THE AWARENESS, PREFERENCE AND DISTINCTIVENESS OF ISLAMIC HOME FINANCING TYPE IN INDONESIA

on

ISSN 1410-4628

THE AWARENESS, PREFERENCE AND DISTINCTIVENESS OF ISLAMIC HOME FINANCING TYPE IN INDONESIA

Dodik Siswantoro

Department of Accounting. Faculty of Economics, Universitas Indonesia

E-mail: dodik.siswantoro@ui.ac.id

Abstract: The Awareness, Preference and Distinctiveness Of Islamic Home Financing Type In Indonesia. This study attempts to evaluate public awareness of domestic financing that enhance Islamic Shari'a on it. Islamic banks have grown so rapidly in Indonesia and also offer financing for household finance products. But not all Islamic banks offer financing for households because it requires strong funding for long-term project and a good credit analysis to meet the payback period. Data analysis in this study using factor analysis, Likert scale and preference information, it also conduct an analysis of website information content and can enrich the study respondents. The results of the study is a diversified financial schemes that need to be analyzed further, and significance is an important issue to promote this finance program.

Abstrak: Kesadaran, Preferensi dan Kekhasan Jenis Pembiayaan Berbasis Syariat Islam di Indonesia. Penelitian ini mencoba untuk mengevaluasi kesadaran masyarakat terhadap pembiayaan untuk rumah tangga secara syariat Islam. Bank syariah telah tumbuh begitu cepat di Indonesia dan juga menawarkan produk pembiayaan untuk rumah tangga. Tetapi tidak semua bank syariah dapat menawarkan pembiayaan untuk rumah tangga karena membutuhkan pendanaan yang kuat untuk proyek jangka panjang dan analisis kredit yang baik untuk memenuhi payback period-nya. Analisis data dalam penelitian ini menggunakan analisis faktor, skala likert dan informasi preferensi, dilakukan juga analisis isi informasi website dan responden untuk dapat memperkaya penelitian. Hasil dari penelitian adalah diversifikasi skema pembiayaan perlu dianalisis lebih lanjut, serta signifikansi merupakan masalah penting untuk mensosialisasikan program ini.

Kata kunci : Rumah tangga, pembiayaan, syariat Islam, kredit bank

INTRODUCTION

Home financing in banks generally can generate income significantly as core products in some banks, especially those which have experiences and capability in this facility. As not all banks actually have capability and strengths in this area, some banks diversify their loans to other products and services. Similar phenomenon also occurs in Islamic bank system which is actually relatively small in funding and less experiences in this area. An Islamic bank may have a specified strength to boost home financing due to inherent characteristics for example

Bank Bukopin Syariah which focused on strategic internal growth and alliance program (Ishak, 2006).

The first Islamic bank, Bank Muamalat, does not emphasize home financing as its core banking. The next Islamic banks such as Bank Syariah Mandiri and Bank Syariah Mega might experience similar cases. However, conventional banks like Bank Tabungan Negara that has focused in home financing, when they have Islamic unit, only focused in this area. Moreover, existing customers which have strong

Islamic belief prefer their home financing in Islamic way to interest based loans.

For home financing in conventional loans, banks can determine their interest rate based on their need. Banks can set lower interest rate to attract customers to take their loans in conventional banks. Then, if the rate starts to increase, they increase the rate and sometimes above the average rate. On the other hand, it was hard to decrease even the central bank has decreased the rate first or in decreasing trend. Unlike Islamic bank, they have to set margin in the beginning of contract. Thus, this cannot be changed even the interest rate increased or changed along the period if they take murabahah (sale) scheme. Thus, Islamic banks usually set the margin above the average interest rate as to mitigate the risk. So, it would be seen that the margin rate set by Islamic banks is more expensive.

To avoid that occurrence, Islamic banks proposed other schemes which may adjust or change the determined margin. Usually they are set based on leasing and gradual ownership, they were musharakah mutanaqisah (investment) and ijarah muntahiya bit tamlik (financing lease). This scheme (leasing) was not very common even in the conventional scheme, it is usually applied in vehicle ownership. In addition, some schemes are affected by specified formula that may suit only in certain circumstances (Siswantoro & Qoyyimah, 2005).

This paper tries to analyze the awareness of Islamic home financing in Indonesia through internet respondents. Using online questionnaires we can see the awareness level of Islamic home financing from respondents. This includes other variety of Islamic financing scheme such as musharakah mutanaqisah (investment) and ijarah muntahiya bit tamlik (financing lease). Further content analysis in related Islamic banks website will enrich the availability of Islamic bank information. There may be a relationship between the awareness of Islamic home

financing with specified Islamic bank in these products.

In 2000s, the data of Islamic home financing is not recorded in detail in Indonesia. This may be caused by Islamic banks still focus in corporate sector. Based on data from Bank Indonesia, even for the construction sector, it is only 8.3% from total financing of Islamic banks in Indonesia (September 2009), while in 2005 it reached 10.1% (Islamic Banking Statistics, 2004; Islamic Banking Statistics, 2009). This may be caused by the longer time period of payment which needs a strong and longer funding from liability side. To overcome this problem, Islamic bank actually can issue sukuk to match the financing figures. In advanced structure, they can securitize the asset or property to get such longer funding.

Currently, some Islamic banks have offered Islamic home financing especially when the biggest state owned banks whose specialize in this area opened Islamic bank unit, namely Bank Tabungan Negara (BTN). Their experiences and ability to manage conventional home financing can be transformed to Islamic bank unit. Thus, it eased when Islamic bank unit penetrated this market. They only opened their Islamic bank unit in 2006, but they may be dominant in the market share. Their plan for the portfolio, 66% was from existing conventional loans. This study was conducted by Patria (2005) who examined 321 BTN’s customers in 2005. Actually, 54% customers would like to convert their loans into Islamic bank scheme.

LITERATURE REVIEW

Researches in Islamic home financing may not as many as conventional ones. Some analysis may be addressed in Malaysia when they applied bay bithaman bil ajil (deferred sale) which suffered from negative spread after monetary crisis in 1998 in South East Asia. Thus, this can be a valuable lesson to adopt murabahah scheme whose the margin cannot be

changed during contract at the same time volatile rates occurred.

Islamic home financing can be an alternative scheme in America which is dominantly controlled by conventional interest based. This is stipulated by demands from Muslims who need financing that is free riba (usury) based. It needs a description in detail on how home financing in Islamic way uses ijara wa iqtina’ (leasing mechanisms) (Thomas, n.d). Furthermore, Abdul-Rahman & Abdelaaty (n.d) compared three institutions in America that offer Islamic home financing, they are Al-Manzil Islamic Financial Services, a business unit of the United Bank of Kuwait PLC. in New York, American Finance House LARIBA–(AFHL) in Pasadena, California, and MSI Financial Services Corporation (MSI) in Houston, Texas. Both of them used ijara wa iqtina (leasing) while MSI adopted sharing investment with lease. In addition, longer period installment caused higher margin, in this case MSI only limited its period to 10 years. Some cases in America are also involved in Islamic home financing are : (a) Islamic term caused resistance (b) lack of subsidy (c) bad Islamic image (d) poor image (e) discrimination (f) lack of competitive products (g) debate of Islamic bank and (h) poor socialization. Compared to Indonesia, some are still relevant in Indonesian context.

Different home Islamic financing can be a problem itself to customers who can assume that lack of authority and transparency from each method (Haris, 2007). Customers would like to be informed in detail for any type of Islamic home financing. Similar phenomenon also occurred in America (Abdul-Rahman & Abdelaaty, n.d).

To measure the awareness of product, actually it refers to brand awareness theory. It can be in a statement asked to some respondents about how well they know the issue in likert scale measurement (Liaogang et al., 2007) and recognize it (Bram, 2005). In addition, the

statement can be in the form of comparison, description and characteristics (Liao et al., n.d) and image (Villarejo-Ramos et al., n.d). Furthermore, Hagijanto (2001) stated that other factors can affect the awareness such as market segment, demography, and segment focus. In the case of Islamic home financing, some characteristics should be identified by respondents.

Brand awareness is quite important for a customer to decide whether to buy the product. This is because of : (a) think a product, (b) consideration, and (c) association of the image (Keller, 1993). Therefore, the number of respondents who are aware of Islamic home financing can be a significant factor in the development of the product.

In relation to this, some statements are raised to measure the awareness of Islamic home financing, they are :

-

a. Prioritization of Islamic bank in Islamic home financing

-

b. The characteristics of Islamic home financing

-

c. The scheme of diversifying Islamic home financing

-

d. Ignorance in other Islamic home financing

In addition, content analysis that investigated Islamic home financing is conducted in order to see the characteristics (legal, status, plafond, tenure, down payment) of Islamic home financing and adequate information.

RESULT AND ANALYSIS

This research tries to analyze the awareness of home Islamic financing in Indonesia. It employed respondents based on questionnaires. Sample was taken from online survey through internet by www.surveygizmo.com. In this research, 140 respondents filled questionnaires, 2 incomplete and 169 who are abandoned. The abandoned means that respondents only opened the website but they did not fill it. This can mean that they may not understand the context or reluctant to answer it. From this, actually we can see

that the awareness of Indonesian people on Islamic bank especially Islamic home financing is quite low.

The location of respondents is mainly dominated in Java, then east Indonesia. Others are in Malaysia,

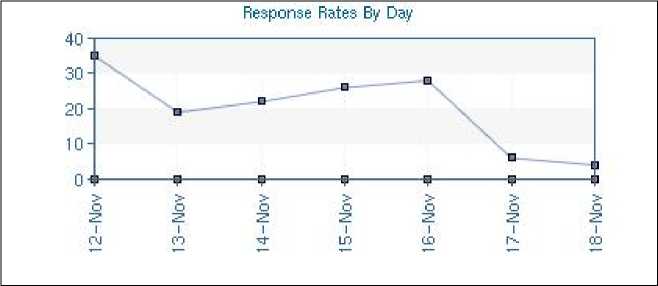

Australia, Middle East, United Kingdom and United States (see Figure 1). From outside Indonesia, they may be Indonesian people who stay in the particular country. The sample was taken from 12 to 19 November 2009 (see Figure 2).

Figure 1. Respondent Location

Source: Data

Blue dots show respondent location

For content analysis, it investigated website of Islamic home financing taken from related Islamic banks on 12 November 2009. It analyzes related information content which might give adequate comprehension to customers.

However, this may relate in socializing of Islamic home financing of Islamic banks which actually needs hard efforts. In addition, this can correlate to respondents’ preferences.

Figure 2. Line Graph of Respondent

Source: Data

Analyses

Total respondents are 311, but only 140 respondents filled the questionnaire. This shows that not many people are aware of this issue. The survey online system only permitted one respondent to fill once. It can detect the IP address and location of the respondents.

Table 1 shows that most respondents are in productive age (between 23 to 40). The number of respondent who has Islamic bank account is bigger than those who do not have (80 compared to 60, or 57.1%). Further research is explore and discuss on the categorization of Islamic bank account customers and otherwise.

Table 1. Crosstab for Islamic Bank Customer and Age Distribution

CUSTOMER * AGE Crosstabulation

|

AGE |

Total | |||||

|

17-20 |

21-23 |

23-30 |

31-40 |

>40 | ||

|

CUSTOMER ya Count % within CUSTOMER |

4 5.0% |

5 6.3% |

34 42.5% |

32 40.0% |

5 6.3% |

80 100.0% |

|

tdk Count % within CUSTOMER |

3 5.0% |

1 1.7% |

21 35.0% |

23 38.3% |

12 20.0% |

60 100.0% |

|

Total Count % within CUSTOMER |

7 5.0% |

6 4.3% |

55 39.3% |

55 39.3% |

17 12.1% |

140 100.0% |

Source: Data

Content analysis is conduct in this research. It is explore from related each Islamic bank website. Some information regarding Islamic home financing was divided into criteria (legal) of each Islamic bank. From table 2, we can see that only small portion (30%) of Islamic bank that has Islamic home financing information in website, 6.7% incomplete and the rest were not available and error. Most

regional banks (Bank Pembangunan Daerah) do not have information about Islamic home financing in their website, neither do the foreign banks that have Islamic unit licensee. However, internet can be an effective way to promote and to socialize information about Islamic home financing, specifically if they also provide interactive application or financing simulation for Islamic financing scheme.

Table 2. Criteria and Information of Islamic Home Financing

CRITERIA * INFO Crosstabulation

|

INFO |

Total | ||||

|

a |

incl |

no |

error | ||

|

CRITERIA private Count % within CRITERIA |

4 66.7% |

1 16.7% |

1 16.7% |

6 100.0% | |

|

SO Count % within CRITERIA |

4 57.1% |

1 14.3% |

2 28.6% |

7 100.0% | |

|

foreign Count % within CRITERIA |

1 50.0% |

1 50.0% |

2 100.0% | ||

|

region Count % within CRITERIA |

1 6.7% |

1 6.7% |

7 46.7% |

6 40.0% |

15 100.0% |

|

Total Count % within CRITERIA |

9 30.0% |

2 6.7% |

11 36.7% |

8 26.7% |

30 100.0% |

Source: Data from website, www.mui.or.id

Note:

a = all information, incl= incomplete, no= no data, error= website error.

Private= private bank, SO= state owned, foreign= foreign bank, region= Islamic regional bank

Further analysis is the relationship of Down Payment (DP), plafond (maximum financing) and criteria, we can see that the bigger the plafond means the bigger the DP (see table 3). In addition, some State

Owned Islamic bank may be able to provide bigger plafond compared to the private Islamic banks in general. It means that State Owned Islamic bank has much available fund to finance this scheme.

Table 3. Criteria, and Plafond, Down Payment (%) of Islamic Home Financing (Plafond in Rp million)

CRITERIA * PLAFOND * DP Crosstabulation

Count

|

DP |

PLAFOND |

Total | ||||||||

|

incl |

no |

error |

1000.0 |

1500.0 |

2000.0 |

3000.0 |

3500.0 |

5000.0 | ||

|

incl CRITER private region Total |

1 1 |

1 1 |

1 1 2 | |||||||

|

no CRITER private SO foreign region Total |

1 3 1 8 13 |

1 3 1 8 13 | ||||||||

|

error CRITER private foreign region Total |

1 1 6 8 |

1 1 6 8 | ||||||||

|

10.00 CRITER private Total |

1 1 |

1 1 | ||||||||

|

20.00 CRITER private SO Total |

1 1 |

1 1 |

1 1 |

1 2 3 | ||||||

|

25.00 CRITER private SO Total |

1 1 |

1 1 |

1 1 2 | |||||||

|

30.00 CRITER SO Total |

1 1 |

1 1 | ||||||||

Source: Data from website, www.mui.or.id

In relation to table 2, table 4 shows respondent preference of Islamic bank for their home financing. Most respondents are preferred state owned (56.1%) and private bank (22%) to others for Islamic home financing. There is no respondent who chose foreign bank for their financing. However, when respondents are asked to specify which Islamic bank that

they would choose for home financing, most respondents chose Bank Muamalat as their top priority for home financing. In fact, Bank Muamalat is not a state owned bank (see table 5). Then, it is followed by state owned banks such as Bank Syariah Mandiri, Bank Negara Indonesia and Bank Tabungan Negara.

Table 4. Sex Type, Customers and Criteria of Islamic Bank

CUSTOMER * CRITERIA * SEX Crosstabulation

|

SEX |

CRITERIA |

Total | ||||||

|

SO |

region |

private |

none | |||||

|

lk |

CUSTOMER |

ya |

Count % within CUSTOMER |

24 43.6% |

14 25.5% |

17 30.9% |

55 100.0% | |

|

tdk |

Count % within CUSTOMER |

22 50.0% |

1 2.3% |

8 18.2% |

13 29.5% |

44 100.0% | ||

|

Total |

Count % within CUSTOMER |

46 46.5% |

1 1.0% |

22 22.2% |

30 30.3% |

99 100.0% | ||

|

pr |

CUSTOMER |

ya |

Count % within CUSTOMER |

13 52.0% |

7 28.0% |

5 20.0% |

25 100.0% | |

|

tdk |

Count % within CUSTOMER |

10 62.5% |

2 12.5% |

4 25.0% |

16 100.0% | |||

|

Total |

Count % within CUSTOMER |

23 56.1% |

9 22.0% |

9 22.0% |

41 100.0% | |||

Source: Data, lk=male, pr=female

Table 5. Respondent Preference

|

Bank |

Weighted Rank |

|

Bank Muamalat Indonesia |

2.2 |

|

Bank Syariah Mandiri |

2.5 |

|

Bank BNI Syariah |

3.4 |

|

Bank BTN Syariah |

4.4 |

|

Bank Niaga Syariah |

4.8 |

|

Bank Syariah Mega Indonesia |

5.3 |

|

Bank Jabar Syariah |

6.2 |

|

Bank DKI Syariah |

6.4 |

Source: Data

For the likert scale questionnaire, the reliability test is 0.76 (see figure a, in appendices). We can say that respondents responses can be reliable in answering the questionnaires. In other words, respondents know the content of questions and it has a consistent pattern.

In the likert scale (from 1 to 5, strongly disagree to strongly agree) (see table 6), the highest score (4.0) is on the reason of applying for Islamic home financing which is based on religion obligation and to avoid riba (usury). Followed by statement that Islamic home financing is better than the conventional loan (3.5). However, the lowest score is on the statement that states ignorance of the Islamic financing scheme, the

important thing is cheap and profitable to respondents (2.7). This can mean that respondents were so aware of which scheme that they would like to apply for Islamic home financing. They really concern about the type of their home financing. Other score is the statement that states Islamic home financing is cheaper than the conventional loans (2.8). As stated above that Islamic bank applied murabahah scheme which usually above the average conventional rate when the interest rate is low. So, Islamic home financing seemed to be expensive compared to conventional bank finance that can visualize by the interest rate that seems cheaper than Islamic Home Financing.

Table 6. Descriptive of Questionnaire

Descriptive Statistics

|

N |

Mean |

Std. Deviation | |

|

F1 |

139 |

3.5396 |

1.1626 |

|

F2 |

139 |

2.8849 |

1.0431 |

|

F3 |

139 |

3.0144 |

.9779 |

|

F4 |

137 |

3.4161 |

.9444 |

|

F5 |

137 |

3.4964 |

.9935 |

|

F6 |

139 |

3.1007 |

1.0515 |

|

F7 |

135 |

3.0667 |

1.0594 |

|

F8 |

138 |

2.7246 |

1.2485 |

|

F9 |

139 |

4.0863 |

1.2007 |

|

Valid N (listwise) |

131 |

Source: Data

Note:

F1= Islamic financing is better than the conventional one

F2 = Islamic home financing of Islamic bank is relatively cheaper than the conventional one

F3 = Islamic home financing of Islamic bank is relatively easier than the conventional one

F4 = I understand Islamic home financing

F5 = I understand murabahah (selling) home financing

F6 = I understand musharakah mutanaqisah (investment) home financing

F7 = I understand ijarah muntahiya bit tamlik (leasing) home financing

F8 = I do not care on Islamic concept, the important is cheap and profitable

F9 = I choose Islamic bank as riba is banned by Islam

In average, respondent’s comprehension in Islamic home financing scheme is 3.41. For each scheme, the highest is in understanding in murabahah (3.49), followed by musharakah mutanaqisah (3.10) and ijarah muntahiya bit tamlik (3.06). From this figure, we can see that murabahah is still the best comprehension in Islamic home financing type.

Most respondents received information from media (31.7%) and friend (29.3%). Only small numbers were from internet (4.9%) (see table a, in appendices). Therefore, one of Islamic Banks important roles is to socializing Islamic Home Financing. In addition, government support also create a sound milieu for an Islamic bank to grow fast in Indonesia.

Islamic bank customers looked likely more concern compared to non-

Islamic bank customers when they were asked about the clarity of scheme for home financing. 62% (17.7%+44.3%) from total Islamic bank customers disagreed when the scheme is ignorance in order to get cheaper and profitable scheme. While, the percentage of non-Islamic bank customers was 45.8% (10.2%+35.6%), the difference actually is not so big (see table 7). However, the significant difference respondents between customers and non-customers are in the understandability of Islamic home financing, ignorance of Islamic scheme and religious reason to apply Islamic home financing. However, for the statement that states Islamic home financing is better, cheaper and easier compared to conventional loans, there was no significant difference between both (see table b, in appendices).

Table 7. Ignorance of Islamic financing scheme

CUSTOMER * F8 Crosstabulation

F8

|

1.00 |

2.00 |

3.00 |

4.00 |

5.00 |

Total | |

|

CUSTOMER ya Count % within CUSTOMER |

14 17.7% |

35 44.3% |

10 12.7% |

15 19.0% |

5 6.3% |

79 100.0% |

|

tdk Count % within CUSTOMER |

6 10.2% |

21 35.6% |

9 15.3% |

13 22.0% |

10 16.9% |

59 100.0% |

|

Total Count % within CUSTOMER |

20 14.5% |

56 40.6% |

19 13.8% |

28 20.3% |

15 10.9% |

138 100.0% |

Source: Data

Factor analysis is conduct to see whether each factor has a consistent pattern for further analysis (see table c, in appendices). Using Kaiser-Meyer-Olkin test, we get above 0.5 (0.75), while

Bartlett test was also significant. Test can also be used to identify which statements are relevant to the research. However, only statement that says ignorance in order to get cheaper and profitable scheme

was below 0.5 (see table d, in appendices). It means that respondents may have difference perception on this. So, the result shows difference pattern compared to other factors.

CONCLUSIONS

Some conclusions regarding this issue are.

(a) Not many people are aware of Islamic home financing; this is shown by the number of abandoned respondents who is bigger than respondents who filled the questionnaire, (b) Islamic bank customers who filled the questionnaire do not believe that Islamic home financing is better, cheaper and easier in the application. This may be caused by risks to be borne along installment period. So, Islamic home financing looked quite expensive even compared to conventional loans, (c) the highest comprehension in Islamic home financing type is murabahah followed by musharakah mutanaqisah then ijarah muntahiya bit tamlik. This may caused by murabahah is already known at the first time in Islamic home financing. Others are still needed to be marketed intensively, and last but not least (d) most people are aware of which scheme that they would like to apply even though others have additional benefits.

REFERENCES

Abdul-Rahman, Y., & Abdelaaty, M. M. (n.d). Islamic Home Financing in the United States

Bram, Y. F. (2005). Analisis Efektivitas Iklan Sebagai Salah Satu Strategi Pemasaran Perusahaan Percetakan dan Penerbitan PT Rambang dengan Menggunakan EPIC Model. Jurnal Manajemen & Bisnis Sriwijaya, 3(6).

Hagijanto, A. D. (2001). Menciptakan Brand Awareness iklan Media

Massa Cetak. NIRMANA, 3(1), 1731.

Haris, H. (2007). Pembiayaan Kepemilikan Rumah (Sebuah Inovasi Pembiayaan Perbankan Syari’ah). Jurnal Ekonomi Islam La Riba, 1(1), 113-125.

Ishak. (2006). Strategi Bisnis Bank Bukopin Syariah dalam

Pengelolaan KPR Syariah.

Universitas Indonesia, Jakarta.

Islamic Banking Statistics. (2004).): Biro Perbankan Syariah-Bank Indonesia.

Islamic Banking Statistics. (2009).):

Directorate of Islamic BankingBank Indonesia.

Keller, K. L. (1993). Conceptualizing, Measuring, and Managing Customer-Based Brand Equity. The Journal of Marketing, 57(1), 1-22.

Liao, S.-H., PA, R. W., & Hu, D.-C. (n.d). Study of the Relationship between Brand Awareness, Brand Association, Perceived Quality and Brand Loyalty

Liaogang, H., Chongyan, G., & Zi’an, L. (2007). Customer-based Brand Equity and Improvement Strategy for Mobile

Phone Brands: Foreign versus Local in the Chinese Market. International Management Review, 3(3), 76-83.

Patria, D. (2005). Analisis Probabilitas Konversi Nasabah KPR BTN Menjadi Nasabah Pembiayaan KPR BTN Syariah dengan

Pendekatan Model Logit.

Universitas Indonesia, Jakarta.

Siswantoro, D., & Qoyyimah, H. (2005). Analysis on the Feasibility Study of Musharakah Mutanaqisah Implementation in Indonesian Islamic Banks. Paper presented at the 6th International Conference on Islamic Economics and Finance, Jakarta.

Thomas, A. (n.d). Methods of Islamic Home Finance in the United

States. The American Journal of Islamic Finance.

Villarejo-Ramos, A. F., Rondán-Cataluña, F. J., & Sánchez-Franco, M. J.

(n.d). Direct and Indirect Effects of Marketing Effort on Brand Awareness and Brand Image

BULETIN STUDI EKONOMI, Volume 17, No. 2, Agustus 2012

201

Discussion and feedback