Testing Commodities as Safe Haven and Hedging Instrument on ASEAN's Five Stock Markets

on

pISSN : 2301 - 8968

eISSN : 2303 - 0186

JEKT ♦ 10 [2] : 231-238

Testing Commodities As Save Haven And Hedging Instrument On Asean’s Five Stock Markets

Robiyanto*

Faculty of Economics and Business, Satya Wacana Christian University, Salatiga 50711, Indonesia

Sugeng Wahyudi-

Faculty of Economics and Business, Diponegoro University, Semarang 50241, Indonesia.

Irene Rini Demi Pangestuti+

Faculty of Economics and Business, Diponegoro University, Semarang 50241, Indonesia.

ABSTRACT

This study attempts to analyze commodity market instruments such as gold, silver, platinum, palladium, and West Texas Intermediate (WTI) crude oil’s potential as hedge and safe haven toward some stock markets in South East Asia such as in Indonesia, Singapore, Malaysia, Philippines, and Thailand. To analyze the data, GARCH (1,1) was applied. The research findings show that gold, silver, platinum, palladium, and WTI could not play their role as hedging instrument for five South East Asian capital markets. WTI could act as a robust safe haven for most South East Asian capital markets. Gold could do the role as a robust safe haven in Singapore and Malaysia, whereas, platinum and silver consistently could be safe haven only for Singapore Stock Exchange. Palladium could only be safe haven for Philippines Stock Exchange.

Keywords : Safe Haven, Hedging, West Texas Intermediate, Precious Metals.

ABSTRAK

Makin maraknya produk-produk investasi yang berasal dari pasar komoditas telah memperkaya instrumen investasi yang dapat menjadi pilihan investor. Selain menjadi alternatif investasi, produk-produk ini juga dapat difungsikan sebagai pelindung nilai (hedge) pada saat pasar normal bahkan aset pengaman (safe haven) pada saat terjadi gejolak di pasar modal. Penelitian ini berupaya menganalisis potensi komoditas seperti emas, perak, platinum, palladium dan minyak mentah West Texas Intermediate (WTI) sebagai hedge dan safe haven bagi beberapa pasar modal di Asia Tenggara seperti di Indonesia, Singapura, Malaysia, Phillipina dan Thailand. Analisis data dilakukan dengan menggunakan Generalized Autoregressive Conditional Heteroscedasticity / GARCH (1,1). Hasil penelitian ini adalah bahwa emas, perak, platinum, palladium dan WTI tidak mampu menjadi pelindung nilai (hedge) bagi kelima pasar modal yang diteliti. WTI cenderung mampu menjadi safe haven yang robust pada hampir semua pasar modal yang diteliti. Emas mampu menjadi safe haven yang robust untuk pasar modal Singapura dan Malaysia, sedangkan Platinum dan perak mampu menjadi safe haven yang konsisten hanya pada pasar modal Singapura, palladium hanya mampu menjadi safe haven pada pasar modal Phillipina.

Kata kunci : Safe Haven, Hedge, West Texas Intermediate, Logam Mulia.

INTRODUCTION

Recently, financial system in most countries has been transformed dramatically. Financial market (like for bonds and stocks) in terms of market capitalization and the number of companies listed is growing tremendously. At the same time, financial innovations in the form of more sophisticated derivative products are also flourishing. These derivative products include complex futures products like stock index contract, currencies contract, and agricultural commodities contract for both soft commodities (e.g. grain, soy, crude palm oil, et cetera) and hard commodities (e.g. precious metals and commodity metals).

These futures products can be classified as an asset class. Baur (2013) noted that an asset class comprised into three major asset classes namely stocks or equities, fixed income securities, and cash. Commodities, real estate, collectible items, and derivatives could be categorized as additional assets class. Specifically for the futures commodities in the form of precious metals had been relatively categorized as an asset class.

Greer (1997) defines an asset class as “a set of asset with same fundamental economic burden and have characteristics which may differentiate this asset with other assets which does not become the part of that asset class”. This definition consistently describes equities and bonds as two different assets.

Commodities have several things in common (i.e. they don’t pay dividend or interest) that differentiate them from both equities and bonds. Moreover, Nastou (2013) hypothesizes that commodities were classified into asset class with two unique characteristics. Their characteristics include the facts that a commodity has sustainable demand and ability to act as a hedging instrument. Baur (2013) has also supported this notation by classifying three major asset classes, i.e. stocks/equities, fixed income instruments, and cash. Meanwhile, commodities are categorized as an additional asset class beside real estate and collectible items.

In the investment analysis, hedging transaction done in order to reduce and

eliminate the primary portfolio risk. An investor will take a secondary position in order to balancing the primary portfolio risk. For example, mutual fund managers will not able to liquidate all asset in their portfolio in the same time during market crash condition, which will make financial market worsening. Risk which faced by mutual fund managers can be balanced by selling any stocks, or take a long/short position in derivative product and both. This secondary position will valuable when some stocks fall but the secondary position can act as a balance (Billingsley 2005). During financial turmoil, investor tend to secure their assets by switching their assets into more liquid asset rather than high quality assets (Beber and others 2006). This action may lead to the searching for safe haven assets.

Gold was often considered to be a safe haven during periods of economic and political stability (Adrangi and others 2003), while Figuerola-Ferretti and Gonzalo (2010) stated that silver and gold prices usually considered as substitutes to reduce similar types of risk in portfolios. The explanation for this is that there are many commonalities in the underlying economic, financials and other factors that drive the prices of those commodities which affect those commodities differently if compared to financial markets. Baur and Tran (2012) support this notion by stating that the populatities of commodities as an investment and a hedge against adverse financial or economic events may constitute a force that affect the long-run relationship.

Baur and Lucey (2010) introduced more measureable safe haven and hedge concepts through their research. According to them, a hedging instrument is defined as “an asset which is not correlated or negatively correlated with other assets or other portfolios”. These hedging assets do not have any characteristic which enable them to reduce any losses during financial turbulence and extreme financial condition.

Thus, it is quite possible that any asset would be positively correlated with other assets during extreme financial condition and negatively correlated with other assets in normal situation. Meanwhile, a safe haven

is defined as an asset which is not correlated or negatively correlated with other assets or other portfolios during extreme market condition. The main characteristic is that there is no positive correlation found among that asset with other assets during extreme financial condition. Such characteristics do not impose that an asset must be positively or negatively correlated on average. However, there is no correlation found or negatively correlated during extreme financial condition. Therefore, it is possible that an asset would be negatively or positively correlated during normal and bullish market conditions. When a safe haven asset is negatively correlated with other assets or other portfolios during extreme market condition, it can give a compensation for investors since the price of a safe haven asset will still increase although other assets decline frantically.

Several researches on safe haven and hedge have been flourishing and have become very attractive after the global financial crisis in 2008. Prior to that, most researches had attempted to scrutinize whether gold was a good safe haven toward U.S. Dollar (e.g. Capie and others (2005)) and a hedge during inflation (i.e.Dubey and others (2002); Ghosh and others (2004); Tkacz (2007); Worthington and Pahlavani (2007)) though their definitions about safe haven and hedge remained unclear.

Some researches which were conducted after the global financial crisis and already used safe haven and hedge were commenced by Baur and Lucey (2010). They studied whether gold and hedge could act as good safe haven in U.S., U.K., and Germany stock and bond market. Baur and Lucey (2010) found that gold could play the role as a hedge for U.S and U.K. stock market but it was powerless in Germany stock market. Conversely, gold could not be a hedge for U.S. and U.K. bond market but it worked very well for Germany bond market. Furthermore, it was also concluded that gold could act as a safe haven for U.S., U.K. and German stock and bond market.

A consistent result was also elaborated by Morley (2011). By using S&P 500, Morley (2011) concluded that during the global financial crisis in 2008, investors tried to

convert their assets to gold immediately. On the other hand, Hood and Malik (2013) found a completely different result. They found that gold was a weak safe haven and hedge for U.S. stock market. Meanwhile, Dee and others (2013) conducted their research in China stock market where they found that gold could not, at all, act a safe haven.

The usage of other precious metals, even industrial metals, as safe haven and hedge were also documented by Agyei-Ampomah and others (2013). They studied the potential usage of other precious metals such as silver and platinum and commodity metals such as zinc, copper, nickel, tins and palladium as a safe haven instead of gold. They found that copper had better ability to act as a safe haven and a hedge for bond market rather than gold and other precious metals. In addition, copper and palladium showed to have better performances after bond market shock.

Meanwhile, researches for stock markets located in South East Asia were also conducted by Ibrahim (2012); Ibrahim and Baharom (2012); Mulyadi and Anwar (2012). Ibrahim (2012) concluded that while gold price was going up, stocks price in Kuala Lumpur Stock Exhange was even going down during financial crisis. They also found that gold could not play its role as a hedge for Malaysia stock market. Similarly, Mulyadi and Anwar (2012) found that gold could act as a safe haven for Indonesia stock market. But Ibrahim and Baharom (2012) on their newer studies found that gold’s role as a safe haven and a hedge was fading away in recent situation and it was only suitable as a diversification instrument.

Those researches above tend to investigate the role of gold as safe haven and hedge only. Meanwhile, only few researches studied the role of other precious metals such as silver and platinum and industrial metals such as copper, palladium, zinc, nickel etc. as safe haven and hedge on capital market mainly in bond market but not in stock market. Furthermore, several studies were done in some emerging markets especially in South East Asia stock markets. Whereas, crude oil’s role as a safe haven and a hedge had never been documented before unlike the researches on

the influence of gold and oil price movements toward stock market, i.e. Jubinski and Lipton (2013); Malliaris and Malliaris (2011); Sujit and Kumar (2011).

Crude oil can be a potential safe haven for some researches had implicitely concluded its relation to capital markets since there unstable relationship among commodities (Batten and others 2013) and some commodities tend to have different movement. Based on the background, the study is emphasized on the attempt to make the research gap getting closer by scrunitizing whether gold and other precious metals and other commodities can be safe haven and hedging asset for South East Asia stock markets especially for ASEAN’s five main stock markets.

After the global financial crisis, instruments like precious metals and major commodity products, i.e. crude oil, have become interesting objects to study due to their ability to play the role as a “safe haven” during turbulence of financial sector. The commodities also often included in mutual fund because their behavior may differ from that of equities (Adrangi and others 2003). Based on the descriptions, this study put its emphasis on whether future commodity products like precious metals (gold, silver, and platinum), commodity metal (palladium), and crude oil can play the role as a safe haven and a hedge on ASEAN’s stock markets in five main countries. They are Indonesia Stock Exchange, Singapore Stock Exchange, Thailand Stock Exchange, Philippines Stock Exchange, and Kuala Lumpur Stock Exchange.

METODOLOGY

Data

Monthly data during January 1999 until December 2013 were used for this study. Monthly closing price of Jakarta Composite Index (JCI) in Indonesia Stock Exchange, Strait Times Index in Singapore Stock Exchange, SET Index in Stok Exchange of Thailand, PSEI Index in Philippine Stock Exchange, and Kuala Lumpur Composite Index in Kuala Lumpur Stock Exchange were obtained from Capital Market Statistic published by Indonesia

Financial Services Authority. Monthly closing price of gold, silver, platinum and palladium were obtained from Bloomberg and www. kitco.com. Whereas, monthly closing price of crude oil (West Texas Intermediate/Light Sweet) were obtained from U.S. Energy Information Administration.

Variables

Monthly return of precious metals, commodity metals, crude oil, and stock markets were used as data variables in this study. All of those variables were measured in ratio scale.

-

a. Precious and Commodity Metals returns

(R ) were formulated as follows:

Metal,t

Metalt — Metalt~1

Where:

Metalt = Precious metals and

commodity metal closing price in month t

Metalt – 1 = Precious metals and

commodity metal closing price in month t – 1

-

b. Crude oil (WTI) return (RWTI,t) was formulated as follows:

_ WTIt - WTIt.1

Rm ^ wτi^~1

Where:

WTIt = WTI closing price in month t

WTIt – 1 = WTI closing price in month t

– 1

-

c. Stock market return (RComposite,t) was formulated as follows:

Compositet - Compositet^1

Rcomposite,t = C0mp0S!tet-1

Where: Compositet

Compositet – 1

= Closing of Composite Stock Index in month t

= Closing of Composite Stock Index in month t – 1

Table 1. Data Stationarity Test Results

|

No. |

Variables |

Level |

1st Order |

2nd Order |

|

1. |

WTI |

-10.68874* |

-10,52327* |

-9,966536* |

|

2. |

GOLD |

-14,99996* |

-10,93304* |

-9,410309* |

|

3. |

SILVER |

-14,23587* |

-11,00536* |

-12,62240* |

|

4. |

PLATINUM |

-15,53311* |

-9,776898* |

-8,575829* |

|

5. |

PALLADIUM |

-12,93601* |

-11,86494* |

-10,89233* |

|

6. |

JCI |

-10,65755* |

-15,89798* |

-12,52144* |

|

7. |

STI |

-11,64011* |

-13,10145* |

-9,049624* |

|

8. |

SET |

-12,88502* |

-13,14490* |

-11,96333* |

|

9. |

PSEI |

-12,27133* |

-10,44302* |

-11,06450* |

|

10. |

KLCI |

-12,91479* |

-11,71101* |

-11,33632* |

* level of significance at the 1%

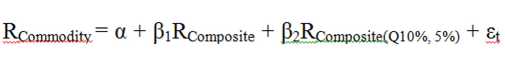

Eneralized Autoregressive Conditional Heteroskedasticity (GARCH)

GARCH (1,1) was applied in data analysis process. Bollerslev (1986) developed GARCH model based on ARCH model. GARCH model was developed in order to avoid high order possibility in ARCH model based on parsimony principle or simplest model selection. So, it was considered to be able to assure that variance values were always positive. GARCH equation applied in this study is as follows :

with

S = Φt ≡t-ι I - 1 Φt ⅛p + η1 Ilt=^t

σ2t=α0 + aιη2t.ι +.. + apη2t.p + βισ2t.ι + ... + βqσ2t.q

^t were independent and identical distributed N(0,1) and independent from previous condition of Ut^p∙

Where,

RCommodity = Commodity Return

(precious metals and commodity metals return (RMetal,t) ; WTI crude oil return (RWTI,t), used separately)

before GARCH analysis. Data stationarity test was conducted by using Augmented Dickey Fuller (ADF) as suggested by Enders (2009); Greene (2003).

EMPIRICAL RESULTS

Data Stationary Test Results

Data stationary test results are shown in the following Table 1.

Table 1 showed that all data variables used in this study have ADF test statistics in level, 1st order and 2nd order which were significant at 1% level of significance. Therefore, all data used in this study were able to fulfill stationary requirements and did not indicate unit root. These data did not need special treatment and they could be analyzed directly using GARCH. Posedel (2005) suggested that GARCH (1,1) was appropriate for data which did not need special treatment. Based on that suggestion, GARCH (1,1) was applied in this study.

GARCH (1,1) Results

WTI crude oil could be a safe haven for Indonesia stock market with JCI as a proxy. It was confirmed through significant Q10% coefficient of estimation with a negative sign and Q5% coefficient of estimation with a negative sign. These findings could be assumed that during market crash, WTI crude oil and JCI tended to move in reverse direction.

RComposite = Stock Market Return

RComposite(Q10%, 5%) = Stock Market Return, 0 if higher than 10% quantile and 5% quantile

Table 2. GARCH (1,1) Results

|

Commodities |

JCI |

STI |

SET |

PSEI |

KLCI |

|

WTI All |

0.2402965** |

0.270266* |

0.258062** |

0.0757895 |

0.3540625** |

|

Q 10oo |

-0.2451* |

-0.061324 |

-0.449721** |

0.13494 |

-0.440458** |

|

Q 5% |

-0.073962 |

-0.012177 |

-0.137623 |

0.343876** |

-0.212119 |

|

GOLD .All |

0.1493345*** |

0.1573725** |

0.147669*** |

0.0953355*** |

0.0955945 |

|

Q 10»o |

0.035819 |

-0.201995 |

-0.260078 |

0.264067*** |

-0.163407 |

|

Q 5% |

0.058271 |

-0.514973*** |

0.059162 |

0.218754*** |

-0.227081 |

|

SILAER .All |

0.163018** |

0.3864865*** |

0.359428*** |

0.2579375** |

0.118366 |

|

Q 10oo |

-0.035611 |

-0.262956 |

-0.55671*** |

0.048756 |

0.118075 |

|

Q 5% |

0.118979 |

-0.374326 |

-0.027302 |

-0.115133 |

-0.082356 |

|

PLATINUM .All |

0.086884 |

0.259693* |

0.146531 |

0.090427 |

0.0370505 |

|

Q 10oo |

0.087277 |

-0.138696 |

0.022417 |

0.205724 |

0.075894 |

|

Q 5o∕o |

0.392612** |

-0.191501 |

0.432610** |

0.195385 |

0.088042 |

|

PALLADIUM .All |

0.253821** |

0.3674295*** |

0.169562 |

0.181309 |

0.3803765*** |

|

Q 10oo |

0.039566 |

0.275894 |

-0.370055 |

-0.339774 |

0.118166 |

|

Q 5o∕o |

0.530139** |

0.210765 |

0.114303 |

-0.24122 |

-0.226789 |

* level of significance at the 10%

** level of significance at the 5%

*** level of significance at the 1%

Gold could be a better diversifier than a safe haven for Indonesia stock market. Although gold’s coefficient of estimation for Q10% and Q5% were not significant at any level, but these coefficient of estimations had a positive sign. Other precious metal such as platinum and commodity metal such as palladium could not play the role both as safe haven and diversifier robustly for, in anxious financial turbulence, these metals tended to have similar direction with JCI. Meanwhile, silver could be a safe haven although could not be robust when situation became much worse.

WTI crude oil, gold, silver, platinum, and palladium could not act as hedge for Indonesia stock market for these commodities had positive coefficient of estimation and some were quite significant (WTI, gold, silver and palladium), which explained that JCI and all commodities under this research tended to move at the same direction over time. Slightly different results were found in Singapore stock market. All commodities could not be hedge for Singapore stock market and tended to move at the same direction over time. However, certain commodities like WTI, gold, silver and platinum were able to act as robust safe havens for Singapore stock market. On the other hand, palladium showed to act a lot better as a diversifier here.

WTI crude oil and silver could be safe havens for Thailand stock market with SET index as a proxy. It was confirmed through Q10% and Q5% negative coefficients of estimation. Gold

and palladium could be safe haven options for Thailand stock market but they had become riskier during the worse conditions. They could even become very volatile when severe financial turbulence happened. Conversely, instead of becoming a safe haven, platinum tended to be influenced by stock market condition in Thailand. All commodities studied could not be hedge for Thailand stock market due to their similar direction in the long term.

For The Philippines stock market, WTI crude oil had positive Q10% coefficient of estimation and Q 5% positively significant coefficient of estimation. It showed that WTI crude oil could be safe haven due to its similar move direction with PSEi index. WTI crude oil could not give protection on effects during extreme condition in Philippines stock market. The same result was also found for gold. Even, gold had a significant similar movement with Philippines stock market in any circumstances. On the contrary result, silver could be a safe haven during extreme financial condition in Philippine stock market. But, Palladium was a better safe haven because it still had negative estimation coefficient in a more extreme financial condition. Meanwhile, platinum tended to become a diversifier for all situations in Philippine stock market.

WTI crude oil and gold had a negative coefficient of estimation for Malaysia stock market with KLCI as a proxy. This finding showed that WTI crude oil and gold could

be safe havens in Malaysia stock market. Platinum tended to become a diversifier for Malaysia stock market due to its insignificant positive coefficient of estimation. Silver and palladium had insignificant Q10% coefficient of estimation with a positive sign. But, this sign was changed in Q5% coefficient of estimation. These findings showed that silver and palladium could play the role as safe haven in more extreme financial condition.

CONCLUSION

All commodities tested in this study could not be a hedge instrument toward ASEAN’s five main stock markets since they had the same direction one and another. WTI crude oil tended to act as robust safe haven for almost all of the ASEAN stock markets except for The Philippines stock market. Furthermore, gold could be a robust safe haven only for Singapore and Malaysia stock markets. Meanwhile, platinum and silver could be consistent safe haven only for Singapore capital market. In addition, industrial metals such as palladium could be safe haven only for Philippines stock market.

Greater attention in the future researches is still needed for commodities and precious metals study. Other precious metals and commodities beside gold still receive lack of attention from researchers. Thus, it is suggested to consider this area to be an attractive research study in the future. It is also suggested that due to more sophisticated index based future instruments which developed recently, like VIX and other stock index futures, the future research should consider the possibility of those indexes as hedge instrument and safe haven.

REFERENCES

Adrangi B, Chatrath A, Raffiee K. 2003. Economic Activity, Inflation, and Hedging: The Case of Gold and Silver Investments. Journal of Wealth Management 6(2):60-77.

Agyei-Ampomah S, Gounopoulos D,

Mzaouz K. 2013. Does Gold Offer a Better

Protection Against Soverign Debt Crisis Than Other Metals. EFMA.

Batten JA, Ciner C, Lucey BM, Szilagyi PG. 2013. The Structure of Gold and Silver Spread Returns. Quantitative Finance 13:561-570.

Baur DG. 2013. Gold - Fundamental Drivers and Asset Allocation. SSRN. Electronic copy available at: http://ssrn.com/ abstract=2240831.

Baur DG, Lucey BM. 2010. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. The Financial Review 45:217-229.

Baur DG, Tran DT. 2012. The Long-run Relationship of Gold and Silver and the Influence of Bubbles and Financial Crises. Working Paper.

Beber A, Brandt MW, Kavajecz KA. 2006. Flight-To-Quality or Flight-To-Liquidity? Evidence From The Euro-Area Bond Market. NBER Working Paper Series. Electronic copy available at: http://www. nber.org/papers/w12376.

Billingsley R. 2005. Understanding Arbitrage: An Intuitive Approach to Financial Analysis. Prentice Hall Professional.

Bollerslev T. 1986. Generalized Autoregressive Conditional Heteroscedasticity. Journal of Econometrics 31:307-327.

Capie F, Mills TC, Wood G. 2005. Gold As a Hedge Against The Dollar. Journal of International Financial Markets Institution & Money 15:343-352.

Dee J, Li L, Zheng Z. 2013. Is Gold a Hedge Or a Safe Haven? Evidence From Inflation and Stock Market. International Journal of Development and Sustainability 2(1):1-16.

Dubey P, Geanakoplos J, Shubik M. 2002. Is Gold an Efficient Store of Value.

Cowles Foundation Discussion Paper. Connecticut: Cowles Foundation For Research in Economics, Yale University.

Enders W. 2009. Applied Econometric Time Series. John Wiley & Sons, Inc.

Figuerola-Ferretti I, Gonzalo J. 2010. Price Discovery and Hedging Properties of Gold and Silver Markets. Working Paper.

Ghosh D, Levin EJ, MacMillan P, Wright RE. 2004. Gold as an Inflation Hedge? Studies in Economics and Finance 22(1):1-25.

Greene WH. 2003. Econometric Analysis 5th Edition. New Jersey: Prentice Hall.

Greer RJ. 1997. What is an Asset Class, Anyway? Journal of Portfolio Management 23(2):86-91.

Hood M, Malik F. 2013. Is Gold the Best Hedge and a Safe Haven Under Changing Stock Market Volatility. Review of Financial Economic 22(2):47-52.

Ibrahim MH. 2012. Financial Risk Market and Gold Investment in an Emerging Market: The Case of Malaysia.

International Journal of Islamic and Middle Eastern Finance and Management Research News 5(1):25-34.

Ibrahim MH, Baharom AH. 2012. The Role of Gold in Financial Market: A Malaysian Perspective. Economic Computation & Economic Cybernetics Studies & Research.

Jubinski D, Lipton AF. 2013. VIX, Gold, and Oil: How Do Commodities React to Financial Market Volatility. Journal of Accounting and Finance 13(1):70-88.

Malliaris AG, Malliaris M. 2011. Are Oil, Gold and the Euro Inter-related? Time

Series and Neural Network Analysis. Munich Personal RePEc Archive MPRA Paper No. 35266.

Morley C. 2011. Is Gold a Safe Haven for Equity Investor? A VAR-GARCH Analysis. Working Paper.

Mulyadi MS, Anwar Y. 2012. Gold Versus Stock Investment: An Econometric Analysis. International Journal of Development and Sustainability 1(1):1-7.

Nastou B. 2013. Thinking About Asset Alocation In 2013. Investment Insight February 2013:1-6.

Posedel P. 2005. Properties and Estimation of GARCH(1,1)Model. Metodoloski zvezk 2(2):243-257.

Sujit KS, Kumar BR. 2011. Study On Dynamic Relationship Among Gold Price, Oil Price, Exchange Rate and Stock Market Returns. International Journal of Applied Business and Economic Research 9(2):145-165.

Tkacz G. 2007. Gold Prices and Inflation.

Bank of Canada Working Paper 2007-35.

Worthington AC, Pahlavani M. 2007. Gold Investment as an Inflationary Hedge: Cointegration Evidence With Allowance for Endogenous Structural Breaks. Applied Financial Economics Letters 3(4):259-262.

238

Discussion and feedback