The Determinants of Taxpayer Compliance with Tax Awareness as a Mediation and Education for Moderation

on

Hardiningsih, Januarti, Oktaviani and Srimindarti, The Determinats of ... 49

The Determinants of Taxpayer Compliance with Tax Awareness as a Mediation and Education for Moderation

Pancawati Hardiningsih1,

Indira Januarti2,

Rachmawati Meita Oktaviani3,

Ceacilia Srimindarti4

-

1,3,4Department of Accounting, Stikubank University, Indonesia

-

2Department of Accounting, Diponegoro University, Indonesia

DOI: https://doi.org/10.24843/JIAB.2020.v15.i01.p05

Jurnal Ilmiah Akuntansi dan Bisnis

(JIAB)

Volume 15

Issue 1

January 2020

Page 49 - 60

p-ISSN 2302-514X

e-ISSN 2303-1018

ARTICLE INFORMATION:

Received:

28 June 2019

Revised:

18 September 2019

Accepted:

28 November 2019

ABSTRACT

This study aims to analyze the effects of tax knowledge, tax sanctions, and tax socialization on taxpayer compliance, as mediated and moderated by taxpayer awareness level of taxpayer education, respectively. The research sample included 196 taxpayers registered in the Primary South Semarang Tax Office. They were selected using the convenience sampling method. The data analysis employed structural equation modeling with warp partial least square. Results show that tax knowledge, tax sanctions, and tax socialization all have a significant positive effect on taxpayer awareness and taxpayer compliance. Meanwhile, the level of education does not moderate tax knowledge on taxpayer compliance. The taxpayers’ awareness mediates the relationship between tax compliance, on the one hand, and tax knowledge, tax socialization, and tax sanctions on the other hand. Thus, the Directorate General of Taxes must increase the intensity of guidance provided to taxpayers to encourage better compliance and reduce tax avoidance behaviors.

Keywords: Tax knowledge, tax sanctions, tax dissemination, taxpayer awareness, taxpayer compliance.

INTRODUCTION

One of the efforts to increase state revenue for development is making tax as a source of funds that comes from within the country (Agung, 2007). Increasing tax revenue will increase a country’s productivity. The success of tax collection depends on two things: public compliance in paying taxes and the government effectiveness in counseling and monitoring the compliance. The phenomenon of tax avoidance often occurs in developing countries so that the government loses the potential for various types of tax for quite large. Tax amnesty is one of the government’s efforts to improve tax compliance.

Tax amnesty is a government policy aiming to provide an opportunity for taxpayers to report their tax obligations that have not been properly paid. Tax amnesty, therefore, is a government attempt to withdraw public funds through taxes. The existence of a tax amnesty taxpayer is not subject to

administrative or criminal sanctions, but must disclose assets and pay a ransom as stipulated by Law No. 11 of 2016.

Based on data, the number of taxpayers from the Directorate General of Taxes in 2018, was 59.98% of the total taxpayers of the Tax Return (SPT) (Pajak, 2018). The tax amnesty program at the Central Java Directorate General of Taxes (DGT) has now penetrated Rp.1.64 trillion. From this amount 80% of them are individual taxpayers, while the rest are corporate taxpayers (Media 2017). There was a decrease in the percentage of the number of taxpayers who had not reported their taxes from 2015 to 2017 in Semarang region alone resulted by 60.48%, 56.93% and 51.88%. This condition creates a gap phenomenon, namely the existence of a tax amnesty program, which is expected to raise awareness of taxpayers to be compliant in their tax obligations. Even though the reality is not yet fully

materialized, it has increased the compliance rate (Pajak, D.J, 2018).

Tax compliance is a form of awareness in fulfilling the tax obligations according to tax regulations without having to carry out checks and sanctions (Zain, 2007). Formal compliance is tax compliance in terms of applying tax rules, while material compliance is tax compliance in terms of applying material tax provisions that includes compliance with calculating the amount of tax that will be paid by taxpayers (Santoso 2008).

Research on taxpayer awareness was carried out by Tiraada (2013); Megawangi & Setiawan (2017); and Sari & Wirakusuma (2018) found that tax awareness had a positive and significant effect on corporate taxpayer compliance. Whereas Yusro and Kiswanto (2014) showed that awareness of paying taxes had no effect on MSME taxpayer compliance. Likewise, taxpayer awareness does not have a mediating role in the relationship of tax socialization, tax knowledge, with taxpayer compliance (Yusro and Kiswanto 2014).

Knowledge is one of the factors that can affect taxpayer compliance as revealed by Harahap (2004) that taxpayer compliance is influenced by taxpayer understanding. Knowledge of tax regulations, tax functions and the taxation system has an important role in fostering compliant behavior so it must be consented and understood by taxpayers. Rahayu’s (2017) research ; Sudrajat & Ompusunggu (2015); Susmiatun & Kusmuriyanto (2014); and Yusro & Kiswanto (2014) found that taxation knowledge had a positive influence on taxpayer compliance, but Aryati (2012) found an opposite result where knowledge had no effect on taxpayer compliance.

Another factor is tax sanctions. Law No. 28/ 2007 concerning General Provisions and Tax Procedures (UU KUP) regulates administrative and criminal sanctions. Administrative sanctions will be imposed when there are violations of tax obligations relating to tax administration so that a Notice of Tax Assessment or Notice of Tax Collection is issued. Whereas criminal sanctions are related to criminal offenses in the tax sector. Forms of administrative sanctions can include fines, interest and increased tax burden. Tiraada (2013) research; Tawas, Poputra, and Lambey (2016); Pujiwidodo (2016); Rahayu (2017); and Sari & Wirakusuma (2018) found that tax sanctions had a positive effect on compliance with taxpayer’s annual tax return reporting. While the opposite results by Susmiatun and Kusmuriyanto

-

(2014) found that sanctions did not affect taxpayer compliance. Likewise, Tawas et al. (2016) found that tax fines had no significant effect on taxpayer compliance.

The next factor influencing taxpayer compliance is tax socialization. Tax socialization is an attempt by DGT to inform and provide guidance to tax payers on all matters related with taxation and legislation (Mutia 2014). DGT is responsible to conduct extension programs or tax socialization through various media. Research by Sudrajat & Ompusunggu (2015) and Binambuni (2013) found that tax socialization had an effect on tax compliance, but Tawas, Poputra, dan Lambey (2016) on the contrary, found that that tax socialization did not have a significant effect on the compliance with corporate taxpayers’ annual tax return reporting. Likewise,Yusro and Kiswanto (2014) found that tax socialization and tax knowledge affected taxpayer awareness and tax compliance. Additional evidence was also found that tax socialization proven to moderate taxpayer awareness on taxpayer corporate compliance.Similar to that of Jordanian government, that providing information to the government is necessary and useful in formulating appropriate policies to reduce tax evasion so as to avoid deviant decisions and can increase the tax revenue (Farhan and Abdul-Jabbar, 2019).

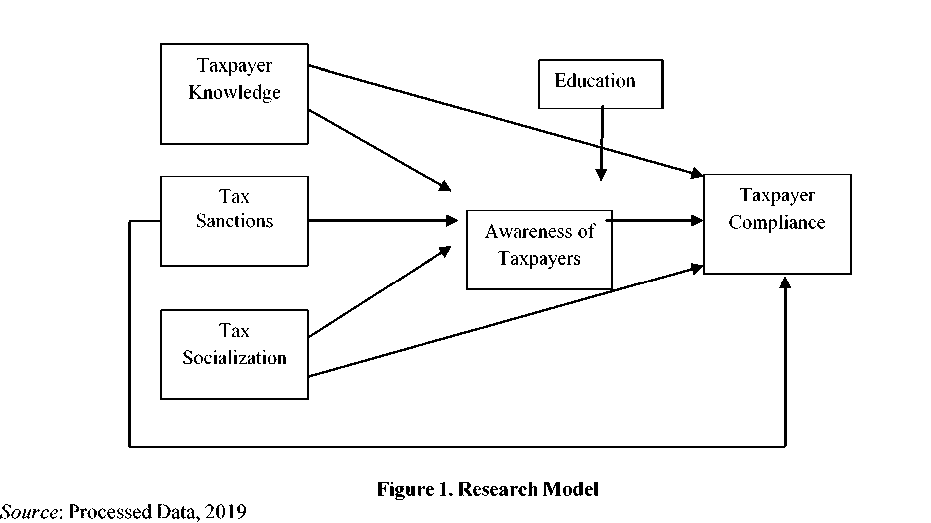

This study aims to analyze the effect of tax knowledge, tax sanctions, tax socialization on taxpayer awareness. It also aims to analyze the effect of awareness of taxpayers, tax knowledge, tax sanctions, and tax socialization on taxpayer compliance, and whether the level of education moderates the effect of knowledge on taxpayer compliance.

This research can be explained using attribution theory. This theory explains the behavior related to individual attitudes and characteristics. By looking at a person’s behavior the attitudes or characteristics of these individuals can be known, so that someone’s behavior when facing certain situations can be predicted (Luthans, 2005). A behavior caused by internal factors is behavior that comes from the personal control of the individual herself in a conscious state, such as personality traits, awareness, abilities, effort, and fatigue. the behavior caused by external factors is behavior that is influenced from outside, it means that the situations make individuals behavior change, such as social influences from others, rules, and weather that can affect the

evaluation of individual performance, including determining how the employer treats his subordinates, and influencing attitudes and individual satisfaction at work. A person’s behavior can be influenced by internal and external factors. Attribution theory is also used by Mulya (2012), Istanto (2010), and Hutagaol (2007) in their research which examines tax compliance.

In relation to taxation, this theory explains the compliance of taxpayers as seen from the attitude of taxpayers in responding to taxes (Sairi, 2004). So that unknowingly, when taxpayers carrying out tax obligations, it will cause other people to be sure that the words and actions reflected taxpayers’ conscious characteristics or if the behavior is merely caused by the force of certain situations (Myers, 1996).

Tax knowledge is a person’s ability to understand regulations, taxation procedures, including tax rate issues and changes that have tax benefits for the community (Budhiartama dan Jati, 2016).

Taxpayers who have knowledge about taxation will be useful for their lives and business. The existence of tax knowledge will make taxpayers to have more understanding and open taxpayer awareness on tax obligations. Research (Wijaya & Arisman, 2016); (Caroko et al., 2015); and (Rohmawati, 2012) found that tax knowledge influenced taxpayer awareness. Then the hypothesis is formulated as follows: H1: Tax knowledge has a positive effect on taxpayer awareness.

Tax sanctions as a guarante for the provisions of tax regulations or tax norms must be obeyed in order to make taxpayers continue with the provisions of tax norms (Mardiasmo, 2011). Administrative sanctions and criminal sanctions are intended so that in the future, taxpayers do not repeat the same mistakes. In the end, the effect of sanctioning will optimally lead taxpayers to become aware to fulfill their tax obligations. Research (Caroko et al. 2015) found that high levels of taxpayer awareness were due to high tax sanctions. Thus the hypothesis can be formulated as follows:

H2: Tax sanctions have a positive effect on taxpayer awareness.

Tax socialization is an attempt to provide understanding of information and guidance to taxpayers, especially regarding taxation and legislation (Mutia, 2014). This tax socialization is important because it serves to increase tax

knowledge which ultimately makes taxpayers aware of meeting tax obligations. The existence of continuous socialization will increase taxpayer awareness. Taxpayers are required to have awareness and understanding of taxation that has been socialized so that it increases taxpayer compliance (Rohmawati et al., 2012). Research (Rohmawati et al. 2012) states that socialization has an influence on taxpayer awareness. Then the hypothesis is formulated as follows:

H3: Tax socialization has a positive effect on taxpayer awareness.

Taxpayer awareness as a behavior reflecting their perceptions related to the beliefs, knowledge, and reasoning power is able to act in a stimulus manner in accordance with the applicable tax system and provisions. Low awareness (lack of awareness) has the potential to decrease compliance. When taxpayers open their consciousness, they tend to act more obediently to fulfill tax rules. Research by Sari and Wirakusuma (2018); Megawangi and Setiawan (2017); Septarini (2015); Sapriadi (2013); and Tiraada (2013) found that taxpayer compliance was due to better taxpayer awareness. Therefore a hypothesis can be formulated as follows:

H4: Tax awareness has a positive effect on taxpayer compliance.

Taxpayers need to know and understand tax knowledge in taking a position related to taxation. Knowledge will direct taxpayers in the implementation of tax rights and obligations (Carolina, 2009). A taxpayer needs to have competence in understanding tax knowledge ranging from tax rates to determine the tax owed to be paid as well as the tax benefits in doing business. Basically, a knowledgeable taxpayer will tend to be more obedient in completing tax obligations and obedient to their rights and obligations without being forced and threatened by sanctions or penalties.Rahayu (2017); Sudrajat & Ompusunggu (2015); and Susmiatun & Kusmuriyanto (2014) research found that better understanding of tax knowledge was proven to increase taxpayer compliance. Thus the hypothesis is formulated as follows: H5: Knowledge of taxpayers has a positive effect

on taxpayer compliance.

Sanctions are negative penalties for people who break the rules, as well taxation sanctions are negative penalties – usually by paying money – for

taxpayers who break the rules. Tax sanctions are guarantees that the provisions of tax legislation (tax norms) will be obeyed (Mardiasmo, 2011). Tax violations can be reduced if tax sanctions are applied. The government will bear a substantial loss if a tax violation occurs. Such conditions will encourage taxpayers to be compliant with tax obligations Jatmiko (2006) and Pratiwi & Setiawan (2014). When taxpayers’ perception of the implementation of sanctions is getting better, it makes tax compliance also getting better. The studies by Sari & Wirakusuma (2018); Rahayu (2017); Pujiwidodo (2016); Tawas et al. (2016); Sudrajat & Ompusunggu (2015) and Tiraada (2013) showed that when tax penalties become heavier it made taxpayers more obedient. So it can be hypothesized as follows: H6: Tax sanctions have a positive effect on taxpayer

compliance.

Tax socialization is an effort to give discourse about the ins and outs of taxes and to provide guidance to taxpayers. Through this socialization tax knowledge becomes better so that it will foster awareness among taxpayers. Tax socialization is needed to increase the number of taxpayers and can lead to taxpayer compliance so that tax revenue will automatically increase (Gunadi, 2005:10). Tax socialization is expected to increase taxpayer compliance so that the amount of tax revenue can increase as targeted by the government (Nurmantu, 2010). Intensive and effective tax socialization will increase taxpayer compliance. Evenmore, the taxation socialization is able to moderate the influence taxpayer awareness on corporate taxpayer compliance. Sudrajat and Ompusunggu (2015); and Binambuni (2013) studies found that there was an influence of UN socialization on taxpayer compliance. Thus the following hypothesis can be formulated: H7: Tax socialization has a positive effect on taxpayer

compliance.

Basically, taxpayers with higher education will have better awareness and compliance with their rights and obligations without being forced and threatened with some sanctions or penalties. Taxpayers who have broader tax knowledge and are supported with a higher level of education will have a better self-awareness attitude and be more obedient in completing their tax obligations. This happens to taxpayers in the State of Lagos, Nigeria. The tax education program is not only given to accounting

students, but also to the government, and other stakeholders to encourage tax compliance. The focus of the program as a form of socio-economic implications to prevent tax avoidance and transparent as well as accountable executions of tax allocations has been proven to have an influence on tax compliance (State, Oyo, 2013). Thus the higher education of taxpayers can motivate taxpayers to be more obedient. Therefore, the hypothesis can be formulated as follows:

H8: Educational Level moderates the effect of knowledge on taxpayer compliance.

RESEARCH METHOD

The population in this study were taxpayers registered at the Primary South Semarang Tax Office amounting to 4,172 taxpayers. The research sample was individual taxpayer (WPOP) who had businesses registered in Primary South Semarang Tax Office totaling 2,542 taxpayers. With convenience sampling technique, 196 taxpayers were obtained with a response rate of 7.7%. Research used survey methods through the distribution of questionnaires to individual taxpayers (Usman dan Akbar, 2003).

Taxpayer knowledge is tax information that can be used by taxpayers as a basis for acting, making decisions and as a direction or certain strategy for the implementation of rights and obligations in the field of taxation (Carolina, 2009). The knowledge variable instrument used an instrument developed by Fikriningrum dan Syafruddin (2012) consisting of 6 items, namely 1) taxpayer identification number (NPWP) registration 2) taxpayer rights and obligations 3) tax violation sanctions 4) Non-Taxable Income (PTKP), Taxable Income (PKP), and tax rates 5) socialization of tax regulations, and 6) tax regulations through training.

Tax sanctions as a form of guarantee for tax regulations and tax norms must be obeyed, so that taxpayers avoid violations of tax norms (Muliari and Setiawan, 2011). The variable instrument of tax sanctions used an instrument developed by Muliari and Setiawan (2011) consisting of 5 items, namely: 1) Criminal sanctions for violating tax rules are quite heavy, 2) Administrative sanctions for violating tax rules are very light, 3) Sanctions are quite heavy, 4 ) Tax sanctions must be imposed without tolerance, 5) Tax violation sanctions can be negotiated.

Tax socialization is an effort of the Director General of Taxes to provide understanding of information and guidance to taxpayers related to

taxation and legislation (Mutia, 2014). The variable socialization instrument used an instrument developed by Soekanto (2002) consisting of 5 items: 1) Utilizing time to socialize taxes, 2) Tax socialization using various mass media, 3) Forms of socialization delivered in the form of taxation material, 4) Information is conveyed using language that is easy for people to understand, 5) The purpose and benefits of socialization provide an understanding of the use of taxes for development.

Taxpayer awareness is behavior in the form of perspective or perception about beliefs, knowledge, and reasoning power to act based on stimulation from the applicable tax rules (Artiningsih, 2013). The variable instrument for taxpayer awareness used an instrument developed by Artiningsih (2013) consisting of 3 questionnaires: 1) Willingness to pay taxes, 2) Reporting tax returns, 3) Order and discipline of tax payments.

Tax compliance is compliance in carrying out tax rights and obligations in accordance with applicable tax provisions (Rahayu, 2010). The variable instrument of tax compliance used an instrument developed by Sapriadi (2013) which consists of 3 questionnaires: 1) Compliance registering themselves, 2) Performing the calculation and payment of tax payable correctly, 3) Never received a penalty of tax crime.

Education as a process with certain methods so that people gain knowledge, understanding, and how to behave according to needs. The level of education

is the highest level of education that has been taken by someone through formal education that is used by the government and authorized by the department of education as a form of competency.

The analysis technique in this study used the analysis of Sructural Equisition Models (SEM) with Partial Least Square Warp (Ghozali, 2014) with the regression equation as follows:

Y1 = α + β1X1 + β2X2 + β3X3 + ε1....................(1)

-

Y 2 = α + β4Y1 + βX1 + β6X2 + β7X3 + β8X1*Z + ε2......................................................... (2)

Where:

-

Y 2 : taxpayer compliance

-

Y 1 : awareness of taxpayers

α : constant coefficient.

-

β1, β2, β3 : coefficient of taxpayer knowledge, tax

sanctions and tax socialization

-

X1, X2, X3 : knowledge of taxpayers, tax sanctions and tax socialization

Z : education

ε : residual

To explain both direct and indirect effects using path analysis that each β value describes the path coefficient based on the path model proposed by the theory that the independent variable has a direct relationship with the dependent variable, however the independent variable also has an indirect relationship with the dependent variable, namely through intervening variables (Ghozali, 2014).

RESULTS AND DISCUSSION

Characteristics of respondents by occupation can be seen in the following table 1.

Table 1. Respondents’ Occupation

|

Occupation |

Frequency |

Percentage (%) |

|

Enterpreneurs |

115 |

58,7 |

|

Free Workers |

81 |

41,3 |

|

Total |

196 |

100 |

Source: Processed Data, 2019

Table 1. explained the types of taxpayers’ occupation in Primary South Semarang Tax Office most of them were entrepreneurs and free workers

respectively at 58.7% and 41.3%. While the model quality test can be seen in the general output of the model fit and quality indices as in Table 2.

Table 2. Model Fit dan Quality Indices

Average path coefficient (APC)

Average R-squared (ARS)

Average adjusted R-squared (AARS)

Average block VIF (AVIF)

Average full collinearity VIF (AFVIF)

Tenenhaus GoF (GoF)

Sympson's paradox ratio (SPR)

R-squared contribution ratio (RSCR)

Statistical suppression ratio (SSR)

Nonlinear bivariate causality direction ratio (NLBCDR)

0.251, P<0.001

0.859, P<0.001

0.855, P<0.001

-

2.478, acceptable if <= 5, ideally <= 3.3

-

3.264, acceptable if <= 5, ideally <= 3.3

0.708, small >= 0.1, medium >= 0.25, large >= 0.36

-

1 .000, acceptable if >= 0.7, ideally = 1

R=1.000, acceptable if >= 0.9, ideally = 1

0.810, acceptable if >= 0.7

0.917, acceptable if >= 0.7

Source: Processed Data, 2019

Overall the research model showed a good fit model quality, with p value on Average Path Coefficient (APC), Average R-squared (ARS), and Average adjusted R-squared (AARS) of <0.001 with APC value = 0.251, ARS value = 0.859 and AARS value = 0.855. Similarly, Average block VIF (AVIF) and Average full collinearity VIF (AFVIF) values obtained <3.3, which means there was no multicollinearity problem between indicators and between exogenous variables. Tenenhaus GoF (GoF) produced 0.708> 0.36 which means this research

model was very good.R-squared contribution ratio (RSCR) produce a value equal to 1 which means there was no causality problem in the model. Likewise, the Statistical suppression ratio (SSR) of 0.810> 0.7 means that this model was acceptable. As for the non-linear bivariate causality direction ratio (NLBCDR) index, the value 0.917> 0.7 means that there was a non-linear causality relationship in the model. Furthermore hypothesis testing can be explained in the following Table 3.

Table 3. Path coefficients and P values

|

KNOWLED |

SANCTI |

SOCIALI |

AWARENE |

COMPLIAN |

TK*EDU | ||

|

coefficients |

AWARENES |

0.431 |

0.139 |

0.458 | |||

|

COMPLIAN |

0.162 |

0.133 |

0.147 |

0.780 |

-0.114 | ||

|

KNOWLED |

SANCTI |

SOCIALI |

AWARENE |

COMPLIAN |

TK*EDU | ||

|

P values |

AWARENES |

<0.001* |

0.041** |

<0.001* | |||

|

COMPLIAN |

0.026** |

0.048** |

0.035** |

<0.001* |

0.089 | ||

*level 0,1%; ** level 5%

Source: Processed Data, 2019

The results of the output path coefficients and p values in table 3 showed that the variables of tax knowledge and tax socialization have a significant direct effect on taxpayer awareness with p values of <0.001 and path coefficients of 0.431 and 0.458

(H1 and H3 are supported). While tax sanctions with a path coefficient of 0.139 at p value <0.05 (H2 supported). Variable awareness of taxpayers influence and significant effect on taxpayer compliance with p value of <0.001 and path

coefficient of 0.780 (H4 supported). Likewise, variable tax knowledge, tax sanctions and tax socialization, have a direct and significant effect on taxpayer compliance with p values of <0.05 and path coefficients respectively 0.162, 0.133 and 0.147 (H5, H6 and H7 are supported). But the level of education (TK * EDU) apparently has no effect on tax compliance with a p value of 0.089 with a path coefficient of -0.114 (H8 is not supported). This shows that education level variables does not

moderate the relationship between tax knowledge and taxpayer compliance.

The results of combined loadings and crossloadings output showed that the reliability indicators of the constructing items of the dimensions of tax knowledge, tax sanctions, tax socialization, education, taxpayer awareness, and taxpayer compliance are all valid with a factor loading value generated> 0.7 with a value p value <0.001. The research contributions can be seen in the following table 4.

Table 4. Latent Variable Coefficients

|

KNOWLED |

SANCTI |

SOCIALI |

AWARENE |

COMPLIAN |

TK*EDU | |

|

R-squared coefficients |

0.796 |

0.922 | ||||

|

Adjusted R-squared |

0.791 |

0.919 | ||||

|

coefficients Composite reliability coefficients |

0.794 |

0.852 |

0.813 |

0.833 |

0.831 |

0.798 |

|

Cronbach's alpha |

0.789 |

0.772 |

0.708 |

0.799 |

0.794 |

0.795 |

|

coefficients | ||||||

|

Average variances |

0.595 |

0.568 |

0.576 |

0.625 |

0.623 |

0.506 |

|

extracted | ||||||

|

Full collinearity |

2.959 |

1.304 |

2.410 |

1.366 |

1.140 |

1.159 |

|

VIFs | ||||||

|

Q-squared coefficients |

0.793 |

0.921 |

Source: Processed Data, 2019

Table 4. shows the adjusted R-square value of 0.791, which means the influence of tax knowledge, tax sanctions, and tax socialization is 79.1%, while the adjusted R-square value is 0.919 for taxpayer compliance with moderation of the education level of 91.9% and the remaining 20.9% of tax awareness and 8.1% of tax compliance are affected by other variables outside this research model. While the Q-square value generated by the taxpayer awareness variable is 0.793> 0 and the taxpayer compliance variable generated is 0.921, which means that the model has a good predictive relevance

Cronbach’s alpha coefficients value above 0.7 for the variables of tax knowledge, tax sanctions, tax socialization, education, taxpayer awareness, and taxpayer compliance with 0.789; .772; 0.708; 0.799; 0.794; and 795. This show that all are reliable for all variables. Likewise, the composite reliability coefficients above 0.7 for the variables of tax knowledge, tax sanctions, tax socialization, education, awareness of taxpayers, and compliance of taxpayers respectively by 0.794; 0.852; 0813; 0.833; 0831; and 0.798 so that it fulfills internal consistency reliability.

The average variances extracted (AVE) for each dimension is very good, namely > 0.5 for variable tax knowledge, tax sanctions, tax socialization, education, taxpayer awareness, and tax compliance for 0.595; 0.568; 0.576; 0.625; 0.623; and 0.506 so that it meets the convergent validity.

The value of Full collinearity VIFs for each contract is also very good, that is <3.3 for the variables of tax knowledge, tax sanctions, tax socialization, education, taxpayer awareness, and taxpayer compliance at 2.959; 1,304; 2,410; 1,366; 1,140; and 1,159 so there are no collinearity problem in the research model.

From the results of hypothesis testing it can be explained that tax knowledge has a significant positive effect on taxpayer awareness. These findings support the attribution theory that a person’s behavior is influenced by internal and external factors such as tax knowledge which can make taxpayers have better awareness. These results are in line with the study of Caroko et al. (2015); Wijaya & Arisman (2016); Caroko et al. (2015); and Rohmawati et al. (2012) that tax knowledge affected taxpayer awareness.

Tax sanctions have an influence on the awareness of taxpayers, which means that taxpayers increasingly open awareness of the sanctions borne. This finding support the attribution theory stated by Fritz Heider that human behavior can be influenced by external forces such as tax sanctions so as to open taxpayers’ awareness of the risks faced when committing violations. This result is in line with Caroko et al. (2015) that tax sanctions have a positive effect on taxpayer awareness.

Tax socialization has an influence on taxpayer awareness, which means that tax socialization conducted by Tax Office is continuously proven to open awareness of taxpayers who previously do not understand the tax and the law. This finding supports the attribution theory that human behavior can be influenced by external forces such as socialization from the tax office so as to increase mandatory awareness. These results are in line with Rohmawati et al. (2012) that socialization affected taxpayer awareness.

Tax awareness has an influence on taxpayer compliance, which means that taxpayer awareness levels become better and are followed up by depositing and reporting taxes in a timely manner. This finding supported the attribution theory that one’s submissiveness would arise if someone has an inner awareness. It indicates that the higher the level of taxpayer awareness, the more obedient they will be with their tax obligations. This finding is in line with Megawangi and Setiawan ( 2017); Septarini (2015); Sapriadi (2013); and Tiraada (2013) that awareness of taxpayers affected tax compliance.

Tax knowledge has an influence on taxpayer compliance, which means that taxpayers have a better understanding of tax regulations, whether it is a matter of tariffs or benefits for the smooth running of the business so that it made it more compliant in fulfilling its obligations. This finding supports the attribution theory that a person’s behavior is influenced by external factors as well as tax knowledge can affect the level of taxpayer compliance. The higher level of tax knowledge will increase taxpayer compliance. These results are in line with Rahayu (2017); Sudrajat & Ompusunggu (2015); and Rohmawati et al. (2012) that tax knowledge has a positive effect on taxpayer compliance.

Tax sanctions have an effect on the compliance of taxpayers which means that tax sanctions will make the tax burden higher so it may create a deterrent effect. This condition makes the taxpayer not repeat the same mistake in the next. It supports

the attribution theory that human behavior can be influenced by external forces such as tax sanctions which indicate if the taxpayers are subject to tax sanctions and it will increase compliance to their tax obligations. This finding is in line with Pujiwidodo (2016); Rahayu (2017); and Sudrajat & Ompusunggu (2015) that tax sanctions affected individual taxpayer compliance.

Tax socialization has an influence on taxpayer compliance, which means that continuous tax socialization has proven to be effective and has an impact on increasing the number of taxpayers and achieving tax revenue targets. This finding supports the attribution theory, in which external factors such as tax socialization can affect the level of taxpayer compliance. This finding is in line with Sudrajat and Ompusunggu (2015); Binambuni (2013); and Rohmawati et al. (2012) that there was an influence of socialization on tax compliance.

Education has not been proven to moderate the influence of knowledge on taxpayer compliance, which means taxpayers who have broader tax knowledge and are supported with higher levels of education are apparently unable to make taxpayers comply with tax regulations. Henceforth the results of the path analysis are shown in Figure 2 as follows.

Based on the first path analysis, the influence of tax knowledge on taxpayer compliance which is mediated by taxpayer awareness shows that the direct effect of taxpayer knowledge on taxpayer compliance is significant (0.162) and taxpayer awareness becomes a mediation between tax knowledge of taxpayer compliance with the significance value of the influence of taxpayer knowledge on taxpayer awareness of 0.431 and the significance value of the effect of taxpayer awareness of taxpayer compliance by 0.780. The results of indirect coefficient of 0.336 are greater than direct of 0.162, so taxpayer awareness is a partial mediation.

Likewise, the second path analysis on the effect of tax sanctions on taxpayer compliance mediated by taxpayer awareness shows that the direct effect of tax sanctions on taxpayer compliance is significant (0.133) and awareness of taxpayers as mediated by the effect of tax sanctions on taxpayer compliance with value the significance of taxpayer awareness of 0.139 and the significance of the effect of taxpayer awareness on taxpayer compliance by 0.780. The indirect coefficient result of 0.108 is smaller than direct value of 0.133, so awareness of taxpayers isclaimed to be fully mediated.

Figure 2. Path Analysis

Source: Data Processed, 2019

Whereas the third path analysis the influence of tax socialization on taxpayer compliance mediated by taxpayer awareness shows that the direct effect of tax socialization on taxpayer compliance is significant (0.147) and taxpayer awareness become mediation of the effect of tax socialization on taxpayer compliance, indicated by the significance value to taxpayer awareness of 0.458 and the taxpayer awareness significance value relationship to taxpayer compliance is 0.780. The indirect coefficient results of 0.357 is greater than direct of 0.147, the awareness of taxpayers as partial mediation.

CONCLUSION

Referring to the results of testing and discussion, it is concluded that tax knowledge, tax sanctions, and tax socialization have a positive and significant effect on taxpayer awareness. Likewise tax knowledge, tax sanctions, tax socialization, and awareness of taxpayers have a positive and significant effect on taxpayer compliance. Likewise, the knowledge of taxpayers, the higher the knowledge they have about taxation made taxpayers more compliant with tax regulations. However, the education level of taxpayers did not determine that taxpayers are more compliant with tax regulations. Taxpayers awareness is proven to be a partial mediation the relationship between tax knowledge and tax socialization with taxpayer compliance, whereas tax awareness is proven to be a full mediation of the relationship between tax sanctions and tax

compliance. Adjusted R-square of 79.1% is obtained for the effect of tax knowledge, tax sanctions, and tax socialization on taxpayers awareness. While 91.9% is obtained for the influence of tax knowledge, tax sanctions, and tax socialization on taxpayers compliance with moderation in education level.

One of the limitations of this study is that it is less focused on individual taxpayers with certain professions and the response rate at Primary South Semarang Tax Office is still low (4.7%). Therefore, it needs an appeal to taxpayers to be able to report and pay taxes on time before the tax payment limit, and encourage orderly and in disciplined manner in paying taxes to avoid tax sanctions. Tax information dissemination by Primary Tax Office needs to be continuously updated with the latest information regarding tax regulations and tax sanctions to taxpayers through several social media. This method will also increase taxpayer knowledge. Intensive guidance must always be done to reduce tax avoidance. Last but not least, the next researcher needs to do a comparative study to other Primary Tax Office areas to see the level of compliance behavior.

REFERENCES

Agung, M. (2007). Teori dan Aplikasi Perpajakan Indonesia. Jakarta: Dinamika Ilmu.

Arikunto, S. (2010). Prosedur Penelitian Suatu Pendekatan Praktik. Jakarta: Rineka Cipta.

Artiningsih. (2013). Pengaruh Kesadaran Wajib Pajak Badan dan Pelayanan Perpajakan

Terhadap Kepatuhan Wajib Pajak di KPP Pratama Sleman (Skripsi). Universitas Negeri Yogyakarta, Yogyakarta.

Arum, H. P. (2012). Pengaruh Kesadaran Wajib Pajak, Pelayanan Fiskus, dan Sanksi Pajak Terhadap Kepatuhan Wajib Pajak Orang Pribadi yang Melakukan Kegiatan Usaha dan Pekerjaan Bebas (Studi di Wilayah KPP Pratama Cilacap) (Skripsi). Universitas Diponegoro, Semarang.

Aryati, T. (2012). Analisis Faktor-Faktor yang Mempengaruhi Tingkat Kepatuhan Wajib Pajak Badan. Media Ekonomi dan Manajemen, 25(1), 13–29.

Basalamah, A. S. M. (2004). Perilaku Organisasi Memahami dan Mengelola Aspek Humaniora dalam Organisasi (ketiga). Depok: Usaha Kami.

Binambuni, D. (2013). Sosialisasi PBB Pengaruhnya terhadap Kepatuhan Wajib Pajak di Desa Karatung Kecamatan Nanusa Kabupaten Talaud. JURNAL EMBA, 1(4), 2078–2087.

Budhiartama, I. G. P., & Jati, I. K. (2016). Pengaruh Sikap, Kesadaran Wajib Pajak dan Pengetahuan Perpajakan pada Kepatuhan Membayar Pajak Bumi dan Bangunan. E-jurnal Akuntansi Universitas Udayana, 15(2), 1510–1535.

Caroko, B., Heru Susilo, & Zahroh Z.A. (2015). Pengaruh Pengetahuan Perpajakan, Kualitas Pelayanan Pajak, dan Sanksi Pajak terhadap Motivasi Wajib Pajak Orang Pribadi dalam Membayar Pajak. Jurnal Perpajakan, 1(1), 1–10.

Carolina, V. (2009). Pengetahuan Pajak. Jakarta: Salemba Empat.

Devano, S., & Rahayu, S. (2006). Perpajakan: Konsep, Teori, dan Isu. Jakarta: Kencana.

Farhan, Ahmad and Hijattulah Abdul-jabbar. 2019. “A Conceptual Model of Sales Tax Compliance among Jordanian SMEs and Its Implications for Future Research.” 11(5):114–27.

Fikriningrum, W. K., & Syafruddin, M. (2012). Analisis Faktor-Faktor Yang Mempengaruhi Wajib Pajak Orang Pribadi Dalam Memenuhi Kewajiban Membayar Pajak (Studi Kasus Pada Kantor Pelayanan Pajak Pratama Semarang Candisari). Diponegoro Journal of Accounting, 1(2), 1–15.

Ghozali, I. (2005). Aplikasi Analisis Multivariate dengan Program SPSS (3 ed.). Semarang: Badan Penerbit Universitas Diponegoro.

Harahap, A. A. (2004). Paradigma Baru Perpajakan Indonesia Perspektif Ekonomi-

Politik. Jakarta: Integrita Dinamika Press.

Hutagaol, J. (2007). Perpajakan: Isu-isu Kontemporer. Yogyakarta: Graha Ilmu.

Istanto, F. (2010). Analisis Pengaruh Pengetahuan tentang Pajak, Kualitas Pelayanan Pajak Ketegasan Sanksi Perpajakan dan Tingkat Pendidikan terhadap Motivasi Wajib Pajak dalam Membayar Pajak (Skripsi). Universitas Islam Negeri Syarif Hidayatullah, Jakarta.

Jatmiko, A. N. (2006). Pengaruh Sikap Wajib Pajak pada Pelaksanaan Sanksi Denda, Pelayanan Fiskus dan Kesadaran Perpajakan terhadap Kepatuhan Wajib Pajak (Studi Empiris Terhadap Wajib Pajak Orang Pribadi di Kota Semarang) (Tesis). Universitas Diponegoro, Semarang.

Kurniawan, D. (2009). Pengaruh Kesadaran Wajib Pajak terhadap Kepatuhan Wajib Pajak di Solok (Skripsi). Universitas Andalas, Padang.

Luthans, F. (2005). Organizational Behavior (Seventh edition). New York: McGraw Hill.

Mardiasmo. (2011). Perpajakan (Revisi 2009). Yogyakarta: Penerbit Andi.

Media, S. D. (2017, Maret 17). Pengampunan Pajak: Dana Tax Amnesty Solo Terbesar se-Jateng II‘. Diambil 1 November 2018, dari http:// news.solopos.com/read/20170317/496/802131/ pengampunan-pajak-dana-tax-amnesty-solo-terbesar-se-jateng-ii

Megawangi, C. A. M., & Setiawan, P. E. (2017). Sosialisasi Perpajakan Memoderasi Pengaruh Kesadaran Wajib Pajak dan Kualitas Pelayanan pada Kepatuhan Wajib Pajak Badan. E-jurnal Akuntansi Universitas Udayana, 19.3, 2348-2377.

Muliari, N. K., & Setiawan, P. E. (2011). Pengaruh Persepsi Tentang Sanksi Perpajakan Dan Kesadaran Wajib Pajak Pada Kepatuhan Pelaporan Wajib Pajak Orang Pribadi Di Kantor Pelayanan Pajak Pratama Denpasar Timur. Jurnal Ilmiah Akutansi dan Bisnis, 6(1).

Mulya, I. (2012). Pengaruh Pengetahuan Pajak dan Sanksi Perpajakan terhadap Kepatuhan Pajak di KPP Pratama Cianjur (Survey Ke pada Wajib Pajak Badan) (Skripsi). Universitas Komputer Indonesia, Bandung.

Mutia, S. P. T. (2014). Pengaruh Sanksi Perpajakan, Kesadaran Perpajakan, Pelayanan Fiskus dan Tingkat Pemahaman terhadap Kepatuhan Wajib Pajak Orang Pribadi (Studi Empiris pada Wajib Pajak Orang Pribadi yang Terdaftar di KPP Pratama Padang), 4–29.

Myers, D. G. (1996). Social Psychology. New York: McGraw Hill.

Nasution. (2003). Metode Research (Penelitian Ilmiah). Jakarta: Bumi Aksara.

Notoatmodjo, S. (2003). Pendidikan dan Perilaku Kesehatan. Jakarta: Rineka Cipta.

Nurlaela, S. (2013). Pengaruh Pengetahuan dan Pemahaman, Kesadaran, Persepsi terhadap Kemauan Membayar Pajak Wajib Pajak Orang Pribadi yang Melakukan Pekerjaan Bebas. Jurnal Paradigma, 11(2), 89–101.

Nurmantu, S. (2010). Pengantar Perpajakan. Jakarta: Kelompok Yayasan Obor.

Pajak, D. J. (2018, April 2). Kepatuhan Meningkat, Penyampaian SPT Tumbuh Double Digit. Diambil 1 November 2018, dari http://www. pajak.go.id/kepatuhan-meningkat-penyampaian-spt-tumbuh-double-digit

Palil, M. R. (2010). Tax Knowledge and Tax Compliance Determinants in Self Assessment System in Malaysia (Tesis). The Uiversity of Birmingham, United Kingdom.

Pratiwi, I. G. A. M. A. M. A., & Setiawan, P. E. (2014). Pengaruh Kesadaran Wajib Pajak, Kualitas Pelayanan, Kondisi Keuangan Perusahaan dan Persepsi tentang Sanksi Perpajakan pada Kepatuhan Wajib Pajak Reklame di Dinas Pendapatan Kota Denpasar. E-jurnal Akuntansi Universitas Udayana, 6(1), 139–153.

Pujiwidodo, D. (2016). Persepsi Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak Orang Pribadi. Jurnal Online Insan Akuntan, 1(1), 92–116.

Rahayu, N. (2017). Pengaruh Pengetahuan Perpajakan, Ketegasan Sanksi Pajak, dan Tax Amnesty terhadap Kepatuhan Wajib Pajak. AKUNTANSI DEWANTARA, 1(1), 15–30.

Rahayu, Siti Kurnia. (2010). Perpajakan Indonesia: Konsep dan Aspek Formal. Yogyakarta: Graha Ilmu.

Rahmawati, Rizki and Agung Yulianto. 2018. “Analysis of the Factors Affecting Individual Taxpayers Compliance.” 7(1):17–24.

Rantung, T. V., & Adi, P. H. (2009). Dampak Program Sunset Policy Terhadap Faktor-Faktor yang Mempengaruhi Kemauan Membayar (Studi pada Wajib Pajak Orang Pribadi Pelaku Usaha di Wilayah KPP Pratama Salatiga).

Rohmawati, L., Prasetyono, & Yuni Rimawati. (2012). Pengaruh Sosialisasi dan Pengetahuan Perpajakan Terhadap Tingkat Kesadaran dan Kepatuhan Wajib (Studi pada Wajib Pajak Orang Pribadi yang Melakukan Kegiatan Usaha dan Pekerjaan Bebas pada KPP Pratama Gresik Utara. Portal Artikel Tugas Akhir, 1–17.

Saifuddin, A. (2003). Reliabilitas dan Validitas. Yogyakarta: Sigma Alpha.

Sairi, M., Taufik Kurrohman, & Andriana. (2004). Pengaruh Sikap, Kesadaran Wajib Pajak Dan Pengetahuan Perpajakan Dalam Membayar Pajak Bumi Dan Bangunan Sebagai Pajak Daerah Di Kabupaten Probolinggo. Artikel Ilmiah Mahasiswa. Diambil dari http:// repository.unej.ac.id/handle/123456789/64003

Santoso, W. (2008). Analisis Risiko Ketidakpatuhan Wajib Pajak Sebagai Dasar Peningkatan Kepatuhan Wajib Pajak (Penelitian terhadap Wajib Pajak Badan di Indonesia). Jurnal Keuangan Publik, 85–138.

Sapriadi, D. (2013). Pengaruh Kualitas Pelayanan Pajak, Sanksi Pajak dan Kesadaran Wajib Pajak terhadap Kepatuhan Wajib Pajak dalam Membayar PBB (pada Kecamatan Selupu Rejang).

Sari, A. P., & Wirakusuma, M. G. (2018). Persepsi Tax Amnesty Sebagai Pemoderasi Pengaruh Kesadaran Wajib Pajak dan Sanksi Perpajakan Pada Kepatuhan WPOP. E-jurnal Akuntansi Universitas Udayana, 22(1), 464–491. https:/ /doi.org/10.24843/EJA.2018.v22.i01.p18

Savitri, Enni. 2015. “The Effect of Tax Socialization, Tax Knowledge, Expediency of Tax ID Number and Service Quality on Taxpayers Compliance With Taxpayers Awareness as Mediating Variables.” 211(September):163–69.

Sekaran, U. (2011). Research Methods for Business Edisi 1 dan 2 (1 dan 2). Jakarta: Salemba Empat.

Septarini, D. F. (2015). Pengaruh Pelayanan, Sanksi, dan Kesadaran Wajib Pajak terhadap Kepatuhan Wajib Pajak Orang Pribadi di KPP Pratama Merauke. Jurnal Ilmu Ekonomi dan Sosial, 6(1), 29–43.

Sevilla, C. G. (2007). Research Methods. Queson City: Rex Printing Company.

Simanjuntak, & Mukhlis. (2012). Dimensi Ekonomi Perpajakan dalam Membangun Ekonomi. RAS.

Soekanto, S. (2002). Sosiologi Suatu Pengantar. Jakarta: Raja Grafindo Persada.

Suardika, I. M. S. (2007). Audit Jurnal Akuntansi dan Bisnis (Vol. 2). Denpasar: Fakultas Ekonomi Universitas Udayana.

Sudrajat, A., & Ompusunggu, A. P. (2015). Pemanfaatan teknologi Informasi, Sosialisasi Pajak, Pengetahuan Perpajakan, dan Kepatuhan Pajak. Jurnal Riset Akuntansi dan Perpajakan, 2(2), 193–202.

Susmiatun, & Kusmuriyanto. (2014). Pengaruh Pengetahuan Perpajakan, Ketegasan Sanksi Perpajakan dan Keadilan Perpajakan Terhadap Kepatuhan Wajib Pajak UMKM di Kota Semarang. Accounting Analysis Journal, 3(1), 378–386.

Tawas, V. B. J., Poputra, A. T., & Lambey, R. (2016). Pengaruh Sosialisasi Perpajakan, Tarif Pajak, dan Sanksi Perpajakan Terhadap Kepatuhan Pelaporan SPT Tahunan Wajib Pajak Orang Pribadi (Studi Kasus pada KPP Pratama Bitung). Jurnal Emba, 4(4), 912–921.

Tiraada, T. A. M. (2013). Kesadaran Perpajakan, Sanksi Pajak, Sikap Fiskus Terhadap Kepatuhan WPOP di Kabupaten Minahasa Selatan. Jurnal Emba, 1(3), 999–1008.

Usman, H., & Akbar, P. S. (2003). Metodologi Penelitian Sosial. Jakarta: Bumi Aksara.

Utomo, P. S. (2002). Analisis Faktor-Faktor yang Mempengaruhi Kesadaran Masyarakat

untuk Membayar Pajak Bumi dan Bangunan di Kecamatan Karangtengah Kabupaten Demak (Tesis). Universitas Diponegoro, Semarang.

Wijaya, S., & Arisman, A. (2016). Pengaruh Pengetahuan Pajak, Sanksi Pajak, dan Kesadaran Wajib Pajak terhadap Kepatuhan Wajib Pajak Dengan Kemauan Membayar Pajak Sebagai Intervening (Studi Kasus KPP Pratama Ilir Barat di Kota Palembang). Jurnal Ilmiah, 1–17.

Yusro, H. W., & Kiswanto. (2014). Pengaruh Tarif Pajak, Mekanisme Pembayaran Pajak dan Kesadaran Membayar Pajak Terhadap Kepatuhan Wajib Pajak UMKM di Kabupaten Jepara. Accounting Analysis Journal, 3(4), 429–436.

Zain, M. (2007). Manajemen Perpajakan. Jakarta: Salemba Empat.

Discussion and feedback