Internal Corporate Governance Mechanisms and Corporate Tax Avoidance in Nigeria: A Quantile Regression Approach

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 16 No. 1, January 2021

AFFILIATION:

1,3 Nnamdi Azikiwe University, Nigeria

2,4 Faculty of Economics and Business, Universitas Pasundan, Indonesia

*CORRESPONDENCE: ardigunardi@unpas.ac.id

THIS ARTICLE IS AVAILABLE IN: https://ojs.unud.ac.id/index.php/jiab

DOI:

10.24843/JIAB.2021.v16.i01.p02

CITATION:

Egbunike, F. C., Gunardi, A., Ugochukwu, U., & Hermawan, A. (2021). Internal Corporate Governance Mechanisms and Corporate Tax Avoidance in Nigeria: A Quantile Regression Approach. Jurnal Ilmiah Akuntansi dan Bisnis, 16(1), 20‐44.

ARTICLE HISTORY Received:

05 November 2020

Revised:

02 January 2021

Accepted:

14 January 2021

Internal Corporate Governance Mechanisms and Corporate Tax Avoidance in Nigeria: A Quantile Regression Approach

Francis Chinedu Egbunike1, Ardi Gunardi2*, Udunze Ugochukwu3, Atang Hermawan4

Abstract

The main objective of the study was to investigate the effect of corporate governance on tax avoidance of quoted manufacturing firms in Nigeria. The study focused on internal corporate governance mechanisms and specifically examined the effect of board size, board independence, board diligence, CEO duality, and audit committee diligence. The ex post facto research design was adopted. The population comprised of all quoted manufacturing companies on the Nigerian Stock Exchange (NSE). The sample was purposively drawn as all companies in the consumer goods sector of the NSE. The hypotheses were validated using Quantile Regression technique. Results showed that board size, board independence, and board diligence were significant at the median and 75th quantile. CEO duality and audit committee diligence were not significant at the 25th, 50th, and 75th quantile. The study recommended among others moderate board sizes to improve efficiency of decision‐ making.

Keywords: corporate governance mechanisms, tax avoidance, quantile regression

Introduction

The objective of this empirical research study is an examination of the effect of various internal corporate governance mechanisms on the level of tax obfuscation by Nigerian manufacturing firms. The dwindling revenue available to the Nigerian government has led to increasing calls for alternative revenue sources for the government to deliver on her basic responsibilities. However, available evidence suggests that the level of tax to GDP ratio still remains low an indication of the tax avoidance at the individual and corporate levels. The import of this study lies in its implication for policy makers in addressing tax loopholes via a regulatory approach in order to generate the needed revenue for governmental functions.

Corporate governance refers to policies and procedures adopted by firms to achieve certain sets of objectives, corporate missions and visions with regard to different stakeholders (Poudel, 2015). Corporate

governance provides the structure through which “the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined” (Organisation for Economic Co-Operation and Development [OECD], 2004). It is directed at improving corporate behaviour and the reliability of accounting information provided to the stakeholders (Ianniello et al., 2013). Corporate governance “deals with whether the suppliers of finance earn a return on their investments”(Pilos, 2017).Traditionally, it specifies rules of business decision making, which served to shape the relations among boards of directors, shareholders, and managers as well as to resolve agency conflicts (Gill, 2008).

Broadly, corporate governance mechanisms are sub‐divided into internal and external mechanisms. The internal mechanisms (such as boards of directors, audit committees, independent and non‐executive directors) and external mechanisms (such as audit quality) are responsible for monitoring and controlling managerial decision (Islam et al., 2010).

Prior to 2012, manufacturing companies in Nigeria were required to prepare accounts using the Statement of Accounting Standards. However, following the recommendation of the Financial Reporting Council of Nigeria (FRCN), henceforth from 2012 all manufacturing companies complied with the provisions of the International Financial Reporting Standards in the preparation of financial statements. The FRCN also recently released the Nigerian Code of Corporate Governance (‘the Code”) on January 15, 2019 pursuant to Sections 11(c) and 41(c) of the Financial Reporting Council of Nigeria Act, 2011. This formed part of the move to strengthen and institutionalise corporate governance best practices in Nigerian companies. The Code adopts a principle‐based approach in specifying minimum standards of practice that companies should adopt (Proshare, 2019).

Tax is a financial charge or other levy imposed upon a taxpayer (an individual or legal entity) by a state or the functional equivalent of a state (Edame & Okoi, 2014). The government uses the proceeds of the tax to render their traditional functions, which include the provision of public goods, maintenance of law and order, defense against external aggression, regulation of trade and business to ensure social and economic support (Edame & Okoi, 2014; Takumah, 2014). Corporate tax avoidance refers to the deliberate attempt to reduce the amount of taxes paid. Tax avoidance can be divided into acceptable (legal) tax avoidance and unacceptable (illegal) tax avoidance (Fadhilah, 2014).

Different stakeholders perceive such tax avoidance acts differently from its consequent implication. For instance, shareholders may prefer tax avoidance because it increases residual income and lowers cost of debt (Lim, 2011); whereas, Government kick against tax avoidance because it lowers the amount of revenue available for developmental activities (Schön, 2008). Negative consequences of tax avoidance include reputational damage and decline in firm value (Hanlon & Slemrod, 2009); which in turn leads to a decrease in the return on investments of the shareholders (Hanlon & Heitzman, 2010). Other consequences which may arise are related to political costs and marginal costs. High corporate tax avoidance leads to higher political costs (Mills et al., 2013). Marginal costs are potential costs, such as penalties and fines imposed by the tax authorities (Chen et al., 2010).

Taxes remain a crucial aspect of many managerial decisions (Lanis & Richardson, 2011). Therefore corporate tax avoidance is an outcome of policies/decisions taken by the leaders of a company (Tandean & Winnie, 2016). Given the differing preferences between shareholders and managers on corporate tax avoidance it is therefore believed that corporate governance influences managerial tax avoidance decisions (Armstrong et al., 2015) as the policies/decisions taken by managers are a reflection of the corporate governance elements, such as: board size and composition, board independence, board diligence, CEO duality and audit committee diligence (Armstrong et al., 2015; Lanis & Richardson, 2011; Pilos, 2017; Richardson et al., 2013).

For instance, mangers can conceal rent extractions through tax aggressiveness (Desai & Dharmapala, 2006). Prior studies have examined the corporate governance and tax avoidance in several countries. They include studies by Oyenike et al. (2016) in Nigeria; Hoseini et al. (2018) in Iran; Bayar et al. (2018) using several databases; Pilos (2017) using Standard and Poor’s 500 firms; among several others. The studies provide counterintuitive predictions on the link between governance and tax avoidance. While some document a positive effect, others report a negative association. Such studies have mainly used proxies such as meeting frequency, board size, board independence, CEO duality, among others as proxies for good corporate governance. This is primarily because the integrity of financial reports depends on the characteristics of the board and the audit committee (Zalata & Roberts, 2016).

Within the Nigerian context, few studies are yet to address the efficiency with which the board and other sub‐committees discharge their responsibilities. Board and committee activity may be measured by the frequency of meetings (Zalata & Roberts, 2016). The Cadbury Report (1992) Report of the Committee on the Financial Aspects of Corporate Governance suggested three or four meetings a year; whereas, the Combined Code by the Financial Reporting Council [FRC] recommended that boards meet regularly and frequently to discharge their duties efficiently.

One important committee within board is the audit committee. The audit committee is an important part of the board responsible for the supervision of the firm’s internal control (Zheng et al., 2018). Therefore, as a corollary to board diligence; is the effect of audit committee presence and activity on corporate tax avoidance. Prior studies, such as Hossain et al. (2011) found that accrual‐based earnings management is negatively related to board and audit committee meeting frequency; whereas, Abbott et al. (2004) found that the probability of restatements is lower in firms with more audit committee meetings.

Lastly, a common methodological approach mainly used in prior studies “is that inferences are based on estimates of how governance relates to the conditional mean of the tax avoidance distribution” (Armstrong et al., 2015). This stems mainly from models based on OLS properties. While such models can conveniently address the issue of nature of relationship based on the conditional mean function; it fails to address the issue of tax avoidance at various quantiles (i.e., low, median or high). The study by Armstrong et al. (2015) found no relation between various corporate governance mechanisms and tax avoidance at the conditional mean and median of the tax avoidance distribution. However, Armstrong et al. (2015) using quantile regression, found a positive relation

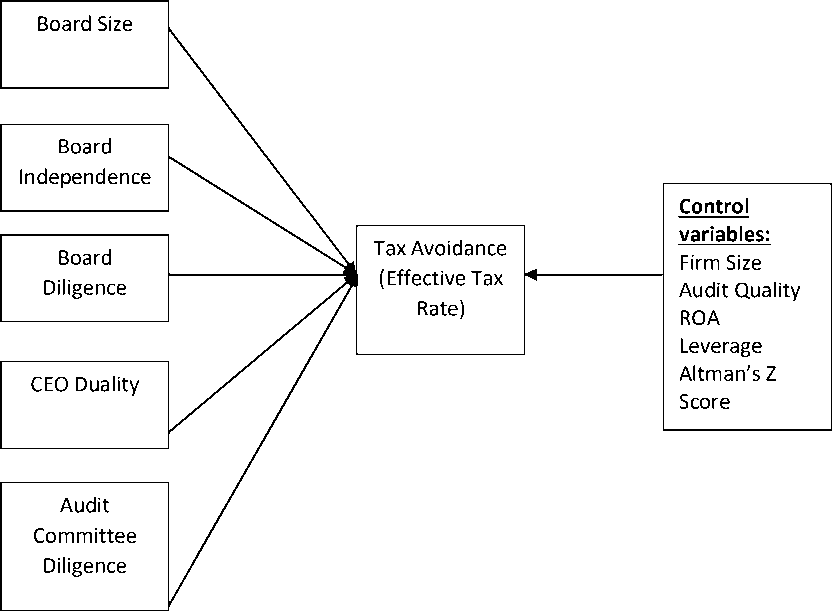

Figure 1. Conceptual Framework

Source: Processed Data, 2019

between board independence and financial sophistication for low levels of tax avoidance; and, a negative relation at high levels of tax avoidance.

Therefore, an approach which specifies varying changes in the conditional distribution of corporate tax avoidance (Y) provides additional insight. In addition, the study signals at which levels of the corporate tax avoidance and governance nexus have managerial implications. This likely signal how managerial over‐or‐underinvestment in tax avoidance are symptomatic and warrant policy attention (Armstrong et al., 2015). The study therefore sought to fill the gap in the literature by analysing the effect of corporate governance on tax avoidance at varying quantiles from a developing country perspective. Against this backdrop, the broad objective of this study is to investigate the effect of corporate governance on tax avoidance of quoted manufacturing firms in Nigeria. The study specifically, assessed effect of board size on effective tax rate of quoted consumer goods firms; effect of board independence on effective tax rate of quoted consumer goods firms; effect of board diligence on effective tax rate of quoted consumer goods firms; effect of CEO duality on effective tax rate of quoted consumer goods firms; and, lastly, effect of audit committee diligence on effective tax rate of quoted consumer goods firms.

Corporate governance refers to policies and procedures adopted by firms to achieve certain sets of objectives, corporate missions and visions with regard to different stakeholders (Poudel, 2015). According to Yusoff & Alhaji (2012) corporate governance is a set of mechanisms through which investors protect themselves against expropriation

(utilize assets without permission) by management (managers and/or controlling shareholders). This expropriation acts includes among others the diversion of profits/output; sale of assets or securities to other firms at below market (fair) prices; employ unqualified family members in managerial positions; and/or over compensation packages. Corporate governance is concerned with promoting corporate fairness, transparency and accountability (Effiong et al., 2012).

Du Plessis et al. (2010) defined corporate governance as the system of regulating and overseeing corporate conduct and of balancing the interests of all internal stakeholders and other parties (external stakeholders, governments and local communities …) who can be affected by the corporation’s conduct, in order to ensure responsible behaviour by corporations and to achieve the maximum level of efficiency and profitability for a corporation (Du Plessis et al., 2010, p.4).

Corporate governance comprises all the mechanisms related to the definition and fulfilment of corporate goals (Silva et al., 2006). Maier (2005) opines that corporate governance “is a set of relationships between a company’s management, its board, its shareholders and its stakeholders. It is the process by which directors and auditors manage their responsibilities towards shareholders and wider company stakeholders”. Solomon & Solomon (2004)a defined corporate governance as “the systems of checks and balances, both internal and external to companies, which ensure that companies discharge their accountability to all their stakeholders”. (Raut, 2003, p.1) opines that “corporate governance is a process that aims to allocate corporate resources in a manner that maximizes value for all stakeholders – shareholders, investors, employees, customers, suppliers, environment and the community at large and holds those at the helms to account by evaluating their decisions on transparency, inclusivity, equity and responsibility”. According to Chapra & Ahmed (2002), corporate governance is a “set of relationships between a company's management, its board, its shareholders and other stakeholders”. The Organisation for Economic Co‐Operation and Development [OECD], (1999) outlined five principles of corporate governance to include: Rights of shareholders; Equitable treatment of shareholders; Role of stakeholders; Disclosure and transparency; and, Responsibility of the board. In the Nigerian context, the main sources of guidance with respect to corporate governance include: Companies and Allied Matters Act (CAMA) as revised; Investment and Securities Act 2007 (ISA); Financial Reporting Council of Nigeria Act 2011 (FRCA); Banks and Other Financial Institutions Act 1991 (BOFIA); Central Bank of Nigeria Code of Corporate Governance for Banks and Discount Houses in Nigeria (the CBN Code); Insurance Act 2003; National Insurance Commission Act 1997 (the NAICOM Act); NAICOM Code of Corporate Governance for the Insurance Industry in Nigeria (the NAICOM Code); Code of Corporate Governance for Licensed Pension Operators (the PENCOM Code), among others.

Board size refers to the total number of directors on the board, i.e., the size of the board, of any corporate organization (Ogbechie & Koufopoulos, 2010; Pilos, 2017). Directors are directly elected by shareholders to represent their interests in the firm. The primary role of directors is that of trusteeship to protect and enhance shareholders’ value through strategic supervision. The board is responsible for verifying financial reliability and its compliance with the laws and regulations; more so, via its role reduces information asymmetry between shareholders and managers (Hill & Jones, 2009). In Nigeria, the board structure of listed companies can best be described as one or single‐tier, which comprises

both executive and non‐executive directors. The SEC Code recommends that the board of a public company should be made up of at least five directors but sets no upper limit for the number of directors on a board. The Code further recommends that the majority of the board members should be non‐executive directors and at least one should be an independent director.

There is no consensus on the optimal board size; however, the optimal size may depend on several factors, such as size and complexity of the firm, nature of industry, the proportion of insiders and outsiders on the board, among others (Coles et al., 2008; Harris & Raviv, 2008; Raheja, 2005). The empirical literature provides evidence of an association between board size and firm performance (Dalton et al., 1999; Majeed et al., 2015; Yermack, 1996). However, the evidence on the effect of board size is inconclusive. A study conducted in Nigeria, by Sanda et al. (2005) found that, firm performance is positively related with small size as opposed to large boards. In contrast, other studies show that large boards may possess a wider range of expertise and monitor actions of management effectively.

The literature also attributes several benefits to large board sizes. For instance, Majeed et al. (2015) document that board size influence corporate disclosure and transparency level. Consistently, Hashim et al. (2014) showed that number of directors significantly affects the level of strategic information disclosure. As regards firm value, Larmou & Vafeas (2010) found a positive association between board size and firm value.

Abbott et al. (2004) found a significant positive relationship between board size and the probability of financial statement fraud and earnings restatement. Makni et al. (2012) found a positive association between board size and higher quality audits. This is consistent with Carcello et al. (2002) that reported that external auditors are more likely to indicate lower risk for firms with large boards; whereas, Osma (2008) found no significant relationship between board size and real earnings management.

H1: There is a significant effect of board size on effective tax rate of quoted consumer goods manufacturing firms.

Board independence refers to the extent a board is composed of independent non‐executive directors who have no relationship with the firm beyond the role of director. The appointment of outside directors is an effective corporate governance mechanism which reduces agency problem and increase earnings quality (Klein, 2002; Peasnell et al., 2000). Such independent directors offer shareholders greater protection in monitoring management. Independent non‐executive directors curtail managers’ discretionary decisions and limit the opportunity of the board to become ‘an instrument of top management’ (Beasley & Petroni, 2001).

The Nigerian Code of Corporate Governance provides that non‐executive directors be selected on the basis of their wide experience, knowledge and personal qualities; and should not be involved in the day‐to‐day operations of the Company. Such neutrality of independent non‐executive directors makes it possible to preserve the shareholders’ interests (Adjaoud et al., 2008). Directors that do not get involved in daily management operations are more objective and able to uphold the public interest from their point of view (Husnin et al., 2016). The SEC Code recommends that there be at least five members of the board with a mix of both executive and non‐executive directors. The CBN Code and the SEC Code provide that the number of non‐executive directors on the board should exceed the number of executive directors. The SEC Code provides for a

minimum of one independent director. The SEC Code describes an independent director as a non‐executive director who, 1) is not a substantial shareholder of the company, that is, one whose shareholding, directly or indirectly, does not exceed 0.1 per cent of the company’s paid‐up capital; 2) is not a representative of a shareholder that has the ability to control or significantly influence management; 3) has not been employed by the company or the group of which it currently forms part, or has not served in any executive capacity in the company or the group for the preceding three financial years; 4) is not a member of the immediate family of an individual who is, or has been in any of the past three financial years, employed by the company or the group in an executive capacity; 5) is not a professional adviser to the company or group, other than in the capacity of a director; 6) is not a significant supplier to or customer of the company or group; 7) has no significant contractual relationship with the company or group and is free from any business or other relationship that could materially interfere with his or her capacity to act in an independent manner; and 8) is not a partner or an executive of the company’s audit firm, internal audit firm, legal or other consulting firm that have material association with the company and has not been a partner or an executive of any such firm for three financial years preceding his or her appointment.

Studies by Klein (2002) and Osma (2008) showed that firms with higher proportion of independent directors are less likely to engage in accrual‐based and real earnings management. This according to Osma (2008) is because independent directors have sufficient technical knowledge to identify opportunistic reductions in R&D; thereby, constrain real earnings management. The meta‐analysis by Lin and Hwang (2010), documented that board independence has a negative relationship with earnings management. Contrary to this, the study by Egbunike et al. (2015) in Nigeria showed a non‐significant coefficient for independent non‐executive directors on earnings management. Also, in Singapore Bradbury et al. (2006) found no association between board independence and earnings management.

H2: There is a significant effect of board independence on effective tax rate of quoted consumer goods manufacturing firms.

Board diligence can be defined as the number of board meetings being held during a year (Al‐Najjar, 2018). The activities of the board reflect its commitment to discharging its role as an agent in the company (Jensen & Meckling, 1976). Vafeas (1999) argues that effectiveness of board can be indexed by a high number of board meetings, since the higher the frequency of board meetings will indicate more monitoring of the board on the financial reporting process. The Nigerian Code of Corporate Governance provides the Board of Directors meet at least once every quarter.

Boards that engage in more frequent meetings allow them to identify problems; which, leads to superior performance of the company (Evans & Weir, 1995). The study by Ferris et al. (2003) provided empirical evidence that diligence on the part of directors often conflicts with busyness.

Using a sample of 481 publicly quoted firms in Malaysia, Foo and Zain (2010) found that firms with more independent and diligent boards were associated with higher liquidity. Tauringana et al. (2008) found a significant negative relationship between board diligence and timeliness of annual report for companies listed on the Nairobi Stock Exchange (NSE) in Kenya.

-

H3: There is a significant effect of board diligence on effective tax rate of quoted consumer goods manufacturing firms.

According to Booth et al. (2002) a measure of board independence is whether the CEO also serves as Board chairman. The separation of CEO from Board chairman provides the necessary checks and balances of power and authority on management behaviour (Chapra & Ahmed, 2002). The non‐separation of the two functions presents an obstacle (Adjaoud et al., 2008) and leads to managerial entrenchment (Minnick & Noga, 2010). Non‐separation of the two roles decreases the effectiveness of the board in monitoring management (Firth et al., 2007); and, its ability to control managers effectively (Holtz & Neto, 2014). The empirical literature documents mixed findings on the association between CEO duality and firm performance.

Huafang & Jianguo (2007) and Al Arussi et al. (2009) found a significant negative association between duality and disclosure. On the contrary, Li et al. (2008), Said et al. (2009) found an insignificant relationship between duality and disclosure. Bliss (2011) reported a positive association between board independence and audit fees. However, the positive association was only present in firms without CEO duality; suggestive of the fact that CEO duality constrains board independence.

-

H4: There is a significant effect of CEO duality on effective tax rate of quoted consumer goods manufacturing firms.

Audit committee are selected members of companies who take an active role in overseeing the companies accounting and financial reporting policies and practices (Hayes et al., 2005). The Code of Corporate Governance in Nigeria, 2003 notes that listed companies should establish Audit Committees, with the key objective of raising standards of corporate governance. The Code further states that such committees should comprise of strong, independent persons. Audit committee diligence can be defined as the number of audit meetings held in a year (Al‐Najjar, 2018). Frequent audit meetings result in better auditing processes (Raghunandan et al., 2001). Hence, for an audit committee to be more effective and functioning properly, it has to meet more frequently (Al‐Najjar, 2018). For example, Abbott et al. (2003) demonstrate that audit committees with frequent meetings (meet four times in a year) result in proper financial accounts.

Audit committees infer three main roles toward external auditors: pressurise management to appoint reputed external auditors; demand greater audit assurance from external auditors (Abbott et al., 2003). However, to effectively undertake their activities, it is expected that members of the audit committee should be independent. The Blue Ribbon Committee [BRC], (1999) notes that audit committee members are independent if: they, their spouses or children do not currently work or have not worked at the organization or its affiliates within the past 5 years; they have not received compensation from the organization or its affiliates for work other than board service; and, they are not partners, shareholders or officers of a business with which the organization has significant business.

Section 359 (4) of Companies and Allied Matters Act (2004) says “the audit committee shall consist of an equal number of directors and representations of the shareholders of the company (subject to a maximum number of six members) and shall examine the auditor’s report and make recommendations thereon to the annual general meeting”.

Using a sample of Chinese a‐share listed firms, Zheng et al. (2018) based on data from the year 2009 to 2016 finds evidence that presence of audit committee mitigates tax aggressiveness. The negative effect was mainly derived from two internal characteristics of audit committees: the independence and the scale, when the independence is higher or scale is larger, the negative impact becomes more significant. However, the expertise of members despite having a negative effect was not significant.

-

H5: There is a significant effect of audit committee diligence on effective tax rate of quoted consumer goods manufacturing firms.

There is no generally accepted definition of corporate tax avoidance [CTA] in the literature (Hanlon & Heitzman, 2010). This lack of universal definition follows the consequential tax effect of every business transaction aimed at increasing profit (Annuar et al., 2014). Terms such as “Tax Planning”, “Aggressive Tax Planning” and “Abusive Tax Planning” are commonly used. According to Martinez (2017, p.106) CTA involves “taking advantage of legitimate concessions and exemptions foreseen in the tax law; and, involves the process of organizing business operations so that tax obligations are optimized at their minimum amount”. According to Mgbame et al. (2017) tax aggressiveness refer to different activities, engaged by management, to lower taxable income and could be legal or illegal. Tax planning forms part of strategic decisions by the managers aimed at reducing explicit and implicit taxes (Franca et al., 2015). Annuar et al. (2014) defined CTA as a reduction in the explicit corporate tax liabilities.

Dyreng et al. (2010, p.1164) opine that CTA refers to “anything that reduces the firm’s taxes relative to its pre‐tax accounting income”. Hanlon and Heitzman (2010, p.137) view tax avoidance as a continuum of tax planning strategies that range from perfectly legal real transactions at one end (e.g., investments in tax‐favoured assets, such as municipal bonds) to aggressive tax avoidance practices (e.g., tax shelters) at the other end (see Figure 2.).

Generally tax planning activities lead to a reduction in tax obligations (Martinez, 2017). This however depends on the intensity and legality with which these practices are adopted. Osuegbu (2007, p.1), defines tax avoidance as “the legal application of tax laws to one’s own advantage, in order to reduce the amount of tax that is payable by means that are within the law.” Braithwaite (2005) defines tax aggressiveness as a scheme or arrangement put in place with the sole or dominant purpose of avoiding tax.

Tax planning, avoidance or aggressiveness has significant costs and benefits to a firm and her shareholders (Desai & Dharmapala, 2008). The benefits to the firm includes such as higher cash flows and net income; while, to the shareholders it implies higher residual income (Blouin, 2014). The costs includes negative consequences such as large penalties, negative publicity (Lisowsky, 2009; Wilson, 2009), political costs (Mills et al., 2013), or the firm labelled as a “poor corporate citizen” (Hanlon & Slemrod, 2009). Three conditions must exist for an individual or firm to engage in tax avoidance; incentive, access, and awareness (Alstadsaeter & Jacob, 2013). Incentive implies that the perceived benefit must outweigh its costs. Access presupposes that the individual or firm have access to tax‐minimizing strategies. Finally, the individual or firm is aware of the applicable tax laws that allow such opportunities available to avoid taxes.

Annuar et al. (2014, p.152) identified three classes of groups used in prior literature to measure tax avoidance. The first group includes measures that consider the multitude of the gap between book and taxable income. These comprise of total book‐tax

Figure 2. The Tax Planning Continuum

Source: Processed Data, 2019

gap; residual book‐tax gap and tax‐effect book‐tax gap. The second group includes measures the proportional amount of taxes to business income. These comprise effective tax rates (with variants such as; ETR; current ETR; cash ETR; long‐run cash ETR; ETR differential; ratio of income tax expense to operating cash flow; and ratio of cash taxes paid to operating cash flow). The third group includes measures such as discretionary permanent differences (PERMIDIFF)/DTAX; unrecognized tax benefits (UTB); and tax shelter estimates.

There are several methods and/or schemes by which corporations engage in tax avoidance. Sikka (2010) identified the use of transfer pricing, royalty programs, off shore tax havens and structured transactions. Gravelle (2013) identified other methods such as debt allocation and earnings stripping, contract manufacturing, check‐the‐box, hybrid entities and instruments as well as cross crediting and sourcing rules for foreign tax credits.

The study conducted by Atwood et al. (2012) which examined whether three tax system characteristics (i.e., required book‐tax conformity, worldwide versus territorial approach, and perceived strength of enforcement) affect corporate tax avoidance across countries found that, on average, tax avoidance is less when required book‐tax conformity is higher, a worldwide approach is used, and tax enforcement is perceived to be stronger.

Research Method

This study adopts the ex post facto research design. Ex post facto research design is a systematic empirical inquiry, in which the observer has no direct control of independent variables because their manifestations have already occurred or because they are inherently not manipulated. The focus of the study is on companies in the consumer goods sector on the Nigerian Stock Exchange (NSE). The study employed a variant of non‐ probability sampling, namely the purposive sampling technique and included all the firms in the consumer goods sector into the sample. The study relied upon secondary sources

Table 1. Description of Variables

|

Variable |

Proxy |

Information |

|

Dependent Variable |

CTA it |

Proxied as the Effective Tax Rate. This is the proportion of the profit before tax paid astax. It is computed as tax paid divided by profit before tax. The Statutory Tax Rate is the official corporate tax rate; which presently in Nigeria is 30% of assessable profit. |

|

Independent Variables |

BOSIZ it |

Measured as the number of directors in the board of directors in the period (t) |

|

BOIND it |

Proportion of independent non‐executive directors on the board to the number of all board members in the period (t) | |

|

BODIL it |

Measured as the number of board meetings being held during a year | |

|

CEODU it |

Takes the value of 1 if CEO and the chairperson positions are held by the same individual, otherwise 0 in the period (t) | |

|

ACDIL it |

Measured as the number of audit committee meetings being held during a year | |

|

Control Variables |

Size it |

Measured as the natural logarithm of total assets in the period (t) |

|

Leverage it |

Measured as the proportion of debt to equity in the period (t) | |

|

ROA it |

Measured as the proportion of net income to total assets in the period (t) | |

|

AQ it |

Dummy variable | |

|

Z Score it |

Altman’s Z Score‐ measures the financial health of a firm (Altman, 1968) Z = 0.012X1 + 0.014X2 + 0.33X3 + 0.006X4 + 0.999X5 |

Source: Processed Data, 2020

of data. The data was retrieved from the annual financial statements of the sampled companies. The data were extracted from the annual reports of the selected manufacturing companies. The reliability of such data is in line with the requirement that all quoted companies conduct independent external audit on published financial statements. The data for the study was analysed using descriptive statistics, correlation analysis and multiple regression technique. The data for the study fitted a panel data. Panel data provides two types of information: Cross‐sectional and Time‐series. Cross‐ sectional information reflects differences between subjects; while, time series information (also known as within subjects) reflects the information of changes in subjects over time (Pilos, 2017). The data was analyzed using Quantile Regression (QR) technique. QR was developed by Koenker & Bassett (1978) to model the relation between a set of predictor variables and specific percentiles (or quantiles) of the response variable. QR differs from Ordinary Least Squares (OLS) by estimating rates of change in not just the mean but all parts of the distribution of a response variable (Olga et al., 2008). QR overcomes the problem of heterogeneity of variance by fitting linear regressions on different conditional quantiles of the range of a response variable (Cade & Noon, 2003;

Koenker & Bassett, 1978). QR is a generalization of median regression: the regression function predicts the conditional Ʈ‐quantile of the dependent variable.

One advantage of QR, relative to the OLS, is that QR regression estimates are

more robust against outliers in the response measurements. Secondly, it is semiparametric as it avoids assumptions about the parametric distribution of the error process (Baum, 2013). QR describes the relation between the independent variables and any specified percentile of the conditional distribution of the dependent variable (Armstrong et al., 2015). In describing the advantages of QR, Hao & Naiman (2007) observed that “the focus on the central location has long distracted researchers from

using appropriate and relevant techniques to address research questions regarding non‐ central locations on the response distribution.

Using conditional‐mean models (e.g., OLS regression) to address these questions may be inefficient or even miss the point of the research altogether. …A set of equally spaced conditional quantiles can characterize the shape of the conditional distribution in addition to its central location.” Assuming a constant only model of Yt = β0 + et, where β0

is a constant parameter and et is an i.i.d. random error term. Koenker and Basset note that the τth quantile of Yt can be derived from a sample of observations, as the solution

β0(τ) to the following minimization problem:

min

βo [∑t∣yt≥βoτ∣yt^βo∣+∑t∣yt≥βo (1^τ)∣yt^βo∣]

This minimization problem, which provides a

means of finding the Ʈthsample quantile, readily extends for the more general case where

Yt is a linear function of explanatory variables (X). The conditional quantiles denoted by Qy(τ∣X) are the inverse of the conditional cumulative distribution function of the response variable, Fy1(τ∣X) where T ∈ [0, 1] denotes the quantiles (Koenker & Machado, 1999).

Model Specification:

CTA (i, t)= α + BOSIZ (i, t) + BOIND (i, t) + BODIL (i, t) + CEODU (i, t) + ACDIL (i, t) + Size (i, t) +

AQ (i, t) + Leverage (i, t) + ROA (i, t) + Z‐Score (i, t) + µ (1)

The model (1) was examined at the 25th, 50th, and 75th quantiles due to their popularity in prior research studies, the model specifications at the quantiles are shown below:

Where: Q.25, Q.50, Q.75 = Quantile 25, Quantile 50 and Quantile 75 respectively.

Result and Discussion

The Table 2., presents the mean (average) for each of the independent variables, median, their maximum and minimum values, standard deviation, Skewness and

Table 2. Descriptive Statistics of Independent (Corporate Governance) Variables

BOARD SIZE BIND BODIL CEODUALITY ACDIL

|

Mean |

9.401 |

0.573 |

5.047 |

0.761 |

3.809 |

|

Median |

9.000 |

0.600 |

5.000 |

1.000 |

4.000 |

|

Maximum |

17.000 |

0.800 |

8.000 |

1.000 |

5.000 |

|

Minimum |

0.000 |

0.000 |

4.000 |

0.000 |

2.000 |

|

Std. Dev. |

3.259 |

0.165 |

0.901 |

0.427 |

0.665 |

|

Skewness |

0.218 |

‐1.198 |

1.876 |

‐1.229 |

‐0.746 |

|

Kurtosis |

2.988 |

4.506 |

6.965 |

2.512 |

4.053 |

|

Jarque‐Bera |

1.175 |

49.116 |

182.568 |

38.511 |

20.468 |

|

Probability |

0.555 |

0.000 |

0.000 |

0.000 |

0.001 |

|

Observations |

147 |

147 |

147 |

147 |

147 |

Source: Processed Data, 2020

Kurtosis, and the Jarque‐Bera statistic (and associated p value). The average number of sitting directors on the corporate board of the sampled firms is nine (9); while, a maximum value of seventeen (17) was observed for Nestle Nigeria Plc. Board independence which is the proportion of independent directors to the total number of sitting directors had an average value of 0.573, i.e. on average 57.3%, of directors in the corporate boards of the entire sample were independent directors. The highest number of independent directors observed from the sample was eight; from companies such as; Flour Mills Nig. Plc., Guinness Nig. Plc., Nigerian Breweries Plc., 7‐Up Bottling Co. Plc. and Northern Nig. Flour Mills Plc., for 2017 financial year. The average number of meetings by the board of directors (BODIL) held for the entire observation was five (5); while, the maximum of eight (8) was observed for Dangote Sugar Refinery Plc. The variable CEO

Duality had an average value of 0.761 (76.2% of the entire observations recorded a value of one, i.e., CEO and Chairman of the Board are same person; while, 23.8% of the entire observation recorded a value of zero). The average number of meetings by the audit committee (ACDIL) held for the entire observation was three (3); while, the maximum of five (5) was observed for Flour Mills Nig. Plc. and Guinness Nig. Plc. The variables of board size and audit committee diligence mirrors normal skewness; board diligence is positively skewed (i.e., distribution to the right); while, board independence and CEO duality are negatively skewed (i.e., distribution to the the left). The kurtosis values for board independence, board diligence and audit committee diligence were

Table 3. Descriptive Statistics of Control Variables

AVERAGE_ASSET AQ LEVERAGE ROA Z

|

Mean |

1.38E+11 |

0.809 |

0.234 |

0.076 |

1.405 |

|

Median |

8.05E+10 |

1.000 |

0.188 |

0.045 |

1.028 |

|

Maximum |

7.45E+11 |

1.000 |

1.580 |

1.973 |

14.666 |

|

Minimum |

0.000 |

0.000 |

‐3.485 |

‐3.021 |

‐0.009 |

|

Std. Dev. |

1.68E+11 |

0.394 |

0.535 |

0.414 |

1.863 |

|

Skewness |

1.627 |

‐1.576 |

‐3.326 |

‐0.733 |

4.516 |

|

Kurtosis |

4.808 |

3.485 |

25.532 |

30.839 |

25.965 |

|

Jarque‐Bera |

84.920 |

62.332 |

3,380.915 |

4,760.304 |

3,730.233 |

|

Probability |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

Observations |

147 |

147 |

147 |

147 |

147 |

Source: Processed Data, 2020

|

BOARD SIZE BIND |

BODIL CEODUALITY ACDIL | ||

|

BOARD SIZE |

1.000 | ||

|

BIND |

‐0.062 |

1.000 | |

|

BODIL |

0.026 |

0.182 |

1.000 |

|

CEODUALITY |

0.506 |

0.239 |

0.154 1.000 |

|

ACDIL |

0.445 |

0.220 |

‐0.304 0.345 1.000 |

Source: Processed Data, 2020

above 3, they can be considered leptokurtic relative to the normal; while, board size and CEO duality had values less than 3, they can be considered platykurtic relative to the normal. The Jarque‐Bera statistic showed a p value >.05 for the variable of board size; while, other variables such as board independence, board diligence, CEO duality, and audit committee diligence had p values>.05. Therefore, board size is normally distributed; while, other variables are not normally distributed.

The control variables (Firm size, Audit quality, Leverage, Return on Assets, and Altman’s Z score) showed p values of the Jarque Bera statistic all less than 0.05; this is an indication of non‐normality of the variables.

The Table 4. shows the correlation between the corporate governance variables; board size is weak and negatively related to board independence but positively related to board diligence. Board size is also positively related to CEO duality and audit committee diligence. Board independence is positively related to board diligence, CEO duality and audit committee diligence. Board diligence is positively related to CEO duality and negatively related to audit committee diligence. CEO duality is positively related to audit committee diligence. None of the computed correlation coefficients exceeded a maximum value of five (5).

The Table 5. shows the correlation between the control variables in the quantile regression model. The proxy for firm size (average asset) is positively related to audit quality and leverage; but, negatively related to ROA and Altman’s Z score. The audit quality is positively related leverage and ROA; but, negatively related to Altman’s Z score. Leverage is positively related to ROA and negatively related to Altman’s Z score. The ROA is positively related to Altman’s Z score.

The hypotheses were tested using Quantile Regression Technique (QRT). Past studies have employed Fixed and Random Effects (Ba’aba, 2020); Panel Estimated Generalised Least Squares (PEGLS) (Nwezoku & Egbunike, 2020); Generalized Least Squares (GLS) (Ogundajo & Onakoya, 2016); and, Ordinary Least Squares (OLS). The use of QRT in the current study represents a significant departure from prior studies.

The quantile regression was estimated using Huber Sandwich as the Coefficient Covariance technique. The Kernel (residual) was chosen as the Sparsity Estimation

Table 5. Correlation Between Control Variables

|

AVERAGE_ASSETAQ |

LEVERAGE ROA |

Z | |

|

AVERAGE_ASSET |

1.000 | ||

|

AQ |

0.071 |

1.000 | |

|

LEVERAGE |

0.135 |

0.133 1.000 | |

|

ROA |

‐0.045 |

0.228 0.040 |

1.000 |

|

Z |

‐0.061 |

‐0.058 ‐0.059 |

0.289 1.000 |

Source: Processed Data, 2020

Table 6. Quantile process estimates, using 147 observations

|

Quantile |

Coefficient |

Std. Error |

t‐Statistic |

Prob. |

Sig. | |

|

C |

0.250 |

‐1.379 |

1.203 |

‐1.145 |

0.253 | |

|

0.500 |

‐1.050 |

0.483 |

‐2.173 |

0.031 |

** | |

|

0.750 |

‐1.374 |

0.435 |

‐3.159 |

0.002 |

*** | |

|

BOARD SIZE |

0.250 |

0.035 |

0.036 |

0.986 |

0.325 | |

|

0.500 |

0.055 |

0.032 |

1.708 |

0.089 |

* | |

|

0.750 |

0.109 |

0.028 |

3.861 |

0.000 |

*** | |

|

BIND |

0.250 |

‐0.477 |

0.754 |

‐0.632 |

0.527 | |

|

0.500 |

‐0.677 |

0.358 |

‐1.887 |

0.061 |

* | |

|

0.750 |

‐0.811 |

0.369 |

‐2.199 |

0.029 |

** | |

|

BODIL |

0.250 |

0.206 |

0.174 |

1.178 |

0.240 | |

|

0.500 |

0.133 |

0.077 |

1.718 |

0.087 |

* | |

|

0.750 |

0.190 |

0.072 |

2.623 |

0.009 |

*** | |

|

CEO DUALITY |

0.250 |

‐0.378 |

0.325 |

‐1.163 |

0.246 | |

|

0.500 |

‐0.141 |

0.162 |

‐0.870 |

0.385 | ||

|

0.750 |

‐0.188 |

0.165 |

‐1.137 |

0.257 | ||

|

ACDIL |

0.250 |

0.174 |

0.287 |

0.606 |

0.545 | |

|

0.500 |

0.138 |

0.103 |

1.335 |

0.184 | ||

|

0.750 |

0.107 |

0.103 |

1.040 |

0.300 | ||

|

AVERAGE ASSET |

0.250 |

‐2.09E‐13 |

7.50E‐13 |

‐0.279 |

0.780 | |

|

0.500 |

‐4.49E‐14 |

4.01E‐13 |

‐0.111 |

0.911 | ||

|

0.750 |

‐7.81E‐14 |

3.18E‐13 |

‐0.245 |

0.806 | ||

|

AQ |

0.250 |

‐0.006 |

0.200 |

‐0.034 |

0.972 | |

|

0.500 |

0.041 |

0.123 |

0.335 |

0.738 | ||

|

0.750 |

0.117 |

0.119 |

0.982 |

0.327 | ||

|

LEVERAGE |

0.250 |

‐0.044 |

0.068 |

‐0.651 |

0.515 | |

|

0.500 |

‐0.027 |

0.058 |

‐0.473 |

0.636 | ||

|

0.750 |

‐0.022 |

0.054 |

‐0.415 |

0.678 | ||

|

ROA |

0.250 |

‐0.264 |

0.133 |

‐1.982 |

0.049 |

** |

|

0.500 |

‐0.094 |

0.164 |

‐0.574 |

0.566 | ||

|

0.750 |

‐0.334 |

0.307 |

‐1.088 |

0.278 | ||

|

Z |

0.250 |

‐0.194 |

0.097 |

‐1.989 |

0.048 |

** |

|

0.500 |

0.002 |

0.051 |

0.056 |

0.955 | ||

|

0.750 |

‐0.004 |

0.035 |

‐0.115 |

0.908 |

Source: Processed Data, 2020

∗ p < 0.10, ∗∗ p < 0.05, ∗∗∗ p < 0.01

method. The results showed that all corporate governance variables were insignificant at the 25th quantile respectively. Studies have shown that low ETR rates implies that a firm engages in tax planning more aggressively; while, higher ETR rates may imply a more conservative approach to tax planning. However, at the 50th and 75th quantile the variables of board size, board independence and board diligence were significant. The evidence confirms our apriori postulation of the possible links between corporate governance and tax avoidance at extreme levels of the ETR. The three variables document mixed finding on this; while board size and board diligence became positive at the 75th quantile; board independence was negative. This evidence goes on to support

Table 7. Quantile Regression Model Summary

|

Quantile |

0.250 |

0.500 |

0.750 |

|

Pseudo R‐squared |

0.022 | ||

|

Quasi‐LR statistic |

18.029 | ||

|

Prob(Quasi‐LR stat) |

0.054 | ||

|

Pseudo R‐squared |

0.015 | ||

|

Quasi‐LR statistic |

21.942 | ||

|

Prob(Quasi‐LR stat) |

0.015 | ||

|

Pseudo R‐squared |

0.026 | ||

|

Quasi‐LR statistic |

54.455 | ||

|

Prob(Quasi‐LR stat) |

0.000 |

Source: Processed Data, 2020

the greater import of board independence on the tax avoidance practice of companies in developing and emerging economies. The other corporate governance variables of CEO duality and audit committee diligence were insignificant at the 25th, 50th and 75th quantiles respectively. CEO duality had a negative coefficient.

The quantile regression was estimated using Huber Sandwich as the Coefficient Covariance technique. The Kernel (residual) was chosen as the Sparsity Estimation method. The results showed that all corporate governance variables were insignificant at the 25th quantile respectively. Studies have shown that low ETR rates implies that a firm engages in tax planning more aggressively; while, higher ETR rates may imply a more conservative approach to tax planning. However, at the 50th and 75th quantile the variables of board size, board independence and board diligence were significant. The evidence confirms our apriori postulation of the possible links between corporate governance and tax avoidance at extreme levels of the ETR. The three variables document mixed finding on this; while board size and board diligence became positive at the 75th quantile; board independence was negative. This evidence goes on to support the greater import of board independence on the tax avoidance practice of companies in developing and emerging economies. The other corporate governance variables of CEO duality and audit committee diligence were insignificant at the 25th, 50th and 75th quantiles respectively. CEO duality had a negative coefficient.

The Pseudo R‐squared is a goodness of fit measure which compares the sum of weighted deviations for the model of interest with the same sum from a model in which only the intercept appears. The Quantile Pseudo R-squared is given as ∑ (βi * Γyi).

The results shown in Table 6. reported that one‐unit positive change in board size will initiate a 0.036 change (for firms within quantile 0.25), 0.055 (for firms within quantile 0.50) and 0.110 (for firm within quantile 0.75). The p value of the t statistics was statistically significant at 10% (for firms within quantile 0.50) and 1% (for firm within quantile 0.75) respectively. The null hypothesis can therefore be rejected and the alternate accepted.

The sign of the coefficient of board size contrasts with the study by Onyali & Okafor (2018) using panel data methods (fixed and random effects); reported a negative non‐significant for board size. Another study by Oyenike et al. (2016) using a sample of listed banks in Nigeria also reported a negative effect of board size. In Tunisia, the study by Boussaidi & Hamed (2015) showed that board size had negative but non‐significant effect on tax aggressiveness. On a sample of firms listed on the SBF 120 index, France

the study by Zemzem & Khaoula (2013) revealed that board size had a negative effect on effective tax rate.

The positive coefficient of board size in the present study suggests that as board size increases tax avoidance also increases. In Nigeria, Ba’aba (2020) found a positive significant relationship between board size and the effective tax rate on a sample of listed conglomerates. This finding is consistent with studies by Hoseini et al. (2018) in Iran; which reported that firms with larger board sizes were associated with more tax avoidance. Also, in Indonesia, Mappadang et al. (2018) using smart PLS showed that board of commissioners had a positive significant effect on tax avoidance. However, in Nigeria the study by Nwezoku & Egbunike (2020) found an insignificant positive effect of board size on effective tax rate. Likewise Jamei (2017) in Iran confirmed a positive effect of board size; but, not significant. Also, Lanis & Richardson (2011) in Australia found an insignificant positive effect of board size on tax aggressiveness.

The results shown in Table 6. reported that one unit positive change in board independence will initiate a ‐0.477 change (for firms within quantile 0.25), ‐0.677 (for firms within quantile 0.50) and ‐0.812 (for firm within quantile 0.75). The p value of the t statistics was statistically significant at 10% (for firms within quantile 0.50) and 5% (for firm within quantile 0.75) respectively. The null hypothesis can therefore be rejected and the alternate accepted.

Board independence had a negative coefficient. Onyali & Okafor (2018) reported a positive significant effect of independent directors. Also, Oyenike et al. (2016) on a sample of listed banks in Nigeria reported a positive significant effect of independent board members. The two studies, contrasts with the present study were board independence had a negative coefficient. However, the study by Pilos (2017) on a sample of firms drawn from S & P 500 reported that board independence had significant negative effect on tax avoidance. Also, Armstrong et al. (2015) using quantile regression technique revealed that board independence had a positive relationship with tax avoidance at low levels of tax avoidance; but, a negative relationship at high levels of tax avoidance. In France, Zemzem & Khaoula (2013) found a negative non‐significant effect of board independence on effective tax rate. As reported by in the study of Lanis & Richardson (2011) inclusion of a higher proportion of outside members on the board reduces the likelihood of tax aggressiveness.

The results shown in Table 6. reported that one unit positive change in board diligence will initiate a 0.206 change (for firms within quantile 0.25), 0.134 (for firms within quantile 0.50) and 0.191 (for firm within quantile 0.75). The p value of the t statistics was statistically significant at 10% (for firms within quantile 0.50) and 1% (for firm within quantile 0.75) respectively. The null hypothesis can therefore be rejected and the alternate accepted.

The results shown in Table 6. reported that one unit positive change in CEO duality will initiate a ‐0.379 change (for firms within quantile 0.25), ‐0.142 (for firms within quantile 0.50) and ‐0.189 (for firm within quantile 0.75). The p value of the t statistics was not statistically significant at 10%, 5% or 1%. The null hypothesis is therefore accepted and the alternate rejected.

The sign of the coefficient of CEO duality is consistent with the study by Pilos (2017) on firms drawn from S & P 500 which documented a negative insignificant effect of CEO duality on tax avoidance. Also, Zemzem & Khaoula (2013) on a sample of firms

listed on the SBF 120 index, France reported a negative non‐significant effect of CEO duality on effective tax rate. Kourdoumpalou (2016) on a sample of firms listed on the Athens Stock Exchange, Greece showed that tax evasion was significantly lower in firms where board chairman is also the CEO. However, the study by Jalali et al. (2013) in Iran using binary logistic regression showed that CEO duality had a significant effect on tax aggressiveness.

The results shown in Table 6. reported that one unit positive change in audit committee diligence will initiate a 0.174 change (for firms within quantile 0.25), 0.139 (for firms within quantile 0.50) and 0.107 (for firm within quantile 0.75). The p value of the t statistics was not statistically significant at 10%, 5% or 1%. The null hypothesis is therefore accepted and the alternate rejected.

The sign of the coefficient of audit committee diligence is similar to the study by Tandean & Winnie (2016) in Indonesia; showed that audit committee and risk had a positive significant effect on tax avoidance. Using a sample of Chinese a‐share listed firms, Zheng et al. (2018) reported that audit committee presence mitigates tax aggressiveness.

The control variables firm size and audit quality were not significant at the 25th, 50th and 75th quantile respectively. Firm size had negative coefficients at the 25th, 50th and 75th quantile; while, audit quality had negative coefficient at the 25th quantile only. However, Tandean & Winnie (2016) in Indonesia reported a positive non‐significant effect of firm size and audit quality on tax avoidance. Boussaidi & Hamed (2015) in Tunisia reported a positive significant effect of firm size. However, the same study found that audit quality was positive but non‐significant. In contrast, Gupta & Newberry (1997) revealed that size is related to GAAP effective tax rates.

The control variable leverage was not significant at the 25th, 50th and 75th quantile; it also had negative coefficients at the 25th, 50th and 75th quantile respectively. ROA and Altman Z score were negative and significant at the 25th quantile only. ROA was negative but not significant at the 50th and 75th quantile respectively. Gupta and Newberry (1997) documented that profitability is related to GAAP effective tax rates. The Altman’s Z score was positive at median (50th) quantile but not significant; and, negative at the 75th quantile but not significant.

Conclusion

The study concluded that a relationship exists between corporate governance and corporate tax avoidance. In checking for the normality of the data set, it was revealed that most of the variables show skewed distribution (heavy tail) and therefore, we relied upon quantile regression analysis as an appropriate analytical tool using the quantile {0.25,0.50,0.75} for the study. The study therefore expands the scope of prior research by estimating the relationship not only at the conditional mean; but, at the lower and upper quantile distributions. With regards to the tail of the distribution none of the corporate governance variables had a significant effect; while, board size, board independence, and board diligence had significant effect at the median and upper quantile distribution. The control variables of firm size, audit quality and leverage did not show any statistical significance with the dependent variable even at 10% level. However, suffice to say here

that control variables of ROA and Altman’s Z score showed negative statistical significance at the lower quantiles.

The study is limited in focus to the choice of a single sector, which is the consumer goods sector. Secondly, the study primarily selects control variables previously used in prior studies which have shown a significant effect in the corporate governance and tax avoidance nexus. Future studies can examine using this approach other sectors that comprised the Nigerian Stock Exchange; and, may also control for other institutional and regulatory forces such as the IFRS adoption mandated in 2012, legal environment and macro‐economic environmental forces. Lastly, future studies may utilise the Dynamic Pane Data or Generalised Method of Moments estimator to further explore more plausible relationships.

Based on the above findings, the study makes the several recommendations: 1) moderate board sizes: An overly large board size may not improve the efficiency of decisions; therefore, a sufficient number necessary to drive the company through its vision is recommended; 2) a greater need for more independent directors’ inclusion on the corporate boards is strongly recommended. This is because independent directors can effectively constrain opportunistic behaviours and offer reputational benefits to the firm; 3) meeting frequency should be tailored to suit the needs of the company: The diligence of a director often conflicts with his/her busyness; thus, the need to consider the level of engagement of a director prior to appointment to the board; 4) the non‐separation of the CEO from Chairman of the Board may lead to higher levels of tax planning; and an opportunity for manager’s rent extraction because of their dominating role. It is therefore recommended that to ensure adequate oversight both roles should be separated; 5) the audit committee should always meet to review internal control posture of the company, identifying areas of loopholes and making suggestions to the board. Moreover, as revealed by the study by Zheng et al. (2018) the independence of such committee can increase the efficiency and effectiveness of the committee.

The study makes the following contribution to literature. Firstly, it contributes to the current tax research by providing evidence of additional determinants of tax planning behaviour. Secondly, the use of quantile regression provides a more robust approach and also shows the relationship between the independent variables and the specified quantile of the conditional distribution of the dependent variable (i.e., effective tax rate).

References

Abbott, L. J., Parker, S., & Peters, G. F. (2004). Audit committee characteristics and restatements. Auditing: A Journal of Practice and Theory, 23(1), 69–87.

Abbott, L. J., Parker, S., Peters, G. F., & Raghunandan, K. (2003). The association between audit committee characteristics and audit fees. Auditing: A Journal of Practice & Theory, 22(2), 17–32.

Adjaoud, F., Mamoghli, C., & Siala, F. (2008). Auditor reputation and internal corporate governance mechanisms: complementary or substitutable? Review of Business Research, 8(1), 84–98.

Al‐Najjar, B. (2018). Corporate governance and audit features: SMEs evidence. Journal of Small Business and Enterprise Development, 25(1), 163–179.

Al Arussi, S. A., Selamat, H. M., & Hanefah, M. M. (2009). Determinants of financial and environmental disclosures through the internet by Malaysian companies. Asian Review of Accounting, 17(1), 59–76.

Alstadsaeter, A., & Jacob, M. (2013). Who participates in tax avoidance? Working paper. University of Oslo and WHU – Otto Beisheim School of Management.

Annuar, H. A., Salihu, I. A., & Obid, S. N. S. (2014). Corporate ownership, governance and tax avoidance: An interactive effects. Procedia-Social and Behavioral Sciences, 164(2014), 150–160.

Armstrong, C. S., Blouin, J. L., Jagolinzer, A. D., & Larcker, D. F. (2015). Corporate governance, incentives, and tax avoidance. Journal of Accounting and Economics, 60(1), 1–17.

Atwood, T. J., Drake, M. S., Myers, J. N., & Myers, L. A. (2012). Home country tax system characteristics and corporate tax avoidance: International evidence. The Accounting Review, 87(6), 1831–1860.

Ba’aba, S. (2020). Corporate governance attributes and tax planning of listed Nigerian conglomerates companies. International Journal of Management Sci. & Entrepreneurship, 11(7), 157–168.

Baum, C. F. (2013). Quantile regression. EC 823: Applied Econometrics, Boston College, Spring 2013.

Bayar, O., Huseynov, F., & Sardarli, S. (2018). Corporate Governance, Tax Avoidance, and Financial Constraints. Financial Management, 47(3), 651–677.

Beasley, M. S., & Petroni, K. R. (2001). Board independence and audit‐firm type. Auditing: A Journal of Practice & Theory, 20(1), 97–114.

Bliss, M. A. (2011). Does CEO duality constrain board independence? Some evidence from audit pricing. Accounting & Finance, 51(2), 361–380.

Blouin, J. (2014). Defining and measuring tax planning aggressiveness. National Tax Journal, 67(4), 875–900.

Blue Ribbon Committee [BRC], (1999). Report and Recommendations of the Blue Ribbon Committee on Improving the Effectiveness of Corporate Audit Committees. (n.d.). NYSE.

Booth, J., Cornett, M., & Tehranian, H. (2002). Boards of directors, ownership, and regulation. Journal of Banking & Finance, 26(10), 1973–1996.

Boussaidi, A., & Hamed, M. S. (2015). The impact of governance mechanisms on tax aggressiveness: Empirical evidence from Tunisian context. Journal of Asian Business Strategy, 5(1), 1–12.

Bradbury, M., Mak, Y. T., & Tan, S. M. (2006). Board characteristics, audit committee characteristics and abnormal accruals. Pacific Accounting Review, 18(2), 47–68.

Braithwaite, J. (2005). Markets in Vice, Markets in Virtue. Federation Press.

Cadbury Report. (1992). Report of the committee on the financial aspects of corporate governance. (n.d.). Gee & Co.

Cade, B. S., & Noon, B. R. (2003). A gentle introduction to quantile regression for ecologists. Frontiers in Ecology and the Environment, 1(8), 412–420.

Carcello, J., Hermanson, D., Neal, T., & Riley, R. (2002). Board characteristics and audit fees. Contemporary Accounting Research, 19(2), 365–385.

Chapra, M. U., & Ahmed, H. (2002). Corporate governance in Islamic financial institutions. Islamic Research and Training Institute, Islamic Development Bank, Saudi Arabia.

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more tax aggressive than non‐family firms? Journal of Financial Economics, 95(1), 41–61.

Coles, J. L., Daniel, N. D., & Naseen, L. (2008). Boards: Does one size fit all? Journal of Financial Economics, 87, 329–356.

Dalton, D. R., Daily, C. M., Johnson, J. L., & Ellstrand, A. E. (1999). Number of directors and financial performance: A meta‐analysis. Academy of Management Journal, 42(6), 674–686.

Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high‐powered incentives. Journal of Financial Economics, 79(1), 145–179.

Desai, M. A., & Dharmapala, D. (2008). Tax and corporate governance: An economic approach. MPI Studies on Intellectual Property, Competition and Tax. Law, 3, 13–30.

Du Plessis, J. J., Hargovan, A., & Bagaric, M. (2010). Principles of Contemporary Corporate Governance.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163–1189.

Edame, G. E., & Okoi, W. W. (2014). The impact of taxation on investment and economic development in Nigeria. Academic Journal of Interdisciplinary Studies, 3(4), 209–218.

Effiong, S. A., Akpan, E. I., & Oti, P. A. (2012). Corporate Governance, Wealth Creation and Social Responsibility Accounting. Management Science and Engineering, 6(4), 110‐ 114.

Egbunike, P. A., Ezelibe, P. C., & Aroh, N. N. (2015). The influence of corporate governance on earnings management practices: A study of some selected quoted companies in Nigeria. American Journal of Economics, Finance and Management, 1(5), 482–493.

Evans, J., & Weir, C. (1995). Decision processes, monitoring, incentives and large firm performance in the UK. Management Decision, 33(6), 32–38.

Fadhilah, R. (2014). Pengaruh (Good Corporate Governance) Terhadap (Tax Avoidance) (Bachelor Thesis).

Ferris, S. P., Jagannathan, M., & Pritchard, A. C. (2003). Too busy to mind the business? Monitoring by directors with multiple board appointments. The Journal of Finance, 58(3), 1087–1111.

Firth, M., Fung, P., & Rui, O. (2007). Ownership, two‐tier board structure, and the informativeness of earnings ‐Evidence from China. Journal of Accounting and Public Policy, 26(4), 463–496.

Foo, Y. B., & Zain, M. M. (2010). Board independence, board diligence and liquidity in Malaysia: A research note. Journal of Contemporary Accounting & Economics, 6(2), 92–100.

Franca, C. J. d., Moraes, A. M. L. d. M. d., & Martinez, A. L. (2015). Tributacao Implicita e Clientelas, Arbitragem, Restricoes e Friccoes. Revista de Administração e Contabilidade Da FAT, 7(1), 5–18.

Gill, A. (2008). Corporate governance as social responsibility: a research agenda. Berkeley Journal of International Law, 26(2), 452–478.

Gravelle, J. G. (2013). Tax havens, international tax avoidance and evasion. Congressional Research Service.

Gupta, S., & Newberry, K. (1997). Determinants of the variability in corporate effective tax rates: Evidence from longitudinal study. Journal of Accounting and Public Policy, 16(1), 1–34.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2), 127–178.

Hanlon, M., & Slemrod, J. (2009). What does tax aggressiveness signal? Evidence from stock price reactions to news about tax shelter involvement. Journal of Public Economics, 93(1–2), 126–141.

Hao, L., & Naiman, D. Q. (2007). Quantile regression.

Harris, M., & Raviv, A. (2008). A theory of board control and size. The Review of Financial Studies, 21(4), 1797–1832.

Hashim, M. H., Nawawi, A., & Salin, A. S. A. P. (2014). Determinants of strategic information disclosure – Malaysian evidence. International Journal of Business and Society, 13(3), 547–572.

Hayes, R., Dassen, R., Schilder, A., & Wallage, P. (2005). Principles of Auditing: An Introduction to International Standards on Auditing. Prentice‐Hall.

Hill, C., & Jones, G. (2009). Strategic Management Essentials (2nd ed.). SouthWestern Cengage Learning.

Holtz, L., & Neto, S. A. (2014). Effects of board of directors’ characteristics on the quality of accounting information in Brazil. Revista Contabilidade & Finanças, 25(66), 255– 266.

Hoseini, M., Gerayli, M. S., & Valiyan, H. (2018). Demographic characteristics of the board of directors’ structure and tax avoidance: Evidence from Tehran Stock Exchange. International Journal of Social Economics, 46(2), 199–212.

Hossain, M., Mitra, S., Rezaee, Z., & Sarath, B. (2011). Corporate governance and earnings management in the pre–and post–Sarbanes‐Oxley Act regimes: Evidence from implicated option backdating firms. Journal of Accounting, Auditing & Finance, 26(2), 279–315.

Huafang, X., & Jianguo, Y. (2007). Ownership structure, board composition and corporate voluntary disclosure: Evidence from listed companies in China. Managerial Auditing Journal, 22(6), 604–619.

Husnin, A. I., Nawawi, A., & Salin, A. S. A. P. (2016). Corporate governance and auditor quality–Malaysian evidence. Asian Review of Accounting, 24(2), 202–230.

Ianniello, G., Mainardi, M., & Rossi, F. (2013). Corporate governance and auditor choice. Bicentenary Conference – Lecce, Italy, September 19-21.

Islam, M. Z., Islam, M. N., Bhattacharjee, S., & Islam, A. K. M. Z. (2010). Agency problem and the role of audit committee: Implications for corporate sector in Bangladesh. International Journal of Economics and Finance, 2(3), 177–188.

Jalali, M., Jalali, F., Moridi, F., Garshasbi, A., & Foroodi, A. (2013). The impact of the board of directors’ structure on tax avoidance in the companies listed in Tehran Stock Exchange. International Research Journal of Applied and Basic Sciences, 4(9), 2526– 2531.

Jamei, R. (2017). Tax avoidance and corporate governance mechanisms: Evidence from Tehran Stock Exchange. International Journal of Economics and Financial Issues, 7(4), 638–644.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics. https://doi.org/10.1016/0304‐405X(76)90026‐X

Klein, A. (2002). Audit committee, board of director characteristics, and earnings

management. Journal of Accounting and Economics, 33(3), 375–400.

Koenker, R., & Bassett, G. (1978). Regression quantiles. Econometrika, 46(1), 33–50.

Koenker, R., & Machado, J. A. (1999). Goodness of fit and related inference processes for quantile regression. Journal of the American Statistical Association, 94(448), 1296– 1310.

Kourdoumpalou, S. (2016). Do corporate governance best practices restrain tax evasion? Evidence from Greece. Journal of Accounting and Taxation, 8(1), 1–10. https://doi.org/10.5897/JAT2015.0203

Lanis, R., & Richardson, G. (2011). The effect of board of director composition on corporate tax aggressiveness. Journal of Accounting and Public Policy, 30(1), 50–70.

Larmou, S., & Vafeas, N. (2010). The relation between board size and firm performance in firms with a history of poor operating performance. Journal of Management & Governance, 14(1), 61–85.

Li, J., Pike, R., & Haniffa, R. (2008). Intellectual capital disclosure and corporate governance structure in UK firms. Accounting and Business Research, 38(2), 137– 159.

Lim, Y. (2011). Tax avoidance, cost of debt and shareholder activism: Evidence from Korea. Journal of Banking & Finance, 35(2), 456–470.

Lin, J. W., & Hwang, M. I. (2010). Audit quality, corporate governance, and earnings management: A meta‐analysis. International Journal of Auditing, 14(1), 57–77.

Lisowsky, P. (2009). Inferring U. S. tax liability from financial statement information. The Journal of the American Taxation Association, 31(1), 29–63.

Maier, S. (2005). How global is good corporate governance. Ethical Investment Research Services.

Majeed, S., Aziz, T., & Saleem, S. (2015). The effect of corporate governance elements on corporate social responsibility (CSR) disclosure: an empirical evidence from listed companies at KSE Pakistan. International Journal of Financial Studies, 3(4), 530–556.

Makni, I., Kolsi, M. C., & Affes, H. (2012). The impact of corporate governance mechanisms on audit quality: evidence from Tunisia. IUP Journal of Corporate Governance, 11(3), 48–70.

Mappadang, A., Widyastuti, T., & Wijaya, A. M. (2018). The Effect of corporate governance mechanism on tax avoidance: Evidence from manufacturing industries listed in the Indonesian Stock Exchange. The International Journal of Social Sciences and Humanities Invention, 5(10), 5003–5007.

Martinez, A. L. (2017). Tax aggressiveness: a literature survey. Revista de Educação e Pesquisa em Contabilidade. Journal of Education and Research in Accounting, 11(Special Edition, 6), 104‐121.

Mgbame, C. O., Chijoke‐Mgbame, M. A., Yekini, S., & Kemi, Y. C. (2017). Corporate social responsibility performance and tax aggressiveness. Journal of Accounting and Taxation, 9(8), 101–108.

Mills, L. F., Nutter, S. E., & Schwab, C. M. (2013). The effect of political sensitivity and bargaining power on taxes: Evidence from federal contractors. The Accounting Review, 88(3), 977–1005.

Minnick, K., & Noga, T. (2010). Do corporate governance characteristics influence tax management? Journal of Corporate Finance, 16(5), 703–718.

Nwezoku, N. C., & Egbunike, P. A. (2020). Board diversity and corporate tax aggressiveness

behaviour of quoted healthcare manufacturing firms in Nigeria. International Journal of Advanced Academic Research, 6(2), 66–96.

Ogbechie, C., & Koufopoulos, D. N. (2010). Corporate governance and board Practices in the Nigerian banking industry. Available at lbs.edu.ng.

Ogundajo, G. O., & Onakoya, A. B. (2016). Tax planning and financial performance of Nigerian Manufacturing companies. International Journal of Advanced Academic Research Social & Management Sciences, 2(7), 64–80.

Olga, I. M., Irwin, S., & Good, D. L. (2008). Quantile Regression Methods of Estimating Confidence Intervals for WASDE Price Forecasts (No. In Selected Paper prepared for presentation at the American Agricultural Economics Association Annual Meeting, Orlando, Florida, July 27-29, 2008 (New Name 2008: Agricultural and Applied Economics Association.

Onyali, C. I., & Okafor, T. G. (2018). Effect of corporate governance mechanisms on tax aggressiveness of quoted manufacturing firms on the Nigerian Stock Exchange. Asian Journal of Economics, Business and Accounting, 8(1), 1–20.

Organisation for Economic Co-Operation and Development [OECD], (1999). OECD Principles of Corporate Governance. Ad-Hoc Task Force on Corporate Governance, OECD, Paris. (n.d.).

Organisation for Economic Co-Operation and Development [OECD], (2004). Principles of Corporate Governance. (n.d.).

Osma, B. G. (2008). Board independence and real earnings management: the case of R&D expenditure. Corporate Governance: An International Review, 16(2), 116–131.

Osuegbu, E. O. (2007). Good tax planning as legal options to the illegality of tax evasion. A paper delivered at the tax awareness forum for public and organised private sector organised by the Federal Inland Revenue Service.

Oyenike, O., Olayinka, E., & Emeni, F. (2016). Female directors and tax aggressiveness of listed banks in Nigeria. 3rd International Conference on African Development Issues (CU‐ICADI. In Covenant University Press (pp. 293–299).

Peasnell, K., Pope, P., & Young, S. (2000). Detecting earnings management using cross‐ sectional abnormal accruals models. Accounting and Business Research, 30(4), 313– 326.

Pilos, N. V. D. (2017). Tax Avoidance and Corporate Governance - Does the board of directors influence tax avoidance? (Unpublished Master’s Thesis). Erasmus School of Economics, Erasmus University.

Poudel, R. L. (2015). Relationship between Corporate Governance and Corporate Social Responsibility: Evidence from Nepalese Commercial Banks. Journal of Nepalese Business Studies, 9(1), 137–144.

Proshare. (2019). The FRCN Nigerian Code of Corporate Governance 2018.

Raghunandan, K., Rama, D. V, & Read, W. J. (2001). Audit committee composition, “gray directors,” and interaction with internal auditing. Accounting Horizons, 15(2), 105– 118.

Raheja, C. G. (2005). Determinants of board size and composition: A theory of corporate boards. Journal of Financial and Quantitative Analysis, 40(2), 283–306.

Raut, S. (2003). Corporate Governance–Concepts and Issues. Institute of Directors, India.

Richardson, G., Taylor, G., & Lanis, R. (2013). The impact of board of director oversight characteristics on corporate tax aggressiveness: An empirical analysis. Journal of

Accounting and Public Policy, 32(3), 68–88.