THE UNITED STATES’ MONETARY POLICY SPILLOVER EFFECT AGAINST RUPIAH -US DOLLAR EXCHANGE DURING USA – CHINA TRADE WAR

on

Vol. 15 No.1, Februari 2022

ISSN : 2301-8968

EKONOMI

KUANTITATIF

TERAPAN

JEKT

The Effect of Banks and Cooperatives in Improving Welfare Inayati Nuraini Dwiputri, Lustina Fajar Prastiwi, Grisvia Agustin

ISSN 2301-8968

Denpasar

Februari 2022

Halaman

1-161

The Role of Social Capital with Local Wisdom in Household Food Security in Bali Province Putu Ayu Pramitha Purwanti, Ida Ayu Nyoman Saskara

Middle Income Trap In A Macroeconomic Perspective A Case Study In Indoensia Apip Supriadi

Trade-Environment Triangle in Indonesia: Ecological Footprint Approach Kuratul Aini, Djoni Hartono

Social And Financial Efficiency Of Lembaga Perkreditan Desa Kajeng Baskara

The The Relationship Between Fiscal Policy And Civil Liberty On Per Capita GDP In Indonesia During 1980-2018

Vita Kartika Sari, Malik Cahyadin

The Effect Of Fiscal Decentralization On Economic Growth: A Study Of The Province Level In Indonesia Setyo Tri Wahyudi, Lutfi Kurniawati

The United States’ Monetary Policy Spillover Effect Against Rupiah -Us Dollar Exchange During Usa – China Trade War

Andryan Setyadharma, Anisa Rahmawati, Anisa Rahmawati

Affecting FactorsTrans Land Function In Bali

I Wayan Sudemen, I Ketut Darma

The General Allocation Fund (DAU) Formulation Policy: Incentives or Disincentives to the Fiscal Independence of Local Governments Kun Haribowo, Latri Wihastuti

Impact Of Rural Development Program On Agriculture Production and Rural-Urban Migration In Indonesia Murjana Yasa, Wayan Sukadana, Luh Gede Meydianawathi

Volume 15 Nomor 1

JEKT ♦ 15 [1] : 43-58

eISSN : 2303 – 0186

THE UNITED STATES’ MONETARY POLICY SPILLOVER EFFECT AGAINST RUPIAH -US DOLLAR EXCHANGE DURING USA – CHINA TRADE WAR

ABSTRACT

The United States (US) and China trade war has resulted in global economic crisis. This causes spillover effects to other countries due to the policies imposed by the two big countries. The objective of the research is to analyze the impact of Fed Fund Rate, as the monetary policy of the US, as well as other variables on the Rupiah -US Dollar Exchange Rate. The method used in this analysis is the Error Correction Model with time series data with period of 22 March 2018 – 16 January 2020. The result indicates that in the long run the depreciation of Rupiah -US Dollar exchange rate is influenced by the increase of Fed Fund Rate, while there is no impact of Fed Fund Rate on Rupiah -US Dollar Exchange Rate in the short run. The results suggest that the US monetary policy during the trade war in form of the increase of Fed Fund Rate in long run has resulted spillover effect in Indonesia i.e., the depreciation of the Rupiah – US Dollar exchange rate.

Keywords: Rupiah, The FED, Trade War, Error Correction Model

INTRODUCTION

Bank of Indonesia assigns the monetary policies to prioritize the economic stability to control the exchange rate. The exchange rate movements are getting severe to the monetary policymakers to monitor and control, especially the relations with the factor that influence the exchange rate fluctuation. The external factor can be a spillover effect through the condition of the external economy related to other countries.

The spillover is the externalities through the economic activity that indirectly influence each other. According to Angelucci and Maro (2015), there are four spillover effects: externalities, social interaction, context equilibrium effects, and equilibrium effects.

According to the Bank of Indonesia (2015), the international spillover transmission that affects a country is because of the existence of monetary policies in a developed country to multiple channels. The first channel is portfolio rebalancing the global economy. The monetary policies in developed countries attract investors to turn their assets from a growth country to a developed country with lower risk. The second channel is through the global financial market. The combination of liquidity channel, asset price also risk-taking channel, where the normalization of monetary policies will decrease the global liquidity, and the interest rate in a developed country will increase. Thirdly, the exchange rate channel is the policies in a developed country that will influence the exchange rate in growth

countries. Therefore, this could drive speculation, which affects the amount and volatility of capital flows.

Through the three-spillover transmission channel above, the depreciation of the Rupiah exchange rate during the United States-China Trade War was suspect to occur due to the policies in developed countries that influenced the fluctuations in the Rupiah exchange rate mentioned in the third channel of spillover transmission. External factors triggered the spillover effect of the economic recession in the form of global pressure.

The trade war situation made The FED carry out a policy by increasing the Fed Funds Rate (FFR) benchmark interest rate. This instrument benefits the United States because it triggers capital outflows from emerging markets to the United States of America.

The monetary policy carried out by Central Banks in developed countries, the United States Central Bank, the Federal Reserve has affected global interest rates. One of The FED's steps to maintain the stability of the United States economy is to control the interest rates. However, the changes in the FED's interest rates affect the interest rates of other countries, as stated by Priola, Lorenzini, Giacomo, and Zicchino (2020) that the FED has influenced the other central banks.

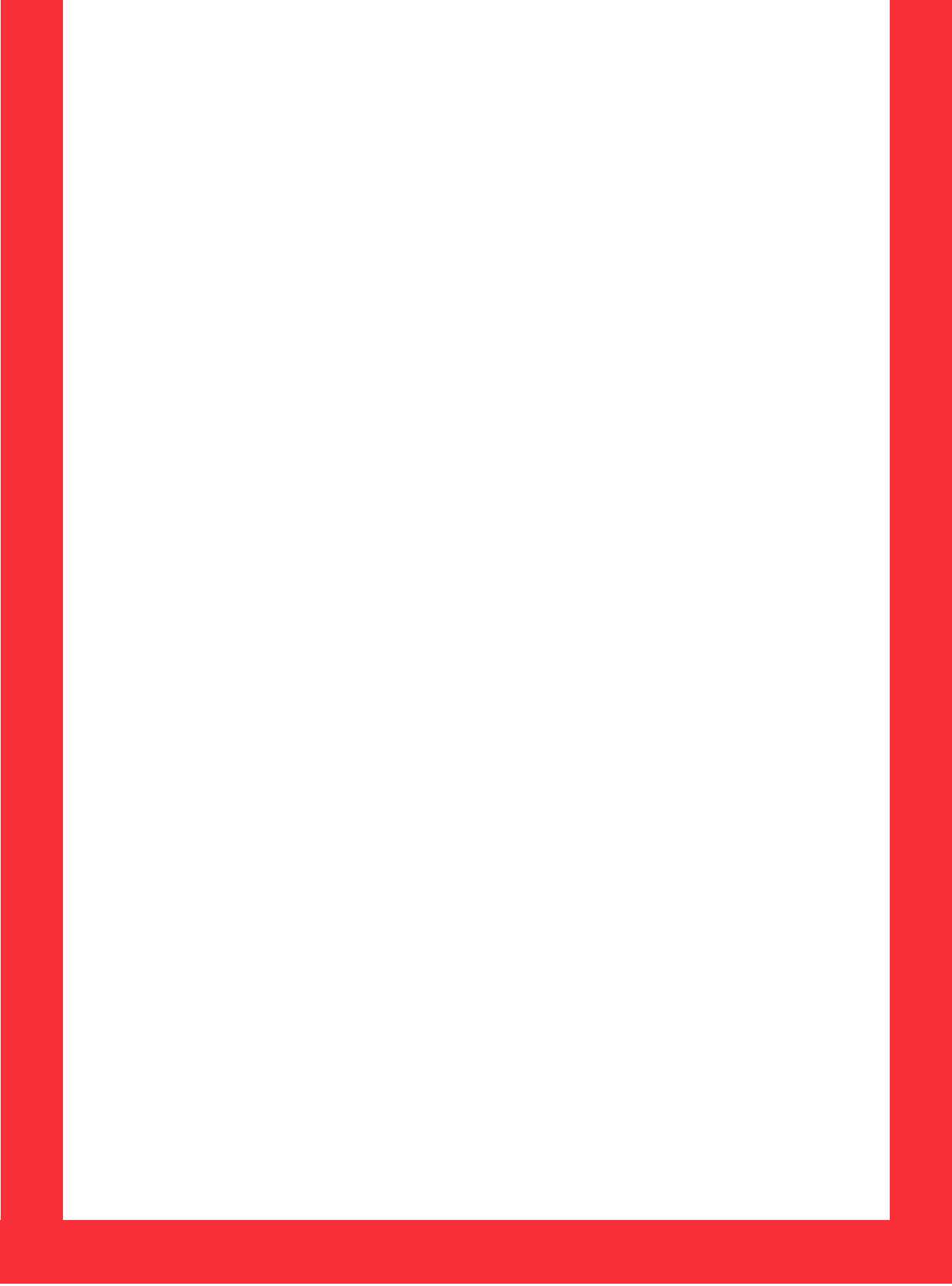

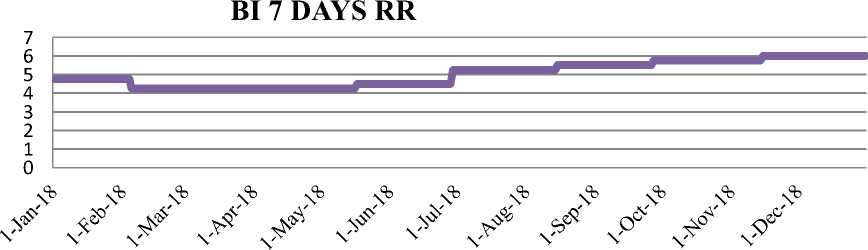

Through research done by Caceres, Carriere, Demir, and Gruss (2016), the central bank, which pegs the US dollar currency, also increases the interest rates when the Fed carries out the normalization policies which will affect global economic shocks. The increase in the FED interest rate or the Fed Fund Rate throughout 2018 can be seen in Figure 1.

FED FUND RATE 2018

Figure 1. Fed Funds Rate 2018

Source: Federal Reserve.gov (2020)

The data shows the increase of the FED interest rate throughout 2018. The increase occurred four times, namely in March the FED for the first time in 2018, 1.42 percent to 1.75 percent. The second increase occurred in June 1.75 percent to 2.00 percent, the third increase occurred in September 2.00 percent to 2.25 percent, and the fourth increase happened at the end of 2018, namely in December 2.25 percent to 2.50 percent. In addition to triggering exchange rate depreciation in emerging market countries, the increase in The FED's interest rate has resulted in foreign investors shifting from emerging markets because they are considered less risky.

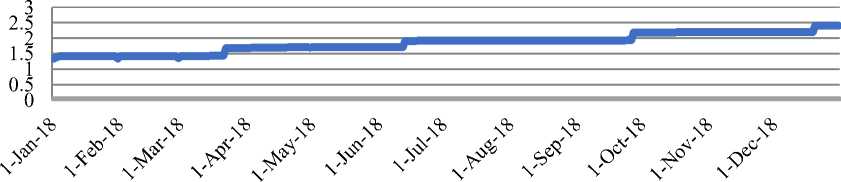

Figure 2. The Dow Jones Average Index

Source : Investing.com (2020)

Figure 2 shows a decrease that occurred around mid-August 2018 until the end of 2018. Then another collapse occurred around December 2019 to April 2020 amid the Trade War between the

As a superpower country, the United States has a more stable currency (dollar) than the developing countries because the dollar is classified as a dominant currency or hard currency. In the forex world, a dollar is also considered the most influential currency, where almost 80% of transactions use USD. The United States currency is deemed to be essential for global economic players, so that the price index in the United States became a concern for the occurrence of the trade war. The changes of the Dow Jones Industrial Average's (DJIA) stock price, which is increasing, will reduce the number of foreign investors to invest in Indonesia, which will cause the demand for the dollar to rise. The Dow Jones Average index is shown in figure 2.

United States and China. A reasonably visible decrease in the graph occurred at the end of 2018, specifically in December around 21,792.20 until the beginning of 2019, which was around January.

Donald Trump, the United States President, has signed a memorandum on March 22, 2018, responding to China's trades that are considered

unfair practices. According to research by Kim and Nguyen (2008), news about the FED interest rate can indirectly affect other markets that indicate the information on the announcement of the FED's target interest rate helps reduce the level of trust among the market's participants.

After Donald Trump, the President, raised the tariffs and restricted the United States' access to China, Chinese assets were affected. These conditions burdened the economy and pressured

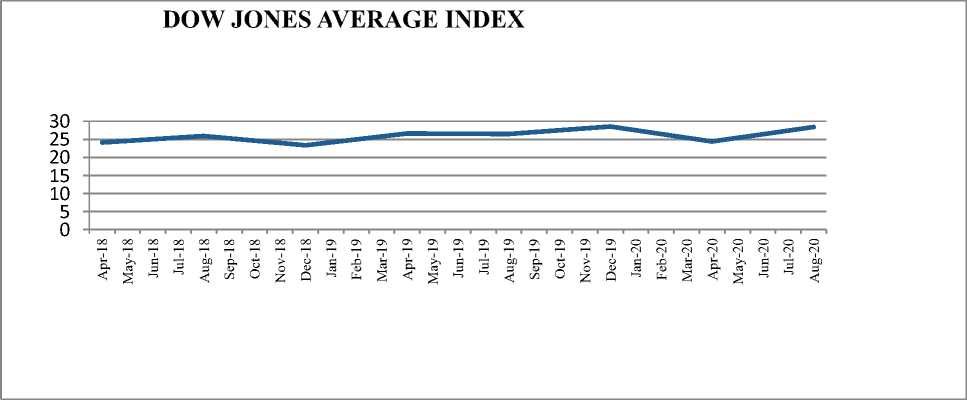

Figure 3. 2018 Shanghai Index

Source : Investing.com (2020)

In Figure 3, there is a graph of the Shanghai Index for the period April 2018 to April 2019. The chart shows a downward trend in the index from the end of 2018 to 2019. In 2018 China played a role in the Trade War with the United States, where the most significant stock index in Asia fell due to the trade war. The average daily transaction on the China Stock Exchange experienced a decline in 2018 4.

the corporate earnings performance in China. As the trade war's executors, China's stock index is also concerned. One of the stock indexes in China that were affected is the Shanghai Index. Liu's research (2020) said that the Chinese stock market deteriorated and was influenced by the trade war. The level index of Shanghai dropped. The Shanghai index posted the worst performance globally, where the index weakened to 24.6 percent, which can be seen in Figure 3.

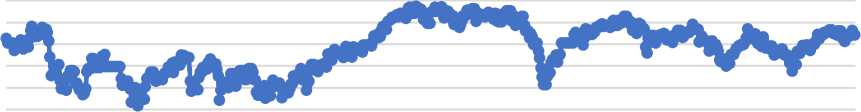

As a partner of the two countries, Indonesia is affected by the policies issued by the two countries. Indonesia Stock Market (JCI) in 2018-2019 also experienced a decline due to the United States-China Trade War. Investors often use this Indonesia Stock Market to determine when investors can add funds to a company or even withdraw funds or sell shares. So, the JCI is an essential consideration for investors. The decreasing index can be shown in Figure 4.

INDONESIA STOCK MARKET

6,800.00

6,600.00

6,400.00

6,200.00

6,000.00

5,800.00

5,600.00

5,400.00

5,200.00

5,000.00

Figure 4. Indonesia Stock Market (JCI)

Source : ihsg-idx.com (2020)

In the graph shown in Figure 4, we can see that the JCI also fluctuated. Stock prices in Indonesia also experienced a level decrease. The decline was below the 6,000 marks, triggered by the sentiment of the United States' trade war with China. A downward line is shown around March 2018 to November 2018 and around March 2019 to July 2019. JCI is an indicator of the economy in Indonesia. When the JCI improves, the Indonesian economy is indicated to be improving and vice versa. The decline in the JCI is an essential concern

for the depreciation of the Rupiah against the Dollar during the United States-China trade war.

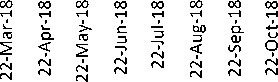

Bank Indonesia, as the central bank that carries out monetary policy, also balances the economic conditions from the policies carried out by The FED. The BI 7 Days RR exchange rate mechanism will encourage an increase in the difference between domestic interest rates and foreign interest rates. They expected that this difference would encourage foreign capital inflows with the ultimate goal of achieving an appreciation of the Rupiah exchange rate. Bank Indonesia, through the BI 7 Days RR also raised interest rates, which can be seen in Figure 5.

Figure 5. BI 7 Days RR 2018

prioritizes profit from interest rate differences

Source : Bank Indonesia (2020)

Figure 5 shows an increase in the trend five times, the increase occurred in May 2018 from 4.25 percent to 4.50 percent, in June 2018 from 4.50 percent to 5.25 percent, in August 2018, it was initially 5.25 percent to 5.50 percent, in September from 5.50 percent to 5.75 percent. Lastly, there was an increase in November 2018 which was initially 5.75 percent to 6.00 percent.

(Galati, G., Heath, A., and McGuire, P. 2007). According to Jang and Ogaki (2001), the effect of US monetary policy on domestic exchange rates when the FED raises interest rates will appreciate in the long run and depreciate in the short time.

The global economic turmoil that has occurred for some time has brought the trend of the Rupiah exchange rate to fluctuate and cause price changes, as shown in Figure 6.

Changes in interest rates between two currencies

can cause a carry trade, a trading system that

RUPIAH

15,500.00

15,000.00

14,500.00

14,000.00

13,500.00

13,000.00

12,500.00

12,000.00

11,500.00

Figure 6. The exchange rate of the Rupiah against the Dollar in 2018-2020

Source : Bank Indonesia (2020)

Through this trend, there was a decrease in the exchange rate of the Rupiah against the Dollar throughout 2018. The change in the United States

against the US Dollar shows the weakening of the Rupiah against the USD, even reaching Rp. 15,253.00 on October 11, 2018. At the same time, this trend had increased since 2018 when the Trade

OOOOCΓ>CΓ>CΓ>CΓ>CΓ>CΓ>CΓ>CΓ>CΓ>CΓ>CΓ>CΓ>

War began, and the Federal Reserve has raised its benchmark interest rate several times.

Based on these conditions, the researchers are interested in studying and further analyzing the fluctuations in the Rupiah exchange rate during the United States-China Trade War.

PREVIOUS RESEARCH

According to Bank Indonesia, based on the theory of spillover transmission, the third path

theory states that the exchange rate channel is caused by tightening monetary policy in developed countries, which causes exchange rate depreciation in developing countries. The United States-China trade war has resulted in the two trade war players carrying out various monetary policies. These policies have a spillover effect on surrounding countries, especially developing countries.

In Purwanti's research (2018), the Fed Fund Rate has a long run effect on the Rupiah/USD Exchange Rate. As a trade war country, the stock price index in the United States has also decreased. According to research by Tsagkanos and Siriopoulos (2013), there is a relationship between the Dow Jones Index and the exchange rate. Both are in the long run and in the short time.

The Shanghai index experienced the worst bookkeeping in 2018 when the trade war between the United States and China occurred. The Shanghai Index is an index of China, which is a rival to the US for the Trade War. Research by Tsagkanos and Siriopoulos (2013) shows a causal relationship between stock prices and exchange rates.

As a partnership between the perpetrators of the trade war, Indonesia experienced fluctuations in the Composite Stock Price Index (JCI) throughout 2018. The JCI is an indicator of whether the economy is good or bad in Indonesia.

Through the BI 7 Days RR mechanism to offset the increase in the FED interest rate, the BI 7 Days RR increased throughout 2018. According to

Charef and Ayachi (2018), there is a significant relationship between the exchange rate and the difference in interest rates.

RESEARCH METHODS

This study using secondary data, and the type of research used is quantitative research. The data used are the Rupiah exchange rate against the United States Dollar, Fed Fund Rate, Dow Jones Index, Shanghai Index, JCI, BI 7 Days RR in the period 22 March 2018 – 16 January 2020.

Secondary data was obtained from Bank Indonesia, Federal Reserve, Investing .com, and ihsg-idx.com. The data processing technique uses the Error Correction Model (ECM) method to see the effect of the dependent variable on the independent variable in the short and long run.

RESULTS AND DISCUSSION

Research result

-

1. Measurement of Error Correction Model (ECM)

Grangers Representation Theory explained that if the relationship between two variables X and Y are cointegrated, their relationship can be included as the ECM in the Error Correction Model analysis, which aims to bind short run values in the long run (Febriana and Muqorobbin, 2014). Before regression with the ECM test, the first step that should be done is to perform a stationary test. The tests are as follows

-

A. Data Stationarity Test

The variable testing on the Fed Fund Rate level, Dow Jones Index, Shanghai Index, Indonesia Stock Market Index, and BI 7 Days RR is not stationary. At the 1st difference, level test the Fed Fund Rate variable, Dow Jones Index, Shanghai Index, Composite Stock Price Index, and BI 7 Days RR is known to be stationary, where the probability value of all variables is below 0.10. So after getting stationary results on the first difference, it can be continued to test long run estimates.

-

B. Long Run Estimate

The results of the long run estimation test show that the probability value of the F-statistic is known to be 0.00000, which is smaller than the alpha value of 0.10. Moreover, the probability value of each variable is the Fed Fund Rate probability value of 0.00040 with a coefficient value of 274.9069. The Shanghai Index probability value of 0.0785 with a coefficient value of -0.227014. JCI probability value of 0.0000 with a coefficient value of -1.254952. LBI 7 Days RR probability value of 0.0000 with a coefficient value of 272.1114. It has a probability value below the alpha value of 10% (0.10). The Fed Fund Rate, Shanghai Index, JCI, and BI 7 Days RR variables significantly affect the Rupiah/USD exchange rate variable.

Meanwhile, the value of the Dow Jones Index variable has a probability value of

0.7049 with a coefficient value of 274.9069. So, the probability value of the Dow Jones Index variable is above the critical value of 10% (0.10), the Dow Jones Index variable has no significant effect on the Rupiah/USD exchange rate variable.

-

C. Cointegration Test

This study uses the Augmented Dicker Fulley Test method on residual data, with the results showing the probability value. 0.0000, which means less than 0.10, implies that the Rupiah/USD Exchange Rate, Fed Fund Rate, Dow Jones Index, Shanghai Index, JCI, and BI 7 Days RR are cointegrated so that the test can proceed to the estimation of short run equations.

-

D. Short run Estimation

The short run estimation results show that only the domestic variables, namely the JCI and BI 7 Days RR, affect the Rupiah/USD Exchange rate variable in the short run.

According to Ahmed and Delin (2019), by Granger's theory, significant ECT has a negative sign. The short run equation model has an ECT probability value of 0.0903 which means it is essential at an alpha level of 0.10 with a coefficient value of 0.091901.

-

E. Coefficient of Determination

Based on the results of data processing in the long run and short run. The value of R², in the long run, is 0.770388. In a long time, the

set of variations of the X variable can explain the interpretation of the Y variable by 77 percent. In contrast, the rest is explained by variations of other variables not used in the study. More specifically, in the long run, the Fed Fund Rate, Dow Jones Index, Shanghai Index, JCI, and BI 7 Days RR variables can explain the Rupiah/USD Exchange Rate by 77%. In contrast, the remaining 23% is explained by other variables not used in the analysis study.

In the short run, the value of R² is 0.101386. In a short time, the set of variables X can explain the variation of variable Y by 10 percent, while the rest is explained by variations of other variables that are not used in the study. More specifically, it means that in the short run, the Fed Fund Rate, Dow Jones Index, Shanghai Index, JCI, and BI 7 Days RR can explain the Rupiah/USD Exchange Rate by 10 percent. In contrast, the remaining 90 percent is explained by other variables not used in the analysis study.

-

2. Classical Assumption Test

-

A. Data Normality Test

The normality test has a probability value of 0.00000 or less than the alpha value of 0.10. So, that shows that the data used in the ECM model is not normally distributed. Central Limit Theory or Central Limit Theory is a theory that says that if in a study with a large sample, the sample distribution will approach the normal distribution. So the data will be

normally distributed when the number of samples increases.

-

B. Autocorrelation Test

Since this study uses multiple linear regression OLS (Ordinary Least Square), there is an autocorrelation problem using the Covarian Method, namely HAC (Newey-west), where all the estimated coefficients are immune to autocorrelation violations. Hari and Brorsen (2002) research stated that HAC could help solve autocorrelation and

heteroscedasticity in hypothesis testing that has overlapping data.

-

C. Multicollinearity Test

The results of the multicollinearity test between the independent variables obtained that the Centered VIF value of the Fed Fund Rate, Dow Jones Index, Shanghai Index, JCI, and BI 7 Days RR is less than 10, so it can be stated that there is no multicollinearity problem.

-

D. Heteroscedasticity Test

The results of processing the heteroscedasticity test data with the Heteroskedasticity Test: Breusch-Pagan-

Godfrey test and in the estimation, the researcher uses the Covariant Method, namely HAC (Newey-west) where the value of probability indicates the p-value chi-square (6) in Obs*R- Squared is equal to 0.1086. Because the p-value is 0.1086 > 0.10, then H0 is

accepted, which means that the regression model does not have heteroscedasticity symptoms.

Discussion

-

1. Interpretation of Regression Results

The influence of each factor that affects the Rupiah/USD Exchange Rate includes the Fed Fund Rate, Dow Jones Index, Shanghai Index, JCI, and BI 7 Days RR are as follows:

-

A. The Effect of the Fed Funds Rate on the Rupiah/USD Exchange Rate

Based on the regression analysis of the ECM model, the short run regression results of the Fed Fund Rate variable have no significant effect on the Rupiah/USD exchange rate, and the coefficient value is 21,59335. Meanwhile, the results of long run regression of the Fed Fund Rate variable have a significant effect on the Rupiah/USD Exchange rate variable with a coefficient value of 274.9069. So, if there is an increase in the Fed Fund Rate variable by 1%, the Rupiah/USD Exchange Rate will increase by 274.9 Rupiah. The increase in the Fed Fund Rate variable is an increase in the amount of the exchange rate, which means there is a depreciation in the exchange rate.

In the long run, the increasing Fed Fund Rate will cause depreciation or weakening of the Rupiah exchange rate against the United States Dollar. This study supports the research conducted by Purwanti, D. (2018), showing the

research results. In the short run, the FED rate does not significantly affect the Rupiah/USD exchange rate, while in the long run, the interest rate has a significant effect on the Rupiah/USD exchange rate. The FED interest rate does not affect the Rupiah exchange rate against the United States Dollar in the short run. So, when certain external economic conditions occur, Bank Indonesia, as the central bank, participates in adjusting the economic conditions in Indonesia. When The FED increased its interest rate, Bank Indonesia made efforts to keep capital from moving from Indonesia to the United States. Suppose the domestic interest rate is higher in the long run compared to foreign interest rates. In that case, it will attract foreign investors to invest their capital in Indonesia, hoping that they will receive high profits and vice versa when domestic long run interest rates tend to be lower. From abroad, there will be a tendency for Capital Outflow to occur.

-

B. . The Influence of the Dow Jones Average on the Rupiah/USD Exchange Rate

The Dow Jones Index data processing in the short run results have no significant effect on the Rupiah/USD exchange rate and have a negative value of -0.043872. The results of the long run regression of the Dow Jones Index also have no significant effect on the Rupiah/USD exchange rate with a coefficient value of 0.007355.

In the short run, fluctuations in the Dow Jones Index do not affect the Rupiah/USD exchange rate value. That fact is supported by the research of Suriani et al. (2015), the results of the Granger Causality test support that there is no relationship between the exchange rate and stock prices. In the mean times, the Dow Jones Index does not affect the Rupiah/USD Exchange Rate. However, it does not rule out the possibility that when foreign stock prices are more attractive than stock prices in Indonesia, it will attract investors domestically and abroad. So, when that happens, the flow of funds will run out and affect economic conditions in Indonesia.

This study contradicts Tsagkanos and Siriopoulos's (2013) research results in that study, which showed a causal relationship between stock prices and exchange rates in the long run and short run. However, this study aligns with Dewanto's research (2014) that the Dow Jones Industrial Average does not significantly affect Indonesia when subprime mortgages erode stock prices in America. The most affected subprime mortgages are banking stocks in Australia, Singapore, Taiwan, China, or India.

-

C. The Effect of the Shanghai Index on the Rupiah/USD Exchange Rate

Based on the regression analysis of the ECM model, in the short run, the Shanghai index variable has no significant effect on the Rupiah/USD exchange rate, and the coefficient

value is 0.167452. While in the long run, the Shanghai Index has a negative and significant effect on the Rupiah/USD exchange rate with a coefficient value of -0.227014. So, when the Shanghai Index variable increases by 1%, the exchange rate variable will decrease by 0.227 Rupiah. The decrease in the Rupiah exchange rate against the United States Dollar, in this case, is a reduction in the amount of the exchange rate, which means there is an appreciation or strengthening of the Rupiah/USD exchange rate. The results of the short run estimation of the Shanghai Index do not affect the Rupiah/USD exchange rate. However, long run estimation has a significant effect and other independent variables on the Rupiah/USD exchange rate.

The condition of the world economy, especially the United States and China, is experiencing tension due to the trade war. The Shanghai index is one of the indices whose movements are watched by investors. The trade war some time ago triggered the emergence of economic problems that impacted the fluctuations in the Rupiah/USD exchange rate. Investors will keep stock assets in countries whose currencies are not susceptible to fluctuations during global economic turmoil. This condition resulted in the decline in stock prices in developing countries, which became a competition for stock prices between countries.

Indonesia is a trading partner of China, so conditions that occur in China can impact

conditions in Indonesia. The Shanghai Index, as an indicator of China's economic condition, is still relatively safe in the midst of the trade war between the United States and China. In the long run, the increase in the Shanghai Index affects the Rupiah/USD Exchange Rate. Capital inflows in the form of portfolio investments are more prone to the risk of instability, so solid and responsive economic fundamentals are needed to maintain the Rupiah/USD Exchange Rate to prevent depreciation.

-

D. The Effect of the Composite Stock Price

Index on the Rupiah/USD Exchange Rate

Based on the results of ECM calculations in the short run, the Composite Stock Price Index has a negative and significant effect on the Rupiah/USD Exchange Rate. The estimation shows the JCI coefficient value of -0.358604. So it can be concluded that for every 1% increase in the JCI, the Rupiah/USD Exchange Rate value will decrease by 0.358 Rupiah. The long run regression results also show a significant Composite Stock Price Index variable against the Rupiah/USD Exchange Rate with a coefficient of -1.234952. That means that when the Composite Stock Price Index variable increases by 1%, the Rupiah/USD Exchange rate variable will decrease by 1.23 Rupiah. The decrease in short run and long run results is a reduction in the Rupiah/USD Exchange Rate value, which

means an appreciation or strengthening of the Rupiah/USD Exchange Rate.

The Composite Stock Price Index influences the attitude of investors on whether to buy, hold or sell their shares. As an indicator of the economy in Indonesia, when stock prices increase, it indicates that the economic conditions in Indonesia are improving. If there is a decline, it indicates that the economic condition in Indonesia is not good.

According to Haryanto's research (2020), there is a negative and significant relationship between the Composite Stock Price Index and the Rupiah/USD Exchange Rate. When the Composite Stock Price Index increases, capital inflows into Indonesia will strengthen the Rupiah/USD exchange rate. This inflow of capital will strengthen the capital market and positively impact the domestic economy, so the demand for domestic currency will increase and appreciate the Rupiah/USD exchange rate. The data aligns with Lee's (2007) research that managing a healthy stock market must maintain exchange rate stability.

-

E. The Influence of BI 7 Days RR on the Rupiah/USD Exchange Rate

The BI 7 Days RR test results in the short run show a probability value of 0.0002 and a coefficient value of 116.8727. So, it can be said that the BI 7 Days RR variable has a significant effect on the Rupiah/USD exchange rate because it has a probability value smaller than the alpha value of 0. ,10. That also means if

there is an increase in the BI 7 Days RR of 1%, the Rupiah/USD Exchange Rate value will increase by 116.8727 Rupiah, assuming all other variables are fixed. The long run regression results have a significant effect with a coefficient of 272.1114. So, when the BI 7 Days RR variable increases by 1%, the Exchange Rate/USD variable strengthens by 272.1 Rupiah. The increase in the short and long run is the addition of the Rupiah exchange rate against the United States Dollar or depreciation. Therefore, this study proves that every 7 Days RR increase in BI causes the Rupiah/USD Exchange Rate to depreciate. This research is not in line with Charef's (2018), which says that any increase in domestic interest rates will encourage the appreciation of the domestic exchange rate because the demand for local currency increases.

The results of this study are also strengthened by the research of Kemu and Ika (2016) regarding the 7 Days RR BI Transmission as an Instrument to achieve Monetary Policy targets, stating that the rise and fall of deposit and credit interest rates will reduce and increase the money supply in the community. In terms of the exchange rate, this will cause the exchange rate of the Rupiah to rise and fall against foreign currencies. The implication can have an impact on the ups and downs of exports and imports. Only at the final stage of the BI 7 Days RR transmission will it touch the ups and downs of inflation, economic

growth, employment opportunities, and the balance of payments.

This study also agrees with the Flexible Price Monetary Model theory and the International Fisher Effect Theory, which states that when domestic interest rates rise against foreign interest rates, it will cause depreciation. The International Fisher Effect Theory assumes that nominal interest rates are the same as actual interest rates. Rising interest rates reflect high inflation expectations. Inflation represents that the price of domestic products is much higher, so they tend to import at a lower price because the high import results in higher demand for foreign currency because payments are made in foreign currencies, causing the depreciation of the Rupiah/USD.

In this study, the authors support Daulay et al. (2013) research, which says that the exchange rate or exchange rate requires a time lag or time to respond to changes in monetary policy. Each variable can contribute to influencing exchange rate fluctuations both in the long and short run. However, in the short run, the only variables that significantly affect the Rupiah/USD exchange rate are the domestic variables, namely the composite stock price index and BI 7 Days RR. In contrast, the Fed Fund Rate, Dow Jones Index, and Shanghai Index variables have no significant effect.

CONCLUSION

The results of the study using the Error Correction Model method from research on the Spillover Effect of US Monetary Policy on the Rupiah exchange rate against the United States Dollar during the United States-China Trade War, namely the Fed Fund Rate variable in the short run is not significant to the Rupiah/USD exchange rate but in the short run significant long run against the Rupiah/USD exchange rate. The Dow Jones Index variable has no significant effect on the Rupiah/USD Exchange Rate both in the long run and short run. The Shanghai Index variable has a significant long run effect on the Rupiah/USD exchange rate. The Composite Stock Price Index variable has an effect in the short and long run. Suggestions from this research are to pay attention to the Fed Fund Rate variable. Solid and responsive economic fundamentals are needed to maintain the Rupiah/USD Exchange Rate, for the Dow Jones Index Variables do not need to be considered. By paying attention to the increase in the Shanghai Index variable to keep the Rupiah exchange rate appreciated. Manage the stability of the Index value Healthy Composite Stock Price. To encourage the stability of the Rupiah Exchange, Pay attention to the increase in BI 7 Days RR to maintain the Rupiah/USD exchange rate so that there is no depreciation.

REFERENCE

Ahmed, Y. N dan Delin, Y. 2019. Current Situation of Egyptian Cotton:

Econometrics Study Using ARDL Model.

Journal of Agricultural Science; Vol. 11, No. 10

Angelucci dan Maro.2015.Programme evaluation and spillover effects. Journal of

Development Effectiveness.

Bank Indonesia (Bank Sentral Republik Indonesia) 2020.https://www.bi.go.id/id/fungsi-utama/moneter/bi-7day-rr/default.aspx

Bank Indonesia(Bank Sentral Republik Indonesia).2020.https://www.bi.go.id/id/sta tistik/informasi-kurs/jisdor/Default.aspx

Board of Governors of the Federal Reserve System.2020.https://www.federalreserve.g ov/

Charef, F. dan Ayachi, F. 2018. Non-linear causality between exchange rates, inflation, interest rate differential and terms of trade in Tunisia. African Journal of Economic and Management Studies

Caceres, C., Carriere, Y., Demir, I., Gruss, B. 2016. U.S. Monetary Policy Normalization and Global Interest Rates.IMF Working Paper

Daulay, N.A., Mayes, A., Maulida, Y. 2013. Analisis Jalur Transmisi Bi Rate Terhadap Nilai Tukar Rupiah Di Indonesia. Jurnal Ekonomi Volume 21, Nomor 1

Dewanto, A. 2014. Pengaruh Inflasi, Harga Minyak Dunia Dandow Jones industrial average terhadap Indeks Harga Saham Sektor manufaktur Pada Perusahaan Yang Terdaftar Di Bursa efek Indonesia Periode 2007-2010. Skripsi

Febriana, A dan Muqorobbin, M.2014. Investasi Asing Langsung Di Indonesia Dan Faktor

Faktor Yang Mempengaruhinya. Jurnal Ekonomi dan Studi Pembangunan Volume 15, Nomor 2

Galati, G., Heath, A., dan McGuire., P. 2007.

Evidence of carry trade activity. BIS

Quarterly Review

Handrayani, Putri dan Puspitasari.2019.Efek Spilloverpada Perubahan Kebijakan Moneter Amerika Terhadap Stock Marketdi Asean. Jurnal Economia.

15(2):232-242

Hari, A. dan Brorsen, B.W. 2002. The

Overlapping Data Problem. Paper of Department of Agricultural Economics Oklahoma State University

Haryanto.2020. Dampak Covid-19 terhadap Pergerakan Nilai Tukar Rupiah dan Indeks Harga Saham Gabungan (IHSG).The Indonesian Journal of Development PlanningVolume IV No. 2

IHSG-IDX.COM.2020 .Diakses pada Maret 2020. IHSG tahu 2018-2020

International Monetary Fund (IMF).

https://www.imf.org/external/index.htm. Diakses pada Juni 2019

Investing.com.2018.

https://id.investing.com/analysis/pengertian -indeks-dow-jones-industrial-average-djia-200199971

Investing.com.2020.

https://id.investing.com/indices/shanghai-composite

Investing.com.2020.

https://id.investing.com/indices/us-30

Kemu, S. Z. dan Ika, S. 2016. Transmisi BI 7 Days RR sebagai Instrumen untuk Mencapai Sasaran Kebijakan Moneter.Kajian Ekonomi Keuangan Vol. 20 No. 3:262-283

Kim, S. dan Nguyena, D. 2008. The reaction of the Australian financial markets to the interest rate news from the Reserve Bank of Australia and the U.S. Fed. Research in International Business and

Finance.22:378–395

Lee-lee, C. dan Hui-Boon, T. 2007. Macroeconomic Factors Of Exchange Rate Volatility Evidence From Four Neighbouring Asean Economies. Studies in Economics and Finance.Vol. 24 No. 4:266285

Purwanti, D. 2018. Analisis Faktor-Faktor Yang Mempengaruhi Nilai Tukar Rupiah Terhadap Dolar Amerika Aplikasi Teori Purchasing Power Parity(Ppp).Naskah Publikasi

Priola, M.P., Lorenzini, P., Tizzanini,G., Zicchino.2020. Measuring central banks’ sentiment and its spillover effects with a network approach.Journal Of Economic Literature(JEL)

Suriani, S., Kumar.M.D., Jamil, F., Muneer, S.2015. Impact of exchange rate on stock market. International Journal of Economics and Financial Issues (ISSN): 2146-4138

Tsagkanos, A. dan Siriopoulos, C. 2013. A long-run relationship between stock price index and exchange rate: A structural

nonparametric cointegrating regression approach. Int. Fin. Markets, Inst: 106–118

Liu, K. 2020. The effects of the China–US trade war during 2018–2019 on the Chinese economy: an initial assessment. Economic and Political Studies

58

Discussion and feedback