The Impact of ASEAN Economic Community on the Textile and Clothing Industry in Indonesia

on

JEKT ♦ 12 [1] : 23-34

pISSN : 2301 - 8968 eISSN : 2303 - 0186

Dampak Masyarakat Ekonomi ASEAN (MEA) terhadap Industri Tekstil dan Produk Tekstil di Indonesia

Agustinus Edi Sutarta1

Albertus Girik Allo23

1Fakultas Ekonomi, Universitas Atma Jaya, Jogyakarta

2Fakultas Ekonomi dan Bisnis, Universitas Papua, Manokwari

ABSTRAK

Masyarakat Ekonomi Asean (MEA) telah diimplementasikan pada tahun 2015. Implementasi MEA berarti ada kebebasan pergerakan barang dan tenaga kerja di antara anggota MEA. Studi ini bertujuan mengevaluasi dampak implementasi MEA pada industri tekstil dan produk tekstil (TPT). Untuk melakukan evaluasi digunakan model keseimbangan umum GTAP versi 8. Hasil studi menunjukkan bahwa negara yang menikmati manfaat yang paling besar dari liberalisasi industri TPT dikawasan MEA adalah Vietnam kemudian diikuti oleh Thailand dan Indonesia.

Kata kunci: MEA, CGE, industri tekstil dan produk tekstil. Klasifikasi JEL: F14, L51, L67

The Impact of ASEAN Economic Community on the Textile and Clothing Industry in Indonesia

ABSTRACT

ASEAN Economic Community (AEC) has implemented in 2015. Implementation of AEC means there will be freedom of movement of goods, labor, and capital among the members of the AEC. This study aims to evaluate the impact of the implementation of AECs in the textile and clothing (T&C) industry in Indonesia. We used computable general equilibrium (CGE) model with model GTAP version 8 to evaluate this impact. This study showed that the country will enjoy the greatest benefits of the liberalization of the T&C industry of AEC regions are Vietnam, followed by Thailand and Indonesia.

Keywords: AEC, CGE, textile and clothing industry. JEL Classification: F14, L51, L67

INTRODUCTION

In 2005, textile and clothing (T&C) industry became liberal after inclusion in the General Agreement on Tariffs and Trade (GATT). It is AEC that no import quotas for products from T&C industry. China and India are two countries that have benefited from the implementation of the GATT for both products based on the results of the simulation model of the Global Trade Analysis Project (GTAP) (Nordas, 2004). However, developing countries can be catching up of China and India because of the nature of the T&C industry needs labor intensive, this implication is the cost of labor per unit of both sectors are cheaper in developing countries rather than in that two countries. This causes the developing countries (like most of the ASEAN member countries) to be more competitive in producing goods of

T&C industry. Ishido (2004) suggested that the liberalization of T&C industry is more benefit in ASEAN plus three (member countries of ASEAN plus China, Japan and Korea).

January 2007, Association of Southeast Asian Nations (ASEAN) agreed to implement the ASEAN Economic Community (AEC) in 2015. AEC materialized from the desire of ASEAN countries to realize the ASEAN into a solid regional economy and the economy are taken into international market. Economic integration is applied in the AEC is not an economic integration as adopted by the EU (European Union) that impose a single currency (Euro). In the AEC objectives is the free flow of goods, services, and trained manpower (skilled labor), as well as investment flows more freely. In application AEC will implement 12 priority sectors, namely agro-based products,

1E-mail Address: aesutarta@gmail.com

3Corresponding author: Faculty of Economic and Bussines, Papua University, Jl. Gunung Salju, Manokwari, West Papua, Indonesia. E-mail address: albertusgirikallo@yahoo.co.id

air travel (air transport), automotive, e-ASEAN, electronics, fisheries, healthcare, rubber-based products, textiles and apparel, tourism, woodbased products and logistics as well as the food, agriculture and forestry sectors (ASEAN Secretariat, 2011).

The results of several studies reveal that with the liberalization of a product or service, such as eliminating tariff and non-tariff barriers, it will provide benefits for the economy (Breinlich, 2008; Busse et al., 2012; Chemingui dan Dessus, 2008; Kawai dan Wignaraja, 2011; Oladipo, 2011; Shepherd dan Wilson, 2009; Winchester, 2009). Petri et al., (2012) revealed that the AEC will increase the real income of all members of ASEAN by 5.3% and will increase by 11.6% if it is integrated with major trading partners such as the East Asian countries, the United States and Europe. The advantage of this trade will be divided among the ASEAN member countries, where a large amount of the benefits depend on the readiness and ability of the country to compete.

In Indonesia, the debate about the readiness or ability of national industries to compete in the domestic market at the time of entry into force of the AEC by 2015 more fierce, especially in academia and policy makers. Conditions of export product processing industry is still dependent on imported raw materials is a major issue that became the focus of criticism (Wangke, 2014). To overcome this, the Indonesian government has made various efforts in accordance with the direction of the development 12th sector priorities AEC in accordance with the ASEAN Policy Blueprint for SME Development (APBSD) 2004-2014, which is then set in the legislation (UU 7/2007 about Trade).

The enactment of the AEC, ASEAN will become a single market, which AECs that all goods and services from countries other ASEAN members will get a free 100 percent goes to the domestic market. Indonesian goods and services completely free to enter into the countries in the ASEAN region and vice versa. Plan the implementation of the ASEAN Economic Community (AEC) in 2015 at its core is no longer barriers to the flow of goods and services, people and capital between member countries of ASEAN. Furthermore, that became a serious problem today and in the future is whether the national industry capable of producing goods that are not only able to compete with the same goods made in other ASEAN countries that enter

the domestic market, but also is able to penetrate the market in other member states.

One group of industry that has been the one of the non-oil export products are Indonesia is the textile and clothing (T&C) industry. The textile industry is one of the pioneering industrial and manufacturing backbones of Indonesia. The strategic position of the industry is increasingly apparent when viewed from the side of its contribution to the economy, especially in the form of export earnings and employment. Even if looking at a period of about 20 years ago the development of the textile industry’s performance shows the golden age, at which time the industry is able to contribute more than 35% of total manufacturing exports and the biggest job creation in the manufacturing sector.

The textile industry is expected to REMain a major contributor to the Indonesian economy in the future. One of the main reasons is that Indonesia still has a comparative advantage in labor-intensive industries and a large domestic market, due to the country’s population of 240 million inhabitants. In 2016, Indonesia is ranked tenth in the world for textile exports, with a market share in the world approximately 1.8%. During the period 2005 and 2007, the rapid growth that is affected by changes in market structure in the United States and the European Union, which impose a quota seat on many textile products and clothing from China. Since 2008, due to the weak global economic situation, the number of factories, export, and production has been reduced. Then in 2011 gradually in line with the trend of the global economy has shown signs to the contrary.

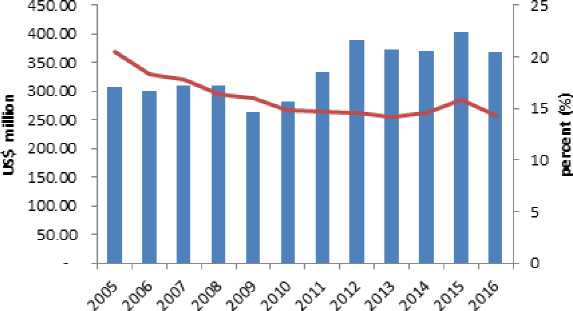

In periode 2005-2016, value Indonesian textile and clothing exports to ASEAN appear to have a positive trend (see Figure 1). In 2016, the value of Indonesian textile and clohing exports to ASEAN reached US$308.25 million, an increase compared to 2016 which was valued at US$367.81 million. Nevertheless, the market share of Indonesian textile and clothing products in the ASEAN market continues to erode. In 2005, the market share of textile product is 20.55%, but in 2016 decreased 6% to only 14.34% (see Figure 1). This is due to the increased product from other countries like Viet Nam.

Textile industry in Indonesia has become important to REMember that most of the companies in this industry group is from the

^M Value Market Share

Figure 1: Export Value and Market Share of Textile and Cloting Industry in Indonesian to

ASEAN, 2005-2016 (source: https://data.aseanstats.org/trade _hs2.php)

category of micro, small and medium enterprises (SMEs). Conceivably, if the Indonesian textile industry can not compete with similar products from countries other ASEAN members, it will be a lot of SMEs are folded with the consequences: (1) unemployment, and (2) increased poverty, and (3) income exchange of results of textile exports will be reduced. The importance of the textile industry in the macro economy is also supported by studies Hermawan (2011). The study states that the textile industry contributes to employment and increase foreign exchange earnings.

The question that arises then is how the opportunities and challenges for the Indonesian textile industry, with the enactment of the AEC or the ASEAN single market? More concretely, if the products of the domestic textile industry is able to compete in the ASEAN member countries other? On the other hand, if the Indonesian textile industry to survive and dominate the domestic market from the invasion of similar products from countries other ASEAN member?

RESEARCH METHOD

Estimates competitiveness of Indonesian textile and cloathing industry when AEC enacted in 2015 will be conducted by using a general equilibrium analysis. This model has been widely used by economists in the world to analyze the impact of international trade policies on the economy of a country or region. General equilibrium model can be illustrated as a bridge between macroeconomic and microeonomic. Using general equilibrium model, the analysis of the impact of macroeconomic policies and

micro policies can be carried out simultaneously. Dixon and Jorgenson (2013) suggested that the general equilibrium model is an economic model that is most relevant to analyze the impact of the government’s economic policy if the economy of the country tends to embrace the free market, or the role of market mechanisms in the economy of the country tend to be dominant.

Based on the above considerations, it is to answer the problems in this research will be used application Computable General Equilibrium (CGE). CGE application model used is the Global Trade Analysis Project (GTAP) version 8. The GTAP model is a multi-regional CGE model of the economy and world trade developed by Hertel and scientists from Purdue University, USA. This model is comparative static models that can be used to AEC sure the impact of international trade.

Simulation Design

This scenario should be used to avoid fixing errors skenario. Results of simulation using GTAP model, the amount of change produced highly dependent variable and sensitive to the magnitude of the shock defined as a simulation scenario. Further research will focus on estimating the implications of policies (shock) in the form of liberalization of trade between ASEAN countries within the framework of the implementation of the ME - ASEAN. Policy (shock) that will be in the form of tariff elimination Textile products (TEX), apparel (wearing apparel (WAP), and wool and silk (silk cocoons and wool (WOL) to zero throughout the ME-ASEAN members. Based on shock been done then will be the economic impact on all members of the ME-ASEAN. As for who will

be analyzed from the policy simulation results are changes to the variables: terms of trade (terms of trade) simulated industry, the demand for labor, the value of exports, balance trade, value added, output, changes in GDP and welfare received by residents of the ME-ASEAN member countries.

Global Trade Analysis Project (GTAP) Model

GTAP model is a Computable General Equilibrium (CGE) model developed by Thomas Hertel and his colleagues at the Center for Global Trade Analysis, Department of Agricultural Economics, Purdue University, Indiana. Unlike the standard CGE model designed to simulate the impact of a policy (shock) of the country, the GTAP model is designed for many countries. GTAP is designed to simulate the impact or effect of a policy change (shock) in some countries or some sectors of some countries or some sectors.

There are three main components in the GTAP model. The first is the framework of the GTAP model, which was developed on the basis of the regional economy to describe the activities and behavior of domestic companies (firms), household consumers (households) and domestic government (government). This section describes the structure of the input-output several industrial sectors that exist in the model simultaneously in the value-added chain that starts from primary products (primary goods) to process goods between (intermediate goods) and ends at the end of the consumption goods (final consumer goods) for household consumers and government. The second major component is the GTAP database. This section contains economic database on bilateral trade matrix, transport, and the protection of each of the countries concerned. This database is derived from the input-output tables for each country. The third component of the GTAP is behavioral parameters, which contains four parameters: the elasticity of substitution (consumption and production), the elasticity of transformation that will determine the degree of mobility between sectors and regional investment allocation flexibility of the primary factor, and the elasticity of consumer demand.

Supply and demand for each commodity including production factors should be the same in the general equilibrium model. Commodities dmeatrekremtinaevdabilya beqleu autinodnesr (1e)q uilibrium conditions determined by equations (1). seREG

The value of VOM(i,r) represents the total value of the value of domestic sales at market prices, VDM(i,r), and the value of exports to all countries at the domestic market price, VXMD(i,r,s). In addition, international transport costs should also be taken into account when output is exported, VST(i,r). This variable is designed to include international transport cost margins. Equation (1) can be rewritten in quantity and price measure

(2)

PMm × QOm = PMm ×

r? the ) commodity, <2 i ■s(i

- seREG

Variables PM(i,r) is market price of nonsaving commodity i in region r and QO(i,r) quantity of non-saving commodity i output or supplied in region r. QDS(i,r) is quantity of domestic sales of tradable commodity i in region r, QST(i,r) is quantity of sales of marginal commodity i to the international transport sector in region r, and QXS(i,r,s) is quantity of exports of tradable commodity i from source r to destination s. After equation (2) dividing by PM(i,r) obtained a general form rI of the equilibrium condition of the traded commodity market:

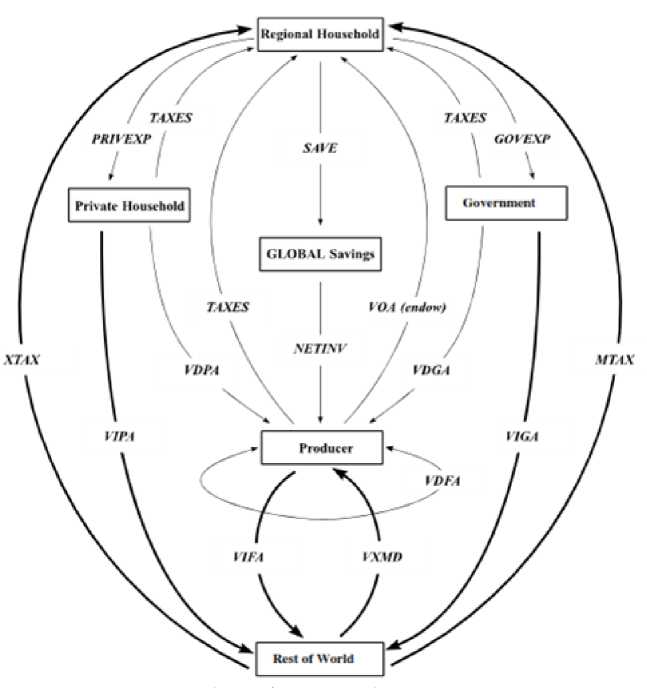

Framework of GTAP Model on Open Economic in Multi Region

GTAP (Global Trade Analysis Project) is an applied general equilibrium model (CGE) many countries which include world economic activity covering 57 industries and 129 arrangement region (composite region) which is aggregation of 229 countries. Thus, the standard theory used for the formation of GTAP model similar to that used in applied general equilibrium models. Because so many of the components in the formation of the GTAP model is so complex that, it is not easy to obtain the basic idea of the theory behind the GTAP model. Because the GTAP model is the 57 sectors covered and covers 129 countries and 45 territories arrangement, then to simplify it, except for one country, other countries covered rolled into one the sector rest of the world (rest of the World (ROW)). One such state is then used to indicate a change in the structure of the model that is used to form an open economy models.

The starting point of the exposition in the GTAP model starts from the regional household is associated as a country or group of countries (regions). Based on per capita Cobb Douglas

utility function, regional household income is spent in the form of final demand, namely: the household consumer expenditure (PRIVEXP), government spending (GOVEX) and savings (SAVE). This approach represents a standard framework (standard closures) where each component of final demand has a constant contribution to regional income. Thus, the increase in regional income will result in a proportional change in household consumer expenditure, government and savings.

Another alternative government expenditure (GOVEX ), savings (save) are both considered to be exogenous to household income consumers is calculated as a residual. Regional household income is derived from the value of the output level agents (VOA) that is paid by the manufacturer as a consideration for the use of resources (endowment commodities).

The amount of government revenue spent on consumer goods wholly expressed as a value of government spending in the Interior (VDGA). In order for government behavior can be incorporated into the model, sub-utility function Cobb Douglas used in the GTAP model. Thus the assumption of a constant share of the budget can be applied to the model.

The second component of final demand is household consumers. Household consumer spends his entire income for consumer goods, which is expressed as the value of Household Consumer Expenditure in the Interior (VDPA). Optimization of household consumer behavior is also incorporated into the GTAP by applying the function of the CDE (Constan Difference Elasticity).

Savings as a third component of final demand entirely used for investment (NETINV). In the GTAP model of investment is due to the saving (driven). Because of these assumptions, the ongoing investment (current investment) is not included in the model during the period of observation so as not to affect the ability of the production industries in the model.

On the producer side, that the producer receives a payment from the sale of consumer goods to household consumers (VDPA) and government (VDGA), the inputs of the other producers (VDFA) and investment goods sector into savings (NETINV). Assuming zero profit, receipts is entirely used to purchase intermediate inputs (VDFA) and primary production factors (VOA).

The Company received additional revenue from the sale of commodities to the rest of the world. Exports are expressed with VXMD. But on the other hand, manufacturers are now using the revenue not only for primary production factors and intermediate inputs produced in the country, but also to import intermediate inputs (VIFA). In addition, the company also had to pay a consumption tax on imported inputs of regional households, this component into the component TAXES.

GTAP model using Armington assumption in the trade sector that allows to distinguish imports by country of origin and explain intraindustry trade of the same product. Thus, based on these assumptions the heterogeneity of goods distinguished also by the country of origin of the goods. The different types of goods not only by sector but also based in each sector (within call now sectors), depending on whether the goods are produced domestically or imported. Based on this assumption, the imported goods are assumed to separate from goods produced in the country. The elasticity of substitution of inputs is in all uses. Under these conditions, then the company decided that it must import sources are based on the combination of various prices of imported commodities. The Company then determines the combination of goods imported and domestic.

GTAP model in open economy also shows the accounting relationships of the components of final demand in an open economy. Government expenditure and household consumers are not only for the consumption of domestic goods, but also imported goods indicated by the symbol (VIPA and VIGA).

In the GTAP model also included government intervention. Government intervention in the form of taxes and subsidies. Taxes and subsidies flow hereinafter stated net of tax flow with TAXES. Tax revenues (TAXES) obtained from household consumers, governments and regional companies to households. From the government side, TAXES consists of the consumption tax on commodities produced by the economy. AEC while TAXES paid by household consumers includes consumption tax and income (net of subsidies). In an open economy model of domestic government and private households have to pay extra taxes for imported commodities to the regional household so that the components of tax to be paid by the

Figure 2: Multi Region Open Economy Source: (Brockmeier, 2001)

government and the private sector also included in the equation in the consumption tax and expenditure on consumption of imported goods.

Analogous to the behavior of a company that has been discussed above, many countries enter the GTAP model equations demand for commodities imported by the government and household consumers. Commodities imported and domestic commodities combined in composite nest for household consumers and government. The elasticity of substitution between goods imported and domestic in composite nest of utility functions are assumed equal. Import demand equation by firms and households differ only in the donation of imports.

The third component of the relationship equation is the final demand savings. Because change is hard savings component depicted in GTAP model in open economy, the savings component reduces to the global savings (GLOBAL Savings). In the GTAP model, savings and investment is calculated globally so that all depositors in the model face the same commodity price savings. This AECns that if all other markets in many countries the model in equilibrium, all

firms will receive a zero profit and all households are at prohibitive costs, the global investment must equal global savings and Walras Law are met.

Finally, we arrive at the equation component rest of the world. Based on GTAP model in open economy, the rest of the world to obtain payment from the sale of goods to domestic consumers, governments and companies. This acceptance will then be spent on goods exports from a single country (countries that are not included in the rest of the world) are expressed by VXMD, import taxes, MTAX, XTAX export tax paid to the regional household.

Data

GTAP model that will be used in this research is the GTAP model version 8. The existing data in the GTAP database version 8 uses the initial equilibrium based on the input-output table. The database version 8 includes 57 sectors and 129 arrangement region (composite region) 229 countries. However, aggregation of data may be aggregated according to the research objectives. In accordance with the purpose of research, the study will use data aggregation countries that joined the AEC: Indonesia, Malaysia, Philippines, Thailand,

Table 1: Impact of AEC on Trade Indicators.

|

Negara |

^domestik p. • import |

p * export |

Changes in Output |

Value-Added |

Changes in Balance of Trade (US$, million) |

Welfare (USS, million) | |||||

|

Textile |

Clothing |

Textile |

Clothing |

Textile |

Clothing |

Textile |

Clothing |

Textile |

Clothing | ||

|

KHM |

0.14 |

0^1 |

-θ√5 |

-2-47 |

-746 |

27.69 |

-746 |

27.69 |

-27849 |

516.2 |

10.05 |

|

IDN |

0.07 |

0.12 |

-1.66 |

-0.62 |

18.56 |

42.28 |

18.56 |

42.28 |

967.82 |

1891.98 |

46143 |

|

LAO |

0.07 |

O.i3 |

"3-5 |

-3.61 |

-1459 |

-17« |

-1449 |

→743 |

-0.22 |

-25-63 |

-11 5 |

|

MYS |

0.11 |

0.12 |

"3-39 |

-5.18 |

3949 |

78.09 |

3949 |

78.09 |

227.27 |

931-3 |

1¼∙97 |

|

PHL |

0.06 |

O.i3 |

->■17 |

-2.2 |

1905 |

37.06 |

1905 |

37.06 |

-276.29 |

1204.76 |

148.14 |

|

SGP |

O. Cl |

0.01 |

-0.04 |

-0.82 |

0.86 |

-5.66 |

0.86 |

-5.66 |

40-59 |

-18.23 |

47∙6q |

|

THA |

0.18 |

O∙34 |

-2.82 |

*9-35 |

26.32 |

19-35 |

26.32 |

579-66 |

1802.97 |

47i-58 | |

|

VNM |

0.21 |

0.28 |

-8.72 |

-13.69 |

82.72 |

232.37 |

82.72 |

232.37 |

-3485.77 |

8209.51 |

862.08 |

Notes: KHM= Cambodia; IDN=Indonesia; LAO=Laos; MYS=Malaysia; PHL=Philippines; SGP=Singapore; THA=Thailand; VNM=Viet Nam Source: data processed, 2017.

Vietnam, Singapore, Cambodia, and Laos. While sectoral aggregation will use the aggregation of three sectors, namely: Textiles (TEX), apparel (wearing apparel/WAP), and wool and silk (silk cocoons of wool/WOL).

RESULT AND ANALYSIS

Is AEC same with Custom Union (CU) or Common Market (CM)?

Balassa (1965) revealed that the economic integration follows the following pattern, Free Trade Area (FTA), the Custom Union (CU), the Common Market (CM), Economic Union (EU), and Complete Economic Integration (CEI). Custom Union (CU) is a fellow member of the economic integration which no tariff restrictions (and quantitative restrictions) as well as nontariff restrictions, the equalization of tariffs in trade with nonmember countries. Common Market (CM) is a form of economic integration which not only eliminates trade barriers but includes factors movements are not limited between members and have one tariff for non-members. While AEC is one concept of economic integration that do not follow the steps mentioned by Balassa (1965). After ASEAN FTA to establish the ASEAN region then towards to AEC, which ACE is the concept of economic integration among member countries where there is no tariff and non-tariff restrictions and movement of factors (labor and capital) is not restricted, but do not have a common tariff for non-members ASEAN.

Differences in the pattern made by ASEAN in comparison with the pattern proposed by Balassa (1965) had some impact; first, the imports of goods and services from countries not members will go to countries that have the lowest tariff policies among member countries AEC. This condition causes an imbalance of trade between countries AEC.

Second, the social problems that arise due to the free flow of labor, in which the AEC member states, there are two differences in population structure, the first group is a country that has a very large population, high unemployment, low employment, low income and low wages. While the second group there are high-income countries, limited land, population a little, and high wages. This causes problems for the social and spatial labor destination countries that have the characteristics of the country in the second group (eg, Brunei and Singapore).

Impact of AEC on Textile and Clothing Industry trade

In general, the impact of liberalization (by eliminating the economic policy of quotas and tariffs) to the textile and clothing industry can be viewed in two approaches: static and dynamic approach (Ishido, 2004). Static approach can be seen in the form of trade diversion and trade creation, changes in the balance of trade, welfare, changes in output, value-added of products and changes in domestic prices, the price of import and export. The dynamic approach can be seen from the accumulation of capital through investment, increase productivity through learning by doing. The focus of this research is a static analysis with parameters ratio of domestic prices to import prices, export prices, changes in output, value added products, changes in the trade balance and well-being derived from the liberalization of textile and clothing in order to AEC.

Simulation will use the GTAP model version 8. In this simulation it is assumed every country REMove tariffs when imported textile products originating from countries AEC. This simulation uses the initial equilibrium based on the inputoutput table. For the purposes of the analysis of the textile sector in the textile in this simulation

differentiate into textile products and clothing. By splitting the product into two parts intended to be obtained results more in-depth analysis for each of these products.

Impact of AEC on Ratio of Domestic Prices to Import Prices on T&C Industry

Heckscher-Ohlin theoREM says that a country has a comparative advantage in producing a good or service should use intensive abundant factor of the country. Thus, free trade will result in an increase in the relative price of goods and services, which then by the Stolper-Samuelson theoREM says that there will be an increase in the rate of return of the abundant factor greater than the increase in the price (Dixit dan Norman, 1980). The results of the study showed that the presence of liberalization, the domestic price tends to increase (Nicita, 2009). However, studies conducted by (Petri et al., (2012); Yean and Das (Yean dan Das, 2015) found AEC sured the impact of price due to liberalization. They shows domestic prices are not affected by greater import penetration. The study conducted by Shaikh and Shah (2014) showed that the tariff cuts will lower the relative price of goods in the domestic level Pakistan.

T&C industry is one of the products included in the ASEAN Economic Community (AEC). With the AEC, then if the ratio of domestic prices to the price of imported textile getting smaller, indicating that the domestic textile products have a relatively high competitiveness of the textile products imported. Conversely, if the ratio of domestic prices to the price of imported textile bigger then the domestic textile products has low competitiveness of the textile products imported. The simulation results show that the Indonesian textile industry is relatively high price competitiveness when compared with countries other AEC members. Ratio of domestic prices to import prices of Indonesian textile is 0.07. Countries that also have a high price competitiveness is the Philippines, with a ratio value of 0.06. Vietnam would have a ratio of the highest value that is equal to 0.21 followed by Thailand and Malaysia. While the country’s most high-price competitiveness is Singapore with a ratio value of 0.01.

For the clothing industry, Indonesia also has high competitiveness in line with Malaysia, Laos and the Philippines. While the country’s competitiveness becomes the lowest price of clothing is Thailand followed by Cambodia 30

and Vietnam. Singapore REMains the country’s competitiveness becomes highest price of clothing such as the textile industry.

Impact of AEC on Export Price

Amiti and Khandelwal (2013) revealed that the presence of globalization, the company will increase the quality of the product to be exported, followed by an increase in export prices. Improved product quality is affected by the increase in technology and improving the quality of inputs (which are largely sourced from imported goods). Fan et al., (2015) find that firms tend to be willing to purchase inputs sourced from abroad / import at a great price and good quality, so that they will produce a product that can compete with other products when exported.

In the textile industry, the country will enjoy a decrease in export prices to fellow members of the highest AEC is Vietnam. In other words, textile products from Vietnam will enjoy a reduction in the market price of the countries highest AEC. This will result in textile products from Vietnam will become increasingly competitive among the member states laiannya AEC. While other countries will enjoy a decrease in the price of exports of textile products are relatively high after consecutive Vietnam is Laos, Malaysia, Thailand and Indonesia. While countries that obtain the lowest export price is Singapore.

Vietnam will also enjoy a decrease in export prices the biggest apparel. Other countries also obtain a large decline in export prices, though not as big as Vietnam, respectively are Malaysia, Laos, Thailand, and Laos. Indonesia is a country that obtains the lowest export prices between countries other AEC members.

Impact of AEC on Changes in Output

Globalization will cause the domestic market to compete with the world market and foreign investment (Foreign Direct Investment / FDI) will be more flow into the country so that it would be more efficient allocation of resources, which in turn will increase the productivity of the domestic industry and in general will increase the output (Melitz dan Ottaviano, 2008; Mishkin, 2009a; b). Various studies have been conducted related to the impact of liberalization on productivity of companies in the countries in the developing world. For example, Fernandes (2007) in Colombia and Amiti and Konings (2007) in Indonesia, found that with the liberalization of the

productivity of domestic industries will increase.

Liberalization of trade in textile and clothing industry in the AEC framework will increase the production of textiles and apparel in Vietnam is relatively higher among member countries other AECs. For textile products, after Vietnam, a country that is also high in textile production is, respectively: Malaysia, Thailand and Indonesia. This illustrates that the liberalization of the textile sector will improve the competitiveness of Vietnam compared to other AEC members. Indonesian rearmost ranks production number indicates that the Indonesian textile industry’s competitiveness will decline due to the liberalization adanaya. Relatively the same condition also occurs in the apparel industry, where Vietnam will produce apparel in the relatively highest number among the countries members of other AECs.

Impact of AEC on Value-Added Industry

Value added is a picture of where the company is adding a bit of difference from competitors so that the resulting product has a greater value than competitors. The addition of this value will increase the price of the product. Eichengreen et al., (2011) found that liberalization will be followed by an increase in the value-added of industry, investment growth and an increase in the average market at the global level. Liberal financial markets will lead to a positive impact on the growth rate of the entire industry value added (Aizenman dan Jinjarak, 2008; Wiersema dan Bowen, 2008).

The simulation results show that the impact of trade liberalization on value-added of textiles and clothing industry in Vietnam is greater than the other AEC countries both in the textile and clothing industry. Even the added value obtained by Vietnam’s clothing industry amounted to 232.37. This value is very large when compared with the added value received by Indonesia, which only amounted to 42.28. Overview, the simulation results show that Vietnam who will enjoy the greatest added value when the textile and clothing industry liberalized within the framework of the implementation of AECs.

Impact of AEC on Balance of Trade

Santos‐Paulino and Thirlwall (2004) shows that the impact of globalization will increase imports by 6% per year while exports will increase by only 2% per year for countries that initially high level of protection. This causes the trade balance

would be predicted to decline by 2% of GDP. Import growth is faster than the growth of exports is a serious problem for the balance of trade of developing countries because it will affect their economic growth. Parikh and Stirbu (2004) found that the balance of trade in developing countries-countries in Asia, Africa and Latin America tend to decline as a result of liberalization, so that economic growth in the next period would be difficult to grow.

Based on the simulation results shown that the liberalization of T&C industry of trade balance shows that the textile liberalization will lead to different outcomes for products at textile and clothing industry in each country. Indonesia (IDN) will obtain the greatest benefit from the trade of textile products, followed by Thailand (THA) and Malaysia (MYS). While the country’s trade balance deficit is the biggest textile Vietnam (VNM), followed by Cambodia (MIC) and the Philippines (PHP).

The simulation results for clothing products give different results when compared with textile products. For clothing, liberalization will give trade surplus clothing greatest Vietnam then followed by Indonesia, Thailand, Philippines, Malaysia and Cambodia. While the deficit countries are Laos (LAO) and Singapore (SGP).

In the case of the textile industry, Vietnam, Laos and Cambodia textile trade balance deficit because these countries to develop a ready-made garment industry still imports of textile raw materials mainly from Indonesia and Thailand (Fry, 2010). This condition is consistent with the simulation results show the textile trade balance surplus Indonesia and Thailand experienced a relatively large among other countries. As for clothing, surplus experienced by Vietnam is relatively large between AEC member countries due to the clothing industry in several Member States AEC ready-made garment factories moving to Vietnam. This is due to an increase in the cost of the production of clothing industry, example labor costs (Fry, 2010). These conditions are for example experienced by Malaysia and Indonesia, so because of the pressure on labor costs are expensive then for the manufacture of clothing and more companies are moving their factories to Vietnam.

Impact of AEC on Welfare

In general, long-term impact of

liberalization on the economy can be seen from the increasing prosperity of a country is AEC sured by the increase in GDP. Liberalization can have an impact on the welfare inequality between Member States which can be seen from the two effects, namely the impact of income and price effects, which examined the impact of income more than the price impact (Goldberg dan Pavcnik, 2007). Dollar and Kraay (2004) showed that with liberalization, there will be economic growth and reduce poverty caused by the unequal distribution of income and increased welfare. However, some have suggested that the presence of liberalization will harm developing countries, such losses have an impact on economic growth is slow, slow pengatasan poverty, and inequality increased prosperity among developing countries (Akmal et al., 2007; Sala-i-Martin, 1997).

The simulation results show that Vietnam will be affected the most substantial increase in the welfare of their liberaliasi textile industry trade between countries AEC. Indonesia will receive the benefits of improving the welfare of US $ 361 million, of which the rate is still relatively small when compared with the increase in welfare benefits received by Vietnam’s US $ 862, 08 million. All member countries of the AEC, only Laos which will decrease the level of welfare, which amounted to US $ 11.5 million. This is because Laos deficit trade balance is good for the textile and clothing industry.

CONCLUSION

Based on the results of simulations with GTAP, it is known that the liberalization of the textile industry in the ASEAN region in the framework of the implementation of the AEC will have a positive impact on the development of the textile industry in the state that the textile industry is relatively competitive with other ASEAN member countries. Countries that will benefit the most from the imposition of the liberalization of the textile industry in the AEC framework is Vietnam, followed by Thailand, and Indonesia. These results indicate that the textile industry in Indonesia has lost its competitive edge when compared with the textile industry in Vietnam. This condition occurs due to the nature of the textile industry which is characterized by footloosing industry is the industry that will move to another country following the input prices are relatively cheaper.

This indicates that the input price of the textile industry, especially labor-intensive because of the textile industry workers, in Indonesia has lost its competitiveness relative when compared with Vietnam.

To maintain the Indonesian textile industry in order not to compete with other countries, especially the textile industry of ASEAN countries, as well textile from China, the government had to restructure the textile industry in Indonesia. If the textile industry is still preserved on the island of Java, the textile industry must be considered to switch to more efficient technology. Another alternative is to move to other areas of the textile industry in Indonesia that wages are relatively cheaper labor.

REFERENCES

Aizenman J., Jinjarak Y. (2008) The collection efficiency of the Value Added Tax: Theory and international evidence. Journal of International Trade and Economic Development 17 (3):391-410.

Akmal M.S., Ahmad Q.M., Ahmad M.H., Butt M.S.

(2007) An empirical investigation of the relationship between trade liberalization and poverty reduction: A case for Pakistan. The Lahore Journal of Economics 12 (1):99-118.

Amiti M., Khandelwal A.K. (2013) Import competition and quality upgrading. Review of Economics and statistics 95 (2):476-490.

ASEAN Secretariat. (2011) ASEAN Economic Community Factbook. The ASEAN Secretariat, Public Outreach and Civil Society Devision, Jakarta.

Balassa B. (1965) Trade liberalisation and “revealed” comparative advantage. The Manchester School 33 (2):99-123.

Breinlich H. (2008) Trade liberalization and industrial restructuring through mergers and acquisitions. Journal of International Economics 76 (2):254-266.

Brockmeier M. (2001) A graphical exposition of the GTAP model. GTAP Technical Papers,

Center for Global Trade Analysis, Purdue University, West Lavayette:5.

Busse M., Gröning S., Groening S. (2012) Assessing the impact of trade liberalization: The case of Jordan. Journal of Economic Integration 27 (3):466-486.

Chemingui M.A., Dessus S. (2008) Assessing non-tariff barriers in Syria. Journal of Policy Modeling 30 (5):917-928.

Dixit A., Norman V. (1980) Theory of

international trade: A dual, general equilibrium approach. Cambridge

University Press.

Dixon P.B., Jorgenson D.W. (2013) Handbook of Computable General Equilibrium Modeling: Volume 1A. North-Holland.

Dollar D., Kraay A. (2004) Trade, growth, and poverty. The Economic Journal 114 (493).

Eichengreen B., Gullapalli R., Panizza U. (2011) Capital account liberalization, financial development and industry

growth: A synthetic view. Journal of International Money and Finance

30 (6):1090-1106.

Fan H., Li Y.A., Yeaple S.R. (2015) Trade liberalization, quality, and export prices. Review of Economics and statistics 97 (5):1033-1051.

Fernandes A.M. (2007) Trade policy, trade volumes and plant-level productivity in Colombian manufacturing industries. Journal of International Economics 71 (1):52-71.

Fry J. (2010) ASEAN: regional trends in economic integration, export competitiveness, and inbound investment for selected industries. United States International Trade Commission, Washington, DC.

Goldberg P.K., Pavcnik N. (2007) Distributional effects of globalization in developing countries. Journal of Economic Literature 45 (1):39-82.

Ishido H. (2004) The Economic Impact of Trade Liberalization on the ASEAN Plus Three: The Case of Textile Industry. APEC Study Center Working Paper Series 03/04-No.3, Institute of Developing Economies, Japan.

Kawai M., Wignaraja G. (2011) Asian FTAs: Trends, prospects and challenges. Journal of Asian Economics 22 (1):1-22.

Melitz M.J., Ottaviano G.I. (2008) Market size, trade, and productivity. The Review of Economic Studies 75 (1):295-316.

Mishkin F.S. (2009a) Globalization and financial development. Journal of development economics 89 (2):164-169.

Mishkin F.S. (2009b) Globalization, macroeconomic performance, and monetary policy. Journal of Money, Credit and Banking 41 (s1):187-196.

Nicita A. (2009) The price effect of tariff liberalization: Measuring the impact on household welfare. Journal of development economics 89 (1):19-27.

Nickerson M., Konings J. (2007) Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. The American Economic Review 97 (5):1611-1638.

Oladipo O.S. (2011) Does trade liberalization cause long run economic growth in Mexico? An empirical investigation. International Journal of Economics and Finance 3 (3):63.

Parikh A., Stirbu C. (2004) Relationship between trade liberalisation, economic growth and trade balance: An econometric investigation. Hamburgisches Welt-Wirtschafts-Archiv (HWWA) Discussion Paper 282.

Petri P.A., Plummer M.G., Zhai F. (2012) ASEAN economic community: A general

equilibrium analysis. Asian Economic Journal 26 (2):93-118.

Sala-i-Martin X.X. (1997) I just ran two million regressions. The American Economic Review:178-183.

Santos‐Paulino A., Thirlwall A.P. (2004) The impact of trade liberalisation on exports, imports and the balance of payments of developing countries. The Economic Journal 114 (493):F50-F72.

Shaikh N.A., Shah P. (2014) Price Effects of Trade Openness on Traded and NonTraded Goods in Pakistan: An Application of H-O-S 2x2x2 Model. International Journal of Economics, Commerce and Management II (8):1-17.

Shepherd B., Wilson J.S. (2009) Trade facilitation in ASEAN member countries: Measuring progress and assessing priorities. Journal of Asian Economics 20 (4):367-383.

Wangke H. (2014) Peluang Indonesia dalam masyarakat ekonomi Asean 2015. Info Singkat Hubungan Internasional Pusat Pengkajian VI (10):5-8.

Wiersema M.F., Bowen H.P. (2008) Corporate diversification: The impact of foreign competition, industry globalization, and product diversification. Strategic Management Journal 29 (2):115-132.

Winchester N. (2009) Is there a dirty little secret? Non-tariff barriers and the gains from trade. Journal of Policy Modeling 31 (6):819-834.

Yean T.S., Das S.B. (2015) The ASEAN economic community and conflicting domestic interests: An overview. Journal of Southeast Asian Economies (JSEAE) 32 (2):189-201.

34

Discussion and feedback