control well can prevent opportunities for fraud to occur (Kazemian et al., 2019; Lokanan, 2014). Based on the informant responses, the company is trying to create an environment that implements internal control better. In the last few years, the internal control system has been improved to mitigate fraud findings so that there will be no more incidents in the future. The fraud cases that have occurred have become valuable experiences and as a consideration for analysis to create an anti-fraud system. It includes awareness of work ethics, recognition and appreciation of individuals for their performance, segregation of duties, and more stringent oversight. Mr. B as a Finance & Adm Head stated:

“Management has created and implemented an anti-fraud system. This system is proven to be able to reduce the opportunity for fraud to occur. We also carried out sudden hospitalizations for several company assets.”

Mr. A as a Branch Head gave an affirmation:

“The system to prevent fraud has shown effectiveness when data shows that the company has succeeded in reducing serious cases of fraud from IDR 169.8 million in the first year to only IDR 46.2 million in the second year and decreased by only IDR 15 million in the third year.”

Employee Fraud Prevention. Fraud prevention programs as recommendations for the automotive company specifically for the object companies in this study to anticipate and minimize the occurrence of employee fraud are as follows

Financial monitoring as a red flag for fraud. As the most dominant fraud in the case study, lapping is necessary to make a prevention program in financial monitoring as a sign of danger and early detection so that any potential fraud is immediately identified and carried out. Financial monitoring is carried out on every account with a risk of fraud, such as customer deposits (DP customers), accounts receivable, cash flow on bank accounts, sales data, accounts payable, and other data. Monitoring and tracing are carried out routinely in each process. If the transaction is unusual (suspicious), it can be immediately found and investigated further.

Strict confirmation to customers of every transaction. Skimming is a type of fraud that is also dominant in case studies; it is necessary to make a prevention program by confirmation system to customers that are carried out strictly every process. Confirmation is an effective detection tool in anti-fraud programs. Confirmation is also a means of communication and customer feedback. Therefore, confirmation has become a mandatory instrument to maintain customer satisfaction and minimize the potential for fraud. Before confirmation, the first thing to do is to validate the customer's phone number obtained from the first transaction, namely since the signing of the Vehicle Order Letter (SPK) and the salesperson that the phone number written on the SPK is valid (active number and customer's property). Every next step, especially related to receiving payment deposits, is necessary to validate incoming funds with confirmation to the customer, especially if the sender's identity (the name is listed on the checking account) is not in the customer's name. Validation is carried out by an independent party that ensures that customer funds have been entered and recorded in the existing customer account.

Routine monitoring and checking of all company assets. Automotive companies have many assets that must be protected from potential theft and misuse, such as cash on hand, cheques, bank accounts, vehicles, STNK and BPKB, inventories, consumables, tools, etc. Another thing that needs to be maintained is official company documents in the form of receipts, orders, proof of vehicle handover, and others so that unscrupulous employees do not misuse them to transact with customers to benefit personally on behalf of the company. Monitoring assets and documents by checking routinely to ensure completeness and nothing is lost based on system records. Monitoring procedures are carried out routinely with an un-patterned schedule and are carried out by an independent party.

Integrated operating system at the outlet business unit. Outlets have the same business processes as branches in the form of sales and aftersales. Still, for each transaction, the recording and reporting system is integrated with the branch so that the branch report includes an outlet transaction. Integrating the operating system at the outlet is very important to accelerate the transaction process and reporting and be a binding control system for every transaction at the outlet. The system will directly detect any errors or irregularities, and this is prevention and, at the same time, the detection of

potential fraud. Integrating operating systems is expensive, but the possible loss resulting from its absence is far greater than the cost of procuring it.

Routine supervision and internal audit at the outlet business unit. The integrated operating system carries out its duties in the supervisory function of system data. It needs to be equipped with manual supervision on physical documents, such as checking for cash in outlet safes, physical vehicles in-unit warehouses, spare parts in aftersales warehouses, service vehicles at workshop stalls, and other company assets located at outlets. This supervision is carried out regularly with an un-patterned schedule to supervise outlet employees and an internal audit of outlet operations. It needs to be done as a form of prevention and detection of potential fraud, and if fraud is detected, it can be investigated soon so that there is no more significant loss.

Conclusions

This study explores asset misappropriation of employee fraud in the automotive industry and provides recommendations for prevention programs to anticipate and minimize employee fraud. This study found the most popular types of fraud are manipulation of customer payments (lapping modus), embezzlement of customer deposits (skimming modus), and theft of inventories. Almost all departments committed fraud, the most dominant occurrences in the department of finance & administration, sales, and aftersales. The driving factors for committing fraud include financial pressure due to low income, a lifestyle with the necessities of life exceeding income, the opportunity to commit fraud, and a lack of understanding of fraudulent behavior. Employee fraud disrupts business operations, consumes additional company time and resources, and damages the company's image. It resulted in the company experiencing losses and wasted expenses, and its profitability in the long term had a lower impact.

This study has limitations on some employees who refuse to be informants and are not willing to provide information considering the confidentiality of company data. Further research can be conducted using quantitative methods to examine the relationship between fraud and organizational variables such as organizational commitment and ethical behavior. Understanding these variables can help companies control and reduce the risk of employee fraud in the organization. Other methods such as market surveys can be used to gather more information from a broader range of participants, either the company or the employees themselves, so that the findings can be generalized to the bigger picture. The scope can also be expanded by inviting value chains such as leasing institutions and banks, suppliers, customers, and other related parties to obtain more comprehensive information in exploring employee fraud.

References

Aba, T., Koomson, A., Matthew, G., Owusu, Y., Bekoe, R. A., & Oquaye, M. (2020).

Determinants of Asset Misappropriation at The Workplace: The Moderating Role of Perceived Strength of Internal Controls. Journal of Financial Crime, 27(4), 1191– 1211. https://doi.org/10.1108/JFC-04-2020-0067

ACFE. (2017). Fraud Examiners Manual. In ACFE.

ACFE Indonesia Chapter. (2019). Survei Fraud Indonesia 2019. ACFE Indonesia.

Adenuga, K., Pressley-borrego, D. L., & Mbuh, P. E. (2020). Employee Fraud: An Empirical Review Of Ghost Workers. International Journal of Innovative Research and Advanced Studies (IJIRAS), 7(3), 119–125.

Albrecht, W. S., & Schmoldt, D. W. (1988). Employee Fraud. Business Horizons, 31(4), 16–18. https://doi.org/10.1016/0007-6813(88)90063-8

Aris, N. A., Maznah, S., Arif, M., Othman, R., & Zain, M. M. (2015). Fraudulent Financial Statement Detection Using Statistical Techniques: The Case Of Small Medium Automotive Enterprise. 31(4), 1469–1478.

Bakri, H. H. M., Mohamed, N., & Said, J. (2017). Mitigating Asset Misappropriation Through Integrity and Fraud Risk Elements: Evidence Emerging Economies. Journal of Financial Crime, 24(2). https://doi.org/10.1108/JFC-04-2016-0024

Bowen, G. A. (2009). Document Analysis as a Qualitative Research Method. Qualitative Research Journal, 9(2), 27–40. https://doi.org/10.3316/QRJ0902027

Bressler, M. S., & Bressler, L. A. (2007). A Model for Prevention and Detection of Criminal Activity Impacting Small Business. The Entrepreneurial Executive, 12, 23– 36.

Cialdini, R. B., Petrova, P. K., & Goldstein, N. J. (2004). The Hidden Costs of Organizational Dishonesty. MIT Sloan Management Review, 45(3), 67–73.

Cressey, D. R. (1950). The Criminal Violation of Financial Trust. American Sociological Review, 15(6), 738–743.

Ermongkonchai, P. (2010). Understanding Reasons for Employee Unethical Conduct in Thai Organizations: A Qualitative Inquiry. Organization Behavior and Human Resource Management, 6(2).

Farooq, K., & Brooks, G. (2013). Arab Fraud and Corruption Professionals’ Views in The Arabian Gulf. Journal of Financial Crime, 20(3), 338–347.

https://doi.org/https://doi.org/10.1108/JFC-03-2013-0017

Feess, E., & Timofeyev, Y. (2020). Behavioral Red Flags and Loss Sizes From Asset Misappropriation: Evidence from The US. Advances in Accounting Behavioral Research, 23, 77–117. https://doi.org/10.1108/S1475-148820200000023004

GAIKINDO. (2015). Perkembangan Industri Otomotif Indonesia.

https://www.gaikindo.or.id/perkembangan/

Goh, E., & Kong, S. (2018). Theft in The Hotel Workplace: Exploring Frontline Employees’ Perceptions Towards Hotel Employee Theft. Tourism and Hospitality Research, 18(4), 442–455. https://doi.org/10.1177/1467358416683770

Hermawan, S., & Amirullah. (2016). Metode Penelitian Bisnis: Pendekatan Kuantitatif& kualitatif. Metode Penelitian Bisnis Bandung, 264.

Hollow, M. (2014). Money, Morals and Motives: An Exploratory Study into Why Bank Managers and Employees Commit Fraud at Work. Journal of Financial Crime, 21(2), 174–190. https://doi.org/10.1108/JFC-02-2013-0010

Johnson, W. C., Xie, W., & Yi, S. (2014). Corporate Fraud and The Value of Reputations in The Product Market. Journal of Corporate Finance, 25, 16–39.

https://doi.org/10.1016/j.jcorpfin.2013.10.005

Kalovya, O. Z. (2020). Determinants of Occupational Fraud Losses: Offenders, Victims and Insights From Fraud Theory. Journal of Financial Crime.

https://doi.org/10.1108/JFC-10-2019-0136

Kassem, R. (2014). Detecting Asset Misappropriation: A Framework for External Auditors. International Journal of Accounting, Auditing and Performance Evaluation, 10(1), 1–42. https://doi.org/10.1504/IJAAPE.2014.059181

Kazemian, S., Said, J., Hady Nia, E., & Vakilifard, H. (2019). Examining Fraud Risk Factors on Asset Misappropriation: Evidence from The Iranian Banking Industry. Journal of

Financial Crime, 26(2), 447–463. https://doi.org/10.1108/JFC-01-2018-0008

Kennedy, J. P. (2016). Sharing the Keys to The Kingdom: Responding to Employee Theft by Empowering Employees to Be Guardians, Place Managers, and Handlers. Journal of Crime and Justice, 39(4), 512–527.

https://doi.org/10.1080/0735648X.2014.998701

Kennedy, J. P. (2018). Asset Misappropriation in Small Businesses. Journal of Financial

Crime, 25(2), 369–383. https://doi.org/10.1108/JFC-01-2017-0004

Kennedy, J. P., & Benson, M. L. (2016). Emotional Reactions to Employee Theft and the Managerial Dilemmas Small Business Owners Face. Criminal Justice Review, 41(3), 257–277. https://doi.org/10.1177/0734016816638899

Krambia‐Kapardis, M., & Zopiatis, A. (2010). Investigating Incidents of Fraud in Small Economies: The Case for Cyprus. Journal of Financial Crime, Vol. 17(2), 195–209.

Kramer, B. (2015). Trust, But Verify: Fraud in Small Businesses. Journal of Small Business and Enterprise Development, 22(1), 4–20. https://doi.org/10.1108/JSBED-08-2012-0097

Le, T. T. H., & Tran, M. D. (2018). The Effect of Internal Control on Asset Misappropriation: The case of Vietnam. Business and Economic Horizons, 14(4), 941–953. https://doi.org/10.15208/beh.2018.64

Lokanan, M. E. (2014). How Senior Managers Perpetuate Accounting Fraud? Lessons for Fraud Examiners from an Instructional Case. Journal of Financial Crime, 21(4), 411– 423. https://doi.org/10.1108/JFC-03-2013-0016

Mani, B. G. (2001). Performance Appraisal Systems, Productivity, and Motivation: A Case Study. Public Personnel Management, 31(2), 141–159.

https://doi.org/10.1177/009102600203100202

Mansor, N. (2017). Understanding the Fraud Triangle Theory and Fraud Diamond Theory, Understanding the Convergent and Divergent For Future Research. International Journal of Academic Research in Accounting, Finance and Management Sciences, 5(October 2015), 38–45.

https://doi.org/10.6007/IJARAFMS/v5-3/1823

Maynard-Patrick, S., & Higgins, L. N. (2019). Gleam Lighting: A Collaborative Experiential Payroll Fraud Case. Management Teaching Review, 4(4), 317–333.

https://doi.org/10.1177/2379298118811149

Moleong, L. J. (2017). Metodologi Penelitian Kualitatif (Revisi). Remaja Rosdakarya.

Moorthy, M. K., Seetharaman, A., Jaffar, N., & Foong, Y. P. (2015). Employee Perceptions of Workplace Theft Behavior: A Study Among Supermarket Retail Employees in Malaysia. Ethics and Behavior, 25(1), 61–85.

https://doi.org/10.1080/10508422.2014.917416

Murray, J. G. (2014). Procurement Fraud Vulnerability: A Case Study. EDPACS: The EDP Audit, Control, and Security Newsletter, 49(5), 7–17.

Nigrini, M. J. (2019). The Patterns of The Numbers Used in Occupational Fraud Schemes. Managerial Auditing Journal, 34(5), 602–622. https://doi.org/10.1108/MAJ-11-2017-1717

Ojo, A. T., & Ayadi, O. F. (2014). Financial Malpractices and Stock Market Development in Nigeria: An Exploratory Study. Journal of Financial Crime, 21(3), 336–354. https://doi.org/10.1108/JFC-05-2013-0034

Omar, M., Nawawi, A., & Puteh Salin, A. S. A. (2016). The Causes, Impact and Prevention of Employee Fraud, a Case Study of an Automotive Company. Journal of Financial

Crime, 23(4), 1012–1027. https://doi.org/10.1108/jfc-04-2015-0020

Pacini, C., Lin, J. W., & Patterson, G. (2021). Using Shell Entities for Money Laundering: Methods, Consequences, and Policy Implications. Journal of Forensic and Investigative Accounting, 13(1), 73–89.

Raj, B., Kolachina, S., Kumar, B. R., & Kusum. (2018). Assessment of Risk Factors in Misappropriation of Assets - Evidence from the Indian Banking Sector. International Journal of Pure and Applied Mathematics, 118(24), 1–13.

Reurink, A. (2018). Financial Fraud: a Literature Review. Journal of Economic Surveys, 32(5), 1292–1325. https://doi.org/10.1111/joes.12294

Sugiyono. (2020). Metode Penelitian Kualitatif. Alfabeta.

Suh, J. B., Shim, H. S., & Button, M. (2018). Exploring The Impact of Organizational Investment on Occupational Fraud: Mediating Effects of Ethical Culture and Monitoring Control. International Journal of Law, Crime and Justice, 53(February), 46–55. https://doi.org/10.1016/j.ijlcj.2018.02.003

Wolfe, D. T., & Hermanson, D. R. (2004). The Fraud Diamond: Considering the Four Elements of Fraud.

Yekini, K., Ohalehi, P., Oguchi, I., & Abiola, J. (2018). Workplace fraud and theft in SMEs: Evidence from the mobile telephone sector in Nigeria. Journal of Financial Crime.

Yin, R. K. (2009). Case Study Research: Design and Methods (Fourth).

Yusrianti, H., Ghozali, I., & N. Yuyetta, E. (2020). Asset Misappropriation Tendency: Rationalization, Financial Pressure, and the Role of Opportunity (Study in Indonesian Government Sector). Humanities & Social Sciences Reviews, 8(1), 373– 382. https://doi.org/10.18510/hssr.2020.8148

Yusuf, Z., Nawawi, A., & Salin, A. S. A. P. (2020). The Effectiveness of Payroll System in The Public Sector to Prevent Fraud. Journal of Financial Crime, 1982. https://doi.org/10.1108/JFC-08-2017-0075

Zuberi, O., & Mzenzi, S. I. (2019). Analysis of Employee and Management Fraud in Tanzania. Journal of Financial Crime.

Year 1

Year 3

|

Case |

Dept |

Location |

Cost (million IDR) |

Case |

Dept |

Location |

Cost (million IDR) |

Case |

Dept |

Location |

Cost (million IDR) | |

|

1 |

Don’t deposit customer’s money to the company (skimming) |

Sales |

Branch |

5.0 |

Don’t deposit customer’s money to the company (skimming) |

Sales |

Outlet |

20.0 |

Abuse of expense (mischaracterized expense) |

Fin & Adm |

Branch |

13.0 |

|

2 |

Switching customer payment allocation (lapping) |

Fin & Adm |

Branch |

125.0 |

Don’t deposit customer’s money to the company (skimming) |

Fin & Adm |

Outlet |

5.0 |

Don’t deposit customer’s money to the company (skimming) |

Sales |

Outlet |

2.0 |

|

3 |

Don’t deposit customer’s money to the company (skimming) |

Sales |

Outlet |

4.5 |

Missing inventories (theft of inventories) |

Fin & Adm |

Outlet |

0.2 | ||||

|

4 |

Missing inventories (theft of inventories) |

Aftersales |

Branch |

35.0 |

Payroll for not an employee (ghost employee) |

Sales |

Branch |

15.0 |

Apendix 1. Employee Fraud Case Analysis

Year 2

|

Setiawan, Tarjo & Haryadi Asset Misappropriation Employee Fraud: A Case Study on an Automotive Company | |

|

5 Abused of Aftersales used oil (theft of inventories) |

Branch 0.3 Fictitious Sales Branch 6.0 commission payments (commission schemes) |

|

Total |

169.8 46.2 15.0 |

Source : Prosseced Data, 2021

Jurnal Ilmiah Akuntansi dan Bisnis, 2022 | 233

Discussion and feedback