The Effect of Intellectual Capital on Firm Performance: A State of the Art

on

Jurnal Ilmiah Akuntansi dan Bisnis

Vol. 18 No. 2, July 2023

AFFILIATION:

1,2,3Faculty of Social and Political Sciences, Universitas Padjadjaran, Indonesia

*CORRESPONDENCE:

fatchatus22001@mail.unpad.ac.id

THIS ARTICLE IS AVAILABLE IN:

DOI:

10.24843/JIAB.2023.v18.i02.p09

CITATION:

Jikhan, F. C., Muftiadi, A. &

Alexandri, M. B. (2023). The Effect of Intellectual Capital on Firm Performance: A State of the Art.

Jurnal Ilmiah Akuntansi dan Bisnis, 18(2) 322-341.

ARTICLE HISTORY

Received:

June 24 2023

Revised:

July 7 2023

Accepted:

July 30 2023

The Effect of Intellectual Capital on Firm Performance: A State of the Art

Fat'Chatus Chanifa Jikhan1*, Anang Muftiadi2, Mohammad Benny

Alexandri3

Abstract

This research scrutinized the impact of intellectual capital on firm performance, identifying pertinent scientific publications using a systematic literature review. The findings reveal an upward annual trend in empirical research concerning the effect of intellectual capital on company performance. Over the past decade, Indonesia has emerged as a dominant contributor to this research. While nine dimensions of intellectual capital have been pinpointed, three specific dimensions are predominantly studied. Research on Small and Medium Enterprises (SMEs) has been a focal point over the last ten years. Additionally, Andreeva & Garanina’s 2016 study stands out as a frequently cited work. Furthermore, the conceptualization of intellectual capital and the evolution of its dimensions were significantly influenced by foundational research. These insights, distilled from the analysis of 35 empirical research articles, enrich the ongoing discourse on intellectual capital and its connection to firm performance. It's noteworthy that human, structural, and relational capital have emerged as dominant dimensions of intellectual capital. This study underscores the importance and prevalence of intellectual capital concepts that various firms leverage to bolster their performance.

Keywords: intellectual capital, firm performance, systematic review

Introduction

Organizations draw their value from intangible, resource-based capabilities, notably intellectual capital (Bansal et al., 2023). Arvidsson (2011) suggests that the value of intellectual assets frequently surpasses that of tangible assets. Corroborating this notion, Corrado et al. (2018) found that intangible assets comprised roughly 40% of the intangible value in the European Union and 60% in the United States. Dost et al. (2016) further highlighted that in the contemporary knowledge-centric era, companies heavily rely on knowledge resources for both survival and growth. Furthermore, Barkat et al. (2018) empirically demonstrated the significant influence of intellectual capital on a company's innovation capability, which Suharman et al. (2022) confirmed has a positive impact on firm performance.

The aim of this research was to undertake a systematic literature review on the influence of intellectual capital on firm performance and to chart the evolution of scientific publications associated with intellectual capital. The selection of firm performance as the dependent variable was

Jikhan, Muftiadi & Alexandri

The Effect of Intellectual Capital on Firm Performance: A State of the Art grounded in its detailed exposition of a company's achievements, which are poised to substantially influence its future value or competitiveness (Meihami et al., 2014).This review was confined to empirical English-language journal articles indexed in Scopus, starting from the early 2000s. Undertaking this research was deemed essential to offer pertinent recommendations for both practitioners and academics regarding the pivotal role of intellectual capital in bolstering a company's bottom line. This was actualized by tracking the evolution of the intellectual capital concept, its various dimensions, and the geographical spread of its proponents.

One notable dimension of intellectual capital is human capital, which is intricately linked to the realization of organizational objectives (Laallam et al., 2022). Human capital encompasses professional training, education, and other initiatives that enrich employees' knowledge, skills, social competencies, and values, all of which synergistically elevate firm performance (Marimuthu et al., 2009). Such insights prompted a deeper exploration of existing literature, spotlighting the relationship between intellectual capital and firm performance.

Since its emergence as a subject of significance in the 1990s, intellectual capital has been meticulously studied and delineated by various scholars to fathom its intricate nuances. Central to this discourse, intellectual capital is predominantly conceived as the assemblage of knowledge and competencies that confer a durable competitive advantage to firms, a sentiment echoed by Roos & Roos (1997), Stewart (1997), and Sullivan (1998). Elaborating on this premise, Stewart (1997) posits that intellectual capital encompasses a vast spectrum, ranging from intellectual property and foundational competencies to indispensable customer affiliations and experiential knowledge that underpin a firm's enduring growth trajectory. In a bid to enrich this conceptual framework, Edvinsson & Malone (1997) and Bontis (1998) proffer that intellectual capital envelops not only applied experiential wisdom and organizational technological acumen but also extends to professional proficiencies and robust customer relationships, challenging the conventional perception of it as a mere static intangible resource. To them, it serves as a dynamic instrument, pivotal for firms to actualize their strategic imperatives. This multifaceted perspective is further complemented by Roos & Roos (1997) who perceive intellectual capital as a holistic aggregation of latent assets vested in a firm's stakeholders. Dzinkowski (2000) encapsulates it as the reservoir of an organization's knowledge-centric assets, whereas Nahapiet & Ghoshal (1998) relate it to the cumulative socio-cognitive capacity of an organization.

The contemporary framework of intellectual capital is generally gauged through three dimensions: human-centered, organization-centered, and relationship-centered (Inkinen, 2015). The human-centered facet pertains to a company's workforce, encompassing their education, skills, proficiencies, and unique traits. The organizationcentered facet encapsulates elements like the organizational structure, knowledge within IT systems, documented knowledge such as intellectual property, databases, and even the layout of buildings. The relationship-centered dimension zeroes in on affiliations with customers, investors, suppliers, communities, and other stakeholders. Inkinen (2015) further posits that, notwithstanding subtle differences, the terminologies used to delineate the facets of intellectual capital share foundational similarities.

Research Method

This study sought to execute a systematic literature review on the subject of intellectual capital and its influence on firm performance, concentrating specifically on empirical research published over the past decade. The review methodology was anchored in the

framework proposed by Denyer & Tranfield (2009), which encompasses the stages of formulating research questions, determining research locations and search strings, selecting and evaluating pertinent documents, and conducting analysis and synthesis. A detailed breakdown of these stages is provided below.

In light of the growing interest in the nexus between intellectual capital and company performance, this research was initiated with the intent to address several salient questions. First, we sought to delineate the annual trajectory of empirical studies focused on the influence of intellectual capital on company outcomes. Secondly, it became imperative to identify the countries that predominantly furnish scholars to this evolving research domain. An additional inquiry centered on discerning the specific dimensions of intellectual capital that have been accentuated in these academic pursuits. We were also keen on understanding which facets of intellectual capital have garnered the lion's share of scholarly attention. Further, an attempt was made to pinpoint the

Table 1. Inclusion and Exclusion Criteria for the Electronic and Manual Screening

No. Inclusion Criteria Exclusion Criteria

-

1 The article focuses on both intellectual capital and company performance.

-

2 The article was conducted empirically using a quantitative approach in the form of a survey.

-

3 Journal articles subjected to peer review to ensure they are trustworthy and of good quality.

-

4 English-language articles because those conducted using foreign languages were not understood.

-

5 The articles conducted within the last 10 years. This was in line with the suggestion of Inkinen (2015) that the development of intellectual capital research was in two phases with each phase covering one decade. However, the recent phase of the last 10 years has not been identified.

-

6 The articles considered relevant through a consensus in the group discussion.

The article only examines one of intellectual capital or company performance.

-

• Articles with qualitative and case

research methods should be exempted because they only provide evidence from a small sample.

-

• Articles conducted using the

accounting approach were also excluded because they used balance sheet figures to calculate the value of intellectual capital. According to Ståhle et al. (2011), such research have been criticized for not having the ability to appropriately analyze the phenomenon of intellectual capital. Documents that are not journal articles or peer reviewed.

Non- English articles

Articles below 2013 are not involved.

The article was not agreed to be relevant to the research in the group discussion.

Source: Processed Data, 2023

primary locus of these investigations. Lastly, an analysis was conducted to ascertain which research articles in this field have amassed the most academic citations.

The Scopus Scientific Publication database was chosen as the primary source for extracting relevant research articles. This preference was influenced by Falagas et al. (2008), who posited that Scopus tends to outperform other scientific databases in terms of search accuracy. Its standing as a preeminent and widely-consulted scientific database further cemented its selection. To streamline the search, specific Boolean search parameters were instituted. The term “intellectual capital” was linked with “company performance” using the Boolean "AND", while the Boolean "OR" was employed to recognize variations of “company performance”. Hence, the search string encapsulated: TITLE-ABS-KEY ("intellectual capital" AND (“firm performance" OR "organizational performance" OR "company performance”)).

Research articles were curated through a combination of digital and manual methods. The selection was guided by an established set of inclusion criteria in Table 1. After the inclusion and exclusion criteria have been determined, an electronic search was conducted on September 15, 2022 and a total of 35 articles were found to be relevant and met the inclusion criteria.

Result and Discussion

The results were discussed based on the research questions, specifically focusing on the annual trend of empirical research examining the effect of intellectual capital on company performance using a quantitative approach.

Figure 1 illustrates an upward trend in research over the past decade, albeit the overall volume remains modest. For instance, a mere single relevant document was recorded in 2015, peaking at nine publications in 2020. The empirical exploration of intellectual capital took root in the 1990s, swiftly ascending as a distinguished and internationally acknowledged research domain. While the field has evolved, its foundational concepts over the last ten years have largely adhered to early frameworks established by

10

9

8

7

6

5

4

3

2

1

0

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Figure 1. Number of publications on intellectual capital dimensions and company performance per year

Source: Processed Data, 2023

Table 2. Literature Mapping's

|

Author |

Methods |

Research Results |

|

Quantitative research |

Intellectual capital has a substantive and significant impact on performance | |

|

Quantitative research |

Regardless of the industry sector, intellectual capital has a substantive and significant relationship with business performance | |

|

Qualitative research |

The use of intellectual capital affects a company's ability to make a money | |

|

Qualitative research |

Models illustrate the connections between various social capital dimensions and the primary mechanisms and processes required for the creation of intellectual capital | |

|

Qualitative research |

Intellectual capital has become the most important factor in economic life | |

|

Quantitative research |

Intellectual capital such as organizational and social capital influenced various innovative capabilities in organizations | |

|

Quantitative research |

The social interaction and network ties dimensions of social capital relate to increased knowledge acquisition, nevertheless, the relationship quality dimension with knowledge acquisition is inversely correlated | |

|

Quantitative research |

A relatively small group of superior performing firms display elevated levels of organizational, social, and human capital |

Source: Processed Data, 2023

pioneering scholars. Noteworthy contributors to this discourse include Bontis (1998), Bontis et al. (2000), Edvinsson & Malone (1997), Nahapiet & Ghoshal (1998), Stewart (1997), Subramaniam & Youndt (2005), Yli-Renko et al. (2001), and Youndt et al. (2004). Their seminal work underscored the methods by which intellectual capital was assessed and its influence on firm performance, enriching both qualitative and quantitative avenues of inquiry. The literature mapping's findings on publication trends are detailed in the subsequent Table 2.

Table 3 reveals the distribution of the country of origin for scholars, indicating that the concept of intellectual capital has gained significant attention globally. A notable

Table 3. Classification of Research Publications on Intellectual Capital by Geographical Location

|

Continent |

Country |

Author |

|

Asia |

Indonesia |

Foster, Saputra, Johansyah, & Muhammad (2022) Purnomo, Purwandari & Sentosa (2022) Pratama & Innayah (2021) Hapsari, Yadiati, Suharman, & Rosdini (2021) Mahaputra, Wiagustini, Yadnyana, & Artini (2021) Astuti, Chariri, & Rohman (2020) |

|

Vietnam |

Do, Thanh Tam, & Kim-Duc (2022) Nhon, Thong, & Trung (2020) | |

|

Taiwan |

Hu & Lee (2022) | |

|

Malaysia |

Aljuboori, Singh, Haddad, Al-Ramahi, & Ali (2022) | |

|

Hong Kong |

Duodu & Rowlinson (2021) | |

|

Pakistan |

Khattak & Shah (2020) Khalique, Hina, Ramayah, & Shaari (2020) Ahmed, Guozhu, Mubarik, Khan & Khan (2020) Khan, Li, Khan, & Anwar (2019) Barkat, Beh, Ahmed, & Ahmed (2018) | |

|

Iran |

Asiaei, Barani, Bontis, & Arabahmadi (2020) Masoomzadeh, Zakaria, Masrom, & Khademi (2020) Asiaei, Jusoh, & Bontis (2018) Ettehadi & Seyyedi (2016) Asiaei & Jusoh (2015) | |

|

Yemen |

AlQershi, Abas, & Mokhtar (2020) | |

|

Sri Lanka |

Kengatharan (2019) | |

|

Thailand |

Kerdpitak & Jermsittiparsert (2019) | |

|

Arabic |

Farah & Abouzeid (2017) | |

|

Africa |

Algeria |

Laallam, Uluyol, Kassim, & Engku (2022) |

|

North |

Dominican |

Gómez-Valenzuela (2022) |

|

America |

Republic | |

|

Mexico |

Ibarra-Cisneros, Hernández-Perlines, & Rodríguez-García (2020) | |

|

United States of America |

McDowell, Peake, Coder, & Harris (2018) | |

|

South |

Argentina |

Beltramino, Garcia-Perez-de-Lema, & Valdez- |

|

America |

Juarez (2022) | |

|

Europe |

Spain |

Ramírez, Dieguez-Soto, & Manzaneque (2021) |

|

Portugal |

Mata, Aftab, Martins, Aslam, Majeed, Correia, & Rita 2021) | |

|

Croatia |

Dabić, Lažnjak, Smallbone, & Švarc (2019) | |

|

Russia |

Andreeva & Garanina (2017) Andreeva & Garanina (2016) |

Source: Processed Data, 2023

surge in research over the past decade has emerged from Asia and Europe, with additional contributions from Africa, North America, and South America. Indonesia stands out with six articles, while Pakistan and Iran follow with five each. This data highlights a shift in the research landscape, suggesting that intellectual capital research is no longer predominantly anchored in the US and the UK, as was observed in the early 2000s.

Over the past decade, Indonesia has led the research in this field, contributing a significant 17.14%. Following closely are Pakistan and Iran, each accounting for 14.28% of the studies. Meanwhile, countries like Taiwan, Malaysia, Hong Kong, Yemen, Sri Lanka, Thailand, Arabia, Algeria, Dominican Republic, Mexico, USA, Argentina, Spain, Portugal, and Croatia have seen less emphasis in this realm, each contributing a mere 2.85% to the research during the same period.

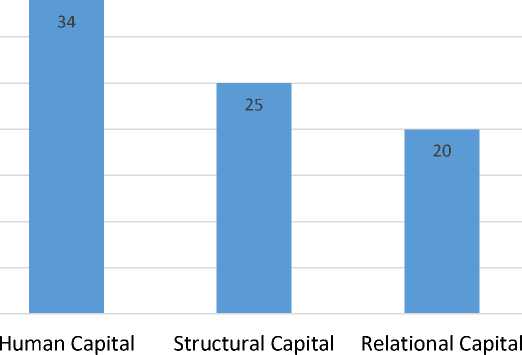

The primary goal of this research was to map the evolution of empirical studies on intellectual capital over time. Figure 3 illustrates that a majority of these studies traditionally used three dimensions to define the concept. However, the last decade has seen an expansion in the understanding of intellectual capital, acknowledging a total of nine dimensions: human, structural, relational, spiritual, social, technology, organizational, information, and customer capital. It's worth noting that while organizational and structural capital have often been used interchangeably in past research, this study differentiates between them, following the recommendations of Inkinen (2015).

Human capital is characterized as the intellectual capacity inherent in individuals within an organization. Indicators of human capital encompass aspects like training, both formal and non-formal education, specialized workers, tenure of employees, human resource policies, risk-taking initiatives, employee engagement and creativity, turnover rates, skill sets of organizational members, their experience, innovation capabilities, loyalty, and motivation for growth (Aljuboori et al., 2022; Andreeva & Garanina, 2016, 2017; Asiaei & Jusoh, 2015; Beltramino et al., 2022; Gómez-Valenzuela, 2022; Hu & Lee, 2022; Laallam et al., 2022). These facets, intrinsically linked to the knowledge, skills, and attitudes of employees, can potentially enhance firm performance through the optimization of human capital.

Structural or organizational capital encompasses those organizational elements that bolster human capital in action. Aljuboori et al. (2022) delineated indicators such as organizational operations, workflow protocols, organizational culture, work ambiance, and the firm's agility in market responsiveness. Such indicators hold the potential to bolster a company's intellectual capital, thereby enhancing firm performance. Further components of structural capital include documentation, advancements in information

40

35

30

25

20

15

10

5

0

Figure 3. Different dimensions of intellectual capital identified

Source: Processed Data, 2023

and communication technology, systematic procedures, data management, intellectual property rights, research and development initiatives, management best practices, and the specialized knowledge repositories of the organization (Andreeva & Garanina, 2016, 2017; Asiaei & Jusoh, 2015; Gómez-Valenzuela, 2022).

Relational capital refers to the knowledge inherent in an organization's relationships with external entities. This includes associations with clients, suppliers, governmental and non-governmental bodies, the organization's public image, partnerships, distribution channels, customers, and other pertinent stakeholders (Aljuboori et al., 2022; Andreeva & Garanina, 2016; Asiaei & Jusoh, 2015; Gómez-Valenzuela, 2022).

Appendix 2 highlights that empirical studies on intellectual capital over the past decade have mainly focused on the dimensions of human, structural, and relational capital. These foundational dimensions, first conceptualized by scholars like Edvinsson & Malone (1997) and Stewart (1997), remain central to intellectual capital research. Intriguingly, the dimension of spiritual capital has gained traction in recent years, as evidenced in journal articles by Ettehadi & Seyyedi (2016), Khalique et al. (2020), and Laallam et al. (2022).

Table 5 shows that the bulk of research conducted over the past decade has been primarily focused on SMEs, indicating that the intellectual capital within these enterprises carries distinct characteristics that both scholars and practitioners find compelling enough to document in academic literature. This focus on SMEs is pervasive across various cultural and economic landscapes. In contrast, Woodcock & Whiting (2009) argued that companies in high IC-intensive industries such as automobiles and components, banking, capital goods, commercial services and supplies, consumer services, diversified financials, health care equipment and services, insurance, media, real estate, software and services, telecommunications services, technology hardware and equipment, as well as pharmaceuticals, biotechnology, and life sciences have been the primary subjects of intellectual capital research.

Over the past decade, SMEs emerged as the primary focus, contributing 20% to this research. Multi-industry was the next dominant sector, accounting for 14.28%, followed closely by SOEs and manufacturing, each contributing 8.57%. Other sectors such as MSME, export trade, construction contracting, automotive, pharmacy, textiles, and various organizations were less frequently studied, each making up just 2.85% of the research during this period.

Appendix 3 highlights that the research article by Andreeva & Garanina (2016) is particularly prominent in the Scopus database (https://www.scopus.com/), boasting 92 citations. Their study, focusing on Russian manufacturing firms, concluded that while structural and human capital positively affected organizational performance, relational capital did not have the same impact. This conclusion has since sparked extensive discussions in the scholarly community globally. Nevertheless, there seems to be limited dialogue on additional dimensions such as spiritual capital, as reflected by the fewer citations related to this aspect.

McDowell et al.'s (2018) article notably bolstered discussions on the relationship between intellectual capital and company performance, particularly within the SME sector. Their conclusions posited that efficiently organizing and utilizing skilled, innovative personnel results in enhanced company performance. When contrasting the citation counts of intellectual capital research from the past decade with those from earlier years, a notable difference emerges. Recent research on intellectual capital frequently cites earlier studies, underscoring the foundational role of these earlier works in evolving the discourse on intellectual capital's influence on firm performance.

Table 5. Classification of Research Publications on Intellectual Capital by Locus

|

Location |

Country |

Author |

|

Multi-Industry |

Vietnam |

Do, Thanh Tam, & Kim-Duc (2022) |

|

Iran |

Asiaei, Barani, Bontis, & Arabahmadi (2020) | |

|

Sri Lanka |

Asiaei, Jusoh, & Bontis (2018) Kengatharan (2019) | |

|

Algeria |

Laallam, Uluyol, Kassim, & Engku (2022) | |

|

Dominican |

Gómez-Valenzuela (2022) | |

|

SMEs |

Republic Malaysia |

Aljuboori, Singh, Haddad, Al-Ramahi, & Ali (2022) |

|

Pakistan |

Khattak & Shah (2020) | |

|

Yemen |

Khalique, Hina, Ramayah, & Shaari (2020) Khan, Li, Khan, & Anwar (2019) AlQershi, Abas, & Mokhtar (2020) | |

|

United States |

McDowell, Peake, Coder, & Harris (2018) | |

|

of America Argentina |

Beltramino, Garcia-Perez-de-Lema, & Valdez-Juarez | |

|

Spain |

(2022) Ramírez, Dieguez-Soto, & Manzaneque (2021) | |

|

Croatia |

Dabić, Lažnjak, Smallbone, & Švarc (2019) | |

|

MSME |

Indonesia |

Purnomo, Purwandari & Sentosa (2022) |

|

Industry |

Taiwan |

Hu & Lee (2022) |

|

Export Trade SOE |

Indonesia |

Foster, Saputra, Johansyah, & Muhammad (2022) |

|

Iran |

Hapsari, Yadiati, Suharman, & Rosdini (2021) Asiaei & Jusoh (2015) | |

|

Arabic |

Farah & Abouzeid (2017) | |

|

High-tech |

Indonesia |

Pratama & Innayah (2021) |

|

Industry |

Vietnam |

Nhon, Thong, & Trung (2020) |

|

Finance |

Indonesia |

Mahaputra, Wiagustini, Yadnyana, & Artini (2021) |

|

Portugal |

Astuti, Chariri, & Rohman (2020) Mata, Aftab, Martins, Aslam, Majeed, Correia, & | |

|

Construction |

Hong Kong |

Rita (2021) Duodu & Rowlinson (2021) |

|

Contractor Manufacturing |

Pakistan |

Ahmed, Guozhu, Mubarik, Khan & Khan (2020) |

|

Mexico |

Ibarra-Cisneros, Hernández-Perlines, & Rodríguez- | |

|

Russia |

García (2020) Andreeva & Garanina (2017) | |

|

Automotive |

Iran |

Andreeva & Garanina (2016) Masoomzadeh, Zakaria, Masrom, & Khademi |

|

Pharmacy |

Thailand |

(2020) Kerdpitak & Jermsittiparsert (2019) |

|

Textiles |

Pakistan |

Barkat, Beh, Ahmed, & Ahmed (2018) |

|

Organization |

Iran |

Ettehadi & Seyyedi (2016) |

Source: Processed Data, 2023

Notably, several Indonesian papers, including those by Astuti et al. (2020), Foster et al. (2022), Hapsari et al. (2021), Pratama & Innayah (2021), and Purnomo et al. (2022), have yet to be cited. These studies span various sectors, such as SOEs, MSMEs, high-tech

industries, and finance, but focus exclusively on Indonesian companies or institutions. As such, these articles offer valuable insights into the dynamics of intellectual capital and firm performance in Indonesia, potentially aiding future researchers exploring the Indonesian corporate landscape.

The study examining the impact of intellectual capital on company performance has unfolded over more than three decades, with Inkinen (2015) outlining its trajectory. The late 1990s, often considered the inaugural decade, witnessed groundbreaking contributions from scholars such as Edvinsson & Malone (1997), Roos & Roos (1997), Stewart (1997), Sveiby (1997), Bontis (1998), Nahapiet & Ghoshal (1998), and Sullivan (1998). Moving into the second decade, from the 2000s to 2010, there was a considerable expansion in the discourse. As showcased in Table 2, researchers identified nine distinct dimensions of intellectual capital in intrapreneurial settings. This growth is particularly significant when compared to the previous decade's research, which was largely limited to just three dimensions. Notably, this decade heralded the introduction of spiritual capital while witnessing a decline in the emphasis on innovation capital.

Since the early 2000s, there has been a growing scholarly focus on the relationship between intellectual capital and firm performance. A systematic literature review, the results of which can be found in the appendix, traces the evolution of various measurement models associated with this concept. This investigation underscores that the central research question, "Does intellectual capital consistently influence firm performance?" cannot be answered with a straightforward "yes."

Interplay of Intellectual Capital Dimensions: The synergy among the dimensions of intellectual capital seems pivotal in steering firm performance. Some studies underscored human capital as vital in establishing an organizational reservoir of knowledge, thereby bolstering performance. Others proposed that melding individual knowledge with an effective external network offers the optimal blueprint for success. Structural capital surfaced as pivotal, acting as a conduit for harnessing both human and relational capital. These insights coalesce around the idea that standalone elements, be they employees, infrastructural supports, or external relationships, offer limited value. However, their integrated form can significantly propel firm performance. Thus, it was discerned that firms with a robust intellectual capital profile tend to outperform their counterparts that are deficient in intellectual capital. For enhanced performance, firms should, therefore, focus on bolstering their composite intellectual capital (Inkinen, 2015).

An expanding corpus of evidence posits that firm performance metrics are shaped through the intermediation between intellectual capital and an array of factors. Some studies designate intellectual capital as the underpinning for certain organizational proficiencies. Conversely, others ascertain that organizational and managerial constructs, such as HR management and cross-functional engagements, lay the groundwork for the nurturing of intellectual capital, which then segues into firm performance. Additionally, both a firm's intellectual property and its entrepreneurial orientation were discerned to mutually reinforce intellectual capital. Competitive advantage was also spotlighted as a possible mediating factor. The overarching takeaway, buttressed by the data, is that the myriad capabilities, undertakings, assets, and organizational orientations are instrumental in decrypting the influence of intellectual capital on firm performance (Inkinen, 2015).

Conclusion

In conclusion, the examination of empirical research on intellectual capital reveals two prominent themes regarding its impact on firm performance. Firstly, interactions and combinations of intellectual capital dimensions are pivotal in enhancing firm

performance. Secondly, the nexus between intellectual capital and firm performance is most coherently elucidated through mediating models. Notably, this study didn't unearth substantial empirical evidence linking intellectual capital to corporate innovation performance and other innovative facets. This perspective concurs with the consensus of the 35 pertinent English-language journal articles reviewed, which collectively eschewed the inclusion of innovation capital as a facet of intellectual capital. Key findings encompass an escalating annual trend of empirical studies on the effect of intellectual capital on company performance, Indonesia's preeminence in the past decade's intellectual capital research, the identification of nine intellectual capital dimensions with three being predominantly examined, SMEs emerging as the primary research focus in the last decade, and the prevalent citation of Andreeva & Garanina’s (2016) research.

This investigation enriches the discourse on intellectual capital and firm performance by dissecting 35 empirical studies. A pivotal takeaway is the current ninedimensional discourse on intellectual capital, marking a progression from the trinity of dimensions prevalent in the earlier research epoch. Additionally, intellectual capital's influence on firm performance principally materializes through its interaction, amalgamation, and mediation. Furthermore, early research indelibly stamps the conceptual framework and empirical measurement paradigms of intellectual capital. An upsurge in empirical intellectual capital research is evinced both by annual publication counts and by its global footprint. However, a recent dip in article outputs signals a potential ebbing in reader interest.

This study's primary limitation is its exclusive reliance on the Scopus academic database. Incorporating other databases like Google Scholar and Web of Science might have provided a more nuanced perspective. Employing different analytical techniques, such as the Systematic Mapping Study (SMS) or bibliographic analysis, could offer a broader understanding. The research's temporal focus is restricted to the last decade, which only partially captures the evolution of intellectual capital research. Even though intellectual capital research can be divided into two primary periods, this study centers mainly on the 2013-2022 timeframe, overlooking insights from the early 2000s. Future research could address this limitation by integrating the formative phase, presenting a more holistic overview of the subject's evolution.

References

Ahmed, S. S., Guozhu, J., Mubarik, S., Khan, M., & Khan, E. (2020). Intellectual capital and business performance: the role of dimensions of absorptive capacity. Journal of Intellectual Capital, 21(1), 23–39. https://doi.org/10.1108/JIC-11-2018-0199

Aljuboori, Z. M., Singh, H., Haddad, H., Al-Ramahi, N. M., & Ali, M. A. (2022). Intellectual Capital and Firm Performance Correlation: The Mediation Role of Innovation Capability in Malaysian Manufacturing SMEs Perspective. Sustainability (Switzerland), 14(1). https://doi.org/10.3390/su14010154

AlQershi, N., Abas, Z. B., & Mokhtar, S. S. M. (2020). Investigating The Influence Of Intellectual Capital Dimensions Practices On Smes Performance. Academy of Entrepreneurship Journal, 26(2), 1–7.

Andreeva, T., & Garanina, T. (2016). Do all elements of intellectual capital matter for organizational performance? Evidence from Russian context. Journal of Intellectual Capital, 17(2), 397–412. https://doi.org/10.1108/JIC-07-2015-0062

Andreeva, T., & Garanina, T. (2017). Intellectual capital and its impact on the financial performance of Russian manufacturing companies. Foresight and STI Governance, 11(1), 31–40. https://doi.org/10.17323/2500-2597.2017.1.31.40

Arvidsson, S. (2011). Disclosure of non-financial information in the annual report: A management-team perspective. Journal of Intellectual Capital, 12(2), 277–300. https://doi.org/10.1108/14691931111123421

Asiaei, K., Barani, O., Bontis, N., & Arabahmadi, M. (2020). Unpacking the black box: How intrapreneurship intervenes in the intellectual capital-performance relationship? Journal of Intellectual Capital, 21(6), 809–834. https://doi.org/10.1108/JIC-06-2019-0147

Asiaei, K., & Jusoh, R. (2015). A multidimensional view of intellectual capital: The impact on organizational performance. Management Decision, 53(3), 668–697.

https://doi.org/10.1108/MD-05-2014-0300

Asiaei, K., Jusoh, R., & Bontis, N. (2018). Intellectual capital and performance measurement systems in Iran. Journal of Intellectual Capital, 19(2), 294–320. https://doi.org/10.1108/JIC-11-2016-0125

Astuti, P. D., Chariri, A., & Rohman, A. (2020). Investigation of Intellectual Capital and Organisational Performance in Supply Chain Management: Modification of the Diamond Specification Model. International Journal of Supply Chain Management, 9(2), 677–684.

Bansal, S., Garg, I., Jain, M., & Yadav, A. (2023). Improving the performance/competency of small and medium enterprises through intellectual capital. Journal of Intellectual Capital, 24(3), 830–853. https://doi.org/10.1108/JIC-07-2021-0189

Barkat, W., Beh, L. S., Ahmed, A., & Ahmed, R. (2018). Impact of intellectual capital on innovation capability and organizational performance: An empirical investigation. Serbian Journal of Management, 13(2), 365–379.

https://doi.org/10.5937/sjm13-16997

Beltramino, N. S., Garcia-Perez-de-Lema, D., & Valdez-Juarez, L. E. (2022). The role of intellectual capital on process and products innovation. Empirical study in SMEs in an emerging country. Journal of Intellectual Capital, 23(4), 741–764.

https://doi.org/10.1108/JIC-07-2020-0234

Bontis, N. (1998). Intellectual capital: an exploratory study that develops measures and models. Management Decision, 36(2), 63–76.

Bontis, N., Keow, W. C. C., & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1), 85– 100. https://doi.org/10.1108/14691930010324188

Corrado, C., Haskel, J., Jona-Lasinio, C., & Iommi, M. (2018). Intangible investment in the EU and US before and since the Great Recession and its contribution to productivity growth. Journal of Infrastructure, Policy and Development, 2(1). https://doi.org/10.24294/jipd.v2i1.205

Dabić, M., Lažnjak, J., Smallbone, D., & Švarc, J. (2019). Intellectual capital, organisational climate, innovation culture, and SME performance: Evidence from Croatia. Journal of Small Business and Enterprise Development, 26(4), 522–544. https://doi.org/10.1108/JSBED-04-2018-0117

Denyer, D., & Tranfield, D. (2009). Producing a systematic review.

Do, M. H., Thanh Tam, V., & Kim-Duc, N. (2022). Investigating intellectual capital: The role of intellectual property rights reform. Cogent Economics and Finance, 10(1). https://doi.org/10.1080/23322039.2022.2106630

Dost, M., Badir, Y. F., Ali, Z., & Tariq, A. (2016). The impact of intellectual capital on innovation generation and adoption. Journal of Intellectual Capital, 17(4), 675– 695. https://doi.org/10.1108/JIC-04-2016-0047

Duodu, B., & Rowlinson, S. (2021). Intellectual Capital, Innovation, and Performance in Construction Contracting Firms. Journal of Management in Engineering, 37(1). https://doi.org/10.1061/(asce)me.1943-5479.0000864

Dzinkowski, R. (2000). The Measurement and Management of Intellectual Capital.

Management Accounting, 78(2), 32–36.

https://www.researchgate.net/publication/247931350

Edvinsson, L., & Malone, M. S. (1997). Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower. Harper Business.

Ettehadi, S., & Seyyedi, M. H. (2016). Study of Effect of Intellectual Capital on Organizational Performance in Iranian Organizations. Social Sciences (Pakistan), 11(24), 5969–5972. https://doi.org/10.3923/sscience.2016.5969.5972

Falagas, M. E., Pitsouni, E. I., Malietzis, G. A., & Pappas, G. (2008). Comparison of PubMed, Scopus, Web of Science, and Google Scholar: strengths and weaknesses. The FASEB Journal, 22(2), 338–342. https://doi.org/10.1096/fj.07-9492LSF

Farah, A., & Abouzeid, S. (2017). The impact of intellectual capital on performance: Evidence from the public sector. Knowledge Management & E-Learning, 9(2), 225–238.

Foster, B., Saputra, J., Johansyah, M. D., & Muhammad, Z. (2022). Do intellectual capital and environmental uncertainty affect firm performance? A mediating role of value chain. Uncertain Supply Chain Management, 10(3), 1055–1064. https://doi.org/10.5267/j.uscm.2022.2.006

Gómez-Valenzuela, V. (2022). Intellectual capital factors at work in Dominican firms: understanding their influence. Journal of Innovation and Entrepreneurship, 11(1). https://doi.org/10.1186/s13731-022-00205-8

Hapsari, D. W., Yadiati, W., Suharman, H., & Rosdini, D. (2021). Intellectual Capital and Environmental Uncertainty on Firm Performance: The mediating role of the value chain. Quality - Access to Success, 22(185), 169–176.

https://doi.org/10.47750/QAS/22.185.23

Hu, Y. P., & Lee, C. M. (2022). Impact of Intellectual Capital on International Trade: Knowledge Management and Business Processes as Intermediaries.

International Journal of Innovative Research and Scientific Studies, 5(2), 101– 111. https://doi.org/10.53894/ijirss.v5i2.396

Ibarra-Cisneros, M. A., Hernández-Perlines, F., & Rodríguez-García, M. (2020). Intellectual capital, organisational performance and competitive advantage. European Journal of International Management, 14(6), 976–998.

Inkinen, H. (2015). Review of empirical research on intellectual capital and firm performance. Journal of Intellectual Capital, 16(3), 518–565.

https://doi.org/10.1108/JIC-01-2015-0002

Kengatharan, N. (2019). A knowledge-based theory of the firm: Nexus of intellectual capital, productivity and firms’ performance. International Journal of Manpower, 40(6), 1056–1074. https://doi.org/10.1108/IJM-03-2018-0096

Kerdpitak, C., & Jermsittiparsert, K. (2019). Investigating the role of intellectual capital on the performance of pharmaceutical firms in Thailand. Systematic Reviews in Pharmacy, 10(2), 244–252. https://doi.org/10.5530/srp.2019.2.33

Khalique, M., Hina, K., Ramayah, T., & Shaari, J. A. N. bin. (2020). Intellectual capital in tourism SMEs in Azad Jammu and Kashmir, Pakistan. Journal of Intellectual Capital, 21(3), 333–355. https://doi.org/10.1108/JIC-11-2018-0206

Khan, N. U., Li, S., Khan, S. Z., & Anwar, M. (2019). Entrepreneurial orientation, intellectual capital, IT capability, and performance. Human Systems Management, 38(3), 297–312. https://doi.org/10.3233/HSM-180393

Khattak, M. S., & Shah, S. Z. A. (2020). The role of intellectual and financial capital in competitiveness and performance: A study of emerging small and medium enterprises. Business Strategy and Development, 3(4), 422–434. https://doi.org/10.1002/bsd2.106

Laallam, A., Uluyol, B., Kassim, S., & Engku Ali, E. R. A. (2022). The components of intellectual capital and organisational performance in waqf institutions: evidence from Algeria based on structural equation modelling. Journal of Islamic Accounting and Business Research, 13(7), 1110–1136. https://doi.org/10.1108/JIABR-07-2021-0192

Mahaputra, I. N. K. A., Wiagustini, N. L. P., Yadnyana, I. K., & Artini, N. L. G. S. (2021). Organization Behavior, Intellectual Capital, and Performance: A Case Study of Microfinance Institutions in Indonesia. Journal of Asian Finance, Economics and Business, 8(4), 549–561. https://doi.org/10.13106/jafeb.2021.vol8.no4.0549

Marimuthu, M., Arokiasamy, L., & Ismail, M. (2009). Human Capital Development And Its Impact On Firm Performance: Evidence From Developmental Economics. The Journal of International Social Research, 2(8).

Masoomzadeh, A., Zakaria, W. N. W., Masrom, M., & Khademi, T. (2020). Intellectual Capital as Key Asset in Iranian Automotive Industry. Journal of Environmental Treatment Techniques, 8(1), 429–439.

Mata, M. N., Aftab, H., Martins, J. M., Aslam, S., Majeed, M. U., Correia, A. B., & Rita, J.

X. (2021). The role of Intellectual capital in shaping Business performance: Mediating role of Innovation and Learning. Academy of Strategic Management Journal, 20(2). https://www.researchgate.net/publication/353342628

McDowell, W. C., Peake, W. O., Coder, L. A., & Harris, M. L. (2018). Building small firm performance through intellectual capital development: Exploring innovation as the “black box.” Journal of Business Research, 88, 321–327. https://doi.org/10.1016/j.jbusres.2018.01.025

Meihami, B., Varmaghani, Z., & Meihami, H. (2014). Role of Intellectual Capital on Firm Performance (Evidence from Iranian Companies) . International Letters of Social and Humanistic Sciences, 1(1), 43–50.

Nahapiet, J., & Ghoshal, S. (1998). Social Capital, Intellectual Capital, And The Organizational Advantage. Academy of Management Review, 23(2), 242–266.

Nhon, H. T., Thong, B. Q., & Trung, N. Q. (2020). The effects of intellectual capital on information communication technology firm performance: A moderated mediation analysis of environmental uncertainty. Cogent Business and Management, 7(1). https://doi.org/10.1080/23311975.2020.1823584

Pratama, B. C., & Innayah, M. N. (2021). Can family ownership strengthen the relationship between intellectual capital and performance in asean high-tech firms? International Journal of Business and Society, 22(3), 1102–1122. https://doi.org/10.33736/ijbs.4286.2021

Purnomo, S., Purwandari, S., & Sentosa, I. (2022). Sustainability MSMEs Performance and Income Distribution: Role of Intellectual Capital and Strategic Orientations. Journal of Distribution Science, 20(4), 85–94. https://doi.org/10.15722/jds.20.04.202204.85

Ramírez, Y., Dieguez-Soto, J., & Manzaneque, M. (2021). How does intellectual capital efficiency affect firm performance? The moderating role of family management. International Journal of Productivity and Performance Management, 70(2), 297– 324. https://doi.org/10.1108/IJPPM-03-2019-0119

Roos, G., & Roos, J. (1997). Measuring your Company’s Intellectual Performance. Long Range Planning, 30(3), 413–426.

Ståhle, P., Ståhle, S., & Aho, S. (2011). Value added intellectual coefficient (VAIC): a critical analysis. Journal of Intellectual Capital, 12(4), 531–551.

https://doi.org/10.1108/14691931111181715

Stewart, T. A. (1997). Intellectual Capital: The New Wealth of Organizations. Bantam Doubleday Dell Publishing Group. Inc.

Subramaniam, M., & Youndt, M. A. (2005). The Influence of Intellectual Capital on the Types of Innovative Capabilities. The Academy of Management Journal, 48(3), 450–463.

Suharman, H., Alipudin, A., & Hidayah, N. (2022). Corporate Social Responsibility, Intellectual Capital, and Corporate Performance in State-Owned Enterprises. Quality - Access to Success, 23(189), 26–32.

https://doi.org/10.47750/QAS/23.189.04

Sullivan, P. H. (1998). Profiting from intellectual capital: Extracting value from innovation. John Wiley & Sons.

Sveiby, K. E. (1997). The new organizational wealth: Managing & measuring knowledgebased assets. Berrett-Koehler Publishers.

Woodcock, J., & Whiting, R. H. (2009). Intellectual Capital Disclosures by Australian Companies. AFAANZ Conference.

Yli-Renko, H., Autio, E., & Sapienza, H. J. (2001). Social capital, knowledge acquisition, and knowledge exploitation in young technology-based firms. Strategic Management Journal, 22(6–7), 587–613. https://doi.org/10.1002/smj.183

Youndt, M. A., Subramaniam, M., & Snell, S. A. (2004). Intellectual Capital Profiles: An Examination of Investments and Returns. Journal of Management Studies, 41(2), 335–361.

Appendix

Appendix 1. Literature Selection Process

Steps

Meeting Inclusion Criteria (Inclusion)

Not Meeting Inclusion Criteria (Inclusion)

|

Step 1 Execute search string on area, title, abstract and keywords |

----► |

Found 555 potentially relevant documents | ||

|

Documents with the types conference paper (86), book chapter (22), review (14), conference review (4), book (2), editorial (22), retracted (2) and erratum (1) did not exist in the study | ||||

|

Step 2 The document type is restricted to articles I |

422 documents with article type were found | |||

|

Step 3 The source type is limited to journal articles | ||

|

---► |

404 English-language journal article documents were found | |

Documents with the source types conference proceedings (4), book series (2), and undefined (1) were not included in the research

|

Step 4 Language is limited to journal articles in English |

---► |

422 documents with article type were found |

---► |

Step 5 Publication time is limited to the last 10 years

Other documents in Spanish (8), Persian (2), Chinese (1), French (1), German (1) and Portuguese (1) were not included

|

Found 324 English journal article documents |

Step 6

Document screening was done manually.

Inclusion criteria performed at this stage are (a) elimination of articles that are not relevant to research on intellectual capital. (b) elimination of articles that do not examine the relationship between intellectual capital and company performance.

(c) elimination of conceptual research (e.g. literature review, framework or just the results of writing without research in the field) while empirical research (e.g. research, surveys and interviews that are research in the field) that has informants and respondents who are indicators will be included.

Other documents below 2013 were not included

|

After reading the abstracts, 289 English-language journal articles were excluded because they did not meet the criteria | |||

|

---► |

35 relevant English-language journal article documents were found and agreed upon |

----► | |

|

Argentina |

Beltramino, Garcia-Perez-de-Lema, & Valdez-Juarez (2022) | |

|

Spain |

Ramírez, Dieguez-Soto, & Manzaneque (2021) | |

|

Portugal |

Mata, Aftab, Martins, Aslam, Majeed, Correia, & Rita (2021) | |

|

Croatia |

Dabić, Lažnjak, Smallbone, & Švarc (2019) | |

|

Russia |

Andreeva & Garanina (2017) | |

|

Andreeva & Garanina (2016) | ||

|

Structural |

Indonesia |

Foster, Saputra, Johansyah, & Muhammad (2022) |

|

Capital |

Pratama & Innayah (2021) | |

|

Hapsari, Yadiati, Suharman, & Rosdini (2021) | ||

|

Mahaputra, Wiagustini, Yadnyana, & Artini (2021) | ||

|

Astuti, Chariri, & Rohman (2020) |

|

Vietnam |

Do, Thanh Tam, & Kim-Duc (2022) | |

|

Malaysia |

Aljuboori, Singh, Haddad, Al-Ramahi, & Ali (2022) | |

|

Pakistan |

Khalique, Hina, Ramayah, & Shaari (2020) | |

|

Khan, Li, Khan, & Anwar (2019) | ||

|

Iran |

Asiaei, Barani, Bontis, & Arabahmadi (2020) | |

|

Masoomzadeh, Zakaria, Masrom, & Khademi (2020) | ||

|

Asiaei, Jusoh, & Bontis (2018) | ||

|

Ettehadi & Seyyedi (2016) | ||

|

Asiaei & Jusoh (2015) | ||

|

Yemen |

AlQershi, Abas, & Mokhtar (2020) | |

|

Thailand |

Kerdpitak & Jermsittiparsert (2019) | |

|

Algeria |

Laallam, Uluyol, Kassim, & Engku (2022) | |

|

Dominican Republic |

Gómez-Valenzuela (2022) | |

|

Mexico |

Ibarra-Cisneros, Hernández-Perlines, & Rodríguez-García (2020) | |

|

Argentina |

Beltramino, Garcia-Perez-de-Lema, & Valdez-Juarez (2022) | |

|

Spain |

Ramírez, Dieguez-Soto, & Manzaneque (2021) | |

|

Portugal |

Mata, Aftab, Martins, Aslam, Majeed, Correia, & Rita (2021) | |

|

Croatia |

Dabić, Lažnjak, Smallbone, & Švarc (2019) | |

|

Russia |

Andreeva & Garanina (2017) | |

|

Andreeva & Garanina (2016) | ||

|

Relational |

Indonesia |

Foster, Saputra, Johansyah, & Muhammad (2022) |

|

Capital |

Hapsari, Yadiati, Suharman, & Rosdini (2021) | |

|

Mahaputra, Wiagustini, Yadnyana, & Artini (2021) | ||

|

Vietnam |

Do, Thanh Tam, & Kim-Duc (2022) | |

|

Malaysia |

Aljuboori, Singh, Haddad, Al-Ramahi, & Ali (2022) | |

|

Hong Kong |

Duodu & Rowlinson (2021) | |

|

Pakistan |

Khan, Li, Khan, & Anwar (2019) | |

|

Barkat, Beh, Ahmed, & Ahmed (2018) | ||

|

Iran |

Asiaei, Barani, Bontis, & Arabahmadi (2020) | |

|

Masoomzadeh, Zakaria, Masrom, & Khademi (2020) | ||

|

Asiaei, Jusoh, & Bontis (2018) | ||

|

Asiaei & Jusoh (2015) | ||

|

Yemen |

AlQershi, Abas, & Mokhtar (2020) | |

|

Thailand |

Kerdpitak & Jermsittiparsert (2019) | |

|

Dominican Republic |

Gómez-Valenzuela (2022) | |

|

Mexico |

Ibarra-Cisneros, Hernández-Perlines, & Rodríguez-García (2020) | |

|

Portugal |

Mata, Aftab, Martins, Aslam, Majeed, Correia, & Rita (2021) | |

|

Croatia |

Dabić, Lažnjak, Smallbone, & Švarc (2019) | |

|

Russia |

Andreeva & Garanina (2017) |

Andreeva & Garanina (2016)

Source: Processed Data, 2023

Appendix 3. Classification of the Number of Citations Number

|

of citations |

Country |

Industry |

Author |

|

92 |

Russia |

Manufacturing |

Andreeva & Garanina (2016) |

|

90 |

United States of America |

SMEs |

McDowell, Peake, Coder, & Harris (2018) |

|

80 |

Iran |

SOE |

Asiaei & Jusoh (2015) |

|

67 |

Iran |

Multi-Industry |

Asiaei, Jusoh, & Bontis (2018) |

|

63 |

Croatia |

SMEs |

Dabić, Lažnjak, Smallbone, & Švarc (2019) |

|

44 |

Pakistan |

Manufacturing |

Ahmed, Guozhu, Mubarik, Khan & Khan (2020) |

|

35 |

Sri Lanka |

Multi-Industry |

Kengatharan (2019) |

|

25 |

Iran |

Multi-Industry |

Asiaei, Barani, Bontis, & Arabahmadi (2020) |

|

17 |

Pakistan |

SMEs |

Khalique, Hina, Ramayah, & Shaari (2020) |

|

16 |

Spain |

SMEs |

Ramírez, Dieguez-Soto, & Manzaneque (2021) |

|

14 |

Pakistan |

SMEs |

Khan, Li, Khan, & Anwar (2019) |

|

13 |

Pakistan |

Textiles |

Barkat, Beh, Ahmed, & Ahmed (2018) |

|

10 |

Russia |

Manufacturing |

Andreeva & Garanina (2017) |

|

7 |

Malaysia |

SMEs |

Aljuboori, Singh, Haddad, Al-Ramahi, & Ali (2022) |

|

6 |

Hong kong |

Construction Contractor |

Duodu & Rowlinson (2021) |

|

6 |

Thailand |

Pharmacy |

Kerdpitak & Jermsittiparsert (2019) |

|

5 |

Pakistan |

SMEs |

Khattak & Shah (2020) |

|

5 |

Iran |

Automotive |

Masoomzadeh, Zakaria, Masrom, & Khademi (2020) |

|

5 |

Mexico |

Manufacturing |

Ibarra-Cisneros, Hernández-Perlines, & Rodríguez-García (2020) |

|

5 |

Arabic |

SOE |

Farah & Abouzeid (2017) |

|

3 |

Argentina |

SMEs |

Beltramino, Garcia-Perez-de-Lema, & Valdez-Juarez (2022) |

|

3 |

Yemen |

SMEs |

AlQershi, Abas, & Mokhtar (2020) |

|

3 |

Vietnam |

High-tech Industry |

Nhon, Thong, & Trung (2020) |

|

1 |

Portugal |

Finance |

Mata, Aftab, Martins, Aslam, Majeed, Correia, & Rita (2021) |

|

1 |

Indonesia |

Finance |

Mahaputra, Wiagustini, Yadnyana, & Artini (2021) |

|

1 |

Iran |

Organization |

Ettehadi & Seyyedi (2016) |

|

0 |

Dominican Republic |

Multi-Industry |

Gómez-Valenzuela (2022) |

|

0 |

Algeria |

Multi-Industry |

Laallam, Uluyol, Kassim, & Engku (2022) |

|

0 |

Vietnam |

Multi-Industry |

Do, Thanh Tam, & Kim-Duc (2022) |

|

0 |

Taiwan |

Export Trade Industry |

Hu & Lee (2022) |

|

0 |

Indonesia |

SOE |

Foster, Saputra, Johansyah, & Muhammad (2022) |

|

0 |

Indonesia |

MSME |

Purnomo, Purwandari & Sentosa (2022) |

|

0 |

Indonesia |

High-tech Industry |

Pratama & Innayah (2021) |

|

0 |

Indonesia |

SOE |

Hapsari, Yadiati, Suharman, & Rosdini (2021) |

|

0 |

Indonesia |

Finance |

Astuti, Chariri, & Rohman (2020) |

Source: Processed Data, 2023

Jurnal Ilmiah Akuntansi dan Bisnis, 2023 | 341

Discussion and feedback